UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21189

PIMCO New York Municipal Income Fund III

(Exact name of registrant as specified in charter)

1633 Broadway, New York, New York 10019

(Address of principal executive offices) (Zip code)

Lawrence G. Altadonna—1633 Broadway, New York, New York 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3371

Date of fiscal year end: September 30, 2014

Date of reporting period: March 31, 2014

Item 1. REPORT TO SHAREHOLDERS

PIMCO Municipal Income Fund III

PIMCO California Municipal Income Fund III

PIMCO New York Municipal Income Fund III

Semi-Annual Report

March 31, 2014

Table of Contents

Letter from the Chairman of the Board &

President

Hans W. Kertess

Chairman

Julian Sluyters

President & CEO

Dear Shareholder:

After a weak first half of the reporting period, municipal bonds rallied and produced solid results during the fiscal six months ended March 31, 2014. US Treasury yields fluctuated but ultimately moved higher as the US economy continued to expand and the Federal Reserve (the “Fed”) clarified its timeline for asset purchase tapering. Investor demand for municipal securities strengthened due to improving fundamentals and attractive valuations.

Six-Month Period in Review

For the six-month fiscal period ended March 31, 2014, PIMCO Municipal Income III returned 10.24% on net asset value (“NAV”) and 10.46% on market price.

For the six-month fiscal period ended March 31, 2014, PIMCO California Municipal Income III returned 9.05% on NAV and 10.74% on market price.

For the six-month fiscal period ended March 31, 2014, PIMCO New York Municipal Income III returned 7.54% on NAV and 3.16% on market price.

The Barclays Municipal Bond Index gained 3.65% while the broad taxable bond market, as represented by the Barclays US Aggregate Bond Index, returned 1.70% during the reporting period.

The US economy continued to grow during the reporting period, albeit at a less robust pace. According to the US Commerce Department, gross domestic product (“GDP”), the value of goods and services produced in the country, the broadest measure of economic activity and the principal indicator of economic performance, expanded at a 2.6% annual pace during the fourth quarter. Moderating growth was attributed to a number of factors, including a deceleration in private inventory investment, declining federal government spending and less residential fixed investments.

The Fed maintained an accommodative monetary policy during the reporting period. The central bank did, however, announce that it would begin tapering its monthly asset purchase program beginning in January 2014 during its December 2013 meeting. At its meetings in both January and March 2014, the Fed announced that it would further taper its asset purchases. However, the Fed repeated that it would not raise interest rates in the near future, saying in March that it expected to maintain “the current target range for the federal funds rate for a considerable time

| | | | |

| 2 | | Semi-Annual Report | | | March 31, 2014 |

after the asset purchase program ends, especially if projected inflation continues to run below the Committee’s 2% longer-run goal.”

Outlook

The US economy has been resilient and we believe has overcome the headwinds associated with higher taxes, rising interest rates and severe winter weather. We continue to expect US economic growth will be above-trend in 2014 due, in part, to the fact that fiscal policy

Receive this report electronically and eliminate paper mailings.

To enroll, visit:

us.allianzgi.com/edelivery.

will be less of a drag than it was last year.

While we are prepared for the Fed to start raising benchmark interest rates in 2015, we think policymakers will remain behind the curve on monetary normalization. Several factors support this view, including: the modest pace of the labor recovery, the lack of inflation pressure, the need to support the deleveraging process, the risk of a bond market crash if rates were to normalize too quickly, and constrained fiscal policy and political pressure.

For specific information on the Funds and their performance, please review the following pages. If you have any questions regarding the information provided, we encourage you to contact your financial advisor or call the Funds’ shareholder servicing agent at (800) 254-5197. In addition, a wide range of information and resources is available on our website, us.allianzgi.com/closedendfunds.

Together with Allianz Global Investors Fund Management LLC, the Funds’ investment manager, and Pacific Investment Management Company LLC (“PIMCO”), the Funds’ sub-adviser, we thank you for investing with us. We remain dedicated to serving your investment needs.

Sincerely,

| | |

| |  |

| Hans W. Kertess | | Julian Sluyters |

| Chairman of the Board of Trustees | | President & Chief Executive Officer |

| | | | | | |

| March 31, 2014 | | | Semi-Annual Report | | | 3 | |

Fund Insights

PIMCO Municipal Income Funds III

March 31, 2014 (unaudited)

For the six-month fiscal period ended March 31, 2014, PIMCO Municipal Income III (“Municipal III”) returned 10.24% on net asset value (“NAV”) and 10.46% on market price.

For the six-month fiscal period ended March 31, 2014, PIMCO California Municipal Income III (“California Municipal III”) returned 9.05% on NAV and 10.74% on market price.

For the six-month fiscal period ended March 31, 2014, PIMCO New York Municipal Income III (“New York Municipal III”) returned 7.54% on NAV and 3.16% on market price.

The municipal bond market overcame a challenging start and generated positive results during the six-month reporting period ended March 31, 2014. The overall municipal market, as measured by the Barclays Municipal Bond Index (the “Index”), was relatively flat for the first half of the reporting period, as it returned 0.32%. Impacting the municipal market were rising interest rates, as well as generally weak demand given concerns over the city of Detroit’s bankruptcy filing and credit issues in Puerto Rico. However, the municipal bond market then strengthened and gained 3.32% over the second half of the reporting period. This turnaround was due to several factors, including improving fundamentals, attractive valuations and falling interest rates. In addition, investor demand improved, while new municipal supply fell sharply over the first three months of 2014. All told, the Index gained 3.65% during the six-month reporting period. In

comparison, the overall taxable fixed income market, as measured by the Barclays US Aggregate Bond Index, gained 1.70%.

Overweight duration relative to the Index contributed to the performance of all three Funds as municipal yields declined during the six-months ended March 31, 2014. All three Funds’ overweighting to the Health Care sector was rewarded as it outperformed the Index. Municipal III’s and New York Municipal III’s overweighting to the Industrial Revenue sector was beneficial for results as it outperformed the Index. Municipal III’s and California Municipal III’s overweighting to the Revenue-Backed sector contributed to results as it outperformed the Index. New York Municipal III’s and California Municipal III’s overweighting to Tobacco sector was beneficial as it outperformed the Index.

Municipal III’s and California Municipal III’s underweighting to the Transportation and Lease-Backed sectors detracted from performance as they outperformed the Index. Municipal III’s underweighting to the Education sector was a negative for results given its outperformance versus the Index. New York Municipal III’s overweighting to the Special Tax sector detracted from results given its underperformance versus the Index. New York Municipal III’s underweighting to the Water and Sewer sector was a negative for results due to its outperformance versus the Index.

| | | | |

| 4 | | Semi-Annual Report | | | March 31, 2014 |

Performance & Statistics

PIMCO Municipal Income Fund III

March 31, 2014 (unaudited)

| | | | | | | | |

| Total Return(1): | | Market Price | | | NAV | |

Six Month | | | 10.46% | | | | 10.24% | |

1 Year | | | -2.54% | | | | -0.58% | |

5 Year | | | 13.65% | | | | 14.61% | |

10 Year | | | 4.57% | | | | 4.08% | |

Commencement of Operations (10/31/02) to 3/31/14 | | | 4.62% | | | | 4.48% | |

| | |

| Market Price/NAV Performance: | | |

Commencement of Operations (10/31/02) to 3/31/14

| | | | |

| Market Price/NAV: | | | |

Market Price | | | $11.07 | |

NAV | | | $10.11 | |

Premium to NAV | | | 9.50% | |

Market Price Yield(2) | | | 6.28% | |

Leverage Ratio(3) | | | 39.80% | |

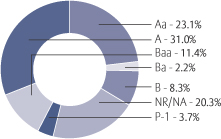

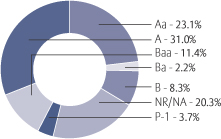

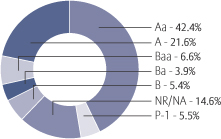

Moody’s Rating

(as a % of total investments)

| | | | | | |

| March 31, 2014 | | | Semi-Annual Report | | | 5 | |

Performance & Statistics

PIMCO California Municipal Income Fund III

March 31, 2014 (unaudited)

| | | | | | | | |

| Total Return(1): | | Market Price | | | NAV | |

Six Month | | | 10.74% | | | | 9.05% | |

1 Year | | | -2.87% | | | | 0.23% | |

5 Year | | | 13.64% | | | | 13.83% | |

10 Year | | | 3.57% | | | | 3.25% | |

Commencement of Operations (10/31/02) to 3/31/14 | | | 3.43% | | | | 3.53% | |

| | |

| Market Price/NAV Performance: | | |

Commencement of Operations (10/31/02) to 3/31/14

| | | | |

| Market Price/NAV: | | | |

Market Price | | | $9.97 | |

NAV | | | $9.53 | |

Premium to NAV | | | 4.62% | |

Market Price Yield(2) | | | 7.22% | |

Leverage Ratio(3) | | | 43.00% | |

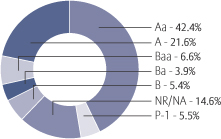

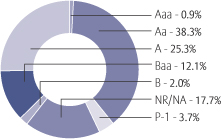

Moody’s Rating

(as a % of total investments)

| | | | |

| 6 | | Semi-Annual Report | | | March 31, 2014 |

Performance & Statistics

PIMCO New York Municipal Income Fund III

March 31, 2014 (unaudited)

| | | | | | | | |

| Total Return(1): | | Market Price | | | NAV | |

Six Month | | | 3.16% | | | | 7.54% | |

1 Year | | | -2.06% | | | | -0.30% | |

5 Year | | | 10.73% | | | | 10.19% | |

10 Year | | | 1.87% | | | | 1.46% | |

Commencement of Operations (10/31/02) to 3/31/14 | | | 2.23% | | | | 2.20% | |

| | |

| Market Price/NAV Performance: | | |

Commencement of Operations (10/31/02) to 3/31/14

| | | | |

| Market Price/NAV: | | | |

Market Price | | | $9.25 | |

NAV | | | $8.82 | |

Premium to NAV | | | 4.88% | |

Market Price Yield(2) | | | 6.81% | |

Leverage Ratio(3) | | | 42.57% | |

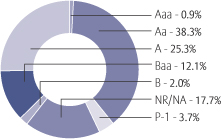

Moody’s Rating

(as a % of total investments)

(1) Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares. Total return for a period of less than one year is not annualized. Total return for a period of more than one year represents the average annual total return.

Performance at market price will differ from results at NAV. Although market price returns typically reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Funds, market conditions, supply and demand for each Fund’s shares, or changes in each Fund’s dividends.

An investment in each Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets attributable to common shareholders less total liabilities divided by the number of common shares outstanding. Holdings are subject to change daily.

(2) Market Price Yield is determined by dividing the annualized current monthly dividend per common share (comprised of net investment income) by the market price per common share at March 31, 2014.

(3) Represents Floating Rate Notes issued in tender option bond transactions and Preferred Shares outstanding (collectively “Leverage”), as a percentage of total managed assets. Total managed assets refer to total assets (including assets attributable to Leverage) minus liabilities (other than liabilities representing Leverage).

| | | | | | |

| March 31, 2014 | | | Semi-Annual Report | | | 7 | |

Schedule of Investments

PIMCO Municipal Income Fund III

March 31, 2014 (unaudited)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | Municipal Bonds & Notes – 93.4% | | | | | | |

| | | | Alabama – 9.5% | | | | | | |

| | $500 | | | Birmingham Special Care Facs. Financing Auth. Rev., Childrens Hospital, 6.00%, 6/1/39 (AGC) | | | | | $559,780 | |

| | 9,000 | | | Birmingham-Baptist Medical Centers Special Care Facs. Financing Auth. Rev.,

Baptist Health Systems, Inc., 5.00%, 11/15/30, Ser. A | | | | | 9,009,180 | |

| | | | Jefferson Cnty. Sewer Rev., | | | | | | |

| | 53,000 | | | zero coupon, 10/1/50, Ser. F (i) | | | | | 27,878,530 | |

| | 12,000 | | | 6.50%, 10/1/53, Ser. D | | | | | 12,434,040 | |

| | 1,000 | | | State Docks Department Rev., 6.00%, 10/1/40 | | | | | 1,121,290 | |

| | | | | | | | | | 51,002,820 | |

| | | | Arizona – 6.7% | | | | | | |

| | | | Health Facs. Auth. Rev., | | | | | | |

| | 1,250 | | | Banner Health, 5.00%, 1/1/35, Ser. A | | | | | 1,282,062 | |

| | 900 | | | Banner Health, 5.50%, 1/1/38, Ser. D | | | | | 954,162 | |

| | 2,250 | | | Beatitudes Campus Project, 5.20%, 10/1/37 | | | | | 1,916,887 | |

| | | | Pima Cnty. Industrial Dev. Auth. Rev., | | | | | | |

| | 13,000 | | | 5.00%, 9/1/39 (h) | | | | | 13,244,270 | |

| | 750 | | | Tucson Electric Power Co., 5.25%, 10/1/40, Ser. A | | | | | 769,478 | |

| | 5,000 | | | Salt River Project Agricultural Improvement & Power Dist. Rev., 5.00%, 1/1/39, Ser. A (h) | | | | | 5,331,750 | |

| | 11,600 | | | Salt Verde Financial Corp. Rev., 5.00%, 12/1/37 | | | | | 12,281,384 | |

| | | | | | | | | | 35,779,993 | |

| | | | California – 19.1% | | | | | | |

| | | | Bay Area Toll Auth. Rev., San Francisco Bay Area, | | | | | | |

| | 1,500 | | | 5.00%, 10/1/29 | | | | | 1,636,065 | |

| | 500 | | | 5.00%, 4/1/34, Ser. F-1 | | | | | 536,600 | |

| | 3,260 | | | 5.00%, 10/1/42 | | | | | 3,414,426 | |

| | 12,000 | | | 5.25%, 4/1/53, Ser. S-4 | | | | | 12,741,720 | |

| | | | Golden State Tobacco Securitization Corp. Rev., Ser. A-1, | | | | | | |

| | 2,630 | | | 4.50%, 6/1/27 | | | | | 2,278,632 | |

| | 3,600 | | | 5.125%, 6/1/47 | | | | | 2,665,080 | |

| | 11,120 | | | 5.75%, 6/1/47 | | | | | 8,999,861 | |

| | | | Health Facs. Financing Auth. Rev., | | | | | | |

| | 2,500 | | | Catholic Healthcare West, 6.00%, 7/1/39, Ser. A | | | | | 2,765,375 | |

| | 600 | | | Sutter Health, 5.00%, 11/15/42, Ser. A (IBC-NPFGC) | | | | | 613,992 | |

| | 4,390 | | | Sutter Health, 5.00%, 8/15/52, Ser. A | | | | | 4,545,845 | |

| | 1,500 | | | Sutter Health, 6.00%, 8/15/42, Ser. B | | | | | 1,710,450 | |

| | 3,350 | | | Indian Wells Redev. Agcy., Tax Allocation, Whitewater Project, 4.75%, 9/1/34, Ser. A (AMBAC) | | | | | 3,105,952 | |

| | 130 | | | Los Angeles Unified School Dist., GO, 5.00%, 7/1/30, Ser. E (AMBAC) | | | | | 136,997 | |

| | 2,000 | | | M-S-R Energy Auth. Rev., 6.50%, 11/1/39, Ser. B | | | | | 2,525,420 | |

| | 1,445 | | | Municipal Finance Auth. Rev., Azusa Pacific Univ. Project, 7.75%, 4/1/31, Ser. B | | | | | 1,623,645 | |

| | 1,250 | | | Palomar Pomerado Health, CP, 6.75%, 11/1/39 | | | | | 1,292,013 | |

| | 1,600 | | | San Marcos Unified School Dist., GO, 5.00%, 8/1/38, Ser. A | | | | | 1,679,920 | |

| | | | State, GO, | | | | | | |

| | 5,000 | | | 5.00%, 6/1/37 | | | | | 5,282,200 | |

| | 5,300 | | | 5.00%, 12/1/37 | | | | | 5,643,864 | |

| | 1,350 | | | 5.25%, 3/1/38 | | | | | 1,454,544 | |

| | | | |

| 8 | | Semi-Annual Report | | | March 31, 2014 |

Schedule of Investments

PIMCO Municipal Income Fund III

March 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | California (continued) | | | | | | |

| | $ 1,300 | | | 5.25%, 11/1/40 | | | | | $1,435,811 | |

| | 3,200 | | | 5.50%, 3/1/40 | | | | | 3,546,176 | |

| | 2,500 | | | 5.75%, 4/1/31 | | | | | 2,891,975 | |

| | 5,000 | | | 6.00%, 4/1/38 | | | | | 5,738,400 | |

| | | | Statewide Communities Dev. Auth. Rev., | | | | | | |

| | 1,000 | | | American Baptist Homes West, 6.25%, 10/1/39 | | | | | 1,044,770 | |

| | 1,635 | | | California Baptist Univ., 5.75%, 11/1/17, Ser. B (a)(b)(d)(j)

(acquisition cost-$1,635,000; purchased 6/22/07) | | | | | 1,783,507 | |

| | 2,580 | | | Methodist Hospital Project, 6.625%, 8/1/29 (FHA) | | | | | 3,039,988 | |

| | 9,200 | | | Methodist Hospital Project, 6.75%, 2/1/38 (FHA) | | | | | 10,802,364 | |

| | 3,000 | | | Trinity Health, 5.00%, 12/1/41 | | | | | 3,119,760 | |

| | 6,200 | | | Tobacco Securitization Auth. of Southern California Rev., 5.00%, 6/1/37, Ser. A-1 | | | | | 4,741,512 | |

| | | | | | | | | | 102,796,864 | |

| | | | Colorado – 0.7% | | | | | | |

| | | | Health Facs. Auth. Rev., Ser. A, | | | | | | |

| | 500 | | | Evangelical Lutheran, 6.125%, 6/1/38 (Pre-refunded @ $100, 6/1/14) (c) | | | | | 504,810 | |

| | 2,000 | | | Sisters of Charity of Leavenworth Health System, 5.00%, 1/1/40 | | | | | 2,062,240 | |

| | 500 | | | Public Auth. for Colorado Energy Rev., 6.50%, 11/15/38 | | | | | 633,870 | |

| | 500 | | | Regional Transportation Dist. Rev., Denver Transportation Partners, 6.00%, 1/15/34 | | | | | 529,395 | |

| | | | | | | | | | 3,730,315 | |

| | | | Connecticut – 0.3% | | | | | | |

| | 1,250 | | | Harbor Point Infrastructure Improvement Dist., Tax Allocation, 7.875%, 4/1/39, Ser. A | | | | | 1,396,488 | |

| | | | District of Columbia – 2.1% | | | | | | |

| | 10,000 | | | Water & Sewer Auth. Rev., 5.50%, 10/1/39, Ser. A (h) | | | | | 11,057,100 | |

| | | | Florida – 3.2% | | | | | | |

| | 3,480 | | | Brevard Cnty. Health Facs. Auth. Rev., Health First, Inc. Project, 5.00%, 4/1/34 | | | | | 3,518,767 | |

| | 500 | | | Broward Cnty. Airport System Rev., 5.375%, 10/1/29, Ser. O | | | | | 552,275 | |

| | 4,500 | | | Broward Cnty. Water & Sewer Utility Rev., 5.25%, 10/1/34, Ser. A (h) | | | | | 5,008,815 | |

| | 3,000 | | | Cape Coral Water & Sewer Rev., 5.00%, 10/1/41 (AGM) | | | | | 3,125,520 | |

| | 350 | | | Dev. Finance Corp. Rev., Renaissance Charter School, 6.50%, 6/15/21, Ser. A | | | | | 364,634 | |

| | 4,200 | | | State Board of Education, GO, 5.00%, 6/1/38, Ser. D (h) | | | | | 4,551,204 | |

| | | | | | | | | | 17,121,215 | |

| | | | Georgia – 0.3% | | | | | | |

| | 1,750 | | | Fulton Cnty. Residential Care Facs. for the Elderly Auth. Rev., Lenbrook Project, 5.125%, 7/1/42, Ser. A | | | | | 1,504,633 | |

| | 400 | | | Medical Center Hospital Auth. Rev., Spring Harbor Green Island Project, 5.25%, 7/1/37 | | | | | 370,152 | |

| | | | | | | | | | 1,874,785 | |

| | | | Hawaii – 0.3% | | | | | | |

| | 1,500 | | | Hawaii Pacific Health Rev., 5.50%, 7/1/40, Ser. A | | | | | 1,595,025 | |

| | | | Illinois – 2.4% | | | | | | |

| | | | Finance Auth. Rev., | | | | | | |

| | 1,000 | | | Leafs Hockey Club Project, 5.875%, 3/1/27, Ser. A (b)(e) | | | | | 340,000 | |

| | 625 | | | Leafs Hockey Club Project, 6.00%, 3/1/37, Ser. A (b)(e) | | | | | 212,500 | |

| | 400 | | | OSF Healthcare System, 7.125%, 11/15/37, Ser. A | | | | | 460,292 | |

| | 1,000 | | | Swedish Covenant Hospital, 6.00%, 8/15/38, Ser. A | | | | | 1,054,390 | |

| | 5,000 | | | Univ. of Chicago, 5.50%, 7/1/37, Ser. B (h) | | | | | 5,566,150 | |

| | 5,000 | | | State Toll Highway Auth. Rev., 5.50%, 1/1/33, Ser. B | | | | | 5,340,550 | |

| | | | | | | | | | 12,973,882 | |

| | | | | | |

| March 31, 2014 | | | Semi-Annual Report | | | 9 | |

Schedule of Investments

PIMCO Municipal Income Fund III

March 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | Indiana – 1.0% | | | | | | |

| | | | Portage, Tax Allocation, Ameriplex Project, | | | | | | |

| | $ 1,000 | | | 5.00%, 7/15/23 | | | | | $1,005,710 | |

| | 775 | | | 5.00%, 1/15/27 | | | | | 766,297 | |

| | 2,800 | | | Vigo Cnty. Hospital Auth. Rev., Union Hospital, Inc., 7.50%, 9/1/22 | | | | | 3,349,584 | |

| | | | | | | | | | 5,121,591 | |

| | | | Iowa – 0.5% | | | | | | |

| | | | Finance Auth. Rev., | | | | | | |

| | 76 | | | Deerfield Retirement Community, Inc., 2.00%, 5/15/56, Ser. B | | | | | 756 | |

| | 3,000 | | | Fertilizer Company Project, 5.25%, 12/1/25 | | | | | 2,913,240 | |

| | | | | | | | | | 2,913,996 | |

| | | | Kentucky – 0.4% | | | | | | |

| | 2,000 | | | Economic Dev. Finance Auth. Rev., Owensboro Medical Healthcare Systems, 6.375%, 6/1/40, Ser. A | | | | | 2,144,120 | |

| | | | Louisiana – 1.3% | | | | | | |

| | | | Local Gov’t Environmental Facs. & Community Dev. Auth Rev., | | | | | | |

| | 400 | | | Westlake Chemical Corp., 6.50%, 11/1/35, Ser. A-2 | | | | | 439,604 | |

| | 1,500 | | | Woman’s Hospital Foundation, 5.875%, 10/1/40, Ser. A | | | | | 1,595,070 | |

| | 1,000 | | | Woman’s Hospital Foundation, 6.00%, 10/1/44, Ser. A | | | | | 1,067,430 | |

| | | | Public Facs. Auth. Rev., Ochsner Clinic Foundation Project, | | | | | | |

| | 1,700 | | | 5.50%, 5/15/47, Ser. B | | | | | 1,728,560 | |

| | 2,000 | | | 6.50%, 5/15/37 | | | | | 2,181,400 | |

| | | | | | | | | | 7,012,064 | |

| | | | Maryland – 0.8% | | | | | | |

| | 1,000 | | | Economic Dev. Corp. Rev., 5.75%, 6/1/35, Ser. B | | | | | 1,029,710 | |

| | | | Health & Higher Educational Facs. Auth. Rev., | | | | | | |

| | 1,500 | | | Calvert Health System, 5.50%, 7/1/36 (Pre-refunded @ $100, 7/1/14) (c) | | | | | 1,519,605 | |

| | 700 | | | Charlestown Community, 6.25%, 1/1/41 | | | | | 744,156 | |

| | 1,000 | | | Lifebridge Health, 6.00%, 7/1/41 | | | | | 1,125,980 | |

| | | | | | | | | | 4,419,451 | |

| | | | Massachusetts – 1.4% | | | | | | |

| | | | Dev. Finance Agcy. Rev., | | | | | | |

| | 295 | | | Adventcare Project, 7.625%, 10/15/37 | | | | | 320,423 | |

| | 140 | | | Linden Ponds, Inc. Fac., zero coupon, 11/15/56, Ser. B (b) | | | | | 889 | |

| | 529 | | | Linden Ponds, Inc. Fac., 6.25%, 11/15/39, Ser. A-1 | | | | | 444,630 | |

| | 4,910 | | | Housing Finance Agcy. Rev., 5.125%, 6/1/43, Ser. H | | | | | 4,910,687 | |

| | 1,600 | | | State College Building Auth. Rev., 5.50%, 5/1/39, Ser. A | | | | | 1,763,280 | |

| | | | | | | | | | 7,439,909 | |

| | | | Michigan – 0.9% | | | | | | |

| | 1,500 | | | Detroit, GO, 5.25%, 11/1/35 | | | | | 1,533,390 | |

| | 1,500 | | | Royal Oak Hospital Finance Auth. Rev., William Beaumont Hospital, 8.25%, 9/1/39 | | | | | 1,825,125 | |

| | 1,300 | | | State Univ. Rev., 6.173%, 2/15/50, Ser. A | | | | | 1,452,204 | |

| | | | | | | | | | 4,810,719 | |

| | | | Missouri – 0.1% | | | | | | |

| | 250 | | | Jennings Rev., Northland Redev. Area Project, 5.00%, 11/1/23 | | | | | 233,565 | |

| | 500 | | | Manchester, Tax Allocation, Highway 141/Manchester Road Project, 6.875%, 11/1/39 | | | | | 513,830 | |

| | | | | | | | | | 747,395 | |

| | | | |

| 10 | | Semi-Annual Report | | | March 31, 2014 |

Schedule of Investments

PIMCO Municipal Income Fund III

March 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | New Hampshire – 0.4% | | | | | | |

| | $ 2,000 | | | Business Finance Auth. Rev., Elliot Hospital, 6.125%, 10/1/39, Ser. A | | | | | $2,097,160 | |

| | | | New Jersey – 4.7% | | | | | | |

| | 4,500 | | | Economic Dev. Auth., Special Assessment, Kapkowski Road Landfill Project, 6.50%, 4/1/28 | | | | | 5,188,365 | |

| | 300 | | | Economic Dev. Auth. Rev., Newark Airport Marriott Hotel, 7.00%, 10/1/14 | | | | | 306,009 | |

| | | | Health Care Facs. Financing Auth. Rev., | | | | | | |

| | 2,000 | | | Robert Wood Johnson Univ. Hospital, 5.50%, 7/1/43, Ser. A | | | | | 2,154,440 | |

| | 1,000 | | | St. Peters Univ. Hospital, 5.75%, 7/1/37 | | | | | 989,780 | |

| | | | Tobacco Settlement Financing Corp. Rev., Ser. 1-A, | | | | | | |

| | 1,600 | | | 4.75%, 6/1/34 | | | | | 1,212,624 | |

| | 20,745 | | | 5.00%, 6/1/41 | | | | | 15,669,736 | |

| | | | | | | | | | 25,520,954 | |

| | | | New Mexico – 0.2% | | | | | | |

| | 1,000 | | | Farmington Pollution Control Rev., 5.90%, 6/1/40, Ser. D | | | | | 1,064,570 | |

| | | | New York – 12.1% | | | | | | |

| | 9,800 | | | Brooklyn Arena Local Dev. Corp. Rev., Barclays Center Project, 6.25%, 7/15/40 | | | | | 10,529,806 | |

| | 5,000 | | | Hudson Yards Infrastructure Corp. Rev., 5.75%, 2/15/47, Ser. A | | | | | 5,498,550 | |

| | 1,700 | | | Liberty Dev. Corp. Rev., Goldman Sachs Headquarters, 5.50%, 10/1/37 | | | | | 1,915,713 | |

| | 3,000 | | | Metropolitan Transportation Auth. Rev., 5.00%, 11/15/36, Ser. D | | | | | 3,160,920 | |

| | 1,150 | | | Nassau Cnty. Industrial Dev. Agcy. Rev., Amsterdam at Harborside, 6.70%, 1/1/43, Ser. A | | | | | 574,575 | |

| | 10,450 | | | New York City Industrial Dev. Agcy. Rev., Yankee Stadium, 7.00%, 3/1/49 (AGC) | | | | | 11,985,209 | |

| | | | New York City Water & Sewer System Rev. (h), | | | | | | |

| | 4,900 | | | 5.00%, 6/15/37, Ser. D | | | | | 5,035,534 | |

| | 4,000 | | | Second Generation Resolutions, 4.75%, 6/15/35, Ser. DD | | | | | 4,123,000 | |

| | | | New York Liberty Dev. Corp. Rev., | | | | | | |

| | 10,000 | | | 1 World Trade Center Project, 5.00%, 12/15/41 | | | | | 10,487,500 | |

| | 11,255 | | | 4 World Trade Center Project, 5.00%, 11/15/44 | | | | | 11,658,042 | |

| | | | | | | | | | 64,968,849 | |

| | | | North Carolina – 1.5% | | | | | | |

| | 1,500 | | | Medical Care Commission Rev., Cleveland Cnty. Healthcare, 5.00%, 7/1/35, Ser. A (AMBAC) (Pre-refunded @ $100, 7/1/14) (c) | | | | | 1,517,775 | |

| | 6,000 | | | New Hanover Cnty. Rev., New Hanover Regional Medical Center, 5.00%, 10/1/28 | | | | | 6,437,400 | |

| | | | | | | | | | 7,955,175 | |

| | | | Ohio – 3.2% | | | | | | |

| | 500 | | | Allen Cnty. Catholic Healthcare Rev., Allen Hospital, 5.00%, 6/1/38, Ser. A | | | | | 518,190 | |

| | 10,350 | | | Buckeye Tobacco Settlement Financing Auth. Rev., 6.50%, 6/1/47, Ser. A-2 | | | | | 9,021,370 | |

| | 1,500 | | | Hamilton Cnty. Healthcare Rev., Christ Hospital Project, 5.00%, 6/1/42 | | | | | 1,521,990 | |

| | 500 | | | Higher Educational Fac. Commission Rev., Univ. Hospital Health Systems,

6.75%, 1/15/39, Ser. 2009-A (Pre-refunded @ $100, 1/15/15) (c) | | | | | 525,700 | |

| | 500 | | | Montgomery Cnty. Rev., Miami Valley Hospital, 6.25%, 11/15/39, Ser. A (Pre-refunded @ $100, 11/15/14) (c) | | | | | 518,790 | |

| | 5,000 | | | State Turnpike Commission Rev., 5.00%, 2/15/48, Ser. A-1 | | | | | 5,233,000 | |

| | | | | | | | | | 17,339,040 | |

| | | | Pennsylvania – 4.0% | | | | | | |

| | 1,000 | | | Allegheny Cnty. Hospital Dev. Auth. Rev., Univ. of Pittsburgh Medical Center, 5.625%, 8/15/39 | | | | | 1,099,000 | |

| | 6,600 | | | Berks Cnty. Municipal Auth. Rev., Reading Hospital Medical Center, 5.00%, 11/1/44, Ser. A | | | | | 6,834,762 | |

| | | | | | |

| March 31, 2014 | | | Semi-Annual Report | | | 11 | |

Schedule of Investments

PIMCO Municipal Income Fund III

March 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | Pennsylvania (continued) | | | | | | |

| | | | Cumberland Cnty. Municipal Auth. Rev., Messiah Village Project, Ser. A, | | | | | | |

| | $ 750 | | | 5.625%, 7/1/28 | | | | | $767,377 | |

| | 670 | | | 6.00%, 7/1/35 | | | | | 688,579 | |

| | 1,000 | | | Dauphin Cnty. General Auth. Rev., Pinnacle Health System Project, 6.00%, 6/1/36, Ser. A | | | | | 1,088,480 | |

| | 1,250 | | | Harrisburg Auth. Rev., Harrisburg Univ. of Science, 6.00%, 9/1/36, Ser. B (e) | | | | | 560,113 | |

| | 100 | | | Luzerne Cnty. Industrial Dev. Auth. Rev., Pennsylvania American Water Co., 5.50%, 12/1/39 | | | | | 108,899 | |

| | 1,645 | | | Philadelphia Hospitals & Higher Education Facs. Auth. Rev., Temple Univ. Health System, 5.625%, 7/1/42, Ser. A | | | | | 1,484,168 | |

| | 500 | | | Philadelphia Water & Wastewater Rev., 5.25%, 1/1/36, Ser. A | | | | | 529,615 | |

| | | | Turnpike Commission Rev., | | | | | | |

| | 5,000 | | | 5.00%, 12/1/43, Ser. C | | | | | 5,237,750 | |

| | 3,000 | | | 5.125%, 12/1/40, Ser. D | | | | | 3,147,600 | |

| | | | | | | | | | 21,546,343 | |

| | | | South Carolina – 4.3% | | | | | | |

| | 1,000 | | | Greenwood Cnty. Rev., Self Regional Healthcare, 5.375%, 10/1/39 | | | | | 1,049,120 | |

| | 800 | | | State Ports Auth. Rev., 5.25%, 7/1/40 | | | | | 851,088 | |

| | | | State Public Service Auth. Rev., | | | | | | |

| | 15,000 | | | 5.50%, 12/1/53, Ser. E | | | | | 16,115,100 | |

| | 5,000 | | | Sanatee Cooper, 5.125%, 12/1/43, Ser. B | | | | | 5,298,650 | |

| | | | | | | | | | 23,313,958 | |

| | | | Tennessee – 0.4% | | | | | | |

| | 1,250 | | | Claiborne Cnty. Industrial Dev. Board Rev., Lincoln Memorial Univ. Project, 6.625%, 10/1/39 | | | | | 1,330,500 | |

| | 1,000 | | | Johnson City Health & Educational Facs. Board Rev., Mountain States Health Alliance, 6.00%, 7/1/38, Ser. A | | | | | 1,089,870 | |

| | | | | | | | | | 2,420,370 | |

| | | | Texas – 9.7% | | | | | | |

| | 1,300 | | | Dallas Rev., Dallas Civic Center, 5.25%, 8/15/38 (AGC) | | | | | 1,380,301 | |

| | 4,500 | | | Grand Parkway Transportation Corp. Rev., 5.00%, 4/1/53, Ser. B | | | | | 4,682,880 | |

| | 2,000 | | | Municipal Gas Acquisition & Supply Corp. III Rev., 5.00%, 12/15/26 | | | | | 2,122,960 | |

| | | | North Harris Cnty. Regional Water Auth. Rev., | | | | | | |

| | 5,500 | | | 5.25%, 12/15/33 | | | | | 5,886,430 | |

| | 5,500 | | | 5.50%, 12/15/38 | | | | | 5,913,380 | |

| | | | North Texas Tollway Auth. Rev., | | | | | | |

| | 3,000 | | | 5.00%, 1/1/38 | | | | | 3,114,510 | |

| | 600 | | | 5.50%, 9/1/41, Ser. A | | | | | 667,368 | |

| | 10,800 | | | 5.625%, 1/1/33, Ser. A | | | | | 11,880,972 | |

| | 700 | | | 5.75%, 1/1/33, Ser. F | | | | | 758,618 | |

| | 3,000 | | | Tarrant Cnty. Cultural Education Facs. Finance Corp. Rev., Baylor Health Care Systems Project, 6.25%, 11/15/29 | | | | | 3,388,320 | |

| | | | Texas Municipal Gas Acquisition & Supply Corp. I Rev., | | | | | | |

| | 150 | | | 5.25%, 12/15/26, Ser. A | | | | | 161,991 | |

| | 9,600 | | | 6.25%, 12/15/26, Ser. D | | | | | 11,468,640 | |

| | 500 | | | Wise Cnty. Rev., Parker Cnty. Junior College Dist., 8.00%, 8/15/34 | | | | | 575,810 | |

| | | | | | | | | | 52,002,180 | |

| | | | |

| 12 | | Semi-Annual Report | | | March 31, 2014 |

Schedule of Investments

PIMCO Municipal Income Fund III

March 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | Virginia – 0.3% | | | | | | |

| | $ 1,000 | | | Fairfax Cnty. Industrial Dev. Auth. Rev., Inova Health Systems, 5.50%, 5/15/35, Ser. A | | | | | $1,100,780 | |

| | | | James City Cnty. Economic Dev. Auth. Rev., United Methodist Home, Ser. A, | | | | | | |

| | 201 | | | 2.00%, 10/1/48 (e) | | | | | 5,317 | |

| | 621 | | | 6.00%, 6/1/43 | | | | | 532,075 | |

| | | | | | | | | | 1,638,172 | |

| | | | Washington – 0.3% | | | | | | |

| | | | Health Care Facs. Auth. Rev., | | | | | | |

| | 500 | | | Kadlec Regional Medical Center, 5.50%, 12/1/39 | | | | | 515,405 | |

| | 1,000 | | | Seattle Cancer Care Alliance, 7.375%, 3/1/38 | | | | | 1,197,350 | |

| | | | | | | | | | 1,712,755 | |

| | | | West Virginia – 0.2% | | | | | | |

| | 1,000 | | | Hospital Finance Auth. Rev., Highland Hospital, 9.125%, 10/1/41 | | | | | 979,030 | |

| | | | Wisconsin – 1.1% | | | | | | |

| | | | Health & Educational Facs. Auth. Rev., | | | | | | |

| | 1,000 | | | Aurora Health Care, Inc., 5.625%, 4/15/39, Ser. A | | | | | 1,041,590 | |

| | 1,000 | | | Prohealth Care, Inc., 6.625%, 2/15/39 | | | | | 1,110,320 | |

| | 3,500 | | | Univ. of Wisconsin Hospitals & Clinics Auth. Rev., 5.00%, 4/1/38, Ser. A | | | | | 3,613,610 | |

| | | | | | | | | | 5,765,520 | |

| | Total Municipal Bonds & Notes (cost-$468,705,548) | | | | | 502,261,808 | |

| | Variable Rate Notes – 2.9% | | | | | | |

| | | | California – 0.4% | | | | | | |

| | 1,675 | | | Los Angeles Community College Dist., GO, 11.866%, 8/1/33, Ser. 3096 (a)(d)(f)(g) | | | | | 2,194,752 | |

| | | | Florida – 1.0% | | | | | | |

| | 5,000 | | | Greater Orlando Aviation Auth. Rev., 8.10%, 10/1/39, Ser. 3174 (a)(b)(d)(f)(g)(j) (acquisition cost-$4,929,498; purchased 4/5/10-1/18/11) | | | | | 5,484,200 | |

| | | | Iowa – 0.0% | | | | | | |

| | 403 | | | Finance Auth. Rev., Deerfield Retirement Community, Inc.,

2.70%, 11/15/46, Ser. A (g) | | | | | 247,004 | |

| | | | Texas – 1.5% | | | | | | |

| | 6,500 | | | JPMorgan Chase Putters/Drivers Trust, GO, 8.031%, 2/1/17, Ser. 3480 (a)(d)(f)(g) | | | | | 7,860,450 | |

| | Total Variable Rate Notes (cost-$13,601,873) | | | | | 15,786,406 | |

| | Short-Term Investments – 3.7% | | | | | | |

| | | | U.S. Government Agency Securities (k) – 2.0% | | | | | | |

| | 400 | | | Federal Home Loan Bank Discount Notes, 0.101%, 8/1/14 | | | | | 399,864 | |

| | 10,200 | | | Freddie Mac Discount Notes, 0.122%, 7/1/14 | | | | | 10,196,906 | |

| | Total U.S. Government Agency Securities (cost-$10,596,770) | | | | | 10,596,770 | |

| | | | U.S. Treasury Obligations – 1.7% | | | | | | |

| | 9,200 | | | U.S. Treasury Notes, 0.50%, 8/15/14 (cost-$9,212,697) | | | | | 9,215,272 | |

| | Total Short-Term Investments (cost-$19,809,467) | | | | | 19,812,042 | |

| | Total Investments (cost-$502,116,888) – 100.0% | | | | | $537,860,256 | |

| | | | | | |

| March 31, 2014 | | | Semi-Annual Report | | | 13 | |

Schedule of Investments

PIMCO Municipal Income Fund III

March 31, 2014 (unaudited) (continued)

Industry classification of portfolio holdings as a percentage of total investments was as follows:

| | | | | | | | |

Revenue Bonds: | | | | | | | | |

Health, Hospital & Nursing Home Revenue | | | 21.2 | % | | | | |

Sewer Revenue | | | 9.6 | | | | | |

Highway Revenue Tolls | | | 8.7 | | | | | |

Tobacco Settlement Funded | | | 8.3 | | | | | |

Miscellaneous Revenue | | | 6.5 | | | | | |

Water Revenue | | | 5.5 | | | | | |

Natural Gas Revenue | | | 5.4 | | | | | |

Recreational Revenue | | | 4.3 | | | | | |

Port, Airport & Marina Revenue | | | 3.6 | | | | | |

Industrial Revenue | | | 3.2 | | | | | |

College & University Revenue | | | 2.7 | | | | | |

Lease (Appropriation) | | | 2.5 | | | | | |

Electric Power & Light Revenue | | | 1.3 | | | | | |

Local or Guaranteed Housing | | | 1.1 | | | | | |

Miscellaneous Taxes | | | 1.0 | | | | | |

Transit Revenue | | | 0.7 | | | | | |

Tax Increment/Allocation Revenue | | | 0.0 | | | | | |

| | | | | | | | |

Total Revenue Bonds | | | | | | | 85.6 | % |

General Obligation | | | | | | | 8.2 | |

U.S. Government Agency Securities | | | | | | | 2.0 | |

U.S. Treasury Obligations | | | | | | | 1.7 | |

Tax Allocation | | | | | | | 1.3 | |

Special Assessment | | | | | | | 1.0 | |

Certificates of Participation | | | | | | | 0.2 | |

| | | | | | | | |

Total Investments | | | | | | | 100.0 | % |

| | | | | | | | |

Notes to Schedule of Investments:

| (a) | | Private Placement–Restricted as to resale and may not have a readily available market. Securities with an aggregate value of $17,322,909, representing 3.2% of total investments. | |

| (c) | | Pre-refunded bonds are collateralized by U.S. Government or other eligible securities which are held in escrow and used to pay principal and interest and retire the bonds at the earliest refunding date (payment date). | |

| (d) | | 144A–Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid. | |

| (f) | | Inverse Floater–The interest rate shown bears an inverse relationship to the interest rate on another security or the value of an index. The interest rate disclosed reflects the rate in effect on March 31, 2014. | |

| (g) | | Variable Rate Notes–Instruments whose interest rates change on specified date (such as a coupon date or interest payment date) and/or whose interest rates vary with changes in a designated base rate (such as the prime interest rate). The interest rate disclosed reflects the rate in effect on March 31, 2014. | |

| (h) | | Residual Interest Bonds held in Trust–Securities represent underlying bonds transferred to a separate securitization trust established in a tender option bond transaction in which the Fund acquired the residual interest certificates. These securities serve as collateral in a financing transaction. | |

| (i) | | Step Bond–Coupon is a fixed rate for an initial period then resets at a specific date and rate. | |

| (j) | | Restricted. The aggregate acquisition cost of such securities is $6,564,498. The aggregate value is $7,267,707, representing 1.4% of total investments. | |

| (k) | | Rates reflect the effective yields at purchase date. | |

| (l) | | Floating Rate Notes–The weighted average daily balance of Floating Rate Notes outstanding during the six months ended March 31, 2014 was $28,421,219 at a weighted average interest rate, including fees, of 0.63%. | |

| | | | |

| 14 | | Semi-Annual Report | | | March 31, 2014 |

Schedule of Investments

PIMCO Municipal Income Fund III

March 31, 2014 (unaudited) (continued)

| (m) | | Fair Value Measurements-See Note 1(b) in the Notes to Financial Statements. | |

| | | | | | | | | | | | | | | | |

| | | Level 1 –

Quoted

Prices | | | Level 2 –

Other Significant

Observable

Inputs | | | Level 3 –

Significant

Unobservable

Inputs | | | Value at

3/31/14 | |

Investments in Securities – Assets | | | | | | | | | | | | | | | | |

Municipal Bonds & Notes | | $ | – | | | | $502,261,808 | | | | $– | | | | $502,261,808 | |

Variable Rate Notes | | | – | | | | 15,786,406 | | | | – | | | | 15,786,406 | |

Short-Term Investments | | | – | | | | 19,812,042 | | | | – | | | | 19,812,042 | |

Totals | | $ | – | | | | $537,860,256 | | | | $– | | | | $537,860,256 | |

At March 31, 2014, there were no transfers between Levels 1 and 2.

Glossary:

| | | | |

| AGC | | - | | insured by Assured Guaranty Corp. |

| AGM | | - | | insured by Assured Guaranty Municipal Corp. |

| AMBAC | | - | | insured by American Municipal Bond Assurance Corp. |

| CP | | - | | Certificates of Participation |

| FHA | | - | | insured by Federal Housing Administration |

| GO | | - | | General Obligation Bond |

| IBC | | - | | Insurance Bond Certificate |

| NPFGC | | - | | insured by National Public Finance Guarantee Corp. |

| | | | | | | | |

| See accompanying Notes to Financial Statements | | | March 31, 2014 | | | Semi-Annual Report | | | 15 | |

Schedule of Investments

PIMCO California Municipal Income Fund III

March 31, 2014 (unaudited)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | California Municipal Bonds & Notes – 91.8% | | | | | | |

| | | | Bay Area Toll Auth. Rev., | | | | | | |

| | $8,000 | | | 5.25%, 4/1/48, Ser. S-4 | | | | | $8,592,800 | |

| | 1,250 | | | San Francisco Bay Area, 5.00%, 4/1/34, Ser. F-1 | | | | | 1,341,500 | |

| | 1,000 | | | Cathedral City Public Financing Auth., Tax Allocation, 5.00%, 8/1/33, Ser. A (NPFGC) | | | | | 936,350 | |

| | 1,150 | | | Ceres Redev. Agcy., Tax Allocation, Project Area No. 1, 5.00%, 11/1/33 (NPFGC) | | | | | 1,115,040 | |

| | 2,000 | | | Chula Vista Rev., San Diego Gas & Electric, 5.875%, 2/15/34, Ser. B | | | | | 2,194,680 | |

| | 550 | | | City & Cnty. of San Francisco, Capital Improvement Projects, CP, 5.25%, 4/1/31, Ser. A | | | | | 593,494 | |

| | 1,415 | | | Contra Costa Cnty. Public Financing Auth., Tax Allocation, 5.625%, 8/1/33, Ser. A | | | | | 1,396,025 | |

| | | | Educational Facs. Auth. Rev. (h), | | | | | | |

| | 9,800 | | | Claremont McKenna College, 5.00%, 1/1/39 | | | | | 10,288,236 | |

| | 10,000 | | | Univ. of Southern California, 5.00%, 10/1/39, Ser. A | | | | | 10,734,900 | |

| | 1,695 | | | El Dorado Irrigation Dist. & El Dorado Water Agcy., CP, 5.75%, 8/1/39, Ser. A (AGC) (Pre-refunded @ $100, 8/ 1/14) (c) | | | | | 1,726,374 | |

| | | | Golden State Tobacco Securitization Corp. Rev., | | | | | | |

| | 11,000 | | | 5.00%, 6/1/45 (AMBAC-TCRS) | | | | | 11,002,970 | �� |

| | 4,000 | | | 5.00%, 6/1/45, Ser. A (FGIC-TCRS) | | | | | 4,001,080 | |

| | 23,585 | | | 5.75%, 6/1/47, Ser. A-1 | | | | | 19,088,284 | |

| | | | Health Facs. Financing Auth. Rev., | | | | | | |

| | 4,000 | | | Adventist Health System, 5.75%, 9/1/39, Ser. A | | | | | 4,446,280 | |

| | 1,935 | | | Catholic Healthcare West, 6.00%, 7/1/34, Ser. A | | | | | 1,952,763 | |

| | 4,000 | | | Catholic Healthcare West, 6.00%, 7/1/39, Ser. A | | | | | 4,424,600 | |

| | 500 | | | Children’s Hospital of Orange Cnty., 6.50%, 11/1/38, Ser. A | | | | | 582,825 | |

| | 6,000 | | | Cottage Health System, 5.00%, 11/1/33, Ser. B (NPFGC) | | | | | 6,008,520 | |

| | 1,300 | | | Scripps Health, 5.00%, 11/15/36, Ser. A | | | | | 1,362,101 | |

| | 2,900 | | | Stanford Hospital, 5.25%, 11/15/40, Ser. A-2 | | | | | 3,137,829 | |

| | 8,305 | | | Stanford Hospital Clinics, 5.00%, 8/15/51, Ser. A | | | | | 8,614,859 | |

| | 1,000 | | | Sutter Health, 5.00%, 8/15/35, Ser. D | | | | | 1,046,320 | |

| | 5,000 | | | Sutter Health, 5.00%, 8/15/38, Ser. A | | | | | 5,212,500 | |

| | 500 | | | Sutter Health, 5.00%, 11/15/42, Ser. A (IBC-NPFGC) | | | | | 511,660 | |

| | 1,200 | | | Sutter Health, 6.00%, 8/15/42, Ser. B | | | | | 1,368,360 | |

| | 10,000 | | | Infrastructure & Economic Dev. Bank Rev., Independent System Operator Corp., 5.00%, 2/1/39 | | | | | 10,464,200 | |

| | | | Lancaster Redev. Agcy., Tax Allocation, | | | | | | |

| | 215 | | | 6.875%, 8/1/39 | | | | | 232,277 | |

| | 285 | | | 6.875%, 8/1/39 (Pre-refunded @ $100, 8/ 1/19) (c) | | | | | 364,663 | |

| | 2,120 | | | Long Beach Airport Rev., 5.00%, 6/1/40, Ser. A | | | | | 2,170,626 | |

| | 5,000 | | | Long Beach Unified School Dist., GO, 5.75%, 8/1/33, Ser. A | | | | | 5,698,550 | |

| | | | Los Angeles Department of Water & Power Rev., | | | | | | |

| | 6,000 | | | 4.75%, 7/1/30, Ser. A-2 (AGM) (h) | | | | | 6,161,940 | |

| | 2,000 | | | 5.00%, 7/1/37, Ser. B | | | | | 2,166,920 | |

| | 10,000 | | | 5.00%, 7/1/39, Ser. A (h) | | | | | 10,614,000 | |

| | 2,115 | | | 5.00%, 7/1/43, Ser. B | | | | | 2,263,706 | |

| | 10,000 | | | Los Angeles Unified School Dist., GO, 5.00%, 1/1/34, Ser. I (h) | | | | | 10,917,700 | |

| | 1,700 | | | M-S-R Energy Auth. Rev., 6.50%, 11/1/39, Ser. B | | | | | 2,146,607 | |

| | 550 | | | Malibu, City Hall Project, CP, 5.00%, 7/1/39, Ser. A | | | | | 563,717 | |

| | 1,000 | | | Manteca Financing Auth. Sewer Rev., 5.75%, 12/1/36 | | | | | 1,109,170 | |

| | 5,000 | | | Metropolitan Water Dist. of Southern California Rev., 5.00%, 7/1/37, Ser. A (h) | | | | | 5,319,500 | |

| | | | |

| 16 | | Semi-Annual Report | | | March 31, 2014 |

Schedule of Investments

PIMCO California Municipal Income Fund III

March 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | $3,000 | | | Montebello Unified School Dist., GO, 5.00%, 8/1/33 (AGM) | | | | | $3,175,410 | |

| | 870 | | | Municipal Finance Auth. Rev., Azusa Pacific Univ. Project, 7.75%, 4/1/31, Ser. B | | | | | 977,558 | |

| | 1,250 | | | Peralta Community College Dist., GO, 5.00%, 8/1/39, Ser. C | | | | | 1,288,787 | |

| | 1,250 | | | Pollution Control Financing Auth. Rev., American Water Capital Corp. Project, 5.25%, 8/1/40 (a)(b)(d)(i) (acquisition cost-$1,250,000; purchased 8/11/10) | | | | | 1,266,687 | |

| | 1,890 | | | Poway Unified School Dist., Special Tax, 5.125%, 9/1/28 | | | | | 1,913,890 | |

| | 500 | | | Rocklin Unified School Dist. Community Facs. Dist., Special Tax, 5.00%, 9/1/29 (NPFGC) | | | | | 500,170 | |

| | 3,000 | | | Sacramento Municipal Utility Dist. Rev., 5.00%, 8/15/37, Ser. A | | | | | 3,242,040 | |

| | 1,325 | | | San Diego Cnty. Regional Airport Auth. Rev., 5.00%, 7/1/43, Ser. A | | | | | 1,401,267 | |

| | 6,250 | | | San Diego Cnty. Water Auth., CP, 5.00%, 5/1/38, Ser. 2008-A (AGM) | | | | | 6,622,750 | |

| | 4,000 | | | San Diego Public Facs. Financing Auth. Sewer Rev., 5.25%, 5/15/39, Ser. A | | | | | 4,386,040 | |

| | 2,200 | | | San Diego Regional Building Auth. Rev., Cnty. Operations Center & Annex,

5.375%, 2/1/36, Ser. A | | | | | 2,394,920 | |

| | 1,500 | | | San Jose Hotel Tax Rev., Convention Center Expansion, 6.50%, 5/1/36 | | | | | 1,710,270 | |

| | 12,200 | | | San Marcos Public Facs. Auth., Tax Allocation, 5.00%, 8/1/33, Ser. A (FGIC-NPFGC) | | | | | 12,283,448 | |

| | 1,000 | | | San Marcos Unified School Dist., GO, 5.00%, 8/1/38, Ser. A | | | | | 1,049,950 | |

| | 500 | | | Santa Clara Cnty. Financing Auth. Rev., El Camino Hospital, 5.75%, 2/1/41, Ser. A (AMBAC) | | | | | 531,950 | |

| | 1,200 | | | Santa Cruz Cnty. Redev. Agcy., Tax Allocation, Live Oak/Soquel Community, 7.00%, 9/1/36, Ser. A | | | | | 1,365,420 | |

| | 4,425 | | | South Tahoe JT Powers Financing Auth. Rev., South Tahoe Redev. Project,

5.45%, 10/1/33, Ser. 1-A | | | | | 4,290,745 | |

| | | | State, GO, | | | | | | |

| | 5,000 | | | 5.00%, 11/1/43 | | | | | 5,345,150 | |

| | 7,300 | | | 6.00%, 4/1/38 | | | | | 8,378,064 | |

| | | | State Public Works Board Rev., | | | | | | |

| | 2,000 | | | California State Univ., 6.00%, 11/1/34, Ser. J | | | | | 2,286,120 | |

| | 2,500 | | | Judicial Council Projects, 5.00%, 3/1/38, Ser. A (b) | | | | | 2,626,425 | |

| | 9,200 | | | State Univ. Rev., 5.00%, 11/1/42, Ser. A | | | | | 9,802,232 | |

| | | | Statewide Communities Dev. Auth. Rev., | | | | | | |

| | 500 | | | American Baptist Homes West, 6.25%, 10/1/39 | | | | | 522,385 | |

| | 1,300 | | | California Baptist Univ., 5.50%, 11/1/38, Ser. A | | | | | 1,239,381 | |

| | 415 | | | California Baptist Univ., 6.50%, 11/1/21 | | | | | 470,627 | |

| | 1,015 | | | Catholic Healthcare West, 5.50%, 7/1/31, Ser. D | | | | | 1,087,644 | |

| | 1,015 | | | Catholic Healthcare West, 5.50%, 7/1/31, Ser. E | | | | | 1,087,644 | |

| | 4,500 | | | Kaiser Permanente, 5.00%, 3/1/41, Ser. B | | | | | 4,552,110 | |

| | 11,220 | | | Kaiser Permanente, 5.00%, 4/1/42, Ser. A | | | | | 11,684,957 | |

| | 1,000 | | | Lancer Student Housing Project, 7.50%, 6/1/42 | | | | | 1,078,470 | |

| | 1,780 | | | Methodist Hospital Project, 6.625%, 8/1/29 (FHA) | | | | | 2,097,356 | |

| | 6,430 | | | Methodist Hospital Project, 6.75%, 2/1/38 (FHA) | | | | | 7,549,913 | |

| | 3,100 | | | St. Joseph Health System, 5.75%, 7/1/47, Ser. A-3 (FGIC) | | | | | 3,363,779 | |

| | 1,800 | | | Sutter Health, 6.00%, 8/15/42, Ser. A | | | | | 2,052,540 | |

| | 1,715 | | | The Internext Group, CP, 5.375%, 4/1/30 | | | | | 1,719,099 | |

| | 11,000 | | | Trinity Health, 5.00%, 12/1/41 | | | | | 11,439,120 | |

| | 2,000 | | | Univ. of California Irvine E. Campus, 5.375%, 5/15/38 | | | | | 2,056,380 | |

| | 1,505 | | | Successor Agcy. to the San Francisco City & Cnty. Redev. Agcy., Special Tax, 5.00%, 8/1/28 | | | | | 1,541,978 | |

| | | | Tobacco Securitization Agcy. Rev., | | | | | | |

| | 8,100 | | | Alameda Cnty., 5.875%, 6/1/35 | | | | | 7,856,190 | |

| | 7,000 | | | Alameda Cnty., 6.00%, 6/1/42 | | | | | 6,566,840 | |

| | | | | | |

| March 31, 2014 | | | Semi-Annual Report | | | 17 | |

Schedule of Investments

PIMCO California Municipal Income Fund III

March 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | $2,000 | | | Kern Cnty., 6.125%, 6/1/43, Ser. A | | | | | $1,999,940 | |

| | 2,950 | | | Torrance Rev., Torrance Memorial Medical Center, 5.50%, 6/1/31, Ser. A | | | | | 2,956,726 | |

| | 2,500 | | | Township Health Care Dist, GO, 5.00%, 8/1/43, Ser. B | | | | | 2,581,325 | |

| | 5,000 | | | Univ. of California Rev., 5.00%, 5/15/43, Ser. J | | | | | 5,273,000 | |

| | 2,000 | | | Western Municipal Water Dist. Facs. Auth. Rev., 5.00%, 10/1/39, Ser. B | | | | | 2,069,840 | |

| | 1,000 | | | Westlake Village, CP, 5.00%, 6/1/39 | | | | | 1,015,690 | |

| | 2,750 | | | Woodland Finance Auth. Rev., 5.00%, 3/1/32 (XLCA) | | | | | 2,777,500 | |

| | Total California Municipal Bonds & Notes (cost-$312,897,016) | | | | | 335,353,653 | |

| | Other Municipal Bonds & Notes – 2.4% | | | | | | |

| | | | Indiana – 1.3% | | | | | | |

| | 5,000 | | | Vigo Cnty. Hospital Auth. Rev., Union Hospital, Inc., 5.75%, 9/1/42 (a)(b)(d)(i) (acquisition cost-$2,942,000; purchased 1/7/09) | | | | | 4,707,150 | |

| | | | New Jersey – 0.2% | | | | | | |

| | 1,000 | | | Tobacco Settlement Financing Corp. Rev., 4.75%, 6/1/34, Ser. 1-A | | | | | 757,890 | |

| | | | New York – 0.9% | | | | | | |

| | 3,300 | | | New York City Water & Sewer System Rev., 5.00%, 6/15/37, Ser. D (h) | | | | | 3,391,278 | |

| | Total Other Municipal Bonds & Notes (cost-$6,681,651) | | | | | 8,856,318 | |

| | California Variable Rate Notes – 0.3% | | | | | | |

| | 1,000 | | | Los Angeles Community College Dist., GO, 11.866%, 8/1/33, Ser. 3096 (a)(d)(f)(g) (cost-$996,722) | | | | | 1,310,300 | |

| | Short-Term Investments – 5.5% | | | | | | |

| | | | U.S. Government Agency Securities – 4.5% | | | | | | |

| | 16,300 | | | Federal Home Loan Bank Discount Notes, 0.101%, 7/30/14 (j) (cost-$16,294,567) | | | | | 16,294,567 | |

| | | | U.S. Treasury Obligations – 1.0% | | | | | | |

| | | | U.S. Treasury Notes, | | | | | | |

| | 2,300 | | | 0.25%, 5/31/14 | | | | | 2,300,853 | |

| | 1,100 | | | 0.50%, 8/15/14 | | | | | 1,101,826 | |

| | 100 | | | 0.50%, 10/15/14 | | | | | 100,231 | |

| | Total U.S. Treasury Obligations (cost-$3,502,261) | | | | | 3,502,910 | |

| | Total Short-Term Investments (cost-$19,796,828) | | | | | 19,797,477 | |

| | Total Investments (cost-$340,372,217) – 100.0% | | | | | $365,317,748 | |

| | | | |

| 18 | | Semi-Annual Report | | | March 31, 2014 |

Schedule of Investments

PIMCO California Municipal Income Fund III

March 31, 2014 (unaudited) (continued)

Industry classification of portfolio holdings as a percentage of total investments was as follows:

| | | | | | | | |

Revenue Bonds: | | | | | | | | |

Health, Hospital & Nursing Home Revenue | | | 26.6 | % | | | | |

Tobacco Settlement Funded | | | 14.0 | | | | | |

College & University Revenue | | | 9.5 | | | | | |

Electric Power & Light Revenue | | | 8.9 | | | | | |

Water Revenue | | | 3.9 | | | | | |

Lease (Abatement) | | | 2.7 | | | | | |

Highway Revenue Tolls | | | 2.7 | | | | | |

Sewer Revenue | | | 1.5 | | | | | |

Natural Gas Revenue | | | 1.2 | | | | | |

Tax Increment/Allocation Revenue | | | 1.2 | | | | | |

Port, Airport & Marina Revenue | | | 1.0 | | | | | |

Local or Guaranteed Housing | | | 0.7 | | | | | |

Hotel Occupancy Tax | | | 0.5 | | | | | |

| | | | | | | | |

Total Revenue Bonds | | | | | | | 74.4 | % |

General Obligation | | | | | | | 10.9 | |

Tax Allocation | | | | | | | 4.8 | |

U.S. Government Agency Securities | | | | | | | 4.5 | |

Certificates of Participation | | | | | | | 3.3 | |

Special Tax | | | | | | | 1.1 | |

U.S. Treasury Obligations | | | | | | | 1.0 | |

| | | | | | | | |

Total Investments | | | | | | | 100.0 | % |

| | | | | | | | |

Notes to Schedule of Investments:

| (a) | | Private Placement – Restricted as to resale and may not have a readily available market. Securities with an aggregate value of $7,284,137, representing 2.0% of total investments. | |

| (c) | | Pre-refunded bonds are collateralized by U.S. Government or other eligible securities which are held in escrow and used to pay principal and interest and retire the bonds at the earliest refunding date (payment date). | |

| (d) | | 144A–Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid. | |

| (f) | | Inverse Floater–The interest rate shown bears an inverse relationship to the interest rate on another security or the value of an index. The interest rate disclosed reflects the rate in effect on March 31, 2014. | |

| (g) | | Variable Rate Notes–Instruments whose interest rates change on specified date (such as a coupon date or interest payment date) and/or whose interest rates vary with changes in a designated base rate (such as the prime interest rate). The interest rate disclosed reflects the rate in effect on March 31, 2014. | |

| (h) | | Residual Interest Bonds held in Trust–Securities represent underlying bonds transferred to a separate securitization trust established in a tender option bond transaction in which the Fund acquired the residual interest certificates. These securities serve as collateral in a financing transaction. | |

| (i) | | Restricted. The aggregate acquisition cost of such securities is $4,192,000. The aggregate value is $5,973,837, representing 1.6% of total investments. | |

| (j) | | Rates reflect the effective yields at purchase date. | |

| (k) | | Floating Rate Notes–The weighted average daily balance of Floating Rate Notes outstanding during the six months ended March 31, 2014 was $33,633,688 at a weighted average interest rate, including fees, of 0.62%. | |

| | | | | | |

| March 31, 2014 | | | Semi-Annual Report | | | 19 | |

Schedule of Investments

PIMCO California Municipal Income Fund III

March 31, 2014 (unaudited) (continued)

| (l) | | Fair Value Measurements-See Note 1(b) in the Notes to Financial Statements. | |

| | | | | | | | | | | | | | | | |

| | | Level 1 –

Quoted

Prices | | | Level 2 –

Other Significant

Observable Inputs | | | Level 3 –

Significant

Unobservable

Inputs | | | Value at

3/31/14 | |

Investments in Securities – Assets | | | | | | | | | | | | | | | | |

California Municipal Bonds & Notes | | $ | – | | | $ | 335,353,653 | | | $ | – | | | $ | 335,353,653 | |

Other Municipal Bonds & Notes | | | – | | | | 8,856,318 | | | | – | | | | 8,856,318 | |

California Variable Rate Notes | | | – | | | | 1,310,300 | | | | – | | | | 1,310,300 | |

Short-Term Investments | | | – | | | | 19,797,477 | | | | – | | | | 19,797,477 | |

Totals | | $ | – | | | $ | 365,317,748 | | | $ | – | | | $ | 365,317,748 | |

At March 31, 2014, there were no transfers between Levels 1 and 2.

Glossary:

| | | | |

AGC | | - | | insured by Assured Guaranty Corp. |

AGM | | - | | insured by Assured Guaranty Municipal Corp. |

AMBAC | | - | | insured by American Municipal Bond Assurance Corp. |

CP | | - | | Certificates of Participation |

FGIC | | - | | insured by Financial Guaranty Insurance Co. |

FHA | | - | | insured by Federal Housing Administration |

GO | | - | | General Obligation Bond |

IBC | | - | | Insurance Bond Certificate |

NPFGC | | - | | insured by National Public Finance Guarantee Corp. |

| TCRS | | - | | Temporary Custodian Receipts |

| XLCA | | - | | insured by XL Capital Assurance |

| | | | | | |

| 20 | | Semi-Annual Report | | | March 31, 2014 | | | See accompanying Notes to Financial Statements |

Schedule of Investments

PIMCO New York Municipal Income Fund III

March 31, 2014 (unaudited)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | New York Municipal Bonds & Notes – 93.5% | | | | | | |

| | $1,000 | | | Brooklyn Arena Local Dev. Corp. Rev., Barclays Center Project, 6.375%, 7/15/43 | | | | | $1,078,110 | |

| | 1,500 | | | Chautauqua Cnty. Industrial Dev. Agcy. Rev., Dunkirk Power Project, 5.875%, 4/1/42 | | | | | 1,565,520 | |

| | 730 | | | Dutchess Cnty. Industrial Dev. Agcy. Rev., Elant Fishkill, Inc., 5.25%, 1/1/37, Ser. A | | | | | 625,391 | |

| | 1,000 | | | Erie Cnty. Industrial Dev. Agcy. Rev., 5.25%, 5/1/25, Ser. A | | | | | 1,136,350 | |

| | 4,000 | | | Hudson Yards Infrastructure Corp. Rev., 5.75%, 2/15/47, Ser. A | | | | | 4,398,840 | |

| | | | Liberty Dev. Corp. Rev., | | | | | | |

| | 2,000 | | | Bank of America Tower at One Bryant Park Project, 5.125%, 1/15/44 | | | | | 2,088,760 | |

| | 1,050 | | | Bank of America Tower at One Bryant Park Project, 6.375%, 7/15/49 | | | | | 1,132,561 | |

| | 2,400 | | | Goldman Sachs Headquarters, 5.50%, 10/1/37 | | | | | 2,704,536 | |

| | 1,500 | | | Long Island Power Auth. Rev., 5.75%, 4/1/39, Ser. A | | | | | 1,677,465 | |

| | | | Metropolitan Transportation Auth. Rev., | | | | | | |

| | 500 | | | 5.00%, 11/15/34, Ser. B | | | | | 534,765 | |

| | 2,000 | | | 5.00%, 11/15/42, Ser. C | | | | | 2,099,960 | |

| | 4,000 | | | 5.00%, 11/15/43, Ser. B | | | | | 4,196,840 | |

| | | | Monroe Cnty. Industrial Dev. Corp. Rev., | | | | | | |

| | 1,500 | | | Unity Hospital Rochester Project, 5.50%, 8/15/40 (FHA) | | | | | 1,670,025 | |

| | 1,750 | | | University of Rochester, 5.00%, 7/1/43, Ser. A | | | | | 1,864,520 | |

| | 500 | | | Nassau Cnty. Industrial Dev. Agcy. Rev., Amsterdam at Harborside, 6.70%, 1/1/43, Ser. A | | | | | 249,815 | |

| | 2,590 | | | New York City, GO, 5.00%, 8/1/31, Ser. D-1 | | | | | 2,847,006 | |

| | | | New York City Industrial Dev. Agcy. Rev., | | | | | | |

| | 600 | | | Pilot Queens Baseball Stadium, 6.50%, 1/1/46 (AGC) | | | | | 664,464 | |

| | 2,200 | | | Yankee Stadium, 7.00%, 3/1/49 (AGC) | | | | | 2,523,202 | |

| | 2,000 | | | New York City Transitional Finance Auth. Future Tax Secured Rev., 5.00%, 11/1/42 | | | | | 2,161,080 | |

| | 2,000 | | | New York City Trust for Cultural Res. Rev., 5.00%, 8/1/43, Ser. A | | | | | 2,123,900 | |

| | | | New York City Water & Sewer System Rev., Second Generation Resolutions, | | | | | | |

| | 5,000 | | | 4.75%, 6/15/35, Ser. DD (a) | | | | | 5,153,750 | |

| | 1,500 | | | 5.00%, 6/15/39, Ser. GG-1 | | | | | 1,593,585 | |

| | 2,500 | | | 5.00%, 6/15/47, Ser. BB | | | | | 2,636,875 | |

| | 2,000 | | | New York Counties Tobacco Trust II Rev., 5.75%, 6/1/43 | | | | | 1,985,840 | |

| | 4,000 | | | New York Liberty Dev. Corp. Rev., 4 World Trade Center Project, 5.75%, 11/15/51 | | | | | 4,362,280 | |

| | 400 | | | Onondaga Cnty. Rev., Syracuse Univ. Project, 5.00%, 12/1/36 | | | | | 426,964 | |

| | 600 | | | Port Auth. of New York & New Jersey Rev., JFK International Air Terminal, 6.00%, 12/1/36 | | | | | 660,684 | |

| | | | State Dormitory Auth. Rev., | | | | | | |

| | 1,225 | | | 5.00%, 5/15/26 | | | | | 1,381,481 | |

| | 2,000 | | | 5.00%, 12/15/27, Ser. A | | | | | 2,269,780 | |

| | 750 | | | 5.00%, 2/15/29, Ser. A | | | | | 841,162 | |

| | 1,000 | | | 5.00%, 3/15/38, Ser. A | | | | | 1,075,140 | |

| | 2,350 | | | 5.00%, 7/1/42, Ser. A | | | | | 2,499,930 | |

| | 250 | | | NYU Hospitals Center, 6.00%, 7/1/40, Ser. A | | | | | 276,933 | |

| | 1,200 | | | Teachers College, 5.50%, 3/1/39 | | | | | 1,262,004 | |

| | 500 | | | The New School, 5.50%, 7/1/40 | | | | | 534,495 | |

| | 750 | | | State Environmental Facs. Corp. Rev., 4.75%, 6/15/32, Ser. B | | | | | 788,558 | |

| | 1,600 | | | State Thruway Auth. Rev., 5.00%, 1/1/42, Ser. I | | | | | 1,676,224 | |

| | | | State Urban Dev. Corp. Rev., | | | | | | |

| | 2,400 | | | 5.00%, 3/15/35, Ser. B | | | | | 2,467,176 | |

| | 2,200 | | | 5.00%, 3/15/36, Ser. B-1 (a) | | | | | 2,367,398 | |

| | 2,000 | | | Triborough Bridge & Tunnel Auth. Rev., 5.25%, 11/15/34, Ser. A-2 (a) | | | | | 2,195,300 | |

| | | | | | |

| March 31, 2014 | | | Semi-Annual Report | | | 21 | |

Schedule of Investments

PIMCO New York Municipal Income Fund III

March 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | $1,400 | | | Troy Capital Res. Corp. Rev., Rensselaer Polytechnic Institute Project, 5.125%, 9/1/40, Ser. A | | | | | $1,449,000 | |

| | | | TSASC, Inc. Rev., Ser. 1, | | | | | | |

| | 2,000 | | | 5.00%, 6/1/26 | | | | | 1,811,260 | |

| | 100 | | | 5.00%, 6/1/34 | | | | | 80,208 | |

| | 500 | | | 5.125%, 6/1/42 | | | | | 382,335 | |

| | 2,000 | | | Warren & Washington Cntys. Industrial Dev. Agcy. Rev., Glens Falls Hospital Project, 5.00%, 12/1/35, Ser. A (AGM) | | | | | 2,001,380 | |

| | 600 | | | Westchester Cnty. Healthcare Corp. Rev., 6.125%, 11/1/37, Ser. C-2 | | | | | 665,760 | |

| | 100 | | | Yonkers Economic Dev. Corp. Rev., Charter School of Educational Excellence Project, 6.00%, 10/15/30, Ser. A | | | | | 102,326 | |

| | Total New York Municipal Bonds & Notes (cost-$76,787,811) | | | | | 80,290,938 | |

| | Other Municipal Bonds & Notes – 2.8% | | | | | | |

| | | | District of Columbia – 0.2% | | | | | | |

| | 175 | | | Tobacco Settlement Financing Corp. Rev., 6.50%, 5/15/33 | | | | | 193,326 | |

| | | | Ohio – 2.0% | | | | | | |

| | 1,950 | | | Buckeye Tobacco Settlement Financing Auth. Rev., 6.50%, 6/1/47, Ser. A-2 | | | | | 1,699,679 | |

| | | | U. S. Virgin Islands – 0.6% | | | | | | |

| | 500 | | | Public Finance Auth. Rev., 6.00%, 10/1/39, Ser. A | | | | | 503,710 | |

| | Total Other Municipal Bonds & Notes (cost-$2,303,018) | | | | | 2,396,715 | |

| | Short-Term Investments – 3.7% | | | | | | |

| | | | U.S. Government Agency Securities – 3.7% | | | | | | |

| | 3,200 | | | Federal Home Loan Bank Discount Notes, 0.091%, 7/18/14 (b) (cost-$3,199,136) | | | | | 3,199,136 | |

| | Total Investments (cost-$82,289,965) – 100.0% | | | | | $85,886,789 | |

Industry classification of portfolio holdings as a percentage of total investments was as follows:

| | | | | | | | |

Revenue Bonds: | | | | | | | | |

Industrial Revenue | | | 13.8 | % | | | | |

Income Tax Revenue | | | 13.0 | | | | | |

Water Revenue | | | 11.8 | | | | | |

College & University Revenue | | | 9.4 | | | | | |

Transit Revenue | | | 8.0 | | | | | |

Tobacco Settlement Funded | | | 7.2 | | | | | |

Health, Hospital & Nursing Home Revenue | | | 6.4 | | | | | |

Miscellaneous Revenue | | | 5.6 | | | | | |

Miscellaneous Taxes | | | 5.1 | | | | | |

Highway Revenue Tolls | | | 4.5 | | | | | |

Recreational Revenue | | | 4.2 | | | | | |

Electric Power & Light Revenue | | | 1.9 | | | | | |

Lease (Appropriation) | | | 1.3 | | | | | |

Port, Airport & Marina Revenue | | | 0.8 | | | | | |

| | | | | | | | |

Total Revenue Bonds | | | | | | | 93.0 | % |

U.S. Government Agency Securities | | | | | | | 3.7 | |

General Obligation | | | | | | | 3.3 | |

| | | | | | | | |

Total Investments | | | | | | | 100.0 | % |

| | | | | | | | |

| | | | |

| 22 | | Semi-Annual Report | | | March 31, 2014 |

Schedule of Investments

PIMCO New York Municipal Income Fund III

March 31, 2014 (unaudited) (continued)

Notes to Schedule of Investments:

| (a) | | Residual Interest Bonds held in Trust–Securities represent underlying bonds transferred to a separate securitization trust established in a tender option bond transaction in which the Fund acquired the residual interest certificates. These securities serve as collateral in a financing transaction. | |

| (b) | | Rates reflect the effective yields at purchase date. | |

| (c) | | Floating Rate Notes–The weighted average daily balance of Floating Rate Notes outstanding during the six months ended March 31, 2014 was $4,933,000 at a weighted average interest rate, including fees, of 0.50%. | |

| (d) | | Fair Value Measurements-See Note 1(b) in the Notes to Financial Statements. | |

| | | | | | | | | | | | | | | | |

| | | Level 1 –

Quoted

Prices | | | Level 2 –

Other Significant

Observable

Inputs | | | Level 3 –

Significant

Unobservable

Inputs | | | Value at

3/31/14 | |

Investments in Securities – Assets | | | | | | | | | | | | | | | | |

New York Municipal Bonds & Notes | | $ | – | | | | $80,290,938 | | | $ | – | | | $ | 80,290,938 | |

Other Municipal Bonds & Notes | | | – | | | | 2,396,715 | | | | – | | | | 2,396,715 | |

U.S. Government Agency Securities | | | – | | | | 3,199,136 | | | | – | | | | 3,199,136 | |

Totals | | $ | – | | | | $85,886,789 | | | $ | – | | | $ | 85,886,789 | |

At March 31, 2014, there were no transfers between Levels 1 and 2.

Glossary:

| | | | |

| AGC | | - | | insured by Assured Guaranty Corp. |

| AGM | | - | | insured by Assured Guaranty Municipal Corp. |

| FHA | | - | | insured by Federal Housing Administration |

| GO | | - | | General Obligation Bond |

| | | | | | | | |

| See accompanying Notes to Financial Statements | | | March 31, 2014 | | | Semi-Annual Report | | | 23 | |

Statements of Assets and Liabilities

PIMCO Municipal Income Funds III

March 31, 2014 (unaudited)

| | | | | | | | | | | | | | | | | | |

| | | | | Municipal III | | | | | California

Municipal III | | | | | New York

Municipal III | |

| Assets: | | | | | | | | | | | | | | | | | | |

| Investments, at value (cost-$502,116,888, $340,372,217 and $82,289,965, respectively) | | | | | $537,860,256 | | | | | | $365,317,748 | | | | | | $85,886,789 | |

| Cash | | | | | 520,780 | | | | | | 18,414 | | | | | | 147,613 | |

| Interest receivable | | | | | 8,509,501 | | | | | | 5,294,315 | | | | | | 1,112,984 | |

| Receivable for investments sold | | | | | 2,115,931 | | | | | | 35,000 | | | | | | – | |

| Prepaid expenses and other assets | | | | | 61,344 | | | | | | 41,426 | | | | | | 29,995 | |

Total Assets | | | | | 549,067,812 | | | | | | 370,706,903 | | | | | | 87,177,381 | |

| | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | |

| Payable for floating rate notes issued | | | | | 28,421,219 | | | | | | 33,633,688 | | | | | | 4,933,000 | |

| Dividends payable to common and preferred shareholders | | | | | 2,280,249 | | | | | | 1,326,090 | | | | | | 297,101 | |

| Investment management fees payable | | | | | 284,737 | | | | | | 184,472 | | | | | | 45,018 | |

| Interest payable | | | | | 51,786 | | | | | | 45,511 | | | | | | 5,647 | |

| Accrued expenses and other liabilities | | | | | 173,347 | | | | | | 210,558 | | | | | | 76,254 | |

Total Liabilities | | | | | 31,211,338 | | | | | | 35,400,319 | | | | | | 5,357,020 | |

| Preferred Shares ($0.00001 par value and $25,000 liquidation preference per share applicable to an aggregate of 7,560 , 5,000 and 1,280 shares issued and outstanding, respectively) | | | | | 189,000,000 | | | | | | 125,000,000 | | | | | | 32,000,000 | |

| Net Assets Applicable to Common Shareholders | | | | | $328,856,474 | | | | | | $210,306,584 | | | | | | $49,820,361 | |

| | | | | | |

| Composition of Net Assets Applicable to Common Shareholders: | | | | | | | | | | | | | | | | | | |

| Common Shares: | | | | | | | | | | | | | | | | | | |

Par value ($0.00001 per share) | | | | | $325 | | | | | | $221 | | | | | | $56 | |

Paid-in-capital in excess of par | | | | | 443,956,525 | | | | | | 298,527,886 | | | | | | 77,237,743 | |

| Undistributed (dividends in excess of) net investment income | | | | | (912,719) | | | | | | 6,782,926 | | | | | | 1,639,552 | |

| Accumulated net realized loss | | | | | (149,931,896) | | | | | | (119,940,070) | | | | | | (32,653,087) | |

| Net unrealized appreciation | | | | | 35,744,239 | | | | | | 24,935,621 | | | | | | 3,596,097 | |

| Net Assets Applicable to Common Shareholders | | | | | $328,856,474 | | | | | | $210,306,584 | | | | | | $49,820,361 | |

| Common Shares Issued and Outstanding | | | | | 32,538,221 | | | | | | 22,064,595 | | | | | | 5,649,573 | |

| Net Asset Value Per Common Share | | | | | $10.11 | | | | | | $9.53 | | | | | | $8.82 | |

| | | | | | |

| 24 | | Semi-Annual Report | | | March 31, 2014 | | | See accompanying Notes to Financial Statements |

Statements of Operations

PIMCO Municipal Income Funds III

Six Months ended March 31, 2014 (unaudited)

| | | | | | | | | | | | | | | | | | |

| | | | | Municipal III | | | | | California

Municipal III | | | | | New York

Municipal III | |

| Investment Income: | | | | | | | | | | | | | | | | | | |

| Interest | | | | | $14,254,362 | | | | | | $9,066,983 | | | | | | $2,009,882 | |

| | | | | | |

| Expenses: | | | | | | | | | | | | | | | | | | |

| Investment management | | | | | 1,630,130 | | | | | | 1,059,677 | | | | | | 260,102 | |

| Auction agent and commissions | | | | | 154,253 | | | | | | 99,871 | | | | | | 26,488 | |

| Interest | | | | | 90,508 | | | | | | 105,912 | | | | | | 12,411 | |

| Custodian and accounting agent | | | | | 57,483 | | | | | | 42,445 | | | | | | 26,152 | |

| Audit and tax services | | | | | 33,403 | | | | | | 31,827 | | | | | | 33,148 | |

| Shareholder communications | | | | | 22,071 | | | | | | 15,333 | | | | | | 13,798 | |

| Trustees | | | | | 15,625 | | | | | | 8,918 | | | | | | 2,116 | |

| New York Stock Exchange listing | | | | | 15,122 | | | | | | 12,525 | | | | | | 12,415 | |

| Transfer agent | | | | | 12,934 | | | | | | 12,517 | | | | | | 12,606 | |

| Insurance | | | | | 9,949 | | | | | | 7,580 | | | | | | 4,305 | |

| Legal | | | | | 6,986 | | | | | | 4,896 | | | | | | 2,743 | |

| Miscellaneous | | | | | 5,640 | | | | | | 6,041 | | | | | | 5,132 | |

Total Expenses | | | | | 2,054,104 | | | | | | 1,407,542 | | | | | | 411,416 | |

| | | | | | |

| Net Investment Income | | | | | 12,200,258 | | | | | | 7,659,441 | | | | | | 1,598,466 | |

| | | | | | |

| Realized and Change in Unrealized Gain (Loss): | | | | | | | | | | | | | | | | | | |

| Net realized gain (loss) on Investments | | | | | (1,203,160) | | | | | | (1,941,203) | | | | | | 255,484 | |

| Net change in unrealized appreciation/depreciation of investments | | | | | 19,903,527 | | | | | | 12,065,486 | | | | | | 1,698,398 | |

| Net realized and change in unrealized gain | | | | | 18,700,367 | | | | | | 10,124,283 | | | | | | 1,953,882 | |

| Net Increase in Net Assets Resulting from Investment Operations | | | | | 30,900,625 | | | | | | 17,783,724 | | | | | | 3,552,348 | |

| Dividends on Preferred Shares from Net Investment Income | | | | | (98,600) | | | | | | (68,250) | | | | | | (17,510) | |

| Net Increase in Net Assets Applicable to Common Shareholders Resulting from Investment Operations | | | | | $30,802,025 | | | | | | $17,715,474 | | | | | | $3,534,838 | |

| | | | | | | | |

| See accompanying Notes to Financial Statements | | | March 31, 2014 | | | Semi-Annual Report | | | 25 | |

Statements of Changes in Net Assets Applicable to Common Shareholders

PIMCO Municipal Income Funds III

| | | | | | | | | | | | |

| | |

| | | | | Municipal III | |

| | | | | Six Months ended

March 31, 2014

(unaudited) | | | | | Year ended

September 30, 2013 | |

| Investment Operations: | | | | | | | | | | | | |

| Net investment income | | | | | $12,200,258 | | | | | | $24,445,921 | |

| Net realized gain (loss) | | | | | (1,203,160) | | | | | | (2,430,181) | |

| Net change in unrealized appreciation/depreciation | | | | | 19,903,527 | | | | | | (41,293,409) | |

| Net increase (decrease) in net assets resulting from investment operations | | | | | 30,900,625 | | | | | | (19,277,669) | |

| | | | |

| Dividends on Preferred Shares from Net Investment Income | | | | | (98,600) | | | | | | (374,516) | |

| Net increase (decrease) in net assets applicable to common shareholders resulting from investment operations | | | | | 30,802,025 | | | | | | (19,652,185) | |

| | | | |

| Dividends to Common Shareholders from Net Investment Income | | | | | (13,657,893) | | | | | | (27,255,960) | |

| | | | |

| Common Share Transactions: | | | | | | | | | | | | |

| Reinvestment of dividends | | | | | 481,484 | | | | | | 1,000,063 | |

| Total increase (decrease) in net assets applicable to common shareholders | | | | | 17,625,616 | | | | | | (45,908,082) | |

| | | | |

| Net Assets Applicable to Common Shareholders: | | | | | | | | | | | | |

| Beginning of period | | | | | 311,230,858 | | | | | | 357,138,940 | |

| End of period* | | | | | $328,856,474 | | | | | | $311,230,858 | |

| *Including undistributed (dividends in excess of) net investment income of: | | | | | $(912,719) | | | | | | $643,516 | |

| | | | |

| Common Shares Issued in Reinvestment of Dividends | | | | | 48,552 | | | | | | 87,544 | |

| | | | | | |

| 26 | | Semi-Annual Report | | | March 31, 2014 | | | See accompanying Notes to Financial Statements |

Statements of Changes in Net Assets Applicable to Common Shareholders

PIMCO Municipal Income Funds III (continued)

| | | | | | | | | | | | | | | | | | |

| | |

| California Municipal III | | | | | New York Municipal III | |

Six Months ended

March 31, 2014

(unaudited) | | | | Year ended

September 30, 2013 | | | | | Six Months ended

March 31, 2014

(unaudited) | | | | | Year ended

September 30, 2013 | |

| | | | | | | | | | | | | | | | | | | |

| $7,659,441 | | | | | $17,355,517 | | | | | | $1,598,466 | | | | | | $3,522,334 | |

| (1,941,203) | | | | | 2,591,445 | | | | | | 255,484 | | | | | | 374,422 | |

| 12,065,486 | | | | | (29,056,661) | | | | | | 1,698,398 | | | | | | (6,714,820) | |

17,783,724 | | | | | (9,109,699) | | | | | | 3,552,348 | | | | | | (2,818,064) | |

(68,250) | | | | | (254,596) | | | | | | (17,510) | | | | | | (66,172) | |

17,715,474 | | | | | (9,364,295) | | | | | | 3,534,838 | | | | | | (2,884,236) | |

| | | | | | | |

| (7,939,449) | | | | | (15,836,250) | | | | | | (1,778,668) | | | | | | (3,551,504) | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 285,094 | | | | | 849,920 | | | | | | 57,088 | | | | | | 115,740 | |

10,061,119 | | | | | (24,350,625) | | | | | | 1,813,258 | | | | | | (6,320,000) | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 200,245,465 | | | | | 224,596,090 | | | | | | 48,007,103 | | | | | | 54,327,103 | |

| $210,306,584 | | | | | $200,245,465 | | | | | | $49,820,361 | | | | | | $48,007,103 | |

$6,782,926 | | | | | $7,131,184 | | | | | | $1,639,552 | | | | | | $1,837,264 | |

| | | | | | | |

| 31,161 | | | | | 82,306 | | | | | | 6,620 | | | | | | 11,968 | |

| | | | | | | | |

| See accompanying Notes to Financial Statements | | | March 31, 2014 | | | Semi-Annual Report | | | 27 | |

Notes to Financial Statements

PIMCO Municipal Income Funds III

March 31, 2014 (unaudited)

1. Organization and Significant Accounting Policies