UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant

Filed by a Party other than the Registrant

Check the appropriate box:

| | Preliminary Proxy Statement |

| | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | Definitive Proxy Statement |

| | Definitive Additional Materials |

| | Soliciting Material Pursuant to Rule 14a-12 |

Sky Petroleum, Inc.

(Name of Registrant as Specified In Its Charter)

______________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | No fee required |

| | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | Fee paid previously with preliminary materials. |

| | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

SKY PETROLEUM, INC.

401 Congress Avenue, Suite 1540, Austin, Texas 78701

Notice of Annual Meeting of Stockholders

To all Stockholders of Sky Petroleum, Inc:

You are invited to attend the 2006 Annual Meeting of Sky Petroleum, Inc. (the “Company”). The Annual Meeting will be held at Jumeirah Essex House, 160 Central Park South, New York, New York, 10019, beginning June 26, 2006 at 4:00 p.m., EST. The purposes of the meeting are:

| | 1. | | The election of the Nominees to the Company’s Board to serve until the Company’s 2007 Annual Meeting of Stockholders or until successors are duly elected and qualified; |

| | 2. | | To ratify the amendment of the Company’s bylaws to allow for an increase in the number of the Company’s Directors (the “Board Size Amendment”); |

| | 3. | | To ratify the Non-U.S. Stock Option Plan, the 2005 U.S. Stock Incentive Plan, as amended by the Board, and other stock option agreements (collectively, “Plans”); and |

| | 4. | | Any other business that may properly come before the meeting. |

The Board of Directors has fixed May 8, 2006, as the record date for the Annual Meeting. Only stockholders of the Company of record at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting. A list of stockholders as of May 8, 2006, will be available at the Annual Meeting for inspection by any stockholder.

Stockholders will need to register at the meeting to attend the meeting. If your shares are not registered in your name, you will need to bring proof of your ownership of those shares to the meeting in order to register. You should ask the broker, bank or other institution that holds your shares to provide you with either a copy of an account statement or a letter that shows your ownership of Sky Petroleum, Inc. Stock as of May 8, 2006. Please bring that documentation to the meeting to register.

IMPORTANT

Whether or not you expect to attend the Annual Meeting, please sign and return the enclosed proxy promptly. If you decide to attend the meeting, you may, if you wish, revoke the proxy and vote your shares in person.

By Order of the Board of Directors,

Michael Noonan, Secretary

Austin, TX

May 31, 2006

SKY PETROLEUM, INC.

401 CONGRESS AVENUE, SUITE 1540 • AUSTIN, TEXAS 78701

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 26, 2006

_________________

Unless the context requires otherwise, references in this statement to “Sky Petroleum,” the “Company,” “we,” “us,” or “our” refer to Sky Petroleum, Inc.

The Annual Meeting of Stockholders of Sky Petroleum will be held on Monday, June 26, 2006 at Jumeirah Essex House, 160 Central Park South, New York, New York 10019, beginning at 4:00 p.m., EST. We are providing the enclosed proxy materials and form of proxy in connection with the solicitation by the Company’s Board of Directors (the “Board”) of proxies for this Annual Meeting. The Company anticipates that this Proxy Statement and the form of proxy will first be mailed to holders of the Company’s Stock on or about June 5, 2006.

You are invited to attend the meeting at the above stated time and location. If you plan to attend and your shares are held in “street name” – in an account with a bank, broker, or other nominee- you must obtain a proxy issued in your name from such broker, bank or other nominee.

You can vote your shares by completing and returning the proxy card or, if you hold shares in “street name,” by completing the voting form provided by the broker, bank or other nominee.A returned signed proxy card without an indication of how shares should be voted will be voted FOR the election of Directors, FOR the ratification of the Board Size Amendment, and FOR the ratification of the Plans.

Our corporate bylaws define a quorum as one-third (1/3) of the voting power of the issued and outstanding voting stock present in person or by proxy. They do not allow cumulative voting for Directors. The nominees who receive the most votes will be elected. A simple majority of the shares present, whether in person or by proxy, is required to ratify the Board Size Amendment and the Plans.

1

QUESTIONS AND ANSWERS ABOUT PROXY MATERIALS AND VOTING

Why am I receiving this Proxy Statement and proxy card?

You are receiving this Proxy Statement and proxy card because you were a stockholder of record at the close of business May 8, 2006, and are entitled to vote at the Annual Meeting. This Proxy Statement describes issues on which the Company would like you, as a stockholder, to vote. It provides information on these issues so that you can make an informed decision. You do not need to attend the Annual Meeting to vote your shares.

When you sign the proxy card you appoint Brent D. Kinney, Chief Executive Officer of Sky Petroleum and a member of the Board, Daniel F. Meyer, a member of the Board, and Michael Noonan, Secretary and Vice President of Corporate for Sky Petroleum and a member of the Board, your representatives at the meeting. As your representatives, they will vote your shares at the meeting (or any adjournments or postponements) as you have instructed them on the proxy card. With proxy voting, your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the meeting, it is a good idea to complete, sign and return your proxy card in advance of the meeting, just in case your plans change.

If an issue comes up for vote at the meeting (or any adjournments or postponements) that is not described in this Proxy Statement, your representatives will vote your shares, under your proxy, at their discretion, subject to any limitations imposed by law.

When is the record date?

The Board of Directors has fixed May 8, 2006, as the record date for the Annual Meeting. Only holders of Sky Petroleum Stock as of the close of business on that date will be entitled to vote at the Annual Meeting.

How many shares are outstanding?

As of May 8, 2006, the Company had 46,571,485 shares of Common Stock issued and outstanding. As of May 8, 2006, the Company had 3,055,556 shares of Preferred Stock issued and outstanding (Preferred Stock will be voted on a as converted basis of four (4) to one (1), equaling 12,222,224 shares of Common Stock).

What am I voting on?

You are being asked to vote on the following:

| | • | | The election of seven (7) directors for terms expiring in 2007; |

| | • | | The ratification of the Board Size Amendment; |

| | • | | The ratification of the Plans, as amended; and |

| | • | | Any other business that may properly come before the meeting. |

Each share of Common Stock is entitled to one vote. Preferred Stock will vote on an as converted basis of four (4) to one (1). No cumulative rights are authorized, and dissenters’ rights are not applicable to any of the matters being voted upon.

2

The Board recommends a voteFOReach of the nominees to the Board andFORthe ratification of the Board Size Amendment andFORthe ratification of the Plans, as amended.

How do I vote?

You have two voting options. You may vote by:

| | • | | Signing your proxy card and mailing it in the enclosed, prepaid and addressed envelope; |

| | • | | Attending the Annual Meeting and voting in person. |

If your shares are held in an account with a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in a “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy card from your broker, bank, or other nominee.

Can stockholders vote in person at the Annual Meeting?

The Company will pass out written ballots to anyone who wants to vote at the meeting. If you hold your shares through a brokerage account but do not have a physical share certificate, or the shares are registered in someone else’s name, you must request a legal proxy from your stockbroker or the registered owner to vote at the meeting.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, it likely means that you have multiple accounts with the transfer agent and/or with stockbrokers. Please vote all of the shares.

What if I share an address with another shareholder and we received only one copy of the proxy materials?

If certain requirements are met under relevant U.S. securities law, including in some circumstances the shareholder’s prior written consent, we are permitted to deliver one annual report and one proxy statement to a group of shareholders who share the same address. If you share an address with another shareholder and have received only one copy of the proxy materials, but desire another copy, please send written request to our offices at the address below or call us at (512) 687-3427 to request another copy of the proxy materials. Please note that each shareholder should receive a separate proxy card to vote the shares they own.

| Send requests to: |

Sky Petroleum, Inc.

401 Congress Avenue, Suite 1540

Austin, Texas 78701

Attention: Secretary |

3

What if I change my mind after I return my proxy?

You may revoke your proxy and change your vote at any time before the polls close at the Annual Meeting. You may do this by:

| | • | | Signing another proxy with a later date and mailing it to the Company’s Inspector of Elections, Michael Noonan, so long as it is received prior to 12:00 p.m., MST, on June 23, 2006; |

| | • | | Voting in person at the Annual Meeting; or |

| | • | | Giving written notice to the Company’s Secretary, Michael Noonan, prior to 12:00 p.m., MST on June 23, 2006. |

How many votes do you need to hold the meeting?

To conduct the Annual Meeting, the Company must have a quorum, which means that one-third (1/3) of outstanding voting shares of the Company as of the record date must be present at the meeting. Your shares will be counted as present at the Annual Meeting if you:

| | • | | Submit a properly executed proxy card (even if you do not provide voting instructions); or |

| | • | | Attend the Annual Meeting and vote in person. |

What if I abstain from voting?

Abstentions with respect to a proposal are counted for purposes of establishing a quorum. If a quorum is present, abstentions will not be included in vote totals and will not affect the outcome of the vote of any proposal contained in this year’s Proxy Statement.

How many votes are needed to elect directors?

The nominees for election as directors at the 2006 Annual Meeting will be elected by a plurality of the votes cast at the meeting. This means that since stockholders will be electing seven (7) directors, the seven nominees receiving the highest number of votes will be elected.

A properly executed proxy card marked “Withheld” with respect to the election of directors will not be voted and will not countFORorAGAINSTany of the nominees.

How many votes are needed to ratify the Board Size Amendment?

The ratification of the Board Size Amendment will be approved if the votes castFORthe proposal exceed the votes castAGAINSTthe proposal (a majority of shares voting). A properly executed proxy card marked “Abstain” with respect to this proposal will not be voted and will not countFORorAGAINSTthis proposal.

How many votes are needed to ratify the Plans, as amended by the Board, and other stock option agreements?

The ratification of the Plans, as amended by the Board, and other stock option agreements, will be approved if the votes castFORthe proposal exceed the votes castAGAINSTthe proposal (a majority of shares voting). A properly executed proxy card marked “Abstain” with respect to this proposal will not be voted and will not countFORorAGAINSTthis proposal.

4

Will my shares be voted if I do not sign and return my Proxy Card?

If your shares are held through a brokerage account, your brokerage firm, under certain circumstances, may vote your shares.

If your shares are registered in your name, and you do not sign and return your proxy card, your shares will not be voted at the meeting.

How are votes counted?

Your shares will be voted as you indicate. If you just sign your proxy card with no further instructions, your shares will be voted:

| | • | | FOReach director nominee for terms expiring in 2007; |

| | • | | FORthe ratification of the Board Size Amendment; and |

| | • | | FOR the ratification of the Plans, as amended. |

Voting results will be tabulated and certified by the Inspector of Elections, Michael Noonan.

Where can I find the voting results of the meeting?

The Company will publish the final results in the Company’s Quarterly Report on Form 10-Q for the second quarter of 2006, which will be filed with the Securities and Exchange Commission (SEC). The Company will file a current report on Form 8-K if the shareholders ratify the Board Size Amendment within four (4) business days of the Annual Meeting.

Who will pay for the costs of soliciting proxies?

The Company will bear the cost of soliciting proxies. In an effort to have as large a representation at the meeting as possible, the Company’s directors, officers and employees may solicit proxies by telephone or in person in certain circumstances. These individuals will receive no additional compensation for their services other than their regular salaries. Upon request, the Company will reimburse brokers, dealers, banks, voting trustees and their nominees who are holders of record of the Company’s Common Stock on the record date for the reasonable expenses incurred for mailing copies of the proxy materials to the beneficial owners of such shares.

When are stockholder proposals due for the 2007 annual meeting of Stockholders?

In order to be considered for inclusion in next year’s (2007) proxy statement, stockholder proposals must be submitted in writing to the Company’s Secretary, Michael Noonan, at Sky Petroleum, Inc., 401 Congress Avenue, Suite 1540, Austin, Texas 78701 and received no later than January 27, 2007. Similarly, stockholder proposals not submitted for inclusion in the proxy statement and received after April 21, 2007 will be considered untimely pursuant to Rule 14a-5(e)(2) of the Securities and Exchange Act of 1934.

5

How can I obtain a copy of the 2005 Annual Report on Form 10-KSB?

The Company’s 2005 Annual Report on Form 10-KSB, including financial statements is available through the SEC’s website athttp://www.sec.gov.

At the written request of any stockholder who owns Common Stock on the record date, the Company will provide to such stockholder, without charge, a paper copy of the Company’s 2005 Annual Report on Form 10-KSB as filed with the SEC, including the financial statements and financial statement schedules but not including exhibits.If requested, the Company will provide copies of the exhibits for a reasonable fee. Requests for additional paper copies of the 2005 Annual Report on Form 10-KSB should be mailed to:

| | Sky Petroleum, Inc.

401 Congress Avenue, Suite 1540

Austin, Texas 78701

Attention: Secretary |

What materials accompany this proxy statement?

The following materials accompany this proxy statement:

| | 2. | | The Company's Annual Report to Shareholders for the year ended December 31, 2005; |

| | 3. | | A copy of the Charters for the Audit, Nominating, and Compensation Committees; |

| | 4. | | A copy of the Company's Code of Ethics; |

| | 5. | | A copy of the 2005 U.S. Stock Incentive Plan and a copy of the Non-U.S. Stock Option Plan. |

| | 6. | | A copy of the Stock Agreement with Donald C. Cameron and the Stock Agreement with Ian Baron. |

6

PROPOSAL 1 — ELECTION OF DIRECTORS

GENERAL QUESTIONS

What is the current composition of the Board?

The Company’s current bylaws require the Board of Directors to have at least one (1) and no more than seven (7) Directors. The current Board is composed of seven (7) Directors.

NOTE: Please read proposal two (2) in this Proxy Statement, which discusses the Board’s recent adoption of an amendment to the bylaws allowing for a minimum of two (2) and more than seven (7) Directors, and which must be ratified by shareholders at the 2006 Annual Meeting to become effective.

Is the Board divided into classes? How long is the term?

No, the Board is not divided into classes. All directors serve one year terms until their successors are elected and qualified at the next Annual Meeting.

Who is standing for election this year?

The Board of Directors has nominated the following seven (7) current Board Members for election at the 2006 Annual Meeting, to hold office until the 2007 Annual Meeting:

What if a nominee is unable or unwilling to serve?

Should any one or more of these nominees become unable or unwilling to serve, which is not anticipated, the Board of Directors may designate substitute nominees, in which event the proxy representatives will vote proxies that otherwise would be voted for the named nominees for the election of such substitute nominee or nominees.

How are nominees elected?

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the meeting.

The Board of Directors recommends a vote FOR each of the nominees.

7

INFORMATION ON THE BOARD OF DIRECTORS, EXECUTIVE OFFICERS, AND KEY EMPLOYEES

The following table sets forth certain information with respect to our current Directors and executive officers. The term for each Director expires at our next annual meeting or until his or her successor is appointed and qualified. The ages of the Directors and officers are shown as of December 31, 2005.

| Name | Position | Director/Officer

Since | Age |

|---|

|

| Brent D. Kinney(1) | | Chief Executive Officer, Director

and Principal Executive Officer | | November 1, 2005 | | 63 | |

| |

| Daniel F. Meyer(2) | | Director | | December 20, 2004 | | 51 | |

| |

| Michael D. Noonan(3) | | Vice President, Corporate, Secretary, Director | | August 25, 2005 | | 47 | |

| |

| Karim Jobanputra | | Director | | November 2, 2005 | | 41 | |

| |

| Ian R. Baron | | Director | | November 16, 2005 | | 49 | |

| |

| Peter J. Cockcroft | | Director | | November 16, 2005 | | 56 | |

| |

| Nigel McCue(4) | | Director | | May 25. 2006 | | 54 | |

| |

| Shafiq Ur Rahman(5) | | Manager of Finance and Administration,

Principal Financial and Accounting Officer | | May 25, 2006 | | 56 | |

| | (1) | | Mr. Kinney was appointed Chief Executive Officer on November 1, 2005, and appointed as director on November 16, 2005. |

| | (2) | | Mr. Meyer was formerly President, Secretary, and Treasurer of the Company; he resigned these positions effective on or about May 30, 2006. |

| | (3) | | Mr. Noonan was appointed as Director on November 16, 2005. Mr. Noonan was appointed Secretary effective on or about May 30, 2006. |

| | (4) | | Mr. McCue was appointed as Director on or about May 30, 2006. |

| | (5) | | Mr. Rahman was appointed Manager of Finance and Administration on or about May 29, 2006. |

Brent D. Kinney — Chief Executive Officer and Director. Mr. Kinney, age 63, holds a BA in Geology and a LLM degree from the University of Manitoba, Canada. Mr. Kinney was a partner with one of Calgary Alberta’s leading energy law firms until 1991 when he moved to Doha, Qatar to advise the Minister of Energy on petroleum matters. On leaving Qatar, Mr. Kinney joined a law firm based in London to work at its Hong Kong office and advised the firms clients on energy matters. From 1997 to 2000, he worked for the firm’s office in Dubai. In 2000, he managed a joint venture with Renaissance Energy Ltd., a Canadian based energy and petroleum company, to pursue opportunities on energy and petroleum matters in Iran. This joint venture was dissolved in 2001, and since that time, Mr. Kinney has worked in Dubai as an independent consultant advising governments and international oil companies. Mr. Kinney sits on the boards of directors of four companies, Husky Energy, Inc., Dragon Oil plc, Western Silver Corporation and Benchmark Energy Corp.

Michael D. Noonan — Vice President, Corporate, Secretary. and Director. Michael D. Noonan, age 47, has been the Company’s Vice President, Corporate since August 25, 2005. Mr. Noonan has more than 15 years of investor relations, corporate finance and corporate governance experience. Prior to joining the Company, Mr. Noonan worked for Forgent Networks since May, 2002 where he most recently served as the Senior Director of Investor Relations. Prior to working at Forgent, Mr. Noonan was employed for two years by Pierpont Communications, an

8

investor and public relations firm, where he was a Senior Vice President. Mr. Noonan has also served as director of investor relations and corporate communications at Integrated Electrical Services, a electrical services company, and manager of investor relations and public affairs for Sterling Chemicals, a manufacturer of commodity chemicals. He received a Master of Business Administration degree from Athabasca University in Alberta, Canada; a Bachelor of Arts degree in Business Administration and Economics from Simon Fraser University in British Columbia, Canada; and an Executive Juris Doctorate from Concord School of Law in Los Angeles, California.

Daniel F. Meyer — Director. Daniel F. Meyer, age 51, was the Company’s President, Secretary and Treasurer and a director since December 20, 2004. In April, 2006, Mr. Meyer resigned as the Company’s President and Secretary, but remains a member of the Board. From November 2003 to the present, Mr. Meyer was self-employed as a financial consultant. From April 2003 to November 2003, Mr. Meyer was Vice President of Operations for Canada’s Choice at Home’n Officer Inc., a division of Canada’s Choice Spring Water Co. Mr. Meyer was responsible for all operations, marketing and client relationship management for Northern Alberta. From 1994 to 2003, Mr. Meyer was president and principle shareholder of Canyon Springs Water Co. Ltd., a private Alberta bottled water company. Mr. Meyer was responsible for overseeing all aspects of the business, including client relations, marketing, strategic planning, transportation and financial and business development. Under Mr. Meyer’s management, Canyon Springs grew to be one of the largest bottled water companies in Alberta, packaging both wholesale and retail water products for distribution to home, office, major grocery chains and other major distribution plants such as Dairyland Alberta. Canyon Springs had offices in Edmonton and Calgary. The company was purchased by Canada’s Choice in 2003.

Karim Jobanputra — Director. Mr. Jobanputra, age 41, is an entrepreneur and owns companies that do business mostly in the Middle East and Europe. Mr. Jobanputra has experience in the areas of corporate finance and international business development, and also works as a self-employed consultant based in the United Kingdom. For the past 5 years he has provided consulting services to companies in the areas of corporate finance and business development in the Asian and Middle East markets, including Indonesia, Qatar, Saudi Arabia, India and China. Karim Jobanputra has been a director of O2 Diesel Corp. since July 15,2003. Mr. Jobanputra was nominated as a director by Sheikh Hamad Bin Jassim Bin Jabr al-Thani, the holder of 3,055,556 shares of Series A Preferred Stock purchased on September 20, 2005. Under the terms of the certificate of designation of rights and preferences of the Series A Preferred Stock, holders of the Series A Preferred Stock are entitled to elect one director to our board of directors. See, “Right to Appoint Directors,” below.

Ian R. Baron — Director. Mr. Baron, age 49, is the founding partner of Energy Services Group Dubai, since February 2002. Mr. Baron is a graduate of Manchester University with a degree in geology. He has served as exploration director of Meridian Oil & Petrogulf Resources, Australia; Vice-President Conoco Middle East Ltd.; and CEO Dragon Oil plc (August 1999-February 2002); COO Aurado Energy Inc., Canada. He currently serves as non-executive director of Forum Energy plc, UK; executive director Drakeley Ltd. BVI.

Peter J. Cockcroft — Director. Mr. Cockcroft, age 56, is a geologist (University of Sydney) and consultant. Mr. Cockcroft has graduate business qualifications, he has recently been honored as a 2004 — 2005 Distinguished Lecturer for the Society of Petroleum Engineers on the topic of International Risk Management. Permanent Resident of Singapore, he was recently appointed as a Research Fellow at the Institute of South East Asian Studies (a Singapore “thinktank”) where he is writing a book on Asian Energy Investment. Mr. Cockcroft is a Life Fellow of the Royal

9

Geographical Society, a Life Member of the Society of Petroleum Engineers, as well as also a non-executive Director of Baraka Petroleum Ltd. and Australian Oil Company Pty. Ltd.

Nigel R. McCue — Director. Mr. McCue, aged 54, has thirty years experience in the upstream sector of the petroleum industry. He is a Director and Chief Executive Officer of Nemmoco Petroleum Limited, a private exploration and production company with interests located principally in Central and Eastern Europe. Prior to this he was a director and Chief Financial Officer of Lundin Oil Plc., a company with interests in over twenty countries with specific experience in mergers & acquisition, equity, corporate and project debt finance, and stock exchange listings. Prior to this, he held various positions with Chevron Overseas Inc. and Gulf Oil Corporation. Mr. McCue is a Non-Executive Director of Dragon Oil Plc and is chairman of its audit committee and a member of the remuneration and nomination committees. He is also a Director of Proprietary Industries Inc. a company listed on the Toronto Stock Exchange.

Shafiq Ur Rahman — Manager of Finance and Administration. Shafiq Ur Rahman, age 56, is the company’s Manager of Finance and Administration. Mr. Rahman has more than 30 years experience in the oil and gas industry. Prior to joining the company he served as Chief Accountant and Director of Finance and Administration for several companies, including Huston Oil and Minerals, Tenneco Oil, Lundin Oil (formerly International Petroleum Inc.), Arabex Petroleum, and Coplex Resources. Mr. Rahman global experience includes working in various countries in the Middle East, North and West Africa, and Asia. Mr. Rahman has a Bachelors in Commerce degree from Karachi University.

Family Relationships

None of our Directors are related by blood, marriage, or adoption to any other Director, executive officer, or other key employees. To our knowledge, there are no arrangement or understanding between any of our officers and any other person, including Directors, pursuant to which the officer was selected to serve as an officer.

10

CORPORATE GOVERNANCE

BOARD OF DIRECTORS STRUCTURE

General Structure

The Company’s current bylaws require the Board of Directors to have at least one (1) and no more than seven (7) Directors. The current Board is composed of seven (7) Directors.

NOTE: Please read proposal two (2) in this Proxy Statement, which discusses the Board’s recent adoption of an amendment to the bylaws allowing for a minimum of two (2) and more than seven (7) Directors, and which must be ratified by shareholders at this annual meeting to become effective.

Right to Appoint Directors

On September 20, 2005, we entered into an agreement with Sheikh Hamad Bin Jassen Bin Jaber Al Thani, wherein the Sheikh purchased 3,055,556 shares of our Series A Preferred Stock, representing all the authorized shares of Series A Preferred Stock. The holders of the Series A Preferred Stock are entitled to elect one Director to our Board of Directors. The Sheikh exercised this right to appoint Karim Jobanputra as a Director. After purchasing the Series A Preferred stock, the Sheikh holds 15,296,424 shares of our common stock assuming conversion of the Series A Preferred stock on a 4 for 1 basis, consisting of 12,222,224 shares of Common Stock issuable upon conversion of the Series A Preferred Stock and 3,074,200 shares of Common Stock.

MEETINGS OF THE BOARD AND BOARD MEMBER ATTENDANCE

OF ANNUAL MEETING

During the fiscal year ending December 31, 2005, the Board held one meeting of the Board. None of the incumbent Directors attended fewer than 75% of the Board meetings.

Board members are not required to attend the annual meeting. All members of the Board, as of the last annual meeting, attended the last annual meeting.

COMMUNICATIONS TO THE BOARD

Shareholders who are interested in communicating directly with members of the Board, or the Board as a group, may do so by writing directly to the individual Board member c/o Secretary, Michael Noonan, Sky Petroleum, Inc., 401 Congress Avenue, Suite 1540, Austin, Texas 78701. The Company’s Secretary will forward communications directly to the appropriate Board member. If the correspondence is not addressed to the particular member, the communication will be forwarded to a Board member to bring to the attention of the Board. The Company’s Secretary will review all communications before forwarding them to the appropriate Board member.

11

BOARD COMMITTEES

Audit Committee and Audit Committee Financial Expert

We do not have an Audit Committee. Our Board performs the functions of an Audit Committee, including engaging a firm of independent certified public accountants to audit the annual financial statements; reviewing the independent auditors independence, the financial statements and their audit report; and reviewing management’s administration of the system of internal accounting controls. Karim Jobanputra, Peter J. Cockcroft, and Nigel McCue would qualify as independent Directors for audit committee purposes under rules of the American Stock Exchange.

Nigel McCue qualifies as a financial expert, and if elected and appointed, will be the Audit Committee Financial Expert.

The Board recently adopted a charter for the Audit Committee. No Directors have been selected for the committee. The Board plans to select members for the Audit Committee following the Annual Meeting. The Audit Committee charter accompanies this proxy statement as Appendix B.

Report of Our Board of Directors on Audited Financial Statements

Our Board of Directors reviewed and discussed the audited financial statements with management. Our Board of Directors discussed with our independent auditors the matters required to be discussed by SAS 61 and has received written disclosure and a letter from our independent auditor required by Independence Standards Board Standard No. 1. Based on the review and discussions, our Board recommended that the audited financial statements be included in the annual report on Form 10-KSB for the year ended December 31, 2005.

Board Members

Brent D. Kinney

Michael D. Noonan

Daniel F. Meyer

Karim Jobanputra

Ian R. Baron

Peter J. Cockcroft

Nominating Committee

We do not have a Nominating Committee. Our Board currently performs the functions associated with a Nominating Committee. The Board has adopted a charter for a Nominating Committee. No Directors have been selected to serve on the committee. The Board plans on selecting Directors to the Nominating Committee following the Annual Meeting. The Nominating Committee charter accompanies this proxy statement as Appendix C.

The current nominees were recommended and selected by the Board. The Board has not adopted a policy with regard to the consideration of nominees. The Board plans on the Nominating Committee adopting such policies and guidelines following the selection of Directors to the Nominating Committee.

12

Compensation Committee

We do not have a Compensation Committee. Our Board currently performs the functions associated with a Compensation Committee. We have adopted a charter for a Compensation Committee. No Directors have been selected to serve on the committee. The Board plans on selecting Directors to the Compensation Committee following the Annual Meeting. The charter for the compensation committee accompanies this proxy statement as Appendix D.

Prior to July 26, 2005, we did not compensate our Chief Executive Officer or any of our officers or Directors. The compensation of Donald Cameron, our former Chief Executive Officer, was determined through negotiation between Mr. Cameron and our Board.

On November 1, 2005, we entered into an employment agreement with Brent Kinney as our new Chief Executive Officer. Mr. Kinney’s compensation was determined through negotiation between Mr. Kinney and our Board.

DIRECTOR COMPENSATION

On January 11, 2006, our Board approved a compensation plan, effective November 16, 2005, pursuant to which each Director would receive the following compensation:

| | • | | Annual Director fees of $30,000 per year, payable quarterly in arrears; |

| | • | | Director compensation options consisting of 200,000 options exercisable to acquire shares of common stock at $1.00 per share for non-U.S. Directors and at fair market value on the date of grant for U.S. directors; |

| | • | | Meeting fees of $1,200 per meeting, including committee meetings; and |

| | • | | Reimbursement of expenses related to service in the capacity of a member of the Board. |

13

OTHER GOVERNANCE MATTERS

Code of Ethics

A code of ethics relates to written standards that are reasonably designed to deter wrongdoing and to promote:

| | 1. | | Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| | 2. | | Full, fair, accurate, timely and understandable disclosure in reports and documents that are filed with, or submitted to, the Commission and in other public communications made by an issuer; |

| | 3. | | Compliance with applicable governmental laws, rules and regulations; |

| | 4. | | The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and |

| | 5. | | Accountability for adherence to the code. |

The Board has adopted a Code of Ethics. The Code of Ethics accompanies this proxy statement as Appendix E.

Compensation Interlocks and Insider Participation

There were no compensation committee or board interlocks among the members of our Board.

Legal Proceedings

Neither we nor any of our property are currently subject to any material legal proceedings or other regulatory proceedings. We do not currently know of any legal proceedings against us involving our Directors, executive officers, or stockholders of more than 5% of our voting stock.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities and Exchange Act of 1934 requires any person who is our Director or executive officer or who beneficially holds more than 10% of any class of our securities which have been registered with the Securities and Exchange Commission, to file reports of initial ownership and changes in ownership with the Securities and Exchange Commission. These persons are also required under the regulations of the Securities and Exchange Commission to furnish us with copies of all Section 16(a) reports they file.

To our knowledge, based solely on our review of the copies of the Section 16(a) reports furnished to us, all Section 16(a) filing requirements applicable to our Directors, executive officers and holders of more than 10% of any class of our registered securities were timely complied with during the year ended December 31, 2005, except:

14

|

| Name | Reporting Person | Form 3/# of

transactions | Form 4/# of

transactions | Form 5/# of

transactions |

|---|

|

| Brent D. Kinney | | Chief Executive Officer,

Director and

Principal Executive Officer | | Late/1 | | Late/2 | | — | |

|

| Daniel F. Meyer | | President, Secretary, Treasurer

and Director (1) | | — | | Late/3 | | — | |

|

| James R. Screaton(2) | | Vice President, Finance and

Chief Financial Officer | | Late/1 | | — | | — | |

|

| Michael D. Noonan(3) | | Vice President, Corporate, Director | | Late/1 | | Late/2 | | — | |

|

| Karim Jobanputra | | Director | | Late/1 | | Late/1 | | — | |

|

| Ian R. Baron | | Director | | Late/1 | | Late/1 | | — | |

|

| Peter J. Cockcroft | | Director | | Late/1 | | Late/1 | | — | |

|

| Sheikh Hamad Bin Jassen | | 10% Shareholder | | Late/1 | | — | | — | |

| Bin Jaber Al Thani | |

|

| | (1) | | Mr. Meyer resigned as President, Secretary and Treasurer on or about May 30, 2006. |

| | (2) | | Mr. Screaton has signed a separation agreement with Sky Petroleum and no longer holds any position with the Company, effective May 29, 2006. |

| | (3) | | Mr. Noonan was appointed Secretary of the Company, effective on or about May 30, 2006. |

15

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth compensation paid to each of the individuals who served as our Chief Executive Officer and our other most highly compensated executive officers (the “named executives officers”) for the fiscal years ended December 31, 2005, 2004 and 2003.

| | Annual Compensation | Long Term Compensation | |

|---|

| | | | | Awards | Payouts | |

|---|

Name and

Principal Position | Year | Salary

($) | Bonus

($) | Other Annual

Compensation

($) | Common

Shares Under

Options/SARs

Granted

(#) | Restricted

Shares or

Restricted

Share

Units

($) | Long Term

Incentive

Plan

Payouts

($) | All Other

Compensation

($) |

|---|

| | |

| Brent H. Kinney(1) | | 2005 | | 35,000 | | -0- | | -0- | | -0- | | -0- | | -0- | | 57,381 | (6) |

| Chief Executive | |

| Officer, Director | |

| | |

| Daniel Meyer(2) | | 2005 | | 63,000 | | -0- | | -0- | | -0- | | -0- | | -0- | | 3,462 | (7) |

| President, Secretary | | 2004 | | -0- | | -0- | | -0- | | -0- | | -0- | | -0- | | -0- | |

| and Treasurer, | |

| Director | |

| | |

| Christine L. Szymarek | | 2004 | | -0- | | -0- | | -0- | | -0- | | -0- | | -0- | | -0- | |

| Former President & | | 2003 | | -0- | | -0- | | -0- | | -0- | | -0- | | -0- | | -0- | |

| Secretary, Treasurer | |

| Director | |

| | |

| Donald C. Cameron | | 2005 | | 99,000 | | -0- | | -0- | | -0- | | -0- | | -0- | | -0- | |

| Former Chief | | 2004 | | -0- | | -0- | | -0- | | -0- | | -0- | | -0- | | -0- | |

| Executive Officer(3) | |

| | |

| James R. Screaton | | 2005 | | 63,080 | | -0- | | -0- | | -0- | | -0- | | -0- | | -0- | |

| Vice President, | | 2004 | | -0- | | -0- | | -0- | | -0- | | -0- | | -0- | | -0- | |

| Finance and Chief | |

| Financial Officer(4) | |

| | |

| Michael Noonan(5) | | 2005 | | 83,500 | | -0- | | -0- | | -0- | | -0- | | -0- | | 3462 | (7) |

| Vice President, | | 2004 | | -0- | | -0- | | -0- | | -0- | | -0- | | -0- | | -0- | |

| Corporate | |

| | (1) | | Mr. Kinney was appointed as our Chief Executive Officer on November 1, 2005 and appointed as a director on November 16, 2005. |

16

| | (2) | | Mr. Meyer was elected as a director at the annual meeting of shareholders on December 20, 2004. Mr. Meyer resigned as President, Secretary, and Treasurer effective on or about May 30, 2006. |

| | (3) | | Mr. Cameron was appointed as our Chief Executive Officer on July 26, 2005 and terminated on November 1, 2005. He was not an officer during 2004, 2003 or 2002. See, “Certain Relationships and Related Transactions” for a description of his compensatory arrangements for 2005. |

| | (4) | | Mr. Screaton was appointed as our Vice President, Finance and Chief Financial Officer on August 25, 2005. He was not an officer during 2004, 2003 or 2002. Mr. Screaton signed a separation agreement with the Company effective on or about May 29, 2006, and no longer holds a position with the Company. See, “Certain Relationships and Related Transactions” for a description of his compensatory arrangements for 2005 and 2006. The Company has since hired Shafiq Ur Rahman as Manager of Finance and Management (Principal Financial and Accounting Officer). |

| | (5) | | Mr. Noonan was appointed as our Vice President, Corporate on August 25, 2005 and appointed as a director on November 16, 2006. He was not an officer during 2004, 2003 or 2002. See, “Certain Relationships and Related Transactions” for a description of his compensatory arrangements for 2005. Mr. Noonan was appointed Secretary of the Company effective on or about May 30, 2006. |

| | (6) | | Includes legal fees of $53,919 paid to Mr. Kinney prior to his appointment as an officer of Sky Petroleum and Directors’ fees of $3462. |

| | (7) | | Consists of director’s fees. |

Director and Officer Stock Option/Stock Appreciation Rights (“SARs”) Grants

We granted a total of 4,250,000 stock options during the fiscal year ended December 31, 2005, excluding stock option grants that were rescinded.

In the year ended December 31, 2005, we adopted an incentive stock plan for non-U.S. residents on July 26, 2005, and an incentive stock plan for U.S. residents on August 25, 2005. Our stock incentive plan for non-U.S. residents authorizes the issuance of stock options to acquire up to 10% of our issued and outstanding shares of common stock and our stock incentive plan for U.S. residents authorizes the issuance of stock options to acquire up to a maximum of 3,321,600 shares of common stock (less the number of shares issuable upon exercise of options granted by us under all other stock incentive plans on the date of any grant under the plan). Subsequent to December 31, 2005, our board of directors approved an amendment to our stock incentive plan for U.S. residents authorizes the issuance of stock options to acquire up to a maximum of 4,657,148 shares of common stock (less the number of shares issuable upon exercise of options granted by us under all other stock incentive plans on the date of any grant under the plan).

The following table sets forth the stock options granted to our named executive officers and directors during the year ended December 31, 2005. No stock appreciation rights were awarded.

| Individual Grants | | | Potential Realized

Value at

Assumed Annual

Rates of

Stock Appreciation

for

Option Term |

|---|

|

| Name | Number of

securities

underlying

options/SARs

granted (#) | Percent of total

options/SARs

granted

to employees in

fiscal year(1) | Exercise or

base

price

($/Sh) | Expiration

date | $000

5%($) | $000

10%($) | $000

0%($) |

|---|

|

| Daniel Meyer(2) | | 200,000 | (10) | 4.7 | % | $1.00 | | Nov. 16, 2012 | | 330 | | 534 | | 177 | |

| President, Secretary | |

| and Treasurer, | |

| Director | |

|

17

| Individual Grants | | | Potential Realized

Value at

Assumed Annual

Rates of

Stock Appreciation

for

Option Term |

|---|

|

| Name | Number of

securities

underlying

options/SARs

granted (#) | Percent of total

options/SARs

granted

to employees in

fiscal year(1) | Exercise or

base

price

($/Sh) | Expiration

date | $000

5%($) | $000

10%($) | $000

0%($) |

|---|

|

| Brent Kinney(3) | | 1,450,000 | (10) | 34.12 | % | $1.00 | | Nov. 16, 2012 | | 2,388 | | 3,864 | | 1,278 | |

| Chief Executive | |

| Officer, Director | |

|

| James R. Screaton(4) | | 400,000 | (10) | 9.4 | % | $0.50- $1.00 | | March 31, 2012 | | 27 | | 86 | | -0- | |

| Vice President, | |

| Finance and Chief | |

| Financial Officer | |

|

| Michael Noonan(5) | | 600,000 | (11) | | | $1.29 | | Sept. 21, 2015 | | 487 | | 1,234 | | -0- | |

| Vice President | | 200,000 | (11) | | | $1.88 | | Nov. 16, 2012 | | 236 | | 599 | | -0- | |

| Corporate | |

| | | | |

|

|

|

| | | 800,000 | | 18.82 | % | | | | | 723 | | 1,833 | | -0- | |

|

| Karim Jobanputra(6) | | 200,000 | (10) | 4.7 | % | $1.00 | | Nov. 16, 2012 | | 330 | | 534 | | 177 | |

| Director | |

|

| Ian R. Baron(7) | | 600,000 | | | | $1.00 | | Nov. 16, 2013 | | 1,065 | | 1,818 | | 528 | |

| Director | | 200,000 | | | | $1.00 | | Nov. 16, 2012 | | 330 | | 534 | | 177 | |

| | |

| | | | |

|

|

|

| | 800,000 | | 18.82 | % | $1.00 | | | | 1,395 | | 2,352 | | 705 | |

|

| Peter J. Cockcroft(8) | | 200,000 | (10) | 4.7 | % | $1.00 | | Nov. 16, 2012 | | 330 | | 534 | | 177 | |

| Director | |

|

| Donald C. Cameron(9) | | 100,000 | (11) | 2.35 | % | $1.00 | | April 30, 2008 | | 118 | | 150 | | 88 | |

| Former Chief Executive | | 100,000 | (11) | 2.35 | % | $1.00 | | April 30, 2009 | | 128 | | 175 | | 88 | |

| Officer | |

| | | | |

|

|

|

| | | 200,000 | | 4.7 | % | | | | | 226 | | 325 | | 176 | |

|

| Total | | 4,250,000 | |

| | (1) | | We issued options to acquire a total of 4,250,000 to our officers, directors and employees during the period from January 1, 2005 to December 31, 2005. |

| | (2) | | Mr. Meyer was elected as a director at the annual meeting of shareholders on December 20, 2004. Mr. Meyer was granted 200,000 options, effective November 16, 2005, under our non-U.S. Employee Stock Option Plan, 1/3 vesting on the first anniversary of the grant and 1/3 vesting each anniversary thereafter. Mr. Meyer resigned as President, Secretary and Treasurer effective on or about May 30, 2006. |

| | (3) | | Mr. Kinney was appointed as our Chief Executive Officer on November 1, 2005. Under the terms of his employment agreement we granted Mr. Kinney options to purchase 1,250,000 shares of common stock of the Company at an exercise price of $1.00 per share, vesting one-third on October 1, 2006, one-third on October 1, 2007 and one-third on October 1, 2008. Mr. Kinney was appointed as a director on November 16, 2005, and was granted 200,000 options, effective November 16, 2005, under our non-U.S. Employee Stock Option Plan, 1/3 vesting on the first anniversary of the grant and 1/3 vesting each anniversary thereafter. |

| | (4) | | Mr. Screaton was appointed as our Vice President, Finance and Chief Financial Officer on August 25, 2005. On August 25, 2005, we agreed to grant Mr. Screaton options to purchase 400,000 shares of common stock of which 133,333 exercisable at $0.50 vest on April 30, 2006, 133,333 exercisable at $0.80 per share vest on April 30, 2007 and 133,334 exercisable at $1.00 per share vest on April 30, 2008. Mr. Screaton signed a separation agreement with the Company effective on or about May 29, 2006, and no longer holds a position with the Company. Under the terms of the agreement Mr. Screaton will receive only the 133,333 shares exercisable at $0.50 per share and |

18

| | | | vesting on half on April 30, 2006, and the other half on April 30, 2007. All other options were terminated by the agreement. See, “Certain Relationships and Related Transactions” for a description of his compensatory arrangements for 2005 and 2006. The Company has since hired Shafiq Ur Rahman as Manager of Finance and Management (Principal Financial and Accounting Officer). |

| | (5) | | Mr. Noonan was appointed as our Vice President, Corporate on August 25, 2005. On August 25, 2005, we agreed to grant Mr. Noonan options to purchase 600,000 shares of common stock exercisable at $1.29 per share, vesting 200,000 options on each April 30th beginning on April 30, 2006. Mr. Noonan was appointed to our board of directors on November 16, 2005 and was granted 200,000 options, effective November 16, 2005, under our U.S. Employee Stock Option Plan, 1/3 vesting on the first anniversary of the grant and 1/3 vesting each anniversary thereafter. Mr. Noonan was appointed Company Secretary effective on or about May 30, 2006. |

| | (6) | | Mr. Jobanputra was appointed to our board of directors on November 16, 2005 and was granted 200,000 options, effective November 16, 2005, under our non-U.S. Employee Stock Option Plan, 1/3 vesting on the first anniversary of the grant and 1/3 vesting each anniversary thereafter. |

| | (7) | | Mr. Baron was appointed to our board of directors on November 16, 2005 and was granted 200,000 options, effective November 16, 2005, under our non-U.S. Employee Stock Option Plan, 1/3 vesting the first anniversary of the grant and 1/3 vesting each anniversary thereafter. We granted Mr. Baron 600,000 options, effective November 16, 2005, under the terms of an option agreement, 1/3 vesting on the first anniversary of the grant and 1/3 vesting each anniversary thereafter. |

| | (8) | | Mr. Cockcroft was appointed to our board of directors on November 16, 2005 and was granted 200,000 options, effective November 16, 2005, under our non-U.S. Employee Stock Option Plan, 1/3 vesting on the first anniversary of the grant and 1/3 vesting each anniversary thereafter. |

| | (9) | | Mr. Cameron served as our Chief Executive Officer from July 26, 2005 to November 1, 2005. We entered into a termination and severance agreement with Mr. Cameron under which we agreed to grant Mr. Cameron 200,000 options exercisable at $1.00 per share, vesting 100,000 options on April 30, 2006 and the balance will vest on April 30, 2007. |

| | (10) | | Granted under our non-U.S. resident stock option plan. (11) Granted under our U.S. resident stock option plan. |

| | (11) | | Granted under option agreement separate from our non-U.S. resident and U.S. resident stock option plans. |

Aggregated Option/SAR Exercises in Last Fiscal Year- and Fiscal Year-End Option/SAR Values

| Number of Shares

Acquired on Exercise | Number of Securities

Underlying Unexercised

Options At

December 31, 2005 | Value of Unexercised

In-the-Money Options

At December 31, 2005(1) |

|---|

|

| Name | Exercised | Value

Realized | Exercisable | Unexercisable | Exercisable | Unexercisable |

|---|

|

| Daniel Meyer | | — | | — | | — | | 200,000 | | — | | $ 171,000 | |

| President & Secretary | |

| Treasurer, Director | |

| |

| Brent Kinney | | — | | — | | — | | 1,450,000 | | — | | $1,239,750 | |

| Chief Executive | |

| Officer, Director | |

| |

| James R. Screaton | | — | | — | | — | | 400,000 | | — | | $ 435,333 | |

| Vice President, Finance | |

| and Chief Financial | |

| Officer | |

| |

| Michael Noonan | �� | — | | — | | — | | 800,000 | | — | | $ 339,000 | |

| Vice President Corporate | |

| |

| Karim Jobanputra | | — | | — | | — | | 200,000 | | — | | $ 171,000 | |

| Director | |

19

| Number of Shares

Acquired on Exercise | Number of Securities

Underlying Unexercised

Options At

December 31, 2005 | Value of Unexercised

In-the-Money Options

At December 31, 2005(1) |

|---|

|

| Name | Exercised | Value

Realized | Exercisable | Unexercisable | Exercisable | Unexercisable |

|---|

|

| | | | | | | | | | | | | |

| Ian R. Baron | | — | | — | | — | | 800,000 | | — | | $ 684,000 | |

| Director | |

| |

| Peter J. Cockcroft | | — | | — | | — | | 200,000 | | — | | $ 171,000 | |

| Director | |

| | |

| Donald C. Cameron | | — | | — | | — | | 200,000 | | — | | $ 171,000 | |

| Former Chief Executive | |

| Officer | |

| | (1) | | Based on the closing price of our common stock on the NASD OTCBB on December 30, 2005, which was $1.855. |

| | (2) | | Mr. Meyer resigned as President, Secretary and Treasurer effective on or about May 30, 2006. |

| | (3) | | Mr. Screaton signed a separation agreement with the Company effective on or about May 29, 2006, and no longer holds a position with the Company. See, “Certain Relationships and Related Transactions”for a description of his compensatory arrangements for 2005 and 2006. The Company has since hired Shafiq Ur Rahman as Manager of Finance and Management (Principal Financial and Accounting Officer). |

| | (4) | | Mr. Noonan was appointed Company Secretary effective on or about May 30, 2006. |

Long Term Incentive Plan Awards

No long-term incentive plan awards have been made by the Company to date.

Defined Benefit or Actuarial Plan Disclosure

We do not provide retirement benefits for the directors or officers.

Certain Relationships and Related Transactions

Employment Agreement with Brent D. Kinney

On November 1, 2005, we entered into an employment agreement with Brent D. Kinney, under which Mr. Kinney was appointed as our chief executive officer. The following are the material terms and conditions of the Employment Agreement:

Mr. Kinney shall perform the duties and services as CEO beginning on November 1, 2005 for a period of three years.

During his employment, Mr. Kinney shall receive (i) a salary of $17,500 per month or such higher rate as may from time-to-time be agreed between us and Mr. Kinney, (ii) an annual bonus in the amount determined by our board of directors, in its sole discretion, and (iii) options to purchase 1,250,000 shares of our common stock at an exercise price of $1.00 per share, vesting one-third on October 1, 2006, one-third on October 1, 2007 and one-third on October 1, 2008.

We may by notice terminate the Employment Agreement, if at any time after October 1, 2006, the two Obligation Wells (as defined in a certain participation agreement) have failed to meet our expectations and the Sir Abu Nu’ayr exploration program does not provide us with commercially useful petroleum assets.

20

Before Mr. Kinney was appointed as our chief executive officer, he was retained by us as special legal counsel to advise us on petroleum matters as of April 1, 2005 and received legal cost of $53,919 from us for these services.

Consulting Agreement with James Screaton

In connection with the appointment of Mr. James Screaton as our Chief Financial Officer on August 25, 2005, we entered into an Independent Contractor Services Agreement and a Confidentiality Agreement, effective April 1, 2005, with Shorewood Financial Inc. for the services of Mr. Screaton as our Chief Financial Officer. Under these agreements, we anticipate that Mr. Screaton will serve as our Chief Financial Officer until July 31, 2006 at a salary of $500 per day on a per diem basis. Under the terms of the Confidentiality Agreement, Mr. Screaton is prohibited from disclosing certain confidential information with respect to Sky Petroleum for a period of five years following the termination of the Independent Contractor Services Agreement. In connection with Mr. Screaton’s appointment as Chief Financial Officer, we agreed to grant Mr. Screaton options to purchase 400,000 shares of common stock of which 133,333 exercisable at $0.50 vest on April 30, 2006, 133,333 exercisable at $0.80 per share vest on April 30, 2007 and 133,334 exercisable at $1.00 per share vest on April 30, 2008.

Separation Agreement with James Screaton

We entered into a separation agreement with James Screaton, our former Chief Financial Officer, and Shorewood Financial Inc. The following are the material terms and conditions of the Separation Agreement:

The Independent Contractor Services Agreement, between us and Mr. Screaton, under which Mr. Screaton provided services as our CFO, was terminated effective on or about May 25, 2006. Mr. Screaton will receive monthly fee of $6,500 for the months of May, June, and July 2006.

We will also grant Mr. Screaton stock options exercisable to acquire 133,333 shares of common stock at $.50 per share, which will vest and become exercisable over two years. The first half will vest on April 30, 2006 and the balance will vest on April 30, 2007. The options will terminate two years after vesting.

Stock options previously granted to Mr. Screaton under the Contractor Agreement were terminated.

Mr. Screaton releases and discharges us from any claims, liabilities, costs and damages which Mr. Screaton has or may have against us for any act or omission occurred on or prior to the date of Mr. Screaton’s execution of the Separation Agreement.

Mr. Screaton acknowledged that all of the confidential information is valuable, proprietary and the exclusive property of the Company and that he will not use or reveal, divulge or permit the use by the third parties of any confidential information.

Consulting Agreement with Michael NoonanIn connection with the appointment of Mr. Michael Noonan as our Vice President Corporate on August 25, 2005, we entered into an Independent Contractor Services Agreement and a Confidentiality Agreement for the services of Mr. Noonan as our Vice President Corporate. Under these agreements, we anticipate that Mr. Noonan will serve as our Vice President Corporate until July 31, 2006 at a base salary of $10,000 per month. Under the terms of the

21

Confidentiality Agreement, Mr. Noonan is prohibited from disclosing certain confidential information with respect to Sky Petroleum for a period of five years following the termination of the Independent Contractor Services Agreement. In connection with Mr. Noonan’s appointment as Vice President Corporate, we granted Mr. Noonan stock options exercisable to acquire 600,000 shares of common stock exercisable at $1.29 per share of which 200,000 shares vest on April 30, 2006, 200,000 vest on April 30, 2007 and 200,000 shares vest on April 30, 2008.

Consulting Agreement with Daniel Meyer

We paid Daniel Meyer a consulting fee of $5,000 per month up to September 30, 2005 for his services as our President under the terms of an arrangement approved by the Board of Directors. On October 1, 2005 we increased the consulting fee paid to Mr. Meyer to $7,500 per month.

Consulting Agreement with Energy Services Group Dubai

Mr. Ian Baron, a director, is the founding partner of Energy Services Group Dubai (ESG), with which we entered into a Consulting Agreement dated April 1, 2005, to retain the services of ESG to assist us to evaluate and develop oil and gas opportunities in the Mubarek field area near Abu Musa Island in the Arabian Gulf. Pursuant to the Consulting Agreement EGS receives $1,500 per day for the first five days of a month and $1,250 per day for each day thereafter in a month. At a minimum, EGS receives a monthly retainer fee of $7,500 per month. During the fiscal year ended December 31, 2005, we incurred fees of $75,775. Subsequent to December 31, 2005, the Consulting Agreement was amended to provide that in addition to the services of Ian Baron, the services of Peter Bradley, an ESG associate, would also be provided to monitor our interest in the Obligation Wells under the Participation Agreement. The Consulting Agreement was further amended to have Ian Baron provide business development services to us on the basis that opportunities to participate in new ventures would first be presented to us and that he would act as our negotiator on new ventures that we wished to pursue. The fiscal arrangements were also amended to provide that ESG would be paid a monthly retainer of US$15,000 and ESD would provide ten days (an increase from five) of service each month between Messrs Bradley and Baron. Additional days would be payable at the rate of US$1,500 per day. Any days unused in a month would carry forward and be available without cost.

The Consulting Agreement may be terminated on sixty day notice by either party.

Effective November 16, 2005, we entered into an option agreement with Mr. Baron, pursuant to which we granted Mr. Baron stock options exercisable to acquire 600,000 shares of common stock at $1.00 per share, vesting 1/3 per year beginning on November 16, 2006 and expiring on the earlier of November 16, 2013 or 90 days after Mr. Baron ceases to be a director or consultant to the corporation.

Separation Agreement with Donald Cameron

We entered into a separation agreement with Donald C. Cameron, our former Chief Executive Officer, and Donald C. Cameron Consulting Ltd. The following are the material terms and conditions of the Separation Agreement:

The Independent Contractor Services Agreement dated April 1, 2005, between us and Mr. Cameron, under which Mr. Cameron provided services as our CEO, was terminated effective October 31, 2005. Mr. Cameron will receive monthly fee of $11,000 for the months of November 2005, December 2005 and January 2006.

22

Under a Contractor Agreement, we will retain Mr. Cameron for six months beginning February 1, 2006 through July 31, 2006 at a monthly consulting fee of $11,000 per month. We will also grant Mr. Cameron stock options exercisable to acquire 200,000 shares of common stock at $1.00 per share, which will vest and become exercisable over two years. The first half will vest on April 30, 2006 and the balance will vest on April 30, 2007. Stock options previously granted to Mr. Cameron under the Contractor Agreement were terminated.

Mr. Cameron releases and discharges us from any claims, liabilities, costs and damages which Mr. Cameron has or may have against us for any act or omission occurred on or prior to the date of Mr. Cameron’s execution of the Separation Agreement.

Mr. Cameron acknowledged that all of the confidential information is valuable, proprietary and the exclusive property of the Company and that he will not use or reveal, divulge or permit the use by the third parties of any confidential information.

Report on Repricing of Options/SARs

We did not reprice any options or SARs outstanding during the fiscal year ended December 31, 2004 or 2005.

Report of the Board of Directors on Executive Compensation

During the year ended December 31, 2005, our Board of Directors was responsible for establishing compensation policy and administering the compensation programs of our executive officers.

The amount of compensation paid by us to each of our directors and officers and the terms of those persons’ employment is determined solely by the Board of Directors. We believe that the compensation paid to its directors and officers is fair to the company.

In the past, Daniel Meyer, our President, has negotiated all executive salaries on our behalf. The Board of Directors reviewed the compensation and benefits of all our executive officers and established and reviewed general policies relating to compensation and benefits of our employees. Currently, directors do not participate in approving or authorizing their own salaries as executive officers.

Our Board of Directors believes that the use of direct stock awards is at times appropriate for employees, and in the future intends to use direct stock awards to reward outstanding service or to attract and retain individuals with exceptional talent and credentials. The use of stock options and other awards is intended to strengthen the alignment of interests of executive officers and other key employees with those of our stockholders.

23

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information regarding the beneficial ownership of shares of our common stock as of March 31, 2006 by:

| | • | | each person who is known by us to beneficially own more than 5% of our issued and outstanding shares of common stock; |

| | • | | our named executive officers; |

| | • | | all of our executive officers and directors as a group. |

| Name of Shareholder | Address | Amount and Nature of

Beneficial Ownership | Percent of Class(1) |

|---|

|

| Directors and Named Executive Officers | | | | | | | |

|

| Daniel Meyer(2) | | Suite 200 - 625 4th Ave. SW | | 2,000,000 | (2) | 4.29 | %(2) |

| President, Secretary, | | Calgary, Alberta, Canada | |

| Treasurer and Director | | T2P OK2 | |

|

| Brent Kinney(3) | | P.O. Box 211247 | | — | | — | |

| Chief Executive Officer | | Dubai | |

| | United Arab Emirates | |

|

| James R. Screaton(4) | | Suite 200 - 625 4th Ave. SW | | — | | — | |

| Vice President, Finance and | | Calgary, Alberta | |

| Chief Financial Officer | | Canada T2P OK2 | |

|

| Michael Noonan(5) | | 401 Congress Avenue | | 210,000 | (5) | 0.5 | %(5) |

| Vice President, Corporate | | Suite 1540 | |

| | Austin, Texas USA 78701 | |

|

| Karim Jobanputra(6) | | P.O. Box 82 | | — | | — | |

| Director | | Doha | |

| | State of Qatar | |

|

| Ian R. Baron(7) | | P.O. Box 72794 | | — | | — | |

| Director | | Dubai | |

| | United Arab Emirates | |

|

| Peter Cockcroft(8) | | 350 Orchard Road | | — | | — | |

| Director | | #21-01 Shaw House | |

| | Singapore 238868 | |

|

| All Officers & Directors as a | | | | 2,210,000 | (9) | 4.79 | %(9) |

| Group | |

|

| 5% Shareholders | |

|

| Sheikh Hamad Bin Jassen Bin | | PO Box 4044 | | 15,296,424 | (10) | 24.93 | %(10) |

| Jaber Al Thani(10) | | Alwajbam Palace | |

| | Doha, Qatar | |

|

| Metage Capital Limited | | 8 Pollen Street | | 4,000,000 | (11) | 8.59 | % |

| | London, W1S 1NG | |

|

24

| | (1) | | Based on 46,571,485 shares issued and outstanding as of February 28, 2006, plus, for each person, the number of shares of common stock such person has the right to acquire within the 60 days after such date. Excludes 12,222,224 shares of common stock acquirable upon conversion of Series A Preferred Stock and stock options that are not exercisable within 60 days of March 31, 2006. |

| | (2) | | Mr. Meyer was elected as a director at the annual meeting of shareholders on December 20, 2004. On August 25, 2005, we accepted 12,000,000 shares of common stock for cancellation from Mr. Meyer. Mr. Meyer was granted 200,000 options, effective November 16, 2005, under our non-U.S. Employee Stock Option Plan, 1/3 vesting on the first anniversary of the grant and 1/3 vesting each anniversary thereafter. None of the options will vest within 60 days of March 31, 2006. Mr. Meyer resigned as President, Secretary, and Treasurer effective on or about May 30, 2006. |

| | (3) | | Mr. Kinney was appointed as our Chief Executive Officer on November 1, 2005. We granted Mr. Kinney options to purchase 1,250,000 shares of common stock exercisable at $1.00 per share. None of the options will vest within 60 days of March 31, 2006. Mr. Kinney was appointed to our board of directors on November 16, 2005 and was granted 200,000 options, effective November 16, 2005, under our U.S. Employee Stock Option Plan, 1/3 vesting on the first anniversary of the grant and 1/3 vesting each anniversary thereafter. |

| | (4) | | Mr. Screaton was appointed as our Vice President, Finance and Chief Financial Officer on August 25, 2005. On August 25, 2005, we agreed to grant Mr. Screaton options to purchase 400,000 shares of common stock exercisable at exercise prices of $0.50 to $1.00 per share. Mr. Screaton signed a separation agreement with the Company effective on or about May 29, 2006, and no longer holds a position with the Company. See, “Certain Relationships and Related Transactions” for a description of his compensatory arrangements for 2005 and 2006. The Company has since hired Shafiq Ur Rahman as Manager of Finance and Management (Principal Financial and Accounting Officer). |

| | (5) | | Mr. Noonan was appointed as our Vice President, Corporate on August 25, 2005. On September 21, 2005, we granted Mr. Noonan options to purchase 600,000 shares of common stock at $1.29 per share, of which 200,000 shares vest on April 30, 2006, 200,000 vest on April 30, 2007 and 200,000 shares vest on April 30, 2008. Includes 10,000 shares of common stock and options to acquire 200,000 shares of common stock vesting on April 30, 2006. Mr. Noonan was appointed Company Secretary effective on or about May 30, 2006. |

| | (6) | | Mr. Jobanputra was appointed to our board of directors on November 16, 2005 and was granted 200,000 options, effective November 16, 2005, under our non-U.S. Employee Stock Option Plan, 1/3 vesting on the first anniversary of the grant and 1/3 vesting each anniversary thereafter. |

| | (7) | | Mr. Baron was appointed to our board of directors on November 16, 2005 and was granted 200,000 options, effective November 16, 2005, under our non-U.S. Employee Stock Option Plan, 1/3 vesting the first anniversary of the grant and 1/3 vesting each anniversary thereafter. We granted Mr. Baron 600,000 options, effective November 16, 2005, under the terms of an option agreement, 1/3 vesting on the first anniversary of the grant and 1/3 vesting each anniversary thereafter. |

| | (8) | | Mr. Cockcroft was appointed to our board of directors on November 16, 2005 and was granted 200,000 options, effective November 16, 2005, under our non-U.S. Employee Stock Option Plan, 1/3 vesting on the first anniversary of the grant and 1/3 vesting each anniversary thereafter. |

| | (9) | | Includes 2,000,000 shares of common stock held by Daniel Meyer, excluding stock options which are not exercisable within 60 days of March 31, 2006. |

| | (10) | | Includes 3,074,200 shares of common stock held by the Sheikh and 12,222,224 shares of common stock issuable upon conversion of 3,055,556 shares of Series A Preferred Stock held by the shareholder. |

| | (11) | | Metage Capital Limited beneficially owns 2,000,000 common shares through Metage Funds Limited, a Cayman Islands investment company, and 2,000,000 common shares through Metage Special Emerging Markets Fund Limited, a Cayman Islands investment company. |

We have no knowledge of any other arrangements, including any pledge by any person of our securities, the operation of which may at a subsequent date result in a change in control of our company. We are not, to the best of our knowledge, directly or indirectly owned or controlled by another corporation or foreign government.

25

EQUITY COMPENSATION PLAN INFORMATION

Subsequent to December 31, 2004, we adopted an incentive stock plan for non-U.S. residents on July 26, 2005, and an incentive stock plan for U.S. residents on August 25, 2005. Our stock incentive plan for non-U.S. residents authorizes the issuance of stock options to acquire up to 10% of our issued and outstanding shares of common stock and our stock incentive plan for U.S. residents authorizes the issuance of stock options to acquire up to a maximum of 3,321,600 shares of common stock (less the number of shares issuable upon exercise of options granted by the us under all other stock incentive plans on the date of any grant under the plan).

Adoption of Non-U.S. Stock Option Plan

On July 26, 2005, we adopted, subject to receiving shareholder approval, the Sky Petroleum, Inc. Non-U.S. Stock Option Plan, effective as of April 1, 2005. The Non-U.S. Plan authorizes the issuance of stock options to acquire up to 10% of our issued and outstanding shares of common stock. The purpose of the Non-U.S. Plan is to aid us in retaining and attracting Non-U.S. residents that are capable of enhancing our prospects for future success, to offer such personnel additional incentives to exert maximum efforts for the success of our business, and to afford such personnel an opportunity to acquire a proprietary interest in the company through stock options. Our Board of Directors or our Compensation Committee, if any, will administer the Non-U.S. Plan and determine the terms and conditions under which options to purchase shares of our common stock may be awarded. The term of an option granted under the Non-U.S. Plan cannot exceed seven years and the exercise price for options granted under the Non-U.S. Plan cannot be less than the fair market value of our common stock on the date of grant.

Adoption of 2005 U.S. Stock Incentive Plan

On August 25, 2005, we adopted, subject to receiving shareholder approval, the Sky Petroleum, Inc. 2005 U.S. Stock Incentive Plan for U.S. residents. The U.S. Plan authorizes the issuance of stock options and other awards to acquire up to a maximum of 3,321,600 shares of our common stock (less the number of shares issuable upon exercise of options granted by us under all other stock incentive plans on the date of any grant under the plan). The purpose of the U.S. Plan is to aid the Company in retaining and attracting U.S. personnel capable of enhancing our prospects for future success, to offer such personnel additional incentives to exert maximum efforts for the success of our business, and to afford such personnel an opportunity to acquire a proprietary interest in the company through stock options and other awards. The U.S. Plan provides for the grant of incentive stock options (within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended), options that are not incentive stock options, stock appreciation rights and various other stock-based grants. Our Board of Directors or a committee thereof, if any, will administer the U.S. Plan and determine the terms and conditions under which options to purchase shares of our common stock or other awards may be granted to eligible participants. The term of an incentive stock option granted under the U.S. Plan cannot exceed ten years and the exercise price for options granted under the U.S. Plan cannot be less than the fair market value of our common stock on the date of grant.

Equity Compensation Plan Information

The following table sets forth information related to our equity compensation plans as of December 31, 2005.

26

| Plan Category | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

(a) | Weighted average

exercise price of

outstanding options,

warrants and rights

(b) | Number of securities remaining

available for future issuance under

equity compensation plans

(excluding securities reflected in

column (a))

(c) |

|---|

|

| Equity Compensation | | — | | — | | — | |

| Plans approved by | |

| Security Holders(1)(2) | |

|

| Equity Compensation | | 4,250,000 | | $1.075 | | 1,157,098 | (3) |

| Plans not approved by | |

| Security Holders(1)(2)(4) | |

|

| Total | | 4,250,000 | | | | 1,157,098 | (3) |

|

| | (1) | | We have two stock option plans: a stock incentive plan for non-U.S. residents and a stock incentive plan for U.S. residents. Our stock incentive plan for non-U.S. residents authorizes the issuance of stock options to acquire up to 10% of our issued and outstanding shares of common stock and our stock incentive plan for U.S. residents authorizes the issuance of stock options to acquire up to a maximum of 3,321,600 shares of common stock (less the number of shares issuable upon exercise of options granted by the us under all other stock incentive plans on the date of any grant under the plan). |

| | (2) | | We intend to submit our incentive stock option plans for shareholder approval at our next annual meeting of shareholders. |

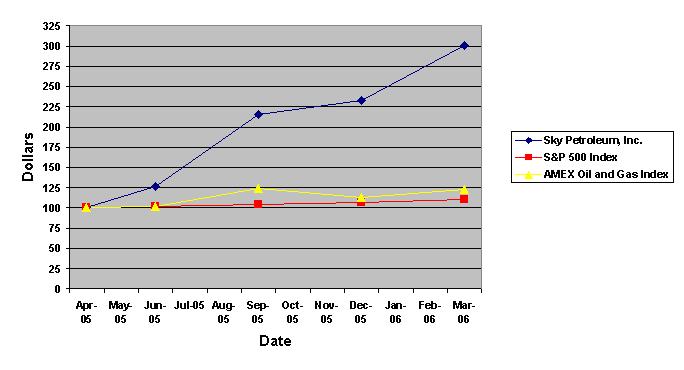

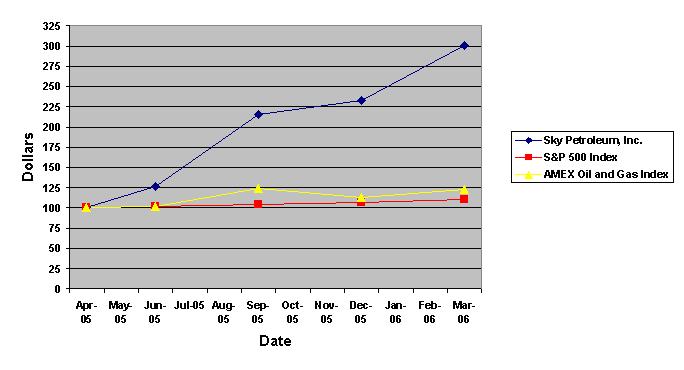

| | (3) | | Issuable under our non-U.S. Stock Option Plan. |