- MTEM Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Molecular Templates (MTEM) DEF 14ADefinitive proxy

Filed: 22 Apr 05, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant to §240.14a-12 |

THRESHOLD

PHARMACEUTICALS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

THRESHOLD PHARMACEUTICALS, INC.

Notice of Annual Meeting of Stockholders

To Be Held May 19, 2005

The Annual Meeting of Stockholders of Threshold Pharmaceuticals, Inc. (the “Company”) will be held on May 19, 2005, at 1:00 p.m. local time at the Company’s principal executive offices located at 1300 Seaport Boulevard, Redwood City, California 94063, for the following purposes, as more fully described in the accompanying proxy statement:

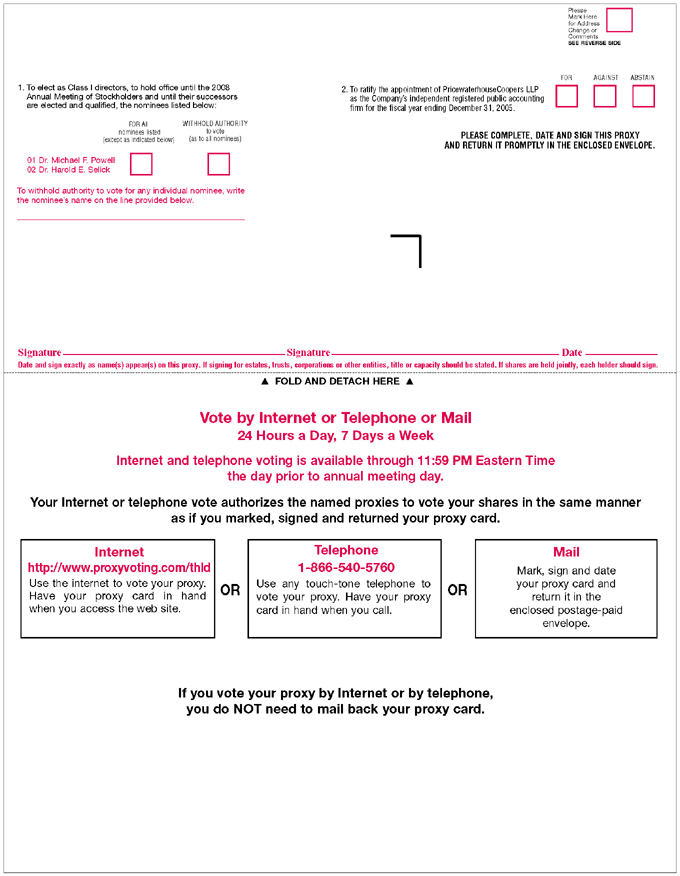

1. To elect two Class I directors to hold office until the 2008 Annual Meeting of Stockholders and until their successors are elected and qualified.

2. To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2005.

3. To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

Only stockholders of record at the close of business on April 7, 2005 will be entitled to notice of, and to vote at, such meeting or any adjournments or postponements thereof.

BY ORDER OF THE BOARD OF DIRECTORS

Dr. Harold E. Selick

Chief Executive Officer

Redwood City, California

April 25, 2005

YOUR VOTE IS IMPORTANT!

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN, DATE AND MAIL PROMPTLY THE ACCOMPANYING PROXY CARD IN THE ENCLOSED RETURN ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. THIS WILL ENSURE THE PRESENCE OF A QUORUM AT THE MEETING. ALTERNATIVELY, YOU MAY VOTE YOUR SHARES ON THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON YOUR PROXY. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON IF YOU WISH TO DO SO EVEN IF YOU HAVE PREVIOUSLY SENT IN YOUR PROXY CARD OR VOTED.

| Page | ||

| 2 | ||

| 3 | ||

| 4 | ||

| 5 | ||

| 6 | ||

| 7 | ||

| 7 | ||

| 7 | ||

Security Ownership by Certain Beneficial Holders and Management | 8 | |

| 11 | ||

| 12 | ||

| 12 | ||

| 13 | ||

| 17 | ||

| 21 | ||

| 22 | ||

| 22 | ||

| 23 | ||

Proposal 2—Ratification of Independent Registered Public Accounting Firm | 23 | |

| 23 | ||

| 24 | ||

THRESHOLD PHARMACEUTICALS, INC.

1300 Seaport Boulevard

Redwood City, California 94063

(650) 474-8200

PROXY STATEMENT

2005 ANNUAL MEETING OF STOCKHOLDERS

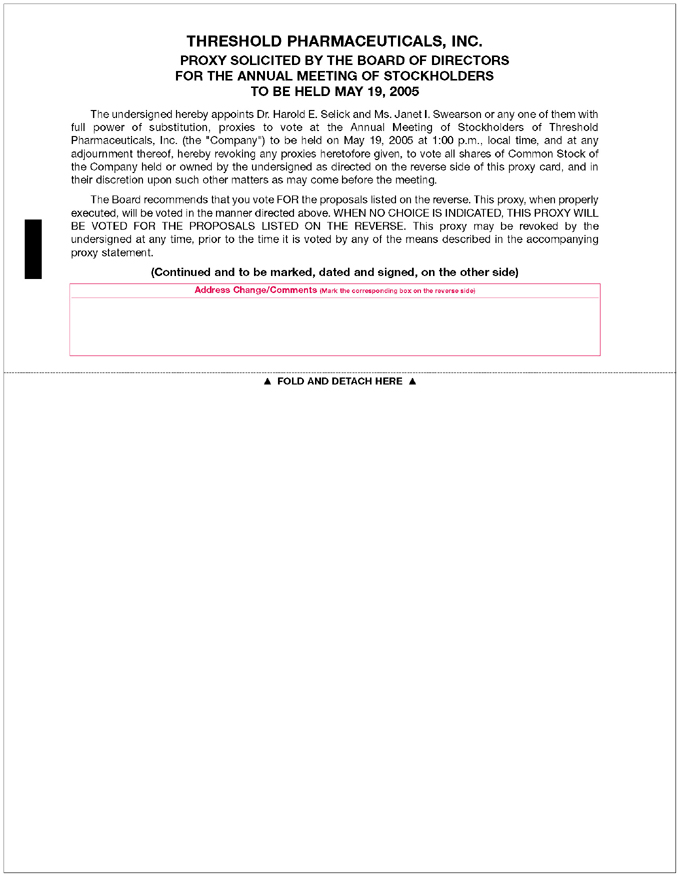

Threshold Pharmaceuticals, Inc., a Delaware corporation (the “Company”) is furnishing this proxy statement and the enclosed proxy in connection with the solicitation of proxies by the Board of Directors of the Company for use at the Annual Meeting of Stockholders to be held on May 19, 2005, at 1:00 p.m. local time, at the Company’s principal executive offices located at 1300 Seaport Boulevard, Redwood City, California 94063 and at any adjournments thereof (the “Annual Meeting”). These materials are being mailed to stockholders on or about April 25, 2005.

Only holders of the Company’s common stock as of the close of business on April 7, 2005 (the “Record Date”) are entitled to vote at the Annual Meeting. Stockholders who hold shares of the Company in “street name” may vote at the Annual Meeting only if they hold a valid proxy from their broker. As of the Record Date, there were 30,746,035 shares of common stock, par value $0.001 per share, outstanding. There are no statutory or contractual rights of appraisal or similar remedies available to stockholders in connection with any matter to be acted on at the Annual Meeting.

A majority of the outstanding shares of common stock entitled to vote at the Annual Meeting must be present in person or by proxy in order for there to be a quorum at the meeting. Stockholders of record who are present at the meeting in person or by proxy and who abstain from voting, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, will be included in the number of stockholders present at the meeting for purposes of determining whether a quorum is present.

Each stockholder of record is entitled to one vote at the Annual Meeting for each share of common stock held by such stockholder on the Record Date. Stockholders do not have cumulative voting rights. Stockholders may vote their shares by using the proxy card enclosed with this proxy statement. Alternatively, you may vote your shares on the Internet or by telephone by following the instructions on your proxy. All proxy cards received by the Company which are properly signed and have not been revoked will be voted in accordance with the instructions contained in the proxy cards. If a signed proxy card is received which does not specify a vote or an abstention, the shares represented by that proxy card will be voted for the nominees to the Board of Directors listed on the proxy card and in this proxy statement and for the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2005. The Company is not aware, as of the date hereof, of any matters to be voted upon at the Annual Meeting other than those stated in this proxy statement and the accompanying Notice of Annual Meeting of Stockholders. If any other matters are properly brought before the Annual Meeting, the enclosed proxy card gives discretionary authority to the persons named as proxies to vote the shares represented by the proxy card in their discretion.

Under Delaware law and the Company’s Amended and Restated Certificate of Incorporation and Bylaws, if a quorum exists at the meeting, (i) the affirmative vote of a plurality of the votes cast at the meeting is required for the election of directors and (ii) the affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote at the Annual Meeting will be required to approve the proposal to ratify

1

the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2005. A properly executed proxy marked “Withhold authority” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. A properly executed proxy marked “Abstain” with respect to any such matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

For shares held in “street name” through a broker or other nominee, the broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if stockholders do not give their broker or nominee specific instructions, their shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval. Shares represented by such “broker non-votes” will, however, be counted in determining whether there is a quorum.

A stockholder of record may revoke a proxy at any time before it is voted at the Annual Meeting by (a) delivering a proxy revocation or another duly executed proxy bearing a later date to the Secretary of the Company at 1300 Seaport Boulevard, Redwood City, California 94063 or (b) attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not revoke a proxy unless the stockholder actually votes in person at the meeting.

The proxy card accompanying this proxy statement is solicited by the Board of Directors of the Company. The Company will pay all of the costs of soliciting proxies. In addition to solicitation by mail, officers, directors and employees of the Company may solicit proxies personally, or by telephone, without receiving additional compensation. The Company, if requested, will also pay brokers, banks and other fiduciaries who hold shares of Common Stock for beneficial owners for their reasonable out-of-pocket expenses of forwarding these materials to stockholders.

The name, age and year in which the term expires of each member of the Board of Directors of the Company is set forth below:

Name | Age | Position | Term Expires on the Annual Meeting held in the Year | |||

Harold E. Selick, Ph.D. | 50 | Chief Executive Officer and Director | 2005 | |||

George F. Tidmarsh, M.D., Ph.D. | 45 | President and Director | 2006 | |||

Wilfred E. Jaeger, M.D.(1)(2) | 48 | Director | 2006 | |||

Michael F. Powell, Ph.D.(1) | 50 | Director | 2005 | |||

Ralph E. Christoffersen, Ph.D.(2)(3) | 66 | Director | 2007 | |||

Patrick G. Enright(1)(3) | 42 | Director | 2007 | |||

William A. Halter(3) | 44 | Director | 2006 | |||

George G.C. Parker, Ph.D. | 65 | Director | 2007 |

| (1) | Member of the audit committee |

| (2) | Member of the compensation committee |

| (3) | Member of the nominating and governance committee |

The Company’s Amended and Restated Certificate of Incorporation divides the Board of Directors into three classes, with staggered three-year terms. The Class I directors, whose terms expire at the Annual Meeting, are Dr. Michael F. Powell and Dr. Harold E. Selick. The Class II directors, whose terms expire at the Company’s 2006 Annual Meeting of Stockholders, are Dr. Wilfred E. Jaeger, Dr. George F. Tidmarsh and Mr. William A. Halter. The Class III directors, whose terms expire at the Company’s 2007 Annual Meeting of Stockholders, are

2

Mr. Patrick G. Enright, Dr. George G.C. Parker and Dr. Ralph E. Christoffersen. You only elect one class of directors at each annual meeting. The other classes continue to serve for the remainder of such classes’ three-year term. Drs. Powell and Selick, each a Class I director previously appointed by the Board of Directors, are nominees for re-election at the Annual Meeting. The nominating and governance committee recommended to the Board of Directors that Drs. Powell and Selick be nominated for election to this class, each for a three year term ending on the date of the annual meeting in 2008 or until a successor is duly elected or appointed. Each nominee has consented to serve an additional three-year term.

NOMINEES AND CONTINUING DIRECTORS

The following individuals have been nominated for election to the Board of Directors at the Annual Meeting:

Harold E. Selick, Ph.D. joined the Company as Chief Executive Officer in May 2003. Since June 2002, Dr. Selick has been a Venture Partner of Sofinnova Ventures, Inc., a venture capital firm. From January 1999 to April 2002, he was Chief Executive Officer of Camitro Corporation, a biotechnology company. From 1992 to 1999, he was at Affymax Research Institute, the drug discovery technology development center for Glaxo Wellcome plc, most recently as Vice President of Research. Prior to working at Affymax he held scientific positions at Protein Design Labs, Inc. and Anergen, Inc. Dr. Selick received his B.S. and Ph.D. from the University of Pennsylvania and was a Damon Runyon-Walter Winchell Cancer Fund Fellow and an American Cancer Society Senior Fellow at the University of California, San Francisco.

Michael F. Powell, Ph.D. has served as a member of the Company’s Board of Directors since 2001. He has been a Managing Director of Sofinnova Ventures, Inc., a venture capital firm, since 1997. Dr. Powell was Group Leader of Drug Delivery at Genentech, Inc. from 1990 to 1997. From 1987 to 1990, he was the Director of Product Development for Cytel Corporation, a biotechnology firm. He was recently an Adjunct Professor at the University of Kansas and an editorial board member of several pharmaceutical journals. Dr. Powell also serves on the board of directors of Seattle Genetics, Inc. and a number of private companies. He received his B.S. and Ph.D. from the University of Toronto and completed his post-doctorate work at the University of California.

The following individuals will continue to serve on the Board of Directors after the Annual Meeting:

George F. Tidmarsh, M.D., Ph.D. is the Company’s founder and has served as a member of the Company’s Board of Directors and as the Company’s President since October 2001. From April 2001 to September 2001, Dr. Tidmarsh was an entrepreneur-in-residence at Three Arch Partners, the venture capital firm that provided initial financing to the company. From October 1996 to December 2000, he held various positions at Coulter Pharmaceuticals, Inc., including chief medical officer from September 1998. Prior to that he held scientific and clinical positions at SEQUUS, Gilead Sciences and SyStemix, Inc. He received his M.D. and Ph.D. from the Stanford University School of Medicine where he also completed fellowships in Pediatric Oncology and Neonatal Intensive Care. In addition, he has been a clinical staff member at Stanford Children’s Hospital and El Camino Hospital.

Wilfred E. Jaeger, M.D. has served as a member of the Company’s Board of Directors since 2001. He has been a Partner of Three Arch Partners, a venture capital firm, since 1993. Dr. Jaeger serves as a director of a number of private companies. He received his B.S. from the University of British Columbia, his M.D. from the University of British Columbia School of Medicine and his M.B.A. from Stanford University.

Ralph E. Christoffersen, Ph.D.has served as a member of the Company’s Board of Directors since 2003. He has been a Partner of Morgenthaler Management Partners VII, LLC, a private equity firm, since 2001. From 2001 to 2002, he was Chairman of the Board of Ribozyme Pharmaceuticals, Inc., a company involved in developing ribozyme-based therapeutic agents, and from 1992 to 2001, he was Chief Executive Officer and President of Ribozyme Pharmaceuticals. Prior to joining Ribozyme Pharmaceuticals, he was the Senior Vice President of Research at SmithKline Beecham Corporation, Vice President of Discovery

3

Research at The Upjohn Company and President of Colorado State University. Dr. Christoffersen also serves as a director of Serologicals Corp. and a number of private companies. He received his B.S. from Cornell College and his Ph.D. from Indiana University and did his post-doctorate work at Nottingham University, United Kingdom and Iowa State University. He also holds an honorary doctor of law degree from Cornell College.

Patrick G. Enrighthas served as a member of the Company’s Board of Directors since 2003. He has been a Managing Director of Pequot Capital Management, Inc., an investment management firm engaged in the activities of Pequot’s venture capital and private equity funds since June 2002. From 1998 to 2001, Mr. Enright was a Managing Member of Diaz & Atschul Group, LLC, a principal investment group. From 1995 to 1998, he served in various executive positions at Valentis, Inc., including Senior Vice President, Corporate Development and Chief Financial Officer. From 1993 to 1994, he was Senior Vice President of Finance and Business Development for Boehringer Mannheim Therapeutics, a pharmaceutical company and a subsidiary of Corange Ltd. From 1989 to 1993, Mr. Enright was employed at PaineWebber Incorporated, an investment banking firm, where he became a Vice President in 1992. Mr. Enright is also currently a director of Valentis, Inc. and a number of private companies. Mr. Enright received his B.S. from Stanford University and his M.B.A. from the Wharton School of Business at the University of Pennsylvania.

William A. Halter has served as a member of the Company’s Board of Directors since October 2004. Mr. Halter was Acting Commissioner and Deputy Commissioner of the Social Security Administration from 1999 to 2001. From 1993 to 1999, Mr. Halter served as Senior Advisor of the Office of Management and Budget in the Executive Office of the President of the United States. Mr. Halter also served as Economist for the Joint Economic Committee of Congress and as Chief Economist for the U.S. Senate Committee on Finance. Prior to entering public service, he was an Associate at McKinsey and Company. Mr. Halter is a Trustee Emeritus of Stanford University where he chaired the Academic Policy Committee and serves on the Humanities and Sciences Council and Stanford Medical School’s National Advisory Council. Mr. Halter also serves on the board of directors of Akamai Technologies, Inc., Intermune, Inc., webMethods, Inc. and Xenogen, Inc. Mr. Halter received his B.A. from Stanford University and his M.Phil. in Economics from Oxford University where he was a Rhodes Scholar.

George G.C. Parker, Ph.D. has served as a member of the Company’s Board of Directors since October 2004. Dr. Parker is the Dean Witter Distinguished Professor of Finance and Management and previously Senior Associate Dean for Academic Affairs and Director of the MBA Program, Graduate School of Business, Stanford University. He serves as a director of Continental Airlines, Inc., Affinity Group International, Inc., BGI Mutual Funds, Tejon Ranch Company, Converium Holding AG and First Republic Bank. Dr. Parker received his B.A. from Haverford College and his M.B.A. and Ph.D. from Stanford University.

There are no family relationships among any of the Company’s directors or executive officers.

Criteria for Board Membership. In selecting candidates for appointment or re-election to the Board, the nominating and governance committee (the “nominating committee”) considers the appropriate balance of experience, skills and characteristics required of the Board of Directors, and seeks to insure that at least a majority of the directors are independent under the rules of the Nasdaq Stock Market, and that members of the Company’s audit committee meet the financial literacy and sophistication requirements under the rules of the Nasdaq Stock Market and at least one of them qualifies as an “audit committee financial expert” under the rules of the Securities and Exchange Commission. Nominees for director are selected on the basis of their depth and breadth of experience, integrity, ability to make independent analytical inquiries, understanding of the Company’s business environment, and willingness to devote adequate time to Board duties.

Stockholder Nominees.The nominating committee will consider written proposals from stockholders for nominees for director. Any such nominations should be submitted to the nominating committee c/o the Secretary

4

of the Company and should include the following information: (a) all information relating to such nominee that is required to be disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); (b) the names and addresses of the stockholders making the nomination and the number of shares of the Company’s common stock which are owned beneficially and of record by such stockholders; and (c) appropriate biographical information and a statement as to the qualification of the nominee, and should be submitted in the time frame described in the Company’s Bylaws and under the caption, “Stockholder Proposals for 2006 Annual Meeting” below.

Process for Identifying and Evaluating Nominees.The nominating committee believes the Company is well-served by its current directors. In the ordinary course, absent special circumstances or a material change in the criteria for Board membership, the nominating committee will renominate incumbent directors who continue to be qualified for Board service and are willing to continue as directors. If an incumbent director is not standing for re-election, or if a vacancy on the Board occurs between annual stockholder meetings, the nominating committee will seek out potential candidates for Board appointment who meet the criteria for selection as a nominee and have the specific qualities or skills being sought. Director candidates will be selected based on input from members of the Board, senior management of the company and, if the nominating committee deems appropriate, a third-party search firm. The nominating committee will evaluate each candidate’s qualifications and check relevant references; in addition, such candidates will be interviewed by at least one member of the nominating committee. Candidates meriting serious consideration will meet with additional members of the Board. Based on this input, the nominating committee will evaluate which of the prospective candidates is qualified to serve as a director and whether the committee should recommend to the Board that this candidate be appointed to fill a vacancy on the Board, or presented for the approval of the stockholders, as appropriate.

The Company has never received a proposal from a stockholder to nominate a director. Although the nominating committee has not adopted a formal policy with respect to stockholder nominees, the committee expects that the evaluation process for a stockholder nominee would be similar to the process outlined above.

Board Nominees for the 2005 Annual Meeting.Each of the nominees listed in this proxy statement are current directors standing for re-election.

Mr. Halter and Dr. Parker each receive $20,000 as an annual retainer, $2,500 for any in-person board meeting attended in excess of five in-person meetings per year, $500 for any telephonic board meeting attended, $1,000 per year for service on a board committee, if any, and $2,500 for service as a committee chairperson, if any. The Company has not provided cash compensation to the Company’s other non-employee directors for their services as directors. All of the Company’s directors are entitled to reimbursement for all reasonable out-of-pocket expenses incurred in connection with attendance at board and committee meetings.

All non-employee directors may receive automatic options grants under the Company’s 2004 Equity Incentive Plan. Commencing in 2005, all non-employee directors who have served for at least six months as of our 2005 Annual Meeting of Stockholders will receive an automatic grant of an option to purchase 6,072 shares of our common stock. All employee directors who are not 5% owners of the Company’s common stock are also eligible to participate in the Company’s 2004 Employee Stock Purchase Plan. In October 2004, the Company granted options to purchase 36,432 shares of the Company’s common stock under the 2001 Equity Incentive Plan to each of Mr. Halter and Dr. Parker. During fiscal 2004, none of the Company’s directors received grants under the 2004 Equity Incentive Plan or the 2004 Employee Stock Purchase Plan as compensation for service as a director.

5

The Company’s Board of Directors met nine times during fiscal 2004 and took action by written consent once. The audit committee met once during fiscal 2004 and neither the compensation committee nor the nominating committee held any meetings during fiscal 2004. Each member of the Board attended 75% or more of the Board meetings, and each member of the Board who served on either the audit, compensation or nominating committee attended at least 75% of the committee meetings.

The Board has determined that the following directors are “independent” under current Nasdaq rules: Dr. Powell, Dr. Jaeger, Dr. Christoffersen, Mr. Enright, Mr. Halter and Dr. Parker.

The Board of Directors has standing (i) audit, (ii) compensation and (iii) nominating and governance committees.

Audit Committee. The audit committee currently consists of Mr. Enright (chair), Dr. Jaeger and Dr. Powell. The Board has determined that all members of the audit committee are independent directors under the rules of the Nasdaq Stock Market and each of them is able to read and understand fundamental financial statements. The Board has determined that Mr. Enright qualifies as an “audit committee financial expert” as defined by the rules of the Securities and Exchange Commission.

The Company’s audit committee oversees the Company’s corporate accounting and financial reporting process. The Company’s audit committee appoints the Company’s independent registered public accounting firm and oversees and evaluates their work, ensures written disclosures and communicates with the independent registered public accounting firm, meets with management and the independent registered public accounting firm to discuss the Company’s financial statements, meets with the independent registered public accounting firm to discuss matters that may affect the Company’s financial statements and approves all related party transactions. The audit committee also reviews the scope and results of the independent audits, reviews and evaluates internal accounting policies, and approves all professional services to be provided to the Company by its independent registered public accounting firm.

Compensation Committee. The compensation committee currently consists of Dr. Christoffersen (chair) and Dr. Jaeger. The Board has determined that both members of the compensation committee are independent directors under the rules of the Nasdaq Stock Market. The compensation committee develops and reviews compensation policies and practices applicable to executive officers, reviews and recommends goals for the Company’s Chief Executive Officer and evaluates his performance in light of these goals, reviews and evaluates goals and objectives for other officers, oversees and evaluates the Company’s equity incentive plans and reviews and approves the creation or amendment of the Company’s equity incentive plans.

Nominating and Governance Committee. The nominating and governance committee currently consists of Mr. Halter (chair), Mr. Enright and Dr. Christoffersen, each of whom the Board has determined is an independent director under the rules of the Nasdaq Stock Market. The nominating committee’s responsibilities include recommending to the Board of Directors nominees for possible election to the Board of Directors. Nominees for the Annual Meeting were recommended for nomination at a meeting of the nominating and governance committee on April 13, 2005. The Board of Directors subsequently approved these nominations in an action by written consent dated April 15, 2005.

6

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Prior to establishing the compensation committee, the Board as a whole made decisions relating to compensation of the Company’s executive officers. No member of the Board of Directors or the compensation committee serves as a member of the Board of Directors or compensation committee of any other entity that has one or more executive officers serving as a member of the Board or compensation committee.

The Company maintains a corporate governance page on its website which includes key information about its corporate governance matters, including the Company’s Code of Ethics, the Company’s Insider Trading Policy, and charters for each of the committees of the Board as well as information regarding any amendment or waiver to the Company’s Code of Ethics. The corporate governance page can be found atwww.thresholdpharm.com, by clicking first on “Investors,” then clicking on “Corporate Governance.”

The Company’s policies and practices reflect corporate governance initiatives that it believes are compliant with the listing requirements of the Nasdaq National Market and the corporate governance requirements of the Sarbanes-Oxley Act of 2002, including:

| • | A majority of the Board members are independent of the Company and its management; |

| • | All members of the key Board committees—the audit committee, the compensation committee and the nominating committee—are independent of the Company and its management; |

| • | The independent members of the Board meet regularly without the presence of management; |

| • | The Company has a clear code of ethics that is monitored by management; |

| • | The charters of the Board committees clearly establish their respective roles and responsibilities; |

| • | The Company’s audit committee has procedures in place for the anonymous submission of employee complaints on accounting, internal controls, or auditing matters; and the Company has adopted a Code of Ethics that applies to all of its officers, directors and employees, including its principal executive officer and all members of its finance department, including its principal financial officer and its controller; and |

| • | Although the Company does not have a policy with respect to attendance by directors at annual meetings of stockholders, the Company encourages all directors to attend annual meetings of stockholders. No directors attended the Company’s 2004 Annual Meeting, which was held before our initial public offering. |

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Stockholders or other interested parties may communicate with any director or committee of the Board by writing to them c/o Corporate Secretary, Threshold Pharmaceuticals, Inc., 1300 Seaport Boulevard, Redwood City, California 94063. Comments or questions regarding the Company’s accounting, internal controls or auditing matters will be referred to members of the audit committee. Comments or questions regarding the nomination of directors and other corporate governance matters will be referred to members of the nominating and governance committee.

7

SECURITY OWNERSHIP BY CERTAIN BENEFICIAL HOLDERS AND MANAGEMENT

The following table sets forth information regarding ownership of the Company’s common stock as of April 7, 2005 or earlier date for information based on filings with the Securities and Exchange Commission by (a) each person known to the Company to own more than 5% of the outstanding shares of the common stock, (b) each director and nominee for director of the Company, (c) the Company’s Chief Executive Officer and each other executive officer named in the compensation tables appearing later in this proxy statement and (d) all directors and executive officers as a group. The information in this table is based solely on statements in filings with the Securities and Exchange Commission or other information the Company believes to be reliable.

Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership(2) | Percent Of Shares Beneficially Owned(2) | |||

Stockholders owning more than 5% | |||||

Entities affiliated with Morgenthaler Partners VII, LLC(3) 2710 Sand Hill Road Suite 100 Menlo Park, California 94025 | 3,553,726 | 11.6 | % | ||

Pequot Capital Management, Inc.(4) 500 Nyala Farm Road Westport, Connecticut 06880 | 3,553,725 | 11.6 | % | ||

Entities affiliated with ProQuest Investments(5) 12626 High Bluff Drive Suite 360 San Diego, California 92130 | 3,440,205 | 11.2 | % | ||

Entities affiliated with Sofinnova Ventures, Inc.(6) 140 Geary Street Tenth Floor San Francisco, California 94108 | 3,440,200 | 11.2 | % | ||

Entities affiliated with Three Arch Partners(7) 3200 Alpine Road Portola Valley, California 94028 | 3,440,202 | 11.2 | % | ||

Entities affiliated with Sutter Hill Ventures(8) 755 Page Mill Road, Suite A-200 Palo Alto, California 94304-1005 | 2,429,669 | 7.9 | % | ||

Directors and Executive Officers | |||||

Harold E. Selick, Ph.D.(9) | 1,127,049 | 3.7 | % | ||

George F. Tidmarsh, M.D., Ph.D.(10) | 1,131,875 | 3.7 | % | ||

Janet I. Swearson(11) | 348,988 | 1.1 | % | ||

Alan Colowick, M.D., M.P.H.(12) | 151,800 | * | |||

Ralph E. Christoffersen(13) | 3,553,726 | 11.6 | % | ||

Patrick G. Enright(14) | 3,553,725 | 11.6 | % | ||

Wilfred E. Jaeger(15) | 3,440,202 | 11.2 | % | ||

Michael F. Powell(16) | 3,440,201 | 11.2 | % | ||

William A. Halter(17) | 36,432 | * | |||

George G.C. Parker(18) | 36,432 | * | |||

All directors and executive officers as a group (10 persons)(19) | 16,820,430 | 54.7 | % | ||

| * | Less than 1%. |

| (1) | Unless otherwise indicated, the address of each of the named individuals is c/o Threshold Pharmaceuticals, Inc., 1300 Seaport Boulevard, Redwood City, California 94063. |

8

| (2) | Percentage ownership is based on 30,746,035 shares of the Company’s common stock outstanding as of April 7, 2005. Beneficial ownership of shares is determined in accordance with the rules of the Securities and Exchange Commission and generally includes any shares over which a person exercises sole or shared voting or investment power, or of which a person has the right to acquire ownership within 60 days after April 7, 2005. Except as otherwise noted, each person or entity has sole voting and investment power with respect to the shares shown. |

| (3) | Includes 3,553,726 shares held of record by Morgenthaler Partners VII, L.P. (MP VII). Dr. Christoffersen, a member of the Board and a Managing Member of MP VII, shares voting or investment power over these shares with Robert C. Bellas, Jr., Greg E. Blonder, James W. Broderick, Andrew S. Lanza, Theodore A. Laufik, Paul H. Levine, Gary R. Little, John D. Lutsi, Gary J. Morgenthaler, Robert D. Pavey, G. Gary Shaffer and Peter G. Taft. Dr. Christoffersen disclaims beneficial ownership in these shares, except to the extent of his pecuniary interest. |

| (4) | Includes shares which may be deemed to be beneficially owned by Pequot Capital Management, Inc., the investment manager of Pequot Private Equity Fund III, L.P., the holder of record of 3,114,659 shares, and Pequot Offshore Private Equity Partners III, L.P., the holder of record of 439,066 shares. Pequot Capital Management, Inc. holds voting and dispositive power for all shares held by Pequot Private Equity Fund III, L.P., and Pequot Offshore Private Equity Partners III, L.P. (collectively, the “Funds”). Mr. Enright is a Managing Director of Pequot Capital Management, Inc. and a General Partner of each of the Funds. Mr. Enright serves as a member of the Board and may be deemed to beneficially own the securities held of record by the Funds. Mr. Enright disclaims beneficial ownership of the shares held by the Funds, except to the extent of his pecuniary interest. |

| (5) | Includes 3,301,565 shares held of record ProQuest Investments II, L.P. and 138,640 shares held of record by ProQuest Investments II Advisors Fund, L.P. The natural persons affiliated with ProQuest Investments who have voting or investment power over these shares are Joyce Tsang, Jay Moorin, Alain Schreiber and Pasquale DeAngelis. |

| (6) | Includes 3,440,200 shares held of record by Sofinnova Venture Partners V, LP, Sofinnova Venture Affiliates V, LP and Sofinnova Venture Principals V, LP, a member of the Board and a Managing Member of Sofinnova Venture Partners, has voting or investment power over these shares. |

| (7) | Includes 3,440,202 shares held of record by Three Arch Partners III, L.P. and Three Arch Associates III, L.P. Dr. Jaeger, who serves as a member of the Board, is a member of Three Arch Management III, L.L.C., which is the general partner for Three Arch Partners III, L.P. and Three Arch Associates III, L.P. Dr. Jaeger disclaims beneficial ownership of shares held by Three Arch Partners III, L.P., Three Arch Associates III, L.P. and Three Arch Management III, L.L.C., except to the extent of his pecuniary interest therein. |

| (8) | Includes 23,762 shares held by Sutter Hill Entrepreneurs Fund (AI), L.P.; 60,170 shares held by Sutter Hill Entrepreneurs Fund (QP), L.P.; 2,345,737 shares held by Sutter Hill Ventures, a California Limited Partnership, over which a managing director of the general partner of the partnerships mentioned herein, shares voting and investment power with seven other managing directors of the general partner of the partnerships mentioned herein. The natural persons who have voting or investment power over the shares held of record by Sutter Hill Ventures are David L. Anderson, G. Leonard Baker, Jr., William H. Younger, Jr., Tench Coxe, Gregory P. Sands, James C. Gaither, Jeffrey W. Bird, and James N. White. |

| (9) | Includes 529,719 shares which the Company have the right to repurchase as of the date that is 60 days after April 7, 2005. |

| (10) | Includes 501,531 shares which the Company has the right to repurchase as of the date that is 60 days after April 7, 2005. |

| (11) | Includes 214,165 shares which the Company has the right to repurchase as of the date that is 60 days after April 7, 2005. |

| (12) | Of the 151,800 shares owned by Dr. Colowick, all remain subject to a right of repurchase by the Company, which right of repurchase as to 1/4 of such shares will lapse as of January 11, 2006 and as to the remainder of his shares, at a rate of 1/36th per month for each month thereafter. |

| (13) | Includes 3,553,726 shares held of record by Morgenthaler Partners VII, L.P. (MP VII). Dr. Christoffersen, a member of the Board and a Managing Member of MP VII, shares voting or investment power over these |

9

shares with Robert C. Bellas, Jr., Greg E. Blonder, James W. Broderick, Andrew S. Lanza, Theodore A. Laufik, Paul H. Levine, Gary R. Little, John D. Lutsi, Gary J. Morgenthaler, Robert D. Pavey, G. Gary Shaffer and Peter G. Taft. Dr. Christoffersen disclaims beneficial ownership in these shares, except to the extent of his pecuniary interest. |

| (14) | Includes shares which may be deemed to be beneficially owned by Pequot Capital Management, Inc., the investment manager of Pequot Private Equity Fund III, L.P., the holder of record of 3,114,659 shares, and Pequot Offshore Private Equity Partners III, L.P., the holder of record of 439,066 shares. Pequot Capital Management, Inc. holds voting and dispositive power for all shares held by Pequot Private Equity Fund III, L.P., and Pequot Offshore Private Equity Partners III, L.P. (collectively, the “Funds”). Mr. Enright is a Managing Director of Pequot Capital Management, Inc. and a General Partner of each of the Funds. Mr. Enright serves as a member of the Board and may be deemed to beneficially own the securities held of record by the Funds. Mr. Enright disclaims beneficial ownership of the shares held by the Funds, except to the extent of his pecuniary interest. |

| (15) | Includes 3,440,202 shares held of record by Three Arch Partners III, L.P. and Three Arch Associates III, L.P. Dr. Jaeger, who serves as a member of the Board, is a member of Three Arch Management III, L.L.C., which is the general partner for Three Arch Partners III, L.P. and Three Arch Associates III, L.P. Dr. Jaeger disclaims beneficial ownership of shares held by Three Arch Partners III, L.P., Three Arch Associates III, L.P. and Three Arch Management III, L.L.C., except to the extent of his pecuniary interest therein. |

| (16) | Includes 3,440,200 shares held of record by Sofinnova Venture Partners V, LP, Sofinnova Venture Affiliates V, LP and Sofinnova Venture Principals V, LP. Dr. Powell, a member of the Board and a Managing Member of Sofinnova Venture Partners, has voting or investment power over these shares. |

| (17) | Of the 36,432 shares owned by Mr. Halter, we have the right to repurchase 31,710 as of 60 days from April 7, 2005, which repurchase right lapses at the rate of 675 shares per month, with such right also lapsing with respect to 12,144 shares on October 7, 2005. |

| (18) | In October 2004, the Company granted options to purchase a total of 36,432 shares to Dr. Parker, we have the right to repurchase 31,710 as of 60 days from April 7, 2005, which repurchase right lapses at the rate of 675 shares per month, with such right also lapsing with respect to 12,144 shares on October 7, 2005. |

| (19) | Total number of shares includes common stock held by entities affiliated with directors and executive officers. See footnotes 9 through 18 above. |

10

The following is a description of transactions that occurred on or after January 1, 2004:

| • | to which the Company is a party; |

| • | in which the amount involved exceeds $60,000; and |

| • | in which any director, executive officer or holder of more than 5% of the Company’s capital stock had or will have a direct or indirect material interest. |

Participation in the Company’s Initial Public Offering

Certain of the Company’s existing stockholders, including entities affiliated with Morganthaler Management Partners VII, LLC, Pequot Capital Management, Inc., ProQuest Investments, Sofinnova Ventures, Inc., Three Arch Partners and Sutter Hill Ventures purchased a total of 1,500,003 shares of the Company’s common stock in the Company’s initial public offering of shares of its common stock on February 3, 2005. At an initial public offering price of $7.00 per share, these stockholders purchased $10.5 million of the Company’s common stock in the initial public offering.

Other Related Party Transactions and Business Relationships

Harold E. Selick has served as a venture partner of Sofinnova Ventures, Inc., a holder of more than 5% of the Company’s common stock, since June 2002. In 2003 and 2004, Dr. Selick received $152,083 and $84,000, respectively, in compensation from Sofinnova Ventures, Inc. Dr. Selick also has a carried interest in a company in which Sofinnova Ventures, Inc. is an investor.

The Company’s Amended and Restated Certificate of Incorporation and Bylaws provide that the Company will indemnify each of the Company’s directors and officers to the fullest extent permitted by Delaware Law. Further, the Company has entered into separate indemnification agreements with each of the Company’s directors and executive officers.

In November 2004, the Company entered into a Development Agreement with MediBIC Co. Ltd. The Chief Operating Officer and a director of Anexus Pharmaceuticals, Inc., a subsidiary of MediBIC, is the wife of Dr. Harold E. Selick, the Company’s Chief Executive Officer.

The Company’s Senior Director of Investor Relations, Denise Powell, a Threshold employee, is the sister of Dr. Michael F. Powell, a member of the Board and a member of the audit committee. Ms. Powell’s annualized salary is $140,000. In addition, in January 2005, Ms. Powell was granted an option to purchase 45,540 shares of the Company’s common stock. Twenty-five percent of these shares vest on the one-year anniversary of the commencement of Ms. Powell’s employment with the Company, and the remaining shares vest monthly over the subsequent three years. Ms. Powell also received a bonus of $24,000. Prior to becoming an employee of Threshold in January 2005, Ms. Powell was an independent investor relations consultant. From 1992 to 1998, Ms. Powell held a variety of positions at Amgen, including Associate Director of Investor Relations from 1995 to 1998.

11

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) and the rules promulgated by the Securities and Exchange Commission, the Company’s directors, executive officers and beneficial owners of more than 10% of any class of equity security are required to file periodic reports of their ownership, and changes in that ownership, with the Securities and Exchange Commission. The Company completed its initial public offering in February 2005. Therefore the Company’s directors and executive officers and persons who own more than 10 percent of the Company’s common stock were not subject to Section 16(a) during the year ended December 31, 2004.

CERTAIN INFORMATION WITH RESPECT TO EXECUTIVE OFFICERS

The following table sets forth, as of April 7, 2005, information about the Company’s executive officers.

Name | Age | Position(s) | ||

Executive Officers | ||||

Harold E. Selick, Ph.D. | 50 | Chief Executive Officer and Director | ||

George F. Tidmarsh, M.D., Ph.D. | 45 | Founder, President and Director | ||

Janet I. Swearson | 57 | Chief Financial Officer, Vice President Finance and Operations | ||

Alan Colowick, M.D., M.P.H. | 42 | Chief Medical Officer |

Biographical information for Drs. Selick and Tidmarsh is included above under the heading “Nominees and Continuing Directors.”

Janet I. Swearson has served as the Company’s Chief Financial Officer and Vice President, Finance and Operations since September 2002. From 1999 to 2001, Ms. Swearson was Chief Financial Officer and Vice President, Finance and Operations of Camitro Corporation, a biotechnology company. From 1997 to 1999, she was Chief Financial Officer and Vice President, Finance and Administration of IntraBiotics Pharmaceuticals, Inc., a biotechnology company. From 1991 to 1997, Ms. Swearson served in a variety of positions at Affymax Research Institute, including Vice President, Finance and Operations, Senior Director, Director and Controller. She received her B.A. from the University of Minnesota, Duluth and her M.B.A. from Santa Clara University.

Alan Colowick, M.D., M.P.H.has served as the Company’s Chief Medical Officer since January 2005. From 1999 to 2005, Dr. Colowick held a variety of positions with Amgen, most recently as Vice President of European Medical Affairs. Prior to that, Dr. Colowick worked as senior director of medical affairs and director of product development. Dr. Colowick received his M.D. from the Stanford University School of Medicine and his M.P.H from the Harvard School of Public Health. He completed sub-specialty training in hematology and oncology at Brigham and Women’s Hospital and the Dana Farber Cancer Institute.

12

The following tables and descriptive materials set forth information concerning compensation earned for services rendered to the Company by the Chief Executive Officer (the “CEO”) and the Company’s next four most highly compensated executive officers for fiscal years ended December 31, 2002, 2003 and 2004 (whose salary and bonus for the fiscal year 2004 exceeded $100,000). Collectively, together with the CEO, these are the “named executive officers”.

Summary Compensation Table

Name And Principal Position(s) | Year | Annual Compensation | Long Term Compensation | All Other Compensation | ||||||||

| Salary($) | Bonus($) | Securities Underlying Options | ||||||||||

Harold E. Selick, Ph.D.(1) Chief Executive Officer | 2004 2003 2002 | $ | 295,833 169,007 4,095 | $ | 374,614 — — | 576,841 464,252 85,956 | ||||||

George F. Tidmarsh, M.D., Ph.D.(2) Founder and President | 2004 2003 2002 | | 245,833 200,000 198,333 | | 311,250 — — | 440,221 — 535,855 | ||||||

Janet I. Swearson(3) Chief Financial Officer | 2004 2003 2002 | | 217,083 238,500 87,206 | | 141,375 — — | 245,916 97,152 5,920 | ||||||

| (1) | Harold E. Selick, Ph.D., the Company’s Chief Executive Officer, initially served as the Company’s part-time Acting Chief Executive Officer, in which capacity he earned $2,340 in 2003. On May 1, 2003, Dr. Selick converted his position to full-time Chief Executive Officer, earning $166,667 on an annualized salary of $250,000. As of February 1, 2004, Dr. Selick’s annual compensation was increased to $300,000. |

| (2) | As of February 1, 2004, Dr. Tidmarsh’s annual compensation was increased to $250,000. |

| (3) | Janet I. Swearson, the Company’s Chief Financial Officer, initially served as a consultant to the Company, in which capacity she earned $99,750 in 2003. She commenced her employment in April 2003, earning $138,750 on an annualized salary of $185,000. As of February 1, 2004, Ms. Swearson’s annual compensation was increased to $220,000. |

Option Grants In Year Ended December 31, 2004

The following table sets forth each grant of stock options during the fiscal year ended December 31, 2004 to each of the named executive officers. All options were granted under the Company’s 2001 Equity Incentive Plan at an exercise price equal to the fair market value of the Company’s common stock, as determined by the Company’s Board of Directors, on the date of grant. The percentage of options granted is based on an aggregate of options to purchase a total of 2,062,663 shares of common stock granted by the Company during the fiscal year ended December 31, 2004 to the Company’s employees. The potential realizable value set forth in the last column of the table is calculated based on the term of the option at the time of grant, which is 10 years. This value is based on assumed rates of stock price appreciation of 5% and 10% compounded annually from the date of grant until their expiration date, assuming a fair market value equal to the Company’s initial public offering price of $7.00 per share, minus the applicable exercise price. These numbers are calculated based on the requirements of the Securities and Exchange Commission and do not reflect the Company’s estimate of future stock price growth. Actual gains, if any, on stock option exercises will depend on the future performance of the common stock on the date on which the options are exercised.

13

Option Grant in Year Ended December 31, 2004

Number of Granted | Percentage Employees* | Exercise Price per Share | Expiration Date | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | |||||||||||||

Named Executive Officers | 5% | 10% | |||||||||||||||

Harold E. Selick, Ph.D | 455,401 | (1) | 22.08 | % | $ | 0.26 | 3/9/2014 | $ | 4,997,134 | $ | 7,957,101 | ||||||

| 121,440 | (2) | 5.89 | % | 0.53 | 5/11/2014 | 1,280,442 | 2,038,889 | ||||||||||

George F. Tidmarsh, M.D., Ph.D | 318,781 | (1) | 15.45 | % | 0.26 | 3/9/2014 | 3,497,997 | 5,569,976 | |||||||||

| 121,440 | (2) | 5.89 | % | 0.53 | 5/11/2014 | 1,280,442 | 2,038,889 | ||||||||||

Janet I. Swearson | 209,484 | (1) | 10.16 | % | 0.26 | 3/9/2014 | 2,298,677 | 3,660,259 | |||||||||

| 36,432 | (2) | 1.77 | % | 0.53 | 5/11/2014 | 384,133 | 611,677 | ||||||||||

| * | The percentage of options is based upon an aggregate of 2,062,663 options granted during fiscal year 2004 to employees, including the named executive officers. |

| (1) | Stock options vest in equal monthly installments over four years from the vesting commencement date. |

| (2) | Stock options vest 25% as of the one-year anniversary of the grant date with the remaining shares vesting in equal monthly installments over the following 36 months. |

Aggregated Option Exercises and Option Values Table

The following table sets forth information for each of the named executive officers regarding the number of shares subject to both exercisable and unexercisable stock options, as well as the value of unexercisable in-the-money options, as of December 31, 2004. There was no public trading market for the Company’s common stock as of December 31, 2004. Accordingly, the value of the unexercised in-the-money options at fiscal year-end has been calculated by determining the difference between the exercise price per share and the Company’s initial public offering price of $7.00 per share.

Named executive officers | Number of Shares Acquired | Value Realized(1) | Number of Securities Underlying Unexercised Options at December 31, 2004 | Value of Unexercised In-The-Money Options at December 31, 2004 | ||||||||||

| Exercisable(2) | Unexercisable | Exercisable | Unexercisable | |||||||||||

Harold E. Selick, Ph.D. | 1,127,050 | $ | 7,618,549 | — | — | $ | — | — | ||||||

George F. Tidmarsh, M.D., Ph.D | 854,636 | 5,813,832 | 121,440 | — | 785,717 | — | ||||||||

Janet I. Swearson | 348,988 | 2,352,650 | — | — | — | — | ||||||||

| (1) | These values have been calculated based on an initial public offering price of $7.00 per share, less the applicable exercise price per share, multiplied by the underlying shares, without taking into account any taxes that may be payable in connection with the transaction. |

| (2) | The outstanding option may be exercised at any time, whether vested or unvested. Upon the exercise of an unvested option or the unvested portion of an option, the holder will receive shares of restricted stock that are subject to the Company’s repurchase right at the original purchase price of the shares, which repurchase right lapses in accordance with the vesting schedule previously applicable to the option. |

14

Equity Compensation Plan Information

The following table provides information as of December 31, 2004 with respect to the shares of the Company’s common stock that may be issued under all of the Company’s existing equity compensation plans including the 2001 Equity Incentive Plan, the 2004 Equity Incentive Plan and the 2004 Employee Stock Purchase Plan.

| (a) | (b) | (c) | ||||||

Plan Category | Number of Securities to Be Issued upon Exercise of Outstanding Options | Weighted Average Exercise Price of Outstanding Options | Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) | |||||

Equity compensation plans approved by stockholders | ||||||||

2001 Equity Incentive Plan 2004 | 447,337 | $ | 0.45 | 274,629 | (1) | |||

2004 Equity Incentive Plan | — | — | 2,428,805 | (2) | ||||

Employee Stock Purchase Plan | — | — | 750,000 | (3) | ||||

Total | 447,337 | $ | 0.45 | 3,453,434 | ||||

| (1) | Upon the completion of the Company’s initial public offering in February 2005, all remaining shares of the Company’s common stock available for issuance pursuant to the 2001 Equity Incentive Plan were transferred and made available for issuance under the 2004 Equity Incentive Plan. |

| (2) | The 2004 Equity Incentive Plan, which became effective upon the Company’s initial public offering in February 2005, contains an “evergreen” provision that automatically increases on the first business day of each fiscal year beginning January 1, 2006, the lesser of an additional (i) 1,214,402 shares of common stock, (ii) 5% of the outstanding shares of capital stock on such date, or (iii) an amount determined by the Board. None of the Company’s other equity compensation plans has an “evergreen” provision. |

| (3) | The 2004 Employee Stock Purchase Plan became effective upon the Company’s initial public offering in February 2005. |

Indemnification Agreements

The Company has entered into indemnification agreements with its directors and executive officers. Such agreements require the Company, among other things, to indemnify its officers and directors, other than for liabilities arising from willful misconduct of a culpable nature, and to advance their expenses incurred as a result of any proceedings against them as to which they could be indemnified.

Change of Control Arrangements

In December 2004, the Company entered into change of control severance agreements with Dr. Selick and Ms. Swearson, and in January 2005, the Company entered into a similar agreement with Dr. Colowick. Each of these agreements provides that if such person’s employment is terminated by the Company without cause or is involuntarily terminated, then such person will be entitled to a severance payment consisting of 12 months base salary as in effect as of the date of termination. If such person’s employment is terminated without cause or involuntarily terminated within 18 months following a change of control, then such person will be entitled to the following severance benefits: 12 months base salary and any applicable allowances in effect as of the date of termination of, if greater, as in effect in the year in which the change of control occurs, immediate acceleration and vesting of all stock options granted prior to the change of control, the termination of the Company’s right to repurchase shares of restricted stock purchased prior to the change of control, extension of the exercise period for stock options granted prior to the change of control to two years following the date of termination and up to 12 months of health benefits.

15

In December 2004, the Company entered into a change of control severance agreement with Dr. Tidmarsh that provides that if Dr. Tidmarsh’s employment is terminated by the Company without cause or is involuntarily terminated, then Dr. Tidmarsh will be entitled to a severance payment consisting of 12 months base salary as in effect as of the date of termination. If Dr. Tidmarsh’s employment is terminated without cause or involuntarily terminated within 18 months following a change of control, then he will be entitled to the following severance benefits: 12 months base salary and any applicable allowances in effect as of the date of termination or, if greater, as in effect in the year in which the change of control occurs, immediate acceleration and vesting of all stock options granted prior to the change of control, the termination of the Company’s right to repurchase shares of restricted stock purchased prior to the change of control, extension of the exercise period for stock options granted prior to the change of control to two years following the date of termination and up to 12 months of health benefits. In addition, in the event Dr. Tidmarsh is no longer an employee but remains a participant on the Company’s clinical or scientific advisory board at the time of a change of control and his participation on such board is terminated without cause within 18 months following a change of control, Dr. Tidmarsh will be entitled to the following severance benefits: immediate acceleration and vesting of all stock options granted prior to the change of control, the termination of the Company’s right to repurchase shares of restricted stock purchased prior to the change of control and extension of the exercise period for stock options granted prior to the change of control to two years following the date of termination.

16

REPORT OF THE COMPENSATION COMMITTEE

Under the guidance of a written charter adopted by the Board of Directors (which charter is available on the Company’s website), the purpose of the compensation committee is to develop and review compensation policies and practices applicable to executive officers, review and recommend goals for the Company’s Chief Executive Officer and evaluate his performance in light of these goals, review and evaluate goals and objectives for other officers, oversee and evaluate the Company’s equity incentive plans and review and approve the creation or amendment of such plans. We believe that the composition of the Company’s compensation committee meets the requirements for independence under, and the functioning of the Company’s compensation committee complies with, any applicable requirements of the Sarbanes-Oxley Act of 2002, the Nasdaq National Market and the rules and regulations of the Securities and Exchange Commission.

Compensation Philosophy

The compensation committee designs the Company’s executive compensation with the following overall objectives:

| • | Attract, retain and motivate key executive talent; |

| • | Encourage high performance; |

| • | Promote employee accountability; and |

| • | Align employee incentives with the interests of stockholders. |

Executive compensation comprises three components:

| • | Base salaries competitive with similarly situated development-stage biopharmaceutical companies, including companies with which Threshold competes for similar talented executives; |

| • | Annual variable compensation or bonuses which are designed to encourage executives to focus on the achievement of specific short-term corporate goals as well as longer-term strategic objectives and reward them for their impact on such achievement; and |

| • | Long-term equity based incentives in the form of stock options, to align the interests of management and stockholders and reward management for performance which benefits our stockholders. |

The Company strives to provide a total compensation package to senior management that is competitive in the marketplace, recognizes individual performance and provides opportunities to earn rewards based on achievement of short-term and long-term individual and corporate objectives.

In the biopharmaceutical industry, many traditional measures of corporate performance, such as earnings per share or sales growth, may not readily apply in reviewing performance of executives. Because of the Company’s current stage of development, we have not used profitability or market value of our stock as a significant factor in review of executives’ performance and setting compensation. As such, we evaluate other indications of performance, such as progress of the Company’s research and development programs and corporate development activities, the Company’s success in recruiting and retaining highly qualified personnel, and the Company’s success in securing capital sufficient to enable it to continue research and development activities. These considerations necessarily involve an assessment by the compensation committee of individual and corporate performance. In addition, total compensation paid by the Company to its executive officers is designed to be competitive with compensation packages paid to the management of similarly situated companies in the biopharmaceutical industry. Toward that end, the compensation committee may review both independent survey data, as well as data gathered internally.

This report is submitted by the compensation committee and addresses the compensation policies for 2004 as such policies affected Dr. Selick, in his capacity as Chief Executive Officer of the Company, and the other executive officers of the Company.

17

Base Salary

Base salary ranges are reviewed annually and adjustments are made at the beginning of the fiscal year to reflect changes in job description or market conditions. When establishing or reviewing compensation levels for each executive officer, the compensation committee considers numerous factors, including the qualifications of the executive, his or her level of relevant experience, specific operating roles and duties and strategic goals for which the executive has responsibility.

The compensation committee reviews surveys of proxy statement data, informal studies presented to the compensation committee, and independent compensation surveys and compares salary levels of its executive officers with those of leading comparable companies in order to determine the competitiveness of the pay structure for its executive officers annually. In setting the annual base salaries for the Company’s executive officers the compensation committee reviews the aggregate salary and bonus compensation for individuals in comparable positions with similarly situated companies, including development stage public biopharmaceutical companies and competitors of the Company. The compensation committee compares the salary levels of its executive officers with those of these similarly situated companies and strives to provide its executive officers with cash compensation competitive with the total annual cash compensation paid by comparable companies.

In setting annual base salaries, the compensation committee also reviews and evaluates the performance of the department or activity for which the executive has responsibility, the impact of that department or activity on the Company and the skills and experience required for the job, coupled with a comparison of these elements with similar elements for peer executives both inside and outside the Company. Adjustments to each individual’s base salary are made in connection with annual performance reviews. The level of salaries paid to the Company’s executive officers also takes into account its research and development and clinical development achievements during the year, as well as an evaluation of the individual performance and contribution of each executive to the Company’s performance for the year. Particular emphasis is placed on the individual officer’s level of responsibility for and role in meeting the Company’s research and development, clinical development, corporate development and strategic, technological and financial objectives.

Variable Compensation (Discretionary Bonuses)

Cash bonuses are awarded on a discretionary basis, usually following our fiscal year-end, and are based on the achievement of corporate and individual goals set by the Board of Directors and our Chief Executive Officer at the beginning of the year, as well as the financial condition of the Company. We award bonuses for accomplishments achieved during the past year. The compensation committee recommends to the Board the amount of the bonus, with advice from our management. The compensation committee makes its recommendations based upon an assessment of the individual’s contributions during the year. The compensation Committee also considers general business and economic factors relating to the Company in recommending the size of the bonus pool and adjusts bonuses based on those factors as well. Each executive officer has a target bonus opportunity that is set by the compensation committee each year and then reviewed based on that year’s performance and recommended to the Board for approval. The compensation committee sets target bonus opportunities for the executive officers, calculated as a percentage of base salary.

Stock Options

The Company has used the grant of options under its 2001 Equity Incentive Plan to underscore the common interests of stockholders and management. Options granted to executive officers are intended to provide a continuing financial incentive to maximize long-term value to stockholders and to make each executive’s total compensation opportunity competitive. In addition, because shares of common stock underlying options generally are subject to a right of repurchase by the Company at the original exercise price, which lapses over a period of several years, options encourage executives to remain in the long-term employ of the Company. In determining the size of an option to be granted to an executive officer, the compensation committee takes into account an officer’s position and level of responsibility within the Company, the officer’s existing stock and

18

option holdings, and the potential reward to the officer if the stock price appreciates in the public market. Stock options awards are intended to align the interests of executives with the interests of the stockholders in our long-term performance. The compensation committee developed guidelines for executive stock option awards, in consultation with our management. The guidelines are based upon:

| • | analysis of long-term incentive awards based on each individual executive’s position; |

| • | responsibilities, performance and contribution to the achievement of our long-term goals; and |

| • | competitive stock option data from similarly situated biotechnology companies. |

In addition, the compensation committee reviews the equity position of all executive officers on an annual basis and awards stock options to executive officers periodically.

Executive Officer Compensation and Chief Executive Officer’s Compensation

In setting certain elements of compensation payable for the 2004 fiscal year and planning the compensation payable for the 2005 fiscal year to our Chief Executive Officer, Dr. Selick, and the other executive officers, the compensation committee reviewed the importance of each executive officer’s individual achievement in meeting the Company’s goals and objectives set during the prior fiscal year as well as the overall achievement of the goals by the entire company. These goals included the progressive development of the Company’s research and clinical development programs, establishment of strategic alliances and collaborative partnerships and the acquisition of additional funding for our operations. Specifically, the compensation committee concluded that the Company successfully achieved many of its objectives through:

| • | initiation of the Company’s Phase 3 trial for glufosfamide for the second-line treatment of pancreatic cancer; |

| • | enrollment and data analysis for the Company’s Phase 2 trial of TH-070 for the treatment of symptomatic BPH; and |

| • | preparation for our initial public offering of common stock resulting in net proceeds of approximately $38 million in February 2005. |

The determination by the compensation committee of the Chief Executive Officer’s remuneration is based upon methods consistent with those used for other executive officers. The compensation committee considers certain quantitative factors, including the Company’s financial, strategic, and operating performance for the year as well as certain qualitative criteria including leadership qualities and management skills, as exhibited by innovations, time and effort devoted to the Company and other general considerations in determining appropriate compensation of the Chief Executive Officer.

In 2004, the compensation committee approved the increase of Dr. Selick’s annualized salary to $300,000 from $250,000 in 2003 (during which year Dr. Selick served as the Company’s full-time Chief Executive Officer for seven months). Dr. Selick is eligible to participate in the same executive compensation plans available to our other executive officers. In determining Dr. Selick’s 2004 compensation, including whether to grant stock options to Dr. Selick, the compensation committee considered Dr. Selick’s overall compensation package as compared with other chief executive officers in our industry and past option grants, as well as the effectiveness of Dr. Selick’s leadership of the Company and the resulting success of the Company in the attainment of its goals. In this regard, the compensation committee determined that Dr. Selick’s base salary was not competitive with other similarly situated public company chief executive officers.

In March and May of 2004, Dr. Selick was granted stock options to purchase 455,401 and 121,440 shares of the Company’s common stock at an exercise price of $0.26 and $0.53 per share, respectively, the fair market value on the dates of grant as determined by the Board of Directors. In March and May of 2004, Dr. Selick was also granted bonuses of $210,614 and $64,000, respectively, as part of a Company wide bonus program. In

19

March 2005, the compensation committee recommended a bonus of $100,000 to Dr. Selick for services performed in 2004.

The compensation committee believes that the continued commitment and leadership of our executive officers through fiscal year 2004 were and continue to be important factors in the achievements of the Company.

Compliance with Internal Revenue Code Section 162(m)

Section 162(m) of the U.S. Internal Revenue Code limits the tax deductibility by a corporation of compensation in excess of $1 million paid to any of its five most highly compensated executive officers. However, compensation which qualifies as “performance-based” is excluded from the $1 million limit if, among other requirements, the compensation is payable only upon attainment of pre-established, objective performance goals under a plan approved by stockholders. The compensation committee does not presently expect total cash compensation payable for salaries to exceed the $1 million limit for any individual executive. Having considered the requirements of Section 162(m), the compensation committee believes that stock option grants to date meet the requirement that such grants be “performance-based” and are, therefore, exempt from the limitations on deductibility. The compensation committee will continue to monitor the compensation levels potentially payable under the Company’s cash compensation programs, but intends to retain the flexibility necessary to provide total cash compensation in line with competitive practice, the Company’s compensation philosophy and its best interests.

Internal Revenue Code Section 162(m)

Under Section 162(m) of the Internal Revenue Code, the amount of compensation paid to certain executives that is deductible with respect to our corporate taxes is limited to $1,000,000 annually. It is the current policy of the compensation committee to maximize, to the extent reasonably possible, our ability to obtain a corporate tax deduction for compensation paid to our executive officers to the extent consistent with the best interests of our company and our stockholders.

COMPENSATION COMMITTEE

Dr. Ralph E. Christoffersen (chair)

Dr. Wilfred E. Jaeger

The compensation committee report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, and shall not otherwise be deemed filed under these acts.

20

Under the guidance of a written charter adopted by the Board of Directors (which charter is available on the Company’s website), the purpose of the audit committee is to oversee the accounting and financial reporting processes of the Company and audits of its financial statements. The responsibilities of the audit committee include appointing and providing for the compensation of the independent registered public accounting firm. Each member of the audit committee meets the independence requirements of Nasdaq.

Management has primary responsibility for the system of internal controls and the financial reporting process. The independent registered public accounting firm has the responsibility to express an opinion on the financial statements based on an audit conducted in accordance with generally accepted auditing standards.

In this context and in connection with the audited financial statements contained in the Company’s Annual Report on Form 10-K, the audit committee:

| • | reviewed and discussed the audited financial statements as of and for the fiscal year ended December 31, 2004 with the Company’s management and PricewaterhouseCoopers LLP, the Company’s independent registered public accounting firm; |

| • | discussed with PricewaterhouseCoopers LLP the matters required to be discussed by Statement of Auditing Standards No. 61, Communication with Audit Committees, as amended by Statement of Auditing Standards No. 90, Audit Committee Communications; |

| • | reviewed the written disclosures and the letter from PricewaterhouseCoopers LLP required by the Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, discussed with the auditors their independence, and concluded that the non-audit services performed by PricewaterhouseCoopers LLP are compatible with maintaining their independence; |

| • | based on the foregoing reviews and discussions, recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004 filed with the Securities and Exchange Commission. |

AUDIT COMMITTEE

Mr. Patrick G. Enright (chair)

Dr. Wilfred E. Jaeger

Dr. Michael F. Powell

The audit committee report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, and shall not otherwise be deemed filed under these acts.

21

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The audit committee has appointed PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2005.

Auditor’s Fees

The following table shows the fees accrued by the Company for the audit and other services provided by PricewaterhouseCoopers LLP for fiscal 2004 and 2003.

| 2004 | 2003 | |||||

Audit Fees(1) | $ | 570,350 | $ | 167,200 | ||

Audit-Related Fees(2) | — | — | ||||

Tax Fees(3) | — | 5,300 | ||||

All other Fees | — | — | ||||

Total | $ | 570,350 | $ | 172,500 | ||

The audit committee has delegated to the chair of the audit committee the authority to pre-approve audit-related and non-audit services not prohibited by law to be performed by the Company’s independent registered public accounting firm and associated fees, provided that the chair shall report any decision to pre-approve such audit-related or non-audit services and fees to the full audit committee at its next regular meeting.