- MTEM Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Molecular Templates (MTEM) DEF 14ADefinitive proxy

Filed: 28 Mar 12, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x |

Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material under Rule 14a-12 | |||||

THRESHOLD

PHARMACEUTICALS, INC.

(Name of the Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

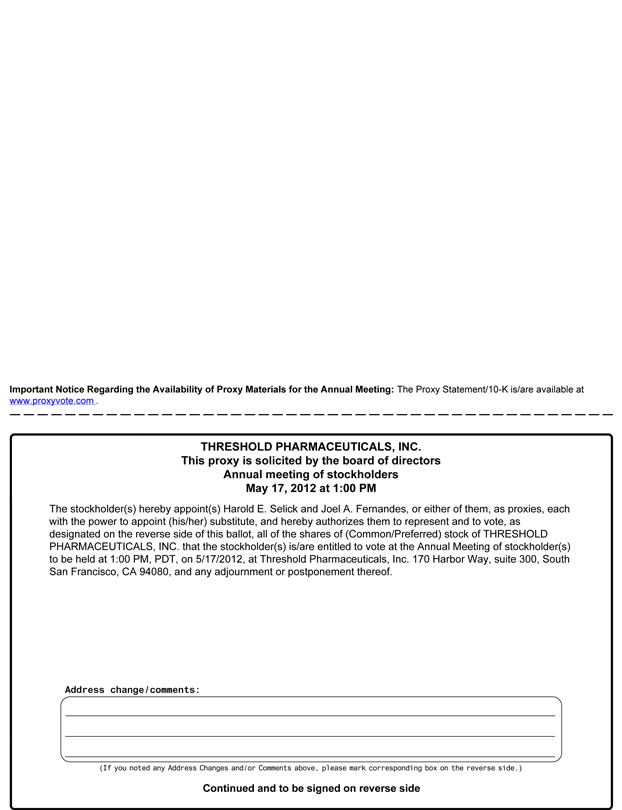

THRESHOLD PHARMACEUTICALS, INC.

Notice of 2012 Annual Meeting of Stockholders

To Be Held May 17, 2012

The 2012 annual meeting of stockholders of Threshold Pharmaceuticals, Inc. will be held on May 17, 2012, at 1:00 p.m., Pacific Time, at our principal executive offices located at 170 Harbor Way, Suite 300, South San Francisco, CA 94080, for the following purposes, as more fully described in the accompanying proxy statement:

1. To elect two Class II directors to hold office until the 2015 annual meeting of stockholders or until their successors are elected and qualified.

2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2012.

3. To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

Only stockholders of record at the close of business on March 23, 2012 will be entitled to notice of, and to vote at, such meeting or any adjournments or postponements thereof.

| BY ORDER OF THE BOARD OF DIRECTORS |

|

| Dr. Harold E. Selick |

| Chief Executive Officer |

South San Francisco, California

March 28, 2012

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON MAY 17, 2012

The proxy statement and annual report to stockholders are available at http://www.thresholdpharm.com.

YOUR VOTE IS IMPORTANT!

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN, DATE AND MAIL PROMPTLY THE ACCOMPANYING PROXY CARD IN THE ENCLOSED RETURN ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. THIS WILL ENSURE THE PRESENCE OF A QUORUM AT THE MEETING. ALTERNATIVELY, YOU MAY VOTE YOUR SHARES ON THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON YOUR PROXY CARD. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON IF YOU WISH TO DO SO EVEN IF YOU HAVE PREVIOUSLY SENT IN YOUR PROXY CARD OR VOTED.

| Page | ||||

| 3 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 8 | ||||

| 8 | ||||

| 10 | ||||

| 10 | ||||

SECURITY OWNERSHIP BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 11 | |||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

PROPOSAL 2—RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 25 | |||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

THRESHOLD PHARMACEUTICALS, INC.

170 Harbor Way, Suite 300

South San Francisco, CA 94080

(650) 474-8200

PROXY STATEMENT

2012 ANNUAL MEETING OF STOCKHOLDERS

We are furnishing this proxy statement and the enclosed proxy in connection with the solicitation of proxies by our board of directors for use at the 2012 annual meeting of stockholders of Threshold Pharmaceuticals, Inc., or the Company, to be held on May 17, 2012, at 1:00 p.m., Pacific time, at our principal executive offices located at 170 Harbor Way, Suite 300, South San Francisco, CA 94080 and at any adjournments or postponements thereof. These materials are being mailed to stockholders on or about April 9, 2012.

Only holders of our common stock as of the close of business on March 23, 2012, or the Record Date, are entitled to vote at the 2012 annual meeting. Stockholders who hold shares in “street name” may vote at the 2012 annual meeting only if they hold a valid proxy from their broker. As of the Record Date, there were 53,634,578 shares of common stock, par value $0.001 per share, outstanding and entitled to vote at the 2012 annual meeting. There are no statutory or contractual rights of appraisal or similar remedies available to stockholders in connection with any matter to be acted on at the 2012 annual meeting.

A majority of the outstanding shares of common stock entitled to vote at the 2012 annual meeting must be present in person or represented by proxy in order for there to be a quorum at the meeting. Stockholders of record who are present at the meeting in person or represented by proxy and who abstain from voting, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, will be included in the number of stockholders present at the meeting for purposes of determining whether a quorum is present.

Each stockholder of record is entitled to one vote at the 2012 annual meeting for each share of common stock held by such stockholder on the Record Date. Stockholders do not have cumulative voting rights. Stockholders may vote their shares by using the proxy card enclosed with this proxy statement. Alternatively, stockholders may vote their shares on the Internet or by telephone by following the instructions on the proxy card. All proxy cards received by us that are properly signed and have not been revoked will be voted in accordance with the instructions contained in the proxy cards. If a signed proxy card is received which does not specify a vote or an abstention, the shares represented by that proxy card will be voted for the nominees to our board of directors listed on the proxy card and in this proxy statement and for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2012. We are not aware, as of the date hereof, of any matters to be voted upon at the 2012 annual meeting other than those stated in this proxy statement. If any other matters are properly brought before the 2012 annual meeting, the enclosed proxy card gives discretionary authority to the persons named as proxies to vote the shares represented by the proxy card in their discretion.

Under Delaware law, our Amended and Restated Certificate of Incorporation and our bylaws, if a quorum exists at the meeting, (i) the affirmative vote of a plurality of the votes cast at the meeting is required for the election of directors and (ii) the affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the 2012 annual meeting will be required to approve the proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2012. A properly executed proxy marked “Withhold Authority” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. A properly executed proxy marked

1

“Abstain” with respect to any other matter will not be voted, although it will be counted for purposes of determining whether there is a quorum.

For shares held in “street name” through a broker or other nominee, the broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if stockholders do not give their broker or nominee specific instructions, their shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval. Shares represented by such “broker non-votes” will, however, be counted in determining whether there is a quorum.

There are four different ways to vote your shares:

| • | By Internet: You may submit a proxy or voting instructions over the Internet by following the instructions atwww.proxyvote.com. |

| • | By Telephone: You may submit a proxy or voting instructions by calling (800) 690-6903 and following the instructions. |

| • | By Mail: If you received your proxy materials via the U.S. mail, you may complete, sign and return the accompanying proxy and voting instruction card in the postage-paid envelope provided to Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| • | In Person: If you are a stockholder as of the Record Date, you may vote in person at the meeting. Submitting a proxy will not prevent a stockholder from attending the 2012 annual meeting and voting in person. |

A stockholder of record may revoke a proxy at any time before it is voted at the 2012 annual meeting by (a) delivering a proxy revocation or another duly executed proxy bearing a later date to our Secretary at 170 Harbor Way, Suite 300, South San Francisco, CA 94080 or (b) attending the 2012 annual meeting and voting in person. Attendance at the 2012 annual meeting will not revoke a proxy unless the stockholder actually votes in person at the meeting. A stockholder who holds shares in “street name” must contact their broker directly to revoke a proxy.

The proxy card accompanying this proxy statement is solicited by our board of directors. We will pay all of the costs of soliciting proxies. In addition to solicitation by mail, our officers, directors and employees may solicit proxies personally, or by telephone, without receiving additional compensation. If requested, we will also pay brokers, banks and other fiduciaries that hold shares of Common Stock for beneficial owners for their reasonable out-of-pocket expenses of forwarding these materials to stockholders.

2

ABOUT THE ANNUAL MEETING

| Q: | Who is soliciting my proxy? |

| A: | Our board of directors. |

| Q: | Where and when is the 2012 annual meeting of stockholders? |

| A: | The 2012 annual meeting of stockholders of Threshold Pharmaceuticals, Inc. to be held on May 17, 2012, at 1:00 p.m., Pacific time, at our principal executive offices located at 170 Harbor Way, Suite 300, South San Francisco, CA 94080. |

| Q: | Who can vote at the 2012 annual meeting? |

| A: | All stockholders of record at the close of business on March 23, 2012, the Record Date for the 2012 annual meeting, will be entitled to notice of and to vote at the 2012 annual meeting. If on that date, your shares were registered directly in your name with our transfer agent, Computershare, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. If on that date, your shares were held in an account at a brokerage firm, bank, dealer or similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the 2012 annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the 2012 annual meeting in person. Nevertheless, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent. As of the close of business on the Record Date, 53,634,578 shares of our common stock were outstanding. |

| Q: | What constitutes a quorum for the meeting? |

| A: | A quorum is required for stockholders to conduct business at the 2012 annual meeting. The presence, in person or represented by proxy, of the holders of a majority of the outstanding shares of our common stock is necessary to establish a quorum at the meeting. Shares present, in person or represented by proxy, including shares as to which authority to vote on any proposal is withheld, shares abstaining as to any proposal and broker non-votes (where a broker submits a properly executed proxy but does not have authority to vote a customer’s shares) on any proposal will be considered present at the meeting for purposes of establishing a quorum for the transaction of business at the meeting. Each of these categories will be tabulated separately. |

| Q: | What am I voting on? |

| A: | You are voting on the following proposals: |

1. To elect two Class II directors to our board of directors (see page 24).

2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2012 (see page 25).

| Q: | How do I vote? |

| A: | If you complete and properly sign the proxy card and return it to Broadridge, 51 Mercedes Way, Edgewood, NY 11717, it will be voted as directed on the proxy card. You may submit a proxy or voting instructions over the Internet by following the instructions atwww.proxyvote.com. You may submit a proxy or voting |

3

| instructions by calling (800) 690-6903 and following the instructions. If you are a registered stockholder and attend the 2012 annual meeting, you may deliver your completed proxy card in person. |

| Q: | Can I change my vote after I return my proxy card? |

| A: | Yes. Even after you have submitted your proxy card, you may revoke your proxy or change your vote at any time before the proxy is exercised by filing with our Secretary either a notice of revocation or a duly executed proxy bearing a later date. The powers of the proxy holders will be suspended if you attend the 2012 annual meeting in person and so request, although attendance at the 2012 annual meeting will not by itself revoke a previously granted proxy. |

| Q: | My shares are held in the “street name.” Will my broker vote my shares? |

| A: | If you hold your shares in “street name,” your broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon, including Proposal 1 to elect directors. If you do not give your broker or nominee specific instructions on such a matter, your shares may not be voted and, in the case of Proposal 1, will not be voted. Shares of common stock represented by “broker non-votes” will, however, be counted in determining whether there is a quorum. |

| Q: | What vote is required to approve each item? |

| A: | Proposal 1 (Election of Directors).The affirmative vote of a plurality of the votes cast at the 2012 annual meeting is required for the election of directors. A properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. Abstentions and broker non-votes will have no legal effect on the election of directors but will be counted for purposes of determining whether there is a quorum. Our Amended and Restated Certificate of Incorporation does not provide for cumulative voting in the election of directors. |

Proposal 2 (Ratify Independent Registered Public Accounting Firm).The affirmative vote of a majority of the votes cast at the 2012 annual meeting is required to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm.

| Q: | How does the board of directors recommend that I vote on the proposals? |

| A: | Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of our board of directors, as set forth below, together with the description of each item in this proxy statement: |

| • | FOR Proposal 1, the election of the nominated slate of two directors (see page 24); and |

| • | FOR Proposal 2, the ratification of the appointment of Ernst & Young LLP as our independent accountants for fiscal year 2012 (see page 25). |

| Q: | Who will bear the cost of this solicitation? |

| A: | We will pay for the cost of soliciting proxies and may reimburse brokerage firms and others for their expenses in forwarding solicitation material. The solicitation will be made primarily through the use of the mail but our regular employees may, without additional compensation, solicit proxies personally by telephone, e-mail, fax or in person. |

| Q: | Whom should I contact with questions? |

| A: | If you need additional copies of this proxy statement or the enclosed proxy card, or if you have other questions about the proposals or how to vote your shares, you may contact our Vice President, Finance, Joel A. Fernandes by telephone at (650) 474-8273. |

4

The name, age and year in which the term expires of each member of our board of directors is set forth below as of March 23, 2012:

Name | Age | Position | Term Expires on the Annual Meeting held in the Year | |||||||

Wilfred E. Jaeger, M.D.(1)(2) | 56 | Director | 2012 | |||||||

David R. Parkinson, M.D.(3) | 61 | Director | 2012 | |||||||

Bruce C. Cozadd(1) | 48 | Director | 2013 | |||||||

David R. Hoffmann(2)(3) | 67 | Director | 2013 | |||||||

George G.C. Parker, Ph.D.(1) | 73 | Director | 2013 | |||||||

Jeffrey W. Bird, M.D., Ph.D.(2)(3) | 51 | Director | 2014 | |||||||

Harold E. Selick, Ph.D. | 57 | Chief Executive Officer and Director | 2014 | |||||||

| (1) | Member of the compensation committee |

| (2) | Member of the audit committee |

| (3) | Member of the nominating and governance committee |

Our Certificate of Incorporation divides our board of directors into three classes, with staggered three-year terms. The Class II directors, whose terms expire at the 2012 annual meeting, are Wilfred E. Jaeger and David R. Parkinson. The Class III directors, whose terms expire at the 2013 annual meeting, are Bruce C. Cozadd, David R. Hoffmann and George G.C. Parker. The Class I directors, whose terms expire at the 2014 annual meeting, are Jeffrey W. Bird and Harold E. Selick. Only one class of directors is elected at each annual meeting. The directors in the other classes continue to serve for the remainder of such class’ three-year term. Dr. Jaeger and Dr. Parkinson, who are Class II directors previously elected by our stockholders, are nominees for re-election at the 2012 annual meeting. The nominating and governance committee has recommended to our board of directors that Dr. Jaeger and Dr. Parkinson be nominated for election to this class, each for a three-year term ending on the date of the 2015 annual meeting or until a successor is duly elected or appointed. Each nominee has consented to serve an additional three-year term.

The following paragraphs below under the section captioned “Nominees and Continuing Directors” provide information as of the date of this proxy statement about each individual nominated for election to our board of directors at the 2012 annual meeting and each continuing member of our board of directors. The information presented includes information each director has given us about his age, all positions he holds, his principal occupation and business experience for the past five years, and the names of other publicly-held companies of which he currently serves as a director or has served as a director during the past five years. In addition to the information presented below regarding each nominee’s specific experience, qualifications, attributes and skills that led our board of directors to the conclusion that he should serve as a director, we also believe that all of our director nominees have demonstrated a depth and breadth of experience, integrity, ability to make independent analytical inquiries, understanding of our business environment and willingness to devote adequate time to their board duties.

Information about the number of shares of common stock beneficially owned by each director appears below under the heading “Security Ownership by Certain Beneficial Owners and Management.” See also “Related Party Transactions.” There are no family relationships among any of our directors or named executive officers.

5

NOMINEES AND CONTINUING DIRECTORS

The following individuals have been nominated for election to our board of directors at the 2012 annual meeting:

Wilfred E. Jaeger, M.D. has served as a member of our board of directors since 2001. He has been a Partner of Three Arch Partners, a venture capital firm, since 1993. Dr. Jaeger serves on the board of directors of North American Scientific, Inc. and a number of private companies. Dr. Jaeger received his B.S. from the University of British Columbia, his M.D. from the University of British Columbia School of Medicine and his M.B.A. from Stanford University. Our board of directors has determined to nominate Dr. Jaeger for election as a director as it believes that Dr. Jaeger’s financial and medical knowledge and experience are valuable to the board, particularly with respect to his service on the audit and compensation committees.

David R. Parkinson, M.D.joined our board of directors in 2010. He is the president and chief executive officer of Nodality, a South San Francisco-based biotechnology company. Prior to 2007, Dr. Parkinson was senior vice president of Oncology Research and Development at Biogen Idec, vice president of Oncology Development at Amgen and vice president of Global Clinical Oncology Development at Novartis. Dr. Parkinson also worked at the National Cancer Institute from 1990 to 1997, serving as chief of the Investigational Drug Branch, then as action associate director of the Cancer Therapy Evaluation Program. He has also held academic positions at the M.D. Anderson Cancer Center, University of Texas and New England Medical Center at Tufts University School of Medicine. Dr. Parkinson received his M.D. as gold medalist from the University of Toronto Faculty of Medicine in 1977, with Internal Medicine and Hematology/Oncology training in Montreal at McGill University and in Boston at New England Medical Center. Dr. Parkinson is a past chairman of the Food and Drug Administration (FDA) Biologics Advisory Committee and is a recipient of the FDA’s Cody Medal. He is a past president of the International Society of Biological Therapy and past editor of the Journal of Immunotherapy. He currently serves on the National Cancer Policy Forum of the Institute of Medicine. He has recently completed a term on the FDA’s Science Board as well as a term on the board of directors of the American Association of Cancer Research (AACR). He continues to serve as Chairman of the AACR Finance Committee. Our board of directors has determined to nominate Dr. Parkinson for election in part because it believes it benefits from Dr. Parkinson’s medical knowledge and experience, especially in the field of oncology, and his industry perspective.

The following individuals will continue to serve on our board of directors after the 2012 annual meeting:

Jeffrey W. Bird,M.D., Ph.D.has served as a member of our board of directors since November 2008. Dr. Bird is a Managing Director of Sutter Hill Ventures, a venture capital firm based in Palo Alto, California. Dr. Bird was previously Senior Vice President, Business Operations at Gilead Sciences, where he oversaw business development and commercial activities. Dr. Bird received a degree in Biological Sciences from Stanford in 1982, a Ph.D. in Cancer Biology in 1988 and a M.D. in 1992 from Stanford Medical School. Dr. Bird is currently a board member of Horizon Pharma, Inc., a public company, and a number of private biotechnology companies. Our board of directors believes it benefits from Dr. Bird’s financial and medical knowledge and experience, which are valuable to the board.

Harold E. Selick, Ph.D. joined us as Chief Executive Officer in June 2002. From June 2002 until July 2007, Dr. Selick was a Venture Partner of Sofinnova Ventures, Inc., a venture capital firm. From January 1999 to April 2002, he was Chief Executive Officer of Camitro Corporation, a biotechnology company. From 1992 to 1999, he was at Affymax Research Institute, the drug discovery technology development center for Glaxo Wellcome plc, most recently as Vice President of Research. Prior to working at Affymax he held scientific positions at Protein Design Labs, Inc. and Anergen, Inc. As a staff scientist at Protein Design Labs, Inc. (now PDL BioPharma, Inc., or PDL) he co-invented the technology underlying the creation of fully humanized antibody therapeutics and applied that to PDL’s first product, Zenapax (daclizumab), which was developed and commercialized by Roche for treating kidney transplant rejection. Dr. Selick serves on the board of directors of PDL, a public company and currently serves as Chairman of

6

the Board of Directors of Catalyst Biosciences, a privately-held drug discovery and development company, serves as a director of InteKrin Therapeutics, a clinical-stage, privately-held biopharmaceutical company, and also serves as a director of Protagonist Therapeutics, a privately-held biotechnology company. Dr. Selick received his B.S. and Ph.D. from the University of Pennsylvania and was a Damon Runyon-Walter Winchell Cancer Fund Fellow and an American Cancer Society Senior Fellow at the University of California, San Francisco. Our board of directors believes that Dr. Selick’s extensive experience with the Company and industry knowledge provides an invaluable insight to the board of directors on issues involving the Company and its goals. Further, the board of directors believes that including the CEO as a director is an efficient way of ensuring continuity between the development and execution of the Company’s business strategies.

Bruce C. Cozadd has served as a member of our board of directors since December 2005. He joined Jazz Pharmaceuticals plc at its inception and was appointed Chairman and Chief Executive Officer in April 2009. From 2004 until 2009, Mr. Cozadd served as Jazz Pharmaceuticals’ Executive Chairman. Prior to co-founding Jazz Pharmaceuticals, Mr. Cozadd served in various executive management positions with ALZA Corporation from 1991 until its acquisition by Johnson & Johnson in 2001. At the time of the merger, Mr. Cozadd was serving as Executive Vice President and Chief Operating Officer of ALZA, with responsibility for research and development, manufacturing, and sales and marketing. Prior to joining ALZA, he was in the Corporate Finance Health Care group at Smith Barney, Harris Upham & Co. Inc. He serves on the board of directors of Jazz Pharmaceuticals, Inc., Cerus Corp., The Nueva School and Stanford Hospital and Clinics. He received his B.S. from Yale University and his M.B.A. from Stanford University. Our board of directors believes that Mr. Cozadd’s leadership experience at other life sciences companies gives him a breadth of knowledge and a unique perspective on the industry.

David R. Hoffmann has served as a member of our board of directors since April 2007. Mr. Hoffmann is retired from ALZA Corporation (now a Johnson & Johnson company) where he held the positions of Vice President and Treasurer from 1992 to until his retirement in October 2002, Vice President of Finance from 1982 to 1992 and Director of Accounting/Finance from 1976 to 1982. Mr. Hoffmann is currently Chief Executive Officer of Hoffmann Associates, a multi-group company specializing in cruise travel and financial and benefit consulting. He serves on the board of directors of DURECT Corporation. Mr. Hoffmann holds a B.S. in Business Administration from the University of Colorado. Our board of directors believes that Mr. Hoffman’s financial knowledge and industry experience are valuable to the board, particularly with respect to his service on the audit committee. Our board of directors has determined that Mr. Hoffmann qualifies as an “audit committee financial expert” as defined by the rules of the SEC.

George G.C. Parker, Ph.D. has served as a member of our board of directors since October 2004. Dr. Parker is the Dean Witter Distinguished Professor of Finance (Emeritus) and previously Senior Associate Dean for Academic Affairs and Director of the MBA Program, Graduate School of Business, Stanford University. Dr. Parker joined the faculty at Stanford University in 1973. He serves on the board of directors of iShares Mutual Funds, Tejon Ranch Company, Colony Financial, Inc. and First Republic Bank and a number of private companies, and was formerly a director of Continental Airlines, Inc. and Netgear, Inc. Dr. Parker received his B.A. from Haverford College and his M.B.A. and Ph.D. from Stanford University. Our board of directors believes it is well served by Dr. Parker’s extensive financial and leadership experience, including his compensation committee experience.

7

Criteria for Board Membership. In selecting candidates for appointment or re-election to our board of directors, the nominating and governance committee considers the appropriate balance of specific experience, qualifications, attributes and skills required of our board of directors, and seeks to insure that at least a majority of the directors are independent under the rules of the NASDAQ Stock Market, and that members of our audit committee meet the financial literacy and sophistication requirements under the rules of the NASDAQ Stock Market and at least one of them qualifies as an “audit committee financial expert” under the rules of the Securities and Exchange Commission, or SEC. Nominees for director are selected on the basis of their depth and breadth of experience, integrity, ability to make independent analytical inquiries, understanding of our business environment, and willingness to devote adequate time to their board duties.

Stockholder Nominees. The nominating and governance committee will consider written proposals from stockholders for nominees for director. Any such nominations should be submitted to the nominating and governance committee c/o our Secretary and should include the following information: (a) all information relating to such nominee that is required to be disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); (b) the names and addresses of the stockholders making the nomination and the number of shares of our common stock which are owned beneficially and of record by such stockholders; and (c) appropriate biographical information and a statement as to the qualification of the nominee, and should be submitted in the time frame described in our bylaws and under the caption, “Stockholder Proposals for 2013 Annual Meeting” below.

Process for Identifying and Evaluating Nominees. The nominating and governance committee believes we are well-served by our current directors. If an incumbent director is not standing for re-election, or if a vacancy on our board of directors occurs between annual stockholder meetings, or if our board of directors desires to increase its size, the nominating and governance committee will seek out potential candidates for appointment to our board of directors who meet the criteria for selection as a nominee and have the specific qualities or skills being sought. Director candidates will be selected based on input from members of our board of directors and, if the nominating and governance committee deems appropriate, a third-party search firm. The nominating and governance committee will evaluate each candidate’s qualifications and check relevant references; in addition, such candidates will be interviewed by at least one member of the nominating and governance committee. Candidates meriting serious consideration will meet with additional members of our board of directors. Based on this input, the nominating and governance committee will evaluate whether the committee should recommend to our board of directors that this candidate be elected to fill a vacancy on our board of directors, or presented for the approval of the stockholders, as appropriate.

We have never received a proposal from a stockholder to nominate a director. Although the nominating and governance committee has not adopted a formal policy with respect to stockholder nominees, the committee expects that the evaluation process for a stockholder nominee would be similar to the process outlined above.

Board Nominees for the 2012 Annual Meeting. Dr. Jaeger and Dr. Parkinson are nominees standing for re-election at the annual meeting.

Our board of directors met eight times during fiscal year 2011. The audit committee met six times during fiscal year 2011, the compensation committee met one time during fiscal year 2011 and the nominating and governance committee met one time during fiscal year 2011. Each member of our board of directors attended at least 75% or more of the aggregate number of board meetings and meetings of committees of the board that each such director served on in fiscal 2011. Five of our seven directors attended the 2011 annual meeting of

8

stockholders. Typically, a board of directors meeting is scheduled on the date of any annual meeting of stockholders. Although the board has not adopted a formal policy, all directors are expected to attend the annual meeting of stockholders if possible.

Our board of directors has determined that the following directors are “independent” under the current rules of the NASDAQ Stock Market: Dr. Bird, Mr. Cozadd, Mr. Hoffmann, Dr. Jaeger, Dr. Parker and Dr. Parkinson. Under applicable rules of the SEC and the rules of the NASDAQ Stock Market, the existence of certain “related party” transactions above certain thresholds between a director and the Company are required to be disclosed and preclude a finding by our board of directors that the director is independent. In addition to transactions required to be disclosed under rules of the SEC, our board of directors considered certain other relationships in making its independence determinations and determined in each case that such other relationships did not impair the director’s ability to exercise independent judgment on behalf of us.

Our board of directors has standing (i) audit, (ii) compensation and (iii) nominating and governance committees, each of which has a written charter, copies of which can be found atwww.thresholdpharm.com.

Audit Committee. The audit committee currently consists of Mr. Hoffmann (chair), Dr. Bird and Dr. Jaeger. Our board of directors has determined that all members of the audit committee are independent directors under the rules of the NASDAQ Stock Market and each of them is able to read and understand fundamental financial statements. Our board of directors has determined that Mr. Hoffmann qualifies as an “audit committee financial expert” as defined by the rules of the SEC.

The purpose of the audit committee is to oversee our accounting and financial reporting processes and audits of our financial statements. Although management has primary responsibility for the system of internal controls and the financial reporting process, the responsibilities of the audit committee include appointing and approving the compensation of the independent registered public accounting firm to conduct the annual audit of our accounts, reviewing and evaluating the scope and results of the annual audit, approving all professional services to be provided to us by our independent registered public accounting firm, meeting with management and the independent registered public accounting firm to discuss our financial statements and matters that may affect our financial statements, and approving all related party transactions.

Compensation Committee. The compensation committee currently consists of Dr. Jaeger (chair), Mr. Cozadd and Dr. Parker. Our board of directors has determined that all members of the compensation committee are independent directors under the rules of the NASDAQ Stock Market. The compensation committee develops and reviews compensation policies and practices applicable to executive officers, reviews and recommends goals for our Chief Executive Officer and evaluates his performance in light of these goals, reviews and evaluates goals and objectives for other officers, oversees and evaluates our equity incentive plans and reviews and approves the creation of or amendment to our equity incentive plans.

Nominating and Governance Committee. The nominating and governance committee currently consists of Mr. Hoffmann (chair), Dr. Bird and Dr. Parkinson. Our board of directors has determined that all members of the nominating and governance committee are independent directors under the rules of the NASDAQ Stock Market. The nominating and governance committee’s responsibilities include recommending to our board of directors nominees for possible election to our board of directors. Nominees for the 2012 annual meeting were recommended to our board of directors for nomination by the nominating and governance committee and our board of directors subsequently approved these nominees at a meeting of our board of directors on March 1, 2012.

Our board of directors has not designated a chairman or lead independent director. We believe that the leadership structure of the board is adequate and appropriate for governance given the existing scope and nature of our operations. To facilitate the board’s responsibility for oversight of company risks, the board delegates specific areas of risk management oversight to applicable board committees. The audit committee oversees our

9

risk policies and processes relating to financial statements and financial reporting, including our system of internal control over financial reporting. The compensation committee oversees risks associated with our compensation plans and the effect that our compensation structure may have on business decisions and on the attraction and retention of a qualified management team. The nominating and governance committee oversees risks related to our governance structure and the evaluation of individual board members and committees.

We maintain a corporate governance page on our website which includes key information about our corporate governance matters, including our Code of Ethics and charters for each committee of our board of directors. If there were any amendment or waiver to our Code of Ethics, it would also be included on the corporate governance page. The corporate governance page can be found atwww.thresholdpharm.com, by clicking first on “Investors & Media,” then clicking on “Corporate Governance.”

Our policies and practices reflect corporate governance initiatives that we believe are compliant with the listing requirements of the NASDAQ Stock Market and the corporate governance requirements of the Sarbanes-Oxley Act of 2002, including:

| • | a majority of our board of directors members are “independent” under the rules of the NASDAQ Stock Market; |

| • | all members of the key board committees—the audit committee, the compensation committee and the nominating and governance committee—are independent under the rules of the NASDAQ Stock Market; |

| • | the independent members of our board of directors meet regularly outside the presence of management; |

| • | we have adopted a Code of Ethics that is monitored by management and that applies to all of our officers, directors and employees, including our principal executive officer and all members of our finance department, including our principal financial officer and our controller; |

| • | the charters of our board of directors committees establish their respective roles and responsibilities; and |

| • | our audit committee has procedures in place for the anonymous submission of employee complaints on accounting, internal controls or auditing matters. |

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Stockholders or other interested parties may communicate with any director or committee of our board of directors by writing to them c/o Secretary, Threshold Pharmaceuticals, Inc., 170 Harbor Way, Suite 300, South San Francisco, CA 94080. Comments or questions regarding our accounting, internal controls or auditing matters will be referred to members of the audit committee. Comments or questions regarding the nomination of directors and other corporate governance matters will be referred to members of the nominating and governance committee.

10

SECURITY OWNERSHIP BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding ownership of our common stock as of March 23, 2012 or earlier date for information based on filings with the SEC by (a) each person known to us to own more than 5% of the outstanding shares of our common stock, (b) each named executive Officer identified in the compensation tables appearing later in this proxy statement, (c) each of our directors and (d) all directors and executive officers as a group. The information in this table is based solely on statements in filings with the SEC or other information we believe to be reliable.

Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership(2) | Percent of Shares Beneficially Owned(2) | ||||||

Stockholders owning more than 5% | ||||||||

Entities affiliated with Alta BioPharma Management III, LLC(3) | 3,451,328 | 6.43 | % | |||||

One Embarcadero Center, Suite 3700 | ||||||||

San Francisco, California 94111 | ||||||||

Entities affiliated with Felix J. Baker and Julian C. Baker(4) | 4,564,426 | 8.51 | % | |||||

667 Madison Avenue | ||||||||

New York, New York 10021 | ||||||||

Entities affiliated with Federated Investors, Inc.(5) | 5,230,849 | 9.75 | % | |||||

Federated Investors Tower | ||||||||

Pittsburgh, Pennsylvania 15222 | ||||||||

Entities affiliated with FMR LLC(6) | 7,464,291 | 13.92 | % | |||||

82 Devonshire Street | ||||||||

Boston, MA 02109 | ||||||||

Entities and persons affiliated with Sutter Hill Ventures(7) | 8,159,605 | 15.21 | % | |||||

755 Page Mill Road, Suite A-200 | ||||||||

Palo Alto, California 94304 | ||||||||

Entities and persons affiliated with Three Arch Partners(8) | 3,299,170 | 6.15 | % | |||||

3200 Alpine Road | ||||||||

Portola Valley, California 94028 | ||||||||

Directors and Executive Officers | ||||||||

Jeffrey W. Bird,M.D., Ph.D.(9) | 5,800,253 | 10.81 | % | |||||

Bruce C. Cozadd(10) | 53,958 | * | ||||||

David R. Hoffmann(11) | 51,458 | * | ||||||

Wilfred E. Jaeger,M.D.(12) | 3,299,170 | 6.15 | % | |||||

Stewart M. Kroll(13) | 167,067 | * | ||||||

Mark D. Matteucci,Ph.D.(14) | 1,047,003 | 1.95 | % | |||||

George G.C. Parker,Ph.D.(15) | 60,030 | * | ||||||

David R. Parkinson,M.D.(16) | 28,124 | * | ||||||

Harold E. Selick,Ph.D.(17) | 1,072,392 | 2.00 | % | |||||

All current directors and executive officers as a group | 11,579,455 | 21.59 | % | |||||

| * | Less than 1%. |

| (1) | Unless otherwise indicated, the address of each of the named individuals is c/o Threshold Pharmaceuticals, Inc., 170 Harbor Way, Suite 300, South San Francisco, CA 94080. |

| (2) | Percentage ownership is based on 53,634,578 shares of our common stock outstanding as of March 23, 2012. Beneficial ownership of shares is determined in accordance with the rules of the SEC and generally includes any shares over which a person exercises sole or shared voting or investment power, or of which a |

11

| person has the right to acquire ownership within 60 days after March 23, 2012. Except as otherwise noted, each person or entity has sole voting and investment power with respect to the shares shown. |

| (3) | According to a Schedule 13G filed with the SEC on January 10, 2012, this number includes 3,161,128 shares held by Alta BioPharma Partners III, L.P., or ABPIII, 212,298 shares held by Alta BioPharma Partners III, GmbH & Co. Beteiligungs KG, or APIIIKG, and 77,902 shares held by Alta Embarcadero BioPharma Partners III, LLC, or AEBPIII. The foregoing shares include warrants exercisable for 926,838 shares, all of which are exercisable within 60 days after March 23, 2012. Alta BioPharma Management III, LLC, or ABMIII, is the general partner of ABPIII and the managing limited partner of ABPIIIKG and has shared voting and dispositive power over the 3,373,426 shares held by ABPIII and APIIIKG. ABMIII disclaims beneficial ownership of all such shares except to the extent of its pecuniary interest therein. Edward Penhoet, Farah Champsi and Edward Hurwitz are the directors of ABPIIIKG and the managers of AEBPIII and each has shared voting and dispositive power over the shares held ABPIII, APIIIKG and AEB. Dr. Penhoet and Messrs. Champsi and Hurwitz each disclaim beneficial ownership of all such shares except to the extent of their pecuniary interest therein. |

| (4) | According to a Schedule 13G/A filed with the SEC on February 14, 2012 and other information we believe to be reliable, 667, L.P. is the holder of 842,398 shares, Baker Brothers Life Sciences, L.P. is the holder of 3,614,484 shares, 14159, L.P. is the holder of 84,231 shares, Baker/Tisch Investments, L.P. is the holder of 22,283 shares and Baker Bros. Investments II, L.P. is the holder of 1,030 shares. By virtue of their ownership of entities that have the power to control the investment decisions of the foregoing limited partnerships, Felix J. Baker and Julian C. Baker may each be deemed to be beneficial owners of the shares owned by such entities and may be deemed to have shared voting and investment power over such shares. |

| (5) | According to a Schedule 13G/A filed with the SEC on March 8, 2012 and other information we believe to be reliable, this number of shares represents shares beneficially owned by registered investment companies and separate accounts advised by subsidiaries of Federated Investors, Inc. that have been delegated the power to direct investments and power to vote the securities by the registered investment companies’ board of trustees or directors and by the separate accounts’ principals. This number of shares also includes warrants to purchase 2,094,238 shares which are exercisable within 60 days after March 23, 2012. All of the voting securities of Federated Investors, Inc. are held in the Voting Shares Irrevocable Trust (“Federated Trust”), the trustees of which are John F. Donahue, Rhodora J. Donahue, and J. Christopher Donahue (“Federated Trustees’). The Federated Trust, Federated Trustees, parent holding company and subsidiary advisers of the parent expressly disclaim that they are the beneficial owners of these shares. |

| (6) | According to a Schedule 13G filed with the SEC on March 12, 2012, this number of shares represents 7,230,181 shares (including warrants to purchase 666,666 shares which are exercisable within 60 days after March 23, 2012) beneficially owned by Fidelity Management & Research Company (“Fidelity”)as a result of acting as investment adviser to various investment companies registered under Section 8 of the Investment Company Act of 1940 and 234,110 shares beneficially owned by Pyramis Global Advisors, LLC (“Pyramis”) as a result of its serving as investment adviser to institutional accounts, non-U.S. mutual funds, or investment companies registered under Section 8 of the Investment Company Act of 1940 owning such shares. Edward C. Johnson III, chairman of FMR LLC, and FMR LLC, through its control of Fidelity, and the funds each has sole power to dispose of the 7,230,181 shares owned by the Funds. Neither FMR LLC nor Edward C. Johnson III, has the sole power to vote or direct the voting of the shares owned directly by the Fidelity Funds, which power resides with the Funds’ Boards of Trustees. Fidelity carries out the voting of the shares under written guidelines established by the Funds’ Boards of Trustees. Edward C. Johnson 3d and FMR LLC, through its control of Pyramis, each has sole dispositive power over 234,110 shares and sole power to vote or to direct the voting of 234,110 shares of Common Stock owned by the institutional accounts or funds advised by Pyramis. |

| (7) | According to a Schedule 13G/A filed with the SEC on February 9, 2012, this number includes 3,960 shares held by Sutter Hill Entrepreneurs Fund (AI), L.P., 10,028 shares held by Sutter Hill Entrepreneurs Fund (QP), L.P. and 5,454,602 shares (including warrants to purchase 1,470,957 shares which are exercisable within 60 days after March 23, 2012) held by Sutter Hill Ventures, a California limited partnership (collectively, Sutter Hill), over which Dr. Bird, who is a member of our board of directors and is a managing director of the general partner of the partnerships mentioned herein, shares voting and investment power |

12

| with ten other managing directors of the general partner of the partnerships mentioned herein. In addition, such stockholders beneficially own 2,359,352 shares (including warrants to purchase 707,560 shares which are exercisable within 60 days after March 23, 2012). The other ten natural persons who have voting or investment power over the shares held of record by Sutter Hill are: David L. Anderson, G. Leonard Baker, Jr., Tench Coxe, James C. Gaither, Gregory P. Sands, Andrew T. Sheehan, Michael L. Speiser, David E. Sweet, James N. White and William H. Younger, Jr. or, collectively, the Sutter Hill Principals. Sutter Hill does not have voting or investment power with respect to the shares held by Dr. Bird or the Sutter Hill Principals. This number also includes 281,786 shares (including warrants to purchase 73,764 shares which are exercisable within 60 days after March 23, 2012) held in the Jeffrey W. Bird and Christina R. Bird Trust Agreement of which Dr. Bird is a trustee, 919 shares held in a Roth IRA for the benefit of Dr. Bird and 48,958 shares subject to options granted to Dr. Bird which are exercisable within 60 days after March 23, 2012. Dr. Bird disclaims beneficial ownership of the trust’s shares except as to his pecuniary interest therein. |

| (8) | According to a Schedule 13G/A filed with the SEC on February 14, 2012, this number includes an aggregate of 3,079,649 shares (including warrants to purchase 769,627 shares which are exercisable within 60 days after March 23, 2012) held by Three Arch Partners III, L.P., and 165,563 shares (including warrants to purchase 41,376 shares which are exercisable within 60 days after March 23, 2012) held by Three Arch Associates III, L.P. Dr. Jaeger, who serves as a member of our board of directors, is a managing member of Three Arch Management III, L.L.C., or TAM III, which is the general partner of Three Arch Partners III, L.P. and Three Arch Associates III, L.P. TAM III may be deemed to have sole power to vote these shares, Mark A. Wan, a managing member of TAM III, may be deemed to have sole power to vote these shares, and Dr. Jaeger, a managing member of TAM III, may be deemed to have sole power to vote these shares. This number also includes 53,958 shares subject to options granted to Dr. Jaeger which are exercisable within 60 days after March 23, 2012. Dr. Jaeger disclaims beneficial ownership of shares held by Three Arch Partners III, L.P., Three Arch Associates III, L.P. and Three Arch Management III, L.L.C., except to the extent of his pecuniary interest therein. |

| (9) | According to a Schedule 13G/A filed with the SEC on February 9, 2012, this number includes 3,960 shares held by Sutter Hill Entrepreneurs Fund (AI), L.P., 10,028 shares held by Sutter Hill Entrepreneurs Fund (QP), L.P. and 5,454,602 shares (including warrants to purchase 1,470,957 shares which are exercisable within 60 days after March 23, 2012) held by Sutter Hill Ventures, a California limited partnership (collectively, Sutter Hill), over which Dr. Bird, who is a member of our board of directors and is a managing director of the general partner of the partnerships mentioned herein, shares voting and investment power with ten other managing directors of the general partner of the partnerships mentioned herein. This number also includes 281,786 shares (including warrants to purchase 73,764 shares which are exercisable within 60 days after March 23, 2012) held in the Jeffrey W. Bird and Christina R. Bird Trust Agreement of which Dr. Bird is a trustee, 919 shares held in a Roth IRA for the benefit of Dr. Bird and 48,958 shares subject to options granted to Dr. Bird which are exercisable within 60 days after March 23, 2012. Dr. Bird disclaims beneficial ownership of the trust’s shares except as to his pecuniary interest therein. |

| (10) | Includes 53,958 shares subject to options granted to Mr. Cozadd which are exercisable within 60 days after March 23, 2012. |

| (11) | Includes 51,458 shares subject to options granted to Mr. Hoffmann which are exercisable within 60 days after March 23, 2012. |

| (12) | According to a Schedule 13G/A filed with the SEC on February 14, 2012, this number includes an aggregate of 3,079,649 shares held by Three Arch Partners III, L.P., including warrants exercisable for 769,627 shares within 60 days after March 23, 2012, and 165,563 shares held by Three Arch Associates III, L.P., including warrants exercisable for 41,376 shares within 60 days after March 23, 2012. Dr. Jaeger, who serves as a member of our board of directors, is a managing member of Three Arch Management III, L.L.C., or TAM III, which is the general partner for Three Arch Partners III, L.P. and Three Arch Associates III, L.P. TAM III may be deemed to have sole power to vote these shares, Mark A. Wan, a managing member of TAM III, may be deemed to have sole power to vote these shares, Dr. Jaeger, a managing member of TAM III, may be deemed to have sole power to vote these shares, and Barclay Nicholson, a managing member of TAM III, may be deemed to have sole power to vote these shares. Dr. Jaeger disclaims beneficial ownership |

13

| of shares held by Three Arch Partners III, L.P., Three Arch Associates III, L.P. and Three Arch Management III, L.L.C., except to the extent of his pecuniary interest therein. This number also includes 53,958 shares subject to options granted to Dr. Jaeger which are exercisable within 30 days after March 23, 2012. |

| (13) | Includes 128,326 shares subject to options granted to Mr. Kroll and warrants to purchase 7,948 shares, all of which are exercisable within 60 days after March 23, 2012. Also includes 18,222 shares acquired by Mr. Kroll under our 2004 Employee Stock Purchase Plan. |

| (14) | Includes 161,456 shares subject to options granted to Dr. Matteucci and warrants to purchase 224,931 shares, all of which are exercisable within 60 days after March 23, 2012. Also includes 17,290 shares acquired by Dr. Matteucci under our 2004 Employee Stock Purchase Plan. |

| (15) | Includes 53,958 shares subject to options granted to Dr. Parker, all of which are exercisable within 60 days after March 23, 2012. |

| (16) | Includes 28,124 shares subject to options granted to Dr. Parkinson, all of which are exercisable within 60 days after March 23, 2012. |

| (17) | Includes 634,475 shares subject to options granted to Dr. Selick and warrants to purchase 59,596 shares, all of which are exercisable within 60 days after March 23, 2012. Also includes 18,653 shares acquired by Dr. Selick under our 2004 Employee Stock Purchase Plan. |

| (18) | Includes outstanding options to purchase 1,214,671 shares and warrants to purchase 2,648,199 shares, all of which are exercisable within 60 days after March 23, 2012. Also includes 54,165 shares acquired under our 2004 Employee Stock Purchase Plan by our current directors and executive officers as a group. |

14

Procedures for Approval of Related Party Transactions

Pursuant to our Code of Ethics and the charter of our audit committee, our executive officers and directors must disclose transactions involving actual or apparent conflicts of interests, such as related party transactions, to the audit committee in writing and must obtain the audit committee’s approval prior to entering into any such transaction. In approving or rejecting any proposed transaction, the audit committee considers the relevant facts and circumstances available and deemed relevant, including but not limited to, the risks, costs, and benefits to us, the terms of the transactions, the availability of other sources for comparable services or products, and, if applicable, the impact on director independence.

Related Party Transactions and Business Relationships

On March 16, 2011, we sold to certain investors, including certain of our executive officers, directors and persons known to us to own more than 5% of the outstanding shares of our common stock, an aggregate of 14,313,081 shares of our common stock and warrants exercisable for a total of 5,725,227 shares of our common stock at a purchase price equal to $2.10 per unit for aggregate gross proceeds of $30.1 million. Net proceeds generated from the offering were approximately $27.8 million. The warrants have a five-year term and an exercise price equal to $2.46 per share of common stock. The exercise price of the warrants may be adjusted in certain circumstances. In addition, the number of shares issuable upon exercise of the warrants and the exercise price are subject to adjustment for subdivisions and stock splits, stock dividends, combinations, reorganizations, reclassifications, consolidations, mergers or sales of properties and assets and upon the issuance of certain assets or securities to holders of our common stock, as applicable. As a result of this sale, the exercise price of all outstanding warrants issued by us on October 5, 2009 was automatically adjusted from $2.23 per share to $2.05 per share.

The dollar amount invested in the offering by each of our executive officers, directors and persons known to us to own more than 5% of the outstanding shares of our common stock, along with the number of shares and warrants purchased by such persons, is set forth in the table below:

Name | Amount Invested($) | Shares Purchased | Warrants Purchased | |||||||||

Entities affiliated with Alta BioPharma Management III, LLC | 1,999,998 | 952,380 | 380,952 | |||||||||

Entities affiliated with Felix J. Baker and Julian C. Baker | 1,250,000 | 595,238 | 238,095 | |||||||||

Frazier Healthcare VI, L.P. | 1,999,998 | 952,380 | 380,952 | |||||||||

Entities affiliated with Sutter Hill Ventures(1) | 1,999,998 | 952,380 | 380,952 | |||||||||

Jeffrey W. Bird,M.D., Ph.D.(2) | 44,020 | 20,962 | 8,385 | |||||||||

John G. Curd,M.D. | 24,998 | 11,904 | 4,761 | |||||||||

Joel A Fernandes | 14,998 | 7,142 | 2,856 | |||||||||

Stewart M. Kroll | 4,998 | 2,380 | 952 | |||||||||

Mark D. Matteucci,Ph.D. | 500,000 | 238,095 | 95,238 | |||||||||

Harold E. Selick,Ph.D. | 100,000 | 47,619 | 19,047 | |||||||||

| (1) | Includes 690,969 shares and 276,388 warrants purchased by Sutter Hill Ventures, a California limited partnership. Dr. Bird, who serves as a member of our board of directors, is a managing director of the general partner of Sutter Hill Ventures. Also includes 261,411 shares and 104,564 warrants purchased by individuals affiliated with Sutter Hill Ventures. |

| (2) | All 20,962 shares and 8,385 warrants were purchased by the Jeffrey W. Bird and Christina R. Bird Trust Agreement of which Dr. Bird is a trustee. Dr. Bird is a managing director of the general partner of each of Sutter Hill Entrepreneurs Fund (AI), L.P., Sutter Hill Entrepreneurs Fund (QP), L.P. and Sutter Hill Ventures. |

15

Our Certificate of Incorporation and bylaws provide that we will indemnify each of our directors and officers to the fullest extent permitted by Delaware law. Further, we have entered into separate indemnification agreements with each of our directors and executive officers.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under Section 16(a) of the Securities Exchange Act of 1934, or the Exchange Act, and the rules promulgated by the SEC, our directors, executive officers and beneficial owners of more than 10% of any class of equity security are required to file periodic reports of their ownership of our equity securities, and changes in that ownership, with the SEC. To our knowledge, based solely on our review of the copies of such reports received or written representations from such persons that no other reports were required, we believe that our directors, executive officers and beneficial owners of more than 10% of our equity securities complied with all applicable filing requirements during 2011.

CERTAIN INFORMATION WITH RESPECT TO EXECUTIVE OFFICERS

The following table sets forth, as of March 23, 2012, information about our executive officers.

Name | Age | Position(s) | ||||

Harold E. Selick, Ph.D. | 57 | Chief Executive Officer and Director | ||||

Tillman Pearce, M.D. | 55 | Chief Medical Officer | ||||

Joel A. Fernandes | 42 | Vice President, Finance and Controller | ||||

Stewart M. Kroll | 53 | Senior Vice President of Biostatistics and | ||||

Mark D. Matteucci,Ph.D. | 58 | Senior Vice President, Discovery Research | ||||

Biographical information for Dr. Selick is included above under the heading “Nominees and Continuing Directors.”

Tillman Pearce, M.D. joined us in February 2012 as Chief Medical Officer. Dr. Pearce served as Chief Medical Officer of KaloBios Pharmaceuticals, Inc., from 2007 through 2011, and since 2011 has been an oncology consultant. Prior to KaloBios, Dr. Pearce was a Senior Director at PDL BioPharma, Inc. from 2002 to 2007 and a Medical Director in the Oncology Business Unit at Sanofi-Synthelabo from 1997 to 2002. He has also held research positions in oncology at Sandoz and Novartis. Dr. Pearce holds a B.A. in philosophy from Tulane University and an M.D. from the Medical College of Georgia.

Joel A. Fernandes joined us in April 2006 and has served as our Vice President, Finance and Controller since May 2011. Prior to May 2011, Mr. Fernandes served as our Senior Director, Finance and Controller. Mr. Fernandes served as Associate Director of Finance at Theravance, Inc. from January 2005 to March 2006, Senior Manager of Corporate Finance at KLA-Tencor from August 2002 to January 2005 and Assistant Controller of ALZA Corporation from 1999 to 2002. Mr. Fernandes has been a Certified Public Accountant since 1996 and has a Masters in Accountancy from Manchester College, Indiana.

Stewart M. Kroll joined us in January 2005 and has served as our Senior Vice President of Biostatistics and Clinical Operations since May 2011. Prior to May 2011, Mr. Kroll served as our Vice President of Biostatistics and Clinical Operations. Mr. Kroll served as the Senior Director of Biostatistics of Corixa Corporation from December 2000 to January 2005, and served in positions of increasing responsibility, most recently as Director of Biostatistics of Coulter Pharmaceuticals, Inc. from January 1997 to December 2000. Mr. Kroll received his B.A. and M.A. from the University of California, Berkeley.

Mark D. Matteucci, Ph.D. joined us in August 2003 and has served as our Senior Vice President, Discovery Research since January 2007. Prior to January 2007, Dr. Matteucci served as our Vice President, Discovery

16

Research. Dr. Matteucci provided medicinal chemistry consultation to several biotechnology companies from 1999 to 2002. He served as the Director of Bioorganic Chemistry at Gilead Sciences, Inc. from 1988 to 1999, where he was the first scientist hired and he established that company’s research program in nucleic acid targeting. Prior to joining Gilead Sciences, Dr. Matteucci was a scientist at Genentech, Inc. Dr. Matteucci received his B.S. from the Massachusetts Institute of Technology and Ph.D. from the University of Colorado.

Summary Compensation Table

The following table sets forth information concerning compensation earned for services rendered to us by (a) our principal executive officer and (b) our two most highly compensated executive officers at the end of fiscal year 2011. Collectively, this group is referred to in this proxy statement as our named executive officers.

Name and Principal Position | Year | Salary(1)($) | Bonus(2)($) | Option Awards(3)($) | All Other Compensation($) | Total($) | ||||||||||||||||||

Harold E. Selick,Ph.D. | 2011 | 500,000 | — | 322,761 | 1,290 | (4) | 824,051 | |||||||||||||||||

Chief Executive Officer | 2010 | 500,000 | — | 245,473 | 1,722 | (4) | 747,195 | |||||||||||||||||

Stewart M. Kroll | 2011 | 278,283 | — | 74,380 | 630 | (4) | 353,293 | |||||||||||||||||

Senior Vice President of Biostatistics and Clinical Operations | 2010 | 262,600 | — | 81,923 | 1,331 | (4)(5) | 345,854 | |||||||||||||||||

Mark D. Matteucci,Ph.D. | 2011 | 275,000 | — | 81,177 | 1,161 | (4) | 357,338 | |||||||||||||||||

Senior Vice President, Discovery Research | 2010 | 275,000 | — | 67,675 | 1,663 | (4)(5) | 344,338 | |||||||||||||||||

| (1) | Includes amounts deferred pursuant to our 401(k) plan. |

| (2) | In 2011, our executive management team requested not to receive any bonuses with respect to fiscal year 2010 to enable the Company to preserve cash. Bonus compensation that may be paid to our named executive officers in 2012 with respect to fiscal year 2011 was not calculable as of the date on which this proxy statement was filed with the SEC. The Company will determine bonus compensation payable with respect to fiscal year 2011, if any, on or before April 30, 2012. |

| (3) | The amounts in this column represent the dollar amount recognized for financial statement reporting purposes with respect to fiscal years 2011 and 2010 in accordance with ASC 718 disregarding any forfeiture assumptions. See Note 9 of the notes to our financial statements in our Annual Report on Form 10-K filed on March 15, 2012 for a discussion of all assumptions we made in determining the ASC 718 values of our equity awards. |

| (4) | Represents group term life insurance premiums paid by us on behalf of the named individual for fiscal years 2011 and 2010. |

| (5) | Includes $750 for the reimbursement of Mr. Kroll’s medical insurance deductible in 2010. Includes $500 for the reimbursement of Dr. Matteucci’s medical insurance deductible in 2010. |

We do not have employment agreements with our named executive officers, other than the change of control severance agreements mentioned below.

17

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth information regarding outstanding equity awards held by our named executive officers at the end of fiscal year 2011.

| Option Awards | ||||||||||||||||

Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price* ($) | Option Expiration Date | ||||||||||||

Harold E. Selick,Ph.D. | 50,000 | 350,000 | 1.64 | 6/06/2021 | ||||||||||||

| 310,729 | 474,271 | 1.44 | 5/24/2020 | |||||||||||||

| 51,041 | 18,959 | 0.79 | 1/08/2019 | |||||||||||||

| 39,472 | 2,194 | 1.30 | 2/26/2018 | |||||||||||||

| 41,666 | — | 1.30 | 3/19/2017 | |||||||||||||

| 25,000 | — | 1.30 | 3/13/2016 | |||||||||||||

Mark D. Matteucci,Ph.D. | 12,500 | 87,500 | 1.64 | 6/06/2021 | ||||||||||||

| 59,375 | 90,625 | 1.44 | 5/24/2020 | |||||||||||||

| 18,229 | 6,771 | 0.79 | 1/08/2019 | |||||||||||||

| 23,026 | 1,974 | 1.30 | 2/26/2018 | |||||||||||||

| 12,500 | — | 1.30 | 3/19/2017 | |||||||||||||

| 8,332 | — | 1.30 | 3/12/2016 | |||||||||||||

Stewart M. Kroll | 15,625 | 109,375 | 1.64 | 6/06/2021 | ||||||||||||

| 47,500 | 72,500 | 1.44 | 5/24/2020 | |||||||||||||

| 14,583 | 5,417 | 0.79 | 1/08/2019 | |||||||||||||

| 23,091 | 1,908 | 1.30 | 2/26/2018 | |||||||||||||

| 4,166 | — | 1.30 | 4/01/2017 | |||||||||||||

| 4,166 | — | 1.30 | 1/23/2017 | |||||||||||||

| 4,166 | — | 1.30 | 10/15/2016 | |||||||||||||

| 3,333 | — | 1.30 | 6/25/2016 | |||||||||||||

| 4,166 | — | 1.30 | 3/09/2016 | |||||||||||||

Potential Payments Upon Termination or Change In Control

Change of Control Arrangements

In December 2004, we entered into a change of control severance agreement with Harold E. Selick, which was amended and restated in November 2008. This agreement provides that if Dr. Selick’s employment is terminated by us without cause or is involuntarily terminated, then he will be entitled to a severance payment consisting of 12 months base salary as in effect as of the date of termination. If we terminate Dr. Selick without cause or involuntarily terminate him within 18 months following a change of control of the Company, then he will be entitled to the following severance benefits: 12 months base salary and any applicable allowances in effect as of the date of termination or, if greater, as in effect in the year in which the change of control occurs; immediate acceleration and vesting of all stock options granted prior to the change of control; the termination of our right to repurchase shares of restricted stock purchased prior to the change of control; extension of the exercise period for stock options granted prior to the change of control to two years following the date of termination; and up to 12 months of health benefits.

Under his amended and restated change of control and severance agreement with us, if Dr. Selick’s employment with us was terminated as of December 31, 2011 and he was entitled to receive the benefits set forth in his change of control agreement, Dr. Selick would have been eligible to receive a lump sum payment of $500,000 in severance in addition to being paid his accrued paid time off. If Dr. Selick’s employment with us was terminated as of December 31, 2011 and he was entitled to receive the benefits set forth in his change of control agreement, and such termination occurred within 18 months following a change of control of us,

18

Dr. Selick would have been eligible to receive a lump sum payment of $500,000 in severance plus his accrued PTO, full acceleration of vesting of all stock options, which had an approximate value of $8,152 as of December 31, 2011 based on the closing price of our common stock on the NASDAQ Capital Market of $1.22 on December 30, 2011, the final trading day of fiscal year 2011, net of the applicable exercise price of such options, and approximately $28,916 of health benefits.

In December 2004, we entered into a change of control severance agreement with Mark D. Matteucci, which was amended and restated in November 2008. Under his amended and restated change of control and severance agreement with us, if Dr. Matteucci’s employment with us was terminated as of December 31, 2011 and he was entitled to receive the benefits set forth in his change of control agreement, Dr. Matteucci would have been eligible to receive a lump sum payment of $275,000 in severance in addition to being paid his accrued PTO. If Dr. Matteucci’s employment with us was terminated as of December 31, 2011 and he was entitled to receive the benefits set forth in his change of control agreement, and such termination occurred within 18 months following a change of control of us, Dr. Matteucci would have been eligible to receive a lump sum payment of $275,000 in severance plus his accrued PTO, full acceleration of vesting of all stock options, which had an approximate value of $2,912 as of December 31, 2011 based on the closing price of our common stock on the NASDAQ Capital Market of $1.22 on December 30, 2011, the final trading day of fiscal year 2011, net of the applicable exercise price of such options, and approximately $28,485 of health benefits.

Indemnification Agreements

We have entered into indemnification agreements with our directors and certain of our officers. Such agreements require us, among other things, to indemnify our directors and officers, other than for liabilities arising from willful misconduct of a culpable nature, and to advance their expenses incurred as a result of any proceedings against them as to which they could be indemnified.

Equity Compensation Plans

The following table provides certain information with respect to all of our equity compensation plans in effect as of December 31, 2011:

| Number of securities to be issued upon exercise of outstanding options | Weighted- average exercise price of outstanding options | Number of securities remaining available for future issuance under equity compensation plans | ||||||||||

Equity compensation plans approved by stockholders | 3,672,179 | 1.45 | 1,431,602 | |||||||||

Equity compensation plans not approved by stockholders | — | — | — | |||||||||

|

|

|

|

|

| |||||||

Total | 3,672,179 | 1.45 | 1,431,602 | (1)(2) | ||||||||

|

|

|

|

|

| |||||||

| (1) | Includes 353,818 shares of our common stock issuable under our 2004 Employee Stock Purchase Plan |

| (2) | On January 1, 2011 and annually thereafter, the number authorized shares under our 2004 Equity Incentive Plan is automatically increased by a number of shares equal to the lesser of: |

| • | 5% of the number of our shares issued and outstanding prior to the preceding December 31; |

| • | 1,250,000 shares; or |

| • | an amount determined by our board of directors. |

19

Each non-employee director receives an annual cash retainer of $30,000. In addition, the chair of the audit committee receives an annual cash retainer of $16,000 and the chairs of the nominating and governance committee and the compensation committee each receive an annual retainer of $14,000. Each other member of the audit committee, the nominating and governance committee and the compensation committee receives an annual cash retainer of $10,000. All of our directors are entitled to reimbursement for all reasonable out-of-pocket expenses incurred in connection with attendance at board and committee meetings.

All non-employee directors receive automatic stock option grants under our 2004 Equity Incentive Plan. In May 2011, each non-employee director received an automatic grant of an option to purchase 12,500 shares of our common stock.

All employee directors who are not 5% owners of our common stock are also eligible to participate in our Amended and Restated 2004 Employee Stock Purchase Plan, or ESPP. In 2011, Dr. Selick purchased 6,000 shares of our common stock under the ESPP.

Director Summary Compensation Table

The following table sets forth all of the compensation awarded to, earned by, or paid to each person who served as a director during 2011, other than a director who also served as a named executive officer.

Name | Fees Earned or Paid in Cash($) | Option Awards($)(1) | Total($) | |||||||||

Jeffrey W. Bird,M.D., Ph.D. | 50,000 | 14,531 | 64,531 | |||||||||

Bruce C. Cozadd | 40,000 | 14,042 | 54,042 | |||||||||

David R. Parkinson,M.D. | 40,000 | 18,089 | 58,089 | |||||||||

David R. Hoffmann | 60,000 | 14,042 | 74,042 | |||||||||

Wilfred E. Jaeger, M.D. | 54,000 | 14,042 | 68,042 | |||||||||

George G.C. Parker,Ph.D. | 40,000 | 14,042 | 54,042 | |||||||||

| (1) | The amounts in this column represent the dollar amount recognized for financial statement reporting purposes with respect to fiscal year 2011 in accordance with ASC 718 disregarding any forfeiture assumptions. See Note 9 of the notes to our financial statements in our Annual Report on Form 10-K filed on March 15, 2012 for a discussion of all assumptions we made in determining the ASC 718 values of our equity awards. |

20

Under the guidance of a written charter adopted by our board of directors (which charter is available atwww.thresholdpharm.com), the purpose of the audit committee is to oversee our accounting and financial reporting processes and audits of our financial statements. The responsibilities of the audit committee include appointing and providing for the compensation of the independent registered public accounting firm. Each member of the audit committee meets the independence requirements of the NASDAQ Stock Market.

Management has primary responsibility for the system of internal controls and the financial reporting process. The independent registered public accounting firm has the responsibility to express an opinion on the financial statements based on an audit conducted in accordance with generally accepted auditing standards.

In this context and in connection with the audited financial statements contained in our Annual Report on Form 10-K, the audit committee:

| • | reviewed and discussed the audited financial statements as of and for the fiscal year ended December 31, 2011 with our management and Ernst & Young LLP, our independent registered public accounting firm for the fiscal year ended December 31, 2011; |