UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under Rule 14a-12 |

|

American Municipal Income Portfolio Inc. Minnesota Municipal Income Portfolio Inc. First American Minnesota Municipal Income Fund II, Inc. American Income Fund, Inc. |

| (Name of the Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | | | | |

| | | |

| | | | 1. | | Title of each class of securities to which transaction applies: |

| | |

| | | | 2. | | Aggregate number of securities to which transaction applies: |

| | |

| | | | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | | | 4. | | Proposed maximum aggregate value of transaction: |

| | |

| | | | 5. | | Total fee paid: |

| | |

| | | | |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | | | |

| | | |

| | | | 1. | | Amount Previously Paid: |

| | |

| | | | 2. | | Form, Schedule or Registration Statement No.: |

| | |

| | | | 3. | | Filing Party: |

| | |

| | | | 4. | | Date Filed: |

| | |

AMERICAN MUNICIPAL INCOME PORTFOLIO INC.

MINNESOTA MUNICIPAL INCOME PORTFOLIO INC.

FIRST AMERICAN MINNESOTA MUNICIPAL INCOME FUND II, INC.

AMERICAN INCOME FUND, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON

DECEMBER 11, 2012

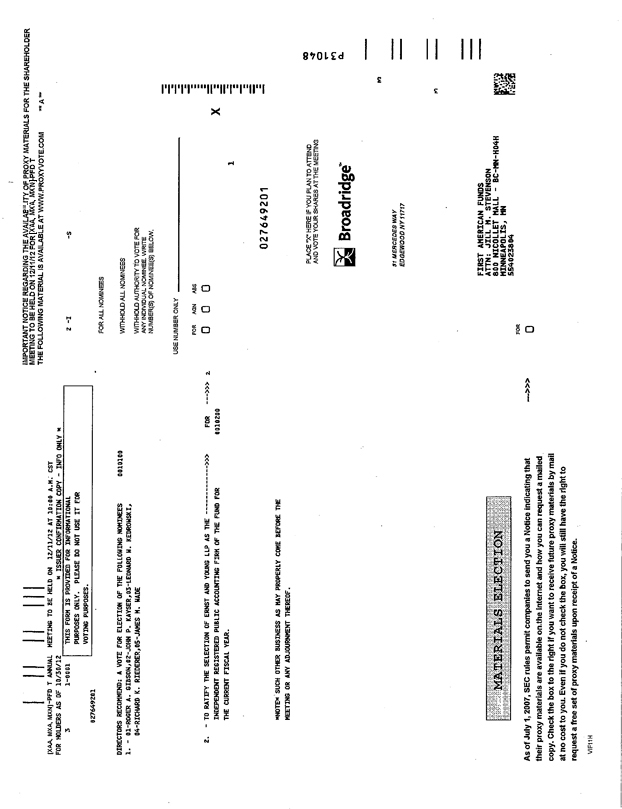

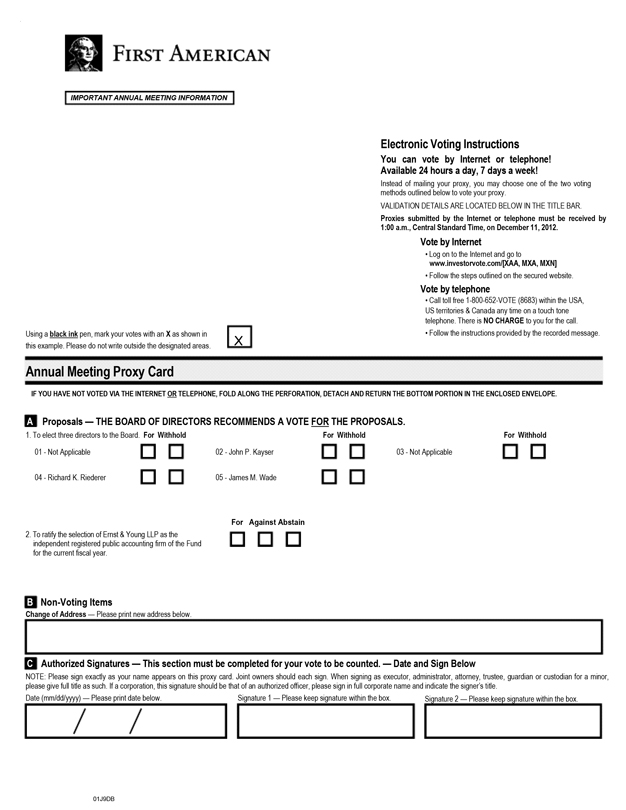

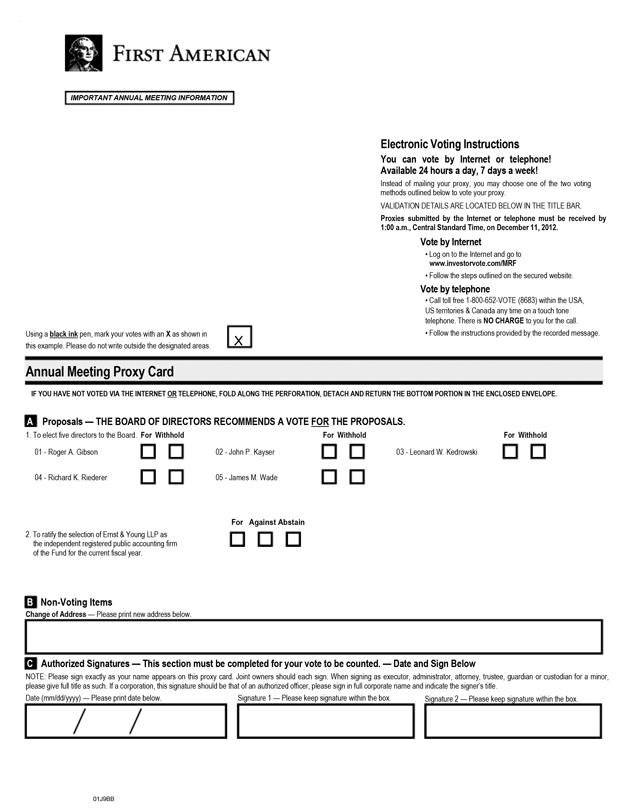

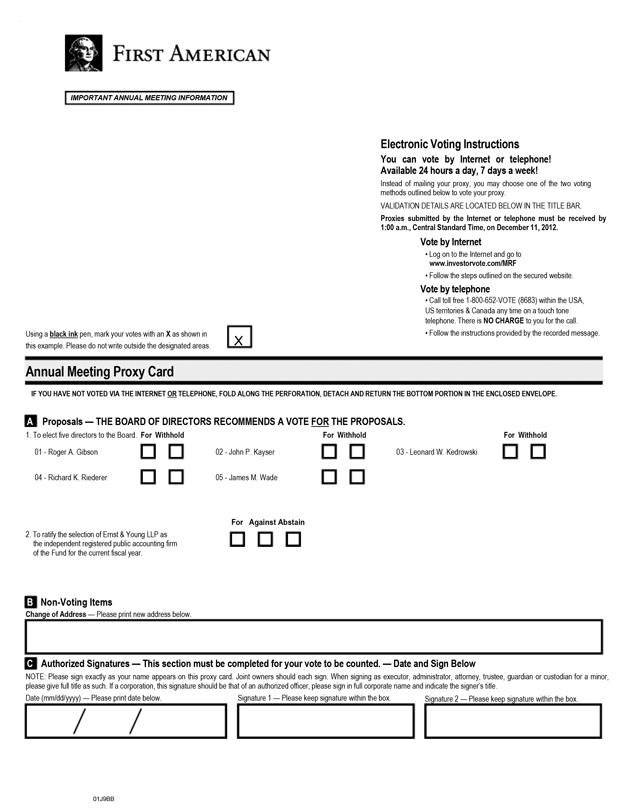

NOTICE IS HEREBY GIVEN that the annual meeting of shareholders of American Municipal Income Portfolio Inc., Minnesota Municipal Income Portfolio Inc., First American Minnesota Municipal Income Fund II, Inc. and American Income Fund, Inc. (individually, a “Fund” and collectively, the “Funds”) will be held at 10:00 a.m., Central Time, on Tuesday, December 11, 2012, at the offices of U.S. Bancorp Asset Management, Inc., 3rd Floor – Training Room A, 800 Nicollet Mall, Minneapolis, Minnesota 55402. The purposes of the meeting are as follows:

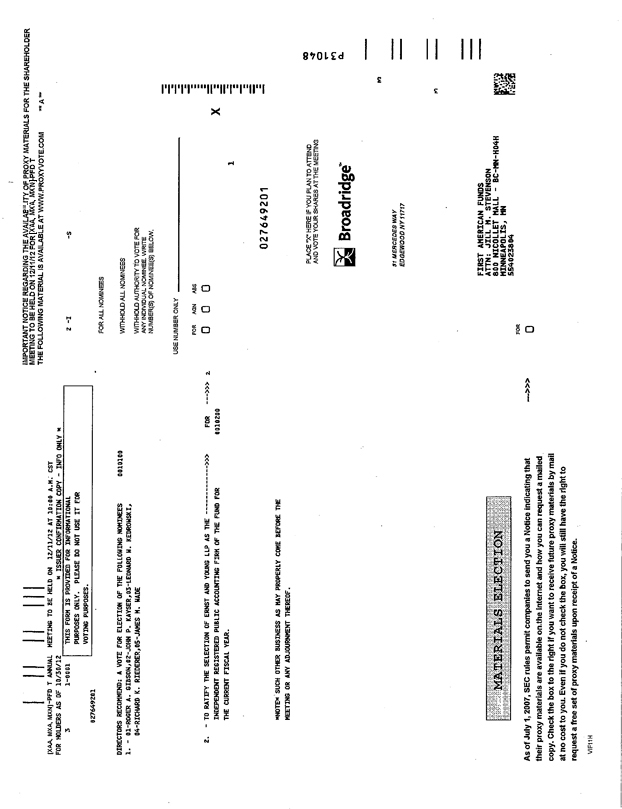

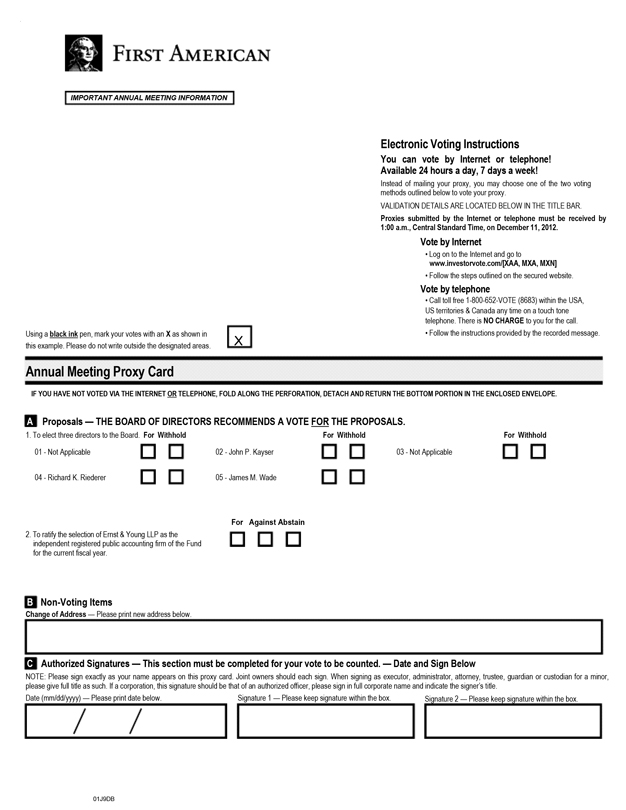

| | 1. | To elect a Board of Directors. |

| | 2. | To ratify the selection of Ernst & Young LLP as the independent registered public accounting firm of each Fund for the current fiscal year. |

| | 3. | To transact any other business properly brought before the meeting. |

THE BOARD OF DIRECTORS RECOMMENDS APPROVAL OF EACH ITEM LISTED ON THIS NOTICE OF ANNUAL MEETING OF SHAREHOLDERS.

Shareholders of record as of the close of business on October 30, 2012 are entitled to notice of, and to vote at, the meeting or any adjournment(s) thereof.

You can vote easily and quickly by toll-free telephone call, by internet or by mail. Just follow the instructions that appear on your enclosed proxy card. Please help the Funds avoid the cost of a follow-up mailing by voting today.

| | |

| October 31, 2012 | | Richard J. Ertel |

| | Secretary |

PROXY STATEMENT

AMERICAN MUNICIPAL INCOME PORTFOLIO INC.

MINNESOTA MUNICIPAL INCOME PORTFOLIO INC.

FIRST AMERICAN MINNESOTA MUNICIPAL INCOME FUND II, INC.

AMERICAN INCOME FUND, INC.

ANNUAL MEETING OF SHAREHOLDERS — DECEMBER 11, 2012

Important Notice Regarding Internet Availability of Proxy Materials for the Annual Meetings of Shareholders to be Held on December 11, 2012: This proxy statement is available at www.firstamericanfunds.com.

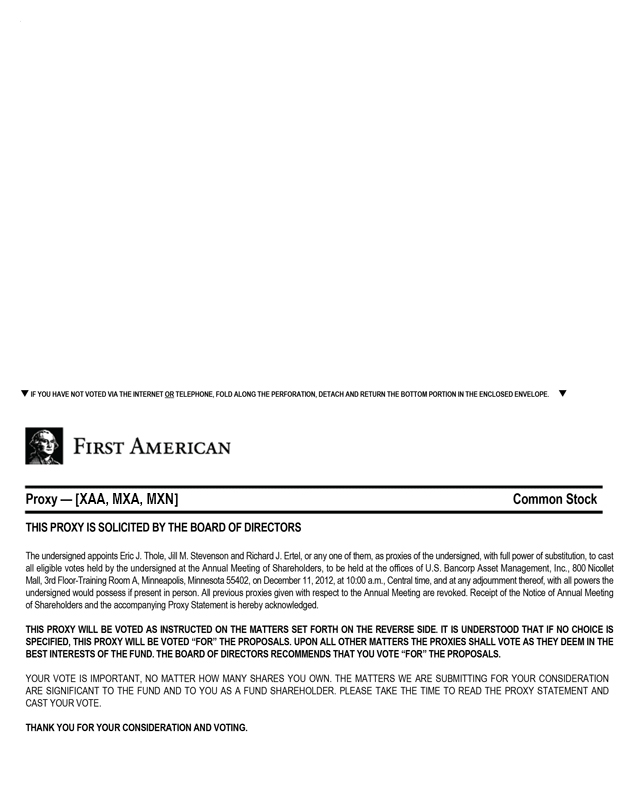

The enclosed proxy is solicited by the Board of Directors (the “Board”) of American Municipal Income Portfolio Inc., Minnesota Municipal Income Portfolio Inc., First American Minnesota Municipal Income Fund II, Inc. and American Income Fund, Inc. (sometimes referred to individually as a “Fund” and collectively as the “Funds”) in connection with each Fund’s annual meeting of shareholders to be held Tuesday, December 11, 2012, and any adjournments thereof (the “Meeting”). Mailing of the Notice of Annual Meeting of Shareholders and this Proxy Statement will take place on or about November 9, 2012.

In order for the Meeting to go forward for a Fund, there must be a quorum. This means that at least a majority of that Fund’s shares must be represented at the Meeting — either in person or by proxy.

For American Municipal Income Portfolio, Minnesota Municipal Income Portfolio and First American Minnesota Municipal Income Fund II (the “Municipal Bond Funds”), all returned proxies count toward a quorum, regardless of how they are voted. If a broker or nominee holding shares in “street name” indicates on the proxy card that it does not have discretionary authority to vote on a proposal and has not received instructions from the beneficial owner (a “broker non-vote”), those shares will not be considered present and entitled to vote on that proposal. Abstentions, however, will be counted as shares present and entitled to vote with respect to a proposal. Abstentions and broker non-votes will have no effect on the proposal to elect directors. With respect to the proposal to ratify the funds’ independent accountants, which requires a majority of votes cast at the Meeting, a broker non-vote will have no effect, and an abstention will have the same effect as a vote against the proposal.

For American Income Fund, shares represented by proxies that withhold authority to vote or that reflect abstentions or broker non-votes are counted as shares that are present and entitled to vote on the matter for purposes of determining the presence of a quorum. Abstentions and broker non-votes will have no effect on the proposal to elect directors, but will have the same effect as a vote against the proposal to ratify the Fund’s independent accountants.

For any Fund, the persons named as proxies may propose one or more adjournments of the Meeting for that Fund to permit further solicitation of proxies, whether or not a quorum is present. In determining whether to adjourn the Meeting, the following factors may be considered: the nature of the proposal; the percentage of votes actually cast; the percentage of negative votes actually cast; the nature of any further solicitation; and the information to be provided to shareholders with respect to the reasons for the solicitation. Any adjournment will require a vote in favor of the adjournment by the holders of a majority of the shares present in person or by proxy at the Meeting (or any adjourned meeting).

1

Only shareholders of record of each Fund on October 30, 2012 may vote at the Meeting or any adjournment thereof. As of that date, the Funds had the following numbers of issued and outstanding common and preferred shares:

| | | | | | | | | | | | | | | | |

| | | American

Municipal Income

Portfolio | | | Minnesota

Municipal Income

Portfolio | | | First American

Minnesota Municipal

Income Fund II | | | American Income

Fund | |

Common Shares | | | 5,756,267 | | | | 4,146,743 | | | | 1,472,506 | | | | 9,464,150 | |

Preferred Shares | | | 1,740 | | | | 1,244 | | | | 520 | | | | None | |

Each shareholder of a Fund is entitled to one vote for each share held. None of the matters to be presented at the Meeting will entitle any shareholder to cumulative voting or appraisal rights.

You may revoke your proxy at any time up until voting results are announced at the Meeting. You can do this by writing to the Funds’ Secretary, or by voting in person at the Meeting and notifying the election judge that you are revoking your proxy. In addition, you can revoke a prior proxy simply by voting again — using your original proxy card or by internet or toll-free telephone call. If you return an executed proxy card without instructions, your shares will be voted “for” each proposal.

Each Fund’s most recent annual report has been mailed to shareholders, and is also available by request without charge by writing to the Funds at 800 Nicollet Mall, Minneapolis, Minnesota 55402, or by calling the Funds at 800-677-3863.

2

PROPOSAL ONE

ELECTION OF DIRECTORS

American Income Fund. The shareholders of American Income Fund will be asked to elect the nominees listed below as members of the Fund’s Board. Each nominee is not considered an “interested person,” as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of the Funds (the “Independent Directors”). It is intended that the enclosed proxy will be voted for the election of the persons named below as directors of the Fund unless such authority has been withheld in the proxy.

Municipal Bond Funds.The shareholders of each Municipal Bond Fund will be asked to elect the nominees listed below to the Fund’s Board. Each nominee is considered an Independent Director. Each Municipal Bond Fund’s preferred shareholders are entitled to elect two of the Fund’s directors, and the remaining three directors are to be elected by the preferred shareholders and the common shareholders, voting together as a single class. The nominees for director to be elected by each Municipal Bond Fund’s preferred shareholders are Roger A. Gibson and Leonard W. Kedrowski. John P. Kayser, Richard K. Riederer and James M. Wade are to be elected by the preferred shareholders and the common shareholders of each Municipal Bond Fund, voting together. It is intended that the enclosed proxy will be voted for the election of each of these individuals as directors of the Municipal Bond Funds unless such authority has been withheld in the proxy.

Biographical Information.Biographical information regarding each nominee is set forth below. Each nominee also serves as a director of the other closed-end and open-end investment companies managed by the Advisor (the “Fund Complex”). The Fund Complex currently consists of eight closed-end funds (each of which is a registered investment company) and six open-end funds (which are portfolios of two registered investment companies). The business address of each of the nominees is First American Funds, P.O. Box 1329, Minneapolis, Minnesota 55440-1329. Each nominee has served as a director since the last annual meeting of shareholders.

Nominees for Election as Independent Directors

| | | | | | | | | | |

Name and Year of Birth | | Position

Held with

the Funds | | Term of Office* and Length of Time Served | | Principal Occupation(s) During Last Five Years | | Number of

Portfolios in

Fund Complex

Overseen by

Director | | Other Director-

ships Held by

Director** |

Roger A. Gibson (1946) | | Director | | Mr. Gibson has served as a director of American Municipal Income Portfolio and Minnesota Municipal Income Portfolio since August 1998, First American Minnesota Municipal Income Fund II since its inception and American Income Fund since October 2000. Fund directors serve for a one-year term that expires at the next annual meeting of shareholders. | | Director, Charterhouse Group, Inc., a private equity firm, since October 2005; Advisor/Consultant, Future Freight™, a logistics/supply chain company; Director, Towne Airfreight; non-profit board member; prior to retirement in 2005, served in several executive positions for United Airlines, including Vice President and Chief Operating Officer – Cargo; Independent Director, First American Fund Complex since 1997 | | 14 | | None |

3

| | | | | | | | | | |

Name and Year of Birth | | Position

Held with

the Funds | | Term of Office* and Length of Time Served | | Principal Occupation(s) During Last Five Years | | Number of

Portfolios in

Fund Complex

Overseen by

Director | | Other Director-

ships Held by

Director** |

John P. Kayser (1949) | | Director | | Mr. Kayser has served as a director of each of the Funds since October 2006. Fund directors serve for a one-year term that expires at the next annual meeting of shareholders. | | Retired; non-profit board member; prior to retirement in 2004, Principal, William Blair & Company, LLC, a Chicago-based investment firm; previously served on board of governors, Chicago Stock Exchange; former Director, William Blair Mutual Funds, Inc., Midwest Securities Trust Company, and John O. Butler Co.; Independent Director, First American Fund Complex since 2006 | | 14 | | None |

| | | | | |

Leonard W. Kedrowski (1941) | | Chair;

Director | | Mr. Kedrowski has served as Chair of each of the Municipal Bond Funds and American Income Fund since January 2011. He has served as a director of American Municipal Income Portfolio and Minnesota Municipal Income Portfolio since August 1998, First American Minnesota Municipal Income Fund II since its inception, and American Income Fund since October 2000. Fund directors serve for a one-year term that expires at the next annual meeting of shareholders. | | Owner and President, Executive and Management Consulting, Inc., a management consulting firm; Chief Executive Officer, Blue Earth Internet, a web site development company; Board member, GC McGuiggan Corporation (dba Smyth Companies), a label printer; Member, investment advisory committee, Sisters of the Good Shepherd; Certified Public Accountant; former Vice President, Chief Financial Officer, Treasurer, Secretary, and Director, Andersen Windows, a large privately-held manufacturer of wood windows; former Director, Protection Mutual Insurance Company, an international property and casualty insurer; Independent Director, First American Fund Complex since 1993 | | 14 | | None |

4

| | | | | | | | | | |

Name and Year of Birth | | Position

Held with

the Funds | | Term of Office* and Length of Time Served | | Principal Occupation(s) During Last Five Years | | Number of

Portfolios in

Fund Complex

Overseen by

Director | | Other Director-

ships Held by

Director** |

Richard K. Riederer (1944) | | Director | | Mr. Riederer has served as a director of American Municipal Income Portfolio, Minnesota Municipal Income Portfolio and American Income Fund since August 2001 and First American Minnesota Municipal Income Fund II since its inception. Fund directors serve for a one-year term that expires at the next annual meeting of shareholders. | | Owner and Chief Executive Officer, RKR Consultants, Inc., a consulting company providing advice on business strategy, mergers and acquisitions; Director, Cliffs Natural Resources, Inc.; Certified Financial Analyst; non-profit board member; former Chief Executive Officer and President, Weirton Steel Corporation; former Vice President and Treasurer, Harnischfeger Industries, a capital machinery manufacturer; former Treasurer and Director of Planning, Allis Chalmers Corporation, an equipment manufacturing company; former Chairman, American Iron & Steel Institute, a North American steel industry trade association; Independent Director, First American Fund Complex since 2001 and Firstar Funds 1988-2001 | | 14 | | Cliffs Natural

Resources, Inc.

(a producer of

iron ore pellets

and coal) |

| | | | | |

James M. Wade (1943) | | Director | | Mr. Wade has served as a director of American Municipal Income Portfolio, Minnesota Municipal Income Portfolio and American Income Fund since August 2001 and First American Minnesota Municipal Income Fund II since its inception. Fund directors serve for a one-year term that expires at the next annual meeting of shareholders. | | Owner and President, Jim Wade Homes, a homebuilding company; formerly, Vice President and Chief Financial Officer, Johnson Controls, Inc.; Independent Director, First American Fund Complex since 2001 and Firstar Funds 1988-2001 | | 14 | | None |

| * | Each director serves for the term specified or, if earlier, until his or her death, resignation, removal or disqualification. |

| ** | Includes only directorships in a company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act or subject to the requirements of Section 15(d) of the Securities Exchange Act, or any company registered as an investment company under the 1940 Act. |

There were six meetings of the Board during the fiscal year ended August 31, 2012. During the fiscal year, each of the directors standing for re-election attended at least 75% of all meetings of the Board and of committees of which he or she was a regular member that were held while he or she was serving on the Board or on such committee.

5

Board Leadership Structure

The Board is responsible for overseeing generally the operation of each Fund. The Board has approved an investment advisory agreement with U.S. Bancorp Asset Management, Inc. (“U.S. Bancorp Asset Management” or the “Advisor”) as well as other contracts with U.S. Bancorp Asset Management, its affiliates, and other service providers.

As noted above, the Board consists entirely of Independent Directors. The directors also serve as directors of the other funds in the Fund Complex. Taking into account the number, diversity and complexity of the funds overseen by the directors and the aggregate amount of assets under management in the Fund Complex, the Board has determined that the efficient conduct of its affairs makes it desirable to delegate responsibility for certain matters to committees of the Board. These committees, which are described in more detail below, review and evaluate matters specified in their charters and make recommendations to the Board as they deem appropriate. Each committee may use the resources of the Funds’ counsel and auditors, counsel to the Independent Directors, if any, as well as other experts. The committees meet as often as necessary, either in conjunction with regular meetings of the Board or otherwise.

The Funds are subject to a number of risks, including investment, compliance, operational, and valuation risks. The Board’s role in risk oversight of each Fund reflects its responsibility to oversee generally, rather than to manage, the operations of the Fund. The actual day-to-day risk management with respect to the Funds resides with U.S. Bancorp Asset Management and the other service providers to the Funds. In line with the Board’s oversight responsibility, the Board receives reports and makes inquiries regarding various risks at its regular meetings or otherwise. However, the Board relies upon the Funds’ Chief Compliance Officer, who reports directly to the Board, and U.S. Bancorp Asset Management (including its Senior Business Line Risk Manager and other members of its management team) to assist the Board in identifying and understanding the nature and extent of such risks and determining whether, and to what extent, such risks may be eliminated or mitigated. Although the risk management policies of U.S. Bancorp Asset Management and the other service providers are designed to be effective, those policies and their implementation vary among service providers and over time, and there is no guarantee that they will be effective. Not all risks that may affect the Funds can be identified or processes and controls developed to eliminate or mitigate their occurrence or effects, and some risks are simply beyond any control of the Funds or U.S. Bancorp Asset Management, its affiliates or other service providers.

Standing Committees

The Board currently has two standing committees: an Audit Committee and a Governance Committee.

The purposes of the Audit Committee are (1) to oversee the Funds’ accounting and financial reporting policies and practices, their internal controls and, as appropriate, the internal controls of certain service providers; (2) to oversee the quality of the Funds’ financial statements and the independent audit thereof; (3) to oversee the valuation of the securities held by the Funds; (4) to assist Board oversight of the Funds’ compliance with legal and regulatory requirements; and (5) to act as a liaison between the Funds’ independent auditors and the full Board. The Audit Committee, together with the Board, has the ultimate authority and responsibility to select, evaluate and, where appropriate, replace the outside auditor (or to nominate the outside auditor to be proposed for shareholder approval in any proxy statement). The Audit Committee has adopted a written charter setting forth, among other things, requirements with respect to the composition of the Committee, the purposes of the

6

Committee, and the Committee’s duties and powers. A copy of this charter is attached hereto asAppendix A. The Audit Committee currently consists of Mr. Gibson (chair), Mr. Kayser, Mr. Kedrowski, Mr. Riederer, Mr. Strauss (who is retiring as a director effective December 31, 2012 and is not standing for re-election at the Meeting) and Mr. Wade. The Board has determined that each member of the Audit Committee is “independent” within the meaning of New York Stock Exchange and NYSE MKT listing standards and is not an “interested person” as defined in the 1940 Act. The Board has designated Mr. Kayser, Mr. Riederer and Mr. Kedrowski as Audit Committee financial experts. The Audit Committee met five times during the fiscal year ended August 31, 2012.

The Governance Committee of the Board is responsible for nominating directors and making recommendations to the Board concerning Board composition, committee structure and governance, director education, and governance practices. The members of the Governance Committee are Mr. Wade (Chair), Mr. Gibson, Mr. Kayser, Mr. Kedrowski, Mr. Riederer and Mr. Strauss (who is retiring as a director effective December 31, 2012 and is not standing for re-election at the Meeting). The Board has determined that each member of the Governance Committee is “independent” within the meaning of New York Stock Exchange and NYSE MKT listing standards and is not an “interested person” as defined in the 1940 Act. The Governance Committee met two times during the fiscal year ended August 31, 2012. The Governance Committee Charter is attached hereto asAppendix B.

In addition to the above committees, the Board also appoints a Fund Review Liaison. The responsibility of the Fund Review Liaison is to lead the Board, together with the Board Chair, in evaluating Fund performance, Fund service provider contracts and arrangements for execution of Fund trades. Mr. Strauss is the current Fund Review Liaison and will retire effective December 31, 2012. Effective January 1, 2013, the function previously performed by the Fund Review Liaison will be assumed by the Board.

Selection of Director Nominees

The Governance Committee will consider shareholder recommendations for director nominees in connection with each annual shareholders meeting of the Funds and any special shareholders meeting that is called for the purpose of electing directors. There are no differences in the manner in which the Governance Committee evaluates nominees for director based on whether the nominee is recommended by a shareholder.

A shareholder who wishes to recommend a director nominee should submit his or her recommendation in writing to the Chair of the Board (Mr. Kedrowski) or the Chair of the Governance Committee (Mr. Wade), in either case at First American Funds, P.O. Box 1329, Minneapolis, Minnesota 55440-1329. At a minimum, the recommendation should include:

| | • | | the name, address, and business, educational, and/or other pertinent background of the person being recommended; |

| | • | | a statement concerning whether the person is “independent” within the meaning of New York Stock Exchange and American Stock Exchange listing standards and is not an “interested person” as defined in the 1940 Act; |

| | • | | any other information that the Funds would be required to include in a proxy statement concerning the person if he or she was nominated; and |

| | • | | the name and address of the person submitting the recommendation, together with the number of Fund shares held by such person and the period for which the shares have been held. |

7

The recommendation also can include any additional information that the person submitting it believes would assist the Governance Committee in evaluating the recommendation. In order for the Governance Committee to consider a shareholder’s recommended nominee for election at the annual shareholders meeting in a given year, the recommendation should be submitted to the Governance Committee no later than August 31 in that year.

The Board currently is composed entirely of persons who are not “interested persons” as defined in the 1940 Act. The Board currently intends to remain composed only of such persons. Shareholders should note that a person who owns securities issued by U.S. Bancorp (the parent company of the Funds’ investment advisor) would be deemed an “interested person” under the 1940 Act. In addition, certain other relationships with U.S. Bancorp or its subsidiaries, with registered broker-dealers, or with the Funds’ outside legal counsel may cause a person to be deemed an “interested person.”

The Governance Committee has not established specific, minimum qualifications that it believes must be met by a director nominee. In evaluating director nominees, the Governance Committee considers, among other things, an individual’s background, skills, and experience; whether the individual is “independent” within the meaning of applicable stock exchange listing standards and is not an “interested person” as defined in the 1940 Act; and whether the individual is “financially literate” or would be deemed an “audit committee financial expert” within the meaning of such listing standards and applicable Securities and Exchange Commission (“SEC”) rules. The Governance Committee also considers whether the individual’s background, skills, and experience will complement the background, skills, and experience of other nominees and will contribute to the diversity of the Board. In addition to considering shareholder recommendations, the Governance Committee may consider recommendations by business and personal contacts of current Board members, by Fund management, and by executive search firms that the committee may engage from time to time.

Before the Governance Committee decides to nominate an individual as a director, committee members and other directors customarily interview the individual in person. In addition, the individual customarily is asked to complete a detailed questionnaire, which is designed to elicit information that must be disclosed under SEC and stock exchange rules and to determine whether the individual is subject to any statutory disqualification from serving as a director of a registered investment company.

Shareholder Communications with Directors

Shareholders of the Funds can communicate directly with the Board by writing to the Chair of the Board, First American Funds, P.O. Box 1329, Minneapolis, Minnesota 55440-1329. Shareholders can communicate directly with an individual director by writing to that director at P.O. Box 1329, Minneapolis, Minnesota 55440-1329. Such communications to the Board or individual directors are not screened before being delivered to the addressee.

Director Attendance at Shareholders Meetings

The Board encourages directors to attend annual shareholders meetings of the Funds in person or by telephone. All of the directors standing for re-election attended the Funds’ 2011 annual shareholder meeting either in person or telephonically.

8

Director Qualifications

The Board has determined that each of its directors (except Mr. Strauss, who will retire as a director effective December 31, 2012) should continue to serve as such based on several factors (none of which alone is decisive). Each director has served in his role as director of the Funds since the dates noted in the table above. Because of this experience, each director is knowledgeable regarding the Funds’ business and service provider arrangements. In addition, each director has served for a number of years as a director of other funds in the Fund Complex, as indicated in the “Independent Directors” table above. Among the factors the Board considered when concluding that an individual should serve on the Board were the following: (i) the individual’s business and professional experience and accomplishments; (ii) the individual’s ability to work effectively with other members of the Board; (iii) the individual’s prior experience, if any, serving on the boards of public companies and other complex enterprises and organizations; and (iv) how the individual’s skills, experiences and attributes would contribute to an appropriate mix of relevant skills, diversity and experience on the Board. The Board believes that, collectively, its directors have balanced and diverse qualifications, skills, experiences, and attributes, which allow the Board to operate effectively in governing the Funds and protecting the interests of shareholders. Information about the specific qualifications, skills, experiences, and attributes of each director, which in each case contributed to the Board’s conclusion that the director should serve (or continue to serve) as director of the Funds, is provided in the “Independent Directors” table above.

Director Compensation

The Fund Complex currently pays directors who are not paid employees or affiliates of any fund in the Fund Complex an annual retainer of $160,000 ($265,000 in the case of the Chair). The Fund Review Liaison, Audit Committee Chair, and Governance Committee Chair each receive an additional annual retainer of $15,000.

Directors also receive $3,500 per day when traveling out of town on Fund Complex business that does not involve a Board or committee meeting. In addition, directors are reimbursed for their out-of-pocket expenses in traveling from their primary or secondary residence to Board and committee meetings, on Fund Complex business and to attend mutual fund industry conferences or seminars. The amounts specified above are allocated evenly among the funds in the Fund Complex.

Prior to January 1, 2012, the directors were paid an annual retainer of $150,000 ($195,000 in the case of the Vice Chair and $265,000 in the case of the Chair). The Fund Review Liaison, Audit Committee Chair, and Governance Committee Chair each received an additional annual retainer of $20,000. In addition, directors were paid the following fees for attending Board and committee meetings:

| | • | | $1,000 for attending an in-person Board meeting that lasted half a day ($1,300 in the case of the Vice Chair and $1,500 in the case of the Chair); |

| | • | | $2,000 for attending an in-person Board meeting that lasted a full day ($2,600 in the case of the Vice Chair and $3,000 in the case of the Chair); and |

| | • | | $500 for in-person attendance at any committee meeting ($750 in the case of the Chair of each committee). |

A director who participated telephonically in any in-person Board or committee meeting received half of the fee that director would have received for attending, in-person, the Board or committee meeting. For telephonic Board and committee meetings, the Chair and each director and committee Chair, as applicable, received a fee equal to half the fee they would have received for attending an in-person meeting. The directors no longer receive such fees for attending Board and committee meetings.

9

Prior to January 1, 2011, the directors could elect to defer payment of up to 100% of the fees they received in accordance with a Deferred Compensation Plan (the “Plan”). Under the Plan, a director could elect to have his or her deferred fees treated as if they had been invested in shares of one or more funds and the amount paid to the director under the Plan would be determined based on the performance of such investments. Effective January 1, 2011, the directors may no longer defer payments under the Plan. The prior deferral of fees in accordance with the Plan will have a negligible impact on Fund assets and liabilities and will not obligate the Funds to retain any director or pay any particular level of compensation. The Funds do not provide any other pension or retirement benefits to directors.

The following table sets forth the compensation received by each director standing for re-election from each Fund for its most recent fiscal year, as well as the total compensation received by each such director from the Fund Complex for the fiscal year ended August 31, 2012.

| | | | | | | | | | | | | | | | | | | | |

Name of Director | | Aggregate

Compensation

from American

Municipal Income

Portfolio | | | Aggregate

Compensation

from Minnesota

Municipal Income

Portfolio | | | Aggregate

Compensation

from First American

Minnesota

Municipal Income

Fund II | | | Aggregate

Compensation

from American

Income Fund | | | Total

Compensation

from

Fund Complex

Paid to Directors (1) | |

Roger A. Gibson | | $ | 12,866 | | | $ | 12,866 | | | $ | 12,866 | | | $ | 12,866 | | | $ | 180,125 | |

John P. Kayser | | | 11,661 | | | | 11,661 | | | | 11,661 | | | | 11,661 | | | | 163,250 | |

Leonard W. Kedrowski | | | 19,500 | | | | 19,500 | | | | 19,500 | | | | 19,500 | | | | 272,750 | |

Richard K. Riederer | | | 11,661 | | | | 11,661 | | | | 11,661 | | | | 11,661 | | | | 163,250 | |

James M. Wade | | | 12,839 | | | | 12,839 | | | | 12,839 | | | | 12,839 | | | | 179,750 | |

| (1) | The Fund Complex consists of six open-end funds (which are portfolios of two investment companies) and eight closed-end investment companies, totaling 14 funds, managed by the Advisor, including the Funds. |

Director Shareholdings

The following table discloses the dollar range of equity securities beneficially owned by each director standing for re-election (i) in the Funds and (ii) on an aggregate basis in all funds in the Fund Complex.

| | | | |

Name of Director | | Dollar Range of Equity

Securities in the Funds* | | Aggregate Dollar Range of

Equity Securities in the Fund Complex* |

Roger A. Gibson | | None | | $10,001-$50,000 |

John P. Kayser | | None | | $10,001-$50,000 |

Leonard W. Kedrowski | | American Income Fund: $10,001-$50,000 | | Over $100,000 |

Richard K. Riederer | | None | | None |

Joseph D. Strauss | | None | | $1-$10,000 |

James M. Wade | | None | | $1-$10,000 |

| * | The dollar range disclosed is based on the value of the securities as of June 30, 2012. |

10

To the knowledge of the Funds, as of September 30, 2012, the officers and directors of each Fund as a group beneficially owned less than 1% of each class of the outstanding shares of each Fund.

Board Recommendation; Required Vote

The Board recommends that the shareholders vote in favor of all nominees to serve as directors. For each Municipal Bond Fund, (i) the vote of a plurality of the preferred shares represented at the Meeting is sufficient for the election of Mr. Gibson and Mr. Kedrowski, provided at least a quorum (one-third of the outstanding preferred shares) is represented in person or by proxy, and (ii) the vote of a plurality of the preferred shares and common shares represented at the Meeting, voting together as a single class, is sufficient for the election of each of the other nominees, provided at least a quorum (a majority of the outstanding preferred shares and common shares) is represented in person or by proxy. For American Income Fund, the vote of a plurality of the shares voted at the Meeting is sufficient for the election of each of the nominees, provided at least a quorum (a majority of the outstanding shares) is represented in person or by proxy. Unless otherwise instructed, the proxies will vote for all nominees. In the event any of the above nominees are not candidates for election at the Meeting due to events not now known or anticipated, the proxies will vote for such other persons as the Board may designate.

11

PROPOSAL TWO

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The 1940 Act provides that the selection of the independent registered public accounting firm of a registered investment company must be approved by a majority of the directors of the investment company who are not interested persons of the investment company (this requirement is subject to certain exceptions). This selection is being submitted for ratification or rejection by the shareholders of each Fund.

Based on the Audit Committee’s recommendation, as discussed below under “Audit Committee Report,” the directors, including a majority who are not interested persons of the Advisor or the Funds, have selected Ernst & Young LLP (“Ernst & Young”) to be the Funds’ independent registered public accounting firm for each Fund’s current fiscal year. Ernst & Young examines the annual financial statements of the Funds and provides certain other audit-related and tax-related services to the Funds. Representatives of Ernst & Young are expected to be present at the Meeting. These representatives will have the opportunity to make a statement to shareholders if they choose to do so and are expected to be available to respond to appropriate questions.

Although the Funds are no longer required by law to submit the selection of their independent public accountants to shareholders for ratification, the Board has elected to continue to do so. If this selection is not ratified, the Board will consider what action to take, including possibly resubmitting the selection to shareholders, continuing the engagement of Ernst & Young, or retaining a different independent registered public accounting firm.

Audit Committee Report

The Audit Committee and the Board have the ultimate authority and responsibility to select, evaluate and, where appropriate, replace the Funds’ independent registered public accounting firm (or to nominate the independent registered public accounting firm to be proposed for shareholder approval in any proxy statement). The function of the Audit Committee is oversight. It is Fund management’s responsibility to maintain appropriate systems for accounting and internal control and for preparing the Funds’ financial statements, and the independent registered public accounting firm’s responsibility is to plan and carry out a proper audit of the financial statements.

In this context, the Audit Committee has met and held discussions with management and the independent accountants. Fund management represented to the Audit Committee that each Fund’s financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the financial statements with management and the independent accountants. The Audit Committee discussed with the independent accountants matters required to be discussed by Statement on Auditing Standards No. 114.

The Funds’ independent registered public accounting firm also provided to the Audit Committee the written disclosures and letter required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountants’ communications with the Audit Committee concerning independence, and the Audit Committee discussed with the independent accountants the accounting firm’s independence. The Committee also considered whether non-audit services provided by the independent accountants during the last fiscal year were compatible with maintaining the accountants’ independence.

12

Based upon the Audit Committee’s discussion with management and the independent accountants and the Audit Committee’s review of the representation of management and the report of the independent accountants to the Audit Committee, the Audit Committee recommended to the Board that, with respect to each Fund, the audited financial statements for the Fund’s most recent fiscal year be included in the Fund’s Annual Report for that fiscal year filed with the SEC.

Members of the Audit Committee

Roger A. Gibson, Chair

John P. Kayser

Leonard W. Kedrowski

Richard K. Riederer

Joseph D. Strauss

James M. Wade

Fees Paid to Ernst & Young

Audit Fees. Ernst & Young’s fees for professional services rendered for the audit of each Fund’s annual financial statements for its two most recently completed fiscal years were as set forth in the following table. These amounts included fees associated with the annual audit, SEC Rule 17f-2 security count filings and filings of the Funds’ Annual Reports on Form N-CSR.

| | | | | | | | |

| | | Fiscal year

ended

8/31/12 | | | Fiscal year

ended

8/31/11 | |

American Municipal Income Portfolio | | $ | 47,038 | | | $ | 28,754 | |

Minnesota Municipal Income Portfolio | | $ | 47,038 | | | $ | 28,754 | |

First American Minnesota Municipal Income Fund II | | $ | 47,038 | | | $ | 28,754 | |

American Income Fund | | $ | 47,038 | | | $ | 30,472 | |

Audit-Related Fees. Ernst & Young’s fees for audit-related services for its two most recently completed fiscal years were as set forth in the following table. These audit-related services primarily related to rating agency agreed upon procedures (except with respect to American Income Fund) and to the review of the semi-annual financial statements.

| | | | | | | | |

| | | Fiscal year

ended

8/31/12 | | | Fiscal year

ended

8/31/11 | |

American Municipal Income Portfolio | | $ | 2,481 | | | $ | 1,740 | |

Minnesota Municipal Income Portfolio | | $ | 2,481 | | | $ | 1,740 | |

First American Minnesota Municipal Income Fund II | | $ | 2,481 | | | $ | 1,740 | |

American Income Fund | | $ | 2,481 | | | $ | 1,871 | |

13

Tax Fees.Ernst & Young’s fees for tax services for its two most recently completed fiscal years were as set forth in the following table. These tax services included tax compliance, tax advice and tax planning services. Tax compliance, tax advice and tax planning services primarily relate to the preparation of original and amended tax returns, timely regulated investment company qualification reviews and tax distribution analysis and planning.

| | | | | | | | |

| | | Fiscal year

ended

8/31/12 | | | Fiscal year

ended

8/31/11 | |

American Municipal Income Portfolio | | $ | 6,743 | | | $ | 5,491 | |

Minnesota Municipal Income Portfolio | | $ | 6,743 | | | $ | 5,491 | |

First American Minnesota Municipal Income Fund II | | $ | 6,743 | | | $ | 5,491 | |

American Income Fund | | $ | 6,743 | | | $ | 6,688 | |

All Other Fees.There were no fees billed by Ernst & Young for other services during each Fund’s two most recently completed fiscal years.

Aggregate Non-Audit Fees.The aggregate non-audit fees billed by Ernst & Young to each of the Funds and the Advisor and entities controlling, controlled by or under common control with the Advisor that provide ongoing services to the Funds for the two most recently completed fiscal years are set forth in the following table.

| | | | | | | | |

| | | Fiscal year

ended

8/31/12 | | | Fiscal year

ended

8/31/11 | |

American Municipal Income Portfolio | | $ | 217,000 | | | $ | 470,000 | |

Minnesota Municipal Income Portfolio | | $ | 217,000 | | | $ | 470,000 | |

First American Minnesota Municipal Income Fund II | | $ | 217,000 | | | $ | 470,000 | |

American Income Fund | | $ | 217,000 | | | $ | 470,000 | |

Audit Committee Pre-Approval Policies

The Audit Committee has established procedures requiring the pre-approval of all audit and non-audit services performed for the Funds by Ernst & Young. Such procedures also require the pre-approval of non-audit services provided to U.S. Bancorp Asset Management, U.S. Bank National Association and any other entity under common control with U.S. Bancorp Asset Management that provides ongoing services to the Funds, but only if those services relate directly to the operations and financial reporting of the Funds. All of the services described above were pre-approved in accordance with the Audit Committee’s pre-approval procedures.

Board Recommendation; Required Vote

The Board recommends that the shareholders vote in favor of the ratification of the selection of Ernst & Young. For each Fund, the vote of a majority of the shares represented at the Meeting is sufficient for the ratification of the selection of the independent registered public accounting firm, provided at least a quorum (a majority of the outstanding shares) is represented in person or by proxy. For the Municipal Bond Funds, the preferred shareholders and the common shareholders vote together as a single class. Unless otherwise instructed, the proxies will vote for the ratification of the selection of Ernst & Young as each Fund’s independent registered public accounting firm.

14

ADDITIONAL INFORMATION

Investment Advisor and Administrator

The investment adviser for the Funds is U.S. Bancorp Asset Management, Inc. U.S. Bancorp Asset Management also acts as the administrator for the Funds. The address of the Funds and the Advisor is 800 Nicollet Mall, Minneapolis, Minnesota 55402.

Solicitation of Proxies

The costs of this proxy solicitation, including the cost of preparing and mailing the Notice of Annual Meeting of Shareholders and this Proxy Statement, will be allocated among and borne by the Funds. In addition to the solicitation of proxies by mail, representatives of the Advisor may, without cost to the Funds, solicit proxies on behalf of management of the Funds by means of mail, telephone or personal calls.

Persons holding shares as nominees will be reimbursed by the Funds, upon request, for the reasonable expenses of mailing soliciting materials to the principals of the accounts.

Officers of the Funds

Information about each officer’s position and term of office with the Funds and business experience during the past five years is set forth below. Unless otherwise indicated, all positions have been held more than five years. No officer receives any compensation from the Funds.* Unless otherwise indicated, the address of each of the officers is U.S. Bancorp Asset Management, Inc., 800 Nicollet Mall, Minneapolis, Minnesota 55402.

| | | | | | |

Name, Address, and Year of Birth | | Position(s) Held with Fund | | Term of Office** and

Length of Time Served | | Principal Occupation(s) During Past Five Years |

Joseph M. Ulrey III (1958) | | President | | Since January 2011 | | Chief Executive Officer and President of U.S. Bancorp Asset Management, Inc. since January 2011; prior thereto, Chief Financial Officer and Head of Technology and Operations, U.S. Bancorp Asset Management, Inc. |

| | | |

Eric J. Thole (1972) | | Vice President | | Since January 2011 | | Chief Operating Officer, U.S. Bancorp Asset Management, Inc. since August 2012; Head of Operations, Technology and Treasury, U.S. Bancorp Asset Management, Inc. from January 2011 through July 2012; prior thereto, Managing Director of Investment Operations, U.S Bancorp Asset Management, Inc. |

| | | |

Jill M. Stevenson (1965) | | Treasurer | | Since January 2011; Assistant Treasurer of the Funds from September 2005 through December 2010 | | Mutual Funds Treasurer, U.S. Bancorp Asset Management, Inc. since January 2011; prior thereto, Mutual Funds Assistant Treasurer, U.S. Bancorp Asset Management, Inc. |

| | | |

Ruth M. Mayr (1959) | | Chief Compliance Officer | | Since January 2011 | | Chief Compliance Officer, U.S. Bancorp Asset Management, Inc. since January 2011; prior thereto, Director of Compliance, U.S. Bancorp Asset Management, Inc. |

15

| | | | | | |

Name, Address, and Year of Birth | | Position(s) Held with Fund | | Term of Office** and Length of Time Served | | Principal Occupation(s) During Past Five Years |

Carol A. Sinn (1959) | | Anti-Money Laundering Officer | | Since January 2011 | | Senior Business Line Risk Manager and Anti-Money Laundering Officer, U.S. Bancorp Asset Management, Inc. since January 2011; prior thereto, Senior Business Line Risk Manager, U.S. Bancorp Asset Management, Inc. |

| | | |

Richard J. Ertel (1967) | | Secretary | | Since January 2011; Assistant Secretary of the Funds from June 2006 through December 2010 and from June 2003 through August 2004 | | General Counsel, U.S. Bancorp Asset Management, Inc. since January 2011; prior thereto, Counsel, U.S. Bancorp Asset Management, Inc. |

| | | |

James D. Alt* Dorsey & Whitney LLP 50 South Sixth Street Suite 1500 Minneapolis, MN 55402 (1951) | | Assistant Secretary | | Since December 2004; Secretary of the Funds from June 2002 through December 2004; Assistant Secretary of the Funds from September 1998 through June 2002 | | Partner, Dorsey & Whitney LLP, a Minneapolis-based law firm |

| | | |

Scott F. Cloutier (1973) | | Assistant Secretary | | Since September 2012 | | Senior Corporate Counsel, U.S. Bancorp Asset Management, Inc. since April 2011; Attorney, Steingart, McGrath & Moore, P.A., a Minneapolis-based law firm, from April 2009 through March 2011; prior thereto, Corporate Counsel, Pine River Capital Management, L.P., a Minneapolis-based investment adviser |

| * | Legal fees and expenses are paid to Dorsey & Whitney LLP, the law firm of which Mr. Alt is a partner. |

| ** | Officers serve at the pleasure of the Board and are re-elected by the Board annually. |

16

Security Ownership of Certain Shareholders

No person, to the knowledge of Fund management, was the beneficial owner of more than 5% of any class of voting shares of any Fund as of October 10, 2012, except as follows:

| | | | | | | | |

Fund and Share Class | | Name and Address of

Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | Percent of Class | |

American Income Fund – common shares | | Sit Investment Associates, Inc. and affiliated entities (“Sit”) 4600 Wells Fargo Center Minneapolis, MN | | 1,202,295 shares;

sole voting and dispositive power(1) | | | 12.70 | % |

| | | |

American Municipal Income Portfolio – preferred shares | | Bank of America Corporation and certain subsidiaries(2) Bank of America Corporate Center 100 North Tryon Street Charlotte, NC 28255 | | 1,256 shares;

shared voting and dispositive power (2) | | | 72.18 | % |

| | | |

| | UBS AG and certain subsidiaries(3) Bahnhofstrasse 45 PO Box CH-8021 Zurich, Switzerland | | 288 shares;

shared voting and dispositive power(3) | | | 16.55 | % |

| | | |

Minnesota Municipal Income Portfolio – preferred shares | | Bank of America Corporation and certain subsidiaries(4) Bank of America Corporate Center 100 North Tryon Street Charlotte, NC 28255 | | 751 shares;

shared voting and dispositive power(4) | | | 60.37 | % |

| | | |

| | UBS AG and certain subsidiaries(5) Bahnhofstrasse 45 PO Box CH-8021 Zurich, Switzerland | | 279 shares;

share voting and dispositive power(5) | | | 22.43 | % |

| | | |

First American Minnesota Municipal Income Fund II – preferred shares | | UBS AG and certain subsidiaries(6) Bahnhofstrasse 45 PO Box CH-8021 Zurich, Switzerland | | 513 shares;

shared voting and dispositive power(6) | | | 98.65 | % |

| (1) | Based on an amended Schedule 13G filing of Sit made on January 26, 2012. |

| (2) | Bank of America Corporation (“BAC”) and its subsidiary Bank of America, N.A. (“BANA”) have shared voting and dispositive power with respect to 35 of the outstanding preferred shares, or 2.0%, and BAC and its subsidiary Blue Ridge Investments, LLC (“Blue Ridge”) have shared voting and dispositive power with respect to 1,221 of the outstanding preferred shares, or 70.2%. The address of BANA is 101 South Tryon Street, Charlotte, NC 28255. The address of Blue Ridge is 214 North Tryon Street, Charlotte, NC 28255. Based on information provided in a Schedule 13D filed January 11, 2011. |

| (3) | UBS AG shares voting and dispositive power with its subsidiaries UBS Securities LLC and UBS Financial Services Inc. Based on information provided in a Schedule 13G filed January 14, 2011. |

| (4) | Bank of America Corporation and its subsidiary Blue Ridge Investments, LLC (“Blue Ridge”) have shared voting and dispositive power with respect to 751 of the outstanding preferred shares, or 60.4%. The address of Blue Ridge is 214 North Tryon Street, Charlotte, NC 28255. Based on information provided in a Schedule 13D filed January 11, 2011. |

| (5) | UBS AG shares voting and dispositive power with its subsidiaries UBS Securities LLC and UBS Financial Services Inc. Based on information provided in a Schedule 13G filed January 14, 2011. |

| (6) | UBS AG shares voting and dispositive power with its subsidiaries UBS Securities LLC and UBS Financial Services Inc. Based on information provided in a Schedule 13G filed October 12, 2010. |

17

Section 16(a) Beneficial Ownership Reporting Compliance

Based on Fund records and other information, the Funds believe that all SEC filing requirements with respect to the Funds applicable to their directors and officers, the Advisor and companies affiliated with the Advisor, pursuant to Section 16(a) of the Securities Exchange Act of 1934, with respect to each Fund’s fiscal year end were satisfied.

Shareholder Proposals

Under the Securities Exchange Act of 1934, Fund shareholders may submit proposals to be considered at the next Annual Meeting. Rule 14a-8 under the Exchange Act sets forth the procedures and requirements for requesting that a Fund include these proposals in its proxy statement. Any proposal submitted under Rule 14a-8 must be received at the Funds’ offices, 800 Nicollet Mall, Minneapolis, Minnesota 55402, not later than July 12, 2013. Shareholders also may submit proposals to be voted on at the next Annual Meeting without having the proposals included in the Funds’ proxy statement. These proposals are known as “non-Rule 14a-8 proposals.” The Funds’ proxies will be able to exercise their discretionary authority to vote all proxies with respect to any non-Rule 14a-8 proposal, unless written notice of the proposal is presented to the Fund not later than September 25, 2013. If a shareholder makes a timely notification on a non-Rule 14a-8 proposal, the proxies may still exercise discretionary voting authority under circumstances consistent with applicable proxy rules.

Other Business

So far as the Board is aware, no matters other than those described in this Proxy Statement will be acted upon at the Meeting. Should any other matters properly come before the Meeting calling for a vote of shareholders, it is the intention of the persons named as proxies to vote upon such matters according to their best judgment.

Dated: October 31, 2012

Richard J. Ertel

Secretary

18

APPENDIX A

First American Funds

Audit Committee Charter

[As amended effective January 1, 2011]

| 1. | The First American Funds Complex Audit Committee (Audit Committee) shall be composed entirely of independent directors1 who are not “interested persons” of the Funds within the meaning of the Investment Company Act of 1940. The Audit Committee shall be comprised of at least three members with one member appointed as chairperson. All committee members shall be financially literate2, at least one member shall have accounting or related financial management expertise3, and at least one member shall be an “audit committee financial expert” as determined by the Board of Directors of the Funds pursuant to SEC Form N-CSR, Items 3(b) and (c). |

| 2. | The purposes of the Audit Committee are: |

| | (a) | to oversee the Funds’ accounting and financial reporting policies and practices, their internal controls and, as appropriate, the internal controls of certain service providers; |

| | (b) | to oversee the quality of the Funds’ financial statements and the independent audit thereof; |

| | (c) | to oversee the valuation of the securities held by the Funds; |

| | (d) | to assist Board oversight of the Funds’ compliance with legal and regulatory requirements; and |

| | (e) | to act as a liaison between the Funds’ independent auditors and the full Board of Directors. |

The function of the Audit Committee is oversight; it is management’s responsibility to maintain appropriate systems for accounting and internal control and for preparing the Funds’ financial statements, and the independent auditor’s responsibility is to plan and carry out a proper audit of the financial statements.

The outside auditor for the Funds is ultimately accountable to the Board of Directors and Audit Committee as representatives of shareholders. The Audit Committee and Board of Directors have the ultimate authority and responsibility to select, evaluate and, where appropriate, replace the outside auditor (or to nominate the outside auditor to be proposed for shareholder approval in any proxy statement).

| 1 | A director shall be deemed “independent” for this purpose only if he or she is independent within the meaning of Rule 10A-3(b)(1)(iii) under the Securities Exchange Act of 1934. The full Board of Directors has reviewed information provided by each Audit Committee member and has found that each such member is “independent” within the meaning of this rule. |

| 2 | For purposes of the applicable New York Stock Exchange Rule, the full Board of Directors, in its business judgment, interprets the term “financially literate” in a manner consistent with the counterpart American Stock Exchange Rule, as meaning that an Audit Committee member is able to read and understand fundamental financial statements, including a balance sheet, income statement, and cash flow statement. |

| 3 | For purposes of the applicable New York Stock Exchange Rule, the full Board of Directors, in its business judgment, interprets this qualification in a manner consistent with the counterpart American Stock Exchange Rule, as meaning that an Audit Committee member has past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the individual’s financial sophistication, including being or having been a chief executive officer, chief financial officer, or other senior officer with financial oversight responsibilities. |

A-1

| 3. | To carry out its purposes, the Audit Committee shall have the following duties and powers: |

| | (a) | to review with management and the independent auditors the audited annual financial statements of the Funds, including their judgment about the quality, not just the acceptability, of accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements; |

| | (b) | to meet with the Funds’ independent auditors, including private meetings, as necessary (i) to review the arrangements for and scope of the annual audit and any special audits; (ii) to discuss any matters or concern relating to the Funds’ financial statements, including any adjustments to such statements recommended by the auditors, or other results of said audit(s); (iii) to consider the auditors’ comments with respect to the Funds’ financial policies, procedures, and internal accounting controls and management’s responses thereto; (iv) to review the form of opinion the independent auditors propose to render to the Board and shareholders with respect to the Funds’ financial statements; and (v) to review the results of internal audits of areas that impact the Funds; |

| | (c) | to prepare and deliver the audit committee reports required to be included in the closed-end Funds’ proxy statements; |

| | (d) | to receive and consider any communications which the Funds’ principal executive officer and principal financial officer are required to make to the Audit Committee in connection with their certifications of the Funds’ filings on SEC Form N-CSR; |

| | (e) | to receive and consider the communications which the Funds’ independent auditors are required to make to the Audit Committee pursuant to SEC Reg. S-X, Rule 2-07(a) (a copy of which is attached hereto as Exhibit A); |

| | (f) | to consider the effect upon the Funds of any changes in accounting principles or practices proposed by management or the auditors; |

| | (g) | to ensure that the auditor submits on a periodic basis to the Audit Committee a formal written statement delineating all relationships between the auditor and the Funds, consistent with Independence Standards Board Statement No. 1, to engage in a dialogue with the auditor with respect to any disclosed relationships or services that may impact the objectivity and independence of the auditor, to evaluate the independence of the auditor, and to recommend that the Board of Directors take appropriate action in response to the auditors’ report to satisfy itself of the auditors’ independence; |

| | (h) | at least annually, to obtain and review a report by the auditor describing the firm’s internal quality-control procedures, any material issues raised by the most recent internal quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carries out by the firm, and any steps taken to deal with any such issues; |

| | (i) | to consider pre-approving any accounting firm’s engagement to render audit or non-audit services to the Funds or, under the circumstances contemplated by SEC Reg. S-X, Rule 2-01(c)(7)(ii) (a copy of which is attached hereto as Exhibit B), to the Funds’ investment adviser or any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the Funds and the accounting firm’s services have a direct impact on the Funds’ operations or financial reporting; provided, that the Audit Committee may establish written pre-approval policies and procedures which conform to the requirements of SEC Reg. S-X, Rule 2-01(c)(7)(i)(B) (a copy of which is attached hereto as Exhibit C); |

| | (j) | to review the fees charged to the Funds by the auditors for audit and non-audit services; |

| | (k) | to oversee the valuation of the securities held by the Funds as set forth in paragraph 4 below; |

| | (l) | to investigate improprieties or suspected improprieties in Fund operations; |

| | (m) | to review procedures to safeguard portfolio securities; |

| | (n) | to review the Funds’ back-up procedures and disaster recovery plans; |

A-2

| | (o) | to discuss policies with respect to risk assessment and risk management; |

| | (p) | to meet separately, periodically, with management, with internal auditors (or other personnel responsible for the internal audit function) and with independent auditors; |

| | (q) | to set clear hiring policies for employees or former employees of the auditors; and |

| | (r) | to report its activities to the full Board on a regular basis and to make such recommendations with respect to the above and other matters as the Committee may deem necessary or appropriate. |

| 4. | The Committee shall oversee the valuation of the securities held by the Funds as follows: |

| | (a) | The Committee is responsible for overseeing the valuation of securities for which market quotations are not readily available, pursuant to procedures established by the Board of Directors of the Funds, which may be amended by the Board (the “Valuation Procedures”). Pursuant to the Valuation Procedures, a committee (the “USBAM Valuation Committee”) comprised of representatives of U.S. Bancorp Asset Management, Inc. (“USBAM”) will determine the value of a security pursuant to the Valuation Procedures in the following circumstances: |

| | (i) | Instances in which USBAM proposes to use valuation methods other than pricing service quotations/pricing service matrix prices, broker-dealer prices or prices from a widely used quotation system in valuing whole loans and similar instruments; |

| | (ii) | Instances in which the value for a security cannot be determined using independent pricing service quotations, independent pricing service model valuation, broker-dealer prices or prices from a widely used quotation system, or where the value obtained from any such sources is deemed to be erroneous or unreliable and where no other pricing service, valuation, dealer quotation or widely used quotation system is readily available; and |

| | (iii) | Instances in which a Significant Event occurs prior to the time a Fund’s net asset value is calculated. For this purpose, a “Significant Event” is one that is related to a single issuer or an entire market sector that is reasonably likely to affect the value of one or more of a Fund’s portfolio securities. |

| | (b) | The Committee is responsible for reviewing any “fair value” determinations made by the USBAM Valuation Committee, in accordance with the Valuation Procedures. In addition, the Committee is responsible for reviewing on a periodic basis certain pricing reports prepared by USBAM in accordance with the Valuation Procedures. |

| | (c) | The Committee is responsible for monitoring pricing services used and the appropriateness of a previously determined fair value methodology, such as, for example, the pricing model used to value whole loans and similar instruments. In addition, the Committee shall oversee the Funds’ Valuation Procedures, including compensating controls to prevent and detect clerical error, and shall review at least annually the Valuation Procedures to ensure their continued appropriateness. The Committee will approve in advance any proposed changes to such pricing services or methodology or to the Valuation Procedures and present such changes for ratification to the Board of Directors of the Funds. |

| | (d) | The Committee shall oversee the responsibility of USBAM to maintain adequate records when the Funds use “fair value” pricing. |

| 5. | The Committee shall meet on a regular basis as often as necessary to fulfill its responsibilities, including at least semi-annually to review the closed-end Funds’ annual and semi-annual financial statements. The Committee is empowered to hold special meetings, as circumstances require. |

| 6. | The Committee shall regularly meet with the Treasurer of the Funds. |

A-3

| 7. | The Committee shall establish procedures for (a) the receipt, retention, and treatment of complaints received by the Funds regarding accounting, internal accounting controls, or auditing matters, and (b) the confidential, anonymous submission by employees of the Funds and of their investment advisers, administrators, principal underwriters, and any other provider of accounting related services for the Funds, of concerns regarding questionable accounting or auditing matters. |

| 8. | The Committee also shall act as the Funds’ “qualified legal compliance committee,” as defined in 17 CFR Section 205.2(k). In this role, the Committee shall: |

| | (a) | adopt written procedures for the confidential receipt, retention and consideration of any report of evidence of a material violation of United States federal or state securities law, material breach of fiduciary duty to the Funds arising under United States federal or state law, or similar material violation of United States federal or state law which is required to be made with respect to the Funds by attorneys who are subject to the reporting rules set forth in 17 CFR Part 205; |

| | (b) | have the authority and responsibility: |

| | (i) | to inform the Funds’ chief legal officer and chief executive officer (or the equivalents thereof) of any report of evidence of a material violation received by the Committee (except in the circumstances described in 17 CFR Section 205.3(b)(4)); |

| | (ii) | to determine whether an investigation is necessary regarding any report of evidence of a material violation received by the Committee and, if the Committee determines an investigation is necessary or appropriate, to (A) notify the Funds’ Board of Directors, (B) initiate an investigation, which may be conducted either by the Funds’ chief legal officer (or the equivalent thereof) or by outside attorneys, and (C) retain such additional expert personnel as the Committee deems necessary; |

| | (iii) | at the conclusion of the investigation, to (A) recommend to the full Board of Directors, by majority vote, that the Funds implement an appropriate response to evidence of a material violation, and (B) inform the Funds’ chief legal officer and chief executive officer and their Board of Directors of the results of any such investigation and the appropriate remedial measures to be adopted; and |

| | (c) | have the authority and responsibility, acting by majority vote, to take all other appropriate action, including the authority to notify the SEC in the event that the Funds fail in any material respect to implement an appropriate response that the Committee has recommended the Funds to take. |

| 9. | The Committee shall have the resources and authority appropriate to discharge its responsibilities, including the power to investigate any matter brought to its attention with full access to all books, records, facilities, and personnel related to the Funds and the authority to retain special counsel and other experts or consultants at the expense of the appropriate Fund(s). |

| 10. | The Committee shall review this Charter at least annually and recommend any changes to the full Board of Directors. The full Board of Directors shall approve this charter at least annually. |

| 11. | The Committee shall evaluate its own performance at least annually. |

A-4

Exhibit A: Reg. S-X, Rule 2-07(a)

| (a) | Each registered public accounting firm that performs for an audit client that is an issuer (as defined in section 10A(f) of the Securities Exchange Act of 1934, other than an issuer that is an Asset-Backed Issuer as defined in Rules 13a-14(g) and 15d-14(g) under the Securities Exchange Act of 1934, or an investment company registered under section 8 of the Investment Company Act of 1940, other than a unit investment trust as defined by section 4(2) of the Investment Company Act of 1940, any audit required under the securities laws shall report, prior to the filing of such audit report with the Commission (or in the case of a registered investment company, annually, and if the annual communication is not within 90 days prior to the filing, provide an update, in the 90 day period prior to the filing, of any changes to the previously reported information), to the audit committee of the issuer or registered investment company: |

| | (1) | All critical accounting policies and practices to be used; |

| | (2) | All alternative treatments within Generally Accepted Accounting Principles for policies and practices related to material items that have been discussed with management of the issuer or registered investment company, including: |

| | (i) | Ramifications of the use of such alternative disclosures and treatments; and |

| | (ii) | The treatment preferred by the registered public accounting firm; |

| | (3) | Other material written communications between the registered public accounting firm and the management of the issuer or registered investment company, such as any management letter or schedule of unadjusted differences; |

| | (4) | If the audit client is an investment company, all non-audit services provided to any entity in an investment company complex, as defined in Rule 2-01 (f)(14), that were not pre-approved by the registered investment company’s audit committee pursuant to Rule 2-01 (c)(7). |

A-5

Exhibit B: Reg. S-X, Rule 2-01(c)(7)(ii)

| (ii) | A registered investment company’s audit committee also must pre-approve its accountant’s engagements for non-audit services with the registered investment company’s investment adviser (not including a sub-adviser whose role is primarily portfolio management and is sub-contracted or overseen by another investment adviser) and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registered investment company in accordance with paragraph (c)(7)(i) of this section, if the engagement relates directly to the operations and financial reporting of the registered investment company, except that with respect to the waiver of the pre-approval requirement under paragraph (c)(7)(i)(C) of this section, the aggregate amount of all services provided constitutes no more than five percent of the total amount of revenues paid to the registered investment company’s accountant by the registered investment company, its investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registered investment company during the fiscal year in which the services are provided that would have to be pre-approved by the registered investment company’s audit committee pursuant to this section. |

A-6

Exhibit C: Reg. S-X, Rule 2-01(c)(7)(i)(B)

| (B) | The engagement to render the service is entered into pursuant to pre-approval policies and procedures established by the audit committee of the issuer or registered investment company, provided the policies and procedures are detailed as to the particular service and the audit committee is informed of each service and such policies and procedures do not include delegation of the audit committees responsibilities under the Securities Exchange Act of 1934 to management; . . . |

A-7

APPENDIX B

FIRST AMERICAN FUNDS

GOVERNANCE COMMITTEE

CHARTER

(Effective January 1, 2012)

The purpose of the Governance Committee is to oversee the Board’s governance processes.

The Governance Committee shall be composed entirely of Directors who are not “interested persons” of the Funds within the meaning of the Investment Company Act of 1940. The Governance Committee will have at least three members.

The Committee will have the following responsibilities:

Board Composition

| | • | | Interview and recommend to the Board of Directors of the Funds nominees for election as directors (whether they are “interested” or “disinterested” within the meaning of the Investment Company Act of 1940) consistent with the needs of the Board and the Funds. The Committee will evaluate candidates’ qualifications for Board membership and, with respect to persons being considered to join the Board as “disinterested” directors, their independence from management and principal service providers. These persons must be independent in terms of both the letter and the spirit of the 1940 Act and the Rules, Regulations and Forms under the 1940 Act. With respect to “disinterested” director candidates, the Committee also will consider the effect of any relationships beyond those delineated in the 1940 Act that might impair independence, such as business, financial or family relationships with Fund managers or service providers. In this regard, the Committee will not consider the following types of candidates to serve as “disinterested” directors: (1) a close family member1 of an employee, officer or interested director of a Fund or its affiliates, and (2) a former officer or director of a Fund’s affiliate. |

| | • | | Review, annually, the independence of all Independent Directors and report its findings to the Board. |

| | • | | Review the composition of the Board of Directors to determine whether it may be appropriate to add individuals with different backgrounds or skills from those already on the Board. |

| | • | | Recommend to the Board a successor to the Board Chair when a vacancy occurs. |

| | • | | Consult with the Board Chair regarding the Board Chair’s recommended Committee assignments. |

| 1 | “Close family member” includes any member of the immediate family and any aunt, uncle or cousin. |

B-1

Committee Structure

| | • | | Assist the Board Chair in his or her annual review of the Board’s Committee structure and membership. |

Director Education

| | • | | Develop an annual education calendar that details the topics to be addressed in the Board’s quarterly education sessions. The educational calendar will be presented to the full Board at its first quarterly meeting. |

| | • | | Encourage and monitor the attendance by each Independent Director at educational seminars, conferences or similar meetings. |

| | • | | Develop and conduct orientation sessions for new Independent Directors before or shortly after the new Directors join the Board. |

| | • | | Manage the Board’s education program in a cost-effective manner. |

Governance Practices

| | • | | Review and make recommendations to the Board of Directors concerning Director compensation at least once every year. |

| | • | | As appropriate or necessary, review, on a regular basis, and make recommendations to the Board of Directors concerning Director expenses, including those related to Board education, Director education, Director travel, legal counsel and consultant support. |

| | • | | Review annually adherence to the Board’s guideline that each Director maintain an ownership stake in the Funds. |