Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ý Annual Report Pursuant To Section 13 or 15(d)

of The Securities Exchange Act of 1934

For the fiscal year ended September 30, 2009

OR

o Transition Report Pursuant To Section 13 or 15(d)

of The Securities Exchange Act of 1934

ACTIVIDENTITY CORPORATION

(Exact name of Registrant as specified in its charter)

| | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 45-0485038

(I.R.S. Employer Identification No.) |

6623 Dumbarton Circle, Fremont, CA

(Address of principal executive offices) |

|

94555

(Zip Code) |

(510) 574-0100

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of each class | | Name of each exchange |

|---|

| Common Stock, $0.001 par value per share | | NASDAQ Global Market |

| Preferred Stock Purchase Rights | | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes o No ý

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes o No o

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check One):

| | | | | | |

| Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o

(Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of Registrant's common stock, $0.001 par value per share, held by non-affiliates of the Registrant on March 31, 2009, the last business day of the Registrant's most recently completed second fiscal quarter, was approximately $90 million based upon the closing sales price of the common stock as reported on the NASDAQ Global Market on such date. Shares of the Registrant's common stock held by officers subject to section 16(b) filing requirements, directors and holders of more than ten percent of the outstanding common stock have been excluded from this calculation because such persons may be deemed to be affiliates. The determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of November 30, 2009, the Registrant had outstanding 45,866,110 shares of common stock.

Documents Incorporated by Reference

The information required by Part III of this Form 10-K, to the extent not set forth herein, is incorporated by reference from the issuer's Proxy Statement to be filed in connection with the 2010 Annual Meeting of Stockholders.

Table of Contents

ACTIVIDENTITY CORPORATION

INDEX TO ANNUAL REPORT ON FORM 10-K

FOR FISCAL YEAR ENDED SEPTEMBER 30, 2009

2

Table of Contents

The statements contained in this Annual Report on Form 10-K that are not historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements regarding our expectations, intentions, strategies, expected operating results, and financial condition. Forward-looking statements also include statements regarding events, conditions and financial trends that may affect our future plans of operations, business strategy, results of operations, and financial position. All forward-looking statements included in this document are based on information available to us on the date hereof, and we disclaim any intent to update any such forward-looking statements. Investors are cautioned that any forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties and that actual results may differ materially from those included within the forward-looking statements as a result of various factors. Factors that could cause or contribute to such differences include, but are not limited to, those described in "Management's Discussion and Analysis of Financial Condition and Results of Operations," under the heading "Risk Factors," and elsewhere in this Annual Report.

PART I

ITEM 1: BUSINESS

Overview

ActivIdentity™ Corporation (the "Company" or "ActivIdentity" and also referred to as "we" or "our") is a global leader in strong authentication and credential management, providing solutions to confidently establish a person's identity when interacting digitally. For more than two decades, the Company's experience has been leveraged by security-minded organizations in large-scale deployments such as the U.S. Department of Defense, Cadence Design Systems, Nissan, and Saudi Aramco. The Company's customers have issued more than 100 million credentials, securing the holder's digital identity. Our strong authentication, credential management, security clients, and authentication devices are embraced by large organizations and governments to defend against security threats and identity fraud.

Founded in 1987, ActivIdentity has been instrumental in providing identity security software solutions to business and government organizations around the world. ActivIdentity is the realization of a strategy to elevate the Company from its original role as a token provider to be a complete authentication solutions provider with significant intellectual property. The Company has achieved success through organic growth and strategic acquisitions. The Company is a Delaware corporation.

We operate on a fiscal year ending September 30. For convenience in this Annual Report, we refer to the fiscal year ended September 30, 2007 as fiscal 2007, the fiscal year ended September 30, 2008 as fiscal 2008 and the fiscal year ended September 30, 2009 as fiscal 2009. We also refer to the fiscal year ending September 30, 2010 as fiscal 2010.

ActivIdentity provides solutions to organization's for identity and access management by providing strong authentication and credential management solutions. In general, ActivIdentity solutions deliver multiple benefits, including increased digital and physical security, protection against online fraud, enhanced business process efficiencies, secure access to digital assets, and a pathway to regulatory compliance.

ActivIdentity delivers solutions today in three primary markets: Employer-to-Employee, Business-to-Customer, and Government-to-Citizen.

ActivIdentity'sEmployer-to-Employee ("E2E") solutions for employee identification access offer a multi-layered security approach across networks, systems, facilities, data, intellectual property, and information assets. The foundation of the Company's E2E solutions is a Versatile Authentication platform to control access to data and / or network assets. The platform supports a variety of authentication methods (e.g., user name and password, knowledge-based authentication, and one-time

3

Table of Contents

password) and authentication devices (e.g., soft tokens, hardware tokens, mobile devices, and smart cards). The authentication platform's versatility enables employers not only to provide access control for their employees, but also to extend the schema to contractors and employees of partner organizations. In these scenarios, organizations can tailor the authentication method based on the risk associated with specific types of transactions. ActivIdentity E2E solutions are highly scalable. In larger deployments, they can be complemented by the ActivIdentity Credential Management products, as well as Security Client software to ease device management.

ActivIdentity's commercialBusiness-to-Customer ("B2C") solutions address the needs of organizations with electronic channels that serve consumers, businesses, suppliers, and partners. ActivIdentity has a complete Strong Authentication and Credential Management solutions portfolio to help organizations secure electronic interactions across multiple channels. ActivIdentity solutions can be tailored to meet each organization's unique needs for a range of transaction risk-levels, device authentication versatility, and user and credential life cycle management.

ActivIdentity'sGovernment-to-Citizen ("G2C") solutions for government-issued identity help systems integrators ("SIs") address the challenges of G2C deployments by offering a Credential Management solution, as well as complementary components that SI clients can leverage to securely upload data onto chip-based authentication cards. In addition, ActivIdentity solutions provide post-issuance update capabilities that are essential for managing applications that require constant data revisions.

Market Trends

There are a variety of market trends that stimulate demand for strong authentication and credential management solutions:

Compliance

Compliance can be seen as a new driver for deployment of strong authentication as it enables pathway to tamper-proof auditing trails to track who did what and when. Regulatory requirements and economic realities are pressuring organizations to secure access to applications and networks. Many industry standards and government regulations now deem static passwords as inadequate and establish guidance that multi-factor authentication should replace single-factor authentication. The Sarbanes-Oxley Act ("SOX"), recommendations from the Federal Financial Institutions Examination Council, and the Health Insurance Portability and Accountability Act have led organizations to use stronger forms of authentication to mitigate fraud and protect customer information and patient privacy.

Internal Threat Risk

While static passwords continue to dominate as the primary mechanism for identity verification, they create numerous issues for users and organizations alike. Static passwords are often created by users to be easily remembered, making them vulnerable to guessing, social engineering, and brute force dictionary attacks. Even static passwords created under a stringent policy are vulnerable because users write them down and display them in open areas. A key security concern with static passwords is the fact that a compromise (via keystroke logger or network sniffer) often goes undetected, introducing unknown risks to the organization. Since the economic downturn, the internal risk for many organizations has increased dramatically:

- •

- According to the annual CPI / FBI survey, 59% of organizations surveyed said they have had one or more attacks reported internally. Almost 8% of those organizations reported 60 or more internal incidents.

4

Table of Contents

- •

- According to a survey of more than 200 organizations globally conducted by Deloitte Touche Tohmatsu, only 28% of respondents rated themselves as "very confident" or "extremely confident" with regard to internal threats, which is down from 51% in 2008.

New Supply Chain Paradigm

The collaboration between companies, other organizations and government agencies is driving requirements to share data across networks and provide access to applications and data behind the firewall. To mitigate risk, many large organizations and government agencies are replacing traditional user names and passwords with digital certificates that enable strong authentication, encryption, and electronic signatures. However, to fully trust the access control and identity assurance services that digital certificates enable, organizations must securely store these digital identities / certificates on authentication devices such as smart cards or smart USB tokens.

Initiatives to Drive Customer Confidence and Loyalty

As a result of the most recent financial crisis, strong authentication is being leveraged as a tool to enhance customer loyalty, especially in the banking and financial services industry.

Product Lines, Products and Services

ActivIdentity provides key building blocks for securing IT infrastructures and digital transactions to defend against security threats and identity fraud and at the same time increase an organization's resource utilization, improve productivity, and maximize return on investment.

ActivIdentity offers four product lines that are the foundation for its E2E, B2C, and G2C solutions:

Strong Authentication

ActivIdentity Strong Authentication suite of products enables organizations to securely address a variety of end-user access control scenarios, ranging from remote access via virtual private networks ("VPN") and secure access to Web-based applications, to secure access to data and applications from the local network.

ActivIdentity offers two distinct Strong Authentication platforms for organizations that are seeking to implement a cost-effective, flexible, and scalable solution.ActivIdentity 4TRESS™ AAA Server for Remote Access addresses the security risks associated with a mobile workforce accessing systems and data remotely.ActivIdentity 4TRESS™ Authentication Server offers support for many authentication methods (e.g., user name and password, knowledge-based authentication, one-time password ("OTP"), and public key infrastructure ("PKI") certificates) and diverse audiences across a variety of service channels, making it the preferred versatile authentication platform for customer-facing transactions.

Credential Management

ActivIdentity Credential Management products enable organizations to securely deploy and manage smart cards and USB tokens containing a variety of credentials, including PKI certificates, OTPs, static passwords, biometrics, demographic data, and virtually any other application.

TheActivIdentity ActivID™ Card Management System is a highly scalable, reliable, proven, and extensible solution that enables organizations to securely issue and manage the complete life cycle of digital credentials on devices, as well as securely update applications and credentials on devices after they have been issued to end users.

5

Table of Contents

Together with its Security Client software, Strong Authentication platform, and Authentication Device offering, ActivIdentity can provide organizations with a complete "Smart Employee ID Solution" that can be leveraged for both physical and logical access control.

Security Clients

ActivIdentity Security Clients software integrates and works seamlessly with ActivIdentity Strong Authentication and Credential Management offerings to deliver a comprehensive solution for security and network access.

TheActivIdentity ActivClient™ secures desktops and networks with strong authentication based on smart cards and PKI.ActivIdentity ActivClient™ supports the U.S. government's most stringent security requirements and standards. Organizations have issued millions of cards to secure network access, encrypt data, sign emails, and log in to Web applications.

ActivIdentity SecureLogin™ Single Sign-On software provides a simple and secure approach, enabling consistent password management and allowing organizations to provide a single secure sign-on for both local and remote users.

TheActivIdentity™ Authentication Client provides end users with self services to temporarily enable access to workstations and reset Windows passwords. In addition, it allows management with auditing, diagnostic, and policy configuration support and enables smart card password authentication.

Authentication Devices

Organizations' strong authentication needs vary widely based on transaction risks, deployment scenarios, and user communities. ActivIdentity offers a broad range of authentication devices that interoperate with its Strong Authentication and Credential Management products. These devices include the ActivIdentity line of OTP Tokens and other third-party devices such as Smart Cards, Smart Card Readers, Smart USB Tokens, Display Card Tokens, Soft Tokens and Hardware Security Modules.

Services

ActivIdentity offers training, implementation and ongoing architecture assessment services to guide and support organizations. Professional services are offered to ensure that the deployment of ActivIdentity solutions meet an organization's security, compliance, and vulnerability management needs. Training programs help an organization learn quickly how to configure, administer, and optimize ActivIdentity strong authentication and credential management solutions in its network environment.

Customers

Our customers include primarily large-scale organizations in the technology, government, manufacturing, banking and financial services industries.

For fiscal 2009 and 2008, Novell accounted for more than 10% of our total revenue. In fiscal 2007, Novell and Electronic Data Systems (EDS) accounted for more than 10% of our total revenue.

Sales, Services, and Marketing

Our sales and marketing efforts are aimed at building long-term relationships with our customers. We market and sell our products and technologies through our worldwide direct sales force and through a network of partners including SIs, original equipment manufacturers ("OEMs"), value added distributors ("VADs"), and VARs. Our direct sales force focuses on the top 2,000 companies worldwide and government agencies, working in concert with our channel sales and business development teams supporting initiatives with our SI, OEM, VAD and VAR partners.

6

Table of Contents

In addition to sales and service offices in the United States, we conduct sales, marketing, and services out of wholly-owned subsidiaries or branches in other countries, including the United Kingdom, France, Germany, Singapore, and Australia. International revenue accounted for approximately 53%, 58%, and 59% of our total revenue in fiscal 2009, 2008, and 2007, respectively. We maintain an export compliance program that is designed to meet the requirements of the U.S. Departments of Commerce and State.

We believe that sales outside the United States will continue to be a significant percentage of our total revenue. Our future performance will depend, in part, on our ability to continue to compete successfully in Europe, one of the largest markets for our solutions. International sales and operations may be adversely affected by the imposition of governmental controls, restrictions on export technology, political instability, trade restrictions, changes in tariffs and the difficulties associated with staffing and managing international operations. In addition, international sales may be adversely affected by the economic conditions in each country. The revenue from our international business may also be affected by fluctuations in currency exchange rates. These factors could have a material adverse effect on our future business and financial results.

ActivIdentity provides technical support from offices located in the U.S., France, and the United Kingdom. These offices provide technical support to our integration and distribution partners, who, in turn, provide first level and second level support to end users. We offer certification training programs and have established a worldwide "ActivIdentity Channel Partner Program". In addition, we provide telephone and online support services to answer inquiries related to implementation, integration, and operation of our products and technologies. Our standard practice is to provide a one-year warranty on hardware and ninety days on software products.

We have organized our marketing efforts into three functional groups to support our business strategies as follows:

Product and Solutions Marketing

The product and solutions marketing team is responsible for synthesizing data from key customers, partners, and industry analysts to assist us in defining next generation solutions/products. Furthermore, the product and solutions marketing team develops all sales and market messaging, positioning, collateral, and selling tools to enable our sales force and channel partners to capitalize on market opportunities and effectively position and sell our products.

Channel and Partner Marketing

Our channel and partner marketing organization defines and implements integrated marketing programs to increase brand and product awareness, as well as capture mindshare and enthusiasm for ActivIdentity solutions with channel and partner sales forces.

Corporate Marketing Services

Corporate marketing efforts include Internet, telemarketing, trade shows, online advertising, email campaigns, channel promotions, associations marketing, and seminars. Our marketing programs target global 2000 companies and government decision makers, information technology managers and service providers using a high value approach addressing business problem solving and return on investment.

Competition

We compete in the strong authentication, credential management, security clients and authentication devices markets. We compete with numerous companies in each of these technology

7

Table of Contents

categories. The overall number of our competitors may increase and the identity and composition of competitors may change over time.

The worldwide market for identity management is highly competitive. In each of our product categories, we face competition from established and potential competitors, some of which may have greater financial, research, engineering, manufacturing and marketing resources than we have, such as RSA Security (the security division of EMC Corporation), VeriSign, SafeNet, IBM, Passlogix, Thales Group, and Vasco Data Security International Inc. We may also face future competition from new market entrants from other overseas and domestic sources. We expect our competitors to continue to improve the design and performance of their current products and processes and to introduce new products and processes with improved price and performance characteristics. We believe that to remain competitive, we will require significant financial resources to offer a broad range of products, to maintain customer service and support centers worldwide, and to invest in product and process research and development.

We believe that the principal factors affecting competition in our product segments include system performance, ease of use, reliability, installed base, technical service and support, product functionality, scalability, flexibility, use of open standards, return on investment, and total cost of ownership. We believe that, while price and delivery are important competitive factors, the customers' overriding requirement is for systems that easily and effectively incorporate into their existing ecosystem and enhance productivity.

We intend to invest in the development of comprehensive, flexible, and cost-effective security solutions that adhere to industry standards and provide advanced features and functions for specific markets. In addition, we will continue to leverage our leadership position in the U.S. Federal government market to expand our business to address customer needs, develop our channel partners, and implement new promotional campaigns to increase the awareness and adoption of our solutions.

Management believes that we are well positioned in the market with respect to both our products and services. However, any loss of competitive position could negatively impact our prices, customer orders, revenue, gross margins, and market share, any of which would negatively impact our operating results and financial condition.

Industry Associations

At ActivIdentity, innovation is born of imagination and molded by pragmatism. As a leading innovator in strong authentication and credential management, ActivIdentity is dedicated to driving industry standards. ActivIdentity belongs to a range of trade groups and industry associations to advance interoperability, ensure the highest technical standards, and promote innovative strong authentication and credential management technologies now and in the future.

As of September 30, 2009, ActivIdentity is a member of the following industry associations:

- •

- GlobalPlatform

- •

- The Smart Card Alliance

- •

- Open AuTHentication (OATH)

- •

- Intellect

Intellectual Property

Our success is heavily dependent on our ability to create proprietary technology and to protect and enforce our intellectual property rights, as well as our ability to defend against adverse claims of third parties with respect to our technology and intellectual property.

8

Table of Contents

We rely primarily on a combination of copyrights, trademarks, service marks, trade secrets, patents, restrictions on disclosure, and other methods to protect our intellectual property. We also enter into confidentiality and/or invention assignment agreements with our employees, consultants, and current and potential affiliates, customers, and business partners. We also generally control access to and distribution of proprietary documentation and other confidential information. In addition, we limit access to and distribution of our software, documentation, and other proprietary information.

We have been issued numerous patents (approximately 100 issued and another 100 pending) in the U.S. and abroad, covering a wide range of our technology. Additionally, we have filed numerous patent applications with respect to certain aspects of our technology in the U.S. Patent and Trademark Office and patent offices outside the U.S.

From time to time, we acquire license rights under United States and foreign patents and other proprietary rights of third parties. For instance, in July 2006 we acquired certain patents and related intellectual property in the area of digital identity management from a third party for approximately $4.0 million to enhance our patent position. In June 2005 we out-licensed on an exclusive basis, with retained rights for internal use, certain of our biometric patents and pending patent applications for $4.1 million.

We continue to file patent applications both in the U.S. and abroad to protect key technologies and innovations provided by our research and development efforts. Patents may not be awarded with respect to these applications and even if such patents are awarded, such patents may not provide us with sufficient protection of our intellectual property.

Research and Development

We have research and development teams in Fremont (United States) and Suresnes (France) that are responsible for the design, development, and release of our products. The research and development function is organized into product management, product architecture, development, quality assurance, and documentation disciplines. When appropriate, we also integrate our products into third party technology that we purchase or license to shorten our time-to-market.

The focus of our research and development efforts is to bring to market enhanced versions of our existing products, as well as new products, in order to address customer needs while maintaining compliance with government and industry standards. Our research and development expenses were $15.1 million, $18.9 million, and $19.9 million in fiscal 2009, 2008, and 2007, respectively.

Operations

We have established relationships with hardware manufacturers and assemblers and software reproducers. Additionally, we have outsourcing arrangements for product warehousing and fulfillment services. Our global production and distribution capacity supports our current requirements and can readily be increased by augmenting existing production lines with current suppliers. We maintain ownership of all manufacturing tools, molds and software, supply all critical components, and define all manufacturing processes and quality control processes, thereby granting us the ability to relocate the manufacturing process or sub-license the manufacturing rights to a third party supplier should any unforeseen interruption occur.

Our hardware products are manufactured by third-party vendors based in China and Singapore. Our hardware products are shipped directly to our distribution partners and customers or to company warehouses in Fremont (United States), Hong Kong, Singapore, and Suresnes (France) for subsequent distribution. Software products are produced and packaged in Fremont (United States) and Suresnes (France).

9

Table of Contents

Backlog

Our backlog for products at any point in time is not significant because products are generally shipped upon receipt of order. We do not believe that our backlog at any particular point in time is indicative of future sales levels. The timing and volume of customer orders are difficult to forecast because our customers typically require prompt delivery of products and a majority of our sales are booked and shipped in the same quarter. In addition, sales are generally made pursuant to standard purchase orders that can be rescheduled, reduced or canceled prior to shipment with little or no penalty.

Employees

As of September 30, 2009, we employed approximately 220 people on a full-time basis, 111 in the United States and 109 elsewhere. Of the total, 82 were in product research and development, 54 in sales and marketing, 30 in product support and consulting services, ten in product management, five in operations, and 39 in general and administration.

Our success is highly dependent on our ability to attract and retain qualified employees. None of our employees are subject to collective bargaining agreements.

Executive Officers

Our executive officers as of September 30, 2009 and their ages and titles as of that date were as follows:

| | | | | |

Name | | Age | | Position |

|---|

| Grant Evans | | | 51 | | Chief Executive Officer and Chairman |

| Jacques Kerrest | | | 63 | | Chief Financial Officer and Chief Operating Officer |

| Michael Sotnick | | | 42 | | Executive Vice President, Worldwide Sales and Field Operations |

| John Boyer | | | 33 | | Senior Vice President, Worldwide Engineering |

Grant Evans has served as our Chief Executive Officer since April 2008 and was elected to the Board in March 2008. Mr. Evans served from January 2003 to March 2007 as the Chief Executive Officer and as a Director of A4Vision, Inc., a developer and manufacturer of machine vision technology for identity security. Prior to this, he served from March 1999 to March 2002 as the Executive Vice President at Identix, a publicly traded developer and manufacturer of identification technology solutions. Mr. Evans was also previously Vice President and General Manager of Identicator Technology and was responsible for leading that company's strategic direction and launching the commercial biometric market. Mr. Evans is a member of the board of directors of Bioscrypt, a security access control company.

Jacques Kerrest joined the Company in August 2008 as our Chief Financial Officer and Chief Operating Officer. Prior to joining the Company, from September 2004 until March 2008, Mr. Kerrest served as the Chief Financial Officer of Virgin Media, Inc., a communications company. From June 2003 to August 2004, Mr. Kerrest was the Managing Director and Chief Financial Officer of Equant, N.V., a global enterprise communications infrastructure company. From August 1997 to May 2003, Mr. Kerrest was the Senior Vice President and Chief Financial Officer of Harte-Hanks, Inc., a worldwide direct and targeted marketing company. From August 1995 to July 1997, Mr. Kerrest served as the Chief Financial Officer of Chancellor Broadcasting Company, a radio broadcasting company. From 1993 to July 1995, Mr. Kerrest was the Chief Financial Officer of Positive Communications, Inc., a private telecommunications company.

10

Table of Contents

Michael Sotnick joined the Company in December 2008 as our Executive Vice President, Worldwide Sales and Field Operations. Prior to joining the Company, from January 2005 until August 2008, Mr. Sotnick served as the Senior Vice President and General Manager of SAP Americas, Inc., a subsidiary of SAP AG, a software company. From 1999 to 2005, Mr. Sotnick served in various roles at Veritas Software Corporation, a storage and management software company, including as the Vice President of Partner Sales from 2001 to 2004 and other sales positions from 1999 to 2001. From 1994 to 1999, Mr. Sotnick served in various sales positions at Seagate Software Corporation, a software company that was a subsidiary of Seagate Technology, including Managing Director, Europe/Middle East/Africa, Director National Sales, and Eastern Area Sales Manager.

John Boyer joined the Company in October 2001 and has served as our Senior Vice President, Engineering since November 2008. Mr. Boyer served from October 2004 to October 2008 as our Director of Architecture and Chief Architect, from January 2003 to September 2004 as our Manager of Product Architecture, and from November 2001 to December 2002 in various engineering management positions. From March 1999 to October 2001, Mr. Boyer held various engineering roles at American Biometric Company, Ltd., a subsidiary of DEW Engineering and Development, Ltd.

Available Information

Additional information about ActivIdentity is available on our website at www.actividentity.com. We make available free of charge on our website our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file them with or furnish them to the Securities and Exchange Commission (SEC). Information contained on our website is not part of this Annual Report on Form 10-K or our other filings with the SEC. Additionally, these filings may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, NE, Washington, DC 20549, by mailing a request to the United States Securities and Exchange Commission, Office of Investor Education and Advocacy, 100 F Street, NE, Washington, DC 20549-0213, by sending an electronic message to the SEC at publicinfo@sec.gov or by sending a fax to the SEC at 1-202-772-9295. In addition, the SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically.

ITEM 1A. RISK FACTORS

Risk Factors That May Affect Results of Operations and Financial Condition

Set forth below are certain risks and uncertainties that could affect our business, financial condition, operating results, and/or stock price. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem less significant also may impair our business operations.

We have a history of losses and we may experience losses in the foreseeable future.

We have not achieved profitability and we may incur losses for the foreseeable future. In fiscal 2009, 2008, and 2007, we incurred losses of approximately $5.5 million, $76.5 million, and $9.3 million, respectively. As of September 30, 2009, our accumulated deficit was $328.6 million, which represents our net losses since inception. Although we had approximately $92.2 million in cash and cash equivalents, and investments as of September 30, 2009, we may not be able to raise additional capital in the event that our current cash and cash equivalents are insufficient.

11

Table of Contents

We will need to achieve incremental revenue growth and manage our costs to achieve profitability. Even if we do achieve profitability, we may be unable to sustain profitability on a quarterly or annual basis thereafter. It is possible that our revenue will grow at a slower rate than we anticipate or that operating expenses will increase beyond our current run rate. The current global economic slowdown could slow customer orders, as well as anticipated revenue growth, and could further delay our prospects for operating profitability.

Our cost-reduction initiatives may not result in the anticipated savings or more efficient operations and may harm our long-term viability.

Over the past several years, we have implemented extensive cost cutting measures and have incurred significant cost-reduction charges as we have attempted to streamline operations, improve efficiency, and reduce costs. We expect that we may undertake further cost-reduction initiatives in the future as we realign our business around areas of strategic focus. Although we believe that it has been and will continue to be necessary to reduce the size and cost of our operations to improve our performance, the reduction in our operations may make it more difficult to develop and market new products and to compete successfully with other companies in our industry. In addition, many of the employees who have been terminated as part of our cost-reduction activities possessed specific knowledge or expertise that may prove to have been important to our operations and we may be required to rehire them or to hire persons with similar skills in order to develop new products to increase our revenue. These efforts may not result in anticipated cost savings, making it difficult for us to achieve profitability. These cost-reduction initiatives may also preclude us from making complementary acquisitions and/or other potentially significant expenditures that could improve our product offerings, competitiveness or long-term prospects.

We derive revenue from only a limited number of products and we do not have a diversified product base.

Substantially all of our revenue is derived from the sale of our credential management and strong authentication systems and products. We anticipate that substantially all of our future revenue, if any, will also be derived from these products. If for any reason our sale of these products is impeded or if we divest existing product lines as part of our ongoing strategic realignment, and we have not diversified our product offerings, our business and results of operations could be harmed. We have reduced our product offerings as part of our prior restructuring initiatives to focus on our core products and do not expect to diversify our product offerings in the foreseeable future.

Our customer base is highly concentrated and the loss of any one of these customers or delay in anticipated orders could adversely affect our business.

Our customers consist primarily of medium to large enterprises, governments, system integrators, resellers, distributors, and OEMs. Historically, we have experienced a concentration of revenue in certain of our channel partners and customers. In fiscal 2009 and 2008, Novell accounted for more than 10% of our total revenue. In fiscal 2007, Novell and Electronic Data Systems (EDS) each accounted for more than 10% of our total revenue. Additionally, a substantial portion of our total product revenue is generated from the governmental sector. In fiscal 2009, 2008, and 2007, worldwide government business accounted for approximately 19%, 20%, and 27%, respectively, of total product revenue. Although government spending is currently high in light of various economic recovery initiatives, diversion of government resources to economic recovery programs and reductions in state and local government spending may harm our business. We expect future revenue variability in this sector due to fluctuations in government ordering patterns and frequent delays associated with larger programs.

Our operating results would be adversely affected if any of the following events occur:

- •

- The loss of the above or other significant customers;

12

Table of Contents

- •

- The failure of any of our significant channel partners to renew their contracts upon expiration, or the termination by these partners of their contracts;

- •

- The divestiture of products or product lines, which would cause the loss of that revenue; or

- •

- Delays in orders from governmental agencies.

We expect to continue to depend upon a small number of large customers for a substantial portion of our revenue and the occurrence of any of the above events could further extend our reliance on remaining customers.

Our quarterly gross and net margins are difficult to predict, and if we miss quarterly financial expectations, our stock price could decline.

Our quarterly revenue, expense levels, and operating results are difficult to predict and fluctuate from quarter to quarter. It is likely that our operating results in some periods will vary from the guidance we have provided, or otherwise not meet investor expectations. If this happens, the market price of our common stock is likely to decline. Fluctuations in our future quarterly operating results may be caused by many factors, including:

- •

- The size and timing of customer orders which are received unevenly and unpredictably throughout a fiscal year and may be subject to seasonality relating to the United States federal government's fiscal year and related spending patterns;

- •

- The mix of products licensed and types of license agreements;

- •

- The effect of generally accepted accounting principles on the timing of revenue recognition; for example, if prices for our products or services vary significantly, we may not maintain vendor specific objective evidence of fair value of undelivered elements which could result in deferring revenue to future periods;

- •

- The timing of customer payments;

- •

- The size and timing of revenue recognized in advance of actual customer billings and customers with installment payment schedules that may result in higher accounts receivable balances;

- •

- Changes in financial markets, which could adversely affect the value of our assets and our liquidity;

- •

- The relative mix of our software and services revenue, as well as the relative mix of product offerings, which could change in connection with strategic realignment initiatives;

- •

- The application of new accounting regulations, which could negatively impact results; and

- •

- Changes in currency exchange rates.

We have a long and often complicated sales cycle, which can result in significant revenue fluctuations between periods.

The sales cycle for our products is typically long and subject to a number of significant risks over which we have little control. The typical sales cycle is six to nine months for an enterprise customer and over twelve months for a network service provider or government. As our operating expenses are based on anticipated revenue levels, a small fluctuation in the timing of sales can cause our operating results to vary significantly between periods. If revenue falls significantly below anticipated levels, our business would be negatively impacted.

Purchasing decisions for our products and systems may be subject to delay due to many factors that are outside of our control, such as:

- •

- Political and economic uncertainties;

13

Table of Contents

- •

- Time required for a prospective customer to recognize the need for our products;

- •

- Time and complexity for us to assess and determine a prospective customer's IT environment;

- •

- Customer's requirements for customized features and functionalities;

- •

- Turnover of key personnel at existing and prospective customers;

- •

- Customer's internal budgeting process; and

- •

- Customer's internal procedures for the approval of large purchases.

Furthermore, the implementation process can be subject to delays resulting from issues associated with incorporating new technologies into existing networks, deployment of a new network system or preservation of existing network infrastructure and data migration to the new system. Full deployment of our technology and products for such networks, servers, or other host systems can be scheduled to occur over an extended period and the licensing of systems and products, including client and server software, smart cards, readers, and tokens, and the recognition of maintenance revenue would also occur over this period. This interaction, thereby can negatively impact the results of our operations in the near term, resulting in unanticipated fluctuations between periods.

The market for some of our products is still developing and if the industry adopts standards or platforms different from our platform, then our competitive position would be negatively affected.

The market for digital identity products is still emerging and is also experiencing consolidation. The evolution of the market is in a constant state of flux that may result in the development of different network computing platforms and industry standards that are not compatible with our current products or technologies.

We believe smart cards are an emerging platform for providing digital identity for network applications and for the procurement of services from private enterprise and government agencies. A key element of our business model is premised on the smart card becoming a common access platform for network computing in the future. Further, we have focused on developing our products for certain operating systems related to smart card deployment and use. Should platforms or form factors other than the smart card emerge as a preferred platform or should operating systems other than the specific systems we have focused on emerge as preferred operating systems, our current product offerings could be at a disadvantage. If this were to occur, our future growth and operating results would be negatively affected. Additionally, consolidation within this industry has created a more difficult competitive environment and may result in the broader adoption of competing platforms and systems.

In addition, the digital identity market has evolving industry-wide standards. While we are actively engaged in discussions with industry peers to define what these standards should be, it is possible that any standards eventually adopted could prove disadvantageous to or incompatible with our business model and product lines. Uncertainty surrounding the Homeland Security Presidential Directive No. 12 (HSPD 12) may affect sales of our products to government agencies. If our products do not comply with the requirements of HSPD 12, we may not be able to sell to agencies that must comply with this Directive.

We rely on strategic relationships with other companies to develop and market our products. If we are unable to enter into additional relationships, or if we lose an existing relationship, our business could be harmed.

Our success depends on establishing and maintaining strategic relationships with other companies to develop, market, and distribute our technology and products and, in some cases, to incorporate our technology into their products. Part of our business strategy has been to enter into strategic alliances and other cooperative arrangements with other companies in the industry. We are currently involved in cooperative efforts to incorporate our products into the products of others, to jointly engage in

14

Table of Contents

research and development efforts, and to jointly engage in marketing efforts and reseller arrangements. To date, none of these relationships is exclusive, and some of our strategic partners have cooperative relationships with certain of our competitors.

If we are unable to enter into cooperative arrangements in the future or if we lose any of our current strategic or cooperative relationships, our business could be adversely affected. We do not control the time and resources devoted to such activities by parties with whom we have relationships. In addition, we may not have the resources available to satisfy our commitments, which may adversely affect these relationships. These relationships may not continue, may not be commercially successful, or may require the expenditure of significant financial, personnel, and administrative resources from time to time. Further, certain of our products and services compete with the products and services of our strategic partners, which may adversely affect our relationships with these partners, which could adversely affect our business.

We may be adversely affected by operating in international markets.

Our international operations subject us to risks associated with operating in foreign markets, including fluctuations in currency exchange rates that could adversely affect our results of operations and financial condition. International revenue and expenses make up a substantial portion of our business. A severe economic decline in any of our major foreign markets could make it difficult for our customers to pay us on a timely basis. Any such failure to pay, or deferral of payment, could adversely affect our results of operations and financial condition. During fiscal 2009, 2008, and 2007, markets outside of North America accounted for 53%, 58%, and 59%, respectively, of total revenue.

We face a number of additional risks inherent in doing business in international markets, including:

- •

- Unexpected changes in regulatory requirements;

- •

- Potentially adverse tax consequences;

- •

- Export controls relating to encryption technology;

- •

- Tariffs and other trade barriers;

- •

- Difficulties in staffing and managing international operations;

- •

- Laws that restrict our ability, and make it costly, to reduce our workforce;

- •

- Changing political conditions;

- •

- Exposures to different legal standards; and

- •

- Burden of complying with a variety of laws and legal systems.

While we present our financial statements in U.S. Dollars, a significant portion of our business is conducted outside of the United States and we incur a significant portion of our expenses in Euros, Australian Dollars and British Pounds. Some revenue transactions are denominated in foreign currencies as well. Significant fluctuations in exchange rates between the U.S. Dollar and foreign currencies may adversely affect our future operating results. Due to fluctuations in foreign currencies we recorded a loss of $0.8 million in fiscal 2009, a loss of $2.0 million in fiscal 2008, and a gain of $3.4 million in fiscal 2007, on our consolidated statements of operations.

We invest in securities that are subject to market risk and the recent problems in the financial markets could adversely affect the value of our assets.

During fiscal 2008, we reclassified $33.0 million at cost of our investments in certain auction rate securities ("ARS") from short-term to long-term investments as the auctions for these holdings effectively ceased with no indication as to when or if these auctions would resume in the future. Given

15

Table of Contents

these developments and the resultant consequences of the lack of liquidity for these investments, coupled with other developments in the credit markets in general, we recorded an other-than-temporary impairment on these holdings of $21.2 million, resulting in a carrying value of $11.8 million at September 30, 2009 and September 30, 2008. We hold an additional $3.1 million of ARS in short-term investments, valued at par as of September 30, 2009. These particular ARS investments have had liquidity events recently and we, therefore, expect that these will be called in full and at par within twelve months. We continually monitor all of our ARS investments and evaluate any changes as to impairment factors on a continual basis.

ARS are structured to provide liquidity through a Dutch auction process that resets the interest rates paid at pre-determined intervals, generally every 28 days. The auctions have historically provided a liquid market for these securities. Our investments in ARS represent interests in collateralized debt obligations ("CDO"), closed-end mutual funds, derivative product companies, and student loans. Uncertainty in the financial markets has affected the liquidity of our ARS holdings and resulted in a significant increase in the risks related to the ARS investments classified as long-term, specifically the CDO and derivative product companies securities, and to a lesser degree, the student loan holdings. During fiscal 2009 and 2008, $0.6 million and $12.3 million respectively, of ARS, specifically the closed-end mutual funds and taxable municipals, were called at par. Based on the liquidity provided by these holdings during the fiscal year, we continue to classify our remaining closed-end mutual fund holdings as short-term. However, future changes in the market regarding these securities may result in reclassifications and/or revaluations in future periods.

Historically, the fair value of ARS approximated par value due to the frequent auction events. However, failed auctions that began in August 2007 have resulted, in most cases, in revised estimates of fair value that are less than par. We have reviewed the ARS investments classified as long-term and have valued these holdings accordingly using a discounted cash flow methodology.

While we have used what we believe to be an appropriate valuation model for these securities and have attempted to incorporate all known and significant risk factors into the analysis, we must still make certain estimates and assumptions when assessing the value of the investment portfolio. These estimates are based on market conditions, which are currently in a state of heightened uncertainty. As a result, there is much independent judgment required in deriving these valuation conclusions. Accordingly, assumptions regarding cash flows, liquidity, discount rates, default and other risks were made as part of management's analysis and valuation of our ARS holdings as of September 30, 2009.

We believe we have made reasonable judgments in our valuation exercise. If the relevant assumptions, estimates, or the related analyses still prove incorrect or, if due to additional information received in the future, management's conclusions change, we may be required to change the recorded value of these securities, or other securities that make up the investment portfolio. We will continue to carefully monitor these securities and the ARS markets, and work diligently to recover any lost value through all available means. We recently sold some of our ARS and the results of those sales may not be indicative of future amounts to be realized.See note—19 Subsequent Events.

If a liquid market for these securities does not develop, the ARS holdings may require us to recognize additional impairment charges. Any of these events could adversely affect our results of operations and our financial condition. A material change in these underlying estimates and assumptions could significantly change the reported value of the securities and could cause us to take charges for additional write-downs in value.

16

Table of Contents

We rely on certain key employees and have faced challenges in the past with employee turnover in senior management. If we are not able to build and maintain a strong management team, our ability to manage and expand our business will be impacted. Employee turnover could adversely impact our revenue, costs and productivity.

In recent years, there has been significant and recurring turnover in all levels of management. In March 2008, our Chief Financial Officer, Mark Lustig, announced his resignation, effective in May 2008. In April 2008, Grant Evans became our Chief Executive Officer following the resignation of Thomas Jahn. In August 2008, we hired a new Chief Financial Officer / Chief Operating Officer, Jacques Kerrest. In November 2008, our President, Yves Audebert, was terminated. We may experience further turnover in management in the future and, as a result, we face challenges in effectively managing our operations during these periods of transition. If new key employees and other members of our senior management team cannot work together effectively, or if other members of our senior management team resign, our ability to effectively manage our business may be impacted.

In part due to our restructuring efforts over the past several years, we have become increasingly dependent on a smaller number of employees. If key employees leave ActivIdentity, we suffer loss of productivity while new employees are hired or promoted into vacant positions. The departure of highly skilled key employees sometimes results in a loss of talent or knowledge that is difficult to replace. There are also costs of recruiting and relocating new employees to fill these positions. For example, the recruiting market for experienced operations personnel is very competitive and we may be limited in our ability to attract and retain key operations talent if the need should arise. New employees must learn the ActivIdentity organization, products, and procedures. All of this takes time, reduces productivity and increases cost. The potential adverse impact of employee turnover is greater for situations involving senior positions in the Company and our turnover rate may be higher if key employees decided to leave on their own accord. If turnover increases, the adverse impact of turnover could materially affect our costs, productivity, or ability to respond quickly to the competitive environment.

We have recorded significant write-downs in recent periods for impairment of acquired intangible assets and goodwill and may have similar write-downs in future periods.

We recorded an impairment charge of $35.9 million to goodwill during fiscal 2008, and had previously recorded goodwill impairments in 2005. Due to our declining stock price, we conducted a goodwill impairment analysis in fiscal 2008, and determined the full carrying value of our goodwill was impaired. At September 30, 2008 and September 30, 2009, we have no goodwill on our balance sheet.

We may terminate additional non-core activities in the future or determine that our long-lived assets or acquired intangible assets have been impaired. Any future termination or impairment related charges could have an adverse effect on our financial position and results of operations.

As of September 30, 2009, we had $1.8 million of other intangible assets, representing approximately 2% of our total assets. If our estimates of future undiscounted cash flows to be derived from the use of our other intangible assets drop below the carrying value of such assets, an additional impairment charge may be required.

The protection of our intellectual property rights is crucial to our business and, if third parties use our intellectual property without our consent, our business could be damaged.

Our success is heavily dependent on protecting intellectual property rights in our proprietary technology, which is primarily our software. It is difficult for us to protect and enforce our intellectual property rights for a number of reasons, including:

- •

- policing unauthorized copying or use of our products is difficult and expensive;

- •

- software piracy is a persistent problem in the software industry;

17

Table of Contents

- •

- our patents may not cover the full scope of our product offerings and may be challenged, invalidated or circumvented, or may be enforceable only in certain jurisdictions; and

- •

- our shrink-wrap licenses may be unenforceable under the laws of certain jurisdictions.

In addition, the laws of many countries do not protect intellectual property rights to as great an extent as those of the United States and France. We believe that effective protection of intellectual property rights is unavailable or limited in certain foreign countries, creating an increased risk of potential loss of proprietary technology due to piracy and misappropriation.

We also seek to protect our confidential information and trade secrets through the use of nondisclosure agreements with our employees, contractors, vendors, and partners. However, there is a risk that our trade secrets may be disclosed or published without our authorization, and in these situations it may be difficult or costly for us to enforce our rights and retrieve published trade secrets.

We sometimes contract with third parties to provide development services to us, and we routinely ask them to sign agreements that require them to assign intellectual property to us that is developed on our behalf. However, there is a risk that they will fail to disclose to us such intellectual property, or that they may have inadequate rights to such intellectual property. This could happen, for example, if they failed to obtain the necessary invention assignment agreements with their own employees.

We are involved in litigation to protect our intellectual property rights, and we may become involved in further litigation in the future. This type of litigation is costly and could negatively impact our operating results. See "Item 3 Legal Proceedings" andNote—15 Commitments and Contingencies

Our operating results could suffer if we are subject to intellectual property infringement claims.

We may face claims of infringement on proprietary rights of others that could subject us to costly litigation and possible restriction on the use of such proprietary rights. There is a risk that potential infringement or invalidity claims may be asserted or prosecuted against us and our products may be found to have infringed the rights of third parties. Such claims are costly to defend and could subject us to substantial litigation costs. If any claims or actions are asserted against us, we may be required to modify our products or may be forced to obtain a license for such intellectual property rights. However, we may not be able to modify our products or obtain a license on commercially reasonable terms, or at all.

We may pursue strategic acquisitions and investments that could have an adverse effect on our business if they are unsuccessful.

As part of our business strategy, we have acquired companies, technologies, product lines and personnel to complement our internally developed products. We expect that we will have a similar business strategy going forward. Acquisitions involve numerous risks, including the following:

- •

- Our acquisitions may not enhance our business strategy;

- •

- W may apply overly optimistic valuation assumptions and models for the acquired businesses, and we may not realize anticipated cost synergies and revenue as quickly as we expected or at all;

- •

- We may not integrate acquired businesses, technologies, products, personnel and operations effectively;

- •

- Management's attention may be diverted from our day to day operations, resulting in disruption of our ongoing business;

- •

- We may not adopt an appropriate business model for integrated businesses, particularly with respect to our go to market strategy;

- •

- Customer demand for the acquired company's products may not meet our expectations;

18

Table of Contents

- •

- We may incur higher than anticipated costs for the support and development of acquired products;

- •

- The acquired products may not be compatible with our existing products, making integration of acquired products difficult and costly and potentially delaying the release of other, internally developed products;

- •

- We may have insufficient revenue to offset the increased expenses associated with acquisitions;

- •

- We may not retain key employees, customers, distributors and vendors of the companies we acquire;

- •

- Ineffective internal controls of the acquired company may require remediation as part of the integration process;

- •

- We may be required to assume pre-existing contractual relationships, which would be costly for us to terminate and disruptive for our customers;

- •

- The acquisitions may result in infringement, trade secret, product liability or other litigation: and

- •

- If we are unable to acquire companies that facilitate our strategic objectives, we may not have sufficient time to develop our own products and may not remain competitive.

As a result, it is possible that the contemplated benefits of these or any future acquisitions may not materialize within the time periods or to the extent anticipated.

We may have exposure to additional tax liabilities as a result of inter-company transfer pricing policies.

As a multinational organization, we conduct business and are subject to income taxes in both the United States and various foreign jurisdictions. Significant judgment and analysis is required in determining our worldwide income tax provision and related tax liabilities. In the ordinary course of a global business, inter-company transactions and calculations result in a variety of uncertain tax positions. Our inter-company pricing policies are subject to audits in the various foreign tax jurisdictions. Although we believe that our tax estimates are reasonable, there is no assurance that the final determination of tax audits or potential tax disputes will not be different from what is reflected in our historical income tax provisions and accruals.

It may be difficult for a third party to acquire the Company, which could affect the price of our common stock.

In July 2008, we adopted a stockholder rights agreement, which is sometimes also called a "poison pill." This agreement has the effect of discouraging a stockholder from acquiring more than 20% of our issued and outstanding common stock without prior approval of our Board of Directors. We are also afforded the protections of Section 203 of the Delaware General Corporation Law, which will prevent us, for a period of three years from engaging in a business combination with a person who acquires more than 15% of our common stock unless our Board of Directors or stockholders' approval is obtained. Defensive measures such as the stockholder rights agreement and Section 203 are expected to have the effect of discouraging coercive hostile takeover attempts where the Board of Directors does not support the transaction. Any delay or prevention of a change of control transaction could deter potential acquirers or prevent the completion of a transaction in which our stockholders could receive a premium over the then current market price for their shares.

ITEM 1B. UNRESOLVED STAFF COMMENTS

We have no unresolved staff comments as of the date of this filing.

19

Table of Contents

ITEM 2. PROPERTIES

Our properties consist primarily of leased office facilities for sales, marketing, research and development, and support and administrative personnel. Our corporate headquarters are located in Fremont, California. The table below shows the lease expiration dates (or the applicable cancellation period) and approximate square footage of the facilities that we lease globally as of September 30, 2009.

| | | | | |

Location | | Area

Leased | | Lease Expiration |

|---|

Fremont, California(1) | | | 41,000 | | February 2011 |

Suresnes, France | | | 7,000 | | June 2012 |

Canberra, Australia | | | 1,200 | | July 2012 |

Centreville, Virginia | | | 5,000 | | June 2010 |

- (1)

- Includes approximately 12,000 square feet of office space vacated as part of our 2002 restructuring plan which has been subleased since July 2005.

We also lease various other smaller properties primarily for our sales and marketing personnel under leases, which are generally for a period of less than one year. We believe that our properties are in good condition, adequately maintained and suitable for the conduct of our business. Certain of our lease agreements provide options to extend the lease for additional specified periods. For additional information regarding our obligations under leases, seeNote 15—Commitments and Contingencies to the consolidated financial statements.

ITEM 3. LEGAL PROCEEDINGS

On October 1, 2008, the Company filed a complaint in the Northern District of California, asserting U.S. Patent No. 6,575,360 against Intercede Group PLC and Intercede Ltd. (collectively, "Intercede"). On January 16, 2009, Intercede filed their answers, including counterclaims seeking declaratory judgment of non-infringement, invalidity, and unenforceability. On February 9, 2009, the Company filed a motion to dismiss Intercede's counterclaims and to strike certain of Intercede's defenses. On March 26, 2009, Intercede filed a First Amended Answer and Counterclaims, amending their previously-asserted defenses and counterclaims, and asserting additional counterclaims for monopolization, attempted monopolization, fraud, and unfair competition. On May 15, 2009, the Company filed a second motion to dismiss Intercede's counterclaims for monopolization, attempted monopolization, fraud and unfair competition. On September 11, 2009, the Court granted in part and denied in part the Company's motion to dismiss. On September 28, 2009, Intercede filed a Second Amended Answer and Counterclaims. The Company believes that it has meritorious defenses to Intercede's counterclaims. No amounts related to the Intercede litigation have been recorded in the Company's financial statements other than legal fees as part of normal expenses for fiscal 2009.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None

20

Table of Contents

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

ActivIdentity Corporation's common stock trades on the NASDAQ Global Market under the symbol "ACTI".

The table below sets forth for the periods indicated the high and low closing sale prices of our common stock on the NASDAQ Global Market.

| | | | | | | | |

| | High | | Low | |

|---|

Fiscal 2009: | | | | | | | |

| | Quarter ended September 30, 2009 | | $ | 3.04 | | $ | 2.25 | |

| | Quarter ended June 30, 2009 | | | 2.77 | | | 1.83 | |

| | Quarter ended March 31, 2009 | | | 2.49 | | | 1.50 | |

| | Quarter ended December 31, 2008 | | | 2.54 | | | 1.07 | |

Fiscal 2008: | | | | | | | |

| | Quarter ended September 30, 2008 | | $ | 2.88 | | $ | 2.26 | |

| | Quarter ended June 30, 2008 | | | 2.99 | | | 2.18 | |

| | Quarter ended March 31, 2008 | | | 3.69 | | | 2.50 | |

| | Quarter ended December 31, 2007 | | | 5.15 | | | 3.39 | |

We estimate that we have approximately 27,619 beneficial owners of our common stock as of September 30, 2009.

We have never declared or paid any cash dividends on shares of our common stock and do not expect to do so in the foreseeable future. Any future decision to pay cash dividends will depend on our growth, profitability, financial condition, and other factors our Board of Directors may deem relevant.

Information regarding equity compensation plans set forth inNote 2—Stock-Based Compensation to the consolidated financial statements, is hereby incorporated by reference into this part II, item 5.

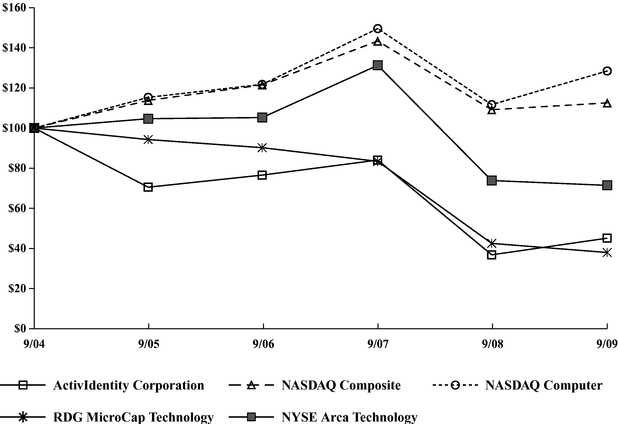

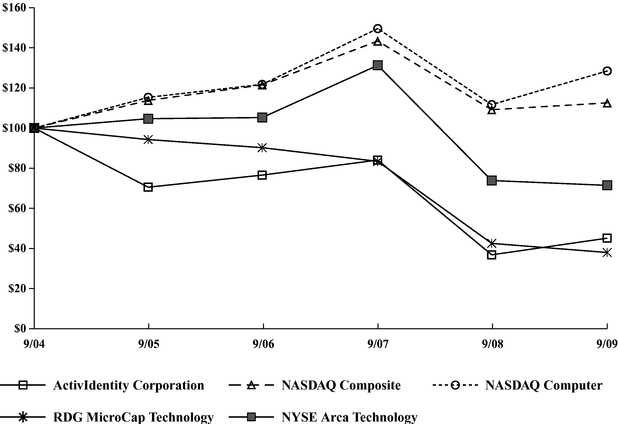

Stock Performance Graph

We list our common stock on the NASDAQ Global Market. The following graph compares the cumulative total stockholder return on our common stock from September 30, 2004 through September 30, 2009, with the cumulative total return of (i) the NASDAQ Global Market System Composite Index (NASDAQ Composite), (ii) the NYSE Arca Computer Technology Index (NYSE Arca Technology), (iii) the NASDAQ Computer Index (NASDAQ Computer), and (iv) the RDG MicroCap Technology Index (RDG MicroCap Technology) over the same periods. For fiscal 2009, we have presented for the first time the NYSE Arca Computer Technology Index, a market capitalization weighted index designed to represent a cross section of widely-held U.S. corporations involved in various phases of the computer industry, and the RDG Micro Cap Technology Index, an index comprised of technology companies with a market capitalization below $300 million. This graph assumes an initial investment of $100 and the reinvestment of any dividends. The comparisons in the graph below are based upon historical data and may not be indicative of future performance of our common stock.

21

Table of Contents

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among ActivIdentity -NASNM, The NYSE Arca Technology Index

and the RDG MicroCap Technology Index

- *

- $100 invested on 9/30/04 in stock & index-including reinvestment of dividends.

Fiscal year ending September 30.

| | | | | | | | | | | | | | | | | | | |

| | 9/30/04 | | 9/30/05 | | 9/30/06 | | 9/30/07 | | 9/30/08 | | 9/30/09 | |

|---|

ActivIdentity Corporation | | | 100.00 | | | 70.52 | | | 76.55 | | | 84.04 | | | 36.81 | | | 45.11 | |

NASDAQ Composite | | | 100.00 | | | 113.78 | | | 121.50 | | | 143.37 | | | 109.15 | | | 112.55 | |

NASDAQ Computer | | | 100.00 | | | 115.31 | | | 121.76 | | | 149.58 | | | 111.69 | | | 128.44 | |

RDG MicroCap Technology | | | 100.00 | | | 94.27 | | | 90.22 | | | 83.40 | | | 42.51 | | | 37.97 | |

NYSE Arca Technology | | | 100.00 | | | 104.67 | | | 105.23 | | | 131.26 | | | 73.84 | | | 71.43 | |

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data should be read in conjunction with the Consolidated Financial Statements and related Notes thereto appearing elsewhere in this Form 10-K. We have derived the statement of income data for the years ended September 30, 2009, 2008 and 2007 and the balance sheet data as of September 30, 2009 and 2008 from the audited consolidated financial statements included elsewhere in this Form 10-K. The statement of income data for the years ended September 30, 2006 and 2005 and the balance sheet data as of September 30, 2007, 2006 and 2005 were derived from the audited consolidated financial statements that are not included in this Form 10-K. The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States ("U.S. GAAP"). The information set forth below is not necessarily indicative of results of future operations and should be read in conjunction with

22

Table of Contents

"Management's Discussion and Analysis of Financial Condition and Results of Operations" and the Consolidated Financial Statements and Notes to the Consolidated Financial Statements.

| | | | | | | | | | | | | | | | | |

| | For the Year Ended September 30, | |

|---|

| | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | |

|---|

Consolidated Income Statement Data: | | | | | | | | | | | | | | | | |

Revenue: | | $ | 62,321 | | $ | 59,009 | | $ | 59,553 | | $ | 53,375 | | $ | 42,156 | |

Income (loss) from operations | | | (7,191 | ) | | (56,482 | ) | | (18,529 | ) | | (27,065 | ) | | (51,367 | ) |

Net income (loss) | | $ | (5,546 | ) | $ | (76,457 | ) | $ | (9.298 | ) | $ | (22,472 | ) | $ | (47,926 | ) |

Net income (loss) per share: | | | | | | | | | | | | | | | | |

| | Basic | | $ | (0.12 | ) | $ | (1.67 | ) | $ | (0.20 | ) | $ | (0.50 | ) | $ | (1.11 | ) |

| | Diluted | | $ | (0.12 | ) | $ | (1.67 | ) | $ | (0.20 | ) | $ | (0.50 | ) | $ | (1.11 | ) |

| | | | | | | | | | | | | | | | |

| | As of September 30, | |

|---|

| | 2009 | | 2008 | | 2007* | | 2006 | | 2005 | |

|---|

Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | |

Cash, cash equivalents and short-term investments | | $ | 78,724 | | $ | 79,829 | | $ | 121,723 | | $ | 128,047 | | $ | 153,554 | |

Working capital | | | 69,895 | | | 72,168 | | | 115,527 | | | 124,155 | | | 145,220 | |

Goodwill | | | — | | | — | | | 35,874 | | | 35,874 | | | 36,162 | |

Total assets | | | 114,577 | | | 117,601 | | | 188,452 | | | 200,988 | | | 215,347 | |

Minority interest | | | 311 | | | 304 | | | 354 | | | 373 | | | 1,240 | |

Total stockholders' equity | | | 87,936 | | | 89,354 | | | 159,443 | | | 168,953 | | | 187,419 | |

- *

- $1.4 million has been reclassified from non-current to current deferred revenue as of September 30, 2007, to correct an error identified in the deferred revenue reconciliation during fiscal 2008. The reclassification resulted in a reduction of working capital by $1.4 million for fiscal 2007. This reclassification had no other effect on our reported financial statements.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS