UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE PRE14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

x | | Preliminary Proxy Statement |

| |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

¨ | | Definitive Proxy Statement |

| |

¨ | | Definitive Additional Materials |

| |

¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

ACTIVCARD CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

ACTIVCARD CORP.

6623 Dumbarton Circle

Fremont, California 94555

2006 ANNUAL MEETING OF STOCKHOLDERS

NOTICE OF ANNUAL MEETING

Dear Stockholder:

ActivCard Corp. will hold its 2006 Annual Meeting of Stockholders on Monday, February 27, 2006 at 1:00 p.m., local time, at the offices of Heller Ehrman LLP, located at 275 Middlefield Road, Menlo Park, California. Stockholders of record at the close of business on January 18, 2006 are entitled to notice of, and to vote at, the meeting. The meeting is being held to take action on the following proposals, each as described more fully in the accompanying proxy statement:

| 1. | To elect a board of six directors to serve until the next annual meeting of stockholders and until their successors are elected and qualified; |

| 2. | To consider and act upon a proposal to amend the Company’s Amended and Restated Certificate of Incorporation to change the name of the Company from ActivCard Corp. to ActivIdentity Corporation; |

| 3. | To ratify the appointment of BDO Seidman, LLP as the Company’s independent registered public accountants for the fiscal year ending September 30, 2006; and |

| 4. | To consider and act upon such other business that may properly come before the meeting. |

Whether or not you plan to attend the meeting, please complete, sign, date and return the enclosed proxy card. Returning the proxy card does not affect your right to attend the meeting and to vote your shares in person.

|

By Order of the Board of Directors, |

|

| |

Ben C. Barnes Chief Executive Officer |

Fremont, California January 31, 2006 |

YOUR VOTE IS IMPORTANT. PLEASE RETURN THE ENCLOSED PROXY, EVEN IF YOU PLAN TO ATTEND THE MEETING AND VOTE IN PERSON. A MAJORITY OF OUR OUTSTANDING SHARES MUST BE REPRESENTED IN PERSON OR BY PROXY AT THE MEETING TO CONSTITUTE A QUORUM.

TABLE OF CONTENTS

ACTIVCARD CORP.

6623 Dumbarton Circle

Fremont, California 94555

(510) 574-0100

2006 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

ActivCard Corp. (the “Company” or “ActivCard”) is furnishing this Proxy Statement and the enclosed proxy in connection with the solicitation of proxies by the Board of Directors of the Company for use at the 2006 Annual Meeting of Stockholders, to be held on Monday, February 27, 2006, at 1:00 p.m. local time, at the offices of Heller Ehrman LLP, located at 275 Middlefield Road, Menlo Park, California, and at any adjournments thereof (the “Annual Meeting”). These materials are being mailed to stockholders on or about January 31, 2006.

Set forth below is general information about the Annual Meeting, the Company and the solicitation of proxies. Following the general information is a detailed description of the proposals to be presented at the Annual Meeting and additional information regarding the Company and its directors and officers.

GENERAL INFORMATION

| A: | A proxy is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. ActivCard has designated Ben C. Barnes and Richard A. Kashnow as the Company’s proxies for the Annual Meeting. |

| Q: | Who may vote at the Annual Meeting? |

| A: | You may vote your ActivCard common stock if our records show that you owned your shares as of the close of business on January 18, 2006 (the “Record Date”). You may cast one vote for each share of common stock held by you on all matters presented. As of the Record Date, there were 45,538,132 shares of common stock issued and outstanding. |

| Q: | What proposals will be voted on at the Annual Meeting? |

| A: | There are three proposals scheduled to be voted on at the Annual Meeting: |

| | • | | Election of six members of the Board to serve until the next annual meeting of stockholders and until their successors are elected and qualified; |

| | • | | To consider and act upon a proposal to amend the Company’s Certificate of Incorporation to change the name of the Company from ActivCard Corp. to ActivIdentity Corporation; and |

| | • | | Ratification of the appointment of BDO Seidman, LLP as our independent registered public accountants for the fiscal year ending September 30, 2006. |

We will also consider other business that properly comes before the meeting.

| Q: | How does the Board recommend that I vote? |

| A: | The Board recommends that you vote: |

| | • | | “FOR” each of the nominees to the Board set forth in this proxy statement; |

| | • | | “FOR” the proposed name change; and |

| | • | | “FOR” ratification of the appointment of BDO Seidman, LLP as our independent registered public accountants for the fiscal year ending September 30, 2006. |

| Q: | How can I vote my shares in person at the Annual Meeting? |

| A: | If your shares are registered directly in your name with our transfer agent, The Bank of New York, you are considered the “stockholder of record” with respect to those shares the proxy materials and proxy card are being sent directly to you. As the stockholder of record, you have the right to vote in person at the meeting. If you choose to do so, you can bring the enclosed proxy card or vote using the ballot provided at the meeting. However, even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the Annual Meeting. |

Most stockholders of ActivCard hold their shares in street name through a stockbroker, bank, or other nominee rather than directly in their own name. In that case, you are considered the “beneficial owner” of shares held in street name, and the proxy materials are being forwarded to you together with a voting instruction card. Because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from the broker, trustee, or nominee that holds your shares, giving you the right to vote those shares at the meeting. If you wish to attend the Annual Meeting and vote in person, you will need to contact your broker, trustee, or nominee to obtain a legal proxy.

| Q: | How can I vote my shares without attending the Annual Meeting? |

| A: | Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct your vote without attending the Annual Meeting by completing and mailing your proxy card or voting instruction card in the enclosed pre-paid envelope. Please refer to the enclosed materials for details. |

| Q: | What happens if additional matters are presented at the Annual Meeting? |

| A: | Other than the three items of business described in this proxy statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy in the form provided with this proxy statement, the persons named as proxy holders will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. |

| Q: | What happens if I do not give specific voting instructions? |

| A: | If you hold shares as a record holder, and you sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our Board on all matters and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote before the meeting. If you do not return a proxy and do not vote at the annual meeting in person, your shares will not be voted. |

If you hold your shares through a broker, bank, or other nominee and you do not provide instructions on how to vote, your broker or other nominee may have authority to vote your shares on your behalf on matters to be considered at the meeting.

| Q: | What is the quorum requirement for the Annual Meeting? |

| A: | A majority of ActivCard’s outstanding shares as of the record date must be present at the meeting in order to hold the meeting and conduct business. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum, even if you wish to abstain from voting on some or all matters introduced at the meeting, if you: |

| | • | | are present and vote in person at the meeting; or |

2

| | • | | have properly submitted a proxy card. |

| Q: | How can I change my vote after I return my proxy card? |

| A: | You may revoke your proxy and change your vote at any time before the final vote at the meeting. You may do this by signing a new proxy card with a later date or by attending the meeting and voting in person. However, your attendance at the meeting will not automatically revoke your proxy unless you vote at the meeting or specifically request in writing that your prior proxy be revoked. |

| Q: | Is my vote confidential? |

| A: | Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within ActivCard or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation. Occasionally, stockholders provide written comments on their proxy card, which may be forwarded to ActivCard management. |

| Q: | Where can I find the voting results of the Annual Meeting? |

| A: | The preliminary voting results will be announced at the meeting. The final voting results will be tallied by our Inspector of Elections and published in our quarterly report on Form 10-Q for the fiscal quarter ending March 31, 2006. |

| Q: | Who pays for the cost of this proxy solicitation? |

| A: | We will pay the costs of the solicitation of proxies. We may also reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding the voting materials to their customers who are beneficial owners and obtaining their voting instructions. In addition to soliciting proxies by mail, our board members, officers and employees may solicit proxies on our behalf, without additional compensation, personally or by telephone. |

| Q: | How can I obtain a copy of ActivCard’s 10-K? |

| A: | A copy of our 2005 annual report on Form 10-K is enclosed. You may obtain additional copies of our Form 10-K by sending a written request to the address listed above under “How can I obtain a separate set of voting materials?” We will furnish our Form 10-K at no charge. Our Form 10-K without exhibits is available in PDF format through our Investor Relations website atwww.actividentity.com, and our Form 10-K with exhibits is available on the Securities and Exchange Commission (the “SEC”) website atwww.sec.gov, which can also be reached from our Investor Relations website. |

| Q: | What is the voting requirement to approve each of the proposals? |

| A: | In the election of directors, the six persons receiving the highest number of “for” votes at the Annual Meeting will be elected. For the proposed change in corporate name, a majority of the outstanding shares of common stock must vote in favor of the amendment in order for that proposal to be approved. The proposal to ratify BDO Seidman, LLP as the Company’s registered independent public accountants will be approved if it receives the affirmative vote of a majority of the shares of common stock present or represented by proxy at the Annual Meeting and entitled to vote on the proposal. |

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Generally, broker non-votes occur when a beneficial owner fails to give voting instructions with respect to “non-routine” matters. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, although broker non-votes are counted for purposes of determining a quorum, broker

3

non-votes will not otherwise affect the outcome of any matter being voted on at the meeting. Abstentions have no effect on the election of directors and have the same effect as votes against the other proposals.

| Q: | Is cumulative voting permitted for the election of directors? |

| A: | No. Cumulative voting is not permitted for the election of directors. |

| Q: | How can I communicate with the non-employee directors on ActivCard’s Board? |

| A: | The Board encourages stockholders who are interested in communicating directly with the non-employee directors as a group to do so by writing to the non-employee directors in care of the Secretary. Stockholders can send communications by mail to Secretary, ActivCard Corp., 6623 Dumbarton Circle, Fremont, California 94555 or through our corporate website located atwww.actividentity.com. Correspondence received that is addressed to the non-employee directors will be reviewed by our corporate secretary or his designee, who will forward to the non-employee directors a summary of all such correspondence and copies of all correspondence that, in the opinion of our corporate secretary, deals with the functions of the board or committees thereof or that the corporate secretary otherwise determines requires their attention. Directors may at any time review the original correspondence received by ActivCard that is addressed to the non-employee members of the board and request copies of any such correspondence. |

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

At the end of fiscal 2005, the Company had eight directors. Messrs. Gordon, Gundle and Koppel have informed the Company that they have decided not to stand for re-election at the Annual Meeting. The tenure for each of these directors will end immediately prior to the Annual Meeting, at which time the size of the Board of Directors will decrease to six directors.

At the Annual Meeting, stockholders will vote on the election of six directors to serve until the next annual meeting of stockholders and until their successors are elected and qualified or until their earlier death, resignation or removal. Set forth below are the six director nominees recommended by the Nominating and Corporate Governance Committee of the Board of Directors (the “Nominating Committee”). All nominees other than James W. Frankola are incumbent directors. Mr. Frankola was initially identified as a nominee by a non-employee director and no fees were paid by the Company in fiscal 2005 in connection with the identification of director nominees. All nominees have indicated that they are willing and able to serve as directors if elected. If any of these nominees become unable or unwilling to serve, the accompanying proxy may be voted for the election of another person designated by the Board of Directors.

Director Nomination Process

Criteria for Board Membership. In selecting candidates for appointment or re-election to the Board, the Nominating Committee considers the appropriate balance of experience, skills and characteristics required of the Board of Directors, and seeks to ensure that at least a majority of the directors are independent under the rules of the Nasdaq Stock Market. Additionally, the Nominating Committee seeks to ensure that members of the Company’s Audit Committee meet the financial literacy and sophistication requirements under the rules of the Nasdaq Stock Market and at least one of them qualifies as an “Audit Committee Financial Expert” under the rules of the SEC. Nominees for director are selected on the basis of their depth and breadth of experience, integrity, ability to make independent analytical inquiries, understanding of the Company’s business environment and industry, and willingness and ability to devote adequate time to Board duties.

Stockholder Nominees. The Nominating Committee will consider written proposals from stockholders for nominees for director. Any such nominations should be submitted to the Nominating Committee c/o the Secretary of the Company and should include the following information: (a) all information relating to such nominee that is required to be disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a

4

director if elected); (b) the names and addresses of the stockholders making the nomination and the number of shares of the Company’s common stock that are owned beneficially and of record by such stockholders; and (c) appropriate biographical information and a statement as to the qualification of the nominee. This information should be submitted within the time periods described in the Stockholder Proposals section below.

Process for Identifying and Evaluating Nominees. The Nominating Committee seeks potential candidates for Board appointment who meet the criteria for selection as a nominee and have the specific qualities or skills being sought. Director candidates are selected based on input from members of the Board, senior management of the Company and, if the Nominating Committee deems appropriate, a third-party search firm. The Nominating Committee evaluates each candidate’s qualifications and checks relevant references; in addition, such candidates are interviewed by at least one member of the Nominating Committee. Based on the input, the Nominating Committee evaluates which of the prospective candidates is qualified to serve as a director and whether the committee should recommend to the Board that this candidate be appointed to fill a current vacancy on the Board, or presented for the approval of the stockholders, as appropriate.

Nominees

Set forth below is the name, age and certain biographical information for each nominee for election to the Board of Directors at the Annual Meeting.

| | | | |

Name

| | Age

| | Principal Occupation and Biographical Information

|

Ben C. Barnes | | 60 | | Mr. Barnes was appointed Chief Executive Officer and elected to the Board of Directors in May 2004. Previously, Mr. Barnes served as President and Chief Executive Officer of Intraspect Software, a privately held enterprise software company, from February 2003 to December 2003, when Intraspect was acquired by Vignette Corp. Prior to Intraspect, Mr. Barnes was the President and Chief Executive Officer of Sagent Technologies, a public enterprise software company. Before joining Sagent in August 2000, Mr. Barnes served for eight years as general manager of International Business Machines’ (“IBM”) Global Business Intelligence Solutions division. Prior to IBM, Mr. Barnes was Chief Marketing Officer at Teradata, now a division of NCR Corporation, and a Director at Unisys Defense Systems. In addition to the Company’s board, Mr. Barnes serves on the board of the Information Technology Association of America Software Division, a leading software industry organization, and on the board of InStranet, Inc., a private enterprise software company. Mr. Barnes holds a Bachelor of Business Administration in Marketing/Accounting degree from Georgia State University in Atlanta, Georgia. |

| | |

Richard A. Kashnow | | 63 | | Mr. Kashnow was elected to the Board of Directors in August 2004 and elected Chairman in July 2005. Mr. Kashnow has been a self-employed consultant since February 2003. From August 1999 until January 2003, Mr. Kashnow served as President of Tyco Ventures, the venture capital arm of Tyco International, Inc., a diversified manufacturing and services company. From October 1995 until its acquisition by Tyco in August 1999, Mr. Kashnow served as Chairman, Chief Executive Officer and President of Raychem Corporation, an electronic components and materials company. Mr. Kashnow held executive positions at the Manville Corporation from 1987 to 1995. From 1970 to 1987, Mr. Kashnow held technical and general management positions at the General Electric Company. Mr. Kashnow served as an officer in the U.S. Army from 1968 to 1970. Mr. Kashnow currently serves as a director on two other public company boards, ParkerVision, Inc. and Ariba, Inc. Mr. Kashnow also serves as the non-executive Chairman of Komag, Incorporated. Mr. Kashnow holds a B.S.

|

5

| | | | |

Name

| | Age

| | Principal Occupation and Biographical Information

|

| | | | | degree in Physics from Worcester Polytechnic Institute in Worcester, Massachusetts and a Ph.D. in Solid State Physics from Tufts University in Medford, Massachusetts. |

| | |

James W. Frankola | | 41 | | Mr. Frankola has served as Executive Vice President and Chief Financial Officer of Ariba, Inc. since December 2001. From December 1997 to October 2001, Mr. Frankola held various positions with Avery Dennison Corporation, a manufacturer of pressure-sensitive materials and office products, most recently as Vice President of Finance and IS, Fasson Roll Worldwide. From 1986 to 1997, Mr. Frankola held various financial and executive positions with IBM. Mr. Frankola holds a Bachelor of Science degree in accounting from Pennsylvania State University and an M.B.A. degree from New York University. |

| | |

Jason Hart | | 34 | | Mr. Hart was appointed Senior Vice President, Sales and Marketing and a director of ActivCard in August 2005 concurrently with the closing of the acquisition of Protocom Development Systems Pty. Ltd. Prior to his joining ActivCard, Mr. Hart was the Chief Executive Officer of Protocom, which he founded in 1989. |

| | |

James E. Ousley | | 59 | | Mr. Ousley was elected to the Board of Directors in September 1996. Mr. Ousley served as the President and Chief Executive Officer of Vytek Wireless Corporation from 2000 until Vytek’s merger with CalAmp in April 2004. From September 1991 to August 1999, Mr. Ousley served as President and Chief Executive Officer of Control Data Systems before it was acquired by British Telecommunications in August 1999. From 1968 to 1999, Mr. Ousley held various operational and executive roles at Control Data Corporation (renamed Ceridian). Mr. Ousley serves on the Boards of Savvis Communications, Inc., Bell Microproducts, Inc., Datalink, Inc. and CalAmp, Inc. Mr. Ousley holds a B.S. degree from the University of Nebraska in Lincoln, Nebraska. |

| | |

Richard White | | 52 | | Mr. White was elected to the Board of Directors in February 2003. Mr. White is currently a Managing Director at Oppenheimer & Co. Inc. and head of its Private Equity Investment Department. Mr. White served as President of Aeolus Capital Group LLC, a private investment management company, from 2003 until mid-2004. From 1985 until 2002, Mr. White served as a Managing Director of CIBC Capital Partners as well as a Managing Director and General Partner of its predecessor by acquisition, Oppenheimer and Co., Inc. Mr. White also serves as a director of G-III Apparel Group, Ltd. and Escalade Inc. Mr. White is a certified public accountant and holds an undergraduate degree in Economics from Tufts University in Medford, Massachusetts and an M.B.A. in Finance and Accounting from the Wharton Graduate School of the University of Pennsylvania in Philadelphia, Pennsylvania. |

There are no family relationships among any of the Company’s directors or executive officers.

Vote Required

Directors will be elected by a plurality of the votes cast, in person or by proxy, at the Annual Meeting, assuming a quorum is present. The six nominees receiving the greatest number of votes will be elected at the Annual Meeting.

The Board of Directors recommends a vote “for” the nominees named above.

6

PROPOSAL NO. 2 - CORPORATE NAME CHANGE

In November 2005, the Company announced a name change from “ActivCard” to “ActivIdentity” in order to more accurately reflect the Company’s business focus and position within the broader identity management market. In adopting this new name, the Company believes that it will better represent and brand the Company’s strategic vision and new corporate identity within the identity management market, particularly following the Company’s acquisition of Protocom Development Systems, which was completed in August 2005.

Since making this announcement, the Company has rebranded itself as ActivIdentity, has changed the corporate name of its principal operating subsidiaries to ActivIdentity and has launched a new corporate website located atwww.actividentity.com. The purpose of this proposal is to seek stockholder approval for a formal change to the name of the Company from “ActivCard Corp.” to “ActivIdentity Corporation.” If this proposal is approved by the stockholders at the Annual Meeting, the Company will file an amendment to its Certificate of Incorporation for the purpose of effecting the name change. This amendment will become effective upon the filing of a Certificate of Amendment with the Secretary of State of the State of Delaware, which is expected to take place shortly after the Annual Meeting.

Vote Required

Approval of this proposal requires the affirmative vote of the holders of a majority of the outstanding shares of Common Stock entitled to vote thereon at the meeting, assuming a quorum is present. Abstentions and broker non-votes will have the same effect as a vote against this proposal.

The Board of Directors recommends a vote “for” Proposal No. 2.

7

PROPOSAL NO. 3 -RATIFICATION OF REGISTERED INDEPENDENT PUBLIC ACCOUNTANTS

At the Annual Meeting, the stockholders will be asked to ratify the appointment of BDO Seidman, LLP (“BDO”) as the Company’s independent registered public accountants for the fiscal year ending September 30, 2006. BDO was first appointed as our independent registered public accountants on September 28, 2004 and has audited our financial statements for the fiscal year ended September 30, 2005 and for the nine-month transition period ended September 30, 2004, following our change in fiscal year in 2004 from December 31 to September 30. Previously, we had engaged Deloitte & Touche LLP as our independent registered public accountants from December 2001.

The selection of the Company’s independent registered public accountants is not required to be submitted to a vote of the stockholders of the Company for ratification. The Sarbanes-Oxley Act of 2002 requires the Audit Committee to be directly responsible for the appointment, compensation and oversight of the audit work of the independent registered public accountants. However, the Board of Directors is submitting this matter to the stockholders as a matter of good corporate governance practice. If the stockholders fail to vote on an advisory basis in favor of the selection, the Audit Committee will reconsider whether to retain BDO and may retain that firm or another without re-submitting the matter to the Company’s stockholders. Even if stockholders vote on an advisory basis in favor of the appointment, the Audit Committee may, in its discretion, appoint different independent registered public accountants at any time during the year if it determines that such a change would be in the best interests of the Company and the stockholders.

We expect that representatives of BDO will be present at the Annual Meeting and will be given an opportunity to make a statement at the meeting if they desire to do so and will be available to respond to appropriate questions.

The Audit Committee reviews audit and non-audit services performed by BDO, as well as the fees charged by BDO for such services. In its review of non-audit service fees, the Audit Committee considers, among other things, the possible impact of the performance of such services on the auditors’ independence. Additional information concerning the Audit Committee and its activities with BDO can be found in the following sections of this Proxy Statement: “Board Meetings and Committees” and “Report of the Audit Committee.”

Audit Fees

The following table summarizes the aggregate fees that were billed by BDO for fiscal 2005 and 2004.

| | | | | | |

Type of fees

| | Fiscal 2005

| | Fiscal 2004*

|

Audit Fees (1) | | $ | 1,149,757 | | $ | 252,282 |

Audit-Related Fees (2) | | | 46,240 | | | — |

Tax Fees (3) | | | 4,716 | | | 55,755 |

All Other Fees | | | — | | | — |

| | |

|

| |

|

|

Total Fees | | $ | 1,200,713 | | $ | 308,037 |

| | |

|

| |

|

|

| * | Nine months ended September 30, 2004. |

| (1) | Fees for audit services consist of: |

| | • | | Audit of the Company’s annual financial statements and the audit of internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act |

| | • | | Reviews of the Company’s quarterly financial statements |

| | • | | Statutory and regulatory audits, consents and other services related to SEC matters |

| (2) | Fees for audit-related services consisted of financial accounting and reporting consultations. |

| (3) | The company expects to pay BDO an additional $55,000 for tax services for fiscal year 2005. |

8

In considering the nature of the services provided by the registered independent public accountants, the Audit Committee determined that such services are compatible with the provision of independent audit services. The Audit Committee discussed these services with the registered independent public accountants and Company management to determine that they are permitted under the rules and regulations concerning auditors’ independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as well as the American Institute of Certified Public Accountants.

Audit Committee’s Pre-Approval Policies and Procedures

Our Audit Committee has adopted a written charter that, among other things, requires the Audit Committee to pre-approve the rendering by our independent registered public accountants of audit or permitted non-audit services. All audit and non-audit services rendered by our independent registered public accountants in fiscal 2005 were pre-approved.

Vote Required

The proposal to ratify BDO Seidman, LLP as the Company’s registered independent public accountants for the year ending September 30, 2006 will be approved if it receives the affirmative vote of a majority of the shares of common stock present or represented at the Annual Meeting and entitled to vote on the proposal.

The Board of Directors recommends a vote “for” Proposal No. 3.

9

DIRECTORS AND EXECUTIVE OFFICERS

Board and Committee Meetings

The Board of Directors currently has standing an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The principal functions of each of these committees are described below. In fiscal 2005 the Company’s Board of Directors met fourteen times and each member of the Board attended 75% or more of the meetings of the Board and the committees on which he served during the year. The Company has a policy of encouraging all directors to attend each annual meeting of stockholders. All of our directors attended the 2005 Annual Meeting of Stockholders except Messrs. Gundle and Koppel.

The Board has determined that all directors and director nominees, other than Messrs. Barnes and Hart, are “independent” under current rules promulgated by the Nasdaq Stock Market.

Audit Committee. The Audit Committee currently consists of Mr. White (chairman) and Messrs. Gordon and Ousley. Mr. Gordon will not stand for re-election at the Annual Meeting and the Company expects that Mr. Frankola, if elected at the Annual Meeting, will serve on the Audit Committee in place of Mr. Gordon. The Board has determined that all members of the Audit Committee are independent directors under the rules of the Nasdaq Stock Market and each of them is able to read and understand fundamental financial statements. The Board has determined that Mr. White qualifies as an “Audit Committee Financial Expert” as defined by the rules of the SEC.

The purpose of the Audit Committee is to oversee the accounting and financial reporting processes of the Company and audits of its financial statements. The responsibilities of the Audit Committee include appointing and providing the compensation of the independent registered public accountants to conduct the annual audit of our accounts, reviewing the scope and results of the independent audits, reviewing and evaluating internal accounting policies, and approving all professional services to be provided to the Company by its independent registered public accountants.

The Audit Committee met fifteen times in fiscal 2005 and operates under a written charter, which was amended by the Board of Directors in November, 2005. A copy of our amended Audit Committee charter is attached as Appendix A to this proxy statement.

Compensation Committee. The Compensation Committee currently consists of Mr. Kashnow (chairman) and Messrs. Ousley and White. The Board has determined that all members of the Compensation Committee are independent directors under the rules of the Nasdaq Stock Market.

The Compensation Committee administers the Company’s benefit plans, reviews and administers all compensation arrangements for executive officers, and establishes and reviews general policies relating to the compensation and benefits of our officers and employees.

The Compensation Committee met eight times in fiscal 2005 and operates under a written charter adopted by the Board of Directors, a copy of which was attached as Appendix B to the Company’s proxy statement for the 2005 Annual Meeting of Stockholders.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee currently consists of Mr. Ousley (chairman) and Messrs. Gordon and Kashnow, each of whom the Board has determined is an independent director under the rules of the Nasdaq Stock Market. Mr. Gordon will not stand for re-election at the Annual Meeting, and the Company expects that Mr. Frankola, if elected at the Annual Meeting, will serve on the Nominating and Corporate Governance Committee in place of Mr. Gordon.

The Nominating Committee’s responsibilities include identifying and approving individuals qualified to serve as members of the Board of Directors of the Company, recommending director nominees for each annual

10

meeting of stockholders, evaluating the Board’s performance, developing and recommending to the Board corporate governance guidelines and providing oversight with respect to corporate governance and ethical conduct.

The Nominating Committee met three times in fiscal 2005 and operates under a written charter adopted by the Board of Directors, a copy of which was attached as Appendix C to the Company’s proxy statement for the 2005 Annual Meeting of Stockholders.

Director Compensation

Non-employee directors are paid a quarterly cash retainer and meeting participation fees and are awarded stock options or other equity-based compensation. The following table sets forth the compensation currently paid to our non-employee directors:

| | | |

| Quarterly retainer fees | | | |

Chairman of the Board | | $ | 15,000 |

Chairman of the Audit Committee | | $ | 2,500 |

Chairman of other standing committees of the Board | | $ | 1,250 |

Non-employee director | | $ | 5,000 |

| |

| Meeting attendance fee | | | |

In-person Board meeting attendance | | $ | 2,000 |

Telephonic Board meeting attendance | | $ | 1,000 |

Committee meeting attendance | | $ | 1,000 |

In addition to the cash compensation described above, the Company has historically compensated non-employee directors with equity-based awards. In fiscal 2005, the Company awarded non-employee directors the following restricted common stock units, which vest in monthly installments over a three-year period from the date of grant:

| | |

Position

| | Shares (#)

|

Chairman of the Board | | 15,000 |

Committee Chairs | | 10,000 |

Other non-employee directors | | 5,000 |

Newly elected directors have historically received one-time option grants following their election. If Mr. Frankola is elected at the Annual Meeting, he is expected to receive such an option to purchase shares of common stock or a restricted stock award. Any such award will be granted on terms to be established by the Compensation Committee.

Compensation Committee Interlocks and Insider Participation

No interlocking relationship exists, or in the past fiscal year has existed, between any member of our Compensation Committee and any member of any other company’s board of directors or Compensation Committee.

Certain Relationships and Related Transactions

In July 2005, the Company acquired Protocom Development Systems Pty. Ltd. (“Protocom”), a privately held Australian-based company, for initial consideration of $21.0 million and 1,650,000 shares of common stock. Concurrently with the closing of the Protocom acquisition, the Company entered into an employment agreement with Protocom’s Chief Executive Officer, Jason Hart, pursuant to which Mr. Hart became ActivCard’s Senior Vice President, Sales and Marketing. Additionally, Mr. Hart was elected to the ActivCard board of directors. Pursuant to the Protocom acquisition agreement, the Company has agreed to issue an aggregate of up to 2,100,000 additional shares of common stock to the former Protocom shareholders, including Mr. Hart, if certain revenue targets are achieved by June 30, 2006.

11

Report of the Audit Committee

Under the guidance of a written charter adopted by the Board, the purpose of the Audit Committee is to oversee the accounting and financial reporting processes of the Company and audits of its financial statements. The responsibilities of the Audit Committee include appointing and providing for the compensation of the independent registered public accountants to conduct the annual audit of our accounts, reviewing the scope and results of the independent audits, reviewing and evaluating internal accounting policies, and approving all professional services to be provided to the Company by its independent registered public accountants. Each of the members of the Audit Committee meets the independence requirements of the Nasdaq Stock Market.

Management has primary responsibility for the system of internal controls and the financial reporting process. The independent registered public accountants have the responsibility to express an opinion on the financial statements based on an audit conducted in accordance with generally accepted auditing standards.

In this context and in connection with the audited financial statements contained in the Company’s Annual Report on Form 10-K, the Audit Committee:

| | • | | reviewed and discussed the audited financial statements as of and for the fiscal year ended September 30, 2005 with the Company’s management and the independent registered public accountants; |

| | • | | oversaw management’s assessment and testing of internal control over financial reporting, as required under Section 404 of the Sarbanes-Oxley Act of 2002; |

| | • | | discussed with BDO Seidman, LLP, the Company’s independent registered public accountants, the matters required to be discussed by Statement of Auditing Standards No. 61,Communication with Audit Committees, as amended by Statement of Auditing Standards No. 90,Audit Committee Communications; |

| | • | | reviewed the written disclosures and the letter from BDO Seidman, LLP required by the Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, discussed with the independent registered public accountants independence, and concluded that no non-audit services were performed by BDO Seidman, LLP; |

| | • | | based on the foregoing reviews and discussions, recommended to the Board of Directors that the audited financial statements be included in the Company’s 2005 Annual Report on Form 10-K for the twelve month period ended September 30, 2005 filed with the SEC; and |

| | • | | instructed the independent registered public accountants that the Audit Committee expects to be advised if there are any subjects that require special attention. |

January 10, 2005

|

| Submitted by the Audit Committee of the Board of Directors |

|

| |

Richard White, Chairman |

John A. Gordon |

James E. Ousley |

12

Executive Officers

Our executive officers and their respective positions as of the Record Date are set forth in the following table. Biographical information regarding each executive officer, who is not also a director, is set forth following the table.

| | | | |

Name

| | Age

| | Position

|

Ben C. Barnes | | 60 | | Chief Executive Officer |

Yves Audebert | | 49 | | President and Chief Strategy Officer |

Dominic Fedronic | | 43 | | Chief Technology Officer |

Jason Hart | | 34 | | Senior Vice President, Sales and Marketing |

Thomas Jahn | | 49 | | Chief Restructuring and Integration Officer, Interim Chief Financial Officer |

Stacey Soper | | 54 | | Senior Vice President, Products |

Yves Audebertco-founded the Company in 1985 and is currently our President and Chief Strategy Officer. Prior to his appointment as President of ActivCard in March 2002, Mr. Audebert served as Chief Technology Officer since 1985. From ActivCard’s inception in 1985, Mr. Audebert has served at times as Chairman, Vice Chairman, director, President, and Chief Executive Officer and he served as a director until August 2005. From 1980 to 1985, Mr. Audebert was responsible for developing shipboard fiber optic systems at Thomson-CSF, a French defense company. Mr. Audebert holds an engineering diploma from the École Polytechnique de Paris and an advanced diploma from the École Supérieure des Télécommunications in France.

Dominic Fedronicjoined ActivCard in November 1995 and has served as our Chief Technology Officer since October 2004. Mr. Fedronic was our Senior Vice President, Engineering from June 2001 to October 2004, prior to which he has served in various roles including Technical Manager, Technical Support Manager, and Sales Consultant. From 1992 to 1995, Mr. Fedronic served in various senior sales engineering, solutions engineering and technical support positions at Société Force-Informatique S.A. From 1987 to 1992, Mr. Fedronic served as Research Assistant in the Data Analysis Group of European Molecular Biology Laboratory. Mr. Fedronic holds a Master of Telecommunications Engineering degree from Paris-Nord Université in France.

Thomas Jahn joined ActivCard in September 2005 as our Chief Restructuring and Integration Officer and, in January 2005, Mr. Jahn was named interim Chief Financial Officer. Prior to joining ActivCard, Mr. Jahn served as Vice President Europe for Sanmina-SCI from 2002 to 2004. Mr. Jahn was the President of Tyco Power Systems and Vice President, Mergers and Acquisitions for Tyco Electronics, from 1999 to 2002. Mr. Jahn was the divisional CFO of a world-wide operating division of Raychem Corporation and the Chief Information Officer of Raychem from 1986 to 1999. Before Raychem, Mr. Jahn worked for Philip Morris and IBM in Europe. Mr. Jahn holds a Master of Science in Mathematics from the University of Dortmund, Germany and has a SEP degree from Stanford Graduate School of Business.

Stacey Soper was appointed our Senior Vice President, Products in October 2004. From January 1998 to December 2003, Mr. Soper held senior management positions including Chief Executive Officer, Chief Operating Officer and Vice President of Products at Intraspect Software. From October 1996 to December 1997, Mr. Soper was Vice President of Engineering at Shomiti Systems, a provider of fast LAN management systems. Prior to that, Mr. Soper held executive positions at Lightscape Technologies, Intergraph Corporation, and The Rand Group. Mr. Soper holds a Bachelor of Science degree in Structural Engineering from Northeastern University in Boston, Massachusetts.

13

Executive Compensation

The following tables describe the compensation paid by the Company to our Chief Executive Officer and our most highly compensated current and former executive officers for fiscal 2005 (collectively, the “Named Executive Officers”) for services rendered in all capacities to the Company for the last three fiscal years.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | |

| | | Year

| | | | Long-term Compensation

| | All Other

Compensation***

|

| | | | Annual Compensation

| | Awards

| | Payouts

| |

| | | | Salary

| | Bonus

| | Securities

Underlying

Options (#)

| | Restricted

Stock

Awards ($)*

| | LTIP

Payouts ($)**

| |

| Current Named Executive Officers | | | | | | | | | | | | | | | | | | | |

Ben C. Barnes (1) Chief Executive Officer | | 2005

2004

2003 | | $

| 300,000

101,154

— | | $

| 133,767

—

— | | —

500,000

— | | $

| 117,450

65,000

— | |

| —

—

— | | $

| 2,169

580

— |

| | | | | | | |

Yves Audebert President and Chief Strategy Officer | | 2005

2004

2003 | |

| 281,712

213,750

276,380 | |

| 177,375

—

142,500 | | —

—

550,000 | |

| 78,300

—

— | | $

| 178,255

—

— | |

| 34,151

15,083

1,680 |

| | | | | | | |

Dominic Fedronic Chief Technical Officer | | 2005

2004

2003 | |

| 200,000

150,000

201,666 | |

| 149,948

—

50,000 | | —

50,000

210,000 | |

| 46,980

—

— | |

| —

—

— | |

| 17,282

270

924 |

| | | | | | | |

Stacey Soper (2) Senior Vice President, Products | | 2005

2004

2003 | |

| 214,038

—

— | |

| 91,595

—

— | | —

—

— | |

| 62,640

—

— | |

| —

—

— | |

| 844

—

— |

| | | | | | | |

| Former Named Executive Officers | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Ragu Bhargava (3) Former Senior Vice President, Finance; Chief Financial Officer | | 2005

2004

2003 | | $

| 199,167

93,051

— | | $

| 73,888

9,000

— | | 100,000

55,000

— | | $

| 46,980

—

— | |

| —

—

— | | $

| 808

352

— |

| | | | | | | |

Frank Bishop (4) Former Senior Vice President, Sales and Marketing | | 2005

2004

2003 | |

| 190,000

207,917

22,917 | |

| 91,104

105,678

— | | —

50,000

525,000 | |

| 46,980

—

— | |

| —

—

— | |

| 170,843

405

— |

| * | Restricted stock awards for fiscal 2005 represent the aggregate value of shares of restricted common stock granted on November 5, 2004. On that date, the fair value of our common stock, as reported on the Nasdaq National Market, was $7.83. These shares of restricted stock vest with respect to one-third of the underlying shares on the first anniversary of the date of grant, and then with respect to one thirty-sixth of the underlying shares monthly thereafter for the next two years. |

| ** | LTIP Payouts for Mr. Audebert for 2005 represent the payment of deferred compensation. |

| *** | “All Other Compensation” for each named executive officer consists of premiums paid for term life insurance policies, except that (i) such compensation for Mr. Audebert in fiscal 2005 also includes an auto allowance of $8,400 and $25,211 paid in lieu of accrued vacation, (ii) such compensation for Mr. Fedronic also includes $16,922 paid in lieu of accrued vacation, and (iii) such compensation for Mr. Bishop in 2005 also includes $21,710 paid in lieu of accrued vacation and personal leave, $95,000 in severance pay and $53,333 in sales commissions. |

| (1) | Mr. Barnes joined the Company in May 2004. |

14

| (2) | Mr. Soper joined the Company in October 2004. |

| (3) | Mr. Bhargava was employed by the Company from March 2004 through December 2005, at which time he resigned. The compensation paid to Mr. Bhargava excludes $100,000 paid in fiscal 2006 as retention payments under his Employee Retention Bonus Agreement with the Company. |

| (4) | Mr. Bishop was employed by the Company from December 2003 until May 2005. |

Fiscal 2005 Stock Option Grants

The following table sets forth options granted to the Named Executive Officers during fiscal 2005 and the potential realizable value of those grants (on a pre-tax basis) determined in accordance with the SEC rules. The information in this table shows how much the Named Executive Officers may eventually realize in future dollars if the price of the common stock increases 5% and if it increases 10% in value per year, compounded over the life of the options. These amounts are hypothetical and represent assumed rates of appreciation. They are not intended to forecast future appreciation of our common stock. The percentage of options granted is based upon an aggregate of 717,000 options granted during the twelve months ended September 30, 2005 to employees, including the Named Executive Officers. All options identified below vest with respect to one quarter of the underlying shares on the first anniversary of the grant and then with respect to one forty-eighth of the underlying shares each month thereafter over the next three years.

| | | | | | | | | | | | | | | | |

| | | Number of Shares Underlying Options Granted

| | Percent of

Total Options

Granted to

Employees in

Fiscal year

| | | Exercise

Price ($/sh)

| | Expiration

Date

| | Potential Realizable Value at

Assumed Annual Rates of Stock Price Appreciation for

Option Term

|

| | | | | | 5% ($)

| | 10% ($)

|

Current Named Executive Officers | | | | | | | | | | | | | | | | |

Ben C. Barnes | | — | | — | | | | — | | — | | | — | | | — |

Yves Audebert | | — | | — | | | | — | | — | | | — | | | — |

Dominic Fedronic | | — | | — | | | | — | | — | | | — | | | — |

Stacey Soper | | — | | — | | | | — | | — | | | — | | | — |

| | | | | | |

Former Named Executive Officers | | | | | | | | | | | | | | | | |

Ragu Bhargava | | 100,000 | | 13.9 | % | | $ | 8.19 | | 11/01/2014 | | $ | 515,065 | | $ | 1,305,275 |

Frank Bishop | | — | | — | | | | — | | — | | | — | | | — |

Option Exercises and Option Values in Last Fiscal Year

The following table sets forth information regarding option exercises in fiscal 2005 by our Named Executive Officers and information concerning the number of exercisable and unexercisable options as of September 30, 2005. The value of the unexercised in-the-money exercisable options is based on the difference between the exercise price of each respective option and $4.33, which was the closing price of our common stock on the Nasdaq Stock Market on September 30, 2005. All unexercisable options have an exercise price in excess of $4.33.

| | | | | | | | | | | | | | |

| | | Shares

Acquired on

Exercise (#)

| | Value

Realized ($)

| | Unexercised Options at

Fiscal Year End (#)

| | Value of Unexercised

In-the-money Options at

Fiscal Year End ($)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Current Named Executive Officers | | | | | | | | | | | | | | |

Ben C. Barnes | | — | | | — | | 166,665 | | 333,335 | | | — | | — |

Yves Audebert | | 125,476 | | $ | 23,840 | | 556,250 | | 268,750 | | | — | | — |

Dominic Fedronic | | 6,062 | | | 12,673 | | 151,826 | | 236,875 | | $ | 12,375 | | — |

Stacey Soper | | — | | | — | | 62,500 | | 187,500 | | | — | | — |

| | | | | | |

Former Named Executive Officers | | | | | | | | | | | | | | |

Ragu Bhargava | | — | | | — | | 13,750 | | 141,250 | | | — | | — |

Frank Bishop | | — | | | — | | 106,249 | | — | | | — | | — |

15

Equity Compensation Plan Information

The following table provides information as of September 30, 2005 with respect to the shares of the Company’s common stock that may be issued under our 2002 Stock Option Plan, 2004 Equity Incentive Plan and other equity plans or arrangements.

| | | | | | | | | | |

Plan Category

| | Number of Securities

to Be Issued Upon

Exercise of

Outstanding Options,

Warrants and Rights

(a)

| | | Weighted Average

Exercise Price of

Outstanding

Options, Warrants

and Rights

(b)

| | | Number of Securities

Remaining Available for

Future Issuance Under Equity

Compensation Plans

(Excluding Securities

Reflected in Column(a))

(c)

| |

Equity compensation plans approved by stockholders | | 5,855,046 | (1) | | $ | 8.70 | (2) | | 4,505,042 | (3) |

| | | |

Equity compensation plans not approved by stockholders | | 430,224 | | | $ | 7.18 | | | — | |

| | |

|

| | | | | |

|

|

Total | | 6,285,270 | | | | | | | 4,505,042 | |

| | |

|

| | | | | |

|

|

| (1) | The total represents 5,482,713 shares issuable upon the exercise of outstanding options granted under the Company’s 2002 Stock Option Plans and 2004 Equity Incentive Plans and 381,500 shares issuable upon the exercise of warrants granted to directors by ActivCard S.A., our predecessor, and assumed by us in connection with our change in domicile. |

| (2) | Represents a total of 5,482,713 shares issuable upon exercise of outstanding stock options with a weighted-average exercise price of $8.76 and 381,500 shares issuable upon exercise of outstanding director warrants with a weighted-average exercise price of $7.75. |

| (3) | Represents shares that may be issued under the 2004 Equity Incentive Plan. The authorized share reserve under that plan equals the number of shares that may be issued under the 2002 Stock Option Plan. To the extent that options granted under the 2002 Stock Option Plan expire unexercised, the shares underlying these options will then become available for grant under the 2004 Equity Incentive Plan. The Company will not grant any further options under the 2002 Stock Option Plan. |

Employment Contracts and Termination of Employment and Change-in-Control Arrangements

Pursuant to a May 2004 employment agreement, Ben C. Barnes, Chief Executive Officer, receives an annual salary of $300,000 and is entitled to receive an annual bonus of up to $150,000, subject to the satisfaction of financial and non-financial performance criteria to be established from time to time. Also pursuant to his employment agreement, Mr. Barnes was initially awarded: (i) a restricted stock award of 10,000 shares of common stock, which vested after one year of service, (ii) a restricted stock award of 100,000 shares of common stock, which was to vest based on the achievement of certain financial goals for fiscal 2005, which, as described under the caption ���Compensation Committee Report on Executive Compensation” were not achieved, and (iii) an option to purchase 500,000 shares of common stock at a price equal to fair market value of our common stock on the date of grant, subject to a four-year vesting schedule. In the event of a termination of Mr. Barnes’s employment without “cause” (as defined) or a termination for “good reason” (as defined), he is entitled to receive post-employment termination benefits in an amount equal to one year’s base salary, a pro rated portion of his target bonus for the year in which the termination occurs and continued health benefits for up to one year. Additionally, if Mr. Barnes’s employment is terminated without cause or for good reason within one year from a “change of control” (as defined), he is also entitled to accelerated vesting of a portion of his stock options.

Pursuant to a November 2004 employment offer letter, Stacey Soper, Senior Vice President, Products, receives an annual salary of $210,000 and is entitled to receive an annual bonus of up to 50% of his base salary, subject to the satisfaction of certain performance criteria to be established from time to time. Also pursuant to his employment agreement, Mr. Soper was awarded an option to purchase 250,000 shares of common stock at a price equal to the fair market value of our common stock on the date of grant, subject to a four-year vesting

16

schedule. In the event of a termination of Mr. Soper’s employment without “cause” (as defined), he is entitled to receive post-employment termination benefits in an amount equal to six months’ base salary. Additionally, Mr. Soper is entitled to receive post-employment termination benefits in an amount equal to six months’ base salary and accelerated vesting of his initial stock option grant in certain circumstances if his employment is actually or constructively terminated within one year following a change in control of the Company.

In April 2003, the Board approved an arrangement pursuant to which Yves Audebert, President and Chief Strategy Officer, is entitled to accelerated vesting of his options in the event he is terminated following a change in control of the Company.

Pursuant to an August 2005 employment letter offer, Thomas Jahn, Chief Restructuring and Integration Officer and interim Chief Financial officer, receives an annual salary of $210,000 and is entitled to participate in Company’s sponsored benefits generally available to the Company’s executives. Also pursuant to his employment agreement, Mr. Jahn was awarded an option to purchase 100,000 shares of common stock at a price equal to the fair market value of our common stock on the date of grant, subject to a one-year vesting schedule.

In connection with the acquisition of the outstanding capital stock of Protocom Development Systems Pty Ltd, a privately held Australian-based company, ActivCard entered into an employment agreement with Jason Hart, pursuant to which Mr. Hart became ActivCard’s Senior Vice President, Sales and Marketing. The employment agreement provides for an annual base salary of $200,000 and cash bonuses of up to an aggregate maximum of $125,000 to be paid upon the achievement of certain individual and company performance milestones. Additionally, Mr. Hart is entitled to receive post-employment termination benefits in an amount equal to six months’ base salary and health benefits for six months if his employment is terminated by the Company without “cause” or by Mr. Hart with “good reason,” as those terms are defined in the agreement.

The Company’s 2002 Stock Option Plan and 2004 Equity Incentive Plan provide that, in the event of a “change in control” (as defined) of the Company, the Compensation Committee or Board of Directors may elect to accelerate some or all of the outstanding option awards granted under such plans.

Compensation Committee Report On Executive Compensation

General Compensation Philosophy

The Compensation Committee administers the Company’s benefit plans, reviews and administers all compensation arrangements for executive officers, and establishes and reviews general policies relating to the compensation and benefits of our officers and employees. The Company’s compensation policy for officers and senior management is to provide market-based compensation to executives and senior managers, with an emphasis on performance-based cash and equity incentives tied to specific strategic business achievements and individual and Company performance.

Executive Compensation

Base Salary. Salaries for executive officers are determined on an individual basis at the time of hire and are set to be competitive with comparable businesses in our industry. Adjustments to base salary are considered annually in light of each officer’s performance, the Company’s performance, and compensation levels at other companies within our industry. In fiscal 2005, the Compensation Committee engaged Cook Associates to undertake an independent review of comparable compensation data at peer companies within our industry. Based on this review, the Compensation Committee determined the base salaries for our executive officers were in line with competitive industry base salaries.

Bonus. Executive officers are eligible to receive annual discretionary cash bonuses at varying levels based on job function, individual performance, achievement of specific goals and milestones, and overall Company performance. Bonuses are determined annually and are typically awarded in the first quarter of the following year.

17

Equity Awards. Executive officers are eligible to receive equity-based compensation. Historically, equity-based compensation has been paid in the form of stock option awards, granted with an exercise price equal to the fair market value of our common stock on the date of grant. The Compensation Committee believes that by providing executive officers with stock options with an exercise price equal to our stock price, the interests of our officers will be better aligned with the interests of our stockholders. Additionally, the gradual vesting of the stock option awards, typically over a four-year period, is intended to provide our executive officers with an incentive to continue their employment with the Company. Additionally, the Company has periodically granted restricted stock awards to executive officers, with vesting of such awards being either time-based or performance-based.

Grants are awarded based on a number of factors, including the Company’s achievement of specific milestones, the individual’s level of responsibility, the individuals length of service with the Company, the amount and term of options already held by the individual, the individual’s contributions to the achievement of Company’s financial and strategic objectives, and industry practices and norms. Based on these factors, the Compensation Committee in November 2004 awarded restricted stock awards to the Named Executive Officers and granted an option to Mr. Bhargava in connection with becoming the Company’s Chief Financial Officer.

Chief Executive Officer Compensation

Pursuant to the terms of his employment agreement, Mr. Barnes is paid an annual base salary of $300,000 and is entitled to receive an annual bonus of up to $150,000, based on personal and Company performance, with 50% of the bonus to be based on the achievement of specific financial objectives and 50% of the bonus to be based on the achievement of other non-financial performance objectives established by the Compensation Committee. In fiscal 2005, the Compensation Committee evaluated the performance of the Company and Mr. Barnes and, based on this review, determined that the financial objectives had not been substantially met and that some of the non-financial objectives had been met. Accordingly, a bonus of $45,000 was awarded to Mr. Barnes.

Mr. Barnes was also awarded 15,000 shares of restricted common stock in fiscal 2005 (the “Restricted Stock”). The Restricted Stock vests with respect to one-third of the shares on the first anniversary of the date of grant and then with respect to one thirty-sixth of the shares monthly thereafter for the next two years.

Mr. Barnes was awarded 100,000 shares of restricted stock in fiscal 2004, with vesting of these shares to be subject to the achievement of specific performance criteria. In fiscal 2005, the Compensation Committee determined that these performance criteria were not satisfied and, as a result, Mr. Barnes was required to forfeit these shares.

|

| Submitted by the Compensation Committee of the Board of Directors |

|

| |

Richard Kashnow, Chairman James E. Ousley Richard White |

18

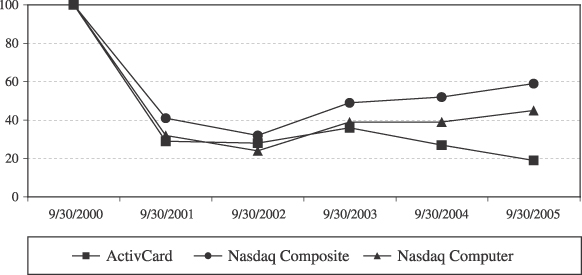

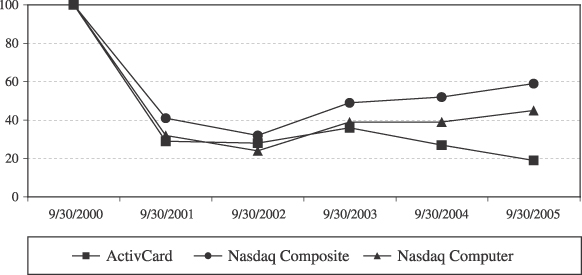

Stock Performance Graph

From March 16, 2000 until our change in domicile on February 6, 2003, our predecessor, ActivCard S.A., maintained a listing on the Nasdaq National Market for its American depositary shares (“ADSs”). On February 7, 2003, ActivCard S.A. terminated the ADS listing and we listed our common stock on the Nasdaq National Market. The following graph compares the cumulative total stockholder return on the ActivCard ADSs from September 30, 2000 through February 6, 2003, and on our common stock from that time through September 30, 2005, with the cumulative total return of (i) the Nasdaq National Market System Composite Index (Nasdaq Composite Index) and (ii) the Nasdaq Computer Index (Nasdaq Computer Index) over the same periods. The Nasdaq Computer Index is a broad industry index that contains companies we consider to be our principal competitors, as well as other Nasdaq-listed companies in the following industries: computer services, Internet, software, computer hardware, electronic office equipment and semiconductors. This graph assumes an initial investment of $100 and the reinvestment of any dividends. The comparisons in the graph below are based upon historical data and may be not indicative of future performance of our common stock.

COMPARISON OF CUMULATIVE TOTAL RETURN

AMONG ACTIVCARD,

THE NASDAQ COMPOSITE INDEX

AND THE NASDAQ COMPUTER INDEX

| | | | | | | | | | | | |

| | | 9/30/2000

| | 9/30/2001

| | 9/30/2002

| | 9/30/2003

| | 9/30/2004

| | 9/30/2005

|

ActivCard | | 100 | | 29 | | 28 | | 36 | | 27 | | 19 |

Nasdaq Composite | | 100 | | 41 | | 32 | | 49 | | 52 | | 59 |

Nasdaq Computer | | 100 | | 32 | | 24 | | 39 | | 39 | | 45 |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers, and persons who own more than 10% of a registered class of our equity securities to file with the SEC initial reports regarding ownership of, and subsequent transactions in, our securities. Such officers, directors, and 10% stockholders are also required by SEC rules to furnish us with copies of all Section 16(a) reports they file. Based solely upon our review of copies of reports provided to us and written representations from our directors and executive officers, we believe that all reports required by Section 16(a) during fiscal 2004 were timely filed,except that the Company failed to file timely Forms 4 on behalf of Mr. White reporting his receipt of restricted stock unit award and on behalf of Mr. Fedronic reporting a sale of common stock acquired upon exercise of an option.

19

SECURITY OWNERSHIP BY CERTAIN BENEFICIAL HOLDERS

The following table sets forth information regarding ownership of our common stock as of January 1, 2006 (unless indicated otherwise below where information is based on filings with the SEC) by (a) each person known to the Company to own more than 5% of the outstanding shares of our common stock, (b) each current director and nominee for director of the Company, (c) the Named Executive Officers, and (d) all current directors and executive officers as a group. The information in this table is based solely on information provided to the Company or on statements in filings made with the SEC.

| | | | | | | | | |

| | | Shares Beneficially Owned and Shares Underlying Options Exercisable within 60 days of January 1, 2006

| | | |

Name and Address of Beneficial Owner †

| | Shares (#)

| | Options and

Warrants (#)

| | Total (#)

| | Percent of Class (1)

| |

OZ Management, LLC (2) 9 West 57th Street, 39th Floor New York, New York 10019 | | 3,197,978 | | — | | 3,197,978 | | 6.5 | % |

| | | | |

Directors, director nominees and current named executive officers | | | | | | | | | |

Jason Hart | | 1,352,140 | | — | | 1,352,140 | | 2.8 | % |

Yves Audebert | | 513,805 | | 613,337 | | 1,127,142 | | 2.3 | % |

Montague Koppel | | 582,241 | | 65,417 | | 647,658 | | 1.3 | % |

Clifford Gundle | | 409,717 | | 57,917 | | 467,634 | | * | |

Ben Barnes | | 10,000 | | 220,003 | | 230,003 | | * | |

Dominic Fedronic | | 19,791 | | 172,328 | | 192,119 | | * | |

James Ousley | | 25,251 | | 72,083 | | 97,334 | | * | |

Stacey Soper | | — | | 78,794 | | 78,794 | | * | |

Richard White | | 20,000 | | 54,583 | | 74,583 | | * | |

Richard Kashnow | | 25,000 | | 19,582 | | 44,582 | | * | |

John Gordon | | 10,000 | | 19,166 | | 29,166 | | * | |

James W. Frankola | | — | | — | | — | | — | |

Thomas Jahn | | — | | — | | — | | — | |

All current directors and current executive officers as a group (12 persons) | | 2,967,945 | | 1,373,210 | | 4,341,155 | | 8.9 | % |

| | | | |

Former named executive officers | | | | | | | | | |

Frank Bishop | | — | | 106,249 | | 106,249 | | * | |

Ragu Bhargava | | — | | 52,875 | | 52,875 | | * | |

| † | Unless indicated otherwise, the address of each beneficial owner is c/o ActivCard Corp., 6623 Dumbarton Circle, Fremont, California 94555. |

| * | Less than 1% of the outstanding common stock. |

| (1) | Applicable percentage of ownership is rounded to the nearest tenth and is based on approximately 45,209,054shares of common stock outstanding as of January 1, 2006, together with applicable stock options for such stockholder. Beneficial ownership is determined in accordance with the rules of the SEC. Shares of common stock subject to options or warrants currently exercisable or exercisable within 60 days of January 1, 2006 are deemed outstanding for computing the percentage of ownership of the person holding such stock options, but are not deemed outstanding for computing the percentage of any other person. Except as otherwise noted, each person or entity has sole voting and investment power with respect to the shares shown, subject to applicable community property laws. |

| (2) | Based on Schedule 13G/A filed on February 22, 2005 by OZ Management, L.L.C. (“OZ”). OZ serves as principal investment manager to a number of investment funds and discretionary accounts with respect to which it has voting and dispositive authority over the Company’s shares reported in such Schedule 13G/A, including such an account for OZ Master Fund, Ltd. (“OZMF”). Mr. Daniel S. Och is the Senior Managing Member of OZ and is the Director of OZMF and, as such, may be deemed to control such entities and therefore may be deemed to be the beneficial owner of the reported shares. |

20

OTHER BUSINESS

We know of no other matters to be submitted to a vote of stockholders at the annual meeting. If any other matter is properly brought before the annual meeting or any adjournment thereof, it is the intention of the persons named in the enclosed proxy to vote the shares they represent in accordance with their judgment. In order for any stockholder to nominate a candidate or to submit a proposal for other business to be acted upon at the Annual Meeting, he or she must provide timely written notice to our corporate secretary in the form prescribed by our bylaws.

STOCKHOLDER PROPOSALS

Stockholder proposals intended to be included in next year’s annual meeting proxy materials must be received by the Secretary of the Company no later than October 3, 2006 (the“Proxy Deadline”). The form and substance of these proposals must satisfy the requirements established by the Company’s bylaws and the SEC.

Additionally, stockholders who intend to present a stockholder proposal at the 2007 annual meeting must provide the Secretary of the Company with written notice of the proposal between 45 and 75 days prior to the anniversary of the mailing date of these proxy materials,provided, however, that if the 2007 annual meeting date is more than 30 days before or after the anniversary date of the 2006 annual meeting, then stockholders must provide notice within time periods specified in our bylaws. Notice must be tendered in the proper form prescribed by our bylaws. Proposals not meeting the requirements set forth in our bylaws will not be entertained at the meeting.

Additionally, any stockholder seeking to recommend a director candidate or any director candidate who wishes to be considered by the Nominating Committee, the committee that recommends a slate of nominees to the Board for election at each annual meeting, must provide the Secretary of the Company with a completed and signed biographical questionnaire on or before the Proxy Deadline. Stockholders can obtain a copy of this questionnaire from the Secretary of the Company upon written request. The Nominating Committee is not required to consider director candidates received after this date, or without the required questionnaire. The Nominating Committee will consider all director candidates who comply with these requirements and will evaluate these candidates using the criteria described above under the caption, “Nomination of Directors.” Director candidates who are then approved by the Board will be included in the Company’s proxy statement for that annual meeting.

ANNUAL REPORT

Our annual report to stockholders for the fiscal year ended September 30, 2005, including audited financial statements, accompanies this proxy statement. Copies of our Annual Report on Form 10-K for fiscal 2005 and the exhibits thereto are available from the Company without charge upon written request of a stockholder. Copies of these materials are also available online through the Securities and Exchange Commission atwww.sec.gov. The Company may satisfy SEC rules regarding delivery of proxy statements and annual reports by delivering a single proxy statement and annual report to an address shared by two or more Company stockholders. This delivery method can result in meaningful cost savings for the Company. In order to take advantage of this opportunity, the Company may deliver only one proxy statement and annual report to multiple stockholders who share an address, unless contrary instructions are received prior to the mailing date. We undertake to deliver promptly upon written or oral request a separate copy of the proxy statement and/or annual report, as requested, to a stockholder at a shared address to which a single copy of these documents was delivered. If you hold stock as a record stockholder and prefer to receive separate copies of a proxy statement or annual report either now or in the future, please contact the Company’s investor relations department at the address below. If your stock is

21

held through a brokerage firm or bank and you prefer to receive separate copies of a proxy statement or annual report either now or in the future, please contact your brokerage firm or bank.

ActivIdentity

Attn: Investor Relations

6623 Dumbarton Circle

Fremont, California 94555

(510) 574-0100

EACH STOCKHOLDER IS URGED TO COMPLETE, DATE, SIGN AND PROMPTLY RETURN

THE ENCLOSED PROXY.

22

APPENDIX A

ACTIVCARD CORP.

Charter of the Audit Committee of the Board of Directors

Purpose

The Audit Committee (Committee) of the Board of Directors oversees the quality and integrity of the accounting, auditing, and reporting practices of ActivCard Corp. (Company). The Committee’s role includes a focus on the qualitative aspects of financial reporting to shareholders, and on the Company’s process to manage business and financial risk, and for compliance with applicable legal, ethical, and regulatory requirements. The Committee is directly responsible for the appointment, compensation and oversight of the independent registered public accountants to prepare and issue an audit report on the annual financial statements of the Company and to perform a review of the quarterly financial statements. The Committee is not responsible, however, for planning or conducting audits, or determining whether the Company’s financial statements are complete and accurate or in accordance with generally accepted accounting principles.

Membership