UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☐ Filed by a Party other than the Registrant ☒

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Under Rule14a-12 |

Cypress Semiconductor Corporation

(Name of Registrant as Specified In Its Charter)

T.J. Rodgers

J. Daniel McCranie

Camillo Martino

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rule14a-6(i)(4) and0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | 5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | 3) | | Filing Party: |

| | 4) | | Date Filed: |

CYPRESS SEMICONDUCTOR CORPORATION

2017 ANNUAL MEETING OF STOCKHOLDERS

JUNE 8, 2017

SUPPLEMENT DATED MAY 1, 2017 TO THE PROXY STATEMENT OF CYPRESSFIRST DATED APRIL 10, 2017

PLEASE SIGN, DATE AND RETURN THE ENCLOSEDGOLD PROXY CARD TODAY.

This proxy statement supplement and the enclosedGOLD proxy card are being filed by T.J. Rodgers, J. Daniel McCranie and Camillo Martino (collectively, “CypressFirst”), in connection with the solicitation of proxies from the holders of shares of common stock, par value $0.01 per share (the “Common Stock”), of Cypress Semiconductor Corporation, a Delaware corporation (the “Company”), for the 2017 Annual Meeting of Stockholders of the Company scheduled to be held at 10:00 a.m. Pacific Daylight Time on June 8, 2017, at the Company’s principal executive offices located at 198 Champion Court, San Jose, California 95134 and at any adjournments, postponements or other delays thereof and at any special meeting that may be called in lieu thereof (the “Annual Meeting”).

CypressFirst is seeking stockholder support at the Annual Meeting to elect two (2) nominees, J. Daniel McCranie and Camillo Martino (the “CypressFirst Nominees”), to the Company’s board of directors (the “Board”).

On April 10, 2017, CypressFirst filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement (the “CypressFirst Proxy Statement”) relating to the 2017 annual meeting of stockholders (the “Annual Meeting”) of the Company. On April 19, 2017, the Company filed its definitive proxy statement with the SEC (the “Cypress Proxy Statement”). The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Cypress Proxy Statement. There is no assurance that any of the Company’s nominees will serve as directors if our nominees are elected.

This supplement discloses certain information about the Annual Meeting included in the Cypress Proxy Statement that had not been publicly available at the time CypressFirst filed the CypressFirst Proxy Statement and CypressFirst’s position with respect to such information.

CypressFirst Has Changed Its Recommendation on Proposal 5 – Amendment and Restatement of the 2013 Stock Plan – From “ABSTAIN” to “FOR.”

As disclosed in the CypressFirst Proxy Statement, the Board had not disclosed certain information related to the proposed amendment and restatement of the Company’s 2013 Stock Plan (the “Plan”) as of the date of the CypressFirst Proxy Statement. Therefore, CypressFirst made no recommendation in the CypressFirst Proxy Statement at that time with respect to the proposal relating to the Plan and disclosed that it recommended that stockholders “ABSTAIN” on the vote to approve the proposal pending the Board’s disclosure of information regarding the number of shares of stock to be added to the Plan. CypressFirst also communicated that it would notify Cypress stockholders with its recommendation on this proposal after the Company provided such information.

In the Cypress Proxy Statement, the Board disclosed additional detail regarding the proposal relating to the amendment and restatement of the Plan. The Board is asking the Company’s stockholders to approve an increase, in the amount of 15.5 million full-value shares (equal to 29.1 million total shares), to the number of shares available for grant and issuance under the Plan as well as certain administrative and clerical changes to the Plan. The Board is also asking the stockholders to approve an extension to the term of the Plan to April 14, 2027. The Board indicated that as of January 1, 2017, 19.3 million shares remained available under the Plan, but because of prior issuances that occurred under the current Plan, only a total of approximately 15 million shares would actually be available for immediate issuance. The Board acknowledged that burn rate was important, stating that it “hopes to maintain a net burn rate below 3%.” The Board disclosed that, as of the date of the Cypress Proxy Statement, approximately 329 million shares of Common Stock were outstanding.

Additional information regarding this proposal is contained in the Cypress Proxy Statement.

CypressFirst has reviewed the proposal relating to the Plan and its key characteristics. CypressFirst generally supports actions to attract, motivate and retain talented employees, to align employee interests with stockholder interest, and to link employee compensation with Company performance. However, CypressFirst has highlighted its concerns about Ray Bingham’s compensation, in particular his $4.5 million in outsized restricted stock awards that are not performance metrics-based but solely time-vested. CypressFirst continues to believe that Mr. Bingham’s position as a highly compensated executive chairman is unnecessary and in no event justifies the compensation that the Board has accorded to Mr. Bingham.

However, CypressFirst does not believe that the unwarranted compensation to Mr. Bingham is by itself a sufficient reason to vote against the proposal which will incentivize employees and help align employee and stockholder interests. With the exception of the Board’s authority to grant strictly service-based awards, CypressFirst believes the proposal is reasonable. If the Plan is approved, the new Board and the Board’s compensation committee will determine the appropriate awards going forward. CypressFirst supports the use of restricted stock units with specific performance metrics for the senior executives under the Performance Accelerated Restrict Stock program. CypressFirst believes that Mr. McCranie and Mr. Martino, if elected, would be able to assist the Board in preventing the grant of any further excessive awards to Mr. Bingham or other executive officers that lack performance-based vesting criteria. At the same time, the Plan would allow the Board to continue to grant performance-based awards to executives and key employees in order to retain and incentivize talent.

For these reasons, CypressFirst recommends that you vote “FOR” this proposal. CypressFirst notes that Messrs. Rodgers, McCranie and Martino intend to vote their shares of Common Stock “FOR” this proposal. Similarly, CypressFirst will vote shares of Common Stock as to which a stockholder executes a proxy but fails to indicate a vote on this issue “FOR��� this proposal.

Assuming a quorum is present, approval of this proposal requires a “FOR” vote from the majority of the votes cast, affirmatively or negatively, on such proposal at the Annual Meeting. Brokernon-votes, if any, will be disregarded and have no effect on the outcome of the vote. Abstentions will be disregarded and have no effect on the outcome of the vote for this proposal. Under Delaware law, abstentions will have the same effect as an “AGAINST” vote with respect to this proposal.

IF YOU HAVE SUBMITTED AGOLD PROXY CARD AND YOU DO NOT WISH TO CHANGE YOUR VOTE, THEN YOU DO NOT HAVE TO TAKE ANY FURTHER ACTION. You should DISREGARD AND DISCARD any WHITE proxy card you receive from the Company.

According to the Cypress Proxy Statement, as of April 18, 2017, the record date for the Annual Meeting, there were 329,380,510 shares of Common Stock outstanding. CypressFirst notes that the Company previously publicly disclosed a record date of April 18, 2017 in its preliminary proxy statement.

For details regarding the qualifications of the CypressFirst Nominees as well as CypressFirst’s reasons for making this solicitation, please see the CypressFirst Proxy Statement. If you need another copy of the CypressFirst Proxy Statement or this supplement, please contact MacKenzie Partners, Inc., the firm assisting CypressFirst in its solicitation of proxies, at the address and toll-free number set forth below.

This supplement is dated May 1, 2017, and is first being filed and made available to stockholders of the Company on or about May 1, 2017. This supplement should be read in conjunction with the CypressFirst Proxy Statement, first furnished to stockholders of the Company on or about, April 10, 2017.

All GOLD proxy cards that have been submitted in connection with our mailing to stockholders of a proxy statement and proxy card on April 10, 2017 remain valid and will be voted at the Annual Meeting as marked.

THEREFORE, IF YOU HAVE SUBMITTED A GOLD PROXY CARD SINCE APRIL 10, 2017 AND YOU DO NOT WISH TO CHANGE YOUR VOTE, THEN YOU DO NOT HAVE TO TAKE ANY FURTHER ACTION. You should DISREGARD AND DISCARD any WHITE proxy card you receive from the Company

THIS SOLICITATION IS BEING CONDUCTED BY CYPRESSFIRST AND NOT BY OR ON BEHALF OF THE COMPANY OR THE BOARD.

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOUR PROMPT ACTION IS IMPORTANT. MAKE YOUR VIEWS CLEAR TO THE BOARD BY AUTHORIZING A PROXY TO VOTE FOR EACH PROPOSAL BY FOLLOWING THE INSTRUCTIONS ON THE ENCLOSED GOLD PROXY CARD.

YOUR VOTE IS IMPORTANT, NO MATTER HOW MANY OR HOW FEW SHARES OF COMMON STOCK YOU OWN.

If you are a record owner of shares of Common Stock as of the close of business on the Record Date and have mailed a proxy card to the Company relating to the Annual Meeting, you may revoke that card before it is voted at the Annual Meeting by mailing a signed GOLD proxy card bearing a date later than the proxy card that you delivered to the Company either to Mr. Rodgers in care of MacKenzie Partners, Inc., 105 Madison Avenue, New York, New York 10016, or to such address as the Company may provide.

Based on information publicly disclosed by the Company, if you are a stockholder of record, you have the right to revoke your proxy and change your vote at any time before the Annual Meeting by (i) returning a later dated proxy card, or (ii) voting again online or by telephone, as more fully described on the proxy card from the Company. You may also revoke your proxy and change your vote by voting in person at the Annual Meeting.

Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request or vote again at the Annual Meeting. If your shares are held by a bank or broker, you may change your vote by submitting new voting instructions to your bank, broker, trustee or agent, or, if you have obtained a legal proxy from your bank or broker giving you the right to vote your shares, by attending the Annual Meeting and voting in person.

Do not return any proxy card that you may receive from the Company relating to the Annual Meeting, even as a protest vote. If you have already submitted a proxy card to the Company relating to the Annual Meeting, it is not too late to change your vote. To revoke your prior proxy and change your vote, simply sign, date and return the enclosed GOLD proxy card in the postage-paid envelope provided. Only your latest signed and dated proxy will be counted.

*****

As further described in the Cypress Proxy Statement, any proposal of a stockholder intended to be included in the Cypress Proxy Statement and form of proxy/voting instruction card for the 2018 Annual Meeting in accordance with Rule14a-8 of the SEC’s rules must be received by the Company no later than the date disclosed in the Cypress Proxy Statement. Such proposals must also comply with the requirements as to form and substance established by the SEC if such proposals are to be included in the Cypress Proxy Statement and form of proxy. All proposals should be addressed to the Corporate Secretary of the Company, Pamela Tondreau, Cypress Semiconductor Corporation, 198 Champion Court, San Jose, California 95134.

As further described in the Cypress Proxy Statement, a stockholder recommendation for nomination of a person for election to the Board or a proposal for consideration at the 2018 Annual Meeting, other than stockholder proposals submitted pursuant to the SEC’s Rule14a-8, must be submitted in accordance with the advance notice procedures and other requirements set forth in the Bylaws. These requirements are separate from the requirements discussed above to have the stockholder nomination or other proposal included in the Cypress Proxy Statement and form of proxy/voting instruction card pursuant to the SEC’s rules. The item to be brought before the meeting must be a proper subject for stockholder action. The Bylaws require that the proposal or recommendation for nomination must be received by the Company Secretary at the above address no later than the date that is disclosed in the Cypress Proxy Statement, unless the date of the 2018 Annual Meeting is more than 30 days before or more than 60 days after the anniversary of the Annual Meeting, in which case notice by the stockholder to be timely must be so received not later than the later of the close of business 90 days prior to such annual meeting or the 10th day following the day on which such notice of the date of the annual meeting was mailed or such public disclosure of the date of the annual meeting was made.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting:

The proxy materials are available at

www.cypressfirst.com

IMPORTANT

Regardless of how many shares of Common Stock you own, your vote is very important. Please vote by signing, dating and returning the enclosedGOLD proxy card to vote FOR the election of the CypressFirst Nominees and in accordance with CypressFirst’s recommendations on the other proposals on the agenda for the Annual Meeting. Please vote eachGOLD proxy card that you receive as each account must be voted separately.

| | • | | If your shares of Common Stock are registered in your own name, please sign and date the GOLD proxy card and return it to CypressFirst in the care of MacKenzie Partners, Inc., 105 Madison Avenue, New York, New York 10016. |

| | • | | If you are a beneficial owner of shares of Common Stock held in “street name” in the name of a bank, brokerage firm, dealer, trust company or other nominee, these proxy materials are being forwarded to you by your bank, brokerage firm, dealer, trust company or other nominee. As a beneficial owner, you must instruct your broker, dealer, trustee or nominee how to vote. Your broker, dealer, trustee or nominee cannot vote your shares of Common Stock on your behalf without your instructions. |

| | • | | If you are a beneficial owner of shares of Common Stock held in “street name” and do not provide voting instructions to your bank, brokerage firm, dealer, trust company or other nominee, your shares of Common Stock will not be voted on any proposal on which your bank, brokerage firm, dealer, trust company or other nominee does not have or does not exercise discretionary authority to vote, such as anon-routine matter for which you do not provide voting instructions. This is referred to as a “brokernon-vote.” CypressFirst believes that due to the contested nature of the election at the Annual Meeting, all of the matters to be voted on at the Annual Meeting are considerednon-routine. Accordingly, banks, brokerage firms, dealers, trust companies and other nominees will be unable to exercise discretionary voting authority with respect to any of the proposals to be voted on at the Annual Meeting. |

| | • | | Depending upon your bank, brokerage firm, dealer, trust company or other nominee, you may be able to vote either by telephone or over the Internet. Please refer to the enclosedGOLD voting instruction form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosedGOLD voting instruction form. |

Do not return any proxy card that you may receive from the Company relating to the Annual Meeting, even as a protest vote. If you have already submitted a proxy card to the Company relating to the Annual Meeting, it is not too late to change your vote. To revoke your prior proxy and change your vote, simply sign, date and return the enclosedGOLD proxy card in the postage-paid envelope provided. Only your latest signed and dated proxy will be counted.

MacKenzie Partners, Inc. is assisting CypressFirst with its effort to solicit proxies. If you have any questions or require assistance in authorizing a proxy or voting your shares of Common Stock, please contact:

105 Madison Avenue

New York, New York 10016

CypressFirst@mackenziepartners.com

Toll-Free(800) 322-2885

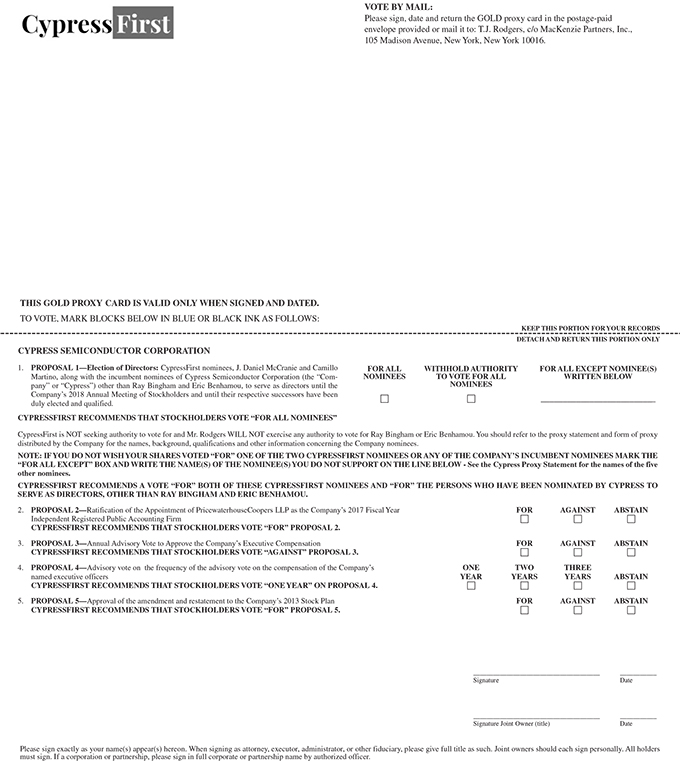

VOTE BY MAIL: Please sign, date and return the GOLD proxy card in the postage-paid envelope provided or mail it to: T.J. Rodgers, c/o MacKenzie Partners, Inc., 105 Madison Avenue, New York, New York 10016. THIS GOLD PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLY CYPRESS SEMICONDUCTOR CORPORATION 1. PROPOSAL 1 Election of Directors: Cypress First nominees, J. Daniel McCranie and Camillo FOR ALL WITHHOLD AUTHORITY FOR ALL EXCEPT NOMINEE(S) Martino, along with the incumbent nominees of Cypress Semiconductor Corporation (the “Com- NOMINEES TO VOTE FOR ALL WRITTEN BELOW pany” or “Cypress”) other than Ray Bingham and Eric Benhamou, to serve as directors until the NOMINEES Company’s 2018 Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified. CYPRESSFIRST RECOMMENDS THAT STOCKHOLDERS VOTE “FOR ALL NOMINEES” CypressFirst is NOT seeking authority to vote for and Mr. Rodgers WILL NOT exercise any authority to vote for Ray Bingham or Eric Benhamou. You should refer to the proxy statement and form of proxy distributed by the Company for the names, background, qualifications and other information concerning the Company nominees. NOTE: IF YOU DO NOT WISH YOUR SHARES VOTED “FOR” ONE OF THE TWO CYPRESSFIRST NOMINEES OR ANY OF THE COMPANY’S INCUMBENT NOMINEES MARK THE “FOR ALL EXCEPT” BOX AND WRITE THE NAME(S) OF THE NOMINEE(S) YOU DO NOT SUPPORT ON THE LINE BELOW—See the Cypress Proxy Statement for the names of the five other nominees. CYPRESSFIRST RECOMMENDS A VOTE “FOR” BOTH OF THESE CYPRESSFIRST NOMINEES AND “FOR” THE PERSONS WHO HAVE BEEN NOMINATED BY CYPRESS TO SERVE AS DIRECTORS, OTHER THAN RAY BINGHAM AND ERIC BENHAMOU. 2. PROPOSAL 2 Ratification of the Appointment of PricewaterhouseCoopers LLP as the Company’s 2017 Fiscal Year FOR AGAINST ABSTAIN Independent Registered Public Accounting Firm CYPRESSFIRST RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL 2. 3. PROPOSAL 3 Annual Advisory Vote to Approve the Company’s Executive Compensation FOR AGAINST ABSTAIN CYPRESSFIRST RECOMMENDS THAT STOCKHOLDERS VOTE “AGAINST” PROPOSAL 3. 4. PROPOSAL 4 Advisory vote on the frequency of the advisory vote on the compensation of the Company’s ONE TWO THREE named executive officers YEAR YEARS YEARS ABSTAIN CYPRESSFIRST RECOMMENDS THAT STOCKHOLDERS VOTE “ONE YEAR” ON PROPOSAL 4. 5. PROPOSAL 5 Approval of the amendment and restatement to the Company’s 2013 Stock Plan FOR AGAINST ABSTAIN CYPRESSFIRST RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL 5. Signature Date Signature Joint Owner (title) Date Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer.

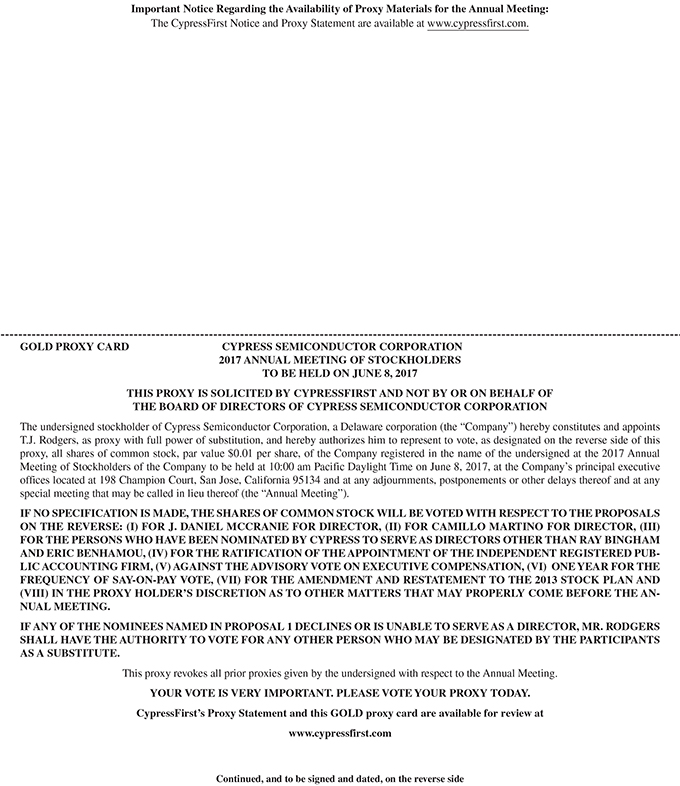

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The CypressFirst Notice and Proxy Statement are available at www.cypressfirst.com. GOLD PROXY CARD CYPRESS SEMICONDUCTOR CORPORATION 2017 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 8, 2017 THIS PROXY IS SOLICITED BY CYPRESSFIRST AND NOT BY OR ON BEHALF OF THE BOARD OF DIRECTORS OF CYPRESS SEMICONDUCTOR CORPORATION The undersigned stockholder of Cypress Semiconductor Corporation, a Delaware corporation (the “Company”) hereby constitutes and appoints T.J. Rodgers, as proxy with full power of substitution, and hereby authorizes him to represent to vote, as designated on the reverse side of this proxy, all shares of common stock, par value $0.01 per share, of the Company registered in the name of the undersigned at the 2017 Annual Meeting of Stockholders of the Company to be held at 10:00 am Pacific Daylight Time on June 8, 2017, at the Company’s principal executive offices located at 198 Champion Court, San Jose, California 95134 and at any adjournments, postponements or other delays thereof and at any special meeting that may be called in lieu thereof (the “Annual Meeting”). IF NO SPECIFICATION IS MADE, THE SHARES OF COMMON STOCK WILL BE VOTED WITH RESPECT TO THE PROPOSALS ON THE REVERSE: (I) FOR J. DANIEL MCCRANIE FOR DIRECTOR, (II) FOR CAMILLO MARTINO FOR DIRECTOR, (III) FOR THE PERSONS WHO HAVE BEEN NOMINATED BY CYPRESS TO SERVE AS DIRECTORS OTHER THAN RAY BINGHAM AND ERIC BENHAMOU, (IV) FOR THE RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM, (V) AGAINST THE ADVISORY VOTE ON EXECUTIVE COMPENSATION, (VI) ONE YEAR FOR THE FREQUENCY OF SAY-ON-PAY VOTE, (VII) FOR THE AMENDMENT AND RESTATEMENT TO THE 2013 STOCK PLAN AND (VIII) IN THE PROXY HOLDER’S DISCRETION AS TO OTHER MATTERS THAT MAY PROPERLY COME BEFORE THE ANNUAL MEETING. IF ANY OF THE NOMINEES NAMED IN PROPOSAL 1 DECLINES OR IS UNABLE TO SERVE AS A DIRECTOR, MR. RODGERS SHALL HAVE THE AUTHORITY TO VOTE FOR ANY OTHER PERSON WHO MAY BE DESIGNATED BY THE PARTICIPANTS AS A SUBSTITUTE. This proxy revokes all prior proxies given by the undersigned with respect to the Annual Meeting. YOUR VOTE IS VERY IMPORTANT. PLEASE VOTE YOUR PROXY TODAY. CypressFirst’s Proxy Statement and this GOLD proxy card are available for review at www.cypressfirst.com Continued, and to be signed and dated, on the reverse side