UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

Commercial Capital Bancorp, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

March 28, 2006

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Commercial Capital Bancorp, Inc. The Annual Meeting will be held at the Irvine/Orange County Airport Hilton, located at 18800 MacArthur Boulevard, Irvine, CA 92612, on Tuesday, April 25, 2006 at 9:00 a.m., Pacific Time. The matters to be considered by stockholders at the Annual Meeting are described in the accompanying materials.

It is very important that you be represented at the Annual Meeting regardless of the number of shares you own or whether you are able to attend the meeting in person. We urge you to mark, sign, and date your proxy card today and return it in the envelope provided, even if you plan to attend the Annual Meeting. This will not prevent you from voting in person, but will ensure that your vote is counted if you are unable to attend.

Your continued support of and interest in Commercial Capital Bancorp, Inc. is sincerely appreciated.

| Sincerely, |

|

|

| Stephen H. Gordon |

| Chairman and Chief Executive Officer |

COMMERCIAL CAPITAL BANCORP, INC.

8105 Irvine Center Drive

Irvine, California 92618

(949) 585-7500

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO

BE HELD ON APRIL 25, 2006

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (“Annual Meeting”) of Commercial Capital Bancorp, Inc. (the “Company”) will be held at the Irvine/Orange County Airport Hilton, located at 18800 MacArthur Boulevard, Irvine, CA 92612, on Tuesday, April 25, 2006 at 9:00 a.m., Pacific Time, for the following purposes, all of which are more completely set forth in the accompanying Proxy Statement:

(1) To elect three (3) directors;

(2) To ratify the appointment by the Board of Directors of KPMG LLP as the Company’s independent auditors for the fiscal year ending December 31, 2006; and

(3) To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. Management is not aware of any other such business.

The Board of Directors has fixed March 10, 2006 as the voting record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting. Only those stockholders of record as of the close of business on that date will be entitled to notice of and to vote at the Annual Meeting.

| By Order of the Board of Directors, |

|

|

| Richard A. Sanchez |

| Secretary |

Irvine, California | |

March 28, 2006 | |

YOU ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING. IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED REGARDLESS OF THE NUMBER YOU OWN. EVEN IF YOU PLAN TO BE PRESENT, YOU ARE URGED TO COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY PROMPTLY IN THE ENVELOPE PROVIDED. IF YOU ATTEND THE MEETING, YOU MAY VOTE EITHER IN PERSON OR BY PROXY. ANY PROXY GIVEN MAY BE REVOKED BY YOU IN WRITING OR IN PERSON AT ANY TIME PRIOR TO THE EXERCISE THEREOF. HOWEVER, IF YOU ARE A STOCKHOLDER WHOSE SHARES ARE NOT REGISTERED IN YOUR OWN NAME, YOU WILL NEED ADDITIONAL DOCUMENTATION FROM YOUR RECORD HOLDER IN ORDER TO VOTE IN PERSON AT THE ANNUAL MEETING.

COMMERCIAL CAPITAL BANCORP, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

April 25, 2006

This Proxy Statement is furnished to holders of common stock, $.001 par value per share (“Common Stock”), of Commercial Capital Bancorp, Inc. (the “Company”). Proxies are being solicited on behalf of the Board of Directors of the Company to be used at the Annual Meeting of Stockholders (“Annual Meeting”) to be held at the Irvine/Orange County Airport Hilton, located at 18800 MacArthur Boulevard, Irvine, CA 92612, on Tuesday, April 25, 2006 at 9:00 a.m., Pacific Time, for the purposes set forth in the Notice of Annual Meeting of Stockholders. This Proxy Statement is first being mailed to stockholders on or about March 28, 2006.

Your vote is important. Because many stockholders cannot attend the Annual Meeting in person, it is necessary that a large number be represented by proxy. Stockholders may vote by completing the enclosed proxy card and mailing it in the postage-paid envelope provided. If your shares are held in the name of a broker or other holder of record, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting.

The proxy card included herein, if properly signed and returned to the Company and not revoked prior to its use, will be voted in accordance with its instructions. If no contrary instructions are given, each proxy card received will be voted (i) FOR the nominees for director described herein; (ii) FOR ratification of the appointment of KPMG LLP as the Company’s independent auditors for 2006; and (iii) upon the transaction of such other business as may properly come before the Annual Meeting in accordance with the best judgment of the persons appointed as proxies.

Any stockholder giving a proxy has the power to revoke it at any time before it is exercised by (i) filing with the Secretary of the Company written notice thereof (mailed to the attention of Secretary, Commercial Capital Bancorp, Inc., 8105 Irvine Center Drive, Irvine, California 92618); (ii) filing a later dated proxy (using a proxy card); or (iii) appearing at the Annual Meeting and giving the Secretary notice of his or her intention to vote in person. Proxies solicited hereby may be exercised only at the Annual Meeting and any adjournment thereof and will not be used for any other meeting.

1

VOTING

Only stockholders of record at the close of business on March 10, 2006 (“Voting Record Date”) will be entitled to notice of and to vote at the Annual Meeting. On the Voting Record Date, there were 57,041,794 shares of Common Stock outstanding and the Company had no other class of equity securities outstanding. Each share of Common Stock is entitled to one vote at the Annual Meeting on all matters properly presented at the meeting.

The presence in person or by proxy of a majority of the shares of Common Stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions are considered in determining the presence of a quorum but will not affect the vote required for the election of directors. Directors are elected by a plurality of the votes cast with a quorum present. The three persons who receive the greatest number of votes of the holders of Common Stock represented in person or by proxy at the Annual Meeting will be elected directors of the Company.

The affirmative vote of the holders of a majority of the total votes present in person or by proxy is required to ratify the appointment of the independent auditors. Abstentions will be counted as present and entitled to vote and will have the same effect as a vote against such proposal. Under rules of the New York Stock Exchange, all of the proposals for consideration at the Annual Meeting are considered “discretionary” items upon which brokerage firms may vote in their discretion on behalf of their clients if such clients have not furnished voting instructions. Thus, there are no proposals to be considered at the Annual Meeting which are considered “non-discretionary” and for which there will be “broker non-votes.”

INFORMATION WITH RESPECT TO NOMINEES FOR DIRECTOR,

CONTINUING DIRECTORS AND EXECUTIVE OFFICERS

Election of Directors

In June 2004, the Company completed the acquisition of Hawthorne Financial Corporation (“Hawthorne”). In accordance with Board of Directors obligation under the Hawthorne Acquisition Agreement and pursuant to its bylaws, the Company reconstituted the Board into three classes in 2005, with each class consisting of a number of directors as nearly as practicable equal to one-third of the total number of directors. All directors stood for re-election at the 2005 Annual Meeting. Three directors were elected for a one-year term expiring at the Annual Meeting of Stockholders in 2006, or at such time as their successors are elected and qualified, three directors were elected for a two-year term expiring at the Annual Meeting of Stockholders in 2007, or at such time as their successors are elected and qualified, and three directors were elected for a three-year term expiring at the Annual Meeting of Stockholders in 2008, or at such time as their successors are elected and qualified.

In connection with the 2006 Annual Meeting, three directors are being nominated for a three-year term expiring at the Annual Meeting in 2009, or at such time as their successors are elected and qualified.

Stockholders of the Company are not permitted to cumulate their votes for the election of directors. No director or executive officer of the Company is related to any other director or executive officer of the Company by blood, marriage or adoption, and each of the nominees currently serve as a director of the Company.

Unless otherwise directed, each proxy executed and returned by a stockholder will be voted for the election of the nominees for director listed below. If the person or persons named as nominees should be unable or unwilling to stand for election at the time of the Annual Meeting, the proxies will nominate and vote for one or more replacement nominees recommended by the Board of Directors. At this time, the Board of Directors knows of no reason why the nominees listed below may not be able to serve as directors if elected.

2

The following tables present information concerning the nominees for director of the Company.

Nominees for Director with Terms Expiring in 2009

Name | | | | Age as of

March 10, 2006 | | Director Since | |

R. Rand Sperry | | | 51 | | | | 2005 | | |

Mark E. Schaffer | | | 64 | | | | 2005 | | |

Richard A. Sanchez | | | 49 | | | | 2005 | (1) | |

(1) In connection with the Board of Directors resignation of Mr. Christopher G. Hagerty, Mr. Sanchez was appointed to the Board of Directors in November 2005.

The Board of Directors recommends that you vote FOR the election of the above nominees for director.

Information concerning the principal position with the Company and principal occupation of each nominee for director and members of the Board of Directors continuing in office during the past five years is set forth below.

Stephen H. Gordon. Mr. Gordon is one of the founding stockholders of the Company and has served as the chairman and chief executive officer of the Company since June 1999 and as the chairman and chief executive officer of Commercial Capital Bank since January 2000. Mr. Gordon has also served as chairman and chief executive officer of Commercial Capital Mortgage, Inc. (“CCM”) since its formation in April 1998. Mr. Gordon also has served as the chief executive officer of ComCap Financial Services (“ComCap”), a registered broker dealer and wholly owned subsidiary of the Company, since founding the company in February 1997. Prior to founding ComCap, Mr. Gordon served as the sole stockholder, director and president of Gen Fin, Inc., the general partner of Genesis Financial Partners, LP, a hedge fund, from July 1995 to December 1996. From October 1988 to July 1995, Mr. Gordon was an investment banker with Sandler O’Neill & Partners, L.P., a New York based investment banking firm, and was a partner of such firm from January 1992. At Sandler O’Neill, Mr. Gordon specialized in advising management and directors of financial institutions on such issues as strategic planning, capital and liquidity management, balance sheet management and restructuring, asset/liability management, and the enhancement of shareholder value. During such years, much of Mr. Gordon’s focus was on the restructuring of loan and securities portfolios and the development of funding strategies for his clients.

David S. DePillo. Mr. DePillo is one of the founding stockholders of the Company and has served as vice chairman, president and chief operating officer of the Company since June 1999 and as the president, chief operating officer and vice chairman of Commercial Capital Bank since January 2000. Mr. DePillo also has served as president and vice chairman of CCM since its formation in April 1998 and as a director of ComCap since July 1998. From April 1991 to March 1998, Mr. DePillo served as the first vice president and director of multifamily banking for Home Savings of America, a savings institution, and as the president and chief operating officer for the real estate development subsidiaries of Home Savings of America and H.F. Ahmanson & Co., its thrift holding company. From May 1987 to March 1991, Mr. DePillo served as senior vice president, director of asset management at Coast Federal Bank, a savings institution, and as president of Coast Mortgage Realty Advisors, a mortgage banking subsidiary of Coast Federal Bank. From January 1985 to April 1987, Mr. DePillo was a certified public accountant with KPMG LLP, an accounting firm.

Richard A. Sanchez has served as executive vice president, head of corporate risk management and government relations and secretary of the Company and Commercial Capital Bank since June 2002, as chief administrative officer since November 2003, and as a director of the Company and Commercial Capital Bank since November 2005. From October 1989 to May 2002, Mr. Sanchez was a thrift regulator

3

with the Office of Thrift Supervision, where he was deputy director of the western region from January 1993 through May 2002. As deputy director, Mr. Sanchez planned and directed examinations and the supervision of approximately 85 savings institutions with total assets over $300 billion.

James G. Brakke. Mr. Brakke has served as a director of the Company since February 2001 and as a director of Commercial Capital Bank since January 2000. Mr. Brakke is currently the president of Brakke-Schafnitz Insurance Brokers, a firm he co-founded in 1971. The commercial insurance brokerage and consulting firm manages in excess of $100 million of insurance premiums with both domestic and international insurers. Mr. Brakke has held numerous director positions for both non-profit and for-profit organizations. He was a founding director and shareholder of Pacific National Bank located in Orange County prior to its sale to Western Bancorp and a past president of the professional insurance fraternity, Gamma Iota Sigma.

Gary W. Brummett. Mr. Brummett is a former director of Hawthorne, which the Company acquired in June 2004. Mr. Brummett is the managing partner of Peak View Advisors, LLC, formerly known as Brummett Consulting Group, a consulting firm serving the financial services industry, since February 1997. Prior to that, he had been executive vice president and chief operating officer of Cal Fed Bancorp and a member of the Board of Directors of California Federal Bank, where he was employed since April 1985. From 1980 to 1985, Mr. Brummett was employed at KPMG LLP as a certified public accountant. Mr. Brummett served as Hawthorne’s interim chief executive officer from November 17, 1999 to December 7, 1999.

Barney R. Northcote. Mr. Northcote has served as a director of the Company since August 2002 and as a director of Commercial Capital Bank since 1987 and was a founding stockholder of Commercial Capital Bank when it was known as Mission Savings and Loan Association. Prior to founding Commercial Capital Bank, Mr. Northcote was a founding stockholder and director of Riverside Thrift and Loan from 1976 until the institution was sold in 1986. In 1965, Mr. Northcote formed Northcote, Inc., a trucking and building materials company.

Mark E. Schaffer. Mr. Schaffer has served as a director of Commercial Capital Bank since March 2003 and served on the Company’s board from February 2004 to June 2004 when he relinquished his position as part of the remix of the Board due to the acquisition of Hawthorne Financial Corporation. Mr. Schaffer currently serves as a managing director of Shamrock Capital Advisors, Inc.’s Real Estate Group and its Genesis Fund. Shamrock Capital Advisors, Inc. is the investment advisor affiliate of Shamrock Holding, Inc., the investment vehicle for the Roy E. Disney family. Prior thereto, Mr. Schaffer worked as a management consultant for a private real estate company. He has previously served as president of Lowe Enterprises Realty Services, where he administered an $800 million portfolio of commercial, industrial, and residential assets. Mr. Schaffer started his career with Tuttle & Taylor, a Los Angeles based law firm specializing in real estate and corporate law, where he became the managing partner of the firm. Mr. Schaffer holds a B.S. from the University of California, Berkeley, and a juris doctor from the University of Southern California.

Robert J. Shackleton. Mr. Shackleton has served as a director of the Company since February 2001 and as a director of Commercial Capital Bank since January 2000. From 1961 to 1997, Mr. Shackleton was an accountant with KPMG LLP, an accounting firm, where he attained the position of partner-in-charge of the Orange County audit and professional practice department and SEC reviewing partner. Mr. Shackleton served as president of the California State Board of Accountancy in 1996 and 1997.

R. Rand Sperry. Mr. Sperry is the co-founder of Sperry Van Ness and the co-founder and chief executive officer of SVN Equities and SVN Asset Management. Sperry Van Ness was founded in 1987 and has over 400 commercial real estate brokers in more than 90 markets across the country. In 1998, Mr. Sperry started SVN Equities and SVN Asset Management to build two new profit centers within the

4

Sperry Van Ness family of companies, which acquire and manage real estate properties. Mr. Sperry holds a bachelors degree in finance and real estate from California State University at Long Beach.

Executive Officers Who are not Directors

Set forth below is information concerning the executive officers of the Company who do not serve on the Board of Directors of the Company. All executive officers are elected by the Board of Directors and serve until their successors are elected and qualified. No executive officer is related to any director or other executive officer of the Company by blood, marriage or adoption, and there are no arrangements or understandings between a director of the Company and any other person pursuant to which such person was elected an executive officer.

Robert O. Williams, age 55, has served as executive vice president of the Company since January 2002, as executive vice president and chief lending officer of CCM since April 1998 and as chief lending officer of Commercial Capital Bank since July 2003. From August 1992 to February 1998, Mr. Williams was vice president of the multifamily banking department for Home Savings of America, a savings institution. From January 1989 to August 1992, Mr. Williams was a senior vice president of Great American Asset Management, Inc., a subsidiary of Great American Bank, San Diego, California. Mr. Williams was in charge of work-outs and modifications of special assets of the troubled parent savings and loan. From 1976 through 1988, Mr. Williams was an attorney specializing in real estate transactions and litigation.

J. Christopher Walsh, age 47, has served as executive vice president of the Company and executive vice president and head of relationship banking of Commercial Capital Bank since September 2002. From August 2000 to September 2002, Mr. Walsh served as president of Sunwest Bank, where he supervised all marketing, business development, operations and credit functions of the bank. From February 1999 to August 2000, Mr. Walsh was employed by California Bank & Trust where he served as senior vice president and regional manager for Orange County. From September 1993 to February 1999, Mr. Walsh was the head of private banking in Orange County for U.S. Trust Company of California.

Robert S. Noble, age 45, has served as executive vice president of the Company since January 2004 and as senior vice president and director of internal asset review, loan servicing, secondary marketing and real estate/facilities administration since May 1999. Mr. Noble is responsible for managing the internal asset review and asset quality functions for the Bank’s loan portfolio. Mr. Noble was formerly a senior vice president at Home Savings of America, a savings institution, from May 1991 to December 1998, with responsibility for managing the overall credit quality of a $20 billion multifamily and commercial real estate loan portfolio.

Timothy S. Harris, age 56, has served as an executive vice president of the Company since February 2005 and as president of Timcor Exchange Corporation since December 1984. Mr. Harris is an attorney at law. He received his B.A. in economics from Cornell University in 1971 and his juris doctor from Cornell Law School in 1974. Mr. Harris also received an M.S. in taxation from Northrop University in 1980. He is admitted to the state bars in both California and Texas and is a Certified Specialist in Taxation by the California Board of Legal Specialization. Timcor Financial Corporation, the predecessor to Timcor Exchange Corporation, was founded in 1977. Mr. Harris began handling 1031 exchanges in 1982. Timcor currently handles in excess of 7,000 exchanges per year and has offices in Los Angeles, Miami, Chicago, Houston and Richmond.

James R. Daley, age 62, has served as executive vice president of the Company, executive vice president and head of the Commercial Banking Division, and president of the Corporate Financial Services Group since July 2005. Mr. Daley joined the Company from Comerica Bank, where he was corporate executive vice president and head of their financial services division, since Comerica’s acquisition of Imperial Bank in January 2001. Prior to January 2001, Mr. Daley held executive management positions and served on executive committees at Imperial Bank. He served as president, chief

5

executive officer and chairman of the board of Sunrise Bancorp and Sunrise Bank of California, as well as positions at Union Bank of California, where he began his banking career. Prior to joining Union Bank of California, Mr. Daley was appointed by then Governor Ronald Reagan to positions of Deputy Director for Industry and Trade of the California Department of Commerce and Executive Director for the Commission of Economic Development. He is a graduate of Concordia College in Minnesota, McGeorge School of Law at the University of the Pacific, and the University of Washington’s Pacific Coast Banking School, and is a member of the California State Bar.

James H. Leonetti, age 46, has served as executive vice president and chief financial officer of the Company and Commercial Capital Bank since November 2005. From 2002 until November 2005, Mr. Leonetti served as chief financial officer for Watt Commercial Properties, a private organization engaged in commercial real estate development in the United States. From 2000 until joining Watt Commercial Properties, Mr. Leonetti served as the global chief financial officer of CB Richard Ellis, the world’s largest real estate services firm. He was a key member of the management team that completed a “going private transaction” in 2001. From 1997 until 2000, Mr. Leonetti served as the chief financial officer for Long Beach Financial, then one of the largest specialty finance companies in the United States. Mr. Leonetti held several executive positions at California Federal Bank between 1989 and 1997, including senior vice president and controller, and held senior positions with Far West Financial Corporation, a diversified financial services company from 1984 to 1989. Prior to joining Far West, Mr. Leonetti was employed as a certified public accountant with KPMG LLP. Mr. Leonetti graduated from the University of Southern California in 1981 with a B.S. in business administration.

Donald E. Royer, age 56, has served as executive vice president and general counsel of the Company and Commercial Capital Bank since February 2006. Prior thereto, during 2003 and until February 2006, while in private practice with Pite, Duncan & Melmet, LLP (“PDM”) as senior litigation counsel, Mr. Royer represented a number of large residential mortgage lenders, loan servicers, banks and credit unions. Prior to joining PDM, Mr. Royer served for ten years as executive vice president, general counsel and corporate secretary for Downey Financial Corp. and its subsidiary, Downey Savings and Loan. From 1979 through 1991, Mr. Royer served as executive vice president and general counsel of American Savings and Loan Association and American Savings Bank, F.A., as it transitioned through changes in ownership and executive management.

Board of Directors Meetings and Committees

Eight regular meetings of the Board of Directors of the Company are scheduled for each calendar year. The Board of Directors held eight regular meetings during 2005 and met another 14 times through telephonic board meetings. Pursuant to applicable Nasdaq National Market requirements, the Board of Directors has made an affirmative determination that the following members of the Board of Directors are “independent” within the meaning of such rule: James G. Brakke, Robert J. Shackleton, Barney R. Northcote, Gary W. Brummett, Mark E. Schaffer and R. Rand Sperry. As such, and pursuant to applicable Nasdaq National Market requirements, a majority of the members of the Board of Directors and all of the members of the Audit Committee are “independent” as so defined. No director attended fewer than 75% of the total number of board meetings or committee meetings on which he served that were held during this period. The Company’s policy is to schedule a Board meeting to be held following the annual meeting of stockholders. Directors of the Company are encouraged to attend the annual meeting of stockholders. Each of the Company’s directors attended the 2005 annual meeting of stockholders.

The Board of Directors of the Company has established the following committees:

Compensation Committee. The Compensation Committee reviews and approves the compensation and benefits for the Company’s employees, grants stock options to employees, management and directors pursuant to the Company’s stock compensation plans and reports its determination on such matters to the

6

Board of Directors regarding such matters. The Board has determined that each member of the Compensation Committee is independent as defined under the rules of Nasdaq National Market requirements. During 2005, the Compensation Committee membership was comprised of Messrs. Brakke (Chairman), Northcote and Shackleton, and met four times during fiscal 2005.

Nominating Committee. The Nominating Committee considers criteria for identifying and selecting individuals who may be nominated for election to the Board, recommends to the Board the slate of nominees for election to the Board at the Company’s annual meeting of shareholders, and considers unsolicited nominations for Board membership in accordance with the Company’s by-laws and committee charter. The Board has determined that each member of the Nominating Committee is independent as defined under the applicable Nasdaq National Market requirements. During 2005, the Nominating Committee’s membership was comprised of Messrs. Brakke, Northcote (Chairman) and Shackleton. The Nominating Committee met once in 2005.

Audit Committee. The Audit Committee has responsibility for oversight of the Company’s audit process and monitoring the accounting, financial reporting, data processing, regulatory, and internal control functions. One of the audit committee’s primary responsibilities is to enhance the independence of the audit function, thereby furthering the objectivity of financial reporting. Accordingly, the Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of the Company’s independent auditors, who must report directly to the Audit Committee. The Audit Committee regularly meets with the Company’s independent auditors who have unrestricted access to the Audit Committee.

The other duties and responsibilities of the Audit Committee include: (i) reviewing the Company’s financial statements, (ii) overseeing the maintenance of an appropriate internal audit program, (iii) establishing procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting matters, and (iv) maintaining an appropriate regulatory compliance program for the Company and its subsidiaries.

The Audit Committee, which is comprised of Messrs. Schaffer, Northcote and Shackleton (Chairman), met 12 times during fiscal 2005. Mr. Brummett served on the Audit Committee until August 5, 2005. See “Additional Information About The Directors And Executive Officers—Transactions with Certain Related Persons.” The Board has determined that each member of the Audit Committee is independent as defined under applicable Nasdaq National Market requirements. In addition, the Company’s Board of Directors has determined that the Audit Committee has an “Audit Committee financial expert” as defined in regulations issued by the Commission pursuant to the Sarbanes-Oxley Act of 2002. The Company’s “Audit Committee financial expert” is Robert J. Shackleton, who previously served as an accountant with KPMG LLP from 1961 to 1997.

The Audit Committee operates under a written charter that was attached as Exhibit D to the Company’s 2004 Annual Meeting Proxy Statement that was filed with the SEC on April 13, 2004.

7

Consideration of Director Nominees

Stockholder Nominees. The policy of the Nominating Committee is to consider properly submitted stockholder nominations for candidates for membership on the Board as described below under “—Identifying and Evaluating Nominees for Directors.” In evaluating such nominations, the nominating committee seeks to achieve a balance of knowledge, experience and capability on the Board and to address the membership criteria set forth under “—Director Qualifications.” Any stockholder nominations proposed for consideration by the Nominating Committee should include the nominee’s name and qualifications for Board membership and should be addressed to:

Corporate Secretary

Commercial Capital Bancorp, Inc.

8105 Irvine Center Drive

Irvine, California 92618

In addition, the bylaws of the Company permit stockholders to nominate directors for consideration at an annual stockholder meeting. For a description of the process for nominating directors in accordance with the Company’s bylaws, see “—Process for Nominating Directors.”

Director Qualifications. The Company’s corporate governance guidelines contain Board membership criteria that apply to Board of Directors-recommended nominees for a position on the Company’s Board. Under these criteria, members of the Board should have the highest professional and personal ethics and values, consistent with longstanding Company values and standards. They should have broad experience at the policy-making level in business, government, education, technology or public interest. They should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties. Each director must represent the interests of all stockholders.

Process for Nominating Directors. Article II, Section 2.11 of the Company’s bylaws governs nominations for election to the Board of Directors. Stockholder nominations must be made pursuant to timely notice in writing to the chairman/chief executive officer or the vice chairman/president of the Company. To be timely, a stockholder’s notice must be delivered or mailed to the Company not later than 120 days prior to the annual anniversary date of the mailing of the proxy materials by the Company in connection with the immediately preceding annual meeting of the stockholders of the Company. Each written notice of a stockholder nomination is required to set forth certain information specified in the bylaws.

Identifying and Evaluating Nominees for Directors. The Nominating Committee intends to utilize a variety of methods for identifying and evaluating nominees for director. The Board of Directors will assess the appropriate size of the Board, and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Board of Directors will consider various potential candidates for director. The Nominating Committee expects that candidates may come to the attention of the Nominating Committee through current Board members, professional search firms, stockholders or other persons. These candidates will be evaluated at regular or special meetings of the Board of Directors, and may be considered at any point during the year. As described above, the Nominating Committee will consider properly submitted stockholder nominations for candidates for the Board of Directors. The Nominating Committee expects that following verification of the stockholder status of persons proposing candidates, recommendations will be aggregated and considered by the Nominating Committee at a regularly scheduled meeting. The Nominating Committee also may review materials provided by professional search firms or other parties in connection with a nominee who is not proposed by a stockholder. In evaluating such nominations, the Nominating Committee will seek to achieve a balance of knowledge, experience and capability on the Board.

8

Stockholder Communication with the Board

Stockholder Communications. The Company provides for a process for stockholders to send communications to the Board of Directors. Stockholders may send communications to the Board of Directors by contacting the Company’s Senior Vice President, Investor Relations in one of the following ways:

In writing at 8105 Irvine Center Drive, Irvine, California 92618,

or by email at www.commercialcapital.com.

The Senior Vice President, Investor Relations will submit each communication received to the Board of Directors at the next regular meeting.

Report of the Audit Committee

The following “Report of the Audit Committee” shall not be deemed incorporated by reference by any general statement incorporating this Proxy Statement into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under the Securities Act or the Exchange Act.

The Audit Committee has:

· reviewed and discussed the audited financial statements of the Company for the year ended December 31, 2005 with the Company’s management and KPMG LLP, the Company’s independent auditors, including a discussion of the quality and effect of the Company’s accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements;

· discussed the matters required by Statement on Auditing Standards No. 61 (Communication with Audit Committees) with KPMG LLP, including the process used by management in formulating particularly sensitive accounting estimates and the basis for the conclusions of KPMG LLP regarding the reasonableness of those estimates;

· received the written disclosures and the letter from KPMG LLP required by Independence Standards Board Standard No. 1 (Independence Discussion with Audit Committees);

· discussed the independence of KPMG LLP and considered whether the provision of non-audit services by KPMG LLP is compatible with maintaining auditor independence, and has satisfied itself as to the auditor’s independence; and

· met with the internal and independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the SEC.

| Mark E. Schaffer |

| Barney R. Northcote |

| Robert J. Shackleton (Chairman) |

9

BENEFICIAL OWNERSHIP OF COMMON STOCK

BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as to the Common Stock beneficially owned by (i) each person or entity, including any “group” as that term is used in Section 13(d)(3) of the Exchange Act, who or which was known to the Company to be the beneficial owner of more than 5% of the issued and outstanding Common Stock, (ii) the directors of the Company, (iii) each executive officer of the Company listed in the Summary Compensation Table, and (iv) all directors and executive officers of the Company as a group.

| Name of Beneficial

Owner or Number of

Persons in Group | | | Amount and Nature

of Beneficial

Ownership as of

March 10, 2006(1) | | Percent of

Common Stock | |

Wasatch Advisors, Inc.

150 Social Hall Avenue

Salt Lake City, Utah 84111(2) | | | 5,036,293 | | | | 8.83 | % | |

Directors: | | | | | | | | | |

James G. Brakke(3) | | | 272,981 | | | | * | | |

Gary W. Brummett(4) | | | 36,558 | | | | * | | |

David S. DePillo(5) | | | 3,325,846 | | | | 5.72 | % | |

Stephen H. Gordon(6) | | | 5,215,251 | | | | 8.95 | % | |

Barney R. Northcote(7) | | | 505,081 | | | | * | | |

Richard A. Sanchez(8) | | | 99,070 | | | | * | | |

Mark E. Schaffer(9) | | | 66,128 | | | | * | | |

Robert J. Shackleton(10) | | | 98,970 | | | | * | | |

R. Rand Sperry (11) | | | 3,333 | | | | * | | |

Named Executive Officers who are not Directors: | | | | | | | | | |

Timothy S. Harris (12) | | | 1,253,860 | | | | 2.20 | % | |

James R. Daley | | | 0 | | | | * | | |

J. Christopher Walsh(13) | | | 69,861 | | | | * | | |

All directors and executive officers as a Group (16 persons) | | | 11,344,426 | | | | 18.98 | % | |

* Represents less than 1% of the outstanding shares of Common Stock.

(1) Based upon information furnished by the respective individuals or entities. Under regulations promulgated pursuant to the Exchange Act shares of common stock are deemed to be beneficially owned by a person if he, she or it directly or indirectly has or shares (i) voting power, which includes the power to vote or to direct the voting of the shares or (ii) investment power, which includes the power to dispose or to direct the disposition of the shares. Unless otherwise indicated, the named beneficial owner has sole voting and dispositive power with respect to the shares.

(2) As reported on a Schedule 13G/A filed with the SEC on February 14, 2006, by Wasatch Advisors, Inc. The entity reported sole voting and dispositive power with respect to all 5,036,293 shares.

(3) Includes 70,000 shares issuable upon exercise of options exercisable within 60 days of the voting record date and 174,541 shares held by the James G. Brakke & Glenys E. Brakke Living Trust and 1,440 shares held in a 401(k) Plan. Also includes 667 shares of restricted stock over which Mr. Brakke has sole voting but no dispositive power.

(4) Includes 28,884 shares issuable upon exercise of options exercisable within 60 days of the voting record date. Also includes 667 shares of restricted stock over which Mr. Brummett has sole voting but no dispositive power.

(Footnotes continued on the following page)

10

(5) Includes 1,061,182 shares issuable upon exercise of options exercisable within 60 days of the voting record date and 65,588 shares held by the DePillo Family Foundation. Also includes 78,267 shares of restricted stock over which Mr. DePillo has sole voting but no dispositive power. Does not include shares held by the DePillo Trust over which Mr. DePillo disclaims beneficial ownership.

(6) Includes 1,216,998 shares issuable upon exercise of options exercisable within 60 days of the voting record date and 57,036 shares held by The Gordon Foundation. Also includes 97,880 shares of restricted stock over which Mr. Gordon has sole voting but no dispositive power. Does not include shares owned by the Gordon Family Trust over which Mr. Gordon disclaims beneficial ownership.

(7) Includes 24,168 shares issuable upon exercise of options exercisable within 60 days of the voting record date. Also includes 667 shares of restricted stock over which Mr. Northcote has sole voting but no dispositive power.

(8) Includes 51,833 shares issuable upon exercise of options exercisable within 60 days of the voting record date and 9,808 shares of restricted stock over which Mr. Sanchez has sole voting but no dispositive power.

(9) Includes 20,000 shares issuable upon exercise of options exercisable within 60 days of the voting record date. Also includes 667 shares of restricted stock over which Mr. Schaffer has sole voting but no dispositive power.

(10) Includes 86,868 shares issuable upon exercise of options exercisable within 60 days of the voting record date and 3,102 shares held by The Shackleton Family Trust. Mr. Shackleton and his wife are the trustees of The Shackleton Family Trust. Also includes 667 shares of restricted stock over which Mr. Shackleton has sole voting but no dispositive power.

(11) Includes 3,333 shares issuable upon exercise of options exercisable within 60 days of the voting record date.

(12) Includes 7,937 shares of restricted stock over which Mr. Harris has sole voting but no dispositive power. Also includes 1,245,923 shares held by the Harris Family Trust.

(13) Includes 17,500 shares issuable upon exercise of options exercisable within 60 days of the voting record date and 52,361 shares of restricted stock over which Mr. Walsh has sole voting but no dispositive power.

Director Compensation

For the year ended December 31, 2005, each non-employee director of the Company received an annual retainer of $12,000 and no additional compensation for attending directors’ committee meetings. In addition, each non-employee director of Commercial Capital Bank received an annual retainer of $48,000 and no additional compensation for attending Commercial Capital Bank directors’ committee meetings.

Directors are also eligible to receive stock options or restricted stock awards under the Commercial Capital Bancorp, Inc. 2000 Stock Plan, the Commercial Capital Bancorp, Inc. 2004 Long Term Incentive Plan and the Hawthorne Financial Corporation 2001 Stock Incentive Plan. On January 25, 2005, Messrs. Brummett, Brakke, Northcote, Schaffer and Shackleton each received 1,000 shares of restricted stock which vests over three years in equal installments on the anniversary date of the grant. The closing share price on the date of grant was $20.36. In April 2005, newly appointed director Sperry received an option to purchase 10,000 shares of common stock at an exercise price of $15.92 per share. These options vest in 36 equal monthly installments, but Mr. Sperry must remain with the Company for one year before any such options are exercisable.

11

Executive Compensation

Summary Compensation Table. The following table sets forth a summary of certain information concerning the compensation paid for services rendered in all capacities during the last three fiscal years ended December 31, 2005 to the Chief Executive Officer and each of the Company’s four other most highly compensated executive officers (“Named Executive Officers”).

| | Annual

Compensation | | Long-Term

Compensation

Awards | | | |

| Name and

Principal Position | | | Fiscal

Year | | Salary(1) | | Bonus(2) | | Other Annual

Compensation(3) | | Restricted

Stock

Awards(4) | | Securities

Underlying

Options | | All Other

Compensation(5) | |

Stephen H. Gordon | | | 2005 | | | $ | 925,750 | | $ | — | | | $ | 12,000 | | | $ | 1,207,500 | | | — | | | | $ | 20,088 | | |

Chairman and Chief | | | 2004 | | | 805,000 | | — | | | 12,000 | | | 200,000 | | | — | | | | 31,069 | | |

Executive Officer | | | 2003 | | | 700,000 | | 400,000 | | | 12,000 | | | — | | | 100,000 | | | | 24,087 | | |

David S. DePillo | | | 2005 | | | $ | 826,523 | | — | | | $ | 12,000 | | | $ | 905,625 | | | — | | | | $ | 30,776 | | |

Vice Chairman, President | | | 2004 | | | 718,750 | | — | | | 12,000 | | | 150,000 | | | — | | | | 39,007 | | |

and Chief Operating Officer | | | 2003 | | | 625,000 | | 300,000 | | | 12,000 | | | — | | | 80,000 | | | | 29,554 | | |

Timothy S. Harris | | | 2005 | | | $ | 473,417 | | — | | | $ | 9,000 | | | — | | | — | | | | — | | |

Executive Vice President | | | 2004 | | | — | | — | | | — | | | — | | | — | | | | — | | |

| | | 2003 | | | — | | — | | | — | | | — | | | — | | | | — | | |

James R. Daley | | | 2005 | | | $ | 249,525 | | $ | 500,000 | | | $ | 462 | | | $ | 4,408,800 | | | — | | | | — | | |

Executive Vice President | | | 2004 | | | — | | — | | | — | | | — | | | — | | | | — | | |

| | | 2003 | | | — | | — | | | — | | | — | | | — | | | | — | | |

J. Christopher Walsh | | | 2005 | | | $375,169 | | —- | | | $ | 12,000 | | | $ | 932,000 | | | —- | | | | $ | 11,792 | | |

Executive Vice President | | | 2004 | | | 263,649 | | — | | | 12,000 | | | — | | | — | | | | 8,200 | | |

| | | 2003 | | | 230,655 | | 40,000 | | | 12,000 | | | — | | | 2,000 | | | | 9,124 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) During 2005, includes taxable fringe benefit in the form of a car service bonus received by Mr. Daley in the amount of $32,217. During 2003, 2004 and 2005 includes $30,665, $51,649 and $86,612, respectively, in commissions paid to Mr. Walsh.

(2) Bonuses were accrued in the fiscal year indicated and paid in January of the subsequent year. During 2005, represents $500,000 signing bonus paid to Mr. Daley.

(3) Includes the amount of a car allowance received by each of the Named Executive Officers. The costs to the Company of providing such benefits did not exceed the lesser of $50,000 or 10% of the total of annual salary and bonus for the particular executive officer reported.

(4) For 2005, reflects the value of restricted stock awards granted to Messrs. Gordon and DePillo on January 21, 2005, as determined by multiplying the number of shares awarded (50,587 to Mr. Gordon and 37,940 to Mr. DePillo) by the closing price of the Company’s common stock on the date of grant of $23.87 per share. Reflects the value of restricted stock awards granted to Mr. Walsh on January 21 and May 31, 2005, as determined by multiplying the number of shares awarded (3,541 and 50,000 respectively) by the closing price of the Company’s common stock on the dates of grant of $23.87 and $16.95, respectively. The restricted shares vest over a three-year period in equal installments beginning on the one-year anniversary date of the grant. Dividends are paid on the restricted stock at the rate paid to all shareholders. Reflects the value of share right awards granted to Mr. Daley on July 20, 2005, as determined by multiplying the number of share rights awarded (240,000) by the Company’s closing stock price on the date of grant, $18.37. The vesting of these awards is subject to certain performance-based conditions and voting and dividend rights are granted to the shareholder

12

upon vesting. At December 31, 2005, the number of shares and value of restricted stock and share right awards held by each of the Named Executive Officers, based upon the closing price of the Company’s common stock on that date of $17.12 per share, was as follows: 58,895 shares valued at $1,008,282 for Mr. Gordon, 44,170 shares valued at $756,190 for Mr. DePillo, 240,000 shares valued at $4,108,800 for Mr. Daley, and 53,541 shares valued at $916,622 for Mr. Walsh.

(5) For 2005, includes matching contributions by the Company to the Company’s 401(k) plan in the amount of $8,400 for Messrs. DePillo, and Walsh; insurance premiums paid on behalf of Messrs. Gordon and DePillo in the amount of $15,568 and $17,472, respectively; and payments made pursuant to the executive bonus agreements of $4,520, $4,904, and $3,392 to Messrs. Gordon, DePillo and Walsh, respectively.

Stock Options

During the year ended December 31, 2005 there were no grants of stock options to the Named Executive Officers.

The following table sets forth certain information concerning exercises of stock options by the Named Executive Officers during the year ended December 31, 2005 and options held at December 31, 2005.

| | Shares

Acquired | | Value | | Number of Securities

Underlying Unexercised

Options at Year End | | Value of Unexercised

In-the-Money Options

at Year End(1) | |

Name | | | | on Exercise | | Realized | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

Stephen H. Gordon | | | 290,000 | | | $ | 5,081,671 | | 1,203,109 | | | 22,223 | | | $ | 15,167,307 | | | $ | 155,339 | | |

David S. DePillo | | | 95,000 | | | 1,794,435 | | 1,125,070 | | | 17,779 | | | 14,992,099 | | | 140,632 | | |

Timothy S. Harris | | | — | | | — | | — | | | — | | | — | | | — | | |

James R. Daley | | | — | | | — | | — | | | — | | | — | | | — | | |

J. Christopher Walsh | | | 9,333 | | | 151,075 | | 17,221 | | | 446 | | | 213,538 | | | 3,528 | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(1) Represents the fair market value per share of Common Stock at fiscal year end based on the closing price of $17.12 at December 31, 2005, as quoted on The Nasdaq Stock Market, minus the exercise price per share of the options outstanding times the number of shares of Common Stock represented by such options.

Employment Agreements with Named Executive Officers

The Company and Commercial Capital Bank have entered into employment agreements with Messrs. Gordon, DePillo, Harris, Daley and Walsh. Each employment agreement has a term of three years. The term of the employment agreements may be extended one additional year by either or both employers upon the approval of the relevant Board of Directors or its designee unless either party elects, not less than 90 days prior to the annual anniversary date, not to extend the employment term. Under the agreements, the executives receive an annual salary that is reviewed annually by the employers’ boards of directors and may be changed. Each of these employees also receives a monthly car allowance of $1,000 per month. The Company, through Commercial Capital Bank, paid Mr. Daley a signing bonus of $500,000 which payment is specifically conditioned on his continued employment for three (3) years in accordance with the terms of his employment agreement. The agreement for Mr. Daley also provides for the payment of certain bonuses conditioned upon continued employment or the attainment of certain performance benchmarks.

Each of the employment agreements is terminable with or without cause by the applicable employer. The executives have no right to compensation or other benefits if their employment is terminated for cause, disability or retirement. In the event of an executive’s death, the agreements will not terminate until

13

one year after the date of the executive’s death, during which time the executive’s estate is entitled to receive his salary, accrued vacation and any bonus earned through the date of termination. In addition, the employers are required to continue benefit coverage of all dependents of the deceased executives through the remainder of the term of the relevant employment agreement.

If an executive is terminated without cause or if an executive terminates for “good reason,” the affected executive is entitled to receive an amount equal to his base salary for the remainder of the term of the employment agreement payable in a lump sum on the date of termination or on a bi-weekly basis in approximately equal installments over a period of time not later than the date that is 2 ½ months following the last day of the calendar year in which the date of termination occurs (except the agreements with Messrs. Gordon and DePillo provide that they shall be entitled to the greater of: (i) the payments due for the remaining term of the agreement or (ii) three times the executive’s highest annual compensation, as defined in the employment agreements, for the last five years) as well as paid benefits for the executive and his dependents for the remainder of the term of the employment agreement to the extent, if any, that the insurance carrier(s) will allow. In addition, all stock options that had not vested at termination will immediately vest and become exercisable for a period of 90 days following the termination date. Good reason includes: (i) failure to be elected or appointed to the position then held by the executive, (ii) a material change in the executive duties or responsibilities, (iii) a relocation of place of employment by more than 30 driving miles, (iv) a material reduction in the benefits and perquisites to the executive, (v) a liquidation or dissolution of the employer or (vi) a breach of the employment agreement by the employer. In the event of a change of control, the executive shall be entitled to the greater of (i) the payments due for the remaining term of the agreement or (ii) 2.99 times the executive’s highest annual compensation for last five years

The employment agreements provide that, in the event that any of the payments to be made there under or otherwise upon termination of employment are deemed to constitute “excess parachute payments” within the meaning of Section 280G of the Internal Revenue Code (the “Code”), the executive will be paid an amount equal to 20% of the excess parachute payment and any additional amounts necessary to compensate the executive for any taxes on the additional 20% payment. The employment agreements with Commercial Capital Bank provide that in the event that any of the payments to be made there under or otherwise upon termination of employment are deemed to constitute “excess parachute payments” within the meaning of Section 280G of the Code, the payment made by Commercial Capital Bank shall be limited to the greater of (i) 2.99 times the executive’s compensation over the past five years or (ii) payments made under the agreement after taking into account any excise tax imposed by Section 280G of the Code.

A change in control is generally defined in the employment agreements to include any change in control required to be reported under the federal securities laws, as well as (i) the acquisition by any person of 20% or more of the Company’s outstanding voting securities, and (ii) a change in a majority of the directors of the Company during any three-year period without the approval of at least three-fourths of the persons who were directors of the Company at the beginning of such period.

Retirement and Death Benefits

Commercial Capital Bank has purchased bank-owned life insurance policies, referred to as BOLI, to provide its key employees identified below with life insurance and to fund other employee benefits. These policies, which are assets of Commercial Capital Bank, have been paid for in their entirety and are intended to fund all obligations entered into by Commercial Capital Bank in connection with the retirement, involuntary termination or disability of these executives. The increase in cash surrender value of the BOLI policies, which accrues tax-free, is recorded as non-interest income in the Company’s consolidated statement of income. Following the BOLI purchase, Commercial Capital Bank entered into the following agreements with each of Messrs. Gordon, DePillo, and Walsh: (1) a split dollar agreement,

14

(2) a salary continuation agreement and (3) an executive bonus agreement. In January 2006, split dollar agreements have been entered into with Messrs. Harris and Daley. Commercial Capital Bank intends to enter into salary continuation and executive bonus agreements with Messrs. Harris and Daley.

Pursuant to the split dollar agreements, Commercial Capital Bank provides a death benefit pursuant to the terms of the life insurance policies to each executive’s designated beneficiary. The policy will pay proceeds of $2,245,000, $2,245,000, $1,075,000, $1,075,000 and $1,075,000 to the designated beneficiaries of Messrs. Gordon, DePillo, Harris, Daley and Walsh, respectively. Commercial Capital Bank retains the right to any amounts payable under the life insurance policies in excess of these specified amounts. Each executive has no rights under the life insurance policies upon the executive’s termination for cause or voluntary termination prior to the executive’s normal retirement age as defined by the agreement. On an annual basis, each executive is required to reimburse Commercial Capital Bank as applicable, an amount equal to the executive’s economic benefit under his split dollar agreement, which amount is repaid to each executive in accordance with the terms of the executive bonus agreements described below.

Pursuant to the salary continuation agreements, Commercial Capital Bank agreed or will agree to pay certain benefits to each executive upon their retirement, involuntary termination, disability, or upon a change of control of Commercial Capital Bank. Upon their retirement, defined as any termination of employment after the executive’s normal retirement age as defined by the agreement for reasons other than death or termination for cause, Messrs. Gordon, DePillo, Harris, Daley and Walsh will be entitled to an annual benefit of $175,000, $150,000, $70,000, $70,000 and $70,000, respectively, payable in equal monthly installments for twenty years. Commercial Capital Bank has reserved the right to increase such benefit. The benefits payable in connection with retirement will be in lieu of any other benefit under the salary continuation agreements. Upon an involuntary termination or a disability, Messrs. Gordon, DePillo, Harris, Daley and Walsh will be entitled to a lump sum payment that increases over time depending on when the involuntary termination or disability occurs. An involuntary termination is defined as any termination prior to retirement other than an approved leave of absence, termination for cause, disability or any termination within twelve months following a change of control. The benefits payable in connection with an involuntary termination or disability will be in lieu of any other benefit under the salary continuation agreements. In the event of a change of control, Messrs. Gordon, DePillo, Harris, Daley and Walsh will be entitled to an annual benefit of $175,000, $150,000, $70,000, $70,000 and $70,000, respectively, for twenty years, payable in equal monthly installments, which payments will commence on the month following the executive’s normal retirement age as defined by the agreement. The benefit payable in connection with a change in control will be in lieu of any other benefit under the salary continuation agreements. A change of control is defined in the agreement as a transfer of more than 20% of the Company’s or Commercial Capital Bank’s outstanding common stock to one entity or person followed within twelve months by the executive’s involuntary termination. All payments under the salary continuation agreements will cease upon the executive’s death.

Pursuant to the executive bonus agreements, Commercial Capital Bank agreed or will agree to pay each executive a bonus award for each calendar year equal to the executive’s economic benefit under the split dollar agreement divided by one minus Commercial Capital Bank’s marginal income tax rate for the calendar year preceding such payment. Commercial Capital Bank will continue to pay the bonus until the earlier of the executive’s voluntary termination, death or termination for cause. Commercial Capital Bank has the right to terminate the executive bonus agreements at any time. The bonus is not fixed and fluctuates based on, among other things, the age of the executives. As of December 31, 2005, the bonus which would be payable to each of Messrs. Gordon, DePillo, and Walsh amounted to $4,520, $4,904 and $3,392 respectively.

15

Report of the Compensation Committee

The following “Report of the Compensation Committee” shall not be deemed incorporated by reference by any general statement incorporating this Proxy Statement into any filling under the Securities Act or under the Exchange Act, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under the Securities Act or the Exchange Act.

During 2005, the Compensation Committee’s membership was comprised of Messrs. Brakke (Chairman) Northcote and Shackleton. The Board had determined that each of the committee members is “independent” as defined by existing Nasdaq National Market requirements.

By the terms of its charter, the Compensation Committee is responsible for: (1) administering the compensation program of the Company; (2) annually reviewing and determining the base salary and incentive compensation for the Chairman and Chief Executive Officer and all executive officers; and (3) reporting to the Board its determination of the appropriate level of compensation for the Company’s executive officer, as well as other compensation matters. In this regard, the Compensation Committee adopted the Executive Performance-Based Compensation Policy (“Executive Compensation Policy”) in 2004 to meet the requirements of Section 162 (m) of the Internal Revenue Code for covered executive officers. The Executive Compensation Policy was approved by vote of the Company’s shareholders at the 2004 annual meeting.

For purposes of conducting its annual review of executive compensation, the Compensation Committee receives information compiled by management and recommendations from the Chairman and Chief Executive Officer. A peer group was used as a basis of comparison for the 2005 yearend review and was comprised of 25 banks and thrifts ranging in size from $3.0 billion to $16.0 billion in total assets.

Executive Performance-Based Compensation Policy. With implementation of the Executive Compensation Policy, the Compensation Committee established in writing financial performance goals for each of the criteria contained in the policy for the calendar year ended 2005. Those criteria included: (1) return on average equity; (2) return on average assets; (3) net income growth; (4) efficiency ratio; (5) nonperforming assets to total assets; (6) earnings per share growth; (7) total market capitalization; and (8) total shareholders’ return. Payment of incentive awards under the policy is dependent upon attainment of three of eight performance goals. The Compensation Committee’s review found that four of eight performance goals had been attained for the calendar year ended 2005.

Base Salaries. The Compensation Committee reviewed comparative analysis of the peer group, which was constructed using the 2005 SNL Executive Compensation Review, and consisted of a compilation of compensation paid to executives in the financial institution industry. Base salaries for the year ended December 31, 2005 were not increased for the Named Executive Officers.

Bonuses. There were no cash bonuses paid to the Named Executive Officers for the years ended 2005 and 2004. Rather, restricted stock awards were granted to certain of the Named Executive Officers in January and/or May 2005, which vest over a three-year period in equal installments on the anniversary date of the grant. A cash bonus was paid in July 2005 as an inducement to the employment of one such Named Executive Officer.

Stock Options. The Company implemented the Commercial Capital Bancorp, Inc. 2000 Stock Plan under which executive officers, directors and employees are eligible to receive stock option grants and restricted stock awards. Through its acquisition of Hawthorne, the Company acquired the Hawthorne 2001 Incentive Plan. Additionally, by vote of its shareholders, the Commercial Capital Bancorp Inc. 2004 Long Term Incentive Plan was approved. Both the Hawthorne 2001 Stock Incentive Plan and the Commercial Capital Bancorp, Inc. 2004 Long Term Incentive Plan similarly provide for the grant of stock options, stock appreciation rights and restricted stock. The Compensation Committee reviews and evaluates stock option

16

grants based on financial performance achieved by the Company and the level of long-term incentive awards granted by its peers. There were no option grants made to Named Executive Officers during 2005 or 2004 compared to 186,000 option grants in 2003.

Restricted Stock. In January 2006, the Compensation Committee granted restricted stock awards to certain of the Named Executive Officers. The dollar amount of such awards totaled $1,855,234, which represents 117,794 restricted shares of the Company’s common stock. Dividing the dollar amount of such awards by the opening market price of the Company’s shares of common stock on the date of the award, which was $15.75 on January 31, 2006, derived the number of restricted shares granted. The restricted shares vest over a three-year period in equal installments on the anniversary date of the grant.

Chairman and Chief Executive Officer. The Compensation Committee reviewed the comparative analysis using information compiled from the 2005 SNL Executive Compensation Review, which compared Mr. Gordon’s compensation with chief executives at the Company’s peers. The following actions were taken with respect to Mr. Gordon’s 2005 compensation as chairman and chief executive officer, the impact of which will be reflected in 2006: (1) base salary for the year ended December 31, 2005 was not changed; (2) no cash bonus related to 2005 performance was paid; (3) no stock option grants; and (4) a January 2006 restricted stock award in the amount of $945,000, representing 60,000 restricted shares of the Company’s common stock. For restricted stock awards, the shares vest over a three-year period in equal installments on the anniversary date of the grant. The number of shares granted was determined by dividing the dollar amount of the award by the closing market price of the Company’s shares on the grant date.

| James G. Brakke (Chairman) |

| Barney R. Northcote |

| Robert J. Shackleton |

17

ADDITIONAL INFORMATION ABOUT THE DIRECTORS AND EXECUTIVE OFFICERS

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s officers, directors and persons who own more than 10% of the Company’s Common Stock to file reports of ownership and changes in ownership with the Commission and the National Association of Securities Dealers, Inc. Officers, directors and greater than 10% stockholders are required by regulation to furnish the Company with copies of all forms they file pursuant to Section 16(a) of the Exchange Act.

Based solely on review of the copies of such forms furnished to the Company, or written representations from its officers and directors, the Company believes that during, and with respect to, the year ended December 31, 2005 the Company’s officers and directors complied in all respects with the reporting requirements promulgated under Section 16(a) of the Exchange Act, except that a late Form 4 was filed by R. Rand Sperry on May 3, 2005 to report stock options granted on April 27, 2005.

Transactions with Certain Related Persons

Brakke Schafnitz Insurance Brokers, Inc., an insurance brokerage company controlled by Mr. Brakke, a director of the Company and Commercial Capital Bank, received $1.5 million in 2005 in insurance premium payments from the Company. Brakke Schafnitz Insurance Brokers, Inc. remits these insurance premium payments to the insurance carriers and receives a commission, which totaled $189,000 in 2005. The Company believes that the commissions earned by Brakke Schafnitz Insurance Brokers, Inc. were comparable to commissions that an independent third party would have earned in an arm’s length transaction. In 2006, the Company terminated the insurance broker relationship with Brakke Schafnitz.

During the year ended December 31, 2005, the Company paid $494,000 in legal fees to the law firm in which Gregory G. Petersen was a partner. Mr. Petersen is the brother-in-law of Stephen H. Gordon, the Company’s chairman and chief executive officer.

In connection with Mr. Daley’s employment by the Company on July 20, 2005, the Company paid a finder’s fee to an executive placement firm which, in turn, paid a fee to a company that is wholly-owned by Mr. Brummett, a director of the Company. Even though permissible under applicable rules, in order to avoid the appearance of a conflict, Mr. Brummett resigned from the Audit Committee on August 5, 2005.

Pursuant to the Stock Exchange Agreement and Plan of Reorganization between TIMCOR and the Company, in January 2006, TIMCOR completed the sale of 5995 Sepulveda LLC, a wholly-owned subsidiary, for $5.1 million to the Harris Family Intervivos Trust, of which Mr. Timothy S. Harris is a trustee. Mr. Harris currently is an executive vice president of the Company and President of TIMCOR, which is a wholly owned subsidiary of the Company. The primary asset owned by 5995 Sepulveda LLC is the office building in which the TIMCOR headquarters currently reside. Upon completion of the sale, TIMCOR entered into a lease agreement with the Harris Family Intervivos Trust for the space occupied by the TIMCOR headquarter offices. The premises lease term is five years and minimum annual lease payments are $307,000 with annual 2.0% increases over the term of the leases. The sale and lease-back of the premises, were conducted in an arm’s length transaction.

In 2005, the Company paid DePillo Catering fees totaling $143,000 for catering services rendered throughout the year. DePillo Catering is owned and operated by Roberta DePillo, the sister of the Company’s President and Chief Operating Officer. In March 2006, the Company terminated the services of DePillo Catering.

As of December 31, 2005, there were no outstanding loans made by the Company or Commercial Capital Bank to their directors or executive officers. The Company and Commercial Capital Bank’s policy

18

is not to make loans to its directors or executive officers. In accordance with the requirements of the Nasdaq National Market, the Audit Committee is required to approve all related party transactions.

Compensation Committee Interlocks and Insider Participation.

During fiscal year 2005, the Company’s Compensation Committee was comprised of Messrs. Brakke, Northcote and Shackleton, all of whom are independent directors.

19

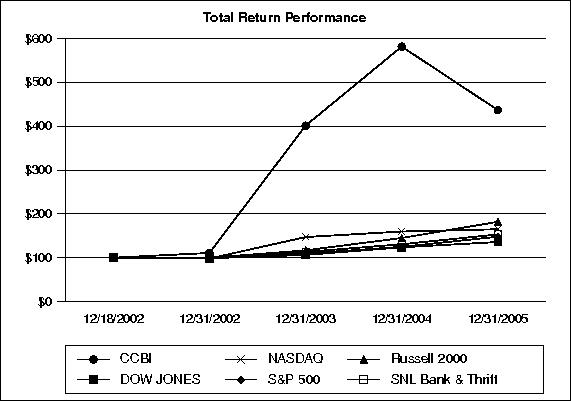

Stock Performance Graph

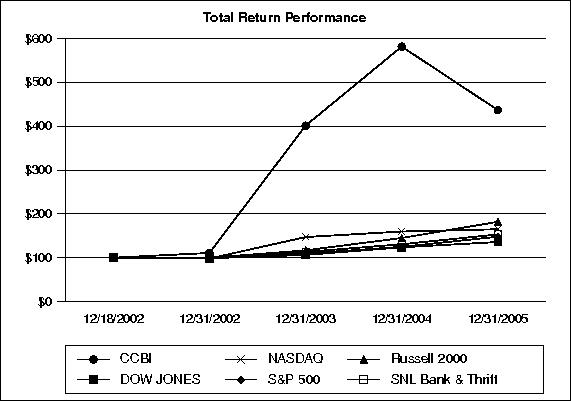

The following stock performance graph compares the performance of the Company’s common stock with that of five other indices referenced below. The comparison of the cumulative total return to stockholders for each of the periods assumes that $100 was invested on December 18, 2002 (the date the Company’s common stock first began trading on the Nasdaq National Market), in Company common stock, and in the five other indices reference below. All of these cumulative returns are computed assuming the reinvestment of dividends at the frequency with which dividends were paid during the period. The stock price performance on the graph below is not necessarily indicative of future price performance. This graph is not “soliciting material,” is not deemed filed with the Commission and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

| | Period Ending | |

| | 12/18/02 | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/31/05 | |

CCBI | | | 100.00 | | | | 110.88 | | | | 401.44 | | | | 581.85 | | | | 436.89 | | |

NASDAQ | | | 100.00 | | | | 98.09 | | | | 147.14 | | | | 159.78 | | | | 164.97 | | |

S&P 500 | | | 100.00 | | | | 98.73 | | | | 109.36 | | | | 124.78 | | | | 147.91 | | |

Russell 2000 | | | 100.00 | | | | 99.77 | | | | 116.76 | | | | 145.03 | | | | 181.95 | | |

DOW Jones | | | 100.00 | | | | 98.75 | | | | 106.37 | | | | 123.75 | | | | 135.81 | | |

SNL Bank & Thrift | | | 100.00 | | | | 99.30 | | | | 113.27 | | | | 130.70 | | | | 153.16 | | |

Source: SNL Financial LC, Charlottesville, VA © 2006

20

RATIFICATION OF APPOINTMENT OF AUDITORS

The Board of Directors of the Company has appointed KPMG LLP independent certified public accountants, to perform the audit of the Company’s financial statements for the year ending December 31, 2005, and further directed that the selection of auditors be submitted for ratification by the stockholders at the Annual Meeting.

The Company has been advised by KPMG LLP that neither that firm nor any of its associates has any relationship with the Company or its subsidiaries other than the usual relationship that exists between independent certified public accountants and clients. KPMG LLP will have one or more representatives at the Annual Meeting who will have an opportunity to make a statement, if they so desire, and who will be available to respond to appropriate questions.

Fees Paid to KPMG LLP. During the fiscal year ended December 31, 2005 and 2004, the Company retained and paid KPMG LLP for the indicated services as follows:

| | 2005 | | 2004 | |

Audit Fees | | $ | 698,000 | | $ | 533,000 | |

Audit-Related Fees | | — | | 77,060 | |

Tax Fees | | $ | 91,100 | | 66,920 | |

All Other Fees | | — | | — | |

| | | | | | | |

Audit Fees. Audit fees for the years ended December 31, 2005 and 2004, were $698,000 and $533,000, respectively, for the annual audit and quarterly reviews of the consolidated financial statements. For the year ended December 31, 2005, audit fees also include fees related to compliance with Section 404 of the Sarbanes-Oxley Act regarding the Company’s internal control over financial reporting and fees related to the audit of the Company’s acquisition of Hawthorne.

Audit-Related Fees. For 2004, audit-related fees related primarily to due diligence and related work in connection with the Company’s acquisition of Hawthorne, including the filing of various registration statements.

Tax fees. Tax fees relate primarily to assistance with tax return compliance.

Audit Committee Pre-Approval Policies and Procedures. The Sarbanes-Oxley Act of 2002 required the Company to implement a pre-approval process for all engagements with its external auditor. In response to the Sarbanes-Oxley requirements pertaining to auditor independence, the Company’s Audit Committee adopted pre-approval procedures for the appointment of the external auditor and any non-audit services, including tax services, to be performed by the external auditor unless such pre-approval is not required under the Sarbanes-Oxley Act. These procedures require that the annual audit services engagement terms and fees be pre-approved by the Company’s Audit Committee. The Audit Committee may delegate to one or more members of the committee the authority to grant pre-approvals for auditing and allowable non-auditing services, which decision shall be presented to the full committee at its next scheduled meeting for ratification.

All internal auditing is performed under the direct control of the internal auditor, who is accountable to the Company’s Audit Committee.

The Board of Directors recommends that you vote FOR the ratification of the appointment of KPMG LLP as independent auditors for the fiscal year ending December 31, 2006.

21

STOCKHOLDER PROPOSALS