This presentation may include forward-looking statements (related to the

plans, beliefs and goals of CCBI and its subsidiaries), which involve certain

risks and uncertainties that could cause actual results to differ materially from

those in the forward-looking statements. Such risks and uncertainties include,

but are not limited to, the following factors: competitive pressure in the

banking industry; changes in the interest rate environment; the health of the

economy, either nationally or regionally; the deterioration of credit quality,

which would cause an increase in the provision for possible loan and lease

losses; changes in the regulatory environment; changes in business conditions,

particularly in California real estate; volatility of rate sensitive deposits;

asset/liability matching risks and liquid ity risks; and changes in the securities

markets. CCBI undertakes no obligation to revise or publicly release any

revision to these forward-looking statements.

Regulation FD

CCBI Overview

Diversified Financial Services Company Based in

Irvine, California

Uniquely focused business strategy

Attractive client base

Strong organic growth

Business Strategy

Focused on financial needs of income property investors, middle-market

businesses, high net-worth individuals and professionals

Integrate borrower and depositor, expand relationship banking:

Business

Private

Continue core asset origination strategy to support broader business objectives:

Grow balance sheet and net interest income by originating high quality multi-family loans

Invest excess liquidity and equity in U.S. Government agency MBS

Expand organically: consider opening branches in locations with high

concentrations of existing franchise borrower and depositor clients

Irvine

Rancho Santa Margarita

Riverside

La Jolla banking office projected to open in September 2003

Platform Supports Strategy

Size, Strength, Growth and Opportunity

$311 billion market value in California (15% of U.S. total) *

6 of the top 10 U.S. markets are in California*

Los Angeles, San Francisco, San Diego, San Jose, Oakland & Orange County

Market grew 35% between 2001 and 2002 ($13.4 billion – $18.1 billion)**

29,000+ loans originated in California in 2002 (average size of $616,000)**

2 largest originators comprise 25% of market (900+ lenders account for the

Attractive Multi-family Market

* source: National Multi Housing Council Oct. 2001

**source: DataQuick Dec. 2002 Data

balance)**

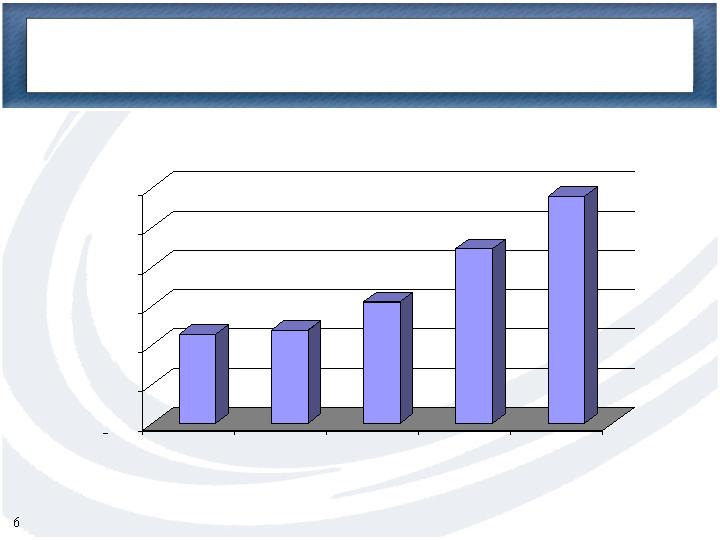

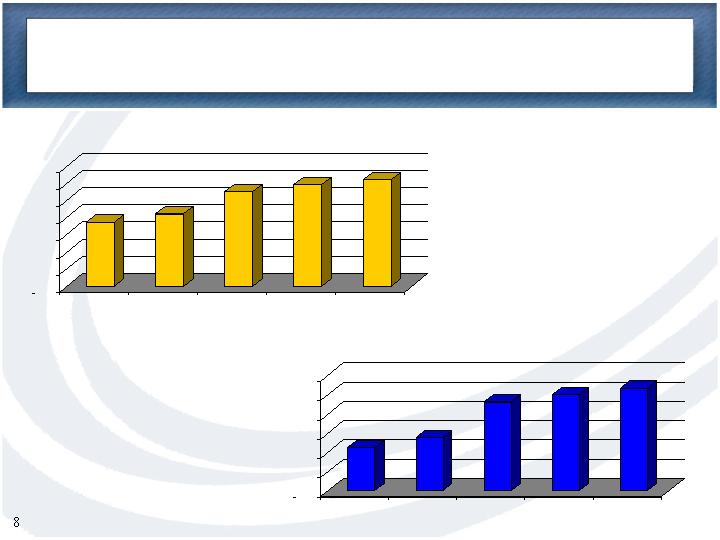

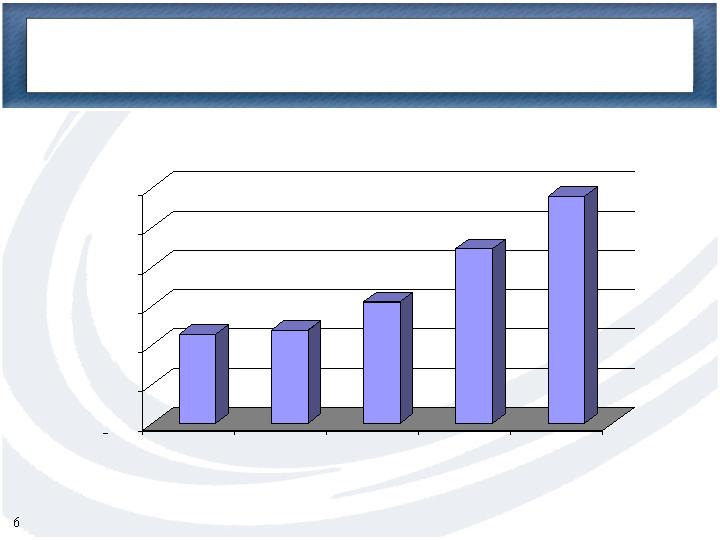

Balance Sheet Growth

$228

$238

$310

$447

$581

$-

$100

$200

$300

$400

$500

$600

6/02

9/02

12/02

3/03

6/03

Total Securities

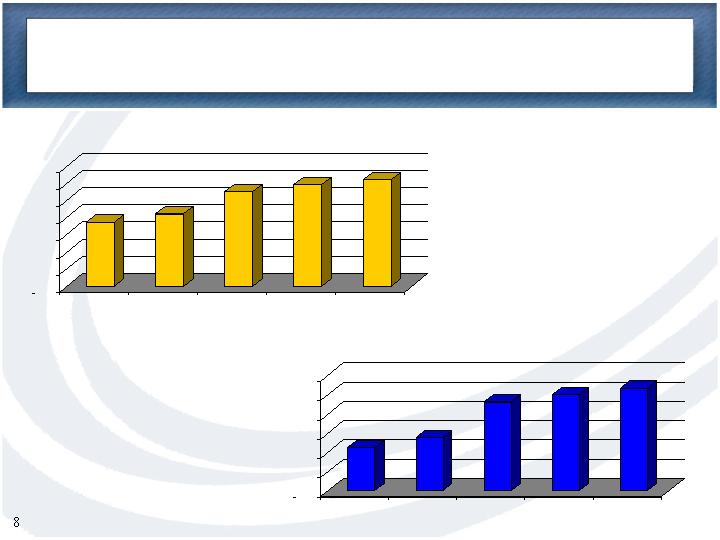

Capital Growth

$33.4

$38.0

$77.6

$84.8

$91.3

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

6/02

9/02

12/02

3/03

6/03

Stockholders' Equity

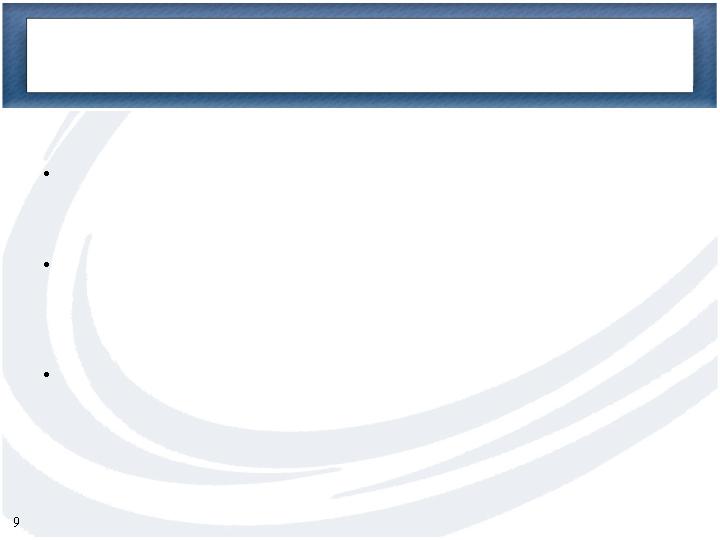

Book Value

$3.73

$4.24

$5.55

$5.91

$6.24

$-

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00

6/02

9/02

12/02

3/03

6/03

Book Value per Share

$2.28

$2.78

$4.62

$5.00

$5.35

$-

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

6/02

9/02

12/02

3/03

6/03

Tangible Book Value per Share

CCB was the fastest growing bank in California over

the 36 months ended 3/31/03, (source www.fdic.gov).

3rd largest multi-family originator in CA with 2.9%

market share for the 12 months ended 3/31/03, (source:

Dataquick Information Systems).

Ranked 7th of 100 largest public thrifts in overall

financial performance by SNL Financial’s

ThriftInvestor.

Leading Loan Originator & High Growth Bank