This presentation may include forward-looking statements (related to the

plans, beliefs and goals of CCBI and its subsidiaries), which involve certain

risks and uncertainties that could cause actual results to differ materially from

those in the forward-looking statements. Such risks and uncertainties include,

but are not limited to, the following factors: competitive pressure in the

banking industry; changes in the interest rate environment; the health of the

economy, either nationally or regionally; the deterioration of credit quality,

which would cause an increase in the provision for possible loan and lease

losses; changes in the regulatory environment; changes in business conditions,

particularly in California real estate; volatility of rate sensitive deposits;

asset/liability matching risks and liquidity risks; and changes in the securities

markets. CCBI undertakes no obligation to revise or publicly release any

revision to these forward-looking statements.

Regulation FD

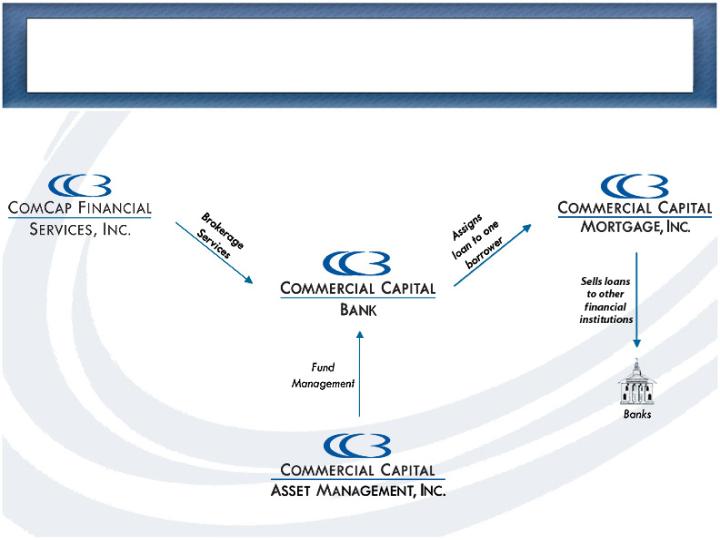

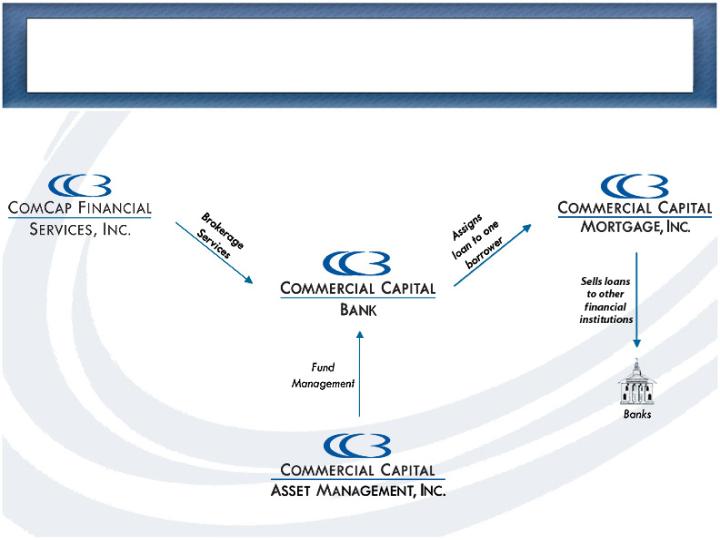

Platform Supports Strategy

CCBI Overview

Diversified Financial Services Company Based in

Irvine, California

Uniquely focused business strategy

Attractive client base

Strong organic growth

Pristine asset quality

Business Strategy

Focused on financial needs of income property investors, middle-market

businesses, high net-worth individuals and professionals

Integrate borrower and depositor, expand relationship banking:

Income property real estate investors

1031 exchange accommodators

Title / escrow companies

Businesses & business owners

High net-worth private clients

Continue core asset origination strategy to support broader business

objectives:

Grow balance sheet and net interest income by originating high quality multi-family loans

Invest excess liquidity and equity in U.S. Government / Agency MBS

Expand organically: consider opening branches in locations with high

concentrations of existing franchise borrower and depositor clients

Irvine

Rancho Santa Margarita

Riverside

La Jolla

Attractive Multi-family Market

California is the largest multi-family market in the U.S., with over 2.5 million units

Los Angeles 2nd highest & San Diego 3rd highest percentage of renters behind New York City*

6 of the top 10 U.S. markets are in California**

Los Angeles, San Francisco, San Diego, San Jose, Oakland & Orange County

Supply constrained by:

lack of land

down zoning

building restrictions

significant portion of California market is rent controlled

35,000+ loans originated in California with avg. size of $667,000 (10/02 – 9/03)***

2 largest originators comprise 28% of market ***

900+ lenders account for remaining 72% of market

*source: U.S. Census Data & National Multi Housing Council **source: National Multi Housing Council ***source: DataQuick,

Portfolio LTV and DCR

Multi-Family

Loan to Value 68.5%

Debt Coverage Ratio 1.29:1

Commercial RE

Loan to Value 65.2%

Debt Coverage Ratio 1.40:1

Values are weighted average ratios, at origination, for the Company’s

Sept. 30, 2003 loan portfolio.

Stockholders’ Equity

Book Value per Share

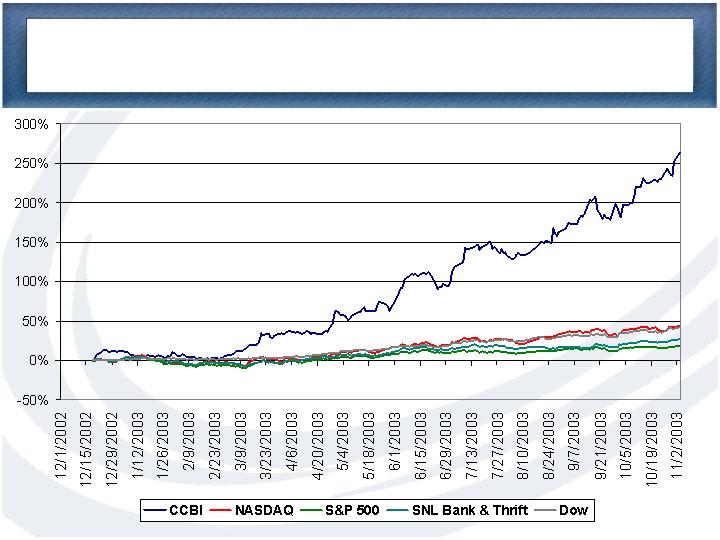

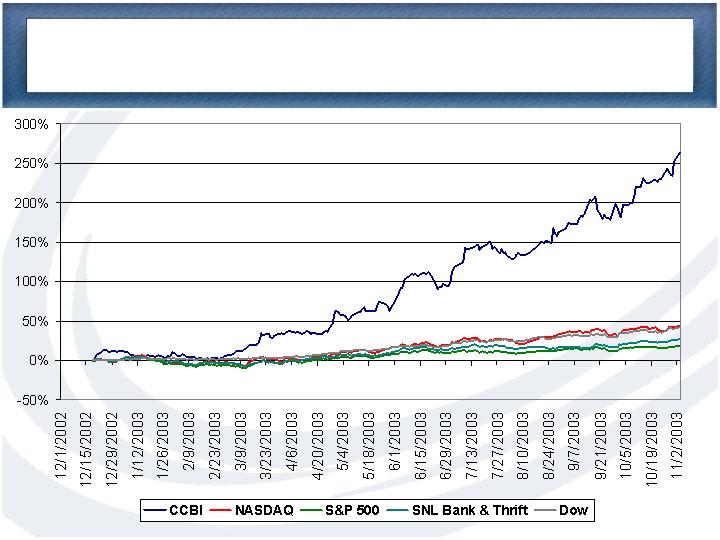

Stock Performance

Dec. 18, 2002 – Nov. 4, 2003