Strategically Compelling

Leading statewide income property lender

Third largest originator of multi-family loans in

CA(1)

Fastest growing savings institution in CA, 6th

largest in California, 26th largest in US (2,3)

Amongst the most efficient operations in the

industry

Approximately 60% of income property

transactions are purchase transactions

Majority of purchase transactions are 1031

exchanges

Business/relationship banking focuses on

income property real estate investors,

property management companies, title and

escrow companies, 1031 exchange

accommodators – businesses touched in

process of making loans.

Leading accommodator of §1031 tax-

deferred exchanges

Providing service for over 25 years

Majority of transactions and clients are So.

California based

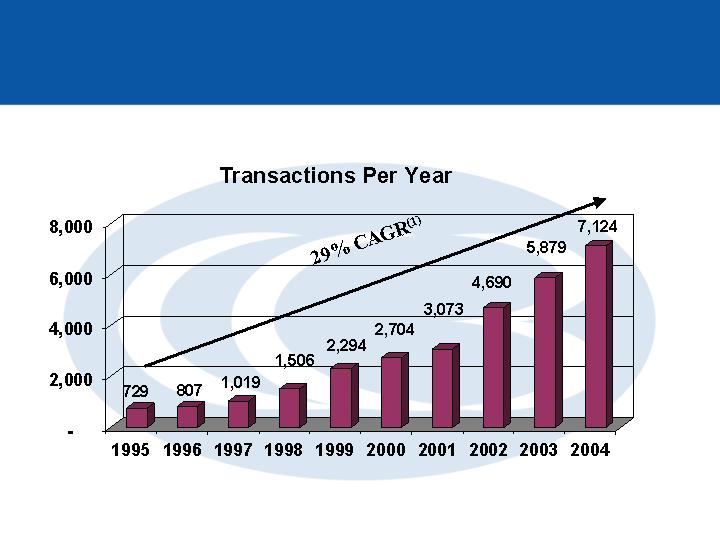

29% compounded annual growth in

transactions since ’95

Approximately $500 per transaction, $250

each way in non-interest fee income

generation

Over 7,000 transactions completed in 2004

Approximately $400 million in exchange

balances held at 1/31/05

Exchange balance deposit cost of

approximately 1.0%

CCBI

TIMCOR

(1)

12 months ended 9/30/04 (Dataquick Info. Sys.)

(2)

36 months ended 9/30/04 (www.fdic.com)

(3)

SNL Financial, SNL Datasource

3