| | |

| | | Filed by COMMERCIAL CAPITAL BANCORP, INC. (Commission File No. 000-50126) pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed pursuant to Rule 14a-12 of the Securities and Exchange Act of 1934, as amended. Subject Company: Hawthorne Financial Corporation (Commission File No. 000-01100) |

.

Forward Looking Statements

This presentation contains forward-looking statements regarding CCBI’s acquisition of

Hawthorne. These forward-looking statements involve certain risks and uncertainties.

Factors that may cause actual results to differ materially from those contemplated by such

forward-looking statements include, among others, the following possibilities: (1)

governmental approvals of the merger may not be obtained or adverse regulatory

conditions may be imposed in connection with governmental approvals of the merger; (2)

the stockholders of CCBI and Hawthorne may fail to provide the required approvals to

consummate the merger; (3) estimated cost savings from the acquisition cannot be fully

realized within the expected time frame or to the extent estimated; (4) revenues following

the acquisition are lower than expected; (5) competitive pressure among depository

institutions increases significantly; (6) costs or difficulties related to the integration of the

businesses of CCBI and Hawthorne are greater than expected; (7) changes in the interest

rate environment reduce interest margins; (8) general economic conditions, either

nationally or in the markets in which CCBI will be doing business, are less favorable than

expected; (9) legislation or changes in regulatory requirements adversely affect the

businesses in which CCBI is engaged; or (10) other factors or events occur which would

result in a condition to the transaction not being met.

2

Strategically Compelling

CCBI

• Leading statewide lender

• High quality asset generator

• Fastest growing bank in CA, with

very efficient deposit franchise(1)

• Fourth largest originator of multi-

family loans in CA(2)

• Amongst the most efficient

operations in the industry

• Strong and consistent culture of

high performance with continuity

of talent

Hawthorne

• Leading independent So. CA

banking franchise

• Providing service for over 50

years

• Strong community-based retail

deposit franchise

• Lending strengths include:

– Single Family

– Construction

– Income Property

• Strong middle level and front line

infrastructure

Franchise positioned for stronger growth

(1) 36 months ended 9/30/03 (www.fdic.com)

(2) 12 months ended 9/30/03 (Dataquick Info. Sys.) 3

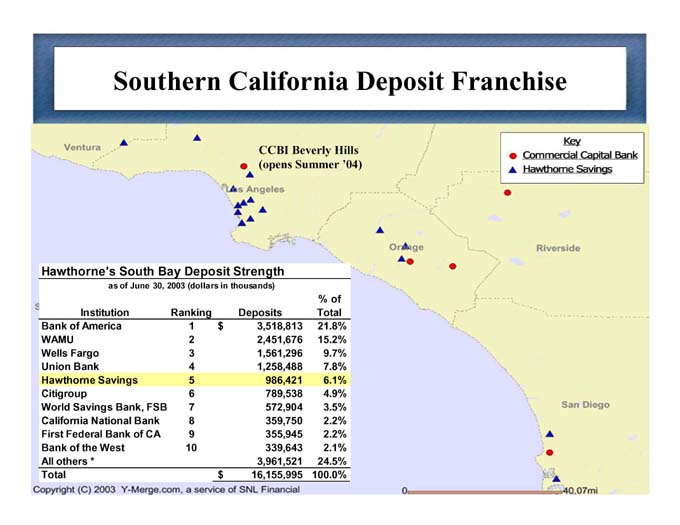

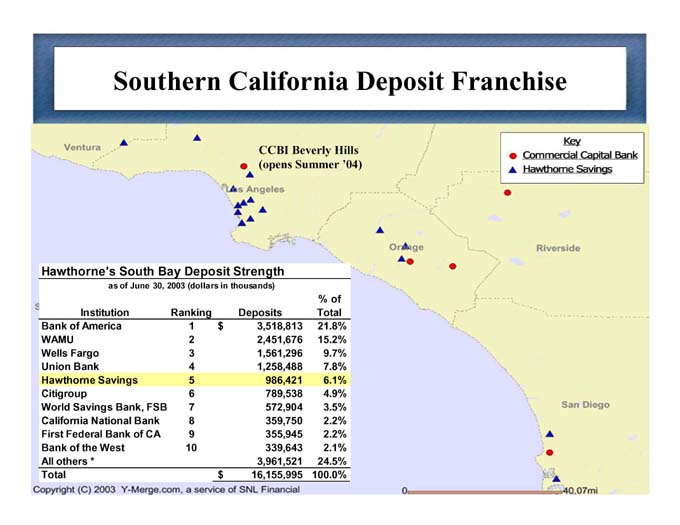

Southern California Deposit Franchise

Hawthorne’s South Bay Deposit Strength

as of June 30, 2003 (dollars in thousands)

% of

Institution Ranking Deposits Total

Bank of America 1 $ 3,518,813 21.8%

WAMU 2 2,451,676 15.2%

Wells Fargo 3 1,561,296 9.7%

Union Bank 4 1,258,488 7.8%

Hawthorne Savings 5 986,421 6.1%

Citigroup 6 789,538 4.9%

World Savings Bank, FSB 7 572,904 3.5%

California National Bank 8 359,750 2.2%

First Federal Bank of CA 9 355,945 2.2%

Bank of the West 10 339,643 2.1%

All others * 3,961,521 24.5%

Total $ 16,155,995 100.0%

Copyright © 2003 y-Merge.com, a service of SNL Financial

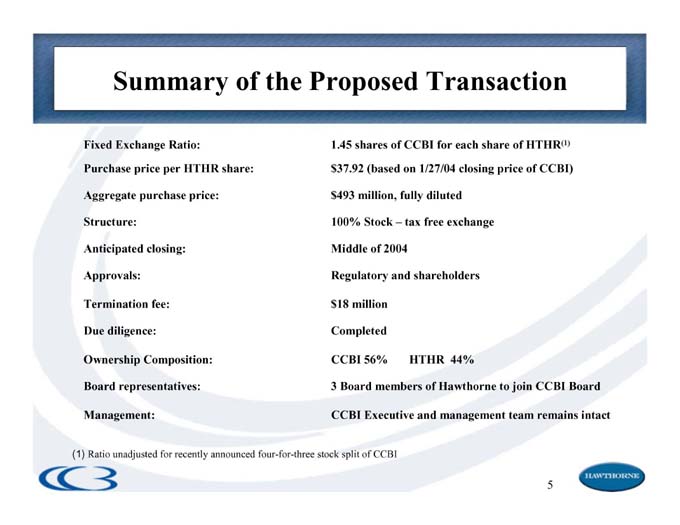

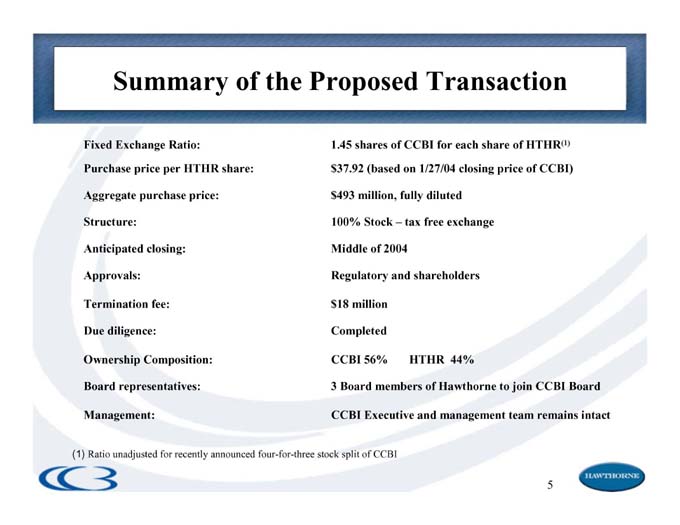

Summary of the Proposed Transaction

Fixed Exchange Ratio: 1.45 shares of CCBI for each share of HTHR(1)

Purchase price per HTHR share: $37.92 (based on 1/27/04 closing price of CCBI)

Aggregate purchase price: $493 million, fully diluted

Structure: 100% Stock – tax free exchange

Anticipated closing: Middle of 2004

Approvals: Regulatory and shareholders

Termination fee: $18 million

Due diligence: Completed

Ownership Composition: CCBI 56% HTHR 44%

Board representatives: 3 Board members of Hawthorne to join CCBI Board

Management: CCBI Executive and management team remains intact

(1) Ratio unadjusted for recently announced four-for-three stock split of CCBI

5

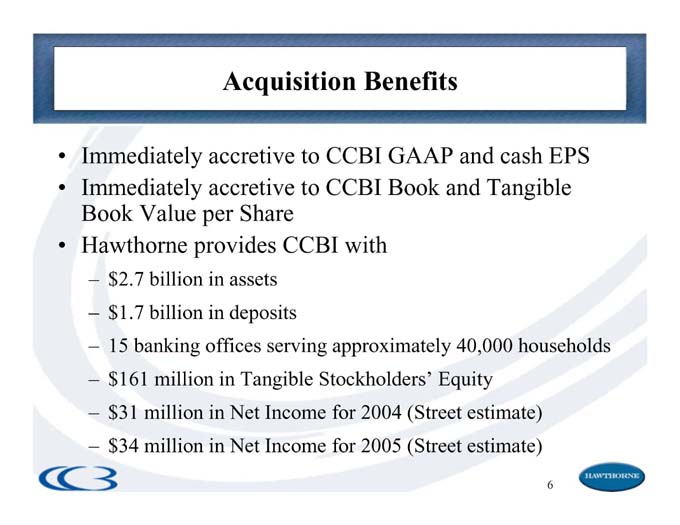

Acquisition Benefits

• Immediately accretive to CCBI GAAP and cash EPS

• Immediately accretive to CCBI Book and Tangible

Book Value per Share

• Hawthorne provides CCBI with

– $2.7 billion in assets

– $1.7 billion in deposits

– 15 banking offices serving approximately 40,000 households

– $161 million in Tangible Stockholders’ Equity

– $31 million in Net Income for 2004 (Street estimate)

– $34 million in Net Income for 2005 (Street estimate)

6

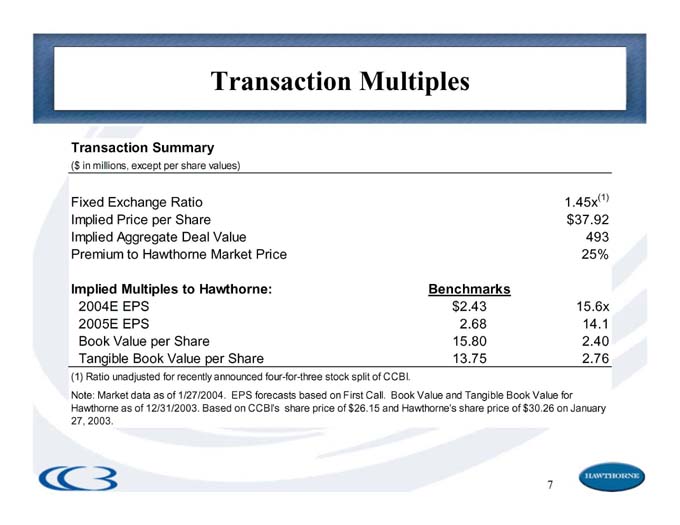

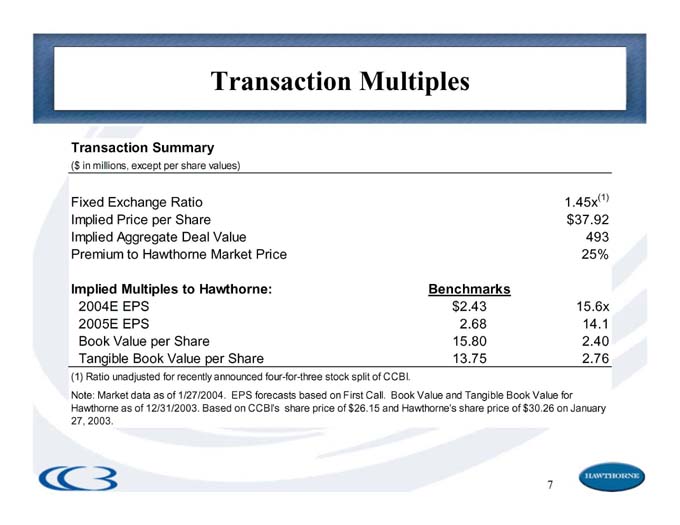

Transaction Multiples

Transaction Summary

($ in millions, except per share values)

Fixed Exchange Ratio 1.45x(1)

Implied Price per Share $ 37.92

Implied Aggregate Deal Value 493

Premium to Hawthorne Market Price 25%

Implied Multiples to Hawthorne: Benchmarks

2004E EPS $ 2.43 15.6x

2005E EPS 2.68 14.1

Book Value per Share 15.80 2.40

Tangible Book Value per Share 13.75 2.76

(1) Ratio unadjusted for recently announced four-for-three stock split of CCBI.

Note: Market data as of 1/27/2004. EPS forecasts based on First Call. Book Value and Tangible Book Value for Hawthorne as of 12/31/2003. Based on CCBI’s share price of $26.15 and Hawthorne’s share price of $30.26 on January 27, 2003.

7

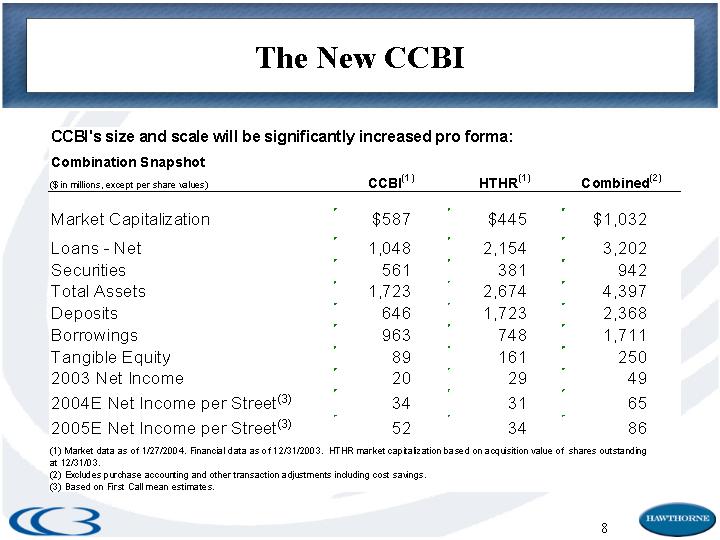

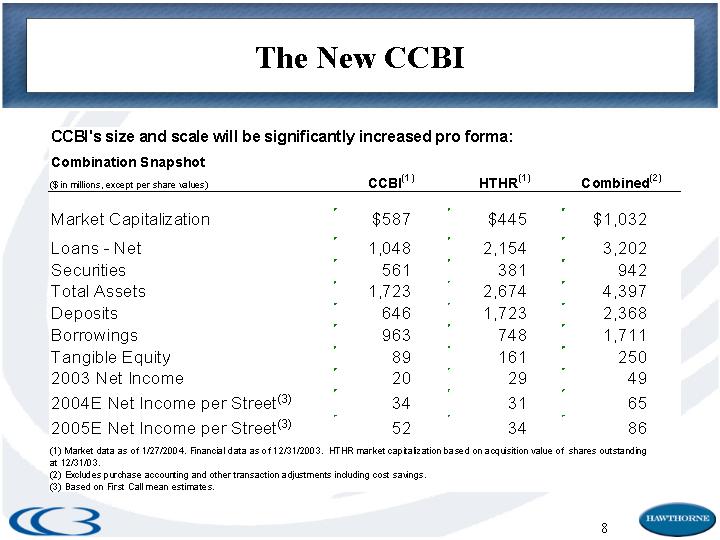

The New CCBI

CCBI’s size and scale will be significantly increased pro forma:

Combination Snapshot

($ in millions, except per share values) CCBI(1) HTHR(1) Combined(2)

Market Capitalization $ 587 $ 445 $ 1,032

Loans—Net 1,048 2,154 3,202

Securities 561 381 942

Total Assets 1,723 2,674 4,397

Deposits 646 1,723 2,368

Borrowings 963 748 1,711

Tangible Equity 89 161 250

2003 Net Income 20 29 49

2004E Net Income per Street(3) 34 31 65

2005E Net Income per Street(3) 52 34 86

(1) Market data as of 1/23/2004. Financial data as of 12/31/2003. HTHR market capitalization based on acquisition value.

(2) Excludes purchase accounting and other transaction adjustments including cost savings.

(3) Based on First Call mean estimates.

8

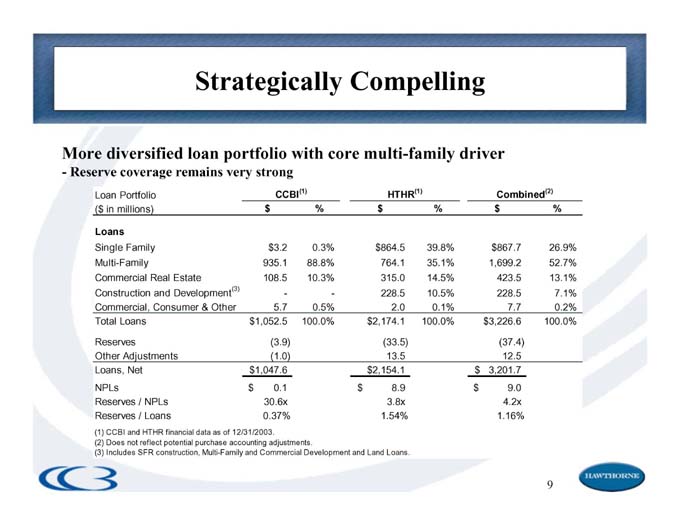

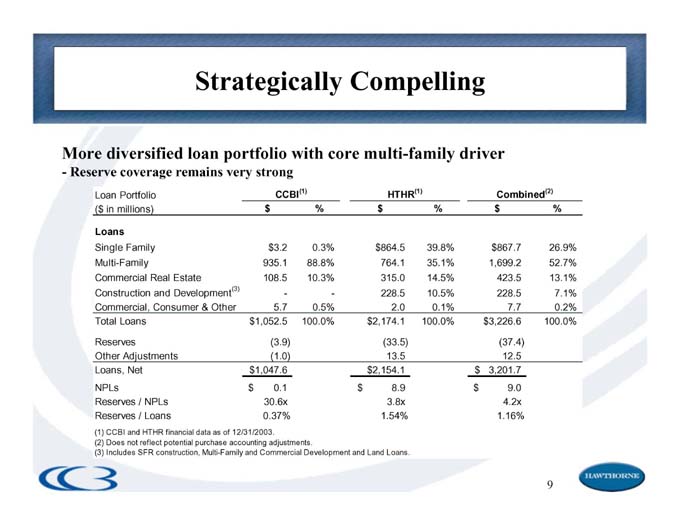

Strategically Compelling

More diversified loan portfolio with core multi-family driver

- Reserve coverage remains very strong

Loan Portfolio CCBI(1) HTHR(1) Combined(2)

($ in millions) $ % $ % $ %

Loans

Single Family $ 3.2 0.3% $ 864.5 39.8% $ 867.7 26.9%

Multi-Family 935.1 88.8% 764.1 35.1% 1,699.2 52.7%

Commercial Real Estate 108.5 10.3% 315.0 14.5% 423.5 13.1%

Construction and Development(3) - - 228.5 10.5% 228.5 7.1%

Commercial, Consumer & Other 5.7 0.5% 2.0 0.1% 7.7 0.2%

Total Loans $ 1,052.5 100.0% $ 2,174.1 100.0% $ 3,226.6 100.0%

Reserves (3.9) (33.5) (37.4)

Other Adjustments (1.0) 13.5 12.5

Loans, Net $ 1,047.6 $ 2,154.1 $ 3,201.7

NPLs $ 0.1 $ 8.9 $ 9.0

Reserves / NPLs 30.6x 3.8x 4.2x

Reserves / Loans 0.37% 1.54% 1.16%

(1) CCBI and HTHR financial data as of 12/31/2003.

(2) Does not reflect potential purchase accounting adjustments.

(3) Includes SFR construction, Multi-Family and Commercial Development and Land Loans.

9

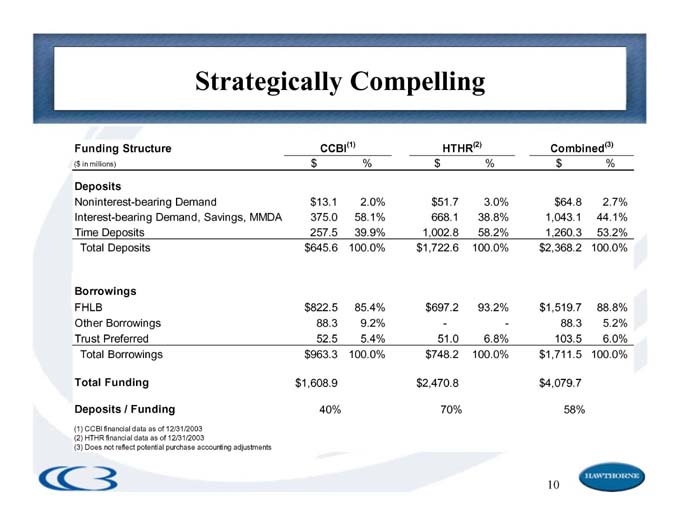

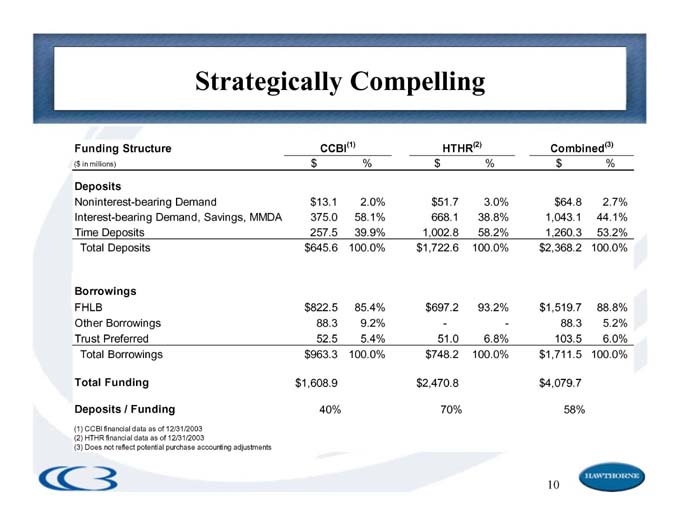

Strategically Compelling

Funding Structure CCBI(1) HTHR(2) Combined(3)

($ in millions) $ % $ % $ %

Deposits

Noninterest-bearing Demand $ 13.1 2.0% $ 51.7 3.0% $ 64.8 2.7%

Interest-bearing Demand, Savings, MMDA 375.0 58.1% 668.1 38.8% 1,043.1 44.1%

Time Deposits 257.5 39.9% 1,002.8 58.2% 1,260.3 53.2%

Total Deposits $ 645.6 100.0% $ 1,722.6 100.0% $ 2,368.2 100.0%

Borrowings

FHLB $ 822.5 85.4% $ 697.2 93.2% $ 1,519.7 88.8%

Other Borrowings 88.3 9.2% - - 88.3 5.2%

Trust Preferred 52.5 5.4% 51.0 6.8% 103.5 6.0%

Total Borrowings $ 963.3 100.0% $ 748.2 100.0% $ 1,711.5 100.0%

Total Funding $ 1,608.9 $ 2,470.8 $ 4,079.7

Deposits / Funding 40% 70% 58%

(1) CCBI financial data as of 12/31/2003

(2) HTHR financial data as of 12/31/2003

(3) Does not reflect potential purchase accounting adjustments

10

Low Risk Transaction

• CCBI team has significant acquisition and

integration experience

• Hawthorne team successfully integrated First

Fidelity

• No expected branch consolidations

• CCBI to migrate to majority of HTHR systems

11

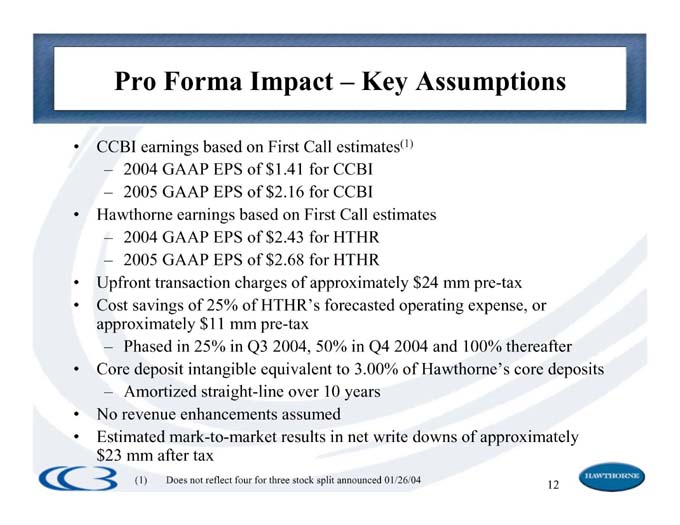

Pro Forma Impact – Key Assumptions

• CCBI earnings based on First Call estimates(1)

– 2004 GAAP EPS of $ 1.41 for CCBI

– 2005 GAAP EPS of $ 2.16 for CCBI

• Hawthorne earnings based on First Call estimates

– 2004 GAAP EPS of $2.43 for HTHR

– 2005 GAAP EPS of $2.68 for HTHR

• Upfront transaction charges of approximately $24 mm pre-tax

• Cost savings of 25% of HTHR’s forecasted operating expense, or

approximately $11 mm pre-tax

– Phased in 25% in Q3 2004, 50% in Q4 2004 and 100% thereafter

• Core deposit intangible equivalent to 3.00% of Hawthorne’s core deposits

– Amortized straight-line over 10 years

• No revenue enhancements assumed

• Estimated mark-to-market results in net write downs of approximately

$23 mm after tax

(1) Does not reflect four for three stock split announced 01/26/04 12

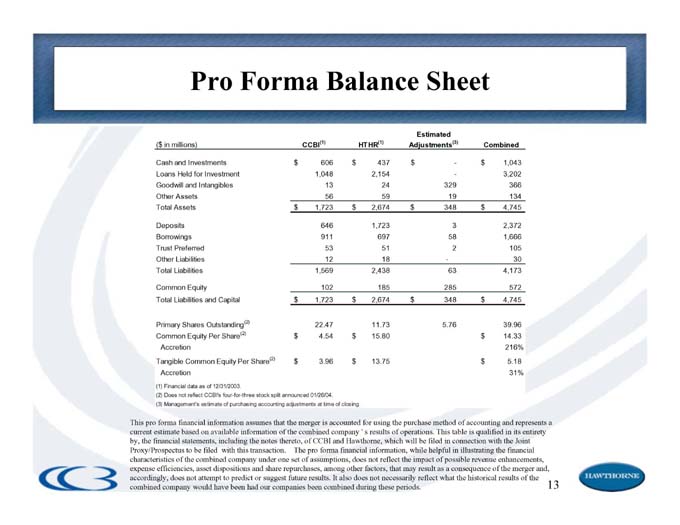

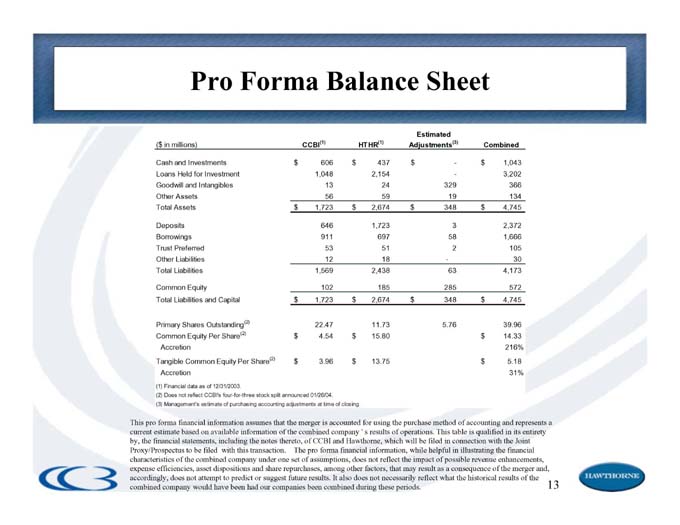

Pro Forma Balance Sheet

Estimated

($ in millions) CCBI(1) HTHR(1) Adjustments(3) Combined

Cash and Investments $ 606 $ 437 $ - $ 1,043

Loans Held for Investment 1,048 2,154 - 3,202

Goodwill and Intangibles 13 24 329 366

Other Assets 56 59 19 134

Total Assets $ 1,723 $ 2,674 $ 348 $ 4,745

Deposits 646 1,723 3 2,372

Borrowings 911 697 58 1,666

Trust Preferred 53 51 2 105

Other Liabilities 12 18 - 30

Total Liabilities 1,569 2,438 63 4,173

Common Equity 102 185 285 572

Total Liabilities and Capital $ 1,723 $ 2,674 $ 348 $ 4,745

Primary Shares Outstanding(2) 22.47 11.73 5.76 39.96

Common Equity Per Share(2) $ 4.54 $ 15.80 $ 14.33

Accretion 216%

Tangible Common Equity Per Share(2) $ 3.96 $ 13.75 $ 5.18

Accretion 31%

(1) Financial data as of 12/31/2003.

(2) Does not reflect CCBI’s four-for-three stock split announced 01/26/04.

(3) Management’s estimate of purchasing accounting adjustments at time of closing.

This pro forma financial information assumes that the merger is accounted for using the purchase method of accounting and represents a current estimate based on available information of the combined company ‘ s results of operations. This table is qualified in its entirety by, the financial statements, including the notes thereto, of CCBI and Hawthorne, which will be filed in connection with the Joint Proxy/Prospectus to be filed with this transaction. The pro forma financial information, while helpful in illustrating the financial

characteristics of the combined company under one set of assumptions, does not reflect the impact of possible revenue enhancements, expense efficiencies, asset dispositions and share repurchases, among other factors, that may result as a consequence of the merger and, accordingly, does not attempt to predict or suggest future results. It also does not necessarily reflect what the historical results of the combined company would have been had our companies been combined during these periods. 13

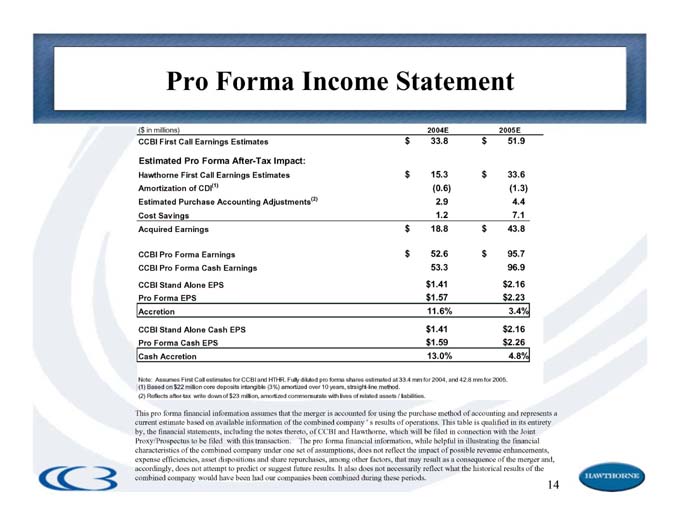

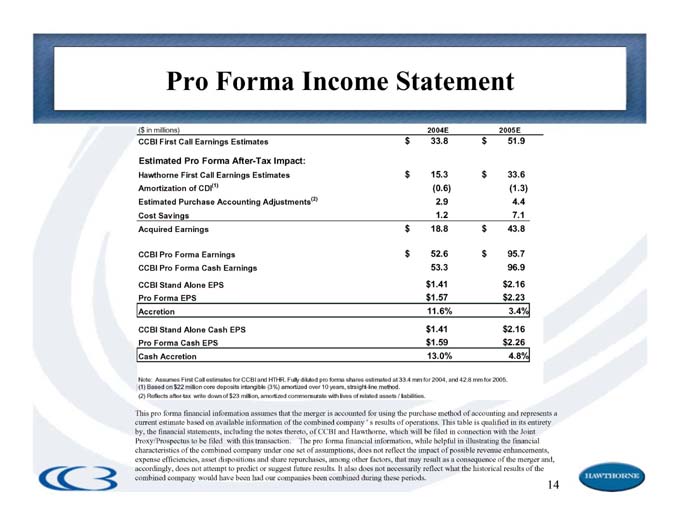

Pro Forma Income Statement

($ in millions) 2004E 2005E

CCBI First Call Earnings Estimates $33.8 $51.9

Estimated Pro Forma After-Tax Impact:

Hawthorne First Call Earnings Estimates $15.3 $33.6

Amortization of CDI(1) (0.6) (1.3)

Estimated Purchase Accounting Adjustments(2) 2.9 4.4

Cost Savings 1.2 7.1

Acquired Earnings $18.8 $43.8

CCBI Pro Forma Earnings $52.6 $95.7

CCBI Pro Forma Cash Earnings 53.3 96.9

CCBI Stand Alone EPS $1.41 $2.16

Pro Forma EPS $1.57 $2.23

Accretion 11.6% 3.4%

CCBI Stand Alone Cash EPS $1.41 $2.16

Pro Forma Cash EPS $1.59 $2.26

Cash Accretion 13.0% 4.8%

Note: Assumes First Call estimates for CCBI and HTHR. Fully diluted pro forma shares estimated at 33.4 mm for 2004, and 42.8 mm for 2005.

(1) Based on $22 million core deposits intangible (3%) amortized over 10 years, straight-line method.

(2) Reflects after-tax write down of $23 million, amortized commensurate with lives of related assets / liabilities.

This pro forma financial information assumes that the merger is accounted for using the purchase method of accounting and represents a current estimate based on available information of the combined company ‘ s results of operations. This table is qualified in its entirety by, the financial statements, including the notes thereto, of CCBI and Hawthorne, which will be filed in connection with the Joint Proxy/Prospectus to be filed with this transaction. The pro forma financial information, while helpful in illustrating the financial

characteristics of the combined company under one set of assumptions, does not reflect the impact of possible revenue enhancements, expense efficiencies, asset dispositions and share repurchases, among other factors, that may result as a consequence of the merger and, accordingly, does not attempt to predict or suggest future results. It also does not necessarily reflect what the historical results of the combined company would have been had our companies been combined during these periods.

14

CCBI Stock Upside

Pro Forma Benchmarks

CCBI Pro Forma Selected Banking Companies(1)

Benchmark Multiple Low Median High

Price to:

2004E EPS $1.57 16.6x 11.3x 14.6x 24.8x

2005E EPS 2.23 11.7x 11.2x 12.8x 20.6x

Book Value 14.33 1.82x 1.64x 2.37x 4.57x

Tangible Book Value 5.18 5.05x 1.75x 3.40x 6.98x

Long-Term Growth Rate 17%(3) 10% 14% 19%

P / E / G Ratio (2) 69% 68% 110% 131%

(1) Includes selected depository institutions with significant portfolio of Multi-Family loans and/or Southern California institutions:

CYN, DCOM, EWBC, FCBP, FED, FFIC, ICBC, NYB, PFB, QCBC, STSA, and UCBH.

(2) Based on Pro Forma 2005 EPS multiple.

(3) Assumes current consensus estimate remains unchanged.

15

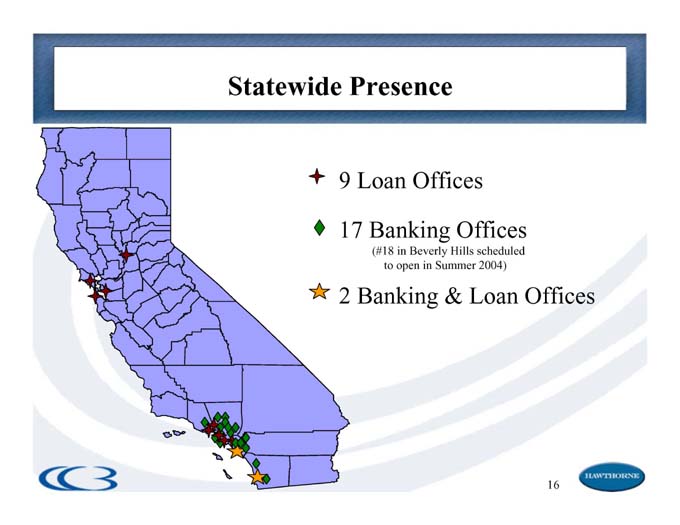

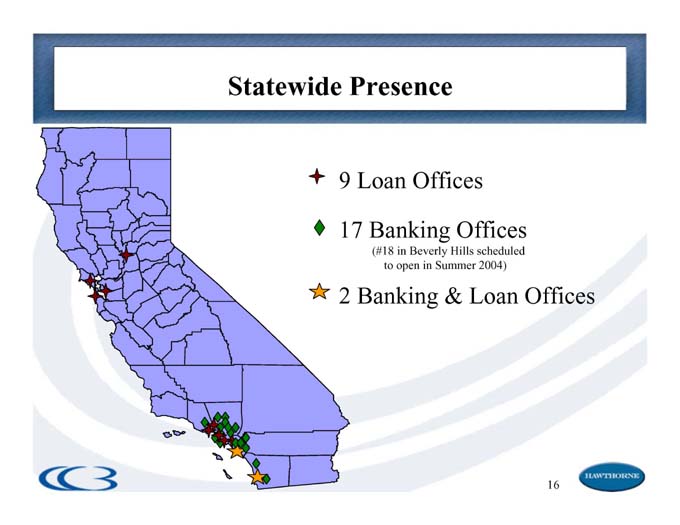

Statewide Presence

9 Loan Offices

17 Banking Offices

(#18 in Beverly Hills scheduled

to open in Summer 2004)

2 Banking & Loan Offices

16

Transaction Summary

• Financially Attractive

• One of the Few Statewide Franchises in California

• Stronger Foundation for Continued Growth

• Upside Potential

17

Additional Information About this Transaction

Commercial Capital Bancorp, Inc. (“CCBI”) and Hawthorne Financial Corporation (“Hawthorne”) will file a Joint Proxy Statement/Prospectus and other documents regarding this transaction with the Securities and Exchange Commission (“SEC”). CCBI and Hawthorne will mail the Joint Proxy Statement/Prospectus to their respective stockholders. These documents will contain important information about the transaction, and CCBI and Hawthorne urge you to read these documents when they become available.

You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). In addition, investors may obtain free copies of the documents filed with the SEC by CCBI by contacting Investor Relations, Commercial Capital Bancorp, Inc., One Venture, 3rd Floor Irvine, CA 92618, telephone: 949-585-7500 or by visiting CCBI’s website atwww.commercialcapital.com, or from Hawthorne by contacting Investor Relations, Hawthorne Financial Corporation, 2381 Rosecrans Avenue, El Segundo, CA 90245, telephone: 310-725-5000 or by visiting Hawthorne’s website atwww.hawthornesavings.com.

Additional Information About this Transaction

Commercial Capital Bancorp, Inc. (“CCBI”) and Hawthorne Financial Corporation (“Hawthorne”) will file a Joint Proxy Statement/Prospectus and other documents regarding this transaction with the Securities and Exchange Commission (“SEC”). CCBI and Hawthorne will mail the Joint Proxy Statement/Prospectus to their respective stockholders. These documents will contain important information about the transaction, and CCBI and Hawthorne urge you to read these documents when they become available.

You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). In addition, investors may obtain free copies of the documents filed with the SEC by CCBI by contacting Investor Relations, Commercial Capital Bancorp, Inc., One Venture, 3rd Floor Irvine, CA 92618, telephone: 949-585-7500 or by visiting CCBI’s website at www.commercialcapital.com, or from Hawthorne by contacting Investor Relations, Hawthorne Financial Corporation, 2381 Rosecrans Avenue, El Segundo, CA 90245, telephone: 310-725-5000 or by visiting Hawthorne’s website at www.hawthornesavings.com.