UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21201

A&Q Technology Fund LLC

(Exact name of registrant as specified in charter)

600 Washington Boulevard

Stamford, Connecticut 06901

(Address of principal executive offices) (Zip code)

Keith A. Weller, Esq.

UBS Hedge Fund Solutions LLC

One North Wacker Drive

Chicago, IL, 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: 203-719-1428

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| | (a) | The Report to Shareholders is attached herewith. |

A&Q TECHNOLOGY FUND LLC

Financial Statements

with Report of Independent Registered Public Accounting Firm

Year Ended

December 31, 2022

An exemption under Regulation 4.5 has been obtained from the Commodity Futures Trading Commission for

A&Q Technology Fund LLC

A&Q TECHNOLOGY FUND LLC

Financial Statements

with Report of Independent Registered Public Accounting Firm

Year Ended

December 31, 2022

Contents

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

This report provides certain performance data for A&Q Technology Fund LLC (the “Fund”) for the fiscal year ended December 31, 2022.

The Fund’s Investment Approach

The Fund commonly is referred to as a “fund of funds.” Its investment objective is to seek capital appreciation over the long term, and it seeks to achieve this investment objective principally through the allocation of assets among a select group of alternative asset managers (the “Investment Managers”) and the funds they operate. Investment Managers generally conduct their investment programs through unregistered investment vehicles, such as hedge funds, that have investors other than the Fund, and in other registered investment companies (collectively, the “Investment Funds”).

The Fund invests in a portfolio of Investment Funds that primarily employ long/short equity strategies. As of December 31, 2022, the Fund was invested in Investment Funds that employed equity hedged strategies.

Performance Review

The Fund generated a negative return for the year ended December 31, 2022.

The fund struggled during the first quarter of 2022. The majority of losses were incurred from exposure to technology-focused and Asia-focused managers. During the quarter growth stocks materially underperformed against value stocks as a sharp move higher in rates pressured longer duration assets. Managers with exposure to the beta of biotechnology and technology sectors were deeply challenged. Asia-focused managers produced negative returns, as performance was challenged from industry deleveraging and factor rotations.

The Fund generated a negative performance during the second quarter of 2022. The majority of losses were incurred from biotechnology-focused and technology-focused managers. Similar to the previous quarter, equities in general experienced a difficult market environment, as central bank activity pressured the asset class. One technology-focused manager experienced extreme losses during the quarter from long positions in the software sector.

The Fund generated a negative performance during the third quarter of 2022. The majority of losses were incurred from biotechnology-focused and technology-focused managers. Notably, one low net exposure biotechnology manger experienced significant losses during the quarter. The fund’s performance was negatively impacted by the continued short squeeze and rally within the biotechnology sector in August.

The Fund generated a positive performance during the fourth quarter of 2022. During the quarter, short alpha contributed positively to performance, and it was the one of the best quarters for long / short alpha over the past decade. Biotechnology managers outperformed during the quarter.

1

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (UNAUDITED)

Fund Performance

For the 12-month period ended December 31, 2022, the Fund returned -16.67%. The HFRI Equity Hedged Technology/Healthcare Index returned -14.55%.

| | | | |

| Returns | | Fund | | HFRI Equity Hedged

Technology/Healthcare

Index |

| | |

Year-to-date | | -16.67% | | -14.55% |

| | |

1-Year | | -16.67% | | -14.55% |

| | |

3-Year (average annual) | | -0.15% | | 3.71% |

| | |

5-Year (average annual) | | 0.87% | | 6.66% |

| | |

10-Year (average annual) | | 3.87% | | 8.65% |

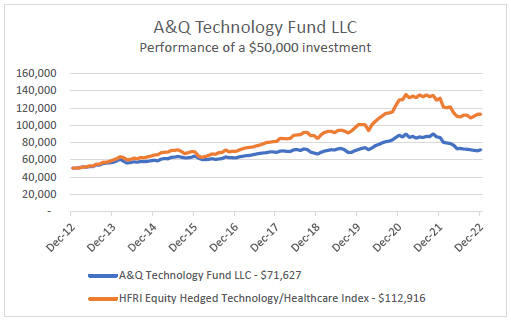

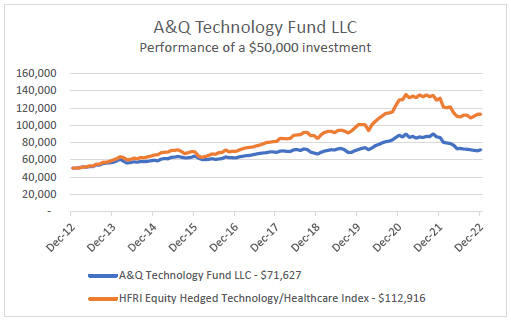

This graph compares a hypothetical $50,000 investment in the Fund with a similar investment in the HFRI Equity Hedged Technology/Healthcare Index. This index does not serve as a benchmark for the Fund and is shown for illustrative purposes only. The Fund does not have a designated performance benchmark. All figures for the Fund are based on its net asset value on the last business day of the first and each subsequent fiscal year, and include the reinvestment of all dividends and capital gains distributions, and the Fund’s maximum sales load of 2%. The index does not reflect expenses, fees or sales loads, which would lower performance.

Although the HFRI Equity Hedged Technology/Healthcare Index is used as a reference point for the A&Q Technology Fund, there may be meaningful differences between the Fund and this index. Because managers self-select into this index, there may not be consistency across the character of underlying funds, and the index may include long-only funds or quantitative funds. Other differences, such as differences in the degree of market beta, will likely lead to differentiated outcomes.

2

| | | | |

| | Ernst & Young LLP One Manhattan West New York, NY - 10001 | | Tel: +1 212 773 3000 ey.com |

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Members of

A&Q Technology Fund LLC

Opinion on the Financial Statements

We have audited the accompanying statement of assets, liabilities and members’ capital of A&Q Technology Fund LLC (the “Fund”), including the schedule of portfolio investments, as of December 31, 2022, and the related statements of operations and cash flows for the year then ended, the statements of changes in members’ capital for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of A&Q Technology Fund LLC at December 31, 2022, the results of its operations and its cash flows for the year then ended, the changes in its members’ capital for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of the Fund’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of investments in investment funds as of December 31, 2022, by correspondence with management of the underlying investment funds. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more of the UBS Hedge Fund Solutions LLC investment companies since 1995.

New York, NY

February 24, 2023

| | |

A member firm of Ernst & Young Global Limited | | 3 |

A&Q Technology Fund LLC

Statement of Assets, Liabilities and Members’ Capital

| | | | |

December 31, 2022 | |

| |

ASSETS | | | | |

| |

Investments in Investment Funds, at fair value (cost $94,810,396) | | $ | 119,823,830 | |

Cash | | | 12,164,801 | |

Receivable from Investment Funds | | | 20,433,180 | |

Other assets | | | 37,686 | |

| |

Total Assets | | | 152,459,497 | |

| |

LIABILITIES | | | | |

| |

Withdrawals payable | | | 28,535,979 | |

Management Fee payable | | | 379,234 | |

Professional fees payable | | | 188,875 | |

Administration fee payable | | | 28,525 | |

Officer’s and Directors’ fees payable | | | 26,795 | |

Payable to Manager | | | 6,251 | |

Custody fee payable | | | 700 | |

Other liabilities | | | 6,599 | |

| |

Total Liabilities | | | 29,172,958 | |

| |

Members’ Capital | | $ | 123,286,539 | |

| |

MEMBERS’ CAPITAL | | | | |

| |

Represented by: | | | | |

Net capital contributions | | $ | 98,273,105 | |

Accumulated net unrealized appreciation/(depreciation) on investments in Investment Funds | | | 25,013,434 | |

| |

Members’ Capital | | $ | 123,286,539 | |

The accompanying notes are an integral part of these financial statements.

4

A&Q Technology Fund LLC

Schedule of Portfolio Investments

December 31, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Investment Fund (a) | | Geographic

Focus | | | Cost | | | Fair Value | | | % of

Members’

Capital | | | Initial

Acquisition Date | | | Redemption

Frequency (b) | | Redemption

Notice

Period (c) | | | First Available

Redemption Date | | | Dollar Amount of

Fair Value for

First Available

Redemption | |

| | | | | | | | | | |

Equity Hedged | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Alta Park Fund Onshore, LP | | | US/Canada | | | $ | 12,037,466 | | | $ | 12,151,281 | | | | 9.86 % | | | | 7/1/2019 | | | Quarterly | | | 45 days | | | | 12/31/2022 | | | | | | | $ | 12,151,281 | |

Averill Partners L.P. | | | US/Canada | | | | 8,273,973 | | | | 9,587,304 | | | | 7.78 | | | | 4/1/2021 | | | Quarterly | | | 60 days | | | | 3/31/2023 | | | | (d),(e) | | | $ | 1,189.853 | |

Avidity Capital Fund L.P. | | | US/Canada | | | | 13,000,000 | | | | 14,244,894 | | | | 11.55 | | | | 4/1/2020 | | | Quarterly | | | 60 days | | | | 12/31/2022 | | | | | | | $ | 14,244,894 | |

Biomedical Value Fund, L.P. | | | US/Canada | | | | 17,145,756 | | | | 20,974,158 | | | | 17.01 | | | | 3/1/2019 | | | Quarterly | | | 120 days | | | | 12/31/2022 | | | | | | | $ | 20,974,158 | |

Cadian Fund, L.P. | | | US/Canada | | | | 3,000,000 | | | | 3,051,779 | | | | 2.47 | | | | 12/1/2022 | | | Quarterly | | | 60 days | | | | 12/31/2022 | | | | (e) | | | $ | 762,945 | |

Dantai Master Fund | | | Greater China | | | | 1,628,169 | | | | 640,969 | | | | 0.52 | | | | 4/1/2021 | | | N/A | | | N/A | | | | N/A | | | | (f) | | | | N/A | |

G2 Investment Partners QP, L.P. | | | US/Canada | | | | 5,765,810 | | | | 11,842,806 | | | | 9.61 | | | | 5/1/2014 | | | Monthly | | | 60 days | | | | 12/31/2022 | | | | (g) | | | $ | 5,921,403 | |

Jericho Capital Partners L.P. | | | US/Canada | | | | 4,696,722 | | | | 12,219,316 | | | | 9.91 | | | | 5/1/2011 | | | Quarterly | | | 60 days | | | | 12/31/2022 | | | | | | | $ | 12,219,316 | |

PFM Healthcare Fund, L.P. | | | US/Canada | | | | 14,000,000 | | | | 13,405,366 | | | | 10.87 | | | | 9/1/2022 | | | Quarterly | | | 45 days | | | | 9/30/2023 | | | | (d) | | | $ | 13,405,366 | |

Visium Balanced Fund, L.P. | | | US/Canada | | | | — | | | | — | | | | 0.00 | | | | 1/1/2010 | | | N/A | | | N/A | | | | N/A | | | | (h) | | | | N/A | |

Woodline Fund LP | | | Global | | | | 15,262,500 | | | | 21,705,957 | | | | 17.61 | | | | 8/1/2019 | | | Quarterly | | | 60 days | | | | 12/31/2022 | | | | (e) | | | $ | 5,426,489 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity Hedged Subtotal | | | | | | | 94,810,396 | | | | 119,823,830 | | | | 97.19 | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | $ | 94,810,396 | | | $ | 119,823,830 | | | | 97.19 % | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Each Investment Fund noted within the Schedule of Portfolio Investments is non-income producing. |

| (b) | Available frequency of redemptions after the initial lock-up period, if any. Different tranches may have varying liquidity terms. |

| (c) | Unless otherwise noted, the redemption notice periods are shown in calendar days. |

| (d) | The holding is under lock-up and is not redeemable without paying a fee. |

| (e) | The Investment Fund is subject to an investor level gate of 25%. |

| (f) | All of the Fund’s interests in the Investment Fund are held in side pockets which have restricted liquidity. |

| (g) | The Investment Fund is subject to an investor level gate of 50% during any 90-day period, without a penalty. |

| (h) | The Investment Fund is in liquidation. In addition to any redemption proceeds that may have already been received, the Fund will continue to receive proceeds periodically as the Investment Fund liquidates its underlying investments. |

Complete information about the Investment Funds’ underlying investments is not readily available.

The Fund’s valuation procedures require evaluation of all relevant factors available at the time the Fund values its portfolio. These relevant factors include the individual Investment Funds’ compliance with fair value measurements, price transparency and valuation procedures in place, and subscription and redemption activity.

The accompanying notes are an integral part of these financial statements.

5

A&Q Technology Fund LLC

Statement of Operations

Year Ended December 31, 2022

| | | | |

| |

EXPENSES | | | | |

| |

Management Fee | | $ | 1,645,477 | |

Professional fees | | | 287,885 | |

Commitment Fee | | | 140,188 | |

Administration fee | | | 127,957 | |

Officer’s and Directors’ fees | | | 108,387 | |

Custody fee | | | 7,200 | |

Other Manager fees | | | 6,251 | |

Interest expense | | | 4,888 | |

Printing, insurance and other expenses | | | 111,889 | |

| |

Total Expenses | | | 2,440,122 | |

| |

Commitment Fee reimbursement (see Note 5) | | | (16,000 | ) |

| |

Net Expenses | | | 2,424,122 | |

| |

Net Investment Loss | | | (2,424,122 | ) |

| |

NET REALIZED AND UNREALIZED GAIN/(LOSS) FROM INVESTMENTS | | | | |

| |

Net realized gain/(loss) from investments in Investment Funds | | | 4,309,281 | |

Net change in unrealized appreciation/depreciation on investments in Investment Funds | | | (33,802,362 | ) |

| |

Net Realized and Unrealized Gain/(Loss) from Investments | | | (29,493,081 | ) |

| |

Net Decrease in Members’ Capital Derived from Operations | | $ | (31,917,203 | ) |

The accompanying notes are an integral part of these financial statements.

6

A&Q Technology Fund LLC

Statements of Changes in Members’ Capital

Years Ended December 31, 2021 and 2022

| | | | | | | | | | | | |

| | | Manager | | | Members | | | Total | |

| | | |

Members’ Capital at January 1, 2021 | | $ | 104,723 | | | $ | 195,458,115 | | | $ | 195,562,838 | |

| | | |

INCREASE (DECREASE) FROM OPERATIONS | | | | | | | | | | | | |

Pro rata allocation: | | | | | | | | | | | | |

Net investment loss | | | (547 | ) | | | (3,050,340 | ) | | | (3,050,887 | ) |

Net realized gain/(loss) from investments in Investment Funds | | | 5,535 | | | | 10,715,827 | | | | 10,721,362 | |

Net change in unrealized appreciation/depreciation on investments in Investment Funds | | | (6,986 | ) | | | (13,759,525 | ) | | | (13,766,511 | ) |

Net Decrease in Members’ Capital Derived from Operations | | | (1,998 | ) | | | (6,094,038 | ) | | | (6,096,036 | ) |

| | | |

MEMBERS’ CAPITAL TRANSACTIONS | | | | | | | | | | | | |

Members’ subscriptions | | | – | | | | 13,150,000 | | | | 13,150,000 | |

Members’ withdrawals | | | – | | | | (9,968,107 | ) | | | (9,968,107 | ) |

Net Increase in Members’ Capital Derived from Capital Transactions | | | – | | | | 3,181,893 | | | | 3,181,893 | |

| | | |

Members’ Capital at December 31, 2021 | | $ | 102,725 | | | $ | 192,545,970 | | | $ | 192,648,695 | |

| | | |

INCREASE (DECREASE) FROM OPERATIONS | | | | | | | | | | | | |

Pro rata allocation: | | | | | | | | | | | | |

Net investment loss | | | (431 | ) | | | (2,423,691 | ) | | | (2,424,122 | ) |

Net realized gain/(loss) from investments in Investment Funds | | | 2,283 | | | | 4,306,998 | | | | 4,309,281 | |

Net change in unrealized appreciation/depreciation on investments in Investment Funds | | | (18,100 | ) | | | (33,784,262 | ) | | | (33,802,362 | ) |

Net Decrease in Members’ Capital Derived from Operations | | | (16,248 | ) | | | (31,900,955 | ) | | | (31,917,203 | ) |

| | | |

MEMBERS’ CAPITAL TRANSACTIONS | | | | | | | | | | | | |

Members’ withdrawals | | | – | | | | (37,444,953 | ) | | | (37,444,953 | ) |

Net Decrease in Members’ Capital Derived from Capital Transactions | | | – | | | | (37,444,953 | ) | | | (37,444,953 | ) |

| | | |

Members’ Capital at December 31, 2022 | | $ | 86,477 | | | $ | 123,200,062 | | | $ | 123,286,539 | |

The accompanying notes are an integral part of these financial statements.

7

A&Q Technology Fund LLC

Statement of Cash Flows

Year Ended December 31, 2022

| | | | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

Net decrease in members’ capital derived from operations | | $ | (31,917,203) | |

Adjustments to reconcile net decrease in members’ capital derived from operations to net cash provided by operating activities: | | | | |

Purchases of investments in Investment Funds | | | (22,065,289) | |

Proceeds from disposition of investments in Investment Funds | | | 51,421,836 | |

Net realized (gain)/loss from investments in Investment Funds | | | (4,309,281) | |

Net change in unrealized appreciation/depreciation on investments in Investment Funds | | | 33,802,362 | |

Changes in assets and liabilities: | | | | |

(Increase)/decrease in assets: | | | | |

Advanced subscriptions in Investment Funds | | | 5,000,000 | |

Receivable from Investment Funds | | | (1,484,534) | |

Other assets | | | (15,554) | |

Increase/(decrease) in liabilities: | | | | |

Administration fee payable | | | (63,651) | |

Loan interest payable | | | (6,440) | |

Management Fee payable | | | (124,018) | |

Officer’s and Directors’ fees payable | | | 12,815 | |

Payable to Manager | | | (4,746) | |

Professional fees payable | | | (51,839) | |

Other liabilities | | | (35,589) | |

| |

Net cash provided by operating activities | | | 30,158,869 | |

| |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

Payments on Members’ withdrawals, including change in withdrawals payable | | | (11,599,092) | |

Principal payment on loan | | | (6,510,000) | |

| |

Net cash used in financing activities | | | (18,109,092) | |

| |

Net increase in cash | | | 12,049,777 | |

Cash-beginning of year | | | 115,024 | |

| |

Cash-end of year | | $ | 12,164,801 | |

| |

| |

Supplemental disclosure of cash flow information: | | | | |

Interest expense paid | | $ | 11,328 | |

The accompanying notes are an integral part of these financial statements.

8

A&Q Technology Fund LLC

Financial Highlights

December 31, 2022

The following represents the ratios to average members’ capital and other supplemental information for all Members, excluding the Manager, for the periods indicated. An individual Member’s ratios and returns may vary from the below based on the Performance Bonus, if applicable, and the timing of capital transactions.

| | | | | | | | | | |

| | | | | Years Ended December 31, | | |

| | | 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

| | | | | |

| Ratio of net investment loss to average members’ capital a, b | | (1.48%) | | (1.53%) | | (1.57%) | | (1.63%) | | (1.54%) |

| | | | | |

| Ratio of gross expenses to average members’ capital a, b | | 1.48% | | 1.53% | | 2.68% | | 1.63% | | 1.54% |

| | | | | |

| Ratio of net expenses to average members’ capital after Performance Bonus a, b, c | | 1.48% | | 1.53% | | 2.68% | | 1.63% | | 1.54% |

| | | | | |

| Portfolio turnover rate | | 15.02% | | 10.42% | | 11.66% | | 32.29% | | 16.45% |

| | | | | |

| Total return after Performance Bonus d, e | | (16.67%) | | (2.89%) | | 23.00% | | 7.91% | | (2.77%) |

| | | | | |

| Asset coverage f | | N/A | | 30.593 | | N/A | | N/A | | N/A |

| | | | | |

| Members’ capital at end of year (including the Manager) | | $123,286,539 | | $192,648,695 | | $195,562,838 | | $173,052,595 | | $180,562,101 |

| a | The average members’ capital used in the above ratios is calculated using pre-tender members’ capital, excluding the Manager’s capital. |

| b | Ratios of net investment loss and gross/net expenses to average members’ capital do not include the impact of expenses and incentive allocations or incentive fees incurred by the underlying Investment Funds. |

| c | The ratios of net expenses to average members’ capital before Performance Bonus were 1.48%, 1.53%, 1.57%, 1.63% and 1.54% for the years ended December 31, 2022, 2021, 2020, 2019 and 2018, respectively. |

| d | The total return is based on the change in value during the year of a theoretical investment made at the beginning of the year. The change in value of a theoretical investment is measured by comparing the aggregate ending value, adjusted for cash flows related to capital subscriptions or withdrawals during the year. |

| e | The total returns before Performance Bonus were (16.67%), (2.89%), 24.24%, 7.91% and (2.77%) for the years ended December 31, 2022, 2021, 2020, 2019 and 2018, respectively. |

| f | Calculated by subtracting the Fund’s liabilities and indebtedness not represented by senior securities from the Fund’s total assets and dividing the result by the aggregate amount of the Fund’s senior securities representing indebtedness then outstanding. The Fund’s senior securities during this time period were comprised only of temporary borrowings made pursuant to secured revolving lines of credit agreements (see Note 5). There were no senior securities payable outstanding at December 31, 2022, 2020, 2019 or 2018. |

The accompanying notes are an integral part of these financial statements.

9

A&Q Technology Fund LLC

Notes to Financial Statements

December 31, 2022

A&Q Technology Fund LLC (the “Fund”) was initially organized as a limited partnership under the laws of Delaware on December 28, 1998, commenced operations on April 1, 1999 and was subsequently reorganized as a limited liability company effective October 15, 2002. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, non-diversified, management investment company. The Fund is commonly referred to as a “fund of funds.” Its investment objective is to maximize capital appreciation over the long-term. The Fund seeks to achieve its objective by investing at least 80% of its assets among a select group of alternative asset managers (the “Investment Managers”) that UBS Hedge Fund Solutions (as defined below) anticipates, at the time of investment, will invest, under normal market conditions, at least 80% of their assets in companies in the technology sector. Investment Managers generally conduct their investment programs through unregistered investment vehicles, such as hedge funds, that have investors other than the Fund, and in other registered investment companies (collectively, the “Investment Funds”).

Subject to the requirements of the 1940 Act, the business and affairs of the Fund shall be managed under the direction of the Fund’s Board of Directors (the “Board”, with an individual member referred to as a “Director”). The Board shall have the right, power and authority, on behalf of the Fund and in its name, to do all things necessary and proper to carry out its duties under the Fund’s Limited Liability Company Agreement, as amended and restated from time to time. Each Director shall be vested with the same powers, authority and responsibilities on behalf of the Fund as are customarily vested in each director of a Delaware corporation, and each Director who is not an “interested person” (as defined in the 1940 Act) of the Fund shall be vested with the same powers, authority and responsibilities on behalf of the Fund as are customarily vested in each director of a closed-end management investment company registered under the 1940 Act that is organized as a Delaware corporation who is not an “interested person” of such company. No Director shall have the authority individually to act on behalf of or to bind the Fund except within the scope of such Director’s authority as delegated by the Board. The Board may delegate the management of the Fund’s day-to-day operations to one or more officers of the Fund or other persons (including, without limitation, UBS Hedge Fund Solutions (as defined below)), subject to the investment objective and policies of the Fund and to the oversight of the Board.

The Board has engaged UBS Hedge Fund Solutions LLC (“UBS Hedge Fund Solutions”, the “Manager” and, when providing services under its Administration Agreement with the Fund, the “Administrator”), a Delaware limited liability company, to provide investment advice regarding the selection of Investment Funds and to be responsible for the day-to-day management of the Fund. The Manager is a wholly owned subsidiary of UBS Group AG and is registered as an investment adviser under the Investment Advisers Act of 1940, as amended.

10

A&Q Technology Fund LLC

Notes to Financial Statements (continued)

December 31, 2022

| 1. | Organization (continued) |

Initial and additional applications for interests by eligible investors may be accepted at such times as the Board may determine and are generally accepted monthly. The Board reserves the right to reject any application for interests in the Fund.

The Fund from time to time may offer to repurchase interests pursuant to written tenders to members (the “Members”). These repurchases will be made at such times and on such terms as may be determined by the Board, in its complete and exclusive discretion. The Manager expects that generally, it will recommend to the Board that the Fund offer to repurchase interests from Members twice each year, near mid-year and year-end. Members can only transfer or assign their membership interests, or a portion thereof, (i) by operation of law pursuant to the death, bankruptcy, insolvency or dissolution of a Member, or (ii) with the written approval of the Board, which may be withheld in the Board’s sole and absolute discretion. Such transfers may be made even if the balance of the capital account to such transferee is equal to or less than the transferor’s initial capital contribution.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative US generally accepted accounting principles (“US GAAP”) recognized by the FASB to be applied by non-governmental entities. The Fund’s financial statements are prepared in accordance with US GAAP.

The Manager has determined that the Fund is an investment company as outlined in the FASB Accounting Standards Update No. 2013-08, Financial Services - Investment Companies (Topic 946) - Amendments to the Scope, Measurement and Disclosure Requirements (“ASU 2013-08”). Therefore, the Fund follows the accounting and reporting guidance for investment companies.

| 2. | Significant Accounting Policies |

The Fund values its investments at fair value, in accordance with US GAAP, which is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The Fund uses net asset value (“NAV”) as its measure of fair value of an investment in an investee when (i) the Fund’s investment does not have a readily determinable fair value and (ii) the NAV of the Investment Fund is calculated in a manner consistent with the measurement principles of investment company accounting, including measurement of the underlying investments at fair value. In evaluating the level at which the fair value measurement of the Fund’s investments have been classified, the Fund has assessed factors including, but not limited to, price transparency, the ability to redeem at NAV at the measurement date and the existence or absence of certain restrictions at the measurement date.

11

A&Q Technology Fund LLC

Notes to Financial Statements (continued)

December 31, 2022

| 2. | Significant Accounting Policies (continued) |

| | a. | Portfolio Valuation (continued) |

US GAAP provides guidance in determining whether there has been a significant decrease in the volume and level of activity for an asset or liability when compared with normal market activity for such asset or liability (or similar assets or liabilities). US GAAP also provides guidance on identifying circumstances that indicate a transaction with regards to such an asset or liability is not orderly. In its consideration, the Fund must consider inputs and valuation techniques used for each class of assets and liabilities. Judgment is used to determine the appropriate classes of assets and liabilities for which disclosures about fair value measurements are provided. Fair value measurement disclosures for each class of assets and liabilities require greater disaggregation than the Fund’s line items in the Statement of Assets, Liabilities and Members’ Capital.

The following is a summary of the investment strategy and any restrictions on the liquidity provisions of the investments in Investment Funds held by the Fund as of December 31, 2022. Investment Funds with no current redemption restrictions may be subject to future gates, lock-up provisions or other restrictions, in accordance with their offering documents. The Fund had no unfunded capital commitments as of December 31, 2022. The Fund used the following category to classify its Investment Funds:

The Investment Funds in the equity hedged strategy (total fair value of $119,823,830) generally utilize fundamental analysis to invest in publicly traded equities through both long and short positions seeking to capture perceived security mispricing. Portfolio construction is driven primarily by bottom-up fundamental research; top-down analysis may also be applied. As of December 31, 2022, the Investment Funds in the equity hedged strategy had $59,593,212 representing 50% of the value of the investments in this category, subject to an investor level gate or lock-ups. Included in this amount is $22,992,670, representing 19% of the value of the investments in this category, that cannot be redeemed in full because the investment includes restrictions that do not allow for redemptions in the first 12-24 months after acquisition. The remaining restriction period for these investments ranges from 3-9 months at December 31, 2022. Investment Funds representing less than 1% of the value of investments in this category are held in side pockets or in liquidation; therefore, the redemption notice period is no longer effective for these investments and the liquidation of assets is uncertain.

The investments within the scope of ASC 820, for which fair value is measured using NAV as a practical expedient, should not be categorized within the fair value hierarchy. The total fair value of the investments in Investment Funds valued using NAV as a practical expedient is $119,823,830 and is therefore excluded from the fair value hierarchy. Additional disclosures, including liquidity terms and conditions of the underlying investments, are included in the Schedule of Portfolio Investments.

12

A&Q Technology Fund LLC

Notes to Financial Statements (continued)

December 31, 2022

| 2. | Significant Accounting Policies (continued) |

| | a. | Portfolio Valuation (continued) |

The three levels of the fair value hierarchy are as follows:

| | | | | | |

| | Level 1— | | quoted prices in active markets for identical investments | | |

| | Level 2— | | inputs to the valuation methodology include quotes for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument | | |

| | Level 3— | | inputs to the valuation methodology include significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) | | |

The NAV of the Fund is determined by the Fund’s administrator, under the oversight of the Manager, as of the close of business at the end of any fiscal period in accordance with the valuation principles set forth below or as may be determined from time to time pursuant to policies established by the Board. The Fund’s investments in Investment Funds are subject to the terms and conditions of the respective operating agreements and offering memorandums, as appropriate. The Manager has adopted procedures pursuant to ASC 820 in which the Fund values its investments in Investment Funds at fair value. Fair value is generally determined utilizing NAVs supplied by, or on behalf of, the Investment Funds’ Investment Managers, which are net of management and incentive fees charged by the Investment Funds. NAVs received by, or on behalf of, the Investment Funds’ Investment Managers are based on the fair value of the Investment Funds’ underlying investments in accordance with the policies established by the Investment Funds. Because of the inherent uncertainty of valuation, the value of the Fund’s investments in the Investment Funds may differ significantly from the value that would have been used had a ready market been available. See Schedule of Portfolio Investments for further information.

The fair value relating to certain underlying investments of these Investment Funds, for which there is no ready market, has been estimated by the respective Investment Fund’s Investment Manager and is based upon available information in the absence of readily ascertainable fair values and does not necessarily represent amounts that might ultimately be realized. Due to the inherent uncertainty of valuation, those estimated fair values may differ significantly from the values that would have been used had a ready market for the investments existed. These differences could be material.

It is unknown, on an aggregate basis, whether the Investment Funds held any investments whereby the Fund’s proportionate share exceeded 5% of the Fund’s members’ capital at December 31, 2022.

The fair value of the Fund’s assets and liabilities which qualify as financial instruments approximates the carrying amounts presented in the Statement of Assets, Liabilities and Members’ Capital.

13

A&Q Technology Fund LLC

Notes to Financial Statements (continued)

December 31, 2022

| 2. | Significant Accounting Policies (continued) |

| | b. | Investment Transactions and Income Recognition |

The Fund accounts for realized gains and losses from Investment Fund transactions based on the pro-rata ratio of the fair value and cost of the underlying investment at the date of redemption. Interest income is recorded on the accrual basis.

The Fund bears all expenses incurred in its business, including, but not limited to, the following: all costs and expenses related to portfolio transactions and positions for the Fund’s account; legal fees; accounting and auditing fees; custodial fees; costs of computing the Fund’s NAV; costs of insurance; registration expenses; interest expense; due diligence, including travel and related expenses; expenses of meetings of the Board; all costs with respect to communications to Members; and other types of expenses approved by the Board. Expenses are recorded on the accrual basis.

The Fund has reclassified $2,424,122 and $4,309,281 from accumulated net investment loss and accumulated net realized gain from investments in Investment Funds, respectively, to net capital contributions during the year ended December 31, 2022. The reclassification was to reflect, as an adjustment to net contributions, the amount of estimated taxable income or loss that has been allocated to the Fund’s Members as of December 31, 2022 and had no effect on members’ capital.

The Fund files income tax returns in the U.S. federal jurisdiction and applicable states. The Manager has analyzed the Fund’s tax positions taken on its federal and state income tax returns for all open tax years, and has concluded that no provision for federal or state income tax is required in the Fund’s financial statements. The Fund’s federal and state income tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue. The Fund will recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. For the year ended December 31, 2022, the Fund did not incur any interest or penalties. The Manager does not believe there are positions for which it is reasonably likely that the total amounts of unrecognized tax liability will significantly change within 12 months of the reporting date.

The cost of investments for federal income tax purposes is adjusted for items of taxable income allocated to the Fund from the Investment Funds. The allocated taxable income is reported to the Fund by the Investment Funds’ tax reports. The Fund has not yet received all such tax reports for the year ended December 31, 2022; therefore, the tax basis of investments for 2022 will not be finalized by the Fund until after the fiscal year end.

14

A&Q Technology Fund LLC

Notes to Financial Statements (continued)

December 31, 2022

| 2. | Significant Accounting Policies (continued) |

| | d. | Income Taxes (continued) |

Each Member is individually required to report on its own tax return its distributive share of the Fund’s taxable income or loss.

Cash consists of monies held at The Bank of New York Mellon. Such cash, at times, may exceed federally insured limits. The Fund has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such accounts. There were no restricted cash balances held as of December 31, 2022.

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in members’ capital from operations during the reporting period. Actual results could differ from those estimates. Because of the uncertainty of valuation, such estimates may differ significantly from values that would have been used had a ready market existed, and the differences could be material.

| 3. | Related Party Transactions |

The Manager provides certain management and administrative services to the Fund, including, among other things, providing office space and other support services. In consideration for such services, the Fund pays the Manager a monthly management fee (the “Management Fee”) at an annual rate of 1% of the Fund’s members’ capital, excluding the capital account attributable to the Manager. The Management Fee is paid to the Manager out of the Fund’s assets and debited against the Members’ capital accounts, excluding the Manager’s capital account. A portion of the Management Fee is paid by UBS Hedge Fund Solutions to its affiliates. For the year ended December 31, 2022, the Fund incurred a Management Fee of $1,645,477, of which $379,234 remains payable and is included on the Statement of Assets, Liabilities and Members’ Capital at December 31, 2022.

UBS Financial Services Inc. (“UBS FSI”), a wholly owned subsidiary of UBS Americas, Inc., together with any other broker or dealer appointed by the Fund as distributor of its interests (the “Distributor”), acts as the distributor, without special compensation from the Fund. Currently, UBS FSI acts as the sole distributor of the Fund’s interests, and bears its own costs associated with its

15

A&Q Technology Fund LLC

Notes to Financial Statements (continued)

December 31, 2022

| 3. | Related Party Transactions (continued) |

activities as distributor. Sales loads, if any, charged on contributions are debited against the contribution amounts, to arrive at a net subscription amount. The sales load does not constitute assets of the Fund.

The net increase or decrease in members’ capital derived from operations (net income or loss) is initially allocated to the capital accounts of all Members on a pro-rata basis, other than the Management Fee which is similarly allocated to all Members other than the Manager as described above. In accordance with the Limited Liability Company Agreement, the Manager is then allocated an amount based on the performance of the Fund (the “Performance Bonus”) for the Measurement Period, as defined in the Confidential Memorandum (i.e., the period commencing on the admission of a Member to the Fund, and thereafter each period commencing on the day following the last Measurement Period and ending generally on the first to occur of (1) a fiscal year-end or (2) a whole or partial redemption). The Performance Bonus is calculated separately with respect to each Member.

The Performance Bonus is equal to 1% of the balance of the Member’s capital account at the end of the Measurement Period, provided that appreciation in the Member’s capital account (net of any Performance Bonus) exceeds the Member’s threshold return. The threshold return is the amount that a Member would have earned for a fiscal year if it had received an annualized rate of return of 20% on its opening capital account balance, as adjusted. No Performance Bonus was earned for the year ended December 31, 2022 or for the year ended December 31, 2021.

Each Director of the Fund receives an annual retainer of $12,500 plus a fee for each meeting attended. The Chair of the Board and the Chair of the Audit Committee of the Board each receive an additional annual retainer in the amount of $20,000. These additional annual retainer amounts are paid for by the Fund on a pro-rata basis along with the two other registered alternative investment funds advised by UBS Hedge Fund Solutions. All Directors are reimbursed by the Fund for all reasonable out of pocket expenses.

During the year ended December 31, 2022, the Fund incurred a portion of the annual compensation of the Fund’s Chief Compliance Officer in the amount of $12,815 which is included in Officer’s and Directors’ fees in the Statement of Operations. The related payable of $26,795 is included in Officer’s and Directors’ fees payable in the Statement of Assets, Liabilities and Members’ Capital.

The Fund, along with the two other registered alternative investment funds advised by UBS Hedge Fund Solutions, and the Directors are insured under an insurance policy which protects against claims alleging a wrongful act, error, omission, misstatement, misleading statement, and other items made in error. The annual premiums are allocated among the funds on a pro-rata basis based on each fund’s assets under management. On an annual basis, the allocation methodology is reviewed and

16

A&Q Technology Fund LLC

Notes to Financial Statements (continued)

December 31, 2022

| 3. | Related Party Transactions (continued) |

approved by the Board and the Manager determines the amounts to be charged to each fund based upon the Board approved methodology. During the year ended December 31, 2022, the Fund incurred $87,190 in insurance fees, which is included in printing, insurance and other expenses in the Statement of Operations, of which none was payable at December 31, 2022.

The Fund, along with several other funds advised by UBS Hedge Fund Solutions, is party to a Credit Agreement (See Note 5). On a quarterly basis, the credit provider charges a fee (the “Commitment Fee”) on the unused portion of the total amount of the Credit Agreement. The Manager negotiates the commitment amount with the counterparty based on the amount each fund will be expected to borrow at a given time. The Commitment Fee is allocated to each fund based on the sub-limit borrowing amount which is disclosed within the Credit Agreement. For the year ended December 31, 2022, the Fund incurred a Commitment Fee of $140,188 to the counterparty, of which $11,600 remains payable and is included in other liabilities in the Statement of Assets, Liabilities and Members’ Capital at December 31, 2022.

The Manager may incur expenses on behalf of the Fund for certain activities which benefit the investment funds managed by the Manager. For the year ended December 31, 2022, the Fund incurred other Manager fees of $6,251. The related payable at December 31, 2022 of $6,251 is included in the Statement of Assets, Liabilities and Members’ Capital at December 31, 2022.

Other investment partnerships sponsored by UBS Group AG or its affiliates may also maintain investment interests in the Investment Funds owned by the Fund.

| 4. | Administration and Custody Fees |

BNY Mellon Investment Servicing (US) Inc. (“BNY Mellon”), as Fund administrator, performs certain additional administrative, accounting, record keeping, tax and investor services for the Fund. BNY Mellon receives a monthly administration fee primarily based upon (i) the average members’ capital of the Fund subject to a minimum monthly administration fee, and (ii) the aggregate members’ capital of the Fund and certain other investment funds sponsored or advised by UBS Group AG, UBS Americas, Inc. or their affiliates. Additionally, the Fund reimburses certain out of pocket expenses incurred by BNY Mellon.

The Bank of New York Mellon serves as the primary custodian of the assets of the Fund, and may maintain custody of such assets with domestic and foreign sub custodians (which may be banks, trust companies, securities depositories and clearing agencies) approved by the Directors. Assets of the Fund are not held by the Adviser or commingled with the assets of other accounts other than to the extent that securities are held in the name of a custodian in a securities depository, clearing agency or omnibus customer account of such custodian.

17

A&Q Technology Fund LLC

Notes to Financial Statements (continued)

December 31, 2022

The Fund, along with several other funds advised by UBS Hedge Fund Solutions, has entered into a secured Amended and Restated Credit Agreement dated as of September 1, 2022, as amended, supplemented or otherwise modified from time to time with a third-party commercial bank, which will terminate on August 31, 2023 unless extended (the “Credit Agreement”). Under the Credit Agreement, the Fund may borrow from time to time on a revolving basis at any time up to $29,000,000 for temporary investment purposes and to meet requests for tenders. Indebtedness outstanding under the Credit Agreement accrues interest at a rate per annum for each day of Daily Simple Secured Overnight Financing Rate (“SOFR”) or Term SOFR for a tenor of one month as determined by the borrower plus 0.10% plus 1.45%. There is a Commitment Fee payable by the Fund, calculated at 45 basis points times the actual daily amount of the line of credit not utilized. The lender will reimburse the Fund $16,000 for the initial set-up of the credit facility. For the year ended December 31, 2022, such reimbursement reduced the Commitment Fee, which is included in the Statement of Operations.

For the year ended December 31, 2022, the Fund’s average interest rate paid on borrowings was 1.59% per annum and the average borrowings outstanding was $307,417. The Fund did not have any borrowings outstanding at December 31, 2022. Interest expense for the year ended December 31, 2022 was $4,888, of which none was payable at December 31, 2022.

As of December 31, 2022, the Fund had investments in Investment Funds, none of which were related parties.

Aggregate purchases and proceeds from sales of investments for the year ended December 31, 2022 amounted to $22,065,289 and $51,421,836, respectively.

The agreements related to investments in Investment Funds provide for compensation to the general partners/managers in the form of management fees of 1.00% to 2.00% (per annum) of net assets and incentive fees or allocations ranging from 20.00% to 25.00% of net profits earned. Detailed information about the Investment Funds’ portfolios is not available. Please see the Schedule of Portfolio Investments for further information.

| 7. | Financial Instruments with Off-Balance Sheet Risk |

In the normal course of business, the Investment Funds in which the Fund invests trade various financial instruments and enter into various investment activities with off-balance sheet risk. These include, but are not limited to, short selling activities, writing option contracts, contracts for differences and equity swaps. The Fund’s risk of loss in these Investment Funds is limited to the fair value of these investments.

18

A&Q Technology Fund LLC

Notes to Financial Statements (continued)

December 31, 2022

In the ordinary course of business, the Fund may enter into contracts or agreements that contain indemnifications or warranties. Future events could occur that lead to the execution of these provisions against the Fund. Based on its history and experience, the Fund believes that the likelihood of such an event is remote.

The Manager has evaluated the impact of all subsequent events on the Fund through the date the financial statements were available to be issued, and has determined that there were no events that required disclosure other than the following:

Subsequent to December 31, 2022, the Fund paid withdrawals payable of $28,535,979 in full.

19

INVESTMENT PROGRAM AND PRINCIPAL RISK FACTORS (UNAUDITED)

INVESTMENT PROGRAM

Investment Objective and Policies and Investment Strategies

The Fund’s investment objective is to maximize capital appreciation over the long term. The Fund is commonly referred to as a “fund of funds” and seeks to achieve its objective by investing at least 80% of its assets among Investment Funds that the Manager anticipates, at the time of investment, will invest, under normal market conditions, at least 80% of their assets in companies in the technology sector. These companies include computer software and service companies, semiconductor manufacturers, computer hardware and peripherals companies, communications and telecommunications companies, networking equipment and service companies, internet-related companies, media companies, retailing companies (including distributors and internet and catalog retail), consumer electronics companies, electronic components and instruments manufacturers, and biomedical, pharmaceutical, life sciences, medical device and healthcare service companies. Additional information about the types of investments that are expected to be made by the Investment Managers, their investment practices and related risk factors is provided below. The Fund’s investment objective is a fundamental policy and may not be changed without the approval of investors in the Fund (“Investors”). Except as otherwise indicated, the Fund’s investment policies and restrictions are not fundamental and may be changed without a vote of the Investors.

Investment Funds are generally unregistered investment vehicles, such as hedge funds, that have investors other than the Fund, but they may also include registered investment companies. The Fund currently intends to invest its assets primarily in Investment Funds. The Fund has been designed to afford the Manager flexibility to deploy assets as it deems appropriate under prevailing economic and market conditions. Accordingly, at any given time, the Fund may not invest in all of the technology-related companies and sectors described herein, and the Fund’s allocation to these investments is not fixed and will not likely be equally-weighted. The Manager may invest in other investment strategies at its discretion, while maintaining compliance with the aforementioned 80% test.

Unregistered investment funds typically provide greater flexibility than traditional investment funds (e.g., registered investment companies) over the types of securities and other financial instruments that may be owned, the types of trading strategies employed, the amount of leverage that can be used and the diversity or concentration of securities within their portfolios. Each Investment Manager may use various investment techniques for hedging and non-hedging purposes. Investment Managers may sell securities short in an effort to profit from anticipated declines in prices of securities and to seek to limit exposure to a possible market decline. Investment Managers also may purchase and sell options and futures contracts and engage in other derivative transactions and, from time to time, may maintain significant cash positions. The use of these techniques may be an integral part of their investment programs and involves certain risks to the Fund. Each Investment Manager may use leverage and may invest in illiquid and restricted securities, which also entail risk.

In some instances, although not expected to be a frequent occurrence or to constitute a significant portion of the Fund’s portfolio, an Investment Manager may pursue its investment strategy by structuring an Investment Fund with a highly concentrated portfolio, perhaps consisting of just a single security.

In general, the Fund limits to less than 25% of its assets its investment in any one Investment Fund. The Fund either will hold non-voting securities of an Investment Fund or will limit its investment in any Investment Fund to less than 5% of the Investment Fund’s voting securities. The Fund may invest substantially all of its assets in non-voting securities of Investment Funds. The Fund would purchase non-voting securities to avoid being an “affiliate” of an Investment Fund within the meaning of the 1940 Act. Nonetheless, the Fund may be considered, under certain circumstances, to be an affiliate of the Investment Fund. As such, the Fund might be subject to limitations imposed by the 1940 Act on purchasing more interests in, or redeeming its interests from, the Investment Fund.

No assurance can be given that the Fund will achieve its investment objective.

20

Selection of Investment Managers

The Manager is not bound by any fixed criteria in allocating assets to Investment Funds. Accordingly, the Manager may consider investment in Investment Funds that pursue a wide range of investment or other market strategies, including strategies not described herein, to the extent that the Manager deems appropriate.

The Manager selects Investment Managers based on a number of factors including, but not limited to, portfolio management experience, strategy style and historical performance. The Manager follows certain general guidelines, described below, when reviewing and selecting Investment Managers. While the Manager attempts to apply such guidelines consistently, the guidelines involve the application of subjective and qualitative criteria and, therefore, the selection of the Investment Managers is a fundamentally subjective process. The use of the selection guidelines may be modified or eliminated at the discretion of the Manager.

The Manager currently uses the following selection guidelines:

Filtering Investment Manager Candidates. The Manager uses a variety of information sources to identify prospective investments, including, without limitation, databases, prime brokers, proprietary UBS resources and other industry contacts. These sources should help narrow down the investable universe to less than 500 Investment Funds. The goal of the filtering process is to identify a group of high quality Investment Managers for further review by the Manager.

Interviews and Selection of Investment Managers. The Manager generally conducts a number of onsite and offsite interviews and substantial other due diligence of an Investment Manager prior to making an investment. The goal of the due diligence process is to evaluate: (i) the background of the Investment Manager’s firm and its managers; (ii) the infrastructure of the Investment Manager’s research, trading and operations; (iii) the Investment Manager’s strategy and method of execution; (iv) the Investment Manager’s risk control and portfolio management; and (v) the differentiating factors that give the Investment Manager’s Investment Fund an investment edge.

By combining historical quantitative analysis with a sound knowledge of these key qualitative attributes, the Manager attempts to forecast the Investment Manager’s potential for generating sustainable positive risk-adjusted returns under a wide variety of market conditions. This investment analysis exercise is an invaluable step in building a portfolio that meets the risk/return objectives set forth by the Manager. The Manager believes it is uniquely qualified to perform this analysis given the depth and breadth of its staff’s experience in proprietary trading, risk monitoring and asset management.

Monitoring of Investment Managers and Reallocation. The Manager is responsible for the day-to-day management of the Fund’s allocations and investments, and undertakes transactions on behalf of the Fund within the parameters set forth herein. Once an asset manager is selected as an Investment Manager, the Manager will continue to review the investment process and performance of the Investment Manager. The Manager monitors Investment Managers through a combination of weekly and/or monthly net asset value updates, portfolio reports and periodic phone calls and visits. When appropriate, the Manager utilizes its proprietary software to analyze the risk of the Fund’s underlying investments. The Manager also relies on its experience to make qualitative assessments about the current risk conditions that each Investment Manager and the Fund overall may face.

The performance of each Investment Manager managing assets for the Fund typically is compared with the performance of other managers that utilize the same strategy (and that may or may not be currently managing assets for the Fund) and against an overall benchmark index of a strategy similar to the one utilized by the Investment Manager. The reasons for reducing or withdrawing entirely the capital allocated to an Investment Fund may include, without limitation: (i) the identification by the Manager of a preferable alternative for investing the capital; (ii)a change in the Investment Manager’s strategy or personnel; (iii) a significant change in the amount of assets under the Investment Manager’s management; (iv) a decline in performance relative to the performance of other asset managers using the same investment strategy; (v) the development of a conflict of interest or legal issue restricting the scope of a relationship with the Fund or the Manager; (vi) a decline in the potential for gains on investment in the Investment Manager’s market niche; (vii) a failure of the Investment Manager to meet expectations of or adhere to restrictions on activities established by the Manager; (viii) the relative gains or losses in the accounts of different Investment Managers that cause the Fund’s allocations among the Investment Funds to become

21

disproportionate or unbalanced with respect to the Manager’s asset allocation models or strategies; (ix) the Fund’s need for liquidity; or (x) any other reason or determination reached by the Manager in its sole discretion.

Because the Manager expects to regularly review new investment opportunities, capital withdrawn from the management of one Investment Manager generally is expected to be reallocated to another Investment Manager within a short period of time.

The Fund’s investment program is speculative and entails substantial risks. There can be no assurance that the Fund’s or the Investment Funds’ investment objectives will be achieved or that their investment strategies will be successful. In particular, an Investment Manager’s use of leverage, short sales and derivative transactions, its sector or geographic focus, its limited diversification and the limited liquidity of some of its portfolio securities, in certain circumstances, can result in or contribute to significant losses to the Fund. Investors should consider the Fund as a supplement to an overall investment program and should invest only if they are willing to undertake the risks involved. Investors could lose some or all of their investment.

PRINCIPAL RISK FACTORS

General

All securities investments risk the loss of capital. The value of the Fund’s total net assets should be expected to fluctuate and, as described below, given the Fund’s emphasis on the technology sector, may be especially volatile. To the extent that the Fund’s portfolio (which, for this purpose, means the aggregate securities positions held by the Investment Managers) is concentrated in securities of a single issuer or issuers in a single industry, the risk of any investment decision is increased. An Investment Manager’s use of leverage is likely to cause the Fund’s net assets to appreciate or depreciate at a greater rate than if leverage were not used. The investment strategies and styles used by an Investment Manager are subject to change without notice.

Technology Sector

The Fund’s emphasis on Investment Managers that invest primarily in the technology sector presents certain risks that may not exist to the same degree as in other types of investments. Some of the principal risks of the Investment Funds’ investments invest in the technology sector are identified below. Depending on economic and market conditions, other risks may be present.

General Risk. While the Investment Managers collectively invest in the securities of entities in several different industries considered to be technology-related, many of those entities share common characteristics that may affect the Investment Managers’ investments. For example, industries throughout the technology field include many smaller and less seasoned companies. These types of companies may present greater opportunities for capital appreciation, but also may involve greater risks. Such companies may have limited product lines, markets or financial resources, or may depend on a limited management group. In addition, the securities of smaller companies may be subject to more volatile market movements than the securities of larger, more established companies. The companies in which each Investment Manager invests also are strongly affected by worldwide scientific or technological developments, and their products and services may not be economically successful or may quickly become outdated. Certain of such companies also offer products or services that are subject to governmental regulation and, therefore, may be affected adversely by governmental policies.

Each Investment Manager may purchase securities of companies that have no earnings or have experienced losses. The Investment Manager generally will make these investments based on a belief that actual or anticipated products or services will produce future earnings. If the anticipated event is delayed or does not occur, or if investor perceptions about the company change, the company’s stock price may decline sharply and its securities may become less liquid.

Technology Company Risk. Technology-related securities, in general, tend to exhibit a greater degree of market risk and price volatility as compared to other types of investments. Since the portfolios of the Investment

22

Managers are concentrated in securities of technology-related companies, the investment risk is greater than if the portfolios were invested in a more diversified manner among various sectors.

Telecommunications Company Risk. Telecommunications companies can be adversely affected by, among other things, changes in governmental regulation, policies and restrictions, competition, dependency on patent protection, significant capital expenditures, significant debt burdens and rapid obsolescence of products and services due to product compatibility or changing consumer preferences, among other things.

Biotechnology and Pharmaceutical Company Risk. The success of biotechnology and pharmaceutical companies is highly dependent on the development, procurement and/or marketing of medical devices and drugs. The values of biotechnology and pharmaceutical companies are dependent on the development, protection and exploitation of intellectual property rights and other proprietary information, and their profitability may be significantly affected by the expiration of patents or the loss of, or the inability to enforce, intellectual property rights.

Healthcare Company Risk. Investments in health care companies are subject to a number of risks that may adversely affect their value, including the adverse impact of governmental regulations and legislative actions. These actions and regulations can affect the approval process for patents, medical devices and drugs, the funding of research and medical care programs, and the operation and licensing of facilities and personnel. Obtaining government approvals may be a lengthy, expensive process with an uncertain outcome. In addition, health care companies are subject to risks of rapid technological change and obsolescence, product liability litigation, and intense competitive pressures.

The Fund is Non-Diversified

The Fund is classified as a “non-diversified” management investment company under the 1940 Act. This means that the Fund may invest a greater portion of its assets in a limited number of issuers than would be the case if the Fund were classified as a “diversified” management investment company. Accordingly, the Fund may be subject to greater risk with respect to its portfolio securities than a “diversified” fund because changes in the financial condition or market assessment of a single issuer may cause greater fluctuation in the value of the Fund’s limited liability company interests (“Interests”). In general, the Fund limits to less than 25% of its assets its investment in any one Investment Fund.

The Incentive Fees Charged by the Investment Managers and the Performance Bonus Charged by the Manager May Create Incentives for Speculative Investment

Each Investment Manager generally charges an asset-based fee, and some or all of the Investment Managers receive incentive fees or allocations. The asset-based fees of the Investment Funds generally are expected to range from 1% to 2% of net assets, and the incentive fees or allocations of the unregistered Investment Funds generally are expected to range from 15% to 25% of net profits, but may be greater or less in some cases.

The incentive fee or allocation that will be received by an Investment Manager may create an incentive for the Investment Manager to make investments that are riskier or more speculative than those that might have been made in the absence of the incentive fee. Gain allocated to an Investment Manager with respect to the incentive allocation that is attributable to the sale or disposition of a capital asset will be recharacterized as short-term capital gain to the extent the capital asset giving rise to the gain has been held for a period of longer than one year but less than or equal to three years. Short-term capital gain is taxed at the higher ordinary income tax rates. As a result of this three year holding period requirement, the interests of an Investment Manager and other investors in the Fund may not always be aligned with respect to the timing of the disposition of an investment, which timing could have an impact on investment performance. In addition, because the incentive fees or allocations are calculated on a basis that includes realized and unrealized appreciation of an Investment Fund’s assets, the fee or allocation may be greater than if it were based solely on realized gains. The Manager’s receipt of the Performance Bonus will give rise to similar risks.

23

The Fund May Borrow Money

The Fund may borrow money temporarily to fund investments in certain Investment Managers, subject to the lender’s terms, or in connection with repurchases of, or tenders for, the Fund’s Interests. The Fund, along with several other funds advised by the Manager, is party to the Credit Agreement, under which the Fund may borrow from time to time on a revolving basis at any time up to $29 million.

If the Fund borrows money, its net asset value may be subject to greater fluctuation until the borrowing is repaid and, therefore, the risks of leverage will be present. The Fund would expect to repay leverage used to fund investments by selling its interests in Investment Funds. If the Fund were unable to sell a sufficient value of interests in Investment Funds to repay these borrowings, the Fund could reduce its leverage by using the proceeds of subsequent offerings of Interests. Because many Investment Funds use leverage as part of their investment strategy, the Fund’s use of leverage to purchase these Investment Funds will magnify the potential volatility of the value of the Fund’s Interests.

Borrowings by the Fund, if any, may be made on a secured basis. The Fund’s custodian will then either segregate the assets securing the Fund’s borrowings for the benefit of the Fund’s lenders or arrangements will be made with a suitable sub-custodian. If the assets used to secure a borrowing decrease in value, the Fund may be required to pledge additional collateral to the lender in the form of cash or securities to avoid liquidation of those assets. In the event of a default, the lender will have the right, through the Fund’s custodian, to redeem the Fund’s investments in Investment Funds without consideration of whether doing so would be in the best interests of the Fund’s Investors. The rights of any lender to the Fund to receive payments of interest on and repayments of principal of borrowings will be senior to the rights of the Fund’s Investors, and the terms of the Fund’s borrowings may contain provisions that limit certain activities of the Fund and could result in precluding the purchase of instruments that the Fund would otherwise purchase. These restrictions may impose asset coverage or portfolio composition requirements that are more stringent than those currently imposed on the Fund by the 1940 Act. Additionally, the Fund must comply with the Asset Coverage Requirement.

Tax Risk

The Fund intends to be treated, and believes that it qualifies for treatment, as a partnership for U.S. federal income tax purposes. Accordingly, the Fund generally should not be subject to U.S. federal income tax, and each investor will be required to report on its own annual tax return its distributive share of the Fund’s taxable income or loss for each year, whether or not the Fund makes any distributions in that year. If it were determined that the Fund should be treated as an association or a publicly traded partnership taxable as a corporation, the taxable income of the Fund would be subject to two levels of taxation, since such income would be subject to U.S. federal corporate income tax. In addition, distributions of profits from the Fund would be treated as dividends subject to each investor’s applicable U.S. federal income tax rate.

Because, among other reasons, the Investment Funds and the Fund may use leverage, a tax-exempt Investor may incur income tax liability to the extent the transactions are treated as giving rise to unrelated business taxable income (“UBTI”). A tax-exempt Investor (including an individual retirement account) may be required to make payments, including estimated payments, and file an income tax return for any taxable year in which it has UBTI. To file the return, it may be necessary for the tax-exempt Investor to obtain an Employer Identification Number.

Distributions to Investors and Payment of Tax Liability

The Fund does not intend to make periodic distributions of its net income or gains, if any, to Investors. Investors will nevertheless be required each year to pay applicable U.S. federal, state and local income taxes on their respective shares of the Fund’s taxable income, and generally will have to pay these taxes from sources other than Fund distributions. The amount and times of distributions, if any, will be determined in the sole discretion of the Board.

24

Investment Funds and Investment Managers May Be Newly Organized

Some Investment Funds and Investment Managers may be newly organized and therefore may have no, or only limited, operating histories. However, the Manager endeavors to select Investment Managers whose principals have capital markets experience. There can be no assurance that the Manager’s assessments of Investment Managers, and, in turn, their assessments of the short-term or long-term prospects of investments, will prove accurate or that the Fund will achieve its investment objective.

Investment Funds May Be Concentrated

One or more Investment Managers, from time to time, may invest a substantial portion of its Investment Fund’s assets in only a limited number of issuers or, in certain cases, in securities of a single issuer. As a result, the investment portfolios of these Investment Funds (as well as the Fund’s portfolio) may be subject to greater risk and volatility than if investments had been made in a broader range of issuers. To the extent that an Investment Fund concentrates its portfolio in a limited number of issuers or in securities of only a single issuer, the risk of any investment decision is increased.

Investors Have Only Limited Liquidity

The Fund is a closed-end investment company designed primarily for long-term Investors. Interests in the Fund are not traded on any securities exchange or other market. Interests are not transferable, except by operation of law upon the death, bankruptcy, insolvency or dissolution of an Investor or otherwise only with the consent of the Board (which consent may be withheld in the Board’s sole and absolute discretion), and liquidity will be provided only through limited repurchase offers. These repurchases will be made at such times and on such terms as may be determined by the Board in its complete and exclusive discretion. The Manager expects that it will recommend to the Board that the Fund offer to repurchase Interests from Investors twice each year, near mid-year and year-end.