Annual Meeting

April 25, 2007

Welcome To

7%

Increase

35%

Increase

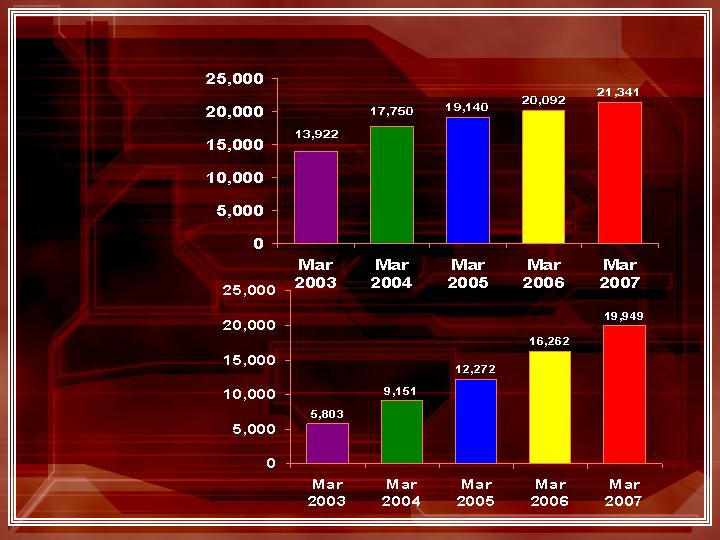

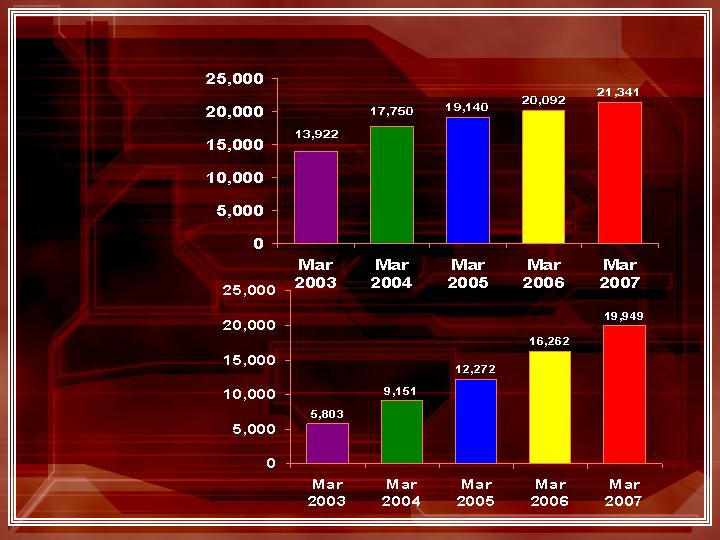

Total Assets

13%

Increase

18%

Increase

26%

Increase

2

Total Assets

13%

Increase

25%

Increase

14%

Increase

22%

Increase

28%

Increase

3

Statement of Operations

Year

Net Income

Change From Prior Year

2002

$ 179

2003

$

1

,173

+ 555

%

2004

$1,359

+ 16

%

2005

$2,115

*

+ 5

6%

2006

$2,198

+ 4

%

*reflects a one time $449,000 reversal of the valuation allowance for taxes

4

Income Trend

2002

2003

2004

2005

2006

2007

1

st

Qtr.

$ 17

$ 110

$ 222

$ 262

$ 475

$

520

2

nd

Qtr.

130

272

313

345

485

3

rd

Qtr.

4

454

410

457

573

4

th

Qtr.

28

33

7

414

1,051*

665

*reflects a one time $449,000 reversal of the valuation allowance for taxes

5

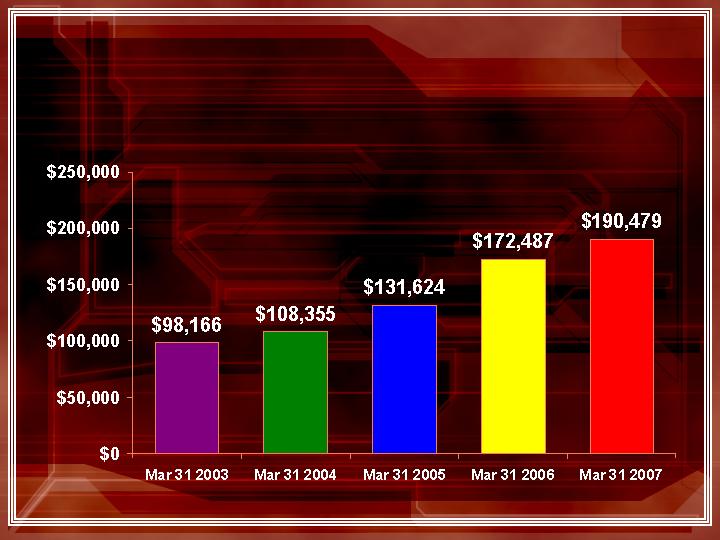

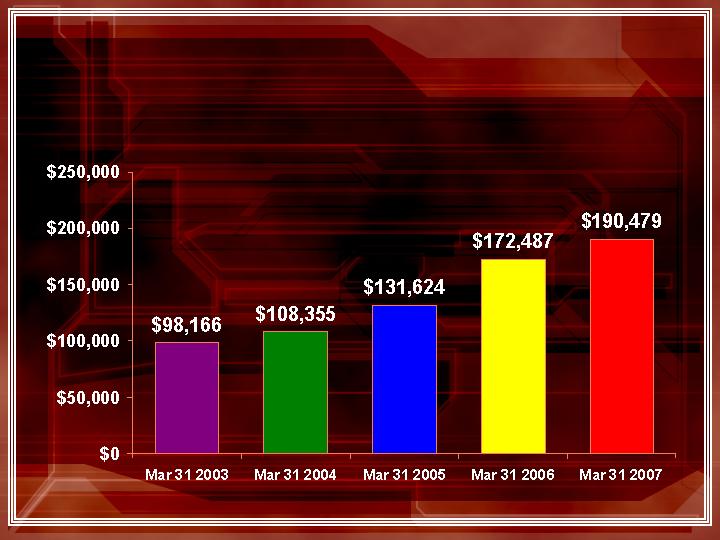

Loan Growth - Total Balances

10%

Increase

20%

Increase

31%

Increase

31%

Increase

10%

Increase

6

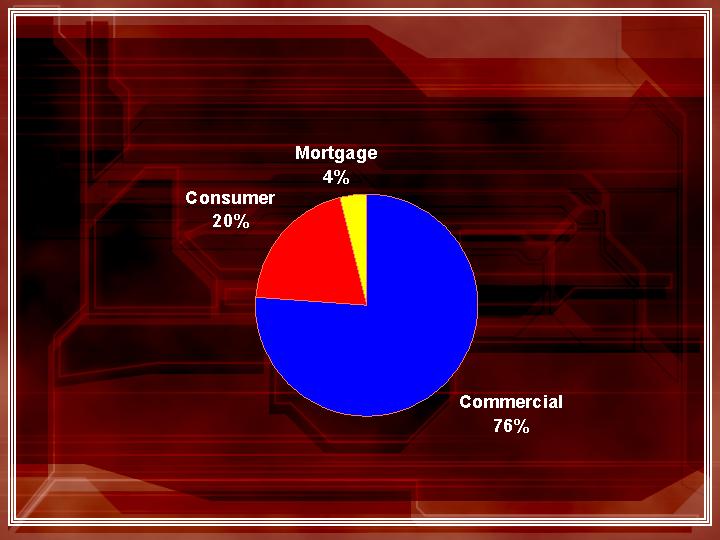

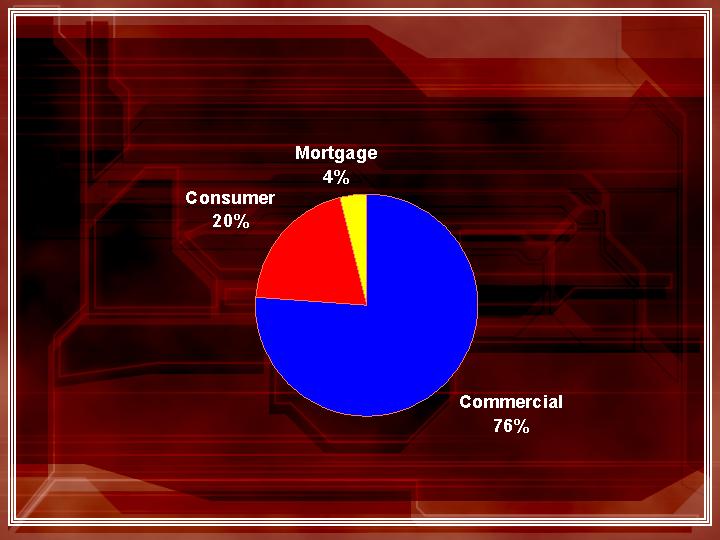

Loan Mix Composition Total Balances

March 31, 2007

7

Net Interest Margin

4.15%

12/31/2006

3.92%

03/31/2007

4.31%

12/31/2005

3.78%

12/31/2004

3.40%

12/31/2003

3.52%

12/31/2002

8

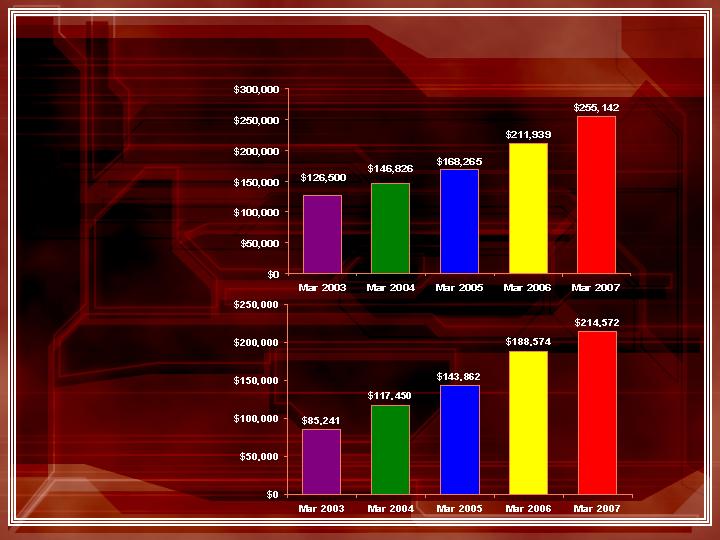

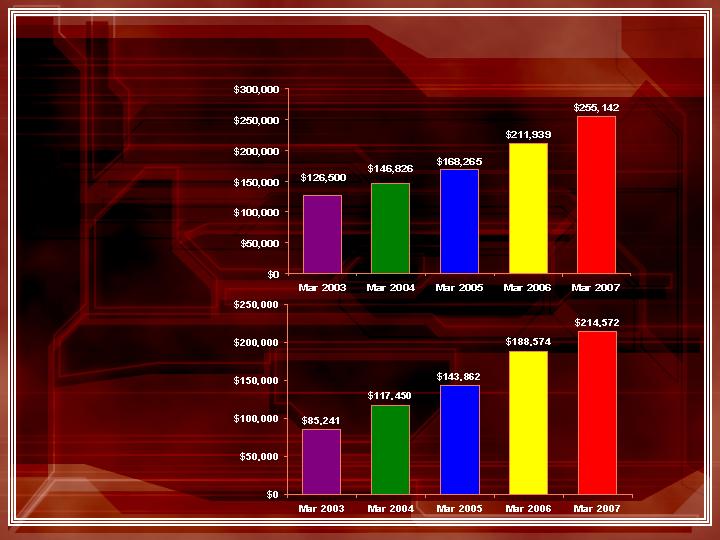

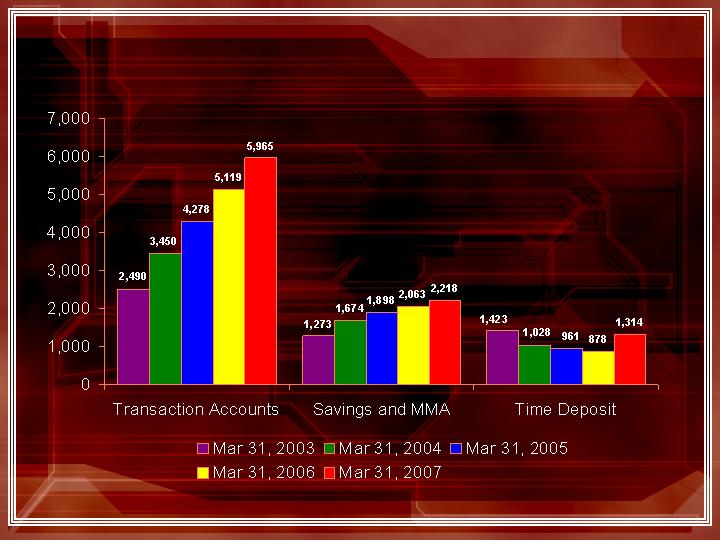

Deposit Growth

Total Deposits

Core Deposits

15%

Increase

22%

Increase

31%

Increase

26%

Increase

14%

Increase

16%

Increase

25%

Increase

38%

Increase

30%

Increase

20%

Increase

9

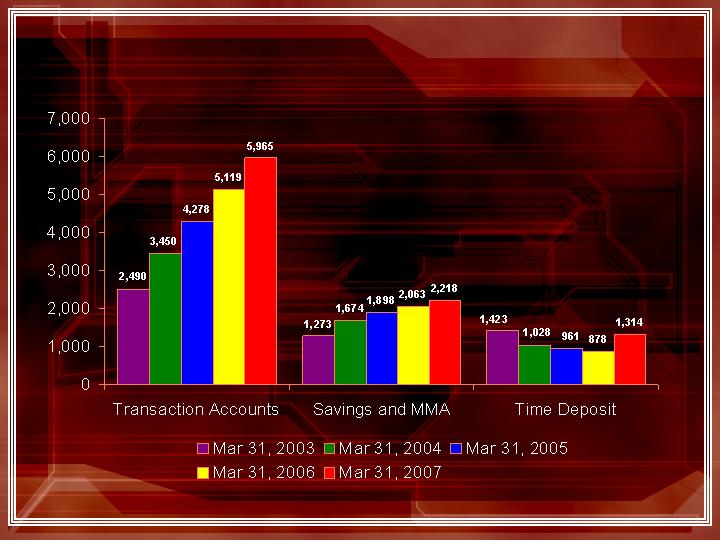

Deposit Mix - Total Balances

86%

35,616

163,590

51,015

12/31/2006

90%

20,731

141,846

45,667

12/31/2005

85%

23,748

94,066

37,061

12/31/2004

79%

30,545

86,111

28,995

12/31/2003

66%

$42,538

$67,520

$15,386

12/31/2002

Core Deposits as a

% of Total Deposits

Time

Deposits

NOW/Money

Market/Savings

Demand

10

Number of Accounts

11

Paramount Checking

Total Balances

Number of Accounts

22%

Increase

16%

Increase

19%

Increase

15%

Increase

3%

Increase

11%

Increase

51%

Increase

48%

Increase

34%

Increase

22%

Increase

12

Paramount Checking -continued

Average Balance Per Account

13

Escrow Ease

Total Balances

14

Escrow Ease - continued

Number of Client Accounts

15

Transaction Activity

Teller Transactions

Per Month

ACH Transactions

Per Month

27%

Increase

8%

Increase

58%

Increase

34%

Increase

5%

Increase

33%

Increase

19%

Increase

55%

Increase

6%

Increase

23%

Increase

16

Asset Quality and Reserves

From the outset, we have implemented a

strong credit culture through the application

of sound banking principles.

As of December 31, 2006 Somerset Hills

Bancorp had non-performing loans of 0.25%

of total loans.

Loan loss reserves as of the same date

totaled $2.2 million.

Loan Loss Reserve 1.13% of total loans.

17

Capital Ratios

Actual

Well Capitalized

December 31, 2006

Amount

Ratio

Amount

Ratio

Total Capital (to risk

-

weighted assets)

$39,063

16.52

%

$23,645

>

10.00%

Tier I Capital (to risk

-

weighted assets)

36,893

15.60

14,187

>

6.00

Tier I Capital (to average asse

ts)

36,893

13.69

13,475

>

5.00

December 31, 2005

Total Capital (to risk

-

weighted assets)

$26,450

12.

7

3

%

$20,772

>

10.00%

Tier I Capital (to risk

-

weighted assets)

24,421

11.76

12,4

63

>

6.00

Tier I Capital (to average assets)

24,421

1

0.4

0

11,739

>

5.00

December 31, 2004

Total Capital (to risk

-

weighted assets)

$23,557

13.77

%

$17,106

>

10.00%

Tier I Capital (to risk

-

weighted assets)

21

,

923

12.82

10,263

>

6.00

Tier I Capital (to average assets)

21,923

11.83

9,268

>

5.00

18

Sullivan Financial Services, Inc.

a subsidiary of Somerset Hills Bank

Headquarters

100 Executive Drive, Suite 140

West Orange, NJ 07052

Phone: 973-325-5000

Fax: 973-736-7947

19

Sullivan Financial Services, Inc.

Products and Services

Conventional Mortgage Loans

Fixed and Adjustable Rate Loans

FHA/VA Loans

Jumbo Mortgages

1st Time Buyer Programs

No Doc Loans

No Cost Refinances

20

Sullivan Financial Services, Inc.

Loan Volume

2002

2003

2004

2005

2006

Originations

$404,513

$530,913

$330,491

$379,114

$341,689

Originations

1

,

701

2

,

159

1

,

297

1

,

362

1

,

293

Closings

$320,978

$505,384

$270,803

$311,273

$293,329

Closings

1

,

384

2

,

098

1

,

091

1

,

132

1

,

089

21

Somerset Hills Wealth Management, LLC

a subsidiary of Somerset Hills Bank

22

Somerset Hills Wealth Management, LLC

For the Individual:

Financial Planning

Investment Management

Estate Review

Life, Health & Long Term Care

Insurance

Property and Casualty Insurance

23

Somerset Hills Wealth Management, LLC

For the Business Owner:

Business Succession Planning

Buy-Sell & Key Person

Agreements

Retirement Plans & Group

Insurance

Property and Casualty Insurance

24

Somerset Hills Title Company, LLC

PROVIDING TITLE SERVICE IN CONNECTION WITH THE

CLOSING OF REAL ESTATE TRANSACTIONS

2005

2006

1

st

Qtr 2007

Total Transactions

62

36

6

Amount of Closed Transactions

(approximate)

$57

Million

$55

Million

$2

Million

Net

Income to Bank

$64

,000

$

101

,000

$

6,000

25

Look to the Future

Building the Franchise

Cross Sell Opportunities

Staffing Opportunities

New Branch Opportunities

Acquisition Opportunities

26

Where We Are

27

Grand Opening Saturday May 12th !

Then and now…

24 Schooley’s Mt. Road

Long Valley, NJ 07853

908-876-5525

28

5% Stock Dividend !!!

29

$0.04 per quarter

33% Increase!!!

Cash Dividend

30

Stock Price

Stock

-

SOMH

Declared 5%

Stock Dividend

(

5/15/2002

)

12/31/2002

$6.46

3/31/2003

6.13

Declared 5% Stock Dividend

6/30/2003

7.52

9/30/2003

7.88

12/31/2003

10.17

3/31/2004

11.06

Declared 5% Stock Dividend

6/30/2004

10.87

9/30/2004

10.73

12/31/2004

11.51

*Prices Adjusted to reflect 5% Stock Dividend of 5/15/2002, 6/30/2003, 6/2/2004, 6/30/2005 and

5/31/2006

31

Stock Price (continued)

Stock

-

SOMH

3/31/2005

$10.29

Declared 5% Stock Dividend and $0.02 Cash Dividend

6/30/2005

10.95

9/30/2005

1

0.71

Declared

$0.02 Cash Dividend

12/31/2005

1

1.95

Declared $0.02 Cash Dividend

3/31/2006

1

3.64

Decl

ared 5% Stock Dividend and $0.03

Cash Dividend

*Prices Adjusted to reflect 5% Stock Dividend of 5/15/2002, 6/30/2003, 6/2/2004, 6/30/2005 and

5/31/2006

32

Stock Price (continued)

Stock

-

SOMH

6/30/2006 13.16

Declared $0.03 Cash Dividend

9/30/2006 12.20

Declared $0.03 Cash Dividend

12/31/2006

13.22

Declared $0.03 Cash Dividend

3/31/2007 14.34

*Prices Adjusted to reflect 5% Stock Dividend of 5/15/2002, 6/30/2003, 6/2/2004, 6/30/2005 and

5/31/2006

33