EXHIBIT 99.1b

Annual Meeting

April 30, 2008

Welcome To

7%

Increase

35%

Increase

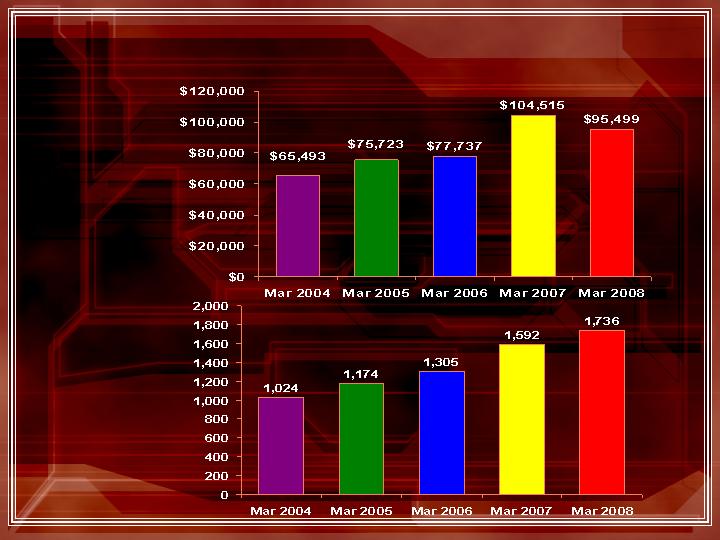

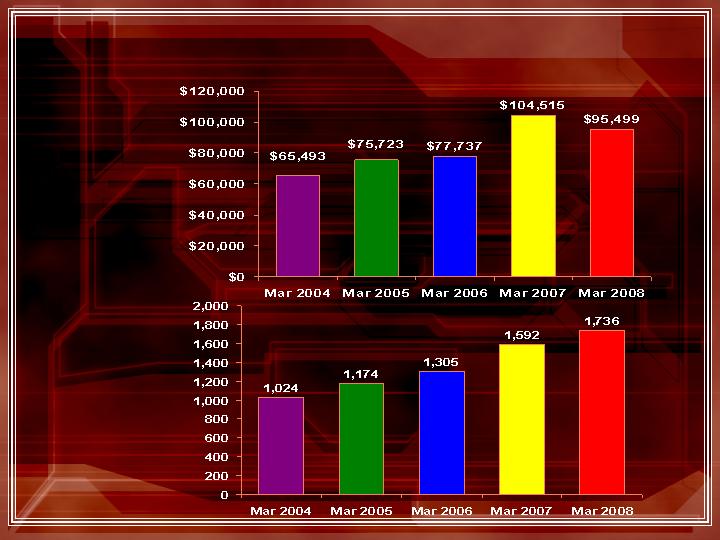

Total Assets

13%

Increase

18%

Increase

1%

Decrease

( in thousands)

2

Total Assets

13%

Increase

25%

Increase

14%

Increase

22%

Increase

2%

Decrease

( in thousands)

3

Statement of Operations

( in thousands)

*reflects a one time $449,000 reversal of the valuation allowance for taxes

** reflects a one time $1,200,000 write off of goodwill and a $1,000,000 increase in loan loss

provisions

Year

Net Income

Change From Prior Year

2003

$1,173

+ 555%

2004

$1,359

+

16%

2005

$2,115 *

+ 56%

2006

$2,198

+

4%

2007

$

382 **

-

83

%

4

Net Income 4 Years – Without

Adjustments

2004-2007

* 2005 and 2007 net income without prior page foot noted adjustments, also reflects the costs

associated with our newly opened branches - Madison (September 2006) and Long Valley (May

2007).

(2.7%)

$2,139*

32%

$2,198

22%

$1,663*

16%

$1,359

Net

Income

%

2007

%

2006

%

2005

%

2004

( in thousands)

5

Income Trend

( in thousands)

*reflects a one time $449,000 reversal of the valuation allowance for taxes

** reflects a one time $1,200,000 write off of goodwill and a $1,000,000 increase in loan loss

provisions

2004

2005

2006

2007

2008

1

st

Qtr.

$ 222

$ 262

$ 475

$520

$444

2

nd

Qtr.

313

345

485

536

3

rd

Qtr.

410

457

573

504

4

th

Qtr.

414

1,051*

665

(1,178)**

6

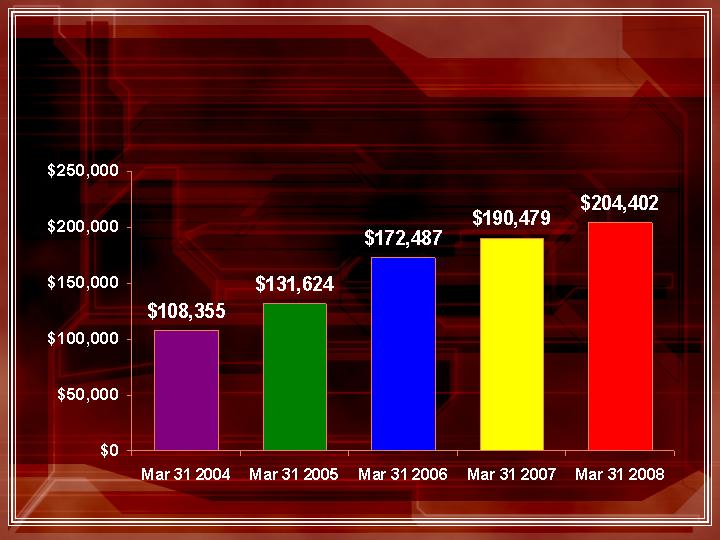

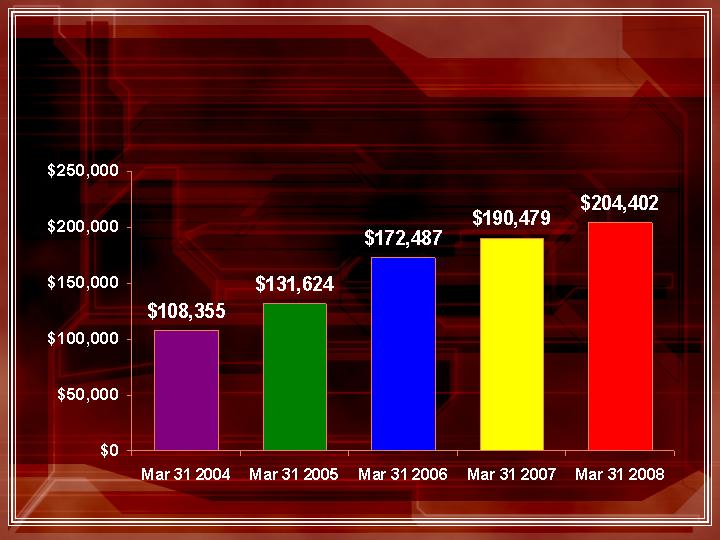

Loan Growth - Total Balances

10%

Increase

20%

Increase

31%

Increase

7%

Increase

10%

Increase

( in thousands)

7

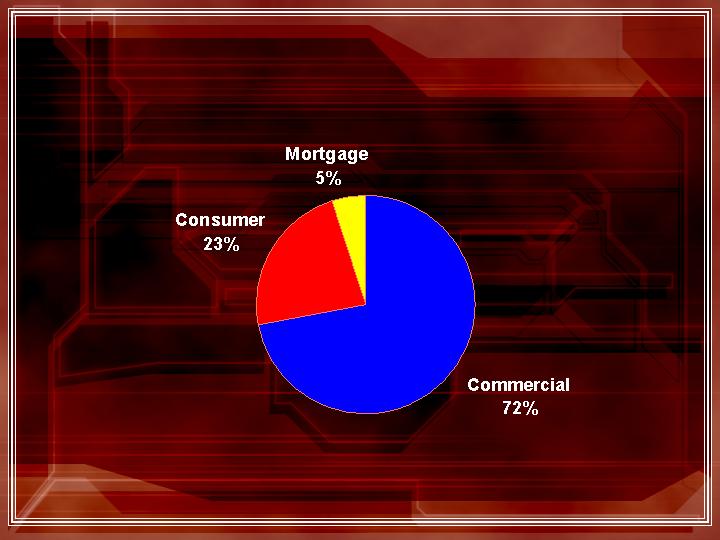

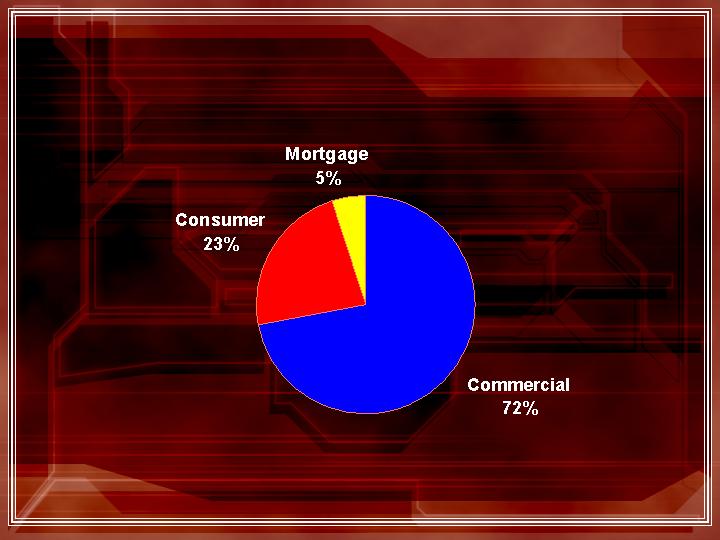

Loan Mix Composition Total Balances

March 31, 2008

8

Net Interest Margin

3.92%

03/31/2007

4.22%

03/31/2008

4.15%

12/31/2006

4.02%

12/31/2007

4.31%

12/31/2005

3.78%

12/31/2004

9

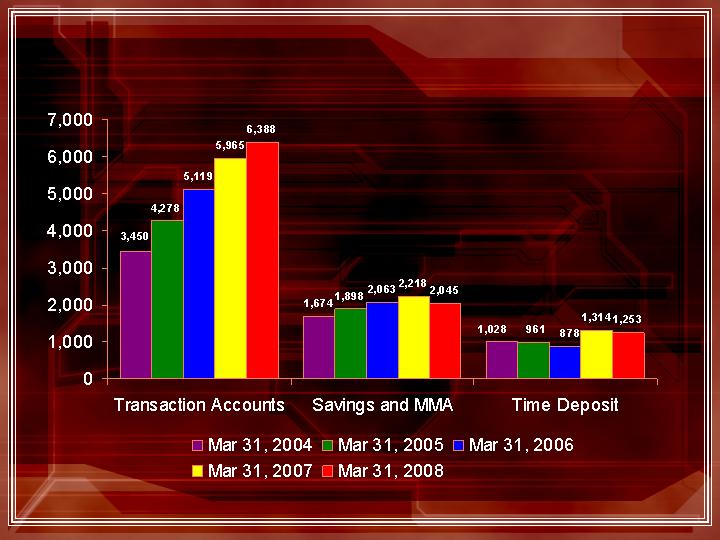

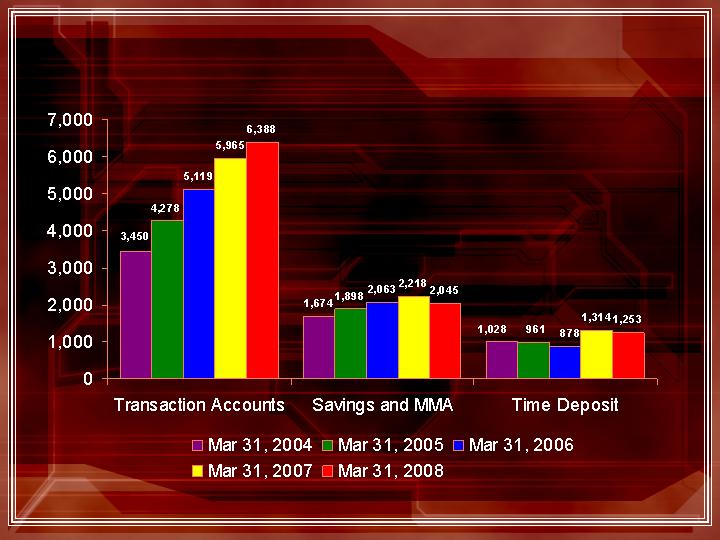

Deposit Growth

Total Deposits

Core Deposits

15%

Increase

22%

Increase

31%

Increase

26%

Increase

14%

Increase

16%

Increase

6%

Decrease

38%

Increase

4%

Decrease

20%

Increase

( in thousands)

10

Deposit Mix - Total Balances

86%

$35,616

$163,590

$51,015

12/31/2006

87%

$31,428

$159,462

$53,783

12/31/2007

90%

$20,731

$141,846

$45,667

12/31/2005

85%

$23,748

$94,066

$37,061

12/31/2004

79%

$30,545

$86,111

$28,995

12/31/2003

Core Deposits as a

% of Total Deposits

Time

Deposits

NOW/Money

Market/Savings

Demand

( in thousands)

11

Number of Accounts

12

Paramount Checking

Total Balances

Number of Accounts

22%

Increase

16%

Increase

19%

Increase

15%

Increase

3%

Increase

11%

Increase

9%

Decrease

9%

Increase

34%

Increase

22%

Increase

( in thousands)

13

Paramount Checking - continued

Average Balance Per Account

14

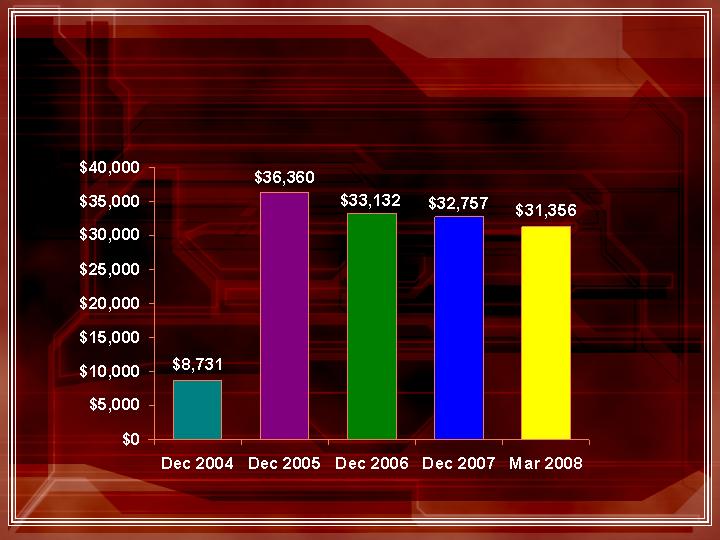

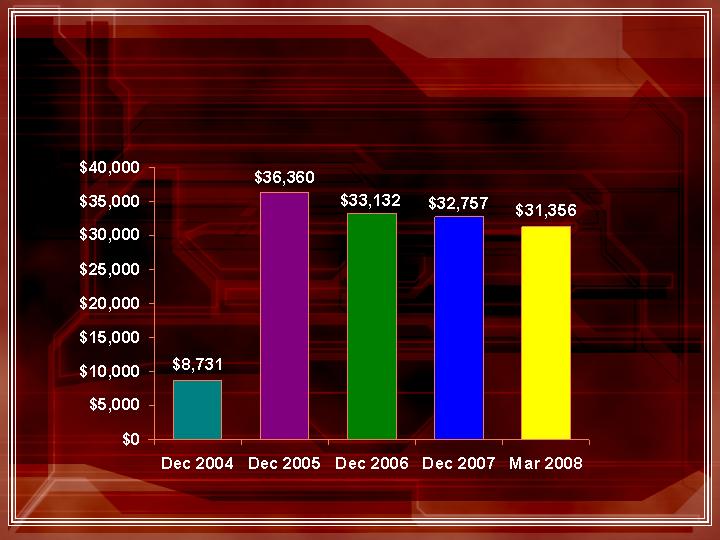

Escrow Ease

Total Balances

( in thousands)

15

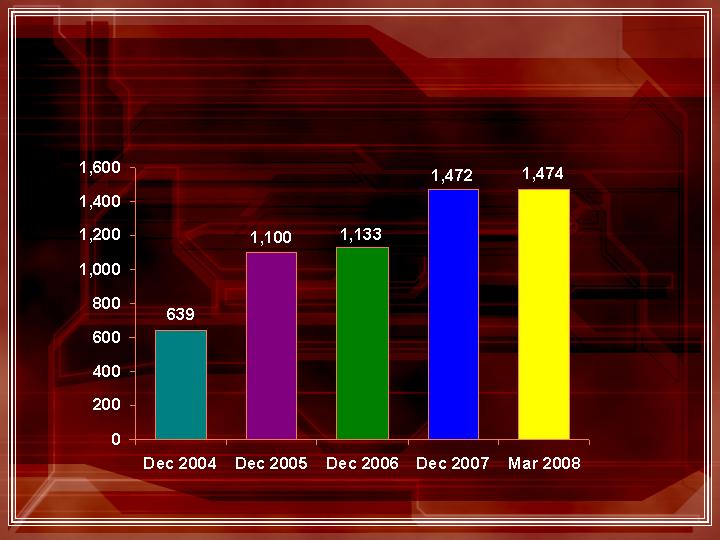

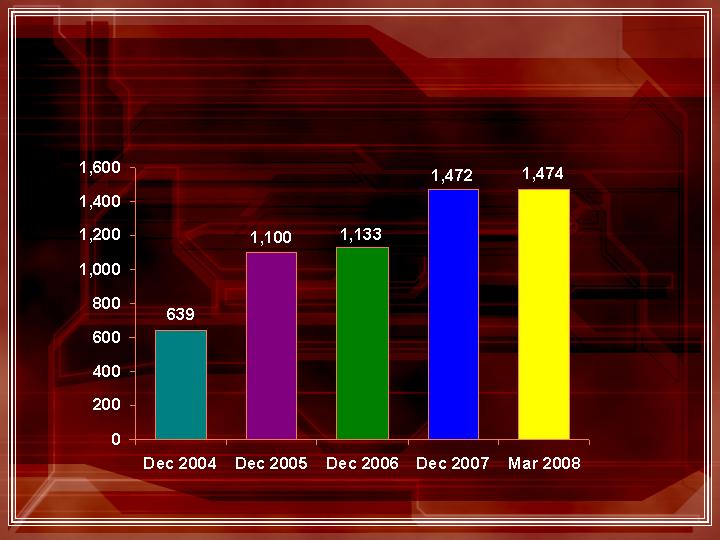

Escrow Ease - continued

Number of Client Accounts

16

Transaction Activity

Teller Transactions

Per Month

ACH Transactions

Per Month

27%

Increase

8%

Increase

58%

Increase

34%

Increase

5%

Increase

33%

Increase

8%

Decrease

4%

Increase

6%

Increase

23%

Increase

17

Capital Ratios

( in thousands)

Actual

Well Capitalized

December 31, 2007

Amount

Ratio

Amount

Ratio

Total Capital (to risk

-

weighted assets)

$39,485

16.01%

$2

4

,657

>

10.00%

Tier I Capital (to risk

-

weighted assets)

36,404

14.76

14,794

>

6.00

Tier I Capital (to average asse

ts)

36,404

12.68

14,353

>

5.00

December 31, 2006

Amount

Ratio

Amount

Ratio

Total Capital (to risk

-

weighted assets)

$39,063

16.52%

$23,645

>

10.00%

Tier I Capital (to risk

-

weighted assets)

36,893

15.60

14,187

>

6.00

Tier I Capital (to avera

ge assets)

36,893

13.69

13,475

>

5.00

December 31, 2005

Total Capital (to risk

-

weighted assets)

$26,450

12.73%

$20,772

>

10.00%

Tier I Capital (to risk

-

weighted assets)

24,421

11.76

12,463

>

6.00

Tier I Capital (to average assets)

24,4

21

10.40

11,739

>

5.00

December 31, 2004

Total Capital (to risk

-

weighted assets)

$23,557

13.77%

$17,106

>

10.00%

Tier I Capital (to risk

-

weighted assets)

21,923

12.82

10,263

>

6.00

Tier I Capital (to average assets)

21,923

11.83

9,268

>

5.00

18

Sullivan Financial Services, Inc.

a subsidiary of Somerset Hills Bank

Headquarters

100 Executive Drive, Suite 140

West Orange, NJ 07052

Phone: 973-325-5000

Fax: 973-736-7947

19

Sullivan Financial Services, Inc.

Products and Services

Conventional Mortgage Loans

Fixed and Adjustable Rate Loans

FHA/VA Loans

Jumbo Mortgages

1st Time Buyer Programs

Reverse Mortgages

No Cost Refinances

20

Sullivan Financial Services, Inc.

Loan Volume

2003

2004

2005

2006

2007

Originations

$530,913

,000

$330,491

,000

$379,114

,000

$341,689

,000

$261,168

,000

Originations

2,159

1,297

1,362

1,293

864

Closings

$505,384

,000

$270,803

,000

$311,273

,000

$293,329

,000

$232,

7

05

,000

Closings

1,384

2,0

98

1,091

1,132

781

21

Somerset Hills Wealth Management, LLC

For the Individual:

Financial Planning

Investment Management

Estate Review

Life, Health & Long Term Care

Insurance

Property and Casualty Insurance

22

Somerset Hills Wealth Management, LLC

For the Business Owner:

Business Succession Planning

Buy-Sell & Key Person

Agreements

Retirement Plans & Group

Insurance

Property and Casualty Insurance

23

Somerset Hills Wealth Management, LLC

Annual Profits

( in thousands)

24

Somerset Hills Title Company, LLC

PROVIDING TITLE SERVICE IN CONNECTION WITH THE

CLOSING OF REAL ESTATE TRANSACTIONS

2005

2006

2007

Total

Transactions

62

36

5

8

Amount of

Closed

Transactions

$57 Million

$55 Million

$

34

Million

Net Income to

Bank

$64,000

$101,000

$4

5

,000

25

Looking at 2008

Realize on existing franchise

Cross Sell Opportunities

Expense Management

Selective staffing

opportunities

26

“Our Franchise”

27

New in 2007

Then and now…

24 Schooley’s Mt. Road

Long Valley, NJ 07853

908-876-5525

28

New in 2008

Remote Deposit Capture Product

Competitively necessary

Opens new markets at minimal costs

Immediate cost savings

29

5% Stock Dividend !!!

30

$0.05 per quarter

25% Increase!!!

Cash Dividend

31