Exhibit 99.1

Investor Presentation

Stifel Nicolaus

May 12, 2009

Forward-Looking Statements

This investor presentation contains certain forward-looking statements which are based on certain

assumptions and describe future plans, strategies and expectations of the Company. These

forward-looking statements are generally identified by use of the words "believe," "expect,"

"intend," "anticipate," "estimate," "project," or similar expressions. The Company's ability to

predict results or the actual effect of future plans or strategies is inherently uncertain. Factors

which could have a material adverse effect on the operations of the Company and the

subsidiaries include, but are not limited to, changes in interest rates, general economic

conditions, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government,

including policies of the U.S. Treasury and the Federal Reserve Board, the quality or composition

of the loan or investment portfolios, demand for loan products, deposit flows, competition,

demand for financial services in the Company's market area and accounting principles and

guidelines. These risks and uncertainties should be considered in evaluating forward-looking

statements and undue reliance should not be placed on such statements. The Company does not

undertake -- and specifically disclaims any obligation -- to publicly release the result of any

revisions which may be made to any forward-looking statements to reflect events or

circumstances after the date of such statements or to reflect the occurrence of anticipated or

unanticipated events.

Company Profile

Commercial banking franchise founded in 1998

Six branches located in one of the Nation’s wealthiest regions in Northern NJ

$316 million in assets as of March 31, 2009

Solid Asset Quality

Only $127,000 in NPL’s out of $207 million loan portfolio (0.06%)

Superior Deposit Mix

More than three-quarters of deposits are “Core”

Strong Capital

Tangible Common Equity Ratio of 12.1%; TCE/Risk Weighted 15.5%

Highly Liquid

$46.4 million in cash as of March 31, 2009

Valuable Branch Network

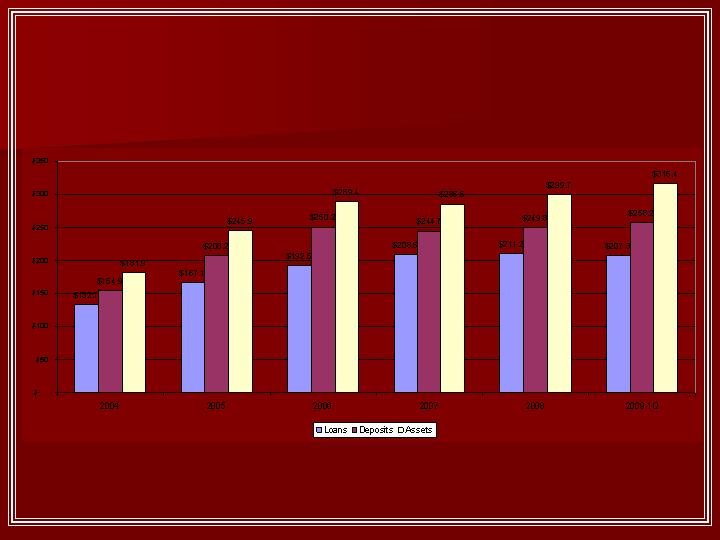

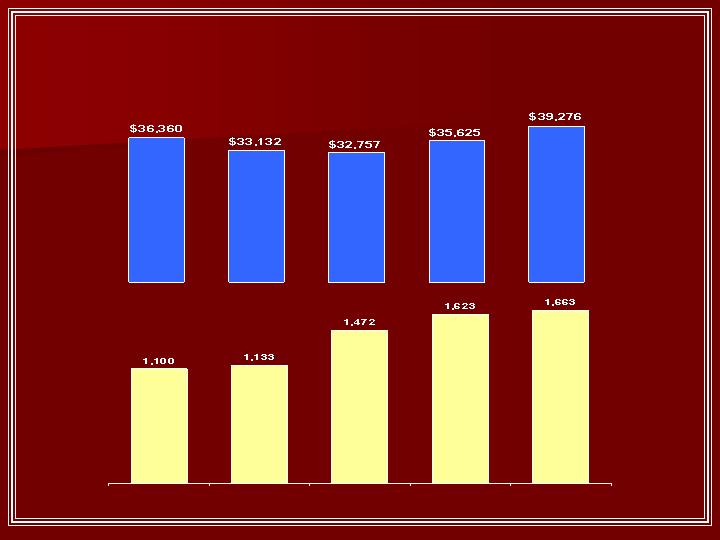

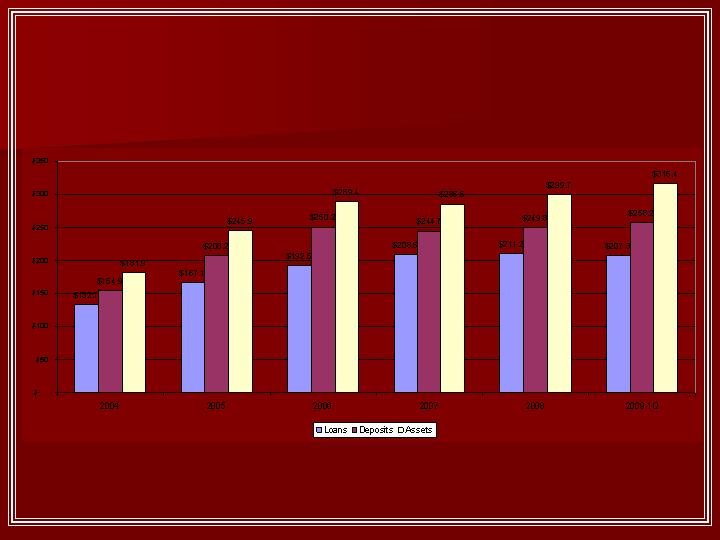

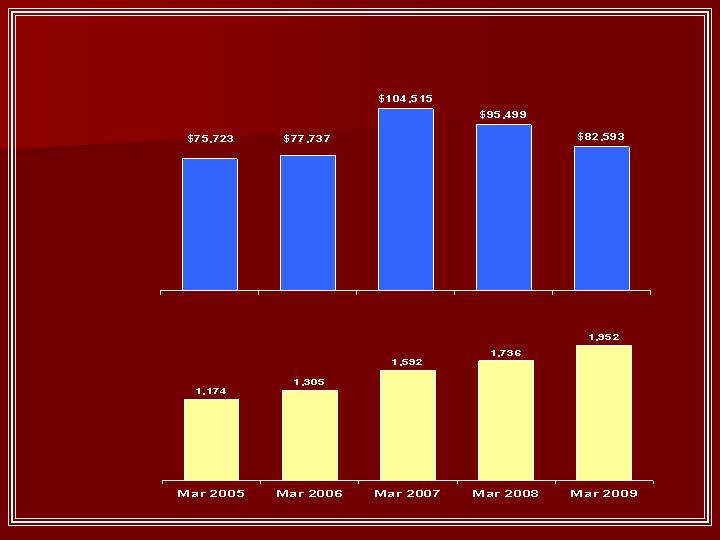

Deposit, Loan and Asset Growth

($ millions)

Net Income

($ thousands)

Our Credit Culture

We understand our local market -- that is where we lend

We adhere to a “know your borrower” philosophy

Our lenders are skilled and highly experienced in the state of New Jersey

We are a collateral lender with minimal unsecured exposure

We seek lower LTV/CLTV ratios, commensurate with loan type and risk

We generally require personal guarantees

Many of our loans are secured by multiple pieces of collateral

Collateral types include commercial R/E, personal homes, marketable

securities and other business assets.

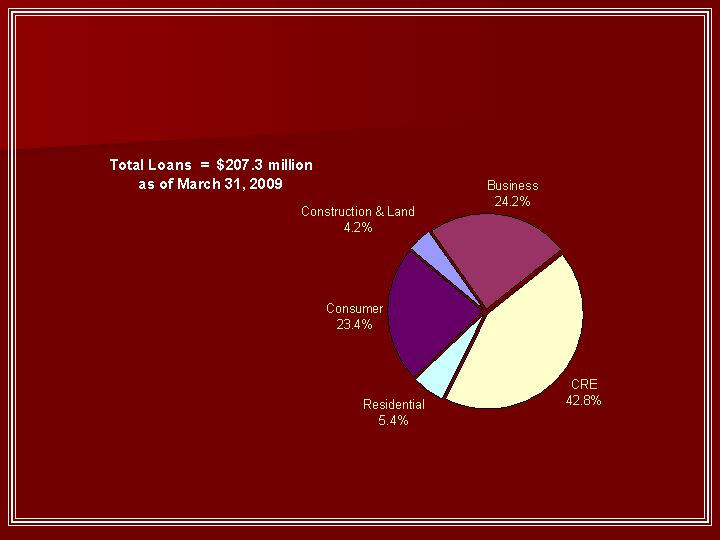

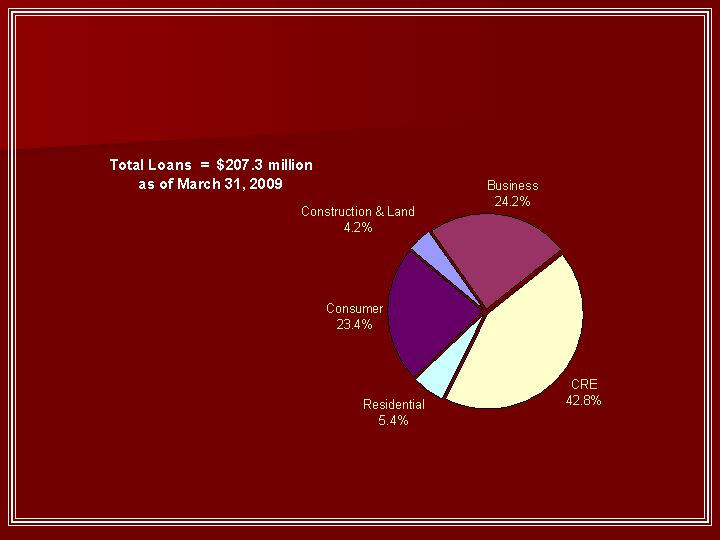

Loan Mix

Note: Business and Construction & Land Loans are included in Commercial and Industrial Loans in the Corporation’s SEC Filings.

Commercial RE Loan Portfolio

Portfolio totals $88.9 million as of March 31, 2009

No nonperforming loans or loans past-due more than 30 days at 3/31/09

We’ve never had a loss in this portfolio

99.6% of portfolio is secured by NJ properties

Diversified exposure with $650,000 average loan size

Weighted average LTV less than 50%

98.5% of portfolio carries a personal guarantee (excludes not for profits)

Business Loan Portfolio

Portfolio totals $50.2 million as of March 31, 2009

As of 3/31/09, no nonperforming loans or loans past due more than 30 days

Average loan size $201,000, reflecting a diverse local customer base, with

strong cross sell and referral opportunities

Virtually all business loans are supported by collateral including:

First- and second-liens on residential and commercial properties

Liquid assets, such as marketable securities

Other business assets including equipment, inventory and trade receivables

Consumer Loan Portfolio

$48.5 million outstanding as of March 31, 2009 (98% Home Equity)

Historical charge-offs in this portfolio = ZERO

Loans past due more than 30 days only 0.35%, and nonaccrual loans only

0.26% of total portfolio

100% in State of NJ

Self-originated, individually underwritten in-house.

We do not use automated underwriting models

Majority originated with a CLTV of 50% to 65%; maximum of 80%

HELOCs (75% of portfolio) are also underwritten on a principal & interest basis

We never entered the “piggy-back” business

Residential Mortgage Lending

Residential portfolio totals $11.1 million at 3/31/09

Primarily “accommodation” jumbos to high net worth individuals

Current avg. LTV is less than 40%

No nonperformers or past-due more than 30 days at 3/31/09

Sullivan Financial Services, Inc. (wholly-owned subsidiary)

All loans sold on a flow basis, servicing released, (i.e. a fee-based operating

model)

Efficient and scalable platform

Managed by mortgage banking veterans

Poised to capitalize on current re-financing wave and expected pick-up in “home

purchase” business

NPA’s/Total Assets vs. Industry

Source: SNL Financial. Community banks between $100mm and $1billion in total assets.

1st Q

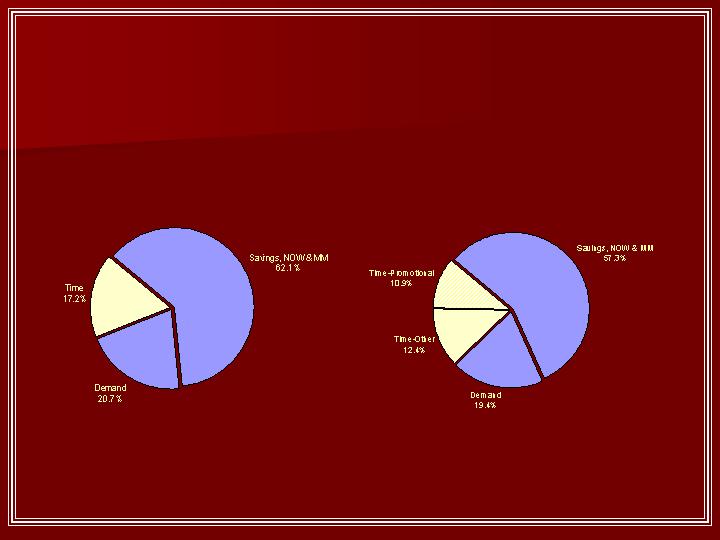

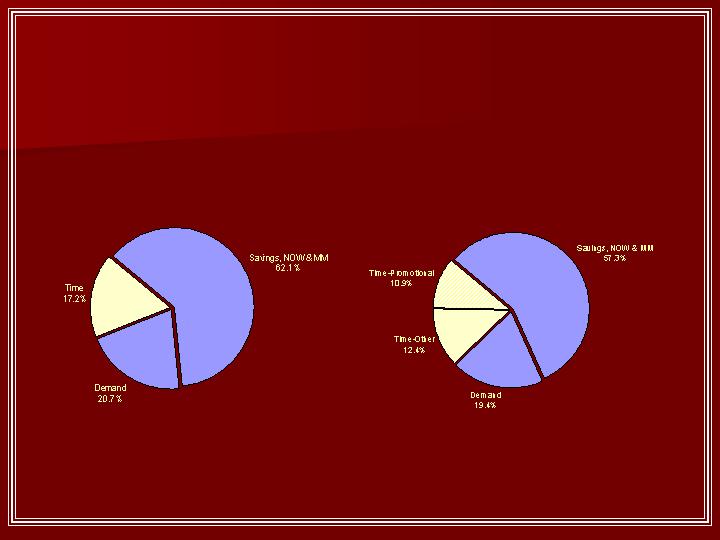

Deposit Mix

2008

1Q 2009

Note: Approximately $27 million of promotional CD’s were issued primarily during the 3 rd qtr of 2008 and mature largely

during the second half of 2009. Percentages reflect average balances for period.

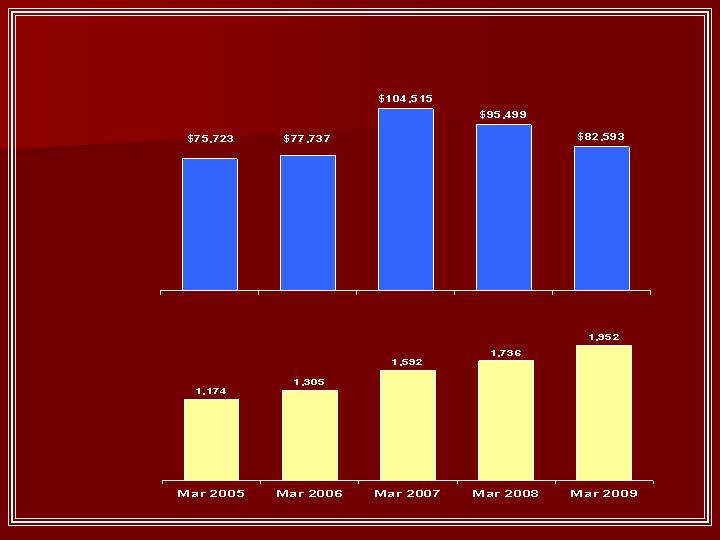

Paramount Checking

($ thousands)

Total Balances

Number of Accounts

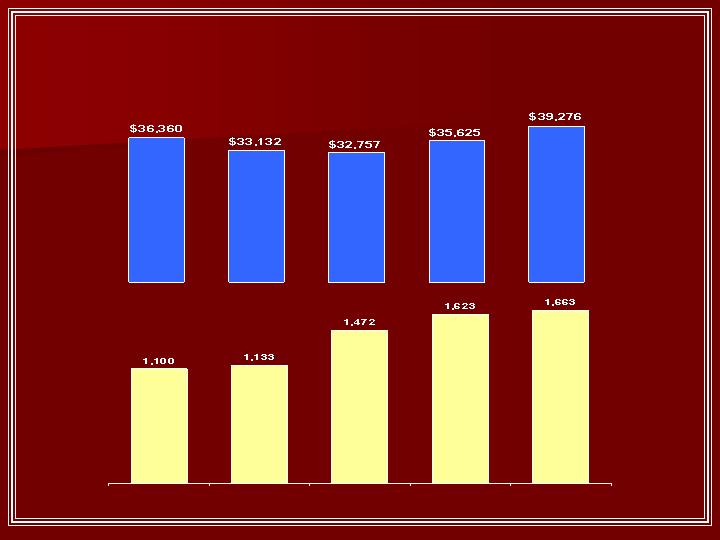

Escrow Ease

($ thousands)

Total Balances

Number of Accounts

12/31/05

12/31/06

12/31/07

12/31/08

3/31/09

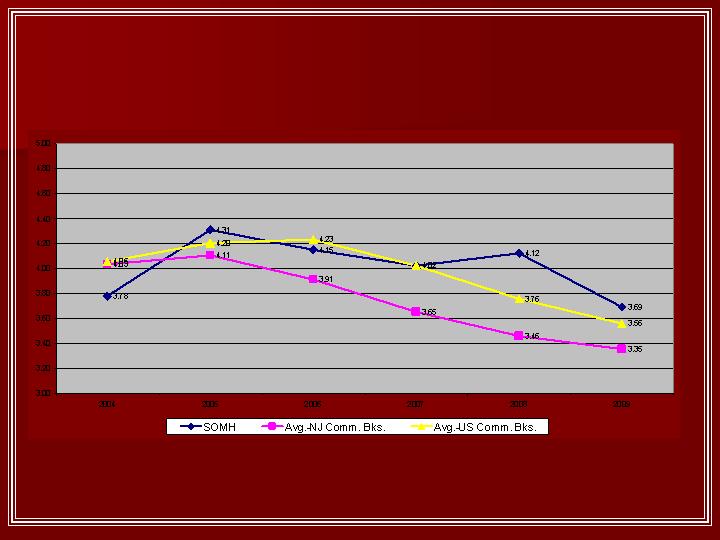

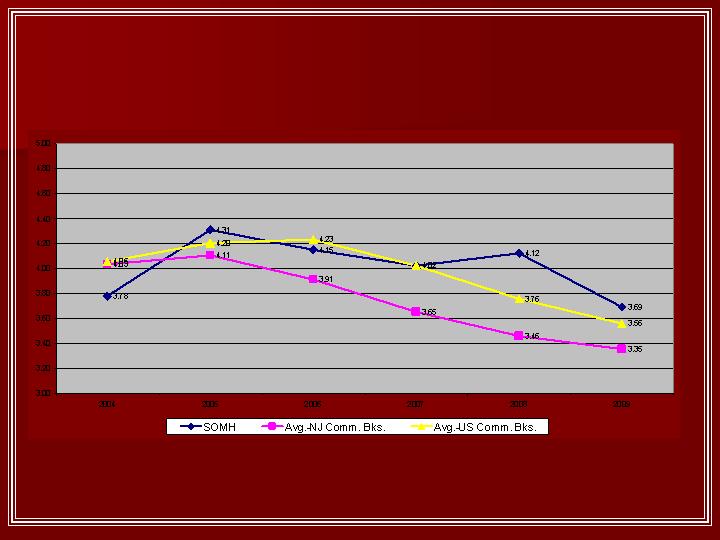

Net Interest Margin vs. Industry

March

Source: SNL Financial. Community banks between $100mm and $1billion in total assets.

1st Q

Strong Capital

Somerset Hills

Bancorp

Except Somerset Hills Bancorp

15.5%

On January 16, 2009 SOMH Issued “TARP Preferred”

$7.4 million in capital proceeds to Holding Company

163,065 warrants to purchase common stock at $6.82

Reasons for Issuing

Perception that only the strongest community banks would be approved

Encouraged by the regulators to participate

Possibly provide greater access to acquisitions of troubled banks, branches and

deposits.

On April 2, 2009, We Filed Notice with our Regulators to Redeem

Market perception for recipients changed from “the Strongest” to “Bailout”

More oversight of lending activities than anticipated

Post issuance market view more as debt, less as capital

Prohibits dividend increases and stock repurchases

On May 8, 2009 our Notice to Redeem was approved

Capital Issued under TARP