FORM 6 - K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

As of May 2, 2008

TENARIS, S.A.

(Translation of Registrant's name into English)

TENARIS, S.A.

46a, Avenue John F. Kennedy

L-1855 Luxembourg

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F.

Form 20-F R Form 40-F £

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12G3-2(b) under the Securities Exchange Act of 1934.

Yes £ No R

If “Yes” is marked, indicate below the file number assigned to the registrant in connection

with Rule 12g3-2(b): 82-

The attached material is being furnished to the Securities and Exchange Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended. This report contains Tenaris' notice of Annual General Meeting of Shareholders and the Shareholder Meeting Brochure and Proxy Statement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 2, 2008

Tenaris, S.A.

By: /s/ Cecilia Bilesio

Cecilia Bilesio

Corporate Secretary

Tenaris

Dear Tenaris Shareholder and ADR Holder,

I am pleased to invite you to attend the Annual General Meeting of Shareholders of the Company. The meeting will be held on Wednesday, June 4, 2008, at 46A, Avenue John F. Kennedy L-1855 Luxembourg and will begin promptly at 11:00 a.m. (Central European Time).

At the Annual General Meeting, you will have the opportunity to hear a report on the Company’s business, financial condition and results of operation and to vote on various matters, including the approval of the Company’s financial statements, the election of the members of the board of directors and the appointment of the independent auditors.

The Notice and Agenda for the meeting, the Shareholder Meeting Brochure and Proxy Statement and the Company’s 2007 annual report (which includes the Company’s consolidated financial statements for the years ended December 31, 2007, 2006 and 2005 and the Company’s annual accounts as at December 31, 2007, together with the board of directors’ and independent auditors reports), are available free of charge at the Company's registered office in Luxembourg and on our website at www.tenaris.com/investors. They may also be obtained upon request, by calling (352) 26-47-89-78 (if you are in Luxembourg), 1-800-555-2470 (if you are in the United States), or +1-267-468-0786 (if you are in another jurisdiction).

Even if you only own a few shares or ADRs, I hope that you will exercise your right to vote at the meeting. You can vote your shares personally or by proxy. If you choose to vote by proxy, you may use the enclosed dedicated proxy form. If you are a holder of ADRs, please see the letter from THE BANK OF NEW YORK MELLON, depositary bank, for instructions on how to exercise your vote by proxy.

Yours sincerely,

Paolo Rocca

Chairman and Chief Executive Officer

April 25, 2008

Re: TENARIS S.A.

| To: | Registered Holders of American Depositary Receipts (“ADRs”) |

for Shares of Common Stock, US$1 Par Value (“Common Stock”), of

Tenaris S.A. (the “Company”):

The Company has announced that its Annual General Meeting of Shareholders will be held on June 4, 2008, at 11:00 a.m. (Central European Time). The meeting will take place at 46A, Avenue John F. Kennedy L-1855 Luxembourg. A copy of the Company’s Notice of Annual General Meeting of Shareholders, including the agenda for such meeting, is enclosed.

The Notice of Annual General Meeting of Shareholders, the Shareholder Meeting Brochure and Proxy Statement, and the Company’s 2007 annual report (which includes the Company’s financial statements for the years ended December 31, 2007, 2006 and 2005 and the Company’s annual accounts as at December 31, 2007, together with the Board of Directors and independent auditors reports), are available on the website at www.tenaris.com/investors and may also be obtained upon request, by calling 1-800-555-2470 (if you are in the United States) or +1-267-468-0786 (if you are outside the United States). These materials are provided to allow the shares represented by your ADRs to be voted at the meeting.

Each holder of ADRs as of April 28, 2008, which continues to hold such ADRs on May 21, 2008, is entitled to instruct THE BANK OF NEW YORK MELLON, as Depositary (the “Depositary”), as to the exercise of the voting rights pertaining to the Company’s shares of Common Stock represented by such holder’s ADRs. Although voting instructions are sent to holders and proxy materials are available on the website beginning on May 2, 2008, only those holders of record at each of April 28, 2008 and May 21, 2008 will be entitled to provide the Depositary with voting instructions. Notwithstanding that holders of ADRs must have held ADRs on each such date, in order to avoid the possibility of double vote, only those positions on May 21, 2008 will be counted for voting instruction purposes. Eligible ADR holders who desire to have their shares represented by their ADRs voted at the meeting must complete, date and sign a proxy form and return it to the Depositary at THE BANK OF NEW YORK MELLON, Proxy Processing P.O. Box 3549, S. Hackensack, NJ 07606-9249, U.S.A. If the Depositary receives properly completed instructions by 3:00 p.m., New York City time, on May 29, 2008, then it shall vote or cause to be voted the shares underlying such ADRs in the manner prescribed by the instructions. However, if by 3:00 p.m., New York time, on May 29, 2008, the Depositary receives no instructions from the holder of ADRs, or the instructions are not in proper form, then the Depositary shall deem such holder to have instructed the Depositary to vote the underlying shares of Common Stock of any such ADRs in favor of any proposals or recommendations of the Company, for which purposes the Depositary shall issue a discretionary proxy to a person appointed by the Company to vote such shares in favor of any proposals or recommendations of the Company (including any recommendation by the Company to vote such shares on any given issue in accordance with the majority shareholder vote on that issue). No instruction shall be deemed given and no discretionary proxy shall be given with respect to any matter as to which the Company informs the Depositary (i) it does not wish such proxy given, (ii) it has knowledge that substantial opposition exists with respect to the action to be taken at the meeting, or (iii) the matter materially and adversely effects the rights of the holders of ADRs.

Any holder of ADRs is entitled to revoke any instructions which it has previously given to the Depositary by filing with the Depositary a written revocation or duly executed instructions bearing a later date at any time prior to 3:00 p.m., New York time, on May 29, 2008. No instructions, revocations or revisions thereof shall be accepted by the Depositary after that time.

IF YOU WANT YOUR VOTE TO BE COUNTED, THE DEPOSITARY MUST RECEIVE YOUR VOTING INSTRUCTIONS PRIOR TO 3:00 P.M. (NEW YORK CITY TIME) ON MAY 29, 2008.

THE BANK OF NEW YORK MELLON

Depositary

April 25, 2008

New York, New York

Tenaris

Tenaris S.A.

Société Anonyme Holding

46A, avenue John F. Kennedy

L-1855, Luxembourg

RCS Luxembourg B 85 203

Notice of the Annual General Meeting of Shareholders to be held on June 4, 2008

Notice is hereby given to holders of shares of common stock of Tenaris S.A. (the “Company”) that the Annual General Meeting of Shareholders will be held on June 4, 2008, at 11:00 a.m. (Central European Time). The meeting will be held at 46A, avenue John F. Kennedy L-1855 Luxembourg. In the Annual General Meeting, shareholders will vote with respect to the items listed below under the heading “Annual General Meeting of Shareholders”.

Agenda

Annual General Meeting of Shareholders

| 1. | Consideration of the Board of Directors’ and independent auditor’s reports on the Company’s consolidated financial statements. Approval of the Company’s consolidated financial statements for the years ended December 31, 2007, 2006 and 2005. |

| 2. | Consideration of the Board of Directors’ and independent auditors’ reports on the Company’s annual accounts. Approval of the Company’s annual accounts as at December 31, 2007. |

| 3. | Allocation of results and approval of dividend payment. |

| 4. | Discharge to the members of the Board of Directors. |

| 5. | Election of the members of the Board of Directors. |

| 6. | Compensation of the members of the Board of Directors. |

| 7. | Authorisation to the Board of Directors to cause the distribution of all shareholder communications, including its shareholder meeting and proxy materials and annual reports to shareholders, by such electronic means as is permitted by any applicable laws or regulations. |

| 8. | Appointment of the independent auditors and approval of their fees. |

Pursuant to the Company’s Articles of Association, resolutions at the Annual General Meeting of Shareholders will be passed by simple majority vote, irrespective of the number of shares present or represented.

Procedures for Attending the Meeting

Holders of shares wishing to attend the meeting must obtain an admission ticket by depositing their certificates representing their common stock, not later than 4:00 p.m. (local time) on May 30, 2008, at the Company’s office in Luxemburg or at the offices of any of the Company’s subsidiaries set forth below:

| Luxembourg: | 46A, Avenue John F. Kennedy |

L-1855 Luxembourg

Attn: Adelia Soares

| Argentina: | Carlos María della Paolera 299, piso 16° |

(C1001ADA) Buenos Aires

Attn: Horacio de las Carreras and/or Eleonora Cimino

| Italy: | c/o Dalmine S.p.A. |

Piazza Caduti 6 luglio 1944 n. 1 24044

Dalmine (BG)

Attn: Marco Tajana and/or Teresa Gaini

| Mexico: | c/o Tubos de Acero de México, S.A. |

Campos Eliseos 400-17

Col. Chapultepec Polanco

11560 Mexico D.F.

Attn: Félix Todd and/or Luis Armando Leviaguirre

Holders of shares holding their shares through fungible securities accounts wishing to attend the meeting must present a certificate (issued by the financial institution or professional depositary holding such shares) evidencing such deposit and certifying the number of shares recorded in the relevant account as of May 30, 2008. Such certificate must be filed no later than 4:00 p.m. (local time) on May 30, 2008, at any of the addresses indicated above and, in the case of shares held in Mexico, with S.D. Indeval, S.A. de C.V. (Paseo de la Reforma #255, 2o. y 3er. piso Col. Cuauhtémoc, Mexico City).

Holders of shares as of May 30, 2008, may also vote by proxy. To vote by proxy, holders must file the required certificate evidencing their holdings of shares and a completed proxy form not later than 4:00 p.m. (local time) on May 30, 2008 at any of the addresses indicated above or, in the case of shares held in Mexico, with S.D. Indeval, S.A. de C.V, in Mexico City.

Holders of American Depositary Receipts (“ADRs”) as of April 28, 2008, which continue to hold such ADRs on May 21, 2008, are entitled to instruct THE BANK OF NEW YORK MELLON, as Depositary (the “Depositary”), as to the exercise of the voting rights pertaining to the Company’s shares of common stock represented by such holder’s ADRs. Although voting instructions are sent to holders and proxy materials are available at our website beginning on May 2, 2008, only those holders of record as of each of April 28, 2008 and May 21, 2008 will be entitled to provide the Depositary with voting instructions. Notwithstanding that holders of ADRs must have held ADRs on each such date, in order to avoid the possibility of double vote, only those positions on May 21, 2008, will be counted for voting instruction purposes. Eligible ADR holders who desire to vote at the meeting must complete, date and sign a proxy form and return it to the Depositary, at THE BANK OF NEW YORK MELLON, Proxy Processing P.O. Box 3549, S. Hackensack, NJ 07606-9249, U.S.A., by 3:00 p.m., New York City time, on May 29, 2008.

The Shareholder Meeting Brochure and Proxy Statement (which contains reports on each item of the agenda for the meeting, and further details on voting procedures) and the forms furnished by the Company in connection with the meeting, may be obtained at any of the addresses indicated above or upon request by calling 1-800-555-2470 (if you are in the United States), +1-267-468-0786 (if you are outside the United States) or (352) 26-47-89-78 (if you are in Luxembourg), but also from the Depositary, Borsa Italiana SpA (Piazza degli Affari 6, 20123, Milan, Italy) and S.D. Indeval S.A. de C.V., as from May 2, 2008, between 10:00 a.m. and 5:00 p.m. (local time).

Copies of the Shareholder Meeting Brochure and Proxy Statement and the forms are also available at www.tenaris.com/investors. Copies of the Company’s 2007 annual reports (including the Company’s consolidated financial statements for the years ended 2007, 2006 and 2005 and the Company’s annual accounts as at December 31, 2007, the Board of Directors and independent auditors reports, and the documents referred to in the preceding sentence) may also be obtained free of charge at the Company's registered office in Luxembourg or upon request by calling 1-800-555-2470 (if you are in the United States), +1-267-468-0786 (if you are outside the United States) or (352) 26-47-89-78 (if you are in Luxembourg).

Cecilia Bilesio

Secretary to the Board of Directors

April 25, 2008

Luxembourg

Tenaris S.A.

Société Anonyme Holding

46A, avenue John F. Kennedy

L-1855, Luxembourg

RCS Luxembourg B 85 203

Shareholder Meeting Brochure and Proxy Statement

Annual General Meeting of Shareholders to be held on June 4, 2008

This Shareholder Meeting Brochure and Proxy Statement is furnished by Tenaris S.A. (the “Company”) in connection with the Annual General Meeting of Shareholders to be held, for the purposes set forth in the accompanying Notice of the Annual General Meeting of Shareholders (the “Notice”), on June 4, 2008, starting at 11:00 a.m., at 46A, avenue John F. Kennedy L-1855 Luxembourg.

As of April 25, 2008, there were issued and outstanding 1,180,536,830 shares of common stock, each entitled to one vote, US$1 par value each, of the Company (the “Common Stock”), including shares of Common Stock (the “Deposited Shares”) deposited with various agents for THE BANK OF NEW YORK MELLON, as depositary (the “Depositary”), under the Amended and Restated Deposit Agreement, dated as of February 28, 2008 (the “Deposit Agreement”), among the Company, the Depositary and all holders from time to time of American Depositary Receipts (the “ADRs”) issued thereunder. The Deposited Shares are represented by American Depositary Shares, which are evidenced by the ADRs (one ADR equals two Deposited Shares).

Each holder of shares of Common Stock is entitled to one vote per share. Holders of shares that hold shares through fungible securities accounts and wish to attend the meeting must present a certificate (issued by the financial institution or professional depositary holding such shares) evidencing such deposit and certifying the number of shares recorded in the relevant account on May 30, 2008. Such certificate must be filed no later than 4:00 p.m. (local time) on May 30, 2008, at any of the addresses indicated in the Notice, or, in the case of shares held in Mexico, with S.D. Indeval, S.A. de C.V., in Mexico City.

Holders of shares as of May 30, 2008, may also vote by proxy. To vote by proxy, holders must file the required certificate evidencing their holdings of shares and a completed proxy form not later than 4:00 p.m. (local time), on May 30, 2008, at any of the addresses indicated in the Notice, or, in the case of shares held in Mexico, with S.D. Indeval, S.A. de C.V., in Mexico City.

Each holder of ADRs as of April 28, 2008, which continues to hold such ADRs on May 21, 2008, is entitled to instruct the Depositary, as to the exercise of the voting rights pertaining to the Company’s shares of Common Stock represented by such holder’s ADRs. Although voting instructions are sent to holders and proxy materials are available at our website beginning on May 2, 2008, only those holders of record as of each of April 28, 2008 and May 21, 2008 will be entitled to provide the Depositary with voting instructions. Notwithstanding that holders of ADRs must have held ADRs on each such date, in order to avoid the possibility of double vote, only those positions on May 21, 2008 will be counted for voting instruction purposes. Eligible holders of ADRs who desire to have their shares represented by their ADRs voted at the meeting must complete, date and sign a proxy form and return it to the Depositary, at THE BANK OF NEW YORK MELLON, Proxy Processing P.O. Box 3549, S. Hackensack, NJ 07606-9249, U.S.A. If the Depositary receives properly completed instructions by 3:00 p.m., New York City time, on May 29, 2008, then it shall vote or cause to be voted the shares underlying such ADRs in the manner prescribed by the instructions. However, if by 3:00 p.m., New York time, on May 29, 2008, the Depositary receives no instructions from the holder of ADRs, or the instructions are not in proper form, then the Depositary shall deem such holder to have instructed the Depositary to vote the underlying shares of Common Stock of any such ADRs in favor of any proposals or recommendations of the Company, for which purposes the Depositary shall issue a discretionary proxy to a person appointed by the Company to vote such shares in favor of any proposals or recommendations of the Company (including any recommendation by the Company to vote such shares on any given issue in accordance with the majority shareholder vote on that issue). No instruction shall be deemed given and no discretionary proxy shall be given with respect to any matter as to which the Company informs the Depositary (i) it does not wish such proxy given (ii) it has knowledge that substantial opposition exists with respect to the action to be taken at the meeting, or (iii) the matter materially and adversely effects the rights of the holders of ADRs. Any holder of ADRs is entitled to revoke any instructions which it has previously given to the Depositary by filing with the Depositary a written revocation or duly executed instructions bearing a later date at any time prior to 3:00 p.m., New York time, on May 29, 2008. No instructions, revocations or revisions thereof shall be accepted by the Depositary after that time.

Due to regulatory differences and market practices in each country where the Company’s shares or ADRs are listed, holders of shares traded on the Argentine and Italian stock exchanges who have requested admission to the meeting, or who have issued a voting proxy, must have their shares blocked for trading until the date of the meeting, while holders of shares traded in the Mexican stock exchange and holders of ADRs traded in the New York stock exchange need not have their shares or ADRs, as the case may be, blocked for trading. However, the votes of holders of shares traded in the Mexican stock exchange who sell their shares between May 29, 2008 and June 3, 2008, shall be disregarded for voting purposes.

The meeting will appoint a chairperson pro tempore to preside the meeting. The chairperson pro tempore will have broad authority to conduct the meeting in an orderly and timely manner and to establish rules for shareholders who wish to address the meeting; the chairperson may exercise broad discretion in recognizing shareholders who wish to speak and in determining the extent of discussion on each item of the agenda.

Pursuant to the Company’s Articles of Association, resolutions at the Annual General Meeting of Shareholders will be passed by majority vote, irrespective of the number of shares present or represented.

The meeting is called to address and vote on the following agenda:

Annual General Meeting of Shareholders

1. Consideration of the Board of Directors’ and independent auditor’s reports on the Company’s consolidated financial statements. Approval of the Company’s consolidated financial statements for the years ended December 31, 2007, 2006 and 2005.

The Board of Directors recommends a vote FOR approval of the Company’s consolidated financial statements for the fiscal years ended December 31, 2007, 2006 and 2005, after due consideration of the reports from each of the Board of Directors and the independent auditors on such consolidated financial statements. The consolidated balance sheet of the Company and its subsidiaries at December 31, 2007, 2006 and 2005 and the related consolidated statement of income, consolidated statement of changes in shareholders’ equity, consolidated cash flow statement and notes to the consolidated financial statements, the independent auditors’ report on such consolidated financial statements and management’s discussion and analysis on the Company’s results of operations and financial condition are included in the Company’s 2007 annual report, a copy of which is available on our website at www.tenaris.com/investors and may also be obtained upon request, by calling (352) 26-47-89-78 (if you are in Luxembourg), 1-800-555-2470 (if you are in the United States), or +1-267-468-0786 (if you are in another jurisdiction).

2. Consideration of the Board of Directors’ and independent auditors’ reports on the Company’s annual accounts. Approval of the Company’s annual accounts as at December 31, 2007.

The Board of Directors recommends a vote FOR approval of the Company’s annual accounts as of, and for the fiscal year ended, December 31, 2007, after due consideration of the report from each of the Board of Directors and the independent auditors on such annual accounts. These documents are included in the Company’s 2007 annual report, a copy of which is available on our website at www.tenaris.com/investors and may also be obtained upon request, by calling (352) 26-47-89-78 (if you are in Luxembourg), 1-800-555-2470 (if you are in the United States), or +1-267-468-0786 (if you are in another jurisdiction)..

3. Allocation of results and approval of dividend payment.

The Board of Directors recommends a vote FOR approval of a dividend in U.S. dollars, in the amount of US$0.38 per share of Common Stock currently issued and outstanding and US$0.76 per ADR currently issued and outstanding. As required by Luxembourg law, this dividend includes the interim dividend of US$0.13 per share (US$0.26 per ADR) paid on November 22, 2007. Accordingly, if this dividend proposal is approved, the Company will make a dividend payment on June 26, 2008, in the amount of US$ 0.25 per share of Common Stock currently issued and outstanding and US$ 0.50 per ADR currently issued and outstanding.

The aggregate amount of US$ 153,469,787.90 distributed as interim dividend on November 22, 2007, was paid from earnings from the nine-month period ended September 30, 2007. The aggregate amount of US$ 295,134,207.50 to be distributed as dividends on June 26, 2008, is to be paid from profits of the year ended December 31, 2007. The balance of the fiscal year’s profits will be allocated to the Company’s retained earnings account.

Upon approval of this resolution, it is proposed that the Board of Directors determine or amend, in its discretion, the terms and conditions of the dividend payment, including the applicable record date.

4. Discharge to the members of the Board of Directors.

In accordance with applicable Luxembourg law and regulations, it is proposed that, upon approval of the Company’s accounts as at December 31, 2007, the members of Board of Directors be discharged of any responsibilities in connection with the management of the Company’s affairs during such year.

5. Election of the members of the Board of Directors.

The Company’s Articles of Association provide for the annual election by the holders of shares of Common Stock of a Board of Directors of not less than five and not more than fifteen members. Members of the Board of Directors have a term of office of one year, but may be reappointed.

Under applicable U.S. laws and regulations, effective as of July 15, 2005, the Company is required to have an Audit Committee comprised solely of directors who are independent.

The present Board of Directors of the Company consists of ten directors. Three members of the Board of Directors (Messrs. Jaime Serra Puche, Amadeo Vázquez y Vázquez and Roberto Monti) qualify as independent directors under the Company’s Articles of Association and applicable law and are members of the Audit Committee.

It is proposed that the size of the Board of Directors be maintained at ten members and that nine of the current members of the Board of Directors be re-elected. Mr. Bruno Marchettini is not running for re-election, and Mr. Alberto Valsecchi, former Chief Operating Officer of the Company, is being proposed as a new member of the Board of Directors in his stead.

Set forth below is summary biographical information of each of the candidates:

| 1. | Mr. Roberto Bonatti. Mr. Bonatti, grandson of Agostino Rocca and first cousin of the Company’s chairman, Paolo Rocca, has been involved in Techint Group businesses, specifically in the engineering and construction and corporate sectors, throughout his career. He was first employed by the Techint Group in 1976, as a deputy resident engineer in Venezuela. In 1984, he became a member of the board of directors of San Faustín N.V. (“San Faustín”), the Company’s controlling shareholder, and, since 2001, he has served as its president. In addition, Mr. Bonatti currently serves as president of Techint Compañía Técnica Internacional S.A.C.I. and Tecpetrol S.A. (“Tecpetrol”), an oil producer, and is a member of the board of directors of Siderca S.A.I.C. (“Siderca”), Siderar S.A.I.C. (“Siderar”), and Ternium S.A. (“Ternium”), an affiliate of the Company. Mr. Bonatti, aged 58, is an Italian citizen. |

| 2. | Mr. Carlos Condorelli. Mr. Condorelli served as the Company’s chief financial officer, a position that he assumed in October 2002 and held until September 30, 2007. He is also a member of the board of directors of Ternium. He began his career within the Techint Group in 1975 as an analyst in the accounting and administration department of Siderar. He has held several positions within the Company or its subsidiaries and other Techint Group companies, including as finance and administration director of Tubos de Acero de México, S.A. (“Tamsa”) and president of the board of directors of Empresa Distribuidora La Plata S.A., an Argentine utilities company. Mr. Condorelli, aged 57, is an Argentine citizen. |

| 3. | Mr. Carlos Manuel Franck. Mr. Franck is the president of Santa María S.A.I.F., and Inverban S.A., the vice president of Siderca and a member of the board of directors of Techint Financial Corporation N.V. (“Techint Financial”), I.I.I., Industrial Investments Inc., Siderar, Tecpetrol and Tecgas N.V. He has financial, planning and control responsibilities in various Techint Group companies. Mr. Franck, aged 57, is an Argentine citizen. |

| 4. | Mr. Roberto Monti. Mr. Monti is the non-executive chairman of Trefoil Limited, a member of the board of directors of Petrobras Energia and John Wood Group PLC. He has served as vice president of Exploration and Production of Repsol YPF and chairman and CEO of YPF. He was also the president of Dowell, a subsidiary of Schlumberger and the president of Schlumberger Wire & Testing division for East Hemisphere Latin America. Mr. Monti, aged 69, is an Argentine citizen. |

| 5. | Mr. Gianfelice Mario Rocca. Mr. Rocca, a grandson of Agostino Rocca and brother of the Company’s chairman, Mr. Paolo Rocca, is the chairman of the board of directors of San Faustín, a member of the board of directors of Tamsa and Ternium, the president of the Humanitas Group, and the president of the board of directors of Techint Compagnia Tecnica Internazionale S.p.A. and Tenova S.p.A. In addition, he is a member of the board of directors or executive committees of several companies, including Allianz S.p.A, RCS Quotidiani and Buzzi Unicem. He is the vice president of Confindustria, the leading association of Italian industrialists. He is a member of the Advisory Board of Allianz Group, of the Trilateral Commission and of the European Advisory Board of the Harvard Business School. Mr. Rocca, aged 60, is an Italian citizen. |

| 6. | Mr. Paolo Rocca. Mr. Rocca, a grandson of Agostino Rocca, is the the Company’s chief executive officer. He is also the chairman of the board of directors of Tamsa and the vice president of Confab Industrial S.A. In addition, he is the chairman of the board of directors of Ternium, a member of the board of directors and vice president of San Faustín and a member of the board of directors of Techint Financial. Mr. Rocca is a vice chairman of the International Iron and Steel Institute and a member of the International Advisory Committee of the New York Stock Exchange. Mr. Rocca, aged 55, is an Italian citizen. |

| 7. | Mr. Jaime Serra Puche. Mr. Serra Puche is the chairman of SAI Consultores, a Mexican consulting firm, and a member of the board of directors of Chiquita Brands International, The Mexico Fund, Grupo Vitro and Grupo Modelo. Mr. Serra Puche served as Mexico’s Undersecretary of Revenue, Secretary of Trade and Industry, and Secretary of Finance. He led the negotiation and implementation of NAFTA. Mr. Serra Puche, aged 57, is a Mexican citizen. |

| 8. | Mr. Alberto Valsecchi. Mr. Valsecchi served as the Company’s chief operating officer, a position he assumed in February 2004 and held until July 31, 2007. He joined the Techint Group in 1968 and has held various positions within the Company or its subsidiaries and the Techint Group. He has retired from executive positions. He is a member of the board of directors of San Faustín and has been elected as the chairman of the board of directors of Dalmine S.p.A., a position he is expected to assume in May 2008. Mr. Valsecchi, aged 63, is an Italian citizen. |

| 9. | Mr. Amadeo Vázquez y Vázquez. Mr. Vázquez y Vázquez is an independent member of the board of directors and of the audit committee of Gas Natural Ban, S.A. He is a member of the Executive Committee of the Asociación Empresaria Argentina and of the Fundación Mediterránea, and he is a member of the Advisory Board of the Fundación de Investigaciones Económicas Latinoamericanas. He served as CEO of Banco Río de la Plata S.A. until August 1997 and was also the chairman of the board of directors of Telecom Argentina S.A. until April 2007. Mr. Vázquez y Vázquez, aged 66, is a Spanish and Argentine citizen. |

| 10. | Mr. Guillermo F. Vogel. Mr. Vogel is the vice chairman of Tamsa, the chairman of Grupo Collado S.A. de C.V., the vice chairman of Estilo y Vanidad S.A. de C.V. and a member of the board of directors of Alfa S.A.B. de C.V., the American Iron and Steel Institute, the North American Steel Council, the North American Competitiveness Council and the International Iron and Steel Institute. In addition, he is a member of the board of directors and of the investment committee of the Corporación Mexicana de Inversiones de Capital, and a member of the board of directors and of the audit committee of HSBC (Mexico). Mr. Vogel, aged 57, is a Mexican citizen. |

Each elected director will hold office until the next Annual General Meeting of Shareholders. Under the current Company’s Articles of Association, such meeting is required to be held on June 3, 2009.

The Company’s Board of Directors met eight times during 2007. On January 31, 2003, the Board of Directors created an Audit Committee pursuant to Article 11 of the Company’s Articles of Association. As permitted under applicable laws and regulations, the Board of Directors does not have any executive, nominating or compensation committee, or any committees exercising similar functions.

6. Compensation of the members of the Board of Directors.

It is proposed that each of the members of the Board of Directors receive an amount of US$ 70,000 as compensation for their services during the fiscal year 2008. It is further proposed that the members of the Board of Directors who are members of the Audit Committee receive an additional fee of US$50,000 and that the Chairman of such Audit Committee receive, in addition, an additional fee of US$10,000.

7. Authorisation to the Board of Directors to cause the distribution of all shareholder communications, including its shareholder meeting and proxy materials and annual reports to shareholders, by such electronic means as is permitted by any applicable laws or regulations.

In order to expedite shareholder communications and ensure their timely delivery, the Board of Directors recommends that it be authorised to cause the distribution of all shareholder communications, including its shareholder meeting and proxy materials and annual reports to shareholders (either in the form of a separate annual report containing financial statements of the Company and its consolidated subsidiaries or in the form of an annual report on Form 20-F or similar document, as filed with the securities authorities or stock markets) by such electronic means as are permitted or required by any applicable laws or regulations (including any interpretations thereof), including, without limitation, by posting such communication on the Company's website, or by sending electronic communications (emails) with attachment(s) in a widely used format or with a hyperlink to the applicable filing by the Company on the website of the above referred authorities or stock markets, or by any other existing or future electronic means of communication as is or may be permitted by any applicable laws or regulations.

In this resolution the Company seeks authorisation under Article 16 of the Luxembourg Transparency Law of 11 January 2008 to give, send or supply information (including any notice or other document) that is required or authorised to be given, sent or supplied to a shareholder by the Company whether required under the Company’s Articles of Association or by any applicable law or any other rules or regulations to which the Company may be subject, by making such information (including any notice or other document) available on the Company’s website or through other electronic means.

8. Appointment of independent auditors and approval of their fees.

Based on the recommendation from the Audit Committee, the Board of Directors recommends a vote FOR the appointment of PricewaterhouseCoopers (acting, in connection with the Company’s annual accounts required under Luxembourg law, through PricewaterhouseCoopers S.àr.l., Réviseur d'entreprises, and, in connection with the Company’s annual and interim financial statements required under the laws of any other relevant jurisdiction, through Pricewaterhouse & Co. S.R.L.) as the Company’s independent auditors for the fiscal year ending December 31, 2008, to be engaged until the next Annual General Meeting that will be convened to resolve on the 2008 accounts.

With respect to independent auditors' fees for audit, audit-related and other services to be rendered during the fiscal year ending December 31, 2008, the Board of Directors recommends a vote FOR approval of fees payable in US dollars or other currency, as appropriate, up to an aggregate amount that, based on the exchange rate between the US dollar and each applicable currency as of December 31, 2007, was equivalent to US$4,753,018. Such fees would cover the audit of the Company's consolidated financial statements and annual accounts, the audit of the Company's internal controls over financial reporting, audit and audit-related services, and other services. The Board of Directors also recommends a vote FOR the grant of an authorization to the Audit Committee of the Board of Directors to approve any increase or reallocation of the independent auditors' fees as may be necessary, appropriate or advisable under the circumstances.

The Company anticipates that the next Annual General Meeting of Shareholders will be held on June 3, 2009. Any holder of shares who intends to present a proposal to be considered at the next Annual General Meeting must submit its proposal in writing to the Company at any of the offices indicated in the Notice not later than 4:00 P.M. (local time) on March 31, 2009, or in accordance with the procedures set forth under applicable Luxembourg law, in order for such proposal to be considered for inclusion on the agenda for the 2009 Annual General Meeting of Shareholders.

PricewaterhouseCoopers are the Company’s independent auditors. A representative of the independent auditors will be present at the meeting to respond to questions.

Cecilia Bilesio

Secretary to the Board of Directors

Annual Report 2007

Company profile

Leading indicators

Chairman’s letter

Business review

Communities and environment review

Corporate governance

Board of directors and executive officers

Operating and financial review

Consolidated financial statements

Report and accounts of Tenaris S.A. (Luxembourg GAAP)

Corporate information

Company profile

Tenaris is a leading supplier of tubes and related services for the world’s energy industry and certain other industrial applications. Our mission is to deliver value to our customers through product development, manufacturing excellence and supply chain management. We minimize risk for our customers and help them reduce costs, increase flexibility and improve time-to-market. Our employees around the world are committed to continuous improvement by sharing knowledge across a single global organization.

Leading indicators

| 2007 | 2006 | 2005 | ||||||||||

| SALES VOLUMES (thousands of metric tons) | ||||||||||||

| Seamless tubes | 2,870 | 2,919 | 2,870 | |||||||||

| Welded tubes | 1,439 | 578 | 501 | |||||||||

| Total steel tubes | 4,309 | 3,497 | 3,371 | |||||||||

| PRODUCTION VOLUMES (thousands of metric tons) | ||||||||||||

| Seamless tube | 2,836 | 3,013 | 2,842 | |||||||||

| Welded pipes | 1,408 | 642 | 476 | |||||||||

| Total steel tubes | 4,244 | 3,655 | 3,318 | |||||||||

| FINANCIAL INDICATORS (millions of USD) | ||||||||||||

| Net sales | 10,042 | 7,728 | 6,210 | |||||||||

| Operating income | 2,957 | 2,792 | 1,946 | |||||||||

| EBITDA (1) | 3,449 | 3,046 | 2,158 | |||||||||

| Net income (2) | 2,076 | 2,059 | 1,387 | |||||||||

| Free cash flow (3) | 2,021 | 1,811 | 1,295 | |||||||||

| Capital expenditures | 448 | 441 | 284 | |||||||||

| BALANCE SHEET (millions of USD) | ||||||||||||

| Total assets | 15,245 | 12,595 | 6,706 | |||||||||

| Total financial debt | 4,020 | 3,651 | 1,010 | |||||||||

| Net financial debt (4) | 2,970 | 2,095 | 183 | |||||||||

| Total liabilities | 7,715 | 6,894 | 2,930 | |||||||||

| Shareholders’ equity including minority interest | 7,530 | 5,702 | 3,776 | |||||||||

| PER SHARE / ADS DATA (USD PER SHARE / PER ADS) | ||||||||||||

Number of shares outstanding (5) (thousands of shares) | 1,180,537 | 1,180,537 | 1,180,537 | |||||||||

| Earnings per share | 1.63 | 1.65 | 1.08 | |||||||||

| Earnings per ADS | 3.26 | 3.30 | 2.16 | |||||||||

| Dividends per share (6) | 0.38 | 0.30 | 0.30 | |||||||||

| Dividends per ADS (6) | 0.76 | 0.60 | 0.60 | |||||||||

| ADS Stock price at year-end | 44.73 | 49.89 | 22.90 | |||||||||

| Number of employees (5) | 23,372 | 21,751 | 17,693 | |||||||||

| (1) | Defined as operating income plus depreciation and amortization from continuing operations. |

| (2) | Defined as borrowings less cash and cash equivalents and other current investments. |

| (3) | On April 26, 2006 the ratio of ADSs to ordinary shares was changed from 1:10 to 1:2. ADS data is stated using the new ratio. |

| (4) | As of December 31. |

| (5) | Proposed or paid in respect of the year. |

Chairman’s letter

Dear Shareholders,

This has been another eventful year for Tenaris. We consolidated our industrial and commercial presence in the USA and substantially enhanced our worldwide positioning in premium connections. We strengthened relations with key global customers including ConocoPhillips, Chevron and OMV. We put into operation important investments to add capacity for processing high value products, started the implementation of an integrated systems platform to improve our response to customers and launched an ambitious project to improve all aspects ofour industrial management.

Our financial performance continues to be strong with record revenues of USD 10.0 billion and a 34% EBITDA margin.

Following our US acquisitions and the lifting of trade restrictions on our imports of seamless OCTG products, we have full access to the North American market. We are now the only supplier able to provide to our customers a full range of products, for every well application, in a strategic market that accounts for around 40% of global OCTG consumption. With the backing of our supply chain and technical services, we are working with distributors and forming alliance partnerships with major oil and gas operators.

As the oil and gas industry develops new reserves in complex operating environments, project-specific solutions and multi-year development and testing programs are increasingly required. In environments with extreme pressure, temperature and corrosion conditions, material selection and handling are critical as errors can cost lives and result in significant financial loss.

With Hydril, we have a unique opportunity to enhance our leadership in servicing the requirements of our customers in these conditions. The integrated TenarisHydril product and technology portfolio is exceptional and offers a complete range of options in applications from the deepest high pressure, high temperature wells to the extended, horizontal reach wells often used to increase recovery from existing fields. We have the people, technology and resources to support our customers worldwide and we have reorganized our commercial team to instill Hydril’s service-oriented focus and offer integrated technical solutions.

The market did not go all our way last year. Demand for high-end products used in more complex drilling activities continued to grow worldwide and we expect that growth to continue in the coming years. However, we had to face a difficult situation in Canada, where the decline in gas drilling activity and demand for OCTG products (40% lower than 2006) affected our operations in Calgary and Sault Ste. Marie. The adjustment in Canadian demand together with inventory adjustments in other markets resulted in a sharp slowdown in global apparent demand. We are confident that overall OCTG apparent demand growth will resume in 2008 but it is unlikely to be at the accelerated rates seen in the three years prior to 2007, which was to some extent influenced by the increase in inventories in key oil-producing areas of the world.

The competitive context of our industry has changed substantially in the past years. The growth of the market and the globalization of trade have made possible the emergence of new players. In addition to our traditional European and Japanese competitors, Chinese, Russian and other producers are starting to qualify their products beyond their domestic markets. At the same time, the consolidation of the industry is under way, and will continue in the future, as we have seen happening in the USA and in Canada in the last two years.

Tenaris has had the leading role in this transformation over the past years. We have become the example to imitate in many aspects for emerging companies, with our ability to anticipate changes, grow and integrate our operations at a global level. We have done so while maintaining levels of profitability that have been consistently higher than the rest of the industry.

At the core of our business, products for the oil and gas industry, we have managed to maintain and increase our market share and move forward in developing and supplying the more sophisticated products required by the market. In the power generation sector, we have a good opportunity for growth, considering the dynamic in demand and the capital we have invested in our industrial system. In the industrial and structural sector, we focus on select industry niches in which we have developed specialized know-how.

How will we maintain our leadership? Certainly, the position we have built up, with its global reach, access to markets and globally integrated industrial system gives us a good start. But, moving forward, we will be working hard to differentiate our performance in terms of improving the quality, reliability and range of products we offer, the service we provide our customers, and our manufacturing cost efficiency.

Competition today takes place in a wider arena, in which the exploration and production challenges facing the oil and gas industry, rising environment standards, the demand for total quality and reliability all combine to set new and higher standards for every player. I believe that Tenaris is better prepared for these challenges than any other competitor.

After two years of extraordinary growth, our financial results in 2007 reflect the continuing good, though less favorable, market conditions we faced during the year and the integration of major acquisitions. Net sales for the year rose 30% to USD 10.0 billion and EBITDA increased by 13% to USD 3.4 billion. Earnings per share, however, remained at the level of the previous year amounting to USD 1.63, or USD 3.26 per ADS. Based on our expectations for continued strong cash generation from our operations and a declining debt level following two major acquisitions, as well as the anticipated cash inflow from the divestiture of the Hydril Pressure Control business, we propose to increase the annual dividend to USD 0.38 per share (USD 0.76 per ADS), a 27% increase over last year, and to pay a dividend, net of the interim we paid in November, of USD 0.25 per share (USD 0.50 per ADS) in June.

It has been another demanding year for our employees as the company has continued to grow and integrate new operations. Accordingly, we have strengthened our focus on training and knowledge management, the development of new skills and the incorporation of new recruits who can contribute to our continuing growth. I want to thank all of our employees for their efforts and also express my thanks to our customers, suppliers and shareholders for their continuous support and confidence in Tenaris.

February 27, 2008

Paolo Rocca

Business review

Market background and outlook

In 2007, global demand for oil and gas continued to rise reflecting economic growth and the importance of oil and gas in the energy matrix. Encouraged by continuing high levels of oil prices, oil and gas companies in most regions of the world continued to increase their level of spending and drilling activity to offset declining rates of production from mature fields and to explore and develop new reserves. In Canada, however, subdued North American gas prices affected gas drilling activity.

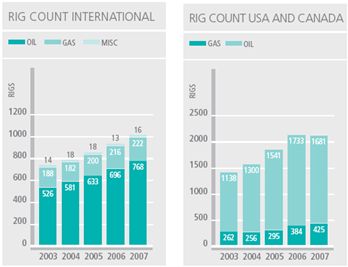

The international count of active drilling rigs, as published by Baker Hughes, after rising steadily in the first three quarters of the year dipped marginally in the fourth quarter to average 1017, an increase of 7% compared to the same quarter of the previous year. The average increase for the full year, compared to 2006, was 9%.

The corresponding rig count in the USA, which is more sensitive to North American gas prices, also showed a positive, though decelerating, trend during the year. It showed an average annual increase of 7% in 2007 compared to 2006 and in the fourth quarter of 2007 was up 4% compared to the fourth quarter of 2006. The corresponding rig count in Canada, however, which began to decline in the second half of 2006, showed an average annual decline of 27% compared to 2006 and a decline of 19% in the fourth quarter compared to the same period of 2006.

We estimate that global apparent demand for OCTG in 2007 remained similar to that in 2006, following strong growth in the previous three years, as an increase in operative consumption was offset by inventory adjustments. We expect growth in apparent demand to resume in 2008 based on continued growth in oil and gas drilling activity outside North America and the maintenance of current levels of drilling activity in North America. However, the annual growth rate is expected to be lower than in the period 2004–2006 and may be affected by market volatility and inventory adjustments in some markets.

Demand for our large diameter pipes for pipeline projects in South America was strong in 2007 as major gas pipeline infrastructure projects in Brazil and Argentina, which had previously been delayed, went forward. Orders for new projects in Brazil and Colombia have been received and we expect to maintain a strong level of sales in this segment in 2008.

Steelmaking raw material costs rose in 2007 and are expected to rise more steeply in 2008. Energy and labor costs also rose during 2007, and may rise further in 2008, with labor costs being affected primarily by currency-related factors. Steel costs for our welded pipe products also rose and are expected to increase further in 2008.

We expect our sales to increase in 2008, led by higher sales of specialized, high-end OCTG products, and that the increase in sales will be reflected in higher operating and net income. However, increased volatility in economic conditions and raw material and commodity prices could affect market conditions for our products and services and, consequently, our results in the second half of the year.

Summary of results

Following several years of strong growth, earnings per share declined marginally in 2007 compared to 2006. Net sales, EBITDA and operating income, on the other hand continued to grow, up 30%, 13% and 6% respectively. These stable results reflect a steady overall demand for our products and services from the global oil and gas industry. They were achieved in a context of rising costs and a severe decline in Canadian gas drilling activity.

Oilfield services

We supply a comprehensive range of high quality seamless and welded casing and tubing, premium connections, coiled tubing and accessories for use in the most demanding oil and gas drilling and well completion activities. Using our unique network of manufacturing, service and distribution and R&D facilities, we focus on reducing costs for our customers through integrated supply chain management and developing industry-leading products and technical services.

Following the acquisition of Hydril, a leading manufacturer of premium connections for the oil and gas industry, we are able to offer our customers worldwide a full range of integral and coupled premium connection products for the most demanding applications. The combined R&D and industrial know-how of the two companies will make a substantial contribution to expanding the frontiers of exploration and production.

Hydril’s strong brand and manufacturing capacity in North America completes Tenaris’s position in the region with a full product range complementing the integration of Maverick in 2006.

We have also established a specialized technical sales team combining resources from Hydril and Tenaris that will work together with our customers in order to provide them with innovative and personalized solutions and services.

Our TenarisBlue® (renamed TenarisHydril Blue™) premium connection is now well established as a leading product in the market.

With sales in more than 35 countries, especially in the Middle East and North Africa, TenarisHydril Blue™ has been a major factor in the growth of our sales of our OCTG products. Its presence in the Caspian Sea and Far East was strengthened through its introduction in Noble Oil, Azerbaijan, and in OMV, New Zealand, along with TenarisHydril Blue™ Dopeless™. TenarisHydril Blue™ has also been selected by ENI for its operations in India, opening the way to affirm our presence in this significant market.

We have also advanced in the introduction of the recently-developed TenarisHydril Blue™ Near Flush connection, which completes our offer of integral connections along with the widely-recognized Hydril connections. New customers that started using this technology include ENI for its operations in Angola, Libya, Pakistan and Nigeria, Lukoil in Russia, Maersk in Angola and Repsol in Peru.

We work with many customers under long-term framework agreements. Although the terms of these agreements vary, our aim is to provide a secure source and comprehensive range of tubular products backed up by integrated logistical and technical assistance services. In October, we were awarded a contract for the provision of Petrom’s 2008 OCTG casing requirements, thus consolidating the relationship already existing between OMV and Tenaris.

Additionally, we have been selected by Lukoil to provide their OCTG requirements for their Primoria field under a long-term agreement signed in July. This agreement includes corrosion-resistant alloy and sour service material designed to resist the most corrosive and demanding conditions, and strengthens our presence in Russia where we have also signed new agreements with Petroalliance and Rosneft. During the year we renewed our worldwide agreement with Chevron, extending it to Australia, and with Shell GTL and Qatar Gas for their corrosion-resistant alloy requirements for the massive LNG development Qatar Gas III & IV.

Maintaining our long-term commitment to service customers in China, we have established a local manufacturing facility of premium connections and couplings in Qingdao to serve domestic operators with the high specification materials their new developments require. From Qingdao, we will supply an ample range of OCTG pipes, ranging from 2 3/8" to13 3/8" all in API 5CT or Tenaris proprietary grades with TenarisHydril premium connections. These products are suitable for the most demanding environments including high H2S content, high collapse, high temperature/high pressure (HT/HP) well sand deepwater projects, amongst others.

Pipeline services

We supply an extensive range of seamless and welded line pipe and coiled line pipe products, complete with coatings and accessories for use in onshore and offshore pipelines, with onsite, ready-for-installation delivery. Our focus is on providing the risers, flow lines and subsea tubular components for the deepwater and ultra deepwater markets where we are a major player, in the Gulf of Mexico, West Africa, Far East, United Kingdom and Scandinavia. Our catalog also includes pipes for complex offshore structures like platforms and rigs.

The seamless line pipe market continues with its growth trend, mainly in the most demanding high-end markets, such as West Africa and the deepwater Gulf of Mexico. As conventional reserves begin to decline, developments are moving towards more stringent conditions (e.g., deeper waters, HP/HT and Arctic conditions) in order to fulfill future energy needs. This trend for increasing complexity in exploration and production results in new and

more challenging requirements for pipes: heavy wall requirements, more stringent internal diameter tolerances and higher steel grades.

Tenaris seeks to differentiate itself from its competitors through product quality and innovation; focusing on high-end markets, developing agreements with key industry players (oil and gas and engineering companies).

During the year, we signed a 5-year agreement with StatoilHydro ASA for line pipe supply, mainly for the Norwegian market. We won an important order to supply 19,000 tons of high specification flow lines and export lines, with the additional wet insulation solution for the Petrobras Chinook and Cascade project in the ultra deepwater Gulf of Mexico. This will be the first Floating Platform, Storage and Offloading (FPSO) unit in the US, producing both oil and gas from the Walker Ridge area, in a water depth of 2,690 meters. In addition, we have been very active in the Indian offshore market, undertaking important projects such as Ravva and Rajas than operated by Cairn Energy.

As the industry continues to reach deeper waters (3,000+ meters), and exploration and production projects enter more complex environments (Arctic and HP/HT), the technical requirements for our products become increasingly stringent and demanding. To overcome all the issues related to current and future critical projects, Tenaris participates in industry standardization with research and development and also in joint industry programs with customers, studying gaps and finding technology solutions. These programs include research into fatigue corrosion in sour environments, offshore welding, high strength steel grades, extreme heavy wall materials and strain base design.

Process and power plant services

We provide comprehensive material planning and supply chain management services and on-time delivery of quality products to enable customers in the process and power plant industry meet the demanding needs of major refinery, petrochemical and power plant contracts.

During the year, we implemented steps to be closer to our customers and to provide prompter responses. We introduced the Tenaris Secured Supply System, which provides an alternative to reduce piping supply risk for hydrocarbon processing industry (HPI) projects by meeting demanding project schedules, even with last minute design changes, and by diminishing pipe cost volatility.

The HPI market leveled off during 2007,with investments in gas and refinery projects on average lower than in the prior year. Gas processing projects are taking more time to move forward due to rising costs, geopolitical risks and capacity constraints of major engineering companies. Refinery investments were driven more by plant revamps than grassroots projects. The petrochemical sector showed strength due to strong demand from Asia, mainly China and India. Major petrochemical complexes like Sabic-Kayan and Borouge are being built in the Middle East and China.

Our focus of activity during 2007continued to be in the Middle East, serving gas processing projects. Major projects during this year included Qatar Shell Pearl, the world’s largest integrated gas to liquids (GTL) complex, in which Tenaris worked closely with MWK/JGC and Chiyoda, and the Khurais Gas projects in Saudi Arabia where Tenaris worked with Snamprogetti and Hyundai.

In refineries, Tenaris continued participating in two large refinery projects, the Reliance Jamnagar refinery in India with Bechtel and the Dung Quat refinery in Vietnam with Technip. Reliance’s refinery expansion in India will make Jamnagar the world’s largest single refinery site. Dung Quat’s refinery will be the first in Vietnam and is expected to meet 40% of local demand with an annual capacity of 6.5million metric tons.

The ever-growing demand for energy and power has resulted in a high level of activity in the power generation sector throughout 2007; despite plant construction cost increases, major power plant component manufacturers have reported strong growth over the previous year with lengthening backlogs. We are participating in this market by supplying tubing for heat recovery steam generators used in combined cycle plants as well as in boilers used in coal-fired power plants. Specialty steels are being developed to support the industry’s demand for higher efficiencies and lower costs as it revamps old plants and builds new ones to satisfy the world’s increasing demand for power.

Industrial and automotive services

We provide a wide variety of seamless pipe products for industrial applications with a focus on segments such as automotive components, hydraulic cylinders, gas cylinders and architectural structures where we can add value with our specialist product development and supply chain management expertise. Sales are concentrated in Europe, where our Italian mill has traditionally served this market, but we also have significant sales in North America, the Far East and South America.

Demand for our specialized industrial products in 2007 was good, particularly for hydraulic cylinders and hollows for gas cylinders.

We registered a 30% increase in sales of hydraulic cylinders driven by growing demand for earth-moving machinery for the construction and infrastructure sectors, mainly in Europe. We opened a new component center in Romania, which was set up to serve the hydraulic cylinder needs of Caterpillar USA. This is already working at full capacity, producing tubes, flanges and assembled components and has registered 100% compliance in delivery performance.

In hollows for gas cylinders, particularly for compressed natural gas applications, where we are the market leader worldwide, we registered sales growth of 15%. In this market segment, we have been making investments in R&D and manufacturing in order to increase our production capacity and product performance in terms of weight reduction, thus contributing to savings in CO2 emissions, a crucial issue in the transportation sector.

Sales to the automotive sector were in line overall with those of last year following a phase-out of some less profitable items, such as axles and some transmissions applications. We registered a significant volume increase in Eastern Europe and South America, also driven by an increase in light vehicles production. Production volumes of tubular components for airbags at our component center in Mexico continued to rise and reached over 27 million pieces in 2007, a 27% increase over the previous year. Through worldwide qualification with all major airbag manufacturers of ultra high-strength steel grade for airbag applications, we have increased our market participation in the USA and Europe and have started to penetrate the market in China.

2007 themes

1. Offshore Drilling

During the course of its ongoing global alliance with ConocoPhillips, the two companies have been at the forefront of introducing innovative tubular technology and services for offshore drilling applications. In 2007, the alliance had a further success in implementing casing directional drilling for the first time in an offshore environment.

As part of its global alliance with ConocoPhillips, Tenaris supplied 10 ¾” and 7 ¾” outside diameter casing with TenarisBlue® premium connections for Eldfisk Bravo, a project that represented a first in terms of offshore drilling technology. Using specially modified TenarisHydril Blue™ premium connections casing in an innovative system called side-by-side wellhead and casing directional drilling, ConocoPhillips drilled the first of two independent well bores from one conductor in the Casing Directional Drilling mode.

Casing Directional Drilling technology relies on the performance of the casing connections, which are pushed to their design limits in terms of fatigue and torque resistance. Prior to the project and in order to guarantee the performance of the TenarisHydril Blue™ connections in such a demanding environment, the strings' fatigue resistance was tested at an independent U.S. laboratory in accordance with ConocoPhillips’ specifications.

For this breakthrough project, Tenaris worked closely with ConocoPhillips in the planning and implementation of the drilling operation. All products were manufactured according to Tenaris's proprietary sour service specifications and threaded with specially modified TenarisHydril Blue™ connections. During the products' initial use in the North Sea, Tenaris provided offshore technical services and carefully monitored the entire process.

2. Global Trainee Program

Recognizing that human resources are critical to its growth and success, Tenaris in recent years has reaffirmed its commitment to the Global Trainee Program (GTP), the Company’s strategic initiative for attracting and developing recent university graduates.

The GTP, where many in Tenaris’s senior management began their professional careers, provides participants with accelerated training and development aimed at preparing them to become the Company’s future leaders. While the program is open to graduates from all disciplines, special emphasis is placed on recruiting engineers with a demonstrated industrial vocation.

During the two-year program, Global Trainees (GTs) are assigned to two different jobs, to broaden their skills and give them exposure to different areas of the Company. All engineering GTs spend their first year in one of the Company’s mill, where, in addition to gaining hands-on experience, they undertake a special project under the guidance of a tutor.

Training plays a key role in the GTP and is continuous throughout the two years. The highlight of this training is the TenarisUniversity Induction Camp, which brings together GTs from around the world for one month of intensive learning at the Company’s plant in Campana, Argentina. GTs are also coached and evaluated closely over the course of the two years, and only those who meet the program’s demanding requirements are allowed to graduate.

To ensure the Company is developing the human resources required to meet its future needs, Tenaris has significantly expanded the GTP in recent years. At the end of 2007 there were more than 750 Global Trainees, compared to 250 at the end of 2004.

3. Technical sales

Following the acquisition of Hydril in May 2007, an oil and gas technical sales team was formed in Tenaris in order to provide customers with a better technical understanding of the advantages of using Tenaris’s products and services in specific oil and gas drilling environments. Building on Hydril’s renowned customer-focused approach and Tenaris’s team of experienced field service professionals, the new unit works with the drilling engineers of our customers to help them identify the optimum technical solutions for their particular drilling operations all over the world.

The unit is made up of engineers who not only understand how best to select and use premium connections and other oil and gas products but who are also aware of how these products interact within oil and gas well-site operations. It is also responsible for providing on-site technical and running assistance services and will work closely with the product development team to identify areas for product development and enhancement.

The new organizational unit, which is led by a former Hydril executive, will reinforce our focus on understanding the needs of our customers and serving them in the best possible way. As drilling takes place in more complex operational environments and the need to employ more cost-effective drilling solutions to enhance production in mature fields increases, a detailed knowledge of how premium connections and other oil and gas products perform in different environments will become increasingly valuable. The ability to deploy a knowledgeable technical sales team around the world should enhance Tenaris’s competitive advantage in a world where there is likely to be a demographic deficit of experienced drilling engineers.

Communities and environment review

Tenaris’s growth has been made possible by adhering to certain values that guide the Company’s internal management and its relationships with customers, suppliers and communities where the Company is present. These values are centered on a conviction that industry plays a key role in promoting lasting and equitable economic growth for societies and that Tenaris will add value to its operations as well as to the wider community by interacting with employees and others in accordance with that conviction.

Consistent with this vision, Tenaris strives to build partnerships, both internally and externally, that foster growth and opportunity for all involved. The importance we place on such relationships is manifested in our commitment to protecting the health and safety of our employees, maintaining transparent relations with customers and suppliers and collaborating with government and non-government organizations in the communities in which we operate.

Valuing education, we invest continuously in the development of our own workforce and support a wide variety of educational initiatives at primary, secondary and university levels. Through a revitalized Global Trainee Program, where many in Tenaris’s senior management began, Tenaris recruits recent university graduates and develops them to be tomorrow’s senior management. At a time when demand for skilled engineers is strong, especially in our own industry, we believe this emphasis on attracting and developing people that have the requisite education and skills is critical to our future growth.

In 2007, the Company’s corporate university, TenarisUniversity, launched a technical training project for the purpose of unifying training policies and programs for the Company’s 16,000 non-salaried plant employees worldwide. Development plans comprising a structured series of training activities for workers in each job area are now being developed and training based on the project’s new guidelines is already being delivered in multiple countries and languages.

In our community relations we stress support for academic excellence. In Argentina and Mexico, we are carrying out a series of projects aimed at improving the quality of primary and secondary education in schools close to our plants in Campana and Veracruz. Drawing on the expertise of UNESCO and international experts as well as local universities and the active participation of school officials, students and their families, we take an integral approach that involves investment in infrastructure, the provision of school supplies and scholarships.

One example of this is the “Sembrar” programme carried out in Argentina to complement the formal education of 100 secondary-school students from the city of Campana, reinforcing their readiness to successfully step from school into the world of employment.

Four state schools with an enrolment of 1,500 students from under-privileged sectors of Campana have been targeted for an institutional development program aimed at improving the currently poor results being shown at the different stages of the learning process by the children that attend them. The “Schools for the Bicentenary” program is sponsored by Tenaris, promoted by the AEA (Association of Argentine Enterprises) and coordinated by the Universidad de San Andrés, focusing on 100 schools across Argentina.

In the area of higher education, we continue to support the Roberto Rocca Education Program, which Tenaris co-founded in 2005. Designed to encourage the study of engineering in selected countries, the Program in 2007 funded 500 Scholarships, for undergraduate students, and 22 Fellowships, for doctoral studies at leading international universities. As is the case with all of our community projects, we seek to reward merit and initiative by granting these Scholarships and Fellowships only to students who combine academic excellence with outstanding personal qualities.

In all of our community programs, we seek to promote social integration and leverage our own contribution by partnering with other governmental and non-governmental organizations on projects that involve the active participation of the project’s beneficiaries.

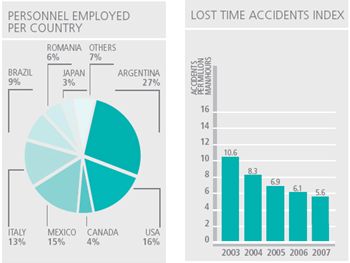

With 23,500 employees drawn from dozens of countries, we view the diversity of our workforce as one of our strengths. The combination of rational analysis and diversity of ideas and cultures will continue to play an instrumental role in the growth of Tenaris. Thus, we make a continuous effort to foster respect among employees for language, cultural and gender differences and are committed to broadening this diversity at all levels of the Company. Achieving greater integration, awareness and understanding among all the various cultures that coexist within Tenaris, requires the building of bridges and programs in which to invest in cultural exchange.

This need gave rise to the setting up of the PROA Foundation, which from its head quarters in Buenos Aires receives support from Tenaris for the dissemination of leading contemporary artistic trends through exhibitions, workshops, seminars and conferences. At the same time, it organizes educational programmes and exchanges with prestigious cultural institutions from around the world. Through PROA, Tenaris has been responsible for several significant events, such as the second edition of the Latin Wave festival of Latin American cinema, held in Houston in association with the Museum of FineArts, and the “Dualidad” exhibition of Mexican art held at its plant in Veracruz.

In Italy, we participate in GAMEC, Associazione per la Galleria d´Arte Moderna e Contemporanea, in Bergamo, providing support for national andinternational artistic research andstrengthening the Gallery’s position as a point of reference for contemporary art.

“Il futuro dell Futurismo” stood out as one of the highlights of the exhibition season.

Health, safety and environment

Tenaris is committed to protecting the health and safety of its employees and the communities in which it operates, as well as to minimizing its own impact on the environment and supporting broader industry and public efforts to protect the environment. In accordance with the principle of sustainable development, our efforts in this area are focused on improving the efficiency of our operations, designing our processes with a sustainable approach, reducing energy consumption, minimizing and recycling waste, and employee training.

We continue to work on the implementation and improvement of our integrated Health, Safety and Environment (HSE) management system. Based on international standards such as ISO 14000 and OHSA 18000, the system applies eco-efficiency and integral safety concepts to all of our operations. Following the further development and deployment of an integrated IT safety and environmental tool, we are able to record, track and analyze safety and environment accidents and incidents at our plants, follow up with corrective actions and track HSE performance. In the case of the recently-acquired Hydril premium connection facilities around the world, we are working to integrate them into our system.

We believe that accidents do not happen by chance. All injuries and work-related illnesses can and must be prevented. To achieve this objective we have instituted innovative programs that reward safe behavior through accident prevention and hold weekly meetings with managers, safety staff and workers at each of our mills to discuss accidents and share ideas to improve safety. We dedicate a percentage of working hours to safety training.

During 2007, a team brought together for this occasion, along with Tenaris experts and external consultants, organized an assessment in order to introduce best practices at every mill.

At Tenaris, investments in training, processes and workplace behavior are complemented by capital investments in the mills. A significant proportion of our capital investment spending is allocated toward improving safety in our operations.

Our lost-time accidents index continued to decline in 2007, falling 8.2% in comparison with 2006. Since 2001, this indicator has fallen 58.2%.

A significant portion of Tenaris’s new investments contributes to reduce the environmental impact of the Company’s operations, products and services. We adopt the most appropriate and eco-efficient designs and technologies available and continuously review our HSE performance so as to improve it. We monitor the operations of our subcontractors in addition to our own, seeking to maximize the efficiency in the use of energy and material resources, to recycle – both at our own facilities and by third parties – , by-products, and to minimize generation of waste, emissions and effluents in the supply chain.

Perhaps one of our most significant contributions to the environment comes from the delivery of products that can perform in the most demanding conditions and on whose quality our customers rely. We work constantly on improving the quality and reliability of our products, developing new products that help our customers to reduce the impact of their operations on the environment, and we aim to supply using an integrated supply chain concept that aims to reduce risk and impact as well as costs.

We actively participate in different governmental and non-governmental forums and associations focused on sustainability issues. These include the environmental commissions and working groups of organizations like the International Iron & Steel Institute (IISI), the Latin American Iron & Steel Institute and various national chapters of the World Business Council for Sustainable Development. Some of the most relevant issues addressed by these organizations are global climate change, by-products and water management, and the definition of sustainability indexes.

Corporate governance

Tenaris has one class of shares, with each share having equal rights, including the entitlement to one vote at our shareholders’ meetings. Our articles of association provide that the annual ordinary shareholders’ meeting, which approves our annual financial statements and appoints the Board of Directors, take place each year on the first Wednesday of June.

Board of Directors