UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-21238

PIMCO Corporate & Income Opportunity Fund

(Exact name of registrant as specified in charter)

1633 Broadway, New York, NY 10019

(Address of principal executive offices)

Bijal Y. Parikh

Treasurer (Principal Financial & Accounting Officer)

650 Newport Center Drive, Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

David C. Sullivan

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, MA 02199

Registrant’s telephone number, including area code: (844) 337-4626

Date of fiscal year end: July 31

Date of reporting period: July 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Shareholders. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

PIMCO CLOSED-END FUNDS

Annual Report

July 31, 2021

PIMCO Corporate & Income Opportunity Fund | PTY | NYSE

PIMCO Corporate & Income Strategy Fund | PCN | NYSE

PIMCO High Income Fund | PHK | NYSE

PIMCO Income Strategy Fund | PFL | NYSE

PIMCO Income Strategy Fund II | PFN | NYSE

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports are not sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports are made available on the Fund’s website, pimco.com/literature, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive shareholder reports and other communications from the Fund electronically by visiting pimco.com/edelivery or by contacting your financial intermediary, such as a broker-dealer or bank, if you do not already.

You may elect to receive all future reports in paper free of charge. If you own these shares through a financial intermediary, such as a broker-dealer or bank, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 844.337.4626. Your election to receive reports in paper will apply to all funds held with the fund complex if you invest directly with the Fund or to all funds held in your account if you invest through a financial intermediary, such as a broker-dealer or bank.

Table of Contents

| | | | |

| Letter from the Chair of the Board & President | | | | |

Dear Shareholder,

We hope that you and your family are remaining safe and healthy during these challenging times. We continue to work tirelessly to navigate markets and manage the assets that you have entrusted with us. Following this letter is the PIMCO Closed-End Funds Annual Report, which covers the 12-month reporting period ended July 31, 2021. On the subsequent pages, you will find specific details regarding investment results and a discussion of the factors that most affected performance during the reporting period.

For the 12-month reporting period ended July 31, 2021

The global economy was severely impacted by the repercussions related to the COVID-19 pandemic (“COVID-19”). Looking back, second-quarter 2020 U.S. annualized gross domestic product (“GDP”) growth was -31.4%. This represented the steepest quarterly decline on record. With the economy reopening, third-quarter GDP growth was 33.4%, the largest quarterly increase on record. GDP growth in the U.S. was then 4.3% and 6.3% during the fourth quarter of 2020 and the first quarter of 2021, respectively. Finally, the Commerce Department’s initial estimate for second-quarter annualized GDP growth was 6.6%.

Despite improving economic data and inflationary concerns, the Federal Reserve (the “Fed”) maintained its accommodative monetary policy. This included keeping the federal funds rate at an all-time low of a range between 0.00% and 0.25%, as well as continuing to purchase at least $80 billion a month of Treasury securities and $40 billion a month of agency mortgage-backed securities. However, at its June 2021 meeting, the Fed pushed forward its forecast for the first rate hikes. The central bank now expects two interest rate increases by the end of 2023. In its March 2021 projections, the Fed anticipated no increases until at least 2024. In addition, while Fed Chair Jerome Powell said it would begin discussing a scaling back of bond purchases, he maintained his view on inflation, saying, “As these transitory supply effects abate, inflation is expected to drop back toward our longer-run goal.” He also said that any discussion of raising rates was “highly premature.”

Economies outside the U.S. also continued to be impacted by COVID-19. In its July 2021 World Economic Outlook Update, the International Monetary Fund (“IMF”) said it expects U.S. GDP growth to be 7.0% in 2021, compared to a 3.5% contraction in 2020. Elsewhere, the IMF expects 2021 GDP growth in the eurozone, U.K. and Japan will be 4.6%, 7.0% and 2.8%, respectively. For comparison purposes, the GDP of these economies was projected to be -6.5%, -9.8% and -4.7%, respectively, in 2020.

Central banks outside the U.S. also maintained their aggressive actions to support their economies. The European Central Bank (the “ECB”) kept rates at an all-time low. It also continued to purchase bonds and, in June 2021, vowed to increase its purchases at a significantly higher pace than earlier in the year. Finally, in July 2021, the ECB announced its first strategy review since 2003, which included a 2% inflation target over the medium term, versus its previous target for inflation that was below but close to 2%. Elsewhere, the Bank of England held its key lending rate at a record low of 0.10% and continued its bond-buying program. In June 2021, the central bank said it did not expect to raise rates until there was clear evidence that significant progress was being made in eliminating spare capacity and achieving its 2% inflation target. Also of note, the U.K. and the European Union agreed to a long-awaited Brexit deal. Finally, the Bank of Japan maintained its short-term interest rate at -0.10%, while increasing the target for its holdings of corporate bonds. In June 2021, it extended the September deadline for its COVID-19 relief program by at least six months.

Both short- and long-term U.S. Treasury yields moved higher, albeit from very low levels, during the reporting period. The yield on the benchmark 10-year U.S. Treasury note was 1.24% at the end of the reporting period, versus 0.55% on July 31, 2020. The Bloomberg Barclays Global Treasury Index (USD Hedged), which tracks fixed-rate, local currency government debt of investment grade countries, including both developed and emerging markets, returned -0.65%. Meanwhile, the Bloomberg Barclays Global Aggregate Credit Index (USD Hedged), a widely used index of global investment grade credit bonds, returned 1.90%. Riskier fixed income asset classes, including high yield corporate

bonds and emerging market debt, produced stronger returns. The ICE BofAML Developed Markets High Yield Constrained Index (USD Hedged), a widely used index of below-investment-grade bonds, returned 10.78%, whereas emerging market external debt, as represented by the JPMorgan Emerging Markets Bond Index (EMBI) Global (USD Hedged), returned 3.57%. Emerging market local bonds, as represented by the JPMorgan Government Bond Index-Emerging Markets Global Diversified Index (Unhedged), returned 3.00%.

Despite the headwinds from COVID-19 and periods of volatility, global equities produced very strong results. All told, U.S. equities, as represented by the S&P 500 Index, returned 36.45%, fueled, in our view, by accommodative monetary and fiscal policy, the COVID-19 vaccine rollout, and improving corporate results. Global equities, as represented by the MSCI World Index, returned 35.07%, whereas emerging market equities, as measured by the MSCI Emerging Markets Index, returned 20.64%. Meanwhile, Japanese equities, as represented by the Nikkei 225 Index (in JPY), returned 27.72% and European equities, as represented by the MSCI Europe Index, returned 32.13%.

Commodity prices were volatile but generally produced positive results. When the reporting period began, Brent crude oil was approximately $43 a barrel, but ended the reporting period at roughly $76 a barrel. We believe oil prices rallied as producers reduced their output and then demand increased as global growth improved. Elsewhere, copper prices moved sharply higher, whereas gold prices declined.

Finally, there were also periods of volatility in the foreign exchange markets, in our view due to fluctuating economic growth, trade conflicts and changing central bank monetary policies, along with the U.S. election and several geopolitical events. The U.S. dollar weakened against several other major currencies. For example, the U.S. dollar returned -0.78% and -6.26% versus the euro and the British pound, respectively. However, the U.S. dollar rose 3.55% versus the Japanese yen.

Thank you for the assets you have placed with us. We deeply value your trust, and we will continue to work diligently to meet your broad investment needs. For any questions regarding your PIMCO Closed-End Funds investments, please contact your financial adviser or call the Funds’ shareholder servicing agent at (844) 33-PIMCO. We also invite you to visit our website at www.pimco.com to learn more about our global viewpoints.

Sincerely,

| | |

| |  |

| |

| |  |

| Deborah A. DeCotis | | Eric D. Johnson |

| Chair of the Board of Trustees | | President |

Past performance is no guarantee of future results. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. This material contains the current opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Unless otherwise noted, index returns reflect the reinvestment of income distributions and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an unmanaged index.

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | JULY 31, 2021 | | | 3 |

| | | | |

| Important Information About the Funds | | | | |

Information regarding each Fund’s principal investment strategies, principal risks and risk management strategies, the effects of each Fund’s leverage, and each Fund’s fundamental investment restrictions, including a summary of certain changes thereto during the most recent fiscal year, can be found within the relevant sections of this report. Please refer to the Table of Contents for further information.

We believe that bond funds have an important role to play in a well-diversified investment portfolio. It is important to note, however, that in an environment where interest rates may trend upward, rising rates would negatively impact the performance of most bond funds, and fixed-income securities and other instruments held by a Fund are likely to decrease in value. A wide variety of factors can cause interest rates or yields of U.S. Treasury securities (or yields of other types of bonds) to rise (e.g., central bank monetary policies, inflation rates, general economic conditions). In addition, changes in interest rates can be sudden and unpredictable, and there is no guarantee that Fund management will anticipate such movement accurately. A Fund may lose money as a result of movements in interest rates.

As of the date of this report, interest rates in the United States and many parts of the world, including certain European countries, are at or near historically low levels. Thus, the Funds currently face a heightened level of risk associated with rising interest rates and/or bond yields. This could be driven by a variety of factors, including but not limited to central bank monetary policies, changing inflation or real growth rates, general economic conditions, increasing bond issuances or reduced market demand for low yielding investments. Further, while bond markets have steadily grown over the past three decades, dealer inventories of corporate bonds are near historic lows in relation to market size. As a result, there has been a significant reduction in the ability of dealers to “make markets.”

Bond funds and individual bonds with a longer duration (a measure used to determine the sensitivity of a security’s price to changes in interest rates) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities or funds with shorter durations. All of the factors mentioned above, individually or collectively, could lead to increased volatility and/or lower liquidity in the fixed income markets or negatively impact a Fund’s performance or cause a Fund to incur losses.

A Fund may enter into opposite sides of multiple interest rate swaps or other derivatives with respect to the same underlying reference instrument (e.g., a 10-year U.S. treasury) that have different effective dates with respect to interest accrual time periods also for the principal purpose of generating distributable gains (characterized as ordinary income for tax purposes) that are not part of the Fund’s duration or yield curve management strategies. In such a “paired swap transaction”, a

Fund would generally enter into one or more interest rate swap agreements whereby the Fund agrees to make regular payments starting at the time the Fund enters into the agreements equal to a floating interest rate in return for payments equal to a fixed interest rate (the “initial leg”). The Fund would also enter into one or more interest rate swap agreements on the same underlying instrument, but take the opposite position (i.e., in this example, the Fund would make regular payments equal to a fixed interest rate in return for receiving payments equal to a floating interest rate) with respect to a contract whereby the payment obligations do not commence until a date following the commencement of the initial leg (the “forward leg”).

A Fund may engage in investment strategies, including those that employ the use of paired swaps transactions, the use of interest rate swaps to seek to capitalize on differences between short-term and long-term interest rates and other derivatives transactions, to, among other things, seek to generate current, distributable income, even if such strategies could potentially result in declines in the Fund’s net asset value (“NAV”). A Fund’s income and gain-generating strategies, including certain derivatives strategies, may generate current income and gains taxable as ordinary income sufficient to support monthly distributions even in situations when the Fund has experienced a decline in net assets due to, for example, adverse changes in the broad U.S. or non-U.S. equity markets or the Fund’s debt investments, or arising from its use of derivatives. For instance, a portion of a Fund’s monthly distributions may be sourced from paired swap transactions utilized to produce current distributable ordinary income for tax purposes on the initial leg, with a substantial possibility that a Fund will later realize a corresponding capital loss and potential decline in its NAV with respect to the forward leg (to the extent there are not corresponding offsetting capital gains being generated from other sources). Because some or all of these transactions may generate capital losses without corresponding offsetting capital gains, portions of a Fund’s distributions recognized as ordinary income for tax purposes (such as from paired swap transactions) may be economically similar to a taxable return of capital when considered together with such capital losses.

Classifications of the Funds’ portfolio holdings in this report are made according to financial reporting standards. The classification of a particular portfolio holding as shown in the Allocation Breakdown and Schedule of Investments sections of this report may differ from the classification used for the Funds’ compliance calculations, including those used in the Funds’ prospectus, investment objectives, regulatory, and other investment limitations and policies, which may be based on different asset class, sector or geographical classifications. Each Fund is separately monitored for compliance with respect to prospectus and regulatory requirements.

The geographical classification of foreign (non-U.S.) securities in this report, if any, are classified by the country of incorporation of a holding. In certain instances, a security’s country of incorporation may be different from its country of economic exposure.

Beginning in January 2020, global financial markets have experienced and may continue to experience significant volatility resulting from the spread of a novel coronavirus known as COVID-19. The outbreak of COVID-19 has resulted in travel and border restrictions, quarantines, supply chain disruptions, lower consumer demand and general market uncertainty. The effects of COVID-19 have and may continue to adversely affect the global economy, the economies of certain nations and individual issuers, all of which may negatively impact the Funds’ performance. In addition, COVID-19 and governmental responses to COVID-19 may negatively impact the capabilities of the Funds’ service providers and disrupt the Funds’ operations.

The United States’ enforcement of restrictions on U.S. investments in certain issuers and tariffs on goods from other countries, each with a focus on China, has contributed to international trade tensions and may impact portfolio securities.

The United Kingdom’s withdrawal from the European Union may impact Fund returns. The withdrawal may cause substantial volatility in foreign exchange markets, lead to weakness in the exchange rate of the British pound, result in a sustained period of market uncertainty, and destabilize some or all of the other European Union member countries and/or the Eurozone.

The Funds may invest in certain instruments that rely in some fashion upon the London Interbank Offered Rate (“LIBOR”). LIBOR is an average interest rate, determined by the ICE Benchmark Administration, that banks charge one another for the use of short-term money. The United Kingdom’s Financial Conduct Authority, which regulates LIBOR, has announced plans to ultimately phase out the use of LIBOR. The transition may result in a reduction in the value of certain instruments held by a Fund or a reduction in the effectiveness of related Fund transactions such as hedges. There remains uncertainty regarding future utilization of LIBOR and the nature of any replacement rate (e.g., the Secured Overnight Financing Rate, which is intended to replace U.S. dollar LIBOR and measures the cost of overnight borrowings through repurchase agreement transactions collateralized with U.S. Treasury securities). Any potential effects of the transition away from LIBOR on a Fund or on certain instruments in which a Fund invests can be difficult to ascertain, and they may vary depending on a variety of factors. The transition may also result in a reduction in the value of certain instruments held by a Fund or a reduction in the effectiveness of related Fund transactions such as hedges. Any such effects of the transition away from LIBOR, as well as other unforeseen effects, could result in losses to a Fund.

The common shares of the Funds trade on the New York Stock Exchange. As with any stock, the price of a Fund’s common shares will fluctuate with market conditions and other factors. If you sell your common shares of a Fund, the price received may be more or less than your original investment. Shares of closed-end management investment companies, such as the Funds, frequently trade at a discount from their NAV and may trade at a price that is less than the initial offering price and/or the NAV of such shares. Further, if a Fund’s shares trade at a price that is more than the initial offering price and/or the NAV of such shares, including at a substantial premium and/or for an extended period of time, there is no assurance that any such premium will be sustained for any period of time and will not decrease, or that the shares will not trade at a discount to NAV thereafter.

On each applicable Fund Summary page in this Shareholder Report, the Average Annual Total Return table measures performance assuming that any dividend and capital gain distributions were reinvested. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions. Total return for a period of more than one year represents the average annual total return. Performance at market price will differ from results at NAV. Although market price returns tend to reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about a Fund, market conditions, supply and demand for the Fund’s shares, or changes in the Fund’s dividends. Performance shown is net of fees and expenses. Historical NAV performance for a Fund may have been positively impacted by fee waivers or expense limitations in place during some or all of the periods shown, if applicable. Future performance (including total return or yield) and distributions may be negatively impacted by the expiration or reduction of any such fee waivers or expense limitations.

The dividend rate that a Fund pays on its common shares may vary as portfolio and market conditions change, and will depend on a number of factors, including without limit the amount of a Fund’s undistributed net investment income and net short- and long-term capital gains, as well as the costs of any leverage obtained by a Fund. As portfolio and market conditions change, the rate of distributions on the common shares and a Fund’s dividend policy could change. There can be no assurance that a change in market conditions or other factors will not result in a change in a Fund distribution rate or that the rate will be sustainable in the future.

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | JULY 31, 2021 | | | 5 |

| | | | |

| Important Information About the Funds | | (Cont.) | | |

The following table discloses the commencement of operations and diversification status of each Fund:

| | | | | | | | | | | | |

| | | |

| Fund Name | | | | | Commencement

of Operations | | | Diversification

Status | |

PIMCO Corporate & Income Opportunity Fund | | | | | | | 12/27/02 | | | | Diversified | |

PIMCO Corporate & Income Strategy Fund | | | | | | | 12/21/01 | | | | Diversified | |

PIMCO High Income Fund | | | | | | | 04/30/03 | | | | Diversified | |

PIMCO Income Strategy Fund | | | | | | | 08/29/03 | | | | Diversified | |

PIMCO Income Strategy Fund II | | | | | | | 10/29/04 | | | | Diversified | |

An investment in a Fund is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Funds.

The Trustees are responsible generally for overseeing the management of the Funds. The Trustees authorize the Funds to enter into service agreements with Pacific Investment Management Company LLC (“PIMCO”) and other service providers in order to provide, and in some cases authorize service providers to procure through other parties, necessary or desirable services on behalf of the Funds. Shareholders are not parties to or third-party beneficiaries of such service agreements. Neither a Fund’s prospectus or Statement of Additional Information (“SAI”), any press release or shareholder report, any contracts filed as exhibits to a Fund’s registration statement, nor any other communications, disclosure documents or regulatory filings (including this report) from or on behalf of a Fund creates a contract between or among any shareholders of a Fund, on the one hand, and the Fund, a service provider to the Fund, and/or the Trustees or officers of the Fund, on the other hand.

The Trustees (or the Funds and their officers, service providers or other delegates acting under authority of the Trustees) may amend its most recent or use a new prospectus or SAI with respect to a Fund, adopt and disclose new or amended policies and other changes in press releases and shareholder reports and/or amend, file and/or issue any other communications, disclosure documents or regulatory filings, and may amend or enter into any contracts to which a Fund is a party, and interpret the investment objective(s), policies, restrictions and contractual provisions applicable to any Fund, without shareholder input or approval, except in circumstances in which shareholder approval is specifically required by law (such as changes to fundamental investment policies) or where a shareholder approval requirement was specifically disclosed in a Fund’s then-current prospectus, SAI or shareholder report and is otherwise still in effect.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted

by the Funds as the policies and procedures that PIMCO will use when voting proxies on behalf of the Funds. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of each Fund, and information about how each Fund voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30th, are available without charge, upon request, by calling the Funds at (844) 33-PIMCO, on the Funds’ website at www.pimco.com, and on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

The Funds file portfolio holdings information with the SEC on Form N-PORT within 60 days of the end of each fiscal quarter. The Funds’ complete schedules of securities holdings as of the end of each fiscal quarter will be made available to the public on the SEC’s website at www.sec.gov and on PIMCO’s website at www.pimco.com, and will be made available, upon request, by calling PIMCO at (844) 33-PIMCO.

The SEC adopted a rule that allows shareholder reports to be delivered to investors by providing access to such reports online free of charge and by mailing a notice that the report is electronically available. Pursuant to the rule, investors may elect to receive all reports in paper free of charge by contacting their financial intermediary or, if invested directly with a Fund, investors can inform the Fund by calling (844) 33-PIMCO. Any election to receive reports in paper will apply to all funds held with the fund complex if invested directly with a Fund or to all funds held in the investor’s account if invested through a financial intermediary, such as a broker-dealer or bank.

In April 2020, the SEC adopted amended rules modifying the registration, communications, and offering processes for registered closed-end funds and interval funds. Among other things, the amendments will: (1) permit qualifying closed-end funds to use a short-form registration statement to offer securities in eligible transactions and certain funds to qualify as Well Known Seasoned Issuers; (2) permit interval funds to pay registration fees based on net issuance of shares in a manner similar to mutual funds; (3) require closed-end funds and interval funds to include additional disclosures in their annual reports; and (4) require certain information to be filed in interactive data format. The new rules have phased compliance and effective dates, with some requirements requiring compliance starting August 1, 2020 and others requiring compliance as late as February 1, 2023.

In October 2020, the SEC adopted a rule related to the use of derivatives, short sales, reverse repurchase agreements and certain other transactions by registered investment companies that rescinds and withdraws the guidance of the SEC and its staff regarding asset segregation and cover transactions. Subject to certain exceptions, and after an eighteen-month transition period, the rule requires funds to trade derivatives and other transactions that create future payment or

delivery obligations (except reverse repurchase agreements and similar financing transactions) subject to a value-at-risk leverage limit, certain derivatives risk management program and reporting requirements. These requirements may limit the ability of the Funds to use derivatives and reverse repurchase agreements and similar financing transactions as part of their investment strategies and may increase the cost of the Funds’ investments and cost of doing business, which could adversely affect investors.

In October 2020, the SEC adopted a rule regarding the ability of a fund to invest in other funds. The rule allows a fund to acquire shares of another fund in excess of certain limitations currently imposed by the Investment Company Act of 1940 (the “Act”) without obtaining individual exemptive relief from the SEC, subject to certain conditions. The rule also included the rescission of certain exemptive relief after a one-year transition period from the SEC and guidance from the SEC staff for funds to invest in other funds. The impact that these changes may have on the Funds is uncertain.

In December 2020, the SEC adopted a rule addressing fair valuation of fund investments. The new rule sets forth requirements for good faith determinations of fair value as well as for the performance of fair value determinations, including related oversight and reporting obligations. The new rule also defines “readily available market quotations” for purposes of the definition of “value” under the Act, and the SEC noted that this definition will apply in all contexts under the Act. The SEC adopted an eighteen-month transition period beginning from the effective date for both the new rule and the associated new recordkeeping requirements. The impact of the new rule on the Funds is uncertain at this time.

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | JULY 31, 2021 | | | 7 |

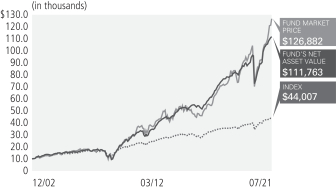

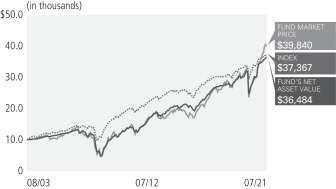

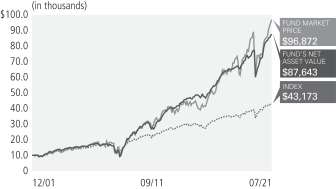

PIMCO Corporate & Income Opportunity Fund

Symbol on NYSE - PTY

Cumulative Returns(1) Through July 31, 2021

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of July 31, 2021†§

| | | | |

Corporate Bonds & Notes | | | 50.5% | |

| |

Loan Participations and Assignments | | | 21.5% | |

| |

Asset-Backed Securities | | | 6.5% | |

| |

Non-Agency Mortgage-Backed Securities | | | 5.9% | |

| |

Preferred Securities | | | 3.3% | |

| |

Short-Term Instruments | | | 3.3% | |

| |

Sovereign Issues | | | 2.8% | |

| |

U.S. Government Agencies | | | 1.4% | |

| |

Municipal Bonds & Notes | | | 1.3% | |

| |

Common Stocks | | | 1.2% | |

| |

Real Estate Investment Trusts | | | 1.1% | |

| |

Other | | | 1.2% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return(1) for the period ended July 31, 2021 | |

| | | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Commencement

of Operations

(12/27/02) | |

| | Market Price | | | 46.75% | | | | 18.25% | | | | 13.55% | | | | 14.65% | |

| | NAV | | | 29.92% | | | | 14.06% | | | | 12.93% | | | | 13.86% | |

| | ICE BofAML US High Yield Index | | | 10.74% | | | | 6.84% | | | | 6.41% | | | | 8.29% | ¨ |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

¨ Average annual total return since 12/31/2002.

It is not possible to invest directly in an unmanaged index.

| (1) | Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. The NAV presented may differ from the NAV reported for the same period in other Fund materials. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

| | Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

| (2) | Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or market price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (‘‘ROC’’) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

| (3) | Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Fund Information as of July 31, 2021(1)

| | | | |

Market Price | | | $20.56 | |

| |

NAV | | | $14.40 | |

| |

Premium/(Discount) to NAV | | | 42.78% | |

| |

Market Price Distribution Rate(2) | | | 7.59% | |

| |

NAV Distribution Rate(2) | | | 10.83% | |

| |

Total Effective Leverage(3) | | | 47.24% | |

Investment Objective and Strategy Overview

PIMCO Corporate & Income Opportunity Fund’s investment objective is to seek maximum total return through a combination of current income and capital appreciation.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » | | Exposure to corporate credit contributed to absolute performance, as the sector posted positive returns. |

| » | | Exposure to corporate special situation investments, which include companies undergoing stress, distress, challenges or significant transition, contributed to absolute performance as the positions posted positive returns. |

| » | | Exposure to mortgage credit contributed to absolute performance, as the sector posted positive returns. |

| » | | U.S. duration positioning in the intermediate to long end of the yield curve detracted from performance, as rates increased. |

Market and Net Asset Value Information

The following table, presented in conformance with annual reporting requirements for funds that have filed a registration statement pursuant to General Instruction A.2 of Form N-2 (“Short Form N-2”), sets forth, for each of the periods indicated, the high and low closing market prices of the Fund’s Common Shares on the NYSE, the high and low NAV per Common Share and the high and low premium/discount to NAV per Common Share. See Note 3, Investment Valuation and Fair Value Measurements in the Notes to Financial Statements for information as to how the Fund’s NAV is determined.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common share

market price(1) | | | Common share

net asset value | | | Premium (discount) as

a % of net asset value | |

| Quarter | | High | | | Low | | | High | | | Low | | | High | | | Low | |

| Quarter ended July 31, 2021 | | $ | 20.59 | | | $ | 18.04 | | | $ | 14.52 | | | $ | 14.14 | | | | 43.09% | | | | 27.58% | |

| Quarter ended April 30, 2021 | | $ | 18.98 | | | $ | 17.78 | | | $ | 14.42 | | | $ | 14.04 | | | | 32.63% | | | | 25.17% | |

| Quarter ended January 31, 2021 | | $ | 18.05 | | | $ | 16.31 | | | $ | 14.22 | | | $ | 12.73 | | | | 29.50% | | | | 25.71% | |

| Quarter ended October 31, 2020 | | $ | 16.84 | | | $ | 15.35 | | | $ | 12.82 | | | $ | 12.43 | | | | 31.36% | | | | 23.49% | |

| Quarter ended July 31, 2020 | | $ | 16.36 | | | $ | 13.61 | | | $ | 12.42 | | | $ | 11.16 | | | | 34.65% | | | | 21.74% | |

| Quarter ended April 30, 2020 | | $ | 19.68 | | | $ | 10.44 | | | $ | 14.98 | | | $ | 10.58 | | | | 32.23% | | | | (8.98)% | |

| Quarter ended January 31, 2020 | | $ | 19.61 | | | $ | 18.35 | | | $ | 14.80 | | | $ | 14.07 | | | | 32.50% | | | | 28.70% | |

| Quarter ended October 31, 2019 | | $ | 18.73 | | | $ | 17.02 | | | $ | 14.64 | | | $ | 14.04 | | | | 31.36% | | | | 21.23% | |

| Quarter ended July 31, 2019 | | $ | 18.91 | | | $ | 17.48 | | | $ | 14.71 | | | $ | 14.40 | | | | 30.13% | | | | 21.22% | |

| Quarter ended April 30, 2019 | | $ | 17.94 | | | $ | 16.40 | | | $ | 14.62 | | | $ | 14.17 | | | | 23.79% | | | | 15.09% | |

| Quarter ended January 31, 2019 | | $ | 17.43 | | | $ | 13.92 | | | $ | 14.60 | | | $ | 13.74 | | | | 19.38% | | | | 0.80% | |

| Quarter ended October 31, 2018 | | $ | 18.22 | | | $ | 16.33 | | | $ | 14.80 | | | $ | 14.47 | | | | 24.28% | | | | 12.70% | |

| 1 | Such prices reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. |

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | JULY 31, 2021 | | | 9 |

The following information is presented in conformance with annual reporting requirements for funds that have filed a Short Form N-2.

Summary of Fund Expenses

The following table is intended to assist investors in understanding the fees and expenses (annualized) that an investor in Common Shares of the Fund would bear, directly or indirectly, as a result of an offering. The table reflects the use of leverage attributable to the Fund’s outstanding Preferred Shares and reverse repurchase agreements averaged over the fiscal year ended July 31, 2021 in an amount equal to 39.07% of the Fund’s total average managed assets (including assets attributable to such leverage), and shows Fund expenses as a percentage of net assets attributable to Common Shares. The percentage above does not reflect the Fund’s use of other forms of economic leverage, such as credit default swaps or other derivative instruments. The table and example below are based on the Fund’s capital structure as of July 31, 2021. The extent of the Fund’s assets attributable to leverage following an offering, and the Fund’s associated expenses, are likely to vary (perhaps significantly) from these assumptions.

Shareholder Transaction Expense

| | | | | | | | |

| | |

Sales load (as a percentage of offering price)(1) | | | | | | | [ ]% | |

| | |

Offering Expenses Borne by Common Shareholders (as a percentage of offering price)(2) | | | | | | | [ ]% | |

| | |

Dividend Reinvestment Plan Fees(3) | | | | | | | None | |

| 1 | In the event that the Common Shares to which this relates are sold to or through underwriters or dealer managers, a corresponding supplement will disclose the applicable sale load and/or commission. |

| 2 | The related supplement will disclose the estimated amount of offering expense, the offering price and the offering expenses borne by the Fund and indirectly by all of its Common Shareholders as a percentage of the offering price. |

| 3 | You will pay broker chargers if you direct your broker or the plan agent to sell your Common Shares that you acquired pursuant to a dividend reinvestment plan. You may also pay a pro rata share of brokerage commissions incurred in connection with open market purchase pursuant to the Fund’s Dividend Reinvestment Plan. |

Annual Fund Operating Expenses

| | | | | | | | |

| | | | | | Percentage of

Net Assets Attributable to

Common Shares (reflecting

leverage attributable to

ARPS and reverse

repurchase agreements) | |

| | |

Management Fees(1) | | | | | | | 0.74% | |

| | |

Dividend Cost on Preferred Shares(2) | | | | | | | 0.04% | |

| | |

Interest Payments on Borrowed Funds(3) | | | | | | | 0.30% | |

| | |

Other Expenses(4) | | | | | | | 0.01% | |

| | |

Total Annual Fund Operating Expenses(5) | | | | | | | 1.09% | |

| 1. | Management fees include fees payable to the Investment Manager for advisory services and for supervisory, administrative and other services. The Fund pays for the advisory, supervisory and administrative services it requires under what is essentially an all-in fee structure. Pursuant to an investment management agreement, PIMCO is paid a Management Fee of 0.65% of the Fund’s average weekly total managed |

| | assets. The Fund (and not PIMCO) will be responsible for certain fees and expenses which are, reflected in the table above, that are not covered by the management fee under the investment management agreement. Please see Note 9, Fees and Expenses in the Notes to Financial Statements for an explanation of the management fee. |

| 2. | Reflects the Fund’s outstanding Preferred Shares averaged over the fiscal year ended July 31, 2021, which represented 8.64% of the Fund’s total average managed assets (including the liquidation preference of outstanding Preferred Shares and assets attributable to reverse repurchase agreements), at an estimated annual dividend rate to the Fund of 0.15% (based on the weighted average Preferred Share dividend rate during the fiscal year ended July 31, 2021) and assumes the Fund will continue to pay Preferred Share dividends at the “maximum applicable rate” called for under the Fund’s Bylaws due to the ongoing failure of auctions for the ARPS. The actual dividend rate paid on the ARPS will vary over time in accordance with variations in market interest rates. |

| 3. | Reflects the Fund’s use of leverage in the form of reverse repurchase agreements averaged over the fiscal year ended July 31, 2021, which represented 30.44% of the Fund’s total average managed assets (including assets attributable to reverse repurchase agreements), at an annual interest rate cost to the Fund of 0.56%, which is the weighted average interest rate cost during the fiscal year ended July 31, 2021. The actual amount of interest expense borne by the Fund will vary over time in accordance with the level of the Fund’s use of reverse repurchase agreements, dollar rolls and/or borrowings and variations in market interest rates. Borrowing expense is required to be treated as an expense of the Fund for accounting purposes. Any associated income or gains (or losses) realized from leverage obtained through such instruments is not reflected in the Annual Fund Operating Expenses table above, but would be reflected in the Fund’s performance results. |

| 4. | Other expenses are estimated for the Fund’s current fiscal year ending July 31, 2021. |

| 5. | “Dividend Cost on Preferred Shares”, including distributions on Preferred Shares, and “Interest Payments on Borrowed Funds” are borne by the Fund separately from management fees paid to PIMCO. Excluding these expenses, Total Annual Fund Operating Expenses are 0.75%. Excluding only distributions on Preferred Shares of 0.03%, Total Annual Fund Operating Expenses are 1.06%. |

Example

The following example illustrates the expenses that you would pay on a $1,000 investment in Common Shares of the Fund, assuming (1) that the Fund’s net assets do not increase or decrease, (2) that the Fund incurs total annual expenses of 1.09% of net assets attributable to Common Shares in years 1 through 10 (assuming assets attributable to Preferred Shares and reverse repurchase agreements representing 39.07% of the Fund’s total managed assets) and (3) a 5% annual return(1):

| | | | | | | | | | | | | | | | | | | | |

| | | | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

| | | | | |

Total Expenses Incurred | | | | | | $ | 11 | | | $ | 35 | | | $ | 60 | | | $ | 133 | |

| 1) | The example above should not be considered a representation of future expenses. Actual expenses may be higher or lower than those shown. The example assumes that the estimated Interest Payments on Borrowed Funds, Dividend Cost on Preferred Shares and Other Expenses set forth in the Annual Fund Operating Expenses table are accurate, that the rate listed under Total Annual Fund Operating Expenses remains the same each year and that all dividends and distributions are reinvested at NAV. Actual expenses may be greater or less than those assumed. Moreover, the Fund’s actual rate of return may be greater or less than the hypothetical 5% annual return shown in the example. The example does not include commissions or estimated offering expenses, which would cause the expenses shown in the example to increase. |

| | | | | | |

| 10 | | PIMCO CLOSED-END FUNDS | | | | |

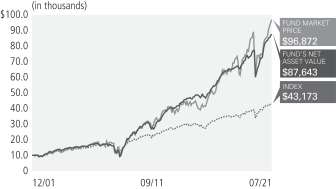

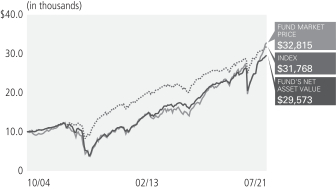

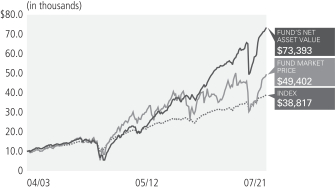

PIMCO Corporate & Income Strategy Fund

Cumulative Returns(1) Through July 31, 2021

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of July 31, 2021†§

| | | | |

Corporate Bonds & Notes | | | 47.0% | |

| |

Loan Participations and Assignments | | | 16.6% | |

| |

Asset-Backed Securities | | | 8.1% | |

| |

Non-Agency Mortgage-Backed Securities | | | 6.6% | |

| |

Preferred Securities | | | 5.3% | |

| |

Short-Term Instruments | | | 4.7% | |

| |

Municipal Bonds & Notes | | | 3.0% | |

| |

Sovereign Issues | | | 2.8% | |

| |

Common Stocks | | | 1.6% | |

| |

Real Estate Investment Trusts | | | 1.5% | |

| |

U.S. Government Agencies | | | 1.4% | |

| |

Warrants | | | 1.1% | |

| |

Convertible Bonds & Notes | | | 0.3% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return(1) for the period ended July 31, 2021 | |

| | | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Commencement

of Operations

(12/21/01) | |

| | Market Price | | | 34.41% | | | | 14.16% | | | | 12.11% | | | | 12.27% | |

| | NAV | | | 25.69% | | | | 11.13% | | | | 11.10% | | | | 11.70% | |

| | ICE BofAML US High Yield Index | | | 10.74% | | | | 6.84% | | | | 6.41% | | | | 7.75%¨ | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

¨ Average annual total return since 12/31/2001.

It is not possible to invest directly in an unmanaged index.

| (1) | Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. The NAV presented may differ from the NAV reported for the same period in other Fund materials. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

| | Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

| (2) | Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or market price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (‘‘ROC’’) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be made on Form 1099 DIV sent to shareholders each January |

| (3) | Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Fund Information as of July 31, 2021(1)

| | | | |

Market Price | | | $18.93 | |

| |

NAV | | | $14.53 | |

| |

Premium/(Discount) to NAV | | | 30.28% | |

| |

Market Price Distribution Rate(2) | | | 7.13% | |

| |

NAV Distribution Rate(2) | | | 9.29% | |

| |

Total Effective Leverage(3) | | | 42.89% | |

Investment Objective and Strategy Overview

PIMCO Corporate & Income Strategy Fund’s primary investment objective is to seek high current income, with a secondary objective of capital preservation and appreciation.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » | | Exposure to corporate credit contributed to absolute performance, as the sector posted positive returns. |

| » | | Exposure to corporate special situation investments, which include companies undergoing stress, distress, challenges or significant transition, contributed to absolute performance as the positions posted positive returns. |

| » | | Exposure to mortgage credit contributed to absolute performance, as the sector posted positive returns. |

| » | | U.S. duration positioning in the intermediate to long end of the yield curve detracted from performance, as rates increased. |

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | JULY 31, 2021 | | | 11 |

| | | | |

| Market and Net Asset Value Information | | | | |

The following table, presented in conformance with annual reporting requirements for funds that have filed a Short Form N-2, sets forth, for each of the periods indicated, the high and low closing market prices of the Fund’s Common Shares on the NYSE, the high and low NAV per Common Share and the high and low premium/discount to NAV per Common Share. See Note 3, Investment Valuation and Fair Value Measurements in the Notes to Financial Statements for information as to how the Fund’s NAV is determined.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common share

market price(1) | | | Common share

net asset value | | | Premium (discount) as

a % of net asset value | |

| Quarter | | High | | | Low | | | High | | | Low | | | High | | | Low | |

| Quarter ended July 31, 2021 | | $ | 18.99 | | | $ | 17.24 | | | $ | 14.56 | | | $ | 14.27 | | | | 30.99% | | | | 20.81% | |

| Quarter ended April 30, 2021 | | $ | 18.03 | | | $ | 16.93 | | | $ | 14.53 | | | $ | 14.22 | | | | 24.86% | | | | 18.64% | |

| Quarter ended January 31, 2021 | | $ | 17.36 | | | $ | 15.68 | | | $ | 14.39 | | | $ | 13.02 | | | | 23.42% | | | | 18.56% | |

| Quarter ended October 31, 2020 | | $ | 16.37 | | | $ | 15.22 | | | $ | 13.10 | | | $ | 12.75 | | | | 27.76% | | | | 16.99% | |

| Quarter ended July 31, 2020 | | $ | 16.74 | | | $ | 14.25 | | | $ | 12.74 | | | $ | 11.57 | | | | 33.92% | | | | 19.50% | |

| Quarter ended April 30, 2020 | | $ | 20.20 | | | $ | 9.98 | | | $ | 15.04 | | | $ | 11.01 | | | | 35.12% | | | | (16.35)% | |

| Quarter ended January 31, 2020 | | $ | 19.86 | | | $ | 18.58 | | | $ | 14.90 | | | $ | 14.40 | | | | 35.33% | | | | 26.44% | |

| Quarter ended October 31, 2019 | | $ | 19.10 | | | $ | 16.40 | | | $ | 14.95 | | | $ | 14.43 | | | | 31.54% | | | | 13.49% | |

| Quarter ended July 31, 2019 | | $ | 18.20 | | | $ | 16.91 | | | $ | 14.96 | | | $ | 14.47 | | | | 23.81% | | | | 14.83% | |

| Quarter ended April 30, 2019 | | $ | 17.29 | | | $ | 15.92 | | | $ | 14.63 | | | $ | 14.23 | | | | 18.83% | | | | 11.41% | |

| Quarter ended January 31, 2019 | | $ | 18.20 | | | $ | 13.83 | | | $ | 14.60 | | | $ | 13.88 | | | | 24.74% | | | | (0.65)% | |

| Quarter ended October 31, 2018 | | $ | 18.90 | | | $ | 16.66 | | | $ | 14.88 | | | $ | 14.53 | | | | 28.66% | | | | 14.34% | |

| 1 | Such prices reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. |

| | | | | | |

| 12 | | PIMCO CLOSED-END FUNDS | | | | |

The following information is presented in conformance with annual reporting requirements for funds that have filed a Short Form N-2.

Summary of Fund Expenses

The following table is intended to assist investors in understanding the fees and expenses (annualized) that an investor in Common Shares of the Fund would bear, directly or indirectly, as a result of an offering. The table reflects the use of leverage attributable to the Fund’s outstanding Preferred Shares and reverse repurchase agreements averaged over the fiscal year ended July 31, 2021 in an amount equal to 33.30% of the Fund’s total average managed assets (including assets attributable to such leverage), and shows Fund expenses as a percentage of net assets attributable to Common Shares. The percentage above does not reflect the Fund’s use of other forms of economic leverage, such as credit default swaps or other derivative instruments. The table and example below are based on the Fund’s capital structure as of July 31, 2021. The extent of the Fund’s assets attributable to leverage following an offering, and the Fund’s associated expenses, are likely to vary (perhaps significantly) from these assumptions.

Shareholder Transaction Expense

| | | | | | | | |

| | |

Sales load (as a percentage of offering price)(1) | | | | | | | [ ]% | |

| | |

Offering Expenses Borne by Common Shareholders (as a percentage of offering price)(2) | | | | | | | [ ]% | |

| | |

Dividend Reinvestment Plan Fees(3) | | | | | | | None | |

| 1 | In the event that the Common Shares to which this relates are sold to or through underwriters or dealer managers, a corresponding supplement will disclose the applicable sale load and/or commission. |

| 2 | The related supplement will disclose the estimated amount of offering expense, the offering price and the offering expenses borne by the Fund and indirectly by all of its Common Shareholders as a percentage of the offering price. |

| 3 | You will pay broker chargers if you direct your broker or the plan agent to sell your Common Shares that you acquired pursuant to a dividend reinvestment plan. You may also pay a pro rata share of brokerage commissions incurred in connection with open market purchase pursuant to the Fund’s Dividend Reinvestment Plan. |

Annual Fund Operating Expenses

| | | | | | | | |

| | | | | | Percentage of

Net Assets Attributable to

Common Shares (reflecting

leverage attributable to

ARPS and reverse

repurchase agreements) | |

| | |

Management Fees(1) | | | | | | | 0.84% | |

| | |

Dividend Cost on Preferred Shares(2) | | | | | | | 0.02% | |

| | |

Interest Payments on Borrowed Funds(3) | | | | | | | 0.28% | |

| | |

Other Expenses(4) | | | | | | | 0.01% | |

| | |

Total Annual Fund Operating Expenses(5) | | | | | | | 1.15% | |

| 1. | Management fees include fees payable to the Investment Manager for advisory services and for supervisory, administrative and other services. The Fund pays for the advisory, supervisory and administrative services it requires under what is essentially |

| | an all-in fee structure. Pursuant to an investment management agreement, PIMCO is paid a Management Fee of 0.81% of the Fund’s average weekly total managed assets. The Fund (and not PIMCO) will be responsible for certain fees and expenses which are, reflected in the table above, that are not covered by the management fee under the investment management agreement. Please see Note 9, Fees and Expenses in the Notes to Financial Statements for an explanation of the management fee. |

| 2. | Reflects the Fund’s outstanding Preferred Shares averaged over the fiscal year ended July 31, 2021, which represented 2.78% of the Fund’s total average managed assets (including the liquidation preference of outstanding Preferred Shares and assets attributable to reverse repurchase agreements), at an estimated annual dividend rate to the Fund of 0.14% (based on the weighted average Preferred Share dividend rate during the fiscal year ended July 31, 2021) and assumes the Fund will continue to pay Preferred Share dividends at the “maximum applicable rate” called for under the Fund’s Bylaws due to the ongoing failure of auctions for the ARPS. The actual dividend rate paid on the ARPS will vary over time in accordance with variations in market interest rates. |

| 3. | Reflects the Fund’s use of leverage in the form of reverse repurchase agreements averaged over the fiscal year ended July 31, 2021, which represented 30.52% of the Fund’s total average managed assets (including assets attributable to reverse repurchase agreements), at an annual interest rate cost to the Fund of 0.56%, which is the weighted average interest rate cost during the fiscal year ended July 31, 2021. The actual amount of interest expense borne by the Fund will vary over time in accordance with the level of the Fund’s use of reverse repurchase agreements, dollar rolls and/or borrowings and variations in market interest rates. Borrowing expense is required to be treated as an expense of the Fund for accounting purposes. Any associated income or gains (or losses) realized from leverage obtained through such instruments is not reflected in the Annual Fund Operating Expenses table above, but would be reflected in the Fund’s performance results. |

| 4. | Other expenses are estimated for the Fund’s current fiscal year ending July 31, 2021. |

| 5. | “Dividend Cost on Preferred Shares”, including distributions on Preferred Shares, and “Interest Payments on Borrowed Funds” are borne by the Fund separately from management fees paid to PIMCO. Excluding these expenses, Total Annual Fund Operating Expenses are 0.85%. Excluding only distributions on Preferred Shares, Total Annual Fund Operating Expenses are 1.15%. |

Example

The following example illustrates the expenses that you would pay on a $1,000 investment in Common Shares of the Fund, assuming (1) that the Fund’s net assets do not increase or decrease, (2) that the Fund incurs total annual expenses of 1.15% of net assets attributable to Common Shares in years 1 through 10 (assuming assets attributable to Preferred Shares and reverse repurchase agreements representing 33.30% of the Fund’s total managed assets) and (3) a 5% annual return(1):

| | | | | | | | | | | | | | | | | | | | |

| | | | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

| | | | | |

Total Expenses Incurred | | | | | | $ | 12 | | | $ | 37 | | | $ | 63 | | | $ | 140 | |

| 1) | The example above should not be considered a representation of future expenses. Actual expenses may be higher or lower than those shown. The example assumes that the estimated Interest Payments on Borrowed Funds, Dividend Cost on Preferred Shares and Other Expenses set forth in the Annual Fund Operating Expenses table are accurate, that the rate listed under Total Annual Fund Operating Expenses remains the same each year and that all dividends and distributions are reinvested at NAV. Actual expenses may be greater or less than those assumed. Moreover, the Fund’s actual rate of return may be greater or less than the hypothetical 5% annual return shown in the example. The example does not include commissions or estimated offering expenses, which would cause the expenses shown in the example to increase. |

| | | | | | | | | | | | |

| | | | ANNUAL REPORT | | | | | | | JULY 31, 2021 | | | 13 |

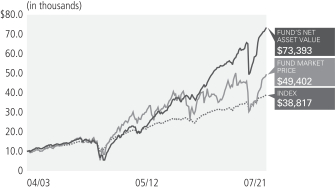

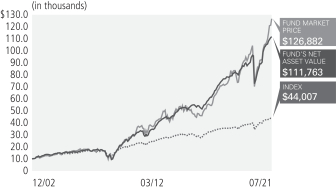

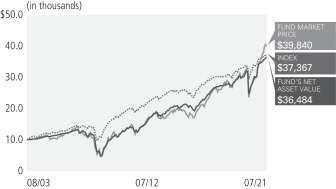

PIMCO High Income Fund

Cumulative Returns(1) Through July 31, 2021

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of July 31, 2021†§

| | | | |

Corporate Bonds & Notes | | | 46.1% | |

| |

Loan Participations and Assignments | | | 13.5% | |

| |

Preferred Securities | | | 9.4% | |

| |

Non-Agency Mortgage-Backed Securities | | | 7.1% | |

| |

Asset-Backed Securities | | | 6.1% | |

| |

Municipal Bonds & Notes | | | 5.9% | |

| |

Short-Term Instruments | | | 2.7% | |

| |

Sovereign Issues | | | 2.4% | |

| |

Real Estate Investment Trusts | | | 2.0% | |

| |

Common Stocks | | | 1.8% | |

| |

U.S. Government Agencies | | | 1.6% | |

| |

Warrants | | | 1.0% | |

| |

Convertible Bonds & Notes | | | 0.4% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return(1) for the period ended July 31, 2021 | |

| | | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Commencement

of Operations

(04/30/03) | |

| | Market Price | | | 47.82% | | | | 4.34% | | | | 6.46% | | | | 9.15% | |

| | NAV | | | 31.21% | | | | 12.06% | | | | 12.58% | | | | 11.54% | |

| | ICE BofAML US High Yield Index | | | 10.74% | | | | 6.84% | | | | 6.41% | | | | 7.71% | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

It is not possible to invest directly in an unmanaged index.

| (1) | Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. The NAV presented may differ from the NAV reported for the same period in other Fund materials. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

| | Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

| (2) | Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or market price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (‘‘ROC’’) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be made on Form 1099 DIV sent to shareholders each January. |

| (3) | Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Fund Information as of July 31, 2021(1)

| | | | |

Market Price | | | $6.95 | |

| |

NAV | | | $5.92 | |

| |

Premium/(Discount) to NAV | | | 17.40% | |

| |

Market Price Distribution Rate(2) | | | 8.29% | |

| |

NAV Distribution Rate(2) | | | 9.73% | |

| |

Total Effective Leverage(3) | | | 41.31% | |

Investment Objective and Strategy Overview

PIMCO High Income Fund’s primary investment objective is to seek high current income, with capital appreciation as a secondary objective.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » | | Exposure to corporate credit contributed to absolute performance, as the sector posted positive returns. |

| » | | Exposure to corporate special situation investments, which include companies undergoing stress, distress, challenges or significant transition, contributed to absolute performance as the positions posted positive returns. |

| » | | Exposure to structured credit contributed to absolute performance, as the sector posted positive returns. |

| » | | U.S. duration positioning in the intermediate to long end of the yield curve detracted from performance, as rates increased. |

| | | | | | |

| 14 | | PIMCO CLOSED-END FUNDS | | | | |

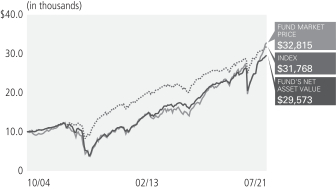

PIMCO Income Strategy Fund

Cumulative Returns(1) Through July 31, 2021

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of July 31, 2021†§

| | | | |

Corporate Bonds & Notes | | | 55.9% | |

| |

Loan Participations and Assignments | | | 16.1% | |

| |

Asset-Backed Securities | | | 6.5% | |

| |

Preferred Securities | | | 4.5% | |

| |

Non-Agency Mortgage-Backed Securities | | | 4.0% | |

| |

Sovereign Issues | | | 2.9% | |

| |

Municipal Bonds & Notes | | | 2.3% | |

| |

Short-Term Instruments | | | 2.2% | |

| |

Common Stocks | | | 1.5% | |

| |

U.S. Government Agencies | | | 1.4% | |

| |

Real Estate Investment Trusts | | | 1.3% | |

| |

Warrants | | | 1.1% | |

| |

Convertible Bonds & Notes | | | 0.3% | |

| | † | % of Investments, at value. |

| | § | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| | | | | | | | | | | | | | | | | | |

|

| Average Annual Total Return(1) for the period ended July 31, 2021 | |

| | | | | |

| | | | | 1 Year | | | 5 Year | | | 10 Year | | | Commencement

of Operations

(08/29/03) | |

| | Market Price | | | 38.31% | | | | 14.32% | | | | 10.76% | | | | 8.02% | |

| | NAV | | | 25.43% | | | | 10.93% | | | | 10.08% | | | | 7.48% | |

| | ICE BofAML US High Yield Index | | | 10.74% | | | | 6.84% | | | | 6.41% | | | | 7.63%¨ | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

¨ Average annual total return since 8/31/2003.

It is not possible to invest directly in an unmanaged index.

| (1) | Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. The NAV presented may differ from the NAV reported for the same period in other Fund materials. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

| | Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

| (2) | Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or market price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (‘‘ROC’’) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be made on Form 1099 DIV sent to shareholders each January. |

| (3) | Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Fund Information as of July 31, 2021(1)

| | | | |

Market Price | | | $12.47 | |

| |

NAV | | | $10.66 | |

| |

Premium/(Discount) to NAV | | | 16.98% | |

| |

Market Price Distribution Rate(2) | | | 8.66% | |

| |

NAV Distribution Rate(2) | | | 10.13% | |

| |