U.S. Glaucoma

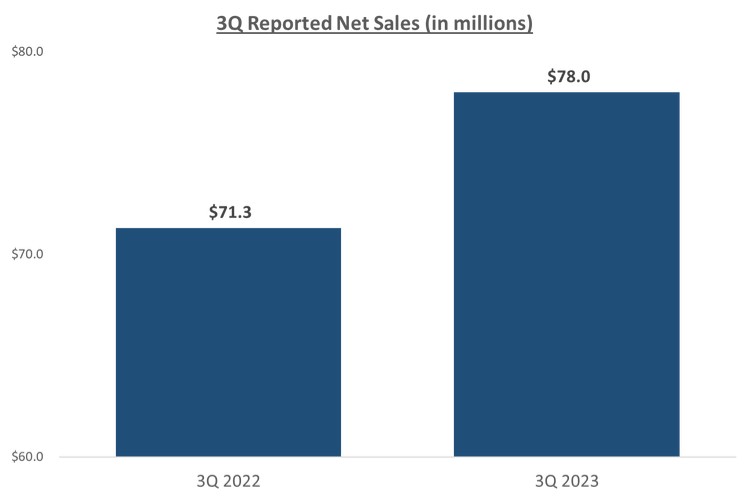

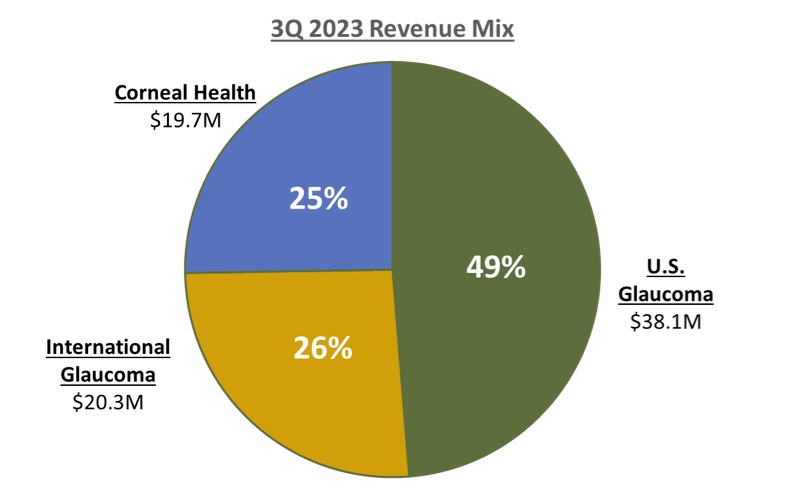

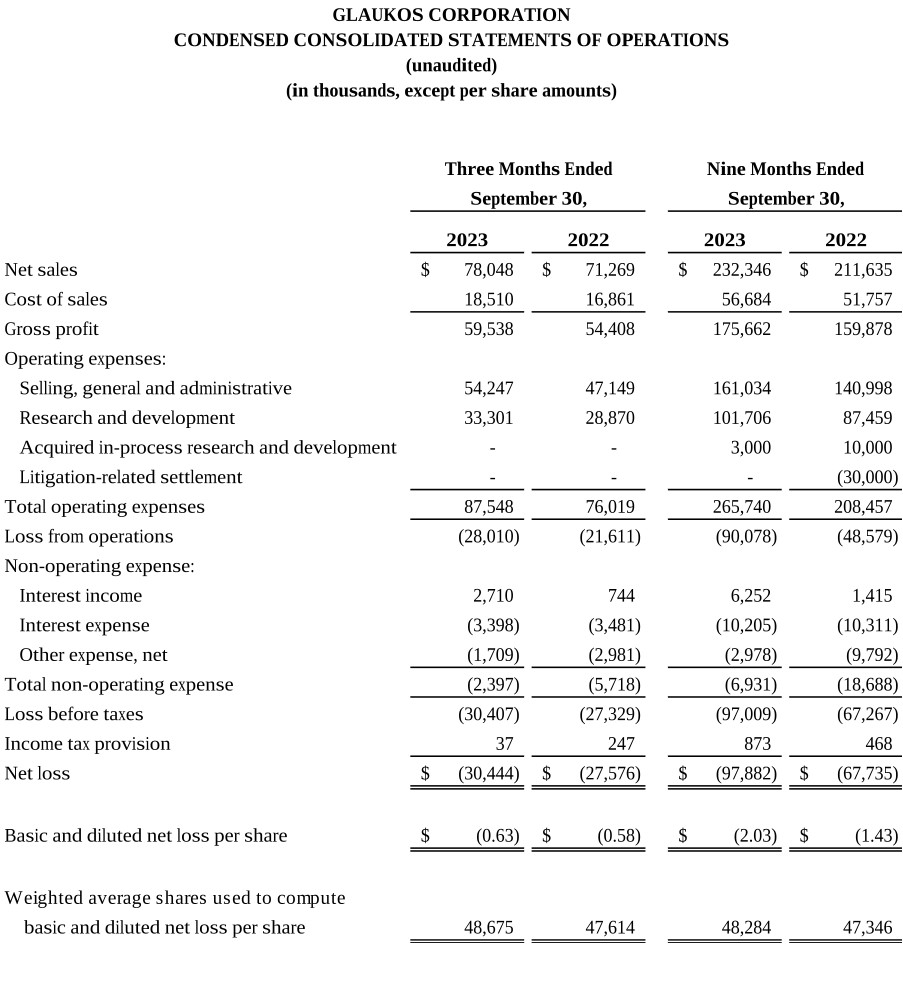

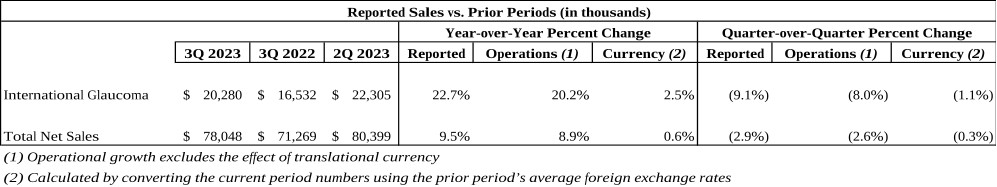

Our third quarter U.S. Glaucoma net revenues of $38.1 million increased 2% year-over-year versus 3Q 2022 as we experienced more pronounced seasonality headwinds in August offset by continued strength in July and September.

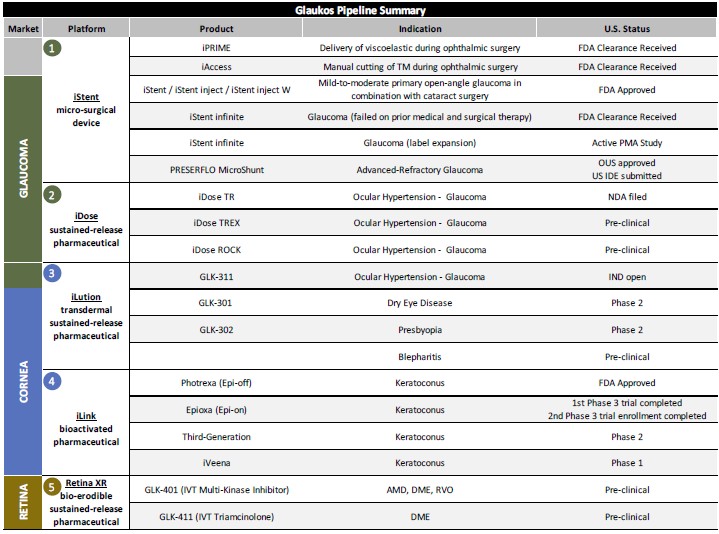

We continue to advance iStent infinite® ahead of establishing formal Medicare Administrative Contractor (MAC) coverage and payment. On that front, just last week, WPS, one of the seven MACs, published an updated MIGS LCD with a future effective date of December 24, 2023, that provides coverage for iStent infinite consistent with FDA approval and our reconsideration request. We are pleased with this final outcome as it relates to iStent infinite, but were disappointed at other aspects of the LCD that severely restricts clinical decision discretion for surgeons fighting a sight-threatening disease. The anticipated net impact to our business from the WPS final LCD, along with potentially additional final LCDs to be issued by other MACs in the future, remains unclear as we continue to evaluate the commercial implications across our entire product portfolio.

Looking ahead, the remaining six MACs have all taken preliminary steps to assess iStent infinite coverage, including four through proposed LCDs, and two with local coverage articles. We will continue to monitor the various MAC processes and policies as they advance and are ultimately finalized in the future as we remain supportive of expanding broad access to interventional glaucoma tools for physicians and patients.

While we await the release of CMS’s 2024 Final Rules, we remain encouraged that, as part of CMS’s 2024 Proposed Rules, the CPT code used to cover iStent infinite in standalone procedures, 0671T, was lifted to APC 5492, and the APC assignment for combined cataract plus trabecular bypass procedures, 66989 and 66991, was proposed to move to a newly restructured APC 5493. If finalized as proposed, we do believe these changes, while positive for our customers and our procedures, may create some transient disruptions to ordering patterns in late 2023 ahead of becoming effective on January 1, 2024.

As we focus on near-term execution, we are also accelerating efforts to support one of our founding missions at Glaukos, which is to advance glaucoma care by driving intervention of therapies earlier in the treatment paradigm for glaucoma disease, and in turn pioneering a new standalone market over time. We continue to lead and work closely with surgeons and thought leaders globally to organically drive this broader evolution in the standard of care, including through numerous events at the ESCRS annual meeting in Vienna in September and the Interventional Glaucoma Consortium in Salt Lake City in October. These efforts will once again be on full display at the upcoming AAO annual meeting being held in San Francisco this weekend.

International Glaucoma

Our third quarter International Glaucoma net revenues were approximately $20.3 million, representing year-over-year reported growth of 23%, or 20% on a constant currency basis, versus 3Q 2022. The strong growth internationally during the third quarter was broad-based as we continue to scale our international infrastructure, we are increasingly driving MIGS forward as the standard of care in each region and every major market in the world.

Corneal Health

Our record third quarter Corneal Health net revenues were approximately $19.7 million, representing year-over-year growth of 12% versus 3Q 2022, including U.S. Photrexa® record sales of $17.0 million,

NOVEMBER 1, 2023

NOVEMBER 1, 2023