Exhibit 99.2

ABOUT THE COMPANY

TXU Corp., (NYSE: TXU) a Dallas-based energy company, manages a portfolio of competitive and regulated energy businesses in North America, primarily in Texas. With $9.3 billion in operating revenues in 2004, TXU ranks in the top half of the Fortune 500. TXU conducts its operations primarily through three core businesses.

TXU’s business model for competitive markets combines production, and retail and wholesale energy sales through its TXU Energy Holdings segment (TXU Energy Company LLC). The regulated electric delivery segment (TXU Electric Delivery Company), comprised of distribution and transmission assets, complements the competitive operations, delivering stable earnings and cash flow for TXU stakeholders. The electric delivery business uses its asset management skills developed over its hundred year history to provide reliable electric delivery to nearly 3 million points of delivery. It is the largest electric delivery business in the state and the sixth largest in the nation.

In its primary market of Texas, TXU’s portfolio includes over 18,300 megawatts of generation and additional contracted capacity with a fuel mix of nuclear, coal/lignite, natural gas/oil, and wind power. TXU Energy serves more than 2.4 million competitive electric customers in Texas where it is the leading energy retailer.

THIS SUMMARY

The consolidated financial data and statistics in this summary reflect the financial position and operating results of TXU through 2004.

This summary is only intended to provide limited supplemental operational and statistical information. Its contents do not constitute a complete set of financial statements prepared in accordance with generally accepted accounting principles. Accordingly, this summary is qualified in its entirety by reference to, and should be read in conjunction with, and not in lieu of, the companies’ reports, including financial statements and their accompanying notes, on file with the Securities and Exchange Commission.

Independent auditors have not audited all of the financial and operating statements. This summary has been prepared primarily for security analysts and investors in the hope that it will serve as a convenient and useful resource. The format of this summary may change in the future as we continue to try to meet the needs of our investors. The company does not undertake to update any of the information in this summary.

This summary is not intended for use in connection with any sale, offer to sell, or solicitation of any offer to buy any securities of TXU Corp. or its subsidiaries. Inquiries concerning this summary should be directed to Investor Relations:

Tim Hogan

214-812-4641

Bill Huber

214-812-2480

Steve Oakley

214-812-2220

| | |

CONTENTS | | Last Update: May 2005 |

| | |

Statements of Consolidated Income | | 2 |

Reconciliation of Operational Earnings to Reported Net Income | | 3 |

Statements of Consolidated Cash Flows | | 4 |

Consolidated Balance Sheets | | 6 |

Operating Statistics – TXU Electric Delivery | | 7 |

Operating Statistics – TXU Power | | 11 |

Operating Statistics – TXU Energy | | 19 |

ERCOT/Texas Market/Regulatory Highlights | | 25 |

Schedule of Long-Term Debt | | 30 |

Schedule of Preferred Securities | | 32 |

Common Stock Data and Credit Ratings | | 33 |

Liquidity and Capital Expenditures | | 34 |

Definitions | | 35 |

Investor Information | | 36 |

1

TXU CORP. AND SUBSIDIARIES

STATEMENTS OF CONSOLIDATED INCOME

| | | | | | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2004

| | | 2003

| | | 2002

| |

| | | (millions of dollars,

except per share amounts) | |

Operating revenues | | $ | 9,308 | | | $ | 8,600 | | | $ | 8,094 | |

| | |

|

|

| |

|

|

| |

|

|

|

Costs and expenses: | | | | | | | | | | | | |

Cost of energy sold and delivery fees | | | 3,847 | | | | 3,640 | | | | 3,199 | |

Operating costs | | | 1,429 | | | | 1,389 | | | | 1,354 | |

Depreciation and amortization | | | 760 | | | | 724 | | | | 733 | |

Selling, general and administrative expenses | | | 1,091 | | | | 907 | | | | 1,046 | |

Franchise and revenue-based taxes | | | 367 | | | | 390 | | | | 428 | |

Other income | | | (148 | ) | | | (58 | ) | | | (41 | ) |

Other deductions | | | 1,172 | | | | 42 | | | | 533 | |

Interest income | | | (28 | ) | | | (36 | ) | | | (33 | ) |

Interest expense and related charges | | | 695 | | | | 784 | | | | 693 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total costs and expenses | | | 9,185 | | | | 7,782 | | | | 7,912 | |

| | |

|

|

| |

|

|

| |

|

|

|

Income from continuing operations before income taxes, extraordinary gain (loss) and cumulative effect of changes in accounting principles | | | 123 | | | | 818 | | | | 182 | |

Income tax expense | | | 42 | | | | 252 | | | | 77 | |

| | |

|

|

| |

|

|

| |

|

|

|

Income from continuing operations before extraordinary gain (loss) and cumulative effect of changes in accounting principles | | | 81 | | | | 566 | | | | 105 | |

Income (loss) from discontinued operations, net of tax effect | | | 378 | | | | 74 | | | | (4,181 | ) |

Extraordinary gain (loss), net of tax effect | | | 16 | | | | — | | | | (134 | ) |

Cumulative effect of changes in accounting principles, net of tax effect | | | 10 | | | | (58 | ) | | | — | |

| | |

|

|

| |

|

|

| |

|

|

|

Net income (loss) | | | 485 | | | | 582 | | | | (4,210 | ) |

Exchangeable preferred membership interest buyback premium | | | 849 | | | | — | | | | — | |

Preference stock dividends | | | 22 | | | | 22 | | | | 22 | |

| | |

|

|

| |

|

|

| |

|

|

|

Net income (loss) available for common stock | | $ | (386 | ) | | $ | 560 | | | $ | (4,232 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Average shares of common stock outstanding (millions): | | | | | | | | | | | | |

Basic | | | 300 | | | | 322 | | | | 278 | |

Diluted | | | 300 | | | | 379 | | | | 278 | |

| | | |

Per share of common stock— Basic: | | | | | | | | | | | | |

Income from continuing operations before extraordinary gain (loss) and cumulative effect of changes in accounting principles | | $ | 0.27 | | | $ | 1.76 | | | $ | 0.37 | |

Exchangeable preferred membership interest buyback premium | | | (2.83 | ) | | | — | | | | — | |

Preference stock dividends | | | (0.07 | ) | | | (0.07 | ) | | | (0.08 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Net income (loss) from continuing operations available for common stock | | | (2.63 | ) | | | 1.69 | | | | 0.29 | |

Income (loss) from discontinued operations, net of tax effect | | | 1.26 | | | | 0.23 | | | | (15.04 | ) |

Extraordinary gain (loss), net of tax effect | | | 0.05 | | | | — | | | | (0.48 | ) |

Cumulative effect of changes in accounting principles, net of tax effect | | | 0.03 | | | | (0.18 | ) | | | — | |

| | |

|

|

| |

|

|

| |

|

|

|

Net income (loss) available for common stock | | $ | (1.29 | ) | | $ | 1.74 | | | $ | (15.23 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Per share of common stock— Diluted: | | | | | | | | | | | | |

Income from continuing operations before extraordinary gain (loss) and cumulative effect of changes in accounting principles | | $ | 0.27 | | | $ | 1.63 | | | $ | 0.37 | |

Exchangeable preferred membership interest buyback premium | | | (2.83 | ) | | | — | | | | — | |

Preference stock dividends | | | (0.07 | ) | | | (0.06 | ) | | | (0.08 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Net income (loss) from continuing operations available for common stock | | | (2.63 | ) | | | 1.57 | | | | 0.29 | |

Income (loss) from discontinued operations, net of tax effect | | | 1.26 | | | | 0.20 | | | | (15.04 | ) |

Extraordinary gain (loss), net of tax effect | | | 0.05 | | | | — | | | | (0.48 | ) |

Cumulative effect of changes in accounting principles, net of tax effect | | | 0.03 | | | | (0.15 | ) | | | — | |

| | |

|

|

| |

|

|

| |

|

|

|

Net income (loss) available for common stock | | $ | (1.29 | ) | | $ | 1.62 | | | $ | (15.23 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Dividends declared | | $ | 0.938 | | | $ | 0.50 | | | $ | 1.925 | |

2

TXU CORP. AND SUBSIDIARIES

RECONCILIATION OF OPERATIONAL EARNINGS TO REPORTED NET INCOME

Reconciliation of Operational Earnings1 to Reported Net Income

For the years ended December 31, 2003 and 2004; $ per share after tax

| | | | | | |

Factor

| | 04

| | | 03

| |

Net income (loss) to common | | (1.29 | ) | | 1.62 | |

Discontinued operations | | (1.26 | ) | | (0.20 | ) |

Extraordinary gain | | (0.05 | ) | | — | |

Cum. effect of changes in accounting principles | | (0.03 | ) | | 0.15 | |

Premium on EPMIs | | 2.83 | | | — | |

Preference stock dividends | | 0.07 | | | 0.06 | |

Income (loss) from continuing operations | | 0.27 | | | 1.63 | |

Preference stock dividends | | (0.07 | ) | | (0.06 | ) |

Effect of diluted shares calculation | | 0.04 | | | 0.01 | |

Special items | | 2.58 | | | — | |

Operational earnings | | 2.82 | | | 1.58 | |

Description of Special Items

For the year ended December 31, 2004; $millions and $ per share after tax

| | | | | | | | | | | | | | |

Special Item

| | Main Earnings

Category

| | Amount

| | | Per

Share

| | | Cash

| | | Non-Cash2

| |

Energy segment: | | | | | | | | | | | | | | |

Software projects write-off | | Other deductions | | 69 | | | 0.22 | | | — | | | 69 | |

Severance and related expenses | | Other deductions | | 72 | | | 0.22 | | | 45 | | | 27 | |

Inventory/gas plant write-downs | | Other deductions | | 55 | | | 0.17 | | | | | | 55 | |

Lease termination expense | | Other deductions | | 117 | | | 0.37 | | | 15 | | | 102 | |

Power contract settlement expense | | Other deductions | | 66 | | | 0.20 | | | 112 | | | (46 | ) |

Disposition of property | | Other income | | (50 | ) | | (0.15 | ) | | (12 | ) | | (38 | ) |

Other charges | | Other deductions | | 10 | | | 0.03 | | | 10 | | | | |

Electric Delivery segment: | | | | | | | | | | | | | | |

Rate case settlement reserve | | Other deductions | | 14 | | | 0.04 | | | — | | | 14 | |

Severance/other expenses | | Other deductions | | 19 | | | 0.06 | | | 11 | | | 8 | |

Corporate and Other: | | | | | | | | | | | | | | |

One-time compensation expense | | SG&A | | 51 | | | 0.16 | | | 51 | | | — | |

Transaction professional fees | | SG&A | | 35 | | | 0.11 | | | 35 | | | — | |

Litigation settlement expense | | Other deductions | | 56 | | | 0.17 | | | — | | | 56 | |

Liability management expense | | Other deductions

income/deductions | | 384 | | | 1.20 | | | 382 | | | 2 | |

Severance charges and other | | Other deductions | | 5 | | | 0.02 | | | 5 | | | — | |

Income tax benefit | | Income tax expense | | (75 | ) | | (0.24 | ) | | — | | | (75 | ) |

| | | | |

|

| |

|

| |

|

| |

|

|

Total | | | | 828 | | | 2.58 | | | 654 | | | 174 | |

| | | | |

|

| |

|

| |

|

| |

|

|

| 1 | Operational earnings is a non-GAAP measure that adjusts net income for special items. See Definitions for a |

detailed definition of operational earnings.

| 2 | While these items are reflected in earnings for the current period, the cash impact, if any, will be realized in future periods. These items are considered non-cash for the current period. |

3

TXU CORP. AND SUBSIDIARIES

STATEMENTS OF CONSOLIDATED CASH FLOWS

| | | | | | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2004

| | | 2003

| | | 2002

| |

| | | (millions of dollars) | |

Cash flows — operating activities | | | | | | | | | | | | |

Income from continuing operations before extraordinary gain (loss) and cumulative effect of changes in accounting principles | | $ | 81 | | | $ | 566 | | | $ | 105 | |

Adjustments to reconcile income from continuing operations before extraordinary gain (loss) and cumulative effect of changes in accounting principles to cash provided by operating activities: | | | | | | | | | | | | |

Depreciation and amortization | | | 826 | | | | 791 | | | | 804 | |

Deferred income taxes and investment tax credits — net | | | (11 | ) | | | (40 | ) | | | 21 | |

Losses on early extinguishment of debt | | | 416 | | | | — | | | | 40 | |

Asset writedowns and lease-related charges | | | 376 | | | | — | | | | 237 | |

Net gain from sales of assets | | | (135 | ) | | | (45 | ) | | | (30 | ) |

Net effect of unrealized mark-to-market valuations of commodity contracts | | | 109 | | | | 100 | | | | 113 | |

Litigation settlement charge | | | 84 | | | | — | | | | — | |

Bad debt expense | | | 90 | | | | 119 | | | | 160 | |

Stock-based compensation expense | | | 56 | | | | 25 | | | | 1 | |

Net equity (income) loss from unconsolidated affiliates and joint ventures | | | (1 | ) | | | 17 | | | | 255 | |

Change in regulatory-related liabilities | | | (70 | ) | | | (144 | ) | | | 34 | |

Changes in operating assets and liabilities: | | | | | | | | | | | | |

Accounts receivable—trade | | | (246 | ) | | | 173 | | | | (632 | ) |

Impact of accounts receivable sales program | | | (73 | ) | | | 100 | | | | (15 | ) |

Inventories | | | 15 | | | | (46 | ) | | | (48 | ) |

Accounts payable—trade | | | 185 | | | | (24 | ) | | | 108 | |

Commodity contract assets and liabilities | | | (5 | ) | | | 24 | | | | (45 | ) |

Margin deposits—net | | | 34 | | | | 25 | | | | — | |

Other — net assets | | | (133 | ) | | | 290 | | | | (97 | ) |

Other — net liabilities | | | 160 | | | | 482 | | | | 41 | |

| | |

|

|

| |

|

|

| |

|

|

|

Cash provided by operating activities | | | 1,758 | | | | 2,413 | | | | 1,052 | |

| | |

|

|

| |

|

|

| |

|

|

|

Cash flows — financing activities | | | | | | | | | | | | |

Issuances of securities: | | | | | | | | | | | | |

Long-term debt | | | 5,090 | | | | 2,846 | | | | 4,446 | |

Common stock | | | 112 | | | | 23 | | | | 1,274 | |

Retirements/repurchases of securities: | | | | | | | | | | | | |

Long-term debt held by subsidiary trusts | | | (546 | ) | | | — | | | | — | |

Equity-linked debt securities | | | (1,105 | ) | | | — | | | | — | |

Other long-term debt | | | (3,088 | ) | | | (2,187 | ) | | | (3,407 | ) |

Exchangeable preferred membership interests | | | (750 | ) | | | — | | | | — | |

Preferred securities of subsidiaries | | | (75 | ) | | | (98 | ) | | | — | |

Common stock | | | (4,687 | ) | | | — | | | | — | |

Change in notes payable: | | | | | | | | | | | | |

Commercial paper | | | — | | | | — | | | | (854 | ) |

Banks | | | 210 | | | | (2,305 | ) | | | 1,490 | |

Cash dividends paid: | | | | | | | | | | | | |

Common stock | | | (150 | ) | | | (160 | ) | | | (652 | ) |

Preference stock | | | (22 | ) | | | (22 | ) | | | (22 | ) |

Premium paid for redemption of exchangeable preferred membership interests | | | (1,102 | ) | | | — | | | | — | |

Redemption deposits applied to debt retirements | | | — | | | | 210 | | | | (210 | ) |

Debt premium, discount, financing and reacquisition expenses | | | (406 | ) | | | (38 | ) | | | (283 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Cash provided by (used in) financing activities | | | (6,519 | ) | | | (1,731 | ) | | | 1,782 | |

| | |

|

|

| |

|

|

| |

|

|

|

4

TXU CORP. AND SUBSIDIARIES

STATEMENTS OF CONSOLIDATED CASH FLOWS (CONT.)

| | | | | | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2004

| | | 2003

| | | 2002

| |

| | | (millions of dollars) | |

Cash flows — investing activities | | | | | | | | | | | | |

Capital expenditures | | | (912 | ) | | | (721 | ) | | | (813 | ) |

Dispositions of businesses | | | 4,814 | | | | 14 | | | | — | |

Acquisition of telecommunications partner’s interest | | | — | | | | (150 | ) | | | — | |

Proceeds from sales of assets | | | 27 | | | | 10 | | | | 447 | |

Change in collateral trust | | | 525 | | | | (525 | ) | | | — | |

Nuclear fuel | | | (87 | ) | | | (44 | ) | | | (51 | ) |

Other, including transaction costs | | | (87 | ) | | | 16 | | | | (186 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Cash provided by (used in) investing activities | | | 4,280 | | | | (1,400 | ) | | | (603 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Discontinued operations | | | | | | | | | | | | |

Cash provided by (used in) operating activities | | | (79 | ) | | | 338 | | | | 203 | |

Cash provided by (used in) financing activities | | | (10 | ) | | | 97 | | | | (966 | ) |

Cash used in investing activities | | | (153 | ) | | | (409 | ) | | | (210 | ) |

Effect of exchange rate changes | | | — | | | | 8 | | | | 60 | |

| | |

|

|

| |

|

|

| |

|

|

|

Cash provided by (used in) discontinued operations | | | (242 | ) | | | 34 | | | | (913 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Net change in cash and cash equivalents | | | (723 | ) | | | (684 | ) | | | 1,318 | |

Cash and cash equivalents — beginning balance | | | 829 | | | | 1,513 | | | | 195 | |

| | |

|

|

| |

|

|

| |

|

|

|

Cash and cash equivalents — ending balance | | $ | 106 | | | $ | 829 | | | $ | 1,513 | |

| | |

|

|

| |

|

|

| |

|

|

|

5

TXU CORP. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| | | | | | |

| | | December 31,

|

| | | 2004

| | 2003

|

| | | (millions of dollars) |

| ASSETS |

Current assets: | | | | | | |

Cash and cash equivalents | | $ | 106 | | $ | 829 |

Restricted cash | | | 49 | | | 12 |

Accounts receivable — trade | | | 1,274 | | | 1,016 |

Income taxes receivable | | | 25 | | | — |

Inventories | | | 320 | | | 419 |

Commodity contract assets | | | 546 | | | 548 |

Accumulated deferred income taxes | | | 224 | | | 94 |

Assets of telecommunications holding company | | | — | | | 110 |

Other current assets | | | 249 | | | 196 |

| | |

|

| |

|

|

Total current assets | | | 2,793 | | | 3,224 |

| | |

|

| |

|

|

Investments: | | | | | | |

Restricted cash | | | 47 | | | 582 |

Other investments | | | 664 | | | 632 |

Property, plant and equipment — net | | | 16,676 | | | 16,803 |

Goodwill | | | 542 | | | 558 |

Regulatory assets — net | | | 1,891 | | | 1,872 |

Commodity contract assets | | | 315 | | | 109 |

Cash flow hedge and other derivative assets | | | 6 | | | 88 |

Other noncurrent assets | | | 283 | | | 214 |

Assets held for sale | | | 24 | | | 7,202 |

| | |

|

| |

|

|

Total assets | | $ | 23,241 | | $ | 31,284 |

| | |

|

| |

|

|

| LIABILITIES, PREFERRED SECURITIES OF SUBSIDIARIES AND SHAREHOLDERS’ EQUITY |

Current liabilities: | | | | | | |

Notes payable - banks | | $ | 210 | | $ | — |

Long-term debt due currently | | | 229 | | | 678 |

Accounts payable — trade | | | 950 | | | 790 |

Commodity contract liabilities | | | 491 | | | 502 |

Litigation and other settlement accruals | | | 391 | | | — |

Liabilities of telecommunications holding company | | | — | | | 603 |

Other current liabilities | | | 1,445 | | | 1,322 |

| | |

|

| |

|

|

Total current liabilities | | | 3,716 | | | 3,895 |

| | |

|

| |

|

|

Accumulated deferred income taxes | | | 2,721 | | | 3,599 |

Investment tax credits | | | 405 | | | 430 |

Commodity contract liabilities | | | 347 | | | 47 |

Cash flow hedge and other derivative liabilities | | | 195 | | | 240 |

Long-term debt held by subsidiary trusts | | | — | | | 546 |

All other long-term debt, less amounts due currently | | | 12,412 | | | 10,608 |

Other noncurrent liabilities and deferred credits | | | 2,762 | | | 2,289 |

Liabilities held for sale | | | 6 | | | 2,952 |

| | |

|

| |

|

|

Total liabilities | | | 22,564 | | | 24,606 |

Preferred securities of subsidiaries | | | 38 | | | 759 |

Contingencies | | | | | | |

Shareholders’ equity | | | 639 | | | 5,919 |

| | |

|

| |

|

|

Total liabilities, preferred securities of subsidiaries and shareholders’ equity | | $ | 23,241 | | $ | 31,284 |

| | |

|

| |

|

|

6

OPERATING STATISTICS – TXU ELECTRIC DELIVERY

TXU Electric Delivery1 consists of regulated electricity transmission and distribution operations in Texas. TXU Electric Delivery provides the essential service of delivering electricity safely, reliably, and economically to approximately three million electric delivery points, or about a third of the state’s population. It is the largest electric transmission and distribution business in the state and the sixth largest in the nation.

Description of TXU Electric Delivery Business

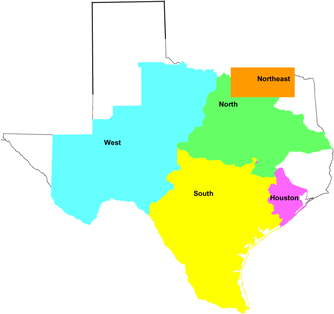

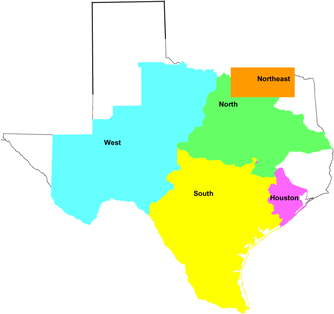

TXU Electric Delivery owns and operates more than 100,000 miles of electric distribution lines and over 14,000 miles of electric transmission lines. The operating assets are located principally in the north-central, eastern and western parts of Texas. TXU Electric Delivery operates within the Electric Reliability Council of Texas (ERCOT) system. ERCOT is an intrastate network of investor-owned entities, cooperatives, public entities, non-utility generators and power marketers.

Electricity Distribution

TXU’s distribution business is responsible for the overall safe and efficient operation of distribution facilities, including power delivery, power quality and system reliability. The electricity distribution business owns, manages, constructs, maintains and operates the distribution system within its certificated service area. Over the past five years, the number of TXU Electric Delivery’s distribution premises served has been growing at an average rate of 2% per year. TXU’s distribution system receives electricity from the transmission system through substations and distributes electricity to end users and wholesale customers through 2,943 distribution feeders.

Distribution Facts

As of December 31, 2000 – 2004; Mixed measures

| | | | | | | | | | |

Item

| | 2004

| | 2003

| | 2002

| | 2001

| | 2000

|

Transformer Capacity (MVA) | | 49,462 | | 47,991 | | 46,722 | | 45,503 | | 43,949 |

Circuit Miles of Line | | 99,638 | | 98,286 | | 96,847 | | 95,793 | | 94,644 |

Count of Load Serving Substations | | 785 | | 780 | | 776 | | 774 | | 772 |

Distribution Feeders | | 2,943 | | 2,914 | | 2,884 | | 2,867 | | 2,831 |

Electric Delivery Owned Poles2 | | 1,898,312 | | 1,886,284 | | 1,877,954 | | 1,893,714 | | 1,885,040 |

Third Party Poles3 | | 295,468 | | 297,188 | | 296,218 | | 270,649 | | 270,620 |

Electric Transmission

TXU’s electricity transmission business is responsible for the safe and reliable operations of its transmission network and substations. These responsibilities consist of the construction and maintenance of transmission facilities and substations and the monitoring, controlling and dispatching of high-voltage electricity over TXU Electric Delivery’s transmission facilities in coordination with ERCOT. The transmission business participates with ERCOT and other member utilities to plan, design, construct, and operate new transmission lines, with regulatory approval, necessary to maintain reliability, increase bulk power transfer capability and to minimize limitations and constraints on the ERCOT transmission grid.

| 1 | TXU Electric Delivery operated under the name ‘Oncor Electric Delivery’ during 2003 and 2002. |

| 2 | Approximately 30,000 poles sold during the 2000 to 2002 timeframe. |

| 3 | Count of third party poles contacted. |

7

OPERATING STATISTICS – ELECTRIC DELIVERY

Transmission Facts

As of December 31, 2000 – 2004; Mixed measures

| | | | | | | | | | |

Item

| | 2004

| | 2003

| | 2002

| | 2001

| | 2000

|

Transformer Capacity (MVA) | | 75,533 | | 70,890 | | 68,385 | | 68,089 | | 66,893 |

Circuit Miles of Line | | 14,191 | | 14,180 | | 14,137 | | 14,010 | | 13,815 |

Count of Substations, Switching Stations and Plant Switchyards | | 950 | | 950 | | 946 | | 941 | | 935 |

Transmission Circuit Breakers | | 5,825 | | 5,749 | | 5,633 | | 5,569 | | 5,466 |

Interconnection to Generation Facilities | | 40 | | 43 | | 41 | | 38 | | 34 |

Interconnection to Other Transmission Providers | | 248 | | 241 | | 200 | | 217 | | 211 |

Key Operational Metrics

For years ended December 31, 2000 – 2004; Mixed measures

| | | | | | | | | | | | | | | |

Metric

| | 2004

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| |

Non-Storm SAIDI (minutes)1 | | 75.54 | | | 74.15 | | | 90.36 | | | 81.77 | | | 87.46 | |

Non-Storm SAIFI (frequency)1 | | 1.10 | | | 1.17 | | | 1.39 | | | 1.23 | | | 1.37 | |

Non-Storm CAIDI (minutes)1 | | 68.67 | | | 63.30 | | | 64.81 | | | 66.48 | | | 63.84 | |

Meter Reading Accuracy | | 99.91 | % | | 99.89 | % | | 99.92 | % | | 99.91 | % | | 99.90 | % |

DART Incident Rate | | 1.96 | | | 1.73 | | | 1.87 | | | 2.35 | | | 2.30 | |

Regulatory Complaints2 | | 484 | | | 367 | | | 394 | | | 852 | | | 297 | |

Selected Financial Metrics

For years ended December 31, 2000 – 2004; $ millions, %

| | | | | | | | | | | | | | | |

Metric

| | 2004

| | | 2003

| | | 2002

| | | 20013

| | | 20003

| |

Total Operating Revenues | | 2,226 | | | 2,087 | | | 1,994 | | | 2,314 | | | 2,081 | |

Total Operating Expenses | | 1,697 | | | 1,565 | | | 1,517 | | | 1,820 | | | 1,597 | |

Net Income Before Extraordinary Items | | 255 | | | 258 | | | 245 | | | 228 | | | 226 | |

Property, Plant & Equipment – Net | | 6,609 | | | 6,333 | | | 6,056 | | | 5,802 | | | 5,445 | |

Capital Expenditures | | 600 | | | 543 | | | 513 | | | 635 | | | 517 | |

Capitalization Ratios | | | | | | | | | | | | | | | |

Long-term debt, less amounts due currently | | 61.0 | % | | 58.2 | % | | 60.6 | % | | 54.9 | % | | 52.1 | % |

Shareholder Equity | | 39.0 | % | | 41.8 | % | | 39.4 | % | | 45.1 | % | | 47.9 | % |

Capitalization Ratios (without transition bonds)4 | | | | | | | | | | | | | | | |

Long-term debt, less amounts due currently | | 53.2 | % | | 55.1 | % | | 60.6 | % | | 54.9 | % | | 52.1 | % |

Shareholder Equity | | 46.8 | % | | 44.9 | % | | 39.4 | % | | 45.1 | % | | 47.9 | % |

| 1 | Based on all outages greater than one minute in duration. |

| 2 | Complaints spiked in 2001 due to implementation of the pilot prior to the opening of the Texas electricity market to competition, and increased public awareness of the PUC’s involvement in regulating electric utilities. 2001 includes statistics for both TXU Electric Delivery and TXU Energy. The increase in 2004 vs 2003 is significantly due to a series of severe storms that struck North Texas during the week of June 1, 2004. Over one million customers lost power during this week and many experienced extended outages. |

| 3 | The 2000 and 2001 financial information for TXU Electric Delivery includes information derived from the historical financial statements of TXU Electric Company. Reasonable allocation methodologies were used to unbundle the financial statements of TXU Electric Company between its generation, retail and T&D operations. Allocation of revenues reflected consideration of return on invested capital, which continues to be regulated for the T&D operations. TXU Electric maintained expense accounts for each of its functional operations. Costs of O&M, plant and equipment and depreciation, as well as other assets and liabilities were specifically identified by component and function and then disaggregated. Interest and other financing costs were determined based upon debt allocated. Allocations reflected in the financial information for 2000 and 2001 did not necessarily result in amounts reported in individual line items that are comparable to actual results in 2002. Had the unbundled T&D operations of TXU US Holdings actually existed as a separate legal entity, its results of operations could have differed materially from those included in the historical financial statements of TXU Electric. |

| 4 | Excludes securitization bonds issued in years 2003 and 2004, as such bonds are serviced by transition charges and are excluded from debt in credit analyses and for regulatory rate proceedings. |

8

OPERATING STATISTICS – TXU ELECTRIC DELIVERY

Service Performance Statistics

TXU Electric Delivery finished 2004 as the best performing transmission and distribution service provider (TDSP) by performing at or above market average in 5 out of 7 key ERCOT service categories. TXU Electric Delivery had 49% of the total ERCOT market transactions.

Service Performance Statistics

For the year ended 12/31/04; %

| | | | | | |

Service Category

| | ERCOT Report Market Average

| | | TXU

| |

Scheduling of Switches | | 99.7 | % | | 99.8 | % |

Scheduling of Move-ins | | Unavailable | | | 99.97 | % |

On Schedule Completion of Switches | | 86.6 | % | | 98.3 | % |

On Schedule Completion of Move-ins | | 85.9 | % | | 91.6 | % |

Providing Historical Usage | | 98.0 | % | | 97.0 | % |

Loading of IDR Metering Data | | 99.7 | % | | 99.8 | % |

Loading of NIDR Metering Data | | 99.7 | % | | 99.6 | % |

Regulatory Environment

TXU Electric Delivery is subject to regulation by Texas authorities. TXU Electric Delivery provides delivery services to Retail Electric Providers (REPs) who sell electricity to retail customers; consequently, the electric delivery business has no commodity supply or price risk. TXU Electric Delivery believes that it operates in a favorable regulatory environment, as evidenced by a regulatory provision that allows annual updates of transmission rates to reflect changes in invested capital. This provision encourages investment in the transmission system to help ensure reliability and efficiency by allowing for timely recovery and return on new transmission investments.

General Rate Information

TXU Electric Delivery has an authorized return on equity of 11.25%. In the fourth quarter of 2004, TXU Electric Delivery recorded a $21 million ($14 million after-tax) charge for estimated settlement payments. The settlement, which was finalized February 22, 2005, is the result of a number of municipalities initiating an inquiry regarding distribution rates. The agreement avoids any immediate rate actions, but would require TXU Electric Delivery to file a rate case in 2006, based on a 2005 test year, unless the municipalities and TXU Electric Delivery mutually agree that such a filing is unnecessary. The final settlement amounts are being determined; however TXU Electric Delivery believes the total will closely approximate the amount accrued.

Transmission Cost of Service (TCOS) and Transmission Cost Recovery Factor (TCRF)

ERCOT transmission service providers (TSPs) recover their TCOS through a network transmission service rate approved by the Public Utility Commission of Texas (PUC). ERCOT TSPs bill their wholesale network transmission service charges to ERCOT distribution utilities, by applying their approved wholesale transmission rates to the distribution utilities’ average loads for the prior summer1. Distribution utilities2 are billed for wholesale transmission service by all ERCOT TSPs. Distribution utilities2 recover these transmission fees by billing the REPs a base retail transmission charge. In the Utility Cost of Service (UCOS) cases, the distribution utilities established base retail transmission charges by rate class. These rates are in addition to the base retail distribution system wires charges and other non-bypassable charges that are billed to retail electric providers.

In the latest wholesale transmission rulemaking, the PUC approved a new rule section, Distribution Service Provider TCRF. The purpose of this rule section is to allow distribution service providers to pass through wholesale transmission rate increases without the need for a distribution utility rate case. The TCRF rule allows distribution utilities to update the TCRF on March 1 and September 1 each year. The TCRF charges are billed in addition to the base retail transmission wires charges.

| 1 | The load for a distribution utility is the average demand at the time of the ERCOT peak for the months of June, July, August, and September. |

| 2 | Investor Owned Utilities (IOU’s) and other entities participating in customer choice. |

9

OPERATING STATISTICS – TXU ELECTRIC DELIVERY

Wire Rate Charges

As shown in the chart below, TXU Electric Delivery has the lowest basic wires rate in the State of Texas.

Operational Wires Rates Comparison – Residential with TCRF Factors (as of March 1, 2005)

| | | | | | | | | | | | | | | |

Charge

| | TXU

| | CenterPoint

| | AEP Central

| | AEP North

| | TNMP

|

Customer Charge | | $ | 2.74/cust/month | | $ | 2.39/cust/month | | $ | 2.58/cust/month | | $ | 4.58/cust/month | | $ | 0.33/cust/month |

Metering Charge | | $ | 2.21/cust/month | | $ | 1.91/cust/month | | $ | 2.38/cust/month | | $ | 4.78/cust/month | | $ | 3.58/cust/month |

Merger Savings/Rate Reduction Charge | | $ | 0.00/cust/month | | $ | 0.00/cust/month | | | ($0.28)/cust/month | | | ($0.48)/cust/month | | $ | 0.00/cust/month |

| | | | | |

Subtotal, Fixed Charges | | $ | 4.95/cust/month | | $ | 4.30/cust/month | | $ | 4.68/cust/month | | $ | 8.88/cust/month | | $ | 3.91/cust/month |

Distribution System Charge | | $ | 0.014070/kWh | | $ | 0.018870/kWh | | $ | 0.015628/kWh | | $ | 0.019863/kWh | | $ | 0.017291/kWh |

Transmission System Charge | | $ | 0.004493/kWh | | $ | 0.004310/kWh | | $ | 0.003712/kWh | | $ | 0.004638/kWh | | $ | 0.004150/kWh |

Transmission Cost Recovery Factor | | $ | 0.000899/kWh | | $ | 0.000752/kWh | | $ | 0.000705/kWh | | $ | 0.000972/kWh | | $ | 0.000866kWh |

Subtotal, Basic Wires Charges | | $ | 0.019462/kWh | | $ | 0.023932/kWh | | $ | 0.020045/kWh | | $ | 0.025473/kWh | | $ | 0.022307/kWh |

| | | | | |

System Benefit Fund | | $ | 0.000655/kWh | | $ | 0.000655/kWh | | $ | 0.000662/kWh | | $ | 0.000660/kWh | | $ | 0.000654/kWh |

Nuclear Decommissioning Charge | | $ | 0.000169/kWh | | | Included in base chges | | | n/a | | | n/a | | | n/a |

Transition Charge | | $ | 0.000712/kWh | | $ | 0.000939/kWh | | $ | 0.004241/kWh | | | n/a | | | n/a |

Excess Mitigation Credit | | | Expired 12/31/03 | | | ($0.004873)/kWh | | | ($0.000822)/kWh | | | n/a | | | n/a |

Merger Savings/Rate Reduction Riders | | | n/a | | | n/a | | | ($ 0.001095)/kWh | | | ($0.001248)/kWh | | | n/a |

| | | | | |

Customer Charge and Wires Charge (no non-by passable charges) for 1,000 kWh | | $ | 24.41 | | $ | 28.23 | | $ | 24.73 | | $ | 34.35 | | $ | 26.22 |

| | | | | |

Customer Charge and Wires Charge (no non-by passable charges) for 1,300 kWh | | $ | 30.25 | | $ | 35.41 | | $ | 30.74 | | $ | 41.99 | | $ | 32.91 |

| | | | | |

Total Wires Charge for 1,000 kWh | | $ | 25.95 | | $ | 24.95 | | $ | 27.71 | | $ | 33.77 | | $ | 26.87 |

| | | | | |

Total Wires Charge for 1,300 kWh | | $ | 32.25 | | $ | 31.15 | | $ | 34.62 | | $ | 41.23 | | $ | 33.76 |

TXU Electric Delivery’s average residential consumption for 2004 was approximately 1,300 kWh. |

Rate Base

For the period ending December 31, 2004, TXU Electric Delivery’s Adjusted Total Invested Capital1 is approximately $5,644,507,000, as compared to 2003 Adjusted Total Invested Capital of $5,381,055,975.

| 1 | Adjusted Total Invested Capital = Total Invested Capital – [Construction Work in Progress + Plant Held for Future Use] |

10

OPERATING STATISTICS – TXU POWER

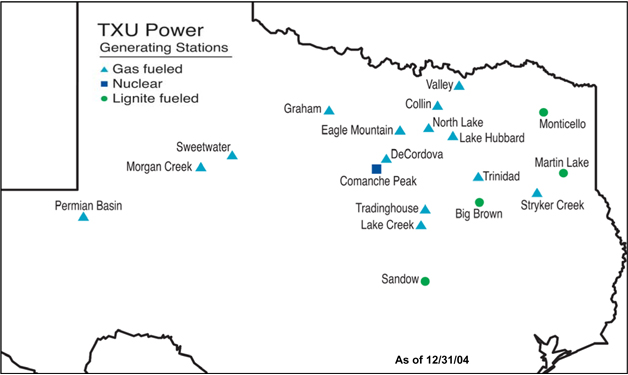

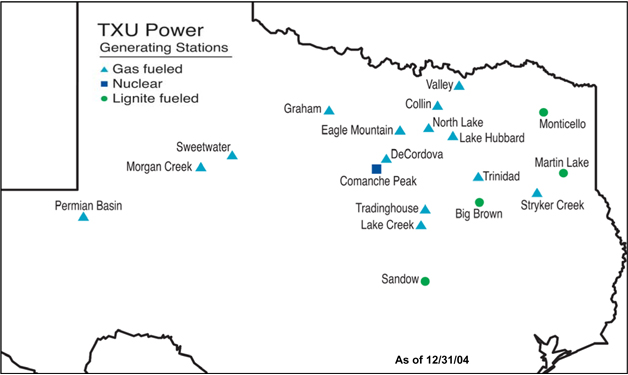

TXU Power’s generating facilities provide the capability to supply a significant portion of the wholesale electricity market demand in Texas, particularly in the North Texas market, at competitive production costs. Low cost nuclear-fueled and lignite/coal-fired (base load) generation is available to supply the electricity demands of its retail customers and other competitive retail electric providers. The generating fleet in Texas consists of 19 owned or leased plants with generating capacity fueled as follows: 2,300 MW nuclear; 5,837 MW coal/lignite; and 10,228 MW gas/oil.

Generating Plant Facts – Texas

| | | | | | | | |

Fact

| | Nuclear

| | Lignite/Coal

| | Gas/Oil

| | Total

|

Number of Generating Units | | 2 | | 9 | | 45 | | 56 |

2004 Installed Capacity (MWs) | | 2,300 | | 5,837 | | 10,228 | | 18,365 |

Annual Generation (3 year average MWhs) | | 17,793,690 | | 42,391,417 | | 12,168,793 | | 72,353,900 |

Generating Plant Locations – Texas

11

OPERATING STATISTICS – TXU POWER

Unit Statistics and Information – Texas

As of 12/31/04; MW

| | | | | | | | | | | | |

Plant

| | Unit

| | Fuel type

| | Type

| | Year in

Service1

| | County

| | Installed

Capacity

|

Comanche Peak | | 1 | | Nuclear | | Base load | | 1990 | | Somervell | | 1,150 |

Comanche Peak | | 2 | | Nuclear | | Base load | | 1993 | | Somervell | | 1,150 |

Subtotal | | | | | | | | | | | | 2,300 |

Big Brown | | 1 | | Lignite/Coal | | Base load | | 1971 | | Freestone | | 575 |

Big Brown | | 2 | | Lignite/Coal | | Base load | | 1972 | | Freestone | | 575 |

Monticello | | 1 | | Lignite/Coal | | Base load | | 1974 | | Titus | | 565 |

Monticello | | 2 | | Lignite/Coal | | Base load | | 1975 | | Titus | | 565 |

Monticello | | 3 | | Lignite/Coal | | Base load | | 1978 | | Titus | | 750 |

Martin Lake | | 1 | | Lignite/Coal | | Base load | | 1977 | | Rusk | | 750 |

Martin Lake | | 2 | | Lignite/Coal | | Base load | | 1978 | | Rusk | | 750 |

Martin Lake | | 3 | | Lignite/Coal | | Base load | | 1979 | | Rusk | | 750 |

Sandow | | 4 | | Lignite/Coal | | Base load | | 1981 | | Milam | | 557 |

| | | | | | | | | | | | |

|

Subtotal | | | | | | | | | | | | 5,837 |

| | | | | | | | | | | | |

|

Collin (M) | | 1 | | Gas/Oil | | Gas - Cycling | | 1955 | | Collin | | 153 |

DeCordova | | 1 | | Gas/Oil | | Gas - Intermediate | | 1975 | | Hood | | 818 |

DeCordova 4 CT’s2 | | | | Gas/Oil | | Gas - Peaking | | 1990 | | Hood | | 260 |

Eagle Mountain (M) | | 1 | | Gas/Oil | | Gas - Cycling | | 1954 | | Tarrant | | 115 |

Eagle Mountain (M) | | 2 | | Gas/Oil | | Gas - Cycling | | 1956 | | Tarrant | | 175 |

Eagle Mountain (RMR) | | 3 | | Gas/Oil | | Gas - Cycling | | 1971 | | Tarrant | | 375 |

Graham | | 1 | | Gas/Oil | | Gas - Cycling | | 1960 | | Young | | 240 |

Graham | | 2 | | Gas/Oil | | Gas - Intermediate | | 1969 | | Young | | 390 |

Lake Creek | | 1 | | Gas/Oil | | Gas - Cycling | | 1953 | | McLennan | | 87 |

Lake Creek | | 2 | | Gas/Oil | | Gas - Cycling | | 1959 | | McLennan | | 230 |

Lake Hubbard | | 1 | | Gas/Oil | | Gas - Cycling | | 1970 | | Dallas | | 393 |

Lake Hubbard | | 2 | | Gas/Oil | | Gas - Intermediate | | 1973 | | Dallas | | 528 |

Morgan Creek (M) | | 5 | | Gas/Oil | | Gas - Cycling | | 1959 | | Mitchell | | 175 |

Morgan Creek (M) | | 6 | | Gas/Oil | | Gas - Intermediate | | 1966 | | Mitchell | | 511 |

Morgan Creek 6 CT’s2 | | | | Gas/Oil | | Gas - Peaking | | 1988 | | Mitchell | | 390 |

North Lake (M) | | 1 | | Gas/Oil | | Gas - Cycling | | 1959 | | Dallas | | 175 |

North Lake (M) | | 2 | | Gas/Oil | | Gas - Cycling | | 1961 | | Dallas | | 175 |

North Lake (M) | | 3 | | Gas/Oil | | Gas - Cycling | | 1964 | | Dallas | | 365 |

Permian Basin | | 5 | | Gas/Oil | | Gas - Cycling | | 1959 | | Ward | | 115 |

Permian Basin | | 6 | | Gas/Oil | | Gas - Intermediate | | 1973 | | Ward | | 540 |

Permian Basin 5 CT’s2 | | | | Gas/Oil | | Gas - Peaking | | 1990 | | Ward | | 325 |

Stryker Creek | | 1 | | Gas/Oil | | Gas - Cycling | | 1958 | | Cherokee | | 175 |

Stryker Creek | | 2 | | Gas/Oil | | Gas - Intermediate | | 1965 | | Cherokee | | 500 |

Tradinghouse | | 1 | | Gas/Oil | | Gas - Intermediate | | 1970 | | McLennan | | 565 |

Tradinghouse | | 2 | | Gas/Oil | | Gas - Intermediate | | 1972 | | McLennan | | 818 |

Valley (M) | | 1 | | Gas/Oil | | Gas - Cycling | | 1962 | | Fannin | | 175 |

Valley (M) | | 2 | | Gas/Oil | | Gas - Intermediate | | 1967 | | Fannin | | 550 |

Valley (M) | | 3 | | Gas/Oil | | Gas - Cycling | | 1971 | | Fannin | | 390 |

Trinidad | | 6 | | Gas/Oil | | Gas - Cycling | | 1965 | | Henderson | | 240 |

Sweetwater | | 4 | | Gas/Oil | | Gas - Cycling | | 1989 | | Nolan | | 85 |

Sweetwater 3 CTs2 | | | | Gas/Oil | | Gas - Peaking | | 1989 | | Nolan | | 175 |

Diesels3 | | | | | | | | | | | | 20 |

| | | | | | | | | | | | |

|

Subtotal | | | | | | | | | | | | 10,228 |

| | | | | | | | | | | | |

|

Total | | | | | | | | | | | | 18,365 |

| | | | | | | | | | | | |

|

(M) – Mothballed (RMR) – Reliability Must Run for ERCOT

| 1 | Average useful lives: nuclear (60 years), lignite (50 years), gas (51 years), and gas CT’s (27 years) |

| 2 | CT - Combustion Turbine; DeCordova and Permian Basin CT capacity is under a purchase power agreement. |

| 3 | Diesels are located at Lake Creek (3), Stryker Creek (5) and Trinidad (2). |

12

OPERATING STATISTICS – TXU POWER

Nuclear Plant Statistics

| | | | |

Item

| | CPSES Unit 1

| | CPSES Unit 2

|

Commercial Operation Date | | August 1990 | | August 1993 |

License Expiration Date | | February 2030 | | February 2033 |

Architect/Engineer | | Gibbs & Hill | | Gibbs & Hill |

Reactor Manufacturer | | Westinghouse | | Westinghouse |

Reactor Type | | PWR | | PWR |

Turbine Generator Manufacturer | | Siemens | | Siemens |

Maximum Dependable Capacity (MW) | | 1,150 | | 1,150 |

Refueling Data | | | | |

Last Date | | March 27, 2004 | | March 26, 2005 |

# of Days | | 38 | | 32 |

Next Scheduled Refueling | | Fall 2005 | | Fall 2006 |

13

OPERATING STATISTICS – TXU POWER

Net Generation – Texas

For years ended December 31, 2000 – 2004; MWh

| | | | | | | | | | | | | | | |

Plant

| | Unit

| | 2004

| | | 2003

| | | 2002

| | | 2001

| | 2000

|

Comanche Peak | | 1 | | 9,013,792 | | | 9,625,953 | | | 7,785,265 | | | 8,444,318 | | 9,619,797 |

Comanche Peak | | 2 | | 10,038,851 | | | 8,123,390 | | | 8,793,819 | | | 9,877,947 | | 8,868,045 |

| | | | |

|

| |

|

| |

|

| |

| |

|

Subtotal | | | | 19,052,643 | | | 17,749,343 | | | 16,579,084 | | | 18,322,265 | | 18,487,842 |

| | | | |

|

| |

|

| |

|

| |

| |

|

Big Brown | | 1 | | 3,837,349 | | | 4,587,394 | | | 4,362,128 | | | 3,733,166 | | 4,230,742 |

Big Brown | | 2 | | 4,464,491 | | | 3,875,181 | | | 3,558,722 | | | 3,539,669 | | 4,314,241 |

Monticello | | 1 | | 4,305,393 | | | 4,134,558 | | | 3,711,998 | | | 3,646,758 | | 4,143,518 |

Monticello | | 2 | | 4,465,894 | | | 3,704,847 | | | 4,030,192 | | | 4,024,631 | | 3,478,659 |

Monticello | | 3 | | 5,277,059 | | | 5,666,922 | | | 5,385,687 | | | 4,904,882 | | 4,748,085 |

Martin Lake | | 1 | | 5,958,153 | | | 4,847,711 | | | 5,148,997 | | | 5,104,000 | | 5,596,189 |

Martin Lake | | 2 | | 5,339,493 | | | 5,781,564 | | | 5,079,555 | | | 4,812,971 | | 5,433,020 |

Martin Lake | | 3 | | 5,941,004 | | | 5,855,120 | | | 4,596,454 | | | 5,305,204 | | 5,492,880 |

Sandow | | 4 | | 4,527,603 | | | 4,787,459 | | | 3,943,323 | | | 4,434,912 | | 3,556,611 |

| | | | |

|

| |

|

| |

|

| |

| |

|

Subtotal | | | | 44,116,439 | | | 43,240,756 | | | 39,817,056 | | | 39,506,193 | | 40,993,945 |

| | | | |

|

| |

|

| |

|

| |

| |

|

Collin (M) | | 1 | | (1,217 | ) | | 98,879 | | | 74,572 | | | 191,886 | | 297,464 |

DeCordova | | 1 | | 206,385 | | | 1,414,916 | | | 2,974,511 | | | 3,338,979 | | 3,911,118 |

DeCordova CT’s | | | | 97,164 | | | 54,144 | | | 68,125 | | | 102,052 | | 181,854 |

Eagle Mountain (M) | | 1 | | 20,071 | | | 57,865 | | | 101,874 | | | 74,725 | | 148,244 |

Eagle Mountain (M) | | 2 | | 23,719 | | | 79,830 | | | 193,175 | | | 197,646 | | 256,133 |

Eagle Mountain (RMR) | | 3 | | 208,557 | | | 479,676 | | | 526,756 | | | 317,572 | | 531,411 |

Graham | | 1 | | 117,645 | | | 186,907 | | | 564,898 | | | 452,737 | | 931,078 |

Graham | | 2 | | 396,060 | | | 575,707 | | | 651,729 | | | 803,227 | | 1,362,246 |

Lake Creek | | 1 | | (2,223 | ) | | 1,858 | | | 29,460 | | | 64,960 | | 208,005 |

Lake Creek | | 2 | | 69,041 | | | 83,025 | | | 281,967 | | | 472,369 | | 691,554 |

Lake Hubbard | | 1 | | 129,333 | | | 400,926 | | | 414,224 | | | 462,944 | | 802,460 |

Lake Hubbard | | 2 | | 576,784 | | | 1,235,607 | | | 1,270,631 | | | 1,584,785 | | 1,863,522 |

Morgan Creek (R) | | 2 | | (347 | ) | | (1,561 | ) | | (1,478 | ) | | 1,492 | | 22,510 |

Morgan Creek (R) | | 3 | | (177 | ) | | (626 | ) | | (719 | ) | | 3,812 | | 16,203 |

Morgan Creek (R) | | 4 | | (418 | ) | | (1,569 | ) | | 6,343 | | | 37,413 | | 127,195 |

Morgan Creek (M) | | 5 | | 39,166 | | | 121,329 | | | 232,540 | | | 365,920 | | 568,993 |

Morgan Creek (M) | | 6 | | 42,720 | | | 629,540 | | | 842,029 | | | 1,979,522 | | 2,687,161 |

Morgan Creek CT’s | | | | 80,773 | | | 38,492 | | | 43,183 | | | 68,387 | | 174,584 |

North Lake(M) | | 1 | | 83,889 | | | 226,630 | | | 352,048 | | | 339,274 | | 337,409 |

North Lake (M) | | 2 | | 89,555 | | | 167,805 | | | 309,276 | | | 378,195 | | 461,831 |

North Lake (M) | | 3 | | 340,276 | | | 479,022 | | | 610,546 | | | 608,939 | | 1,120,695 |

North Main (R) | | 4 | | (181 | ) | | (832 | ) | | 56,863 | | | 14,775 | | 145,506 |

Parkdale (R) | | 1 | | (285 | ) | | 12,203 | | | 62,470 | | | 50,900 | | 141,342 |

Parkdale (R) | | 2 | | (169 | ) | | 21,096 | | | 99,219 | | | 81,301 | | 209,655 |

Parkdale (R) | | 3 | | (195 | ) | | 30,029 | | | 124,749 | | | 120,699 | | 263,059 |

Permian Basin | | 5 | | 17,241 | | | 40,019 | | | 95,770 | | | 221,266 | | 321,259 |

Permian Basin | | 6 | | 904,003 | | | 1,802,737 | | | 2,136,339 | | | 2,367,173 | | 2,607,556 |

Permian Basin CT’s | | | | 72,416 | | | 35,266 | | | 31,412 | | | 62,367 | | 165,561 |

River Crest (R) | | 6 | | (140 | ) | | (833 | ) | | (584 | ) | | 8,348 | | 183,042 |

Stryker Creek | | 1 | | 3,820 | | | 72,005 | | | 56,704 | | | 312,232 | | 449,959 |

Stryker Creek | | 2 | | 506,676 | | | 1,019,363 | | | 1,058,502 | | | 1,417,285 | | 1,921,490 |

Tradinghouse | | 1 | | 121,069 | | | 552,739 | | | 1,483,468 | | | 1,520,938 | | 1,806,095 |

Tradinghouse | | 2 | | 186,958 | | | 1,548,337 | | | 1,578,856 | | | 3,568,742 | | 3,595,258 |

Valley (M) | | 1 | | 5,851 | | | 141,253 | | | 192,241 | | | 327,436 | | 496,770 |

Valley (M) | | 2 | | (989 | ) | | 325,731 | | | 1,236,428 | | | 1,668,866 | | 2,086,165 |

Valley (M) | | 3 | | 823 | | | 95,422 | | | 199,461 | | | 366,490 | | 610,776 |

Trinidad | | 6 | | 45,330 | | | 144,262 | | | 218,517 | | | 415,436 | | 397,010 |

Sweetwater | | 4 | | 76,293 | | | 244,802 | | | 153,002 | | | — | | — |

Sweetwater CT | | 1 | | 44,560 | | | 65,316 | | | 85,440 | | | — | | — |

Sweetwater CT | | 2 | | 92,595 | | | 290,888 | | | 39,504 | | | — | | — |

Sweetwater CT | | 3 | | 81,478 | | | 330,777 | | | 279,435 | | | — | | — |

| | | | |

|

| |

|

| |

|

| |

| |

|

Subtotal | | | | 4,673,910 | | | 13,098,982 | | | 18,733,486 | | | 24,371,090 | | 32,102,173 |

| | | | |

|

| |

|

| |

|

| |

| |

|

Total | | | | 67,842,992 | | | 74,089,081 | | | 75,129,626 | | | 82,199,548 | | 91,583,960 |

| | | | |

|

| |

|

| |

|

| |

| |

|

| | |

Note: Excludes Handley and Mountain Creek Units sold in 2002. | | (R) Retired during 2004. |

(M) Mothballed | | (RMR) Reliability Must Run for ERCOT |

14

OPERATING STATISTICS – TXU POWER

Unit Capacity Factors – Texas

For years ended December 31, 2000 – 2004; %

| | | | | | | | | | | | |

Plant

| | Unit

| | 2004

| | 2003

| | 2002

| | 2001

| | 2000

|

Comanche Peak | | 1 | | 89.2 | | 95.6 | | 77.2 | | 83.8 | | 95.2 |

Comanche Peak | | 2 | | 99.4 | | 80.6 | | 87.2 | | 98.1 | | 87.7 |

| | | | | | |

Big Brown | | 1 | | 76.0 | | 91.1 | | 86.6 | | 74.1 | | 83.8 |

Big Brown | | 2 | | 88.4 | | 76.9 | | 70.7 | | 70.3 | | 85.4 |

Monticello | | 1 | | 86.8 | | 83.5 | | 75.0 | | 73.7 | | 83.5 |

Monticello | | 2 | | 90.0 | | 74.9 | | 81.4 | | 81.3 | | 70.1 |

Monticello | | 3 | | 80.1 | | 86.3 | | 82.0 | | 74.7 | | 72.1 |

Martin Lake | | 1 | | 90.4 | | 73.8 | | 78.4 | | 77.7 | | 84.9 |

Martin Lake | | 2 | | 81.0 | | 88.0 | | 77.3 | | 73.3 | | 82.5 |

Martin Lake | | 3 | | 90.2 | | 89.1 | | 70.0 | | 80.7 | | 83.4 |

Sandow | | 4 | | 94.6 | | 100.3 | | 82.6 | | 92.9 | | 74.3 |

| | | | | | |

Collin (M) | | 1 | | — | | 7.4 | | 5.6 | | 14.3 | | 22.1 |

DeCordova | | 1 | | 2.9 | | 19.7 | | 41.5 | | 46.6 | | 54.4 |

Decordova CT’s | | | | 3.5 | | 1.9 | | 2.4 | | 3.6 | | 6.5 |

Eagle Mountain (M) | | 1 | | 2.0 | | 5.7 | | 10.1 | | 7.4 | | 14.7 |

Eagle Mountain (M) | | 2 | | 1.5 | | 5.2 | | 12.6 | | 12.9 | | 16.7 |

Eagle Mountain (RMR) | | 3 | | 6.3 | | 14.6 | | 16.0 | | 9.7 | | 16.1 |

Graham | | 1 | | 5.6 | | 8.9 | | 26.9 | | 21.5 | | 44.2 |

Graham | | 2 | | 11.6 | | 16.9 | | 19.1 | | 23.5 | | 39.8 |

Lake Creek | | 1 | | — | | 0.2 | | 3.9 | | 8.5 | | 27.2 |

Lake Creek | | 2 | | 3.4 | | 4.1 | | 14.0 | | 23.4 | | 34.2 |

Lake Hubbard | | 1 | | 3.7 | | 11.6 | | 12.0 | | 13.4 | | 23.2 |

Lake Hubbard | | 2 | | 12.4 | | 26.7 | | 27.5 | | 34.3 | | 40.2 |

Morgan Creek (R) | | 2 | | — | | — | | — | | 0.8 | | 11.6 |

Morgan Creek (R) | | 3 | | — | | — | | — | | 1.0 | | 4.2 |

Morgan Creek (R) | | 4 | | — | | — | | 1.0 | | 6.1 | | 20.7 |

Morgan Creek (M) | | 5 | | 2.5 | | 7.9 | | 15.2 | | 23.9 | | 37.0 |

Morgan Creek (M) | | 6 | | 1.0 | | 14.1 | | 18.8 | | 44.2 | | 59.9 |

Morgan Creek CT’s | | | | 1.9 | | 0.9 | | 1.0 | | 1.6 | | 4.1 |

North Lake (M) | | 1 | | 5.5 | | 14.8 | | 23.0 | | 22.1 | | 22.0 |

North Lake (M) | | 2 | | 5.8 | | 10.9 | | 20.2 | | 24.7 | | 30.0 |

North Lake (M) | | 3 | | 10.6 | | 15.0 | | 19.1 | | 19.0 | | 35.0 |

North Main (R) | | 4 | | — | | — | | 8.1 | | 2.1 | | 20.7 |

Parkdale (R) | | 1 | | — | | 1.6 | | 8.2 | | 6.7 | | 18.5 |

Parkdale (R) | | 2 | | — | | 2.1 | | 9.8 | | 8.1 | | 20.8 |

Parkdale (R) | | 3 | | — | | 2.7 | | 11.4 | | 11.0 | | 24.0 |

Permian Basin | | 5 | | 1.7 | | 4.0 | | 9.5 | | 22.0 | | 31.8 |

Permian Basin | | 6 | | 19.1 | | 38.1 | | 45.2 | | 50.0 | | 55.0 |

Permian Basin CT’s | | | | 2.1 | | 1.0 | | 0.9 | | 1.8 | | 4.7 |

River Crest (R) | | 6 | | — | | — | | — | | 0.9 | | 18.9 |

Stryker Creek | | 1 | | 0.2 | | 4.7 | | 3.7 | | 20.4 | | 29.3 |

Stryker Creek | | 2 | | 11.5 | | 23.3 | | 24.2 | | 32.4 | | 43.8 |

Tradinghouse | | 1 | | 2.4 | | 11.2 | | 30.0 | | 30.7 | | 36.4 |

Tradinghouse | | 2 | | 2.6 | | 21.6 | | 22.0 | | 49.8 | | 50.0 |

Valley (M) | | 1 | | 0.4 | | 9.2 | | 12.5 | | 21.4 | | 32.3 |

Valley (M) | | 2 | | — | | 6.8 | | 25.7 | | 34.6 | | 43.2 |

Valley (M) | | 3 | | — | | 2.8 | | 5.8 | | 10.7 | | 17.8 |

Trinidad | | 6 | | 2.2 | | 6.9 | | 10.4 | | 19.8 | | 18.8 |

Sweetwater | | 4 | | 11.4 | | 36.8 | | 23.0 | | — | | — |

Sweetwater CT | | 1 | | 12.4 | | 18.2 | | 23.8 | | — | | — |

Sweetwater CT | | 2 | | 12.3 | | 38.6 | | 5.2 | | — | | — |

Sweetwater CT | | 3 | | 10.8 | | 43.9 | | 37.1 | | — | | — |

(R) Retired during 2004. (M) Mothballed (RMR) Reliability Must Run for ERCOT

15

OPERATING STATISTICS – TXU POWER

Net Heat Rates – Texas

Btu/kWh

| | | | | | |

Plant

| | Unit

| | Low

| | High

|

Comanche Peak | | 1 | | 10,200 | | 10,500 |

Comanche Peak | | 2 | | 9,500 | | 10,500 |

| | | |

Big Brown | | 1 | | 10,587 | | 11,517 |

Big Brown | | 2 | | 10,587 | | 11,517 |

Monticello | | 1 | | 10,587 | | 11,517 |

Monticello | | 2 | | 10,587 | | 11,517 |

Monticello | | 3 | | 10,587 | | 11,517 |

Martin Lake | | 1 | | 10,587 | | 11,517 |

Martin Lake | | 2 | | 10,587 | | 11,517 |

Martin Lake | | 3 | | 10,587 | | 11,517 |

Sandow | | 4 | | 10,587 | | 11,517 |

| | | |

Collin | | 1 | | 10,430 | | 32,426 |

DeCordova | | 1 | | 9,812 | | 13,316 |

Decordova CT’s | | | | 9,250 | | 9,800 |

Eagle Mountain | | 1 | | 10,430 | | 32,426 |

Eagle Mountain | | 2 | | 10,430 | | 32,426 |

Eagle Mountain | | 3 | | 10,430 | | 32,426 |

Graham | | 1 | | 10,430 | | 32,426 |

Graham | | 2 | | 9,812 | | 13,316 |

Lake Creek | | 1 | | 10,430 | | 32,426 |

Lake Creek | | 2 | | 10,430 | | 32,426 |

Lake Hubbard | | 1 | | 10,430 | | 32,426 |

Lake Hubbard | | 2 | | 9,812 | | 13,316 |

Morgan Creek (R) | | 2 | | 10,430 | | 32,426 |

Morgan Creek (R) | | 3 | | 10,430 | | 32,426 |

Morgan Creek (R) | | 4 | | 10,430 | | 32,426 |

Morgan Creek | | 5 | | 10,430 | | 32,426 |

Morgan Creek | | 6 | | 9,812 | | 13,316 |

Morgan Creek CT’s | | | | 9,250 | | 9,800 |

North Lake | | 1 | | 10,430 | | 32,426 |

North Lake | | 2 | | 10,430 | | 32,426 |

North Lake | | 3 | | 10,430 | | 32,426 |

North Main (R) | | 4 | | 10,430 | | 32,426 |

Parkdale (R) | | 1 | | 10,430 | | 32,426 |

Parkdale (R) | | 2 | | 10,430 | | 32,426 |

Parkdale (R) | | 3 | | 10,430 | | 32,426 |

Permian Basin | | 5 | | 10,430 | | 32,426 |

Permian Basin | | 6 | | 9,812 | | 13,316 |

Permian Basin CT’s | | | | 9,250 | | 9,800 |

River Crest (R) | | 6 | | 10,430 | | 32,426 |

Stryker Creek | | 1 | | 10,430 | | 32,426 |

Stryker Creek | | 2 | | 9,812 | | 13,316 |

Tradinghouse | | 1 | | 9,812 | | 13,316 |

Tradinghouse | | 2 | | 9,812 | | 13,316 |

Valley | | 1 | | 10,430 | | 32,426 |

Valley | | 2 | | 9,812 | | 13,316 |

Valley | | 3 | | 10,430 | | 32,426 |

Trinidad | | 6 | | 10,430 | | 32,426 |

Sweetwater | | 4 | | 11,500 | | 12,000 |

Sweetwater CT | | 1 | | 11,500 | | 12,000 |

Sweetwater CT | | 2 | | 11,500 | | 12,000 |

Sweetwater CT | | 3 | | 11,500 | | 12,000 |

(R) Retired during 2004.

16

OPERATING STATISTICS – TXU POWER

Fuel Mix and Average Cost – Texas

For the years ended December 31, 2000 – 2004; Mixed measures

| | | | | | | | | | | | | | | |

Statistic

| | 2004

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| |

Generation (MWh) | | | | | | | | | | | | | | | |

Nuclear | | 19,052,643 | | | 17,749,343 | | | 16,579,084 | | | 18,322,265 | | | 18,487,842 | |

Lignite/Coal | | 44,116,439 | | | 43,240,756 | | | 39,817,056 | | | 39,506,193 | | | 40,993,945 | |

Gas/Oil | | 4,673,910 | | | 13,098,982 | | | 18,733,486 | | | 24,371,090 | | | 32,102,173 | |

Gas/Oil Divested | | — | | | — | | | 854,232 | | | 3,626,265 | | | 5,292,578 | |

| | | | | |

Total | | 67,842,992 | | | 74,089,081 | | | 75,983,858 | | | 85,825,813 | | | 96,876,538 | |

Generation Mix (%) | | | | | | | | | | | | | | | |

Nuclear | | 28 | % | | 24 | % | | 22 | % | | 21 | % | | 19 | % |

Lignite/Coal | | 65 | % | | 58 | % | | 52 | % | | 46 | % | | 42 | % |

Gas/Oil | | 7 | % | | 18 | % | | 26 | % | | 33 | % | | 39 | % |

| | | | | |

Total | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

Fuel Cost ($000)1 | | | | | | | | | | | | | | | |

Nuclear | | 81,748 | | | 79,503 | | | 76,365 | | | 88,796 | | | 99,151 | |

Lignite/Coal | | 548,650 | | | 517,470 | | | 482,811 | | | 543,498 | | | 464,558 | |

| | | | | |

Total Base Load | | 630,398 | | | 596,973 | | | 559,176 | | | 632,294 | | | 563,709 | |

Average Fuel Cost ($/MWh)1 | | | | | | | | | | | | | | | |

Nuclear | | 4.29 | | | 4.48 | | | 4.61 | | | 4.85 | | | 5.36 | |

Lignite/Coal | | 12.43 | | | 11.97 | | | 12.13 | | | 13.76 | | | 11.33 | |

Total Base Load | | 9.98 | | | 9.79 | | | 9.92 | | | 10.93 | | | 9.48 | |

| 1 | Based on settled volumes, which exclude company use and sales to Alcoa. Includes depreciation and amortization of lignite mining plant and equipment and related asset retirement obligations which are reported as depreciation and amortization expense but are part of overall fuel costs. |

17

OPERATING STATISTICS – TXU POWER

O&M/SG&A

For the years ended December 31, 2000 – 2004; $ thousands

| | | | | | | | | | |

Plant Type

| | 2004

| | 2003

| | 2002

| | 2001

| | 2000

|

Nuclear | | 235,786 | | 213,725 | | 236,305 | | 194,300 | | 208,571 |

Lignite/Coal | | 208,805 | | 218,272 | | 195,458 | | 163,925 | | 146,978 |

Gas/Oil | | 92,070 | | 111,283 | | 105,904 | | 120,016 | | 125,123 |

Other | | 143,049 | | 57,773 | | 98,973 | | 133,359 | | 103,223 |

Total | | 679,710 | | 601,053 | | 636,640 | | 611,600 | | 583,895 |

Depreciation Rates

For the years ended December 31, 2000 – 2004, except as noted; %

| | | | | | | | | | | | |

Plant Type

| | 2004

| | Apr-Dec 2003

| | Jan -

Mar 2003

| | 2002

| | 2001

| | 2000

|

Nuclear | | 1.70 | | 1.83 | | 2.51 | | 2.51 | | 2.51 | | 2.51 |

Lignite/Coal | | 1.98 | | 2.97 | | 2.46 | | 2.46 | | 2.46 | | 2.46 |

Gas/Oil | | 2.31 | | 2.31 | | 2.00 | | 2.00 | | 2.00 | | 2.00 |

Net Heat Rate

For the years ended December 31, 2000 – 2004; Btu/kWh

| | | | | | | | | | |

Plant Type

| | 2004

| | 2003

| | 2002

| | 2001

| | 2000

|

Nuclear | | 10,280 | | 10,399 | | 10,470 | | 9,983 | | 10,401 |

Lignite/Coal | | 11,237 | | 11,220 | | 11,192 | | 11,216 | | 11,119 |

Gas/Oil | | 12,040 | | 11,201 | | 10,998 | | 10,698 | | 10,715 |

Outage Management (Base Load)

For the years ended December 31, 2000 – 2004; TWh

| | | | | | | | | | |

Category

| | 2004

| | 2003

| | 2002

| | 2001

| | 2000

|

Total | | | | | | | | | | |

Planned | | 3.8 | | 3.3 | | 5.1 | | 3.1 | | 3.3 |

Unplanned | | 3.5 | | 5.6 | | 6.6 | | 6.8 | | 4.6 |

Total | | 7.3 | | 8.9 | | 11.7 | | 9.9 | | 7.9 |

Nuclear | | | | | | | | | | |

Planned | | 1.1 | | 0.7 | | 2.2 | | 0.8 | | 1.0 |

Unplanned | | 0.1 | | 1.1 | | 0.6 | | 0.4 | | 0.0 |

Total | | 1.2 | | 1.8 | | 2.8 | | 1.2 | | 1.0 |

Lignite/Coal | | | | | | | | | | |

Planned | | 2.7 | | 2.6 | | 2.9 | | 2.3 | | 2.3 |

Unplanned | | 3.4 | | 4.5 | | 6.0 | | 6.4 | | 4.6 |

Total | | 6.1 | | 7.1 | | 8.9 | | 8.7 | | 6.9 |

18

OPERATING STATISTICS – TXU ENERGY – WHOLESALE MARKETS

Wholesale Markets optimizes the value of the TXU Energy Holdings portfolio by balancing customer demand for energy with the supply of energy in an economically efficient and effective manner. This effort includes hedging and risk management as well as other value creation activities. Retail and wholesale demand has generally been greater than volumes that can be supplied by the base load (nuclear and lignite/coal-fired) production; however, the supply demand relationship will evolve over time as market fundamentals and the retail competitive landscape change. The wholesale markets operation acts to provide additional supply balancing through the gas/oil-fired generation assets or purchases of power. These operations manage the commodity volume and price risks inherent in TXU Energy Holdings’ generation and sales operations through supply structuring, pricing and hedging activities, including hedging both future power sales and purchases of fuel supplies for the generation plants. These operations are also responsible for the efficient dispatch of power from the generation plants.

Commodity Market Prices

For periods ended 2002 – 2004; Mixed measures

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | Power Prices (MWD)1

| | Heat Rates

|

| | | | | NYMEX (GDD)2

| | 5 X 16

| | 5 X 8

| | 7 X 24

| | 5 X 16

| | 5 X 8

| | 7 X 24

|

2004 | | Q1 | | $ | 5.612 | | $ | 39.862 | | $ | 28.727 | | $ | 34.197 | | 7.115 | | 5.119 | | 6.098 |

| | | Q2 | | $ | 6.085 | | $ | 48.496 | | $ | 34.037 | | $ | 41.134 | | 7.963 | | 5.559 | | 6.760 |

| | | Q3 | | $ | 5.450 | | $ | 47.530 | | $ | 31.451 | | $ | 39.374 | | 8.714 | | 5.762 | | 7.217 |

| | | Q4 | | $ | 6.254 | | $ | 48.907 | | $ | 31.592 | | $ | 40.124 | | 7.802 | | 5.003 | | 6.382 |

| | | | |

|

| |

|

| |

|

| |

|

| |

| |

| |

|

| | | Total 2004 | | $ | 5.850 | | $ | 46.210 | | $ | 31.455 | | $ | 38.707 | | 7.901 | | 5.371 | | 6.614 |

| | | | |

|

| |

|

| |

|

| |

|

| |

| |

| |

|

2003 | | Q1 | | $ | 5.878 | | $ | 52.796 | | $ | 37.348 | | $ | 45.781 | | 8.982 | | 6.354 | | 7.789 |

| | | Q2 | | $ | 5.738 | | $ | 51.098 | | $ | 31.964 | | $ | 44.224 | | 8.905 | | 5.571 | | 7.707 |

| | | Q3 | | $ | 4.897 | | $ | 42.873 | | $ | 28.794 | | $ | 36.913 | | 8.755 | | 5.880 | | 7.538 |

| | | Q4 | | $ | 5.498 | | $ | 38.535 | | $ | 24.695 | | $ | 34.368 | | 7.009 | | 4.491 | | 6.251 |

| | | | |

|

| |

|

| |

|

| |

|

| |

| |

| |

|

| | | Total 2003 | | $ | 5.503 | | $ | 46.326 | | $ | 30.700 | | $ | 40.322 | | 8.413 | | 5.574 | | 7.321 |

| | | | |

|

| |

|

| |

|

| |

|

| |

| |

| |

|

2002 | | Q1 | | $ | 2.491 | | $ | 21.448 | | $ | 14.158 | | $ | 18.880 | | 8.611 | | 5.684 | | 7.580 |

| | | Q2 | | $ | 3.405 | | $ | 29.885 | | $ | 15.145 | | $ | 24.499 | | 8.777 | | 4.448 | | 7.195 |

| | | Q3 | | $ | 3.192 | | $ | 30.072 | | $ | 18.031 | | $ | 25.803 | | 9.422 | | 5.650 | | 8.085 |

| | | Q4 | | $ | 4.325 | | $ | 34.796 | | $ | 22.449 | | $ | 30.308 | | 8.046 | | 5.191 | | 7.008 |

| | | | |

|

| |

|

| |

|

| |

|

| |

| |

| |

|

| | | Total 2002 | | $ | 3.353 | | $ | 29.050 | | $ | 17.446 | | $ | 24.872 | | 8.714 | | 5.243 | | 7.467 |

| | | | |

|

| |

|

| |

|

| |

|

| |

| |

| |

|

| 1 | Power Prices are the Megawatt Daily non zonal ERCOT day ahead cash prices in $/MWh. |

| 2 | NYMEX gas price is the Gas Daily data for day ahead prices in the cash month in $/MMBtu. |

19

OPERATING STATISTICS – TXU ENERGY

Selected Credit Statistics for Wholesale Sales1

As of December 31, 2002 – 2004; $ millions, %

| | | | | | | | | | | | |

Statistic

| | 2004

| | | 2003

| | | 2002

| |

Gross Credit Exposure (Net of Collateral) | | $ | 600 | | | $ | 740 | | | $ | 866 | |

Investment Grade Credit Exposure (Net of Collateral) | | | | | | | | | | | | |

Less than 2 years | | $ | 317 | | | $ | 424 | | | $ | 624 | |

2 - 5 years | | | 86 | | | | 119 | | | | 22 | |

Greater than 5 years | | | 77 | | | | 119 | | | | 4 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total | | $ | 480 | | | $ | 662 | | | $ | 650 | |

| | |

|

|

| |

|

|

| |

|

|

|

Non Investment Grade Credit Exposure (Net of Collateral) | | | | | | | | | | | | |

Less than 2 years | | $ | 79 | | | $ | 50 | | | $ | 195 | |

2 - 5 years | | | 22 | | | | 14 | | | | 21 | |

Greater than 5 years | | | 19 | | | | 14 | | | | 0.3 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total | | $ | 120 | | | $ | 78 | | | $ | 216 | |

| | |

|

|

| |

|

|

| |

|

|

|

% Investment Grade (Net of Collateral) | | | 80 | % | | | 89 | % | | | 75 | % |

% Non Investment Grade (Net of Collateral) | | | 20 | % | | | 11 | % | | | 25 | % |

| | |

|

|

| |

|

|

| |

|

|

|

Total | | | 100 | % | | | 100 | % | | | 100 | % |

| | |

|

|

| |

|

|

| |

|

|

|

Credit Exposure Maturities (Net of Collateral) | | | | | | | | | | | | |

Less than 2 years | | | 66 | % | | | 64 | % | | | 94 | % |

2 - 5 years | | | 18 | % | | | 18 | % | | | 5 | % |

Greater than 5 years | | | 16 | % | | | 18 | % | | | 1 | % |

| | |

|

|

| |

|

|

| |

|

|

|

Total | | | 100 | % | | | 100 | % | | | 100 | % |

| | |

|

|

| |

|

|

| |

|

|

|

Selected Credit Statistics For Large Business Retail Sales1

As of December 31, 2002 – 2004; $ millions, %

| | | | | | | | | | | | |

Statistic

| | 2004

| | | 2003

| | | 2002

| |

Gross Credit Exposure (Net of Collateral) | | $ | 184 | | | $ | 226 | | | $ | 319 | |

Investment Grade Credit Exposure | | | | | | | | | | | | |

(Net of Collateral) | | | | | | | | | | | | |

Less than 2 years | | $ | 148 | | | $ | 155 | | | $ | 139 | |

2 - 5 years | | | 3 | | | | 10 | | | | 28 | |

Greater than 5 years | | | 0 | | | | 0 | | | | 0 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total | | $ | 151 | | | $ | 165 | | | $ | 167 | |

| | |

|

|

| |

|

|

| |

|

|

|

Non Investment Grade Exposure (Net of Collateral) | | | | | | | | | | | | |

Less than 2 years | | $ | 33 | | | $ | 57 | | | $ | 152 | |

2 - 5 years | | | 0 | | | | 4 | | | | 0 | |

Greater than 5 years | | | 0 | | | | 0 | | | | 0 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total | | $ | 33 | | | $ | 61 | | | $ | 152 | |

| | |

|

|

| |

|

|

| |

|

|

|

% Investment Grade | | | 82 | % | | | 73 | % | | | 52 | % |

% Non Investment | | | 18 | % | | | 27 | % | | | 48 | % |

| | |

|

|

| |

|

|

| |

|

|

|

Total | | | 100 | % | | | 100 | % | | | 100 | % |

| | |

|

|

| |

|

|

| |

|

|

|

Credit Exposure Maturities (Net of Collateral) | | | | | | | | | | | | |

Less than 2 years | | | 98 | % | | | 94 | % | | | 91 | % |

2 - 5 years | | | 2 | % | | | 6 | % | | | 9 | % |

Greater than 5 years | | | 0 | % | | | 0 | % | | | 0 | % |

| | |

|

|

| |

|

|

| |

|

|

|

Total | | | 100 | % | | | 100 | % | | | 100 | % |

| | |

|

|

| |

|

|

| |

|

|

|

| 1 | The tables shown above present the distribution of credit exposure for trade accounts receivable from large business customers, commodity contract assets and other derivative assets that arise primarily from hedging activities. |

20

OPERATING STATISTICS – TXU ENERGY

Financial and Operating Data

For the years ended December 31, 2002 – 2004; Mixed measures

| | | | | | | | | | | | |

Statistic

| | 2004

| | | 2003

| | | 2002

| |

Electric Operating Revenues ($ millions) | | | | | | | | | | | | |

Residential | | $ | 3,462 | | | $ | 3,311 | | | $ | 3,108 | |

Small Business | | | 1,137 | | | | 1,238 | | | | 1,330 | |

Large Business | | | 1,771 | | | | 1,935 | | | | 2,085 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total | | $ | 6,370 | | | $ | 6,484 | | | $ | 6,523 | |

| | |

|

|

| |

|

|

| |

|

|

|

Electric Energy Sales (GWh) | | | | | | | | | | | | |

Residential | | | 33,986 | | | | 35,981 | | | | 37,692 | |

Small Business | | | 10,839 | | | | 12,986 | | | | 15,907 | |

Large Business | | | 25,466 | | | | 30,955 | | | | 36,982 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total | | | 70,291 | | | | 79,922 | | | | 90,581 | |

| | |

|

|

| |

|

|

| |

|

|

|

Number of Electric Customers (thousands of meters) | | | | | | | | | | | | |

Native Market: | | | | | | | | | | | | |

Residential | | | 1,951 | | | | 2,059 | | | | 2,204 | |

Small Business | | | 309 | | | | 316 | | | | 328 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total Native Market | | | 2,260 | | | | 2,375 | | | | 2,532 | |

| | |

|

|

| |

|

|

| |

|

|

|

Other Markets: | | | | | | | | | | | | |

Residential | | | 194 | | | | 148 | | | | 98 | |

Small Business | | | 6 | | | | 5 | | | | 5 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total Other Markets | | | 200 | | | | 153 | | | | 103 | |

| | |

|

|

| |

|

|

| |

|

|

|

Large Business | | | 76 | | | | 69 | | | | 78 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total Electric Customers | | | 2,536 | | | | 2,597 | | | | 2,713 | |

| | |

|

|

| |

|

|

| |

|

|

|

Net Customer Change | | | | | | | | | | | | |

Native Market | | | (4.8 | )% | | | (6.2 | )% | | | (3.5 | )% |

Other Markets | | | 30.7 | % | | | 48.5 | % | | | 1,473 | % |

| | | |

Call Center Metrics | | | | | | | | | | | | |

Answer Speed (seconds) | | | 39 | | | | 268 | | | | 93 | |

Abandoned Calls | | | 4 | % | | | 26 | % | | | 11 | % |

Credit and Collection Metrics | | | | | | | | | | | | |

| | | |

Average Receivables ($ millions) | | | | | | | | | | | | |

Less than 30 days | | | 262.4 | | | | 302.7 | | | | 341.7 | |

30-60 days | | | 37.1 | | | | 55.9 | | | | 88.3 | |

60-90 days | | | 8.8 | | | | 19.5 | | | | 55.2 | |

Greater than 90 days | | | 8.2 | | | | 24.7 | | | | 78.4 | |

| | | |

Bad Debt Expense ($ millions) | | | 94.6 | | | | 120.5 | | | | 118.4 | |

Bad Debt as % of Total Revenues | | | 1.49 | % | | | 1.84 | % | | | 1.80 | % |

21

OPERATING STATISTICS – TXU ENERGY

Price to Beat and Gas Component Information – Residential

| | | | | | | | | | | | | | | | | |

Affiliate REP

| | Docket

No.

| | | Effective

| | Gas Price As Filed

| | Gas Price Increase

| | | Months

| | Fuel Factor

| | Average Price1 (¢/kWh)

|

TXU | | 24040 | | | 01/01/2002 | | $ | 3.111 | | — | | | — | | — | | 8.26 |

| | | 25802 | | | 08/27/2002 | | $ | 3.619 | | 16.3 | % | | All | | 2.8935 | | 8.66 |

| | | 27281 | | | 03/11/2003 | | $ | 4.910 | | 35.7 | % | | All | | 3.9265 | | 9.69 |

| | | 28191 | | | 08/22/2003 | | $ | 5.362 | | 9.2 | % | | All | | 4.2877 | | 10.06 |

| | | 29516 | | | 05/20/2004 | | $ | 5.785 | | 7.9 | % | | All | | 4.6264 | | 10.39 |

| | | 29837 | | | 08/04/2004 | | $ | 6.517 | | 12.7 | % | | All | | 5.2140 | | 10.98 |

| | | 31004 | | | 05/12/2005 | | $ | 7.872 | | 20.8 | % | | All | | 6.2985 | | 12.07 |

First Choice | | 24194 | | | 01/01/2002 | | $ | 3.111 | | — | | | — | | — | | 8.66 |

| | | 25885 | | | 08/27/2002 | | $ | 3.817 | | 22.7 | % | | All | | 2.67396 | | 9.15 |

| | | 27167 | | | 02/04/2002 | | $ | 4.526 | | 18.6 | % | | All | | 3.17085 | | 9.65 |

| | | 27390 | | | 03/27/2003 | | $ | 5.166 | | 14.1 | % | | All | | 3.61921 | | 10.10 |

| | | 27511 | | | 04/22/2003 | | $ | 5.958 | | 15.3 | % | | All | | 4.17403 | | 10.65 |

| | | 29800 | | | 07/07/2004 | | $ | 6.454 | | 8.32 | % | | All | | 4.52131 | | 11.00 |

| | | 30375 | | | 12/21/2004 | | $ | 7.450 | | 15.4 | % | | All | | 5.21895 | | 11.70 |

| | | 30999 | | | 05/12/2005 | | $ | 7.845 | | 5.3 | % | | All | | 5.49555 | | 11.98 |

Mutual Energy - CPL | | 24195 | | | 01/01/2002 | | $ | 3.111 | | — | | | — | | — | | 8.88 |

| | | 25873 | | | 08/27/2002 | | $ | 3.795 | | 22.0 | % | | Mar-Jun

Jul-Oct

Nov-Feb | | 4.2908

3.9793

3.3763 | | 9.52 |

| | | 27376 | | | 03/25/2003 | | $ | 5.123 | | 35.0 | % | | Mar-Jun

Jul-Oct

Nov-Feb | | 5.7926

5.3721

4.5580 | | 10.93 |

| | | 29293 | | | 03/16/2004 | | $ | 5.586 | | 9.0 | % | | Mar-Jun

Jul-Oct

Nov-Feb | | 6.3139

5.8556

4.9682 | | 11.42 |

| | | 29845 | | | 08/10/2004 | | $ | 6.517 | | 16.7 | % | | Mar-Jun

Jul-Oct

Nov-Feb | | 7.3683

6.8335

5.7979 | | 12.41 |

| | | 30966 | | | 05/03/2005 | | $ | 7.603 | | 16.7 | % | | Mar-Jun

Jul-Oct

Nov-Feb | | 8.5988

7.9747

6.7661 | | 13.56 |

Mutual Energy - WTU | | 24335 | | | 01/01/2002 | | $ | 3.111 | | — | | | — | | — | | 8.90 |

| | | 25874 | | | 08/27/2002 | | $ | 3.795 | | 22.0 | % | | Dec-Feb

Mar-May

Jun-Aug

Sep-Nov | | 3.9894

6.0140

4.9507

3.8627 | | 9.71 |

| | | 27377 | | | 03/25/2003 | | $ | 5.123 | | 35.0 | % | | Dec-Feb

Mar-May

Jun-Aug

Sep-Nov | | 5.3857

8.1189

6.6834

5.2146 | | 11.34 |

| | | 29292 | | | 03/16/2004 | | $ | 5.586 | | 9.0 | % | | Dec-Feb

Mar-May

Jun-Aug

Sep-Nov | | 5.8704

8.8496

7.2849

5.6839 | | 11.91 |

| | | 29845 | | | 08/10/2004 | | $ | 6.517 | | 16.7 | % | | Dec-Feb

Mar-May

Jun-Aug

Sep-Nov | | 6.8508

10.3275

8.5015

6.6331 | | 13.46 |

Reliant | | 23950 | | | 01/01/2002 | | $ | 3.111 | | — | | | — | | — | | 8.62 |

| | | 25840 | | | 08/27/2002 | | $ | 3.729 | | 19.9 | % | | All | | 3.0377 | | 9.12 |

| | | 26933 | | | 12/20/2002 | | $ | 4.017 | | 7.7 | % | | All | | 3.2716 | | 9.35 |

| | | 27320 | | | 03/11/2003 | | $ | 4.956 | | 23.4 | % | | All | | 4.0372 | | 10.12 |

| | | 27956 | | | 07/26/2003 | | $ | 6.100 | | 23.1 | % | | All | | 4.9698 | | 11.05 |

| | | 30378 | | | 12/21/2004 | | $ | 7.500 | | 23.0 | % | | All | | 6.1079 | | 12.19 |

| | | 30774 | 2 | | 050/2/2005 | | $ | 7.500 | | N/A | | | All | | 6.1079 | | 12.80 |

| 1 | Average price calculated based on 1000 KWh/month. |

| 2 | Increase due to elimination of EMC credit and addition of transition charge reflected in an increased base rate. |

22

OPERATING STATISTICS – TXU ENERGY

Native Market Price Comparison1

Various dates; ¢/kWh

| | | | | | | | | | |

Retail Electric Provider

| | 06/01/05

| | 12/31/04

| | 12/31/03