|

Exhibit 99.1

|

Third Quarter 2016 Investor Call

November 3, 2016

Oncor Electric Delivery

Forward Looking Statements

This presentation contains forward-looking statements, which are subject to various risks and uncertainties. Discussion of risks and uncertainties that could cause actual results to differ materially from management’s current projections, forecasts, estimates and expectations is contained in filings made by Oncor Electric Delivery Company LLC (Oncor) with the Securities and Exchange Commission (SEC). Specifically, Oncor makes reference to the section entitled “Risk Factors” in its annual and quarterly reports. In addition to the risks and uncertainties set forth in Oncor’s SEC filings, the forward-looking statements in this presentation could be affected by, among other things: prevailing governmental policies and regulatory actions; legal and administrative proceedings and settlements, including the exercise of equitable powers by courts; any impacts on Oncor as a result of the bankruptcy proceedings involving Energy Future Holdings Corp. (EFH) and certain of its subsidiaries and the change in indirect ownership of Oncor proposed in such proceedings; weather conditions and other natural phenomena; acts of sabotage, wars or terrorist or cyber security threats or activities; economic conditions, including the impact of a recessionary environment; unanticipated population growth or decline, or changes in market demand and demographic patterns; changes in business strategy, development plans or vendor relationships; unanticipated changes in interest rates or rates of inflation; unanticipated changes in operating expenses, liquidity needs and capital expenditures; inability of various counterparties to meet their financial obligations to Oncor, including failure of counterparties to perform under agreements; general industry trends; hazards customary to the industry and the possibility that Oncor may not have adequate insurance to cover losses resulting from such hazards; changes in technology used by and services offered by Oncor; significant changes in Oncor’s relationship with its employees; changes in assumptions used to estimate costs of providing employee benefits, including pension and other post-retirement employee benefits, and future funding requirements related thereto; significant changes in critical accounting policies material to Oncor; commercial bank and financial market conditions, access to capital, the cost of such capital, and the results of financing and refinancing efforts, including availability of funds in the capital markets and the potential impact of disruptions in US credit markets; circumstances which may contribute to future impairment of goodwill, intangible or other long-lived assets; financial restrictions under Oncor’s revolving credit facility and indentures governing its debt instruments; Oncor’s ability to generate sufficient cash flow to make interest payments on its debt instruments; actions by credit rating agencies; and Oncor’s ability to effectively execute its operational strategy. Any forward-looking statement speaks only as of the date on which it is made, and Oncor undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of unanticipated events.

Regulation G

This presentation includes certain non-GAAP financial measures. Reconciliations of these measures to the most directly comparable GAAP measures are included in this presentation, which is available on Oncor’s website, www.oncor.com, in the Investor section, and also filed with the SEC.

Oncor Electric Delivery 1

3rd Quarter 2016 Investor Call Agenda

Financial Overview David Davis

Chief Financial Officer

Operational Review Bob Shapard

Chief Executive

Q&A

Oncor Electric Delivery

2

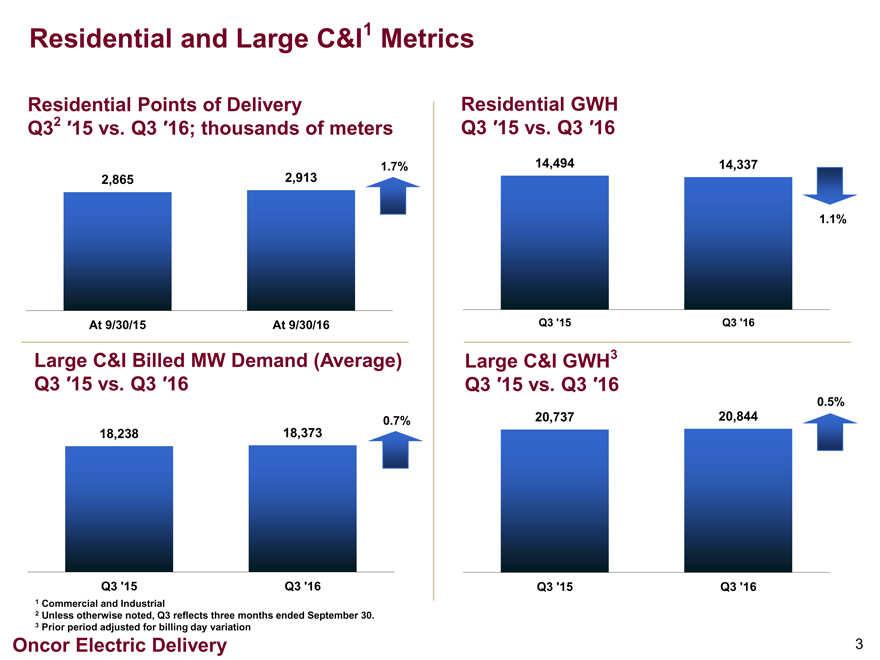

Residential and Large C&I1 Metrics

Residential Points of Delivery

Q32 ’15 vs. Q3 ’16; thousands of meters

2,913 1.7% 2,865

At 9/30/15 At 9/30/16

Large C&I Billed MW Demand (Average)

Q3 ’15 vs. Q3 ’16

0.7%

18,238 18,373

Q3 ‘15 Q3 ‘16

1 Commercial and Industrial

2 Unless otherwise noted, Q3 reflects three months ended September 30.

3 Prior period adjusted for billing day variation

Residential GWH

Q3 ’15 vs. Q3 ’16

14,494 14,337

1.1%

Q3 ‘15 Q3 ‘16

Large C&I GWH3 Q3 ’15 vs. Q3 ’16

20,737 20,844

0.5%

Q3 ‘15 Q3 ‘16

Oncor Electric Delivery

3

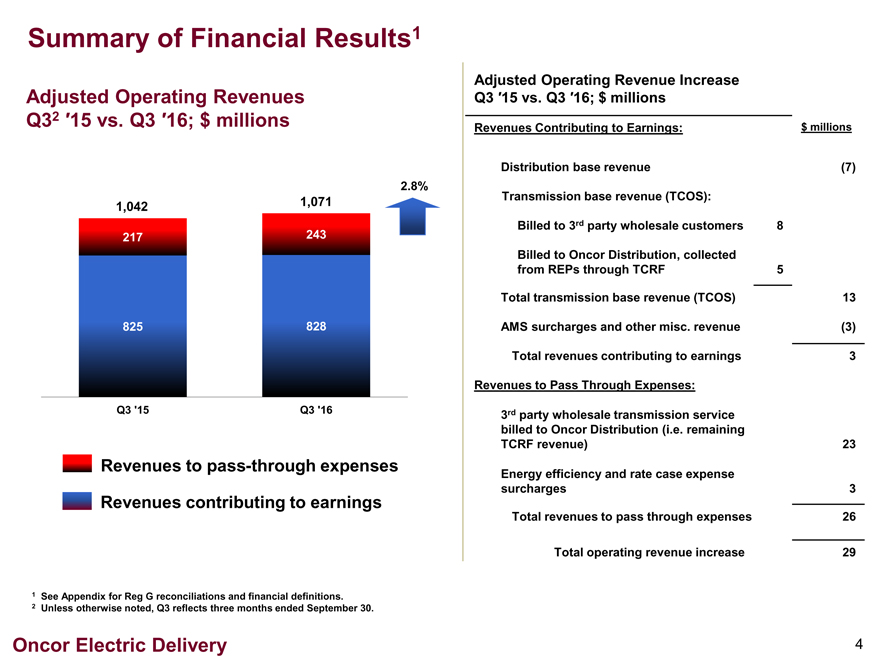

Summary of Financial Results1

Adjusted Operating Revenues Q32 ’15 vs. Q3 ’16; $ millions

2.8%

1,042 1,071

217 243

825 828

Q3 ‘15 Q3 ‘16

Revenues to pass-through expenses

Revenues contributing to earnings

1 See Appendix for Reg G reconciliations and financial definitions. 2 Unless otherwise noted, Q3 reflects three months ended September 30.

Oncor Electric Delivery

Adjusted Operating Revenue Increase

Q3 ’15 vs. Q3 ’16; $ millions

Revenues Contributing to Earnings: $ millions

Distribution base revenue (7)

Transmission base revenue (TCOS):

Billed to 3rd party wholesale customers 8

Billed to Oncor Distribution, collected

from REPs through TCRF 5

Total transmission base revenue (TCOS) 13

AMS surcharges and other misc. revenue (3)

Total revenues contributing to earnings 3

Revenues to Pass Through Expenses:

3rd party wholesale transmission service

billed to Oncor Distribution (i.e. remaining

TCRF revenue) 23

Energy efficiency and rate case expense

surcharges 3

Total revenues to pass through expenses 26

Total operating revenue increase 29

4

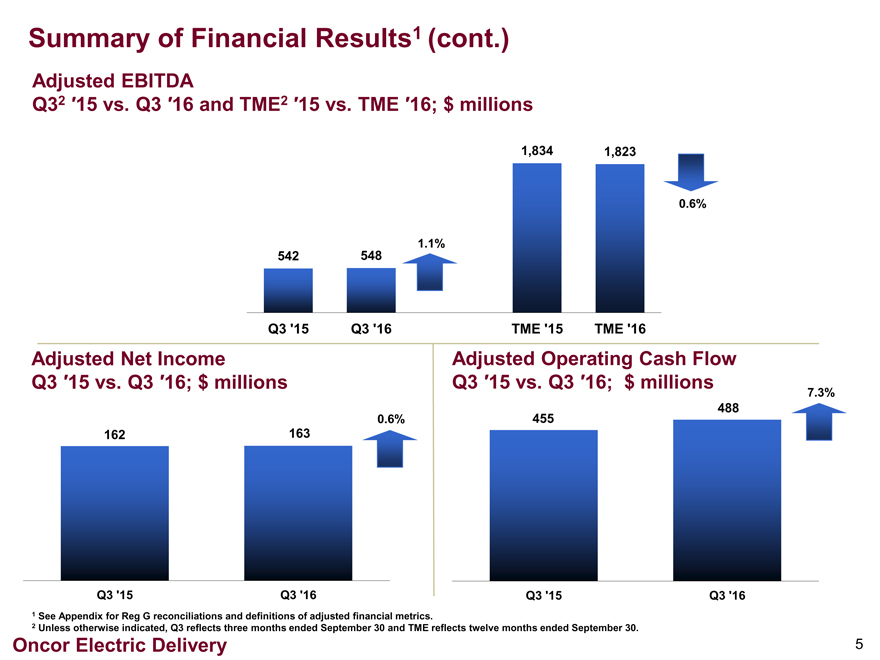

Summary of Financial Results1 (cont.)

Adjusted EBITDA

Q32 ’15 vs. Q3 ’16 and TME2 ’15 vs. TME ’16; $ millions

1,8341,823

0.6%

1.1%

542 548

Q3 ‘15 Q3 ‘16 TME ‘15TME ‘16

Adjusted Net Income Q3 ’15 vs. Q3 ’16; $ millions

0.6%

162 163

Q3 ‘15 Q3 ‘16

Adjusted Operating Cash Flow Q3 ’15 vs. Q3 ’16; $ millions

488 455

7.3%

Q3 ‘15 Q3 ‘16

1 See Appendix for Reg G reconciliations and definitions of adjusted financial metrics.

2 Unless otherwise indicated, Q3 reflects three months ended September 30 and TME reflects twelve months ended September 30.

Oncor Electric Delivery

5

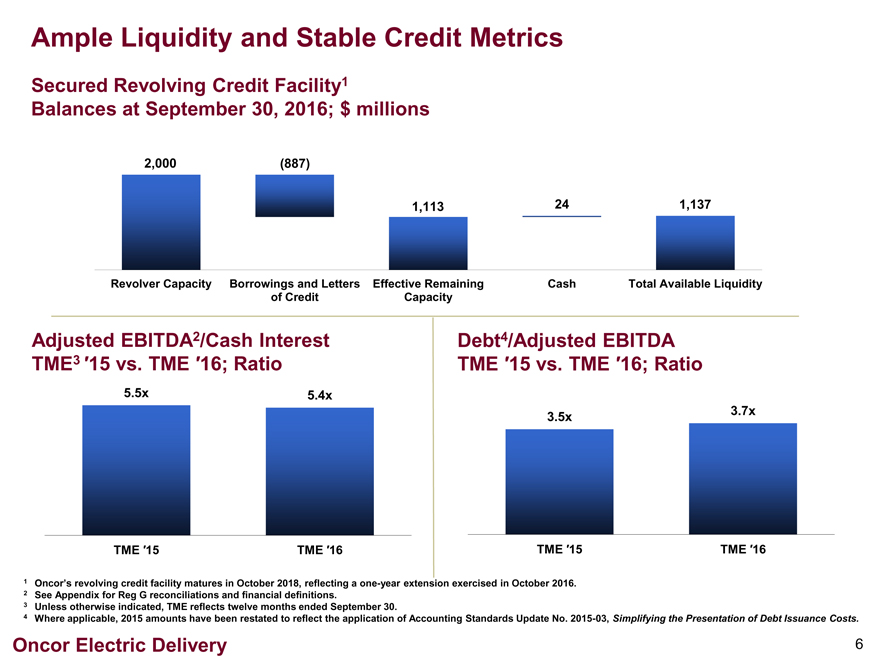

Ample Liquidity and Stable Credit Metrics

Secured Revolving Credit Facility1

Balances at September 30, 2016; $ millions

2,000 (887)

1,113241,137

Revolver Capacity Borrowings and Letters of Credit Effective Remaining CapacityCashTotal Available Liquidity

Adjusted EBITDA2/Cash Interest

TME3 ’15 vs. TME ’16; Ratio

5.5x 5.4x

TME ’15 TME ’16

Debt4/Adjusted EBITDA

TME ’15 vs. TME ’16; Ratio

3.7x

3.5x

TME ’15 TME ’16

1 Oncor’s revolving credit facility matures in October 2018, reflecting a one-year extension exercised in October 2016.

2 See Appendix for Reg G reconciliations and financial definitions.

3 Unless otherwise indicated, TME reflects twelve months ended September 30.

4 Where applicable, 2015 amounts have been restated to reflect the application of Accounting Standards Update No. 2015-03, Simplifying the Presentation of Debt Issuance Costs.

Oncor Electric Delivery 6

3rd Quarter 2016 Investor Call Agenda

Financial Overview

Operational Review

Q&A

David Davis

Chief Financial Officer

Bob Shapard Chief Executive

Oncor Electric Delivery

7

Appendix—

Regulation G Reconciliations and Financial Definitions

Oncor Electric Delivery

8

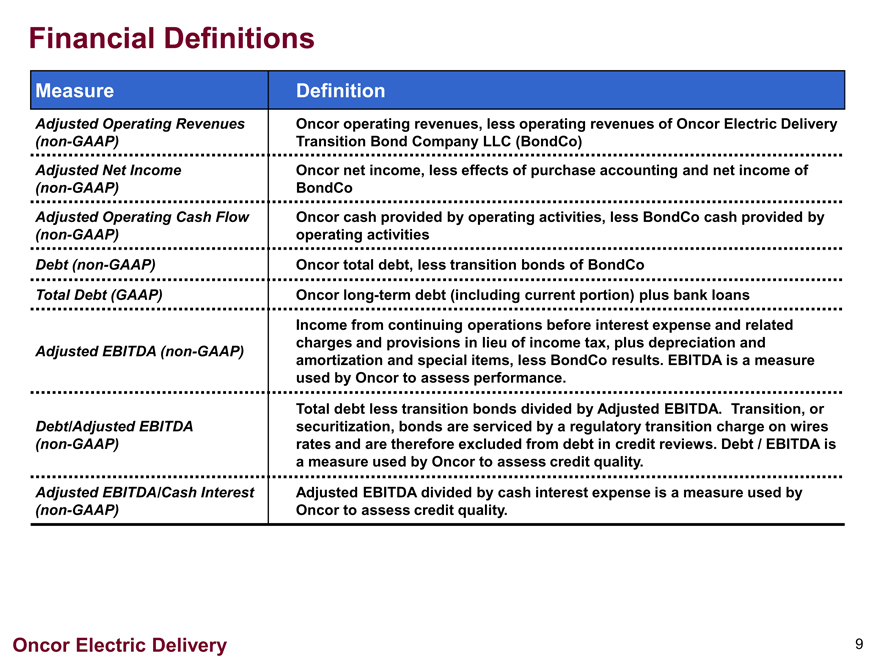

Financial Definitions

Measure Definition

Adjusted Operating Revenues Oncor operating revenues, less operating revenues of Oncor Electric Delivery

(non-GAAP) Transition Bond Company LLC (BondCo)

Adjusted Net Income Oncor net income, less effects of purchase accounting and net income of

(non-GAAP) BondCo

Adjusted Operating Cash Flow (non-GAAP) Oncor cash provided by operating activities, less BondCo cash provided by operating activities

Debt (non-GAAP) Oncor total debt, less transition bonds of BondCo

Total Debt (GAAP) Oncor long-term debt (including current portion) plus bank loans

Adjusted EBITDA (non-GAAP) Income from continuing operations before interest expense and related charges and provisions in lieu of income tax, plus depreciation and amortization and special items, less BondCo results. EBITDA is a measure used by Oncor to assess performance.

Debt/Adjusted EBITDA (non-GAAP) Total debt less transition bonds divided by Adjusted EBITDA. Transition, or securitization, bonds are serviced by a regulatory transition charge on wires rates and are therefore excluded from debt in credit reviews. Debt / EBITDA is a measure used by Oncor to assess credit quality.

Adjusted EBITDA/Cash Interest (non-GAAP) Adjusted EBITDA divided by cash interest expense is a measure used by Oncor to assess credit quality.

Oncor Electric Delivery

9

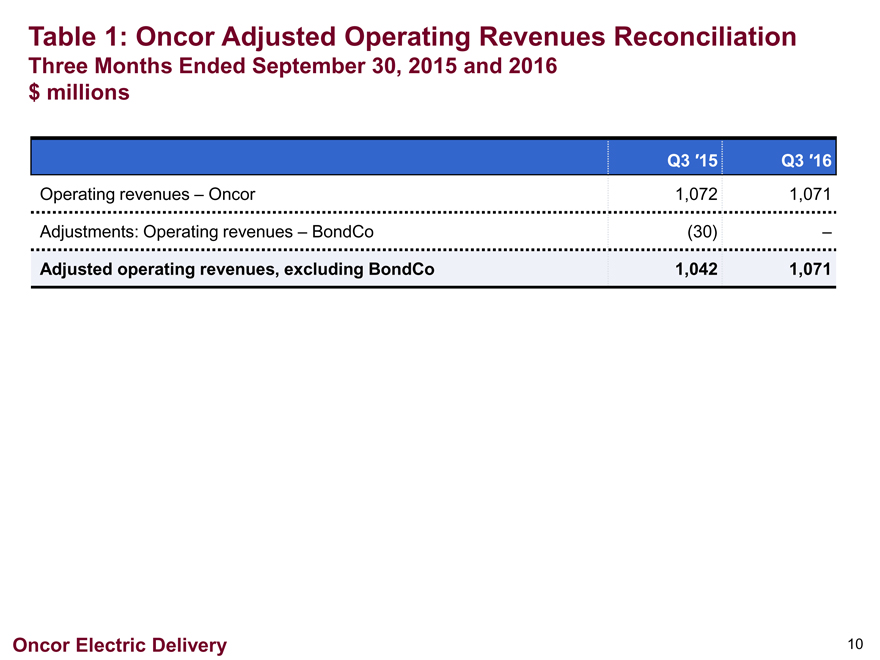

Table 1: Oncor Adjusted Operating Revenues Reconciliation

Three Months Ended September 30, 2015 and 2016 $ millions

Q3 ’15 Q3 ’16

Operating revenues – Oncor 1,072 1,071

Adjustments: Operating revenues – BondCo (30) —

Adjusted operating revenues, excluding BondCo 1,042 1,071

Oncor Electric Delivery

10

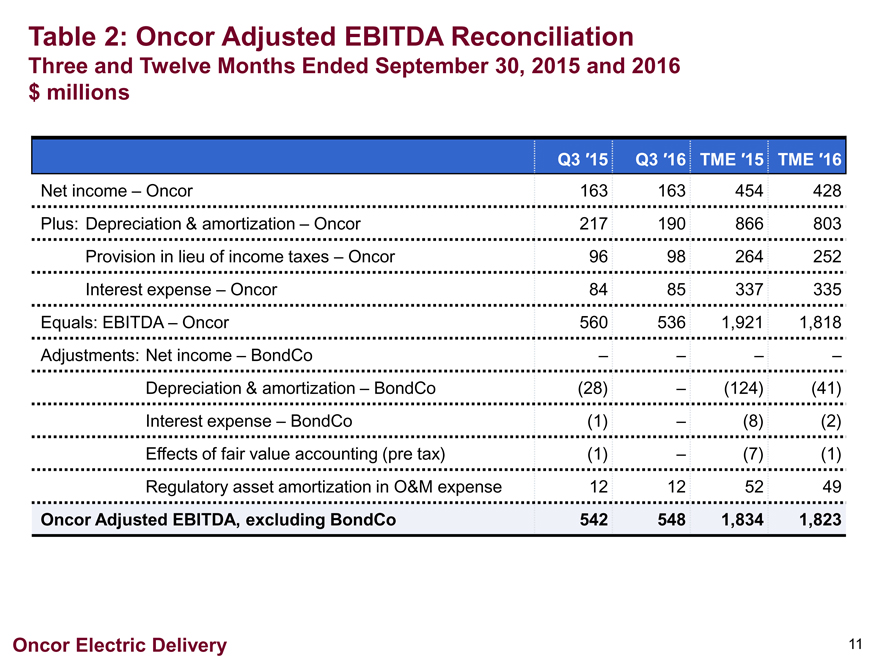

Table 2: Oncor Adjusted EBITDA Reconciliation

Three and Twelve Months Ended September 30, 2015 and 2016 $ millions

Q3 ’15 Q3 ’16TME ’15TME ’16

Net income – Oncor 163 163454428

Plus: Depreciation & amortization – Oncor 217 190866803

Provision in lieu of income taxes – Oncor 96 98264252

Interest expense – Oncor 84 85337335

Equals: EBITDA – Oncor 560 5361,9211,818

Adjustments: Net income – BondCo ? ???

Depreciation & amortization – BondCo (28) ?(124)(41)

Interest expense – BondCo (1) ?(8)(2)

Effects of fair value accounting (pre tax) (1) ?(7)(1)

Regulatory asset amortization in O&M expense 12 125249

Oncor Adjusted EBITDA, excluding BondCo 542 5481,8341,823

Oncor Electric Delivery

11

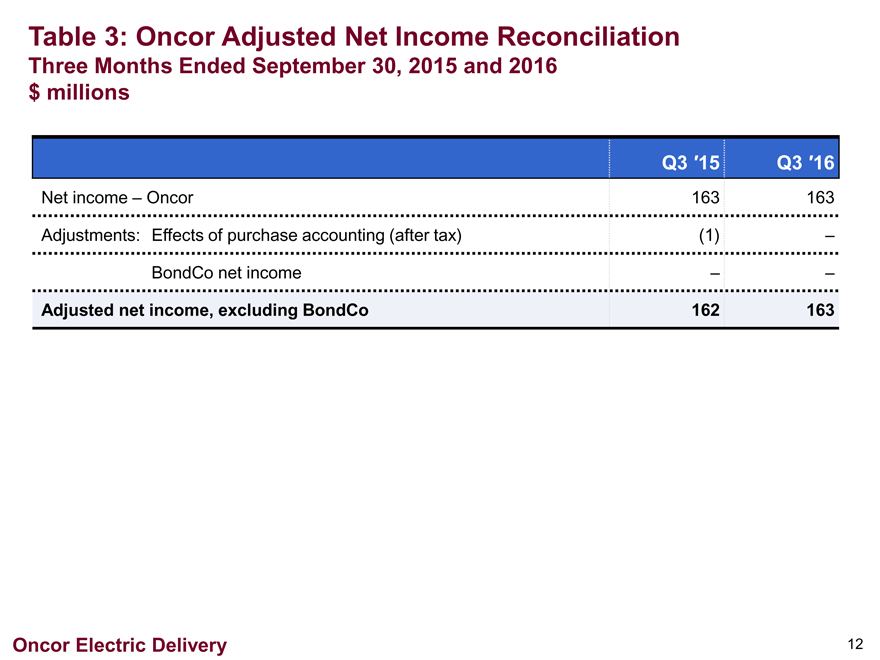

Table 3: Oncor Adjusted Net Income Reconciliation

Three Months Ended September 30, 2015 and 2016 $ millions

Q3 ’15Q3’16

Net income – Oncor 163163

Adjustments: Effects of purchase accounting (after tax) (1)—

BondCo net income —

Adjusted net income, excluding BondCo 162163

Oncor Electric Delivery

12

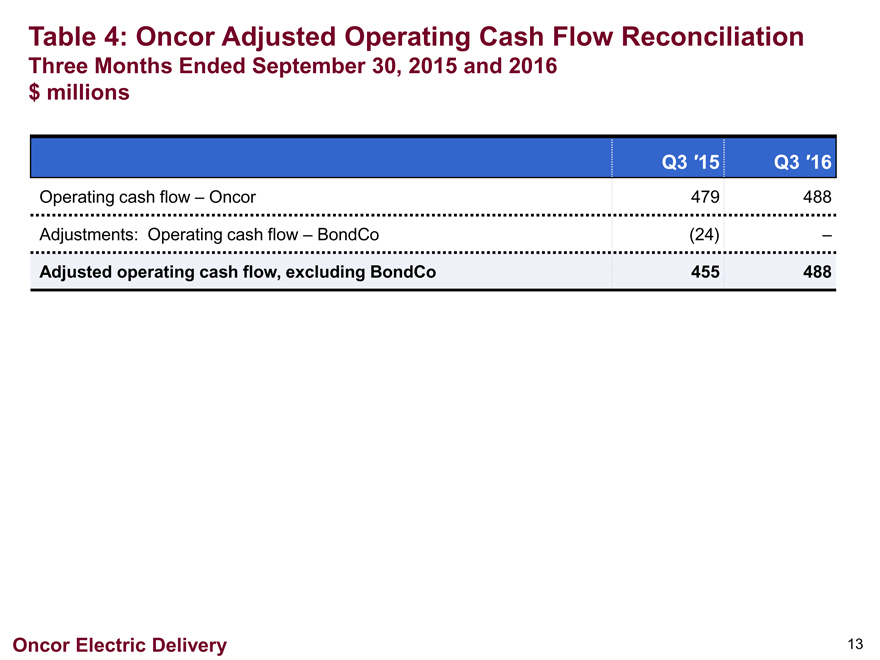

Table 4: Oncor Adjusted Operating Cash Flow Reconciliation

Three Months Ended September 30, 2015 and 2016 $ millions

Q3 ’15Q3’16

Operating cash flow – Oncor 479488

Adjustments: Operating cash flow – BondCo (24)—

Adjusted operating cash flow, excluding BondCo 455488

Oncor Electric Delivery

13

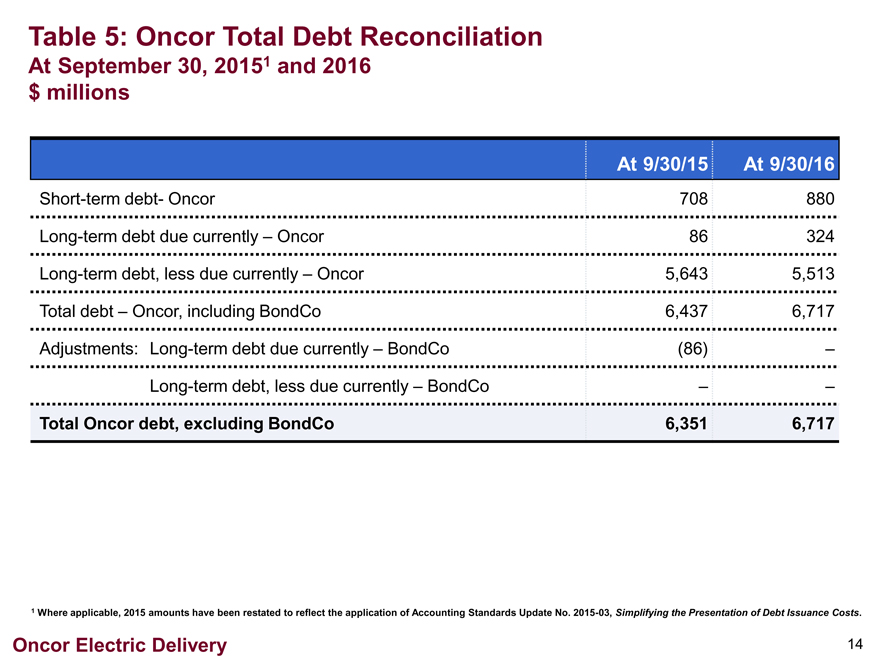

Table 5: Oncor Total Debt Reconciliation

At September 30, 20151 and 2016 $ millions

At 9/30/15At9/30/16

Short-term debt- Oncor 708880

Long-term debt due currently – Oncor 86324

Long-term debt, less due currently – Oncor 5,6435,513

Total debt – Oncor, including BondCo 6,4376,717

Adjustments: Long-term debt due currently – BondCo (86)—

Long-term debt, less due currently – BondCo —

Total Oncor debt, excluding BondCo 6,3516,717

1 Where applicable, 2015 amounts have been restated to reflect the application of Accounting Standards Update No. 2015-03, Simplifying the Presentation of Debt Issuance Costs.

Oncor Electric Delivery 14

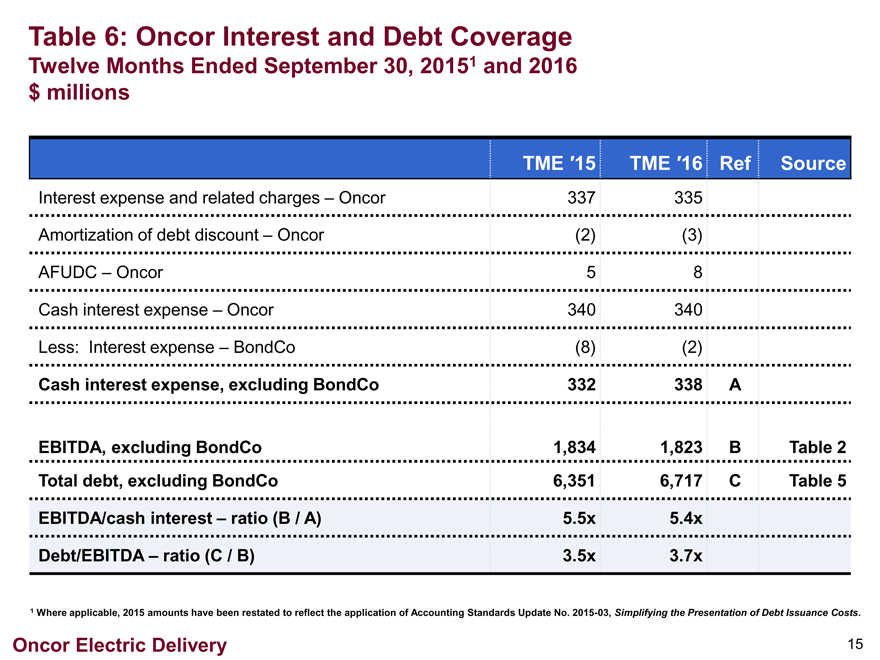

Table 6: Oncor Interest and Debt Coverage

Twelve Months Ended September 30, 20151 and 2016 $ millions

TME ’15 TME ’16RefSource

Interest expense and related charges – Oncor 337 335

Amortization of debt discount – Oncor (2) (3)

AFUDC – Oncor 5 8

Cash interest expense – Oncor 340 340

Less: Interest expense – BondCo (8) (2)

Cash interest expense, excluding BondCo 332 338A

EBITDA, excluding BondCo 1,834 1,823BTable 2

Total debt, excluding BondCo 6,351 6,717CTable 5

EBITDA/cash interest – ratio (B / A) 5.5x 5.4x

Debt/EBITDA – ratio (C / B) 3.5x 3.7x

1 Where applicable, 2015 amounts have been restated to reflect the application of Accounting Standards Update No. 2015-03, Simplifying the Presentation of Debt Issuance Costs.

Oncor Electric Delivery 15