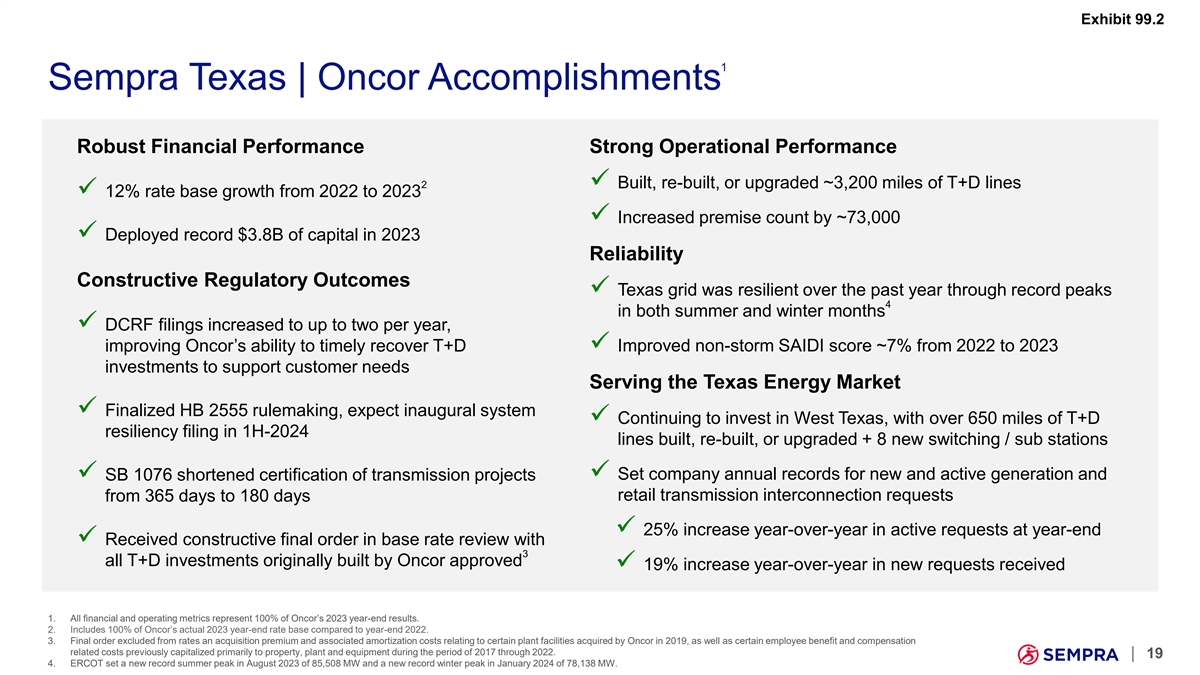

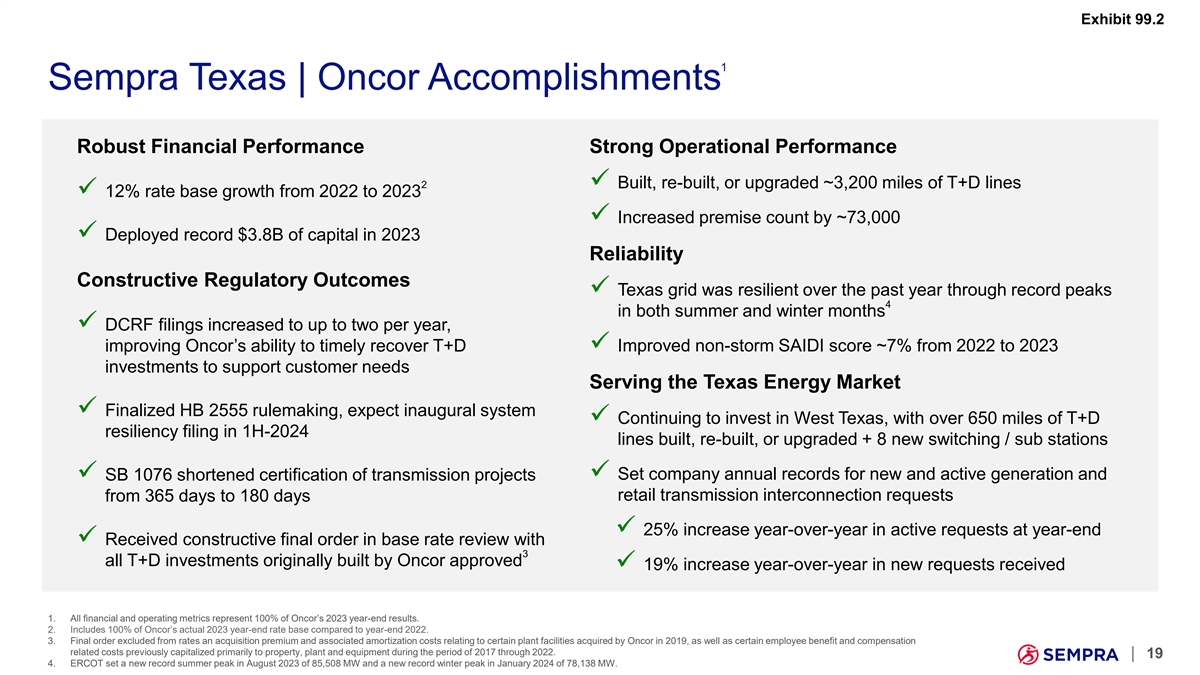

Exhibit 99.2 1 Sempra Texas | Oncor Accomplishments Robust Financial Performance Strong Operational Performance 2✓ Built, re-built, or upgraded ~3,200 miles of T+D lines ✓ 12% rate base growth from 2022 to 2023 ✓ Increased premise count by ~73,000 ✓ Deployed record $3.8B of capital in 2023 Reliability Constructive Regulatory Outcomes ✓ Texas grid was resilient over the past year through record peaks 4 in both summer and winter months ✓ DCRF filings increased to up to two per year, improving Oncor’s ability to timely recover T+D ✓ Improved non-storm SAIDI score ~7% from 2022 to 2023 investments to support customer needs Serving the Texas Energy Market ✓ Finalized HB 2555 rulemaking, expect inaugural system ✓ Continuing to invest in West Texas, with over 650 miles of T+D resiliency filing in 1H-2024 lines built, re-built, or upgraded + 8 new switching / sub stations ✓ Set company annual records for new and active generation and ✓ SB 1076 shortened certification of transmission projects from 365 days to 180 days retail transmission interconnection requests ✓ 25% increase year-over-year in active requests at year-end ✓ Received constructive final order in base rate review with 3 all T+D investments originally built by Oncor approved ✓ 19% increase year-over-year in new requests received 1. All financial and operating metrics represent 100% of Oncor’s 2023 year-end results. 2. Includes 100% of Oncor’s actual 2023 year-end rate base compared to year-end 2022. 3. Final order excluded from rates an acquisition premium and associated amortization costs relating to certain plant facilities acquired by Oncor in 2019, as well as certain employee benefit and compensation related costs previously capitalized primarily to property, plant and equipment during the period of 2017 through 2022. | 19 4. ERCOT set a new record summer peak in August 2023 of 85,508 MW and a new record winter peak in January 2024 of 78,138 MW.

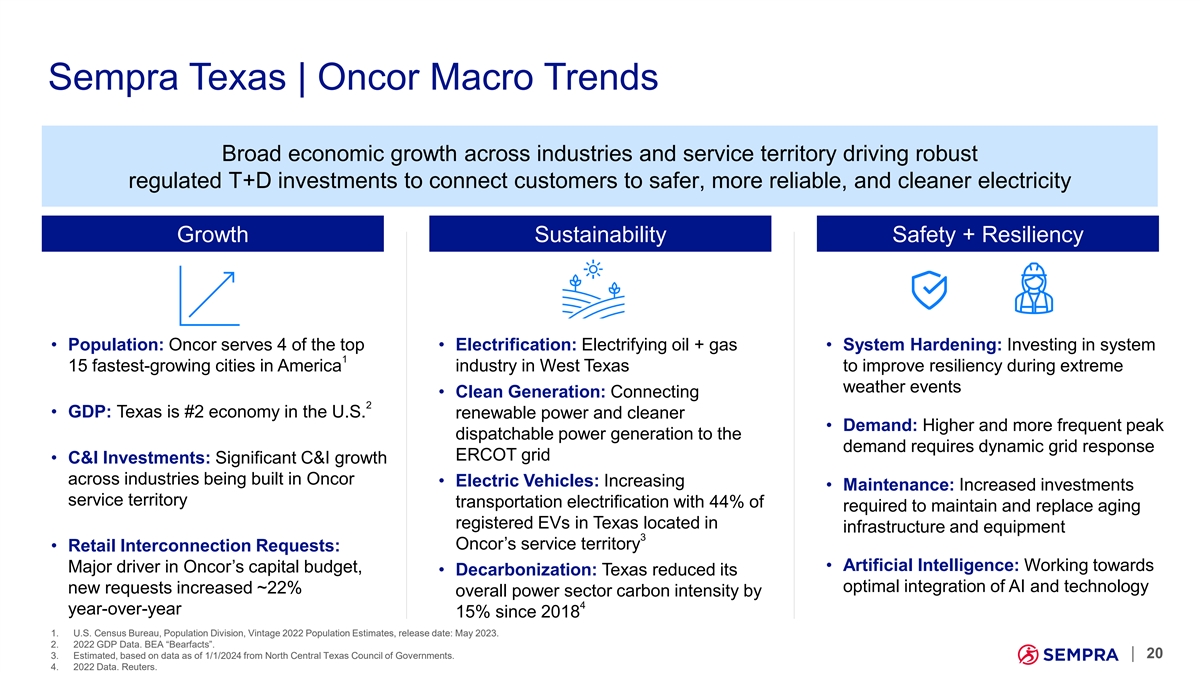

Sempra Texas | Oncor Macro Trends Broad economic growth across industries and service territory driving robust regulated T+D investments to connect customers to safer, more reliable, and cleaner electricity Growth Sustainability Safety + Resiliency • Population: Oncor serves 4 of the top • Electrification: Electrifying oil + gas • System Hardening: Investing in system 1 15 fastest-growing cities in America industry in West Texas to improve resiliency during extreme weather events • Clean Generation: Connecting 2 • GDP: Texas is #2 economy in the U.S. renewable power and cleaner • Demand: Higher and more frequent peak dispatchable power generation to the demand requires dynamic grid response ERCOT grid • C&I Investments: Significant C&I growth across industries being built in Oncor • Electric Vehicles: Increasing • Maintenance: Increased investments service territory transportation electrification with 44% of required to maintain and replace aging registered EVs in Texas located in infrastructure and equipment 3 Oncor’s service territory • Retail Interconnection Requests: • Artificial Intelligence: Working towards Major driver in Oncor’s capital budget, • Decarbonization: Texas reduced its optimal integration of AI and technology new requests increased ~22% overall power sector carbon intensity by 4 year-over-year 15% since 2018 1. U.S. Census Bureau, Population Division, Vintage 2022 Population Estimates, release date: May 2023. 2. 2022 GDP Data. BEA “Bearfacts”. 3. Estimated, based on data as of 1/1/2024 from North Central Texas Council of Governments. | 20 4. 2022 Data. Reuters.

Sempra Texas | Oncor Foundation for Economic Growth Oncor’s T+D investments are providing safer, more reliable, and cleaner electric service to customers and providing the backbone for Texas’ grid modernization and facilitating economic growth Grid Modernization, Reliability + Resiliency Multi-Faceted Growth Microchips + Data Centers Semiconductor Manufacturing Residential Growth Electrification of Oil + Gas DFW Airport Expansion Zero-Emission Vehicles Transmission + Distribution Infrastructure Integrating a Diverse Set of Supply Resources Manufacturing, Distribution, Arlington Entertainment + Cold Storage District | 21

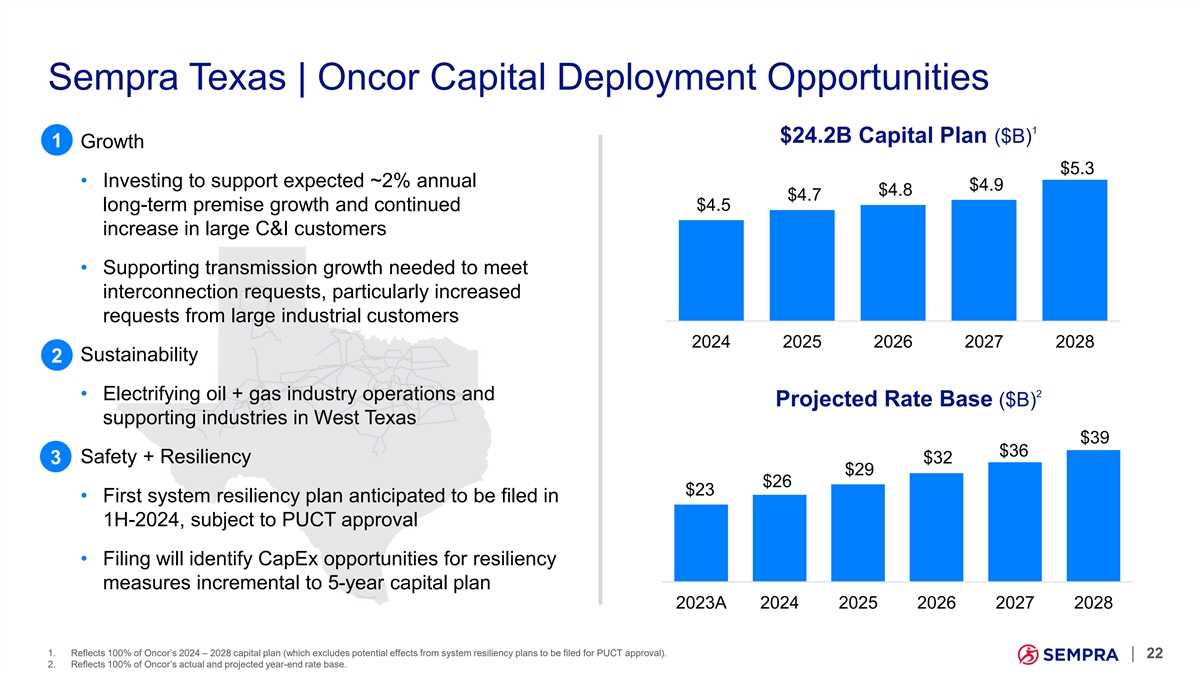

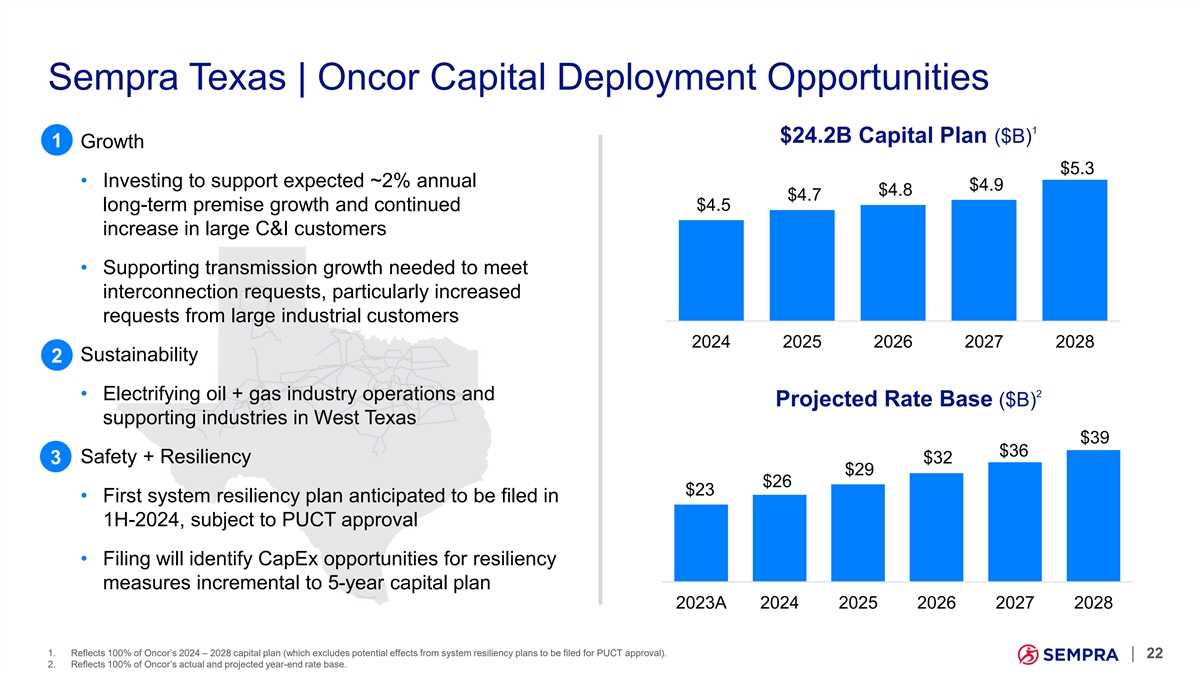

Sempra Texas | Oncor Capital Deployment Opportunities 1 $24.2B Capital Plan ($B) 1 Growth $5.3 • Investing to support expected ~2% annual $4.9 $4.8 $4.7 long-term premise growth and continued $4.5 increase in large C&I customers • Supporting transmission growth needed to meet interconnection requests, particularly increased requests from large industrial customers 2024 2025 2026 2027 2028 Sustainability 2 2 • Electrifying oil + gas industry operations and Projected Rate Base ($B) supporting industries in West Texas $39 $36 Safety + Resiliency $32 3 $29 $26 $23 • First system resiliency plan anticipated to be filed in 1H-2024, subject to PUCT approval • Filing will identify CapEx opportunities for resiliency measures incremental to 5-year capital plan 2023A 2024 2025 2026 2027 2028 1. Reflects 100% of Oncor’s 2024 – 2028 capital plan (which excludes potential effects from system resiliency plans to be filed for PUCT approval). | 22 2. Reflects 100% of Oncor’s actual and projected year-end rate base.

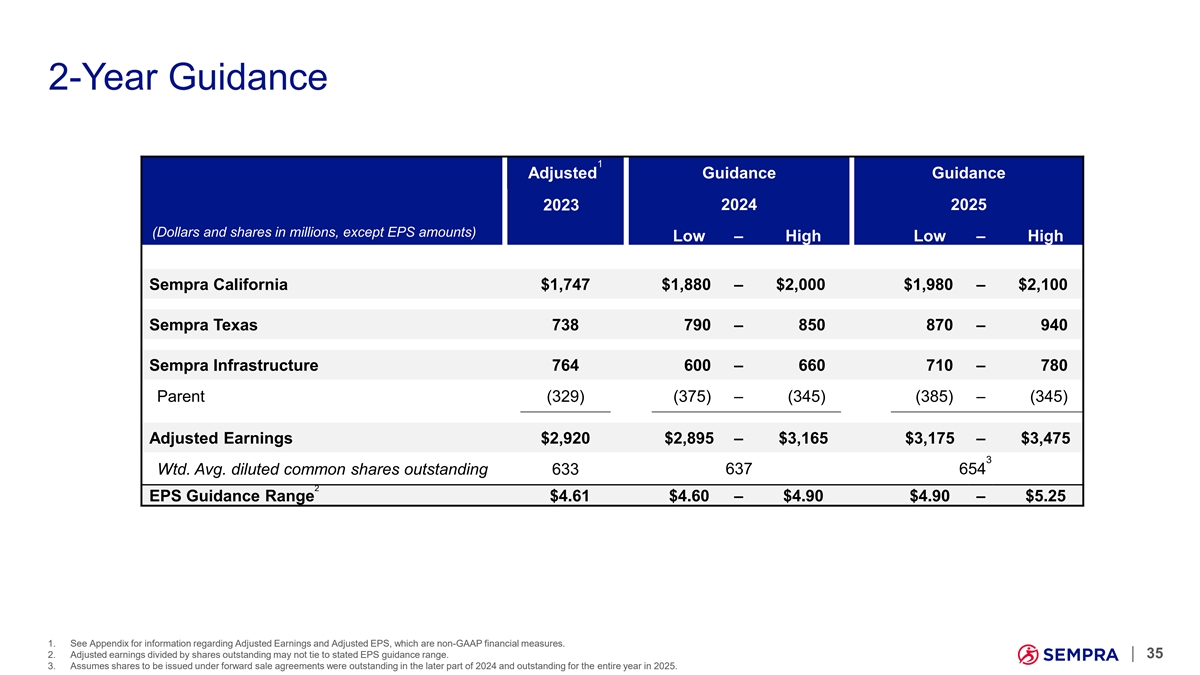

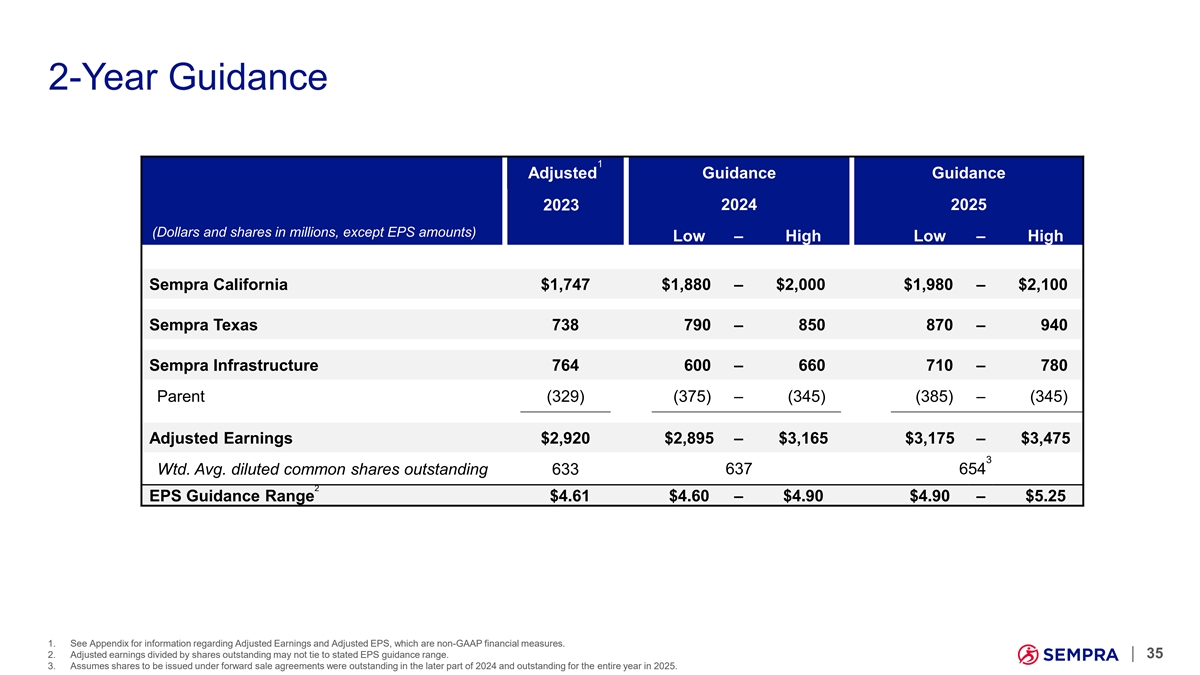

2-Year Guidance 1 Adjusted Guidance Guidance 2024 2025 2023 (Dollars and shares in millions, except EPS amounts) Low– High Low– High Sempra California $1,747 $1,880 – $2,000 $1,980– $2,100 Sempra Texas 738 790 – 850 870– 940 Sempra Infrastructure 764 600 – 660 710– 780 Parent (329) (375) – (345) (385) – (345) Adjusted Earnings $2,920 $2,895 – $3,165 $3,175– $3,475 3 Wtd. Avg. diluted common shares outstanding 633 637 654 2 EPS Guidance Range $4.61 $4.60 – $4.90 $4.90 – $5.25 1. See Appendix for information regarding Adjusted Earnings and Adjusted EPS, which are non-GAAP financial measures. 2. Adjusted earnings divided by shares outstanding may not tie to stated EPS guidance range. | 35 3. Assumes shares to be issued under forward sale agreements were outstanding in the later part of 2024 and outstanding for the entire year in 2025.

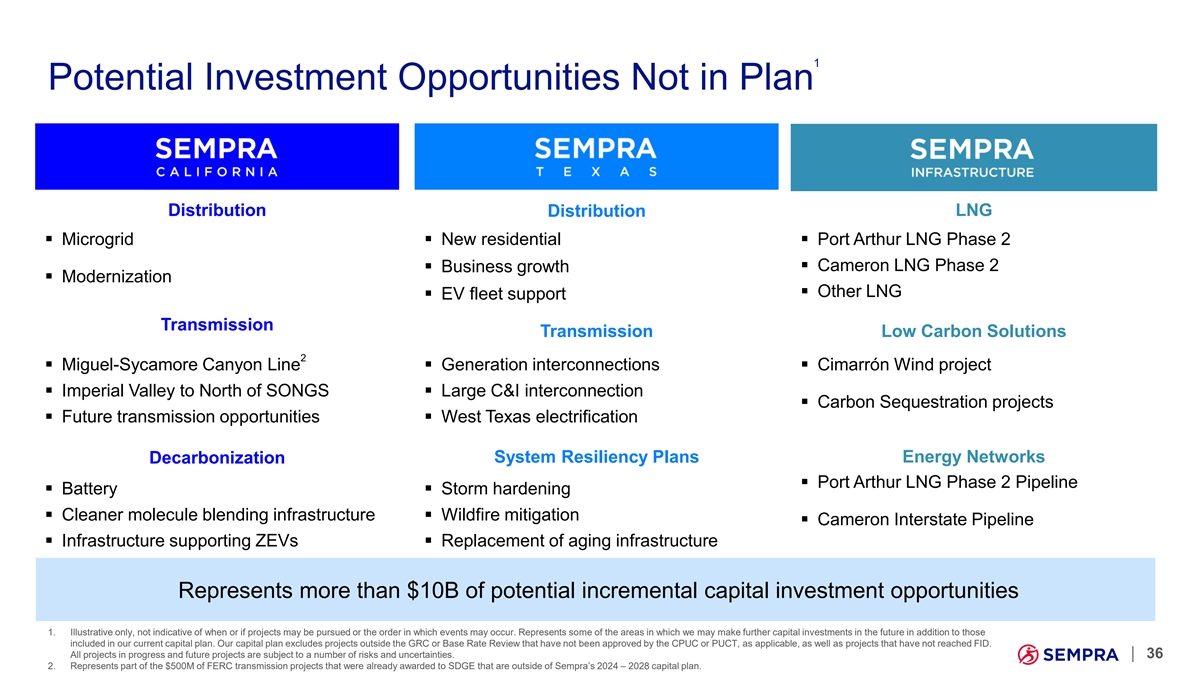

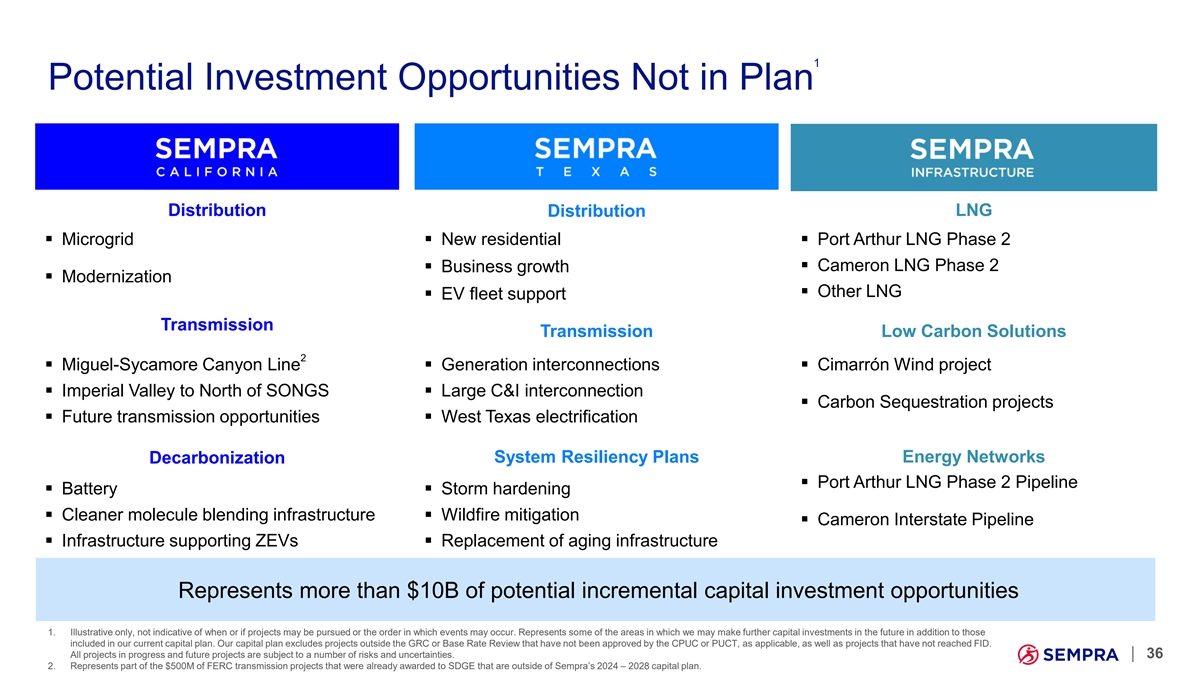

1 Potential Investment Opportunities Not in Plan Distribution LNG Distribution ▪ Microgrid▪ New residential ▪ Port Arthur LNG Phase 2 ▪ Cameron LNG Phase 2 ▪ Business growth ▪ Modernization ▪ Other LNG ▪ EV fleet support Transmission Transmission Low Carbon Solutions 2 ▪ Miguel-Sycamore Canyon Line▪ Generation interconnections▪ Cimarrón Wind project ▪ Imperial Valley to North of SONGS▪ Large C&I interconnection ▪ Carbon Sequestration projects ▪ Future transmission opportunities▪ West Texas electrification System Resiliency Plans Energy Networks Decarbonization ▪ Port Arthur LNG Phase 2 Pipeline ▪ Battery▪ Storm hardening ▪ Cleaner molecule blending infrastructure▪ Wildfire mitigation ▪ Cameron Interstate Pipeline ▪ Infrastructure supporting ZEVs▪ Replacement of aging infrastructure Represents more than $10B of potential incremental capital investment opportunities 1. Illustrative only, not indicative of when or if projects may be pursued or the order in which events may occur. Represents some of the areas in which we may make further capital investments in the future in addition to those included in our current capital plan. Our capital plan excludes projects outside the GRC or Base Rate Review that have not been approved by the CPUC or PUCT, as applicable, as well as projects that have not reached FID. All projects in progress and future projects are subject to a number of risks and uncertainties. | 36 2. Represents part of the $500M of FERC transmission projects that were already awarded to SDGE that are outside of Sempra’s 2024 – 2028 capital plan.

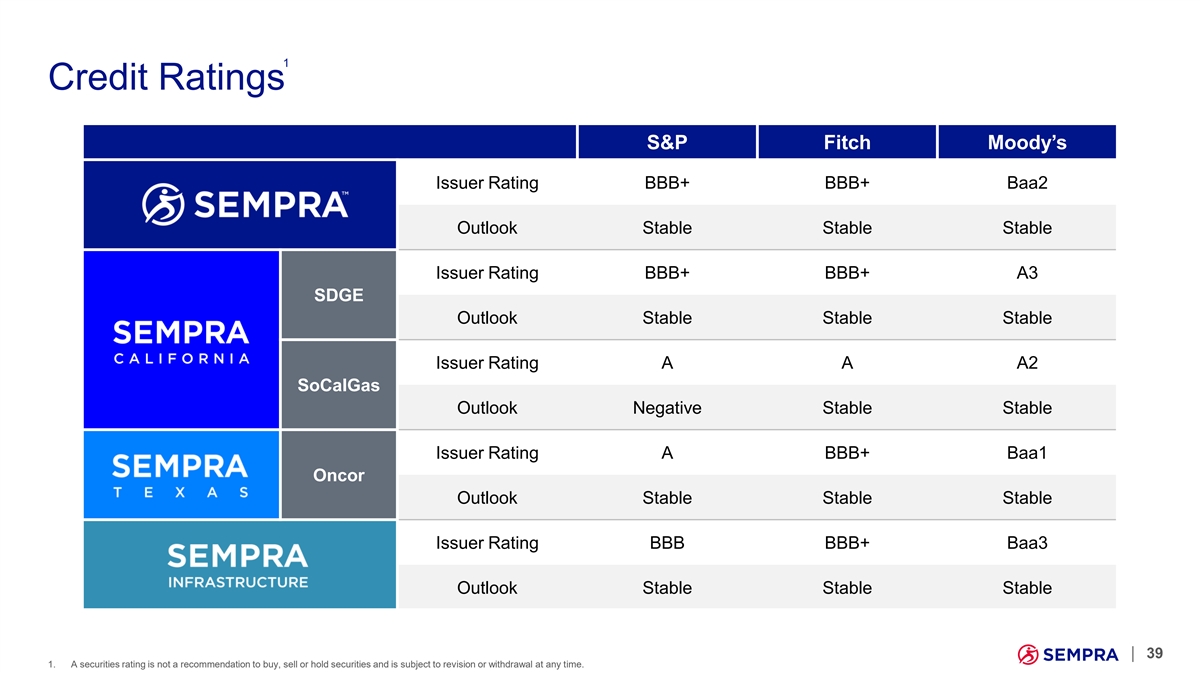

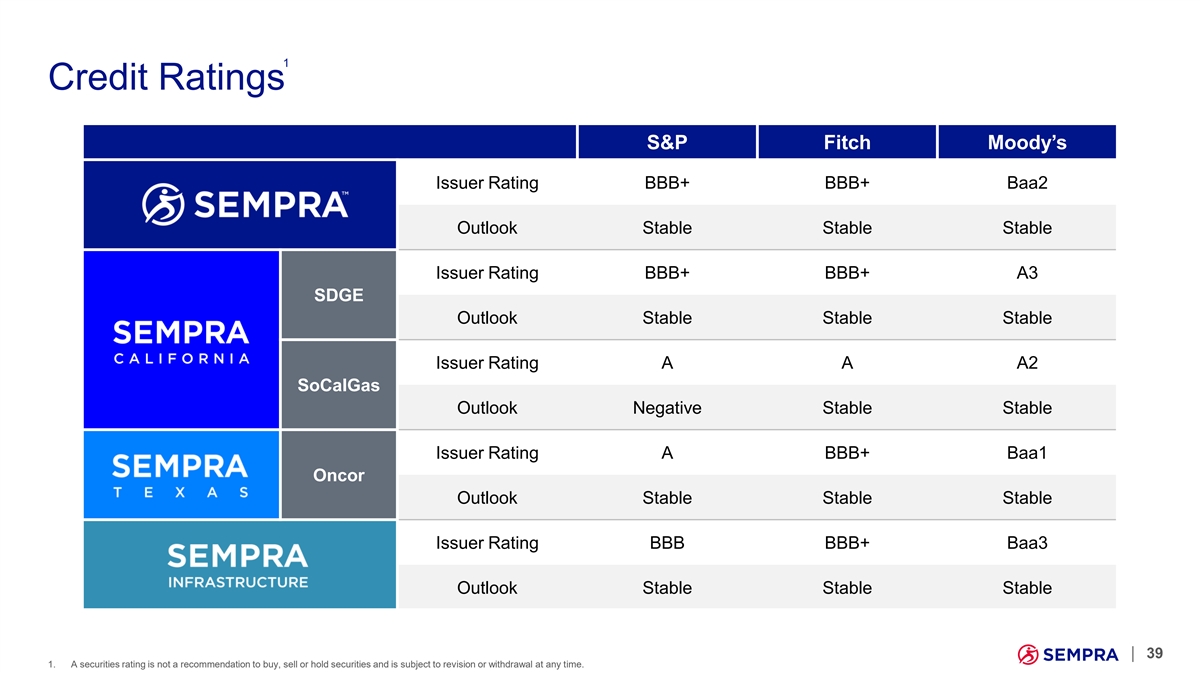

1 Credit Ratings S&P FitchMoody’s Issuer Rating BBB+ BBB+ Baa2 Outlook Stable Stable Stable Issuer Rating BBB+ BBB+ A3 SDGE Outlook Stable Stable Stable Issuer Rating A A A2 SoCalGas Outlook Negative Stable Stable Issuer Rating A BBB+ Baa1 Oncor Outlook Stable Stable Stable Issuer Rating BBB BBB+ Baa3 Outlook Stable Stable Stable | 39 1. A securities rating is not a recommendation to buy, sell or hold securities and is subject to revision or withdrawal at any time.

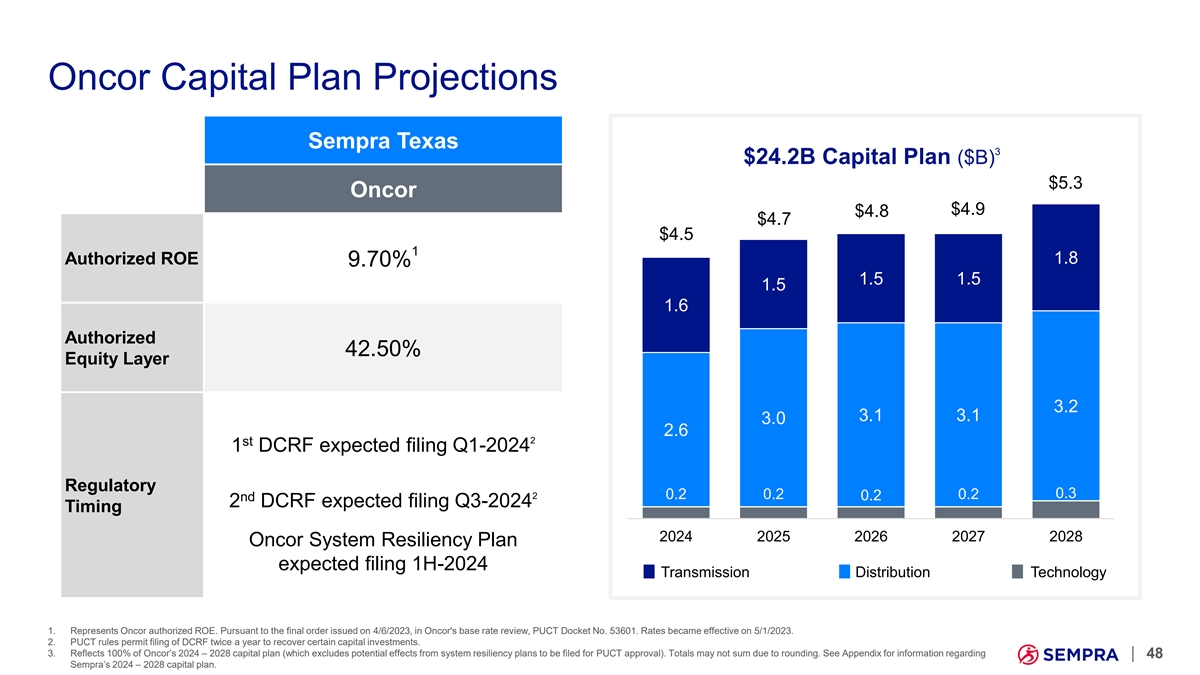

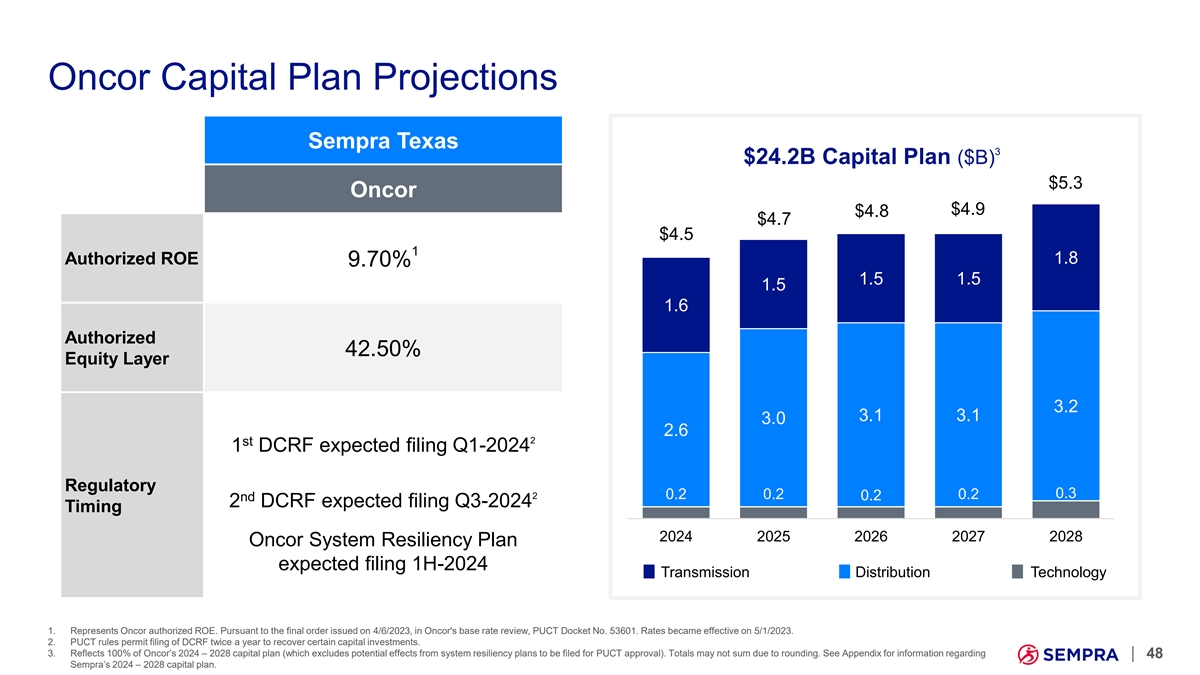

Oncor Capital Plan Projections Sempra Texas 3 $24.2B Capital Plan ($B) $5.3 Oncor $4.9 $4.8 $4.7 $4.5 1 1.8 Authorized ROE 9.70% 1.5 1.5 1.5 1.6 Authorized 42.50% Equity Layer 3.2 3.1 3.1 3.0 2.6 2 st 1 DCRF expected filing Q1-2024 Regulatory 2 0.2 0.2 0.2 0.3 0.2 nd 2 DCRF expected filing Q3-2024 Timing 2024 2025 2026 2027 2028 Oncor System Resiliency Plan expected filing 1H-2024 Transmission Distribution Technology 1. Represents Oncor authorized ROE. Pursuant to the final order issued on 4/6/2023, in Oncor's base rate review, PUCT Docket No. 53601. Rates became effective on 5/1/2023. 2. PUCT rules permit filing of DCRF twice a year to recover certain capital investments. 3. Reflects 100% of Oncor’s 2024 – 2028 capital plan (which excludes potential effects from system resiliency plans to be filed for PUCT approval). Totals may not sum due to rounding. See Appendix for information regarding | 48 Sempra’s 2024 – 2028 capital plan.

Sempra Texas Three months ended Years ended December 31, December 31, (Dollars in millions) 2023 2022 2023 2022 Sempra Texas Utilities GAAP Earnings $ 146 $ 132 $ 694 $ 736 Equity losses from write-off of rate base disallowances resulting from Public Utility Commission of Texas' final order in Oncor Electric Delivery Company LLC's comprehensive base rate review – – 44 – 1 Sempra Texas Utilities Adjusted Earnings $ 146 $ 132 $ 738 $ 736 Q4-2023 earnings are higher than Q4-2022 earnings primarily due to higher equity earnings from Oncor Holdings driven by: • higher revenues attributable to: ◦ rate updates to reflect increases in invested capital, ◦ new base rates implemented in May 2023, and ◦ customer growth, offset by ◦ lower customer consumption primarily attributable to weather, partially offset by • higher interest expense and depreciation expense attributable to invested capital, and • higher O&M. FY-2023 adjusted earnings are higher than FY-2022 earnings primarily due to higher equity earnings from Oncor Holdings driven by: • higher revenues attributable to: ◦ rate updates to reflect increases in invested capital, ◦ increases in transmission billing units, ◦ new base rates implemented in May 2023, and ◦ customer growth, offset by ◦ lower customer consumption primarily attributable to weather, partially offset by • higher interest expense and depreciation expense attributable to invested capital, and • higher O&M. | 54 1. See Appendix for information regarding Adjusted Earnings, which represents a non-GAAP financial measure.