Exhibit 99.1 Oncor Electric Delivery Company LLC Oncor Investor Day April 2, 2024

Information Regarding Forward Looking Statements This presentation contains forward-looking statements relating to Oncor Electric Delivery Company LLC (“Oncor”) within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to risks and uncertainties. All statements, other than statements of historical facts, that are included in this presentation, as well as statements made in presentations, in response to questions or otherwise, that address activities, events or developments that Oncor expects or anticipates to occur in the future, including such matters as projections, capital allocation, future capital expenditures, business strategy, competitive strengths, goals, future acquisitions or dispositions, development or operation of facilities, market and industry developments and the growth of Oncor’s business and operations (often, but not always, through the use of words or phrases such as “intends,” “plans,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “forecast,” “should,” “projection,” “target,” “goal,” “objective” and “outlook”), are forward- looking statements. Although Oncor believes that in making any such forward-looking statement its expectations are based on reasonable assumptions, any such forward-looking statement involves risks, uncertainties and assumptions. Factors that could cause Oncor’s actual results to differ materially from those projected in such forward-looking statements include: legislation, governmental policies and orders, and regulatory actions; legal and administrative proceedings and settlements, including the exercise of equitable powers by courts; weather conditions and other natural phenomena, including any weather impacts due to climate change; acts of sabotage, wars, terrorist activities, cybersecurity attacks, wildfires, fires, explosions, hazards customary to the industry, or other emergency events and the possibility that Oncor may not have adequate insurance to cover losses or third- party liabilities related to any such event; actions by credit rating agencies; health epidemics and pandemics, including their impact on Oncor’s business and the economy in general; interrupted or degraded service on key technology platforms, facilities failures, or equipment interruptions; economic conditions, including the impact of a recessionary environment, inflation, supply chain disruptions, competition for goods and services, service provider availability, and labor availability and cost; unanticipated population growth or decline, or changes in market demand and demographic patterns, particularly in the Electric Reliability Council of Texas (“ERCOT”) region; ERCOT grid needs and ERCOT market conditions, including insufficient electric capacity within ERCOT or disruptions at power generation facilities that supply power within ERCOT; changes in business strategy, development plans or vendor relationships; changes in interest rates or rates of inflation; significant changes in operating expenses, liquidity needs and/or capital expenditures; inability of various counterparties to meet their financial and other obligations to Oncor, including failure of counterparties to timely perform under agreements; general industry and ERCOT trends; significant decreases in demand or consumption of electricity delivered by Oncor, including as a result of increased consumer use of third-party distributed energy resources or other technologies; changes in technology used by and services offered by Oncor; significant changes in Oncor’s relationship with its employees, including the availability of qualified personnel, and the potential adverse effects if labor disputes or grievances were to occur; changes in assumptions used to estimate costs of providing employee benefits, including pension and retiree benefits, and future funding requirements related thereto; significant changes in accounting policies or critical accounting estimates material to Oncor; commercial bank and financial market conditions, macroeconomic conditions, access to capital, the cost of such capital, and the results of financing and refinancing efforts, including availability of funds and the potential impact of any disruptions in U.S. capital and credit markets; circumstances which may contribute to future impairment of goodwill, intangible or other long-lived assets; financial and other restrictions under Oncor’s debt agreements; Oncor’s ability to generate sufficient cash flow to make interest payments on its debt instruments; and Oncor’s ability to effectively execute its operational strategy. Further discussion of risks and uncertainties that could cause actual results to differ materially from management’s current projections, forecasts, estimates and expectations is contained in filings made by Oncor with the U.S. Securities and Exchange Commission (“SEC”), which are available on the SEC’s website and also available on the Investor Relations section of Oncor’s website, oncor.com. Specifically, Oncor makes reference to the section entitled “Risk Factors” in its annual and quarterly reports. Any forward-looking statement speaks only as of the date on which it is made, and, except as may be required by law, Oncor undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for Oncor to predict all of them; nor can it assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. As such, you should not unduly rely on such forward-looking statements. 2 The information included on any websites referenced in this presentation shall not be deemed a part of, or incorporated by reference into, this presentation.

Oncor | A Premier Utility Structure Pure-Play Transmission Supportive Ownership Structure and Distribution (T+D) Company 1 • Largest utility in Texas • Publicly traded ~$45B market cap • Premium Utility Operator • 54,000 sq. mile • Leading Infrastructure Investor distribution service territory (Size of the 3 state of New York) • Does not generate electricity for resale • Sovereign wealth • Canadian pension fund of Singapore fund; C$128.6B in • No end use customer net assets • Global long-term billing exposure investor • A member first, service oriented platform • Diversified • 97% of capital portfolio over six • Infrastructure specialty expenditures eligible key asset classes for tracker recovery 1. Oncor is the largest electric utility in Texas, based on estimated population served and 143,000+ miles of transmission and distribution lines in service. 3 2. Estimated population of distribution service territory. 3. Statistics as of 12/31/2023. 19.75% co-owners 80.25% owner

Oncor | Powering the Texas Miracle Premier Market Premier Jurisdiction Premier Operator Premier Growth • Reliability: Consistently among industry top performers • Safety: Consistently among industry top performers • Sustainability: Rated in the top 2% of lowest- risk electric utilities 1 (Oct 2023) • Affordability: Among the lowest wires charges for Texas Investor-Owned Utilities Select Transmission Lines 1. Sustainalytics ESG (Environmental, Social, Governance) Risk Rating, issued October 2023. Sustainalytics, a Morningstar Company, is a leading independent ESG research, ratings, and data firm and has provided the ESG Risk Rating research set forth in the ESG Risk Rating Summary Report available in the Investor Relations section of Oncor’s website. 2. 2023 Oncor Annual Data. 4 3. Company record for new and active POI requests from generation and retail (large commercial & industrial) customers. 4. More than 70% of 2024-2028 capital plan (excluding anticipated system resiliency plan spend).

Texas | Premier Market 1. Federal Reserve Bank of Dallas 2. State of Texas Data 3. EIA Aggregate Data 4. Texas Named Top Business Climate in America 5. Texas Economic Snapshot 6. Census Data 7. U.S. Bureau of Economic Analysis 8. Dallas Morning News; 2/23/24 9. ERCOT Data 10. U-Haul Data 2023 11. Census Data 12. Office of Texas Governor Greg Abbott 13. Chief Executive Magazine; April 2023 5

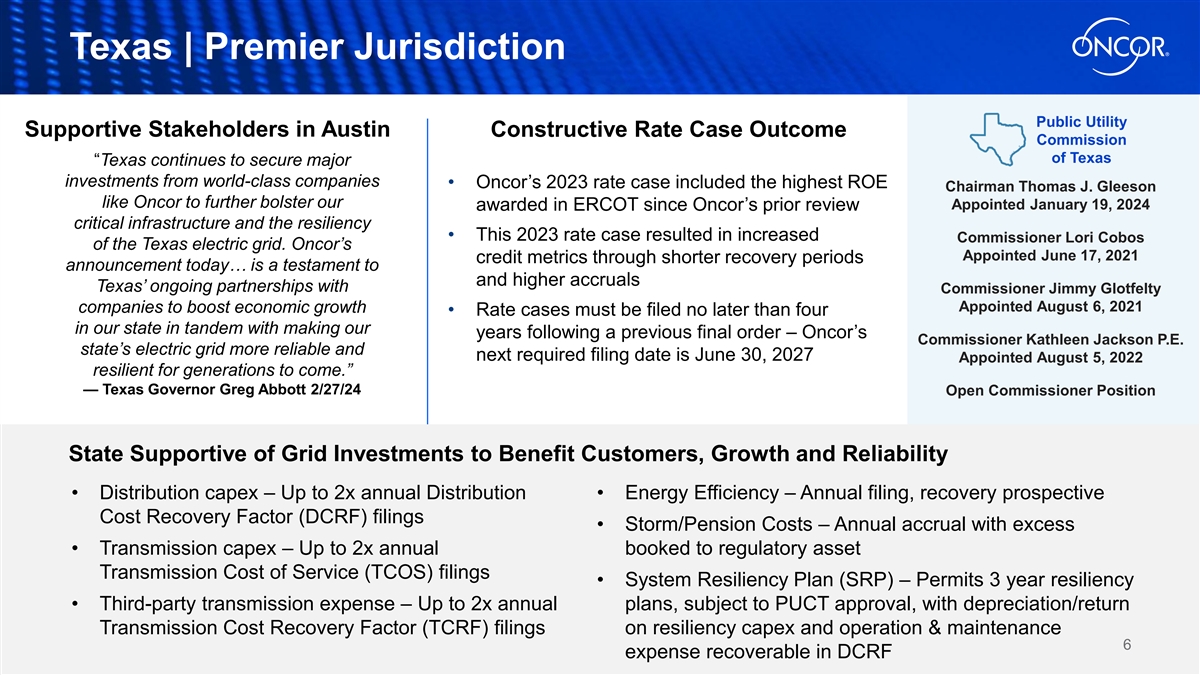

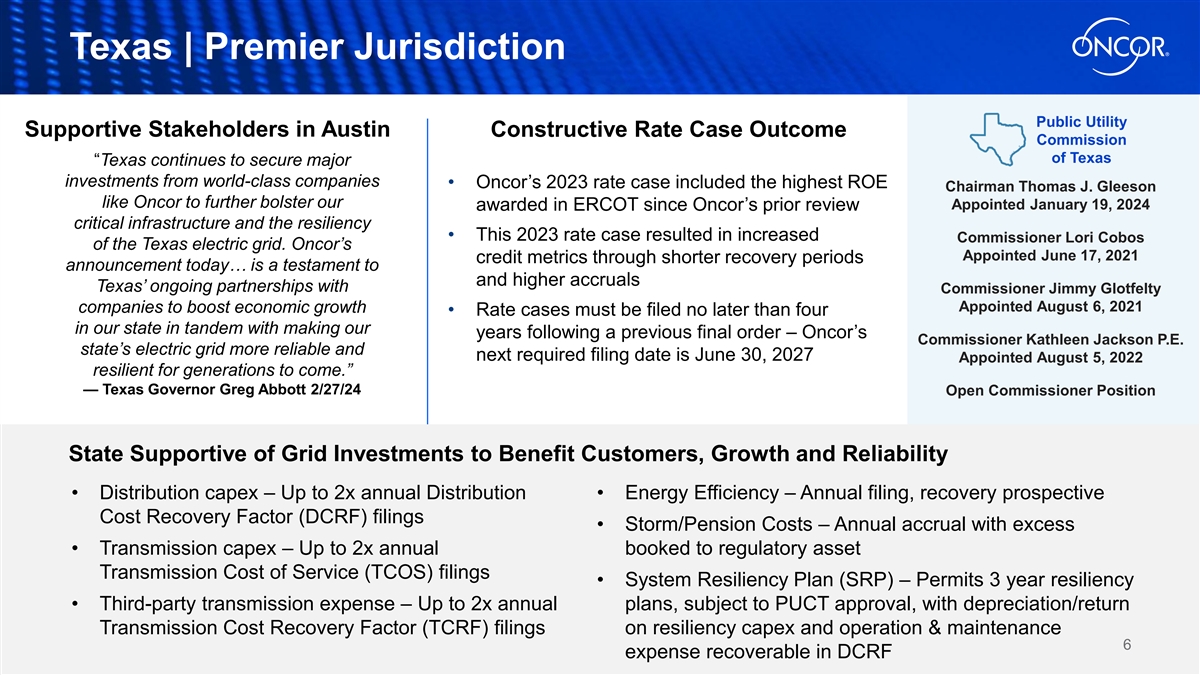

Texas | Premier Jurisdiction Public Utility Supportive Stakeholders in Austin Constructive Rate Case Outcome Commission of Texas “Texas continues to secure major investments from world-class companies • Oncor’s 2023 rate case included the highest ROE Chairman Thomas J. Gleeson like Oncor to further bolster our Appointed January 19, 2024 awarded in ERCOT since Oncor’s prior review critical infrastructure and the resiliency • This 2023 rate case resulted in increased Commissioner Lori Cobos of the Texas electric grid. Oncor’s Appointed June 17, 2021 credit metrics through shorter recovery periods announcement today… is a testament to and higher accruals Texas’ ongoing partnerships with Commissioner Jimmy Glotfelty Appointed August 6, 2021 companies to boost economic growth • Rate cases must be filed no later than four in our state in tandem with making our years following a previous final order – Oncor’s Commissioner Kathleen Jackson P.E. state’s electric grid more reliable and next required filing date is June 30, 2027 Appointed August 5, 2022 resilient for generations to come.” — Texas Governor Greg Abbott 2/27/24 Open Commissioner Position State Supportive of Grid Investments to Benefit Customers, Growth and Reliability • Distribution capex – Up to 2x annual Distribution • Energy Efficiency – Annual filing, recovery prospective Cost Recovery Factor (DCRF) filings • Storm/Pension Costs – Annual accrual with excess • Transmission capex – Up to 2x annual booked to regulatory asset Transmission Cost of Service (TCOS) filings • System Resiliency Plan (SRP) – Permits 3 year resiliency • Third-party transmission expense – Up to 2x annual plans, subject to PUCT approval, with depreciation/return Transmission Cost Recovery Factor (TCRF) filings on resiliency capex and operation & maintenance 6 expense recoverable in DCRF

Oncor | Premier Operator Corporate Sustainability A Premium Utility Disciplined Approach to Grid Construction 1 1 Leader Operator Cost Management Expertise Top 2% Industry Top Decile Industry Top Quartile 12,880 miles 2 T+D O&M Expense per Asset of Rated Electric Utilities Lost Time Injury Rate (~6 miles/day) First and only Industry Top Quartile Industry Top Quartile The miles of transmission Texas electric utility T+D O&M per MWh Delivered Days Away, Restricted and distribution lines or Transferred Rate to have issued a Oncor has built, rebuilt Industry Top Quartile social bond, a green or reconductored T+D O&M per Circuit Mile Industry Top Quartile bond, and a 2018-2023 Non-Storm System sustainability-linked Average Interruption credit facility Duration Index (SAIDI) 1. Based on Oncor 2022 performance against 2022 industry results from: Edison Electric Institute's safety survey, Oncor internal SAIDI benchmarking of ~120 industry peers, and industry cost management data from First Quartile Consulting. 2. Sustainalytics ESG (Environmental, Social, Governance) Risk Rating, issued October 2023. Sustainalytics, a Morningstar Company, is a leading independent ESG research, ratings, and data firm and has provided the ESG Risk Rating research set forth in the ESG Risk Rating Summary Report available in the Investor Relations section of Oncor’s website. The ESG Risk Rating Summary Report contains information developed by Sustainalytics (www.sustainalytics.com). 7 Such information and data are proprietary of Sustainalytics and/or its third-party suppliers and are provided for informational purposes only. They do not constitute an endorsement of any product or project, nor an investment advice and are not warranted to be complete, timely, accurate or suitable for a particular purpose. Their use is subject to conditions available at https://www.sustainalytics.com/legal-disclaimers.

Oncor | Severe Weather Risk Mitigation Oncor has developed a proactive Wildfire Mitigation Plan designed to address the unique wildfire risk profile present in the Oncor operational territory. Key Elements Include: • Oncor has built upon the expertise and experience of industry leaders to Risk modeling and near-real-time accelerate the creation of a wildfire situational awareness Oncor Operational mitigation approach that is appropriate Territory for the Oncor operational territory Fire safe devices and prioritized asset management • Oncor is partnering with best in class leaders like San Diego Gas & Electric to Active incident protocol and share wildfire prevention best practices fire-safe work practices • Oncor has built a strong relationship with Strong stakeholder engagement the Texas Forest Service, the lead agency and industry partnership for wildfire management in Texas, and established a leadership position for utilities Technology enabled vegetation in Texas regarding wildfire prevention management program • The System Resiliency Plan that will be filed Remotely enabled fire-safe with the Texas PUC this spring will provide protection scheme additional support to these mitigation plans 8

Oncor | Premier Resiliency Framework Texas HB 2555 empowered the PUCT to approve a new category of utility System Resiliency Plans (SRPs); based on weather history, the number of customers in specific areas and other factors, Oncor has identified high-impact areas where strategic investments are expected to help improve system resiliency. 9 1. Anticipated capital expenditure amount. System Resiliency Plan subject to PUCT approval. Statute contemplates that the PUCT will review and approve, modify or deny a filed SRP within 180 days.

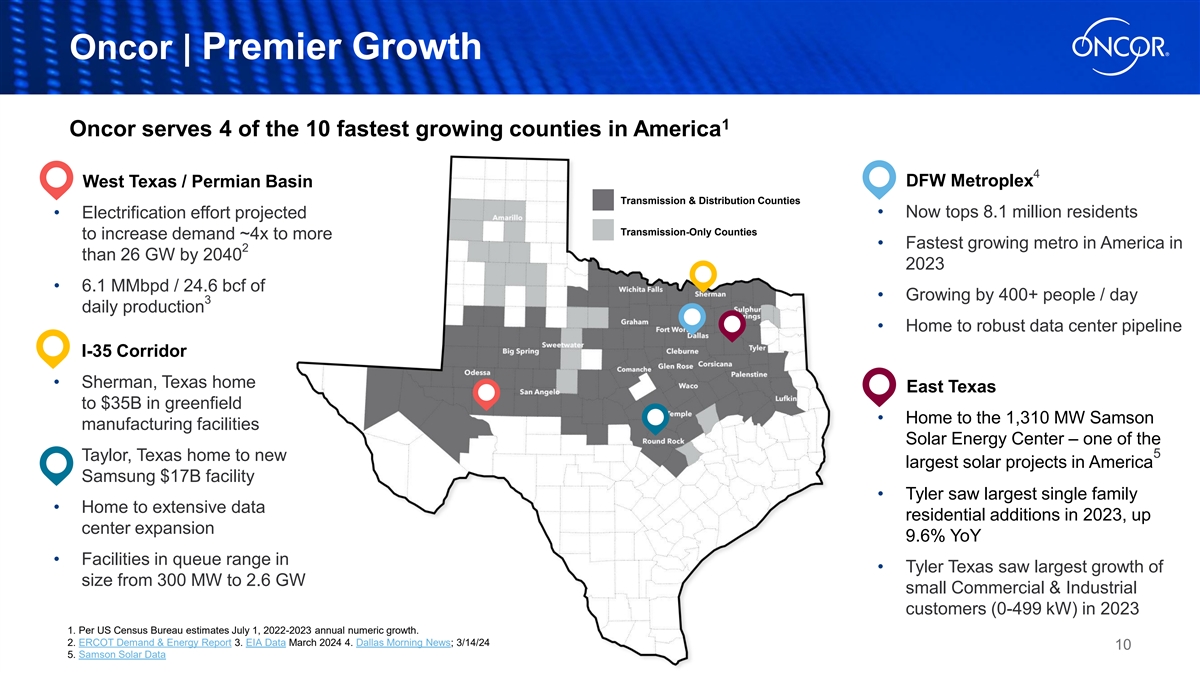

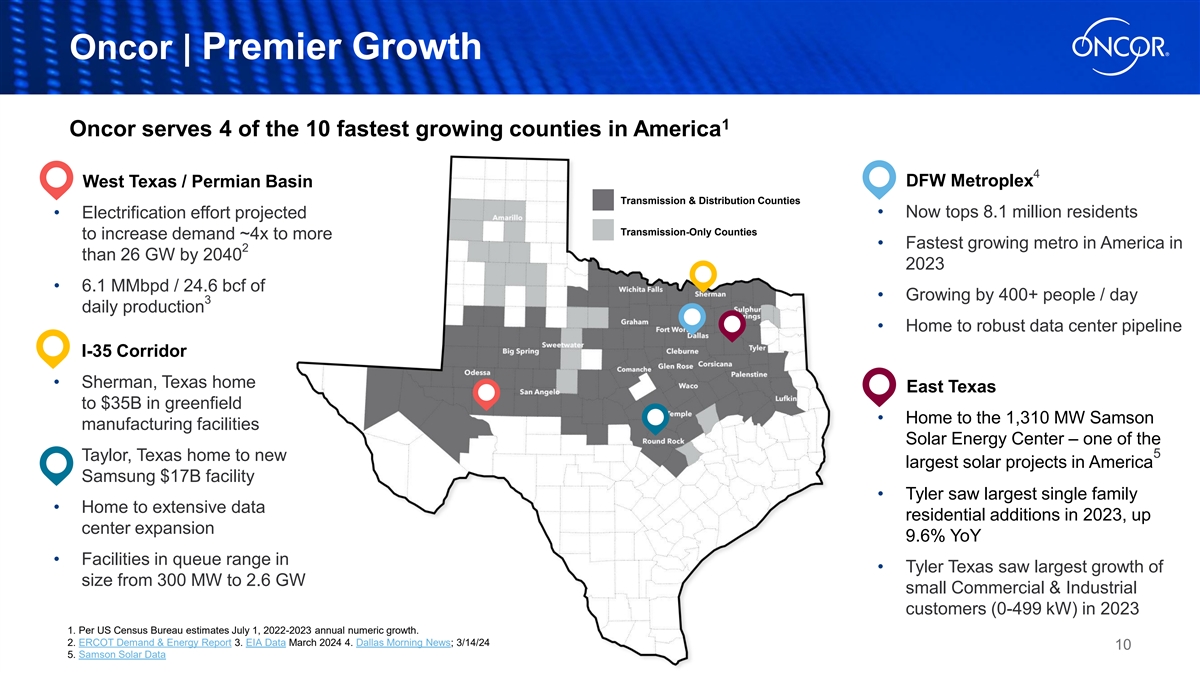

Oncor | Premier Growth 1 Oncor serves 4 of the 10 fastest growing counties in America 4 DFW Metroplex West Texas / Permian Basin Transmission & Distribution Counties • Now tops 8.1 million residents • Electrification effort projected Transmission-Only Counties to increase demand ~4x to more • Fastest growing metro in America in 2 than 26 GW by 2040 2023 • 6.1 MMbpd / 24.6 bcf of • Growing by 400+ people / day 3 daily production • Home to robust data center pipeline I-35 Corridor • Sherman, Texas home East Texas to $35B in greenfield • Home to the 1,310 MW Samson manufacturing facilities Solar Energy Center – one of the 5 • Taylor, Texas home to new largest solar projects in America Samsung $17B facility • Tyler saw largest single family • Home to extensive data residential additions in 2023, up center expansion 9.6% YoY • Facilities in queue range in • Tyler Texas saw largest growth of size from 300 MW to 2.6 GW small Commercial & Industrial customers (0-499 kW) in 2023 1. Per US Census Bureau estimates July 1, 2022-2023 annual numeric growth. 2. ERCOT Demand & Energy Report 3. EIA Data March 2024 4. Dallas Morning News; 3/14/24 10 5. Samson Solar Data