Exhibit 99.2 | Business Updates Strong Operational Performance • In Q2-2024, Oncor: ▪ Built, re-built, or upgraded 1,050 miles of T+D lines ▪ Increased premise count by 20,000, continue to expect 2% long-term premise growth rate ▪ Achieved a 13% year-over-year increase in active transmission point of interconnection requests Constructive Regulatory Environment 1 • Reached settlement in principle on SRP, capital would be incremental to existing plan • Oncor’s first of two anticipated DCRF filings in 2024 was approved with updated rates taking effect July 1 1. PUCT Docket No. 56545. On August 5, 2024, Oncor filed a letter in the docket noting that the parties have reached a settlement in principle and that Oncor is working to finalize a written settlement agreement by August 16, 2024 for PUCT review and approval. Subject to finalization of the settlement and approval by the PUCT, Oncor expects SRP spend could begin as early as | 6 the fourth quarter of 2024.

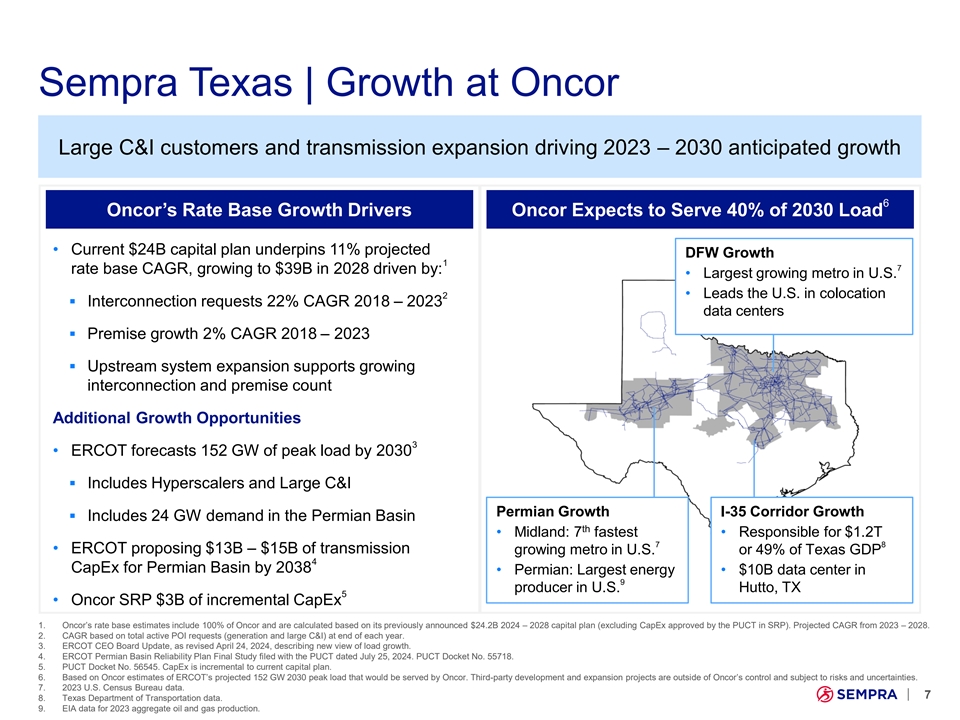

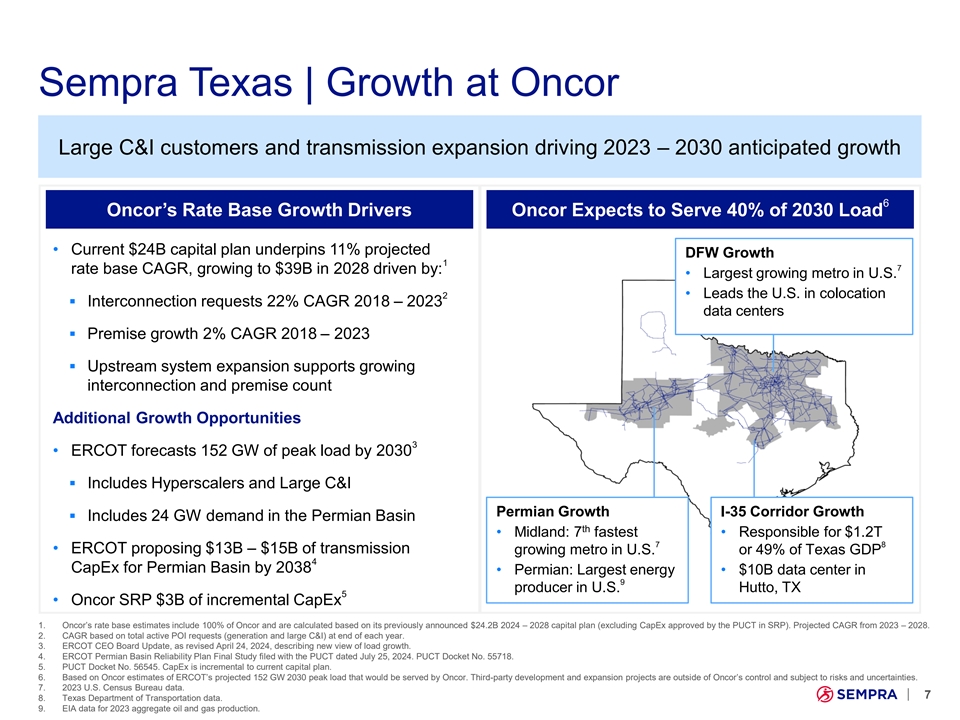

Sempra Texas | Growth at Oncor Large C&I customers and transmission expansion driving 2023 – 2030 anticipated growth 6 Oncor’s Rate Base Growth Drivers Oncor Expects to Serve 40% of 2030 Load • Current $24B capital plan underpins 11% projected DFW Growth 1 7 rate base CAGR, growing to $39B in 2028 driven by: • Largest growing metro in U.S. 2 • Leads the U.S. in colocation ▪ Interconnection requests 22% CAGR 2018 – 2023 data centers ▪ Premise growth 2% CAGR 2018 – 2023 ▪ Upstream system expansion supports growing 15 GW 25 GW interconnection and premise count High Other Additional Growth Opportunities 5 Confidence 3 • ERCOT forecasts 152 GW of peak load by 2030 (63%) ▪ Includes Hyperscalers and Large C&I Permian Growth I-35 Corridor Growth ▪ Includes 24 GW demand in the Permian Basin th • Midland: 7 fastest • Responsible for $1.2T 7 8 • ERCOT proposing $13B – $15B of transmission growing metro in U.S. or 49% of Texas GDP 4 CapEx for Permian Basin by 2038 • Permian: Largest energy • $10B data center in 9 producer in U.S. Hutto, TX 5 • Oncor SRP $3B of incremental CapEx 1. Oncor’s rate base estimates include 100% of Oncor and are calculated based on its previously announced $24.2B 2024 – 2028 capital plan (excluding CapEx approved by the PUCT in SRP). Projected CAGR from 2023 – 2028. 2. CAGR based on total active POI requests (generation and large C&I) at end of each year. 3. ERCOT CEO Board Update, as revised April 24, 2024, describing new view of load growth. 4. ERCOT Permian Basin Reliability Plan Final Study filed with the PUCT dated July 25, 2024. PUCT Docket No. 55718. 5. PUCT Docket No. 56545. CapEx is incremental to current capital plan. 6. Based on Oncor estimates of ERCOT’s projected 152 GW 2030 peak load that would be served by Oncor. Third-party development and expansion projects are outside of Oncor’s control and subject to risks and uncertainties. 7. 2023 U.S. Census Bureau data. | 7 8. Texas Department of Transportation data. 9. EIA data for 2023 aggregate oil and gas production.