Investor Update, March 2025 Oncor Electric Delivery Company LLC Exhibit 99.1

Information Regarding Forward Looking Statements This presentation contains forward-looking statements relating to Oncor Electric Delivery Company LLC (“Oncor”) within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to risks and uncertainties. All statements, other than statements of historical facts, that are included in this presentation, as well as statements made in presentations, in response to questions or otherwise, that address activities, events or developments that Oncor expects or anticipates to occur in the future, including such matters as projections, capital allocation, future capital expenditures, business strategy, competitive strengths, goals, future acquisitions or dispositions, development or operation of facilities, market and industry developments and the growth of Oncor’s business and operations (often, but not always, through the use of words or phrases such as “intends,” “plans,” “will likely result,” “expects,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “forecast,” “should,” “projection,” “target,” “goal,” “objective” and “outlook”), are forward-looking statements. Although Oncor believes that in making any such forward-looking statement its expectations are based on reasonable assumptions, any such forward-looking statement involves risks, uncertainties and assumptions. Factors that could cause Oncor’s actual results to differ materially from those projected in such forward-looking statements include: legislation, governmental policies and orders, and regulatory actions; legal and administrative proceedings and settlements, including the exercise of equitable powers by courts; weather conditions and other natural phenomena, including any weather impacts due to climate change and damage to Oncor’s system caused by severe weather events, natural disasters or wildfires; cyber-attacks on Oncor or Oncor’s third-party vendors; changes in expected Electric Reliability Council of Texas, Inc. (“ERCOT”) and service territory growth; changes in, or cancellations of, anticipated projects, including customer requested interconnection projects; physical attacks on Oncor’s system, acts of sabotage, wars, terrorist activities, wildfires, fires, explosions, natural disasters, hazards customary to the industry, or other emergency events and the possibility that Oncor may not have adequate insurance to cover losses or third-party liabilities related to any such event; actions by credit rating agencies to downgrade Oncor’s credit ratings or place those ratings on negative outlook; health epidemics and pandemics, including their impact on Oncor’s business and the economy in general; interrupted or degraded service on key technology platforms, facilities failures, or equipment interruptions; economic conditions, including the impact of a recessionary environment, inflation, supply chain disruptions, foreign policy, global trade restrictions, tariffs, competition for goods and services, service provider availability, and labor availability and cost; unanticipated changes in electricity demand in ERCOT or Oncor’s service territory; ERCOT grid needs and ERCOT market conditions, including insufficient electricity generation within the ERCOT market or disruptions at power generation facilities that supply power within the ERCOT market; changes in business strategy, development plans or vendor relationships; changes in interest rates, foreign currency exchange rates, or rates of inflation; significant changes in operating expenses, liquidity needs and/or capital expenditures; inability of various counterparties to meet their financial and other obligations to Oncor, including failure of counterparties to timely perform under agreements; general industry and ERCOT trends; significant decreases in demand or consumption of electricity delivered by Oncor, including as a result of increased consumer use of third-party distributed energy resources or other technologies; changes in technology used by and services offered by Oncor; significant changes in Oncor’s relationship with its employees, including the availability of qualified personnel, and the potential adverse effects if labor disputes or grievances were to occur; changes in assumptions used to estimate costs of providing employee benefits, including pension and retiree benefits, and future funding requirements related thereto; significant changes in accounting policies or critical accounting estimates material to Oncor; commercial bank and financial market conditions, macroeconomic conditions, access to capital, the cost of such capital, and the results of financing and refinancing efforts, including availability of funds and the potential impact of any disruptions in U.S. or foreign capital and credit markets; financial market volatility and the impact of volatile financial markets on investments, including investments held by Oncor’s pension and retiree benefit plans; circumstances which may contribute to future impairment of goodwill, intangible or other long-lived assets; adoption and deployment of AI; financial and other restrictions under Oncor’s debt agreements; Oncor’s ability to generate sufficient cash flow to make interest payments on its debt instruments; and Oncor’s ability to effectively execute its operational and financing strategy. Further discussion of risks and uncertainties that could cause actual results to differ materially from management’s current projections, forecasts, estimates and expectations is contained in filings made by Oncor with the U.S. Securities and Exchange Commission (“SEC”), which are available on the SEC’s website and also available on the Investor Relations section of Oncor’s website, oncor.com. Specifically, Oncor makes reference to the section entitled “Risk Factors” in its annual and quarterly reports. Any forward-looking statement speaks only as of the date on which it is made, and, except as may be required by law, Oncor undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for Oncor to predict all of them; nor can it assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. As such, you should not unduly rely on such forward-looking statements. The information included on any websites referenced in this presentation shall not be deemed a part of, or incorporated by reference into, this presentation.

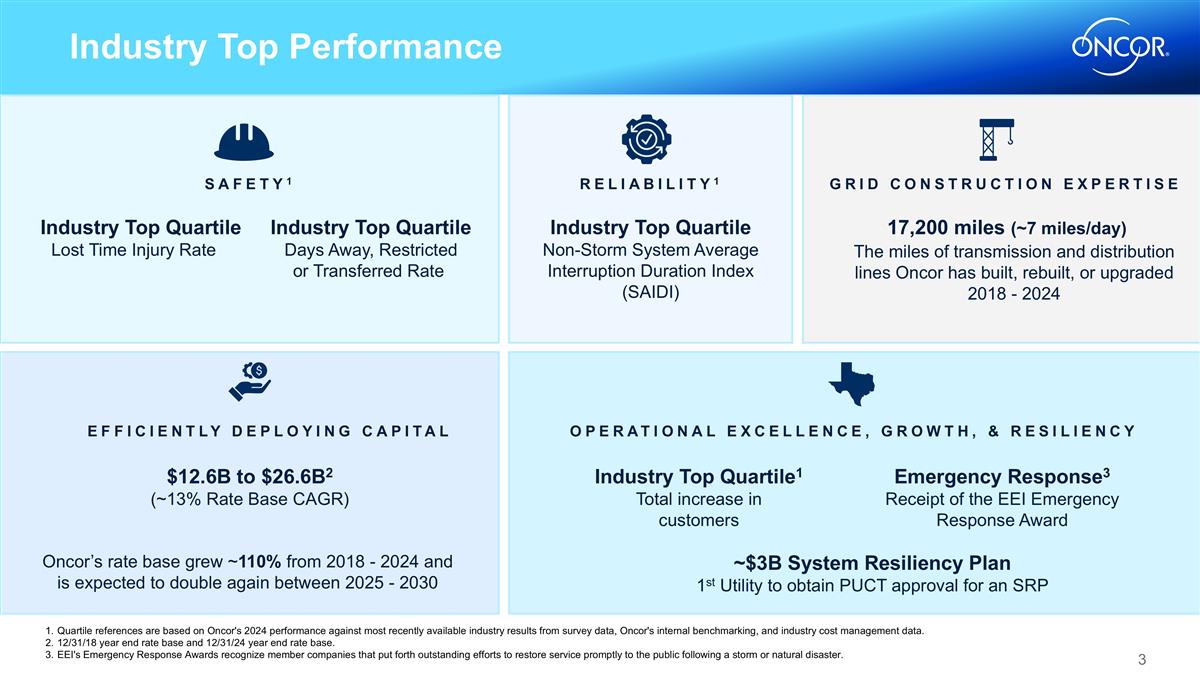

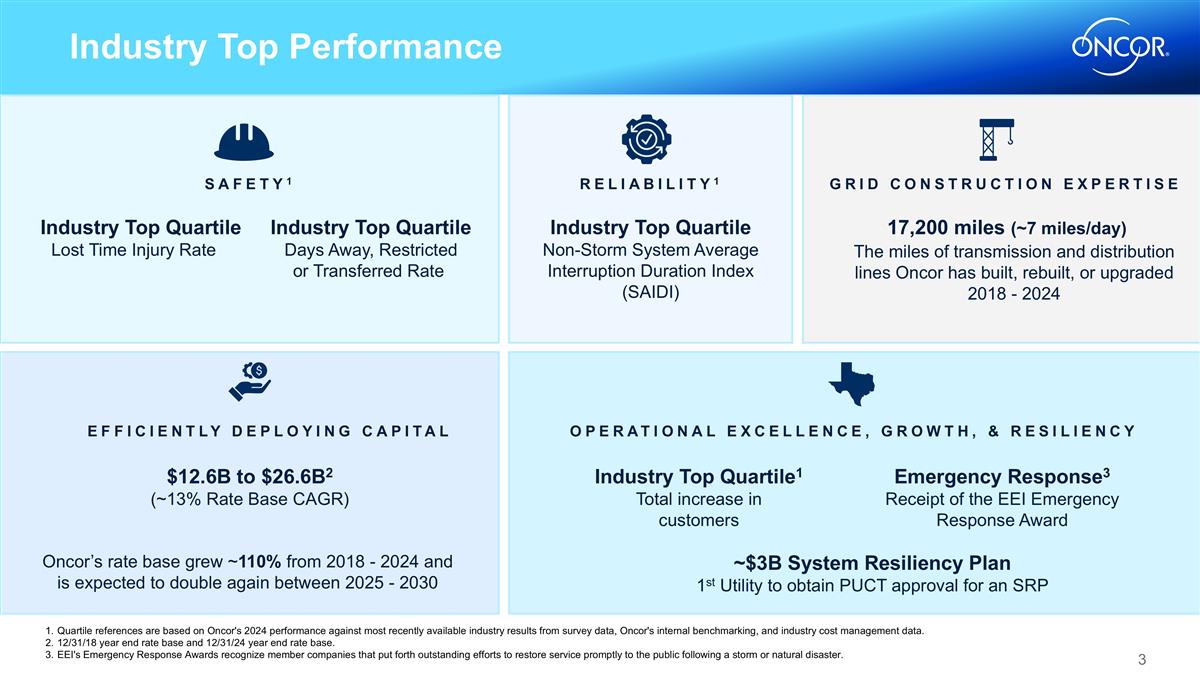

Industry Top Performance GRID CONSTRUCTION EXPERTISE RELIABILITY1 SAFETY1 EFFICIENTLY DEPLOYING CAPITAL OPERATIONAL EXCELLENCE, GROWTH, & RESILIENCY Oncor’s rate base grew ~110% from 2018 - 2024 and is expected to double again between 2025 - 2030 ~$3B System Resiliency Plan 1st Utility to obtain PUCT approval for an SRP Industry Top Quartile1 Total increase in customers Emergency Response3 Receipt of the EEI Emergency Response Award Industry Top Quartile Non-Storm System Average Interruption Duration Index (SAIDI) 17,200 miles (~7 miles/day) Industry Top Quartile Lost Time Injury Rate Industry Top Quartile Days Away, Restricted or Transferred Rate Quartile references are based on Oncor's 2024 performance against most recently available industry results from survey data, Oncor's internal benchmarking, and industry cost management data. 12/31/18 year end rate base and 12/31/24 year end rate base. EEI's Emergency Response Awards recognize member companies that put forth outstanding efforts to restore service promptly to the public following a storm or natural disaster. The miles of transmission and distribution lines Oncor has built, rebuilt, or upgraded 2018 - 2024 $12.6B to $26.6B2 (~13% Rate Base CAGR)

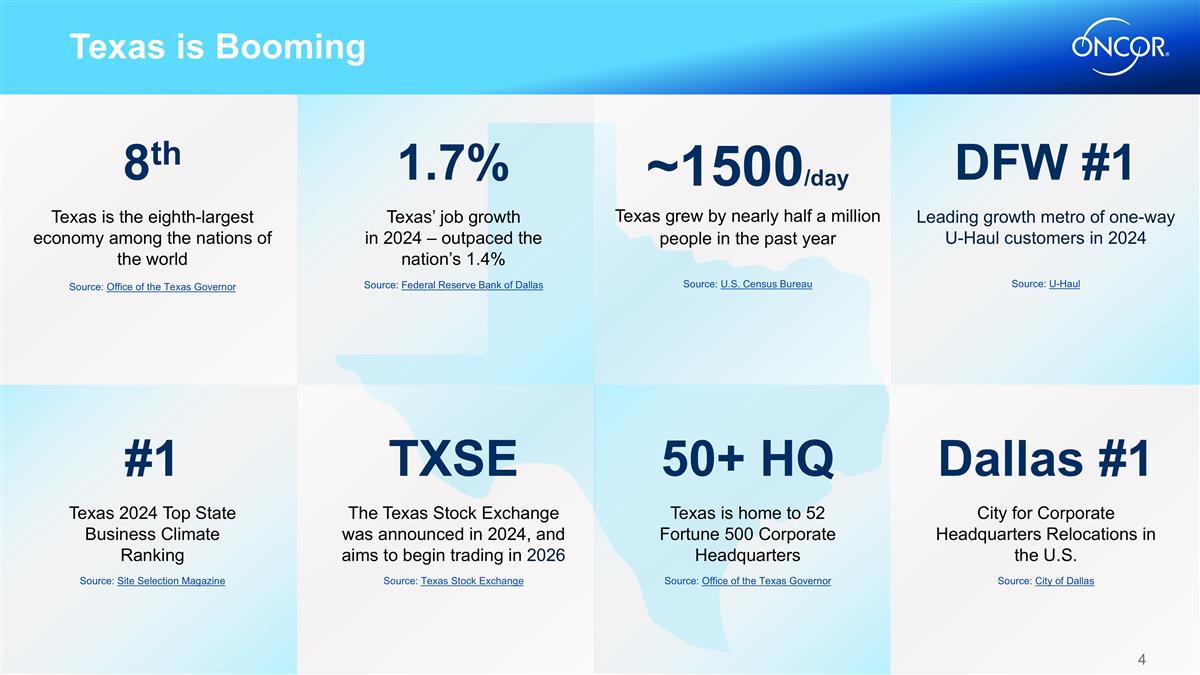

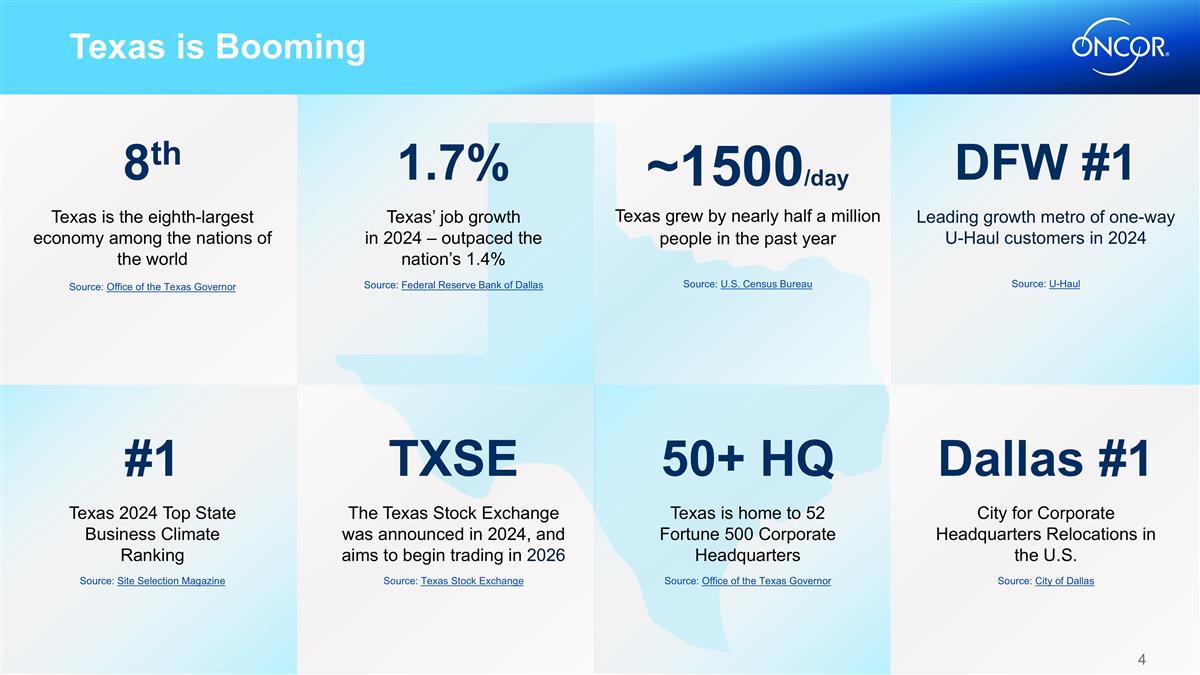

Texas is Booming ~1500/day Texas grew by nearly half a million people in the past year Source: U.S. Census Bureau 8th Texas is the eighth-largest economy among the nations of the world Source: Office of the Texas Governor #1 Texas 2024 Top State Business Climate Ranking Source: Site Selection Magazine Dallas #1 City for Corporate Headquarters Relocations in the U.S. Source: City of Dallas TXSE The Texas Stock Exchange was announced in 2024, and aims to begin trading in 2026 Source: Texas Stock Exchange 50+ HQ Texas is home to 52 Fortune 500 Corporate Headquarters Source: Office of the Texas Governor DFW #1 Leading growth metro of one-way U-Haul customers in 2024 Source: U-Haul 1.7% Texas’ job growth in 2024 – outpaced the nation’s 1.4% Source: Federal Reserve Bank of Dallas

Significant Service Territory Growth WEST TEXAS Long-Term Load Forecast: S&P (IHS) anticipates the region will remain a high producer for years and quantifies the impact of electrifying upstream and midstream processes ERCOT-Identified Synchronous Condensers: Essential for sustaining industrial growth CENTRAL TEXAS Samsung Microchip Manufacturing: Expansion plans for Samsung site State Highway I-30 Corridor: Distribution center growth and proximity to Tesla Gigafactory Hutto Megasite: 1,400-acre development including proposed 300 MW data center Oncor Distribution Service Territory/Transmission Footprint by County DFW Alliance Texas: Logistics hub and planned future development that includes a large concentration of data centers DFW Airport Upgrades: Announcement of new terminal and major expansion Large Semi-Conductor Sector: Increased expansion will create additional projects SOUTHERN DALLAS COUNTY International Inland Port: Union Pacific Railway Intermodal Facility Prime Pointe Industrial Park: Manufacturing, distribution, and cold storage Large Data Center Cluster: 5+ large-scale data centers in the planning phase

…based primarily on SRP, Multiple Transmission Projects and Continued Customer Growth 2025 – 2029 Capital Plan SRP TRANSMISSION Delaware Basin Load Integration 2 Projects underway West Texas Infrastructure Project 18 projects have all regulatory approvals Permian Basin Reliability Plan $2B of brownfield local common projects have all regulatory approvals LC&I ~$2B customer collateral held for signed interconnection agreements, a ~900% increase since 20181 82 Generation projects under construction 95 LC&I projects under construction currently2 ~$3B in capital spend Covers reliability, resiliency, cyber security and wildfire mitigation Favorable rate treatment of approved expenditures Oncor 5-year Capital Plan $36.1B Value of collateral provided by customers to Oncor as of 12/31/24, 76% through letters of credit, 14% through affiliate guarantees, and 10% in cash. Customer collateral is subject to return in accordance with PUCT rules, ERCOT requirements, or our tariffs, including upon Oncor’s placement of the project into service. Third-party development and expansion projects are outside of Oncor’s control and subject to risks and uncertainties. Distribution Transmission Technology $36.1B CAPITAL PLAN BREAKDOWN Capital Plan 2025 - 2029 $ billions Note: Numbers may not sum due to rounding $8.5 ‘24 – ‘28 Capex Plan ‘25 – ‘29 Capex Plan $7.5 $7.1 $6.9 $6.1 SRP 4%

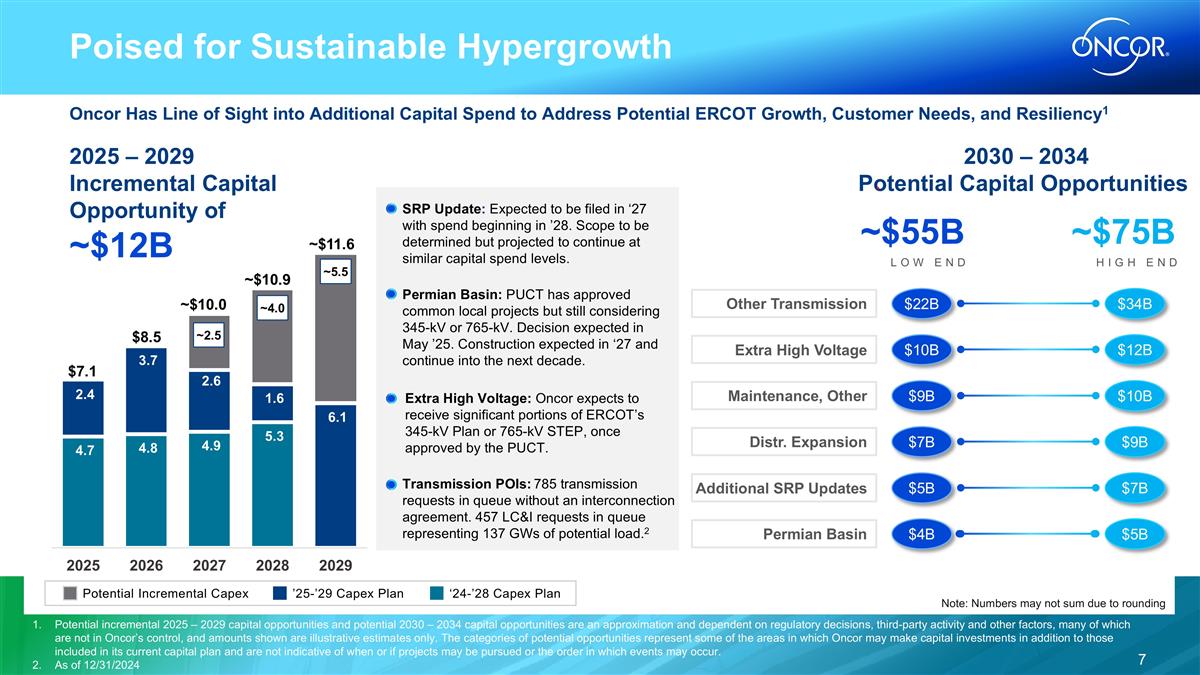

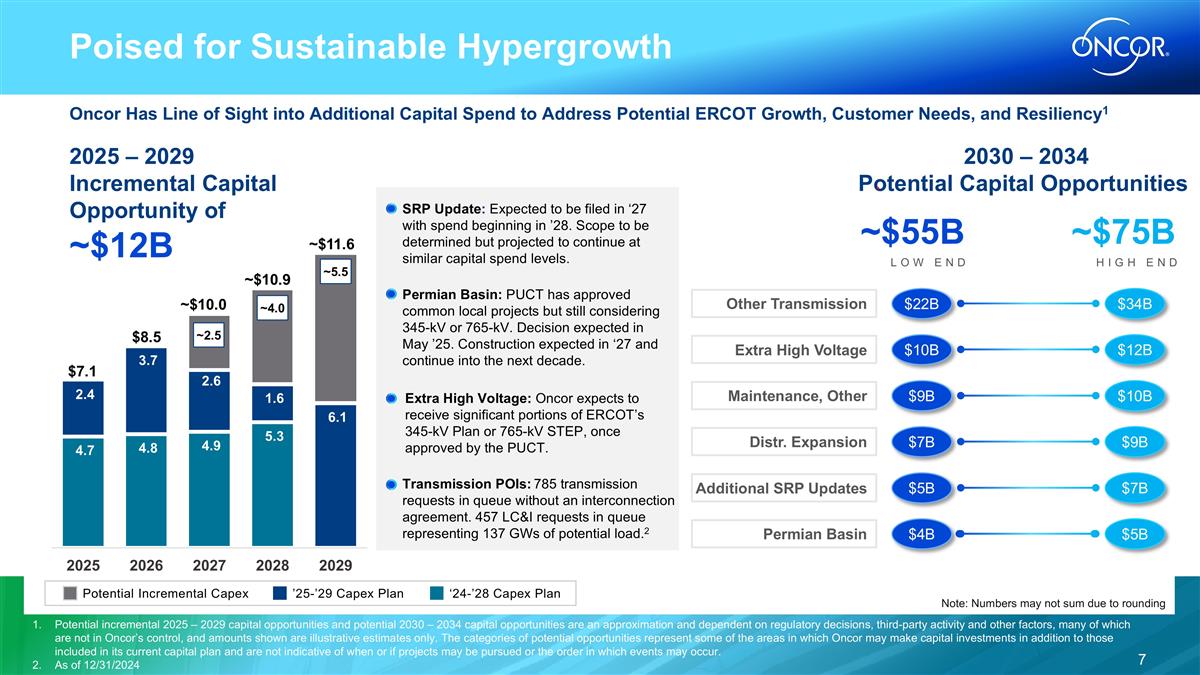

2025 – 2029 Incremental Capital Opportunity of ~$12B Poised for Sustainable Hypergrowth Additional SRP Updates Other Transmission Distr. Expansion Maintenance, Other Permian Basin $22B $34B $7B $9B $9B $10B $4B $5B $5B $7B 2030 – 2034 Potential Capital Opportunities LOW END HIGH END ~$55B ~$75B Oncor Has Line of Sight into Additional Capital Spend to Address Potential ERCOT Growth, Customer Needs, and Resiliency1 ‘24-’28 Capex Plan ’25-’29 Capex Plan Potential Incremental Capex Extra High Voltage $10B $12B $7.1 ~$10.9 ~4.0 ~$10.0 ~2.5 $8.5 ~$11.6 ~5.5 Note: Numbers may not sum due to rounding Potential incremental 2025 – 2029 capital opportunities and potential 2030 – 2034 capital opportunities are an approximation and dependent on regulatory decisions, third-party activity and other factors, many of which are not in Oncor’s control, and amounts shown are illustrative estimates only. The categories of potential opportunities represent some of the areas in which Oncor may make capital investments in addition to those included in its current capital plan and are not indicative of when or if projects may be pursued or the order in which events may occur. As of 12/31/2024 SRP Update: Expected to be filed in ‘27 with spend beginning in ’28. Scope to be determined but projected to continue at similar capital spend levels. Permian Basin: PUCT has approved common local projects but still considering 345-kV or 765-kV. Decision expected in May ’25. Construction expected in ‘27 and continue into the next decade. Extra High Voltage: Oncor expects to receive significant portions of ERCOT’s 345-kV Plan or 765-kV STEP, once approved by the PUCT. Transmission POIs: 785 transmission requests in queue without an interconnection agreement. 457 LC&I requests in queue representing 137 GWs of potential load.2

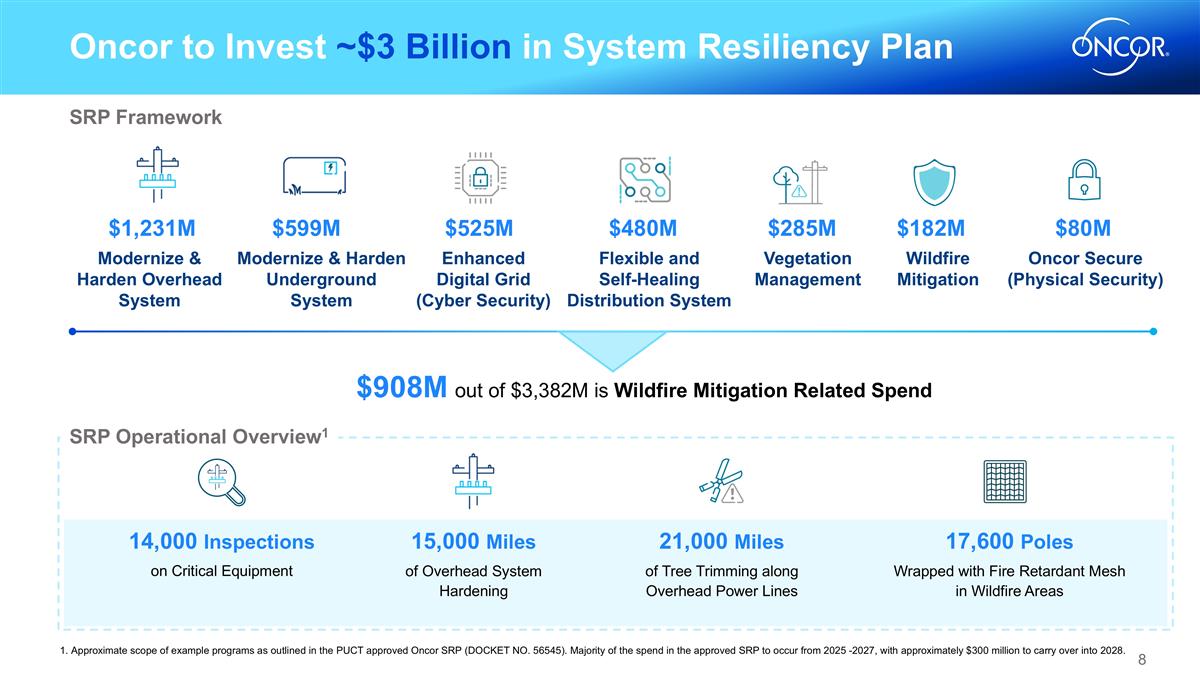

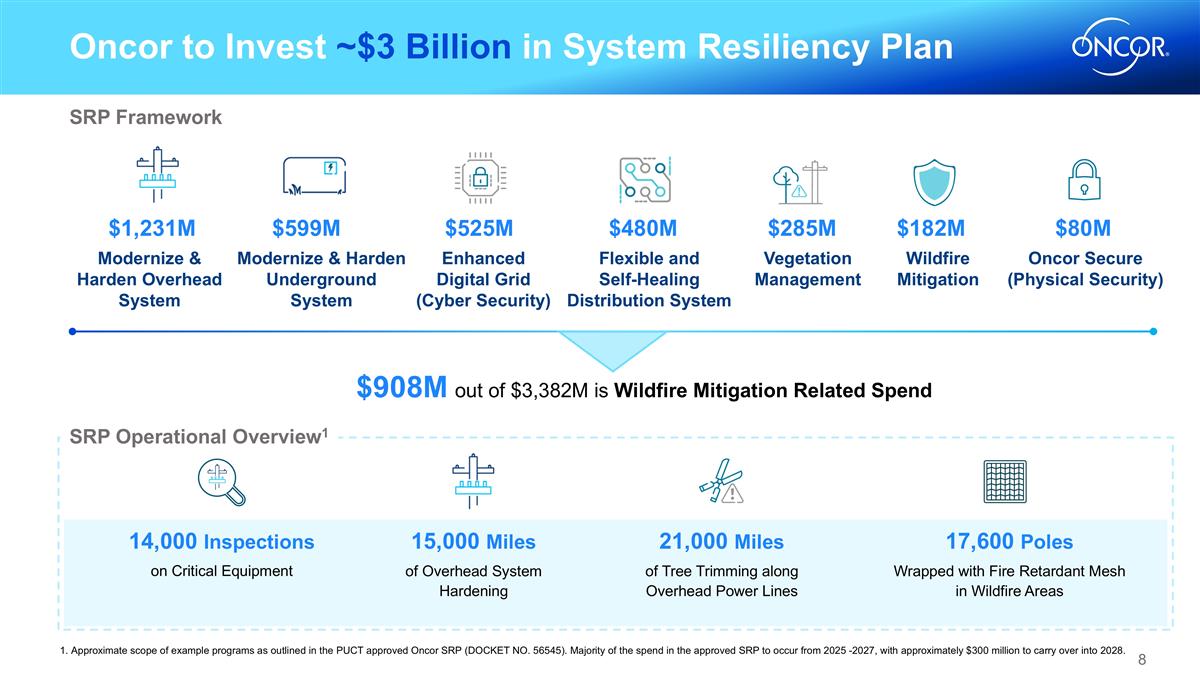

Modernize & Harden Overhead System Modernize & Harden Underground System Flexible and Self-Healing Distribution System Vegetation Management Wildfire Mitigation Enhanced Digital Grid (Cyber Security) $1,231M $599M $525M $480M $285M $182M $80M Oncor Secure (Physical Security) $908M out of $3,382M is Wildfire Mitigation Related Spend Oncor to Invest ~$3 Billion in System Resiliency Plan SRP Framework 15,000 Miles of Overhead System Hardening 21,000 Miles of Tree Trimming along Overhead Power Lines 1. Approximate scope of example programs as outlined in the PUCT approved Oncor SRP (DOCKET NO. 56545). Majority of the spend in the approved SRP to occur from 2025 -2027, with approximately $300 million to carry over into 2028. SRP Operational Overview1 14,000 Inspections on Critical Equipment 17,600 Poles Wrapped with Fire Retardant Mesh in Wildfire Areas

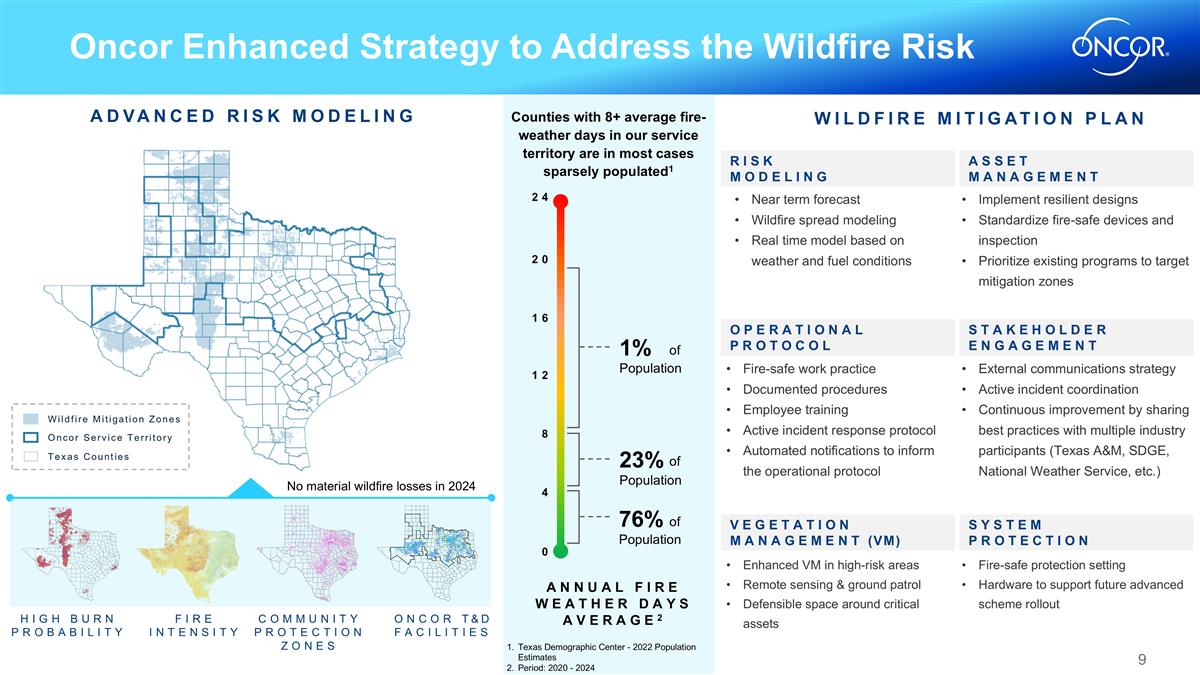

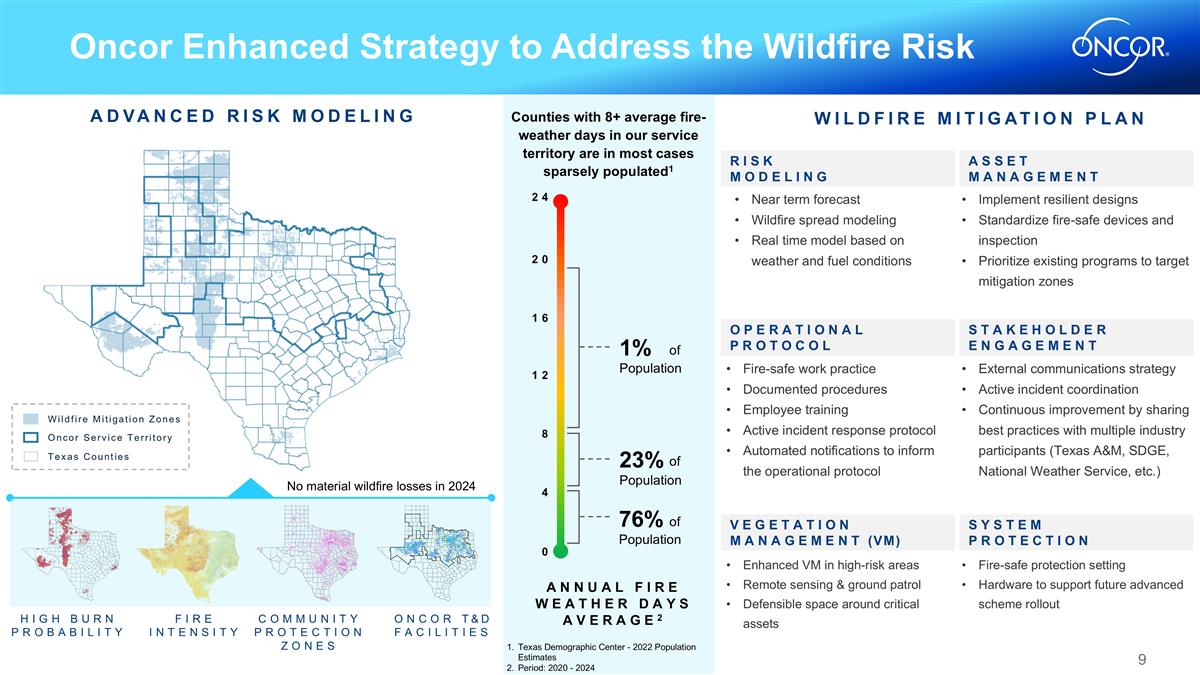

Oncor Enhanced Strategy to Address the Wildfire Risk HIGH BURN PROBABILITY FIRE INTENSITY COMMUNITY PROTECTION ZONES ONCOR T&D FACILITIES Wildfire Mitigation Zones Oncor Service Territory Texas Counties Annual Fire weather days Average2 Advanced Risk Modeling RISK MODELING OPERATIONAL PROTOCOL ASSET MANAGEMENT STAKEHOLDER ENGAGEMENT SYSTEM PROTECTION VEGETATION MANAGEMENT (VM) WILDFIRE MITIGATION PLAN Near term forecast Wildfire spread modeling Real time model based on weather and fuel conditions Implement resilient designs Standardize fire-safe devices and inspection Prioritize existing programs to target mitigation zones Fire-safe work practice Documented procedures Employee training Active incident response protocol Automated notifications to inform the operational protocol External communications strategy Active incident coordination Continuous improvement by sharing best practices with multiple industry participants (Texas A&M, SDGE, National Weather Service, etc.) Enhanced VM in high-risk areas Remote sensing & ground patrol Defensible space around critical assets Fire-safe protection setting Hardware to support future advanced scheme rollout Texas Demographic Center - 2022 Population Estimates Period: 2020 - 2024 23% Population of 76% Population of 1% Population of 24 0 20 16 12 8 4 Counties with 8+ average fire-weather days in our service territory are in most cases sparsely populated1 No material wildfire losses in 2024

Growth in Permian Basin Not all local Permian project will require a CCN filing Total Import CCN filings will depend on import path voltage decided by the PUCT Import paths are not shown on the figure As the largest electric utility in the Permian Basin, Oncor is well-positioned to advance Texas’ goal of expanding its network to support significantly higher electric demand 1. Source: ERCOT Permian Basin Reliability Plan Study Report (published July 2024) ; 2. Not all local Permian projects will require a CCN filing; 3. Total Import CCN filings will depend on import path voltage decided by the PUCT Significant demand growth from Oil & Gas, Large C&I, technical manufacturing, data centers, and crypto mining ERCOT forecasts Permian Basin peak load to reach 26.4 GW by 2038, a 4X surge from the current peak demand1 PUCT will decide import path voltage by May 1, 2025 (345-kV or 765-kV) Expected CCN Local Filings2: 7 Expected CCN Import Filings3: 4 -11 All other Permian Project CCNs: 11 PUCT approved the Permian Basin Reliability Plan in September 2024 All local CCN projects approved to be completed by 2030 Expected CCN Local Filings1: 7 PERMIAN PLAN TIMELINE Expected CCN Local Filings1: 1 2024 2025 2026 2027 2030 Oncor expected to file ~2 CCNs per month in 2025 LOCAL TRANSMISSION UPGRADES BY 20301 Existing 69-kV Line Existing 138-kV Line Existing 345-kV Line New 345-kV Line under RPG Review Proposed New 345-kV Line Proposed New 138-kV Line Upgrade Existing Line Existing Substation New/Converted 345-kV Substation New/Converted 138-kV Substation Map Legend

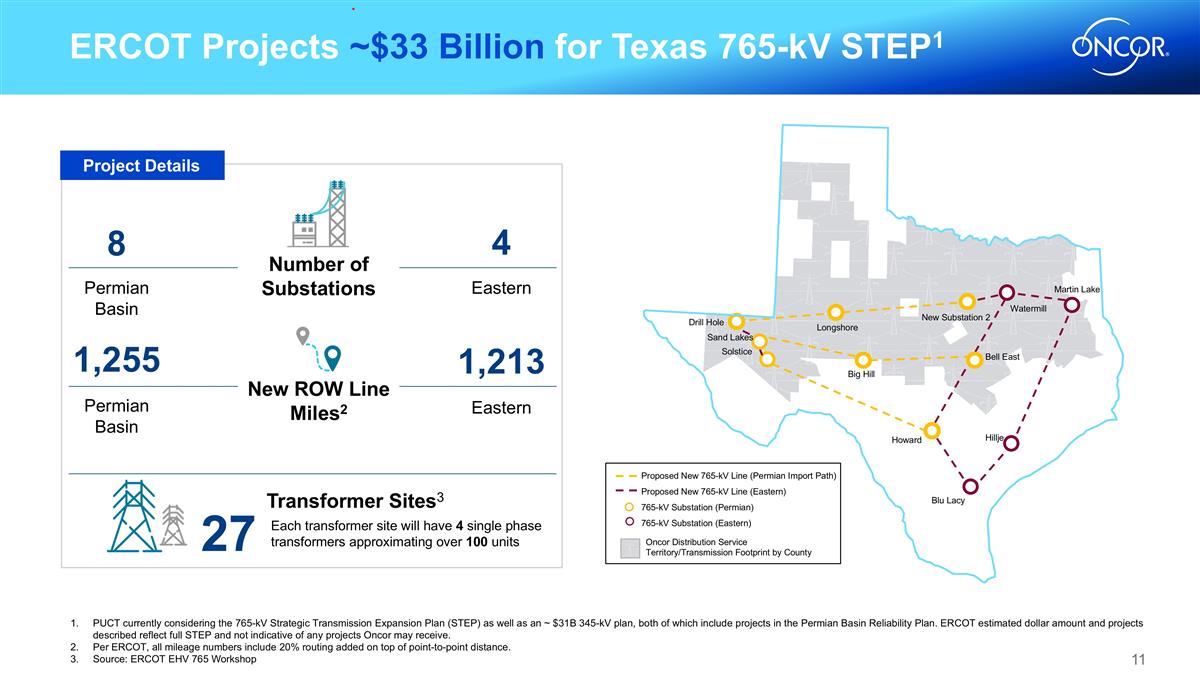

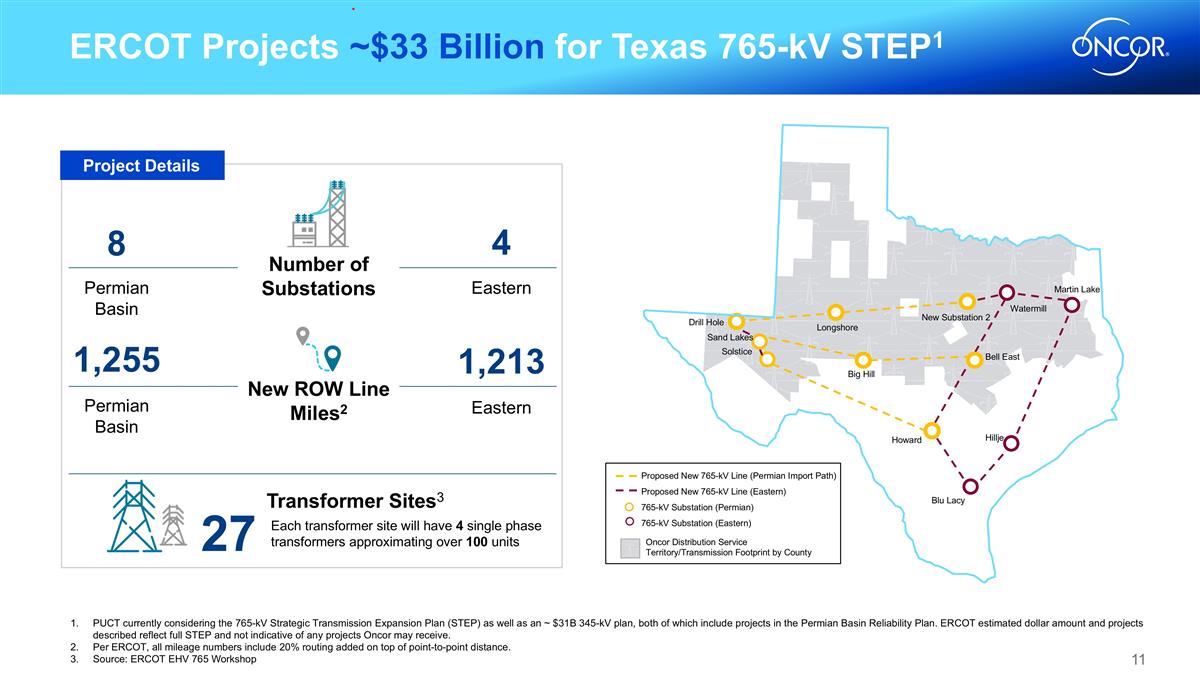

ERCOT Projects ~$33 Billion for Texas 765-kV STEP1 © 2024 Oncor Electric Delivery Company LLC. All rights reserved. 8 Permian Basin 4 Eastern 1,255 Permian Basin 1,213 Eastern Transformer Sites3 New ROW Line Miles2 Number of Substations Project Details PUCT currently considering the 765-kV Strategic Transmission Expansion Plan (STEP) as well as an ~ $31B 345-kV plan, both of which include projects in the Permian Basin Reliability Plan. ERCOT estimated dollar amount and projects described reflect full STEP and not indicative of any projects Oncor may receive. Per ERCOT, all mileage numbers include 20% routing added on top of point-to-point distance. Source: ERCOT EHV 765 Workshop 27 Each transformer site will have 4 single phase transformers approximating over 100 units Drill Hole Sand Lakes Solstice Longshore Big Hill New Substation 2 Watermill Martin Lake Bell East Howard Hillje Blu Lacy Proposed New 765-kV Line (Permian Import Path) Proposed New 765-kV Line (Eastern) 765-kV Substation (Permian) 765-kV Substation (Eastern) Oncor Distribution Service Territory/Transmission Footprint by County

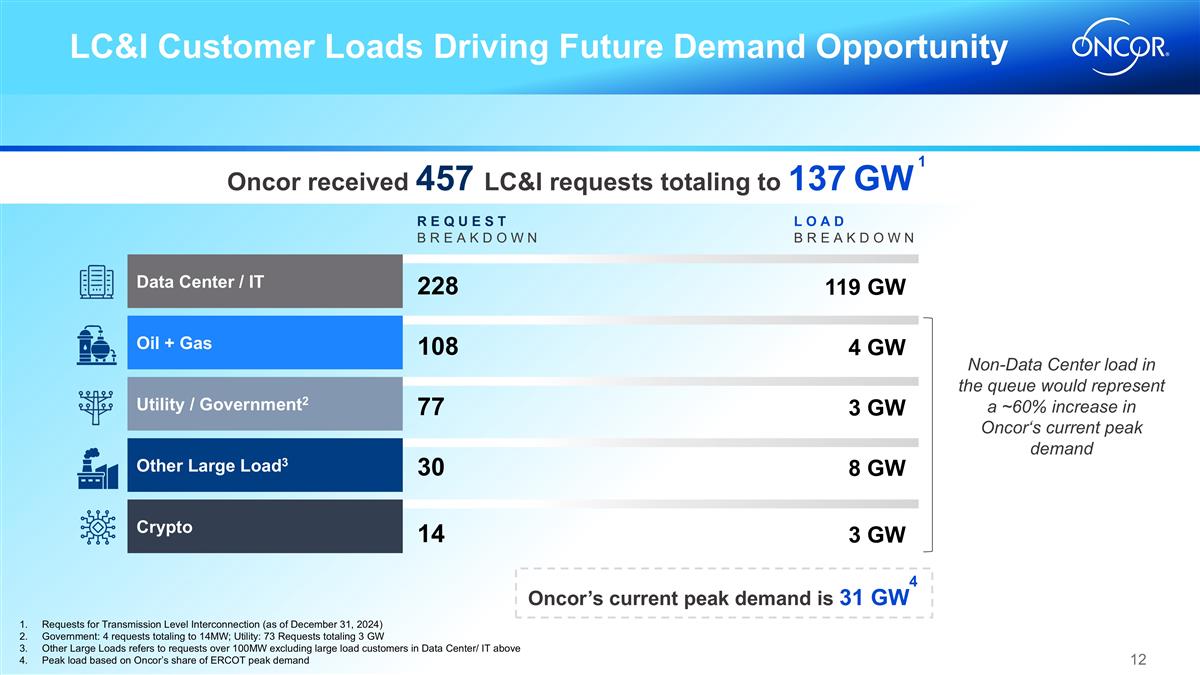

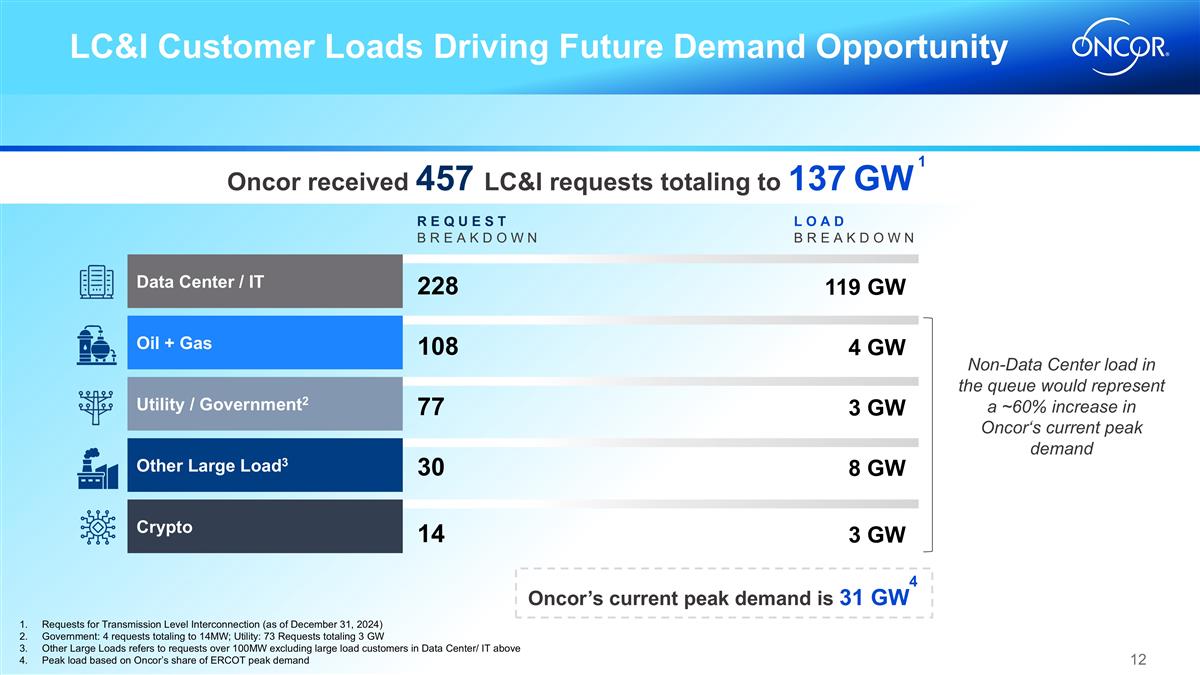

LC&I Customer Loads Driving Future Demand Opportunity Requests for Transmission Level Interconnection (as of December 31, 2024) Government: 4 requests totaling to 14MW; Utility: 73 Requests totaling 3 GW Other Large Loads refers to requests over 100MW excluding large load customers in Data Center/ IT above Peak load based on Oncor’s share of ERCOT peak demand 119 GW 228 108 77 30 14 Crypto Other Large Load3 Oil + Gas Utility / Government2 3 GW 8 GW 4 GW 3 GW Non-Data Center load in the queue would represent a ~60% increase in Oncor‘s current peak demand Data Center / IT REQUEST BREAKDOWN LOAD BREAKDOWN Oncor received 457 LC&I requests totaling to 137 GW 4 Oncor’s current peak demand is 31 GW 1

Executing for the Future Not all local Permian project will require a CCN filing Total Import CCN filings will depend on import path voltage decided by the PUCT Import paths are not shown on the figure We have long-term, multi-year supplier agreements in place expected to cover the materials needed for our five-year plan New facility incorporates re-engineered and optimized materials management processes HV circuit breakers Distribution Center 422,000 sq.ft Wood Poles In February 2025, strengthened financial flexibility by adding an additional $1B in revolver capacity ENHANCING LIQUIDITY TO SUPPORT GROWTH External contractor FTE Growth: Since 2019, Oncor's external operations contractor base has expanded by 238%, with projections indicating another 150% growth by 2030 – ensuring ample resources for project execution 2019 ~3100 Expected 2030 Current ~4000 5100+ +28% 29% Internal Operations Staff Growth SCALING OPERATIONAL TALENT1 FOR THE FUTURE Over the last five years, we have increased our suppliers for … SUPPLIER BASE INVENTORY 5X 3X Medium Power Transformers 3X Growing supply chain footprint across the service area Operational staff and contractors (field and other transmission and distribution operations roles). The majority of the contractor costs and employee compensation for these roles are expected to be capitalized amounts and are included in the five-year capital plan.

Glossary CAGR Compound Annual Growth Rate Capex Capital Expenditures CCN Certificate Of Convenience And Necessity EEI Edison Electric Institute EHV Extra High Voltage ERCOT Electric Reliability Council Of Texas, Inc FTE Full Time Employee GW Gigawatt LC&I Large Commercial And Industrial Customers POI Point Of Interconnection PUCT Public Utility Commission Of Texas SAIDI System Average Interruption Duration Index SDGE San Diego Gas & Electric Company SRP System Reliability Plan S&P (IHS) Standard & Poor’s Information Handling Services