Exhibit 99.2 ICR Consumer Conference January 9, 2023

Cautionary Statements Forward-Looking Statements In addition to historical information, this presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended and the Private Securities Litigation Reform Act of 1995. Forward-looking statements, written, oral or otherwise made, represent the Company's expectation or belief concerning future events. Without limiting the foregoing, the words “believes,” “expects,” “may,” “might,” “will,” “should,” “seeks,” “intends,” “plans,” “strives,” “goal,” “estimates,” “forecasts,” “projects” or “anticipates” or the negative of these terms and similar expressions are intended to identify forward-looking statements. Forward-looking statements included in this presentation may include, among others, statements relating to our (i) 2024 strategic growth targets related to AUVs, shop-level margins, refranchising of company shops and franchise unit growth, (ii) ability to successfully execute against our Five-Pillar Strategy and Franchise Growth Acceleration Initiative, (iii) business strategy, including investments in G&A growth, the refranchising of shops, expansion and deployment of high-return strategic marketing, (iv) ability to strengthen sales through the use of promotional campaigns, (v) ability to recruit and retain employees, (vi) ability to successfully grow our digital channels, increase guest acquisition and brand loyalty and accelerate our franchise development pipeline. By nature, forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected or implied by the forward-looking statement, due to reasons including, but not limited to, risks related to compliance with our Credit Agreement covenants; competition; general economic conditions; the COVID-19 outbreak; our ability to successfully implement our business strategy; the success of our initiatives to increase sales and traffic; changes in commodity, energy and other costs; our ability to attract and retain management and employees; consumer reaction to industry-related public health issues and perceptions of food safety; our ability to manage our growth; reputational and brand issues; price and availability of commodities; consumer confidence and spending patterns; and weather conditions. In addition, there may be other factors of which we are presently unaware or that we currently deem immaterial that could cause our actual results to be materially different from the results referenced in the forward-looking statements. All forward-looking statements contained in this presentation are qualified in their entirety by this cautionary statement. Although we believe that our plans, intentions and expectations are reasonable, we may not achieve our plans, intentions or expectations. Forward-looking statements are based on current expectations and assumptions and currently available data and are neither predictions nor guarantees of future events or performance. You should not place undue reliance on forward-looking statements, which speak only as of the date hereof. See “Risk Factors” and “Cautionary Statement on Forward-Looking Statements” included in our most recent annual report on Form 10-K and other risk factors described from time to time in subsequent quarterly reports on Form 10-Q or other subsequent filings, all of which are available on our website at www.potbelly.com. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law The financial results included in this presentation are preliminary and unaudited, have not been reviewed by the Company's independent registered public accountants, and remain subject to the completion of normal year-end accounting procedures and adjustments and are subject to change. Further information learned during that completion may alter the final results. Accordingly, you should not place any undue reliance upon this preliminary information. Note Regarding Non-GAAP Measures This presentation includes financial measures, including shop-level profit margin that are derived on the basis of methodologies other than generally accepted accounting principles (“GAAP”). We offer these measures to assist the users of our financial statements in assessing our financial performance under GAAP, but these measures are non-GAAP measures and investors should not rely on these measures as a substitute for any GAAP measure. In addition, our non-GAAP financial measures may be different from non-GAAP measures used by other companies, limiting their usefulness for comparison purposes. The Company is not able to reconcile preliminary shop-level profit and shop-level profit margin to their most directly comparable GAAP financial measures without unreasonable efforts because the Company is unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact GAAP measures but would not impact the non-GAAP measures. Such items may include franchise marketing expenses, general and administrative expenses, depreciation expense, and impairment, loss on disposal of property and equipment and shop closures and could have a material impact on the Company’s GAAP financial results. . LEGAL DISCLOSURE 2

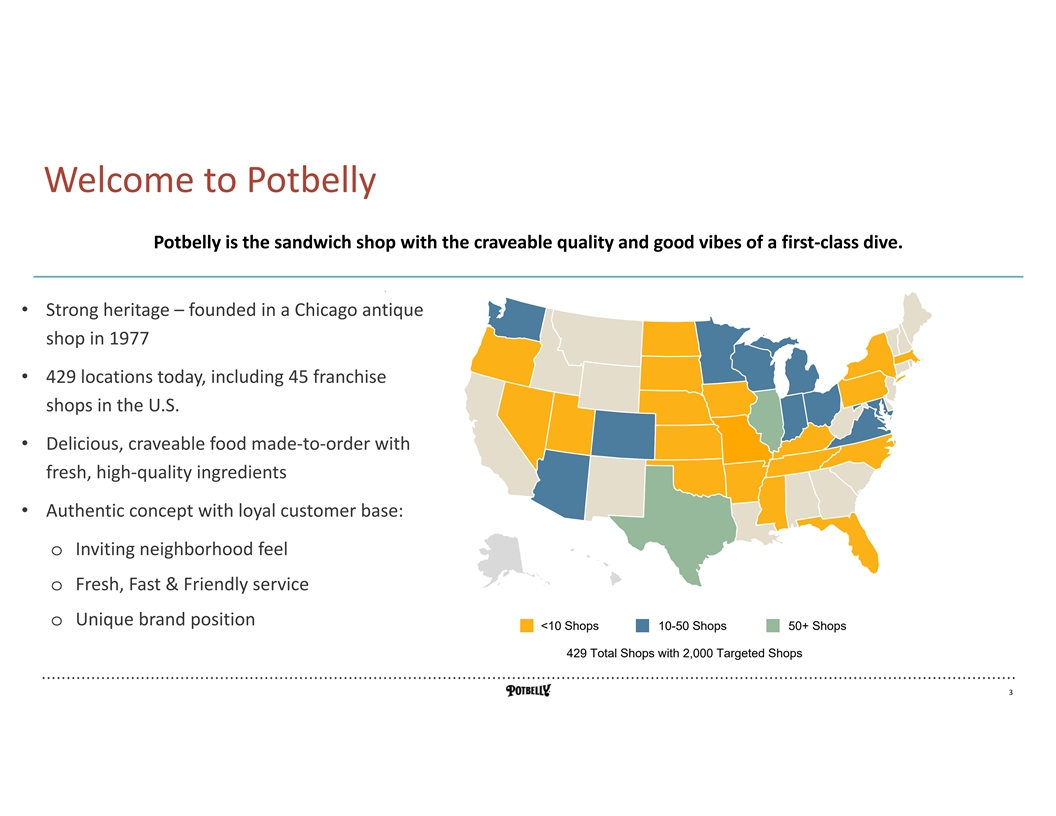

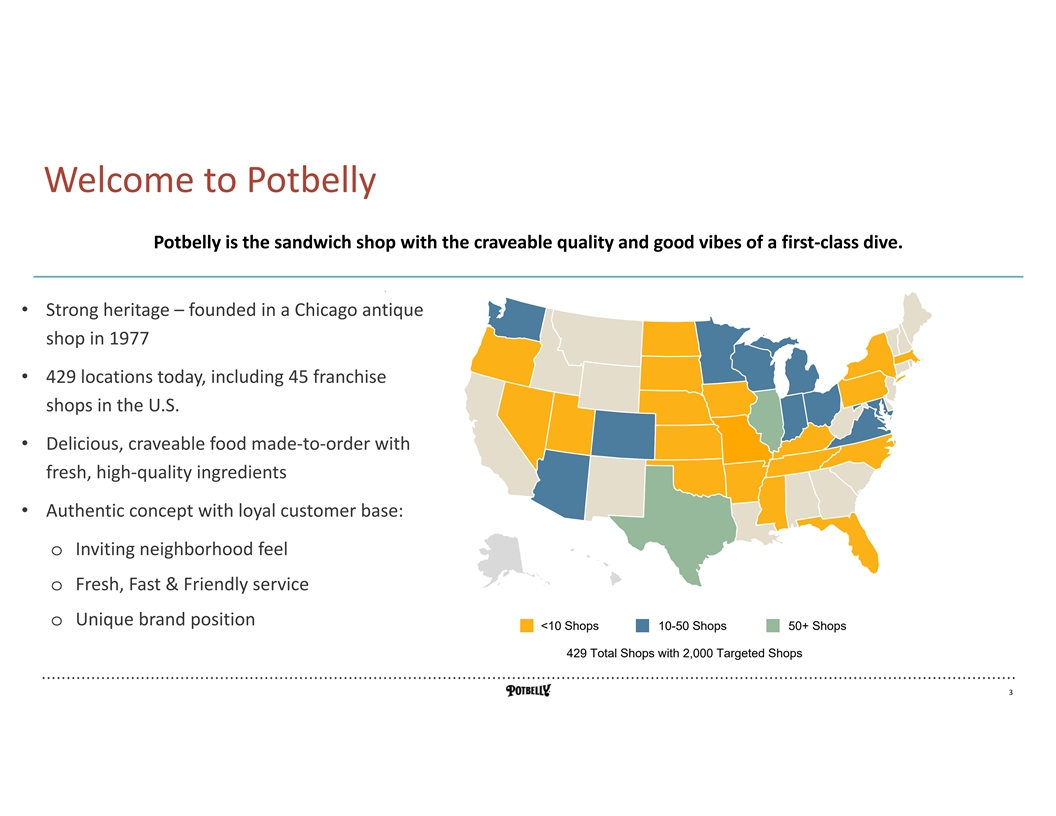

Welcome to Potbelly Potbelly is the sandwich shop with the craveable quality and good vibes of a first-class dive. • Strong heritage – founded in a Chicago antique shop in 1977 • 429 locations today, including 45 franchise shops in the U.S. • Delicious, craveable food made-to-order with fresh, high-quality ingredients • Authentic concept with loyal customer base: o Inviting neighborhood feel o Fresh, Fast & Friendly service o Unique brand position <10 Shops 10-50 Shops 50+ Shops 429 Total Shops with 2,000 Targeted Shops LEGAL DISCLOSURE 3

Why Invest in PBPB? Strong Brand, Differentiated Experience Authentic fast casual concept, with fresh, fast, & friendly service and high brand recognition across 400+ locations Strong Leadership Team Highly experienced executive leadership team with deep restaurant roots and a reinvigorated results-oriented culture Executing Against Five-Pillar Strategy Positive momentum driven by renewed focus on food innovation and promotions, leveraging of tech stack to drive an increase in user base and heightened engagement Focus on Volume and Profitability Targets NASDAQ: PBPB 2024 strategic growth objectives including $1.3M in annualized AUVs, shop-level margins of 16% with continued recovery across shop portfolio, targeted marketing/advertising and cost discipline Franchise Growth Acceleration Initiative Capital light franchise growth targets of refranchising ~25% of company- owned shops, achieving at least 10% franchise unit growth with long-term goal of ~2,000 shops LEGAL DISCLOSURE 4

Brand Position Potbelly is the sandwich shop with the craveable quality and good vibes of a first-class dive. LEGAL DISCLOSURE 5

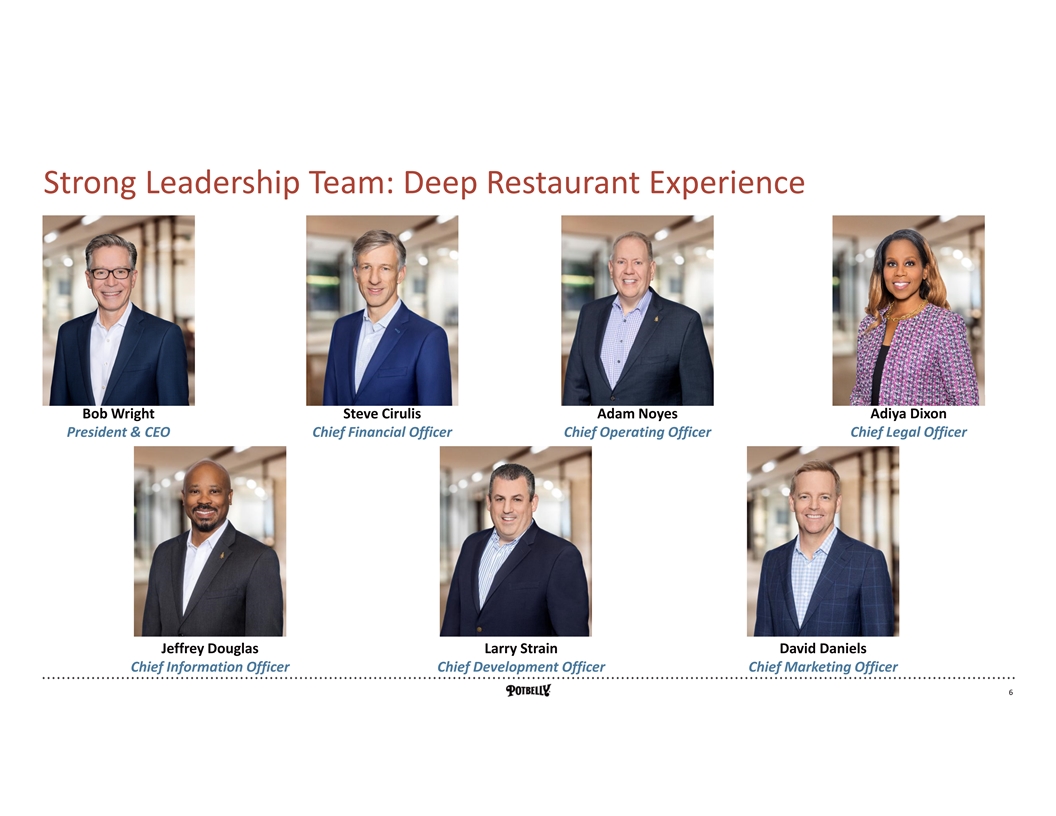

Strong Leadership Team: Deep Restaurant Experience Bob Wright Steve Cirulis Adam Noyes Adiya Dixon President & CEO Chief Financial Officer Chief Operating Officer Chief Legal Officer Jeffrey Douglas Larry Strain David Daniels Chief Information Officer Chief Development Officer Chief Marketing Officer LEGAL DISCLOSURE 6

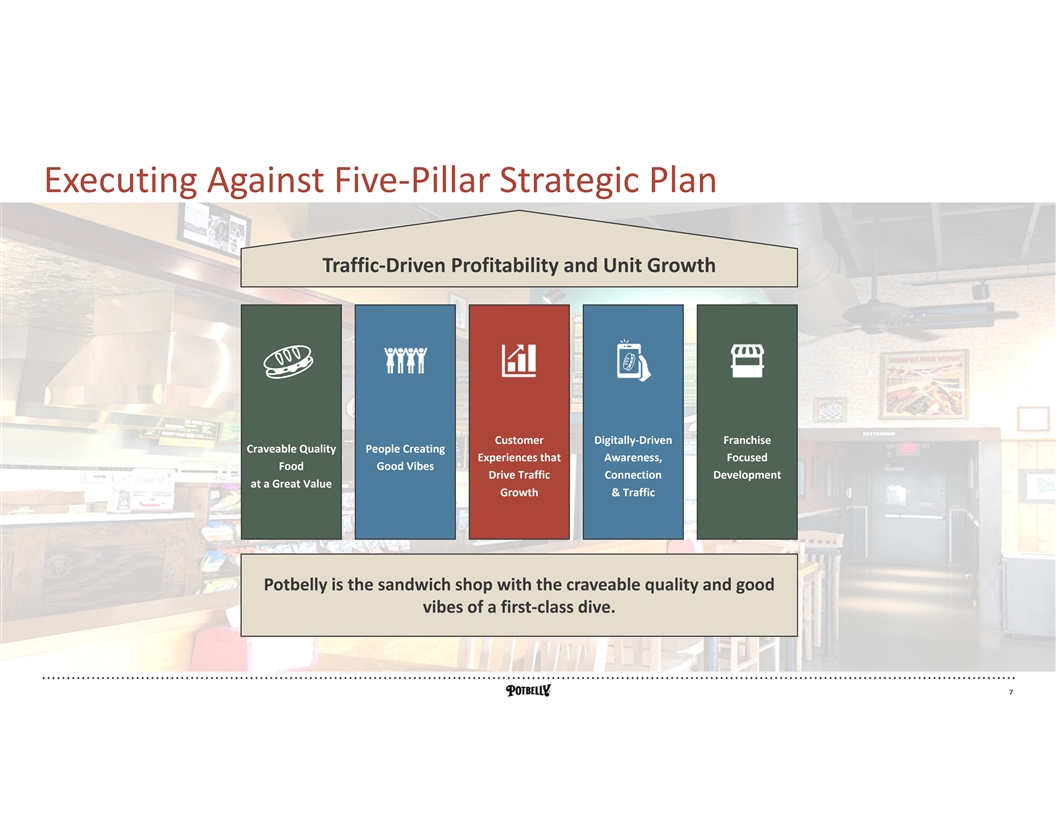

Executing Against Five-Pillar Strategic Plan Traffic-Driven Profitability and Unit Growth Customer Digitally-Driven Franchise Craveable Quality People Creating Experiences that Awareness, Focused Food Good Vibes Drive Traffic Connection Development at a Great Value Growth & Traffic Potbelly is the sandwich shop with the craveable quality and good vibes of a first-class dive. LEGAL DISCLOSURE 7

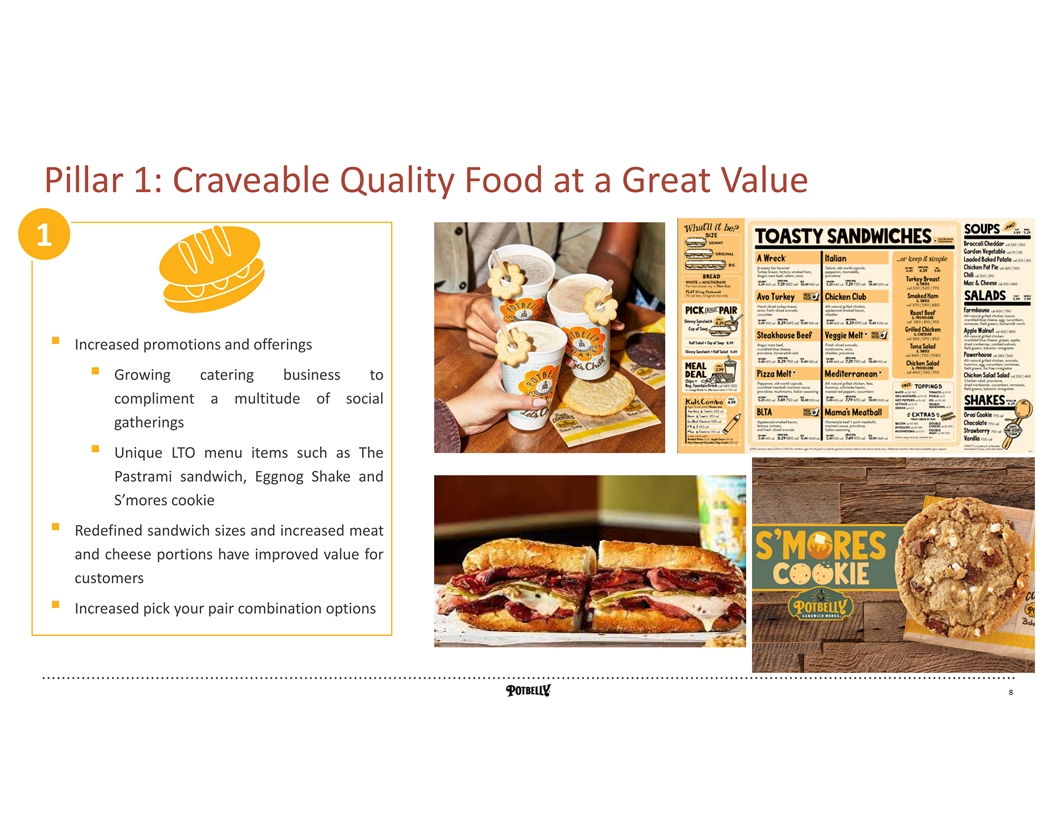

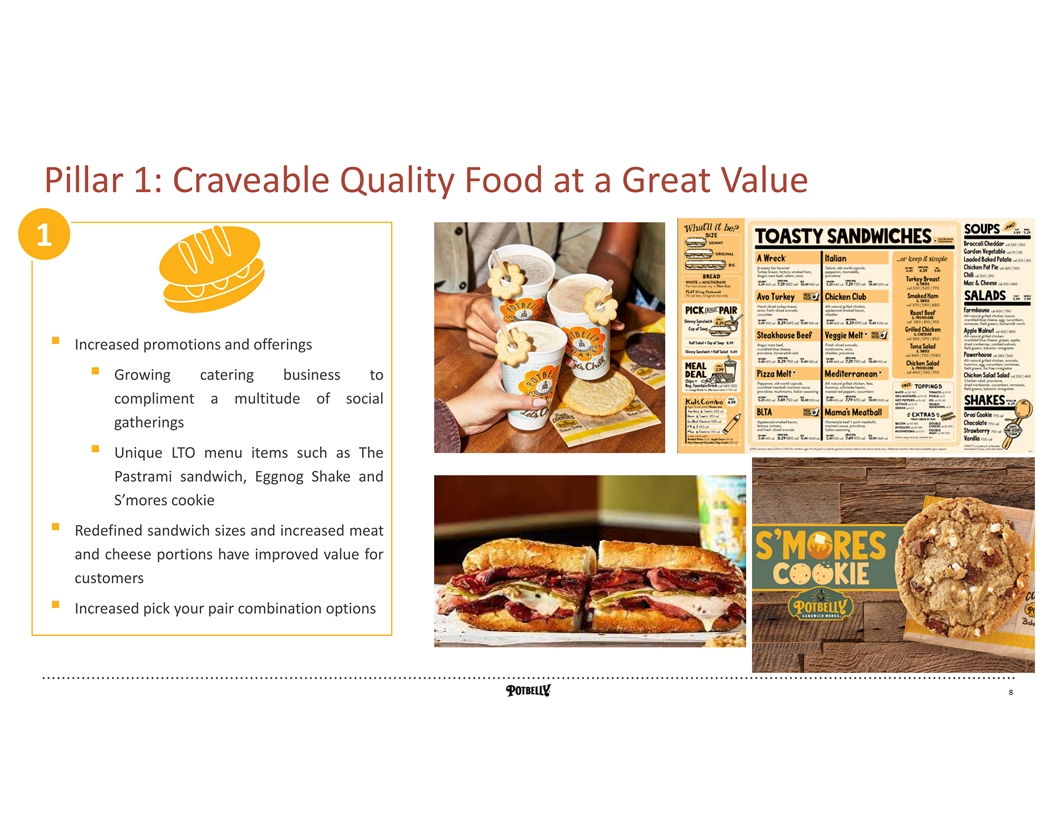

Pillar 1: Craveable Quality Food at a Great Value 1 § Increased promotions and offerings § Growing catering business to compliment a multitude of social gatherings § Unique LTO menu items such as The Pastrami sandwich, Eggnog Shake and S’mores cookie § Redefined sandwich sizes and increased meat and cheese portions have improved value for customers § Increased pick your pair combination options LEGAL DISCLOSURE 8

Pillar 2: People Creating Good Vibes 2 § Continue to embrace ‘Hire for attitude, train for skills’ mantra § Hours-based labor management improves deployment and employee performance while reducing cost § Implemented new employee retention and acquisition initiatives including referral bonus programs, pay band modifications, and digital tipping feature § Balanced score card system at shop level to align incentives around driving traffic and profitable growth LEGAL DISCLOSURE 9

Pillar 3: Customer Experiences that Drive Traffic Growth 3 § Focus on food quality, speed, throughput and cleanliness driving customer satisfaction and sales § Leveraging two-line kitchen to deliver digital and off premise business while maintaining in shop line speed and experience § Expanded testing and implementing in shop technology innovation platform ‘Potbelly Digital Kitchen’, designed to improve the employee experience and enhancement of speed, thru-put, accuracy and food quality § Staffing & training systems and materials simplified and updated for associates and managers § Successful campaigns with third-party partners like Grubhub and Uber Eats LEGAL DISCLOSURE 10

Pillar 4: Digitally-Driven Awareness, Connection & Traffic 4 § Continued positive customer response to app, website and digital order integration § Strong Perks loyalty program allowing for more personalization, easy re-ordering capability and targeted offers § Continual improvements in digital channels, with digital revenue representing ~38% of sales § Strong digital marketing campaign drives a balance of awareness, traffic, sales, and ROI LEGAL DISCLOSURE 11

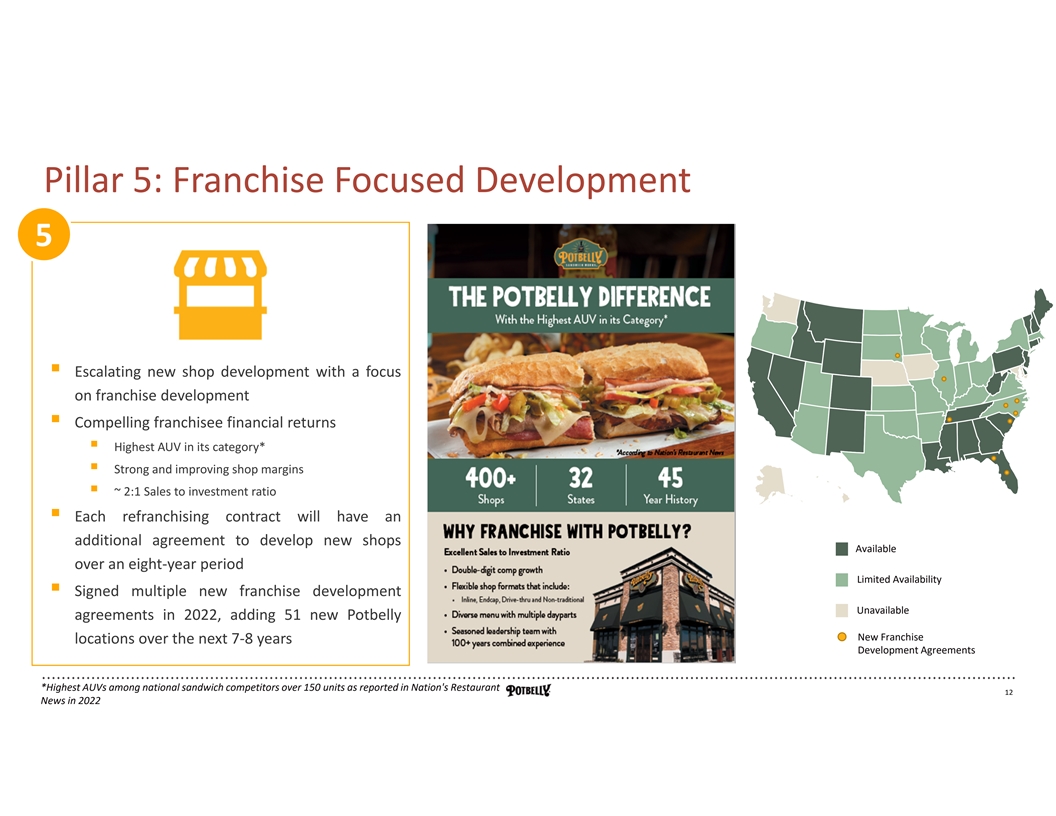

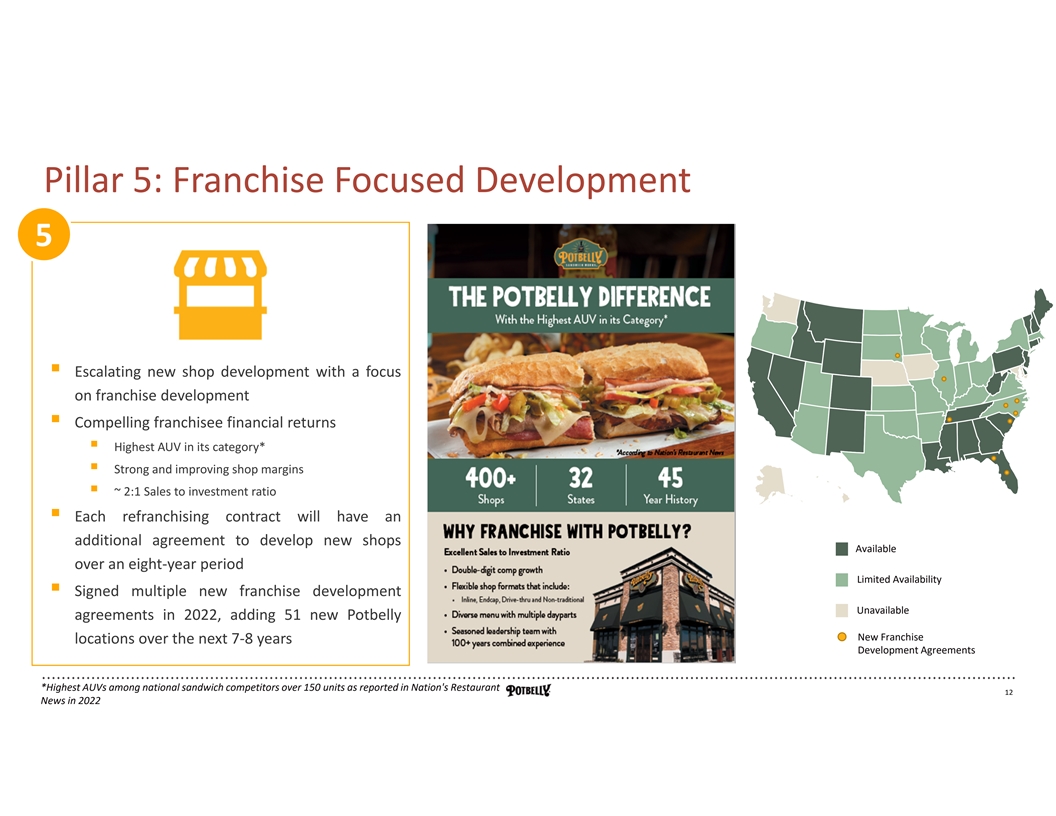

Pillar 5: Franchise Focused Development 5 § Escalating new shop development with a focus on franchise development § Compelling franchisee financial returns § Highest AUV in its category* § Strong and improving shop margins § ~ 2:1 Sales to investment ratio § Each refranchising contract will have an additional agreement to develop new shops Available over an eight-year period Limited Availability § Signed multiple new franchise development Unavailable agreements in 2022, adding 51 new Potbelly New Franchise locations over the next 7-8 years Development Agreements *Highest AUVs among national sandwich competitors over 150 units as reported in Nation's Restaurant LEGAL DISCLOSURE 12 News in 2022

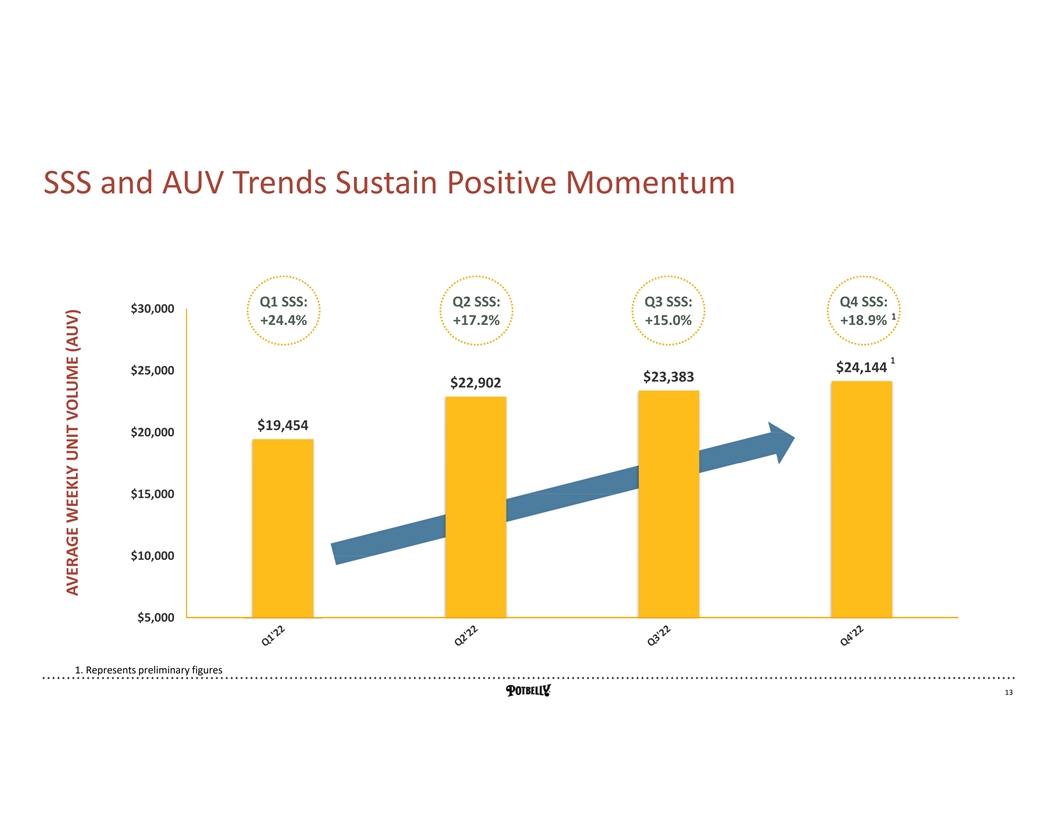

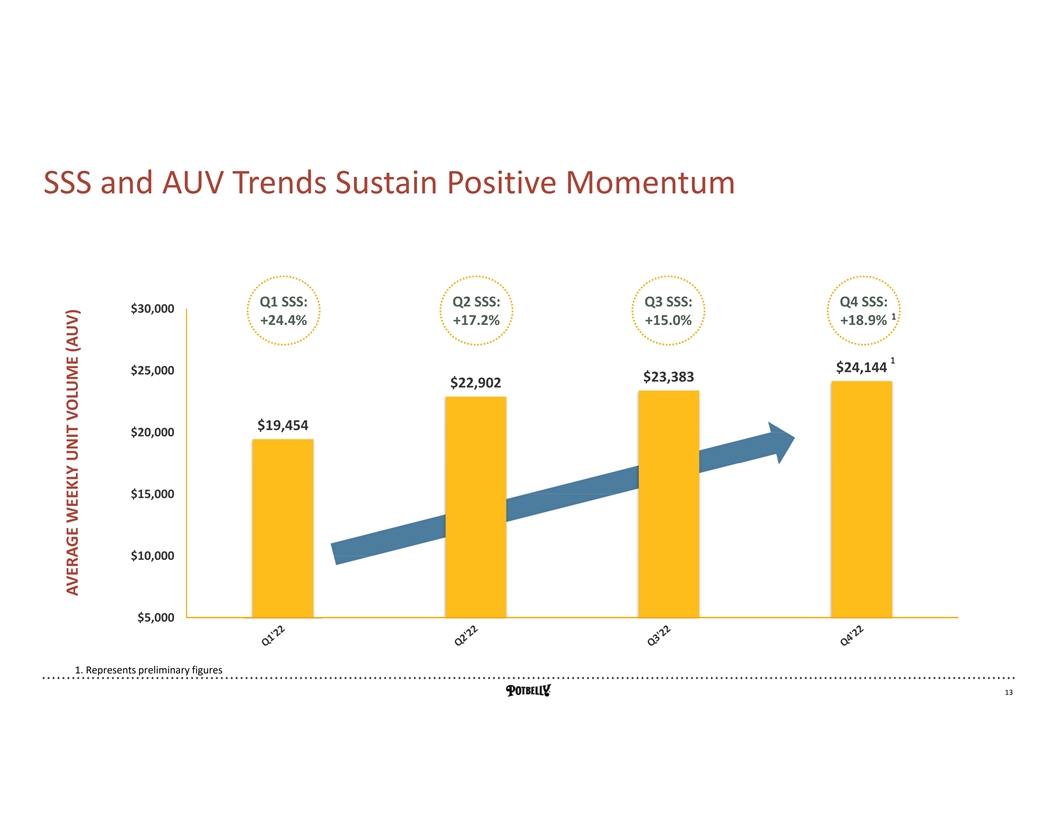

SSS and AUV Trends Sustain Positive Momentum Q1 SSS: Q2 SSS: Q3 SSS: Q4 SSS: $30,000 1 +24.4% +17.2% +15.0% +18.9% 1 $24,144 $25,000 $23,383 $22,902 $19,454 $20,000 $15,000 $10,000 $5,000 1. Represents preliminary figures LEGAL DISCLOSURE 13 AVERAGE WEEKLY UNIT VOLUME (AUV)

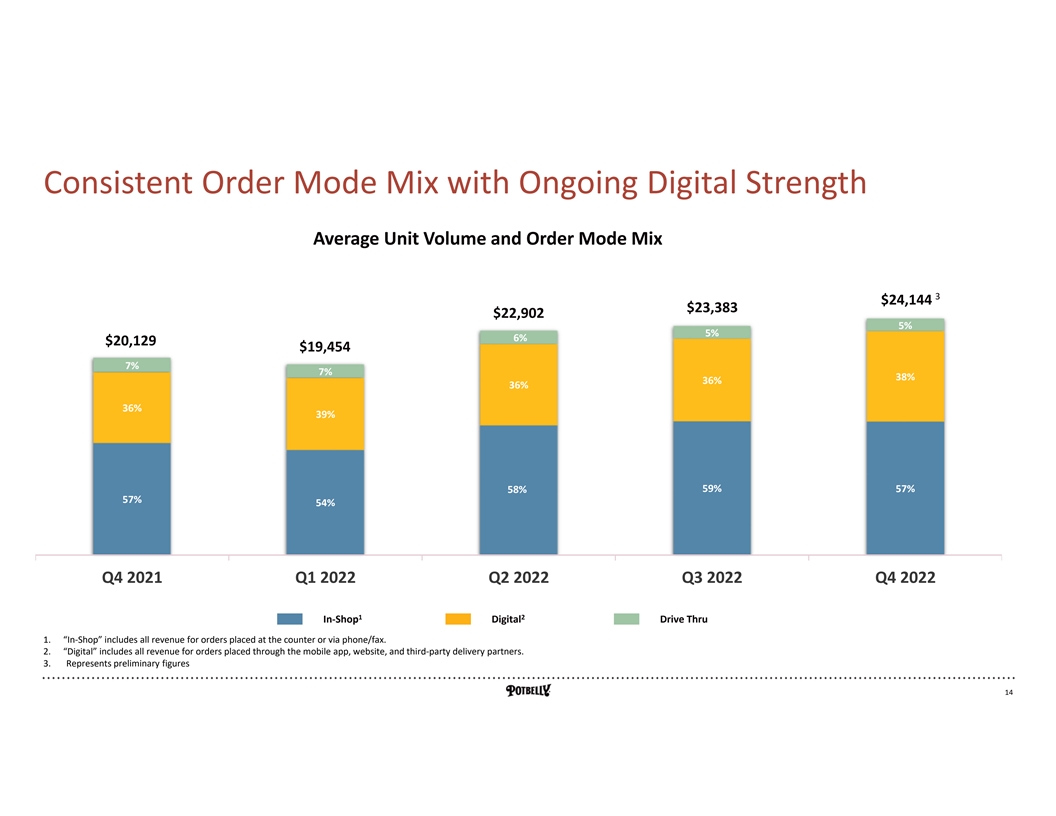

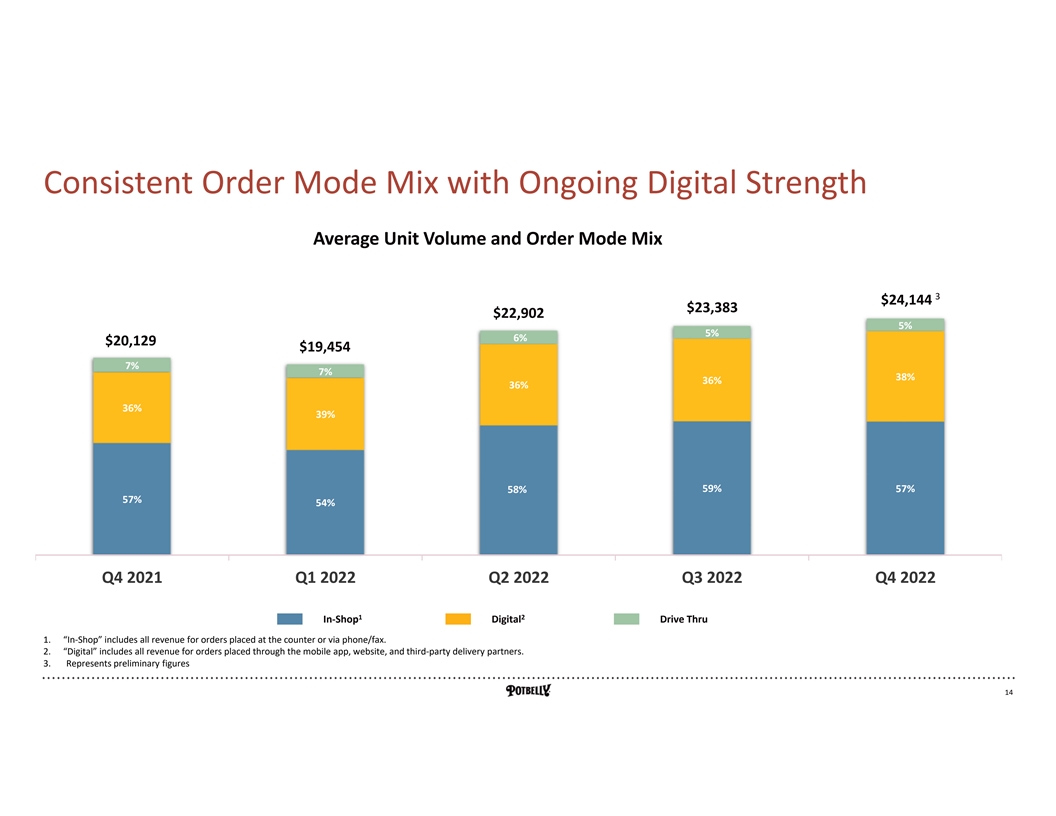

Consistent Order Mode Mix with Ongoing Digital Strength Average Unit Volume and Order Mode Mix 3 $24,144 $23,383 $22,902 5% 5% 6% $20,129 $19,454 7% 7% 38% 36% 36% 36% 39% 59% 57% 58% 57% 54% Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 1 2 In-Shop Digital Drive Thru 1. “In-Shop” includes all revenue for orders placed at the counter or via phone/fax. 2. “Digital” includes all revenue for orders placed through the mobile app, website, and third-party delivery partners. 3. Represents preliminary figures LEGAL DISCLOSURE 14

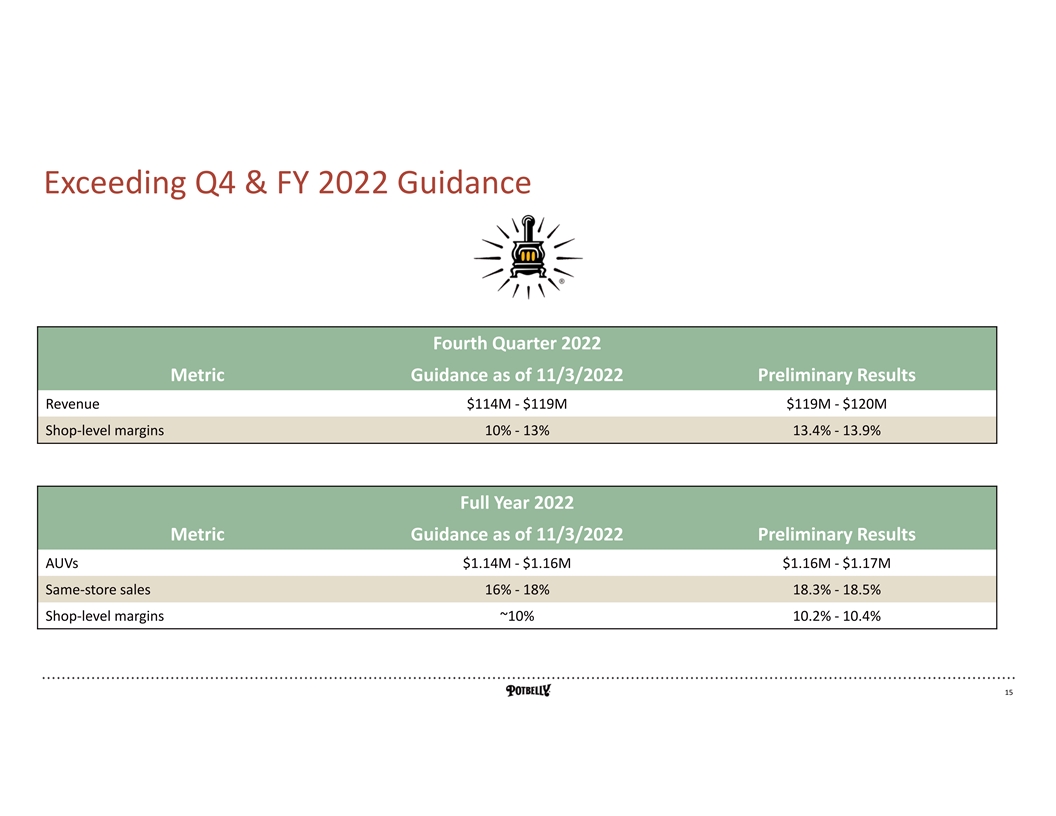

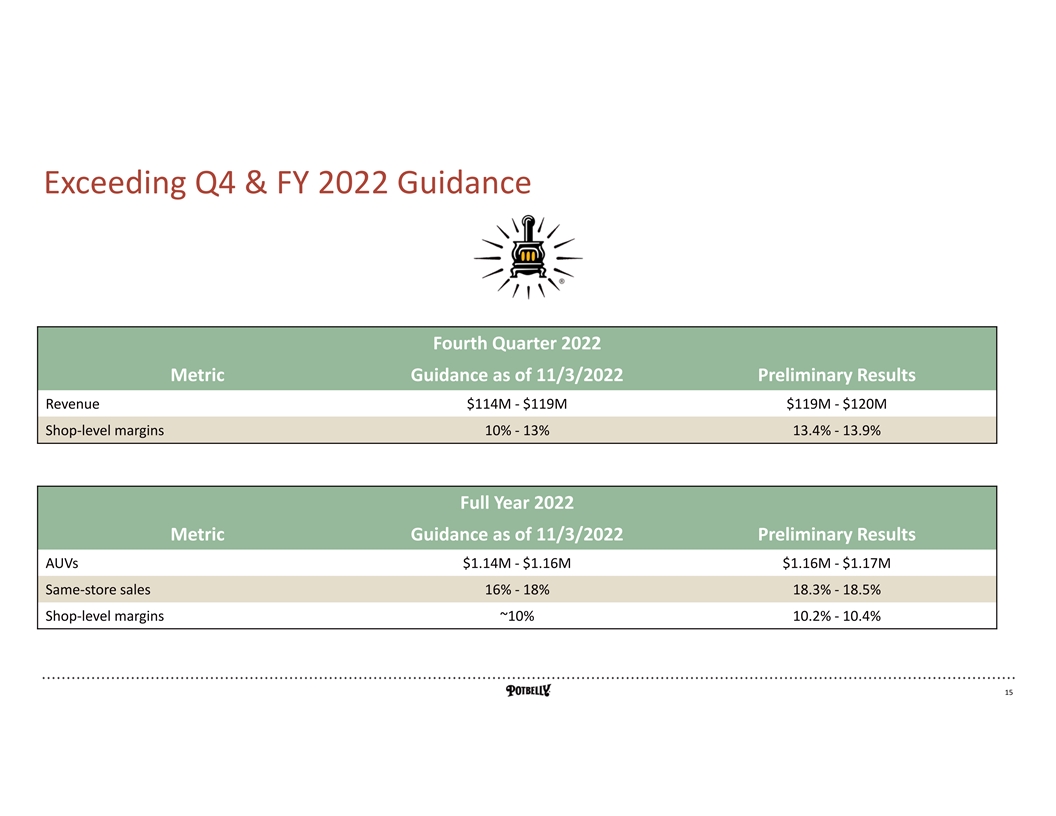

Exceeding Q4 & FY 2022 Guidance Fourth Quarter 2022 Metric Guidance as of 11/3/2022 Preliminary Results Revenue $114M - $119M $119M - $120M Shop-level margins 10% - 13% 13.4% - 13.9% Full Year 2022 Metric Guidance as of 11/3/2022 Preliminary Results AUVs $1.14M - $1.16M $1.16M - $1.17M Same-store sales 16% - 18% 18.3% - 18.5% Shop-level margins ~10% 10.2% - 10.4% LEGAL DISCLOSURE 15

2024 Strategic Growth Targets & Long-Term Unit Potential Volume & Profitability Franchise Growth Targets Acceleration Initiative AUVs à $1.3 Shop-Level Refranchise Franchise Unit Million Marginsà > 16% ~ 25% of Shops Growth à 10% § Sales leverage through execution § Provides catalyst for franchise § Franchisees attracted to strong § Continued customer experience of Five-Pillar Strategy unit growth Potbelly brand and economics enhancements and refreshed corporate branding § Effective management of supply § Drives new shop development in § Shop Development Area chain and food costs market – refranchising delivers 2- Agreements (SDAAs) of 10-20 § Increased digital marketing and 5:1 new shops : existing shops shops per agreement targeted loyalty engagement § Continue roll-out of Potbelly Digital Kitchen, improving § Appeals to high quality § Franchise First organizational § Expanded advertising investment operations franchisees mindset § Continued catering sales growth § Lower labor and shop operating § Focuses company capital § Market and trade area planning § Food innovation and LTOs costs through efficiency and and resources in existing and new markets technology Long-term goal of 2,000 total shops LEGAL DISCLOSURE 16

Why Invest in PBPB? Strong Brand, Differentiated Experience Authentic fast casual concept, with fresh, fast, & friendly service and high brand recognition across 400+ locations Strong Leadership Team Highly experienced executive leadership team with deep restaurant roots and a reinvigorated results-oriented culture Executing Against Five-Pillar Strategy Positive momentum driven by renewed focus on food innovation and promotions, leveraging of tech stack to drive an increase in user base and heightened engagement Focus on Volume and Profitability Targets NASDAQ: PBPB 2024 strategic growth objectives including $1.3M in annualized AUVs, shop-level margins of 16% with continued recovery across shop portfolio, targeted marketing/advertising and cost discipline Franchise Growth Acceleration Initiative Capital light franchise growth targets of refranchising ~25% of company- owned shops, achieving at least 10% franchise unit growth with long-term goal of ~2,000 shops LEGAL DISCLOSURE 17

APPENDIX: Q3’22 FINANCIALS & GAAP TO NON-GAAP RECONCILIATIONS LEGAL DISCLOSURE 18

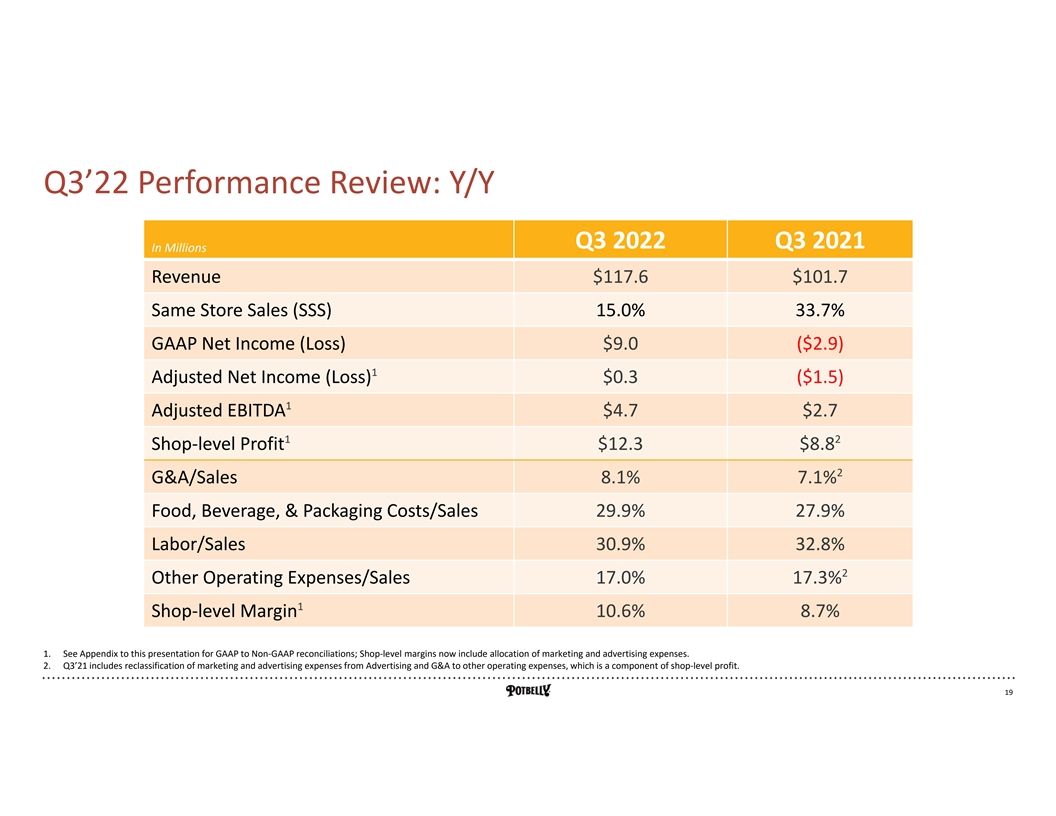

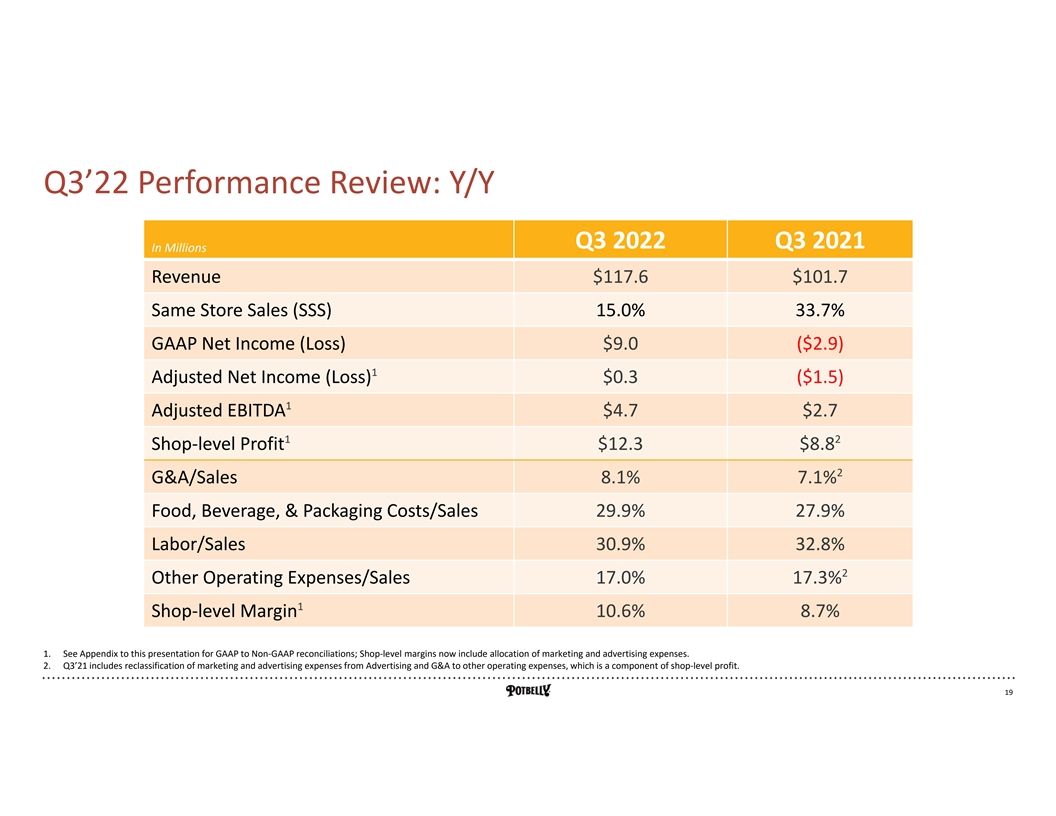

Q3’22 Performance Review: Y/Y Q3 2022 Q3 2021 In Millions Revenue $117.6 $101.7 Same Store Sales (SSS) 15.0% 33.7% GAAP Net Income (Loss) $9.0 ($2.9) 1 Adjusted Net Income (Loss) $0.3 ($1.5) 1 Adjusted EBITDA $4.7 $2.7 1 2 Shop-level Profit $12.3 $8.8 2 G&A/Sales 8.1% 7.1% Food, Beverage, & Packaging Costs/Sales 29.9% 27.9% Labor/Sales 30.9% 32.8% 2 Other Operating Expenses/Sales 17.0% 17.3% 1 Shop-level Margin 10.6% 8.7% 1. See Appendix to this presentation for GAAP to Non-GAAP reconciliations; Shop-level margins now include allocation of marketing and advertising expenses. 2. Q3’21 includes reclassification of marketing and advertising expenses from Advertising and G&A to other operating expenses, which is a component of shop-level profit. LEGAL DISCLOSURE 19

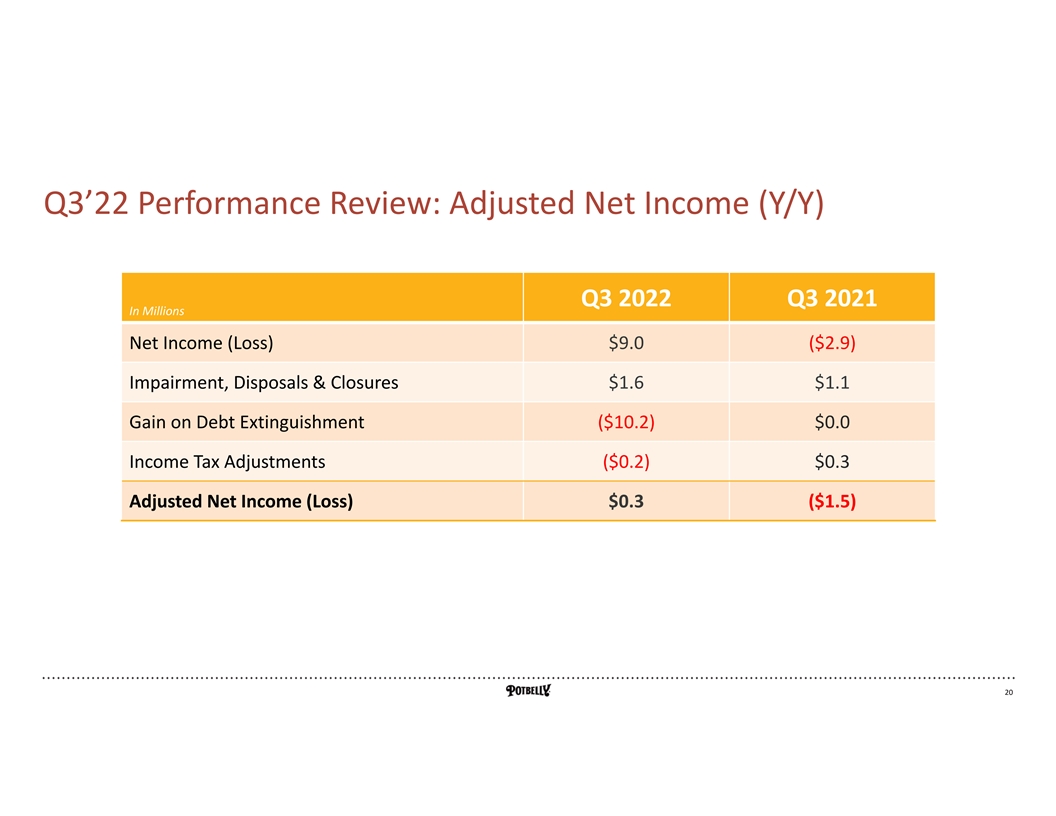

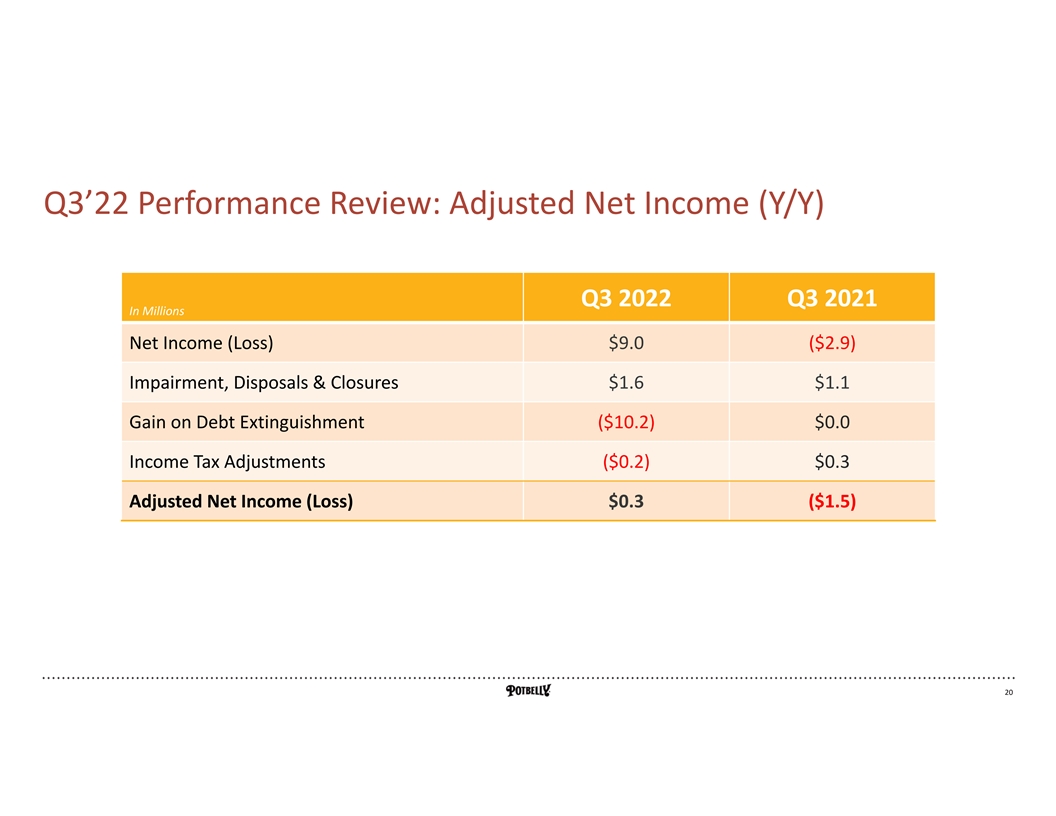

Q3’22 Performance Review: Adjusted Net Income (Y/Y) Q3 2022 Q3 2021 In Millions Net Income (Loss) $9.0 ($2.9) Impairment, Disposals & Closures $1.6 $1.1 Gain on Debt Extinguishment ($10.2) $0.0 Income Tax Adjustments ($0.2) $0.3 Adjusted Net Income (Loss) $0.3 ($1.5) LEGAL DISCLOSURE 20

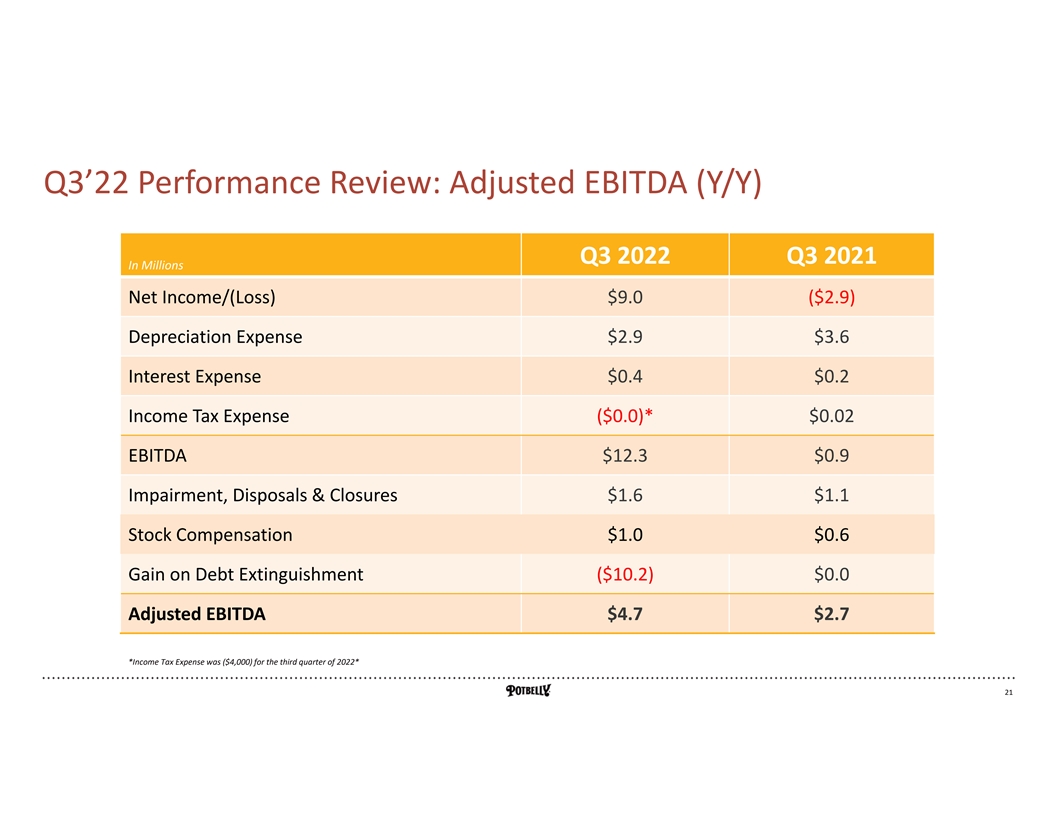

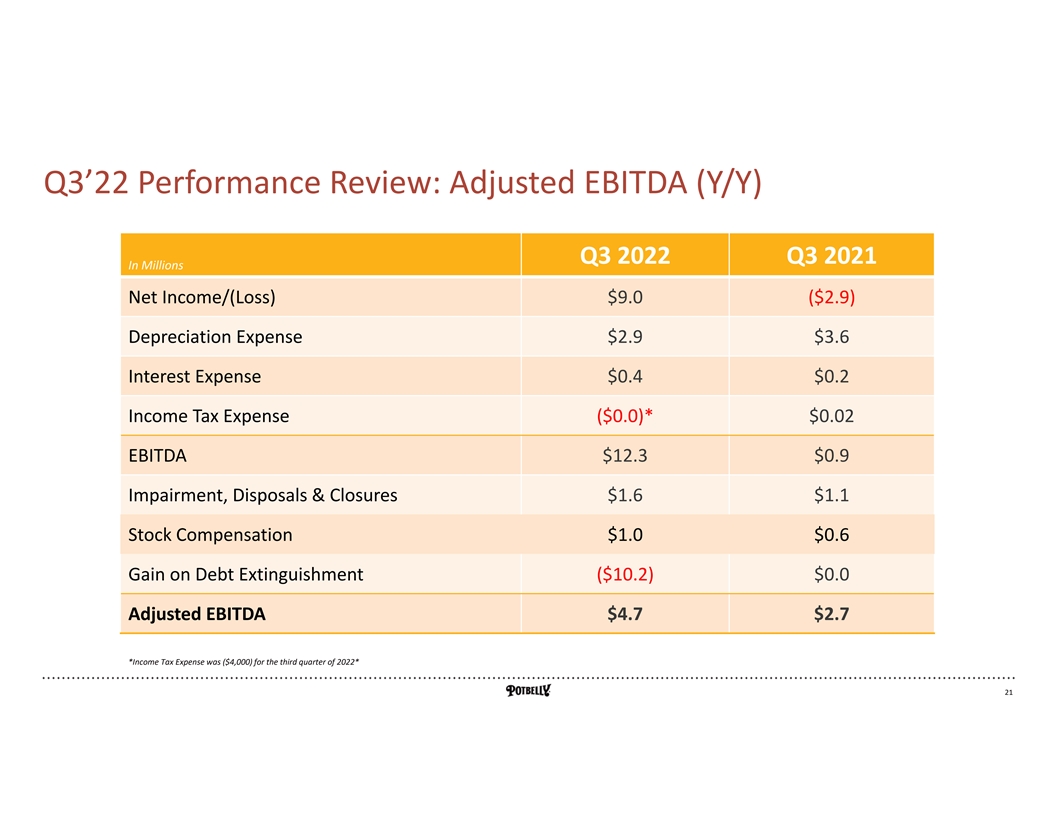

Q3’22 Performance Review: Adjusted EBITDA (Y/Y) Q3 2022 Q3 2021 In Millions Net Income/(Loss) $9.0 ($2.9) Depreciation Expense $2.9 $3.6 Interest Expense $0.4 $0.2 Income Tax Expense ($0.0)* $0.02 EBITDA $12.3 $0.9 Impairment, Disposals & Closures $1.6 $1.1 Stock Compensation $1.0 $0.6 Gain on Debt Extinguishment ($10.2) $0.0 Adjusted EBITDA $4.7 $2.7 *Income Tax Expense was ($4,000) for the third quarter of 2022* LEGAL DISCLOSURE 21

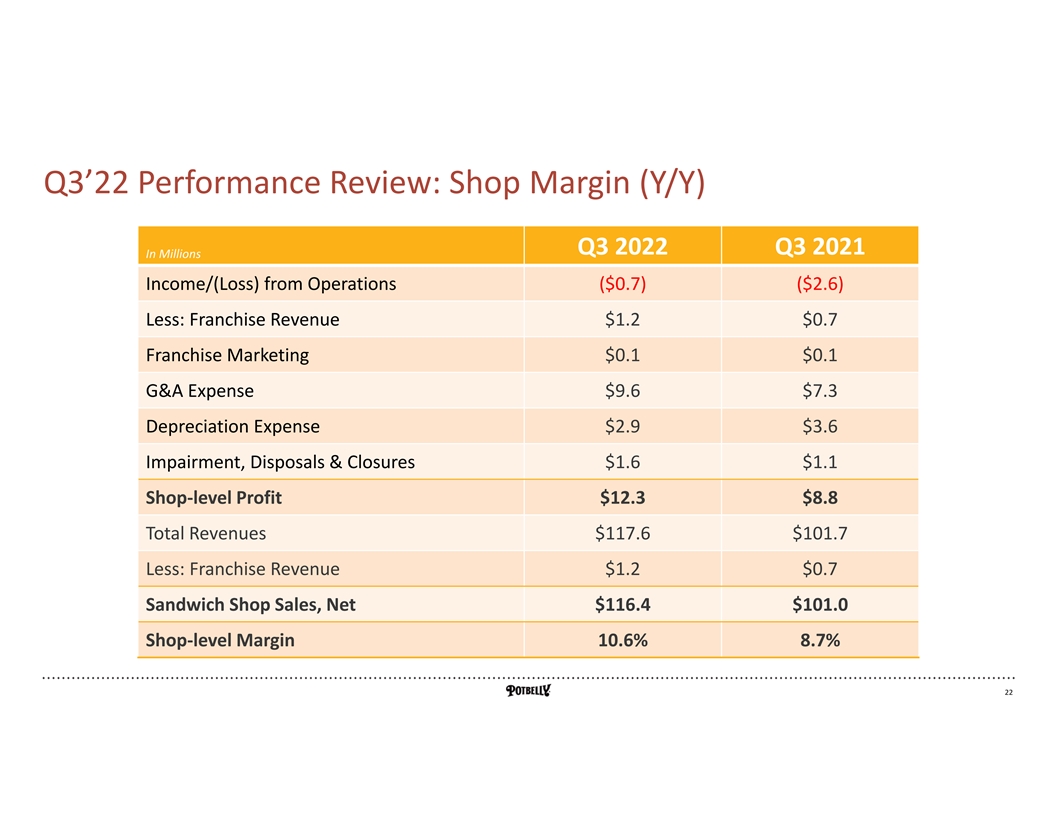

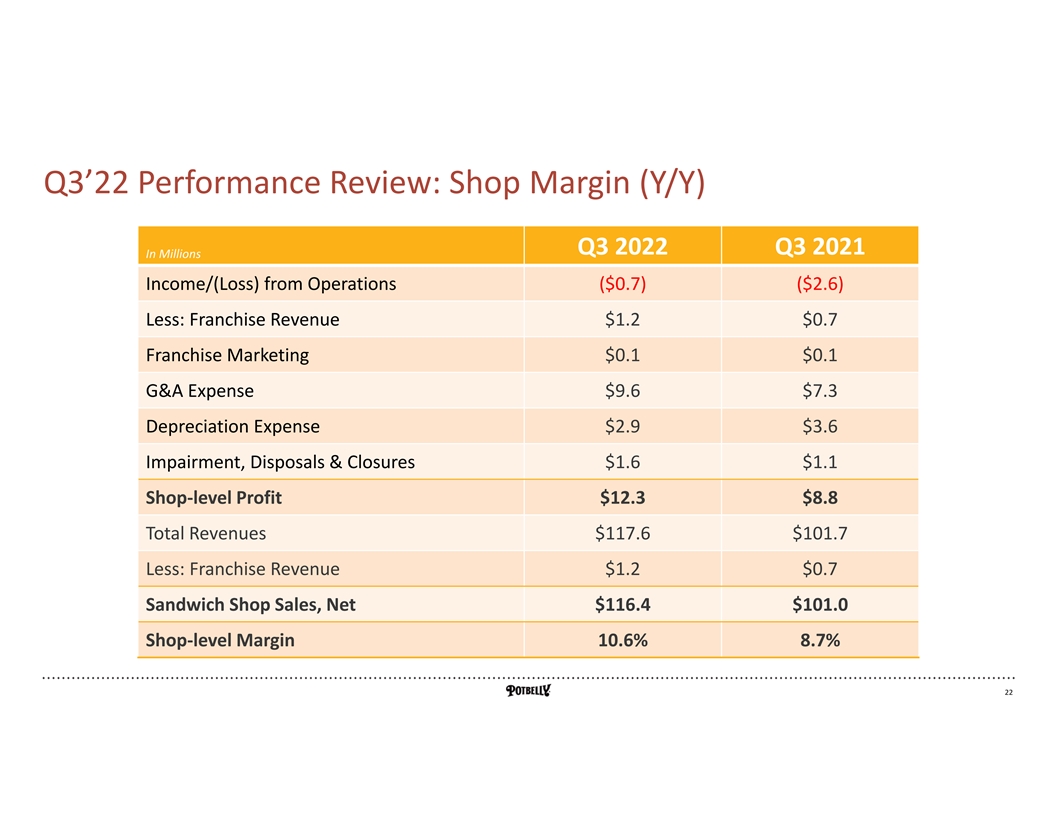

Q3’22 Performance Review: Shop Margin (Y/Y) Q3 2022 Q3 2021 In Millions Income/(Loss) from Operations ($0.7) ($2.6) Less: Franchise Revenue $1.2 $0.7 Franchise Marketing $0.1 $0.1 G&A Expense $9.6 $7.3 Depreciation Expense $2.9 $3.6 Impairment, Disposals & Closures $1.6 $1.1 Shop-level Profit $12.3 $8.8 Total Revenues $117.6 $101.7 Less: Franchise Revenue $1.2 $0.7 Sandwich Shop Sales, Net $116.4 $101.0 Shop-level Margin 10.6% 8.7% LEGAL DISCLOSURE 22

Use of Non-GAAP Measures Note Regarding Non-GAAP Measures We prepare our financial statements in accordance with Generally Accepted Accounting Principles (“GAAP”). Within this presentation, we make reference to EBITDA, adjusted EBITDA, adjusted diluted EPS, adjusted net loss, shop-level profit, and shop-level profit margin, which are non-GAAP financial measures. The Company includes these non-GAAP financial measures because management believes they are useful to investors in that they provide for greater transparency with respect to supplemental information used by management in its financial and operational decision making. Management uses adjusted EBITDA, adjusted net income and adjusted diluted EPS to evaluate the Company’s performance and in order to have comparable financial results to analyze changes in our underlying business from quarter to quarter. Adjusted EBITDA, adjusted net income and adjusted diluted EPS exclude the impact of certain non-cash charges and other items that affect the comparability of results in past quarters and which we do not believe are reflective of underlying business performance. Management uses shop-level profit and shop-level profit margin as key metrics to evaluate the profitability of incremental sales at our shops, to evaluate our shop performance across periods and to evaluate our shop financial performance against our competitors. Accordingly, the Company believes the presentation of these non-GAAP financial measures, when used in conjunction with GAAP financial measures, is a useful financial analysis tool that can assist investors in assessing the Company’s operating performance and underlying prospects. This analysis should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. This analysis, as well as the other information in this press release, should be read in conjunction with the Company’s financial statements and footnotes contained in the documents that the Company files with the U.S. Securities and Exchange Commission. The non-GAAP financial measures used by the Company in this press release may be different from the methods used by other companies. For more information on the non-GAAP financial measures, please refer to the table, “Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures.” Information reconciling forward-looking shop-level profit margin to GAAP financial measures is unavailable to the Company without unreasonable effort. The Company is not able to provide reconciliations of shop-level profit margins to GAAP financial measures because certain items required for such reconciliations are outside of the Company’s control and/or cannot be reasonably predicted. These items include but are not limited to impairment charges, gain or loss on asset disposals, shop closure costs, and restructuring costs that are difficult to predict in advance in order to include in a GAAP estimate and may be significant. Definitions The following definitions apply to these terms as used throughout this presentation: • Revenues – represents net company-operated sandwich shop sales and our franchise royalties and fees. Net company-operated shop sales consist of food and beverage sales, net of promotional allowances and employee meals. Franchise royalties and fees consist of an initial franchise fee, a franchise development agreement fee and royalty income from the franchisee. • Company-operated comparable store-sales or same-store traffic– represents the change in year-over-year sales or transactions for the comparable company-operated store base open for 15 months or longer. • Average Unit Volumes (AUV) – represents the average sales of all company-operated shops which reported sales during the associated time period. • EBITDA – represents income before depreciation and amortization expense, interest expense and the provision for income taxes. • Adjusted EBITDA – represents income before depreciation and amortization expense, interest expense and the provision for income taxes, adjusted to eliminate the impact of other items, including certain non-cash and other items that we do not consider representative of our ongoing operating performance. • Shop-level profit (loss) – represents income (loss) from operations excluding franchise royalties and fees, franchise marketing expenses, general and administrative expenses, depreciation expense, pre-opening costs, restructuring costs and impairment, loss on the disposal of property and equipment and shop closures. • Shop-level profit (loss) margin – represents shop-level profit expressed as a percentage of net company-operated sandwich shop sales. • Adjusted net income (loss) – represents net income (loss), adjusted to eliminate the impact of restructuring costs, impairment, loss on the disposal of property and equipment, shop closures, and other items we do not consider representative of our ongoing operating performance, including the income tax effects of those adjustments. • Adjusted diluted EPS – represents adjusted net income (loss) divided by the weighted average number of fully dilutive common shares outstanding. LEGAL DISCLOSURE 23

Investor Relations Contacts Investor Relations Contacts: Lisa Fortuna or Ashley Gruenberg Alpha IR Group 312-445-2870 PBPB@alpha-ir.com LEGAL DISCLOSURE 24