Q1 2003 Infinity Property And Casualty Corporation Earnings Conference Call

OPERATOR: Good day, ladies and gentlemen, and welcome to the Infinity Property and Casualty Corporation first quarter earnings call. At this time, all participants are in listen-only mode. My name is Nick and I will be your coordinator today.

If at any time during the call you require assistance, please press star, zero and a coordinator will be happy to assist you. As a reminder, this conference is being recorded.

I would now like to turn the program over to your host for today’s call, Amy Starling, Director of Investor Relations.

AMY STARLING, DIRECTOR OF INVESTOR RELATIONS, INFINITY PROPERTY & CASUALTY CORPORATION: Good morning, and thank you for joining us for Infinity Property and Casualty Corporation’s first quarter earnings conference call.

If you’re reviewing the Website’s, Webcast from our Website, you can follow along with the slide presentation, if you’d like.

Certain statements may be made during this call that may be seen to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934.

All statements in this call not dealing with historical results are forward looking and are based on estimates, assumptions, and projections. Statements, which include the words, “believe,” “expect,” “may,” “should,” “intend,” “plan,” “anticipate,” “estimate,” or the negative version of these words and similar statements as a future or forward-looking nature identify forward-looking nature identify forward-looking statements. Examples of such forward-looking statements include statements relating to Infinity’s expectations concerning market and other conditions, long-term financing, future premiums, revenues, earnings, and investment activities, expected losses, rate increases, improved loss experience, and expected expense savings resulting from consolidations of the operations of our insurance subsidiaries.

Actual results could differ materially from those expected by Infinity depending on changes in economic conditions and financial markets, including interest rates, the adequacy or accuracy of our pricing methodology, the presence of competitors with greater financial resources in the impact of competitive price, the ability to obtain timely approval for requested rate changes, judicial and regulatory developments adverse to the automobile insurance industry, the outcome of pending litigation against Infinity, weather conditions (including the severity and frequency of storms, hurricanes, snowfalls, hail and winter conditions), changes in driving patterns and loss trends, acts of war and terrorist activities, and the challenges posed by consolidating the operations of insurance expidarity (ph). Infinity undertakes no obligation to publicly update or revise any use of forward-looking statements. For more detailed discussion of some of the foregoing risks and uncertainties, please see Infinity’s filing with the Securities and Exchange Commission.

And now, let me introduce Jim Gober, President and CEO of Infinity.

JIM GOBER, PRESIDENT & CEO, INFINITY PROPERTY AND CASUALTY CORPORATION: Good morning. Welcome to Infinity P&C’s Webcast for the first quarter of 2003. We continue to be excited about Infinity’s prospects and are committed to executing our business plan, certainly delivering the company and the results we discussed with you during our visits while on the Otheo (ph) Road Show, or during the fourth quarter 2002 Webcast, just a little over a month ago.

We’re here today, though, to talk about our 2003 first quarter results that we released yesterday evening. Following our initial remarks, we’ll open the lines up for questions.

I’d like to start out by saying that I’m very pleased with our first quarter results. I’ll expand on this in detail a little later, but here’s the three major highlights I want to cover with you.

Number one, we continue to see improvement in our combined ratio, as compared to the prior year. Number two; we continue to concentrate our efforts on the target states that offer the best prospects for underwriting profitability and growth. And, number three; we do continue to reap expense savings from a consolidation effort.

For those of you that’s following the Webcast, if you will, turn to slide number three. Here, you’ll see a comparison of Infinity versus the insurance industry, the personal lines industry. And, as you can see, we continue to have improvement in our combined ratio over 2002. As compared to the first quarter of 2002, our combined ratio actually improved by 4.3 points, from a 99.5 to a 95.2.

Again, we do outperform the overall industry. I think A.M. Best is projecting that the personal insurance industry’s combined ratio for 2003 should be about a 102.7. I don’t think we have any industry actual combined ratios for the first quarter, yet. But, in our belief, we think that the industry is still well above a 100 combined.

If you’ll turn to slide number four, you know, what’s driving the underwriting improvement for Infinity? You know, a number of things. The rate increases, certainly, we took in 2002, 12 percent. That’s very significant. Also, accident frequencies are lower. They declined in the first quarter. Evidently, that’s been pretty common in our industry. And, it’s always a challenge to pinpoint the cause. Gosh, we’ve heard all kinds of reasons, everything from gasoline prices certainly being lower; the CNN effect from the Iraq War, I guess. The improvement, though, also in better than average conditions for us. In particular, in California, which makes up a big part of our business, in terms of the claims severity trends have been moderate. The severity trends on BI (ph) claims were up, although they were still within comparable ranges within the industry numbers. And, I want to remind everyone, also, keep in mind that over 90 percent of our business is still written at minimum statutory limits. So, again, our claim files are not going to be open as long as perhaps those of some other companies that are writing higher limits. And, therefore, we’re less prone to medical cost inflation.

In terms of the severity trends on material damage claims, I refer to that as sort of the metal to metal claims, collision claims, property damage claims, that was slightly higher than we expected for the first quarter, although not, again, surprising. I think part of it was just due to the fact that our mix of business is changing somewhat. We’re writing more newer vehicles than we, perhaps, did. That’s, certainly, in the first quarter of ‘02.

In terms of our continued focus on our key states, that, again, is the big part of our plan, while, at the same time, exiting the unprofitable states. This is going to cause an overall improvement in a combined ratio. And, also the consolidation effort. I mentioned that as the third highlight. You know, we’ve talked about it in the past, that Infinity was four separate companies. Each company had separate management systems, personnel. We also discussed with you in the past that we began two years ago, actually, to consolidate all of these separate operations in order to eliminate the redundancies that we had among the companies. And, from actions taken in 2002 toward that end, we were able to generate savings of $13 million; four million of which we enjoyed in ‘02; nine million, which we will enjoy in ‘03.

And, another footnote, just to keep in mind, also, for the first quarter of ‘03, those consolidation efforts continue. We’ve also attacked our business development area, product management, customer service. We’re making some changes there; continuing to look at other expenses, office closings, things of that nature that could still impact our expense as far as savings going forward.

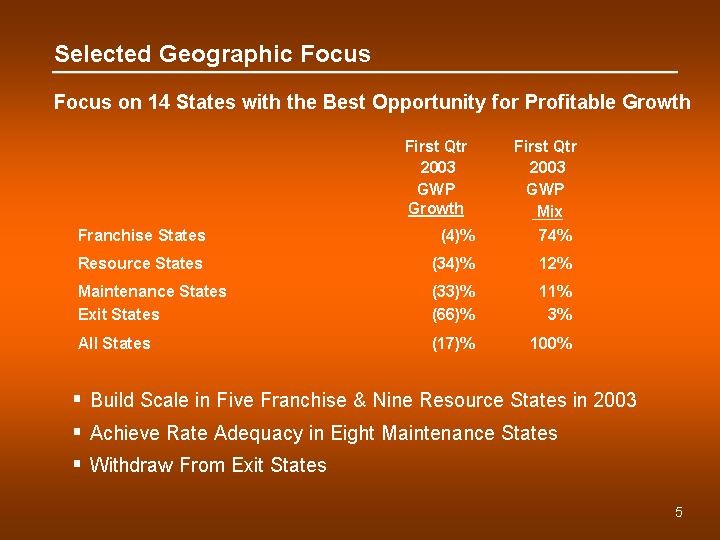

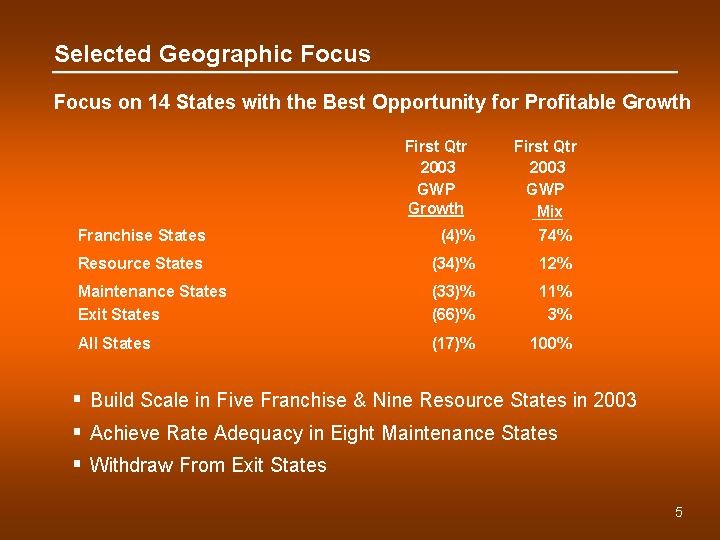

On slide five, in terms of our geographic focus, you know, we’ve talked in the past about our 25 focus states. For 2003, really, we’re focusing on 14 states with the best opportunity for profitable growth. And, we’ve broken down, actually, our states, those 25 states in total into four categories.

Our franchise states, that’s where 74 percent of our current volume is today. Those states consist of California, Florida, Georgia, Pennsylvania, and Connecticut. And, that’s where we’ll have the primary emphasis for growth this year.

All right, if you look at our resource states, we’ve got nine states in that category, about 12 percent of our volume. We do have emphasis, this year, on shaping up our product lines in those states. And, we’re looking for late ‘03 growth. Really, that’s the time when we think those states will start kicking off for us, as far as our growth prospects are concerned.

And, then we have maintenance states. There are eight states in that category, about 11 percent of our current volume. And, those are states where we currently have a credible book of business. We want to maintain our presence there, but we’re really not looking to grow this year, or in early 2004 in those maintenance states. Again, maintain our book of business, but no growth there in the near term.

And, again, these three categories that you’re looking at here do make up the focus states that we discussed with you last quarter.

In the franchise states, I want to make a couple of other comments about those states. The premiums did decline modestly from about four percent for the first quarter of ‘03, compared to ‘02. California, which is our largest state, makes up, now, over 40 percent of our total gross premium volume. That’s in the first quarter. That state grew by 20 percent. So, we’re very, very pleased with that.

I know in the first quarter, excuse me the fourth quarter 2002 Webcast, I mentioned also that we were refilling rating plans, policy forms, in several of our top focus states. And, I’m very, very happy today to report that we will begin writing new business in our new Georgia program on May 5, and we’re scheduled to introduce our new Florida program in late next month, late in May.

We also have new programs in Pennsylvania and Connecticut slated for introduction in July and August. And we expect the premium and policy counts in these four states will grow once these programs are on the street. So, that’s very, very good news; exciting times for us coming ahead.

In terms of the resource states, again, premiums down by about 34 percent in the first quarter, as compared to 2002 first quarter. Keep in mind, we raised rates 12 percent in ‘02, you know, well ahead of the competition and, certainly, the marketplace. And, some of that reduction is due to that. Although, if you look at policy counts, actually from December ‘02 to March ‘03, the policy counts have actually slowed to about seven percent. You know, that’s compared to about 11 percent from September to December of ‘02. And, again, competitors are still playing catch-up on rates.

And, just another footnote, if you want to look at the fourth quarter ‘02, compared to first quarter ‘03, actually in those resource states, we’re still up about 11.4 percent, which is still good and still executing on the plan that we discussed with you.

In terms of maintenance states, again, premiums were down. Some heavy rate increases in those states in ‘02. Half of that decline was in New York. You know, we were able to get some rate increases implemented in New York, but we’re still not at levels that I’m comfortable with, certainly, at this point in time. So, still some work to be done there.

You know, the exit states, we’re continuing to aggressively shrink that business. Those are non-focus exit states for us, and we’re happy with the progress we’ve made there. Again, as we’ve told you before, our goal is to be completely out of those exit states by the third quarter of this year.

Again, by the third quarter, though, we do expect growth in our in-force policy count, overall, and that’s good news, also.

One other point I wanted to make in terms of California and the growth for this year. You know, the cause of the exit states impact they’re having on us, certainly, the increases that we’ve taken, we’re really looking at overall gross written premium for this year to be pretty flat, maybe a little bit down from ‘02, but we should see fairly healthy growth this year in the top five franchise states. You know, again, I mentioned the writing plans that we’ve got coming up here next month in July and August. That’s not limited to California, either. That’s a pretty healthy growth, overall, in the top five states.

On page, on slide six, if you will, turn to that. It gives you another recap of the rate actions that we’ve taken. And, we talked to you before about the fact that we were ahead of the competition in taking rates, and certainly, that’s still the case.

You know, we’re now comfortable with our rate structure, especially in our focus states. So, rate increases for Infinity in ‘03 will moderate to account for really inflationary-type trends. We do intend to stay ahead of inflationary-type trends, and again, you know, you’re looking at something in the four to six percent rate increase range for ‘03, which should serve that goal very well.

You know, again, industry is still catching up on rates, combined ratios, in our opinions, still well above 100. So, we’re still seeing many companies taking really significant rate increases re-underwriting their renewals. And, the overall industry shows a rate increase of about nine percent in ‘03 at this point in time.

So, I’m going to turn the presentation over to Roger. Roger’s our Chief Financial Officer, and he’s going to get into some detail with you on the financial results.

ROGER SMITH, CHIEF FINANCIAL OFFICER, INFINITY PROPERTY AND CASUALTY CORPORATION: Thanks, Jim, and good morning. I’m going to discuss the financial results for the first quarter 2003. For your information, our Website provides more detailed quarterly financial data, including what I discuss today, in a convenient Excel spreadsheet. The Website iswww.ipacc.com. You’ll find the detailed spreadsheets under the quarterly reports tab on the investor relations page of the Website. And, the definition of reconciliation of non-GAAP items can also be found on sheet 10 of that spreadsheet.

In addition, we just posted, recently, our consolidated annual statement for 2002. That’s also found on the Website under the annual reports section.

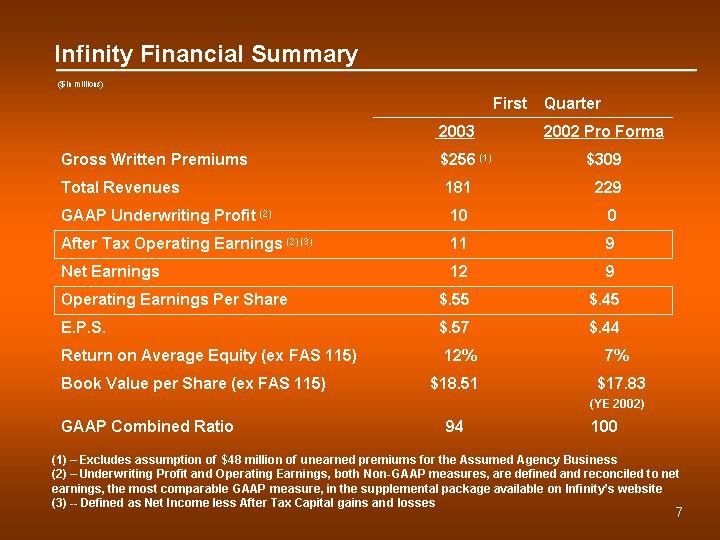

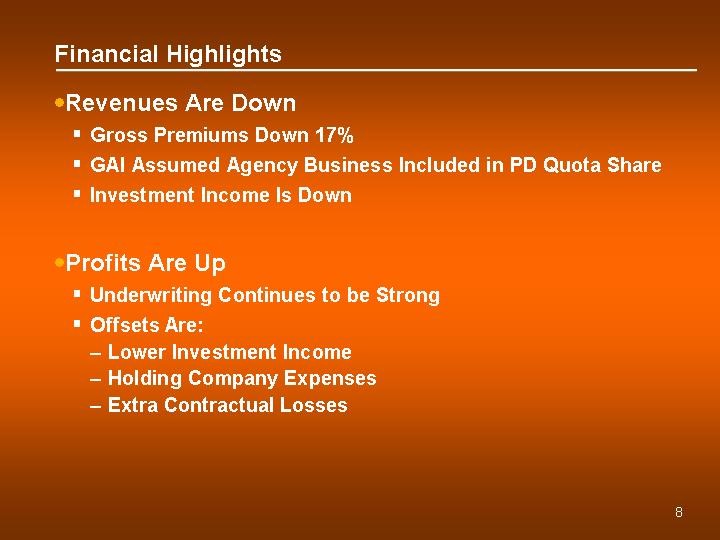

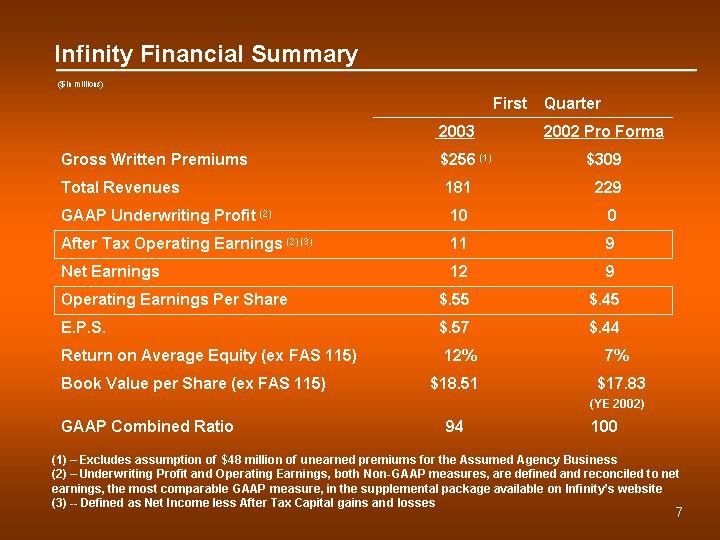

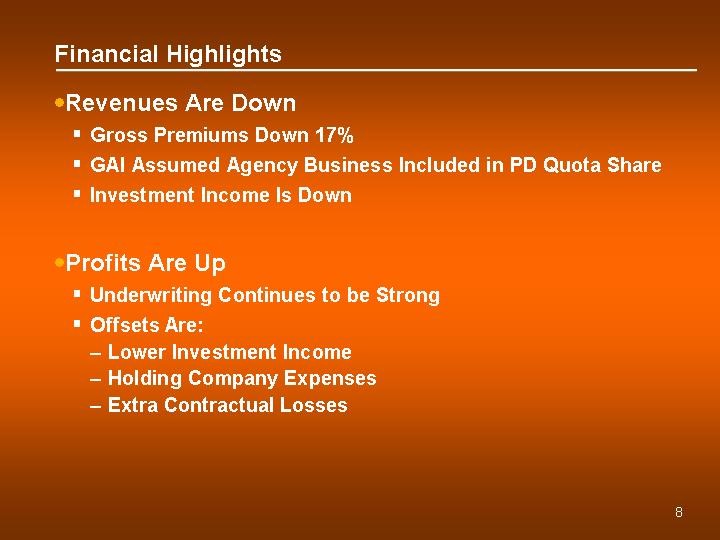

Now, let’s first turn to an overview of the financial results on slide number seven. It’s kind of a busy slide, but the punch line is that, you know, gross premiums and revenues are down, and profitability and ROEs are up. And, on page eight, which summarizes the discussion of why it is what it is, it’s summarized on page eight. So, we’ll talk about that right now.

Revenues are down about 21 percent. Jim’s already talked about the gross rate and premiums being down about 17 percent, so I won’t spend a lot of time on that. In addition, for the first quarter of 2002, compared to 2003, we began seeding some premium under the physical damage quarter share for the assumed agency business beginning in late 2002, so we have about 11 million sessions in the first quarter of 2003 for that business that we didn’t, obviously, see it in early 2002 first quarter.

Investment income on a gross basis, gross of expenses, is down about $4.6 million. About half of that is attributed to just a smaller portfolio. As you recall, our prior parent, American Financial, took some dividends out in late 2002.

Secondly, just the other half of the reason for the decline in the investment income was just lower investment yields. For example, from March of 2002 to March of 2003, the overall book yield on the portfolio for fixed incomes security has dropped about 60 basis points. New money rates, now, are about five percent for us. For 2003, about 12 percent of our portfolio, somewhat, will mature. So, between those two reasons, that’s the reason for the investment income decline.

Profits are up. Jim’s talked about the underwriting performance. Offsetting the increase of about $10 million of pretax underwriting income, as I mentioned, the $4.6 million reduction in investment income. In addition, we have holding company expenses in the first quarter of about $1 million. We were not public last year, so the 2002 first quarter numbers don’t have holding company expenses in those. And then, we also had an increase of about $1 million in extra contractual charges. The first quarter of 2002 was just a light year for extra contractual expenses, for example bad faith claims. So, this year, it’s more of a steady run rate. We did have one large claim in the first quarter. It was a death claim in California for about $600,000, explaining the increase over 2002.

Some of the extra contractual charges that we’ve taken, and, of course, we will take in the future because it’s kind of the cost of doing business, might be eligible for indemnification under the American Financial Indemnification that we discussed last quarter.

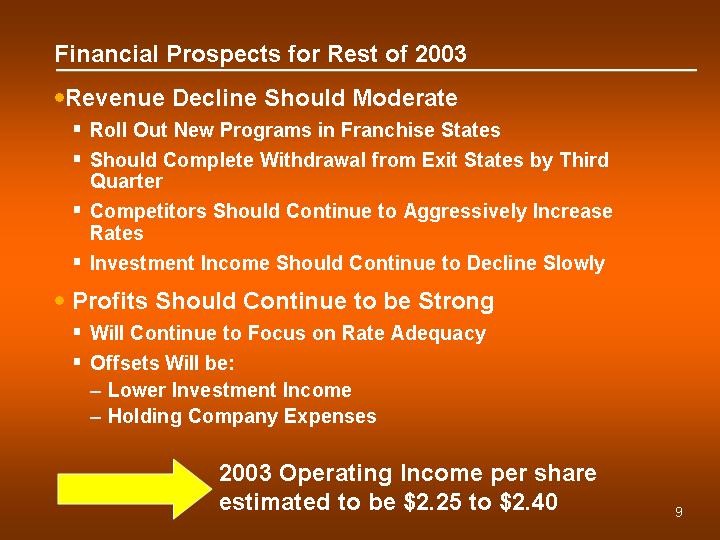

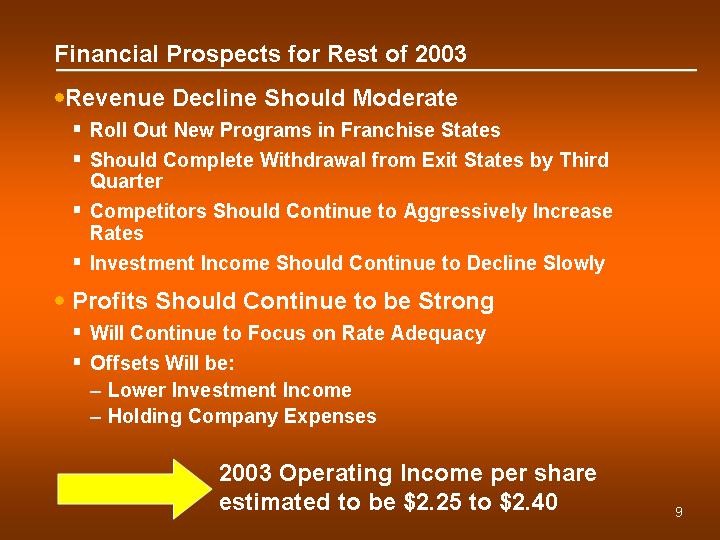

On slide number 9, in terms of prospects for the rest of this year, and how is this year shaping up for us. The revenue of the clients, as Jim talked about, should moderate, and actually turn positive on a quarterly basis, by year’s end. By the middle of the second quarter to third quarter, we’ll have the key programs, new forms, and rates approved and rolled out in the four franchise states of Florida, Georgia, Pennsylvania, and Connecticut. That should be a positive on premiums for the end of the year.

We should complete our exit, from the withdrawal from the exit states by the third quarter. New Jersey, for example, should be completely rolled off our books by the third quarter.

Competitors will, some of our competitors will continue to take aggressive actions on rates, and that will, essentially, narrow the rate differential between ours and their rates, making our rates more competitive. And, in the offsets of investment income being lower, essentially, because of market yields, and in the holding company expenses will dampen, a little bit, the effect of the underwriting, the improvement underwriting results.

So, all told, we see that, in terms of what this year is shaping up to be on an operating income per share basis of a range of two, two and a quarter, to $2.40.

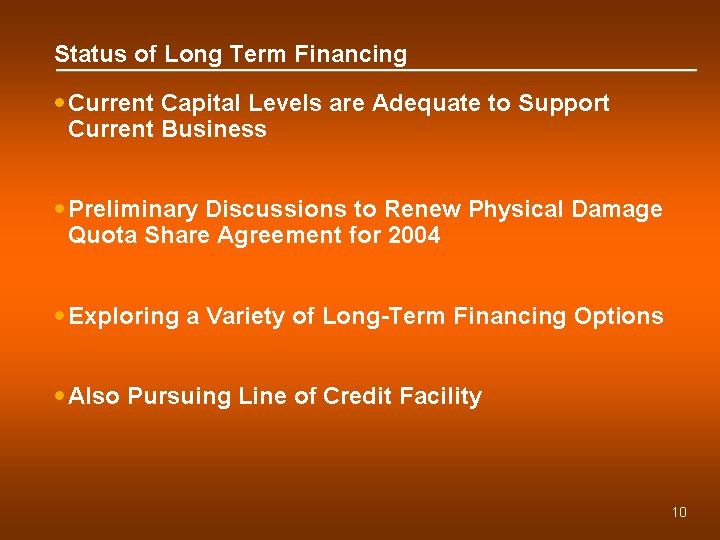

Last quarter, we talked a little bit about the long-term financing and, again, it was only a month ago, believe it or not, so I just wanted to give you a little bit of an update on that. Keep in mind that our current capital structure is more than adequate to support our business. Our premiums are down. Our surplus on a statutory basis is about $325 million, currently. We’re riding at about a 2.2 to one premium surplus ratio, so that’s more than adequate to support the business. We have the reinsurance, the physical damage reinsurance agreement, in place for the rest of this year.

In addition, we have begun preliminary discussions with our reinsurer to renew the physical-damage, quarter share agreement for 2004. We’re also exploring a variety of long-term financing options. So, we are pursuing that and by the next quarterly Webcast, we’ll be able to apprise you on our status there. And, then, as we mentioned last time, we’re also pursuing a line of credit facility.

So, in short, for this year, we certainly have more than adequate capital, and we’ll give you an update on the long-term financing in the next quarter’s Webcast.

So, now, we’ll open it up for questions.

OPERATOR: Thank you. Ladies and gentlemen, if you wish to ask a question, please press star, one on your telephone keypad now. If your question has been answered, or you wish to withdraw your question, please press star, two. Questions will be taken in the order received. Please press star, one now, if you have a question. We’ll just pause for questions.

Ladies and gentlemen, once again, star, one to ask a question this morning.

Our first question comes from Rob Maton (ph) of Schneider Capital (ph). Please go ahead, sir.

ROB MATON (ph), SCHNEIDER CAPITAL (ph): Good morning.

UNIDENTIFIED PARTICIPANT: Good morning.

UNIDENTIFIED PARTICIPANT: Good morning.

MATON (ph): You guys may have said this on the last call, but, basically, in your core states, other than California, am I correct that you haven’t been accepting any new business because you’re waiting to get the rating plans approved?

GOBER: Yes, Rob. This is Jim Gober. Actually, in the states of Georgia and Florida, we shut down new business in several of the rating plans in those states probably late second or third quarter of last year. And, as we talked about in the last conference call, I mentioned the rating plans pending with the DOI (ph). And, again, the good news, of course, is that we’ve got the Georgia program approved, and we’re very close on Florida and anticipate a late May introduction there, as well.

So, we’re excited about that and are very confident and comfortable with those rating plans that the rates are competitive, they’re adequate, and it’s going to allow us, really, to get back on track and start writing business in those states going forward.

So, yes, you’re correct.

MATON (ph): OK. And, historically, do you know, roughly, what kind of a differential you’ve had in your loss ratio between new and renewal business?

GOBER: You know, I can’t give you a specific number. We do know that renewals do perform, certainly, than new business, but, Rob, I really don’t have a specific percentage point differential I can quote or lay my finger on right now in front of me.

MATON (ph): OK. Then, unrelated, in the quarter, was there any positive or negative development on prior year reserves?

SMITH: We had for the overall book, about a $4 million unfavorable development that was primarily driven by some losses on New York personal injury protection PIP (ph). In addition, we had a little bit of BI (ph) development on the AC (ph) book in Florida and South Carolina.

We did, on the other books of business, and California is a good example of that, if we had favorable development on losses offset slightly by a little bit of unfavorable in (INAUDIBLE). But, overall, about a four million, four to five million dollar development on the first quarter.

MATON (ph): OK.

GOBER: One comment, Rob, about New York. You know, I mentioned that state not being up to our standards. Today, we’re still not comfortable with the rate structure. We have really discontinued any marketing efforts in the state at this point in time. And, we’re sort of in a mode of getting our rates to an adequate level. And, as such, that state falls into that maintenance state category. You know, it’s not in the resource or franchise states where we’re looking to really grow in ‘03, or even in early ‘04.

So, still some work to do there, obviously, the PIP (ph) developments are something that we’re not happy about, either.

MATON (ph): OK. And then my last one, have you made any decisions, at all, on whether to dial back the quota share, kind of during this period while you’ve got some flat to negative premium growth. You’re quite a bit below where your target level, I think, is on premium surplus, and I was just wondering what your thoughts were there.

SMITH: It’s certainly an option, as the gross premiums bounces back, because we’ve, right now, we’re at a 90 percent level. That will automatically dial back on the amount seeded just because it’s a percentage of gross. We’ll certainly look at that. And, we have, as you know, a quarterly option to dial back on that all the way back to 20 percent. So, we’ll monitor it, and we, certainly, don’t want to give any more profit away than necessary. And, again, that’s a fairly low-cost way of providing some surplus relief. So, yes, we’ll take a look at it. But, right now, we’re at 90 percent, and we’ll monitor it.

MATON (ph): OK. Thanks a lot.

UNIDENTIFIED PARTICIPANT: Thanks Rob.

OPERATOR: Your next question comes from Charles Gates of CSFB. Please go ahead, sir.

CHARLES GATES, CSFB: Good morning.

UNIDENTIFIED PARTICIPANT: Good morning.

GATES: A couple of questions. One, I don't know which of you made reference to the $600,000 loss. Was that a non-standard loss?

SMITH: Yes it was. It was a death claim in California. And, as you know, Charlie, that sometimes stuff happens on a $15,000 or $30,000 policy, and it just wasn't settled adequately, and so we took a $600,000 charge.

GATES: What happens, basically, if you, basically, reject a claim, then effectively, it goes into the courts and that’s how something like this occurs?

GOBER: Charlie, I can’t quote you the California statutes. I think if it’s a death claim, failure to pay policy limits immediately upon demand, then there could have been a time limit demand. I’m not familiar with the circumstances of this particular claim, but there could have been a time limit demand to pay policy limits on a death claim. And, you know, it could be a situation where an adjuster failed to respond to that demand. I mean, typically, that’s what happens in some of these cases when they pop up like that. You know, that’s something that we’re not happy about.

We’ve actually, have gone through over the past, probably, six to nine months of what we refer to as good faith training for all of our adjusters, all of our staff, to make certain that they’re aware, you know, of the critical nature of anything, such as that, and that, hopefully, will prevent those things from happening in the future. But, that’s one that did get through.

GATES: One of you indicated that you had $4 million of unfavorable developments in this year’s quarter. What would have been the comparable number in last year’s quarter?

SMITH: I don’t have that in front of me. It’s—yes, I don’t have that number in front of me. We had, overall, last year about a million dollars of unfavorable development for the entire year on the non-standard book (ph). And, so, last year compared to this year. And, as you know, first quarter, it’s fairly green and we continue to look at it throughout the year. But it was, primarily, this year, it was primarily driven by the New York PIP (ph).

GATES: Where in this gradation of states does New York fit?

GOBER: It’s in a maintenance mode, Charlie. You know, I mentioned that we’re not comfortable with the rate structure there. Today, we have a number of rate filings, either ready to be filed, or have been filed in the state. And, currently, it’s in a maintenance mode. So, it’s not a state we’re looking to grow this year. Probably not through the first half of ‘04. There’s still a lot of work to be done, although it’s a sizable market share, and we just don’t want to not have a presence there, albeit a small one. But, it’s pretty far down the list in terms of our focus right now.

GATES: California, I guess, represented 46 percentage of sales in the first quarter. Given the changes in your rating program and the other franchise states that you went through, I would assume that California would be of a lesser consequence for full year. Is that good analysis?

GOBER: That’s a fair assumption. Again, when we talk about Florida and Georgia, they’re two very sizable markets, and we’ve had, you know, in the past, a significant presence there. So, our intent is to really get those programs going.

We’re throwing every resource that we have, really, at those two states next month. And, what I’m talking about, is our marketing resources, promotions, sales campaigns, we’ve got new agency software that’s state-of-the-art. It’s very user friendly that we’re implementing with these programs, as well. And, we’re very optimistic about the opportunity for us to really get back on track and grow our revenues in those states.

So, that is a fair assumption. I would anticipate that the Florida percentage of the total would decline as we move throughout the year.

UNIDENTIFIED PARTICIPANT: And, I think on a seasonal kind of basis, the first quarter for California, typically, is a large quarter for us.

UNIDENTIFIED PARTICIPANT: Right.

UNIDENTIFIED PARTICIPANT: So, I mean as the year goes on, that will mitigate the concentration in California, also.

GOBER: Although, Charlie, I will say that our California results have been outstanding. They’ve been significantly better than the overall results, so we’re not crying the blues too much, given the current mix of business that with California, so.

GATES: My last question at this time, if you said—no, actually, I have two more questions. My first question, to what extent did you guys benefit from reduced frequencies, do you believe during the period?

GOBER: Every cogridge (ph) of the Axton (ph) frequencies were down. We haven’t compiled them in total, although, when you look at them by a company, they vary quite a bit, anywhere from property damage frequencies being down about six percent, actually collision frequencies being down about 10 percent. So, you know, again, it varies by coverage. In terms of how much we benefited from that, I really can’t give you a number. I will say, however, that everything that we’re doing today, and the assumptions that we’re making today, are that that is a trend will not continue. We’re not banking anything on that in terms of our outlook, in our rate making, in price in going forward. You know, it’s nice to have today, but again, even in our reserve estimate, we’re not using those declining frequencies in making the assumption that that’s a trend that will continue throughout 2003. So, we’re being pretty conservative. It’s nice, but we think that that trend, probably, will change.

GATES: My final question, is there any way that you can guesstimate, and maybe that an inappropriate word, to what extent earnings in periods benefited as a result of the reduction in expenses specific to the consolidation programs that you guys have spoken to?

GOBER: In the first quarter?

GATES: Yes, sir.

UNIDENTIFIED PARTICIPANT: It's a "swag guesstimate." My guess is it's probably at least a half a point.

GATES: On a combined ratio.

UNIDENTIFIED PARTICIPANT: On the combined ratio.

GATES: OK. Thank you.

UNIDENTIFIED PARTICIPANT: But, those are numbers that once you do the consolidation, those are numbers that perpetuate.

UNIDENTIFIED PARTICIPANT: About a one-time savings.

UNIDENTIFIED PARTICIPANT: It's like an annuity. Wouldn't it be?

UNIDENTIFIED PARTICIPANT: You'd get it on a recurring basis.

UNIDENTIFIED PARTICIPANT: Absolutely.

GATES (ph): OK. Thank you.

OPERATOR: Your next question comes from Bruce Wilcox (ph) from Cumberland (ph).

BRUCE WILCOX (ph), CUMBERLAND (ph): Good morning. This is not a question, it’s a request, actually. I haven’t met any of you guys, but we were fairly sizable buyers on the offering. And I would like to know, it is a question, what plan do you have for, maybe, circling back through New York to get to know, or get to know better your new shareholders in this public company?

GOBER: Well, actually, it’s funny you mention that, Bruce. That is one of my objectives for the second quarter of this year. So, we do plan to do just that. Certainly, the New York area is one of the areas that we want to return and visit investors, and we look forward to making arrangements and setting up a time and meeting with you.

WILCOX (ph): Right. I mean, I tuned in late to the call, but then I’ll catch up with the analysts, but I thought the, what I heard of the report was very clear, very crisp, and it sounds like it’s been a good first quarter for our company, so I’ll leave it at that, but we’ll look forward to seeing you.

UNIDENTIFIED PARTICIPANT: All right, thank you.

OPERATOR: Your next question comes from Tamara Cravick (ph) of Bank of America.

TAMARA CRAVICK (ph), BANK OF AMERICA: Hi. Good morning.

UNIDENTIFIED PARTICIPANT: Morning.

UNIDENTIFIED PARTICIPANT: Good morning.

CRAVICK (ph): A couple of questions. The classification of the states, in the resource states, what—you know, you talked about the rate increases that you’re taking—what’s really going to drive the PIP (ph) growth in those states and are there any states that stand out in that segment.

And, then the second question will be for the maintenance states, you know, you talked about New York and the fact that it’s credible book, you have the market share there. Is there a probability that you’re focus will narrow to less than 25 states, given that maybe some of the maintenance states aren’t really in the same position as New York, and you may look at those and consider that it’s not worth the effort to continue a presence there?

GOBER: Yes. And, in terms of the resource states, what we’re looking to in terms of driving some growth there. And, again, I mentioned late ‘03 as far as that sort of turning the corner for us.

Our approach to the market has been to give consumers a choice, to permit them to opt between different policy types, a low-cost policy that’s more affordable. We have a mid-tier policy, and then an upper-end policy, a premier policy for the more standard-preferred drivers.

And, what we’re doing right now, is we’re in the process of filing that array of products, those policies in these resource states. And, what we’ve got to do is get those approved and implemented. And again, we’re looking toward, probably, the third quarter of this year as that being the case.

In terms of specific states, you know, I really can’t cite states off the top of my head. I do recall South Carolina as being a state where we do have those filings pending, currently. We’re sort of on hold for the state of Texas, only because we’re waiting to see what happens in the legislature out there, as far as some pending laws regarding the insurance industry. So, it’s sort of a wait-and-see situation for that state.

Again, if it’s something that’s favorable, or at least not detrimental to our ability to make an underwriting profit, then we’ll turn it back on in Texas, certainly early third quarter of this year and start trying to grow our revenues in those states. But again, that’s really the driver for us in the resource states, today. You know, just a matter of getting that array of products, those programs lined up and ready to go prior to the third quarter.

In terms of, will the mix of states change, in terms of, you know, a state that currently is a maintenance state today, you know, could it drop off the list? Absolutely. You know, we’ve been very clear with investors that this is not something that is static. It’s fluid. If a state does not have the potential, again, for profitable growth, we are not going to devote resources to those states, given the fact that we have other states out there that offer better opportunities. So, could it change? Yes.

We’re giving investors this information, and we’re breaking the states down on this basis, so everyone understands where we’re going in ‘03. This is the business plan that we’ve talked about over the past six months. We just want to make sure everyone understands that we’re sort of in a transition, here in ‘03, that we’re in a process of realigning our (INAUDIBLE), making sure rates are adequate, consolidating operations. And, we’re doing quite well at it. We’re certainly very excited about that.

But, when you look at the Infinity P&C Corp., and you look at ‘04, that’s when we really get excited. We’ve got many of the pieces in place by the end of this year. The consolidation effort is not completely finished, although much of it will be under our belt. Then, we’ll be ready to go. Then, we’ll be set. Again, though, those states could change. It’s just a matter of keeping on top of them and making certain we’ve got the right ones in the right categories.

CRAVICK (ph): OK. Great. A second follow-up, is, actually, on the expense ratio. I know the fourth quarter had some items that were affected by the transfer of the assumed agency business and the reinsurance agreement that you have. And, the first quarter seems to be back up to 12.9, and I realize some of the consolidation savings are flowing through that. But what would you anticipate to be a reasonable run rate going forward just given that it’s kind of all over the place in 2002, and try and just get a grasp on what’s really going to flow through there and what’s driving that?

SMITH: I think in terms of historicals, you’re best probably to look at the results gross of the quarter share and the Website with the supplemental guide should help you do that.

CRAVICK (ph): OK.

SMITH: And, we’re committed to getting below 20 percent over the next several years. And, we’ve talked about what some of the things we’ve done, even in the first quarter. We feel that we’re well on our way to accomplishing that.

CRAVICK (ph): OK. So, you feel comfortable, kind of, in heading towards 20 percent, and it’s been running about 20, 22, 23.

SMITH: The historical run rate’s been about 22. And, yes, we feel confident that given the actions we’ve taken and have planned, that we’re still confident that we commit to the 20 within the next couple of years.

CRAVICK (ph): OK. Great. Thanks.

UNIDENTIFIED PARTICIPANT: Your welcome.

OPERATOR: And, your final question this morning comes from David Kelly (ph) of RS Investments (ph). Please go ahead, sir.

DAVID KELLY (ph), RS INVESTMENTS (ph): Good morning.

UNIDENTIFIED PARTICIPANT: Good morning.

KELLY (ph): I understand ‘03 sets the table for 2004, and also that there are a lot of moving parts to it. What are your initial plans or thoughts for premium growth for 2004?

GOBER: I think, you know, we really haven’t put a pencil to it at this point. It’s hard to say. Certainly, when you look at our five focus states, you know, we’re expecting double-digit growth in those states, probably double-digit growth in the resource states. In maintenance states, I would expect that premium volume to remain flat, probably drop a little bit. If we get the right actions in place, then again, certainly, the exit states should be off the books by the end of the third quarter of this year.

So, it’s hard to say at this point. The only thing I would say is that we are expecting some pretty significant growth in those franchise and resource states next year.

KELLY (ph): OK. So, it's fair to say high, single digits, maybe low, double digits?

GOBER: Yes. For those states, absolutely.

KELLY (ph): OK. Thank you.

OPERATOR: You have one more question from Ernie Jacob (ph) of Longnook (ph) Capital Management. ERNIE JACOB (ph), LONGNOOK CAPITAL MANAGEMENT: Yes, good morning.

UNIDENTIFIED PARTICIPANT: Good morning.

UNIDENTIFIED PARTICIPANT: Good morning.

JACOB (ph): With respect to your thoughts on finance, I was wondering with this appreciation in your stock price, whether some vehicle that might have an equity component to it would, possibly, enter your thinking?

SMITH: We’re not right now entertaining that. There’s a lot of people out there, investment bankers included, asking us about that, but right now, we’re not including that.

JACOB (ph): OK. Thank you.

SMITH: We're looking for the optimal. We're looking for the optimal capital mix, and we think that that, at least in this next debt issue, will be debt.

JACOB (ph): OK. Thank you.

OPERATOR: And, there are no further questions this morning.

GOBER: Thank you, all, for participating in the conference call. Again, we look forward to talking with you and meeting with you in the future. Thank you.

UNIDENTIFIED PARTICIPANT: Thank you.

END