UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21217 |

|

Eaton Vance Insured California Municipal Bond Fund II |

(Exact name of registrant as specified in charter) |

|

The Eaton Vance Building, 255 State Street, Boston, Massachusetts | 02109 |

(Address of principal executive offices) | (Zip code) |

|

Alan R. Dynner

The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (617) 482-8260 | |

|

Date of fiscal year end: | September 30 | |

|

Date of reporting period: | March 31, 2005 | |

| | | | | | | |

Item 1. Reports to Stockholders

| |

|

Semiannual Report March 31, 2005 |

| | EATON VANCE

INSURED

MUNICIPAL

BOND

FUNDS | | CLOSED-END FUNDS:

Insured Municipal II

Insured California II

Insured Florida

Insured Massachusetts

Insured Michigan

Insured New Jersey

Insured New York II

Insured Ohio

Insured Pennsylvania | |

| |

| | | | | |

IMPORTANT NOTICES REGARDING PRIVACY,

DELIVERY OF SHAREHOLDER DOCUMENTS,

PORTFOLIO HOLDINGS AND PROXY VOTING

Privacy. The Eaton Vance organization is committed to ensuring your financial privacy. Each of the financial institutions identified below has in effect the following policy (“Privacy Policy”) with respect to nonpublic personal information about its customers:

• Only such information received from you, through application forms or otherwise, and information about your Eaton Vance fund transactions will be collected. This may include information such as name, address, social security number, tax status, account balances and transactions.

• None of such information about you (or former customers) will be disclosed to anyone, except as permitted by law (which includes disclosure to employees necessary to service your account). In the normal course of servicing a customer’s account, Eaton Vance may share information with unaffiliated third parties that perform various required services such as transfer agents, custodians and broker/dealers.

• Policies and procedures (including physical, electronic and procedural safeguards) are in place that are designed to protect the confidentiality of such information.

• We reserve the right to change our Privacy Policy at any time upon proper notification to you. Customers may want to review our Policy periodically for changes by accessing the link on our homepage: www.eatonvance.com.

Our pledge of privacy applies to the following entities within the Eaton Vance organization: the Eaton Vance Family of Funds, Eaton Vance Management, Eaton Vance Investment Counsel, Boston Management and Research, and Eaton Vance Distributors, Inc.

In addition, our Privacy Policy only applies to those Eaton Vance customers who are individuals and who have a direct relationship with us. If a customer’s account (i.e. fund shares) is held in the name of a third-party financial adviser/broker-dealer, it is likely that only such adviser’s privacy policies apply to the customer. This notice supersedes all previously issued privacy disclosures.

For more information about Eaton Vance’s Privacy Policy, please call 1-800-262-1122.

Delivery of Shareholder Documents. The Securities and Exchange Commission permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. This practice is often called “householding” and it helps eliminate duplicate mailings to shareholders.

Eaton Vance, or your financial adviser, may household the mailing of your documents indefinitely unless you instruct Eaton Vance, or your financial adviser, otherwise.

If you would prefer that your Eaton Vance documents not be householded, please contact Eaton Vance at 1-800-262-1122, or contact your financial adviser.

Your instructions that householding not apply to delivery of your Eaton Vance documents will be effective within 30 days of receipt by Eaton Vance or your financial adviser.

Portfolio Holdings. Each Eaton Vance Fund and it’s underlying Portfolio will file a schedule of its portfolio holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Form N-Q will be available on the Eaton Vance website www.eatonvance.com, by calling Eaton Vance at 1-800-262-1122 or in the EDGAR database on the SEC’s website at www.sec.gov. Form N-Q may also be reviewed and copied at the SEC’s public reference room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the public reference room).

Proxy Voting. From time to time, funds are required to vote proxies related to the securities held by the funds. The Eaton Vance Funds or their underlying Portfolios (if applicable) vote proxies according to a set of policies and procedures approved by the Funds’ and Portfolios’ Boards. You may obtain a description of these policies and procedures and information on how the Funds or Portfolios voted proxies relating to Portfolio securities during the 12 month period ended June 30, without charge, upon request, by calling 1-800-262-1122. This description is also available on the SEC’s website at www.sec.gov.

Eaton Vance Insured Municipal Bond Funds as of March 31, 2005

LETTER TO SHAREHOLDERS

Thomas J. Fetter

President

The municipal bond market is a center of capital formation for states, municipalities and, in some cases, private economic initiatives. In this edition of our continuing educational series, we will discuss industrial development revenue (IDR) bonds. IDR bonds have long been used as a financing mechanism by local governments to provide assistance to local employers and encourage job retention and creation within their communities.

IDR bonds finance private activities that benefit the public...

IDR bonds are issued by municipal authorities to finance projects and facilities used by private corporations. Historically, IDR bonds have represented a partnership between the private and public sectors – a source of dedicated funding for companies and a source of job creation in projects beneficial to local communities. The “Private-Activities” provision of the Tax Reform Act of 1986 permits issuance of tax-exempt bonds for specific activities, including pollution control; gas and electric service; water distribution; wastewater systems; solid waste disposal; airports and selected transportation projects; and other industrial projects.

The Act also placed a cap on the dollar amount that may be raised for IDR bonds in each state, limiting the amount to $50 per person/per state/per year, with a $150 million maximum. These limitations provide protection against potential abuse and ensure that tax-exempt IDR bonds will indeed be issued for projects that will benefit the public.

IDR bonds finance utility-related projects and other industrial initiatives...

Typically, IDR bonds provide financing for manufacturing, processing or utility facilities. Historically, about one-half of these bonds have been issued to finance pollution control facilities for manufacturers and electric utilities. As many utilities and manufacturers have been ordered to comply with stricter environmental and fuel standards, pollution control bonds have helped finance the retrofits of existing plants. Other IDR bonds have served as inducements from state and local issuers to locate plants or build new facilities, in the hope that such construction might generate further economic growth for a community.

IDR bonds are secured by corporate revenues – not those of state or local governments...

IDR bond issues are secured by the credit of the underlying corporation. The municipal issuing authority acts solely as a conduit to permit tax-exempt financing. The corporation pledges to make payments sufficient to meet all debt service obligations. Unlike some revenue issues, IDR bonds are backed by revenues of the entire corporation, not solely by those of the project being financed.

Because IDR bonds are backed by corporate revenues and not by the taxing authority of a state or local jurisdiction, they have historically provided coupon premiums above those of general obligations and other more traditional revenue bonds. Bonds may be either collateralized or unsecured. Collateralized bonds have a lien against the company’s assets, which may provide bond holders enhanced bargaining power in the event of a bankruptcy. Unsecured bonds have no such lien.

While providing new opportunities, IDR bonds require rigorous analysis...

While IDR bonds may provide unusual investment opportunities, they also may entail increased risk and, therefore, demand especially intensive analysis. At Eaton Vance, we have credit analysts and resources dedicated to IDR bond research.

IDR bonds represent a key segment of the municipal bond market and should remain an important source of capital formation. In our view, the experience and resources needed to evaluate these issues further demonstrates the value of professional management. We will continue to look for opportunities in this sector of the municipal market.

| Sincerely, |

| |

| /s/ Thomas J. Fetter | |

| Thomas J. Fetter |

| President |

| May 4, 2005 |

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

2

Eaton Vance Insured Municipal Bond Funds as of March 31, 2005

MARKET RECAP

The U.S. economy continued to generate moderate growth during the six months ended March 31, 2005. While higher gasoline and energy prices pinched consumers, the weak U.S. dollar raised inflationary concerns and helped push interest rates higher.

After a promising recovery in 2004, slower growth in early 2005...

The nation’s Gross Domestic Product grew by 3.1% in the first quarter of 2005, according to preliminary Commerce Department figures, following a 3.8% rise in the fourth quarter of 2004. Manufacturing activity, which had expanded strongly in the second half of 2004, slackened somewhat in the first quarter of 2005, amid slower industrial production and weakening demand for durable goods.

Consumer spending, which helped fuel the economic recovery over the past year, weakened considerably, as higher fuel costs and rising interest rates on loans and mortgages prompted consumers to tighten their belts. Capital spending also slowed, as businesses curtailed new investments in plants and factories, while reducing the pace of investment in productivity-enhancing equipment and software. Residential construction remained relatively strong, although slightly off the torrid pace set in 2004.

After recovering dramatically in 2004, job creation weakened somewhat in early 2005...

The nation’s labor markets strengthened during the year, although the pace of job creation weakened at the close of the period. Hiring picked up during the year in areas that had suffered large technology sector layoffs. Also, manufacturing, financial services, business services, trucking, shipping, construction, energy, health care, and media also generated new jobs. In the first quarter of 2005, however, employers showed some reticence in hiring practices, as they were forced to cope with unpredictable fuel cost hikes.

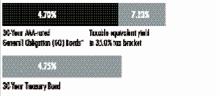

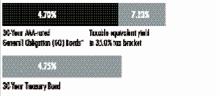

Municipal bond yields were 99% of Treasury yields

Principal and interest payments of Treasury securities are guaranteed by the U.S. government.

*GO yields are a compilation of a representative variety of general obligations and are not necessarily representative of a Fund’s yield. Statistics as of March 31, 2005.

Past performance is no guarantee of future results.

Source: Bloomberg, L.P.

The Federal Reserve continued to raise short-term interest rates in 2005...

The Federal Reserve pushed short-term rates higher, suggesting it will continue to raise rates to keep the economy from growing too quickly and, thereby, reviving inflation. Beginning in June 2004, the Fed increased its Federal Funds rate – a key short-term interest rate barometer – on eight occasions, raising that benchmark from 1.00% to 3.00%, including its most recent rate hike in May 2005.

The municipal bond market posted a modest gain for the year, slightly outperforming the Treasury market. For the six months ended March 31, 2005, the Lehman Brothers Municipal Bond Index – an unmanaged index of longer-term, investment-grade, municipal debt securities made up of issues larger than $50 million – had a total return of 1.21.%.*

* It is not possible to invest directly in an Index. The Index’s total return does not reflect commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

The views expressed throughout this report are those of the various portfolio managers and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and Eaton Vance disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for an Eaton Vance fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any Eaton Vance fund.

3

Eaton Vance Insured Municipal Bond Fund II as of March 31, 2005

INVESTMENT UPDATE

The Fund

• Based on share price (traded on the American Stock Exchange), the Fund had a total return of 4.49% for the six months ended March 31, 2005. That return was the result of an increase in share price from $14.82 on September 30, 2004 to $14.98 on March 31, 2005 and the reinvestment of $0.500 in monthly dividends.(1)

• Based on net asset value, the Fund had a total return of 4.07% for the six months ended March 31, 2005. That return was the result of an increase in net asset value per share from $15.03 on September 30, 2004 to $15.13 on March 31, 2005, and the reinvestment of all distributions.

• In comparison, the Lehman Brothers Municipal Bond Index – an unmanaged index of longer-term, investment-grade, municipal debt securities made up of issues larger than $50 million – had a total return of 1.21% for the six months ended March 31, 2005.(2)

• Based on the last dividend of the semi-annual period and a share price of $14.98, the Fund had a market yield of 6.68% at March 31, 2005.(3) The Fund’s market yield is equivalent to a taxable yield of 10.28%.(4)

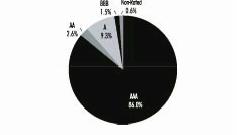

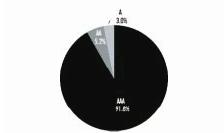

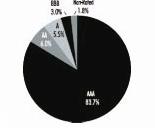

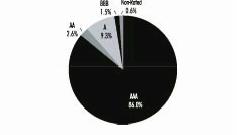

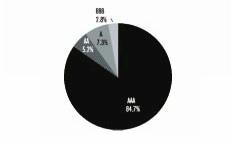

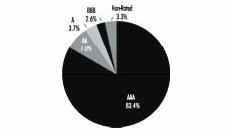

Rating Distribution(5),(6)

By total investments

* Private insurance does not decrease the risk of loss of principal associated with this investment.

William H. Ahern

Portfolio Manager

Management Discussion

• The U.S. economy expanded moderately during the period, despite concerns over rising fuel costs. Manufacturing rebounded somewhat, while financial services, business services, transportation, construction, energy and health care posted strong job growth. The U.S. jobless rate was 5.2% in March 2005, down from 5.7% a year ago.

• Insured* transportation bonds constituted the Fund’s largest sector weighting at March 31, 2005. The Fund’s investments represented a broad range of transportation projects, including bridge and tunnel authorities, highway and turnpike authorities, a monorail project and an urban skywalk.

• Insured* general obligations (GOs) were a significant investment. The Fund’s investments included state and municipal issuers alike, ranging from large urban centers to local school district bond issuers. GOs are backed by the taxing power of the issuing jurisdiction.

• Insured* water revenue bonds were key investments for the Fund. Amid more stringent environmental regulations, many communities have issued bonds to finance improvements to water filtration and discharge facilities. Water utilities have historically represented a relatively stable revenue source.

• At March 31, 2005, the Fund had leverage in the amount of approximately 37% of the Fund’s total assets. The Fund uses leverage through the issuance of preferred shares. Use of financial leverage creates an opportunity for increased income but, at the same time, creates special risks (including the likelihood of greater volatility of net asset value and market price of common shares).

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return.

Fund Information

as of March 31, 2005

Performance(7)

Average Annual Total Return (by share price, American Stock Exchange) | | | |

One Year | | 3.81 | % |

Life of Fund (11/29/02) | | 9.22 | |

Average Annual Total Return (by net asset value) | | | |

One Year | | 10.05 | % |

Life of Fund (11/29/02) | | 9.69 | |

(1) A portion of the Fund’s income may be subject to federal income tax and/or alternative minimum tax; income may be subject to state income tax.

(2) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

(3) The Fund’s market yield is calculated by dividing the most recent dividend per share by the share price at the end of the period and annualizing the result.

(4) Taxable-equivalent yield assumes a maximum 35.00% federal income tax rate. A lower tax rate would result in a lower tax-equivalent figure.

(5) Rating Distribution may not be representative of the Fund’s current or future investments.

(6) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(7) Returns are historical and are calculated by determining the percentage change in share price or net asset value with all distributions reinvested. Performance results reflect the effect of leverage resulting from the Fund’s issuance of Auction Preferred Shares.

4

Eaton Vance Insured California Municipal Bond Fund II as of March 31, 2005

INVESTMENT UPDATE

The Fund

• Based on share price (traded on the American Stock Exchange), the Fund had a total return of 4.37% for the six months ended March 31, 2005. That return was the result of an increase in share price from $14.58 on September 30, 2004 to $14.73 on March 31, 2005 and the reinvestment of $0.474 in monthly dividends.(1)

• Based on net asset value, the Fund had a total return of 3.73% for the six months ended March 31, 2005. That return was the result of an increase in net asset value per share from $14.51 on September 30, 2004 to $14.57 on March 31, 2005, and the reinvestment of all distributions.

• In comparison, the Lehman Brothers Municipal Bond Index – an unmanaged index of longer-term, investment-grade, municipal debt securities made up of issues larger than $50 million – had a total return of 1.21% for the six months ended March 31, 2005.(2)

• Based on the last dividend of the semi-annual period and a share price of $14.73, the Fund had a market yield of 6.44% at March 31, 2005.(3) The Fund’s market yield is equivalent to a taxable yield of 10.92%.(4)

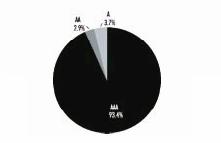

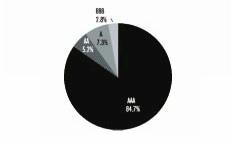

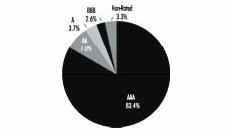

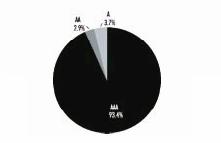

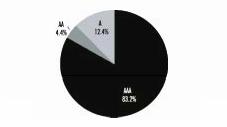

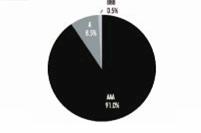

Rating Distribution(5),(6)

By total investments

* Private insurance does not decrease the risk of loss of principal associated with this investment.

Cynthia J. Clemson

Portfolio Manager

Management Discussion

• California’s economy generated good job growth in late 2004 and early 2005. The business services sector added the largest number of jobs, with construction and financial services also making significant contributions. The government sector, subject to budgetary restraints, remained a sore spot in the state economy. The state’s March 2005 jobless rate was 5.8%, down from 6.4% a year ago.

• Insured* general obligations (GOs) constituted the Fund’s largest sector weighting at March 31, 2005. The Fund’s investments included issues of the state – whose credit rating has been modestly upgraded within the past year – as well as issues for local school districts and assessment districts.

• Insured* lease revenue/certificates of participation (COPs) were major investments. COPs provide cost-effective, lease financing for borrowers at the state, county and municipal level for a broad range of public works projects.

• Insured* special assessment revenue bonds remained among the Fund’s prominent holdings. The Fund’s investments included issues that financed housing redevelopment projects, as well as various infrastructure-related projects.

• At March 31, 2005, the Fund had leverage in the amount of approximately 38% of the Fund’s total assets. The Fund uses leverage through the issuance of preferred shares. Use of financial leverage creates an opportunity for increased income but, at the same time, creates special risks (including the likelihood of greater volatility of net asset value and market price of common shares).

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return.

Fund Information

as of March 31, 2005

Performance(7)

Average Annual Total Return (by share price, American Stock Exchange) | | | |

One Year | | 5.21 | % |

Life of Fund (11/29/02) | | 7.90 | |

Average Annual Total Return (by net asset value) | | | |

One Year | | 3.72 | % |

Life of Fund (11/29/02) | | 7.40 | |

(1) A portion of the Fund’s income may be subject to federal income tax and/or alternative minimum tax; income may be subject to state income tax.

(2) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

(3) The Fund’s market yield is calculated by dividing the most recent dividend per share by the share price at the end of the period and annualizing the result.

(4) Taxable-equivalent yield assumes a maximum 41.05% combined federal and state income tax rate. A lower tax rate would result in a lower tax-equivalent figure.

(5) Rating Distribution may not be representative of the Fund’s current or future investments.

(6) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(7) Returns are historical and are calculated by determining the percentage change in share price or net asset value with all distributions reinvested. Performance results reflect the effect of leverage resulting from the Fund’s issuance of Auction Preferred Shares.

5

Eaton Vance Insured Florida Municipal Bond Fund as of March 31, 2005

INVESTMENT UPDATE

The Fund

• Based on share price (traded on the American Stock Exchange), the Fund had a total return of -1.34% for the six months ended March 31, 2005. That return was the result of a decrease in share price from $14.75 on September 30, 2004 to $14.10 on March 31, 2005 and the reinvestment of $0.465 in monthly dividends.(1)

• Based on net asset value, the Fund had a total return of 4.42% for the six months ended March 31, 2005. That return was the result of an increase in net asset value per share from $14.52 on September 30, 2004 to $14.69 on March 31, 2005, and the reinvestment of all distributions.

• In comparison, the Lehman Brothers Municipal Bond Index – an unmanaged index of longer-term, investment-grade, municipal debt securities made up of issues larger than $50 million – had a total return of 1.21% for the six months ended March 31, 2005.(2)

• Based on the last dividend of the semi-annual period and a share price of $14.10, the Fund had a market yield of 6.60% at March 31, 2005.(3) The Fund’s market yield is equivalent to a taxable yield of 10.15%.(4)

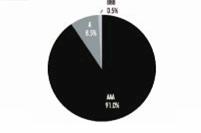

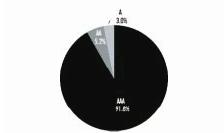

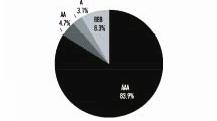

Rating Distribution(5),(6)

By total investments

* Private insurance does not decrease the risk of loss of principal associated with this investment.

Craig Brandon

Portfolio Manager

Management Discussion

• Florida’s economy continued to expand during the period. Residential construction and service sectors remained very strong, a result of a population growth rate twice that of the U.S. rate. Despite a severe hurricane season, even tourism grew in 2004, boosted by the weak U.S. dollar. The state’s jobless rate was 4.5% in March 2005, down from 4.8% a year ago.

• Insured* special tax revenue bonds were the Fund’s largest sector weightings at March 31, 2005. These bonds are used to build or expand facilities or infrastructure.

• The Fund remained very selective within the hospital sector, given the industry’s increasing competition and cost pressures. The Fund focused on facilities with good management, marketable health care specialties and sound underlying fundamentals.

• Insured* transportation bonds also provided opportunities for the Fund. Investments included issues for highway and road construction projects, and port facility improvement projects.

• At March 31, 2005, the Fund had leverage in the amount of approximately 37% of the Fund’s total assets. The Fund uses leverage through the issuance of preferred shares. Use of financial leverage creates an opportunity for increased income but, at the same time, creates special risks (including the likelihood of greater volatility of net asset value and market price of common shares).

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return.

Fund Information

as of March 31, 2005

Performance(7)

Average Annual Total Return (by share price, American Stock Exchange) | | | |

One Year | | -0.37 | % |

Life of Fund (11/29/02) | | 5.84 | |

Average Annual Total Return (by net asset value) | | | |

One Year | | 4.70 | % |

Life of Fund (11/29/02) | | 7.71 | |

(1) A portion of the Fund’s income may be subject to federal income tax and/or alternative minimum tax and state intangibles tax.

(2) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

(3) The Fund’s market yield is calculated by dividing the most recent dividend per share by the share price at the end of the period and annualizing the result.

(4) Taxable-equivalent yield assumes a maximum 35.00% combined federal and state intangibles tax rate. A lower tax rate would result in a lower tax-equivalent figure.

(5) Rating Distribution may not be representative of the Fund’s current or future investments.

(6) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(7) Returns are historical and are calculated by determining the percentage change in share price or net asset value with all distributions reinvested. Performance results reflect the effect of leverage resulting from the Fund’s issuance of Auction Preferred Shares.

6

Eaton Vance Insured Massachusetts Municipal Bond Fund as of March 31, 2005

INVESTMENT UPDATE

The Fund

• Based on share price (traded on the American Stock Exchange), the Fund had a total return of 9.29% for the six months ended March 31, 2005. That return was the result of an increase in share price from $15.57 on September 30, 2004 to $16.52 on March 31, 2005 and the reinvestment of $0.474 in monthly dividends.(1)

• Based on net asset value, the Fund had a total return of 3.35% for the six months ended March 31, 2005. That return was the result of an increase in net asset value per share from $14.87 on September 30, 2004 to $14.92 on March 31, 2005, and the reinvestment of all distributions.

• In comparison, the Lehman Brothers Municipal Bond Index – an unmanaged index of longer-term, investment-grade, municipal debt securities made up of issues larger than $50 million – had a total return of 1.21% for the six months ended March 31, 2005.(2)

• Based on the last dividend of the semi-annual period and a share price of $16.52, the Fund had a market yield of 5.74% at March 31, 2005.(3) The Fund’s market yield is equivalent to a taxable yield of 9.33%.(4)

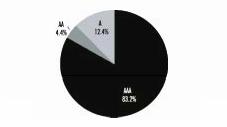

Rating Distribution(5),(6)

By total investments

* Private insurance does not decrease the risk of loss of principal associated with this investment.

Robert B. MacIntosh

Portfolio Manager

Management Discussion

• The Massachusetts economy made progress in 2004 and 2005, although not yet achieving pre-recession employment levels. Business services, health care, education and residential building remained areas of strong job creation. The manufacturing sector continued to struggle. The state’s March 2005 jobless rate was 4.9%, down from 5.4% a year ago and below the national rate.

• Insured* private and public education bonds remained among the the Fund’s largest sector weightings at March 31, 2005. The Fund’s investments included some of the Commonwealth’s well-regarded colleges and universities that enjoy strong applicant demand.

• Insured* lease revenue/certificates of participation (COPs) were large investments. These bonds provided flexible and cost effective financing for Massachusetts projects. COPs and lease revenue bonds typically finance the purchase of equipment and facilities, and are secured by lease payments by the borrower.

• Insured* transportation bonds were a large investment for the Fund. The Fund’s investments focused mainly on state turnpike authority issues, which have financed major improvements in recent years.

• At March 31, 2005, the Fund had leverage in the amount of approximately 37% of the Fund’s total assets. The Fund uses leverage through the issuance of preferred shares. Use of financial leverage creates an opportunity for increased income but, at the same time, creates special risks (including the likelihood of greater volatility of net asset value and market price of common shares).

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Fund performance during certain periods reflects the strong bond market performance and/or the strong performance of bonds held during those periods. This performance is not typical and may not be repeated. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return.

Fund Information

as of March 31, 2005

Performance(7)

Average Annual Total Return (by share price, American Stock Exchange) | | | |

One Year | | 9.69 | % |

Life of Fund (11/29/02) | | 13.56 | |

Average Annual Total Return (by net asset value) | | | |

One Year | | 6.43 | % |

Life of Fund (11/29/02) | | 8.72 | |

(1) A portion of the Fund’s income may be subject to federal income tax and/or alternative minimum tax; income may be subject to state income tax.

(2) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

(3) The Fund’s market yield is calculated by dividing the most recent dividend per share by the share price at the end of the period and annualizing the result.

(4) Taxable-equivalent yield assumes a maximum 38.45% combined federal and state income tax rate. A lower tax rate would result in a lower tax-equivalent figure.

(5) Rating Distribution may not be representative of the Fund’s current or future investments.

(6) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(7) Returns are historical and are calculated by determining the percentage change in share price or net asset value with all distributions reinvested. Performance results reflect the effect of leverage resulting from the Fund’s issuance of Auction Preferred Shares.

7

Eaton Vance Insured Michigan Municipal Bond Fund as of March 31, 2005

INVESTMENT UPDATE

The Fund

• Based on share price (traded on the American Stock Exchange), the Fund had a total return of 10.55% for the six months ended March 31, 2005. That return was the result of an increase in share price from $15.49 on September 30, 2004 to $16.60 on March 31, 2005 and the reinvestment of $0.474 in monthly dividends.(1)

• Based on net asset value, the Fund had a total return of 2.67% for the six months ended March 31, 2005. That return was the result of a decrease in net asset value per share from $14.84 on September 30, 2004 to $14.77 on March 31, 2005, and the reinvestment of all distributions.

• In comparison, the Lehman Brothers Municipal Bond Index – an unmanaged index of longer-term, investment-grade, municipal debt securities made up of issues larger than $50 million – had a total return of 1.21% for the six months ended March 31, 2005.(2)

• Based on the last dividend of the semi-annual period and a share price of $16.60, the Fund had a market yield of 5.71% at March 31, 2005.(3) The Fund’s market yield is equivalent to a taxable yield of 9.14%.(4)

Rating Distribution(5),(6)

By total investments

* Private insurance does not decrease the risk of loss of principal associated with this investment.

William H. Ahern

Portfolio Manager

Management Discussion

• Michigan’s economy continued to set a lackluster pace and remained the only state in the nation where employment has declined in the past year. The largest losses were in the manufacturing, retail and government areas. There were pockets of strength in the construction sector. The state’s March 2005 jobless rate was 7.5%, up from 7.1% a year ago.

• Insured* general obligations (GOs) constituted the Fund’s largest sector weighting at March 31, 2005. Given the state’s unsteady economy, management focused on issues of fiscally sound school districts and building authorities.

• Insured* special tax revenue bonds constituted another large investment sector. These high-quality bonds were issued to finance improvements, such as renewal projects in downtown Detroit and airport-related projects. These bonds are backed by a variety of special taxes approved solely for the projects.

• Hospital bonds were also a large investment for the fund. In a very competitive and cost-conscious environment, the Fund focused on acute care facilities that management believes are well managed, financially strong and leading care providers in their respective communities.

• At March 31, 2005, the Fund had leverage in the amount of approximately 37% of the Fund’s total assets. The Fund uses leverage through the issuance of preferred shares. Use of financial leverage creates an opportunity for increased income but, at the same time, creates special risks (including the likelihood of greater volatility of net asset value and market price of common shares).

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Fund performance during certain periods reflects the strong bond market performance and/or the strong performance of bonds held during those periods. This performance is not typical and may not be repeated. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return.

Fund Information

as of March 31, 2005

Performance(7)

Average Annual Total Return (by share price, American Stock Exchange) | | | |

One Year | | 8.22 | % |

Life of Fund (11/29/02) | | 13.11 | |

Average Annual Total Return (by net asset value) | | | |

One Year | | 5.38 | % |

Life of Fund (11/29/02) | | 7.60 | |

(1) A portion of the Fund’s income may be subject to federal income tax and/or alternative minimum tax; income may be subject to state income tax.

(2) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

(3) The Fund’s market yield is calculated by dividing the most recent dividend per share by the share price at the end of the period and annualizing the result.

(4) Taxable-equivalent yield assumes a maximum 37.54% combined federal and state income tax rate. A lower tax rate would result in a lower tax-equivalent figure.

(5) Rating Distribution may not be representative of the Fund’s current or future investments.

(6) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(7) Returns are historical and are calculated by determining the percentage change in share price or net asset value with all distributions reinvested. Performance results reflect the effect of leverage resulting from the Fund’s issuance of Auction Preferred Shares.

8

Eaton Vance Insured New Jersey Municipal Bond Fund as of March 31, 2005

INVESTMENT UPDATE

The Fund

• Based on share price (traded on the American Stock Exchange), the Fund had a total return of 1.14% for the six months ended March 31, 2005. That return was the result of a decrease in share price from $15.49 on September 30, 2004 to $15.18 on March 31, 2005 and the reinvestment of $0.480 in monthly dividends.(1)

• Based on net asset value, the Fund had a total return of 3.90% for the six months ended March 31, 2005. That return was the result of an increase in net asset value per share from $14.99 on September 30, 2004 to $15.09 on March 31, 2005, and the reinvestment of all distributions.

• In comparison, the Lehman Brothers Municipal Bond Index – an unmanaged index of longer-term, investment-grade, municipal debt securities made up of issues larger than $50 million – had a total return of 1.21% for the six months ended March 31, 2005.(2)

• Based on the last dividend of the semi-annual period and a share price of $15.18, the Fund had a market yield of 6.32% at March 31, 2005.(3) The Fund’s market yield is equivalent to a taxable yield of 10.68%.(4)

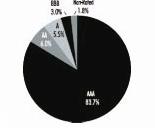

Rating Distribution(5),(6)

By total investments

* Private insurance does not decrease the risk of loss of principal associated with this investment.

Robert B. MacIntosh

Portfolio Manager

Management Discussion

• In late 2004 and early 2005, New Jersey enjoyed good job growth, the state’s strongest since 2000. Leisure, business services, trade, transportation, and utilities generated the fastest job growth. Not surprisingly, manufacturing remained among the state’s weakest sectors. The state’s March 2005 jobless rate was 4.4%, down from 5.2% a year ago.

• Insured* public education bonds were the Fund’s largest sector weighting at March 31, 2005. The Fund’s investments included issues for a community college, a four-year university and the state medical and dental school. These institutions have enjoyed stable revenues in a range of economic climates.

• Insured* general obligations (GOs) constituted a large commitment by the Fund. Investments were dominated by city, township and board of education issues. These local GO’s provided high quality and excellent liquidity.

• Insured* transportation bonds were a major focus of the Fund. Investments included bonds for a marine terminal in Newark, as well as river, transportation, port and highway authorities throughout the state, all key elements of the New Jersey economy.

• At March 31, 2005, the Fund had leverage in the amount of approximately 37% of the Fund’s total assets. The Fund uses leverage through the issuance of preferred shares. Use of financial leverage creates an opportunity for increased income but, at the same time, creates special risks (including the likelihood of greater volatility of net asset value and market price of common shares).

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return.

Fund Information

as of March 31, 2005

Performance(7)

Average Annual Total Return (by share price, American Stock Exchange) | | | |

One Year | | 1.78 | % |

Life of Fund (11/29/02) | | 9.57 | |

Average Annual Total Return (by net asset value) | | | |

One Year | | 5.42 | % |

Life of Fund (11/29/02) | | 9.29 | |

(1) A portion of the Fund’s income may be subject to federal income tax and/or alternative minimum tax; income may be subject to state income tax.

(2) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

(3) The Fund’s market yield is calculated by dividing the most recent dividend per share by the share price at the end of the period and annualizing the result.

(4) Taxable-equivalent yield assumes a maximum 40.83% combined federal and state income tax rate. A lower tax rate would result in a lower tax-equivalent figure.

(5) Rating Distribution may not be representative of the Fund’s current or future investments.

(6) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(7) Returns are historical and are calculated by determining the percentage change in share price or net asset value with all distributions reinvested. Performance results reflect the effect of leverage resulting from the Fund’s issuance of Auction Preferred Shares.

9

Eaton Vance Insured New York Municipal Bond Fund II as of March 31, 2005

INVESTMENT UPDATE

The Fund

• Based on share price (traded on the American Stock Exchange), the Fund had a total return of 3.94% for the six months ended March 31, 2005. That return was the result of an increase in share price from $14.46 on September 30, 2004 to $14.55 on March 31, 2005 and the reinvestment of $0.482 in monthly dividends.(1)

• Based on net asset value, the Fund had a total return of 4.13% for the six months ended March 31, 2005. That return was the result of an increase in net asset value per share from $14.91 on September 30, 2004 to $15.03 on March 31, 2005, and the reinvestment of all distributions.

• In comparison, the Lehman Brothers Municipal Bond Index – an unmanaged index of longer-term, investment-grade, municipal debt securities made up of issues larger than $50 million – had a total return of 1.21% for the six months ended March 31, 2005.(2)

• Based on the last dividend of the semi-annual period and a share price of $14.55, the Fund had a market yield of 6.62% at March 31, 2005.(3) The Fund’s market yield is equivalent to a taxable yield of 11.04%.(4)

Rating Distribution(5),(6)

By total investments

* Private insurance does not decrease the risk of loss of principal associated with this investment.

Thomas J. Fetter

Portfolio Manager

Management Discussion

• During 2004 and into early 2005, New York State posted positive job growth for the first time since 2000. Job creation in business services, education, health care and tourism have been the main drivers of growth. Gains in finance have been modest, while the state continued to lose manufacturing jobs at a faster rate than the nation as a whole. The state’s March 2005 jobless rate was 5.1%, down from 6.1% a year ago.

• Insured* private education bonds were the Fund’s largest weighting at March 31, 2005. The Fund emphasized dormitory authority bonds, which helped finance the building of living quarters and classroom facilities for some of the state’s leading colleges and universities.

• Transportation is vital to New York’s position as the nation’s economic capital and insured* transportation bonds have played a major role in the Fund. Holdings included issues for public transit, bridges and tunnels, ports and highway authorities.

• Insured* water and sewer bonds represented a major investment. The Fund’s holdings financed improvements to water and wastewater facilities and included issues for New York City and for the upstate City of Niagara Falls.

• At March 31, 2005, the Fund had leverage in the amount of approximately 37% of the Fund’s total assets. The Fund uses leverage through the issuance of preferred shares. Use of financial leverage creates an opportunity for increased income but, at the same time, creates special risks (including the likelihood of greater volatility of net asset value and market price of common shares).

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return.

Fund Information

as of March 31, 2005

Performance(7)

Average Annual Total Return (by share price, American Stock Exchange) | | | |

One Year | | 1.84 | % |

Life of Fund (11/29/02) | | 7.85 | |

Average Annual Total Return (by net asset value) | | | |

One Year | | 6.53 | % |

Life of Fund (11/29/02) | | 9.36 | |

(1) A portion of the Fund’s income may be subject to federal income tax and/or alternative minimum tax; income may be subject to state income tax.

(2) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

(3) The Fund’s market yield is calculated by dividing the most recent dividend per share by the share price at the end of the period and annualizing the result.

(4) Taxable-equivalent yield assumes a maximum 40.01% combined federal and state income tax rate. A lower tax rate would result in a lower tax-equivalent figure.

(5) Rating Distribution may not be representative of the Fund’s current or future investments.

(6) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(7) Returns are historical and are calculated by determining the percentage change in share price or net asset value with all distributions reinvested. Performance results reflect the effect of leverage resulting from the Fund’s issuance of Auction Preferred Shares.

10

Eaton Vance Insured Ohio Municipal Bond Fund as of March 31, 2005

INVESTMENT UPDATE

The Fund

• Based on share price (traded on the American Stock Exchange), the Fund had a total return of 1.62% for the six months ended March 31, 2005. That return was the result of a decrease in share price from $15.20 on September 30, 2004 to $14.98 on March 31, 2005 and the reinvestment of $0.461 in monthly dividends.(1)

• Based on net asset value, the Fund had a total return of 3.10% for the six months ended March 31, 2005. That return was the result of no change in net asset value per share from $14.64 on September 30, 2004 to March 31, 2005, and the reinvestment of all distributions.

• In comparison, the Lehman Brothers Municipal Bond Index – an unmanaged index of longer-term, investment-grade, municipal debt securities made up of issues larger than $50 million – had a total return of 1.21% for the six months ended March 31, 2005.(2)

• Based on the last dividend of the semi-annual period and a share price of $14.98, the Fund had a market yield of 6.09% at March 31, 2005.(3) The Fund’s market yield is equivalent to a taxable yield of 10.13%.(4) The dividend declared on April 29, 2005 reflects a reduction of the monthly dividend of $0.005 per share.

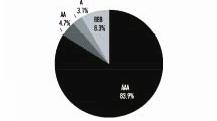

Rating Distribution(5),(6)

By total investments

* Private insurance does not decrease the risk of loss of principal associated with this investment.

Thomas J. Fetter

Portfolio Manager

Management Discussion

• Ohio’s economy generated job growth in 2004 and early 2005, benefiting from the strength in the service sector. Business services, education and health care were areas of job growth. However, while losses in the key manufacturing sector slowed, a continuing focus on productivity and restructurings limited the extent of the recovery. The state’s March 2005 jobless rate was 6.4%, up slightly from 6.1% a year ago.

• Insured* general obligations (GOs) were the Fund’s largest sector weighting at March 31, 2005, represented predominantly by school district bonds. Management focused on communities with a relatively broad local economic base, stable property tax revenues and manageable foreseeable borrowing needs.

• Insured* public education bonds remained a large commitment in the Fund. Management emphasized universities within the Ohio state university system, as well as a community college well-known in the state for its cooperative and clinical studies programs.

• Selected Puerto Rico bonds offered opportunities for further diversification by sector, issuer and coupon. The Fund’s Puerto Rico investments included electric utilities, lease revenue bonds, special tax revenues and transportation bonds.

• At March 31, 2005, the Fund had leverage in the amount of approximately 37% of the Fund’s total assets. The Fund uses leverage through the issuance of preferred shares. Use of financial leverage creates an opportunity for increased income but, at the same time, creates special risks (including the likelihood of greater volatility of net asset value and market price of common shares).

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return.

Fund Information

as of March 31, 2005

Performance(7)

Average Annual Total Return (by share price, American Stock Exchange) | | | |

One Year | | 1.26 | % |

Life of Fund (11/29/02) | | 8.31 | |

Average Annual Total Return (by net asset value) | | | |

One Year | | 6.46 | % |

Life of Fund (11/29/02) | | 7.25 | |

(1) A portion of the Fund’s income may be subject to federal income tax and/or alternative minimum tax; income may be subject to state income tax.

(2) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

(3) The Fund’s market yield is calculated by dividing the most recent dividend per share by the share price at the end of the period and annualizing the result.

(4) Taxable-equivalent yield assumes a maximum 39.88% combined federal and state income tax rate. A lower tax rate would result in a lower tax-equivalent figure.

(5) Rating Distribution may not be representative of the Fund’s current or future investments.

(6) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(7) Returns are historical and are calculated by determining the percentage change in share price or net asset value with all distributions reinvested. Performance results reflect the effect of leverage resulting from the Fund’s issuance of Auction Preferred Shares.

11

Eaton Vance Insured Pennsylvania Municipal Bond Fund as of March 31, 2005

INVESTMENT UPDATE

The Fund

• Based on share price (traded on the American Stock Exchange), the Fund had a total return of 2.79% for the six months ended March 31, 2005. That return was the result of a decrease in share price from $14.98 on September 30, 2004 to $14.93 on March 31, 2005 and the reinvestment of $0.469 in monthly dividends.(1)

• Based on net asset value, the Fund had a total return of 3.49% for the six months ended March 31, 2005. That return was the result of an increase in net asset value per share from $14.41 on September 30, 2004 to $14.46 on March 31, 2005, and the reinvestment of all distributions.

• In comparison, the Lehman Brothers Municipal Bond Index – an unmanaged index of longer-term, investment-grade, municipal debt securities made up of issues larger than $50 million – had a total return of 1.21% for the six months ended March 31, 2005.(2)

• Based on the last dividend of the semi-annual period and a share price of $14.93, the Fund had a market yield of 6.28% at March 31, 2005.(3) The Fund’s market yield is equivalent to a taxable yield of 9.97%.(4)

Rating Distribution(5),(6)

By total investments

* Private insurance does not decrease the risk of loss of principal associated with this investment.

Thomas M. Metzold

Portfolio Manager

Management Discussion

• Pennsylvania saw positive job growth in 2004 for the first time since 2000, although growth was uneven around the state. Business, education, tourism, construction and health care were major contributors. Manufacturing, especially in western Pennsylvania, continued to shed jobs. Pennsylvania’s March 2005 jobless rate was 5.2%, down from 5.5% a year ago.

• Insured* general obligations (GOs) were the Fund’s largest sector weighting at March 31, 2005. The Fund’s investments focused on city, county and school district bonds in areas with a relatively strong tax base and solid economic resources, two key variables for investors in general obligations.

• Insured* transportation bonds remained a significant commitment for the Fund. Investments focused predominantly on port authority and Pennsylvania turnpike issues. The bonds have financed repairs and expansions needed to accommodate the Commonwealth’s increasing commercial and passenger traffic.

• Insured* private education bonds constituted a large investment. Historically less sensitive to economic changes, the Fund’s investments included state and county bonds that financed the construction of university housing and teaching facilities.

• At March 31, 2005, the Fund had leverage in the amount of approximately 38% of the Fund’s total assets. The Fund uses leverage through the issuance of preferred shares. Use of financial leverage creates an opportunity for increased income but, at the same time, creates special risks (including the likelihood of greater volatility of net asset value and market price of common shares).

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return.

Fund Information

as of March 31, 2005

Performance(7)

Average Annual Total Return (by share price, American Stock Exchange) | | | |

One Year | | -0.84 | % |

Life of Fund (11/29/02) | | 8.59 | |

Average Annual Total Return (by net asset value) | | | |

One Year | | 3.38 | % |

Life of Fund (11/29/02) | | 7.12 | |

(1) A portion of the Fund’s income may be subject to federal income tax and/or alternative minimum tax; income may be subject to state income tax.

(2) It is not possible to invest directly in an Index. The Index’s total return does not reflect the commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

(3) The Fund’s market yield is calculated by dividing the most recent dividend per share by the share price at the end of the period and annualizing the result.

(4) Taxable-equivalent yield assumes a maximum 37.00% combined federal and state income tax rate. A lower tax rate would result in a lower tax-equivalent figure.

(5) Rating Distribution may not be representative of the Fund’s current or future investments.

(6) Rating Distribution is determined by dividing the total market value of the issues by the total investments of the Fund.

(7) Returns are historical and are calculated by determining the percentage change in share price or net asset value with all distributions reinvested. Performance results reflect the effect of leverage resulting from the Fund’s issuance of Auction Preferred Shares.

12

Eaton Vance Insured Municipal Bond Fund II as of March 31, 2005

PORTFOLIO OF INVESTMENTS (Unaudited)

| |

Tax-Exempt Investments - 157.4% | | | | | | | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| | General Obligations - 7.5% | | | | | | | | |

| $ | 4,500 | | | California, 5.25%, 4/1/30 | | $ | 4,682,925 | | |

| | 2,215 | | | California, 5.50%, 11/1/33 | | | 2,373,616 | | |

| | 4,000 | | | New York City, NY, 5.25%, 1/15/33 | | | 4,169,640 | | |

| | | | | | | $ | 11,226,181 | | |

| | Hospital - 5.8% | | | | | | | | |

| $ | 650 | | | California Statewide Communities Development Authority,

(Daughters of Charity Health System), 5.25%, 7/1/30 | | $ | 668,635 | | |

| | 380 | | | Cuyahoga County, OH, (Cleveland Clinic Health System),

5.50%, 1/1/29 | | | 400,429 | | |

| | 500 | | | Hawaii Pacific Health, 5.60%, 7/1/33 | | | 509,575 | | |

| | 1,000 | | | Highlands County, FL, Health Facilities Authority,

(Adventist Health System), 5.375%, 11/15/35 | | | 1,035,220 | | |

| | 1,500 | | | Lehigh County, PA, General Purpose Authority,

(Lehigh Valley Health Network), 5.25%, 7/1/32 | | | 1,518,855 | | |

| | 4,500 | | | South Miami, FL, Health Facility Authority,

(Baptist Health), 5.25%, 11/15/33 | | | 4,623,210 | | |

| | | | | | | $ | 8,755,924 | | |

| | Insured-Electric Utilities - 12.4% | | | | | | | | |

| $ | 1,500 | | | Burke County, GA, Development Authority,

(Georgia Power Co.), (FGIC), 4.75%, 5/1/34(1) | | $ | 1,473,240 | | |

| | 2,500 | | | Burlington, KS, PCR, (Kansas Gas & Electric Co.),

(MBIA), 5.30%, 6/1/31 | | | 2,645,825 | | |

| | 22,685 | | | Chelan County, WA, Public Utility District No. 1,

(Columbia River), (MBIA), 0.00%, 6/1/23 | | | 9,006,626 | | |

| | 3,900 | | | Jea, FL, Electric System, (FSA), 5.00%, 10/1/34 | | | 3,962,283 | | |

| | 1,500 | | | Municipal Energy Agency, NE, (Power Supply System),

(FSA), 5.00%, 4/1/36 | | | 1,542,210 | | |

| | | | | | | $ | 18,630,184 | | |

| | Insured-General Obligations - 19.6% | | | | | | | | |

| $ | 1,600 | | | Alvin, TX, Independent School District, (MBIA),

3.25%, 2/15/27 | | $ | 1,265,440 | | |

| | 2,550 | | | Butler County, KS, Unified School District No. 394,

(FSA), 3.50%, 9/1/24 | | | 2,176,144 | | |

| | 1,640 | | | California, (XLCA), Variable Rate,

9.955%, 10/1/28(2)(3) | | | 1,777,776 | | |

| | 1,515 | | | Chicago, IL, (MBIA), 5.00%, 1/1/42 | | | 1,534,801 | | |

| | 10,000 | | | Chicago, IL, Board of Education, (FGIC),

0.00%, 12/1/23 | | | 3,875,600 | | |

| | 1,000 | | | Desert Sands, CA, Unified School District,

(Election of 2001), (FSA), 5.00%, 6/1/24 | | | 1,043,650 | | |

| | 4,830 | | | King County, WA, (MBIA), 5.25%, 1/1/34 | | | 5,030,445 | | |

| | 2,080 | | | Philadelphia, PA, (FSA), Variable Rate,

9.92%, 9/15/31(2)(3) | | | 2,203,718 | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Insured-General Obligations (continued) | | | | | |

| $ | 1,270 | | | Phoenix, AZ, (AMBAC), 3.00%, 7/1/28 | | $ | 974,827 | | |

| | 5,490 | | | Port Orange, FL, Capital Improvements, (FGIC),

5.00%, 10/1/35 | | | 5,660,574 | | |

| | 10,000 | | | Washington, (Motor Vehicle Fuel), (MBIA),

0.00%, 12/1/23 | | | 3,898,900 | | |

| | | | | | | $ | 29,441,875 | | |

| Insured-Hospital - 2.6% | | | | | |

| $ | 3,000 | | | Maryland HEFA, (Medlantic/Helix Issue), (FSA),

Variable Rate, 10.665%, 8/15/38(2)(3) | | $ | 3,934,920 | | |

| | | | | | | $ | 3,934,920 | | |

Insured-Lease Revenue / Certificates of

Participation - 2.9% | | | | | |

| $ | 4,250 | | | Massachusetts Development Finance Agency, (MBIA),

5.125%, 2/1/34 | | $ | 4,386,595 | | |

| | | | | | | $ | 4,386,595 | | |

| Insured-Private Education - 3.8% | | | | | |

| $ | 2,500 | | | Massachusetts Development Finance Agency,

(Boston University), (XLCA), 6.00%, 5/15/59 | | $ | 3,019,900 | | |

| | 2,500 | | | Massachusetts Development Finance Agency,

(Franklin W. Olin College), (XLCA), 5.25%, 7/1/33 | | | 2,614,700 | | |

| | | | | | | $ | 5,634,600 | | |

| Insured-Public Education - 9.3% | | | | | |

| $ | 1,500 | | | Central Michigan University, (AMBAC),

4.75%, 10/1/29 | | $ | 1,514,220 | | |

| | 3,500 | | | College of Charleston, SC, Academic and Administrative

Facilities, (XLCA), 5.125%, 4/1/30 | | | 3,615,675 | | |

| | 750 | | | Florida Education System, Housing Facility Revenue,

(International University), (MBIA), 4.50%, 7/1/34 | | | 722,775 | | |

| | 5,335 | | | University of California, (AMBAC), 5.00%, 9/1/27 | | | 5,489,555 | | |

| | 2,500 | | | University of Massachusetts Building Authority, (AMBAC),

5.25%, 11/1/29 | | | 2,661,600 | | |

| | | | | | | $ | 14,003,825 | | |

| Insured-Sewer Revenue - 1.8% | | | | | |

| $ | 2,575 | | | Tacoma, WA, Sewer Revenue, (FGIC), 5.00%, 12/1/31 | | $ | 2,626,732 | | |

| | | | | | | $ | 2,626,732 | | |

| Insured-Special Assessment Revenue - 1.5% | | | | | |

| $ | 2,165 | | | San Jose, CA, Redevelopment Agency Tax, (MBIA),

Variable Rate, 9.955%, 8/1/32(2)(3) | | $ | 2,287,734 | | |

| | | | | | | $ | 2,287,734 | | |

See notes to financial statements

13

Eaton Vance Insured Municipal Bond Fund II as of March 31, 2005

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

Principal Amount

(000's omitted) | |

Security | |

Value | |

| | Insured-Special Tax Revenue - 6.4% | | | | | | | | |

| $ | 4,000 | | | Metropolitan Pier and Exposition Authority, (McCormick

Place Expansion), IL, (MBIA), 5.25%, 6/15/42 | | $ | 4,183,280 | | |

| | 5,325 | | | Utah Transportation Authority Sales Tax, (FSA),

5.00%, 6/15/32 | | | 5,442,469 | | |

| | | | | | | $ | 9,625,749 | | |

| | Insured-Transportation - 37.6% | | | | | | | | |

| $ | 1,000 | | | Central, TX, Regional Mobility Authority, (FGIC),

5.00%, 1/1/45 | | $ | 1,012,630 | | |

| | 4,000 | | | Chicago, IL, Transportation, (Skywalk), (AMBAC),

5.25%, 1/1/31 | | | 4,321,720 | | |

| | 11,900 | | | E-470 Public Highway Authority, CO, (MBIA),

0.00%, 9/1/22 | | | 4,992,407 | | |

| | 12,390 | | | E-470 Public Highway Authority, CO, (MBIA),

0.00%, 9/1/24 | | | 4,607,593 | | |

| | 2,345 | | | Massachusetts Turnpike Authority, Metropolitan Highway

System, (AMBAC), 5.00%, 1/1/39 | | | 2,380,949 | | |

| | 1,500 | | | Massachusetts Turnpike Authority, Metropolitan Highway

System, (MBIA), 5.00%, 1/1/37 | | | 1,521,120 | | |

| | 3,835 | | | Massachusetts Turnpike Authority, Metropolitan Highway

System, (MBIA), Variable Rate, 9.995%, 1/1/37(2)(3) | | | 3,996,990 | | |

| | 13,885 | | | Nevada Department of Business and Industry, (Las Vegas

Monorail-1st Tier), (AMBAC), 0.00%, 1/1/20 | | | 6,721,173 | | |

| | 1,200 | | | North Texas Tollway Authority, (FSA), 4.50%, 1/1/38 | | | 1,130,412 | | |

| | 5,000 | | | South Carolina Transportation Infrastructure, (AMBAC),

5.25%, 10/1/31 | | | 5,264,000 | | |

| | 10,000 | | | Texas Turnpike Authority, (AMBAC), 5.00%, 8/15/42(4) | | | 10,113,100 | | |

| | 10,000 | | | Triborough Bridge and Tunnel Authority, NY, (MBIA),

5.00%, 11/15/32 | | | 10,283,400 | | |

| | | | | | | $ | 56,345,494 | | |

| | Insured-Utilities - 8.5% | | | | | | | | |

| $ | 6,500 | | | Los Angeles, CA, Department of Water and Power,

(FGIC), 5.00%, 7/1/43 | | $ | 6,584,305 | | |

| | 6,000 | | | Philadelphia, PA, Gas Works Revenue, (FSA),

5.00%, 8/1/32 | | | 6,153,780 | | |

| | | | | | | $ | 12,738,085 | | |

| | Insured-Water and Sewer - 12.7% | | | | | | | | |

| $ | 2,240 | | | Atlanta, GA, Water and Sewer, (FGIC),

5.00%, 11/1/38(5) | | $ | 2,276,893 | | |

| | 4,895 | | | Atlanta, GA, Water and Wastewater, (MBIA),

5.00%, 11/1/39 | | | 4,978,264 | | |

| | 8,155 | | | Birmingham, AL, Waterworks and Sewer Board, (MBIA),

5.00%, 1/1/37 | | | 8,351,699 | | |

| | 1,950 | | | New York City, NY, Municipal Water Finance Authority,

(Water and Sewer System), (AMBAC), 5.00%, 6/15/38 | | | 1,999,335 | | |

| | 1,275 | | | Pittsburgh, PA, Water and Sewer Authority, (AMBAC),

Variable Rate, 10.304%, 12/1/27(2)(3) | | | 1,426,495 | | |

| | | | | | | $ | 19,032,686 | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Insured-Water Revenue - 14.1% | | | | | |

| $ | 2,330 | | | Contra Costa, CA, Water District, (FSA), Variable Rate,

9.959%, 10/1/32(2)(3) | | $ | 2,534,691 | | |

| | 3,450 | | | Detroit, MI, Water Supply System, (MBIA), Variable Rate,

9.82%, 7/1/34(2)(3) | | | 3,712,959 | | |

| | 7,000 | | | Metropolitan Water District, CA, (FGIC),

5.00%, 10/1/36 | | | 7,223,510 | | |

| | 2,870 | | | San Antonio, TX, Water Revenue, (FGIC),

5.00%, 5/15/23 | | | 2,986,063 | | |

| | 4,610 | | | Texas Southmost Regional Water Authority, (MBIA),

5.00%, 9/1/32 | | | 4,702,799 | | |

| | | | | | | $ | 21,160,022 | | |

Lease Revenue / Certificates of

Participation - 0.7% | | | | | |

| $ | 1,000 | | | Metropolitan Transportation Authority of New York,

Lease Contract, 5.125%, 1/1/29 | | $ | 1,029,810 | | |

| | | | | | | $ | 1,029,810 | | |

| Other Revenue - 0.9% | | | | | |

| $ | 1,250 | | | Capital Trust Agency, FL, (Seminole Tribe Convention),

8.95%, 10/1/33 | | $ | 1,400,000 | | |

| | | | | | | $ | 1,400,000 | | |

| Special Tax Revenue - 3.8% | | | | | |

| $ | 3,155 | | | Massachusetts Bay Transportation Authority, Sales Tax,

5.00%, 7/1/29 | | $ | 3,388,628 | | |

| | 750 | | | New Jersey EDA, (Cigarette Tax), 5.50%, 6/15/24 | | | 781,373 | | |

| | 1,480 | | | New Jersey EDA, (Cigarette Tax), 5.75%, 6/15/29 | | | 1,555,954 | | |

| | | | | | | $ | 5,725,955 | | |

| Transportation - 5.5% | | | | | |

| $ | 7,980 | | | Puerto Rico Highway and Transportation Authority,

5.125%, 7/1/43 | | $ | 8,167,690 | | |

| | | | | | | $ | 8,167,690 | | |

| | Total Tax-Exempt Investments - 157.4%

(identified cost $227,687,885) | | | | | $ | 236,154,061 | | |

| | Other Assets, Less Liabilities - 0.9% | | | | | $ | 1,419,219 | | |

| | Auction Preferred Shares Plus Cumulative

Unpaid Dividends - (58.3)% | | | | | $ | (87,502,339 | ) | |

| | Net Assets Applicable to Common

Shares - 100.0% | | | | | $ | 150,070,941 | | |

See notes to financial statements

14

Eaton Vance Insured Municipal Bond Fund II as of March 31, 2005

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

AMBAC - AMBAC Financial Group, Inc.

FGIC - Financial Guaranty Insurance Company

FSA - Financial Security Assurance, Inc.

MBIA - Municipal Bond Insurance Association

XLCA - XL Capital Assurance, Inc.

The Fund invests primarily in debt securities issued by municipalities. The ability of the issuers of the debt securities to meet their obligations may be affected by economic developments in a specific industry or municipality. In order to reduce the risk associated with such economic developments, at March 31, 2005, 84.6% of the securities in the portfolio of investments are backed by bond insurance of various financial institutions and financial guaranty assurance agencies. The aggregate percentage insured by an individual financial institution ranged from 4.7% to 34.8% of total investments.

(1) When-issued security.

(2) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At March 31, 2005, the aggregate value of the securities is $21,875,283 or 14.6% of the Fund's net assets.

(3) Security has been issued as a leveraged inverse floater bond. The stated interest rate represents the rate in effect at March 31, 2005.

(4) Security (or a portion thereof) has been segregated to cover when-issued securities.

(5) Security (or a portion thereof) has been segregated to cover margin requirements on open financial futures contracts.

See notes to financial statements

15

Eaton Vance Insured California Municipal Bond Fund II as of March 31, 2005

PORTFOLIO OF INVESTMENTS (Unaudited)

| |

Tax-Exempt Investments - 158.0% | | | | | | | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

| | General Obligations - 5.9% | | | | | | | | |

| $ | 775 | | | California, 5.00%, 6/1/34 | | $ | 790,128 | | |

| | 900 | | | California, 5.25%, 4/1/30 | | | 936,585 | | |

| | 1,465 | | | California, 5.50%, 11/1/33 | | | 1,569,909 | | |

| | | | | | | $ | 3,296,622 | | |

| | Insured-Electric Utilities - 10.5% | | | | | | | | |

| $ | 3,475 | | | Glendale Electric, (MBIA), 5.00%, 2/1/32 | | $ | 3,566,497 | | |

| | 1,650 | | | Puerto Rico Electric Power Authority, (FSA), Variable Rate,

8.39%, 7/1/29(1)(2) | | | 1,869,730 | | |

| | 455 | | | Sacramento Municipal Electric Utility District, (FSA),

Variable Rate, 9.957%, 8/15/28(1)(3) | | | 493,466 | | |

| | | | | | | $ | 5,929,693 | | |

| | Insured-General Obligations - 37.8% | | | | | | | | |

| $ | 1,000 | | | California, (AMBAC), 4.25%, 3/1/27 | | $ | 936,730 | | |

| | 1,250 | | | California, (AMBAC), 5.00%, 4/1/27 | | | 1,283,775 | | |

| | 415 | | | California, (XLCA), Variable Rate,

9.955%, 10/1/28(1)(3) | | | 449,864 | | |

| | 5,000 | | | Clovis Unified School District, (FGIC), 0.00%, 8/1/20 | | | 2,350,050 | | |

| | 2,000 | | | Laguna Salada Union School District, (FGIC),

0.00%, 8/1/22 | | | 837,580 | | |

| | 2,350 | | | Long Beach Unified School District, (Election of 1999),

(FSA), 5.00%, 8/1/31 | | | 2,409,431 | | |

| | 1,710 | | | Los Angeles Unified School District, (FGIC),

5.375%, 7/1/25 | | | 1,819,406 | | |

| | 1,945 | | | Los Osos Community Services, Wastewater Assessment

District, (MBIA), 5.00%, 9/2/33 | | | 1,988,957 | | |

| | 1,000 | | | Mount Diablo Unified School District, (FSA),

5.00%, 8/1/25 | | | 1,031,510 | | |

| | 735 | | | San Diego Unified School District, (MBIA), Variable Rate,

11.455%, 7/1/24(1)(3) | | | 1,055,364 | | |

| | 4,300 | | | San Mateo County Community College District,

(Election of 2001), (FGIC), 0.00%, 9/1/21 | | | 1,903,825 | | |

| | 1,750 | | | Santa Ana Unified School District, (MBIA),

5.00%, 8/1/32 | | | 1,800,172 | | |

| | 1,000 | | | Simi Valley Unified School District, (MBIA),

5.00%, 8/1/28 | | | 1,038,860 | | |

| | 3,200 | | | Union Elementary School District, (FGIC), 0.00%, 9/1/22 | | | 1,336,800 | | |

| | 2,600 | | | Union Elementary School District, (FGIC), 0.00%, 9/1/23 | | | 1,023,828 | | |

| | | | | | | $ | 21,266,152 | | |

Principal Amount

(000's omitted) | |

Security | |

Value | |

Insured-Lease Revenue / Certificates of

Participation - 21.0% | | | | | |

| $ | 4,000 | | | Anaheim, Public Financing Authority Lease Revenue,

(FSA), 5.00%, 3/1/37 | | $ | 4,051,960 | | |

| | 4,250 | | | California Public Works Board Lease Revenue, (Department

of General Services), (AMBAC), 5.00%, 12/1/27(4) | | | 4,368,192 | | |

| | 2,250 | | | Orange County Water District Certificates of Participation,

(MBIA), 5.00%, 8/15/34 | | | 2,303,190 | | |

| | 1,075 | | | San Jose Financing Authority, (Civic Center), (AMBAC),

5.00%, 6/1/32 | | | 1,097,704 | | |

| | | | | | | $ | 11,821,046 | | |

| Insured-Public Education - 14.3% | | | | | |

| $ | 4,000 | | | California State University, (AMBAC), 5.00%, 11/1/33 | | $ | 4,107,760 | | |

| | 3,790 | | | University of California, (FGIC), 5.125%, 9/1/31 | | | 3,929,624 | | |

| | | | | | | $ | 8,037,384 | | |

| Insured-Sewer Revenue - 6.3% | | | | | |

| $ | 3,425 | | | Los Angeles Wastewater Treatment System, (FGIC),

5.00%, 6/1/28 | | $ | 3,531,894 | | |

| | | | | | | $ | 3,531,894 | | |

| Insured-Special Assessment Revenue - 18.5% | | | | | |

| $ | 2,500 | | | Cathedral City Public Financing Authority,

(Housing Redevelopment), (MBIA), 5.00%, 8/1/33 | | $ | 2,564,525 | | |

| | 2,500 | | | Cathedral City Public Financing Authority, (Tax Allocation

Redevelopment), (MBIA), 5.00%, 8/1/33 | | | 2,564,525 | | |

| | 1,750 | | | Irvine Public Facility and Infrastructure Authority

Assessment, (AMBAC), 5.00%, 9/2/26 | | | 1,804,670 | | |

| | 2,000 | | | Murrieta Redevelopment Agency Tax, (MBIA),

5.00%, 8/1/32 | | | 2,052,240 | | |

| | 1,335 | | | San Jose Redevelopment Agency Tax, (MBIA),

Variable Rate, 9.955%, 8/1/32(1)(3) | | | 1,410,681 | | |

| | | | | | | $ | 10,396,641 | | |

| Insured-Special Tax Revenue - 8.7% | | | | | |

| $ | 1,000 | | | San Francisco Bay Area Rapid Transportation District

Sales Tax Revenue, (AMBAC), 5.00%, 7/1/31 | | $ | 1,024,990 | | |

| | 3,750 | | | San Francisco Bay Area Rapid Transportation District,

(AMBAC), 5.125%, 7/1/36 | | | 3,871,050 | | |

| | | | | | | $ | 4,896,040 | | |

See notes to financial statements

16

Eaton Vance Insured California Municipal Bond Fund II as of March 31, 2005

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

Principal Amount

(000's omitted) | |

Security | |

Value | |

| Insured-Transportation - 15.4% | | | | | |

| $ | 4,000 | | | California Infrastructure and Economic Development,

(Bay Area Toll Bridges), (AMBAC), 5.00%, 7/1/36 | | $ | 4,125,160 | | |

| | 2,250 | | | Los Angeles County Metropolitan Transportation Authority,

(FGIC), 5.25%, 7/1/30 | | | 2,369,048 | | |

| | 6,670 | | | San Joaquin Hills Transportation Corridor Agency,

(MBIA), 0.00%, 1/15/27 | | | 2,154,143 | | |

| | | | | | | $ | 8,648,351 | | |

| Insured-Utilities - 3.2% | | | | | |

| $ | 1,750 | | | Los Angeles Department of Water and Power,

(FGIC), 5.125%, 7/1/41 | | $ | 1,785,088 | | |

| | | | | | | $ | 1,785,088 | | |

| Insured-Water and Sewer - 10.3% | | | | | |

| $ | 5,700 | | | East Bay Municipal Utility District Water System, (MBIA),

5.00%, 6/1/38 | | $ | 5,810,010 | | |

| | | | | | | $ | 5,810,010 | | |

| Insured-Water Revenue - 1.6% | | | | | |

| $ | 835 | | | Contra Costa Water District, (FSA), Variable Rate,