UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21233

PARADIGM FUNDS

(Exact name of registrant as specified in charter)

Nine Elk Street, Albany, NY 12207-1002

(Address of principal executive offices) (Zip code)

Robert A. Benton

Nine Elk Street, Albany, NY 12207-1002

(Name and address of agent for service)

Registrant's telephone number, including area code: (518) 431-3500

Date of fiscal year end: December 31

Date of reporting period: December 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e -1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number.

Item 1. Reports to Stockholders.

Paradigm Funds

Paradigm Value Fund

Paradigm Select Fund

Paradigm Opportunity Fund

Paradigm Micro-Cap Fund

For Investors Seeking Long-Term Capital Appreciation

ANNUAL REPORT

December 31, 2015

| Table of Contents | |

| PARADIGM FUNDS | |

| Letter to Shareholders | 2 |

| Sector Allocation | 5 |

| Performance Information | 7 |

| Schedules of Investments | 11 |

| Statements of Assets and Liabilities | 21 |

| Statements of Operations | 21 |

| Statements of Changes in Net Assets | 23 |

| Financial Highlights | 25 |

| NOTES TO FINANCIAL STATEMENTS | 27 |

| DISCLOSURE OF EXPENSES | 33 |

| ADDITIONAL INFORMATION | 35 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 37 |

| TRUSTEES & OFFICERS | 38 |

2015 Annual Report 1

Letter to Shareholders

Dear Fellow Shareholders:

Last year’s letter touched on falling energy prices, a trend that continued and accelerated in 2015, resulting in significant market dispersion and genuine geopolitical concerns on a global level. We are acutely cognizant of these risks and more focused than ever on smaller companies that we believe are poised to benefit from the resurgent American economy, minimizing exposure to the malaise of global markets.

Large-cap stocks materially outperformed small-cap stocks in 2015. Growth also significantly outperformed value. While that was challenging in the short term, our simple take-away from this continuation of a trend that carried over from 2014 is cautious optimism for 2016. Investing climates changes and two consecutive years of small-cap underperfor-mance contribute to our constructive outlook for small- to mid-sized companies, particularly those with value characteristics. The micro-cap sector in particular appears oversold. One of the advantages of investing in smaller, less complicated companies is the ability to identify and limit geographic exposures and other factors, which can be more challenging with highly diversified global giants.

In contrast to our conversations with company management teams a year ago, some now sound slightly more cautious about expectations for their businesses and their industries against an increasingly complex global economic environment. We believe that some management teams are dialing back expectations as a reflection of the fragile psychology of investors, and the markets appear more focused on investor sentiment than underlying fundamentals, which we believe to still be sound. Thus, despite the market turmoil we have seen in the early days of 2016, we remain optimistic and constructive about the longer-term prospects for well-managed, attractively valued micro- to mid-cap equities.

We believe that markets are discounting a lot right now, and with the insights we are able to achieve for our longer-term holdings and their business models, we find these times to be opportunities to selectively add to our positions, or revisit names that have retreated. This remains the hardest part of the investing process: knowing when to step up to the plate. We continue to adhere to our investment discipline day to day, recognizing that there is no guarantee of instant gratification.

Paradigm Value Fund

The Paradigm Value Fund (PVFAX) appreciated 1.35% in 2015, compared to a decline of 7.47% for the benchmark Russell 2000 Value.

Outperformance in 2015 was broad-based; the Fund’s portfolio holdings outperformed its benchmark in eight out of 10 sectors. The principal reason for such outperformance was stock selection.

Stock selection was most especially strong in the Industrials sector. Over the year, portfolio holdings in that sector appreciated 11.35%, while benchmark holdings in the same sector lost 10.39% .

Stock selection was also strong in the Information Technology sector. Over the year, portfolio holdings in that sector gained 3.55%, while benchmark holdings in the same sector lost 2.36% .

2015 Annual Report 2

Paradigm Select Fund

The Paradigm Select Fund (PFSLX) declined 1.26% in 2015, compared to a loss of 2.90% for the benchmark Russell 2500.

Strong stock selection in the Health Care sector was the top contributor to the Fund’s outperformance in 2015, with portfolio holdings’ 22.41% return more than double the benchmark sector’s 9.23% gain.

Materials holdings in the portfolio declined 4.63%, well ahead of the benchmark sector’s 11.68% drop.

The portfolio’s holdings in the Financials sector also outperformed the benchmark sector; however, this was offset by an underweight allocation to the sector.

The Industrials sector proved most challenging in the quarter due to setbacks in the Aerospace and Transportation industries.

Paradigm Opportunity Fund

The Paradigm Opportunity Fund (PFOPX) declined 4.76% in 2015, representing only a slight underperformance of the benchmark Russell 2000, which declined 4.41% over the same period.

Strong stock selection made the Financials sector the top contributor in 2015. Portfolio holdings appreciated 26.46%, compared to the benchmark sector’s 0.71% decline. However, an underweight allocation to the sector offset these gains.

The Fund’s concentration in the Information Technology sector again contributed most to relative performance in 2015, with the portfolio sector’s significant overweight to this outperforming sector contributing to relative performance.

The Consumer Discretionary sector was the largest detractor in the quarter due to a combination of slightly lower performance than the benchmark sector and an overweight allocation to this underperforming sector.

Paradigm Micro-Cap Fund

The Paradigm Micro-Cap Fund (PVIVX) declined 10.05% in 2015, compared to a loss of 5.16% for the benchmark Russell Microcap.

The Fund’s underperformance over the year resulted primarily from relative underperfor-mance in the Consumer Discretionary and Healthcare sectors.

The Fund’s overweight allocation to the Consumer Discretionary sector was the primary driver to underperformance in 2015, due in part to the portfolio’s focus on Specialty Retail, which sold off significantly over the period.

In the Healthcare sector, stock selection was the primary driver of underperformance. Over the year, portfolio holdings in that sector declined by 10.93%, while benchmark holdings in

2015 Annual Report 3

the same sector gained 1.60% . This discrepancy largely reflects the Fund’s avoidance of the Biotech sub-sector, which accounted for the majority of the benchmark sector’s positive performance.

In addition, the Fund’s avoidance of the Financials sector, which was the largest benchmark contributor over the year, adversely affected performance.

Sincerely,

Candace King Weir | Amelia F. Weir |

2015 Annual Report 4

Paradigm Funds (Unaudited)

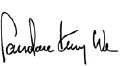

| PARADIGM VALUE FUND Sector Allocation as of December 31, 2015 (As a Percentage of Equity Securities Held) |

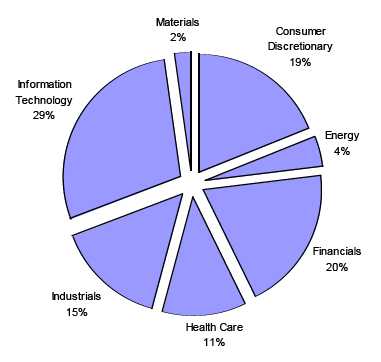

| PARADIGM SELECT FUND Sector Allocation as of December 31, 2015 (As a Percentage of Equity Securities Held) |

2015 Annual Report 5

Paradigm Funds (Unaudited)

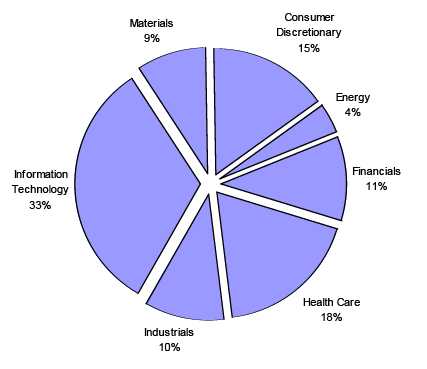

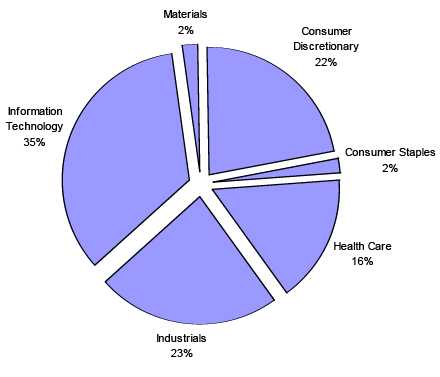

| PARADIGM OPPORTUNITY FUND Sector Allocation as of December 31, 2015 (As a Percentage of Equity Securities Held) |

| PARADIGM MICRO-CAP FUND Sector Allocation as of December 31, 2015 (As a Percentage of Equity Securities Held) |

2015 Annual Report 6

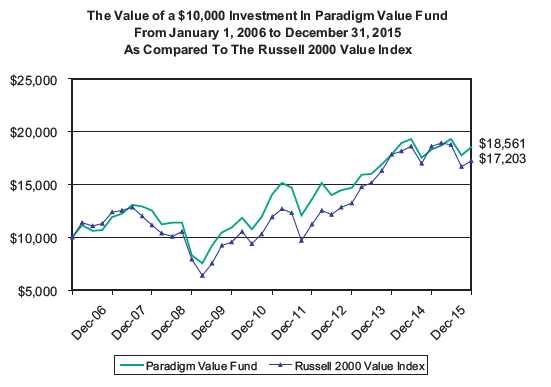

Paradigm Value Fund (Unaudited)

PERFORMANCE INFORMATION

Average Annual Rate of Return (%) for The Periods Ended December 31, 2015.

December 31, 2015 NAV $43.02

| 1 Year(A) | 3 Year(A) | 5 Year(A) | 10 Year(A) | |||||

| Paradigm Value Fund | 1.35% | 8.15% | 5.73% | 6.38% | ||||

| Russell 2000® Value Index(B) | -7.47% | 9.06% | 7.67% | 5.58% |

(A) 1 Year, 3 Year, 5 Year and 10 Year returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions. The inception date of the Paradigm Value Fund was January 1, 2003.

(B) The Russell 2000® Value Index (whose composition is different from the Fund) is an unmanaged index of small-capitalization stocks with lower price-to-book ratios and lower forecasted growth values than the total population of small-capitalization stocks.

For purposes of the graph and the accompanying table, it is assumed that all dividends and distributions were reinvested.

Per the Fund’s most recent prospectus, the Fund’s total annual operating expense ratio (before any fee waiver) is 1.97%, and 1.50% post waiver. The Advisor has contractually agreed to waive management fees and reimburse expenses to the extent necessary to maintain total annual operating expenses of the Fund (excluding brokerage fees and commissions, interest and other borrowing expenses, taxes, extraordinary expenses and the indirect costs of investing in Acquired Funds) at 1.50% of its average daily net assets through April 30, 2016.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAT THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-800-239-0732 OR VISIT OUR WEBSITE AT www.paradigm-funds.com.

2015 Annual Report 7

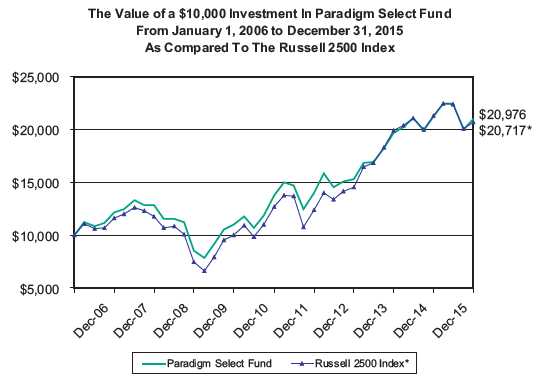

Paradigm Select Fund (Unaudited)

PERFORMANCE INFORMATION

Average Annual Rate of Return (%) for The Periods Ended December 31, 2015.

December 31, 2015 NAV $29.09

| 1 Year(A) | 3 Year(A) | 5 Year(A) | 10 Year(A) | |||||

| Paradigm Select Fund | -1.26% | 11.12% | 8.82% | 7.69% | ||||

| Russell 2500® Index(B) | -2.90% | 12.46% | 10.32% | 7.56% |

(A) 1 Year, 3 Year, 5 Year and 10 Year returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions. The inception date of the Paradigm Select Fund was January 1, 2005.

(B) The Russell 2500® Index (whose composition is different from the Fund) measures the performance of the small to mid-cap segment of the U.S. equity universe, commonly referred to as “mid” cap. The Russell 2500 Index is a subset of the Russell 3000® Index. It includes approximately 2,500 of the smallest securities based on a combination of their market cap and current index membership.

For purposes of the graph and the accompanying table, it is assumed that all dividends and distributions were reinvested.

Per the Fund’s most recent prospectus, the Fund’s total annual operating expense ratio (before any fee waiver) is 1.50%, and 1.15% post waiver. The Advisor has contractually agreed to waive management fees and reimburse expenses to the extent necessary to maintain total annual operating expenses of the Fund (excluding brokerage fees and commissions, interest and other borrowing expenses, taxes, extraordinary expenses and the indirect costs of investing in Acquired Funds) at 1.15% of its average daily net assets through April 30, 2016.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAT THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-800-239-0732 OR VISIT OUR WEBSITE AT www.paradigm-funds.com.

2015 Annual Report 8

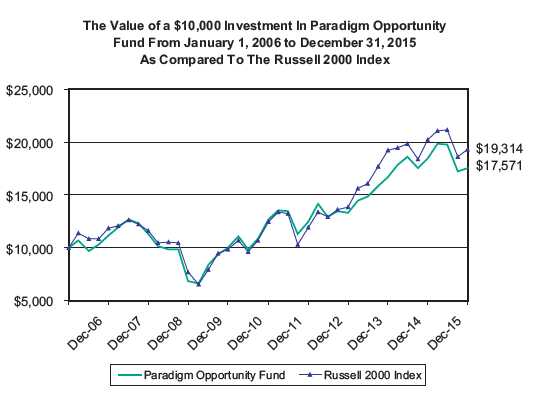

Paradigm Opportunity Fund (Unaudited)

PERFORMANCE INFORMATION

Average Annual Rate of Return (%) for The Periods Ended December 31, 2015.

December 31, 2015 NAV $31.14

| 1 Year(A) | 3 Year(A) | 5 Year(A) | 10 Year(A) | |||||

| Paradigm Opportunity Fund | -4.76% | 9.65% | 6.78% | 5.80% | ||||

| Russell 2000® Index(B) | -4.41% | 11.65% | 9.19% | 6.80% |

(A) 1 Year, 3 Year, 5 Year and 10 Year returns include change in share prices and in each case includes reinvestment of any dividends, capital gain distributions and return of capital. The inception date of the Paradigm Opportunity Fund was January 1, 2005.

(B) The Russell 2000® Index (whose composition is different from the Fund) consists of the smallest 2,000 companies in the Russell 3000 Index (which represents approximately 98% of the investable U.S. equity market). The Index is an unmanaged index generally considered as the premier of small capitalization stocks.

For purposes of the graph and the accompanying table, it is assumed that all dividends and distributions were reinvested.

Per the Fund’s most recent prospectus, the Fund’s total annual operating expense ratio (before any fee waiver) is 2.01%, and 1.26% post waiver. The Advisor has contractually agreed to waive management fees and reimburse expenses to the extent necessary to maintain total annual operating expenses of the Fund (excluding brokerage fees and commissions, interest and other borrowing expenses, taxes, extraordinary expenses and the indirect costs of investing in Acquired Funds) at 1.25% of its average daily net assets through April 30, 2016.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAT THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-800-239-0732 OR VISIT OUR WEBSITE AT www.paradigm-funds.com.

2015 Annual Report 9

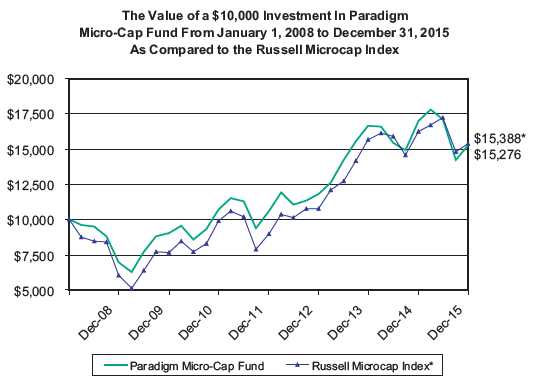

Paradigm Micro-Cap Fund (Unaudited)

PERFORMANCE INFORMATION

Average Annual Rate of Return (%) for The Period Ended December 31, 2015.

| December 31, 2015 NAV $24.32 | ||||||||

| Since | ||||||||

| 1 Year(A) | 3 Year(A) | 5 Year(A) | Inception(A) | |||||

| Paradigm Micro-Cap Fund | -10.05% | 9.00% | 7.35% | 5.44% | ||||

| Russell Microcap® Index(B) | -5.16% | 12.70% | 9.23% | 5.53% |

(A) 1 Year, 3 Year, 5 Year and Since Inception returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions. The inception date of the Paradigm Micro-Cap Fund was January 1, 2008. Effective December 27, 2011, the name of the Paradigm Intrinsic Value Fund was changed to the Paradigm Micro-Cap Fund.

(B) The Russell Microcap® Index measures the performance of the microcap segment of the U.S. equity market. Microcap stocks make up less than 3% of the U.S. equity market (by market cap) and consist of the smallest 1,000 securities in the small-cap Russell 2000® Index, plus the next smallest eligible securities by market cap. The Russell Microcap is completely reconstituted annually to ensure larger stocks do not distort performance and characteristics of the true microcap opportunity set. Effective December 27, 2011 the Fund changed its investment strategy. Under normal circumstances, the Micro-Cap Fund invests at least 80% of its net assets in common stocks of U.S. micro-cap companies. Therefore, the primary comparative index was changed from the S&P 500® Index to the Russell Microcap® Index.

For purposes of the graph and the accompanying table, it is assumed that all dividends and distributions were reinvested.

Per the Fund’s most recent prospectus, the Fund’s total annual operating expense ratio is 1.25% .

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAT THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-800-239-0732 OR VISIT OUR WEBSITE AT www.paradigm-funds.com.

2015 Annual Report 10

| Paradigm Value Fund | |||||

| Schedule of Investments | |||||

| December 31, 2015 | |||||

| Shares | Fair Value | % of Net Assets | |||

| COMMON STOCKS | |||||

| Air Courier Services | |||||

| 178,500 | Air Transport Services Group, Inc. * | $ | 1,799,280 | 2.69 | % |

| Aircraft Parts & Auxiliary Equipment, NEC | |||||

| 50,000 | Ducommun Incorporated * | 811,000 | 1.21 | % | |

| Computer Communications Equipment | |||||

| 400,000 | Extreme Networks, Inc. * | 1,632,000 | |||

| 72,000 | QLogic Corp. * | 878,400 | |||

| 2,510,400 | 3.75 | % | |||

| Construction - Special Trade Contractors | |||||

| 74,800 | Matrix Service Co. * | 1,536,392 | 2.30 | % | |

| Deep Sea Foreign Transportation of Freight | |||||

| 112,100 | Ardmore Shipping Corporation (Ireland) | 1,425,912 | 2.13 | % | |

| Electrical Work | |||||

| 39,000 | EMCOR Group Inc. | 1,873,560 | 2.80 | % | |

| Guided Missiles & Space Vehicles & Parts | |||||

| 50,000 | Kratos Defense & Security Solutions, Inc. * | 205,000 | 0.31 | % | |

| Heavy Construction Other Than Building Construction - Contractors | |||||

| 35,500 | Granite Construction Incorporated | 1,523,305 | 2.28 | % | |

| Household Furniture | |||||

| 20,000 | La-Z-Boy Incorporated | 488,400 | 0.73 | % | |

| Industrial Organic Chemicals | |||||

| 23,400 | Sensient Technologies Corp. | 1,469,988 | 2.20 | % | |

| Instruments for Measuring & Testing of Electricity & Electric Signals | |||||

| 100,000 | Xcerra Corporation * | 605,000 | 0.90 | % | |

| Laboratory Analytical Instruments | |||||

| 32,400 | PerkinElmer Inc. | 1,735,668 | 2.59 | % | |

| Laboratory Apparatus & Furniture | |||||

| 20,800 | Newport Corporation * | 330,096 | 0.49 | % | |

| Metal Forgings & Stampings | |||||

| 14,300 | Park-Ohio Holdings Corp. | 525,954 | 0.79 | % | |

| Miscellaneous Electrical Machinery, Equipment & Supplies | |||||

| 149,600 | Electro Scientific Industries, Inc. * | 776,424 | 1.16 | % | |

| Motor Vehicles & Passenger Car Bodies | |||||

| 40,000 | Federal Signal Corporation | 634,000 | 0.95 | % | |

| Motor Vehicle Parts & Accessories | |||||

| 67,600 | Tower International, Inc. | 1,931,332 | 2.89 | % | |

| National Commercial Banks | |||||

| 51,700 | First Merchants Corporation | 1,314,214 | |||

| 43,436 | National Bank Holdings Corporation - Class A | 928,228 | |||

| 2,242,442 | 3.35 | % | |||

| Orthopedic, Prosthetic & Surgical Appliances & Supplies | |||||

| 80,000 | RTI Surgical, Inc. * | 317,600 | 0.47 | % | |

| Periodicals: Publishing or Publishing & Printing | |||||

| 32,000 | Rovi Corporation * | 533,120 | 0.80 | % | |

| Photographic Equipment & Supplies | |||||

| 30,000 | Avid Technology, Inc. * | 218,700 | 0.33 | % | |

| Radio & TV Broadcasting & Communications Equipment | |||||

| 120,000 | Mitel Networks Corporation * (Canada) | 922,800 | 1.38 | % | |

| Retail - Apparel & Accessory Stores | |||||

| 30,000 | Citi Trends, Inc. | 637,500 | |||

| 99,500 | Express Inc. * | 1,719,360 | |||

| 30,700 | The Men's Wearhouse, Inc. | 450,676 | |||

| 35,800 | Tilly’s, Inc. - Class A * | 237,354 | |||

| 3,044,890 | 4.55 | % | |||

| * Non-Income Producing Securities. The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 11

| Paradigm Value Fund | ||||||

| Schedule of Investments | ||||||

| December 31, 2015 | ||||||

| Shares | Fair Value | % of Net Assets | ||||

| COMMON STOCKS | ||||||

| Retail - Family Clothing Stores | ||||||

| 113,200 | American Eagle Outfitters, Inc. | $ | 1,754,600 | |||

| 50,000 | Stein Mart, Inc. | 336,500 | ||||

| 2,091,100 | 3.12 | % | ||||

| Retail - Retail Stores, NEC | ||||||

| 25,400 | IAC/InterActiveCorp. | 1,525,270 | ||||

| 50,000 | Kirkland's, Inc. | 725,000 | ||||

| 2,250,270 | 3.36 | % | ||||

| Retail - Shoe Stores | ||||||

| 30,300 | Foot Locker, Inc. | 1,972,227 | 2.95 | % | ||

| Retail - Women's Clothing Stores | ||||||

| 340,000 | New York & Company, Inc. * | 778,600 | 1.16 | % | ||

| Savings Institution, Federally Chartered | ||||||

| 44,800 | LegacyTexas Financial Group, Inc. | 1,120,896 | ||||

| 166,242 | United Financial Bancorp | 2,141,197 | ||||

| 3,262,093 | 4.87 | % | ||||

| Semiconductors & Related Devices | ||||||

| 48,100 | Kulicke & Soffa Industries Inc. * (Singapore) | 561,327 | ||||

| 160,000 | Lattice Semiconductor Corporation * | 1,035,200 | ||||

| 54,600 | Microsemi Corporation * | 1,779,414 | ||||

| 28,900 | Qorvo, Inc. * | 1,471,010 | ||||

| 60,000 | Ultra Clean Holdings, Inc. * | 307,200 | ||||

| 5,154,151 | 7.70 | % | ||||

| Services - Business Services, NEC | ||||||

| 33,500 | Rightside Group, Ltd. * | 278,050 | 0.41 | % | ||

| Services - Computer Integrated Systems Design | ||||||

| 100,000 | Allscripts Healthcare Solutions, Inc. * | 1,538,000 | ||||

| 70,000 | Convergys Corp. | 1,742,300 | ||||

| 3,280,300 | 4.90 | % | ||||

| Services - Computer Processing & Data Preparation | ||||||

| 33,000 | Demand Media, Inc. * | 181,500 | 0.27 | % | ||

| Services - Equipment Rental & Leasing, NEC | ||||||

| 50,000 | Neff Corporation - Class A * | 383,000 | 0.57 | % | ||

| Services - Help Supply Services | ||||||

| 66,100 | Kforce Inc. | 1,671,008 | 2.50 | % | ||

| Services - Hospitals | ||||||

| 25,900 | Magellan Health Services Inc. * | 1,596,994 | ||||

| 25,600 | MEDNAX, Inc. * | 1,834,496 | ||||

| 3,431,490 | 5.13 | % | ||||

| Services - Motion Picture Theaters | ||||||

| 71,400 | Regal Entertainment Group Class A | 1,347,318 | 2.01 | % | ||

| Special Industry Machinery, NEC | ||||||

| 150,600 | Brooks Automation, Inc. | 1,608,408 | ||||

| 200,000 | Mattson Technology, Inc. * | 706,000 | ||||

| 2,314,408 | 3.46 | % | ||||

| State Commercial Banks | ||||||

| 32,000 | Banner Corporation | 1,467,520 | ||||

| 36,000 | Renasant Corporation | 1,238,760 | ||||

| 2,706,280 | 4.04 | % | ||||

| Telegraph & Other Message Communications | ||||||

| 23,900 | j2 Global, Inc. | 1,967,448 | 2.94 | % | ||

| Telephone & Telegraph Apparatus | ||||||

| 48,500 | Polycom, Inc. * | 610,615 | 0.91 | % | ||

| Transportation Services | ||||||

| 20,200 | GATX Corp. | 859,510 | 1.28 | % | ||

| Total for Common Stocks (Cost $45,082,576) | $ | 62,000,631 | 92.63 | % | ||

| * Non-Income Producing Securities. The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 12

| Paradigm Value Fund | |||||||

| Schedule of Investments | |||||||

| December 31, 2015 | |||||||

| Shares | Fair Value | % of Net Assets | |||||

| REAL ESTATE INVESTMENT TRUSTS | |||||||

| 51,300 | Blackstone Mortgage Trust, Inc. - Class A | $ | 1,372,788 | ||||

| 182,929 | Gramercy Property Trust Inc. | 1,412,209 | |||||

| 21,700 | Mid-America Apartment Communities Inc. | 1,970,577 | |||||

| 12,000 | PennyMac Mortgage Investment Trust | 183,120 | |||||

| Total for Real Estate Investment Trusts (Cost $3,553,711) | 4,938,694 | 7.38 | % | ||||

| MONEY MARKET FUNDS | |||||||

| 314,294 | SEI Daily Income Treasury Government CL A 0.02% ** | 314,294 | 0.47 | % | |||

| (Cost $314,294) | |||||||

| Total Investment Securities | 67,253,619 | 100.48 | % | ||||

| (Cost $48,950,581) | |||||||

| Liabilities in Excess of Other Assets | (322,450 | ) | -0.48 | % | |||

| Net Assets | $ | 66,931,169 | 100.00 | % | |||

| * Non-Income Producing Securities. ** Variable Rate Security; the rate shown was the rate at December 31, 2015. The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 13

| Paradigm Select Fund | |||||

| Schedule of Investments | |||||

| December 31, 2015 | |||||

| Shares | Fair Value | % of Net Assets | |||

| COMMON STOCKS | |||||

| Air Transportation, Nonscheduled | |||||

| 600 | Air Methods Corporation * | $ | 25,158 | 0.47 | % |

| Aircraft & Parts | |||||

| 1,850 | Triumph Group, Inc. | 73,538 | 1.36 | % | |

| Chemical & Allied Products | |||||

| 500 | Innospec Inc. | 27,155 | |||

| 1,450 | Olin Corp. | 25,027 | |||

| 52,182 | 0.97 | % | |||

| Computer Communications Equipment | |||||

| 7,700 | Brocade Communications Systems, Inc. | 70,686 | 1.31 | % | |

| Construction - Special Trade Contractors | |||||

| 4,900 | Matrix Service Co. * | 100,646 | 1.86 | % | |

| Electrical Work | |||||

| 1,375 | EMCOR Group Inc. | 66,055 | 1.22 | % | |

| Electromedical & Electrotherapeutic Apparatus | |||||

| 4,000 | Masimo Corporation * | 166,040 | 3.08 | % | |

| Electronic Computers | |||||

| 3,500 | Cray Inc. * | 113,575 | |||

| 1,700 | Omnicell, Inc. * | 52,836 | |||

| 166,411 | 3.08 | % | |||

| Fire, Marine & Casualty Insurance | |||||

| 150 | Alleghany Corporation * | 71,689 | |||

| 1,100 | American Financial Group Inc. | 79,288 | |||

| 1,750 | Aspen Insurance Holdings Limited (Bermuda) | 84,525 | |||

| 608 | Endurance Specialty Holdings Ltd. (Bermuda) | 38,906 | |||

| 274,408 | 5.08 | % | |||

| Footwear (No Rubber) | |||||

| 3,000 | Caleres, Inc. | 80,460 | 1.49 | % | |

| Household Furniture | |||||

| 2,200 | La-Z-Boy Incorporated | 53,724 | 1.00 | % | |

| Industrial Organic Chemicals | |||||

| 1,200 | Sensient Technologies Corporation | 75,384 | |||

| 1,100 | Westlake Chemical Corp. | 59,752 | |||

| 135,136 | 2.50 | % | |||

| Instruments For Measurement & Testing of Electricity & Electric Signals | |||||

| 5,000 | Teradyne, Inc. | 103,350 | 1.91 | % | |

| Laboratory Analytical Instruments | |||||

| 2,650 | PerkinElmer Inc. | 141,961 | 2.63 | % | |

| Miscellaneous Business Credit Institution | |||||

| 1,450 | PHH Corporation * | 23,490 | 0.44 | % | |

| Miscellaneous Manufacturing Industries | |||||

| 2,350 | Hillenbrand, Inc. | 69,630 | 1.29 | % | |

| Mortgage Bankers & Loan Correspondents | |||||

| 2,150 | Walter Investment Management Corp. * | 30,573 | 0.57 | % | |

| Motor Vehicle Parts & Accessories | |||||

| 600 | Visteon Corporation * | 68,700 | 1.27 | % | |

| Periodicals: Publishing or Publishing & Printing | |||||

| 8,750 | Rovi Corporation * | 145,775 | 2.70 | % | |

| Petroleum Refining | |||||

| 2,150 | Delek US Holdings, Inc. | 52,890 | |||

| 1,750 | Western Refining, Inc. | 62,335 | |||

| 115,225 | 2.13 | % | |||

| Plastics Products | |||||

| 800 | AptarGroup Inc. | 58,120 | 1.08 | % | |

| * Non-Income Producing Securities. The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 14

| Paradigm Select Fund | |||||

| Schedule of Investments | |||||

| December 31, 2015 | |||||

| Shares | Fair Value | % of Net Assets | |||

| COMMON STOCKS | |||||

| Printed Circuit Boards | |||||

| 3,350 | Jabil Circuit, Inc. | $ | 78,022 | ||

| 2,800 | TTM Technologies, Inc. * | 18,228 | |||

| 96,250 | 1.78 | % | |||

| Radio & TV Broadcasting & Communications Equipment | |||||

| 5,600 | Mitel Networks Corporation * (Canada) | 43,064 | 0.80 | % | |

| Retail - Apparel & Accessory Stores | |||||

| 4,600 | Express Inc. * | 79,488 | |||

| 1,750 | The Men's Wearhouse, Inc. | 25,690 | |||

| 105,178 | 1.95 | % | |||

| Retail - Family Clothing Stores | |||||

| 6,000 | American Eagle Outfitters, Inc. | 93,000 | 1.72 | % | |

| Retail - Radio, TV & Consumer Electronics Stores | |||||

| 2,800 | Best Buy Co., Inc. | 85,260 | 1.58 | % | |

| Retail - Retail Stores, NEC | |||||

| 1,550 | IAC/InterActiveCorp. | 93,077 | 1.72 | % | |

| Retail - Shoe Stores | |||||

| 2,000 | Foot Locker, Inc. | 130,180 | 2.41 | % | |

| Rolling Drawing & Extruding of Nonferrous Metals | |||||

| 12,991 | Alcoa, Inc. | 128,221 | 2.38 | % | |

| Rubber & Plastics Footwear | |||||

| 800 | Deckers Outdoor Corporation * | 37,760 | 0.70 | % | |

| Savings Institution, Federally Chartered | |||||

| 2,200 | Capitol Federal Financial, Inc. | 27,632 | 0.51 | % | |

| Search, Detection, Navigation, Guidance, Aeronautical Systems | |||||

| 1,200 | Garmin Ltd. (Switzerland) | 44,604 | 0.83 | % | |

| Semiconductors & Related Devices | |||||

| 3,350 | Kulicke & Soffa Industries Inc. * (Singapore) | 39,094 | |||

| 5,000 | Marvell Technology Group Ltd. (Bermuda) | 44,100 | |||

| 4,400 | Microsemi Corporation * | 143,396 | |||

| 2,100 | Qorvo, Inc. * | 106,890 | |||

| 1,550 | Skyworks Solutions, Inc. | 119,087 | |||

| 452,567 | 8.39 | % | |||

| Services - Auto Rental & Leasing | |||||

| 800 | Ryder System, Inc. | 45,464 | 0.84 | % | |

| Services - Computer Integrated Systems Design | |||||

| 6,600 | Allscripts Healthcare Solutions, Inc. * | 101,508 | |||

| 3,650 | Convergys Corp. | 90,849 | |||

| 6,800 | Datalink Corporation * | 46,240 | |||

| 238,597 | 4.42 | % | |||

| Services - Help Supply Services | |||||

| 3,550 | Kelly Services, Inc. - Class A | 57,332 | |||

| 3,800 | Kforce Inc. | 96,064 | |||

| 153,396 | 2.84 | % | |||

| Services - Hospitals | |||||

| 1,575 | Magellan Health Services Inc. * | 97,115 | |||

| 1,450 | MEDNAX, Inc. * | 103,907 | |||

| 201,022 | 3.72 | % | |||

| Services - Motion Picture Theaters | |||||

| 4,800 | Regal Entertainment Group Class A | 90,576 | 1.68 | % | |

| Services - Prepackaged Software | |||||

| 2,800 | Imprivata, Inc. * | 31,640 | |||

| 2,350 | Progress Software Corporation * | 56,400 | |||

| 88,040 | 1.63 | % | |||

| * Non-Income Producing Securities. The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 15

| Paradigm Select Fund | |||||||

| Schedule of Investments | |||||||

| December 31, 2015 | |||||||

| Shares | Fair Value | % of Net Assets | |||||

| COMMON STOCKS | |||||||

| Steel Pipe & Tubes | |||||||

| 1,950 | Allegheny Technologies Incorporated | $ | 21,937 | 0.41 | % | ||

| Steel Works, Blast Furnaces & Rolling Mills (Coke Ovens) | |||||||

| 600 | Carpenter Technology Corporation | 18,162 | |||||

| 3,900 | Commercial Metals Company | 53,391 | |||||

| 71,553 | 1.33 | % | |||||

| Surgical & Medical Instruments & Apparatus | |||||||

| 7,200 | Globus Medical, Inc. - Class A * | 200,304 | |||||

| 900 | NuVasive, Inc. * | 48,699 | |||||

| 249,003 | 4.61 | % | |||||

| Telegraph & Other Message Communications | |||||||

| 1,850 | j2 Global, Inc. | 152,292 | 2.82 | % | |||

| Telephone & Telegraph Apparatus | |||||||

| 2,800 | Fabrinet * (Thailand) | 66,696 | |||||

| 7,750 | Polycom, Inc. * | 97,573 | |||||

| 164,269 | 3.04 | % | |||||

| Title Insurance | |||||||

| 1,650 | Fidelity National Financial, Inc. | 57,205 | |||||

| 600 | Fidelity National Financial Ventures * | 6,738 | |||||

| 63,943 | 1.18 | % | |||||

| Transportation Services | |||||||

| 1,100 | GATX Corporation | 46,805 | 0.87 | % | |||

| Wholesale - Computers & Peripheral Equipment & Software | |||||||

| 800 | SYNNEX Corporation | 71,944 | 1.33 | % | |||

| Wholesale - Electrical Apparatus & Equipment, Wiring Supplies | |||||||

| 800 | EnerSys | 44,744 | 0.83 | % | |||

| Wholesale - Lumber & Other Construction Materials | |||||||

| 1,100 | Boise Cascade Company * | 28,083 | 0.52 | % | |||

| Total for Common Stocks (Cost $3,720,456) | $ | 5,089,729 | 94.28 | % | |||

| REAL ESTATE INVESTMENT TRUSTS | |||||||

| 1,400 | Mid-America Apartment Communities Inc. | 127,134 | 2.35 | % | |||

| Total for Real Estate Investment Trusts (Cost $73,803) | |||||||

| MONEY MARKET FUNDS | |||||||

| 187,189 | SEI Daily Income Treasury Government CL A 0.02% ** | 187,189 | 3.47 | % | |||

| (Cost $187,189) | |||||||

| Total Investment Securities | 5,404,052 | 100.10 | % | ||||

| (Cost $3,981,448) | |||||||

| Liabilities in Excess of Other Assets | (5,428 | ) | -0.10 | % | |||

| Net Assets | $ | 5,398,624 | 100.00 | % | |||

| * Non-Income Producing Securities. ** Variable Rate Security; the rate shown was the rate at December 31, 2015. The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 16

| Paradigm Opportunity Fund | |||||

| Schedule of Investments | |||||

| December 31, 2015 | |||||

| Shares | Fair Value | % of Net Assets | |||

| COMMON STOCKS | |||||

| Construction - Special Trade Contractors | |||||

| 8,600 | Matrix Service Co. * | $ | 176,644 | 2.93 | % |

| Electrical Work | |||||

| 2,825 | EMCOR Group Inc. | 135,713 | 2.25 | % | |

| Industrial Organic Chemicals | |||||

| 2,550 | Sensient Technologies Corporation | 160,191 | 2.66 | % | |

| Instruments For Measurement & Testing of Electricity & Electric Signals | |||||

| 7,075 | Teradyne, Inc. | 146,240 | 2.43 | % | |

| Laboratory Analytical Instruments | |||||

| 2,725 | PerkinElmer Inc. | 145,978 | 2.43 | % | |

| Miscellaneous Electrical Machinery, Equipment & Supplies | |||||

| 27,800 | Electro Scientific Industries, Inc. * | 144,282 | 2.40 | % | |

| Miscellaneous Manufacturing Industries | |||||

| 5,500 | Hillenbrand, Inc. | 162,965 | 2.71 | % | |

| Periodicals: Publishing or Publishing & Printing | |||||

| 15,800 | Rovi Corporation * | 263,228 | 4.37 | % | |

| Retail - Apparel & Accessory Stores | |||||

| 9,475 | Express Inc. * | 163,728 | |||

| 4,375 | The Men's Wearhouse, Inc. | 64,225 | |||

| 227,953 | 3.79 | % | |||

| Retail - Department Stores | |||||

| 1,400 | Dillard's, Inc. - Class A | 91,994 | 1.53 | % | |

| Retail - Family Clothing Stores | |||||

| 12,100 | American Eagle Outfitters, Inc. | 187,550 | 3.12 | % | |

| Retail - Retail Stores, NEC | |||||

| 3,250 | IAC/InterActiveCorp. | 195,163 | 3.24 | % | |

| Retail - Shoe Stores | |||||

| 1,200 | DSW Inc. - Class A | 28,632 | |||

| 4,325 | Foot Locker, Inc. | 281,514 | |||

| 310,146 | 5.15 | % | |||

| Rolling Drawing & Extruding of Nonferrous Metals | |||||

| 19,183 | Alcoa, Inc. | 189,336 | 3.15 | % | |

| Semiconductors & Related Devices | |||||

| 6,425 | Kulicke & Soffa Industries Inc. * (Singapore) | 74,980 | |||

| 8,300 | Microsemi Corporation * | 270,497 | |||

| 4,650 | Qorvo, Inc. * | 236,685 | |||

| 3,300 | Skyworks Solutions, Inc. | 253,539 | |||

| 835,701 | 13.88 | % | |||

| Services - Computer Integrated Systems Design | |||||

| 8,350 | Convergys Corp. | 207,832 | 3.45 | % | |

| Services - Help Supply Services | |||||

| 7,600 | Kelly Services, Inc. - Class A | 122,740 | 2.04 | % | |

| Services - Hospitals | |||||

| 3,150 | Magellan Health Services Inc. * | 194,229 | |||

| 1,975 | MEDNAX, Inc. * | 141,528 | |||

| 335,757 | 5.58 | % | |||

| Services - Motion Picture Theaters | |||||

| 11,475 | Regal Entertainment Group Class A | 216,533 | 3.60 | % | |

| Services - Prepackaged Software | |||||

| 6,700 | Progress Software Corporation * | 160,800 | 2.67 | % | |

| Special Industry Machinery (No Metalworking Machinery) | |||||

| 2,000 | Kadant Inc. | 81,220 | 1.35 | % | |

| * Non-Income Producing Securities. The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 17

| Paradigm Opportunity Fund | ||||||

| Schedule of Investments | ||||||

| December 31, 2015 | ||||||

| Shares | Fair Value | % of Net Assets | ||||

| COMMON STOCKS | ||||||

| Special Industry Machinery, NEC | ||||||

| 17,625 Brooks Automation, Inc. | $ | 188,235 | 3.13 | % | ||

| Surgical & Medical Instruments & Apparatus | ||||||

| 10,125 AtriCure, Inc. * | 227,205 | 3.77 | % | |||

| Telegraph & Other Message Communications | ||||||

| 3,775 j2 Global, Inc. | 310,758 | 5.16 | % | |||

| Telephone & Telegraph Apparatus | ||||||

| 14,200 Polycom, Inc. * | 178,778 | 2.97 | % | |||

| Total for Common Stocks (Cost $3,616,405) | $ | 5,402,942 | 89.76 | % | ||

| REAL ESTATE INVESTMENT TRUSTS | ||||||

| 3,200 Mid-America Apartment Communities Inc. | 290,592 | |||||

| Total for Real Estate Investment Trusts (Cost $138,916) | 290,592 | 4.83 | % | |||

| MONEY MARKET FUNDS | ||||||

| 331,442 SEI Daily Income Treasury Government CL A 0.02% ** | 331,442 | 5.51 | % | |||

| (Cost $331,442) | ||||||

| Total Investment Securities | 6,024,976 | 100.09 | % | |||

| (Cost $4,086,763) | ||||||

| Liabilities in Excess of Other Assets | (5,592 | ) | -0.09 | % | ||

| Net Assets | $ | 6,019,384 | 100.00 | % | ||

| * Non-Income Producing Securities. ** Variable Rate Security; the rate shown was the rate at December 31, 2015. The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 18

| Paradigm Micro-Cap Fund | |||||

| Schedule of Investments | |||||

| December 31, 2015 | |||||

| Shares | Fair Value | % of Net Assets | |||

| COMMON STOCKS | |||||

| Aircraft Parts & Auxiliary Equipment, NEC | |||||

| 80,000 | Ducommun Incorporated * | $ | 1,297,600 | ||

| 120,000 | LMI Aerospace, Inc. * | 1,208,400 | |||

| 2,506,000 | 5.91 | % | |||

| Computer Communications Equipment | |||||

| 280,000 | Extreme Networks, Inc. * | 1,142,400 | 2.69 | % | |

| Construction - Special Trade Contractors | |||||

| 160,000 | Furmanite Corporation * | 1,065,600 | 2.51 | % | |

| Electronic Computers | |||||

| 60,000 | Omnicell, Inc. * | 1,864,800 | |||

| 80,000 | Silicon Graphics International Corp. * | 472,000 | |||

| 2,336,800 | 5.51 | % | |||

| Footwear (No Rubber) | |||||

| 70,000 | Caleres, Inc. | 1,877,400 | 4.43 | % | |

| Guided Missiles & Space Vehicles & Parts | |||||

| 260,000 | Kratos Defense & Security Solutions, Inc. * | 1,066,000 | 2.51 | % | |

| In Vitro & In Vivo Diagnostic Substances | |||||

| 50,000 | Trinity Biotech plc ** | 588,000 | 1.39 | % | |

| Millwood, Veneer, Plywood, & Structural Wood Members | |||||

| 140,000 | Ply Gem Holdings, Inc. * | 1,755,600 | 4.14 | % | |

| Miscellaneous Manufacturing Industries | |||||

| 200,000 | Summer Infant, Inc. * | 446,000 | 1.05 | % | |

| Motor Vehicles & Passenger Car Bodies | |||||

| 60,000 | Federal Signal Corporation | 951,000 | 2.24 | % | |

| Orthopedic, Prosthetic & Surgical Appliances & Supplies | |||||

| 360,000 | RTI Surgical, Inc. * | 1,429,200 | 3.37 | % | |

| Paper Mills | |||||

| 30,000 | KapStone Paper and Packaging Corporation | 677,700 | 1.60 | % | |

| Pharmaceutical Preparations | |||||

| 90,000 | Nature's Sunshine Products | 910,800 | 2.15 | % | |

| Photographic Equipment & Supplies | |||||

| 120,000 | Avid Technology, Inc. * | 874,800 | 2.06 | % | |

| Printed Circuit Boards | |||||

| 180,000 | TTM Technologies, Inc. * | 1,171,800 | 2.76 | % | |

| Radio & TV Broadcasting & Communications Equipment | |||||

| 140,000 | Mitel Networks Corporation * (Canada) | 1,076,600 | 2.54 | % | |

| Retail - Apparel & Accessory Stores | |||||

| 60,000 | Citi Trends, Inc. | 1,275,000 | |||

| 90,000 | Francesca’s Holdings Corporation * | 1,566,900 | |||

| 27,400 | Gordmans Stores, Inc. * | 86,310 | |||

| 85,800 | Tilly’s, Inc. - Class A * | 568,854 | |||

| 3,497,064 | 8.25 | % | |||

| Retail - Catalog & Mail-Order Houses | |||||

| 50,000 | PC Connection, Inc. | 1,132,000 | 2.67 | % | |

| Retail - Family Clothing Stores | |||||

| 60,000 | Stage Stores, Inc. | 546,600 | |||

| 100,000 | Stein Mart, Inc. | 673,000 | |||

| 1,219,600 | 2.88 | % | |||

| Retail - Retail Stores, NEC | |||||

| 80,000 | Kirkland's, Inc. | 1,160,000 | 2.74 | % | |

| Retail - Women's Clothing Stores | |||||

| 400,000 | New York & Company, Inc. * | 916,000 | 2.16 | % | |

| * Non-Income Producing Securities. The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 19

| Paradigm Micro-Cap Fund | ||||||

| Schedule of Investments | ||||||

| December 31, 2015 | ||||||

| Shares | Fair Value | % of Net Assets | ||||

| COMMON STOCKS | ||||||

| Semiconductors & Related Devices | ||||||

| 300,000 | Lattice Semiconductors Corporation * | $ | 1,941,000 | |||

| 100,000 | MaxLinear, Inc. - Class A * | 1,473,000 | ||||

| 3,414,000 | 8.05 | % | ||||

| Services - Computer Integrated Systems Design | ||||||

| 80,000 | Allscripts Healthcare Solutions, Inc. * | 1,230,400 | ||||

| 160,000 | Datalink Corporation * | 1,088,000 | ||||

| 2,318,400 | 5.47 | % | ||||

| Services - Computer Processing & Data Preparation | ||||||

| 50,200 | Brightcove Inc. * | 311,240 | 0.73 | % | ||

| Services - Equipment Rental & Leasing, NEC | ||||||

| 100,000 | Neff Corporation - Class A * | 766,000 | 1.81 | % | ||

| Services - Prepackaged Software | ||||||

| 120,000 | Imprivata, Inc. * | 1,356,000 | 3.20 | % | ||

| Special Industry Machinery (No Metalworking Machinery) | ||||||

| 15,000 | Kadant Inc. | 609,150 | 1.44 | % | ||

| Special Industry Machinery, NEC | ||||||

| 340,000 | Mattson Technology, Inc. * | 1,200,200 | 2.83 | % | ||

| Steel Works, Blast Furnaces & Rolling & Finishing Materials | ||||||

| 40,000 | Insteel Industries, Inc. | 836,800 | 1.98 | % | ||

| Surgical & Medical Instruments & Apparatus | ||||||

| 50,000 | Globus Medical, Inc. - Class A * | 1,391,000 | 3.28 | % | ||

| Telephone & Telegraph Apparatus | ||||||

| 120,000 | Shoretel, Inc. * | 1,062,000 | 2.51 | % | ||

| Total for Common Stocks (Cost $41,957,393) | $ | 41,065,154 | 96.86 | % | ||

| CONTINGENT VALUE RIGHTS | ||||||

| 50,000 | Synergetics USA, Inc. * + | - | 0.00 | % | ||

| (Cost $0) | ||||||

| MONEY MARKET FUNDS | ||||||

| 652,748 | SEI Daily Income Treasury Government CL A 0.02% *** | 652,748 | 1.54 | % | ||

| (Cost $652,748) | ||||||

| Total Investment Securities | 41,717,902 | 98.40 | % | |||

| (Cost $42,610,141) | ||||||

| Other Assets in Excess of Liabilities | 676,993 | 1.60 | % | |||

| Net Assets | $ | 42,394,895 | 100.00 | % | ||

| * Non-Income Producing Securities. ** Variable Rate Security; the rate shown was the rate at December 31, 2015. + Under the terms of the Contingent Value Rights (“CVR”), the holder has the right to receive cash payments of between $0.50 and $1.00 if Synergetic’s ophthalmology busi- ness achieves certain revenue performance milestones. |

| The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 20

| Paradigm Funds | |||||||

| Statements of Assets and Liabilities | Value | Select | |||||

| December 31, 2015 | Fund | Fund | |||||

| Assets: | |||||||

| Investment Securities at Fair Value* | $ | 67,253,619 | $ | 5,404,052 | |||

| Receivable for Fund Shares Sold | 366 | - | |||||

| Dividends Receivable | 60,939 | 848 | |||||

| Interest Receivable | 54 | 4 | |||||

| Total Assets | 67,314,978 | 5,404,904 | |||||

| Liabilities: | |||||||

| Payable for Fund Shares Redeemed | 236,518 | 1,000 | |||||

| Payable for Securities Purchased | 58,267 | - | |||||

| Payable to Advisor | 89,024 | 5,280 | |||||

| Total Liabilities | 383,809 | 6,280 | |||||

| Net Assets | $ | 66,931,169 | $ | 5,398,624 | |||

| Net Assets Consist of: | |||||||

| Paid In Capital | $ | 48,649,527 | $ | 4,010,209 | |||

| Accumulated Undistributed Net Investment Income | 3,078 | 3,421 | |||||

| Accumulated Undistributed Realized Loss on Investments - Net | (24,474 | ) | (37,610 | ) | |||

| Unrealized Appreciation in Value of Investment Securities - Net | 18,303,038 | 1,422,604 | |||||

| Net Assets | $ | 66,931,169 | $ | 5,398,624 | |||

| Net Asset Value, Offering and Redemption Price (Note 2) | $ | 43.02 | $ | 29.09 | |||

| * Investments at Identified Cost | $ | 48,950,581 | $ | 3,981,448 | |||

| Shares Outstanding (Unlimited number of shares | 1,555,990 | 185,567 | |||||

| authorized without par value) | |||||||

| Statements of Operations | |||||||

| For the fiscal year ended December 31, 2015 | |||||||

| Investment Income: | |||||||

| Dividends (Net of foreign withholding taxes of $0 and $0, respectively) | $ | 1,142,375 | $ | 81,617 | |||

| Interest | 339 | 35 | |||||

| Total Investment Income | 1,142,714 | 81,652 | |||||

| Expenses: | |||||||

| Investment Advisor Fees | 1,571,864 | 90,323 | |||||

| Total Expenses | 1,571,864 | 90,323 | |||||

| Less: Expenses Waived | (392,966 | ) | (21,075 | ) | |||

| Net Expenses | 1,178,898 | 69,248 | |||||

| Net Investment Income (Loss) | (36,184 | ) | 12,404 | ||||

| Realized and Unrealized Gain (Loss) on Investments: | |||||||

| Net Realized Gain on Investments | 10,102,364 | 455,515 | |||||

| Net Change in Unrealized Appreciation on Investments | (8,943,339 | ) | (502,967 | ) | |||

| Net Realized and Unrealized Gain (Loss) on Investments | 1,159,025 | (47,452 | ) | ||||

| Net Increase (Decrease) in Net Assets from Operations | $ | 1,122,841 | $ | (35,048 | ) | ||

| The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 21

| Paradigm Funds | |||||||

| Statements of Assets and Liabilities | Opportunity | Micro-Cap | |||||

| December 31, 2015 | Fund | Fund | |||||

| Assets: | |||||||

| Investment Securities at Fair Value* | $ | 6,024,976 | $ | 41,717,902 | |||

| Cash | - | 189,581 | |||||

| Receivable for Fund Shares Sold | - | 594,151 | |||||

| Dividends Receivable | 766 | 75,400 | |||||

| Interest Receivable | 6 | 27 | |||||

| Total Assets | 6,025,748 | 42,577,061 | |||||

| Liabilities: | |||||||

| Payable for Fund Shares Redeemed | - | 49 | |||||

| Payable for Securities Purchased | - | 137,909 | |||||

| Payable to Advisor | 6,364 | 44,208 | |||||

| Total Liabilities | 6,364 | 182,166 | |||||

| Net Assets | $ | 6,019,384 | $ | 42,394,895 | |||

| Net Assets Consist of: | |||||||

| Paid In Capital | $ | 4,322,666 | $ | 43,473,865 | |||

| Accumulated Realized Loss on Investments - Net | (241,495 | ) | (186,731 | ) | |||

| Unrealized Appreciation (Depreciation) in Value of Investment Securities - Net | 1,938,213 | (892,239 | ) | ||||

| Net Assets | $ | 6,019,384 | $ | 42,394,895 | |||

| Net Asset Value, Offering and Redemption Price (Note 2) | $ | 31.14 | $ | 24.32 | |||

| * Investments at Identified Cost | $ | 4,086,763 | $ | 42,610,141 | |||

| Shares Outstanding (Unlimited number of shares | 193,314 | 1,743,038 | |||||

| authorized without par value) | |||||||

| Statements of Operations | |||||||

| For the fiscal year ended December 31, 2015 | |||||||

| Investment Income: | |||||||

| Dividends (Net of foreign withholding taxes of $0 and $0, respectively) | $ | 71,312 | $ | 299,130 | |||

| Interest | 62 | 320 | |||||

| Total Investment Income | 71,374 | 299,450 | |||||

| Expenses: | |||||||

| Investment Advisor Fees | 134,081 | 448,155 | |||||

| Total Expenses | 134,081 | 448,155 | |||||

| Less: Expenses Waived | (50,280 | ) | - | ||||

| Net Expenses | 83,801 | 448,155 | |||||

| Net Investment Loss | (12,427 | ) | (148,705 | ) | |||

| Realized and Unrealized Gain (Loss) on Investments: | |||||||

| Net Realized Gain (Loss) on Investments | (201,820 | ) | 395,501 | ||||

| Net Change in Unrealized Appreciation (Depreciation) on Investments | (86,400 | ) | (5,063,818 | ) | |||

| Net Realized and Unrealized Loss on Investments | (288,220 | ) | (4,668,317 | ) | |||

| Net Decrease in Net Assets from Operations | $ | (300,647 | ) | $ | (4,817,022 | ) | |

| The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 22

| Paradigm Funds | ||||||||||||||||

| Statements of Changes in Net Assets | Value Fund | Select Fund | ||||||||||||||

| 1/1/2015 | 1/1/2014 | 1/1/2015 | 1/1/2014 | |||||||||||||

| to | to | to | to | |||||||||||||

| 12/31/2015 | 12/31/2014 | 12/31/2015 | 12/31/2014 | |||||||||||||

| From Operations: | ||||||||||||||||

| Net Investment Income (Loss) | $ | (36,184 | ) | $ | (107,161 | ) | $ | 12,404 | $ | 137 | ||||||

| Net Realized Gain on Investments | 10,102,364 | 18,526,403 | 455,515 | 1,307,264 | ||||||||||||

| Change in Net Unrealized Appreciation | (8,943,339 | ) | (15,116,940 | ) | (502,967 | ) | (774,706 | ) | ||||||||

| Increase (Decrease) in Net Assets from Operations | 1,122,841 | 3,302,302 | (35,048 | ) | 532,695 | |||||||||||

| From Distributions to Shareholders: | ||||||||||||||||

| Net Investment Income | - | - | (9,124 | ) | - | |||||||||||

| Net Realized Gain from Security Transactions | (8,355,645 | ) | (16,140,005 | ) | (456,985 | ) | (1,288,457 | ) | ||||||||

| Total Distributions to Shareholders | (8,355,645 | ) | (16,140,005 | ) | (466,109 | ) | (1,288,457 | ) | ||||||||

| From Capital Share Transactions: | ||||||||||||||||

| Proceeds From Sale of Shares | 3,224,508 | 5,191,517 | 485,080 | 263,258 | ||||||||||||

| Proceeds from Redemption Fees (Note 2) | 2,584 | 2,317 | 500 | - | ||||||||||||

| Shares Issued on Reinvestment of Dividends | 8,044,376 | 15,495,221 | 446,727 | 1,239,535 | ||||||||||||

| Cost of Shares Redeemed | (33,269,143 | ) | (44,803,134 | ) | (1,569,443 | ) | (2,391,358 | ) | ||||||||

| Net Decrease from Shareholder Activity | (21,997,675 | ) | (24,114,079 | ) | (637,136 | ) | (888,565 | ) | ||||||||

| Net Decrease in Net Assets | (29,230,479 | ) | (36,951,782 | ) | (1,138,293 | ) | (1,644,327 | ) | ||||||||

| Net Assets at Beginning of Period | 96,161,648 | 133,113,430 | 6,536,917 | 8,181,244 | ||||||||||||

| Net Assets at End of Period | $ | 66,931,169 | $ | 96,161,648 | $ | 5,398,624 | $ | 6,536,917 | ||||||||

| Accumulated Undistributed Net Investment Income | $ | 3,078 | $ | - | $ | 3,421 | $ | 137 | ||||||||

| Share Transactions: | ||||||||||||||||

| Issued | 65,850 | 89,913 | 14,617 | 6,963 | ||||||||||||

| Reinvested | 184,886 | 318,308 | 15,195 | 38,175 | ||||||||||||

| Redeemed | (684,272 | ) | (780,306 | ) | (47,255 | ) | (62,920 | ) | ||||||||

| Net Decrease in Shares | (433,536 | ) | (372,085 | ) | (17,443 | ) | (17,782 | ) | ||||||||

| Shares Outstanding Beginning of Period | 1,989,526 | 2,361,611 | 203,010 | 220,792 | ||||||||||||

| Shares Outstanding End of Period | 1,555,990 | 1,989,526 | 185,567 | 203,010 | ||||||||||||

| The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 23

| Paradigm Funds | ||||||||||||||||

| Statements of Changes in Net Assets | Opportunity Fund | Micro-Cap Fund | ||||||||||||||

| 1/1/2015 | 1/1/2014 | 1/1/2015 | 1/1/2014 | |||||||||||||

| to | to | to | to | |||||||||||||

| 12/31/2015 | 12/31/2014 | 12/31/2015 | 12/31/2014 | |||||||||||||

| From Operations: | ||||||||||||||||

| Net Investment Loss | $ | (12,427 | ) | $ | (9,308 | ) | $ | (148,705 | ) | $ | (139,881 | ) | ||||

| Net Realized Gain (Loss) on Investments | (201,820 | ) | 351,681 | 395,501 | 3,112,369 | |||||||||||

| Change in Net Unrealized Appreciation (Depreciation) | (86,400 | ) | 269,876 | (5,063,818 | ) | (2,502,304 | ) | |||||||||

| Increase (Decrease) in Net Assets from Operations | (300,647 | ) | 612,249 | (4,817,022 | ) | 470,184 | ||||||||||

| From Distributions to Shareholders: | ||||||||||||||||

| Net Investment Income | - | - | - | - | ||||||||||||

| Net Realized Gain from Security Transactions | (872 | ) | (344,703 | ) | (543,398 | ) | (2,982,290 | ) | ||||||||

| Total Distributions to Shareholders | (872 | ) | (344,703 | ) | (543,398 | ) | (2,982,290 | ) | ||||||||

| From Capital Share Transactions: | ||||||||||||||||

| Proceeds From Sale of Shares | 394,205 | 180,230 | 23,904,401 | 584,411 | ||||||||||||

| Proceeds from Redemption Fees (Note 2) | 556 | 17 | - | - | ||||||||||||

| Shares Issued on Reinvestment of Dividends | 870 | 344,703 | 543,357 | 2,981,619 | ||||||||||||

| Cost of Shares Redeemed | (768,997 | ) | (134,699 | ) | (2,792,347 | ) | (2,163,948 | ) | ||||||||

| Net Increase (Decrease) from Shareholder Activity | (373,366 | ) | 390,251 | 21,655,411 | 1,402,082 | |||||||||||

| Net Increase (Decrease) in Net Assets | (674,885 | ) | 657,797 | 16,294,991 | (1,110,024 | ) | ||||||||||

| Net Assets at Beginning of Period | 6,694,269 | 6,036,472 | 26,099,904 | 27,209,928 | ||||||||||||

| Net Assets at End of Period | $ | 6,019,384 | $ | 6,694,269 | $ | 42,394,895 | $ | 26,099,904 | ||||||||

| Accumulated Undistributed Net Investment Income | $ | - | $ | - | $ | - | $ | - | ||||||||

| Share Transactions: | ||||||||||||||||

| Issued | 11,226 | 5,362 | 881,559 | 20,394 | ||||||||||||

| Reinvested | 28 | 10,468 | 22,115 | 108,344 | ||||||||||||

| Redeemed | (22,648 | ) | (4,276 | ) | (113,529 | ) | (72,446 | ) | ||||||||

| Net Increase (Decrease) in Shares | (11,394 | ) | 11,554 | 790,145 | 56,292 | |||||||||||

| Shares Outstanding Beginning of Period | 204,708 | 193,154 | 952,893 | 896,601 | ||||||||||||

| Shares Outstanding End of Period | 193,314 | 204,708 | 1,743,038 | 952,893 | ||||||||||||

| The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 24

| Paradigm Value Fund | ||||||||||||||||||||

| Financial Highlights - Paradigm Value Fund | ||||||||||||||||||||

| Selected data for a share outstanding | 1/1/2015 | 1/1/2014 | 1/1/2013 | 1/1/2012 | 1/1/2011 | |||||||||||||||

| throughout the period: | to | to | to | to | to | |||||||||||||||

| 12/31/2015 | 12/31/2014 | 12/31/2013 | 12/31/2012 | 12/31/2011 | ||||||||||||||||

| Net Asset Value - Beginning of Period | $ | 48.33 | $ | 56.37 | $ | 56.47 | $ | 52.54 | $ | 55.09 | ||||||||||

| Net Investment Income (Loss) (a) | (0.02 | ) | (0.05 | ) | (0.19 | ) | 0.15 | (0.15 | ) | |||||||||||

| Net Gain (Loss) on Securities (Realized and Unrealized) | 0.74 | 1.50 | 12.45 | 4.01 | (1.64 | ) | ||||||||||||||

| Total from Investment Operations | 0.72 | 1.45 | 12.26 | 4.16 | (1.79 | ) | ||||||||||||||

| Distributions (From Net Investment Income) | - | - | - | (0.16 | ) | - | ||||||||||||||

| Distributions (From Capital Gains) | (6.03 | ) | (9.49 | ) | (12.37 | ) | - | (0.78 | ) | |||||||||||

| Distributions (From Return of Capital) | - | - | - | (0.07 | ) | - | ||||||||||||||

| Total Distributions | (6.03 | ) | (9.49 | ) | (12.37 | ) | (0.23 | ) | (0.78 | ) | ||||||||||

| Proceeds from Redemption Fee (Note 2) | - | + | - | + | 0.01 | - | + | 0.02 | ||||||||||||

| Net Asset Value - End of Period | $ | 43.02 | $ | 48.33 | $ | 56.37 | $ | 56.47 | $ | 52.54 | ||||||||||

| Total Return (b) | 1.35 | % | 2.44 | % | 21.82 | % | 7.93 | % | (3.22 | )% | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net Assets - End of Period (Thousands) | $ | 66,931 | $ | 96,162 | $ | 133,113 | $ | 244,606 | $ | 234,849 | ||||||||||

| Before Reimbursement | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets | 2.00 | % | 1.97 | % | 1.91 | % | 1.84 | % | 1.83 | % | ||||||||||

| After Reimbursement | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets ++ | 1.50 | % | 1.50 | % | 1.50 | % | 1.50 | % | 1.50 | % | ||||||||||

| Ratio of Net Investment Income (Loss) to Average | ||||||||||||||||||||

| Net Assets ++ | (0.05 | )% | (0.09 | )% | (0.31 | )% | 0.26 | % | (0.26 | )% | ||||||||||

| Portfolio Turnover Rate | 14.35 | % | 31.47 | % | 48.01 | % | 62.22 | % | 83.95 | % | ||||||||||

| Paradigm Select Fund | ||||||||||||||||||||

| Financial Highlights - Paradigm Select Fund | ||||||||||||||||||||

| Selected data for a share outstanding throughout the period: | 1/1/2015 | 1/1/2014 | 1/1/2013 | 1/1/2012 | 1/1/2011 | |||||||||||||||

| to | to | to | to | to | ||||||||||||||||

| 12/31/2015 | 12/31/2014 | 12/31/2013 | 12/31/2012 | 12/31/2011 | ||||||||||||||||

| Net Asset Value - Beginning of Period | $ | 32.20 | $ | 37.05 | $ | 32.50 | $ | 30.24 | $ | 29.71 | ||||||||||

| Net Investment Income (a) | 0.07 | - | + | 0.06 | 0.24 | 0.06 | ||||||||||||||

| Net Gain (Loss) on Securities (Realized and Unrealized) | (0.45 | ) | 2.98 | 9.29 | 2.49 | 0.52 | ||||||||||||||

| Total from Investment Operations | (0.38 | ) | 2.98 | 9.35 | 2.73 | 0.58 | ||||||||||||||

| Distributions (From Net Investment Income) | (0.05 | ) | - | (0.05 | ) | (0.28 | ) | (0.05 | ) | |||||||||||

| Distributions (From Capital Gains) | (2.68 | ) | (7.83 | ) | (4.75 | ) | (0.19 | ) | - | |||||||||||

| Total Distributions | (2.73 | ) | (7.83 | ) | (4.80 | ) | (0.47 | ) | (0.05 | ) | ||||||||||

| Proceeds from Redemption Fee (Note 2) | - | + | - | - | + | - | + | - | + | |||||||||||

| Net Asset Value - End of Period | $ | 29.09 | $ | 32.20 | $ | 37.05 | $ | 32.50 | $ | 30.24 | ||||||||||

| Total Return (b) | (1.26 | )% | 7.86 | % | 28.83 | % | 9.07 | % | 1.97 | % | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net Assets - End of Period (Thousands) | $ | 5,399 | $ | 6,537 | $ | 8,181 | $ | 9,462 | $ | 7,930 | ||||||||||

| Before Reimbursement | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets | 1.50 | % | 1.50 | % | 1.50 | % | 1.50 | % | 1.50 | % | ||||||||||

| After Reimbursement | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets ++ | 1.15 | % | 1.15 | % | 1.15 | % | 1.15 | % | 1.20 | % | ||||||||||

| Ratio of Net Investment Income to Average | ||||||||||||||||||||

| Net Assets ++ | 0.21 | % | 0.00 | % | + | 0.16 | % | 0.73 | % | 0.21 | % | |||||||||

| Portfolio Turnover Rate | 19.57 | % | 36.25 | % | 46.80 | % | 86.71 | % | 58.40 | % | ||||||||||

| (a) Per share amount calculated using the average shares method. (b) Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares. + Amount calculated is less than $0.005/0.005% . ++ Such percentages reflect an expense waiver by the Advisor (for Value since 2010 and for Select since 2011). See Note 4. |

| The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 25

| Paradigm Opportunity Fund | ||||||||||||||||||||

| Financial Highlights - Paradigm Opportunity Fund | ||||||||||||||||||||

| Selected data for a share outstanding throughout the period: | 1/1/2015 | 1/1/2014 | 1/1/2013 | 1/1/2012 | 1/1/2011 | |||||||||||||||

| to | to | to | to | to | ||||||||||||||||

| 12/31/2015 | 12/31/2014 | 12/31/2013 | 12/31/2012 | 12/31/2011 | ||||||||||||||||

| Net Asset Value - Beginning of Period | $ | 32.70 | $ | 31.25 | $ | 26.44 | $ | 25.04 | $ | 25.59 | ||||||||||

| Net Investment Loss (a) | (0.06 | ) | (0.05 | ) | (0.08 | ) | (0.03 | ) | (0.20 | ) | ||||||||||

| Net Gain (Loss) on Securities (Realized and Unrealized) | (1.50 | ) | 3.27 | 6.82 | 1.71 | (0.14 | ) | |||||||||||||

| Total from Investment Operations | (1.56 | ) | 3.22 | 6.74 | 1.68 | (0.34 | ) | |||||||||||||

| Distributions (From Net Investment Income) | - | - | - | - | - | |||||||||||||||

| Distributions (From Capital Gains) | - | + | (1.77 | ) | (1.93 | ) | (0.28 | ) | (0.21 | ) | ||||||||||

| Distributions (From Return of Capital) | - | - | - | - | + | - | ||||||||||||||

| Total Distributions | - | (1.77 | ) | (1.93 | ) | (0.28 | ) | (0.21 | ) | |||||||||||

| Proceeds from Redemption Fee (Note 2) | - | + | - | + | - | - | - | |||||||||||||

| Net Asset Value - End of Period | $ | 31.14 | $ | 32.70 | $ | 31.25 | $ | 26.44 | $ | 25.04 | ||||||||||

| Total Return (b) | (4.76 | )% | 10.28 | % | 25.54 | % | 6.72 | % | (1.34 | )% | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net Assets - End of Period (Thousands) | $ | 6,019 | $ | 6,694 | $ | 6,036 | $ | 4,807 | $ | 4,491 | ||||||||||

| Before Reimbursement | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets | 2.00 | % | 2.00 | % | 2.00 | % | 2.00 | % | 2.00 | % | ||||||||||

| After Reimbursement | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets (c) | 1.25 | % | 1.25 | % | 1.25 | % | 1.33 | % | 1.50 | % | ||||||||||

| Ratio of Net Investment Loss to Average | ||||||||||||||||||||

| Net Assets (c) | (0.19 | )% | (0.15 | )% | (0.28 | )% | (0.10 | )% | (0.76 | )% | ||||||||||

| Portfolio Turnover Rate | 16.21 | % | 7.59 | % | 44.00 | % | 61.11 | % | 65.44 | % | ||||||||||

| Paradigm Micro-Cap Fund | ||||||||||||||||||||

| Financial Highlights - Paradigm Micro-Cap Fund | ||||||||||||||||||||

| Selected data for a share outstanding throughout the period: | 1/1/2015 | 1/1/2014 | 1/1/2013 | 1/1/2012 | 1/1/2011 | |||||||||||||||

| to | to | to | to | to | ||||||||||||||||

| 12/31/2015 | 12/31/2014 | 12/31/2013 | 12/31/2012 | 12/31/2011 | ||||||||||||||||

| Net Asset Value - Beginning of Period | $ | 27.39 | $ | 30.35 | $ | 23.24 | $ | 21.01 | $ | 21.20 | ||||||||||

| Net Investment Income (Loss) (a) | (0.11 | ) | (0.17 | ) | (0.06 | ) | 0.09 | (0.04 | ) | |||||||||||

| Net Gain (Loss) on Securities (Realized and Unrealized) | (2.64 | ) | 0.74 | 9.69 | 2.23 | (0.15 | ) | |||||||||||||

| Total from Investment Operations | (2.75 | ) | 0.57 | 9.63 | 2.32 | (0.19 | ) | |||||||||||||

| Distributions (From Net Investment Income) | - | - | - | (0.09 | ) | - | ||||||||||||||

| Distributions (From Capital Gains) | (0.32 | ) | (3.53 | ) | (2.52 | ) | - | - | ||||||||||||

| Total Distributions | (0.32 | ) | (3.53 | ) | (2.52 | ) | (0.09 | ) | - | |||||||||||

| Proceeds from Redemption Fee (Note 2) | - | - | - | - | + | - | ||||||||||||||

| Net Asset Value - End of Period | $ | 24.32 | $ | 27.39 | $ | 30.35 | $ | 23.24 | $ | 21.01 | ||||||||||

| Total Return (b) | (10.05 | )% | 1.81 | % | 41.41 | % | 11.06 | % | (0.90 | )% | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net Assets - End of Period (Thousands) | $ | 42,395 | $ | 26,100 | $ | 27,210 | $ | 17,598 | $ | 7,026 | ||||||||||

| Ratio of Expenses to Average Net Assets | 1.25 | % | 1.25 | % | 1.25 | % | 1.25 | % | 1.25 | % | ||||||||||

| Ratio of Net Investment Income (Loss) to Average | ||||||||||||||||||||

| Net Assets | (0.41 | )% | (0.58 | )% | (0.21 | )% | 0.38 | % | (0.20 | )% | ||||||||||

| Portfolio Turnover Rate | 70.95 | % | 101.19 | % | 70.07 | % | 60.47 | % | 126.43 | % | ++ | |||||||||

| (a) Per share amount calculated using the average shares method. (b) Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares. (c) Such percentages reflect an expense waiver by the Advisor. See Note 4. + Amount calculated is less than $0.005. ++ The Fund's portfolio turnover rate increased due to the change in the Fund's principal investment strategy to invest (under normal circumstances) at least 80% of its net assets in the common stocks of U.S. micro-cap companies effective December 27, 2011. |

| The accompanying notes are an integral part of these financial statements. |

2015 Annual Report 26

NOTES TO FINANCIAL STATEMENTS

PARADIGM FUNDS

December 31, 2015

1.) ORGANIZATION

Paradigm Funds (the “Trust”) is an open-end management investment company that was organized in Ohio as a business trust on September 13, 2002 that may offer shares of beneficial interest in a number of separate series, each series representing a distinct fund with its own investment objectives and policies. The Paradigm Value Fund (“Value”) commenced operations on January 1, 2003. The Paradigm Value Fund’s investment objective is long-term capital appreciation. The Paradigm Select Fund (“Select”) and Paradigm Opportunity Fund (“Opportunity”) both commenced operations on January 1, 2005 with long-term capital appreciation as their objective. The Paradigm Micro-Cap Fund (“Micro-Cap”) commenced operations on January 1, 2008. The Paradigm Micro-Cap Fund’s investment objective is long-term capital appreciation. Under normal circumstances, the Micro-Cap Fund invests at least 80% of its net assets in the common stocks of U.S. micro-cap companies. Prior to December 27, 2011, the principal investment strategy of the Fund was to invest primarily in the common stocks of small, mid or large capitalization companies that the Advisor believed had the potential for capital appreciation. Value, Select, Opportunity and Micro-Cap are all diversified funds. The advisor to Value, Select, Opportunity and Micro-Cap (each a “Fund” and collectively the “Funds”) is Paradigm Funds Advisor LLC (the “Advisor”).

2.) SIGNIFICANT ACCOUNTING POLICIES

SECURITY VALUATION: The Funds are investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services - Investment Companies. All investments in securities are recorded at their estimated fair value, as described in Note 3.

SECURITY TRANSACTIONS AND OTHER: Security transactions are recorded based on a trade date for financial statement reporting purposes. Dividend income is recognized on the ex-dividend date. Interest income is recognized on an accrual basis. The Funds use the highest cost basis in computing gain or loss on sale of investment securities. Discounts and premiums on fixed income securities purchased are amortized over the lives of the respective securities. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates. The Funds may invest in real estate investment trusts (“REITs”) that pay distributions to their shareholders based on available funds from operations. It is common for these distributions to exceed the REITs taxable earnings and profits resulting in the excess portion of such distribution to be designated as return of capital. Distributions received from REITs are generally recorded as dividend income and, if necessary, are reclassified annually in accordance with tax information provided by the underlying REITs.

The Funds may hold investments in master limited partnerships (“MLPs”). It is common for distributions from MLPs to exceed taxable earnings and profits resulting in the excess portion of such dividend to be designated as return of capital. Annually, income or loss from MLPs is reclassified upon receipt of the MLPs K-1. For financial reporting purpose management does not estimate the tax character of MLP distributions for which actual information has not been reported.

SHARE VALUATION: The net asset value (the “NAV”) is calculated as of the close of trading on the New York Stock Exchange (normally 4:00 p.m. Eastern time) every day the Exchange is open. The NAV for each Fund is calculated by taking the total value of the Fund’s assets, subtracting its liabilities, and then dividing by the total number of shares outstanding, rounded to the nearest cent. The offering price and redemption price per share is equal to the net asset value per share, except that shares of each Fund are subject to a redemption fee of 2% if redeemed within 90 days of purchase. During the fiscal year ended December 31, 2015 proceeds from redemption fees were $2,584, $500, $556 and $0 for Value, Select, Opportunity and Micro-Cap, respectively.

SHORT SALES: A Fund may sell a security it does not own in anticipation of a decline in the fair value of the security. When a Fund sells a security short, it must borrow the security sold short and deliver it to the broker-dealer through which it made the short sale. A gain, limited to the price at which a Fund sold the security short, or a loss, unlimited in size, will be recognized upon the termination of a short sale.

INCOME TAXES: The Funds’ policy is to continue to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all of their taxable income to shareholders. Therefore, no federal income tax provision is required. It is the Funds’ policy to distribute annually, prior to the end of the calendar year, dividends sufficient to satisfy excise tax requirements of the Internal Revenue Code. This Internal Revenue Code requirement may cause an excess of distributions over

2015 Annual Report 27

Notes to Financial Statements - continued

the book year-end accumulated income. In addition, it is the Funds’ policy to distribute annually, after the end of the fiscal year, any remaining net investment income and net realized capital gains.

The Funds recognize the tax benefits of certain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Funds’ tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years (2012-2014), or expected to be taken on the Funds’ 2015 tax return. The Funds identify their major tax jurisdictions as U.S. Federal and New York State tax authorities; the Funds are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statements of Operations. During the fiscal year ended December 31, 2015, the Funds did not incur any interest or penalties.

ESTIMATES: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

DISTRIBUTIONS TO SHAREHOLDERS: Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The Funds may utilize earnings and profits distributed to shareholders on redemptions of shares as part of the dividends paid deduction. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassification will have no effect on net assets, results of operations or net asset values per share of any Fund. At December 31, 2015, the following permanent adjustments were recorded. Such adjustments were attributed to the reclassification of net investment loss, distribution adjustments and the usage of equalization for tax purposes.

| Value | |||

| Paid In Capital | $1,106,713 | ||

| Accumulated Undistributed Net Investment Income | $39,262 | ||

| Accumulated Realized Loss on Investments - Net | ($1,145,975 | ) | |

| Opportunity | |||

| Paid In Capital | ($12,427 | ) | |

| Accumulated Undistributed Net Investment Income | $12,427 | ||

| Micro-Cap | |||

| Paid In Capital | ($112,723 | ) | |

| Accumulated Undistributed Net Investment Income | $148,705 | ||

| Accumulated Realized Loss on Investments - Net | ($35,982 | ) | |

3.) SECURITIES VALUATIONS

The Funds utilize various methods to measure the fair value of their investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities.

Level 2 - Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Funds’ best information about the assumptions a market participant would use in valuing the assets or liabilities.

The availability of inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is

2015 Annual Report 28

Notes to Financial Statements - continued

based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

FAIR VALUE MEASUREMENTS

A description of the valuation techniques applied to the Funds’ major categories of assets measured at fair value on a recurring basis follows.