UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-21237 |

| | |

| Unified Series Trust |

| (Exact name of registrant as specified in charter) |

| |

| 225 Pictoria Drive, Suite 450 |

| Cincinnati, OH 45246 |

| (Address of principal executive offices) |

| (Zip code) |

| |

| Zachary P. Richmond |

| Ultimus Fund Solutions, LLC |

| 225 Pictoria Drive. Suite 450 |

| Cincinnati, OH 45246 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 513-587-3400 |

| | |

| Date of fiscal year end: | 11/30 | |

| | | |

| Date of reporting period: | 11/30/24 | |

| | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Shareholder Report - November 30, 2024

This annual shareholder report contains important information about Auer Growth Fund (the "Fund") for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at https://sbauerfunds.com/sbauer-documents/. You can also request this information by contacting us at (888) 711-2837.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Auer Growth Fund | $222 | 1.96% |

How did the Fund perform during the reporting period?

The Fund, focused on long-term capital appreciation, delivered a strong return in 2024. Its disciplined investment approach - combining quantitative screening and fundamental analysis - prioritizes undervalued growth opportunities, particularly among small and mid-cap companies. While sectors like financials, energy, and materials contributed significantly, the Fund’s underweight in mega-cap technology stocks limited its performance relative to the S&P 500® Index. Investments in First Solar, Tidewater, and Super Micro Computer stood out as key drivers, capitalizing on trends in renewable energy and AI.

Despite successes, the Fund faced challenges in communication services and health care, with holdings like Gravity Co. and Protalix Biotherapeutics underperforming. Rising interest rates also pressured the utilities sector, impacting Altus Power’s returns. The Fund’s active management, reflected in its 146% turnover rate, allowed it to adapt to market conditions, though its expense ratio of 1.96% is higher than passive alternatives. This year marked a significant milestone for the Fund, achieving a 5-star Morningstar rating for its risk-adjusted returns over various timeframes.

Looking ahead, the Fund remains vigilant in addressing macroeconomic risks like inflation, high market valuations, and global instability. Elevated P/E ratios in the market limit attractively priced opportunities, especially in mega-cap stocks, but the Fund maintains its focus on smaller companies with strong fundamentals. By adhering to its valuation discipline and sector diversification strategy, the Fund is positioned to navigate uncertainties and deliver long-term value to shareholders in a volatile market environment.

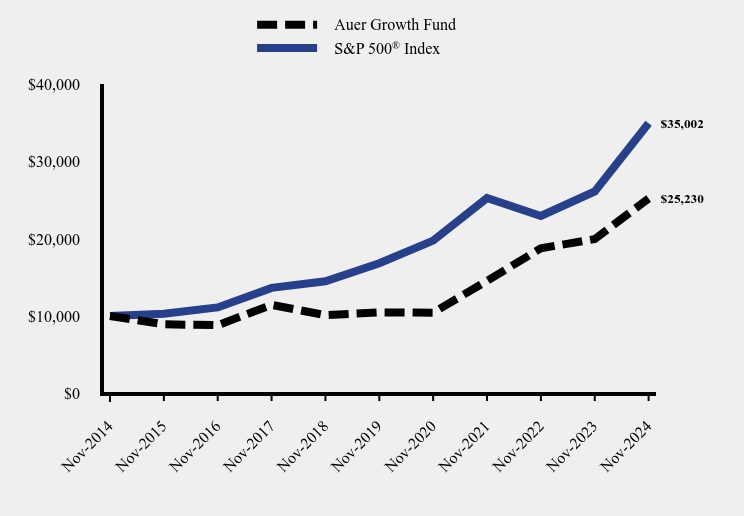

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Auer Growth Fund | S&P 500® Index |

|---|

| Nov-2014 | $10,000 | $10,000 |

| Nov-2015 | $8,919 | $10,275 |

| Nov-2016 | $8,803 | $11,103 |

| Nov-2017 | $11,441 | $13,642 |

| Nov-2018 | $10,103 | $14,498 |

| Nov-2019 | $10,450 | $16,834 |

| Nov-2020 | $10,425 | $19,773 |

| Nov-2021 | $14,543 | $25,294 |

| Nov-2022 | $18,777 | $22,964 |

| Nov-2023 | $19,970 | $26,142 |

| Nov-2024 | $25,230 | $35,002 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Auer Growth Fund | 26.34% | 19.28% | 9.70% |

S&P 500® Index | 33.89% | 15.77% | 13.35% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

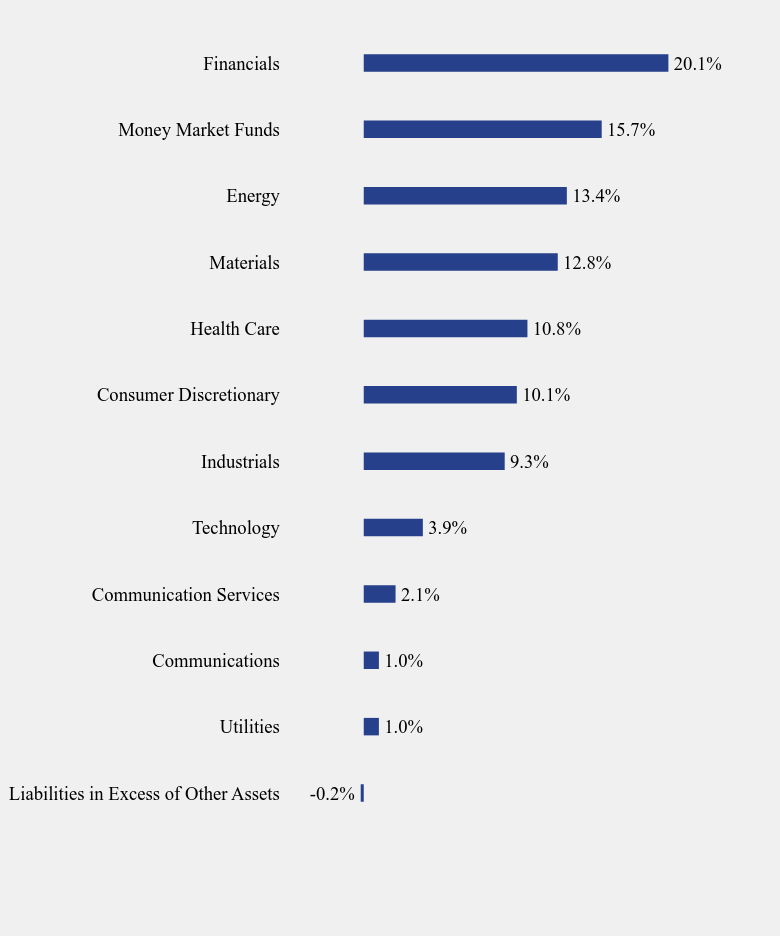

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.2% |

| Utilities | 1.0% |

| Communications | 1.0% |

| Communication Services | 2.1% |

| Technology | 3.9% |

| Industrials | 9.3% |

| Consumer Discretionary | 10.1% |

| Health Care | 10.8% |

| Materials | 12.8% |

| Energy | 13.4% |

| Money Market Funds | 15.7% |

| Financials | 20.1% |

- Net Assets$65,500,660

- Number of Portfolio Holdings78

- Advisory Fee $882,170

- Portfolio Turnover146%

No material changes occurred during the year ended November 30, 2024.

Annual Shareholder Report - November 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://sbauerfunds.com/sbauer-documents/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Item 2. Code of Ethics.

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. Pursuant to Item 12(a)(1), a copy of registrant’s code of ethics is filed as an exhibit to this Form N-CSR. During the period covered by this report, the code of ethics has not been amended, and the registrant has not granted any waivers, including implicit waivers, from the provisions of the code of ethics.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant’s Board of Trustees has determined that there is at least one audit committee financial expert serving on its audit committee.

(a)(2) Freddie Jacobs, Jr. is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

(a)(3) Not applicable.

Item 4. Principal Accountant Fees and Services.

| Auer Growth Fund: | FY 2024 | $15,800 |

| | FY 2023 | $14,600 |

| | | |

| Auer Growth Fund: | FY 2024 | $0 |

| | FY 2023 | $0 |

| | | |

| Auer Growth Fund:: | FY 2024 | $3,300 |

| | FY 2023 | $4,300 |

| | | |

| Nature of the fees: | Preparation of the 1120 RIC and Excise review |

| | |

| Auer Growth Fund: | FY 2024 | $0 |

| | FY 2023 | $0 |

| | | |

| (e) | (1) | Audit Committee’s Pre-Approval Policies |

The Audit Committee Charter requires the Audit Committee to be responsible for the selection, retention or termination of auditors and, in connection therewith, to (i) evaluate the proposed fees and other compensation, if any, to be paid to the auditors, (ii) evaluate

the independence of the auditors, (iii) pre-approve all audit services and, when appropriate, any non-audit services provided by the independent auditors to the Trust, (iv) pre-approve, when appropriate, any non-audit services provided by the independent auditors to the Trust's investment adviser, or any entity controlling, controlled by, or under common control with the investment adviser and that provides ongoing services to the Trust if the engagement relates directly to the operations and financial reporting of the Trust, and (v) receive the auditors’ specific representations as to their independence;

| (2) | There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | During audit of registrant’s financial statements for the most recent fiscal year, less than 50 percent of the hours expended on the principal accountant’s engagement were attributed to work performed by persons other than the principal accountant's full-time, permanent employees. |

| (g) | The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant: |

| | Registrant | Adviser |

| FY 2024 | $0 | $0 |

| FY 2023 | $0 | $0 |

| | | |

| (h) | Not applicable. The auditor performed no services for the registrant’s investment adviser or any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant. |

Item 5. Audit Committee of Listed Companies.

Certain series of the registrant that appear in the shareholder report included in Item 1 are listed issuers as defined in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and have a separately-designated standing audit committee established in accordance with Section 3(a)(58)A of the Exchange Act. The audit committee consists of Daniel J. Condon, Freddie Jacobs, Jr. and Ronald C. Tritschler.

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Auer Growth Fund

Annual Financial Statements

and Additional Information

November 30, 2024

Fund Adviser:

SBAuer Funds, LLC

8801 River Crossing Blvd, Suite 100

Indianapolis, IN 46240

Toll Free (888) 711-AUER (2837)

www.sbauerfunds.com

| Auer Growth Fund |

| Schedule of Investments |

| November 30, 2024 |

| COMMON STOCKS — 84.58% | | Shares | | | Fair Value | |

| | | | | | | |

| Communication Services — 2.06% | | | | | | | | |

| Gravity Co. Ltd. - ADR | | | 20,000 | | | $ | 1,350,200 | |

| | | | | | | | | |

| Communications — 1.04% | | | | | | | | |

| Opera Ltd. - ADR(a) | | | 34,000 | | | | 680,340 | |

| | | | | | | | | |

| Consumer Discretionary — 10.11% | | | | | | | | |

| AMREP Corp.(a) | | | 16,000 | | | | 576,640 | |

| General Motors Co. | | | 28,000 | | | | 1,556,520 | |

| GigaCloud Technology, Inc., Class A(a) | | | 46,000 | | | | 1,136,200 | |

| Green Brick Partners, Inc.(a) | | | 18,000 | | | | 1,286,280 | |

| Landesa Home Corp.(a) | | | 57,000 | | | | 651,510 | |

| Taylor Morrison Home Corp.(a) | | | 10,000 | | | | 738,700 | |

| TRI Pointe Group, Inc.(a) | | | 15,500 | | | | 674,715 | |

| | | | | | | | 6,620,565 | |

| Energy — 13.42% | | | | | | | | |

| APA Corp. | | | 22,000 | | | | 498,300 | |

| Borr Drilling Ltd.(a) | | | 200,000 | | | | 744,000 | |

| California Resources Corp. | | | 12,000 | | | | 709,920 | |

| First Solar, Inc.(a) | | | 7,500 | | | | 1,494,525 | |

| North American Construction Group Ltd.(a) | | | 35,000 | | | | 709,800 | |

| Obsidian Energy Ltd.(a) | | | 90,000 | | | | 518,400 | |

| Permian Resources Corp. | | | 42,000 | | | | 657,720 | |

| PrimeEnergy Resources Corp.(a) | | | 3,000 | | | | 603,150 | |

| Ring Energy, Inc.(a) | | | 550,000 | | | | 841,500 | |

| Tidewater, Inc.(a) | | | 21,000 | | | | 1,086,120 | |

| Valaris Ltd.(a) | | | 20,000 | | | | 923,800 | |

| | | | | | | | 8,787,235 | |

| Financials — 20.13% | | | | | | | | |

| AG Mortgage Investment Trust, Inc. | | | 45,000 | | | | 307,350 | |

| BankUnited, Inc. | | | 9,000 | | | | 378,630 | |

| Enstar Group Ltd.(a) | | | 2,000 | | | | 649,400 | |

| First Bank | | | 24,000 | | | | 354,960 | |

| First Internet Bancorp | | | 9,000 | | | | 377,370 | |

| First Savings Financial Group, Inc.(a) | | | 15,000 | | | | 450,900 | |

| Goldman Sachs Group, Inc. (The) | | | 3,000 | | | | 1,825,710 | |

| Hamilton Insurance Group Ltd.(a) | | | 82,000 | | | | 1,564,560 | |

| Hanover Bancorp Inc./NY(a) | | | 16,000 | | | | 403,040 | |

| Investar Holding Corp. | | | 15,000 | | | | 357,300 | |

| Jefferies Financial Group, Inc. | | | 13,500 | | | | 1,068,390 | |

| Old Point Financial Corp.(a) | | | 9,000 | | | | 202,680 | |

| OptimumBank Holdings, Inc.(a) | | | 67,000 | | | | 319,590 | |

| PRA Group, Inc.(a) | | | 28,000 | | | | 593,600 | |

| Primis Financial Corp. | | | 28,000 | | | | 350,000 | |

| Redwood Trust, Inc. | | | 47,000 | | | | 336,520 | |

| RenaissanceRe Holdings Ltd. | | | 5,200 | | | | 1,487,980 | |

| Shore Bancshares, Inc.(a) | | | 22,500 | | | | 370,125 | |

See accompanying notes which are an integral part of these financial statements.

| Auer Growth Fund |

| Schedule of Investments (continued) |

| November 30, 2024 |

| COMMON STOCKS — 84.58% - (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Financials — 20.13% - (continued) | | | | | | | | |

| Siebert Financial Corp.(a) | | | 70,000 | | | $ | 200,900 | |

| TPG RE Finance Trust, Inc.(a) | | | 37,000 | | | | 337,810 | |

| VersaBank | | | 47,000 | | | | 845,530 | |

| White Mountains Insurance Group Ltd. | | | 200 | | | | 401,998 | |

| | | | | | | | 13,184,343 | |

| Health Care — 10.81% | | | | | | | | |

| Aurinia Pharmaceuticals, Inc.(a) | | | 190,000 | | | | 1,683,400 | |

| Catalyst Pharmaceuticals, Inc.(a) | | | 80,000 | | | | 1,765,600 | |

| Harmony Biosciences Holdings, Inc.(a) | | | 37,000 | | | | 1,282,790 | |

| Protalix Biotherapeutics, Inc.(a) | | | 200,000 | | | | 344,000 | |

| Sensus Healthcare, Inc.(a) | | | 50,000 | | | | 425,500 | |

| SIGA Technologies, Inc. | | | 90,000 | | | | 655,200 | |

| United Therapeutics Corp.(a) | | | 2,500 | | | | 926,225 | |

| | | | | | | | 7,082,715 | |

| Industrials — 9.32% | | | | | | | | |

| Costamare, Inc. | | | 93,000 | | | | 1,227,600 | |

| Genco Shipping & Trading Ltd. | | | 32,000 | | | | 507,840 | |

| Golden Ocean Group Ltd. | | | 45,000 | | | | 450,000 | |

| Great Lakes Dredge & Dock Corp.(a) | | | 64,000 | | | | 808,320 | |

| Optex Systems Holdings, Inc.(a) | | | 50,000 | | | | 445,000 | |

| Orion Group Holdings, Inc.(a) | | | 100,000 | | | | 872,000 | |

| Pyxis Tankers, Inc.(a) | | | 60,000 | | | | 226,200 | |

| Seanergy Maritime Holdings Corp. | | | 130,000 | | | | 1,050,400 | |

| Star Bulk Carriers Corp. | | | 30,000 | | | | 519,600 | |

| | | | | | | | 6,106,960 | |

| Materials — 12.79% | | | | | | | | |

| AdvanSix, Inc. | | | 22,000 | | | | 714,340 | |

| Anglogold Ashanti PLC | | | 27,000 | | | | 673,380 | |

| B2Gold Corp. | | | 375,000 | | | | 1,080,000 | |

| Coeur Mining, Inc.(a) | | | 52,000 | | | | 335,920 | |

| Eldorado Gold Corp.(a) | | | 52,000 | | | | 832,000 | |

| Galiano Gold, Inc.(a) | | | 220,000 | | | | 310,200 | |

| IAMGOLD Corp.(a) | | | 140,000 | | | | 770,000 | |

| Kinross Gold Corp. | | | 63,000 | | | | 611,730 | |

| Kronos Worldwide, Inc.(a) | | | 28,000 | | | | 316,680 | |

| MAG Silver Corp.(a) | | | 26,000 | | | | 399,620 | |

| New Gold, Inc.(a) | | | 225,000 | | | | 618,750 | |

| Ramaco Resources, Inc. | | | 42,000 | | | | 535,500 | |

| Silvercorp Metals, Inc.(a) | | | 95,000 | | | | 312,550 | |

| Ternium SA - ADR | | | 18,000 | | | | 597,060 | |

| TRX Gold Corp.(a) | | | 760,000 | | | | 270,180 | |

| | | | | | | | 8,377,910 | |

| Technology — 3.88% | | | | | | | | |

| Immersion Corp. | | | 36,000 | | | | 321,840 | |

See accompanying notes which are an integral part of these financial statements.

| Auer Growth Fund |

| Schedule of Investments (continued) |

| November 30, 2024 |

| COMMON STOCKS — 84.58% - (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Technology — 3.88% - (continued) | | | | | | | | |

| Micron Technology, Inc. | | | 12,000 | | | $ | 1,175,400 | |

| Super Micro Computer, Inc.(a) | | | 32,000 | | | | 1,044,480 | |

| | | | | | | | 2,541,720 | |

| Utilities — 1.02% | | | | | | | | |

| Altus Power, Inc.(a) | | | 155,000 | | | | 669,600 | |

| Total Common Stocks (Cost $51,618,935) | | | | | | | 55,401,588 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 15.65% | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Class I, 4.51%(b) | | | 10,248,447 | | | | 10,248,447 | |

| Total Money Market Funds (Cost $10,248,447) | | | | | | | 10,248,447 | |

| | | | | | | | | |

| Total Investments — 100.23% (Cost $61,867,382) | | | | | | | 65,650,035 | |

| Liabilities in Excess of Other Assets — (0.23)% | | | | | | | (149,375 | ) |

| NET ASSETS — 100.00% | | | | | | $ | 65,500,660 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of November 30, 2024. |

ADR - American Depositary Receipt

See accompanying notes which are an integral part of these financial statements.

| Auer Growth Fund |

| Statement of Assets and Liabilities |

| November 30, 2024 |

| Assets | | | | |

| Investments in securities at fair value (cost $61,867,382) | | $ | 65,650,035 | |

| Receivable for fund shares sold | | | 2,850 | |

| Dividends receivable | | | 47,223 | |

| Tax reclaims receivable | | | 6,572 | |

| Prepaid expenses | | | 11,108 | |

| Total Assets | | | 65,717,788 | |

| Liabilities | | | | |

| Payable for fund shares redeemed | | | 101,483 | |

| Payable to Adviser | | | 79,419 | |

| Payable to affiliates | | | 11,847 | |

| Other accrued expenses | | | 24,379 | |

| Total Liabilities | | | 217,128 | |

| Net Assets | | $ | 65,500,660 | |

| Net Assets consist of: | | | | |

| Paid-in capital | | $ | 49,626,667 | |

| Accumulated earnings | | | 15,873,993 | |

| Net Assets | | $ | 65,500,660 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 3,704,865 | |

| Net asset value, offering and redemption price per share(a) | | $ | 17.68 | |

| (a) | The Fund charges a 1.00% redemption fee on shares redeemed within 7 days of purchase. |

See accompanying notes which are an integral part of these financial statements.

| Auer Growth Fund |

| Statement of Operations |

| For the Year Ended November 30, 2024 |

| Investment Income | | | | |

| Dividend income (net of foreign taxes withheld of $9,574) | | $ | 1,289,698 | |

| Total investment income | | | 1,289,698 | |

| Expenses | | | | |

| Adviser | | | 882,170 | |

| Administration | | | 60,834 | |

| Fund accounting | | | 41,601 | |

| Legal | | | 23,063 | |

| Transfer agent | | | 21,004 | |

| Audit and tax preparation | | | 20,600 | |

| Trustee | | | 19,793 | |

| Registration | | | 18,236 | |

| Compliance services | | | 12,439 | |

| Report printing | | | 10,720 | |

| Custodian | | | 8,709 | |

| Insurance | | | 3,153 | |

| Pricing | | | 2,057 | |

| Miscellaneous | | | 28,578 | |

| Total expenses | | | 1,152,957 | |

| Net investment income | | | 136,741 | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

| Net realized gain on investment securities transactions | | | 12,621,921 | |

| Net realized loss on foreign currency translations | | | (8 | ) |

| Net change in unrealized appreciation of investment securities | | | 489,914 | |

| Net change in unrealized appreciation of foreign currency translations | | | 5 | |

| Net realized and change in unrealized gain on investments | | | 13,111,832 | |

| Net increase in net assets resulting from operations | | $ | 13,248,573 | |

See accompanying notes which are an integral part of these financial statements.

| Auer Growth Fund |

| Statements of Changes in Net Assets |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | November 30, | | | November 30, | |

| | | 2024 | | | 2023 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 136,741 | | | $ | 313,347 | |

| Net realized gain on investment securities and foreign currency translations | | | 12,621,913 | | | | 1,059,257 | |

| Net change in unrealized appreciation of investment securities | | | 489,919 | | | | 629,969 | |

| Net increase in net assets resulting from operations | | | 13,248,573 | | | | 2,002,573 | |

| | | | | | | | | |

| Distributions From | | | | | | | | |

| Earnings | | | (2,037,992 | ) | | | (2,139,895 | ) |

| | | | | | | | | |

| Capital Transactions | | | | | | | | |

| Proceeds from shares sold | | | 15,805,141 | | | | 15,218,656 | |

| Proceeds from redemption fees(a) | | | 49 | | | | 148 | |

| Reinvestment of distributions | | | 1,992,774 | | | | 1,820,710 | |

| Amount paid for shares redeemed | | | (7,837,927 | ) | | | (13,551,876 | ) |

| Net increase in net assets resulting from capital transactions | | | 9,960,037 | | | | 3,487,638 | |

| Total Increase in Net Assets | | | 21,170,618 | | | | 3,350,316 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 44,330,042 | | | | 40,979,726 | |

| End of year | | $ | 65,500,660 | | | $ | 44,330,042 | |

| | | | | | | | | |

| Share Transactions | | | | | | | | |

| Shares sold | | | 1,027,828 | | | | 1,120,240 | |

| Shares issued in reinvestment of distributions | | | 141,031 | | | | 139,625 | |

| Shares redeemed | | | (488,644 | ) | | | (1,044,284 | ) |

| Net increase in shares outstanding | | | 680,215 | | | | 215,581 | |

| (a) | The Fund charges a 1.00% redemption fee on shares redeemed within 7 days of purchase. |

See accompanying notes which are an integral part of these financial statements.

| Auer Growth Fund |

| Financial Highlights |

| (For a share outstanding during each year) |

| | | For the Years Ended November 30, | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 14.66 | | | $ | 14.59 | | | $ | 11.30 | | | $ | 8.10 | | | $ | 8.12 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.04 | | | | 0.10 | | | | (0.01 | ) (a) | | | (0.08 | ) | | | (0.02 | ) |

| Net realized and unrealized gain | | | 3.65 | | | | 0.73 | | | | 3.30 | | | | 3.28 | | | | — | (b)(c) |

| Total from investment operations | | | 3.69 | | | | 0.83 | | | | 3.29 | | | | 3.20 | | | | (0.02 | ) |

| Net investment income | | | (0.11 | ) | | | — | | | | — | | | | — | | | | — | |

| Net realized gains | | | (0.56 | ) | | | (0.76 | ) | | | — | | | | — | | | | — | |

| Total distributions | | | (0.67 | ) | | | (0.76 | ) | | | — | | | | — | | | | — | |

| Paid in capital from redemption fees | | | — | (b) | | | — | (b) | | | — | (b) | | | — | | | | — | |

| Net asset value, end of year | | $ | 17.68 | | | $ | 14.66 | | | $ | 14.59 | | | $ | 11.30 | | | $ | 8.10 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return(d) | | | 26.34 | % | | | 6.35 | % | | | 29.12 | % | | | 39.51 | % | | | (0.25 | )% |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 65,501 | | | $ | 44,330 | | | $ | 40,980 | | | $ | 23,838 | | | $ | 18,434 | |

| Ratio of expenses to average net assets | | | 1.96 | % | | | 2.06 | % | | | 2.20 | % | | | 2.37 | % | | | 2.56 | % |

| Ratio of net investment income (loss) to average net assets | | | 0.23 | % | | | 0.72 | % | | | (0.05 | )% | | | (0.76 | )% | | | (0.09 | )% |

| Portfolio turnover rate | | | 146 | % | | | 134 | % | | | 149 | % | | | 150 | % | | | 169 | % |

| (a) | Calculation based on the average number of shares outstanding during the period. |

| (b) | Rounds to less than $0.005 per share. |

| (c) | Realized and unrealized gains and losses in the caption are balancing amounts necessary to reconcile the change in net in net asset value for the period and may not reconcile with the Statement of Operations due to share transactions for the period. |

| (d) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

| Auer Growth Fund |

| Notes to the Financial Statements |

| November 30, 2024 |

NOTE 1. ORGANIZATION

The Auer Growth Fund (the “Fund”) was registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified series of Unified Series Trust (the “Trust”) on September 10, 2007. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated October 14, 2002, as amended (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series. The investment objective of the Fund is long-term capital appreciation. The Fund is one of a series of funds currently authorized by the Board. The Fund’s investment adviser is SBAuer Funds, LLC (the “Adviser”).

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”, including Accounting Standards Update 2013-08. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Regulatory Update – Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds (“ETFs”) – The Securities and Exchange Commission adopted rule and form amendments that have resulted in changes to the design and delivery of shareholder reports of mutual funds and ETFs, requiring them to transmit concise and visually engaging streamlined annual and semi-annual reports to shareholders that highlight key information. Other information, including financial statements, no longer appears in a streamlined shareholder report but is available online, delivered free of charge upon request, and filed on a semi-annual basis on Form N-CSR.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2024 |

income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended November 30, 2024, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations when incurred. During the fiscal year ended November 30, 2024, the Fund did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds of the Trust based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Distributions received from investments in real estate investment trusts (“REITs”) that represent a return of capital or capital gain are recorded as a reduction of the cost of investment or as a realized gain, respectively. The calendar year-end amounts of ordinary income, capital gains, and return of capital included in distributions received from the Fund’s investments in REITs are reported to the Fund after the end of the calendar year; accordingly, the Fund estimates these amounts for accounting purposes until the characterization of REIT distributions is reported. Estimates are based on the most recent REIT distributions information available. Withholding taxes on foreign dividends and related reclaims have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Foreign Currency Translation – The accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the current rate of exchange each business day to determine the value of investments, and other assets and liabilities. Purchases and sales of foreign securities, and income and expenses, are translated at the prevailing rate of exchange on the respective date of these transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuations arising from changes in market

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2024 |

prices of securities held. These fluctuations are included with the realized and unrealized gain or loss from investments. Net realized gain (loss) on foreign currency translations on the Statement of Operations represents currency gains (losses) realized between the trade and settlement dates on securities transactions, and the difference between the amount of investment income and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. The change in unrealized currency gains (losses) on foreign currency translations for the period is reflected in the Statement of Operations.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

Redemption Fees – The Fund charges a 1.00% redemption fee for shares redeemed within 7 days of purchase. These fees are deducted from the redemption proceeds otherwise payable to the shareholder. The Fund will retain the fee charged as an increase in paid-in capital and such fees become part of the Fund’s daily NAV calculation.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m. Eastern Time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment or transferring a liability in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2024 |

in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the Nasdaq over-the-counter market are generally valued at the Nasdaq Official Closing Price. When using market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, securities are valued in good faith by the Adviser, as Valuation Designee, under the oversight of the Board’s Pricing & Liquidity Committee. The Valuation Designee has adopted written policies and procedures for valuing securities and other assets in circumstances where market quotes are not readily available in conformity with guidelines adopted by the Board. In the event that market quotes are not readily available, and the security or asset cannot be valued pursuant to one of the valuation methods, the value of the security or asset will be determined in good faith

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2024 |

by the Valuation Designee pursuant to its policies and procedures. Any fair value provided by the Valuation Designee is subject to the ultimate review of the pricing methodology by the Pricing & Liquidity Committee of the Board on a quarterly basis. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV provided by the service agent of the mutual funds. These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation policies and fair value determinations pursuant to Rule 2a-5 under the 1940 Act, the Valuation Designee is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Valuation Designee would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Valuation Designee’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Valuation Designee is aware of any other data that calls into question the reliability of market quotations. The Valuation Designee may obtain assistance from others in fulfilling its duties. For example, it may seek assistance from pricing services, fund administrators, sub-advisers, accountants, or counsel; it may also consult the Trust’s Fair Value Committee. The Valuation Designee, however, remains responsible for the final fair value determination and may not designate or assign that responsibility to any third party.

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2024 |

The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2024:

| | | | | | Valuation Inputs | | | | | | | |

| Investments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks(a) | | $ | 55,401,588 | | | $ | — | | | $ | — | | | $ | 55,401,588 | |

| Money Market Funds | | | 10,248,447 | | | | — | | | | — | | | | 10,248,447 | |

| Total | | $ | 65,650,035 | | | $ | — | | | $ | — | | | $ | 65,650,035 | |

| (a) | Refer to Schedule of Investments for sector classifications. |

The Fund did not hold any investments during or at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

The Adviser, under the terms of the management agreement (the “Agreement”), manages the Fund’s investments. As compensation for its management services, the Fund is obligated to pay the Adviser a management fee computed and accrued daily and paid monthly at an annual rate of 1.50% of the Fund’s average daily net assets. For the fiscal year ended November 30, 2024, the Adviser earned a management fee of $882,170 from the Fund. At November 30, 2024, the Fund owed the Adviser $79,419 for management services.

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting and transfer agent services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services.

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives fees from the Fund, which are approved annually by the Board.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers of the Trust are also employees of Ultimus and such persons are not paid by the Fund for serving in such capacities.

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2024 |

The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chair of the Board and more than 75% of the Trustees are “Independent Trustees,” which means that they are not “interested persons” as defined in the 1940 Act. The Independent Trustees review and establish compensation at least annually. Each Trustee of the Trust receives annual compensation, which is an established amount paid quarterly per fund in the Trust at the time of the regular quarterly Board meetings. The Chair of the Board receives the highest compensation, commensurate with his additional duties and each Chair of a committee receives additional compensation as well. Trustees also receive additional fees for attending any special meetings. In addition, the Trust reimburses Trustees for out-of-pocket expenses incurred in conjunction with attendance at meetings. Beginning in May 2024, the interested Trustee began receiving the same compensation as the Independent Trustees.

The Trust, with respect to the Fund, has adopted a distribution plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. Under the Plan, the Fund can pay the Distributor, the Adviser and/or other financial institutions or any other person (the “Recipient”) a fee of 0.25% of the average daily net assets of the Fund in connection with the promotion and distribution of the Fund’s shares or the provision of personal services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts (“12b-1 Expenses”). The Fund or Adviser may pay all or a portion of these fees to any Recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. The Plan is a compensation plan, which means that compensation is provided regardless of 12b-1 expenses actually incurred. The Fund has not implemented its 12b-1 Plan, although the Fund may do so at any time upon 60 days’ notice to shareholders.

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the fiscal year ended November 30, 2024, purchases and sales of investment securities, other than short-term investments, were $76,123,344 and $73,658,007, respectively.

There were no purchases or sales of long-term U.S. government obligations during the fiscal year ended November 30, 2024.

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2024 |

NOTE 6. BENEFICIAL OWNERSHIP

As of November 30, 2024, each of the following entities owned beneficially 25% or greater of the Fund’s outstanding shares. The shares are held under omnibus accounts (whereby the transactions of two or more shareholders are combined and carried in the name of the origination broker rather than designated separately).

| | | Percentage |

| Charles Schwab & Co. | | 51% |

| National Financial Services, LLC | | 40% |

NOTE 7. FEDERAL TAX INFORMATION

At November 30, 2024, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes were as follows:

| Gross unrealized appreciation | | $ | 7,469,507 | |

| Gross unrealized depreciation | | | (3,671,925 | ) |

| Net unrealized appreciation/(depreciation) on investments | | $ | 3,797,582 | |

| Tax cost of investments | | $ | 61,852,453 | |

The tax character of distributions paid for the fiscal years ended November 30, 2024 and November 30, 2023 were as follows:

| | | 2024 | | | 2023 | |

| Distributions paid from: | | | | | | | | |

| Ordinary income | | $ | 1,527,358 | | | $ | 2,139,895 | |

| Long-term capital gains | | | 510,634 | | | | — | |

| Total distributions paid | | $ | 2,037,992 | | | $ | 2,139,895 | |

| (a) | Short-term capital gain distributions are treated as ordinary income for tax purposes. |

At November 30, 2024, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed ordinary income | | $ | 7,915,561 | |

| Undistributed long-term capital gains | | | 4,160,845 | |

| Unrealized appreciation on investments | | | 3,797,587 | |

| Total accumulated earnings | | $ | 15,873,993 | |

As of November 30, 2024, the difference between book basis and tax basis unrealized appreciation (depreciation) is attributable to the passive foreign investment company basis adjustments of underlying securities, C-corp basis adjustments, and REIT basis adjustments.

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2024 |

Capital losses and specified gains realized after October 31, and net investment losses realized after December 31 of the Fund’s fiscal year may be deferred and treated as occurring on the first business day of the following fiscal year for tax purposes. For the fiscal year ended November 30, 2024, the Fund did not defer any post-October capital losses or late year ordinary losses.

NOTE 8. SECTOR RISK

If the Fund has significant investments in the securities of issuers within a particular sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss in the Fund and increase the volatility of the Fund’s NAV per share. For instance, economic or market factors, regulatory changes or other developments may negatively impact all companies in a particular sector, and therefore the value of the Fund’s portfolio will be adversely affected.

NOTE 9. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 10. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

On December 13, 2024, the Fund paid a capital gain distribution of $3.2336 per share and an ordinary income distribution of $0.414 per share to shareholders of record on December 12, 2024.

Report of Independent Registered Public Accounting Firm

To the Shareholders of Auer Growth Fund and

Board of Trustees of Unified Series Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Auer Growth Fund (the “Fund”) as of November 30, 2024, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of November 30, 2024, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2024, by correspondence with the custodian. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2008.

COHEN & COMPANY, LTD.

Cleveland, Ohio

January 29, 2025

| Additional Federal Income Tax Information (Unaudited) |

The Form 1099-DIV you receive in January 2025 will show the tax status of all distributions paid to your account in calendar year 2024. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately 43.95% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for a reduced tax rate.

Qualified Business Income. The Fund designates approximately 0% of its ordinary income dividends, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified business income.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s calendar year 2024 ordinary income dividends, 40.87% qualifies for the corporate dividends received deduction.

For the fiscal year ended November 30, 2024, the Fund designated $510,634 as long-term capital gain distributions.

| Additional Information (Unaudited) |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the period covered by this report.

Proxy Disclosures

Not applicable.

Remuneration Paid to Directors, Officers and Others

Refer to the financial statements included herein.

Statement Regarding Basis for Approval of Investment Advisory Agreement

The Auer Growth Fund (the “Fund”) is a series of Unified Series Trust (the “Trust”). The Trust’s Board of Trustees (the “Board”) oversees the management of the Fund and, as required by law, has considered the renewal of the management agreement with its investment adviser, SBAuer Funds, LLC (“Auer”). In connection with such renewal, the Board requested and evaluated all information that the Trustees deemed reasonably necessary under the circumstances.

The Trustees held a teleconference on August 14, 2024 to review and discuss materials compiled by Ultimus Fund Solutions, LLC, the Trust’s administrator, with regard to the management agreement between the Trust and Auer. At the Trustees’ quarterly meeting held in August 2024, the Board interviewed certain executives of Auer, including Auer’s Chief Compliance Officer, Portfolio Manager and Operations Manager, and Senior Portfolio Manager. They also received a compliance review from the Trust CCO. After discussion, the Trustees, including the Trustees who are not “interested persons” (as that term is defined in the Investment Company Act of 1940, as amended) of the Trust or Auer (the “Independent Trustees”), approved the renewal of the management agreement between the Trust and Auer for an additional year. The Trustees’ renewal of the Fund’s management agreement was based on a consideration of all the information provided to the Trustees, and was not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations are described below, although individual Trustees may have evaluated this information differently, ascribing different weights to various factors.

(i) The Nature, Extent, and Quality of Services. The Trustees reviewed and considered information regarding the nature, extent, and quality of services that Auer provides to the Fund, which include, but are not limited to, providing a continuous investment program for the Fund, adhering to the Fund’s investment restrictions, complying with the Trust’s policies and procedures, and voting proxies on behalf of the Fund. The Trustees considered the qualifications and experience of Auer’s portfolio managers who are responsible for the day-to-day management of the Fund’s portfolio, as well as the qualifications and experience of the other individuals at Auer who provide services to the Fund. They discussed the succession plan as presented by Auer. They noted Auer’s systematic and manual approach to its investment process, comprehensive compliance program, and quality of personnel, having discussed Auer’s investment strategy and process in depth with its management team. They discussed with Auer whether the strategy is subject to capacity constraints or operational challenges and the positive impact of adding more compliance personnel. The Trustees

| Additional Information (Unaudited) (continued) |

concluded that they were satisfied with the nature, extent, and quality of investment management services provided by Auer to the Fund.

(ii) Fund Performance. The Trustees next reviewed and discussed the Fund’s performance for periods ended June 30, 2024. The Trustees observed that the Fund had outperformed its benchmark, the S&P 500 Index, the median return of its Morningstar Small Value category, and the peer group median, for the one-year, three-year and five-year periods, but underperformed each for the since inception period. The Trustees acknowledged Auer’s explanation that it adjusted the Fund’s allocation methodology in 2018 to reduce the risk of overweighting, and that these enhancements had positively impacted the Fund’s performance. They also noted the Lipper Awards and Auer’s assertion that the portfolio is healthy and well positioned for continued strong performance. It was the consensus of the Trustees that it was reasonable to conclude that Auer has successfully managed the Fund from a performance standpoint.

(iii) Fee Rate and Profitability. The Trustees reviewed a fee and expense comparison for funds in the Morningstar Small Value category and peer group, which indicated that the Fund’s management fee and net expense ratio are higher than the averages and medians of the Morningstar category and peer group. The Trustees considered Auer’s explanation that the actively managed nature of the Fund, including the extensive qualitative and quantitative analysis required to effectively implement the Fund’s strategy and mitigate downside risk, supported the management fee. The Trustees also noted that Auer believes its net expense ratio is justified due to the inability to benefit from economies of scale in the same manner as the larger funds in its peer group and Morningstar category.

The Trustees also considered a profitability analysis prepared by Auer with respect to its management of the Fund, which indicated that Auer is earning a slight profit from managing the Fund before deduction of marketing expenses. The Board also discussed and considered the financial status of Auer.

The Trustees considered other potential benefits that Auer may receive in connection with its management of the Fund, noting Auer’s representation that it does not enter into soft dollar arrangements on behalf of the Fund. After considering the above information, the Trustees concluded that the current management fee for the Fund represents reasonable compensation in light of the nature and quality of Auer’s services to the Fund.

(iv) Economies of Scale. In determining the reasonableness of the management fee, the Trustees also considered the extent to which Auer will realize economies of scale as the Fund grows larger. The Trustees determined that, in light of the current size of the Fund and Auer’s level of profitability in managing the Fund, Auer is not realizing benefits from economies of scale in managing the Fund and therefore it is premature to reduce the management fee or introduce breakpoints in the management fee at this time.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (888) 711-2837 and (2) in Fund documents filed with the SEC on the SEC’s website at www.sec.gov.

TRUSTEES

Daniel J. Condon, Chair

David R. Carson

Kenneth G.Y. Grant

Freddie Jacobs, Jr.

Catharine B. McGauley

Ronald C. Tritschler | INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115 |

| | |

| | |

OFFICERS

Martin R. Dean, President

Gweneth K. Gosselink, Chief Compliance Officer Zachary P. Richmond, Treasurer and Chief Financial Officer | LEGAL COUNSEL

Thompson Hine LLP

312 Walnut Street, 20th Floor

Cincinnati, OH 45202 |

| | |

| | |

INVESTMENT ADVISER

SBAuer Funds, LLC

8801 River Crossing Blvd, Suite 100

Indianapolis, IN 46240 | CUSTODIAN

Huntington National Bank

41 South High Street

Columbus, OH 43215 |

| | |

| | |

DISTRIBUTOR

Ultimus Fund Distributors, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 | ADMINISTRATOR, TRANSFER

AGENT AND FUND ACCOUNTANT

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 |

| | |

| | |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Ultimus Fund Distributors, LLC

Member FINRA/SIPC

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Not applicable

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Included under Item 7

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Included under Item 7

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable

Item 15. Submission of Matters to a Vote of Security Holders.

None

Item 16. Controls and Procedures

(a) The registrant’s Principal Executive Officer and Principal Financial Officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act) are effective in design and operation and are sufficient to form the basis of the certifications required by Rule 30a-(2) under the Act, based on their evaluation of these disclosure controls and procedures as of a date within 90 days of this report on Form N-CSR.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable

Item 18. Recovery of Erroneously Awarded Compensation.

Item 19. Exhibits.

(a)(1) Code of Ethics attached hereto.

(a)(2) Not applicable

(a)(3) Certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2 under the Investment Company Act of 1940 are filed herewith.

(a)(4) Not applicable

(a)(5) Not applicable

(b) Certifications required by Rule 30a-2(b) under the Act (17 CFR 270.30a-2(b)) are filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Unified Series Trust

| By | /s/ Martin R. Dean | |

| | Martin R. Dean, Principal Executive Officer | |

| | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ Martin R. Dean | |

| | Martin R. Dean, Principal Executive Officer | |

| | | |

| By | /s/ Zachary P. Richmond | |

| | Zachary P. Richmond, Principal Financial Officer | |

| | | |