Exhibit 99.3

| IASG / Protection One A Diversified Market Leader in Security December 21, 2006 |

| Forward-Looking Statements Certain statements in this presentation may contain forward-looking information regarding Protection One, Inc. and Integrated Alarm Services Group, Inc. (“IASG”) and the combined company after the completion of the transaction that are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified as such because the context of the statement includes words such as “believe,” “expect,” “anticipate,” “will,” “should” or other words of similar import. These statements also include, but are not limited to, the benefits of the business combination transaction involving Protection One and IASG, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of the management of Protection One and IASG and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the ability to obtain governmental approvals of the transaction on the proposed terms and schedule; the failure of IASG’s stockholders to approve the transaction; the risk that the businesses of Protection One and IASG will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, management, employees or suppliers; costs and availability of alarm equipment; competition and its effect on pricing, spending, third-party relationships and revenues; social and political conditions such as war, political unrest or terrorism; general economic conditions and normal business uncertainty. Additional risks and factors are identified in Protection One’s and IASG’s filings with the Securities and Exchange Commission (“SEC”), including Protection One’s and IASG’s Annual Reports on Form 10-K/A and Form 10-K for the fiscal year ending December 31, 2005, which are available on Protection One’s website (http://www.protectionone.com) and IASG’s website (http://www.iasg.us), respectively. Protection One and IASG undertake no obligation to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date of this filing. |

| Additional Information About the MergerIn connection with the proposed merger of Protection One and IASG, the parties intend to file relevant materials with the SEC, including a proxy statement/prospectus regarding the proposed transaction. Such documents, however, are not currently available. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE, BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain a free copy of the proxy statement/prospectus, as well as other filings containing information about Protection One and IASG without charge, at the SEC’s Web site (http://www.sec.gov) once such documents are filed with the SEC. Copies of the proxy statement/prospectus can also be obtained, without charge, once they are filed with the SEC, by (1) directing a written request to Protection One, Inc., Attention: Corporate Secretary, 1035 N 3rd Street, Suite 101, Lawrence, KS 66044, or by calling (785) 856-9368 or (2) directing a written request to Integrated Alarm Services Group, Inc., Attention: Brian Shea, 99 Pine street Albany NY, 12207, or by calling (518) 426-1515. Protection One, IASG and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from IASG stockholders in respect of the proposed transaction. Information regarding Protection One’s directors and executive officers is available in Protection One’s information statement for its 2006 annual meeting of stockholders, as filed with the SEC on April 28, 2006. Information regarding IASG’s directors and executive officers is available in IASG’s proxy statement for its 2006 annual meeting of stockholders, as filed with the SEC on August 3, 2006. Additional information regarding the interests of such potential participants will be included in the proxy statement/prospectus and the other relevant documents filed with the SEC when they become available.. |

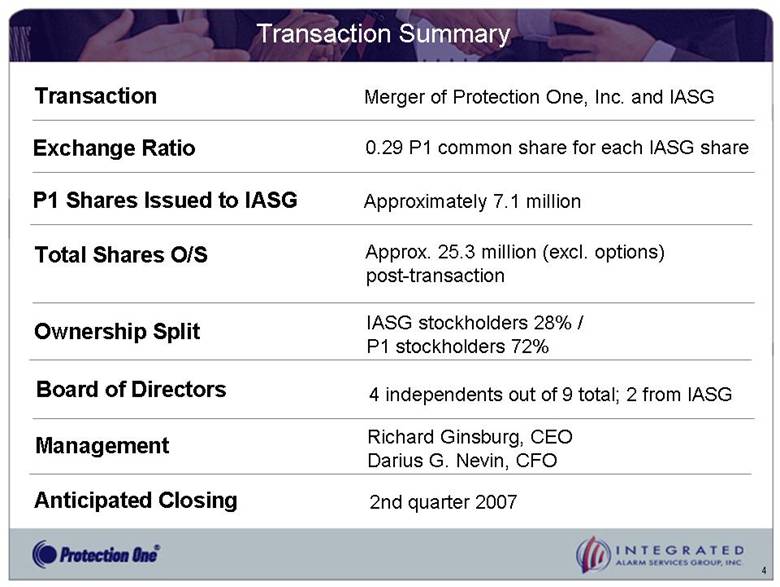

| Transaction Summary TransactionMerger of Protection One, Inc. and IASG Exchange Ratio 0.29 P1 common share for each IASG share P1 Shares Issued to IASG Approximately 7.1 million Total Shares O/S Approx. 25.3 million (excl. options) post-transaction Ownership Split Anticipated Closing 2nd quarter 2007 IASG stockholders 28% / P1 stockholders 72% 4 independents out of 9 total; 2 from IASG Board of Directors Management Richard Ginsburg, CEO Darius G. Nevin, CFO |

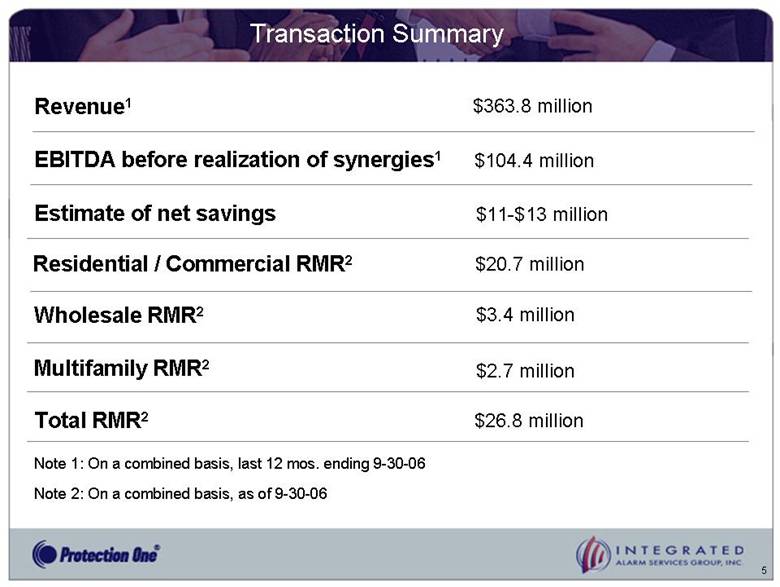

| Transaction Summary Revenue1$363.8 million EBITDA before realization of synergies1$104.4 million Residential / Commercial RMR2$20.7 million Wholesale RMR2$3.4 million Multifamily RMR2Note 2: On a combined basis, as of 9-30-06 $2.7 million $26.8 million Total RMR2Note 1: On a combined basis, last 12 mos. ending 9-30-06 Estimate of net savings $11-$13 million |

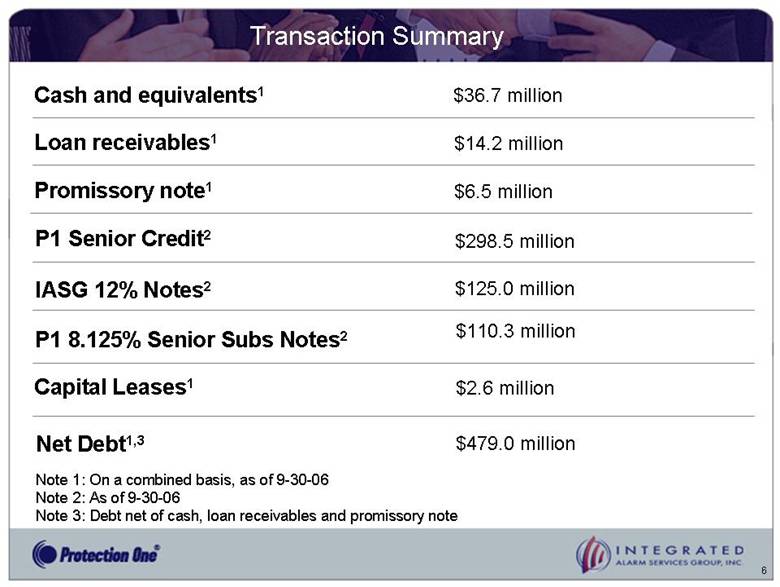

| Transaction Summary Cash and equivalents1$36.7 million Loan receivables1$14.2 million Promissory note1$6.5 million P1 Senior Credit2$298.5 million IASG 12% Notes2$125.0 million $110.3 million P1 8.125% Senior Subs Notes2Note 1: On a combined basis, as of 9-30-06 Note 2: As of 9-30-06 Note 3: Debt net of cash, loan receivables and promissory note Capital Leases1$2.6 million Net Debt1,3$479.0 million |

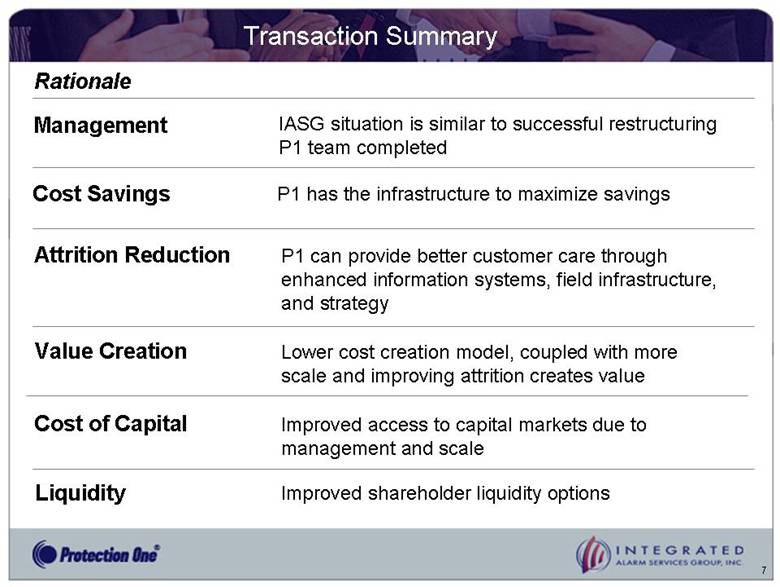

| Transaction Summary RationaleCost Savings Attrition Reduction Management IASG situation is similar to successful restructuring P1 team completed Value Creation Lower cost creation model, coupled with more scale and improving attrition creates value Improved access to capital markets due to management and scale Cost of Capital Liquidity Improved shareholder liquidity options P1 has the infrastructure to maximize savings P1 can provide better customer care through enhanced information systems, field infrastructure, and strategy |

| Protection One Business Overview Richard Ginsburg - President & CEO |

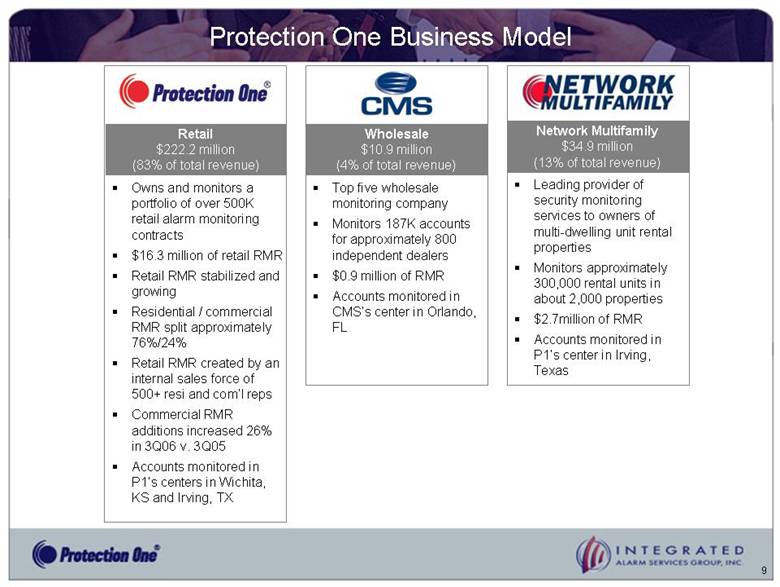

| Protection One Business Model Owns and monitors a portfolio of over 500K retail alarm monitoring contracts $16.3 million of retail RMR Retail RMR stabilized and growing Residential / commercial RMR split approximately 76%/24% Retail RMR created by an internal sales force of 500+ resi and com’l reps Commercial RMR additions increased 26% in 3Q06 v. 3Q05 Accounts monitored in P1’s centers in Wichita, KS and Irving, TX Retail $222.2 million (83% of total revenue) Wholesale $10.9 million (4% of total revenue) Network Multifamily $34.9 million (13% of total revenue) Top five wholesale monitoring company Monitors 187K accounts for approximately 800 independent dealers $0.9 million of RMR Accounts monitored in CMS’s center in Orlando, FL Leading provider of security monitoring services to owners of multi-dwelling unit rental properties Monitors approximately 300,000 rental units in about 2,000 properties $2.7million of RMR Accounts monitored in P1’s center in Irving, Texas |

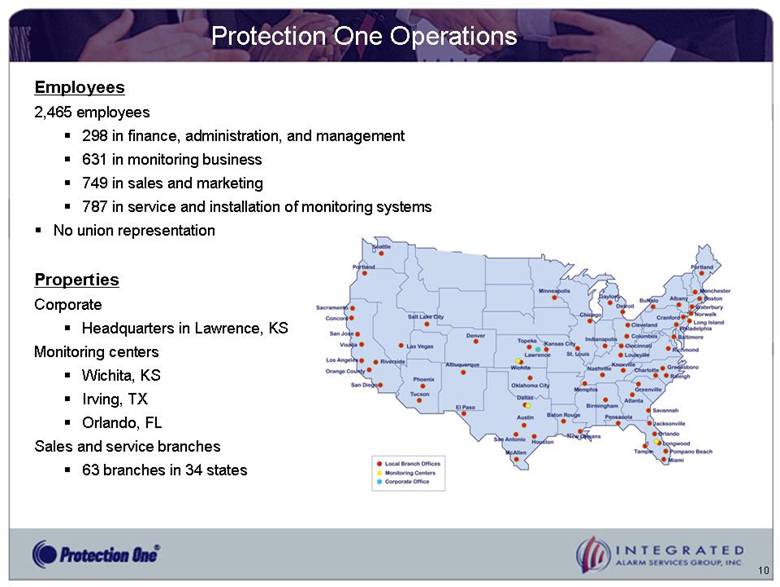

| Protection One Operations Employees 2,465 employees 298 in finance, administration, and management 631 in monitoring business 749 in sales and marketing 787 in service and installation of monitoring systems No union representation Properties Corporate Headquarters in Lawrence, KS Monitoring centers Wichita, KS Irving, TXOrlando, FLSales and service branches 63 branches in 34 states |

| Richard GinsburgChief Executive Officer and President 21 years in IndustryDarius G. NevinExecutive Vice President and Chief Financial Officer 20 years in industryLeadership Track Record Proven management team Successfully led P1 restructuring Reduced attrition Eliminated costs Realized organic growth Full team in place Successful turnaround experience with track record of creating shareholder value |

| IASG Business Overview Charles T. May - CEO |

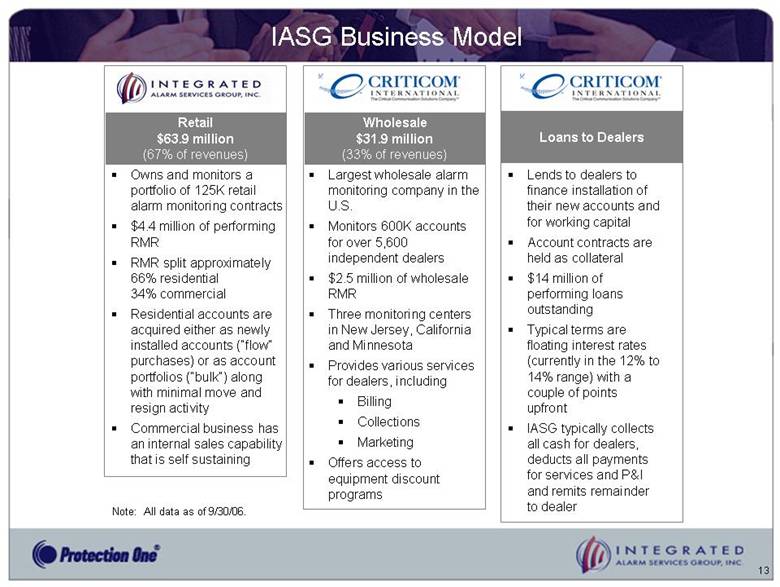

| IASG Business Model Owns and monitors a portfolio of 125K retail alarm monitoring contracts $4.4 million of performing RMR RMR split approximately 66% residential 34% commercial Residential accounts are acquired either as newly installed accounts (“flow” purchases) or as account portfolios (“bulk”) along with minimal move and resign activity Commercial business has an internal sales capability that is self sustaining Retail $63.9 million (67% of revenues) Wholesale $31.9 million (33% of revenues) Loans to Dealers Largest wholesale alarm monitoring company in the U.S. Monitors 600K accounts for over 5,600 independent dealers $2.5 million of wholesale RMR Three monitoring centers in New Jersey, California and Minnesota Provides various services for dealers, including Billing Collections Marketing Offers access to equipment discount programs Lends to dealers to finance installation of their new accounts and for working capital Account contracts are held as collateral $14 million of performing loans outstanding Typical terms are floating interest rates (currently in the 12% to 14% range) with a couple of points upfront IASG typically collects all cash for dealers, deducts all payments for services and P&I and remits remainder to dealer Note: All data as of 9/30/06. |

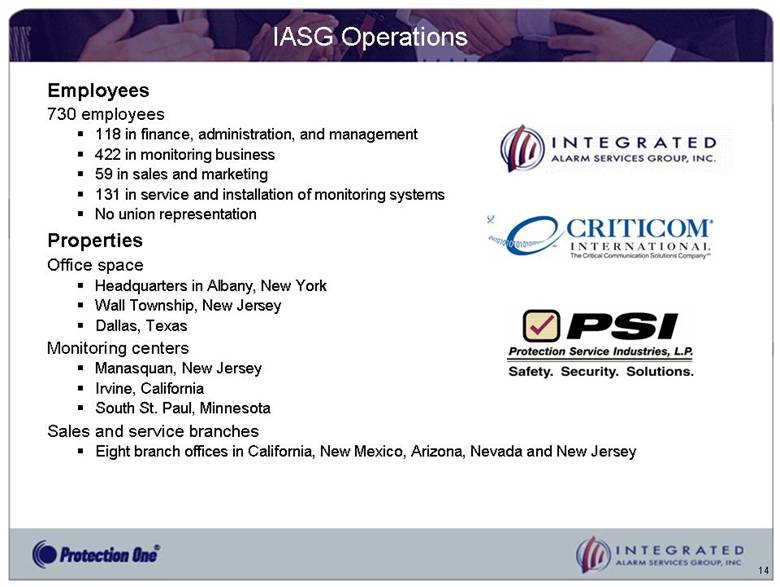

| IASG Operations Employees730 employees 118 in finance, administration, and management 422 in monitoring business 59 in sales and marketing 131 in service and installation of monitoring systems No union representation PropertiesOffice space Headquarters in Albany, New York Wall Township, New Jersey Dallas, Texas Monitoring centers Manasquan, New Jersey Irvine, California South St. Paul, Minnesota Sales and service branches Eight branch offices in California, New Mexico, Arizona, Nevada and New Jersey |

| PSI Operation 35 year old market leading commercial integratorBurglary Access Control Fire CCTV More than 15,000 contracts $1.0 million of RMR |

| Transaction Rationale |

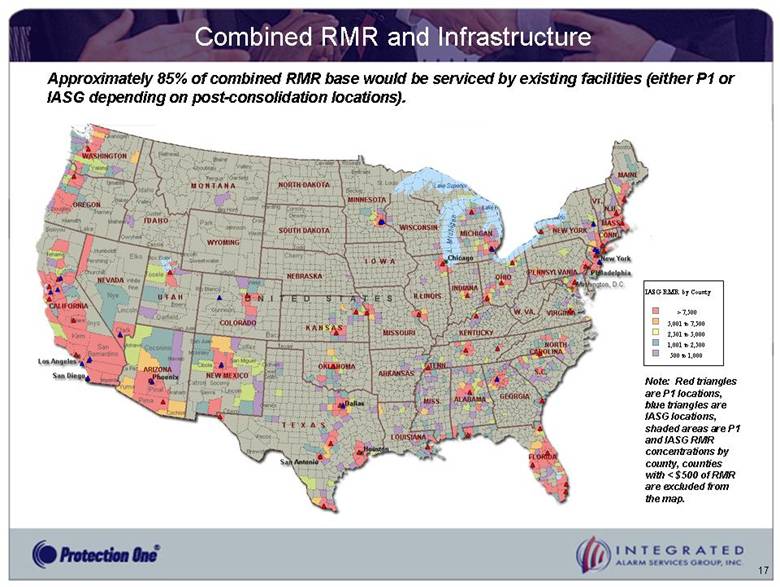

| Combined RMR and Infrastructure Approximately 85% of combined RMR base would be serviced by existing facilities (either P1 or IASG depending on post-consolidation locations).Note: Red triangles are P1 locations, blue triangles are IASG locations, shaded areas are P1 and IASG RMR concentrations by county, counties with < $500 of RMR are excluded from the map.IASG RMR by County> 7,5005,001 to 7,5002,501 to 5,0001,001 to 2,500500 to 1,000 |

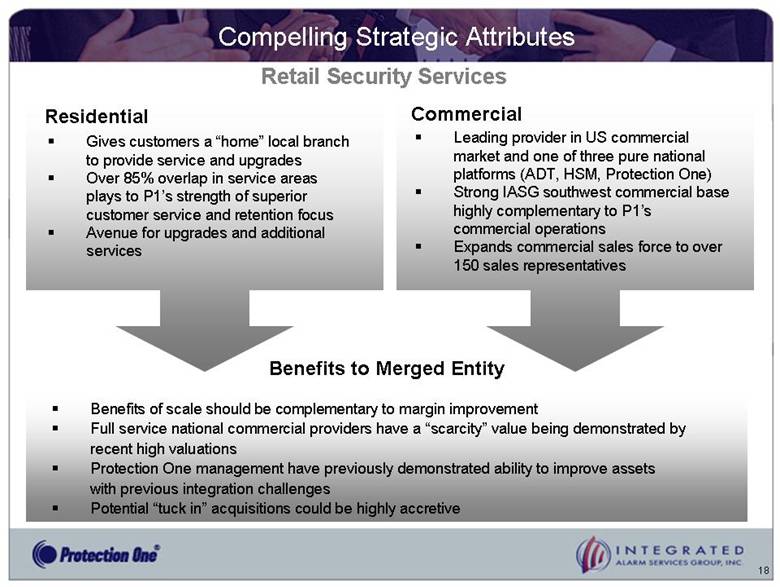

| Residential Gives customers a “home” local branch to provide service and upgrades Over 85% overlap in service areas plays to P1’s strength of superior customer service and retention focus Avenue for upgrades and additional services Compelling Strategic Attributes Retail Security Services Commercial Benefits to Merged Entity Leading provider in US commercial market and one of three pure national platforms (ADT, HSM, Protection One) Strong IASG southwest commercial base highly complementary to P1’s commercial operations Expands commercial sales force to over 150 sales representatives Benefits of scale should be complementary to margin improvement Full service national commercial providers have a “scarcity” value being demonstrated by recent high valuations Protection One management have previously demonstrated ability to improve assets with previous integration challenges Potential “tuck in” acquisitions could be highly accretive |

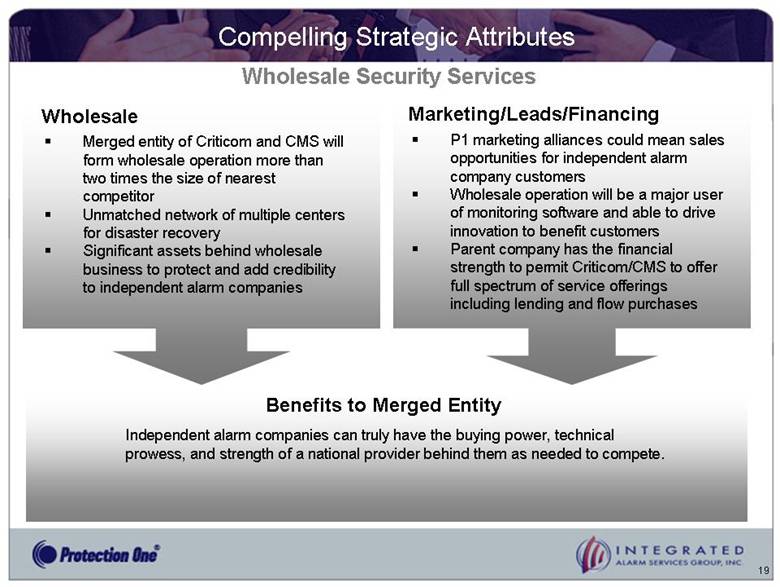

| Compelling Strategic Attributes Wholesale Security Services Wholesale Merged entity of Criticom and CMS will form wholesale operation more than two times the size of nearest competitor Unmatched network of multiple centers for disaster recovery Significant assets behind wholesale business to protect and add credibility to independent alarm companies Marketing/Leads/Financing Benefits to Merged Entity P1 marketing alliances could mean sales opportunities for independent alarm company customers Wholesale operation will be a major user of monitoring software and able to drive innovation to benefit customers Parent company has the financial strength to permit Criticom/CMS to offer full spectrum of service offerings including lending and flow purchases Independent alarm companies can truly have the buying power, technical prowess, and strength of a national provider behind them as needed to compete. |

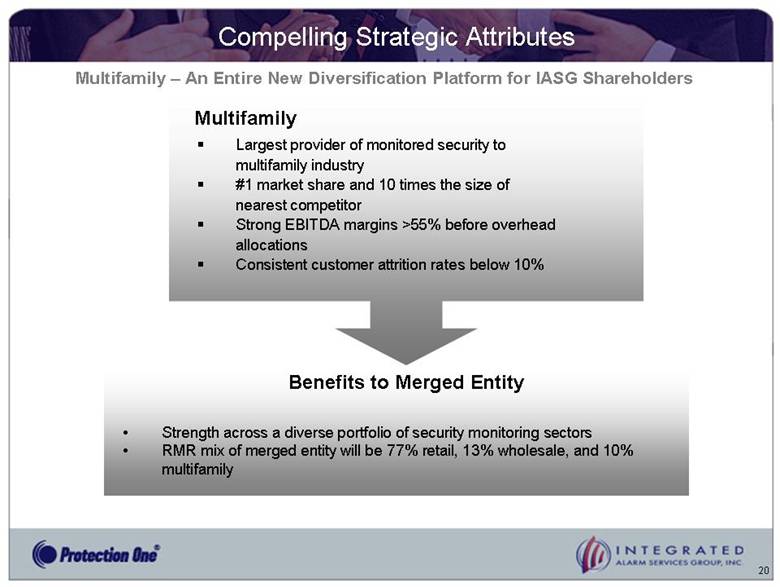

| Compelling Strategic Attributes Multifamily – An Entire New Diversification Platform for IASG Shareholders Multifamily Largest provider of monitored security to multifamily industry #1 market share and 10 times the size of nearest competitor Strong EBITDA margins >55% before overhead allocations Consistent customer attrition rates below 10% Benefits to Merged Entity Strength across a diverse portfolio of security monitoring sectors RMR mix of merged entity will be 77% retail, 13% wholesale, and 10% multifamily |

| Questions |