SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement o Confidential, for Use of the

Commission Only (as permitted by Rule 14a-6(e)(2))

Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Additional Materials

o Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

Integrated Alarm Services Group, Inc.

(Name of Registrant as Specified in its Charter)

Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1).

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

99 Pine Street, 3rd Floor

Albany, New York 12207

Dear Stockholder:

You are cordially invited to attend the annual meeting of the stockholders of Integrated Alarm Services Group, Inc., a Delaware corporation (the "Company") to be held at 10:30 a.m. on August 16, 2005 (the "Annual Meeting"), at the Crowne Plaza Albany Hotel located at State and Lodge Streets, Albany, New York 12207. A Notice of Annual Meeting of Stockholders, Proxy Statement and Proxy Card are enclosed for your review. All holders of shares of common stock of the Company as of the close of business on July 13, 2005 (the record date), are entitled to notice of, and to vote at, the Annual Meeting.

The business of the Annual Meeting is to: (i) elect the Company's Board of Directors; (ii) consider and transact such other business as may properly and lawfully come before the Annual Meeting.

While stockholders may exercise their right to vote their shares in person, we recognize that many stockholders may not be able to attend the Annual Meeting. Accordingly, we have enclosed a proxy card which will enable you to vote your shares on the issues to be considered at the Annual Meeting even if you are unable to attend. All you need to do is mark the proxy to indicate your vote, date and sign the proxy card, and return it in the enclosed postage-paid envelope for receipt prior to the meeting. If you desire to vote in accordance with management's recommendations, you need not mark your votes on the proxy card but need only sign, date and return the proxy card in the enclosed postage-paid envelope in order to record your vote.

If you would like to attend the meeting and your shares are held by a broker, bank or other nominee, you must bring to the meeting a recent brokerage statement or a letter from the nominee confirming your beneficial ownership of the shares. You must also bring a form of personal identification. In order to vote your shares at the meeting, you must obtain from the nominee a proxy in your name.

/s/ Timothy M. McGinn

Timothy M. McGinn

Chairman and Chief Executive Officer

July 15, 2005

2

INTEGRATED ALARM SERVICES GROUP, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD AUGUST 16, 2005

TO THE STOCKHOLDERS OF INTEGRATED ALARM SERVICES GROUP, INC.:

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders (the "Annual Meeting") of Integrated Alarm Services Group, Inc. (the "Company"), will be held at 10:30 a.m. on August 16, 2005, at the Crowne Plaza Albany Hotel located at State and Lodge Streets, Albany, New York 12207, for the following purposes:

| 1. | To elect the Company's Board of Directors; |

| 2. | To consider and transact such other business, if any, as may properly and lawfully come before the Annual Meeting or any adjournment thereof. |

All of the foregoing is more fully set forth in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on July 13, 2005, as the record date for the determination of the stockholders entitled to notice of and to vote at the annual meeting and any adjournments or postponements thereof. Only holders of record of the Company's common stock on the record date are entitled to vote at the meeting. A list of such stockholders will be available at the time and place of the meeting and, during the ten days prior to the meeting, at the office of the Secretary of the Company at 99 Pine Street, 3rd Floor, Albany, New York 12207; Attention: Brian E. Shea.

If you would like to attend the meeting and your shares are held by a broker, bank or other nominee, you must bring to the meeting a recent brokerage statement or a letter from the nominee confirming your beneficial ownership of the shares. You must also bring a form of personal identification. In order to vote your shares at the meeting, you must obtain from the nominee a proxy in your name.

You can ensure that your shares are voted at the meeting by signing and dating the enclosed proxy card and returning it in the envelope provided. Sending in a signed proxy card will not affect your right to attend the meeting and to vote in person. You may revoke your proxy at any time before it is voted by notifying American Stock Transfer & Trust Company in writing before the meeting, or by executing a subsequent proxy, which revokes your previously executed proxy. The address for the American Stock Transfer & Trust Company is 40 Wall Street, New York, New York 10005.

WHETHER OR NOT YOU EXPECT TO ATTEND, WE URGE YOU TO SIGN AND DATE THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENVELOPE PROVIDED.

By Order of the Board of Directors

/s/ Brian E. Shea

July 15, 2005 Brian E. Shea

Albany, New York Executive Vice President and Corporate Secretary

3

INTEGRATED ALARM SERVICES GROUP, INC.

ANNUAL MEETING OF STOCKHOLDERS

August 16, 2005

PROXY STATEMENT

The enclosed proxy is solicited on behalf of the Board of Directors of Integrated Alarm Services Group, Inc. (the "Company") for the annual meeting of stockholders (the "Annual Meeting") to be held at 10:30 a.m. on August 16, 2005 at the Crowne Plaza Albany Hotel located at State and Lodge Streets, Albany, New York 12207, or any adjournment or adjournments thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. These proxy solicitation materials are being mailed on or about July 20, 2005 to all stockholders entitled to vote at the meeting.

GENERAL INFORMATION

Record Date; Outstanding Shares

Only stockholders of record at the close of business on July 13, 2005 (the "Record Date"), are entitled to receive notice of and to vote at the Annual Meeting. The outstanding voting securities of the Company as of July 13, 2005 consisted of 24,681,462 shares of common stock, $.001 par value. For information regarding stock ownership by management and holders of more than 5% of the outstanding common stock, see "Securities Ownership of Certain Beneficial Owners and Management."

Voting of Proxies and Revocability

All shares represented by properly executed proxies will be voted in accordance with the specifications on the proxy. IF NO SUCH SPECIFICATIONS ARE MADE ON AN EXECUTED PROXY, THE PROXY WILL BE VOTED FOR THE ELECTION OF THE NOMINEES FOR DIRECTORS LISTED UNDER THE CAPTION "ELECTION OF DIRECTORS". A stockholder who has given a proxy pursuant to this proxy solicitation may revoke it at any time before it is exercised by giving written notice thereof prior to the meeting to the Company's transfer agent, American Stock Transfer & Trust Company, or by signing and returning a later dated proxy, or by voting in person at the meeting. Sending in a signed proxy will not affect a stockholder's right to attend the meeting and vote in person. However, mere attendance at the meeting will not, in and of itself, have the effect of revoking the proxy.

The Company has not received any stockholder proposals for inclusion in this proxy statement. The Company knows of no specific matter to be brought before the Annual Meeting which is not referred to in the attached Notice of Annual Meeting.

If any other matter or matters are properly presented for action at the meeting, the persons named in the enclosed proxy card and acting thereunder will have the discretion to vote on such matters in accordance with their best judgment, unless such authorization is withheld.

If you would like to attend the meeting and your shares are held by a broker, bank or other nominee, you must bring to the meeting a recent brokerage statement or a letter from the nominee confirming your beneficial ownership of the shares. You must also bring a form of personal identification. In order to vote your shares at the meeting, you must obtain from the nominee a proxy in your name.

Required Vote

The holder of each outstanding share of common stock as of the record date is entitled to one vote on each matter to be voted on at the Annual Meeting. With respect to the election of directors, the holder of each outstanding share of common stock as of the record date is entitled to one vote for as many persons as there are directors to be elected; however stockholders do not have a right to cumulate their votes for directors. The candidates for election as directors will be elected by the affirmative vote of a plurality of the shares of common stock present in person or by proxy and actually voting at the meeting and for any other matter that may properly come before the meeting. THE MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING ARE OF GREAT IMPORTANCE AND THE STOCKHOLDERS ARE URGED TO READ AND CAREFULLY CONSIDER THE INFORMATION PRESENTED IN THIS PROXY AND TO COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE.

4

Solicitation of Proxies

The cost of soliciting proxies will be borne by the Company. In addition, the Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Proxies may also be solicited by certain of the Company's directors, officers and regular employees, without additional compensation, personally or by telephone, telecopy or electronic mail. We have engaged American Stock Transfer & Trust Company to assist in the solicitation process. The Company estimates the cost of solicitation to be $10,000.

Quorum; Abstentions; Broker Non-Votes

Votes cast by proxy or in person at the meeting will be tabulated by the election inspectors appointed for the meeting, who will determine whether or not a quorum is present. The presence in person or by proxy of stockholders entitled to vote a majority of the outstanding shares of common stock will constitute a quorum. Shares represented by a proxy or in person at the meeting, including shares represented by proxies that reflect abstentions, will be counted as present in the determination of a quorum. An abstention as to any particular matter, however, does not constitute a vote "for" or "against" such matter. "Broker non-votes" (i.e. where a broker or nominee submits a proxy specifically indicating the lack of discretionary authority to vote on a matter) will be treated in the same manner as abstentions. Therefore, abstentions and “broker non-votes” will have no effect on the outcome of the proposal to elect directors.

Annual Report

The Company's Annual Report to Stockholders, which includes its Annual Report on Form 10-K for the fiscal year ended December 31, 2004, is enclosed with this Proxy Statement. The Annual Report contains financial and other information about the activities of the Company, but is not incorporated into this Proxy Statement and should not be considered to be part of the proxy soliciting materials.

5

ELECTION OF DIRECTORS

Proposal 1

General

The Company’s By-laws provide that the number of directors shall be not less than three nor more than 11 directors and empowers the Board of Directors to fix the exact number of directors and appoint persons to fill any vacancies on the Board until the next Annual Meeting. The Board has set the number of directors at eight.

The Board has nominated the current directors, Timothy M. McGinn, Thomas J. Few, Sr., David L. Smith, R. Carl Palmer, Jr., Timothy J. Tully, Ralph S. Michael III, John W. Mabry and Raymond C. Kubacki to be re-elected to serve a one-year term and until their successors are duly elected and qualified. Unless authorization is withheld, the persons named as proxies will vote FOR the election of the nominees of the Board of Directors named above. Each nominee has agreed to serve if elected. In the event that any nominee shall unexpectedly be unable to serve, the proxies will be voted for such other person as the Board of Directors may designate.

Stockholder Vote Required

The affirmative vote of a plurality of shares of common stock present in person or by proxy at the Annual Meeting will be required to approve the appointment of each director.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" EACH OF THE NOMINEES.

Information Regarding Nominee for Directors

Set forth below is certain information regarding each of the nominees for director of the Company.

Name | Age | Position |

| Timothy M. McGinn | 57 | Chairman of the Board, Chief Executive Officer and Director |

| Thomas J. Few, Sr. | 58 | Vice Chairman, President and Director |

| Raymond C. Kubacki | 60 | Director |

| John W. Mabry | 67 | Director |

| Ralph S. Michael III | 50 | Director, Chair Audit Committee |

| R. Carl Palmer, Jr. | 64 | Director |

| David L. Smith | 60 | Director |

| Timothy J. Tully | 41 | Director, Chair Compensation Committee |

Mr. McGinn has served as our Chairman of the Board and Chief Executive Officer since January 2003. Mr. McGinn was the President of Integrated Alarm Services, Inc. from January 2002 to January 2003. Mr. McGinn is the non-executive Chairman of the Board of McGinn, Smith & Co., Inc. He has served as Chairman of the Board and as an executive officer of McGinn, Smith since 1980. Mr. McGinn also serves as a Director of Same Day Surgery, Inc. From 1994 to 2004 he also served on the Board of Pointe Financial Corp., and on the Board of Pointe Bank. Mr. McGinn was also the Chairman of Capital Center Credit Corporation, a private company which provided financing to the residential security and alarm industry, from 1995 to 2002. From November 2000 to June 2002, Mr. McGinn also served as Chairman of First Integrated Capital Corporation, a financial services firm majority owned by Mr. McGinn and Mr. Smith.

Mr. Few, Sr. has served as our Vice Chairman and President since January 2003. Mr. Few also served as our Chief Operating Officer from January 2003 until April 2005 and has over 35 years of experience in the security alarm industry. Mr. Few, Sr. has been with KC Acquisition and its predecessors since 1985, where he started as Executive Vice President. Prior thereto, Mr. Few, Sr. held senior positions with Holmes Protection, Inc., ADEMCO, Guardian and ADT. Prior to his work with these firms, Mr. Few, Sr. owned and operated an independent alarm company and central station in New Jersey.

Mr. Kubacki has served as a director since June 2004. Mr. Kubacki has been President and Chief Executive Officer of Psychemedics Corporation, a biotechnology company with a proprietary drug test product, since July 1991. He has also served as Chairman of the Board since November 2003. Prior to joining Psychemedics, he held senior management positions in marketing and operations with Reliance Electric Company and ACME Cleveland Corporation. He is also a trustee for the Center for Excellence in Education based in Washington, D.C.

6

Mr. Mabry has served as a director of IASG since March 2003. Mr. Mabry has approximately 35 years of experience in the alarm industry. In 1969 he founded and began building the American Alarm Company that was purchased by Honeywell in 1983. He remained with Honeywell through 1993 with responsibilities for operations, sales and business development. From 1993 to 2000, Mr. Mabry was President of Security Network of America. Mr. Mabry serves on numerous alarm industry associations' boards and was President of the National Burglary and Fire Alarm Association.

Mr. Michael has served as a director of IASG since January 2003. In June 2005, Mr. Michael was named President and Chief Operating Officer of Ohio Casualty Insurance Co. From 2003 to June 2005, Mr. Michael was Executive Vice President of U.S. Bank, N.A. and President of U.S. Bank -- Oregon. From 1979 to 2002, Mr. Michael held management and executive positions with PNC Financial Services Group. Mr. Michael also serves on the boards of Ohio Casualty Corp. and Key Energy Services, Inc. Mr. Michael is Chairman of the IASG audit committee.

Mr. Palmer has served as a director of IASG since January 2003. Mr. Palmer is the market President for South Florida for Mercantile Bank, a wholly owned subsidiary of the South Financial Group, Inc. Prior to its May 2005 merger into Mercantile Bank, Mr. Palmer was Chairman of the Board and has been CEO of Pointe Financial Corp. a publicly traded commercial bank, since 1995. Prior to joining Pointe, Mr. Palmer held several executive positions within the banking industry.

Mr. Smith has served as a director of IASG since October 2002. Mr. Smith is the President and a Director of McGinn, Smith & Co., where he has served in this capacity since the company's founding in 1980. Previously he was with Paine Webber. Mr. Smith also serves on the board and as an executive officer of several privately held companies.

Mr. Tully has served as a director of IASG since January 2003. Mr. Tully is a managing member of Tully Capital Partners, LLC, a diversified private investment firm that he co-founded in 1997. Mr. Tully is the Chairman of the compensation committee.

Director Attendance

The Board met a total of 7 times during the fiscal year ended December 31, 2004. The Board has a standing Audit Committee and Compensation Committee. No incumbent Director, other than Mr. Kubacki, who missed two meetings due to a death in the family, attended less than 75% of the aggregate of all meetings of the Board of Directors and any committees of the Board on which he served, if any, during the fiscal year ended December 31, 2004.

Committees of the Board

The Audit Committee appoints and provides for the compensation of the Company’s independent auditors; oversees and evaluates the work and performance of the independent auditors; reviews the scope of the audit; examines the results of audits and quarterly reviews; considers comments made by the independent auditors with respect to accounting procedures and internal controls and the consideration given thereto by the Company’s management; approves all professional services to be provided to the Company by its independent auditors; reviews internal accounting procedures and controls with the Company’s financial and accounting staff; oversees a procedure that provides for the receipt, retention and treatment of complaints received by the Company and of confidential and anonymous submissions by employees regarding questionable accounting or auditing matters; and performs related duties as set forth in applicable securities laws, NASDAQ corporate governance guidelines and the Audit Committee charter. The Audit Committee functions pursuant to its charter adopted by the Board in August 2003.

The members of the Company’s Audit Committee are Messrs. Michael, Mabry, Tully, Palmer and Kubacki. Mr. Ralph S. Michael III is the Audit Committee Chairman. The Audit Committee met ten (10) times during the fiscal year ended December 31, 2004. Mr. Kubacki was elected to the Audit Committee in June 2004. Because Mr. McGinn, our Chairman and CEO, has been a member of the Compensation Committee of Pointe Bank within the past three years, of which Mr. Palmer is an executive officer, Mr. Palmer is deemed to be a “non-independent” director under the rules of the NASDAQ Stock Market. As permitted under the NASDAQ requirements, the Board carefully considered Mr. Palmer’s non-independence as well as his accounting and financial expertise and determined that it is in the best interest of the Company and its stockholders that he continue to serve as a member of the Audit Committee. Each of Messrs. Michael, Mabry, Kubacki and Tully are independent directors under the rules of the NASDAQ Stock Market. Each of the members of the Audit Committee are able to read and understand fundamental financial statements. While more than one member of the Company’s Audit Committee qualifies as an “audit committee financial expert” under Item 401(h) of Regulation S-K, Mr. Michael is the designated audit committee financial expert.

7

The members of the Company’s Compensation Committee are Messrs. Tully, Mabry and Kubacki. Mr. Tully became the Compensation Committee Chairman in May 2005. The Compensation Committee has such powers as may be assigned to it by the Board of Directors from time to time and is currently charged with, among other things, reviewing and recommending compensation packages for our officers, administering our Stock Option Plan and establishing and reviewing general policies relating to compensation and benefits of the Company’s employees. The Compensation Committee met two (2) times during fiscal 2004. In February 2004, the Board elected Mr. Mabry to the Compensation Committee. In March 2005, the Board elected Mr. Kubacki to the compensation committee. Messrs. Tully, Allen, Kubacki and Mabry are deemed independent Directors under the rules of the NASDAQ Stock Market. Mr. Allen resigned from the Company’s Board and Chair of the Compensation Committee in May 2005.

The Board does not have a Nominating Committee; however, the nominees selected for the Board of Directors for fiscal 2005 were nominated by the independent Directors of the Company’s Board.

Compensation of Directors

During fiscal 2004, the Company paid its non-employee Directors an annual retainer of $25,000. Mr. Michael received an additional $10,000 for serving as the Chairman of the Audit Committee. Mr. Allen received an additional $5,000 for serving as the Compensation Committee Chairman. Mr. Palmer received an additional $3,500 for acting as Lead Director. The lead director is the person responsible for interfacing between the board at large and senior management as well as the standing committees. Directors also receive Board Meeting fees of $1,000 per meeting. During fiscal 2005, the Company will pay each of its non-employee Directors an annual retainer of $25,000. Additional fees will be paid as follows: $5,000 for Audit Committee members and $10,000 for the Audit Committee Chairman, $3,500 for Compensation Committee members and $5,000 for the Compensation Committee Chairman, $3,500 for the Lead Director and Board Meeting fees of $1,000 per meeting. We also reimburse Directors for reasonable expenses in attending meetings. In July 2003, in connection with the Company’s initial public offering, the Company granted each of its non-employee Directors a stock option to purchase 8,000 shares of the Company’s common stock at an exercise price of $9.25 per share, which was the initial public offering price. In June, 2004, the Company granted each of its non-employee Directors options to purchase 5,000 shares of the Company’s common stock at an exercise price of $5.75 per share.

Code of Ethics

We have adopted a Code of Ethics for our officers, including our principal executive officer, principal financial officer, principal accounting officer, persons performing similar functions and directors.

Stockholders may request a free copy of the Code of Ethics and/or Annual Report from:

Integrated Alarm Services Group, Inc.

Attn: Investor Relations

99 Pine Street, 3rd floor

Albany, NY 12207

(518) 426-1515

Any amendment of our Code of Ethics or waiver thereof applicable to any of our principal executive officer, principal financial officer, principal accounting officer or persons performing similar functions will be disclosed on our website within 5 days of the date of such amendment or waiver. In the case of a waiver, the nature of the waiver, the name of the person to whom the waiver was granted and the date of the waiver will also be disclosed.

8

EXECUTIVE OFFICERS AND COMPENSATION

Executive Officers

Name | Age | Position |

| Timothy M. McGinn | 57 | Chairman of the Board and Chief Executive Officer |

| Thomas J. Few, Sr. | 58 | Vice Chairman and President |

| Bruce E. Quay | 47 | Chief Operating Officer |

| Curtis E. Quady | 63 | Executive Vice President |

| Brian E. Shea | 46 | Executive Vice President |

| Robert B. Heintz | 49 | Executive Vice President-Monitoring COO |

| Michael T. Moscinski | 53 | Chief Financial Officer |

Executive Officers hold office until their successors are chosen and qualified, subject to earlier removal by the Board of Directors.

Biographical information regarding each executive officer other than Timothy M. McGinn and Thomas J. Few Sr. is set forth below. Timothy M. McGinn and Thomas J. Fews’ biographical information is set forth above under “Election of Directors”.

Mr. Quay is our Chief Operating Officer. He joined the Company in April 2005. Prior to serving in his current role, Mr. Quay was Executive Vice President and Principal of Aquatic Development Group, a privately held company servicing the aquatics industry through its project services and equipment systems divisions from 2003 to 2005. Prior to Aquatic Development Group, he served as President and Chief Executive Officer of Cookson Plastic Molding Group from 1998 to 2002. Cookson Plastic Molding Group is a wholly owned subsidiary of Cookson Group, PLC, which is a global leader in the supply of plastic products to the material handling, pool construction, office equipment and lawn and garden markets. Prior to Cookson Plastic Molding Group, Mr. Quay held various senior level management positions with Heldor Industries, a leading national manufacturer and distributor of swimming pool products.

Mr. Quady founded Criticom, which we acquired in September 2002. Mr. Quady has served as an Executive Vice President since October 2002. He has more than 20 years of experience in the security industry. Prior to founding Criticom, Mr. Quady served as a pilot in the United States Army and was an airline captain for a major international airline for 18 years. Mr. Quady is the Chief Manager of Royal Thoughts, LLC, in which we have a minority ownership position.

Mr. Shea has served as an Executive Vice President since March 2003 and is the Company’s Secretary. In this role, he heads our retail account acquisition division, including portfolio management, due diligence, performance monitoring and billing and collection. Prior to serving in his current role, he was our Chief Financial Officer and had served as the Chief Financial Officer of IASI and its predecessor companies since 1992. Prior thereto, he was Vice President of Finance/Controller of Hiland Park, a real estate development company. Prior to joining Hiland Park, he was an Analyst at Galesi Group and a Financial Manager for General Electric Corporation, where he graduated from GE's Financial Management Training Program.

Mr. Heintz has served as our Executive Vice President-Monitoring Services COO since February 2005. Prior to serving in his current role, he was our Vice President, Finance and Administration—Monitoring Services since January 2003. He was previously our Chief Financial Officer, a position he held since April 2000. Prior to joining KC Acquisition, he was Vice President and Chief Financial Officer of Monital Signal Corporation, from January 1997 to April 2000, which we acquired in April 2000. Before working for Monital, he was Vice President Finance & Information Services for Brownstone Studio, Inc., a garment cataloger and manufacturer, where he worked from 1994 to 1996. Before Brownstone, he spent 14 years with the Dun & Bradstreet Corporation where he held several finance and accounting positions.

Mr. Moscinski has served as our Chief Financial Officer since March 2003. Prior to serving in his current role, Mr. Moscinski served IASG and its predecessor companies in various financial positions since April 2002. Prior to joining IASG, he served as Vice President, Corporate Controller and Interim Chief Financial Officer for United Road Services, Inc., a public company based in Albany, New York, where he worked from 1998 through 2001. From 1987 to 1998, Mr. Moscinski was the Director of Corporate Accounting for National Micronetics, Inc. From 1976 to 1987, Mr. Moscinski was with KPMG International and its predecessor firms, where he was a Senior Manager in audit. Mr. Moscinski is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants and the New York State Society of Certified Public Accountants.

9

Executive Compensation and Related Matters

Executive Compensation

The following table sets forth certain information regarding compensation paid or accrued by us to our Chief Executive Officer and to the four most highest compensated executive officers who were paid in excess of $100,000 in salary and bonus for all services rendered to us in all capacities during the years ended December 31, 2004, 2003 and 2002.

Annual Compensation | ||||||||||||||||||||

Name and Principal Position | Year | Salary | Other Annual Compensation | Bonus | ||||||||||||||||

| Timothy M. McGinn | 2004 | 416,000 | 14,400 | (2 | ) | 100,000 | (1 | ) | ||||||||||||

| Chairman and Chief Executive Officer | 2003 | 380,000 | 14,400 | (2 | ) | 175,000 | (1 | ) | ||||||||||||

| 2002 | 100,000 | (5 | ) | - | - | |||||||||||||||

| Thomas J. Few, Sr. | 2004 | 416,000 | 14,677 | (2 | ) | 100,000 | (1 | ) | ||||||||||||

| Vice Chairman and President | 2003 | 378,463 | 14,400 | (2 | ) | 175,000 | (1 | ) | ||||||||||||

| 2002 | 364,639 | - | - | |||||||||||||||||

| Curtis E. Quady | 2004 | 200,000 | 14,801 | (2,4 | ) | - | ||||||||||||||

| Executive Vice President | 2003 | 203,846 | 14,400 | (2 | ) | - | ||||||||||||||

| 2002 | 100,000 | 38,747 | (3 | ) | - | |||||||||||||||

| Brian E. Shea | 2004 | 170,000 | 4,440 | (4 | ) | - | ||||||||||||||

| Executive Vice President | 2003 | 129,923 | 3,500 | (4 | ) | 22,500 | ||||||||||||||

| 2002 | 10,833 | (5 | ) | - | - | |||||||||||||||

| Michael T. Moscinski | 2004 | 145,000 | 3,996 | (4 | ) | - | ||||||||||||||

| Chief Financial Officer | 2003 | 116,597 | 3,500 | (4 | ) | 22,500 | ||||||||||||||

| 2002 | 33,667 | (5 | ) | - | - | |||||||||||||||

| Robert B. Heintz | 2004 | 135,291 | 12,537 | (2,4 | ) | - | ||||||||||||||

| Executive Vice President | 2003 | 130,000 | 15,000 | (2 | ) | 12,500 | ||||||||||||||

| 2002 | 120,789 | - | 16,864 | |||||||||||||||||

1) Includes a fixed contractual bonus of $100,000 and a discretionary merit bonus of $75,000 paid in 2004 for performance in 2003. No discretionary bonus was granted for

performance in 2004.

performance in 2004.

2) Represents payments of automobile allowance.

3) Represents payment of personal expenses on behalf of Mr. Quady.

4) Represents Company’s matching contribution under 401 (k) plan.

5) Messrs. McGinn, Shea and Moscinski were not employed by us until August 2002.

Option Grants in 2004

We issued 30,500 stock options in total to four of our executive officers during 2004.

Number of Securites Underlying Options | Percent of Total Options Granted to Employees in | Exercise or Base Price | Expiration | Potential Realizable Value at Assumed Annual Rate of Stock Price Appreciation for Option Term (1) | |||||||||||||||

Name | Granted (#) (2) | Fiscal Year (3) | ($/Sh) | Date | 5% | 10% | |||||||||||||

| Robert B. Heintz | 8,000 | 5% | $ | 5.75 | 6/15/2014 | $ | 28,929 | $ | 73,312 | ||||||||||

| Brian E. Shea | 8,000 | 5% | 5.75 | 6/15/2014 | 28,929 | 73,312 | |||||||||||||

| Michael T. Moscinski | 12,000 | 8% | 5.75 | 6/15/2014 | 43,394 | 109,968 | |||||||||||||

| Peter Fidelman | 2,500 | 2% | 5.75 | 6/15/2014 | 9,040 | 22,910 | |||||||||||||

10

Aggregate Option Exercises in Last Fiscal Year and Fiscal Year-End Values

Name | Shares Acquired on Exercise | Value Realized | Number of Securities Underlying Unexercised Options/SARs at FY-End (Exercisable/Unexercisable) | Value of Unexercised In-the-Money Options/SARs at FY-End (Exercisable/Unexercisable) | ||||

| Timothy M. McGinn | - | - | 106,957 / 249,567 | $0 / $0 | ||||

| Thomas J. Few | - | - | 267,262 / 623,614 | $0 / $0 | ||||

| Curtis E. Quady | - | - | 29,252 / 68,254 | $0 / $0 | ||||

| Brian E. Shea | - | - | 0 / 8,000 | $0 / $0 | ||||

| Michael T. Moscinski | - | - | 0 / 12,000 | $0 / $0 |

Long-Term Incentive Plans

2003 Stock Option Plan

The 2003 Stock Option Plan ("SOP") permits the grant of options which may either be "incentive stock options", ("ISOs"), within the meaning of Section 422 of the Code or "non-qualified stock options" ("NSOs"), which do not meet the requirements of Section 422 of the Code. The total number of shares of our common stock that may be issued under the SOP may not exceed 150,000, subject to possible adjustment in the future as described below. As of December 31, 2004, 150,000 shares have been granted under this plan.

All employees, officers, directors, consultants and independent contractors of the Company, or of any subsidiary or affiliate are eligible to be granted options.

Within the limits of the SOP, the Compensation Committee has exclusive authority, among other things, to select those to whom options shall be granted, to determine the number of shares of common stock to be covered by each option. Only employees may be granted ISOs and to determine the other terms of each option, including, but not limited to, the exercise price and duration.

The exercise price of an option granted under the SOP may not be less than 100% of the fair market value of our common stock on the date of grant (110% of such fair market value in the case of an ISO granted to an optionee who owns or is deemed to own stock possessing more than 10% of the combined voting power of all classes of our stock).

Options are not transferable or assignable other than by will or the laws of descent and distribution and may be exercised during the holder's lifetime only by the holder.

The number of shares of common stock authorized for issuance under the SOP may be adjusted in the event our shares of common stock are changed into, or exchanged for cash, or securities of another entity through a reorganization, merger, recapitalization, reclassification, stock split, stock dividend, stock consolidation or combination or other similar transaction. In the event of the occurrence of any of the following, the Compensation Committee may adjust the number of authorized shares under the SOP, and the options issued under the SOP, as appropriate under the circumstances.

2004 Stock Option Plan

In June 2004 the stockholders approved the 2004 Stock Option Plan (“2004 Plan”). The adoption and approval of the 2004 Plan did not amend or modify the 2003 Plan or adversely affect rights under any outstanding stock options previously granted under the 2003 Plan.

The 2004 Plan is administered by our compensation committee. The compensation committee has the full authority to select the recipients of awards granted under the 2004 Plan, to determine the type and size of awards, and to determine and amend the terms, restrictions and conditions of awards. Eligibility for awards under the 2004 Plan is limited to our key employees (including employees who are also officers and/or directors) and consultants as selected by the committee based on, among other things, their duties and the compensation committee’s assessment of their present and potential contributions to our success.

11

Awards under the 2004 Plan may be granted in the form of ISOs that qualify under Section 422 of the Code, NSOs, stock appreciation rights, restricted stock, deferred stock awards and performance awards. The number of shares of our common stock reserved for issuance under the 2004 Plan is 1,200,000, subject to adjustment. As of December 31, 2004, 48,000 options have been granted under the 2004 Plan.

The exercise price of options granted under the 2004 Plan is determined at the discretion of the compensation committee, but the exercise price per share generally may not be less than the fair market value of a share of our common stock on the grant date of the option. In the case of ISOs granted to any holder on the date of grant of more than 10% (directly or by attribution through relatives or entities in which the holder has an ownership interest) of the total combined voting power of all classes of our stock or a parent or subsidiary corporation (a “10% Stockholder”), the exercise price per share may not be less than 110% of the fair market value of a share of our common stock on the grant date.

Equity Compensation Plan Information

The following table provides information as of December 31, 2004 with respect to our common shares issuable under our equity compensation plans:

| (a) | (b) | (c) | |||

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||

| Equity compensation plans approved by security holders - 2003 Plan | 144,166 | $6.92 | 5,834 | ||

| Equity compensation plans approved by security holders - 2004 Plan | 42,000 | $5.75 | 1,158,000 |

Retirement Plans

Effective September 1, 2004, the parent Company and its subsidiaries merged their three 401(k) plans into one plan which provides benefits to all Company employees meeting customary eligibility requirements. The Company matches 50% of employees’ contributions up to 6% of employee compensation. The Company matching contributions are discretionary and subject to management review and approval. The total expense for all 401(k) plans was approximately $10,000 and $168,000 for the years ended December 31, 2003 and 2004, respectively.

Compensation Committee Interlocks and Insider Participation

In February 2004, our Board of Directors elected Mr. Mabry to the Compensation Committee. Messrs. Tully, Allen, Kubacki and Mabry were deemed independent directors under the rules of the Nasdaq Stock Market. Mr. Tully became the Compensation Committee Chairman in May 2005 upon the resignation of Mr. Allen from the Company’s Board of Directors.

During the fiscal year ended December 31, 2003, Mr. McGinn, our Chairman and CEO, served on the Compensation Committee of the Board of Directors of Pointe Financial Corp. Mr. Palmer, one of our Directors is the Chairman and CEO of Pointe Financial Corp and has served as such since 1995. In January, 2004, Mr. McGinn resigned from the Compensation Committee of the Board of Directors of Pointe Financial Corp.; however, Mr. McGinn remained a member of the Board of Directors of Pointe Financial Corp. until its sale in May 2005.

Employment Agreements

We have entered into employment agreements with Messrs. McGinn, Few, Sr., Quady, Shea, Moscinski and Heintz. The employment agreements for Messrs. McGinn and Few, Sr., were entered into on January 31, 2003 and have a term of three years. Mr. Few, Sr.’s employment agreement automatically extends for an additional three (3) year period and thereafter automatically extends for additional one (1) year periods unless either party elects, not less than 90 days prior to the anniversary date, not to extend the term. Mr. McGinn’s employment agreement automatically extends for additional one (1) year periods unless either party elects, not less than 90 days prior to the anniversary date, not to extend the term.

12

The employment agreements with Messrs., Quady and Heintz, were entered into on October 1, 2002, and have a term of three years. The employment agreements with Messrs. Moscinski and Shea were entered into on March 2003 and also have a term of three years. The term of the employment agreements automatically extends for additional one (1) year periods, unless either party elects, not less than 90 days prior to the annual anniversary date, not to extend the employment term. Under the agreements, Messrs. McGinn and Few, Sr. each receive an annual salary of $416,000, and Messrs. Quady, Shea, Moscinski and Heintz receive annual salaries of $200,000, $170,000, $145,000, and $155,000, respectively. Messrs. McGinn, Few, Sr. and Quady also receive a leased car paid for by us ranging from $1,000 to $1,200 per month. In addition, each of the employees may receive an annual bonus at the discretion of our Board of Directors. Messrs. McGinn and Few, Sr. have a minimum bonus guarantee of $100,000 per year. The Board of Directors may also provide additional benefits to the employees, including but not limited to, health insurance, disability insurance and life insurance.

We may terminate the agreements for Cause (as defined below) and in such event we will not be responsible for the payment of any compensation under the agreement other than amounts accrued as of the termination date. In the event of an employee’s death, the agreement automatically terminates, except that the respective employee’s estate shall receive any accrued salary or bonus as of the date of death. “Cause” is defined as: (i) employee’s misconduct as could reasonably be expected to have a material adverse effect on our business and affairs; (ii) employee’s disregard of lawful instructions of our Board of Directors consistent with employee’s position relating to our business or neglect of duties or failure to act, which, in each case, could reasonably be expected to have a material adverse effect on our business and affairs; (iii) engaging by the employee in conduct that constitutes activity in competition with us; (iv) the conviction of employee for the commission of a felony; or (v) the habitual abuse of alcohol or controlled substances. In no event shall the alleged incompetence of an employee, in the performance of such employee’s duties, be deemed grounds for termination for Cause.

If an employee is terminated without Cause, or in breach of the agreement, or if an employee terminates following the occurrence of certain Events (as defined below), the effected employee is entitled to receive an amount equal to 12 months salary and payment of any previously declared bonus. An “Event” includes: (i) failure to be elected or appointed to the position then held by the employee; (ii) a material change in the employee’s duties or responsibilities; (iii) a relocation of place of employment by more than 30 miles; (iv) a material reduction in the base compensation or other benefits to the employee; (v) failure by us to obtain the assumption of this Agreement by any successor, or, termination of employment following (a) a breach of the employment agreement by us, or (b) a change of control.

In the event that employment is terminated following a change of control or if such individuals are required to relocate to an unacceptable location within two years of the change of control, Messrs. McGinn, Few, Sr., Quady, Shea, Moscinski and Heintz shall be entitled to: (i) a cash bonus, equal on an after-tax basis to two times their average compensation, including salary, bonus, and any other compensation, for the three previous fiscal years (with the exception of the agreements of Messrs. McGinn, Quady and Few, Sr. which call for a cash bonus equal to three times the employee’s average compensation, including salary, bonus, and any other compensation, for the three previous fiscal years), and (ii) the vesting and acceleration of any stock options or warrants held by such person.

In the event that any of the payments to be made thereunder or otherwise upon termination of employment are deemed to constitute a “parachute payment” within the meaning of Section 280G of the Internal Revenue Code of 1986, as amended (the “Code”), we shall assume all liability for the payment of any exercise tax imposed on such parachute payment under the Code, and we shall immediately reimburse such

person on a “gross-up” basis for any income taxes attributable to them from our payment of the exercise tax and reimbursements.

A “change in control” means: (i) the acquisition by any person or group of 50% or more of the combined voting power of our then outstanding securities, (ii) a majority of our Board of Directors-nominated slate of candidates for our Board of Directors is not elected, (iii) we consummate a merger in which we are not the surviving entity, (iv) the sale of substantially all of our assets, or (v) our stockholders approve the dissolution or liquidation of our company.

13

Under the employment agreements, the employee may terminate the agreement by providing 30 days written notice. In such event, the employee is only entitled to any accrued and unpaid compensation as of the date of the termination.

Indemnification Agreements

In addition to the indemnification provisions contained in our certificates of incorporation and bylaws, we have entered into separate indemnification agreements with each of our directors and officers. These agreements require us, among other things, to indemnify each such director or officer to the fullest extent permitted by Delaware law against expenses (including attorneys’ fees), judgments, fines and settlements incurred by such individual in connection with any action, suit or proceeding by reason of such individual’s status or service as a director or officer (other than liabilities with respect to which such individual receives payment from another source, arising in connection with certain final legal judgments, arising from knowing fraud, deliberate dishonesty, willful misconduct, in connection with assertions by such individuals not made in good faith or which are frivolous or which we are prohibited by applicable law from paying) and to advance expenses incurred by such individual in connection with any proceeding against such individual with respect to which such individual may be entitled to indemnification by us.

Report of the Audit Committee

The following is the report of the Audit Committee with respect to the Company's audited financial statements for the fiscal year ended December 31, 2004. The information contained in this report shall not be deemed to be "soliciting material" or to be "filed" with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates such information in such filing.

The Audit Committee has reviewed and discussed the Company's audited financial statements for the fiscal year ended December 31, 2004 with management and has received the written disclosures and the letter from PricewaterhouseCoopers LLP, the Company's independent auditors, required by Independence Standards Board Standard No. 1 (Independent Discussions with Audit Committee). The Audit Committee has also discussed with PricewaterhouseCoopers the Company's audited financial statements for the fiscal year ended December 31, 2004, including among other things the quality of the Company's accounting principles, the methodologies and accounting principles applied to significant transactions, the underlying processes and estimates used by management in its financial statements and the basis for the auditor's conclusions regarding the reasonableness of those estimates, and the auditor's independence, as well as the other matters required by Statement on Auditing Standards No. 61 of the Auditing Standards Board of the American Institute of Certified Public Accountants.

Based on these discussions with PricewaterhouseCoopers and the results of the audit of the Company's financial statements, the Audit Committee members recommended unanimously to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2004.

Section 404 of the Sarbanes-Oxley Act of 2002 ("SOX 404") and related rules of the SEC require management of public companies to periodically assess the effectiveness of internal control over financial reporting and to annually report their conclusions, including the disclosure of all material weaknesses in internal control over financial reporting. In addition, SOX 404 requires the Company to provide a report of its independent registered public accounting firm on management's annual assessment of the effectiveness of the Company's internal control over financial reporting.

As an "accelerated filer," the Company is required to comply with SOX 404 as of December 31, 2004 and thus management's report on the effectiveness of the Company's internal control over financial reporting as of December 31, 2004, as well as the attestation report of the Company's independent registered public accounting firm on management's assessment of the effectiveness of the Company’s internal control over financial reporting, must be included in the Form 10-K for the year ended December 31, 2004. The Company was unable to file this Form 10-K on its due date of March 16, 2005 and filed a Form 12b-25 on March 17, 2005 disclosing, among other things, the fact that its closing process was not then complete. The Company was still unable to complete the closing process by March 31, 2005 and filed a Form 8-K disclosing such on March 31, 2005. Management has now completed its assessment as described below in Management’s Annual Report on Internal Control over Financial Reporting and filed Form 10-K on June 13, 2005.

14

The Audit Committee has taken aggressive action relative to identifying and resolving the SOX 404 issues and the filing of the Form 10-K. During the first six months of 2005 the committee met 12 times versus 5 for the same time period in 2004.

The Company, at the direction of the Audit Committee, added internal and external resources to complete their reporting requirements. The cost of professional fees associated with the audit, 404 certification, and regulatory interactions was $1.7 million in the first five months of 2005, an increase of 500 percent over 2004. The Company also added several key executive positions, including, Chief Operating Officer, Vice President Corporate Information Technology and Director of Internal Audit. Additionally, four experienced accounting professionals have been added to our staff.

The members of the Audit Committee for fiscal 2004 were Messrs. Michael, Mabry, Tully, Kubacki and Palmer. Because Mr. McGinn, our Chairman and CEO, has been a member of the Compensation Committee of Pointe Bank within the past three years, of which Mr. Palmer is an executive officer, Mr. Palmer is deemed to be a "non-independent" director under the rules of the Nasdaq Stock Market. As permitted under the Nasdaq requirements, the Board carefully considered Mr. Palmer's non-independence as well as his accounting and financial expertise and determined that it is in the best interest of the Company and its stockholders that he continue to serve as a member of the Audit Committee. Each of Messrs. Michael, Tully, Mabry and Kubacki are independent directors under the rules of the Nasdaq Stock Market. Each of the members of the Audit Committee are able to read and understand fundamental financial statements. While more than one member of the Company's Audit Committee qualifies as an "audit committee financial expert" under Item 401(h) of Regulation S-K, Mr. Michael is the designated audit committee financial expert.

By the Audit Committee:

Ralph S. Michael III, Chairman

Raymond C. Kubacki

John W. Mabry

R. Carl Palmer, Jr.

Timothy J. Tully

Report of the Compensation Committee of the Board of Directors on Executive Compensation

The following is the report of the Compensation Committee. The information contained in this report shall not be deemed to be "soliciting material" or to be "filed" within the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates such information in such filing.

The Compensation Committee of the Board of Directors (the “Committee”) consists of three non-employee independent directors as defined by the rules of Nasdaq Stock Market. The committee approves compensation of executive officers, including the Chief Executive Officer. The Committee is responsible for approving executive compensation programs, including incentive compensation and benefits plans.

The Board of Directors and the Committee believe that the Company’s total executive compensation programs should be related to short and long-term corporate performance and improvement in Stockholder value. The overall objectives of executive compensation programs are to:

| · | Attract and retain talented executives: |

| · | Motive executives to achieve long-term business strategies while achieving near-term financial targets: and |

| · | Align executive performance with the Company’s goals for delivering Stockholder value. |

The Committee’s goal is to offer compensation that is competitive with the compensation offered by companies of similar size and complexity. The Compensation Committee also authorized the retention of a compensation consulting firm to advise on matters including, but not limited to, incentive stock option plans, executive compensation and other incentive plans as may be appropriate.

The Compensation Committee has reviewed and discussed the Company's compensation arrangements with the Company's senior employees, as well as the compensation to be paid to its non-employee directors. The Committee authorized the payment of $250,000 of performance cash bonuses for the year 2003, payable in 2004, at the discretion of the CEO. It also authorized executive compensation increases in annual base salaries not to exceed 6.00%, at the discretion of the CEO.

By the Compensation Committee:

Timothy J. Tully, Chairman

Raymond C. Kubacki

John W. Mabry

Timothy M. McGinn

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of the date hereof, with respect to the beneficial ownership of the Company’s common stock by each beneficial owner of more than 5% of the outstanding shares thereof, by each director, each nominee to become a director and each executive named in the Summary Compensation Table and by all executive officers, directors and nominees to become our directors. As of the date hereof, we had 24,681,462 shares of our common stock outstanding. Pursuant to the rules and regulations of the Securities and Exchange Commission, shares of common stock that an individual or group has a right to acquire within 60 days pursuant to the exercise of options or warrants are deemed to be outstanding for the purposes of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purposes of computing the percentage ownership of any other person shown in the table:

Name and Address of Beneficial Owner | Number of Shares of Common Stock Beneficially Owned | Percentage of Outstanding Common Stock Beneficially Owned | |||||

| Thomas J. Few, Sr. (2)(1) | 817,550 | 3.31 | % | ||||

| Timothy M. McGinn (3) (7)(1) | 448,425 | 1.82 | % | ||||

| Curtis E. Quady (4)(1) | 82,644 | * | |||||

| David L. Smith (5) (7)(1) | 360,925 | 1.46 | % | ||||

| Brian E. Shea (1) | 500 | * | |||||

| Robert B. Heintz (1) | 1,000 | * | |||||

| Michael T. Moscinski (1) | 1,000 | * | |||||

| R. Carl Palmer, Jr. (8)(1) | 25,000 | * | |||||

| Timothy J. Tully (8)(1) | 36,000 | * | |||||

| Ralph S. Michael, III (8)(1) | 20,000 | * | |||||

| John W. Mabry (8)(1) | 18,500 | * | |||||

| Raymond C. Kubacki (6)(1) | 7,000 | * | |||||

| All Executive Officers, and Directors, | 1,818,544 | 7.46 | % | ||||

| as a Group 13 persons | |||||||

5% Stockholders | |||||||

| Eubel Brady & Suttman Asset Management 7777 Washington Village Drive, Suite 210 Dayton, OH 45459 | 3,891,276 | 15.77 | % | ||||

| Franklin Mutual Advisers LLC 51 John F. Kennedy Parkway , Short Hills, NJ 07078 | 2,619,600 | 10.61 | % | ||||

| Contrarian Capital Management, LLC 411 West Putnam Avenue, Suite 225, Greenwich, CT 06830 | 2,467,970 | 10.00 | % | ||||

| INVESCO Asset Management Ltd. 4350 South Monaco St., Denver, CO 80237 | 1,993,400 | 8.08 | % | ||||

| Boston Partner Asset Management LP 28 State Street, 20th Floor, Boston, MA 02109 | 1,908,810 | 7.73 | % | ||||

| Wasatch Advisors, Inc. 150 Social Hall Ave. Suite 400, Salt Lake City, UT 84111 | 1,636,184 | 6.63 | % | ||||

| Potomac Capital Management LLC 153 East 53rd St., New York, NY 10022 | 1,272,967 | 5.16 | % | ||||

____________________

* represents persons who beneficially own less than 1% of our common stock.

16

| (1) | The address of each of such individuals is c/o Integrated Alarm Services Group, Inc., One Capital Center, 99 Pine Street, 3rd Floor, Albany, New York, 12207. |

| (2) | Includes 49,600 shares of common stock owned by TJF Enterprises, LLC, which is owned by Mr. Few, Sr. Does not include up to 890,876 shares issuable upon the exercise of options. |

(3) Does not include 356,524 shares issuable upon the exercise of options.

(4) Does not include 97,506 shares issuable upon the exercise of options.

(5) Does not include 361,524 shares issuable upon the exercise of options.

| (6) | Includes 5,000 shares of common stock issuable upon the exercise of currently exercisable options. |

| (7) | Includes an aggregate of 42,400 shares owned by First Integrated Capital Corporation, which is majority owned and controlled by Messrs. McGinn and Smith. |

| (8) | Includes 13,000 shares of common stock issuable upon the exercise of currently exercisable stock options. |

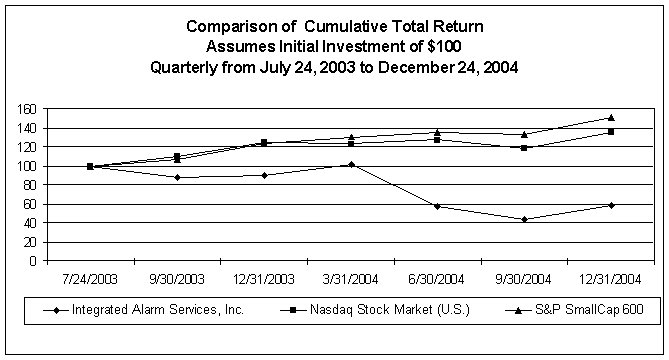

STOCK PERFORMANCE GRAPH

The graph below provides an indicator of cumulative total return on the Company's common stock as compared with the Nasdaq Index and the S&P SmallCap 600 during the period from July 24, 2003 through the end of fiscal 2004. The graph shows the value, at the end of each fiscal quarter, of $100 invested in the Company's common stock or the indices on July 24, 2003 and assumes reinvestment of all dividends. The graph depicts the change in the value of the Company's common stock relative to the noted indices as of the end of each fiscal quarter and not for any interim period. Historical stock price performance is not necessarily indicative of future stock performance.

17

IASG cumulative Total return Versus Selected Equity Indices

| 7/24/2003 | 9/30/2003 | 12/31/2003 | 3/31/2004 | 6/30/2004 | 9/30/2004 | 12/31/2004 | |

| Integrated Alarm Services Group, Inc. | 100.00 | 88.59 | 90.14 | 101.27 | 57.26 | 43.80 | 58.22 |

| Nasdaq Stock Market (U.S.) | 100.00 | 110.22 | 123.77 | 123.33 | 126.78 | 117.61 | 135.09 |

| S&P SmallCap 600 | 100.00 | 107.08 | 122.90 | 130.54 | 135.25 | 133.39 | 150.73 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In September 2002, we (as a successor to KC Acquisition), acquired all of the capital stock of Criticom International Corporation in a merger transaction in consideration for the issuance of 155,911 shares of our common stock, $1.0 million in cash and a contingent payment of 68,182 shares of our common stock tied to Criticom’s financial performance. Curtis Quady, one of our Executive Vice Presidents, was the President of Criticom. Mr. Quady and certain members of his family who owned approximately 72% of Criticom received 112,836 shares of our common stock pursuant to the KC Acquisition Merger Agreement. The shares were valued at $1,241,196, based on a price of $11 per share. During December 2003 and January 2004, an additional 68,182 shares of our common stock were issued as a purchase price adjustment to the former stockholders of Criticom as a result of Criticom’s financial performance in 2003. Mr. Quady and certain members of his family received 49,344 of these additional shares.

Suzanne Sweeney, the daughter of Mr. Few, Sr. is Director of Legal Affairs, and has received aggregate compensation of approximately $130,000 for fiscal year 2004.

Jeffrey Few, the son of Mr. Few, Sr. is Vice President of Sales for Morlyn, and has received aggregate compensation of approximately and $135,000 for fiscal year 2004.

Thomas J. Few, Jr., the son of Mr. Few, Sr. is Vice President of Sales and Marketing West Coast Operations—Criticom International Corp., and has received aggregate compensation of approximately $127,000 for fiscal year 2004.

Robert W. Few, the son of Mr. Few, Sr. is Vice President of East Coast Operations—Criticom International Corp., and has received aggregate compensation of approximately $96,000 for fiscal year 2004.

All compensation matters related to the children of Mr. Few Sr. are determined by either their direct supervisor or Mr. McGinn, without input from Mr. Few Sr.

Mary Ann McGinn, the wife Mr. McGinn (Chairman of the Board and Chief Executive Officer), was Senior Vice President-Legal Affairs and remains a consultant through 2005. She has received aggregate compensation of approximately $132,000 for fiscal year 2004.

Four trusts, for which M&S Partners acts as a trustee (Security Participation Trust, Security Participation Trust II, Security Participation Trust III, and Security Participation Trust IV) receive monitoring services from us at a discounted rate of approximately $3.00 per account, per month, and billing and collection services from us, at no cost. These trusts purchase alarm monitoring contracts on a monthly basis, with the final trust maturing on December 1, 2004. Messrs. McGinn and Smith serve as trustees of these trusts. Neither Messrs. McGinn or Smith, nor M&S Partners has any beneficial ownership in such trusts. During 2004, these trusts were purchased by entities controlled by Messrs. McGinn and Smith and we continue to provide services.

18

Policy Regarding Transactions With Affiliates

Although we believe the foregoing transactions were fair and in our best interests we did not have any formal policy in place. Our Board of Directors adopted a policy in May 2003 that any future transactions with affiliates, including without limitation, our officers, Directors, and principal stockholders, will be on terms no less favorable to us than we could have obtained from unaffiliated third parties. Any such transactions will be approved by a majority of our Board of Directors, including a majority of the independent and disinterested members, or, if required by law, a majority of our disinterested stockholders.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") requires the Company's officers and Directors and persons who own more than 10% of the Company's common stock to file reports of ownership and changes in ownership of the Company's common stock with the Securities and Exchange Commission and Nasdaq. One officer and Director of the Company, Curtis Quady, acquired shares without properly filing a Form 4, he subsequently filed a Form 5 disclosing the acquisition. Based solely on a review of the copies of such reports and written representations from the reporting persons that no other reports were required, the Company believes that, other than Mr. Quady's report, during the fiscal year ended December 31, 2004, its executive officers, Directors and greater than ten percent stockholders filed on a timely basis all reports due under Section 16(a) of the Exchange Act.

19

OTHER MATTERS

Management knows of no other business will be presented at the Annual Meeting; however, if any other business should properly and lawfully come before the Annual Meeting, the proxies will vote in accordance with their best judgment.

DEADLINE FOR RECEIPT OF STOCKHOLDER PROPOSALS

Proposals of stockholders of the Company, which are intended to be presented, by such stockholders at the Company's 2006 annual meeting must be received by the Company no later than February 28, 2006 in order to be included in the proxy statement and form of proxy relating to that meeting. Any such proposal should be addressed to the Company's Corporate Secretary and delivered to the Company's principal executive offices at 99 Pine Street, 3rd Floor, Albany, New York 12207.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Brian E. Shea

Executive Vice President and Corporate Secretary

July 15, 2005

Albany, New York

20