UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21242 |

|

Nuveen Quality Preferred Income Fund 3 |

(Exact name of registrant as specified in charter) |

|

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606 |

(Address of principal executive offices) (Zip code) |

|

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 917-7700 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2010 | |

| | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Closed-End Funds

Nuveen Investments

Closed-End Funds

Seeks High Current Income from a Portfolio of Investment-Grade Preferred Securities

Annual Report

December 31, 2010

Nuveen Quality Preferred Income Fund

JTP

Nuveen Quality Preferred Income Fund 2

JPS

Nuveen Quality Preferred Income Fund 3

JHP

INVESTMENT ADVISER NAME CHANGE

Effective January 1, 2011, Nuveen Asset Management, the Funds' investment adviser, changed its name to Nuveen Fund Advisors, Inc. ("Nuveen Fund Advisors"). Concurrently, Nuveen Fund Advisors formed a wholly-owned subsidiary, Nuveen Asset Management, LLC, to house its portfolio management capabilities.

NUVEEN INVESTMENTS COMPLETES STRATEGIC COMBINATION WITH FAF ADVISORS

On December 31, 2010, Nuveen Investments completed the strategic combination between Nuveen Asset Management, LLC, the largest investment affiliate of Nuveen Investments, and FAF Advisors. As part of this transaction, U.S. Bancorp—the parent of FAF Advisors—received cash consideration and a 9.5% stake in Nuveen Investments in exchange for the long term investment business of FAF Advisors, including investment-management responsibilities for the non-money market mutual funds of the First American Funds family.

The approximately $27 billion of mutual fund and institutional assets managed by FAF Advisors, along with the investment professionals managing these assets and other key personnel, have become part of Nuveen Asset Management, LLC. With these additions to Nuveen Asset Management, LLC, this affiliate now manages more than $100 billion of assets across a broad range of strategies from municipal and taxable fixed income to traditional and specialized equity investments.

This combination does not affect the investment objectives or strategies of the Funds in this report. Over time, Nuveen Investments expects that the combination will provide even more ways to meet the needs of investors who work with financial advisors and consultants by enhancing the multi-boutique model of Nuveen Investments, which also includes highly respected investment teams at HydePark, NWQ Investment Management, Santa Barbara Asset Management, Symphony Asset Management, Tradewinds Global Investors and Winslow Capital. Nuveen Investments managed approximately $195 billion of assets as of December 31, 2010.

Table of Contents

| Chairman's Letter to Shareholders | | | 4 | | |

|

| Portfolio Managers' Comments | | | 5 | | |

|

| Common Share Distribution and Share Price Information | | | 10 | | |

|

| Performance Overviews | | | 11 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 14 | | |

|

| Portfolio of Investments | | | 15 | | |

|

| Statement of Assets & Liabilities | | | 32 | | |

|

| Statement of Operations | | | 33 | | |

|

| Statement of Changes in Net Assets | | | 34 | | |

|

| Statement of Cash Flows | | | 36 | | |

|

| Financial Highlights | | | 38 | | |

|

| Notes to Financial Statements | | | 41 | | |

|

| Board Members & Officers | | | 52 | | |

|

| Annual Investment Management Agreement Approval Process | | | 58 | | |

|

| Reinvest Automatically Easily and Conveniently | | | 66 | | |

|

| Glossary of Terms Used in this Report | | | 68 | | |

|

| Other Useful Information | | | 71 | | |

|

Chairman's

Letter to Shareholders

Dear Shareholders,

The global economy recorded another year of recovery from the financial and economic crises of 2008, but many of the factors that caused the crises still weigh on the prospects for continued recovery. In the U.S., ongoing weakness in housing values is putting pressure on homeowners and mortgage lenders. Similarly, the strong earnings recovery for corporations and banks has not been translated into increased hiring or more active lending. In addition, media and analyst reports on the fiscal conditions of various state and local entities have raised concerns with some investors. Globally, deleveraging by private and public borrowers is inhibiting economic growth and this process is far from complete.

Encouragingly, a variety of constructive actions are being taken by governments around the world to stimulate further recovery. In the U.S., the recent passage of a stimulatory tax bill relieves some of the pressure on the Federal Reserve System to promote economic expansion through quantitative easing and offers the promise of faster economic growth. A number of European governments are undertaking programs that could significantly reduce their budget deficits. Governments across the emerging markets are implementing various steps to deal with global capital flows without undermining international trade and investment.

The success of these government actions could have an important impact on whether 2011 brings further economic recovery and financial market progress. One risk associated with the extraordinary efforts to strengthen U.S. economic growth is that the debt of the U.S. government will continue to grow to unprecedented levels. Another risk is that over time there could be upward pressures on asset values in the U.S. and abroad, because what happens in the U.S. impacts the rest of the world economy. We must hope that the progress made on the fiscal front in 2010 will continue into 2011. In this environment, your Nuveen investment team continues to seek sustainable investment opportunities and to remain alert to potential risks in a recovery still facing many headwinds. On your behalf, we monitor their activities to assure they maintain their investment disciplines.

As you will note elsewhere in this report, on January 1, 2011, Nuveen Investments completed the acquisition of FAF Advisors, Inc., the manager of the First American Funds. The acquisition adds highly respected and distinct investment teams to meet the needs of investors and their advisors and is designed to benefit all fund shareholders by creating a fund organization with the potential for further economies of scale and the ability to draw from even greater talent and expertise to meet these investor needs.

As always, I encourage you to contact your financial consultant if you have any questions about your investment in a Nuveen fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board and Lead Independent Director

February 22, 2011

Nuveen Investments

4

Portfolio Managers' Comments

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Any reference to credit ratings for portfolio holdings denotes the highest rating assigned by a Nationally Recognized Statistical Rating Organization (NRSRO) such as Standard & Poor's, Moody's or Fitch. AAA, AA, A and BBB ratings are investment grade; BB, B, CCC, CC, C and D ratings are below investment grade. Holdings and ratings may change over time.

Nuveen Quality Preferred Income Fund (JTP)

Nuveen Quality Preferred Income Fund 2 (JPS)

Nuveen Quality Preferred Income Fund 3 (JHP)

The Nuveen Quality Preferred Income Funds are sub-advised by a team of specialists at Spectrum Asset Management, Inc., a wholly-owned subsidiary of Principal Global Investors, LLC. Mark Lieb and Phil Jacoby, who have more than 50 years of combined experience in the preferred securities markets, lead the team. Here Mark and Phil talk about general economic and market conditions, their management strategy and the performance of each Fund for the twelve-month period ended December 31, 2010.

What were the general market conditions for the twelve-month period ended December 31, 2010?

During this reporting period, the U.S. economy remained under considerable stress, and both the Federal Reserve and the federal government continued their efforts to improve the overall economic environment. For its part, the Fed held the benchmark fed funds rate in a target range of zero to 0.25% after cutting it to this record low level in December 2008. At its September 2010 meeting, the central bank renewed its commitment to keep the fed funds rate at "exceptionally low levels" for an "extended period." The Fed also stated that it was "prepared to take further policy actions as needed" to support economic recovery. The federal government continued to focus on implementing the economic stimulus package passed early in 2009 that was intended to provide job creation, tax relief, fiscal assistance to state and local governments, and expand unemployment benefits and other federal social welfare programs. Cognizant of the fragility of the financial system, in the fall of 2010 the Federal Reserve announced a second round of quantitative easing designed to help stimulate increased economic growth.

Nearly all recent U.S. indicators of production, spending, and labor market activity have pointed toward an acceleration in economic growth. At the same time, inflation remained relatively tame, as the Consumer Price Index rose just 1.5% year-over-year as of December 31, 2010. However, unemployment remained at historically high levels. As of December 2010, the national unemployment rate was 9.4%. In addition, the housing market continued to show signs of weakness with the average home price in the Standard & Poor's/Case-Shiller Index of 20 large metro areas falling 1.6% over the twelve months ended November 2010 (the latest available figures at the time this report was prepared).

Nuveen Investments

5

The liquidity environment for credit improved as the period progressed despite macro concerns about several European countries. An accommodative central bank policy in the United States and in Europe fostered declining volatility in the equity markets—supportive earnings were a byproduct of adequate fiscal and monetary support. Preferred securities, in particular, did well against a good fundamental backdrop and a lower interest rate trend over the period. Global bank capital improvement was a very strong theme for the improving credit environment of financial institutions. Bank capital reform led the headlines with new rules coming from the Basel Committee on Banking that will seek to forestall future financial shocks and broaden credit support in the industry. As a result, the structure of the preferred market will be changing with newer, more equity-like hybrids (i.e., higher yielding preferred securities) that will replace existing structures as they are retired. Rating agency changes in equity credit analysis have also helped to increase the likelihood of tenders and early retirement of some preferred securities. Consequently, the hybrid preferred securities market experienced a number of tender events from issuers, which have led to better prices and are leading to expectations for a generally lower volatility environment for preferred securities going forward.

What was your management strategy during the period?

The investment objective of each Fund is to earn high current income consistent with capital preservation. Each Fund's secondary objective is to enhance portfolio value. Under normal market conditions, the Funds seek to invest at least 80% of their net assets in preferred securities and up to 20% in debt securities, including convertible debt securities and convertible preferred securities.

As we reported in the last shareholder report, the preferred securities market over the last several years has changed from an investment grade rated market, with more than 75% rated single A or higher, to a market where over 40% of all issues are rated below-investment grade, as measured by using the constituents of the Merrill Lynch Fixed Rate Preferred Index. In addition, the issuer concentration in the index has increased even further, with the largest five issuers now representing 40% of the index's market value. As noted in a previous shareholder report, the Funds' Board of Trustees adopted some changes in investment policies and procedures in response to these changing conditions. For much of the Funds' histories, all of their investments had to be rated investment grade at the time of purchase. The new guidelines now allow each Fund to have 20% of its net assets in securities rated below investment grade at the time of purchase. However, no Fund may purchase issues rated Caa1/CCC+ or lower, and if a portfolio holding is downgraded to that rating or below, the manager is required to sell the security as soon as practicable. Addressing the increase in issuer concentration, the new guidelines allow for a slightly greater concentration of higher rated securities from the same issuer within a portfolio, which allows managers more flexibility given the current market conditions.

The Board of Trustees also expanded the internal duration guidelines followed by the Funds. Duration is a measure of price sensitivity to changes in market interest rates. The purpose of the Funds' duration guidelines is to help control their interest rate risk. This is a complex issue with regards to preferred securities since, depending on the underlying market situation, preferreds could behave at times like equities and at other times like

Nuveen Investments

6

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares.

For additional information, see the individual Performance Overview for your Fund in this report.

1. The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index that includes all investment-grade, publicly issued, fixed-rate, dollar denominated, nonconvertible debt issues and commercial mortgage backed securities with maturities of at least one year and outstanding par values of $150 million or more. Index returns do not include the effects of any sales charges or management fees. It is not possible to invest directly in an index.

2. Comparative Benchmark performance is a blended return consisting of: 1) 55% of the Merrill Lynch Preferred Stock Hybrid Securities Index, an unmanaged index of investment-grade, exchange traded preferred stocks with outstanding market values of at least $30 million and at least one year to maturity; and 2) 45% of the Barclays Capital Tier 1 Capital Securities Index, an unmanaged index that includes securities that can generally be viewed as hybrid fixed-income securities that either receive regulatory capital treatment or a degree of "equity credit" from a rating agency. Benchmark returns do not include the effects of any sales charges or management fees. It is not possible to invest directly in this Benchmark.

fixed income securities. In cases where preferred securities behave more like equities, interest rates are not drivers of performance and therefore not a significant risk factor. In other times, the market may perceive preferreds more as fixed income securities, making interest rate risk more relevant. The new internal guideline will help the Funds' managers distinguish between time periods when preferreds behave more like equities or fixed income, with specific duration policies implemented primarily during periods when preferred securities perform more like fixed income investments.

Changes in capital rules driven by the Basel Committee on Banking, the Dodd-Frank Act, and equity credit reductions on enhanced equity hybrid structures helped to drive hybrid prices higher against a generally favorable fundamental backdrop of earnings gains and liquidity improvements. We traded for longer call optionality in an effort to proactively protect each Fund's income objective. We also sold higher priced structures and switched into lower dollar priced structures in order to allow for more capital appreciation without sacrificing income. We sold foreign bank paper that had little upside left due to structural features and re-balanced into paper that we believe will perform well in the insurance sectors. Overall, our allocation went up in $1000 par capital securities because of our desire to emphasize certain structural benefits that are more prevalent in these securities than in the more individual investor oriented $25 par market.

How did the Funds perform over this twelve-month period?

The performance of JTP, JPS and JHP, as well as a comparative benchmark and general market index, is presented in the accompanying table.

Average Annual Total Returns on Common Share Net Asset Value

For periods ended 12/31/10

| Fund | | 1-Year | | 5-Year | |

| JTP | | | 23.09 | % | | | -2.08 | % | |

| JPS | | | 21.99 | % | | | -1.10 | % | |

| JHP | | | 21.49 | % | | | -1.42 | % | |

| Barclays Capital U.S. Aggregate Bond Index1 | | | 6.56 | % | | | 5.80 | % | |

| Comparative Benchmark2 | | | 15.22 | % | | | 1.38 | % | |

For this twelve-month period ended December 31, 2010, the total return on common share net asset value (NAV) for all three Funds outperformed the general market and comparative benchmark indexes.

Among the largest positive contributors to Fund returns over the twelve-month reporting period for JPS and JHP were Wachovia Bank, Aegon, Union Planters and XL Capital. For JTP, the top performers were Firststar Realty (US Bancorp), Agfirst Farm Credit and Aegon. In general, the U.S. bank trust preferred sector benefited performance as many of these securities gained in price because some market observers believed they are likely to be gradually redeemed in response to certain provisions in the recently enacted financial sector reform bill.

Several tactics also contributed to the Funds outperformance. We reduced exposure in foreign banking, primarily in Spanish banks. We reduced some structural risk by moving

Nuveen Investments

7

from fixed to floating capital securities. We traded for discounts. We increased allocations to below investment grade paper. We improved the non-callable term of the portfolio.

We also increased concentrations in the U.S. bank and life insurance sectors, and purchased deeply discounted floating rate securities (although these did not perform as well as the fixed rate sector because interest rates and swap rates declined).

We did have several holdings that detracted from performance. For JTP, these included AXA Insurance, Ageas Hybrid Financing, Lloyds Capital, Bank America and Barclays Bank. For JPS, the bottom performers were HSBC Upper Tier-2 Floaters, Bank America, Ageas Hybrid Financing, AXA Insurance and Lloyds Capital. Finally, JHP's detractors were HSBC Upper Tier-2 Floaters, BBVA, Lloyds Capital, AXA Insurance and Santander Bank.

IMPACT OF THE FUNDS' LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the return of the Funds relative to the comparative indexes was the Funds' use of financial leverage through the use of bank borrowings. The Funds use leverage because their managers believe that, over time, leveraging provides opportunities for additional income and total return for common shareholders. However, use of leverage also can expose common shareholders to additional volatility. For example, as the prices of securities held by a Fund decline, the negative impact of these valuation changes on common share net asset value and common shareholder total return is magnified by the use of leverage. Conversely, leverage may enhance common share returns during periods when the prices of securities held by a Fund generally are rising. Leverage made a positive contribution to the performance of the Funds over this reporting period.

RECENT EVENTS CONCERNING THE FUNDS' REDEMPTION OF AUCTION RATE PREFERRED SHARES

Shortly after their inceptions, the Funds issued auction rate preferred shares (ARPS) to create financial leverage. As noted in past shareholder reports, the weekly auctions for those ARPS began in February 2008 to consistently fail, causing the Funds to pay the so-called "maximum rate" to ARPS shareholders under the terms of the ARPS in the Funds' charter documents. The Funds redeemed their ARPS at par in 2009 and since then have relied upon bank borrowings to create financial leverage.

During 2010, certain Nuveen leveraged closed-end funds (including these Funds) received a demand letter from a law firm on behalf of purported holders of common shares of each such fund, alleging that Nuveen and the funds' officers and Board of Directors/Trustees breached their fiduciary duties related to the redemption at par of the funds' ARPS. In response, the Board established an ad hoc Demand Committee consisting of certain of its disinterested and independent Board members to investigate the claims. The Demand Committee retained independent counsel to assist it in conducting an extensive investigation. Based upon its investigation, the Demand Committee found that it was not in the best interests of each fund or its shareholders to take the actions suggested in the demand letters, and recommended that the full Board reject the demands made in the demand letters. After reviewing the findings and

Nuveen Investments

8

recommendation of the Demand Committee, the full Board of each fund unanimously adopted the Demand Committee's recommendation.

Subsequently, the funds that received demand letters (including these Funds) were named in a consolidated complaint as nominal defendants in a putative shareholder derivative action captioned Martin Safier, et al. v. Nuveen Asset Management, et al. that was filed in the Circuit Court of Cook County, Illinois, Chancery Division (the "Cook County Chancery Court") on February 18, 2011 (the "Complaint"). The Complaint, filed on behalf of purported holders of each fund's common shares, also name Nuveen Asset Management as a defendant, together with current and former Officers and interested Director/Trustees of each of the funds (together with the nominal defendants, collectively, the "Defendants"). The Complaint contains the same basic allegations contained in the demand letters. The suits seek a declaration that the Defendants have breached their fiduciary duties, an order directing the Defendants not to redeem any ARPS at their liquidation value using fund assets, indeterminate monetary damages in favor of the funds and an award of plaintiffs' costs and disbursements in pursuing the action. Nuveen Asset Management believes that the Complaint is without merit, and intends to defend vigorously against these charges.

Nuveen Investments

9

Common Share Distribution

and Share Price Information

The following information regarding your Fund's distributions is current as of December 31, 2010, and likely will vary over time based on each Fund's investment activities and portfolio investment value changes.

During the twelve-month reporting period, the Funds increased their monthly distributions to common shareholders in September. Some of the important factors affecting the amount and composition of these distributions are summarized below.

The Funds employ financial leverage through the use of bank borrowings. Financial leverage provides the potential for higher earnings (net investment income), total returns and distributions over time, but—as noted earlier—also increases the variability of common shareholders' net asset value per share in response to changing market conditions.

During certain periods, the Funds may pay dividends at a rate that may be more or less than the amount of net investment income actually earned by the Funds during the period. If a Fund has cumulatively earned more than it has paid in dividends, it holds excess in reserve as undistributed net investment income (UNII) as part of the Fund's NAV. Conversely, if a Fund has cumulatively paid dividends in excess of earnings, the excess constitutes negative UNII that is likewise reflected in a Funds' NAV. As of December 31, 2010, all three Funds had positive UNII balances for tax purposes and positive UNII balances for financial statement purposes.

Common Share Repurchases and Shares Price Information

Since the inception of the Funds' repurchase program, the Funds have not repurchased any of their outstanding common shares.

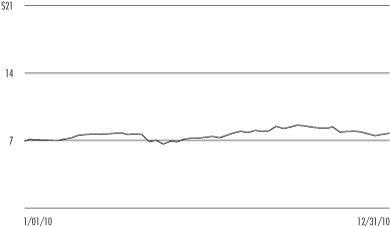

At December 31, 2010, the Funds' common share prices were trading at (-) discounts to their common share NAVs as shown in the accompanying table.

| Fund | | 12/31/10

(-) Discount | | Twelve-Month

Average

(-) Discount | |

| JTP | | | -8.30 | % | | | -5.29 | % | |

| JPS | | | -8.56 | % | | | -4.88 | % | |

| JHP | | | -7.53 | % | | | -4.23 | % | |

Nuveen Investments

10

JTP

Performance

OVERVIEW

Nuveen Quality Preferred Income Fund

as of December 31, 2010

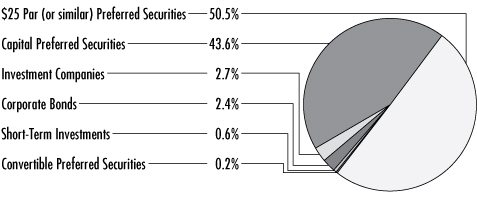

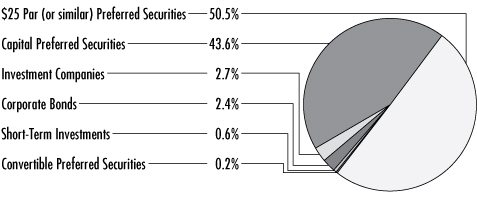

Portfolio Allocation (as a % of total investments)3

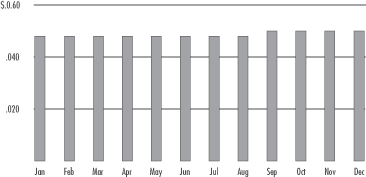

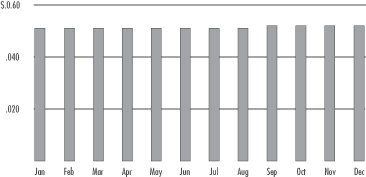

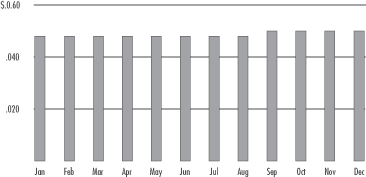

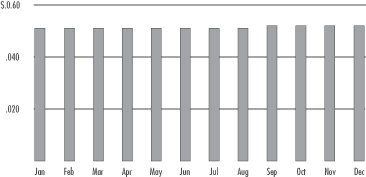

2010 Monthly Distributions Per Common Share

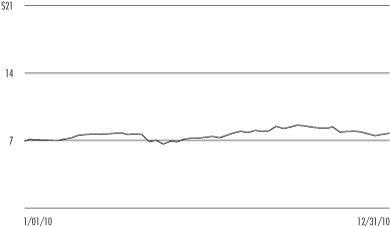

Common Share Price Performance — Weekly Closing Price

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund's Performance Overview page.

1 Current Distribution Rate is based on the Fund's current annualized monthly distribution divided by the Fund's current market price. The Fund's monthly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the calendar year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the Fund's distributions, a tax return of capital.

2 Excluding short-term investments.

3 Holdings are subject to change.

4 Rounds to less than 0.1%.

Fund Snapshot

| Common Share Price | | $ | 7.40 | | |

| Common Share Net Asset Value (NAV) | | $ | 8.07 | | |

| Premium/(Discount) to NAV | | | -8.30 | % | |

| Current Distribution Rate1 | | | 8.11 | % | |

Net Assets Applicable to

Common Shares ($000) | | $ | 521,347 | | |

Average Annual Total Return

(Inception 6/25/02)

| | | On Share Price | | On NAV | |

| 1-Year | | | 21.94 | % | | | 23.09 | % | |

| 5-Year | | | -0.68 | % | | | -2.08 | % | |

| Since Inception | | | 0.77 | % | | | 2.02 | % | |

Portfolio Composition3

(as a % of total investments)

| Insurance | | | 31.7 | % | |

| Commercial Banks | | | 26.0 | % | |

| Real Estate/Mortgage | | | 11.8 | % | |

| Media | | | 5.8 | % | |

| Diversified Financial Services | | | 4.9 | % | |

| Capital Markets | | | 4.9 | % | |

| Short-Term Investments | | | 0.4 | % | |

| Other | | | 14.5 | % | |

Country Allocation

(as a % of total investments)3

| United States | | | 68.7 | % | |

| United Kingdom | | | 6.7 | % | |

| Netherlands | | | 6.1 | % | |

| Bermuda | | | 3.9 | % | |

| France | | | 3.7 | % | |

| Other | | | 10.9 | % | |

Top Five Issuers3

(as a % of total investments)2

| Firstar Realty LLC | | | 3.3 | % | |

| AXA S.A. | | | 2.9 | % | |

| Viacom Inc. | | | 2.8 | % | |

| Kimco Realty Corporation | | | 2.7 | % | |

| Wells Fargo | | | 2.7 | % | |

Nuveen Investments

11

Fund Snapshot

| Common Share Price | | $ | 7.90 | | |

| Common Share Net Asset Value (NAV) | | $ | 8.64 | | |

| Premium/(Discount) to NAV | | | -8.56 | % | |

| Current Distribution Rate1 | | | 8.35 | % | |

Net Assets Applicable to

Common Shares ($000) | | $ | 1,039,917 | | |

Average Annual Total Return

(Inception 9/24/02)

| | | On Share Price | | On NAV | |

| 1-Year | | | 18.31 | % | | | 21.99 | % | |

| 5-Year | | | 0.21 | % | | | -1.10 | % | |

| Since Inception | | | 1.80 | % | | | 3.16 | % | |

Portfolio Composition3

(as a % of total investments)

| Insurance | | | 31.1 | % | |

| Commercial Banks | | | 24.3 | % | |

| Real Estate/Mortgage | | | 12.2 | % | |

| Diversified Financial Services | | | 6.2 | % | |

| Media | | | 5.6 | % | |

| Capital Markets | | | 4.9 | % | |

| Multi-Utilities | | | 3.2 | % | |

| Short-Term Investments | | | 0.6 | % | |

| Other | | | 11.9 | % | |

Country Allocation

(as a % of total investments)3

| United States | | | 70.7 | % | |

| Netherlands | | | 6.6 | % | |

| United Kingdom | | | 5.9 | % | |

| Bermuda | | | 4.3 | % | |

| France | | | 4.1 | % | |

| Other | | | 8.4 | % | |

Top Five Issuers3

(as a % of total investments)2

| Wells Fargo | | | 4.9 | % | |

| Deutsche Bank AG | | | 3.2 | % | |

| Aegon N.V. | | | 2.8 | % | |

| AXA S.A. | | | 2.7 | % | |

| ING Groep N.V. | | | 2.6 | % | |

JPS

Performance

OVERVIEW

Nuveen Quality Preferred Income Fund 2

as of December 31, 2010

Portfolio Allocation (as a % of total investments)3

2010 Monthly Distributions Per Common Share

Common Share Price Performance — Weekly Closing Price

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund's Performance Overview page.

1 Current Distribution Rate is based on the Fund's current annualized monthly distribution divided by the Fund's current market price. The Fund's monthly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the calendar year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the Fund's distributions, a tax return of capital.

2 Excluding short-term investments.

3 Holdings are subject to change.

Nuveen Investments

12

JHP

Performance

OVERVIEW

Nuveen Quality Preferred Income Fund 3

as of December 31, 2010

Portfolio Allocation (as a % of total investments)3

2010 Monthly Distributions Per Common Share

Common Share Price Performance — Weekly Closing Price

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund's Performance Overview page.

1 Current Distribution Rate is based on the Fund's current annualized monthly distribution divided by the Fund's current market price. The Fund's monthly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the calendar year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the Fund's distributions, a tax return of capital.

2 Excluding short-term investments.

3 Holdings are subject to change.

Fund Snapshot

| Common Share Price | | $ | 7.74 | | |

| Common Share Net Asset Value (NAV) | | $ | 8.37 | | |

| Premium/(Discount) to NAV | | | -7.53 | % | |

| Current Distribution Rate1 | | | 8.06 | % | |

Net Assets Applicable to

Common Shares ($000) | | $ | 198,513 | | |

Average Annual Total Return

(Inception 12/18/02)

| | | On Share Price | | On NAV | |

| 1-Year | | | 20.66 | % | | | 21.49 | % | |

| 5-Year | | | -0.66 | % | | | -1.42 | % | |

| Since Inception | | | 0.97 | % | | | 2.27 | % | |

Portfolio Composition3

(as a % of total investments)

| Insurance | | | 30.0 | % | |

| Commercial Banks | | | 28.5 | % | |

| Real Estate/Mortgage | | | 11.1 | % | |

| Capital Markets | | | 6.3 | % | |

| Diversified Financial Services | | | 5.6 | % | |

| Media | | | 3.0 | % | |

| Investment Companies | | | 3.0 | % | |

| Short-Term Investments | | | 1.0 | % | |

| Other | | | 11.5 | % | |

Country Allocation

(as a % of total investments)3

| United States | | | 71.2 | % | |

| United Kingdom | | | 5.9 | % | |

| France | | | 4.9 | % | |

| Netherlands | | | 4.7 | % | |

| Bermuda | | | 4.0 | % | |

| Other | | | 9.3 | % | |

Top Five Issuers3

(as a % of total investments)2

| Wells Fargo | | | 4.6 | % | |

| Deutsche Bank AG | | | 3.6 | % | |

| Bank of America Corporation | | | 3.0 | % | |

| Aegon N.V. | | | 2.8 | % | |

| AXA S.A. | | | 2.5 | % | |

Nuveen Investments

13

Report of INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Board of Trustees and Shareholders

Nuveen Quality Preferred Income Fund

Nuveen Quality Preferred Income Fund 2

Nuveen Quality Preferred Income Fund 3

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of Nuveen Quality Preferred Income Fund, Nuveen Quality Preferred Income Fund 2 and Nuveen Quality Preferred Income Fund 3 (the "Funds") as of December 31, 2010, and the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Funds' management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds' internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds' internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2010, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial positions of Nuveen Quality Preferred Income Fund, Nuveen Quality Preferred Income Fund 2 and Nuveen Quality Preferred Income Fund 3 at December 31, 2010, the results of their operations and their cash flows for the year then ended, the changes in their net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended in conformity with U.S. generally accepted accounting principles.

Chicago, Illinois

February 25, 2011

Nuveen Investments

14

JTP

Nuveen Quality Preferred Income Fund

Portfolio of INVESTMENTS

December 31, 2010

| Shares | | Description (1) | | Coupon | | | | Ratings (2) | | Value | |

| | | $25 Par (or similar) Preferred Securities – 64.2% (49.8% of Total Investments) | |

| | | Capital Markets – 5.8% | |

| | 137,200 | | | Ameriprise Financial, Inc. | | | 7.750 | % | | | | | | A | | $ | 3,656,380 | | |

| | 118,100 | | | BNY Capital Trust V, Series F | | | 5.950 | % | | | | | | A1 | | | 2,947,776 | | |

| | 515,776 | | | Credit Suisse | | | 7.900 | % | | | | | | A3 | | | 13,812,481 | | |

| | 241,721 | | | Deutsche Bank Capital Funding Trust II | | | 6.550 | % | | | | | | BBB | | | 5,595,841 | | |

| | 83,000 | | | Deutsche Bank Contingent Capital Trust III | | | 7.600 | % | | | | | | BBB | | | 2,110,690 | | |

| | 1,969 | | | Goldman Sachs Group Inc., Series 2003-06 (SATURNS) | | | 6.000 | % | | | | | | Aa3 | | | 47,768 | | |

| | 37,900 | | | Goldman Sachs Group Inc., Series GSC-3 (PPLUS) | | | 6.000 | % | | | | | | A3 | | | 848,202 | | |

| | 2,200 | | | Goldman Sachs Group Inc., Series GSG-1 (PPLUS) | | | 6.000 | % | | | | | | A1 | | | 51,942 | | |

| | 4,500 | | | Goldman Sachs Group Inc., Series GSG-2 (PPLUS) | | | 5.750 | % | | | | | | A1 | | | 103,950 | | |

| | 43,900 | | | Morgan Stanley Capital Trust IV | | | 6.250 | % | | | | | | Baa2 | | | 1,000,920 | | |

| | | Total Capital Markets | | | | | | | | | | | | | | | 30,175,950 | | |

| | | Commercial Banks – 8.5% | |

| | 327,038 | | | Banco Santander Finance | | | 10.500 | % | | | | | | A- | | | 9,111,279 | | |

| | 2,100 | | | Barclays Bank PLC | | | 6.625 | % | | | | | | A- | | | 48,993 | | |

| | 118,500 | | | BB&T Capital Trust VI | | | 9.600 | % | | | | | | Baa1 | | | 3,424,650 | | |

| | 30,300 | | | BB&T Capital Trust VII | | | 8.100 | % | | | | | | Baa1 | | | 832,947 | | |

| | 116,800 | | | CoBank ACB, 144A | | | 7.000 | % | | | | | | N/R | | | 5,270,600 | | |

| | 46,000 | | | CoBank ACB | | | 11.000 | % | | | | | | A | | | 2,468,190 | | |

| | 48,600 | | | CoBank ACB | | | 11.000 | % | | | | | | A | | | 2,628,959 | | |

| | 18,400 | | | HSBC Holdings PLC | | | 8.000 | % | | | | | | A- | | | 490,360 | | |

| | 13,800 | | | HSBC Holdings PLC | | | 6.200 | % | | | | | | A- | | | 316,020 | | |

| | 80,308 | | | Merrill Lynch Preferred Capital Trust V | | | 7.280 | % | | | | | | Baa3 | | | 1,967,546 | | |

| | 5,000,000 | | | National Australia Bank | | | 8.000 | % | | | | | | A+ | | | 5,368,000 | | |

| | 275,041 | | | National City Capital Trust II | | | 6.625 | % | | | | | | BBB | | | 6,870,524 | | |

| | 19,400 | | | National City Capital Trust II | | | 6.625 | % | | | | | | BBB | | | 482,284 | | |

| | 20,400 | | | Wachovia Capital Trust IX | | | 6.375 | % | | | | | | A- | | | 503,472 | | |

| | 120,000 | | | Wells Fargo Capital Trust XII | | | 7.875 | % | | | | | | A- | | | 3,218,400 | | |

| | 60,000 | | | Wells Fargo Capital Trust IX | | | 5.625 | % | | | | | | A- | | | 1,449,000 | | |

| | | Total Commercial Banks | | | | | | | | | | | | | | | 44,451,224 | | |

| | | Diversified Financial Services – 3.9% | |

| | 10,000 | | | Citigroup Capital Trust XII | | | 8.500 | % | | | | | | BB+ | | | 264,600 | | |

| | 150,514 | | | Citigroup Capital XIII | | | 7.875 | % | | | | | | BB+ | | | 4,050,332 | | |

| | 800 | | | Citigroup Capital XIV | | | 6.875 | % | | | | | | BB+ | | | 19,160 | | |

| | 36,200 | | | ING Groep N.V. | | | 7.375 | % | | | | | | Ba1 | | | 839,116 | | |

| | 625,276 | | | ING Groep N.V. | | | 7.200 | % | | | | | | Ba1 | | | 14,487,645 | | |

| | 19,108 | | | National Rural Utilities Cooperative Finance Corporation | | | 6.100 | % | | | | | | A3 | | | 479,420 | | |

| | 15,141 | | | National Rural Utilities Cooperative Finance Corporation | | | 5.950 | % | | | | | | A3 | | | 369,592 | | |

| | | Total Diversified Financial Services | | | | | | | | | | | | | | | 20,509,865 | | |

| | | Diversified Telecommunication Services – 0.2% | |

| | 6,227 | | | BellSouth Capital Funding (CORTS) | | | 7.120 | % | | | | | | A | | | 158,983 | | |

| | 28,000 | | | Telephone and Data Systems Inc. | | | 6.875 | % | | | | | | Baa2 | | | 695,800 | | |

| | | Total Diversified Telecommunication Services | | | | | | | | | | | | | | | 854,783 | | |

Nuveen Investments

15

JTP

Nuveen Quality Preferred Income Fund (continued)

Portfolio of INVESTMENTS December 31, 2010

| Shares | | Description (1) | | Coupon | | | | Ratings (2) | | Value | |

| | | Electric Utilities – 1.4% | |

| | 181,800 | | | Entergy Texas Inc. | | | 7.875 | % | | | | | | BBB+ | | $ | 5,012,226 | | |

| | 80,611 | | | PPL Energy Supply LLC | | | 7.000 | % | | | | | | BBB+ | | | 2,094,274 | | |

| | | Total Electric Utilities | | | | | | | | | | | | | | | 7,106,500 | | |

| | | Food Products – 0.5% | |

| | 28,100 | | | Dairy Farmers of America Inc., 144A | | | 7.875 | % | | | | | | BBB- | | | 2,507,925 | | |

| | | Insurance – 19.6% | |

| | 795,723 | | | Aegon N.V. | | | 6.375 | % | | | | | | BBB | | | 17,219,445 | | |

| | 286,206 | | | Allianz SE | | | 8.375 | % | | | | | | A+ | | | 7,539,754 | | |

| | 487,295 | | | Arch Capital Group Limited | | | 8.000 | % | | | | | | BBB | | | 12,426,023 | | |

| | 1,403 | | | Arch Capital Group Limited, Series B | | | 7.875 | % | | | | | | BBB | | | 35,875 | | |

| | 228,238 | | | Delphi Financial Group, Inc. | | | 7.376 | % | | | | | | BB+ | | | 5,340,769 | | |

| | 619,204 | | | EverestRe Capital Trust II | | | 6.200 | % | | | | | | Baa1 | | | 13,783,481 | | |

| | 209,030 | | | Markel Corporation | | | 7.500 | % | | | | | | BBB | | | 5,288,459 | | |

| | 276,263 | | | PartnerRe Limited, Series C | | | 6.750 | % | | | | | | BBB+ | | | 6,796,070 | | |

| | 20,539 | | | PartnerRe Limited, Series D | | | 6.500 | % | | | | | | BBB+ | | | 494,579 | | |

| | 40,600 | | | PLC Capital Trust III | | | 7.500 | % | | | | | | BBB | | | 1,021,496 | | |

| | 386,042 | | | PLC Capital Trust IV | | | 7.250 | % | | | | | | BBB | | | 9,612,446 | | |

| | 2,300 | | | PLC Capital Trust V | | | 6.125 | % | | | | | | BBB | | | 53,751 | | |

| | 166,360 | | | Prudential Financial Inc. | | | 6.750 | % | | | | | | A- | | | 4,172,309 | | |

| | 4,100,000 | | | Reinsurance Group of America Inc. | | | 6.750 | % | | | | | | BBB- | | | 3,799,987 | | |

| | 34,500 | | | RenaissanceRe Holdings Limited, Series C | | | 6.080 | % | | | | | | BBB+ | | | 784,530 | | |

| | 233,502 | | | RenaissanceRe Holdings Limited, Series D | | | 6.600 | % | | | | | | BBB+ | | | 5,751,154 | | |

| | 312,743 | | | W. R. Berkley Corporation, Capital Trust II | | | 6.750 | % | | | | | | BBB- | | | 7,815,448 | | |

| | | Total Insurance | | | | | | | | | | | | | | | 101,935,576 | | |

| | | Media – 7.5% | |

| | 131,141 | | | CBS Corporation | | | 6.750 | % | | | | | | BBB- | | | 3,313,933 | | |

| | 612,684 | | | Comcast Corporation | | | 7.000 | % | | | | | | BBB+ | | | 15,500,905 | | |

| | 47,000 | | | Comcast Corporation | | | 6.625 | % | | | | | | BBB+ | | | 1,196,150 | | |

| | 747,738 | | | Viacom Inc. | | | 6.850 | % | | | | | | BBB+ | | | 18,977,589 | | |

| | | Total Media | | | | | | | | | | | | | | | 38,988,577 | | |

| | | Multi-Utilities – 3.4% | |

| | 244,700 | | | Dominion Resources Inc. | | | 8.375 | % | | | | | | BBB | | | 6,934,798 | | |

| | 10,000 | | | Scana Corporation | | | 7.700 | % | | | | | | BBB- | | | 277,600 | | |

| | 392,142 | | | Xcel Energy Inc. | | | 7.600 | % | | | | | | BBB | | | 10,756,455 | | |

| | | Total Multi-Utilities | | | | | | | | | | | | | | | 17,968,853 | | |

| | | Oil, Gas & Consumable Fuels – 2.3% | |

| | 475,976 | | | Nexen Inc. | | | 7.350 | % | | | | | | BB+ | | | 11,999,355 | | |

| | | Pharmaceuticals – 0.1% | |

| | 19,600 | | | Bristol Myers Squibb Company (CORTS) | | | 6.250 | % | | | | | | A+ | | | 493,920 | | |

| | 200 | | | Bristol-Myers Squibb Company Trust (CORTS) | | | 6.800 | % | | | | | | A+ | | | 5,245 | | |

| | | Total Pharmaceuticals | | | | | | | | | | | | | | | 499,165 | | |

| | | Real Estate/Mortgage – 11.0% | |

| | 3,800 | | | Commomwealth REIT | | | 7.500 | % | | | | | | BBB | | | 80,370 | | |

| | 5,000 | | | Commomwealth REIT | | | 7.125 | % | | | | | | Baa3 | | | 120,650 | | |

| | 153,147 | | | Developers Diversified Realty Corporation, Series H | | | 7.375 | % | | | | | | Ba1 | | | 3,621,927 | | |

| | 80,607 | | | Duke Realty Corporation, Series L | | | 6.600 | % | | | | | | Baa3 | | | 1,811,239 | | |

| | 31,000 | | | Duke Realty Corporation, Series N | | | 7.250 | % | | | | | | Baa3 | | | 761,050 | | |

| | 18,500 | | | Kimco Realty Corporation, Series F | | | 6.650 | % | | | | | | Baa2 | | | 454,175 | | |

| | 652,387 | | | Kimco Realty Corporation, Series G | | | 7.750 | % | | | | | | Baa2 | | | 17,223,016 | | |

| | 10,294 | | | Kimco Realty Corporation, Series H | | | 6.900 | % | | | | | | Baa2 | | | 248,085 | | |

Nuveen Investments

16

| Shares | | Description (1) | | Coupon | | | | Ratings (2) | | Value | |

| | | Real Estate/Mortgage (continued) | |

| | 92,378 | | | Prologis Trust, Series G | | | 6.750 | % | | | | | | Baa3 | | $ | 2,119,151 | | |

| | 12,400 | | | PS Business Parks, Inc. | | | 0.000 | % | | | | | | BBB- | | | 302,312 | | |

| | 11,800 | | | Public Storage, Inc., Series E | | | 6.750 | % | | | | | | BBB+ | | | 293,820 | | |

| | 3,300 | | | Public Storage, Inc., Series F | | | 6.450 | % | | | | | | BBB+ | | | 80,025 | | |

| | 800 | | | Public Storage, Inc., Series H | | | 6.950 | % | | | | | | BBB+ | | | 20,128 | | |

| | 42,800 | | | Public Storage, Inc., Series K | | | 7.250 | % | | | | | | BBB+ | | | 1,088,404 | | |

| | 9,000 | | | Public Storage, Inc., Series M | | | 6.625 | % | | | | | | BBB+ | | | 224,640 | | |

| | 2,000 | | | Public Storage, Inc., Series W | | | 6.500 | % | | | | | | BBB+ | | | 48,820 | | |

| | 107,100 | | | Public Storage, Inc., Series Y | | | 6.850 | % | | | | | | BBB+ | | | 2,429,831 | | |

| | 12,693 | | | Realty Income Corporation | | | 7.375 | % | | | | | | Baa2 | | | 326,337 | | |

| | 100,500 | | | Realty Income Corporation | | | 6.750 | % | | | | | | Baa2 | | | 2,464,260 | | |

| | 9,873 | | | Regency Centers Corporation | | | 7.250 | % | | | | | | Baa3 | | | 244,159 | | |

| | 437,734 | | | Vornado Realty LP | | | 7.875 | % | | | | | | BBB | | | 11,674,366 | | |

| | 165,282 | | | Wachovia Preferred Funding Corporation | | | 7.250 | % | | | | | | A- | | | 4,229,566 | | |

| | 298,102 | | | Weingarten Realty Investors, Series F | | | 6.500 | % | | | | | | Baa3 | | | 6,945,777 | | |

| | 32,765 | | | Weingarten Realty Trust | | | 8.100 | % | | | | | | BBB | | | 748,680 | | |

| | 100 | | | Weingarten Realty Trust, Series E | | | 6.950 | % | | | | | | Baa3 | | | 2,437 | | |

| | | Total Real Estate/Mortgage | | | | | | | | | | | | | | | 57,563,225 | | |

| | | Total $25 Par (or similar) Preferred Securities (cost $327,623,883) | | | | | | | | | | | | | | | 334,560,998 | | |

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value | |

| | | Corporate Bonds – 3.7% (2.9% of Total Investments) | |

| | | Capital Markets – 0.2% | |

| $ | 1,000 | | | Man Group PLC | | | 5.000 | % | | 8/09/17 | | Baa3 | | $ | 847,649 | | |

| | | Commercial Banks – 1.6% | |

| | 8,400 | | | LBG Capital I PLC, 144A | | | 7.875 | % | | 11/01/20 | | BB- | | | 7,686,000 | | |

| | 700 | | | Lloyds Banking Group LBG Capital 1, 144A | | | 8.000 | % | | 6/15/20 | | B+ | | | 616,000 | | |

| | 9,100 | | | Total Commercial Banks | | | | | | | | | | | | | | | 8,302,000 | | |

| | | Diversified Financial Services – 0.6% | |

| | 3,100 | | | Fortis Hybrid Financing | | | 8.250 | % | | 8/27/49 | | BBB | | | 3,027,150 | | |

| | | Electric Utilities – 0.6% | |

| | 3,400 | | | FPL Group Capital Inc. | | | 6.650 | % | | 6/15/17 | | BBB | | | 3,370,349 | | |

| | | Insurance – 0.5% | |

| | 2,500 | | | Prudential PLC., Convertible Bond | | | 11.750 | % | | 12/23/14 | | A- | | | 2,907,250 | | |

| | | Multi-Utilities – 0.2% | |

| | 1,000 | | | Wisconsin Energy Corporation | | | 6.250 | % | | 5/15/17 | | Baa1 | | | 986,274 | | |

| $ | 20,100 | | | Total Corporate Bonds (cost $19,108,349) | | | | | | | | | | | | | | | 19,440,672 | | |

Principal

Amount (000)/

Shares | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value | |

| | | Capital Preferred Securities – 57.4% (44.6% of Total Investments) | |

| | | Capital Markets – 0.3% | |

| | 1,200 | | | ABN AMRO North America Holding Capital, 144A | | | 6.523 | % | | 12/31/49 | | BB+ | | $ | 1,029,000 | | |

| | 1,000 | | | Credit Suisse Guernsey | | | 0.976 | % | | 5/15/17 | | A3 | | | 741,250 | | |

| | | Total Capital Markets | | | | | | | | | | | | | | | 1,770,250 | | |

Nuveen Investments

17

JTP

Nuveen Quality Preferred Income Fund (continued)

Portfolio of INVESTMENTS December 31, 2010

Principal

Amount (000)/

Shares | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value | |

| | | Commercial Banks – 23.3% | |

| | 9,600 | | | AgFirst Farm Credit Bank | | | 8.393 | % | | 12/15/11 | | A | | $ | 9,864,000 | | |

| | 2,100 | | | American Express Company | | | 6.800 | % | | 9/01/16 | | Baa2 | | | 2,094,750 | | |

| | 4,420 | | | Banco Santander Finance | | | 10.500 | % | | 9/29/49 | | A- | | | 4,808,067 | | |

| | 4,000 | | | BankAmerica Institutional Capital Trust, Series B, 144A | | | 7.700 | % | | 12/31/26 | | Baa3 | | | 4,030,000 | | |

| | 2,800 | | | Barclays Bank PLC | | | 6.278 | % | | 12/15/34 | | A- | | | 2,401,000 | | |

| | 2,500 | | | Barclays Bank PLC, 144A | | | 6.860 | % | | 6/15/32 | | A- | | | 2,387,500 | | |

| | 900 | | | Barclays Bank PLC, 144A | | | 7.434 | % | | 12/15/17 | | A- | | | 888,750 | | |

| | 2,500 | | | BB&T Capital Trust IV | | | 6.820 | % | | 6/12/37 | | Baa1 | | | 2,475,000 | | |

| | 2,800 | | | BBVA International Unipersonal | | | 5.919 | % | | 4/18/17 | | A- | | | 2,130,604 | | |

| | 5,460 | | | Credit Agricole, S.A., 144A | | | 8.375 | % | | 10/13/49 | | A- | | | 5,637,450 | | |

| | 454 | | | Credit Agricole, S.A. | | | 9.750 | % | | 12/26/54 | | A- | | | 480,105 | | |

| | 400 | | | First Empire Capital Trust I | | | 8.234 | % | | 2/01/27 | | Baa2 | | | 398,480 | | |

| | 575 | | | First Empire Capital Trust II | | | 8.277 | % | | 6/01/27 | | Baa2 | | | 574,466 | | |

| | 850 | | | First Union Capital Trust I, Series A | | | 7.935 | % | | 1/15/27 | | A- | | | 876,417 | | |

| | 5,400 | | | First Union Institutional Capital Securities I | | | 8.040 | % | | 12/01/26 | | A- | | | 5,508,394 | | |

| | 3,500 | | | Fulton Capital Trust I | | | 6.290 | % | | 2/01/36 | | Baa3 | | | 2,645,930 | | |

| | 300 | | | HBOS Capital Funding LP, 144A | | | 6.071 | % | | 6/30/14 | | Ba2 | | | 247,500 | | |

| | 11,650 | | | HSBC Capital Funding LP, Debt | | | 10.176 | % | | 6/30/50 | | A- | | | 15,348,875 | | |

| | 2,000 | | | KeyCorp Capital III | | | 7.750 | % | | 7/15/29 | | Baa3 | | | 1,985,182 | | |

| | 2,509 | | | NB Capital Trust II | | | 7.830 | % | | 12/15/26 | | Baa3 | | | 2,527,818 | | |

| | 2,400 | | | NB Capital Trust IV | | | 8.250 | % | | 4/15/27 | | Baa3 | | | 2,448,000 | | |

| | 5,000 | | | Nordea Bank AB | | | 8.375 | % | | 3/25/15 | | A- | | | 5,342,500 | | |

| | 6,300 | | | Rabobank Nederland, 144A | | | 11.000 | % | | 6/30/19 | | AA- | | | 8,166,709 | | |

| | 17,500 | | | Reliance Capital Trust I, Series B | | | 8.170 | % | | 5/01/28 | | N/R | | | 14,065,835 | | |

| | 12,400 | | | Societe Generale | | | 8.750 | % | | 10/07/49 | | BBB+ | | | 12,772,000 | | |

| | 1,600 | | | Sovereign Capital Trust VI | | | 7.908 | % | | 6/13/36 | | BBB+ | | | 1,652,056 | | |

| | 3,000 | | | Sparebanken Rogaland, Notes, 144A | | | 6.443 | % | | 5/01/49 | | Ba1 | | | 2,755,734 | | |

| | 2,600 | | | Standard Chartered PLC, 144A | | | 6.409 | % | | 1/30/17 | | BBB | | | 2,427,246 | | |

| | 1,550 | | | Standard Chartered PLC, 144A | | | 7.014 | % | | 7/30/37 | | BBB | | | 1,522,176 | | |

| | 1,100 | | | Suntrust Capital Trust VIII | | | 6.100 | % | | 12/01/66 | | Baa3 | | | 1,009,619 | | |

| | 605 | | | Wachovia Capital Trust I, Capital Securities, 144A | | | 7.640 | % | | 1/15/27 | | A- | | | 601,887 | | |

| | 1,200 | | | Wachovia Capital Trust V, 144A | | | 7.965 | % | | 6/01/27 | | A- | | | 1,184,650 | | |

| | | Total Commercial Banks | | | | | | | | | | | | | | | 121,258,700 | | |

| | | Diversified Financial Services – 1.8% | |

| | 200 | | | Bank One Capital III | | | 8.750 | % | | 9/01/30 | | A2 | | | 237,614 | | |

| | 700 | | | JPMorgan Chase & Company | | | 7.900 | % | | 4/30/18 | | BBB+ | | | 746,600 | | |

| | 1,140 | | | JPMorgan Chase Capital XXV | | | 6.800 | % | | 10/01/37 | | A2 | | | 1,179,113 | | |

| | 4,000 | | | JPMorgan Chase Capital Trust XXVII | | | 7.000 | % | | 11/01/39 | | A2 | | | 4,201,400 | | |

| | 47,500 | | | JPMorgan Chase Capital Trust XXIX | | | 6.700 | % | | 4/02/40 | | A2 | | | 1,213,150 | | |

| | 1,800 | | | MBNA Corporation, Capital Trust A | | | 8.278 | % | | 12/01/26 | | Baa3 | | | 1,836,000 | | |

| | | Total Diversified Financial Services | | | | | | | | | | | | | | | 9,413,877 | | |

| | | Diversified Telecommunication Services – 3.2% | |

| | 15 | | | Centaur Funding Corporation, Series B | | | 9.080 | % | | 4/21/20 | | BBB | | | 16,555,780 | | |

| | | Electric Utilities – 0.7% | |

| | 2,300 | | | Dominion Resources Inc. | | | 7.500 | % | | 6/30/16 | | BBB | | | 2,406,191 | | |

| | 1,500 | | | PPL Capital Funding, Inc. | | | 6.700 | % | | 3/30/17 | | BBB- | | | 1,471,844 | | |

| | | Total Electric Utilities | | | | | | | | | | | | | | | 3,878,035 | | |

| | | Insurance – 20.7% | |

| | 3,500 | | | Allstate Corporation | | | 6.125 | % | | 5/15/17 | | Baa1 | | | 3,508,750 | | |

| | 10,850 | | | AXA S.A., 144A | | | 6.463 | % | | 12/14/18 | | Baa1 | | | 9,792,125 | | |

| | 4,800 | | | AXA S.A., 144A | | | 6.379 | % | | 12/14/36 | | Baa1 | | | 4,386,000 | | |

Nuveen Investments

18

Principal

Amount (000)/

Shares | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value | |

| | | Insurance (continued) | |

| | 4,800 | | | AXA | | | 8.600 | % | | 12/15/30 | | A3 | | $ | 5,392,037 | | |

| | 700 | | | Catlin Insurance Company Limited | | | 7.249 | % | | 1/19/17 | | BBB+ | | | 619,500 | | |

| | 9,925 | | | Glen Meadows Pass Through Trust | | | 6.505 | % | | 2/15/17 | | BB+ | | | 8,312,188 | | |

| | 5,500 | | | Great West Life & Annuity Capital I, 144A | | | 6.625 | % | | 11/15/34 | | A- | | | 5,137,798 | | |

| | 3,800 | | | Great West Life and Annuity Insurance Company, 144A | | | 7.153 | % | | 5/16/16 | | A- | | | 3,838,000 | | |

| | 2,500 | | | Liberty Mutual Group, 144A | | | 7.800 | % | | 3/15/37 | | Baa3 | | | 2,487,500 | | |

| | 5,100 | | | Lincoln National Corporation | | | 7.000 | % | | 5/17/16 | | BBB | | | 5,023,500 | | |

| | 2,500 | | | Lincoln National Corporation | | | 6.050 | % | | 4/20/17 | | BBB | | | 2,331,250 | | |

| | 6,300 | | | MetLife Capital Trust IV, 144A | | | 7.875 | % | | 12/15/37 | | BBB | | | 6,693,750 | | |

| | 600 | | | MetLife Capital Trust X, 144A | | | 9.250 | % | | 4/08/68 | | BBB | | | 708,000 | | |

| | 10,150 | | | National Financial Services Inc. | | | 6.750 | % | | 5/15/37 | | Baa2 | | | 9,378,093 | | |

| | 1,400 | | | Nationwide Financial Services Capital Trust | | | 7.899 | % | | 3/01/37 | | Baa2 | | | 1,224,779 | | |

| | 7,225 | | | Oil Insurance Limited, 144A | | | 7.558 | % | | 6/30/11 | | Baa1 | | | 6,692,655 | | |

| | 7,400 | | | Old Mutual Capital Funding, Notes | | | 8.000 | % | | 6/22/53 | | Baa3 | | | 7,085,500 | | |

| | 1,000 | | | Progressive Corporation | | | 6.700 | % | | 6/15/67 | | A2 | | | 1,028,839 | | |

| | 3,200 | | | Prudential Financial Inc. | | | 8.875 | % | | 6/15/18 | | BBB+ | | | 3,752,000 | | |

| | 2,000 | | | Prudential PLC | | | 6.500 | % | | 6/29/49 | | A- | | | 1,875,000 | | |

| | 17,000 | | | XL Capital Ltd | | | 6.500 | % | | 10/15/57 | | BBB- | | | 14,790,000 | | |

| | 2,536 | | | ZFS Finance USA Trust II, 144A | | | 6.450 | % | | 12/15/65 | | A | | | 2,520,150 | | |

| | 1,260 | | | ZFS Finance USA Trust V | | | 6.500 | % | | 5/09/67 | | A | | | 1,234,800 | | |

| | | Total Insurance | | | | | | | | | | | | | | | 107,812,214 | | |

| | | Real Estate – 4.2% | |

| | 19 | | | Firstar Realty LLC, 144A | | | 8.875 | % | | 12/31/50 | | A2 | | | 22,010,310 | | |

| | | Road & Rail – 2.2% | |

| | 10,900 | | | Burlington Northern Santa Fe Funding Trust I | | | 6.613 | % | | 1/15/26 | | BBB | | | 11,309,426 | | |

| | | Thrifts & Mortgage Finance – 0.3% | |

| | 2,000 | | | Caisse Nationale Des Caisses d'Epargne et de Prevoyance | | | 6.750 | % | | 1/27/49 | | BBB- | | | 1,850,000 | | |

| | | U.S. Agency – 0.7% | |

| | 3 | | | Farm Credit Bank of Texas | | | 10.000 | % | | 12/15/60 | | A3 | | | 3,673,063 | | |

| | | Total Capital Preferred Securities (cost $297,235,789) | | | | | | | | | | | | | | | 299,531,655 | | |

| Shares | | Description (1) | | Coupon | | | | Ratings (2) | | Value | |

| | | Convertible Preferred Securities – 0.0% (0.0% of Total Investments) | |

| | | Commercial Banks – 0.0% | |

| | 200 | | | Wells Fargo & Company | | | 7.500 | % | | | | | | A- | | $ | 200,110 | | |

| | | Total Convertible Preferred Securities (cost $203,196) | | | | | | | | | | | | | | | 200,110 | | |

| Shares | | Description (1) | | | | | | | | Value | |

| | | Investment Companies – 3.0% (2.3% of Total Investments) | |

| | 315,548 | | | BlackRock Credit Allocation Income Trust II | | | | | | | | | | | | | | $ | 3,101,837 | | |

| | 415,561 | | | Flaherty and Crumrine/Claymore Preferred Securities Income Fund Inc. | | | | | | | | | | | | | | | 6,736,244 | | |

| | 352,012 | | | John Hancock Preferred Income Fund III | | | | | | | | | | | | | | | 5,628,672 | | |

| | | Total Investment Companies (cost $20,895,950) | | | | | | | | | | | | | | | 15,466,753 | | |

Nuveen Investments

19

JTP

Nuveen Quality Preferred Income Fund (continued)

Portfolio of INVESTMENTS December 31, 2010

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity | | | | Value | |

| | | Short-Term Investments – 0.5% (0.4% of Total Investments) | |

| $ | 2,454 | | | Repurchase Agreement with Fixed Income Clearing Corporation,

dated 12/31/10, repurchase price $2,454,348,

collateralized by $2,375,000 U.S. Treasury Notes, 3.625%,

due 8/15/19, value $2,505,625 | | | 0.040 | % | | 1/03/11 | | | | | | $ | 2,454,340 | | |

| | | Total Short-Term Investments (cost $2,454,340) | | | | | | | | | | | | | | | 2,454,340 | | |

| | | Total Investments (cost $667,521,507) – 128.8% | | | | | | | | | | | | | | | 671,654,528 | | |

| | | Borrowings – (29.7)% (3), (4) | | | | | | | | | | | | | | | (154,875,000 | ) | |

| | | Other Assets Less Liabilities – 0.9% | | | | | | | | | | | | | | | 4,567,452 | | |

| | | Net Assets Applicable to Common Shares – 100% | | | | | | | | | | | | | | $ | 521,346,980 | | |

For Fund portfolio compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

(1) All percentages shown in the Portfolio of Investments are based on net assets applicable to Common shares unless otherwise noted.

(2) Ratings (not covered by the report of independent registered public accounting firm): Using the highest of Standard & Poor's Group ("Standard & Poor's"), Moody's Investor Service, Inc. ("Moody's") or Fitch, Inc. ("Fitch") rating. Ratings below BBB by Standard & Poor's, Baa by Moody's or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies.

(3) Borrowings as a percentage of Total Investments is 23.1%.

(4) The Fund may pledge up to 100% of its eligible investments in the Portfolio of Investments as collateral for Borrowings. As of December 31, 2010, investments with a value of $381,353,227 have been pledged as collateral for Borrowings.

N/R Not rated.

144A Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration, which are normally those transactions with qualified institutional buyers.

CORTS Corporate Backed Trust Securities.

PPLUS PreferredPlus Trust.

SATURNS Structured Asset Trust Unit Repackaging.

See accompanying notes to financial statements.

Nuveen Investments

20

JPS

Nuveen Quality Preferred Income Fund 2

Portfolio of INVESTMENTS

December 31, 2010

| Shares | | Description (1) | | Coupon | | | | Ratings (2) | | Value | |

| | | $25 Par (or similar) Preferred Securities – 64.8% (50.5% of Total Investments) | |

| | | Capital Markets – 5.2% | |

| | 381,200 | | | Ameriprise Financial, Inc. | | | 7.750 | % | | | | | | A | | $ | 10,158,980 | | |

| | 6,400 | | | Credit Suisse | | | 7.900 | % | | | | | | A3 | | | 171,392 | | |

| | 92,800 | | | Deutsche Bank Capital Funding Trust I | | | 7.350 | % | | | | | | BBB | | | 2,333,920 | | |

| | 1,276,135 | | | Deutsche Bank Capital Funding Trust II | | | 6.550 | % | | | | | | BBB | | | 29,542,525 | | |

| | 40,500 | | | Deutsche Bank Capital Funding Trust V | | | 8.050 | % | | | | | | BBB | | | 1,058,670 | | |

| | 95,651 | | | Deutsche Bank Capital Funding Trust VIII | | | 6.375 | % | | | | | | BBB | | | 2,147,365 | | |

| | 13,800 | | | Deutsche Bank Capital Funding Trust IX | | | 6.625 | % | | | | | | BBB | | | 317,676 | | |

| | 256,400 | | | Deutsche Bank Contingent Capital Trust III | | | 7.600 | % | | | | | | BBB | | | 6,520,252 | | |

| | 21,751 | | | Goldman Sachs Group Inc. | | | 6.125 | % | | | | | | A | | | 503,536 | | |

| | 70,214 | | | Goldman Sachs Group Inc., Series GSC-3 (PPLUS) | | | 6.000 | % | | | | | | A3 | | | 1,571,389 | | |

| | 5,200 | | | Goldman Sachs Group Inc., Series GSC-4 Class A (PPLUS) | | | 6.000 | % | | | | | | A3 | | | 118,508 | | |

| | 4,000 | | | Goldman Sachs Group Inc., Series GSG-1 (PPLUS) | | | 6.000 | % | | | | | | A1 | | | 94,440 | | |

| | 2,290 | | | Morgan Stanley Capital Trust III | | | 6.250 | % | | | | | | Baa2 | | | 51,342 | | |

| | 2,800 | | | Morgan Stanley Capital Trust V | | | 5.750 | % | | | | | | Baa2 | | | 61,236 | | |

| | | Total Capital Markets | | | | | | | | | | | | | | | 54,651,231 | | |

| | | Commercial Banks – 6.1% | |

| | 181,000 | | | Banco Santander Finance | | | 10.500 | % | | | | | | A- | | | 5,042,660 | | |

| | 243,928 | | | BB&T Capital Trust VI | | | 9.600 | % | | | | | | Baa1 | | | 7,049,519 | | |

| | 66,429 | | | BB&T Capital Trust VII | | | 8.100 | % | | | | | | Baa1 | | | 1,826,133 | | |

| | 227,100 | | | CoBank ACB, 144A | | | 7.000 | % | | | | | | N/R | | | 10,247,888 | | |

| | 82,000 | | | CoBank ACB | | | 11.000 | % | | | | | | A | | | 4,399,817 | | |

| | 42,800 | | | CoBank ACB | | | 11.000 | % | | | | | | A | | | 2,315,215 | | |

| | 2,200 | | | Fifth Third Capital Trust VI | | | 7.250 | % | | | | | | Baa3 | | | 55,022 | | |

| | 10,500,000 | | | HSBC Bank PLC | | | 1.000 | % | | | | | | A | | | 6,431,250 | | |

| | 404,800 | | | HSBC Holdings PLC | | | 8.000 | % | | | | | | A- | | | 10,787,920 | | |

| | 102,700 | | | HSBC Holdings PLC | | | 6.200 | % | | | | | | A- | | | 2,351,830 | | |

| | 4,871 | | | KeyCorp Capital Trust X | | | 8.000 | % | | | | | | Baa3 | | | 123,821 | | |

| | 7,100,000 | | | National Australia Bank | | | 8.000 | % | | | | | | A+ | | | 7,622,560 | | |

| | 202,101 | | | National City Capital Trust II | | | 6.625 | % | | | | | | BBB | | | 5,048,483 | | |

| | | Total Commercial Banks | | | | | | | | | | | | | | | 63,302,118 | | |

| | | Consumer Finance – 0.0% | |

| | 19,600 | | | HSBC USA Inc., Series H | | | 6.500 | % | | | | | | A- | | | 478,828 | | |

| | | Diversified Financial Services – 4.3% | |

| | 94,800 | | | Citigroup Capital Trust XII | | | 8.500 | % | | | | | | BB+ | | | 2,508,408 | | |

| | 271,589 | | | Citigroup Capital XIII | | | 7.875 | % | | | | | | BB+ | | | 7,308,460 | | |

| | 770,313 | | | ING Groep N.V. | | | 7.200 | % | | | | | | Ba1 | | | 17,848,152 | | |

| | 729,055 | | | ING Groep N.V. | | | 7.050 | % | | | | | | Ba1 | | | 16,658,907 | | |

| | | Total Diversified Financial Services | | | | | | | | | | | | | | | 44,323,927 | | |

| | | Diversified Telecommunication Services – 0.2% | |

| | 3,228 | | | BellSouth Capital Funding (CORTS) | | | 7.120 | % | | | | | | A | | | 82,415 | | |

| | 70,501 | | | Telephone and Data Systems Inc. | | | 6.875 | % | | | | | | Baa2 | | | 1,751,950 | | |

| | | Total Diversified Telecommunication Services | | | | | | | | | | | | | | | 1,834,365 | | |

Nuveen Investments

21

JPS

Nuveen Quality Preferred Income Fund 2 (continued)

Portfolio of INVESTMENTS December 31, 2010

| Shares | | Description (1) | | Coupon | | | | Ratings (2) | | Value | |

| | | Electric Utilities – 1.7% | |

| | 59,650 | | | Entergy Louisiana LLC | | | 5.875 | % | | | | | | A- | | $ | 1,478,276 | | |

| | 69,300 | | | Entergy Texas Inc. | | | 7.875 | % | | | | | | BBB+ | | | 1,910,601 | | |

| | 32,500 | | | FPL Group Capital Trust I | | | 5.875 | % | | | | | | BBB | | | 807,950 | | |

| | 216,900 | | | PPL Capital Funding, Inc. | | | 6.850 | % | | | | | | BBB | | | 5,537,457 | | |

| | 315,707 | | | PPL Energy Supply LLC | | | 7.000 | % | | | | | | BBB+ | | | 8,202,068 | | |

| | | Total Electric Utilities | | | | | | | | | | | | | | | 17,936,352 | | |

| | | Food Products – 0.5% | |

| | 53,400 | | | Dairy Farmers of America Inc., 144A | | | 7.875 | % | | | | | | BBB- | | | 4,765,950 | | |

| | | Insurance – 18.1% | |

| | 1,717,889 | | | Aegon N.V. | | | 6.375 | % | | | | | | BBB | | | 37,175,118 | | |

| | 617,913 | | | Allianz SE | | | 8.375 | % | | | | | | A+ | | | 16,278,176 | | |

| | 963,175 | | | Arch Capital Group Limited | | | 8.000 | % | | | | | | BBB | | | 24,560,963 | | |

| | 1,400 | | | Arch Capital Group Limited, Series B | | | 7.875 | % | | | | | | BBB | | | 35,798 | | |

| | 358,596 | | | Assured Guaranty Municipal Holdings | | | 6.250 | % | | | | | | A+ | | | 7,627,337 | | |

| | 404,700 | | | Delphi Financial Group, Inc. | | | 7.376 | % | | | | | | BB+ | | | 9,469,980 | | |

| | 315,840 | | | EverestRe Capital Trust II | | | 6.200 | % | | | | | | Baa1 | | | 7,030,598 | | |

| | 479,400 | | | Markel Corporation | | | 7.500 | % | | | | | | BBB | | | 12,128,820 | | |

| | 579,892 | | | PartnerRe Limited, Series C | | | 6.750 | % | | | | | | BBB+ | | | 14,265,343 | | |

| | 107,300 | | | PLC Capital Trust III | | | 7.500 | % | | | | | | BBB | | | 2,699,668 | | |

| | 443,898 | | | PLC Capital Trust IV | | | 7.250 | % | | | | | | BBB | | | 11,053,060 | | |

| | 12,063 | | | Protective Life Corporation | | | 7.250 | % | | | | | | BBB | | | 300,731 | | |

| | 200,842 | | | Prudential Financial Inc. | | | 9.000 | % | | | | | | BBB+ | | | 5,521,147 | | |

| | 322,005 | | | Prudential Financial Inc. | | | 6.750 | % | | | | | | A- | | | 8,075,885 | | |

| | 4,000,000 | | | Reinsurance Group of America Inc. | | | 6.750 | % | | | | | | BBB- | | | 3,707,304 | | |

| | 410,974 | | | RenaissanceRe Holdings Limited, Series D | | | 6.600 | % | | | | | | BBB+ | | | 10,122,290 | | |

| | 1,200 | | | Torchmark Capital Trust III | | | 7.100 | % | | | | | | BBB+ | | | 30,720 | | |

| | 717,785 | | | W. R. Berkley Corporation, Capital Trust II | | | 6.750 | % | | | | | | BBB- | | | 17,937,447 | | |

| | | Total Insurance | | | | | | | | | | | | | | | 188,020,385 | | |

| | | Media – 7.2% | |

| | 746,750 | | | CBS Corporation | | | 6.750 | % | | | | | | BBB- | | | 18,870,373 | | |

| | 1,084,356 | | | Comcast Corporation | | | 7.000 | % | | | | | | BBB+ | | | 27,434,207 | | |

| | 145,000 | | | Comcast Corporation | | | 6.625 | % | | | | | | BBB+ | | | 3,690,250 | | |

| | 965,340 | | | Viacom Inc. | | | 6.850 | % | | | | | | BBB+ | | | 24,500,329 | | |

| | | Total Media | | | | | | | | | | | | | | | 74,495,159 | | |

| | | Multi-Utilities – 3.9% | |

| | 543,823 | | | Dominion Resources Inc. | | | 8.375 | % | | | | | | BBB | | | 15,411,944 | | |

| | 148,500 | | | Scana Corporation | | | 7.700 | % | | | | | | BBB- | | | 4,122,360 | | |

| | 771,182 | | | Xcel Energy Inc. | | | 7.600 | % | | | | | | BBB | | | 21,153,522 | | |

| | | Total Multi-Utilities | | | | | | | | | | | | | | | 40,687,826 | | |

| | | Oil, Gas & Consumable Fuels – 1.9% | |

| | 800,773 | | | Nexen Inc. | | | 7.350 | % | | | | | | BB+ | | | 20,187,487 | | |

| | | Pharmaceuticals – 0.0% | |

| | 5,000 | | | Bristol Myers Squibb Company (CORTS) | | | 6.250 | % | | | | | | A+ | | | 126,000 | | |

| | | Real Estate/Mortgage – 15.7% | |

| | 16,607 | | | AMB Property Corporation, Series L | | | 6.500 | % | | | | | | Baa2 | | | 405,709 | | |

| | 42,480 | | | Commomwealth REIT | | | 7.125 | % | | | | | | Baa3 | | | 1,025,042 | | |

| | 267,403 | | | Developers Diversified Realty Corporation, Series G | | | 8.000 | % | | | | | | Ba1 | | | 6,661,009 | | |

| | 19,908 | | | Developers Diversified Realty Corporation, Series H | | | 7.375 | % | | | | | | Ba1 | | | 470,824 | | |

| | 162,167 | | | Duke Realty Corporation, Series L | | | 6.600 | % | | | | | | Baa3 | | | 3,643,892 | | |

| | 8,710 | | | Harris Preferred Capital Corporation, Series A | | | 7.375 | % | | | | | | A- | | | 219,579 | | |

Nuveen Investments

22

| Shares | | Description (1) | | Coupon | | | | Ratings (2) | | Value | |

| | | Real Estate/Mortgage (continued) | |

| | 73,200 | | | Kimco Realty Corporation, Series F | | | 6.650 | % | | | | | | Baa2 | | $ | 1,797,060 | | |

| | 909,889 | | | Kimco Realty Corporation, Series G | | | 7.750 | % | | | | | | Baa2 | | | 24,021,070 | | |

| | 62,865 | | | Kimco Realty Corporation, Series H | | | 6.900 | % | | | | | | Baa2 | | | 1,515,047 | | |

| | 82,301 | | | Prologis Trust, Series C | | | 8.540 | % | | | | | | Baa3 | | | 4,572,849 | | |

| | 6,524 | | | Prologis Trust, Series F | | | 6.750 | % | | | | | | Baa3 | | | 150,052 | | |

| | 89,050 | | | Prologis Trust, Series G | | | 6.750 | % | | | | | | Baa3 | | | 2,042,807 | | |

| | 11,500 | | | Public Storage, Inc., Series C | | | 6.600 | % | | | | | | BBB+ | | | 282,210 | | |

| | 110,300 | | | Public Storage, Inc., Series E | | | 6.750 | % | | | | | | BBB+ | | | 2,746,470 | | |

| | 10,900 | | | Public Storage, Inc., Series F | | | 6.450 | % | | | | | | BBB+ | | | 264,325 | | |

| | 17,530 | | | Public Storage, Inc., Series H | | | 6.950 | % | | | | | | BBB+ | | | 441,055 | | |

| | 11,700 | | | Public Storage, Inc., Series I | | | 7.250 | % | | | | | | BBB+ | | | 296,127 | | |

| | 46,000 | | | Public Storage, Inc., Series K | | | 7.250 | % | | | | | | BBB+ | | | 1,169,780 | | |

| | 67,600 | | | Public Storage, Inc., Series Y | | | 6.850 | % | | | | | | BBB+ | | | 1,533,675 | | |

| | 78,184 | | | Realty Income Corporation | | | 7.375 | % | | | | | | Baa2 | | | 2,010,111 | | |

| | 447,758 | | | Realty Income Corporation | | | 6.750 | % | | | | | | Baa2 | | | 10,979,026 | | |

| | 185,300 | | | Regency Centers Corporation | | | 7.450 | % | | | | | | Baa3 | | | 4,695,502 | | |

| | 223,406 | | | Regency Centers Corporation | | | 7.250 | % | | | | | | Baa3 | | | 5,524,830 | | |

| | 1,079,521 | | | Vornado Realty LP | | | 7.875 | % | | | | | | BBB | | | 28,790,825 | | |

| | 1,790,366 | | | Wachovia Preferred Funding Corporation | | | 7.250 | % | | | | | | A- | | | 45,815,463 | | |

| | 159,700 | | | Weingarten Realty Trust | | | 8.100 | % | | | | | | BBB | | | 3,649,145 | | |

| | 149,245 | | | Weingarten Realty Trust | | | 6.950 | % | | | | | | Baa3 | | | 3,637,101 | | |

| | 198,268 | | | Weingarten Realty Trust | | | 6.500 | % | | | | | | Baa3 | | | 4,619,644 | | |

| | | Total Real Estate/Mortgage | | | | | | | | | | | | | | | 162,980,229 | | |

| | | Wireless Telecommunication Services – 0.0% | |

| | 20,227 | | | Telephone and Data Systems Inc. | | | 7.600 | % | | | | | | Baa2 | | | 509,923 | | |

| | | Total $25 Par (or similar) Preferred Securities (cost $663,004,669) | | | | | | | | | | | | | | | 674,299,780 | | |

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value | |

| | | Corporate Bonds – 3.1% (2.4% of Total Investments) | |

| | | Capital Markets – 0.1% | |

| $ | 600 | | | Man Group PLC | | | 5.000 | % | | 8/09/17 | | Baa3 | | $ | 508,589 | | |

| | | Commercial Banks – 0.8% | |

| | 1,000 | | | Den Norske Bank | | | 0.875 | % | | 2/18/35 | | Baa1 | | | 597,550 | | |

| | 1,000 | | | Den Norske Bank | | | 0.541 | % | | 2/24/37 | | Baa1 | | | 585,000 | | |

| | 6,500 | | | LBG Capital I PLC, 144A | | | 7.875 | % | | 11/01/20 | | BB- | | | 5,947,500 | | |

| | 500 | | | Lloyds Banking Group LBG Capital 1, 144A | | | 8.000 | % | | 6/15/20 | | B+ | | | 440,000 | | |

| | 650 | | | Swedbank ForengingsSparbanken AB, 144A | | | 7.500 | % | | 9/11/12 | | Ba1 | | | 634,361 | | |

| | 9,650 | | | Total Commercial Banks | | | | | | | | | | | | | | | 8,204,411 | | |

| | | Diversified Financial Services – 0.2% | |

| | 2,600 | | | Fortis Hybrid Financing | | | 8.250 | % | | 8/27/49 | | BBB | | | 2,538,900 | | |

| | | Electric Utilities – 0.9% | |

| | 8,000 | | | FPL Group Capital Inc. | | | 6.650 | % | | 6/15/17 | | BBB | | | 7,930,232 | | |

| | 1,800 | | | WPS Resource Corporation | | | 6.110 | % | | 12/01/16 | | Baa2 | | | 1,739,113 | | |

| | 9,800 | | | Total Electric Utilities | | | | | | | | | | | | | | | 9,669,345 | | |

| | | Insurance – 0.7% | |

| | 2,000 | | | AXA S.A. | | | 2.983 | % | | 8/06/49 | | A3 | | | 1,350,000 | | |

| | 5,200 | | | Prudential PLC. | | | 11.750 | % | | 12/23/14 | | A- | | | 6,047,080 | | |

| | 7,200 | | | Total Insurance | | | | | | | | | | | | | | | 7,397,080 | | |

Nuveen Investments

23

JPS

Nuveen Quality Preferred Income Fund 2 (continued)

Portfolio of INVESTMENTS December 31, 2010

Principal

Amount (000) | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value | |

| | | Multi-Utilities – 0.2% | |

| $ | 2,000 | | | Wisconsin Energy Corporation | | | 6.250 | % | | 5/15/17 | | Baa1 | | $ | 1,972,548 | | |

| | | Oil, Gas & Consumable Fuels – 0.2% | |

| | 1,625 | | | TranCanada Pipelines Limited | | | 6.350 | % | | 5/15/17 | | Baa1 | | | 1,606,654 | | |

| $ | 33,475 | | | Total Corporate Bonds (cost $31,356,303) | | | | | | | | | | | | | | | 31,897,527 | | |

Principal

Amount (000)/

Shares | | Description (1) | | Coupon | | Maturity | | Ratings (2) | | Value | |

| | | Capital Preferred Securities – 55.9% (43.6% of Total Investments) | |

| | | Capital Markets – 1.1% | |

| | 5,800 | | | ABN AMRO North America Holding Capital, 144A | | | 6.523 | % | | 12/31/49 | | BB+ | | $ | 4,973,500 | | |

| | 8,200 | | | Credit Suisse Guernsey | | | 0.976 | % | | 5/15/17 | | A3 | | | 6,078,250 | | |

| | | Total Capital Markets | | | | | | | | | | | | | | | 11,051,750 | | |

| | | Commercial Banks – 24.0% | |