Exhibit 99.1

PRESENTED BY Angela Selden President and CEO American Public Education, Inc. William Blair 42 nd Annual Growth Stock Conference Investor Presentation June 7, 2022

Safe Harbor Statement Please note that statements made in this presentation regarding American Public Education and its subsidiaries (the “Company”) that are not historical facts may be forward - looking statements based on current expectations, assumptions, estimates and projections about the Company and the industry . These forward - looking statements are subject to risks and uncertainties that could cause actual future events or results to differ materially from those expressed or implied by such statements . Forward - looking statements may be able to be identified by words such as anticipate, believe, seek, could, estimate, expect, intend, may, plan, should, will, would, and similar words or their opposites . Forward - looking statements include, without limitation, statements about expected growth, registrations and enrollments, and the anticipated nursing shortage . Actual results could differ materially from those expressed or implied by forward - looking statements as a result of various factors, including risks related to the effects of and the Company’s response to the COVID - 19 pandemic, including impacts on the demand environment as the pandemic abates, the Company’s dependence on the effectiveness of its ability to attract students who persist in its institutions’ programs, changing market demands, the Company’s inability to market its programs, the loss of the Company’s ability to receive funds under tuition assistance programs or ability to process tuition assistance financial aid, the Company’s inability to maintain strong relationships with the military and maintain course registrations and enrollments from military students, the Company’s failure to comply with regulatory and accrediting agency requirements and to maintain institutional accreditation, the Company’s loss of eligibility to participate in Title IV programs or ability to process Title IV financial aid, the Company’s need to successfully adjust to future market demands by updating existing programs and developing new programs, entering into and integrating acquisitions, including the integration of Rasmussen University and Graduate School USA, and the risk factors described in the risk factor section and elsewhere in the Company’s annual report on Form 10 - K, subsequent quarterly report on Form 10 - Q and in the Company’s other SEC filings . You should not place any undue reliance on any forward - looking statements . The Company undertakes no obligation to update publicly any forward - looking statements for any reason, unless required by law, even if new information becomes available or other events occur in the future .

The Bottom - Line Up Front Large National Nursing Platform Poised for Organic and Inorganic Growth ▪ HCN + Rasmussen = $208MM 1 of nursing revenue ▪ 30 Campuses across 9 States with 10,900 nursing students ▪ Strong demand for nurses: >190k annual RN openings and >60k annual PN openings projected by BLS over next decade 1Q’22 Growth in “Right to Win” Markets ▪ APUS: Rebound in military registration momentum – 11% Army growth in 1Q’22 vs prior year, 7% total military growth ▪ Nursing: Strong overall enrollment against steep prior year comps – 4% 1Q’22 vs prior year (30+%), 14% on two - year CAGR basis Strong Balance Sheet with Solid Capital Structure and Liquidity Position #1 Positions in Key “Right to Win” Markets; Diversified Revenue ▪ #1 Market Positions : – Active - duty military, veterans, pre - licensure nursing ▪ Diversified Revenue : – Approximately 1/3 military and veterans, 1/3 nursing, 1/3 other service - minded students 1. Pro forma trailing twelve months 3 /31/22 ▪ Unrestricted cash position of $145MM at end of 1Q 22 with $20MM undrawn revolver ▪ $26MM of net debt with $20MM undrawn revolver

The “New” APEI: Educating Service - Minded Students Student Focus • Military • Veterans • Public service • Service - minded Offerings • Remote / one - course - at - a - time • Specific bundles (e.g. officer requirements) • Practical training + specialized degrees: • Space • Intelligence • Security • Fire • Police Demographics • Non - traditional • Avg age: ~32 • Working adult • 1 st Generation • Some college Student Focus • Nurses • Clinical & health Sciences • Career - oriented Demographics • Non - traditional • Working adult • 1 st generation Student Focus • Federal employees • Public service • Government • Service - minded Offerings • Short - form courses • Training • Career advancement & mobility • Continuing education Offerings • Purpose - built curriculum and pacing • Direct path to career • Career placements Flexible learning solutions, including for military and veterans to utilize their earned education benefit Helping to solve US nursing shortage by creating new nurses and health science professionals Modernizing government and professional training Fully Online Blended Online / On - Ground HEROIC TM : Higher Education Return on Investment for Customers

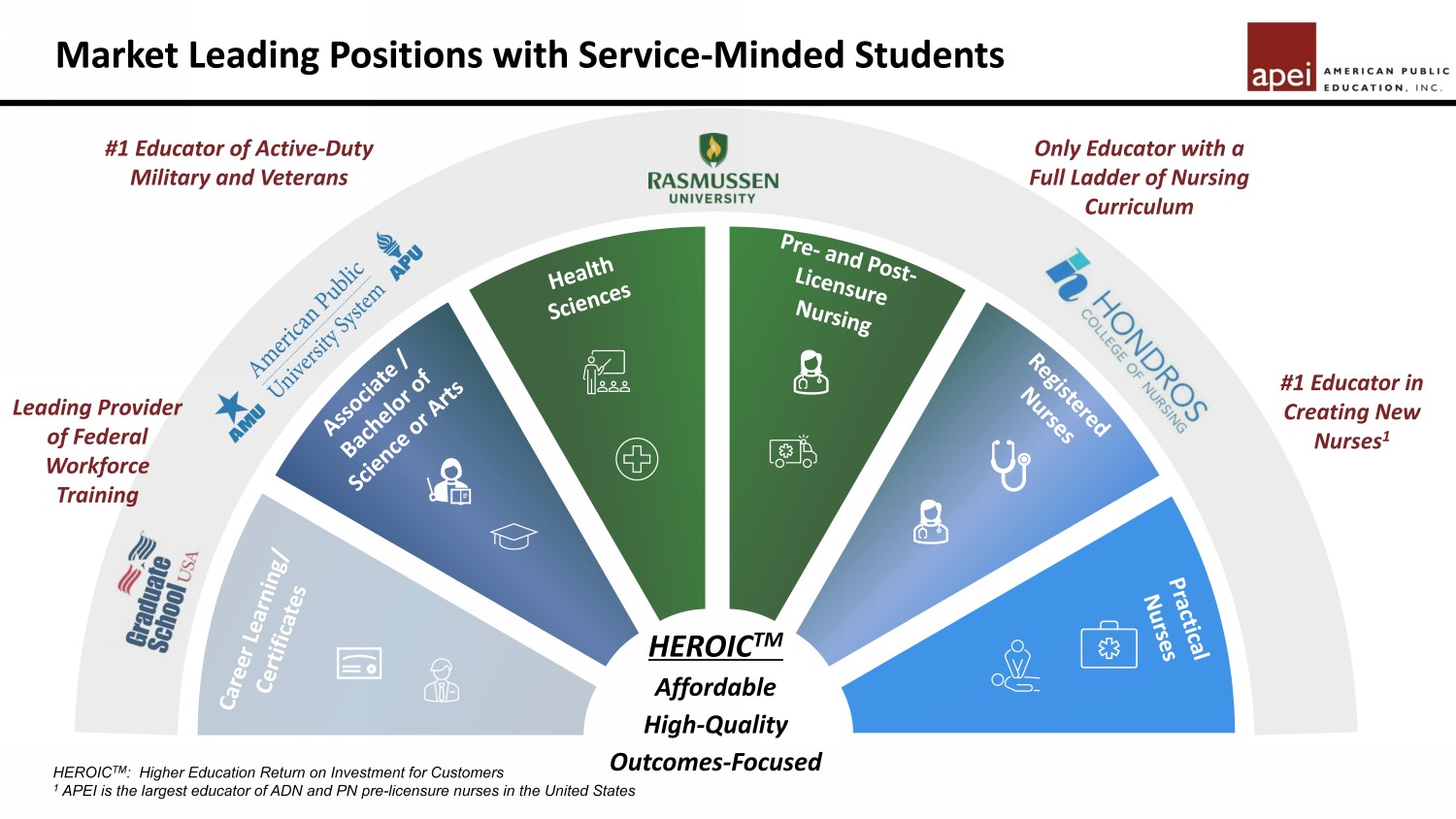

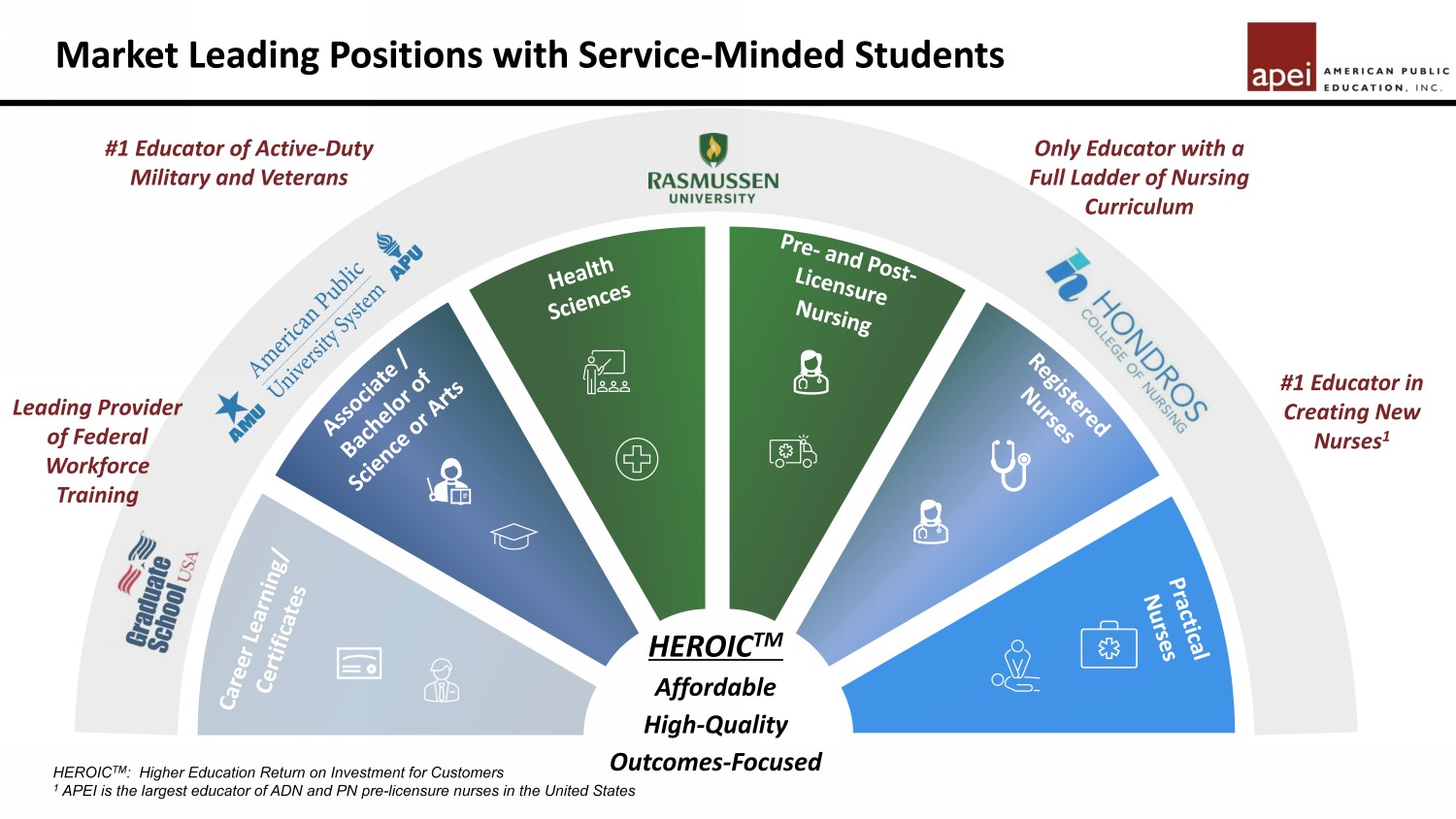

Market Leading Positions with Service - Minded Students HEROIC TM Affordable High - Quality Outcomes - Focused #1 Educator of Active - Duty Military and Veterans #1 Educator in Creating New Nurses 1 HEROIC TM : Higher Education Return on Investment for Customers 1 APEI is the largest educator of ADN and PN pre - licensure nurses in the United States Leading Provider of Federal Workforce Training Only Educator with a Full Ladder of Nursing Curriculum

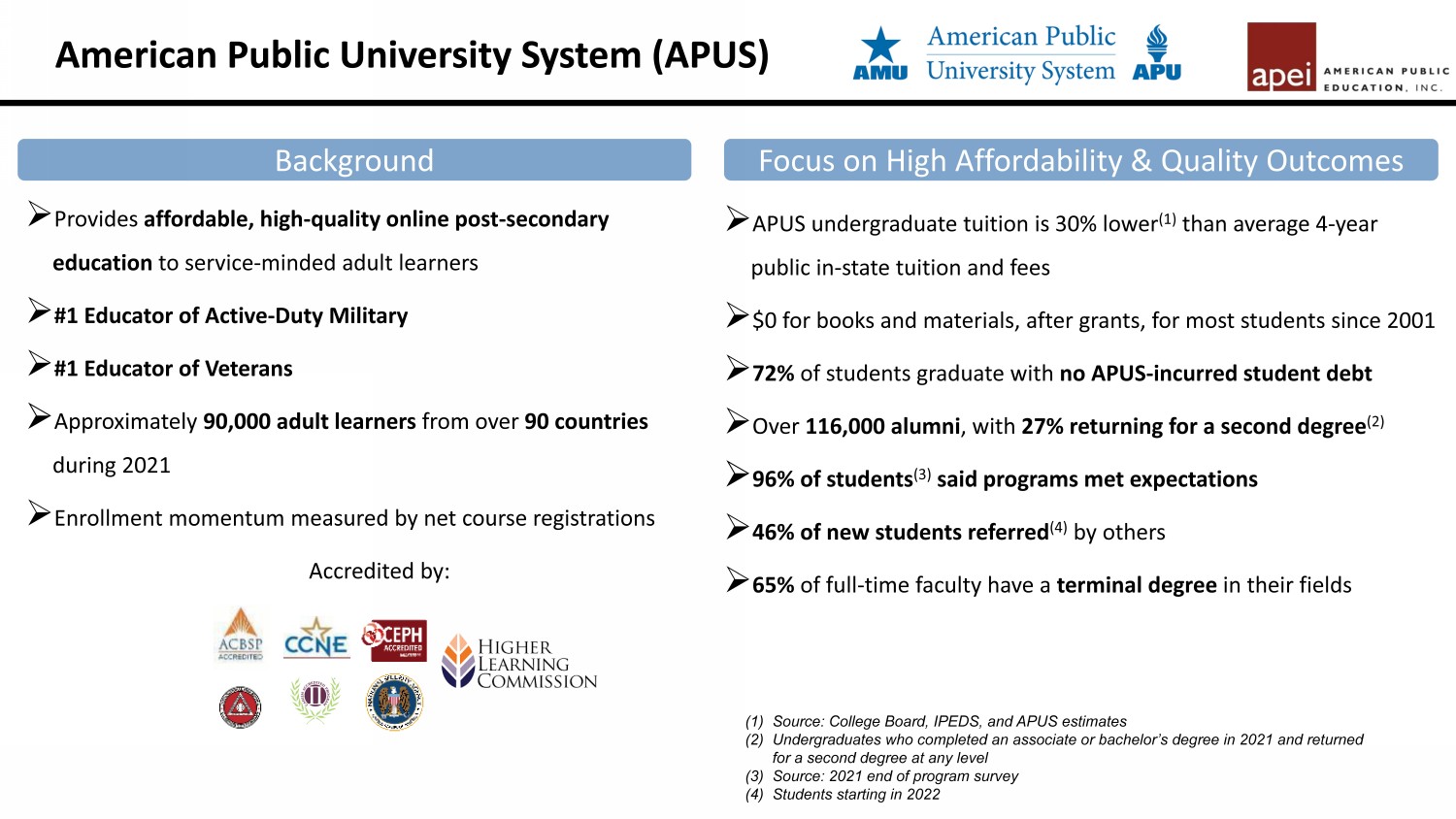

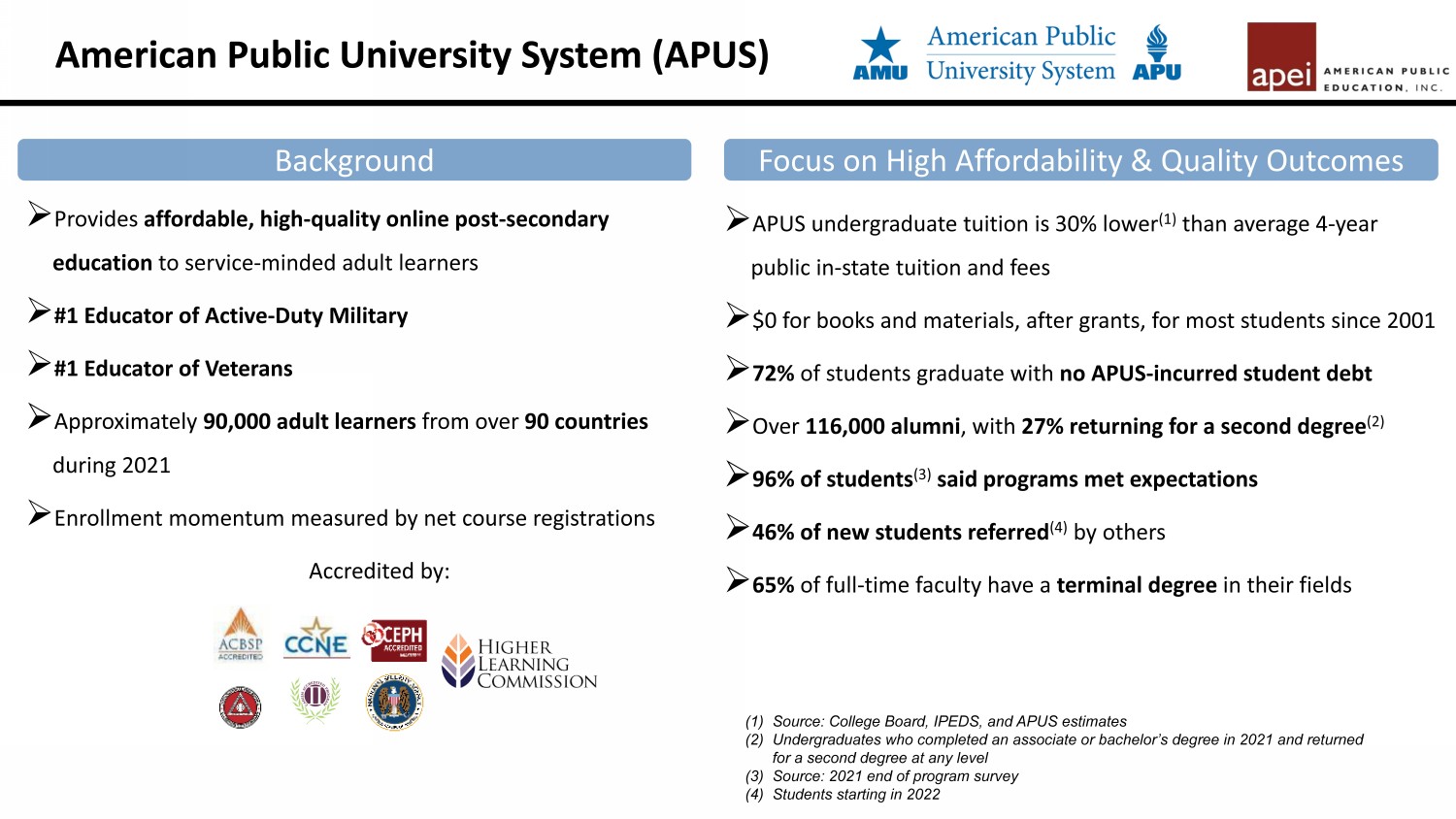

American Public University System (APUS) Background Focus on High Affordability & Quality Outcomes » Provides affordable, high - quality online post - secondary education to service - minded adult learners » #1 Educator of Active - Duty Military » #1 Educator of Veterans » Approximately 90,000 adult learners from over 90 countries during 2021 » Enrollment momentum measured by net course registrations Accredited by: » APUS undergraduate tuition is 30% lower (1) than average 4 - year public in - state tuition and fees » $0 for books and materials, after grants, for most students since 2001 » 72% of students graduate with no APUS - incurred student debt » Over 116,000 alumni , with 27% returning for a second degree (2) » 96% of students (3) said programs met expectations » 46% of new students referred (4) by others » 65% of full - time faculty have a terminal degree in their fields (1) Source: College Board, IPEDS, and APUS estimates (2) Undergraduates who completed an associate or bachelor’s degree in 2021 and returned for a second degree at any level (3) Source: 2021 end of program survey (4) Students starting in 2022

APEI: Building a National Nursing Platform to Address Chronic Issue 1. Pro forma trailing twelve months 3 /31/22 Hondros Rasmussen Future Campuses Current Campuses Chronic Nursing Shortfall » BLS annual job projections: RNs: 9% increase from 2020 to 2030; 195k annual openings LPNs: 9% increase from 2020 to 2030; 61k annual openings » More than 40% of nursing population is age 55+ » Healthcare systems experiencing depressed margins on elevated temporary and overtime labor costs » APEI’s curriculum gets new LPNs to work in as little as 15 months and new RNs to work in as little as 2.5 years » Significant barriers to entry exist due to regulatory, state board, and accreditation requirements; clinical partnership needs; and physical campus locations needed in pre - licensure space APEI’s Nursing Platform 30 campuses $208MM in revenue 1 RU APUS HCN Doctor of Nursing Practice (DNP) ● Family Nurse Practitioner (Master’s) 2022 ● Master of Science in Nursing (MSN) ● ● RN to BSN ● ● Direct Entry / Accelerated (ABSN) ● Traditional (BSN) Bachelor of Science in Nursing ● Associate Degree Nurse (RN) ● ● Direct Entry Associate Degree Nurse (RN) ● Practical Nursing Diploma (LPN) ● ● APEI’s Full Nursing Curriculum Ladder Post - Licensure Online Pre - Licensure Campus, online x Laddered program that encompasses nursing education lifecycle x RN program has significant enrollment due to market demand x Attractive multiple entry points for diverse populations x 15 additional programs in Allied Health and Healthcare Administration

Strong Tailwind from Chronic National Nursing Shortage Projected US Nursing Education Market Size (2) 3.08 3.11 3.14 3.16 3.19 3.22 3.25 3.27 3.30 3.33 3.36 3.00 3.10 3.20 3.30 3.40 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 NURSING WORKFORCE (MM’S) Nursing education market poised for significant growth as nursing shortage projected to continue Licensed practical / licensed vocational nurses also expected to grow at ~9% annually with ~60k average annual openings (1) Source: Bureau of Labor Statistics (2) Technavio Nursing Education Report (2020) (3) National Nursing Workforce Study and AMN Healthcare survey $28 $33 $41 $49 $60 $0 $10 $20 $30 $40 $50 $60 $70 2020 2021 2022 2023 2024 ($ in billions) x Aging US population driving demand for healthcare services x Nursing shortage causing use of expensive temporary labor and overtime, pressuring healthcare system margins x Increase in nurse retirements: 43% of nursing population >55 years old (3) x Continued demand from both hospitals and home healthcare services Factors Driving Demand for Nursing Education Projected 9% Increase in RN Workforce by 2030 (1) Annual Gap of >190k RNs Over Next 10 Years (1) McKinsey estimates US direct patient care nursing gap of 200k - 450k by 2025

• 2Q22 total nursing student enrollment growth of - 1% versus PY comparable period • Comping to steep 30+% PY growth periods • Represents +14% 2 - year CAGR APEI Nursing Enrollment Update 1Q 2022 Forecast 2Q 2022 • 1Q22 nursing enrollment reached record number • 3% growth in nursing in total • ADN/RN growth increased ~4% 6,700 1,600 8,300 8,200 2,300 10,500 8,400 2,500 10,900 Rasmussen HCN Total Nursing Nursing Enrollment 1Q 2020 1Q 2021 1Q 2022 + 2% + 8% + 3% +15% 2 Yr CAGR

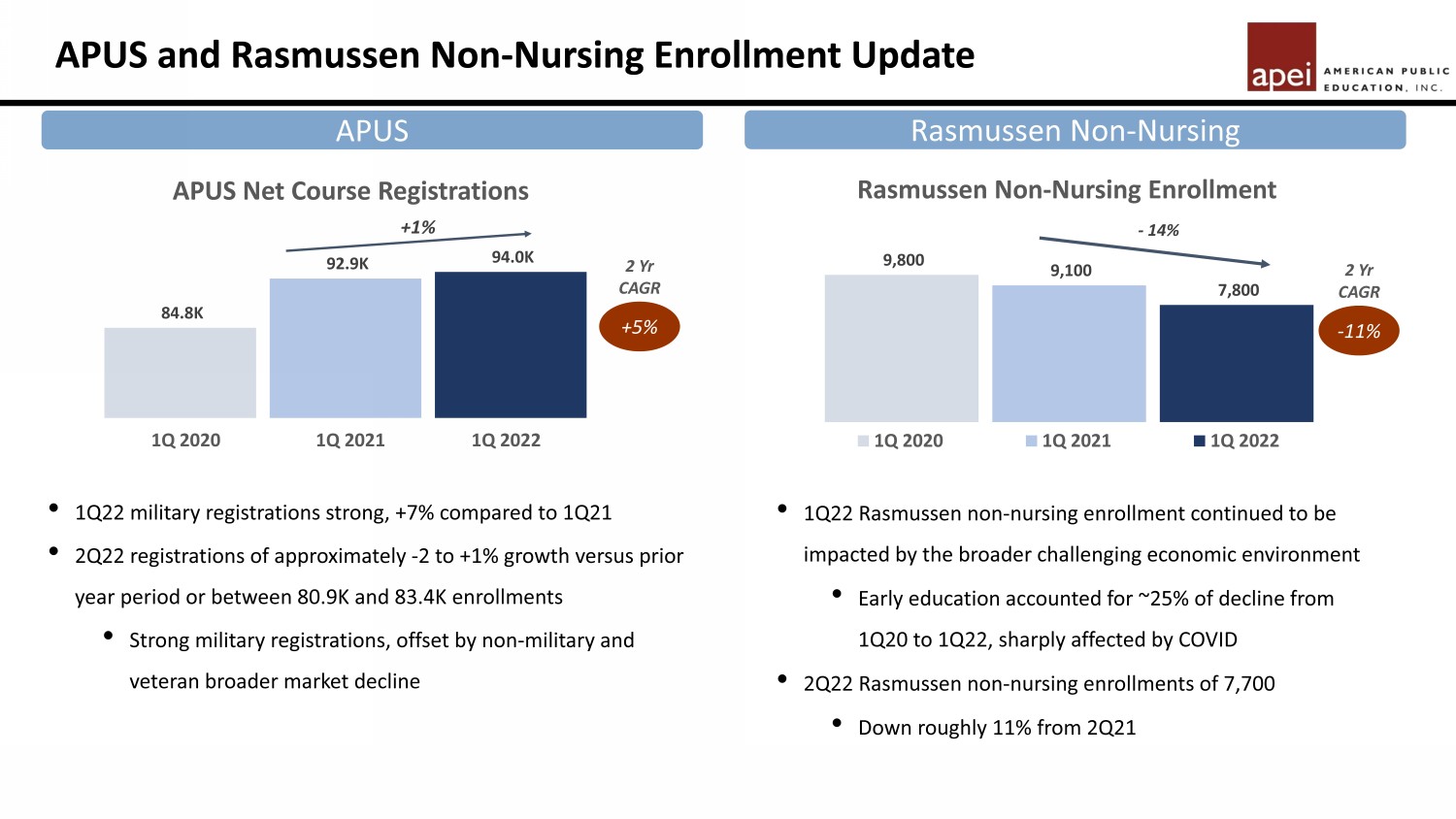

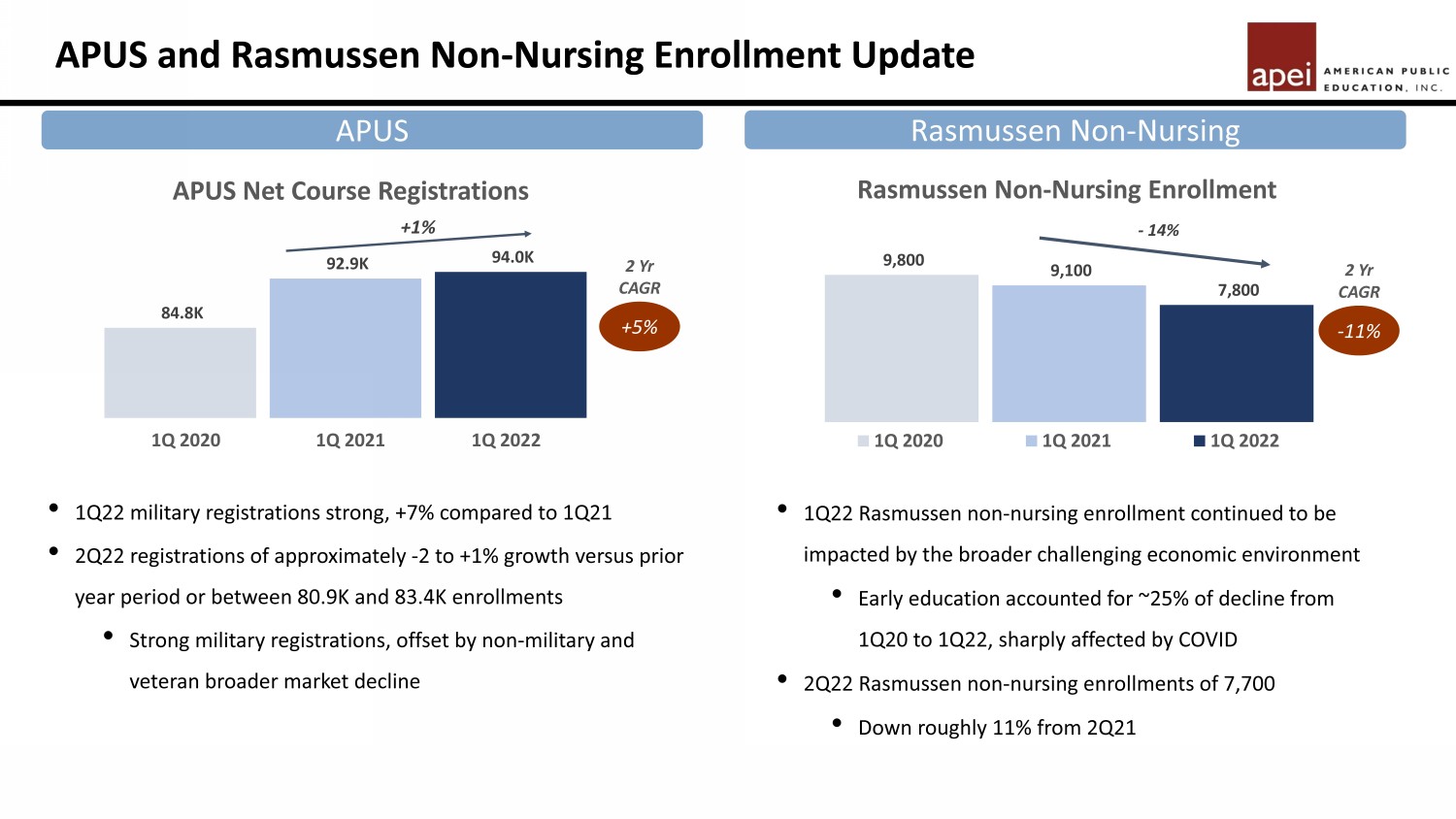

• 1Q22 military registrations strong, +7% compared to 1Q21 • 2Q22 registrations of approximately - 2 to +1% growth versus prior year period or between 80.9K and 83.4K enrollments • Strong military registrations, offset by non - military and veteran broader market decline APUS and Rasmussen Non - Nursing Enrollment Update APUS Rasmussen Non - Nursing • 1Q22 Rasmussen non - nursing enrollment continued to be impacted by the broader challenging economic environment • Early education accounted for ~25% of decline from 1Q20 to 1Q22, sharply affected by COVID • 2Q22 Rasmussen non - nursing enrollments of 7,700 • Down roughly 11% from 2Q21 +5% 2 Yr CAGR - 11% 2 Yr CAGR 84.8K 92.9K 94.0K APUS Net Course Registrations +1% 1Q 2020 1Q 2021 1Q 2022

Thank You