1 American Public Education Third Quarter 2007 Earnings Conference Call November 16, 2007

2 Statements made in this presentation regarding American Public Education, or its subsidiaries, that are not historical facts are forward-looking statements based on current expectations, assumptions, estimates and projections about American Public Education and the industry. These forward-looking statements are subject to risks and uncertainties that could cause actual future events or results to differ materially from such statements. Forward-looking statements can be identified by words such as "anticipate", "believe", "could", "estimate", "expect" "intend", "may", "should" "will" and "would". These forward-looking statements include, without limitation, statements on the slide “Fourth Quarter 2007 Outlook" and statements regarding expected growth. Actual results could differ materially from those expressed or implied by these forward-looking statements as a result of various factors, including the various risks described in the "Risk Factors" section and elsewhere in the Prospectus that forms a part of the Registration Statement on Form S-1 (SEC File No. 333-145185) filed with the Securities and Exchange Commission on November 9, 2007, for the Company's initial public offering. The Company undertakes no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future. Safe Harbor Statement

3 PRIOR EXPERIENCE CFO, COO, or CEO, of: Meridian HealthCare Manor HealthCare NeighborCare Pharmacies Sun Healthcare Group Wallace E. Boston, Jr. President and Chief Executive Officer Member, Board of Trustees Member, Board of Directors Joined as Chief Financial Officer in 2002 to implement financial, operational and critical IT systems. Promoted to President and CEO in 2004. Harry T. Wilkins, CPA Executive Vice President and Chief Financial Officer PRIOR EXPERIENCE Former CFO of Strayer Education, Inc. Founding Partner of Wilkins, Little & Matthews, LLP Director of Wooden & Benson Senior Consultant with Deloitte Touche Board Member of Concorde Career Colleges, Inc. Joined as Executive Vice President and Chief Financial Officer in 2007, after serving on the Board of Trustees and Board of Directors for three years. Today’s Speakers

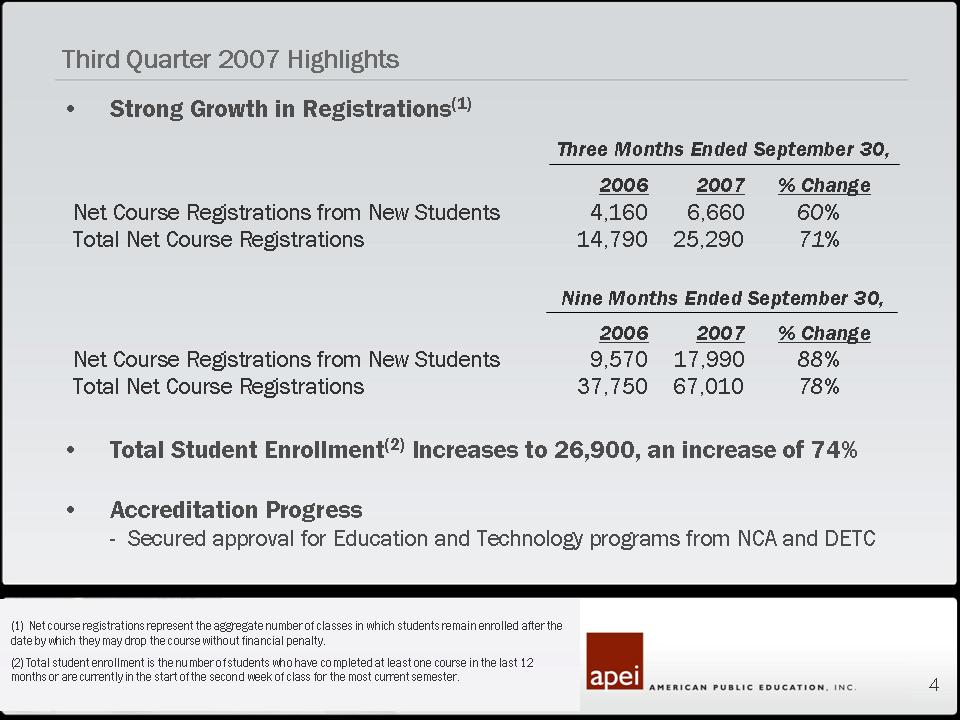

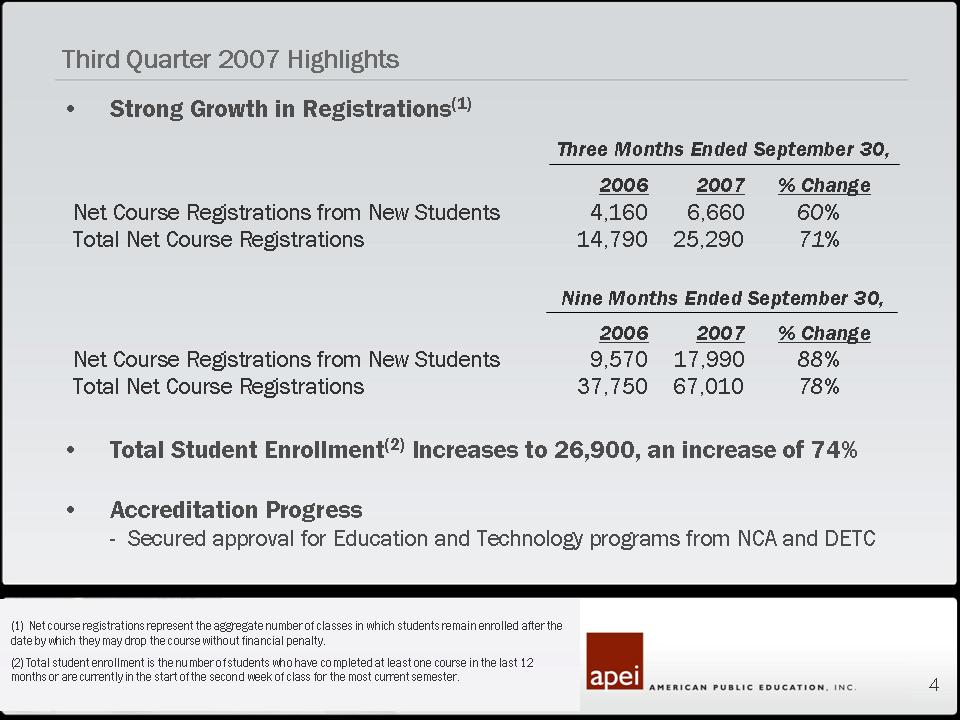

4 Strong Growth in Registrations(1) Total Student Enrollment(2) Increases to 26,900, an increase of 74% Accreditation Progress - Secured approval for Education and Technology programs from NCA and DETC 2006 2007 % Change Net Course Registrations from New Students 4,160 6,660 60% Total Net Course Registrations 14,790 25,290 71% Three Months Ended September 30, Third Quarter 2007 Highlights 2006 2007 % Change Net Course Registrations from New Students 9,570 17,990 88% Total Net Course Registrations 37,750 67,010 78% Nine Months Ended September 30, (1) Net course registrations represent the aggregate number of classes in which students remain enrolled after the date by which they may drop the course without financial penalty. (2) Total student enrollment is the number of students who have completed at least one course in the last 12 months or are currently in the start of the second week of class for the most current semester.

5 Six New Articulation Agreements, Including: Community College of The Air Force (UA-ABC Program) Florida Community College at Jacksonville Company Continues to Deepen Military Market Relationships Signed agreements for a permanent presence on three additional military bases. Lieutenant General Julius Becton, Jr. Joins Board of Trustees Company Completes Initial Public Offering Other Recent Developments

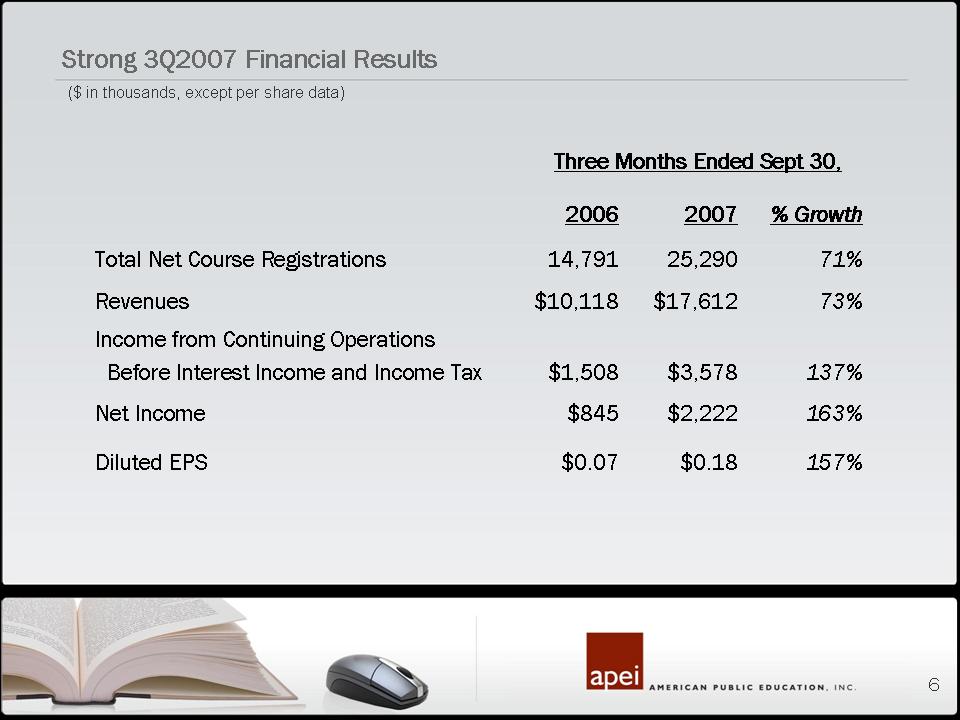

6 Strong 3Q2007 Financial Results ($ in thousands, except per share data) 137% $3,578 $1,508 Income from Continuing Operations Before Interest Income and Income Tax 157% $0.18 $0.07 Diluted EPS 163% $2,222 $845 Net Income 73% $17,612 $10,118 Revenues 71% 25,290 14,791 Total Net Course Registrations % Growth 2007 2006 Three Months Ended Sept 30,

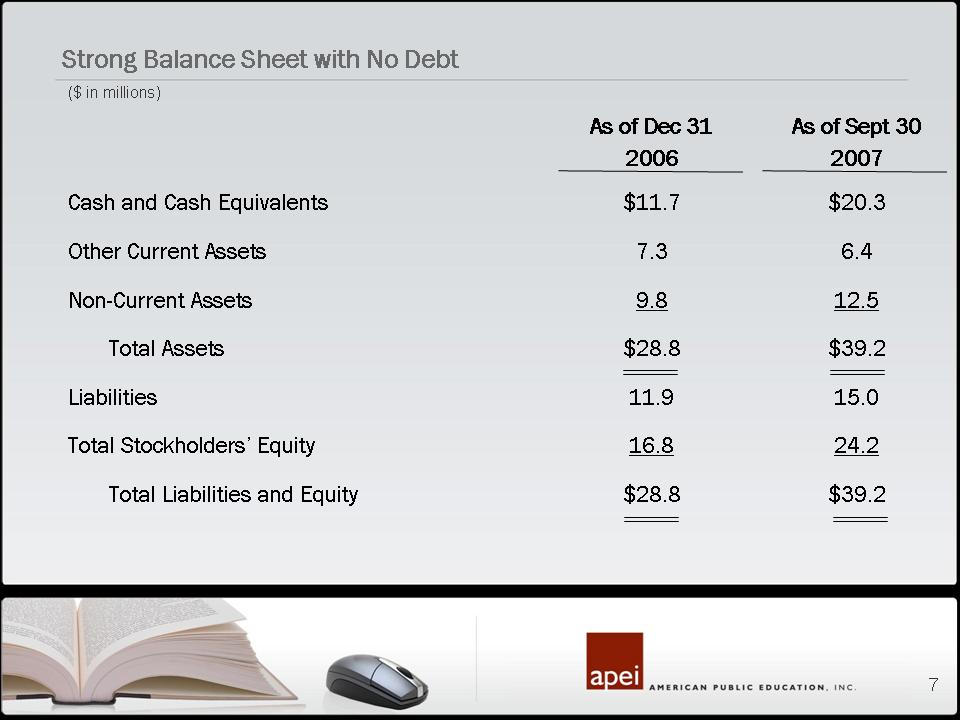

7 Strong Balance Sheet with No Debt ($ in millions) $39.2 $28.8 Total Liabilities and Equity 6.4 7.3 Other Current Assets 24.2 16.8 Total Stockholders’ Equity 15.0 11.9 Liabilities $39.2 $28.8 Total Assets 12.5 9.8 Non-Current Assets $20.3 $11.7 Cash and Cash Equivalents As of Sept 30 2007 As of Dec 31 2006

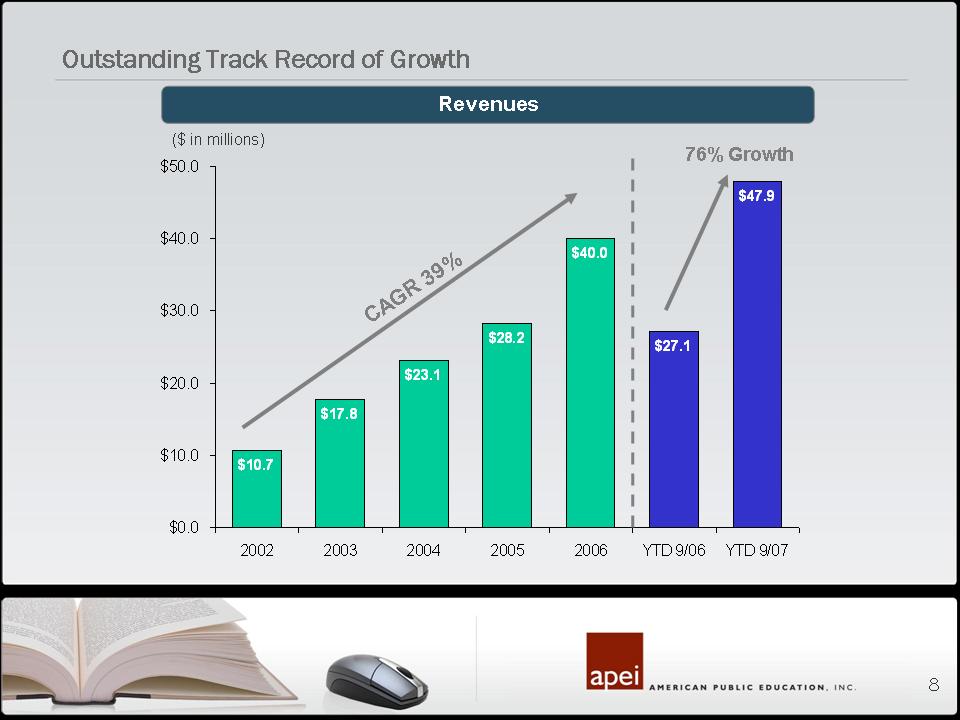

8 $47.9 $40.0 $27.1 $28.2 $10.7 $17.8 $23.1 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 2002 2003 2004 2005 2006 YTD 9/06 YTD 9/07 76% Growth Revenues CAGR 39% ($ in millions) Outstanding Track Record of Growth

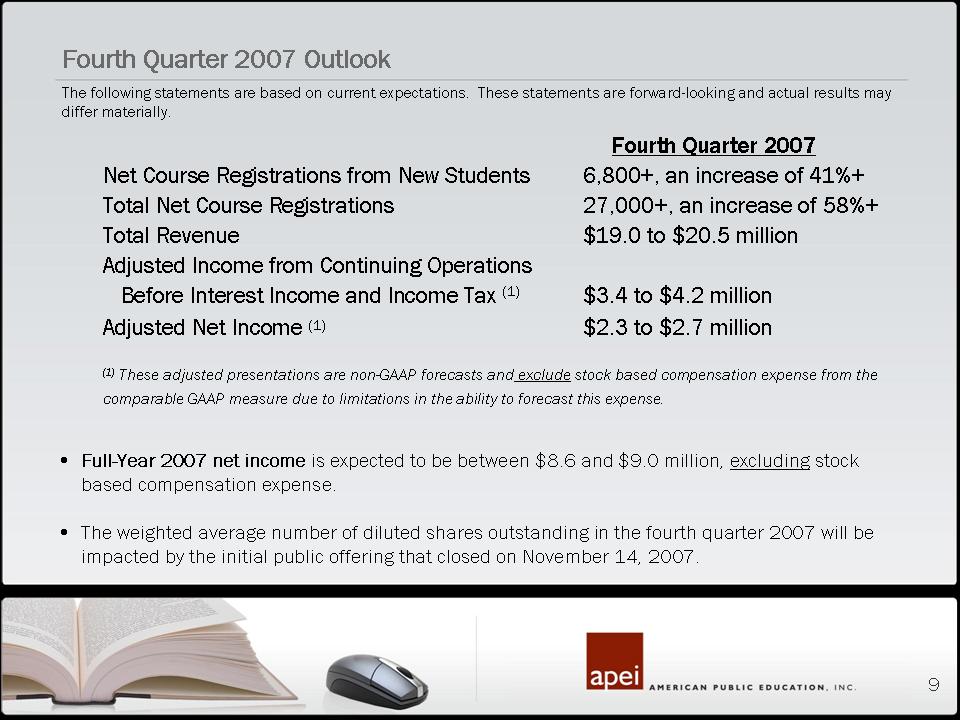

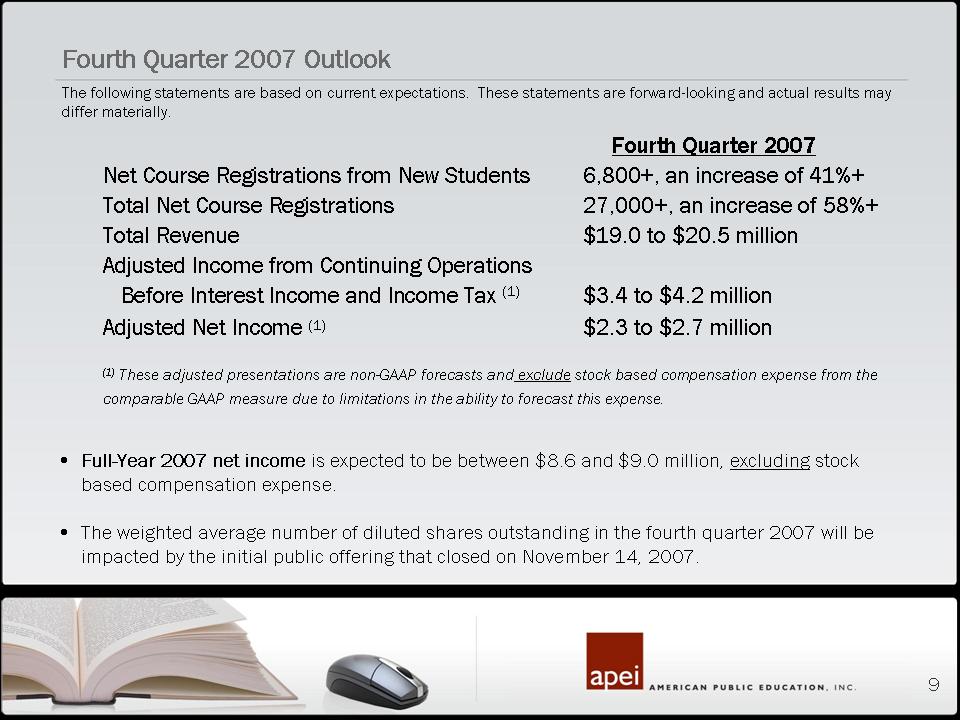

9 Fourth Quarter 2007 Net Course Registrations from New Students 6,800+, an increase of 41%+ Total Net Course Registrations 27,000+, an increase of 58%+ Total Revenue $19.0 to $20.5 million Adjusted Income from Continuing Operations Before Interest Income and Income Tax (1) $3.4 to $4.2 million Adjusted Net Income (1) $2.3 to $2.7 million (1) These adjusted presentations are non-GAAP forecasts and exclude stock based compensation expense from the comparable GAAP measure due to limitations in the ability to forecast this expense. Fourth Quarter 2007 Outlook The following statements are based on current expectations. These statements are forward-looking and actual results may differ materially. Full-Year 2007 net income is expected to be between $8.6 and $9.0 million, excluding stock based compensation expense. The weighted average number of diluted shares outstanding in the fourth quarter 2007 will be impacted by the initial public offering that closed on November 14, 2007.

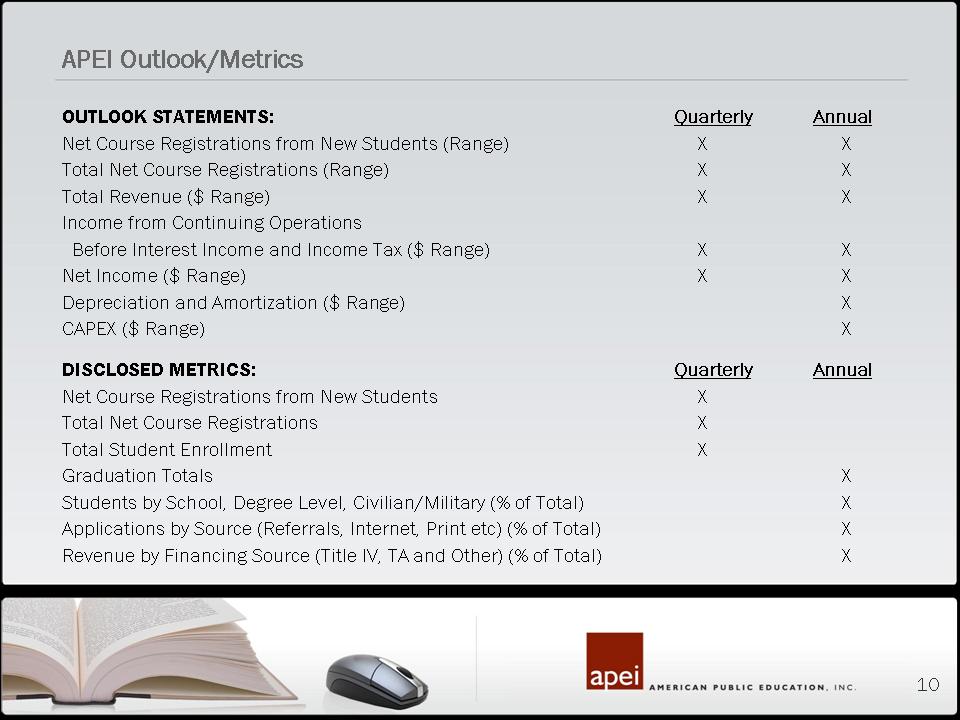

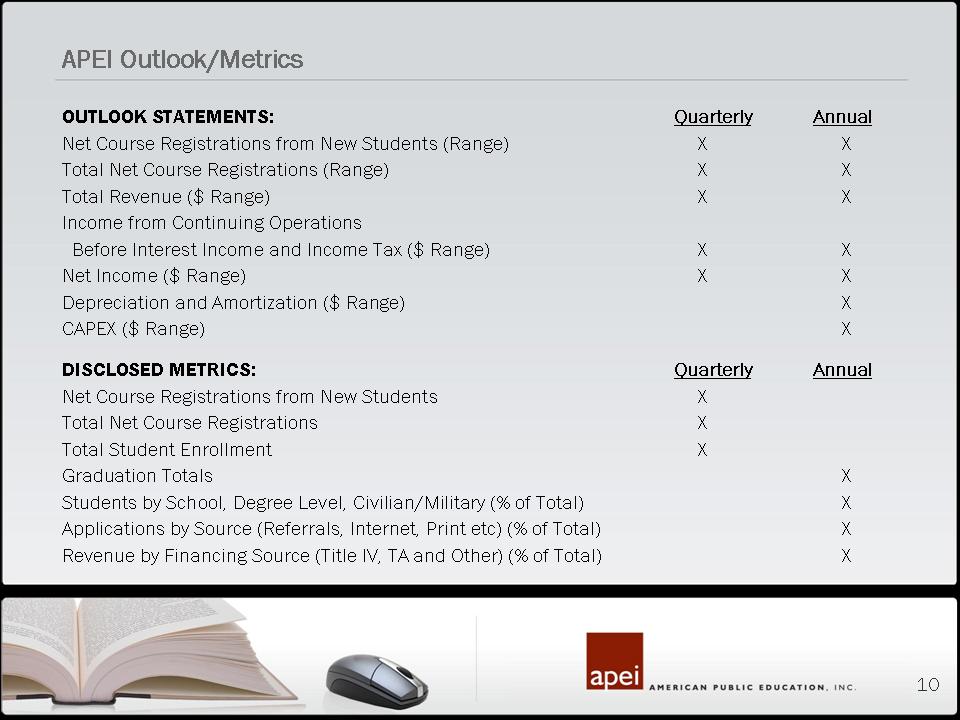

10 OUTLOOK STATEMENTS: Quarterly Annual Net Course Registrations from New Students (Range) X X Total Net Course Registrations (Range) X X Total Revenue ($ Range) X X Income from Continuing Operations Before Interest Income and Income Tax ($ Range) X X Net Income ($ Range) X X Depreciation and Amortization ($ Range) X CAPEX ($ Range) X DISCLOSED METRICS: Quarterly Annual Net Course Registrations from New Students X Total Net Course Registrations X Total Student Enrollment X Graduation Totals X Students by School, Degree Level, Civilian/Military (% of Total) X Applications by Source (Referrals, Internet, Print etc) (% of Total) X Revenue by Financing Source (Title IV, TA and Other) (% of Total) X APEI Outlook/Metrics

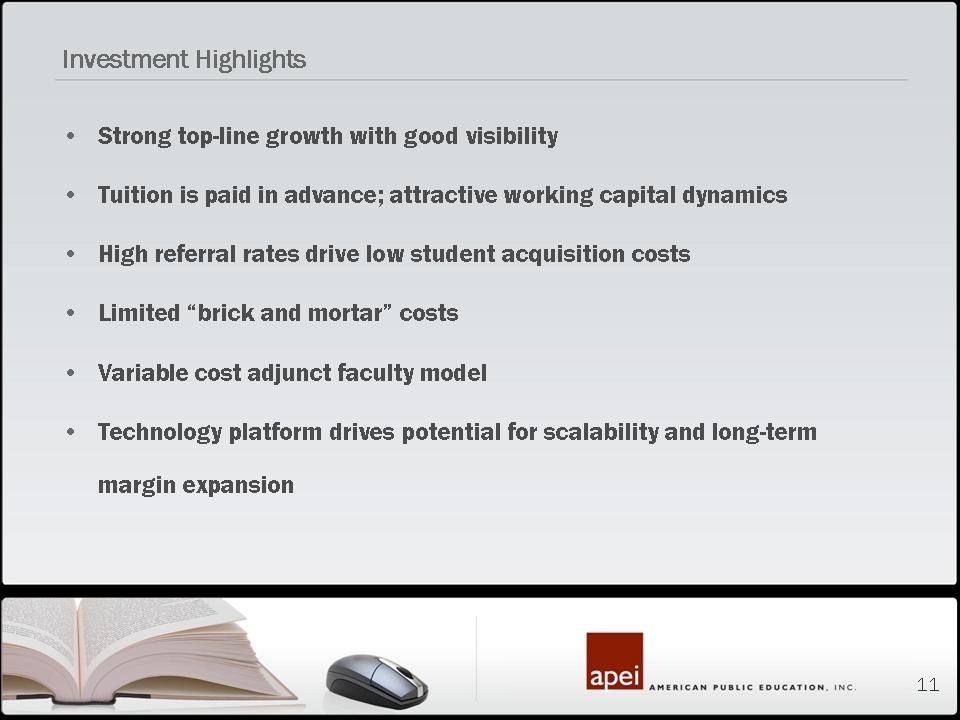

11 Strong top-line growth with good visibility Tuition is paid in advance; attractive working capital dynamics High referral rates drive low student acquisition costs Limited “brick and mortar” costs Variable cost adjunct faculty model Technology platform drives potential for scalability and long-term margin expansion Investment Highlights

12 Proprietary - Not for duplication