Exhibit 99.2

Advancing Online Higher Education A M E R I C A N P U B L I C E D U C A T I O N , I N C. Second Quarter 2010 Investor Call

2 Safe Harbor Statement Statements made in this presentation regarding American Public Education, or its subsidiaries, that are not historical facts are forward-looking statements based on current expectations, assumptions, estimates and projections about American Public Education and the industry. These forward-looking statements are subject to risks and uncertainties that could cause actual future events or results to differ materially from such statements. Forward-looking statements can be identified by words such as "anticipate", "believe", "could", "estimate", "expect“, "intend", "may", "should“, "will" and "would". These forward-looking statements include, without limitation, statements on slides “Advancing Our Current Strategic Plan” and “Third Quarter Outlook”, as well as statements regarding expected growth. Actual results could differ materially from those expressed or implied by these forward-looking statements as a result of various factors, including the various risks described in the "Risk Factors" section and elsewhere in the Company’s Annual Report on Form 10-K for the year ended December 31, 2009 as filed with the SEC, and in the Company’s other filings with the SEC. The Company undertakes no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

3 Recent Highlights & Academic Accolades Student enrollment increased 35% to 72,300 students as of June 30, 2010 Net course registrations increased 34% Net course registrations from new students increased 24% Revenue and earnings growth in second quarter 2010 Revenues increased 30% to $46.3 million Operating income increased 34% to $11.7 million Net income increased 32% to $7.0 million, or $0.37 per diluted share Increasingly Recognized for Academic Excellence APUS awarded an Effective Practice Award by Sloan-C for research on Semantic Mapping of Learning Assets Dr. Gwendolyn M. Hall, Dean of Security and Global Studies, has been appointed as a member of the U.S. Department of Defense Threat Reduction Advisory Committee (TRAC) Dr. Phil Ice, Director of Course Design, Research & Development, is one of four academic leaders worldwide elected to Adobe’s Higher Education Leaders Advisory Board

4 Advancing Our Current Strategic Plan Decline in Military Course Registrations Impacting AMU; Likely from Level of Deployments and Activity. The Company is uncertain of the total impact. Company anticipates third quarter 2010 net course registrations to increase between 20% and 22% year over year. As a result, APUS intends to accelerate its existing strategic plans to address civilian markets. Increase civilian outreach with existing marketing model Expand PR efforts/branding APU in civilian communities Enhance successful outreach to Veterans and other military-affiliated audiences Engage political influencers and academic audiences Provide high academic quality and customer satisfaction Continue improving retention rates and driving higher customer satisfaction Implement new, state-of-the-art learning management system (LMS) Launch new degree programs and specializations in 4Q2010/1Q2011 The above statements are based on current expectations. These statements are forward-looking and actual results may differ materially.

5 Financial Overview

6 Increased Operating Efficiency Three Months Six Months Ended June 30, 2010 2009 Ended June 30, 2010 2009 Revenues 100.0 % 100.0 % 100.0 % 100.0 % Costs and expenses: Instructional costs and services 37.6 40.2 37.8 39.4 Selling and promotional 17.6 14.4 16.3 13.8 General and administrative 16.1 16.9 16.1 17.6 Depreciation and amortization 3.4 3.8 3.2 3.8 Total costs and expenses 74.7 75.3 73.4 74.6 Income from operations before interest income and income taxes 25.3 24.7 26.6 25.4 Interest income, net 0.1 0.0 0.1 0.1 Income from operations before income taxes 25.4 24.7 26.7 25.5 Income tax expense 10.3 9.8 11.0 10.2 Net Income 15.1 % 14.9 % 15.7 % 15.3 %

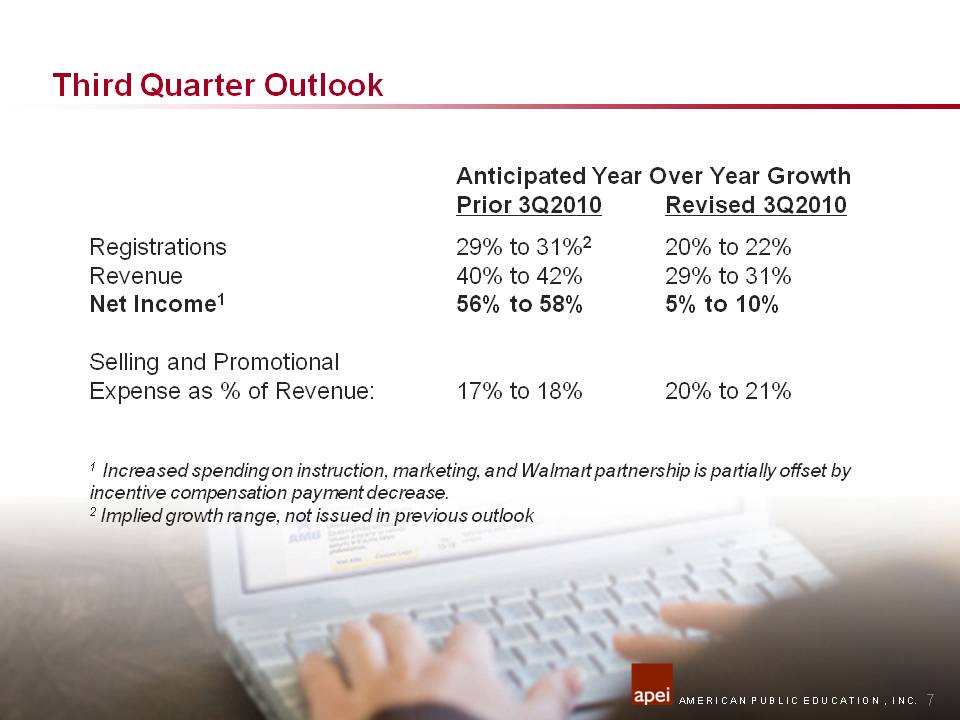

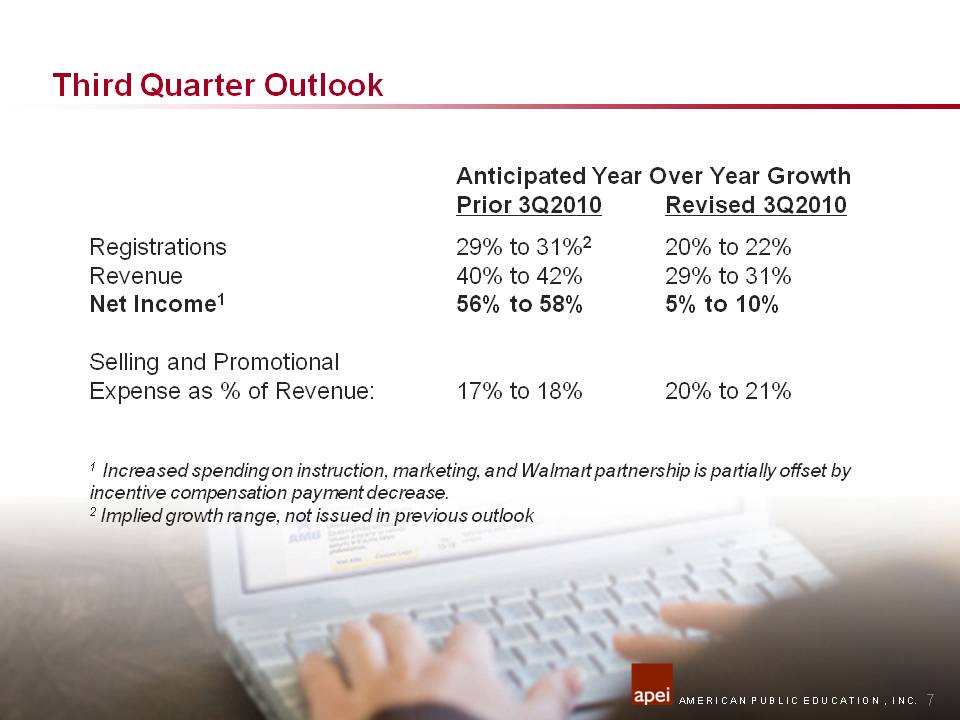

7 Third Quarter Outlook Anticipated Year Over Year Growth Prior 3Q2010 Revised 3Q2010 Registrations 29% to 31%2 20% to 22% Revenue 40% to 42% 29% to 31% Net Income1 56% to 58% 5% to 10% Selling and Promotional Expense as % of Revenue: 17% to 18% 20% to 21% 1 Increased spending on instruction, marketing, and Walmart partnership is partially offset by incentive compensation payment decrease. 2 Implied growth range, not issued in previous outlook

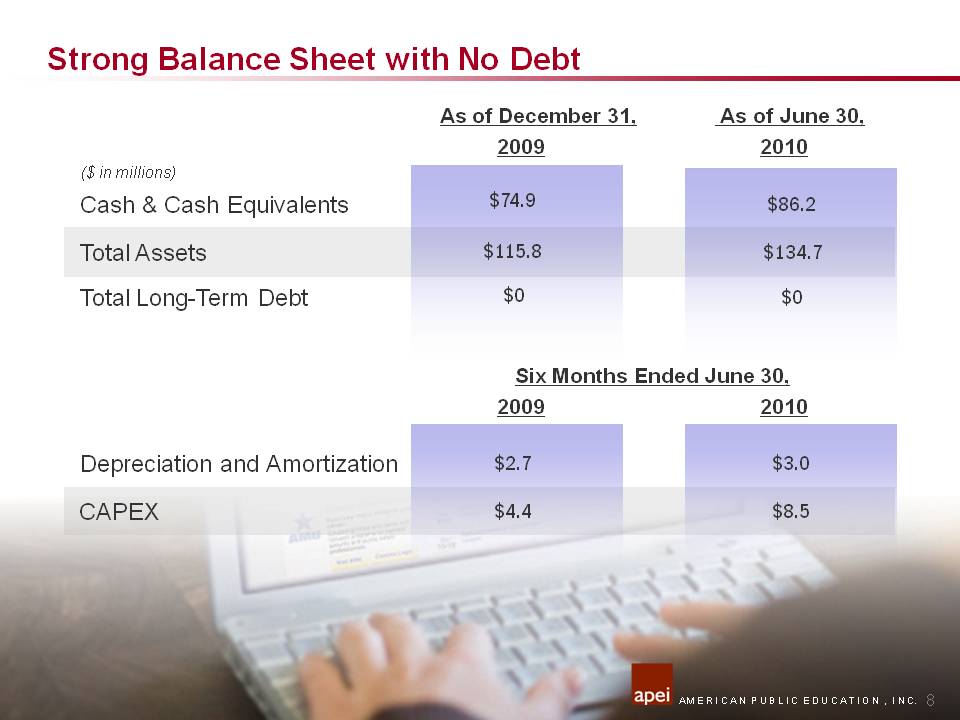

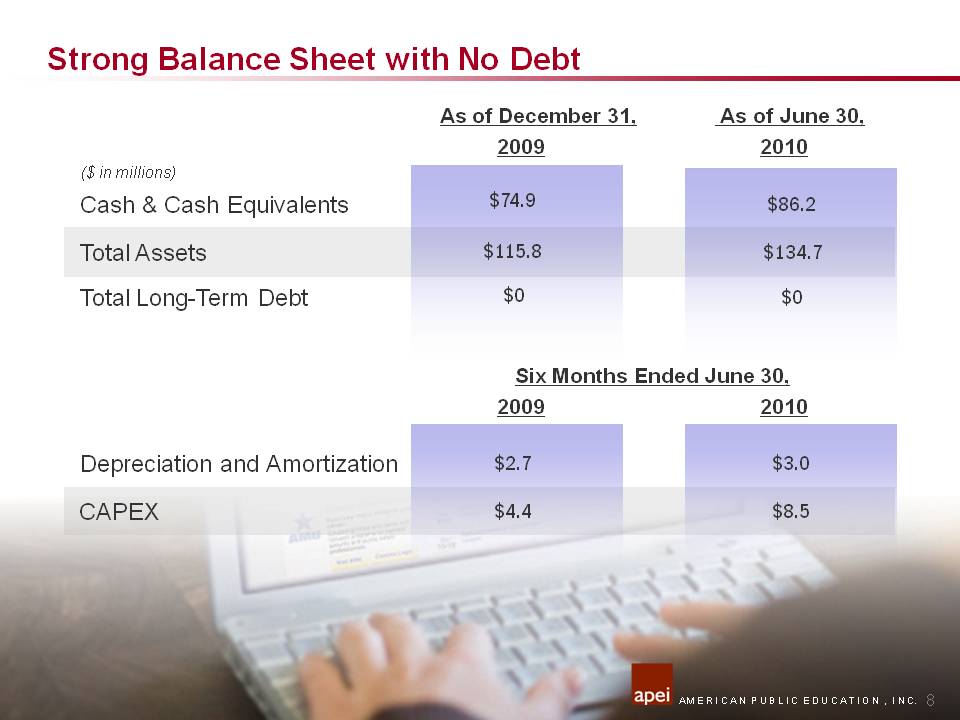

8 Strong Balance Sheet with No Debt As of December 31, 2010 As of June 30, 2010 ($ in millions) Cash & Cash Equivalents Total Assets Total Long-Term Debt $74.9 $115.8 $0 $86.2 $134.7 $0 Six Months Ended June 30, 2009 2010 Depreciation and Amortization CAPEX $2.7 $4.4 $3.0 $8.5

9 Additional Highlights Board of Directors authorized $20 million share repurchase program Open market trades, including ability to use a 10b5-1 plan Intended to result in no fewer than 18.0 million shares outstanding Recertification application for Title IV participation has been approved, removing APUS from provisional status

10 Advancing Online Higher Education A M E R I C A N P U B L I C E D U C A T I O N , I N C. Second Quarter 2010 Investor Call