UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| x | Quarterly report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended March 31, 2007.

or

| ¨ | Transition report pursuant to section 13 or 15(d) of the Securities Exchange act of 1934 |

For the transition period from to

Commission File No. 0-50072

Energytec, Inc.

(Exact name of registrant as specified in its charter)

| | |

| Nevada | | 75-2835634 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

4965 Preston Park Blvd., Suite 270 E Plano, Texas 75093

(Address of principal executive offices and Zip Code)

(972) 985-6715

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days, (3) is not a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark whether the registrant is a shell company (as described in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 69,851,545 shares of common stock as of May 11, 2007.

TABLE OF CONTENTS

2

ENERGYTEC, INC.

AND SUBSIDIARIES

Consolidated Balance Sheets

March 31, 2007 (Unaudited) and December 31, 2006

ASSETS

| | | | | | |

| | | March 31, 2007 | | December 31, 2006 |

| | | (Unaudited) | | |

CURRENT ASSETS | | | | | | |

Cash and cash equivalents | | $ | 174,531 | | $ | 532,925 |

Accounts receivable, revenue | | | 499,935 | | | 598,322 |

Accounts receivable, joint interests | | | 1,375,000 | | | 1,375,000 |

Accounts receivable, other | | | 209,010 | | | 388,948 |

Refundable income taxes | | | 1,669,541 | | | 1,669,541 |

Prepaid expenses | | | 187,445 | | | 112,746 |

| | | | | | |

| | |

TOTAL CURRENT ASSETS | | | 4,115,462 | | | 4,677,482 |

| | | | | | |

| | |

PROPERTY AND EQUIPMENT | | | | | | |

Oil and gas properties, successful efforts | | | 30,916,482 | | | 30,875,159 |

Oil and gas properties, available for sale | | | 1,050,000 | | | 1,050,000 |

Gas pipeline | | | 1,640,238 | | | 1,640,238 |

Oil and gas supplies | | | 344,270 | | | 344,270 |

Well service and related equipment | | | 4,376,369 | | | 4,468,262 |

| | | | | | |

| | | 38,327,359 | | | 38,377,929 |

| | |

Less accumulated depreciation, depletion and amortization | | | 2,336,794 | | | 2,173,695 |

| | | | | | |

| | |

NET PROPERTY AND EQUIPMENT | | | 35,990,565 | | | 36,204,234 |

| | | | | | |

| | |

OTHER ASSETS | | | | | | |

Railroad commission bond | | | 250,000 | | | 250,000 |

Loan origination fee, net of amortization of $19,731 and $16,448, respectively | | | — | | | 3,288 |

Deposits | | | 9,150 | | | 13,977 |

Deferred tax asset, net of valuation allowance of $1,802,607 and $1,457,459, respectively | | | — | | | — |

Long-term receivables, joint interests, net of allowance of $7,500,000 | | | 1,503,496 | | | 1,133,840 |

| | | | | | |

| | |

TOTAL OTHER ASSETS | | | 1,762,646 | | | 1,401,105 |

| | | | | | |

| | $ | 41,868,673 | | $ | 42,282,821 |

| | | | | | |

(Continued)

3

ENERGYTEC, INC.

AND SUBSIDIARIES

Consolidated Balance Sheets(Continued)

March 31, 2007 (Unaudited) and December 31, 2006

LIABILITIES AND SHAREHOLDERS’ EQUITY

| | | | | | | | |

| | | March 31, 2007 | | | December 31, 2006 | |

| | | (Unaudited) | | | | |

CURRENT LIABILITIES | | | | | | | | |

Accounts payable and accrued expenses | | $ | 3,268,006 | | | $ | 3,163,215 | |

Accounts payable, revenue | | | 2,417,073 | | | | 1,862,533 | |

Turnkey costs payable | | | 1,800,004 | | | | 1,800,004 | |

Prepaid drilling program | | | 4,057,429 | | | | 4,057,429 | |

Other current liabilities | | | 1,305,453 | | | | 1,305,453 | |

Debenture bonds | | | 125,000 | | | | 125,000 | |

Notes payable, current maturities | | | 1,660,775 | | | | 1,428,815 | |

| | | | | | | | |

| | |

TOTAL CURRENT LIABILITIES | | | 14,633,740 | | | | 13,742,449 | |

| | | | | | | | |

| | |

LONG-TERM LIABILITIES | | | | | | | | |

Notes payable, net of current maturities | | | 3,242,209 | | | | 3,633,072 | |

Asset retirement obligations | | | 2,069,755 | | | | 1,997,520 | |

Deferred federal income taxes | | | — | | | | — | |

| | | | | | | | |

| | |

TOTAL LONG-TERM LIABILITIES | | | 5,311,964 | | | | 5,630,592 | |

| | | | | | | | |

| | |

TOTAL LIABILITIES | | | 19,945,704 | | | | 19,373,041 | |

| | | | | | | | |

| | |

COMMITMENTS AND CONTINGENCIES | | | | | | | | |

| | |

SHAREHOLDERS’ EQUITY | | | | | | | | |

Preferred stock (10,000,000 shares authorized, none issued and outstanding, $.001 par) | | | — | | | | — | |

Common stock (90,000,000 shares authorized, 69,795,542 issued and 69,795,542, outstanding and 69,777,125 issued and 69,777,125 outstanding, respectively, $.001 par) | | | 69,797 | | | | 69,779 | |

Additional paid-in capital | | | 35,322,720 | | | | 35,285,905 | |

Retained deficit | | | (13,469,548 | ) | | | (12,445,904 | ) |

| | | | | | | | |

| | |

TOTAL SHAREHOLDERS’ EQUITY | | | 21,922,969 | | | | 22,909,780 | |

| | | | | | | | |

| | $ | 41,868,673 | | | $ | 42,282,821 | |

| | | | | | | | |

The accompanying notes are an integral part

of these consolidated financial statements.

4

ENERGYTEC, INC.

AND SUBSIDIARIES

Unaudited Consolidated Statements of Operations

For the Three Months Ended March 31, 2007 and 2006 (Unaudited)

| | | | | | | | |

| | | Three Months Ended | |

| | | 2007 | | | 2006 | |

REVENUES | | | | | | | | |

Oil and gas revenue | | $ | 687,348 | | | $ | 1,208,824 | |

Well service revenue | | | 552,416 | | | | 1,177,878 | |

Gas sales | | | 406,989 | | | | 709,990 | |

Drilling revenue | | | — | | | | — | |

Miscellaneous income | | | 53,855 | | | | 3,650 | |

| | | | | | | | |

| | |

TOTAL REVENUES | | | 1,700,608 | | | | 3,100,342 | |

| | | | | | | | |

EXPENSES | | | | | | | | |

Oil and gas lease operating expenses | | | 422,390 | | | | 414,503 | |

Well service expenses | | | 874,604 | | | | 1,981,047 | |

Gas purchases | | | 396,207 | | | | 701,516 | |

Drilling expenses | | | — | | | | — | |

Oil and gas supply expenses | | | — | | | | 30,317 | |

Depreciation, depletion and amortization | | | 259,790 | | | | 256,568 | |

Impairment of long-lived assets | | | — | | | | — | |

Environmental remediation | | | — | | | | 109,854 | |

Interest expense | | | 107,878 | | | | 36,495 | |

General and administrative expenses | | | 644,925 | | | | 792,426 | |

| | | | | | | | |

| | |

TOTAL EXPENSES | | | 2,705,794 | | | | 4,322,726 | |

| | | | | | | | |

| | |

(LOSS) INCOME FROM OPERATIONS | | | (1,005,186 | ) | | | (1,222,384 | ) |

| | | | | | | | |

| | |

OTHER INCOME (EXPENSE) | | | | | | | | |

Interest income | | | 335 | | | | 2,892 | |

Loss on disposition of assets | | | (18,793 | ) | | | — | |

| | | | | | | | |

| | |

TOTAL OTHER INCOME (EXPENSE) | | | (18,458 | ) | | | 2,892 | |

| | | | | | | | |

| | |

(LOSS) INCOME BEFORE PROVISION | | | | | | | | |

(BENEFIT) FOR INCOME TAXES | | | (1,023,644 | ) | | | (1,219,492 | ) |

| | |

(BENEFIT) PROVISION FOR INCOME TAXES | | | — | | | | (426,822 | ) |

| | | | | | | | |

| | |

NET (LOSS) INCOME | | $ | (1,023,644 | ) | | $ | (792,670 | ) |

| | | | | | | | |

| | |

LOSS PER SHARE | | | | | | | | |

Basic | | $ | (0.01 | ) | | $ | (0.01 | ) |

| | | | | | | | |

Diluted | | $ | (0.01 | ) | | $ | (0.01 | ) |

| | | | | | | | |

| | |

WEIGHTED AVERAGE SHARES | | | | | | | | |

OUTSTANDING | | | 69,780,195 | | | | 69,651,476 | |

| | | | | | | | |

The accompanying notes are an integral part

of these consolidated financial statements.

5

ENERGYTEC, INC.

AND SUBSIDIARIES

Consolidated Statements of Changes in Shareholders’ Equity

For the Year Ended December 31, 2006, and Three Months Ended March 31, 2007 (Unaudited)

| | | | | | | | | | | | | | | | | | | |

| | | Number of Common Shares | | | Common Stock $.001 Par Value | | | Additional Paid-In Capital | | | Retained Deficit | | | Total | |

BALANCE, December 31, 2005 | | 69,648,406 | | | $ | 69,650 | | | $ | 35,094,768 | | | $ | (1,745,467 | ) | | $ | 33,418,951 | |

| | | | | |

Capital stock issued for services | | 75,000 | | | | 75 | | | | 94,925 | | | | — | | | | 95,000 | |

Capital stock issued under stock compensation plan | | 73,333 | | | | 73 | | | | 156,838 | | | | — | | | | 156,911 | |

Cancellation of stock dividend | | (19,614 | ) | | | (19 | ) | | | (60,626 | ) | | | 60,645 | | | | — | |

Net loss | | — | | | | — | | | | — | | | | (10,761,082 | ) | | | (10,761,082 | ) |

| | | | | | | | | | | | | | | | | | | |

BALANCE, December 31, 2006 | | 69,777,125 | | | | 69,779 | | | | 35,285,905 | | | | (12,445,904 | ) | | | 22,909,780 | |

| | | | | |

Capital stock issued under stock compensation plan | | 18,417 | | | | 18 | | | | 36,815 | | | | | | | | 36,833 | |

Net loss | | | | | | | | | | | | | | (1,023,644 | ) | | | (1,023,644 | ) |

| | | | | | | | | | | | | | | | | | | |

BALANCE, March 31, 2007 | | 69,795,542 | | | $ | 69,797 | | | $ | 35,322,720 | | | $ | (13,469,548 | ) | | $ | 21,922,969 | |

| | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part

of these consolidated financial statements.

6

ENERGYTEC, INC.

AND SUBSIDIARIES

Consolidated Statements of Cash Flows

For the Three Months Ended March 31, 2007 and 2006 (Unaudited)

| | | | | | | | |

| | | 2007 | | | 2006 | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | |

Net (loss) income | | $ | (1,023,644 | ) | | $ | (792,670 | ) |

Adjustments to reconcile net (loss) income to net cash provided by (used in) operating activities | | | | | | | | |

Acquisition of Railroad Commission Bond | | | — | | | | (250,000 | ) |

Capital stock issued under stock compensation plan | | | 36,833 | | | | 36,834 | |

Loss on disposition of assets | | | 18,793 | | | | — | |

Depreciation, depletion and amortization | | | 259,790 | | | | 212,659 | |

Changes in operating assets and liabilities | | | | | | | | |

Accounts receivable, revenue | | | 98,387 | | | | (59,038 | ) |

Accounts receivable, programs | | | — | | | | 596,700 | |

Accounts receivable, other | | | 179,938 | | | | (57,859 | ) |

Deposits | | | 4,826 | | | | — | |

Accrued interest, related party | | | — | | | | (1,125 | ) |

Prepaid expenses and other current assets | | | (74,699 | ) | | | (168,850 | ) |

Accounts payable and accrued expenses | | | 104,793 | | | | (104,178 | ) |

Accounts payable, revenue | | | 554,540 | | | | (304,060 | ) |

Turnkey costs payable | | | — | | | | (1,204,583 | ) |

Other current liabilities | | | — | | | | 958,024 | |

Deferred federal income taxes | | | — | | | | (426,822 | ) |

| | | | | | | | |

Net cash flows provided by (used in) operating activities | | | 159,557 | | | | (1,564,968 | ) |

| | | | | | | | |

| | |

CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

Purchases of property and equipment | | | (63,491 | ) | | | (2,435,446 | ) |

Proceeds from sale of assets | | | 74,100 | | | | — | |

Advance revenue payments | | | (369,656 | ) | | | (2,110,004 | ) |

| | | | | | | | |

Net cash flows used in investing activities | | | (359,047 | ) | | | (4,545,450 | ) |

| | | | | | | | |

| | |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

Payments on notes payable | | | (249,167 | ) | | | (123,047 | ) |

Proceeds provided from borrowings on notes payable | | | 90,263 | | | | 99,825 | |

Proceeds provided from draws on line of credit | | | — | | | | 2,980,269 | |

Payments on line of credit | | | — | | | | (80,000 | ) |

| | | | | | | | |

Net cash flows (used in) provided by financing activities | | | (158,904 | ) | | | 2,877,047 | |

| | | | | | | | |

| | |

NET DECREASE IN CASH | | | (358,394 | ) | | | (3,233,371 | ) |

| | |

CASH, beginning | | | 532,925 | | | | 4,037,284 | |

| | | | | | | | |

| | |

CASH, ending | | $ | 174,531 | | | $ | 803,913 | |

| | | | | | | | |

(Continued)

7

ENERGYTEC, INC.

AND SUBSIDIARIES

Consolidated Statements of Cash Flows(Continued)

For the Three Months Ended March 31, 2007 and 2006 (Unaudited)

| | | | | | |

| | | 2007 | | 2006 |

SUPPLEMENTAL DISCLOSURE OF CASH FLOWS | | | | | | |

Cash paid for interest | | $ | 107,878 | | $ | 36,495 |

| | | | | | |

Cash paid for income taxes | | $ | — | | $ | — |

| | | | | | |

| | |

SUPPLEMENTAL DISCLOSURE OF NONCASH | | | | | | |

INVESTING AND FINANCING ACTIVITIES | | | | | | |

Assets acquired through issuance of notes payable | | $ | — | | $ | 91,219 |

| | | | | | |

Loan origination fee taken from draw on line of credit | | $ | — | | $ | 19,731 |

| | | | | | |

The accompanying notes are an integral part

of these consolidated financial statements.

8

ENERGYTEC, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – (Unaudited)

1. BASIS OF PRESENTATION

These condensed consolidated financial statements are unaudited but, in the opinion of management, reflect all adjustments necessary for a fair presentation of the results for the periods reported. All such adjustments are of a normal recurring nature unless disclosed otherwise. These financial statements, including selected notes, have been prepared in accordance with the applicable rules of the Securities and Exchange Commission and do not include all of the information and disclosures required by accounting principles generally accepted in the United States of America for complete financial statements. Certain reclassifications of prior year data have been made to conform to 2007 classifications. These interim financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in our annual report filed on Form 10-K with the Securities and Exchange Commission April 17, 2007. The Company’s exploration and production activities are accounted for under the “successful efforts” method.

2. LOSS PER SHARE

Basic earnings (loss) per share amounts are computed by dividing net income (loss) available to common stockholders by the weighted average number of common stock shares outstanding during the periods. Diluted earnings (loss) per share amounts take into consideration all potentially dilutive common shares such as options and convertible securities.

For basic earnings (loss) per share purposes, for the three months ended March 31, 2007 and 2006, weighted average common stock shares outstanding totaled 69,780,195 and 69,651,476, respectively. Net income (loss) for diluted earnings per share purposes includes the add back of the interest savings from the assumed conversion of notes and debentures, net of the related tax effects. For the three months ended March 31, 2006, potentially dilutive securities are excluded from the computation as their effect is anti-dilutive. There were no potentially dilutive securities outstanding at March 31, 2007.

3. ASSET RETIREMENT OBLIGATIONS

Effective January 1, 2003, the Company adopted SFAS No. 143, “Accounting for Asset Retirement Obligations”. Pursuant to this accounting standard, the Company recognized a reduction in net liabilities at December 31, 2006, of $254,944 for asset retirement obligations related to the future costs of plugging and abandoning its oil and gas properties, the removal of equipment and facilities from lease acreage and returning such land to its original condition. These costs reflect the legal obligations associated with the normal operation of oil and gas properties and were capitalized by increasing the carrying amounts of the related long-lived assets by the fair value of these obligations, discounted to their present value. The changes in the carrying amount of the Company’s asset retirement obligations for the three months ended March 31, 2007 and year ended December 31, 2006, are as follows.

| | | | | | | |

| | | 2007 | | 2006 | |

Balance at beginning of period | | $ | 1,997,520 | | $ | 2,252,464 | |

| | |

Accretion expense | | | 72,235 | | | 164,127 | |

| | |

Dispositions | | | — | | | (458,600 | ) |

| | |

Payments | | | — | | | (681,310 | ) |

| | |

Liabilities incurred | | | — | | | 720,839 | |

| | | | | | | |

Balance at end of period | | $ | 2,069,755 | | $ | 1,997,520 | |

| | | | | | | |

Accretion expense of $72,235 and $164,127 is included in “Depreciation, depletion, and amortization” in the accompanying consolidated statements of operations.

9

4. BORROWINGS

The Company’s borrowings consist of two notes payable to banks totaling $4,376,988 and a letter of credit of $25,000, which secures a bond on the Company’s Wyoming properties, two vehicle loans totaling $54,482, an insurance financing agreement for $90,263, a settlement agreement on final costs of restoration and remediation totaling $356,250, and debenture notes totaling $125,000. None of these borrowings contain any significant debt covenants or restrictions on dividend payments. The letter of credit bears interest at 7.5% and IS due along with all accrued interest on September 10, 2007.

The vehicle loans are due in monthly installments of $1,272 and $1,262 through March 31, 2009, and bear no interest. During March 2007, the Company renewed its general liability insurance and entered into a financing agreement which bears interest at 8.5% per annum and is due in monthly installments of $10,388 per month through December 24, 2007.

The note payable to the bank bears interest at 8% and is payable in monthly installments of $35,312 of principal plus interest. The loan is collateralized by accounts receivable and by various oil and gas properties or other equipment and matures April 2008. The balance at March 31, 2007, was $448,023.

On February 27, 2007, the Company renewed its loan with Gladewater National Bank, with an outstanding balance of $4,000,000, as a 48 month term loan due February 27, 2011 at prime plus 1.5%. The monthly payments will fluctuate as the prime rate fluctuates. The balance outstanding at March 31, 2007, was $3,928,965.

This loan is collateralized by the Company’s mineral interest in the Quitman Field. During the term of the loan, the bank will periodically re-evaluate the value of the properties pledged to secure the loan to determine compliance with the loan borrowing base which equals 80% of the present worth of the properties pledged, as calculated by the bank, discounted 17.5%, or 80% of the average of the preceding six months’ net monthly income times 32 months, whichever is less. If the loan exceeds the borrowing base as calculated, the Company will have 30 days to pledge additional collateral or make a principal reduction on the loan. In connection with the loan, the Company can make no additional loans to officers of the Company, or from the date of the loan agreement, may not increase the salary of any officer by more than 10% annually. Additionally, the Company may not form any new subsidiary or merge or invest in or consolidate with any other entity or sell, lease, assign, transfer, or otherwise dispose of all or substantially all of the Company’s assets pledged as collateral on the loan.

On October 19, 2006, the Company agreed to a proposed settlement of the final costs of remediation and restoration related to a November 2004 oil spill. The terms of the proposed settlement call for twenty-four equal installments of $18,750 beginning November 20, 2006. The agreement bears no interest and is not collateralized. In case of default, the Company has ten days to cure the default. Should the Company fail to make and cure three payments and those payments are outstanding at any time, the Company is subject to an accelerated judgment and the creditor could then proceed against whatever non-exempt assets are owned by the Company.

Future maturities required under the terms of the above debt are as follows:

| | | |

Year Ending Amount | | March 31, |

2008 | | $ | 1,660,775 |

2009 | | | 1,134,316 |

2010 | | | 1,052,070 |

2011 | | | 1,055,822 |

| | | |

| | $ | 4,902,983 |

| | | |

In June 2003, the Company issued debenture notes to various individuals. The notes bear interest at 8.0%, are unsecured and mature in 2008. Interest is payable monthly in arrears on or before the 15th. of each month. Additional interest equal to .5% or 1% of the principal amount is payable to the holder if the average mcf price of gas does not fall within given ranges for each six month measurement period. The debentures are convertible at the holders’ option into the Company’s common stock shares at a conversion price of $2.00 per share. Due to the conversion option, these debenture notes are treated as current liabilities.

10

5. INCOME TAXES

The Company accounts for income taxes pursuant to SFAS No. 109, ‘Accounting for Income Taxes”, which requires the establishment of deferred tax assets and liabilities for the recognition of future deductions or taxable amounts and operating loss and tax credit carry forwards. Deferred federal income tax expense or benefit is recognized as a result of the change in the deferred tax asset or liability during the year using the currently enacted tax laws and rates that apply to the period in which they are expected to affect taxable income. Valuation allowances are established, if necessary, to reduce deferred tax assets to the amounts that will more likely than not be realized.

The Company’s provision for income taxes reflects the federal income taxes calculated at the statutory rates and state taxes calculated at the statutory rates net of any federal income tax benefit. The Company’s statutory rate and effective tax rate are approximately 35%. A reconciliation of income tax expense at the statutory federal and state income tax rates to income tax expense at the Company’s effective tax rate for the three months ended March 31, 2007 and 2006 is as follows:

| | | | | | | |

| | | Three Months Ended March 31, |

| | | 2007 | | | 2006 |

Income tax, benefit statutory rates | | $ | 358,276 | | | $ | 426,822 |

Valuation allowance | | | (358,276 | ) | | | — |

State taxes, net | | | — | | | | — |

| | | | | | | |

Benefit of income taxes | | $ | — | | | $ | 426,822 |

| | | | | | | |

The provision for federal income tax included both current and deferred taxes for the three months ended March 31, 2007, and 2006, as follows:

| | | | | | | | |

| | | 2007 | | | 2006 | |

Current income tax benefit (expense) | | $ | 371,404 | | | $ | 746,203 | |

Deferred income tax benefit (expense) | | | (13,128 | ) | | | (319,381 | ) |

| | | | | | | | |

Income tax benefit (expense) at statutory rates | | $ | 358,276 | | | $ | 426,822 | |

| | | | | | | | |

The following temporary differences gave rise to the deferred tax asset and liability at:

| | | | | | | | |

| | | March 31, 2007 | | | December 31,

2006 | |

Deferred tax asset: | | | | | | | | |

Balance, January 1 | | $ | 2,744,295 | | | $ | 440,028 | |

Valuation allowance | | | (345,148 | ) | | | (1,457,459 | ) |

Effect of impairment of long-lived assets not currently deductible | | | — | | | | — | |

Effect of current year net loss | | | 358,276 | | | | 3,761,726 | |

| | | | | | | | |

Net deferred tax asset | | | 2,757,423 | | | | 2,744,295 | |

| | | | | | | | |

Deferred tax liability: | | | | | | | | |

Balance, January 1 | | | 2,744,295 | | | | 2,322,671 | |

Effect of intangible drilling costs expensed for tax purposes which were capitalized for financial statement purposes | | | 13,128 | | | | 421,624 | |

| | | | | | | | |

Gross deferred tax liability | | | 2,757,423 | | | | 2,744,295 | |

| | | | | | | | |

Net deferred tax liability | | $ | — | | | $ | — | |

| | | | | | | | |

11

The deferred tax asset arises from impairment recognized for financial statement purposes, but not expensed for Federal tax purposes and the effect of net operating losses which will begin to expire in 2026. The deferred tax liability arises from intangible drilling costs deductible for tax purposes. These costs are capitalized and depleted over the life of the oil and gas reserves for financial statement purposes. At December 31, 2006 and March 31, 2007, a valuation allowance has been provided against the future realization of the net operating losses to the extent that they cannot be applied against the deferred tax liability.

6. COMMITMENTS AND CONTINGENCIES

Put Option

On February 7, 2007, Oil Is Fab & We Are Glad LLC, a New York limited liability company of which Amanda Petito is a managing member, and other individual plaintiffs filed a complaint against Energytec. In the complaint plaintiffs allege that they purchased common stock from Energytec in November 2005 at a price of $2.75 per share, at the time of purchase they were granted a contractual right to put the shares back to Energytec at a price of $3.75 per share in November 2006, they have exercised the put option, and they have not been paid the put price for the common stock in the amount of $5,799,015. On the basis of these allegations, plaintiffs claim Energytec has breached the put option contract and demand payment of $5,799,015. Alternatively, plaintiffs claim that at the time the stock was sold in 2005, Energytec made negligent misrepresentations with respect to payment of the put options and were damaged in the amount $4,252,611, which is the amount they paid for the common stock. In early March 2007, Energytec filed an answer to the complaint denying the substantive allegations and asserting that payment of the put options would be a violation of Nevada corporate law, that Frank W Cole acted without authority and in violation of law when he made the alleged put option agreements so they are void, and that unlawful commission and other payments made in connection with the sale of the shares of common stock render the alleged put option agreement unenforceable. Energytec also filed a third party complaint against Frank W Cole, persons who participated in sale of the common shares and received commission payments, and all other persons who tendered common stock to Energytec under the alleged put option. Against Cole and the commission recipients Energytec alleges they conspired in a scheme to package and unlawfully sell the shares and alleged put options. With respect to the holders of shares who tendered them under the alleged put option, Energytec seeks the same relief set forth in its answer to the original complaint. No initial trial date has been set, and we cannot predict when this matter may be resolved or what the potential outcome may be.

Legal Matters

The Company has filed various complaints and is the defendant in various actions as discussed in PART II. ITEM 1. LEGAL PROCEEDINGS.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

Overview

Energytec, Inc. was formed under the laws of the state of Nevada in July 1999. Energytec was formed for the purpose of engaging in oil and gas producing activities through the acquisition of oil and gas properties that have previously been the object of exploration or producing activity, but which are no longer producing or operating due to abandonment or neglect. The traditional focus of the Company has been the production of remaining recoverable hydrocarbons that can be developed through conventional and non-conventional improvement methods and production enhancement techniques. We own working interests in 60,701 acres of oil and gas leases in Texas and Wyoming. Our wholly owned subsidiary, Comanche Well Service Corporation, became the operator of all properties owned by Energytec on April 1, 2006, by posting a cash bond of $250,000 with the Texas Railroad Commission. During 2006 the Company extensively evaluated existing non-operational wells, determining the potential for placing those back on production. Options considered included joint ventures, farm-outs, or other partnering arrangements. Through this analysis process we have determined that any incremental production that could be realized from certain unprofitable fields and problematic wells may not justify the expenditures that would be necessary to realize such production. During 2007, we intend to continue the evaluation of fields and wells that show the potential for profitability through enhanced recovery methods and to evaluate opportunities beyond those associated with current oil and gas properties held by the Company.

12

We also own a gas pipeline of approximately 63 miles in Texas and a well service business operated through our subsidiary, Comanche Well Service Corporation, a drilling business operating through our subsidiary, Comanche Rig Services Corporation, and a sales and distribution business for enhanced oil recovery chemicals and materials related to well operation services through our subsidiary, Comanche Supply Corporation.

It is the opinion of management that the Company will need to expand its activities beyond its traditional focus and divest unprofitable properties in order to improve results of operations. In the Company’s annual report filed on April 17, 2007, under PART I. ITEM 1. BUSINESS we discussed our plan and approach to the business which addresses a diversification of the Company’s positions and opportunities for growth. The Company is faced with uncertainties related to litigation as discussed in PART II. ITEM 1. LEGAL PROCEEDINGS and related to contingencies, the outcome of which cannot be accurately predicted. But as we move forward with the evaluation and possible divestiture of unprofitable properties, our abilities to enter into new opportunities will come into focus more clearly and we should be able to attract potential joint ventures and strategic partner arrangements to implement plans for restructure and growth.

Regulatory Issues

In December 2005, the Company engaged an independent engineering firm to conduct a study of its reserves as of December 31, 2005. Pursuant to the reserve study it was determined that 23 wells were dually completed in non-permitted separately recognized reservoirs in the Talco/Trix-Liz Field without the proper permitting and spacing required by the Texas Railroad Commission (TRC). Additionally, commingling of production from permitted and non-permitted reservoirs resulted in the inability to assign reserves to either the permitted or non-permitted reservoirs causing the reserves to be substantially understated as of December 31, 2005.

During the year ended December 31, 2006, the Company resolved the commingling of production from the dually completed wells in the Trix/Liz Field by isolating the non-permitted zones in order to restore production to permitted zones. This isolation will allow the establishment of production from the legally permitted zones.

The Company also sought permits to establish production for additional reservoirs from these dually completed wells. The Company must comply with the appropriate field spacing rules which not only regulate amount of acreage, per producing reservoir, required for each well but also the space between producing wells. The previous management drilled and completed these wells without regard to securing the necessary permits for each producing reservoir and without regard to the applicable field spacing rules. The Company can petition to amend the field spacing rules in order to bring additional wells into compliance with the field spacing rules; however, this petition may not be granted to the extent necessary to return all of these dually completed wells back to production.

The Company must be in complete regulatory compliance in order to establish reserves for the leases in the Trix/Liz field. The Company has completed a significant amount of the regulatory compliance that was ignored by the previous management. At

13

December 31, 2006, the Company was in the final phase of compliance for two out of the four significant leases contained in the Trix/Liz Field. The Company expects to receive regulatory clearing by the end of the second quarter of 2007 in order to establish reserves for these two leases. On the remaining two leases, the Company is continuing efforts to obtain permission from an offset operator and complete regulatory filings in order to reestablish production

Results of Operations

Revenue

For the three months ended March 31, 2007, oil and gas revenue has decreased from $1,208,824, for the three months ended March 31, 2006, to $687,348, a 43% decrease. During the quarter ended March 31, 2006, the Company reflected the first full quarter of production from its Como field which was acquired in the fourth quarter of 2005. During 2006, production and oil and gas revenue reflected increases over 2005 due to the addition of this property. However, regulatory violations (as discussed above) resulting in lease severances in other fields resulted in declining production and revenues in those areas. The three months ending March 31, 2007 as compared to March 31, 2006, is the first period in which the production from the Como field is included for both years. The decline from 2006 to 2007 reflects the effect of the severances and reduced production in other fields. In addition to severances, production has declined primarily due to a lack of capital to fund even routine maintenance and workovers which exacerbates the declining revenues and has affected production across all fields. Additionally, the average oil price over the first three months of 2007 was approximately $10.71 per barrel lower than the comparable period in 2006. The following table shows the gross and net oil and gas production for each month in the three-month period ended March 31, 2007.

| | | | | | | | |

| | | Oil (Bbl) | | Gas (Mcf) |

Month in

2007 | | Gross | | Net | | Gross | | Net |

January | | 18,229 | | 6,399 | | 23,129 | | 3,038 |

| | | | |

February | | 13,505 | | 5,392 | | 13,193 | | 2,307 |

| | | | |

March | | 14,402 | | 4,886 | | 17,763 | | 3,824 |

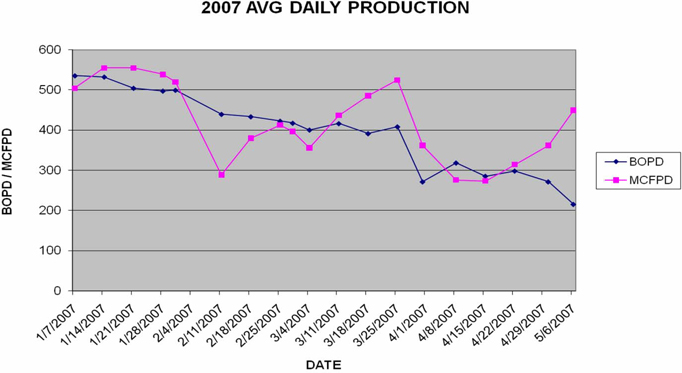

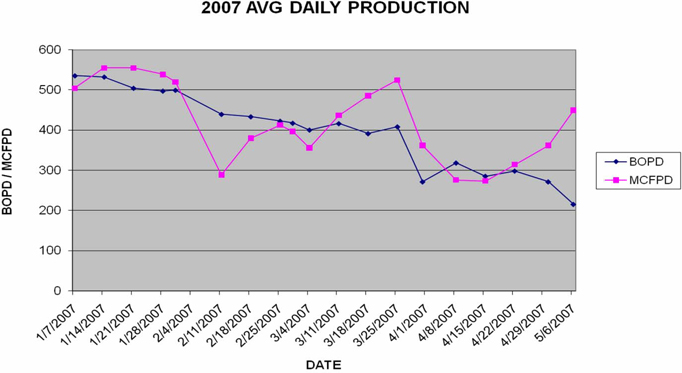

As we have evaluated the capabilities of various wells, we have found their production potential to be substantially less than estimated and reported by previous management. At the end of the first quarter of 2007, the Company was averaging slightly more than 400 BOPD and slightly more than 600 MDFPD. The following chart reflects the steady decline in the oil production and the sporadic gas production through May 6, 2007.

14

Well service activities have also slowed due to regulatory issues and capital needs. For the three months ended March 31, 2007, well service revenue decreased $625,462 from $1,177,878 for the same period of the prior year, a 53% decrease. There is a corresponding decrease in well service expenses due to the curtailment of activity and a workforce reduction. Through March 31, 2007, the number of employees was reduced to 68 full time production and support employees in Comanche Well Service Corporation. On April 10, 2007, the Company terminated approximately 20 non-essential field personnel, consisting primarily of mechanics and welders after an evaluation of the Company’s need for these services. For the year ended December 31, 2006, the growth in well services expenses was slowed significantly and management continues to evaluate the well service operations for opportunities to further curtail and/or recoup costs. For the period ended March 31, 2006, the Company incurred a loss on well service activities of approximately $803,000. For the same period in 2007, the loss from well service activities has been reduced to approximately $322,000.

For the three months ended March 31, 2007, gas sales decreased by 43%, to $406,989 from $709,990 from the same period in 2006. Gas purchases also decreased by 43% from $701,516 for the three months ended March 31, 2006 to $396,207 for the three months ended March 31, 2007. The net revenues for the three months March 31, 2007, were $10,782 and as compared to $8,474 for the same period in 2006.

Oil and gas expenses

For the three months ended March 31, 2007, the lease operating expenses have increased from $414,503 at March 31, 2006, to $422,390. This is an increase of 2%. Although the lease operating expenses are higher than the comparable period for the prior year, expenses are being captured and billed to all working interest owners in proportion to their ownership interests. During the three months ended March 31, 2007, the lifting costs per barrel averaged $7.27 for a total of $130,923. Lease operating expenses for the three months ended March 31, 2007 also include $291,558 of costs associated with non-producing wells. Lease operating expenses as compared to oil and gas revenues appear to be high due to the expenses on these non-producing wells, creating a high ratio of expense to revenue. Until additional wells are recompleted and brought onto production, the costs as a percentage of the revenue will continue to be higher than industry norms. Additionally, the costs of maintaining non-producing wells, until we can plug them in accordance with RRC requirements will inflate the lease operating expenses.

General and administrative

General and administrative expenses decreased 19% from $792,429 for the three months ended March 31, 2006, to $644,925 for the same period in 2007. Salaries and consulting fees decreased by approximately $56,000 and $76,000, respectively, from March 31, 2006 to the same period in 2007. Rent declined by approximately $41,000 over the same period. Legal and professional fees increased by approximately $23,000 from March 31, 2006 to March 31, 2007.

Liquidity and Capital Resources

As discussed in our quarterly filings with the Securities and Exchange Commission on Forms 10-Q for the periods ending March 31, 2006 and June 30, 2006, the availability of operating cash was severely impacted by the payment of $1,178,771 of commissions related to the 2005 sale of working interests and stock payments made to working interest owners during January and February of 2006, which exceeded actual revenues due to them by $1,853,979. Cash was further impacted by the payment of past due vendor invoices totaling approximately $1,150,000, which were accrued as of December 31, 2005. The payment of commissions and excess revenue distributions combined with payments for past due invoices and necessary capital expenditures severely impacted the operating cash available, resulting in a decline in cash from over $4,000,000 at December 31, 2005 to approximately $800,000 at March 31, 2006. The Company’s cash flow has not been able to recover from the effect of these transactions.

In order to meet continuing operational expenses and capital expenditures without further sales of working interests, the Company entered into a loan agreement with Gladewater National Bank for $4,000,000 on February 27, 2006. On February 27, 2007,

15

the Company renewed this loan with an outstanding balance of $4,000,000, as a 48 month term loan due February 27, 2011 at prime plus 1.5%. The monthly payments will fluctuate as the prime rate fluctuates. The balance outstanding at March 31, 2007, was $3,928,965.

This loan is collateralized by the Company’s mineral interest in the Como Field. During the term of the loan, the bank will periodically re-evaluate the value of the properties pledged to secure the loan to determine compliance with the loan borrowing base which equals 80% of the present worth of the properties pledged, as calculated by the bank, discounted 17.5%, or 80% of the average of the preceding six months’ net monthly income times 32 months, whichever is less. If the loan exceeds the borrowing base as calculated, the Company will have 30 days to pledge additional collateral or make a principal reduction on the loan. In connection with the loan, the Company can make no loans to officers of the Company, or from the date of the loan agreement, may not increase the salary of any officer by more than 10% annually. Additionally, the Company may not form any new subsidiary or merge or invest in or consolidate with any other entity or sell, lease, assign, transfer, or otherwise dispose of all or substantially all of the Company’s assets pledged as collateral on the loan.

This debt is subject to interest at 1.5% above the Wall Street Prime Rate and is susceptible to fluctuations. Through May 11, 2007, the Wall Street Prime Rate has ranged from a low of 7. 5% to a high of 8.25%. Production payments related to the properties collateralizing the loan are deposited directly with Gladewater National Bank. Any excess funds, after the monthly principal and interest payments are available for the general use of the Company.

Due to factors related to regulatory issues as discussed above and production levels, we did not drill any new wells or perform any workovers in the first quarter. Many of the wells which require remedial work are owned by non-operating owners who have purported working interests. The expenditures necessary to maintain, restore, or improve production from wells which are owned primarily by non-operating owners are substantial. Historically the Company has advanced these expenditures with the intention of recouping the advances for net lease operating and capital expenditures against revenue distributions. However, without capital to improve production and raise revenues from these wells, the Company cannot achieve collection of the advanced payments from production over a reasonable period of time. Non-operating owners have not paid their share of lease operating expenses and capital costs, which adversely affects working capital and deprives the Company of funds that could be used to maintain and improve production. Going forward the Company will implement procedures for collection of outstanding accounts receivable, joint interest, if such expenditures cannot be recaptured through revenues within sixty days of incurrence.

Capital Commitments The following table discloses aggregate information about our contractual obligations including notes payable and lease obligations, and the periods in which payments are due as of March 31, 2007:

| | | | | | | | | | | | | | | |

| | | | | Payments due by period |

| | | Total | | Less than 1 Year | | 1-3 Years | | 3-5 Years | | After 5 Years |

Long-term Debt | | $ | 4,902,983 | | $ | 1,660,775 | | $ | 3,242,208 | | $ | — | | | — |

Debenture Bonds | | | 125,000 | | | 125,000 | | | — | | | — | | | — |

Operating Lease Obligations | | | 469,053 | | | 50,280 | | | 261,754 | | | 157,019 | | | — |

Asset Retirement Obligation | | | 2,069,755 | | | 125,000 | | | 210,000 | | | 535,000 | | | 1,199,755 |

| | | | | | | | | | | | | | | |

Total | | $ | 7,566,791 | | $ | 1,961,055 | | $ | 3,713,962 | | $ | 692,019 | | $ | 1,199,755 |

| | | | | | | | | | | | | | | |

The financial statements of the Company have been prepared assuming that the Company will continue as a going concern. However, the Company has ongoing litigation and potential rescission liabilities as described in our annual report on Form 10-K for 2006 under ITEM 3. LEGAL PROCEEDINGS, and in this report under PART II. ITEM 1. LEGAL PROCEEDINGS.

The Company does not currently have cash reserves sufficient to meet its capital and operational expenditure budget of approximately $17,000,000 for the remainder of 2007. Additionally, due to the regulatory violations as described above, production has been severed on specific leases and the Company has incurred significant costs associated with bringing wells on these leases back into compliance in order to resume production. This has severely impacted the Company’s cash flow, resulting in the accumulation in 2006 of past due vendor payables of approximately $2,400,000. The Company also expects general working capital needs to total approximately $3,000,000 through the remainder of 2007.

16

In light of the Company’s current cash position, the reduction in revenue due to severed leases, and the uncertainties related to potential litigation and resulting liability, if any, there is substantial doubt about the Company’s ability to continue as a going concern. In the opinion of management, approximately $22,400,000 will be required during the year 2007 to fund continuing operations. The funds necessary may be reduced by the disposition of unprofitable leases. Management believes that as much as $2,200,000 may be eliminated from the 2007 budget through the disposition of such leases by the end of the second quarter of 2007, with additional savings of approximately $1,300,000 possible by the beginning of the third quarter of 2007. Management intends to focus operational and capital expenditures in areas that would result in achievement of immediate revenue and improved cash flow to the Company. By doing so, the capital and operational budget may be reduced by an additional $3,600,000. Funds to meet the remaining capital and operational expenditure budget and satisfy vendors, totaling approximately $15,300,000 are expected to be derived from operations, sale of surplus equipment and unprofitable leases, joint venture and partner financing, and debt lending or mezzanine financing (in support of drilling opportunities). Despite these alternatives, there can be no assurance that management’s efforts to achieve the foregoing objectives and adequately provide for the contingencies will be successful.

The accompanying consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Critical Accounting Policies and Estimates

Energytec prepares its financial statements in accordance with accounting principles generally accepted in the United States of America, or GAAP. The preparation of these financial statements requires management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues, and expenses. In response to SEC Release No. 33-8040, “Cautionary Advice Regarding Disclosure About Critical Accounting Policies,” described below are certain of these policies that are likely to be of particular importance to the portrayal of Energytec’s financial position and results of operations and require the application of significant judgment by management. Energytec will analyze estimates, including those related to oil and gas revenues, reserves and properties, as well as goodwill and contingencies, and base its estimates on historical experience and various other assumptions that management believes to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions. You should expect the following critical accounting policies will affect management’s more significant judgments and estimates used in the preparation of Energytec’s financial statements.

Revenue Recognition

Energytec recognizes revenue associated with the sales of crude oil and natural gas when title passes to the customer. Crude oil and natural gas is sold to approximately five purchasers located in Texas. The Company receives revenues directly from the purchasers. Revenues from the production of properties in which we have an interest with other producers are recognized on the basis of our net working interest or royalty interest. Revenues owned by working interest partners are recorded as accounts payable, revenues. Lease operating expenses and capital expenditures to be borne by the working interest partners are netted against their portion of revenues.

Revenues from the work-over and rehabilitation of oil and gas properties through the Company’s wholly owned subsidiary, Comanche Well Service Corporation, are recognized when the services have been performed.

The Company also recognizes income from the transportation of natural gas through its pipeline. Revenue is recognized when title passes to the customer and is based upon the volume of natural gas passing through the pipeline. Gas sales are recognized based upon the volume of gas exiting the pipeline at a spot rate determined pursuant to a purchase contract with the customer. Gas purchases represent the gas purchased as it enters the pipeline at the spot rate as defined by the purchase contract less a fee of $0.55 per mcf.

The Company recognizes drilling revenues under a drilling program agreement at a standard daily drilling rate of $3,000 per day plus costs as drilling progresses.

Oil and Gas Properties

Energytec uses the successful efforts method of accounting for oil and gas producing activities. Costs to acquire mineral interests in oil and gas properties, to drill and equip exploratory wells that find proved reserves, and costs to drill and equip development wells are capitalized. Costs to drill exploratory wells that do not find proved reserves and geological and geophysical costs and costs of carrying and retaining undeveloped properties are expensed as incurred.

Unproved oil and gas properties that are individually significant are periodically assessed for impairment of value, and a loss is recognized at the time of impairment. Other unproved properties are amortized based on the Energytec’s experience of successful

17

drilling and average holding period. Capitalized costs of producing oil and gas properties, after considering estimated residual salvage values, are depreciated and depleted by the unit of production method. Support equipment and other property and equipment are depreciated over their estimated useful lives.

The Company accounts for suspended well costs in accordance with FSP FAS 19-1. Under the guidelines set forth in FAS 19-1, in the opinion of management, as of December 31, 2006 and current with this filing, the Company has found a sufficient quantity of reserves to justify completion of wells, with suspended costs, as producing wells and the Company is making sufficient progress assessing the reserves and the economic and operating viability of such wells.

On the sale or retirement of a complete or partial unit of a proved property, the cost and related accumulated depreciation, depletion, and amortization are eliminated from the property accounts, and the resultant gain or loss is recognized.

On the sale of an entire interest in an unproved property for cash or cash equivalent, gain or loss on the sale is recognized, taking into consideration the amount of any recorded impairment if the property had been assessed individually. If a partial interest in an unproved property is sold, the amount received is treated as a reduction of the cost of the interest retained.

Oil and Gas Reserves

The process of estimating quantities of oil and gas reserves is complex, requiring significant decisions in the evaluation of all available geological, geophysical, engineering and economic data. The data for a given field may also change substantially over time as a result of numerous factors including, but not limited to, additional development activity, evolving production history and continual reassessment of the viability of production under varying economic conditions. As a result, material revisions to existing reserve estimates may occur from time to time. Although every reasonable effort is made to ensure that reserve estimates reported represent the most accurate assessments possible, the subjective decisions and variances in available data for various fields make these estimates generally less precise than other estimates included in the financial statement disclosures.

Energytec uses the unit-of-production method to depreciate and deplete the capitalized costs of our producing oil and gas properties. Changes in proved developed reserve quantities will cause corresponding changes in depletion expense in periods subsequent to the quantity revision.

Impairment of Long-Lived Assets

Energytec accounts for its long-lived assets, including oil and gas properties, under the provisions of SFAS No. 144. This provision requires the recognition of an impairment loss only if the carrying amount of a long-lived asset is not recoverable from its undiscounted cash flows and measures an impairment loss as the difference between the carrying amount and the fair value of the asset.

Accounting for Asset Retirement Obligations

Energytec accounts for the asset retirement obligations under the provisions of FASB No. 143, which requires the fair value of the liability for an asset retirement obligation be recognized in the period in which it is incurred. When the liability is initially recorded, the offset is capitalized by increasing the carrying amount of the long-lived asset. Over time, the liability is accreted to its present value each period, and the capitalized cost is depreciated over the useful life of the related asset. To settle the liability, the obligation is paid, and to the extent there is a difference between the liability and the amount of cash paid, a gain or loss upon settlement is recognized.

Federal Income Taxes

Energytec accounts for Federal income taxes under the provisions of SFAS No. 109, which requires the recognition of deferred tax assets and liabilities for the future tax consequences attributable to differences between financial statement carrying amounts of existing assets and liabilities and their respective tax basis. In addition, the recognition of future tax benefits, such as net operating loss carry forwards, are required to the extent that realization of such benefits are more likely than not.

Accounting for Stock-Based Compensation

In December 2004, the FSAB issued SFAS No. 123R, “Share-Based Payments”, revising SFAS No. 123,Accounting for Stock-Based Compensation, and superseding Accounting Principles Board (APB) Opinion No. 25, “Accounting for Stock Issued to Employees”. SFAS No. 123R establishes standards for the accounting for transactions in which an entity exchanges its equity instruments for goods or services, including obtaining employee services in share-based payment transactions. SFAS No. 123R applies to all awards granted after the required effective date and to awards modified, purchased or canceled after that date. Adoption

18

was effective June 15, 2005. There have been no such awards granted, modified, purchased, or canceled since March 15, 2005. Management does not believe the adoption of this accounting pronouncement will have a material impact on the Company’s financial position or operating results.

Goodwill

Energytec will account for any goodwill it may recognize in the future in accordance with Statement of Financial Accounting Standard (SFAS) No. 142,Goodwill and Other Intangible Assets. SFAS No. 142 requires an annual impairment assessment. A more frequent assessment is required if certain events occur that reasonably indicate an impairment may have occurred. The volatility of oil and gas prices may cause more frequent assessments. The impairment assessment requires Energytec to make estimates regarding the fair value of the reporting unit. The estimated fair value is based on numerous factors, including future net cash flows of Energytec’s estimates of proved reserves as well as the success of future exploration for and development of unproved reserves. These factors are each individually weighted to estimate the total fair value of the reporting unit. If the estimated fair value of the reporting unit exceeds its carrying amount, goodwill of the unit is considered not impaired. If the carrying amount exceeds the estimated fair value, then a measurement of the loss must be performed, with any deficiency recorded as an impairment.

Contingencies

A provision for contingencies is charged to expense when the loss is probable and the cost can be reasonably estimated. Determining when expenses should be recorded for these contingencies and the appropriate amounts for accrual is a complex estimation process that includes subjective judgment. In many cases, this judgment is based on interpretation of laws and regulations, which can be interpreted differently by regulators and/or courts of law. Energytec will closely monitor known and potential legal, environmental, and other contingencies and periodically determine when it should record losses for these items based on information available to it.

Recent Accounting Developments

During June 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48,Accounting for Uncertainty in Income Taxes – an Interpretation of FASB Statement No. 109. FIN 48 clarifies the accounting for uncertainty in income taxes recognized in accordance with FASB Statement No. 109 and is effective for fiscal years beginning after December 15, 2006. The Company will adopt FIN 48 in the first quarter of 2007, but does not expect such adoption to have a material impact on its financial statements or disclosures.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157,Fair Value Measurements, which provides a common definition of fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements. Statement No. 157 is effective for fiscal years beginning after November 15, 2007. The Company is currently reviewing Statement No. 157 to determine any effects the adoption might have on its financial statements and related disclosures.

The FASB also issued Statement of Financial Accounting Standards No. 158,Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans – an Amendment of FASB Statements No. 87, 88, 106, and 132(R)in September of 2006 and Statement of Financial Accounting Standards No. 159,The Fair Value Option for Financial Assets and Financial Liabilities – Including an Amendment of FASB Statement No. 115 in February 2007. The Company does not currently have a defined benefit pension plan or other postretirement plans and does not anticipate that Statement No. 158 will have any effect on the Company’s financial statements or disclosures. The Company is evaluating Statement No. 159, but is not currently involved in any hedging activities and does not anticipate any significant impact on its financial statements or disclosures as a result of adoption of Statement No. 159.

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

Market risk is the potential loss arising from adverse changes in market rates and prices, such as foreign currency exchange, interest rates, and commodity prices.

The Company is not currently involved in any hedge contracts or foreign contracts and therefore has no exposure to such risks.

In February 2007, the Company renewed debt totaling $4,000,000 that is subject to interest at 1.5% above the Wall Street Prime Rate and is susceptible to fluctuations. During 2006, the Wall Street Prime Rate ranged from a low of 7.5% to a high of 8.25%. Through May 11, 2007, the Wall Street Prime Rate has remained at 8.25%.

19

Our major market risk exposure is in the pricing applicable to our oil production and natural gas sales. Realizing pricing is primarily driven by the prevailing domestic price for crude oil. Historically, prices received for oil and gas sales have been volatile and unpredictable. We expect pricing volatility to continue. Oil prices ranged from a low of $31.96 per barrel to a high of $58.39 per barrel during the first three months of 2007 and from a low of $35.75 per barrel to a high of $72.81 per barrel during the year ended December 31, 2006. Gas prices during 2006 ranged from a low of $1.11 per mcf to a high of $10.56 per mcf. During the first three months of 2007, gas prices have ranged from a low of $1.02 per mcf to a high of $5.20 per mcf. A significant decline in the prices of oil or natural gas could have a material adverse effect on our financial condition and results of operations.

| ITEM 4. | CONTROLS AND PROCEDURES |

With the participation of management, Energytec’s chief executive officer and chief financial officer evaluated disclosure controls and procedures on March 31, 2007. Based on this evaluation, the chief executive officer and the chief financial officer concluded that the disclosure controls and procedures are effective in connection with Energytec’s filing of its quarterly report on Form 10-Q for the three months and six months ended March 31, 2007.

During the three-month period ended March 31, 2007 there have been no significant changes in Energytec’s internal controls or in other factors that could significantly affect these controls, including any significant deficiencies or material weaknesses of internal controls that would require corrective action.

PART II

Energytec, Inc., v. Frank W Cole, et al., U.S. District Court, Northern District of Texas, Case No. 3-06 CV-871-L (Consolidated with Case No. 3-06CV0933-G).

This lawsuit filed by Energytec is against Frank W Cole, a former officer and director, Josephine Jackson, a former officer and employee, Phillip M. Proctor, a registered broker, and G. Norman Munro, Raymond J. Vula, John J. Petito, Melvin R. Seligsohn, Sam Miller and Corrine I. Wesloh, who are all unregistered brokers. In the complaint Energytec alleges defendants engaged in activities that violated the anti-fraud prohibitions set forth in Section 10(b) of the Securities Exchange Act of 1934 and applicable state securities laws, and perpetrated common law fraud. Energytec also claims that Frank W Cole and Josephine Jackson engaged in conduct that violated their respective fiduciary and other duties to Energytec, and disclosure rules, internal control requirements, and certification requirements under the Securities Exchange Act of 1934. In addition, Energytec claims the broker defendants received payment of commissions in violation of Section 15(a) of the Securities Exchange Act of 1934 and/or applicable state statutes, or did not disclose the commission arrangement to the brokerage firm with which they were affiliated and engaged in selling away, which is a violation of NASD regulations.

This case is a consolidation by order of the court issued in August 2006 of complaints filed in May 2006. In August 2006 the court also issued an order permitting Energytec to file an amended consolidated complaint to resolve motions previously filed by defendants to dismiss the claims against them for failure to state sufficient facts to support a cause of action. Since filing the amended consolidated compliant, certain defendants filed a motion asking the court to reconsider its order allowing the filing of the amended consolidated complaint, which the court rejected. One defendant answered the complaint denying the substantive allegations. All of the remaining defendants refiled motions in August and September 2006, to dismiss the claims against them for failure to state sufficient facts to support a cause of action, and Energytec responded to these motions in October 2006. The court’s ruling on Defendant Cole’s motion was to deny the motion to dismiss on all claims. On the other defendants who had motions to dismiss pending, the court’s ruling dismissed the claims under Section 10(b) of the Securities Exchange Act and the Texas Securities Act, but allowed the other claims, including the claim of fraud under state common law, to go forward. All of the defendants are now required to answer the complaint and Energytec can pursue its claims against them.

Frank W Cole and Josephine Jackson, v. Energytec, Inc., et al., District Court of Dallas County, Texas, Case No.06-06216.

20

On or about June 29, 2006, Frank W Cole and Josephine Jackson filed the above-referenced lawsuit on behalf of themselves and the other Energytec shareholders alleging Energytec and its officers and directors acted improperly in removing them from office and have since acted improperly in the management of Energytec, misappropriated corporate assets, and breached their respective fiduciary duties to Energytec. In August 2006 John E. Wasson filed a petition to intervene in the case as an additional plaintiff. In July 2006, Energytec and the other defendants filed a motion to stay further proceedings in the state court case pending resolution of the proceedings in Federal court brought by Energytec as described above. At the end of August 2006, the Texas state court issued an order staying further proceedings in the state court case pending resolution of the proceedings in Federal court. In October 2006, Mr. Cole, Ms. Jackson and Mr. Wasson filed a petition for a writ of mandamus with the Fifth District Court of Appeals of the State of Texas seeking to have the order granting the stay vacated, which was subsequently denied by the appeals court. In December 2006, the plaintiffs filed the petition for writ of mandamus with the Texas Supreme Court, and the court requested a response from the defendants on the petition, which was filed in early March 2007. In April 2007 the Texas Supreme Court denied the plaintiffs’ petitions and this matter will remain stayed pending resolution of the Federal court proceedings brought by Energytec.

Energytec, Inc. and Comanche Well Service Corp., v. Calvin Bass and Jerry Bass, District Court of Titus County, Texas, Case No. 32228.

On or about June 1, 2006, Energytec filed the above-referenced lawsuit alleging the defendants engaged in a regular pattern of theft and conversion of Company property and resources, falsification of Company records, and breach of duties as employees to Energytec, all in violation of Texas law. Defendants filed an answer to the complaint on June 26, 2006, alleging certain deficiencies in the pleading and requesting an order requiring amendment, denying the substantive allegations asserted by Energytec, and asserting counterclaims for additional compensation from Energytec and claiming Energytec, through its agents, slandered the defendants. Energytec filed a response denying the substantive allegations of the counterclaims. No trial date has been set and the parties are now pursuing discovery. Energytec cannot predict the potential outcome of this litigation.

John J. Petito, v. Eric A. Brewster, et al., U.S. District Court, Eastern District of New York, Case No. CV-06 2536.

John J. Petito, one of the defendants in the action,Energytec, Inc., v. Frank W Cole, et al., described above, filed this lawsuit on May 23, 2006. The lawsuit is against 17 defendants, including Energytec, each of the directors and officers of Energytec (except for Frank W Cole), certain employees of Energytec, a former director, and certain attorneys and law firms representing Energytec. The complaint alleges that the directors and officers of Energytec conspired to drive down the price of Energytec’s common stock as part of a plan to take over control of Energytec, and used Energytec to wrongfully take money from investors and deprive them of the benefit of their investment in oil and gas working interests. The complaint seeks compensatory damages of $1 billion and punitive damages of $2.5 billion. Energytec intends to vigorously defend the lawsuit and is of the view that the lawsuit was filed in retaliation for the lawsuit it filed against Mr. Petito. Mr. Petito’s prayer for damages is, in Energytec’s opinion, unrealistic and devoid of merit, and the likelihood that he will recover these amounts is remote. Energytec and the other defendants have filed different motions to dismiss the complaint on a variety of grounds. Energytec’s motion to dismiss alleges the complaint fails to state a cause of action on which relief can be granted. We cannot predict at this time when the court will rule on any of the pending motions to dismiss.

Redwaterpet Oil & Gas Royal Family Oil Delectation LLC v. Energytec, Inc., District Court of Dallas County, Texas, Case No. DC 06-011021-A.

On October 31, 2006, Energytec was served with the above-referenced complaint filed by a New York limited liability company of which John J. Petito is the managing member. Mr. Petito is involved in other legal proceedings with Energytec as described herein. The complaint alleges that in June 2005, Redwaterpet and Energytec entered into a purchase agreement under which Redwaterpet agreed to purchase for $8,000,000 a 100% working interest less a 35% net profits overriding royalty interest in certain oil and gas properties in Energytec’s Sulphur Bluff and Redwater properties in Texas. Redwaterpet claims Energytec breached the agreement by failing to complete assignment of the interests acquired, failing to complete drilling and development work, and failing to account to Redwaterpet for the operation of the properties. Redwaterpet seeks specific performance of the agreement with respect to assignment of the interests allegedly acquired and development of the properties, compensation for lost contractual profits, and an accounting for revenues and expenses for the properties. In December 2006, Energytec filed an answer denying the allegations of the complaint. In March 2007, Energytec filed an amended answer and counterclaim against Redwaterpet asserting in the alternative that the original purchase contract was modified and Energytec has complied with its obligations, the alleged contract is impossible to perform as demanded by Redwaterpet, Energytec is not obligated to provide further performance on the alleged contract because of illegal commissions and payments received by John J. Petito and another individual, because Frank W Cole and other parties are responsible for any damages allegedly suffered by Redwaterpet, and because Redwaterpet is obligated as the working interest owner to pay drilling and development costs to Energytec. At the time Energytec filed the amended answer, it also filed a third party complaint

21

against Frank W Cole (individually and d/b/a/ Frank W Cole Engineering) and John J. Petito alleging that Cole and Petito conspired in a scheme to package and unlawfully sell certain interests in the Sulphur Bluff and Redwater properties to the members of Redwaterpet and that these persons are liable for any costs or damages that Energytec may suffer as a result of the Redwaterpet transaction. Mr. Cole has answered the third-party complaint denying the allegations. Mr. Petito filed a motion challenging the jurisdiction of the Texas court over him, which is still pending. Redwaterpet has since filed a second amended complaint, to which we have not filed a response. The parties are now engaged in discovery and an initial trial date has been set for October 29, 2007. We cannot predict when this matter may be resolved or what the potential outcome may be.

Oil Is Fab & We Are Glad LLC, et al., v. Energytec, Inc., District Court of Collin County, Texas, Case No. 296-00397-07.

On February 7, 2007, Oil Is Fab & We Are Glad LLC, a New York limited liability company of which we believe Amanda Petito (the spouse of John J. Petito) is a managing member, and other individual plaintiffs filed the above-referenced complaint (which was subsequently amended to remove certain plaintiffs from the complaint) against Energytec. In the complaint plaintiffs allege that they purchased common stock from Energytec in November 2005 at a price of $2.75 per share, at the time of purchase they were granted a contractual right to put the shares back to Energytec at a price of $3.75 per share in November 2006, they have exercised the put option, and they have not been paid the put price for the common stock in the amount of $5,799,015. On the basis of these allegations, plaintiffs claim Energytec has breached the put option contract and demand payment of $5,799,015. Alternatively, plaintiffs claim that at the time the stock was sold in 2005, Energytec made negligent misrepresentations with respect to payment of the put options and were damaged in the amount $4,252,611, which is the amount they paid for the common stock. In early March 2007, Energytec filed an answer to the complaint denying the substantive allegations and asserting that payment of the put options would be a violation of Nevada corporate law, that Frank W Cole acted without authority and in violation of law when he made the alleged put option agreements so they are void, and that unlawful commission and other payments made in connection with the sale of the shares of common stock render the alleged put option agreement unenforceable. The original plaintiffs in the lawsuit are not the only persons who allegedly acquired common stock and a put option in 2005. In total, approximately 69 persons (including plaintiffs) allegedly purchased a total of 3,098,843 common shares with a contractual right to put the shares back to Energytec at a price of $3.75 per share, who tendered the shares to Energytec in November 2006 in an attempt to exercise the put option. In order to avoid disparate treatment between purchasers of the shares who are plaintiffs in the lawsuit and those who are not and to advance Energytec’s claims raised in the answer to the lawsuit, Energtec filed a third party complaint in early April 2007 seeking a declaration that the put option contracts are unenforceable and that Frank W Cole and the individuals who received unlawful commissions and payments in connection with the sale of the common shares are liable for any damages Energytec may suffer as a result of their illegal conduct. No initial trial date has been set, and we cannot predict when this matter may be resolved or what the potential outcome may be.

The Private Securities Litigation Reform Act of 1985 provides a safe harbor for forward-looking statements made by Energytec, except where such statements are made in connection with an initial public offering. All statements, other than statements of historical fact, which address activities, actions, goals, prospects, or new developments that we expect or anticipate will or may occur in the future, including such things as development and maintenance of our oil and gas properties, prospects for financing or sales of assets to fund operations, and litigation or potential claims against Energytec are forward-looking statements. Forward-looking statements are based on current expectations, estimates, and projections as of the date of this report, and they are subject to a number of risks, uncertainties, and assumptions that could cause actual results to differ materially from those described in the forward-looking statements. Such forward-looking statements should, therefore, be considered in light of various important factors, including those set forth in this report and in our annual report on form 10-K for the year ended December 31, 2006, under the caption “ITEM 1A. RISK FACTORS.” In particular, the matters discussed above under PART I, ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS should be viewed as creating substantial uncertainty about Energytec and its prospects for the future. Any one or a combination of factors could materially affect our operations and financial condition. Because of the factors discussed in this report and below, as well as other factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2006, actual results may differ from those in the forward-looking statements.

22

| | |

| Exhibit No. | | Title of Document |

| 31.1 | | Certification of the Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| |

| 31.2 | | Certification of the Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| |

| 32.1 | | Certifications of the Chief Executive Officer and Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

23

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | |

| | | | Energytec, Inc. |

| | | |

Date: May 10, 2007 | | | | By: | | /s/ Don Lambert |

| | | | | | Don Lambert |

| | | | | | President and Chief Executive Officer |

| | | |

Date: May 10, 2007 | | | | By: | | /s/ Dorothea Krempein |

| | | | | | Dorothea Krempein Chief Financial Officer |

24