POINTS.COM INC.

Notice of Annual Meeting of Shareholders

and

Management Information Circular

March 24, 2022

Due to the global COVID-19 public health emergency, Points' Annual Meeting of Shareholders will be held on Wednesday May 11, 2022 in a virtual-only format, via live audio webcast. A virtual-only meeting format is being adopted to enfranchise and give all shareholders an equal opportunity to participate at the Meeting regardless of their geographic location or other particular constraints, circumstances or risks they may be facing as a result of COVID-19. You will not be able to attend the Meeting physically. Important details about the Meeting and how shareholders can participate virtually, are set out in this Management Information Circular and the accompanying Meeting materials.

POINTS.COM INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual meeting (the "Meeting") of shareholders of POINTS.COM INC. ("Points") will be held on Wednesday May 11, 2022, at 2:00 p.m. (Eastern Time). In light of the ongoing COVID-19 pandemic and to mitigate against its risks, the Meeting will be held in a virtual-only format at https://meetnow.global/MMX4CLG. You will not be able to attend the Meeting physically.

The Meeting will be held for the following purposes:

1. to receive and consider the audited financial statements of Points for its financial year ended December 31, 2021 and the report of the auditors thereon;

2. to elect directors to hold office until the next annual meeting of shareholders or until their respective successors are elected or appointed;

3. to reappoint KPMG LLP as the auditors of Points until the next annual meeting of shareholders and authorize the directors to fix the auditors' remuneration; and

4. to transact such other business as may properly be brought before the Meeting or any adjournment(s) or postponement(s) thereof.

Given the unprecedented public health impact of the Coronavirus disease known as COVID-19 and Points' unwavering commitment to the health and well-being of its employees, customers, suppliers, partners, shareholders, communities and other stakeholders, Points will be conducting the Meeting in a virtual-only format. A virtual-only Meeting format is being adopted in response to the rapidly evolving COVID-19 situation to enfranchise and give all of our shareholders an equal opportunity to participate at the Meeting regardless of their geographic location or the particular constraints, circumstances or risks they may be facing as a result of COVID-19.

This notice, the accompanying management information circular ("Circular") and the form of proxy or the voting instruction form have been sent to you in connection with the Meeting. As described in the enclosed Meeting materials, registered shareholders are entitled to participate, vote and communicate at the virtual Meeting if they held their common shares as of the close of business on March 24, 2022, the record date for the Meeting. Non-registered shareholders as of the record date that wish to participate and vote at the virtual Meeting will be required to first appoint themselves as proxyholder in advance of the Meeting by writing their own name in the appropriate space on the voting instruction form provided by their intermediary, generally being a bank, trust company, investment dealer, clearing agency or other institution. Non-registered shareholders who have not duly appointed themselves as a proxyholder will be able to attend the Meeting as guests. Guests will not be able to vote or communicate at the Meeting. In all cases, shareholders must carefully follow the instructions set out in their applicable form of proxy or voting instruction form AND in the enclosed Circular under "General Proxy Information". The Meeting will be accessible by logging in online at https://meetnow.global/MMX4CLG. To be admitted to the virtual Meeting, registered shareholders and duly appointed proxyholders, including non-registered shareholders that have appointed themselves as proxyholders, must enter their username which is a control number found on their form of proxy or an Invitation Code that is otherwise provided by Computershare Trust Company of Canada ("Computershare") as described in the Circular.

A shareholder who wishes to appoint a person or Company other than the management nominees identified on the form of proxy or voting instruction form (including a non-registered shareholder who wishes to appoint themselves as proxyholder to participate at the Meeting) must carefully follow the instructions in the Circular and on their form of proxy or voting instruction form. These include the additional step of registering that proxyholder with our Transfer Agent and Registrar, Computershare, after submitting the form of proxy or voting instruction form. Failure to register the proxyholder with Computershare will result in the proxyholder not receiving their Invitation Code and only being able to attend the Meeting as a guest.

The form of proxy or voting instruction form must be completed and returned in accordance with the instructions set out therein and in the Circular to Computershare no later than 2:00 p.m. (Eastern Time) on May 9, 2022 or not less than 48 hours (excluding Saturdays, Sundays and statutory holidays in the city of Toronto) prior to the time fixed for any adjourned or postponed meeting, provided however, that the Chair of the Meeting may, in his or her sole discretion, accept proxies delivered to him or her up to the time when any vote is taken at the Meeting or any adjournment(s) or postponement(s) thereof, or in accordance with any other manner permitted by law. The proxy cut-off time may be waived by the Chair of the Meeting, in his or her sole discretion without notice.

DATED at Toronto, Ontario, this 24th day of March, 2022.

By Order of the Board of Directors

"Robert MacLean"

Robert MacLean

Chief Executive Officer

POINTS.COM INC.

MANAGEMENT INFORMATION CIRCULAR

This management information circular (also referred to herein as this "Circular") is furnished in connection with the solicitation by, or on behalf of, the management of Points.com Inc. ("Points", "we", "our" or "us") of proxies to be used at the annual meeting (the "Meeting") of the shareholders of Points to be held on Wednesday May 11, 2022, at 2:00 p.m. (Eastern Time) or at any adjournment(s) or postponement(s) thereof, for the purposes set out in the accompanying notice of meeting. Points' board of directors (the "Board") has fixed the close of business on March 24, 2022, as the record date (the "Record Date"), being the date for the determination of the shareholders entitled to notice of and to vote at the Meeting, and any adjournment(s) or postponement(s) thereof. In light of the ongoing COVID-19 pandemic and to mitigate against its risks, the Meeting will be held in a virtual-only format at https://meetnow.global/MMX4CLG. You will not be able to attend the Meeting physically.

The Meeting has been called for the purposes of considering and voting on the annual business of Points, which includes the election of directors to the Board and the reappointment of Points' auditors. Unless otherwise stated, all amounts listed in this Circular are expressed in United States Dollars.

Given the unprecedented public health impact of COVID-19 and Points' unwavering commitment to the health and well-being of its employees, customers, suppliers, partners, shareholders, communities and other stakeholders, Points will be conducting the Meeting in a virtual-only format. A virtual-only Meeting format is being adopted in response to the rapidly evolving COVID-19 situation to enfranchise and give all of our shareholders an equal opportunity to participate at the Meeting regardless of their geographic location or the particular constraints, circumstances or risks they may be facing as a result of COVID-19.

For further details concerning how registered and non-registered shareholders may participate at the virtual Meeting, see "General Proxy Information" below. The instructions and procedures for registered and non-registered shareholders to participate at the virtual Meeting differ and should be read carefully. If you have questions regarding your ability to participate at the Meeting or would like assistance in the event you encounter difficulties during the registration process or while accessing and attending the Meeting, please contact our Transfer Agent and Registrar, Computershare Trust Company of Canada ("Computershare") at 888-724-2416 (or at 781-575-2748 for international calls).

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE IN FAVOUR OF: (I) THE ELECTION OF THE DIRECTORS NOMINATED IN THIS CIRCULAR AND (II) THE REAPPOINTMENT OF KPMG LLP AS AUDITORS.

Dated March 24, 2022

Table of Contents

FORWARD-LOOKING STATEMENTS

This Circular contains or incorporates forward-looking statements within the meaning of United States securities legislation and forward-looking information within the meaning of Canadian securities legislation (collectively, "forward-looking statements"). These forward-looking statements relate to, among other things: our approach to executive compensation (including expected changes in 2022); our decision to no longer include grants of stock options as part of our long term incentives going forward; our financial performance; plans we have implemented in response to the COVID-19 pandemic and its expected impact on us (including with respect to: cost saving measures that have been implemented, our liquidity and efforts to strengthen our balance sheet, expected impacts on transaction volumes, revenue, gross profit and profitability, the impact of our annual revenue guarantees, and our ability to deliver on our long-term goals); our growth strategies (including our ability to grow the number of loyalty program partners, cross-selling existing partners, and retain and grow existing loyalty program partner deployments); our beliefs on the long-term sustainability of the loyalty industry; future purchases of common shares under the 2021 Repurchase (as defined below); other objectives, strategic plans and business development goals; and may also include other statements that are predictive in nature, or that depend upon or refer to future events or conditions, and can generally be identified by words such as "may," "will," "expects," "anticipates," "continue," "intends," "plans," "believes," "estimates" or similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. These statements are not historical facts but instead represent only our expectations, estimates and projections regarding future events.

Although we believe the expectations reflected in such forward-looking statements are reasonable, such statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict. Undue reliance should not be placed on such statements. Certain material assumptions or estimates are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such statements. Known and unknown factors could cause actual results to differ materially from those expressed or implied in the forward looking statements. In particular, uncertainty around the duration and scope of the COVID-19 pandemic and the impact of the pandemic and actions taken in response on global and regional economies, economic activity, and all elements of the travel and hospitality industry may have a significant and materially adverse impact on our business. In addition, the risks, uncertainties and other factors that may impact the results expressed or implied in such forward-looking statements include, but are not limited to: airline or travel industry disruptions, such as an airline insolvency and continued airline consolidation; our dependence on a limited number of large clients for a significant portion of our consolidated revenue; our reliance on contractual relationships with loyalty program partners that are subject to termination and renegotiation; our exposure to significant liquidity risk if we fail to meet contractual performance commitments; the risk of an event of default under our senior secured credit facility; our ability to convert our pipeline of prospective partners or launch new products with new or existing partners as expected or planned; our dependence on various third-parties that provide certain solutions in our Platform Partners segment that we market to loyalty program partners; and the fact that our operations are conducted in multiple jurisdictions and in multiple currencies and as such dramatic fluctuations in exchange rates of the foreign currencies can have a dramatic effect on our financial results. These and other important risk factors that could cause actual results to differ materially are discussed in our filings with applicable securities regulators, including our most recently filed audited consolidated financial statements (including the notes thereon) and management's discussion and analysis related thereto. The forward-looking statements contained in this Circular are made as at the date of this Circular and, accordingly, are subject to change after such date. Except as required by law, we do not undertake any obligation to update or revise any forward-looking statements made or incorporated in this Circular, whether as a result of new information, future events or otherwise.

NON-GAAP FINANCIAL MEASURES

This Circular contains certain non-GAAP financial measures. For additional details, see "Non-GAAP Financial Measures" below, as well as our most recently filed management's discussion and analysis.

COMMITMENT TO GOVERNANCE

The Board and management of Points acknowledge the importance of good governance practices in the conduct of Points' affairs. The Board assumes overall responsibility for the structure of Points' approach to governance. Our Human Resources & Corporate Governance Committee (the "HRCGC") is responsible for assisting the Board in discharging its duties, including assuming responsibility for the development of our governance practices and policies.

We regularly engage in a review of our governance practices and policies. Most recently, in November of 2021, we implemented a clawback policy (the "Clawback Policy"). A detailed description of our approach to corporate governance is set forth in our "Statement of Corporate Governance Practices" included in Schedule A to this Circular. Copies of certain of our governance policies are also available on our website at www.points.com. Highlights of our corporate governance practices and policies include the following:

- Independent Chair: The Chair of the Board is an independent director.

- Board Independence: A majority of the members of the Board are independent (75% or 6 of 8 of the current directors).

- Committee Independence: All of the Board committees (HRCGC and Audit Committee) are 100% independent.

- Majority Voting Policy: If a director nominee receives a greater number of votes "withheld" than votes "for", that director shall immediately submit their resignation to the Chair for consideration following the Meeting. See "Business of the Meeting - Election of Directors - Majority Voting Policy" below for more details.

- Diversity and Board Renewal Policy: We value and recognize the benefits of diversity, including increased organizational strength, improved leadership and increased innovation. In furtherance of this, we have adopted a Diversity and Board Renewal Policy that sets out our policies with respect to diversity on the Board and in senior management. See "Business of the Meeting - Election of Directors - Diversity and Board Renewal Policy" below for more details.

- Share Ownership Policy: To more closely align the members of the Board and certain members of senior management with the interests of shareholders, the Board has adopted a share ownership policy that requires these individuals to maintain prescribed levels of ownership of Points' common shares and/or restricted share units ("RSUs") based on targets varying by position level. See "Executive Compensation - Share Ownership Guidelines" below for more details.

- Code of Business Conduct and Ethics: We are committed to conducting our business in accordance with the highest standards of ethical conduct, and we have adopted a Code of Business Conduct and Ethics that reflects this. We also maintain a whistleblower hotline and protocol for ensuring that any compliance matters are brought to the attention of an independent officer. See Schedule A, "Statement of Corporate Governance Practices - Ethical Business Conduct" below for more details.

- Anti-Hedging Policy: To promote alignment of interests between our shareholders and our directors, officers and employees, these individuals are prohibited from hedging Points' securities. See "Executive Compensation - Compensation Governance - Anti-Hedging Policy" below for more details.

- Clawback Policy: Our Clawback Policy authorizes the Board to take direct and appropriate action to prevent the unjust enrichment of executives who, through their own misconduct, improperly receives incentive compensation beyond what they would be entitled to receive in the absence of such misconduct. See "Executive Compensation - Compensation Governance - Clawback Policy" below for more details.

BUSINESS OF THE MEETING

Audited Consolidated Financial Statements

The audited consolidated financial statements of Points for the financial year ended December 31, 2021 and the auditors' report thereon will be submitted to shareholders at the Meeting. Receipt at the Meeting of our audited consolidated financial statements and the auditors' report thereon will not constitute approval or disapproval of any matters referred to therein. A copy of the audited consolidated financial statements and the auditors' report thereon has been mailed to shareholders who requested them and is also available on our website at www.points.com and on SEDAR at www.sedar.com.

Election of Directors

The present term of office of each current director will expire immediately prior to the election of directors at the Meeting. The number of directors to be elected at the Meeting is eight. These directors will serve until the next annual meeting of shareholders or until a successor is elected or appointed. Unless authority to do so is withheld, the shares represented by the proxies in favour of management proxyholders will be voted in favour of the election of the persons whose names appear below as directors of Points. Although the Board is not aware of any nominee who would be unwilling or unable to serve if elected, should any nominee be unwilling or unable to serve as a director of Points, the persons named in the form of proxy reserve the right to nominate and vote for another nominee at their discretion.

The election of directors will be by individual voting and not by slate voting.

Majority Voting Policy

The Board has adopted a "majority voting policy" providing that in an uncontested election of directors, any nominee who receives a greater number of votes "withheld" than votes "for" will tender his or her resignation to the Chair of the Board promptly following the Meeting. The HRCGC will consider the offer of resignation and will make a recommendation to the Board on whether to accept it. In considering whether or not to recommend acceptance of the resignation, the HRCGC will consider all factors deemed relevant by its members. The Board shall, in accordance with its fiduciary duties, determine whether to accept the resignation in light of any exceptional circumstances that would warrant the applicable director continuing to serve on the Board. The Board will make its final decision and announce it in a press release within 90 days following the Meeting. A director who tenders his or her resignation pursuant to this policy will not participate in any meeting of the Board or the HRCGC at which the resignation is considered.

Where the Board accepts the resignation of a director, the Board may, subject to applicable laws, the articles and by-laws of Points and any previously-passed shareholder resolutions, exercise its discretion with respect to the resulting vacancy and may, without limitation, leave the vacancy unfilled until the next annual meeting of shareholders, fill the vacancy through the appointment of a new director, reduce the size of the Board (within the minimum and maximum number of directors fixed under our articles) or call a special meeting of shareholders to elect a new nominee to fill the vacant position. If any director fails to tender his or her resignation as contemplated in the majority voting policy, the Board will not re-nominate that director at the next election.

Diversity and Board Renewal

We value and recognize the benefits of diversity, including increased organizational strength, improved leadership and increased innovation. In furtherance of this, the Board has adopted a Diversity and Board Renewal Policy, which, among other things, recognizes that diversity is an important consideration for us in determining the composition of the Board. We believe that a Board made up of highly qualified individuals from diverse backgrounds promotes better corporate governance and performance and effective decision-making.

To support the Board's diversity goals, the HRCGC will, when identifying and considering the selection of nominees for the Board:

- consider only candidates who are highly qualified based on their experience, functional expertise and personal skills and qualities;

- consider diversity criteria including the designated groups specified in the Employment Equity Act (Canada); and

- seek to maintain a Board in which each gender represents not less than 20% of independent directors.

The Board also recognizes that periodic renewal of Board members brings new perspectives which enrich and enhance the effectiveness of the Board and, accordingly, strives to maintain a Board with an average tenure of 15 years or less among independent directors. However, the Board believes that such renewal and the new perspectives it brings can happen naturally without imposing retirement policies or other arbitrary limits on the tenure of its Board members. In addition, in light of our business and the time necessary for persons to develop a thorough understanding of it, the Board believes that the quality of Board level decisions directly benefits from the continuity, experience and knowledge that comes from permitting longer-term service on the Board. Accordingly, in considering the age and tenure of directors, we have not adopted formal retirement policies, strict term limits, or other mechanisms for forcing the replacement of our directors.

Director Nominees

All current directors of Points are being nominated for re-election to the Board. The following tables provide certain background information with respect to each nominee for the Board.

David Adams |

Age: 65

Quebec, Canada Chair Since: June 2018 Director Since: May 2016 Independent | Corporate Director. Mr. Adams served as the Executive Vice President and Chief Financial Officer of Aimia Inc. from 2007 until his retirement in March, 2016. At the time of his retirement, Aimia Inc. was a publicly traded global data driven marketing and loyalty analytics company which had close to 4,000 employees in 20 countries and owned and operated well known coalition loyalty programs such as Aeroplan in Canada and Nectar in the U.K. He currently serves on the Board of Directors and is Chair of the Audit Committee and a member of the Nominating and Governance Committee of Cardlytics Inc. (Nasdaq), a transaction based marketing company headquartered in Atlanta. He is a non-executive director, Chair of the Audit Committee and a member of the Remuneration Committee of TCC Global, a private global loyalty company. He is also on the Board of Directors of Plan International Canada where he is a member of the Human Resources and Compensation Committee and the Audit Committee. He is the Vice-Chair of the Board of Governors and the Chair of the Governance Committee of The Stratford Festival, North America's largest classical repertory theater company. He is also a member of the Stratford Shakespearean Festival Endowment Foundation of Canada Board. Until he resigned in December 2018, Mr. Adams served on the Board of Directors and Audit and Human Resource Committees of Club Premier, AeroMexico's frequent flyer program and previously was a board member of Nectar Italia and Prisma in Brazil. Before joining Aimia, Mr. Adams was Senior Vice President and Chief Financial Officer at Photowatt Technologies Inc. Prior to Photowatt, he acted as Senior Vice President Finance and Chief Financial Officer of SR Telecom Inc. Mr. Adams has also previously held a variety of executive positions at CAE Inc., a global market leader in the production of flight simulators and control systems. Prior to these roles, Mr. Adams held a number of progressively senior roles with the Bank of Nova Scotia and Clarkson Gordon (Ernst & Young). Mr. Adams is a CPA, CA and holds a Bachelor of Commerce and Finance Degree from the University of Toronto and has completed the Stanford Executive Program.

|

2021 Board and Committee Attendance |

Board (Chair) | 8 of 8 (100%) |

Audit | 4 of 4 (100%) |

HRCGC | 4 of 4 (100%) |

Past Annual Meeting Voting Results |

Year | Votes for | % of Votes for | Votes Withheld | % of Votes Withheld |

2021 | 7,615,600 | 87.40% | 1,097,913 | 12.60% |

Securities Held (as at February 28, 2022) |

Common Shares | RSUs | Total | Value(1) | Meets Share Ownership Requirement |

31,841 | 8,204 | 40,045 | $742,141 | Yes |

Other Public Board Directorships and Committee Memberships |

Company | Committee |

Cardlytics Inc. | Audit Committee (Chair) Nominating and Governance Committee |

Public Board Interlocks |

None |

| | | | | | | | | | |

Christopher Barnard |

Age: 53

Ontario, Canada Director Since: May 2007 (and Feb. 2000 to Apr., 2005) Non-Independent | President of Points. Mr. Barnard is a founder of Points. As President of Points, Mr. Barnard is currently responsible for corporate strategy, corporate development and investor relations. He has also held various interim operating positions at Points including Chief Financial Officer, as well as being responsible for both product development and marketing. Mr. Barnard has also been instrumental in developing significant commercial relationships and key strategic partnerships with various parties over Points' history and in 2015 he was named as one of the 100 most influential leaders in Fintech globally. In his corporate development capacity, he led Points' three corporate acquisitions of MilePoint, PointsHound and Crew Marketing as well as the strategic partnership with Amadeus. Mr. Barnard has also been instrumental in raising capital for Points, including multiple equity financings and a strategic investment from InterActive Corp/IAC, a New York based, NASDAQ 100 leading internet firm. In 1998, Mr. Barnard co-founded Canada's first internet business incubator, Exclamation International, from which Points was created. Prior to Exclamation, Mr. Barnard was with HDL Capital, a Toronto boutique merchant bank. While at HDL he assisted a number of companies in entering the public markets, including Bid.com which was, at the time, one of Canada's most notable internet technology stories. Mr. Barnard holds a Masters of Business Administration degree from the Richard Ivey School of Business in London, Ontario.

|

2021 Board Attendance |

Board | 8 of 8 (100%) |

Past Annual Meeting Voting Results |

Year | Votes for | % of Votes for | Votes Withheld | % of Votes Withheld |

2021 | 8,128,533 | 93.29% | 584,980 | 6.71% |

Securities Held (as at February 28, 2022) |

Common Shares | RSUs | Total | Value(1) | Meets Share Ownership Requirement |

245,259 | 60,059 | 305,318 | $5,658,359 | Yes |

Other Public Board Directorships and Committee Memberships |

Company | Committee |

None | |

Public Board Interlocks |

None |

| | | | | | | | | | | |

Michael Beckerman |

Age: 58

Ontario, Canada Director Since: May 2010 Independent | Mr. Beckerman's sales and marketing career spans over twenty years, three continents and several industries. His experience has included senior roles in Canada, Europe and Asia. At the start of his career, Mr. Beckerman was responsible for marketing of the NIKE brand across Asia-Pacific and later in Europe. He was at the helm when NIKE was named Brand of the Year. He then served as Vice President, Marketing for Canadian Airlines, where he led a comprehensive rebrand. Subsequently, he headed up Marketing and International expansion for MVP.com, a high- profile e-commerce site. In 2001, Mr. Beckerman took on the role of Chief Marketing Officer for Bank of Montreal where he was responsible for increasing the marketing orientation and customer focus throughout that organization. In 2006, he joined digital, CRM and content agency, Ariad Communications, as President. During his ten-year tenure at the company, Ariad enjoyed record growth and won numerous awards, including being named as one of the Top Places to Work in Canada. Mr. Beckerman is currently the Chief Client Officer at Torstar Corporation. Prior to this he was President and CEO of global lifestyle marketing agency, MKTG Canada. Mr. Beckerman is a sought-after speaker on marketing trends, branding and consumer behaviour. He is a frequent judge for industry events and asked to sit on numerous industry panels. He often lends his marketing experience to help charities and foundations clearly articulate their cause and generate uplift for their fundraising campaigns.

|

2021 Board and Committee Attendance |

Board | 8 of 8 (100%) |

HRCGC | 4 of 4 (100%) |

Past Annual Meeting Voting Results |

Year | Votes for | % of Votes for | Votes Withheld | % of Votes Withheld |

2021 | 7,517,054 | 86.27% | 1,196,459 | 13.73% |

Securities Held (as at February 28, 2022) |

Common Shares | RSUs | Total | Value(1) | Meets Share Ownership Requirement |

29,355 | 5,333 | 34,688 | $642,861 | Yes |

Other Public Board Directorships and Committee Memberships |

Company | Committee |

Enthusiast Gaming Holdings Inc. | |

Public Board Interlocks |

None |

| | | | | | | | | | | |

Bruce Croxon |

Age: 60

Ontario, Canada Director Since: February 2008 Independent

| Investor and Advisor. Mr. Croxon was a founder of Lavalife, a category leader and internationally recognized brand in the online dating industry. He was instrumental in growing the company to just under $100 million in revenue and was CEO when the company was sold to Vertrue, Inc. in 2004 and remained CEO until midway through 2006. Mr. Croxon has since been active as both an investor and advisor in early-stage companies in the technology and hospitality sectors. He is currently the Managing Partner of Round13 Capital, a fund that invests in early-stage digital businesses in Canada. He is also active in a number of charities, including 13th Round Fight for Life, Food Allergy Canada and Helping Hands Jamaica. |

2020 Board and Committee Attendance |

Board | 7 of 8 (100%) |

HRCGC | 4 of 4 (100%) |

Past Annual Meeting Voting Results |

Year | Votes for | % of Votes for | Votes Withheld | % of Votes Withheld |

2020 | 6,313,577 | 96.12% | 255,178 | 3.88% |

Securities Held (as at February 28, 2022) |

Common Shares | RSUs | Total | Value(1) | Meets Share Ownership Requirement |

36,344 | 5,333 | 41,677 | $772,386 | Yes |

Other Public Board Directorships and Committee Memberships |

Company | Committee |

None | |

Public Board Interlocks |

None |

| | | | | | | | | |

Robert MacLean |

Age: 55

Ontario, Canada Director Since:

February 2002 Non-Independent | Chief Executive Officer of Points. Mr. MacLean is a founder of Points and has served as Chief Executive Officer of Points since its beginnings in February 2000. As CEO, Mr. MacLean champions the vision for Points and directs an exceptional team of executives. Mr. MacLean has led his team to deliver a suite of innovative solutions for the global loyalty industry, earning a growing number of partnerships with the world's leading loyalty programs as well as numerous industry technology providers. Prior to founding Points, Mr. MacLean recorded an impressive list of leadership roles and achievements during 12 years in the airline and loyalty industry. As Vice President, Sales with Canadian Airlines International, Mr. MacLean led a team throughout North America, delivering over $2 billion in annual revenue. Mr. MacLean was responsible for the airline's award-winning Canadian Plus loyalty program and also served as Canadian Airlines' senior representative on the Oneworld™ Alliance's Customer Loyalty Steering Committee. Mr. MacLean is an active member of the global loyalty community and has spoken frequently at industry events worldwide. Mr. MacLean is a member of the board of directors of Prodigy Ventures, a TSXV listed technology company and advisor of Tidal Migrations. He is a past member of the board of directors of Hope Air. Hope Air is a national charity that helps Canadians get to medical treatment when they cannot afford the flight costs. Mr. MacLean also sits on multiple advisory boards in the technology industry. Mr. MacLean is a graduate of Acadia University.

|

2021 Board Attendance |

Board | 8 of 8 (100%) |

Past Annual Meeting Voting Results |

Year | Votes for | % of Votes for | Votes Withheld | % of Votes Withheld |

2021 | 8,392,701 | 96.32% | 320,812 | 3.68% |

Securities Held (as at February 28, 2022) |

Common Shares | RSUs | Total | Value(1) | Meets Share Ownership Requirement |

297,893 | 100,776 | 398,669 | $7,388,403 | Yes |

Other Public Board Directorships and Committee Memberships |

Company | Committee |

Prodigy Ventures Inc. | Audit Committee Human Resources, Compensation and Governance Committee Diversity and Inclusion Committee |

Public Board Interlocks |

None |

| | | | | | | | | | |

Jane Skoblo |

Age: 59

Ontario, Canada Director Since: May 2019 Independent | Independent Corporate Director. Ms. Skoblo has extensive financial services, payments, customer loyalty and digital and technology experience. In her last role, she was Vice President, Digital Operations at Rogers Communications, leading digital transformation for the company. Ms. Skoblo was previously CFO of AMEX Bank of Canada and has deep experience in the customer loyalty industry, having acted as CFO, Global Rewards for American Express (USA). Prior to that, she was CFO and COO of two start-ups - myNext Mortgage Company and Mortgage Architects Inc. In 2021, Ms. Skoblo was appointed to the Board of Directors and as the Chair of the Audit and Risk Committee for Teranet Inc., the exclusive provider of electronic land and commercial registration services on behalf of the Provinces of Ontario and Manitoba. In 2020, Ms. Skoblo was appointed to the Board of Directors for Digital Research Alliance of Canada, a national not-for-profit organization that supports an agile digital research infrastructure for Canada, where she chairs the Audit, Investment and Risk Committee. Ms. Skoblo also sits on the board of Allstate Canada Group, a wholly owned Canadian subsidiary of Allstate Corporation (USA) and is a member of both Audit and Governance Committees. Ms. Skoblo was previously a board member of AMEX Bank of Canada between 2011 and 2016. Ms. Skoblo was a member of the Advisory Board at the University of Waterloo School of Accounting and Finance from 2010 to 2020. Ms. Skoblo holds a Bachelor of Business Administration from the Schulich School of Business, York University. She also holds a CPA, CITP designation (from the AICPA), as well as an ICD.D designation from the Institute of Corporate Directors and has completed the Director's Education Program.

|

2021 Board Attendance |

Board | 8 of 8 (100%) |

Audit | 4 of 4 (100%) |

Past Annual Meeting Voting Results |

Year | Votes for | % of Votes for | Votes Withheld | % of Votes Withheld |

2021 | 8,708,691 | 99.94% | 4,822 | 0.06% |

Securities Held (as at February 28, 2022) |

Common Shares | RSUs | Total | Value(1) | Meets Share Ownership Requirement |

9,345 | 5,333 | 14,678 | $272,023 | Has until May 2024 to meet guideline |

Other Public Board Directorships and Committee Memberships |

Company | Committee |

None | |

Public Board Interlocks |

None |

| | | | | | | | | | | |

John Thompson |

Age: 74

Ontario, Canada Director Since:

February 2002 Independent | Corporate Director. Mr. Thompson has 28 years of executive experience with a range of private and public companies. From 1999 to 2003, Mr. Thompson was a managing director of Kensington Capital Partners, the investment and advisory firm that did the first fund raise for Points in September 2000. At that time Mr. Thompson made his first investment in Points and has held it since. Prior to joining Kensington, Mr. Thompson spent more than twenty years with Loblaw Companies Limited, Canada's leading grocery chain, last serving as Executive Vice President and prior to that as Senior Vice President, Finance and Administration. Mr. Thompson's responsibilities at Loblaws included, amongst other things, responsibility for human resources and President's Choice, one of the largest, most recognized and most profitable brands in Canada. Mr. Thompson is currently a member of the Governing Council of the Sunnybrook Foundation, the fundraising foundation for Sunnybrook Hospital, a premier academic health sciences centre in Canada, that is fully affiliated with the University of Toronto. He is a past member of the Board of Governors and Chair of the Finance Committee of The Corporation of Roy Thomson Hall and Massey Hall, two of Canada's finest concert venues. Mr. Thompson holds an Honours Business Administration degree from the Richard Ivey School of Business at the University of Western Ontario. Mr. Thompson is also a CPA, CA.

|

2021 Board and Committee Attendance |

Board | 8 of 8 (100%) |

Audit | 4 of 4 (100%) |

HRCGC (Chair) | 4 of 4 (100%) |

Past Annual Meeting Voting Results |

Year | Votes for | % of Votes for | Votes Withheld | % of Votes Withheld |

2021 | 7,024,390 | 80.61% | 1,689,123 | 19.39% |

Securities Held (as at February 28, 2022) |

Common Shares | RSUs | Total | Value(1) | Meets Share Ownership Requirement |

201,984 | 5,948 | 207,932 | $3,853,536 | Yes |

Other Public Board Directorships and Committee Memberships |

Company | Committee |

None | |

Public Board Interlocks |

None |

| | | | | | | | | | | |

Leontine van Leeuwen-Atkins |

Age: 57

Alberta, Canada Director Since: May 2019 Independent | Corporate Director. Ms. van Leeuwen-Atkins (Atkins) is a board member and Audit Committee member of ARC Resources Ltd. (TSX), Cameco Corporation (TSX and NYSE) and EPCOR Utilities Inc. (one of Canada's largest municipally-owned utilities). Ms. Atkins previously served as a Board member and Audit Committee chair of Seven Generations Energy, before its merger with ARC Resources. Ms. Atkins previously served, until the end of 2018, as a board member of KPMG Canada LLP's Board of Directors, and its Acquisitions and Admissions and Succession committees. Ms. Atkins served as a Partner with KPMG Canada from 2006 until early 2019 and with KPMG Netherlands until she moved to Canada in 2006. Ms. Atkins has extensive experience in M&A and post-merger integration, as well as transaction and deal advisory. She is a past member of the board, and chair of the Audit Committee, of Calgary Economic Development. Ms. Atkins is a member of the Executive Committee of the Calgary Chapter of the Institute of Corporate Directors (ICD) and is an Alumni of, and guest speaker with, ICD's Director Education programme at the University of Calgary. In addition to her CPA, CA and ICD.D designations, Ms. Atkins holds a Bachelor of Business Administration in Finance from Acadia University and a Masters of Business Administration from Dalhousie University.

|

2021 Board and Committee Attendance |

Board | 8 of 8 (100%) |

Audit (Chair) | 4 of 4 (100%) |

Past Annual Meeting Voting Results |

Year | Votes for | % of Votes for | Votes Withheld | % of Votes Withheld |

2021 | 8,704,170 | 99.89% | 9,343 | 1.07% |

Securities Held (as at February 28, 2022) |

Common Shares | RSUs | Total | Value(1) | Meets Share Ownership Requirement |

10,311 | 5,606 | 15,917 | $294,985 | Has until May 2024 to meet guideline |

Other Public Board Directorships and Committee Memberships |

Company | Committee |

ARC Resources Ltd.

Cameco Corporation EPCOR Utilities Inc. (municipally-owned, with public debt) | Audit and Finance Committee Risk Committee Governance Nominating Committee Audit Committee Technical Committee Audit and Finance Committee Health, Safety and Environment Committee |

Public Board Interlocks |

None |

| | | | | | | | | | | |

Notes:

(1) Calculated in accordance with our Share Ownership Policy. See "Executive Compensation - Share Ownership Guidelines" below for more details.

Common Directorships

None of the proposed Board nominees serve on the same board of directors of another publicly listed company.

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

To the knowledge of Points, no director nominee is, or within the last 10 years has been, a director, chief executive officer or chief financial officer of any company that: (a) while that person was acting in that capacity, was the subject of a cease trade or similar order or an order that denied the company access to any exemption under securities legislation for a period of more than 30 consecutive days, or (b) was subject to a cease trade or similar order or an order that denied the company access to any exemption under securities legislation, for a period of more than 30 consecutive days, that was issued after that person ceased to be a director, chief executive officer or chief financial officer, but which resulted from an event that occurred while that person was acting in that capacity.

To the knowledge of Points, no director nominee is, or within the last 10 years has been, a director or executive officer of any company that, while the individual was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

To the knowledge of Points, no director nominee of Points has been subject to: (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

To the knowledge of Points, no director nominee of Points has, within the last 10 years, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold his or her assets.

Reappointment of Auditors

Management proposes to reappoint KPMG LLP as the auditors of Points to hold office until the close of the next annual meeting of shareholders, and proposes that the shareholders authorize the directors to fix the remuneration of the auditors. KPMG was first appointed as auditors of Points on June 9, 2011. The shares represented by proxies in favour of management proxyholders will be voted in favour of the reappointment of KPMG LLP as auditors of Points, to hold office until the next annual meeting of shareholders and the authorization of the directors to fix the remuneration of the auditors, unless authority to do so is withheld.

A copy of the audited consolidated financial statements of Points for the fiscal year ended December 31, 2021 has been made available to the shareholders of Points.

EXECUTIVE COMPENSATION

Letter from the Chair of the HRCGC and the Chair of the Board

Dear shareholders,

As the Chair of the HRCGC and Chair of the Board, one of our core responsibilities is to ensure that Points has a principled approach to executive compensation. We want to take this opportunity to share with you, our shareholders, the approach that we take to executive compensation, and changes that we have implemented, that we believe will help ensure that senior management is aligned with the interests of our shareholders.

Commitment to Pay for Performance

We believe that compensation plays an important role in achieving Points' short- and long-term business objectives, and are committed to linking our senior management's pay with performance. We believe that a meaningful portion of the compensation received by our senior management should be incentive-based, contingent on financial performance. We also believe that a meaningful portion of senior management's compensation should be equity-based, and that senior management should be required to maintain meaningful equity ownership levels.

Similar to 2020, our short and long-term incentives in 2021 were focused on Points' gross profit and adjusted EBITDA1 . These metrics are key indicators of the operating performance of the business, and align with Points' long-term business plan and strategic objectives.

Below we highlight some of the significant achievements of our senior management, which informed the compensation they received in 2021.

2021 Performance Highlights

Note: All figures contained in this section are in thousands of US dollars. See also "Non-GAAP Financial Measures" below.

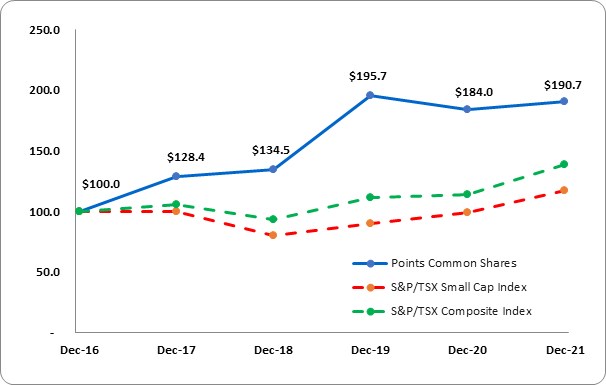

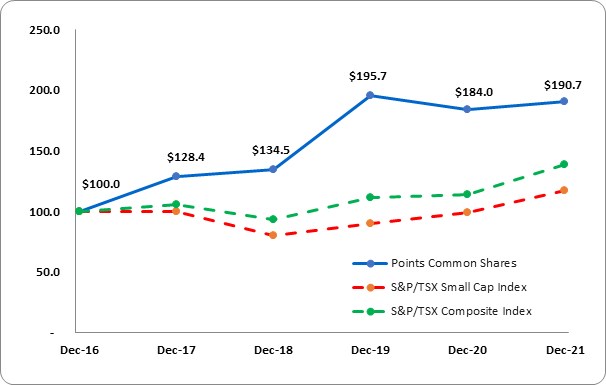

Revenue for the year ended December 31, 2021 was $370,008, an increase of $152,621 or 70% over 2020. Gross profit in 2021 was $50,791, an increase of 45% over 2020. The increase in revenue and gross profit was primarily due to organic growth from our existing partnerships, as we continued to see signs of recovery from the pandemic throughout 2021 in our core geographic markets, particularly in the United States. Adjusted EBITDA for the year ended December 31, 2021 was $12,097, an increase of 285% over 2020, largely due to the increase in gross profit outpacing the growth in our operating expenses.

1 Adjusted EBITDA (Earnings before income tax expense, depreciation and amortization, foreign exchange, finance costs, equity-settled share-based compensation and impairment charges) is considered by management to be a useful supplemental measure when assessing financial performance. Management also believes that adjusted EBITDA is an important indicator of Points' ability to generate liquidity through operating cash flow to fund future capital expenditures and working capital needs. However, adjusted EBITDA is not a measure of financial performance under IFRS and should not be considered a substitute for Net Income, which we believe to be the most directly comparable IFRS measure. See "Non-GAAP Financial Measures" below for more details.

It has been two years since the onset of the COVID-19 pandemic and there continues to be uncertainty regarding the duration and severity of the pandemic and the ability to control resurgences and novel variants worldwide. The COVID-19 pandemic had a significant adverse impact on our financial performance in 2020 and had a negative impact on our business in 2021. During this time, management remained focused on its stewardship role and continued to emphasize a growth oriented strategic plan. As we saw positive momentum in growing our in-market deployments, we also continued to execute on our other core growth drivers in 2021, including launching new partnerships and expanding our existing loyalty partnerships by cross selling our products and services. From a new partnership perspective, we launched a new multi-service and multi-year partnership with Eva Air's Infinity MileageLands program in 2021, representing our most comprehensive partnership with an APAC carrier to date. In addition, we launched our exchange service with Bilt Rewards, a rewards program that allows renters to earn points on rent and build a path towards homeownership and have connected Bilt Rewards with our Loyalty Commerce Platform and enabled exchanges into 9 of our loyalty program partners throughout 2021, including American AAdvantage, Emirates Skywards, World of Hyatt, IHG Rewards, and Turkish Airlines' Miles & Smiles program.

We also successfully expanded several existing loyalty program partnerships during 2021. In the fourth quarter of 2021, we expanded the reach of our Buy solution for the Marriott Bonvoy program into Marriott's redemption flow, moving the existing Marriott top up channel onto Points' Loyalty Commerce Platform. Furthermore, we also launched six deployments of our Accelerate Anything service in 2021, which allows members to accelerate their current miles balance - regardless of how miles are earned. Partners launched on this service in 2021 include Air Canada's Aeroplan, AirFrance-KLM's Flying Blue, Qatar Privilege Club, Etihad Guest, Copa Airlines' ConnectMile and the Emirates Skywards program.

Since March 2021, our business performance and associated transaction metrics started to experience sustained levels of improvement relative to the low point of the pandemic experienced from Q2 2020 to Q4 2020. In addition to management's careful stewardship of the business and the implementation of a growth oriented strategic plan, this improved performance also coincided with the rollout of vaccines globally and the curtailing of travel restrictions, particularly in the United States. Gross profit generated in the quarter ended December 31, 2021 increased for the fifth consecutive quarter and represented our highest quarterly gross profit over the last two years.

Continued Emphasis on Performance in 2021

In 2019 and further in 2021, we reviewed our compensation philosophy and peer group, and conducted a market benchmarking to assess the compensation of our senior management. As a result of this review we have made certain changes to the compensation of our CEO to target total direct compensation around the market median. This was accomplished through a pay mix that is more heavily weighted towards short- and long-term incentives with a more modest base salary.

In addition, to further align senior management with the interests of shareholders and consistent with our commitment to "pay for performance", performance share units ("PSUs") now form a significant component of our long-term incentive compensation in 2021 and going forward. The Board approved a performance-based compensation program pursuant to which our senior management receive a portion of their long-term incentive compensation in the form of PSUs. The PSU program was designed to reward senior management for consistent, long-term performance on our key financial metrics, including adjusted EBITDA and gross profit. The combination of PSUs with our existing long-term incentive programs helps to ensure that members of our senior management receive a balanced mix of time-based and performance-based equity awards.

We invite you to review the balance of our disclosure in this Circular for additional details on our executive compensation programs, and thank you for your continued support of Points.

Sincerely,

"John Thompson" | | "David Adams" |

John Thompson

Chair of the HRCGC | | David Adams

Chair of the Board |

Executive Compensation Philosophy

The Board and the HRCGC believe that compensation plays an important role in achieving Points' short- and long-term business objectives. A sound compensation program contributes to our success, and helps to ensure that senior management is aligned with the interests of our shareholders.

We believe that a meaningful portion of the compensation received by our senior management should be incentive-based and contingent on financial performance. In particular, compensation should be linked to the key performance metrics that we believe drive our operations and align with our mid- and long-term business plans and strategic objectives.

We also believe that a meaningful portion of the compensation received by our senior management should be equity-based, and that senior management should be required to maintain meaningful equity ownership levels to align with the interests of our shareholders.

Finally, we believe that our senior management should receive market competitive compensation packages so that we can attract and retain the key talent we need to drive our success. Our policy is to target total direct compensation around the market median and to provide an opportunity to earn above market median for outstanding performance. We accomplish this through the use of a pay mix that is more heavily weighted towards short- and long-term incentives, combined with modest base salaries.

Our philosophy on compensation is reflected in the best practices that we follow.

What We Do | What We Don't Do |

- Link senior management pay to performance through our short- and long-term incentive programs

| - No hedging of Points' securities

|

- Balance among short- and long-term incentives, cash and equity and fixed and "at-risk" pay

| - No excessive perquisites or supplemental retirement benefits

|

- Benchmark executive compensation to relevant peer group companies

| |

- Require senior management to meet minimum share ownership requirements

| - No aspect of our compensation program encourages inappropriate or excessive risks

|

| |

- Executive incentive compensation is subject to clawback

| |

Executive Compensation Program Summary

Overview of Points' Compensation Mix

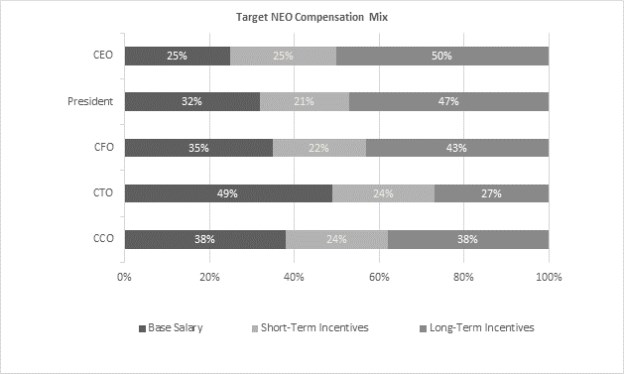

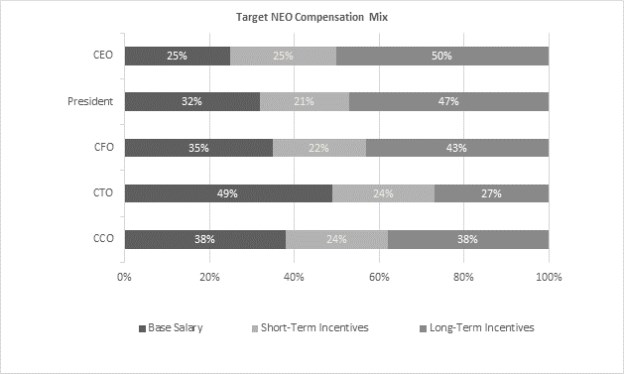

Our commitment to "pay for performance" is reflected in the target compensation mix set for our senior management. In establishing the appropriate pay mix, we consider what compensation is contingent on financial performance ("at-risk"), compared to the compensation that is fixed or "guaranteed". Our target compensation for the most senior members of management (and in particular, our CEO) is more heavily weighted towards "at-risk" compensation, including long-term equity incentives, creating greater alignment with the interests of our shareholders. We consider all long-term equity incentives, including PSUs and RSUs, to be "at-risk" given their value is tied to the common share price of Points.

The following chart provides the target compensation mix for our NEOs for 2021:

Compensation Governance

The Board has overall responsibility for the structure of our compensation strategy as well as the total compensation of the members of the Board and the CEO. The HRCGC is responsible for assisting the Board in discharging its responsibilities relating to compensation and for overseeing the matters described below.

The HRCGC is composed entirely of independent directors. The members of the HRCGC are: Mr. John Thompson (Chair), Mr. David Adams, Mr. Michael Beckerman and Mr. Bruce Croxon. The general background, skills and experience of the members of the HRCGC are set forth above under the section entitled "Director Biographies". All of the members of the HRCGC have significant direct experience with human resources and executive compensation.

In addition to making recommendations to the Board in connection with its oversight responsibility, the HRCGC is specifically responsible for:

developing and/or reviewing Points' human resources and compensation policies and programs for attracting, retaining, developing and motivating employees including senior management;

producing an annual report on executive compensation for inclusion in Points' annual management proxy circular, in accordance with applicable rules and regulations;

reviewing and assessing the management of succession and development plans for senior management and people and knowledge strategies;

assisting Board oversight of Points' compliance with employment related legal and regulatory requirements;

assisting the Board in identifying, recruiting and nominating suitable candidates to serve on the Board;

assuming responsibility for developing Points' approach to governance issues in compliance with all applicable legal and stock exchange listing requirements and with such recommendations of relevant securities regulatory authorities and stock exchanges as the HRCGC may consider appropriate; and

reviewing the adequacy and form of the compensation of the executive leadership team and ensuring that the compensation realistically reflects the responsibilities and risks of such positions.

The HRCGC has the authority to seek information it requires from any employee of Points. The committee also has the power to retain a consulting firm to provide advice regarding our compensation strategy and programs, and to retain outside legal counsel and any other advisers as the committee may deem appropriate. The HRCGC and its Chair are appointed by the Board. Committee members meet regularly without any member of management present.

Risk Management

The Board has oversight responsibility for risks associated with our compensation policies and practices as part of its broader risk oversight mandate. The HRCGC is responsible for identifying, assessing and ensuring the appropriate management of any risks created by our compensation policies and practices. The Board exercises its oversight responsibility through an annual review and approval of the total compensation of Points' CEO and through review and approval of any changes in the structure of our compensation strategy. The HRCGC exercises its risk assessment responsibility through an annual review of the form of the compensation of our senior management, including the elements and quantum of such compensation.

The HRCGC has not identified any risks arising from Points' compensation policies and practices that are reasonably likely to have a material adverse effect on Points. In particular, our compensation structure has been designed to encourage employees not to take inappropriate or excessive risks. Our compensation structure contains a mix of short- and long-term elements using a combination of annual base salary, annual bonus opportunities and long-term equity incentives. Annual bonuses are paid out on achievement of objective performance goals tied to corporate financial performance and individual operational goals that support achievement of Points' business plan. Our long-term equity incentive program is in the form of a combination of time vested and performance-based equity awards that encourage the creation of shareholder value by incenting management and employees to create sustainable long-term growth.

Anti-Hedging Policy

Our insider trading policy specifically includes an anti-hedging policy (the "Anti-Hedging Policy"). Pursuant to the Anti-Hedging Policy, NEOs, directors and employees are prohibited from entering into financial instruments that are designed to hedge or offset any decrease in the market value of Points' securities that are held directly or indirectly by them or granted as compensation to them.

Clawback Policy

Our Clawback Policy applies to the NEOs and certain other members of senior management. Under the Clawback Policy, the Board has discretion to cancel, withhold or otherwise take appropriate action to recoup incentive compensation received by an executive if there is a restatement of all or part of our financial statements and the executive, through their own misconduct, receives incentive compensation beyond what they would receive in the absence of such misconduct. Incentive compensation subject to clawback includes cash bonuses and equity based incentive awards (including stock options, RSUs and PSUs) granted or paid to the individual, or that the individual might become entitled to receive, under their employment arrangements. For the purposes of the Clawback Policy, misconduct means an act of embezzlement, fraud, breach of fiduciary duty or any other misconduct which constitutes cause for dismissal during the executive's employment or engagement that significantly contributed to an obligation to restate our financial statements (whether required by law, accounting principles, regulatory policy or settlement with regulators having jurisdiction over us).

Share Ownership Policy

We believe that senior management should have meaningful equity ownership levels to more closely align them with the interests of our shareholders. Accordingly, we have a share ownership policy that requires minimum holdings of common shares and/or RSUs based on targets varying by position level:

Each NEO is required to achieve the ownership requirements by the fifth anniversary of the date they first become subject to the policy. Our CEO and each other NEO currently meets or exceeds the required ownership levels. See "Share Ownership Guidelines" below for more details.

Name | Common Shares | RSUs(1) | Total | Value(2) | Meets Share

Ownership Requirement(3) |

Robert MacLean

CEO | 297,893 | 100,776 | 398,669 | $7,388,403 | Yes |

Christopher Barnard

President | 245,259 | 60,059 | 305,318 | $5,658,359 | Yes |

Erick Georgiou

CFO | 20,572 | 32,673 | 53,245 | $986,772 | Yes |

Jay Malowney

CCO | 61,860 | 27,895 | 89,755 | $1,665,068 | Yes |

Donald Dew

CTO | 1,622 | 17,651 | 19,273 | $357,180 | Yes |

Notes:

(1) On vesting, RSUs are settled through common shares delivered from a share purchase trust (net of any applicable taxes, which are paid in cash by Points) - See below under heading "Employee Share Unit Plan (ESUP) - Overview".

(2) Calculated in accordance with the share ownership policy. Calculated in Canadian Dollars and converted to US Dollars at the average exchange rate for the year.

(3) Share Ownership Requirement compliance is required by the fifth anniversary of the date that such individual first becomes subject to the Share Ownership Policy. Our Share Ownership Policy was implemented in 2017.

Independent Compensation Consultant

The HRCGC periodically retains independent compensation consultants to advise on the design and market competitiveness of our senior management compensation program.

While the advice of external consultants is an important input into the decision-making process, the design of our senior management compensation program is ultimately the responsibility of the Board and the HRCGC. When making recommendations to the Board, the HRCGC exercises its judgment and considers a variety of important factors, including Points' long-term business plan and strategic objectives, competitive market forces, independent external advice, internal business needs, external factors (such as COVID-19), governance best practices and alignment with the interests of our shareholder.

Executive and Board Compensation-Related Consulting Fees

The total fees billed by Willis Towers Watson ("WTW") in 2021 were CDN$14,473. In August 2021, the HRCGC retained Southlea Group Limited Partnership ("Southlea") as Points' primary compensation consultant. The total fees billed by Southlea in 2021 were CDN$50,326. The total fees billed by WTW in 2020 were CDN$67,305. The compensation consultants' 2021 mandates included general advisory services related to board and executive compensation programs including benchmarking executive and board compensation, consulting on the design of Points' executive incentive plans and providing guidance on the impact of COVID-19 on 2021 compensation. See under heading "2021 Compensation" below for more details. WTW had served as an advisor to Points since 2011.

Peer Groups

In 2019, the HRCGC, with the assistance of WTW, reviewed and revised the composition of our peer group. The new peer group, which is discussed below, informed the design of our executive compensation program for 2020 and beyond. Consistent with prior practice, the HRCGC will periodically review the composition of our peer group and, if appropriate, make adjustments.

Our 2021 peer group, developed in 2019, includes Canadian and U.S. publicly-traded companies selected from:

Companies in related industries (e.g., loyalty, technology, consumer finance, etc.) that require senior management with similar skills to those of our senior management;

Companies roughly similar in size based on revenue (roughly 0.25x to 4x Points' revenue, in the case of Canadian peers, and 0.5x to 2x Points' revenue, in the case of U.S. peers), with market capitalizations between $100 million and $4 billion; and

Companies with strong revenue growth, reflecting similar growth expectations as Points.

In assessing our levels of compensation relative to our peer group, we compare nominal dollars reported by each peer, and do not make adjustments to account for foreign exchange rates.

The resulting peer group is composed of 15 companies, with a relatively equal weighting between Canadian and U.S. companies.

Canadian Peers | U.S. Peers |

Absolute Software Corporation | Alarm.com Holdings, Inc. |

Aimia Inc. | Benefitfocus, Inc. |

Enghouse Systems Limited | Bottomline Technologies (de), Inc. |

Kinaxis Inc. | Ebix, Inc. |

Real Matters Inc. | Quotient Technology Inc. |

Shareworks by Morgan Stanley | Verra Mobility Corporation |

The Descartes Systems Group Inc. | Yelp Inc. |

Tucows Inc. | |

The median revenues, EBITDA2 and market capitalization for the above peer group were $323 million, $44 million and $1,019 million respectively. The foregoing revenue and EBITDA figures reflect the most recent publicly available fiscal year-end data for 2019 that was available at the time of the prior review of our peer group. Market capitalization data is as of December 31, 2019 (other than in respect of Shareworks by Morgan Stanley, in respect of which the most recent available data was as of May 1, 2019).

Compensation Discussion and Analysis

Our 2021 named executive officers ("NEOs"), who are the subject of this Compensation Discussion and Analysis, are:

Robert MacLean, Chief Executive Officer

Christopher Barnard, President

Erick Georgiou, Chief Financial Officer

Jay Malowney, Chief Commercial Officer

Donald Dew, Chief Technology Officer

The NEO compensation program consists of four components: (i) base salary, (ii) short-term incentives, (iii) long-term incentives and (iv) other benefits. Each component has a different function, as described below, but all elements work together to reward the NEOs appropriately for personal and corporate performance.

We consider all compensation other than base salary and other benefits to be "at-risk". In establishing the appropriate pay mix for each NEO, we consider the impact that such NEO has on driving our business success - the greater the potential impact, the higher the "at-risk" portion.

2 EBITDA is a non-GAAP financial performance measure and may be calculated differently by each of the members of our peer group.

Design Objectives | What We Reward |

- Attract, motivate and retain high performing senior management

| - Increasing shareholder value

|

- Align the interests of NEOs with our shareholders

| - Achieving corporate performance that meets pre-defined objective criteria

|

- Establish an objective connection between NEO compensation and our financial and business performance

| - Improving operations and executing on corporate strategy

|

- Incent NEOs to continuously improve operations and execute on corporate strategy

| |

Base Salary

Base salaries are considered an essential element in attracting and retaining Points' senior management and rewarding them for corporate and individual performance. Base salary is determined using the following considerations: (i) the salary offered for a comparable position at comparable companies, (ii) Points' recent financial and business performance, (iii) recent individual performance, and (iv) retention.

Corporate and personal performance is assessed using the same criteria discussed below for Points' short-term incentive plan.

The CEO's base salary is reviewed annually and any increase must be specifically approved by the HRCGC and by the Board as part of its oversight over the total compensation paid to the CEO. The annual review includes interviews with the CEO and comments solicited from members of the Board.

Base salaries for the other NEOs are also reviewed annually. While the Board and the HRCGC have overall responsibility for the design and scope of the compensation program for senior management, the CEO has primary responsibility for the review of individual NEO performance, and determines any increases in salary within the parameters of the programs approved by the Board and the HRCGC. The annual review process is conducted by the CEO in consultation with the HRCGC, and takes into account any recommendations of the HRCGC.

Short-Term Incentives

Bonus Plan

Points has adopted an annual incentive program to provide most employees, including the NEOs, with the opportunity to receive annual bonuses based on achievement of operational, financial and strategic goals. The bonus program is designed to align the financial interests and personal motivations of employees with the interests of Points which are represented by measurable performance metrics.

Annual bonuses are paid to NEOs in the form of grants of RSUs under Points' ESUP. Any such grants vest immediately and are subject to the terms and conditions of the ESUP. See "Long-Term Incentives - Employee Share Unit Plan - Restricted Share Units" below for more details on the ESUP.

Each NEO is eligible to receive an annual bonus amount under the bonus plan equal to a percentage of their base salary. The annual percentage bonus level for each NEO is based on the achievement of certain corporate performance goals that are common to all of the NEOs and, in some cases, team performance goals for that NEO. Performance goals include goals based on financial metrics (such as gross profit and adjusted EBITDA) as well as goals related to furthering Points' strategic agenda. Performance of each goal is measured relative to a target level and payout on that goal is based on actual performance relative to the target level. Each NEO has an overall target bonus level as a percentage of salary and each goal is weighted based on its relative importance.

Our individual and corporate performance goals include specific targets that would, if made public, provide explicit identification of both the financial and strategic direction of Points, including strategic initiatives, and therefore provide highly competitive data as well as inappropriate market guidance to our competitors. The Board and the HRCGC believe that disclosure of these performance goals under the annual bonus plan would seriously prejudice Points' interests and significantly weaken its ability to maintain and build market leadership. As a result, these performance goals are not disclosed.

The threshold, target and outstanding performance levels and corresponding payouts are approved each year by the HRCGC and the Board based on Points' financial plan. For 2021, in respect of gross profit and adjusted EBITDA, these were:

Threshold Performance: 70% achievement of the relevant target results in a payout of 50% of the bonus amount. If Points achieves less than 70% of the target, no bonus is paid.

Target Performance: 100% achievement of the relevant target results in a payout of 100% of the bonus amount.

Outstanding Performance: Greater than 100% achievement of the relevant target could result in a payout above 100% of the bonus amount at a level determined by the Board at its discretion.

If actual performance levels are between the threshold and target, the bonus payout is determined on a straight-line basis. For strategic goals, the threshold, target and outstanding performance levels are defined when the goals are set.

For 2021, the performance goals were based solely on financial metrics of gross profit and adjusted EBITDA. The overall target bonus levels, and performance goal weightings, for the NEOs is set forth in the table below:

Name | Target Bonus

Level

(% of Base

Salary) | Corporate Performance Goals (% Weight) |

Gross Profit | Adjusted EBITDA(1)(2) |

Robert MacLean

CEO | 100% | 50% | 50% |

Christopher Barnard

President | 65% | 50% | 50% |

Erick Georgiou

CFO | 65% | 50% | 50% |

Jay Malowney

CCO | 65% | 50% | 50% |

Donald Dew

CTO | 50% | 50% | 50% |

Notes:

(1) Non-GAAP financial performance measure. See "Non-GAAP Financial Measures" below for more details.

(2) For purposes of the annual bonus plan, adjusted EBITDA is calculated by adding back any amounts in respect of annual bonuses.

From time to time, Points' business may be impacted by unanticipated events. Accordingly, the Board has the discretion to award bonuses to NEOs in the absence of NEOs satisfying the performance criteria associated with receipt of such bonuses. Similarly, the Board also has the discretion to not award bonuses even if the performance criteria is met. The Board takes a principled approach to this, and strives to ensure that its discretion is exercised: (i) consistently year over year; (ii) to account for events that are outside the scope of senior management's control and ability to manage, or outside Points' normal corporate planning and budgeting, such as COVID-19; and (iii) in a manner that does not relieve senior management from the consequences of their decision making. In respect of NEO bonuses paid or payable in fiscal 2021, the Board did not exercise discretionary power to award such bonuses in the absence of the satisfaction of the applicable performance criteria.

Long-Term Incentives

Our long-term incentives program is designed to: (i) promote alignment of interests between employees and our shareholders; (ii) attract and retain the key employees we need to drive our success; and (iii) provide employees with market competitive compensation.

Our long-term incentives program includes grants of RSUs, PSUs, Performance Options and stock options.

Award Type | Design Details | Design Objectives |

RSUs | - Awards are based on percentage of base salary

- Vesting is 1/3 per year over three years from date of grant

| - Align plan participants with interests of shareholders

- Motivate plan participants to pursue strategies that will enhance shareholder value over the long-term

|

PSUs | - Awards are based on percentage of base salary

- Cliff vest at end of three-year performance period:

- 50% based on achievement of three-year aggregate adjusted EBITDA(1) target

- 50% based on achievement of three-year aggregate gross profit target

| - Align plan participants with interests of shareholders

- Reward consistent, long-term performance on key financial metrics

- Adjusted EBITDA(1) and gross profit are key indicators of operating performance

|

Performance Options | - To date, the 2018 and 2019 grants of Performance Options are the only awards that have been granted

- Vesting is based on achievement of specified performance milestones:

- 50% based on adjusted EBITDA(1)

- 50% based on gross profit

- Expiry is six years after date of grant

| - Align plan participants with interests of shareholders

- Reward achievement of long-term goals and strategic objectives

- Adjusted EBITDA(1) and gross profit are key indicators of operating performance

|

Stock Options | - Non-performance awards have not been granted since 2016

- Historically, awards:

- were based on percentage of base salary

- vested 1/3rd per year over three years from date of grant

- expired five years after date of grant

| - Align plan participants with interests of shareholders

- Motivate plan participants to pursue strategies that will enhance shareholder value over the long-term

|

Notes:

(1) Non-GAAP financial performance measure. See "Non-GAAP Financial Measures" below for more details.

The below table provides the target long-term incentives grants for each of the NEOs for 2021:

Name | Total Target Long-Term Incentives

(% of Base Salary) | Target Long-Term Incentives Mix |

RSUs | PSUs |

Robert MacLean

CEO | 200% | 75% | 25% |

Christopher Barnard

President | 150% | 75% | 25% |

Erick Georgiou

CFO | 125% | 75% | 25% |

Jay Malowney

CCO | 100% | 75% | 25% |

Donald Dew

CTO | 55% | 75% | 25% |

Employee Share Unit Plan (ESUP) - Overview

All NEOs are eligible for grants under Points' Employee Share Unit Plan (the "ESUP"). The Board administers the ESUP.