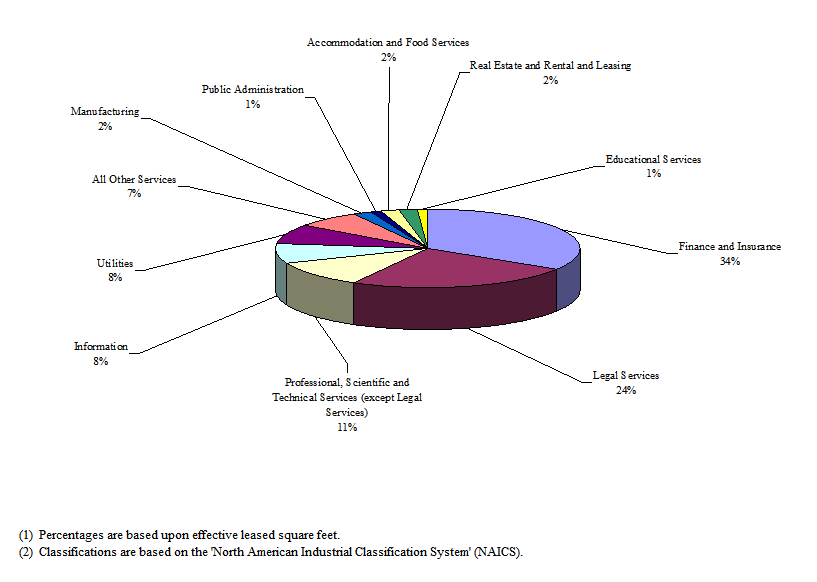

Maguire Properties, Inc. (the “Company”), a self-administered and self-managed real estate investment trust, is one of the largest owners, managers and developers of first-class office properties in the Los Angeles metropolitan area and has a significant presence in nine submarkets, located in Los Angeles County, Orange County, and San Diego County. The Company’s predecessor was founded in 1965 and developed and managed over 30 million square feet of office properties nationally.

As of December 31, 2006, the office portfolio was comprised of whole or partial interests in 24 properties with approximately 15.5 million net rentable square feet, one 350-room hotel with 266,000 square feet and total on- and off-site structured parking of approximately 9.9 million square feet, plus surface parking, which in total accommodates approximately 32,000 vehicles. The Company owns undeveloped land that it believes could support up to 6.7 million square feet of office, retail and residential uses and an additional 6.1 million square feet of structured parking.

This Supplemental Operating and Financial Data package supplements the information provided in our quarterly and annual reports filed with the Securities and Exchange Commission (SEC). Additional information about us and our properties is also available at our website www.maguireproperties.com.

Acquisitions and Dispositions:

None

Debt:

On October 10, the Company completed a $273.0 million refinancing with Bank of America, N.A. for the property located at 777 South Figueroa Street, Los Angeles, California. The mortgage loan is an interest-only, seven-year mortgage, which bears interest at a fixed rate of 5.844% and matures on November 1, 2013. On October 13, 2006, $104.0 million of the proceeds from this refinancing and $63.0 million of available cash on hand were used to repay the remaining $167.0 million outstanding on the Company’s Term Loan.

As of December 31, 2006, approximately 99.0% of our outstanding debt is fixed (including hedges) at a weighted average interest rate of 5.4% for a weighted average remaining term of approximately 6.4 years .

As of December 31, 2006, there were no borrowings outstanding on the Company’s $100.0 million revolving line of credit. The Company’s ratio of consolidated debt to market capitalization was 53.5% and our ratio of consolidated debt plus preferred stock to market capitalization was 58.3% as of December 31, 2006.

Development Activities:

Construction activities continued with the build-out of the core and shell portion of the project at Park Place - 3161 Michelson. Parking Structure #5 was topped out in early December 2006. Completion is targeted for the second quarter of 2007 for the parking garages and third quarter 2007 for the office building. 3161 Michelson is a 530,380 square foot office building and two parking garages with a parking capacity of approximately 5,100 vehicles.

The parking structure at Mission City Corporate Center has been completed. Construction on the 92,000 square foot office building has commenced with targeted completion set for the fourth quarter of 2007.

During the fourth quarter, the majority of the foundation work was completed at 17885 Von Karman Avenue at the Washington Mutual Irvine Campus. The project is scheduled to be completed in the fourth quarter of 2007.

Construction at Lantana East commenced in November 2006 under a foundation permit and is scheduled to be complete in February, 2008. Receipt of the building permit for Lantana East and the foundation permit for Lantana South is expected to be received in February 2007. Construction at Lantana South is expected to commence upon issuance of the foundation permit with anticipated completion in July 2008.

Leasing Activities:

During the fourth quarter, new leases and renewals were executed totaling approximately 851,000 square feet including a new lease for 76,635 square feet at San Diego Tech Center with Qualcomm and an early renewal for 112,439 square feet to 2021with Rutan & Tucker at Pacific Arts Plaza in Orange County. Cash rent on leases executed during the fourth quarter decreased 11.9%. GAAP rent growth increased 4.1% for the quarter. Cash rent growth and GAAP rent growth on leases executed during the quarter in Downtown Los Angeles decreased by 16.2% and 3.1%, respectively.

In December, the lease with CONAGRA Foods, Inc (“ConAgra”) for approximately 393,000 square feet at the Park Place office building in Orange County, California was terminated. The agreement terminates the non-subleased portion of the premises and assigns the remaining subleased premises of approximately 126,000 to the Company. The subleased premises are currently leased to E*Trade Securities (approximately 48,000 square feet) and New Century Financial Corporation (approximately 78,000 square feet). ConAgra will continue to lease approximately 10,000 square feet on a month to month basis. In consideration of the termination agreement, ConAgra agreed to pay a termination fee in the amount of $20.3 million as follows: $18.5 million on December 31, 2006 and the remainder on a monthly basis through August 31, 2010.