Exhibit 99.2

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

| | PAGE |

Corporate Data | 1 |

| | | 2 |

| | | 3 |

| | | 5 |

| | | 6 |

Consolidated Financial Results | 7 |

| | | 8 |

| | | 10 |

| | | 11 |

| | | 12 |

| | | 13 |

| | | 14 |

| | | 15 |

| | | 16 |

| | | 17 |

| | | 18 |

| | | 19 |

| | | 20 |

| | | 22 |

| | | 23 |

| | | 24 |

Portfolio Data | 25 |

| | | 26 |

| | | 27 |

| | | 31 |

| | | 32 |

| | | 33 |

| | | 34 |

| | | 35 |

| | | 36 |

| | | 37 |

| | | 38 |

| | | 39 |

| | | 40 |

| | | 41 |

| | | 42 |

| | | 43 |

| | | 44 |

| | | 45 |

| | | 46 |

| | | 48 |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

Corporate Data

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

This supplemental package contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We caution investors that any forward-looking statements presented herein are based on management’s beliefs and assumptions and information currently available to management. Such statements are subject to risks, uncertainties and assumptions and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control. Should one or more of these risks or uncertainties materialize or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. These factors include, without limitation: risks associated with management’s focus on asset dispositions, loan defaults, cash generation and general strategic matters; risks associated with the timing and consequences of loan defaults and related asset dispositions; risks associated with contingent guarantees by our Operating Partnership; risks associated with our liquidity situation; risks associated with the negative impact of the current credit crisis and economic slowdown; general risks affecting the real estate industry (including, without limitation, the inability to enter into or renew leases at favorable rates, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate); risks associated with the availability and terms of financing and the use of debt to fund acquisitions and developments; risks associated with our ability to dispose of properties, if and when we decide to do so, at prices or terms set by or acceptable to us; risks and uncertainties affecting property development and construction; risks associated with increases in interest rates, volatility in the securities markets and contraction in the credit markets affecting our ability to extend or refinance existing loans as they come due; risks associated with joint ventures; potential liability for uninsured losses and environmental contamination; risks associated with our potential failure to qualify as a REIT under the Internal Revenue Code of 1986, as amended, and possible adverse changes in tax and environmental laws; and risks associated with our dependence on key personnel whose continued service is not guaranteed.

For a further list and description of such risks and uncertainties, see our Annual Report on Form 10-K/A filed on April 30, 2009 and our Quarterly Report on Form 10-Q filed on November 9, 2009 with the Securities and Exchange Commission. We do not update forward-looking statements and disclaim any intention or obligation to update or revise them, whether as a result of new information, future events or otherwise.

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

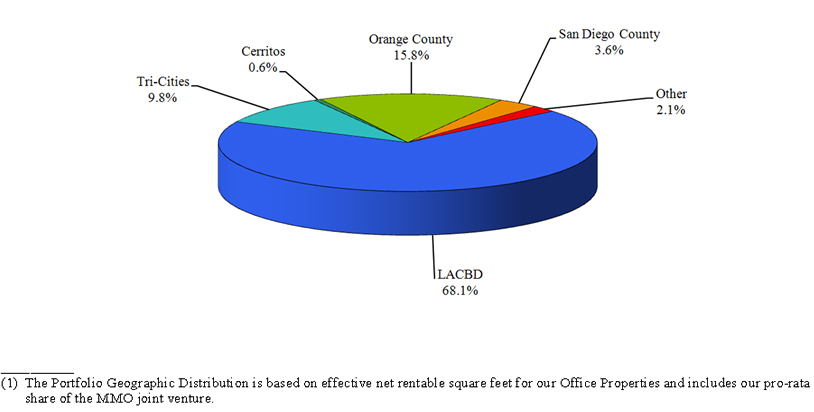

Maguire Properties, Inc. (the “Company”), a self-administered and self-managed real estate investment trust, is the largest owner and operator of Class A office properties in the Los Angeles central business district and is primarily focused on owning and operating high-quality office properties in the Southern California market. We are a full-service real estate company with substantial in-house expertise and resources in property management, marketing, leasing, acquisitions, development and financing.

As of December 31, 2009, our office portfolio (including Properties in Default) was comprised of whole or partial interests in 31 properties totaling approximately 17 million net rentable square feet, one 350-room hotel with 266,000 square feet, and on- and off-site structured parking plus surface parking totaling approximately 11 million square feet, which accommodates approximately 36,000 vehicles. We have one recently completed development project that totals approximately 188,000 square feet of office space. We also own undeveloped land that we believe can support up to approximately 5 million square feet of office and mixed-use development and approximately 5 million square feet of structured parking, excluding development sites that are encumbered by the mortgage loans on our 2600 Michelson and Pacific Arts Plaza properties, which are in default.

As used in the “Consolidated Financial Results” section of this Supplemental Operating and Financial Data package, the term “Properties in Default” refers to our Stadium Towers Plaza, Park Place II, 2600 Michelson, Pacific Arts Plaza, 550 South Hope and 500 Orange Tower properties, whose mortgage loans are in default as of the date of this filing. As used in the “Portfolio Data” section of this Supplemental Operating and Financial Data package, the term “Properties in Default” includes the properties previously mentioned, along with Quintana Campus (a joint venture property in which we have a 20% interest), whose mortgage loan is also in default as of the date of this filing.

This Supplemental Operating and Financial Data package should be read in conjunction with our consolidated financial statements for the year ended December 31, 2009 in our Annual Report on Form 10-K to be filed with the Securities and Exchange Commission (SEC) in March 2010. For more information on Maguire Properties, visit our website at www.maguireproperties.com.

Asset Disposition Program:

As previously announced, six special purpose property-owning subsidiaries are or will be in default on their mortgage loans. These defaults occurred as result of the board of directors’ approval of management’s plan to cease funding cash shortfalls at these properties: Stadium Towers in Central Orange County, Park Place II in Irvine, 2600 Michelson in Irvine, Pacific Arts Plaza in Costa Mesa, 550 South Hope in Downtown Los Angeles, and 500 Orange Tower in Central Orange County. Mortgage loans totaling $888.5 million are currently in default, and the Company is accruing default interest at a rate of 5% per annum on these loans. In October 2009, we completed the disposition of 130 State College located in Orange County, California. We received net proceeds of $6.1 million from this transaction. In December 2009, we completed the disposition of the Lantana Media Campus located in Santa Monica, California. We received proceeds of approximately $195 million, net of transaction costs, of which $175.8 million was used to repay

| | the balances outstanding under the mortgage and construction loans secured by the Lantana Media Campus. We have no further obligations with respect to the mortgage and construction loans on the property. Additionally, our Operating Partnership has no further obligation to guarantee the repayment of the construction loan. Net of debt repayment, we received net proceeds of approximately $19 million. Debt: As of December 31, 2009, excluding mortgages encumbering the Properties in Default, approximately 69% of our outstanding debt is fixed (or swapped to a fixed rate) at a weighted average interest rate of approximately 5.8% with a weighted average remaining term of approximately six years. |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

During the fourth quarter, we recorded impairment charges totaling $290.3 million, of which $264.3 million has been recorded as part of continuing operations and $26.0 million as part of discontinued operations. Of the $264.3 million impairment charge recorded in continuing operations, $99.9 million was related to the writedown of Griffin Towers and 2385 Northside to their estimated fair value as of December 31, 2009. The remaining $164.4 million impairment charge recorded in continuing operations was the result of an impairment analysis performed as of December 31, 2009 which resulted in certain properties being written down to fair value. The $26.0 million impairment charge recorded in discontinued operations was related to the disposition of Lantana Media Campus. Leasing Activities: During the fourth quarter, new leases and renewals were executed for approximately 0.4 million square feet (including our pro rata share of our joint venture properties). Cash rent on new leases completed during the quarter decreased 9.3% in our Effective Portfolio, compared to cash rents on those spaces immediately prior to their expiration, and GAAP rent decreased 3.9% compared to prior GAAP rents. Leases totaling approximately 0.3 million square feet expired during the fourth quarter (including our pro rata share of our joint venture properties).

| | |

Supplemental Operating and Financial Data

Fourth Quarter 2009

| 355 South Grand Avenue, Suite 3300 |

| Los Angeles, CA 90071 |

| Tel. (213) 626-3300 |

| Fax (213) 687-4758 |

| Nelson C. Rising | President and Chief Executive Officer | Jonathan L. Abrams | Senior Vice President, General Counsel and Secretary |

| Shant Koumriqian | Executive Vice President, Chief Financial Officer | Robert P. Goodwin | Senior Vice President, Construction and Development |

| Peggy M. Moretti | Executive Vice President, Investor and Public Relations | Peter K. Johnston | Senior Vice President, Leasing |

| | & Chief Administrative Officer | | Senior Vice President, Strategic Initiatives |

| Robert J. White | | | |

| Investor Relations Contact: Peggy M. Moretti at (213) 613-4558 |

Please visit our corporate website at: www.maguireproperties.com |

| Transfer Agent | | Timing |

| | | Quarterly results for 2010 will be announced according to the following schedule: |

American Stock Transfer & Trust Company 59 Maiden Lane New York, NY 10038 (718) 921-8201 www.amstock.com | | |

| | First Quarter | May 2010 |

| | Second Quarter | August 2010 |

| | Third Quarter | November 2010 |

| | Fourth Quarter | March 2011 |

| | Credit Suisse | Steven Benyik | (212) 538-0239 |

| | Deutsche Bank Securities, Inc. | Vincent Chao | (212) 250-6799 |

| | Goldman Sachs & Co. | Jay Haberman | (917) 343-4260 |

| | Green Street Advisors | Michael Knott | (949) 640-8780 |

| | KeyBanc Capital Markets | Jordan Sadler | (917) 368-2280 |

| | Raymond James Associates | Paul Puryear | (727) 567-2253 |

| | RBC Capital Markets | Dave Rodgers | (440) 715-2647 |

| | Robert W. Baird & Company | David Aubuchon | (314) 863-4235 |

| | Stifel, Nicolaus & Co., Inc. | John Guinee | (443) 224-1307 |

Maguire Properties, Inc. is currently followed by the sell-side analysts listed above, with the exception of Green Street Advisors, which is an independent research firm. This list may not be complete and is subject to change as firms add or delete coverage of our company. Please note that any opinions, estimates or forecasts regarding our historical or predicted performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of Maguire Properties, Inc. or its management. We are providing this listing as a service to our stockholders and do not by listing these firms imply our endorsement of or concurrence with such information, conclusions or recommendations. Interested persons may obtain copies of analysts’ reports on their own; we do not distribute these reports. Various of these firms may from time-to-time own our stock and/or hold other long or short positions in our stock, and may provide compensated services to us.

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

Our common stock is traded on the New York Stock Exchange under the symbol MPG. Selected information about our common stock for the past five quarters (based on NYSE prices) is as follows: |

| | | 2009 | | | 2008 | |

| | | 4th Quarter | | | 3rd Quarter | | | 2nd Quarter | | | 1st Quarter | | | 4th Quarter | |

| High price | | $ | 3.24 | | | $ | 3.09 | | | $ | 2.05 | | | $ | 3.12 | | | $ | 6.79 | |

| Low price | | $ | 1.20 | | | $ | 0.51 | | | $ | 0.66 | | | $ | 0.33 | | | $ | 1.03 | |

| Closing price | | $ | 1.51 | | | $ | 2.10 | | | $ | 0.85 | | | $ | 0.72 | | | $ | 1.46 | |

| Dividends per share - annualized | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | – | |

| Closing dividend yield - annualized | | | (1 | ) | | | (1 | ) | | | (1 | ) | | | (1 | ) | | | (1 | ) |

Closing common shares and Operating Partnership units outstanding (in thousands) | | | 54,639 | | | | 54,620 | | | | 54,642 | | | | 54,656 | | | | 54,650 | |

Closing market value of common shares and Operating Partnership units outstanding (in thousands) | | $ | 82,505 | | | $ | 114,702 | | | $ | 46,446 | | | $ | 39,352 | | | $ | 79,788 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Dividend Information: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | | | | | | | | | | | | | | | | | | | |

| Dividend amount per share | | | (1 | ) | | | (1 | ) | | | (1 | ) | | | (1 | ) | | | (1 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Series A Preferred Stock | | | | | | | | | | | | | | | | | | | | |

| Dividend amount per share | | | (2 | ) | | | (2 | ) | | | (2 | ) | | | (2 | ) | | | (2 | ) |

__________

| (1) | The Board of Directors did not declare a dividend on our common stock for the quarters ended December 31, September 30, June 30 and March 31, 2009 and December 31, 2008. |

| | There can be no assurance that we will make distributions on our common stock at historical levels or at all. |

| (2) | The Board of Directors did not declare a dividend on our Series A Preferred Stock during the three months ended January 31, 2010 and October 31, July 31, April 30 and January 31, 2009. |

| | Dividends on our Series A Preferred Stock are cumulative, and therefore, will continue to accrue at an annual rate of $1.9064 per share. |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

Consolidated Financial Results

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

(unaudited and in thousands, except share, per share, percentage and ratio amounts)

| | | For the Three Months Ended |

| | | December 31, 2009 | | September 30, 2009 | | June 30, 2009 | | March 31, 2009 | | December 31, 2008 |

| Income Items: | | | | | | | | | | | | | | | |

| Revenue (1) | | $ | 119,391 | | | $ | 118,855 | | | $ | 119,853 | | | $ | 118,649 | | | $ | 124,122 | |

| Straight line rent | | | 2,994 | | | | 2,201 | | | | 3,019 | | | | 2,533 | | | | 2,412 | |

| Fair value lease revenue (2) | | | 4,360 | | | | 4,434 | | | | 5,617 | | | | 4,605 | | | | 5,145 | |

| Lease termination fees | | | 120 | | | | 11 | | | | 1,152 | | | | 81 | | | | 860 | |

| Office property operating margin (3) | | | 63.2 | % | | | 63.0 | % | | | 62.5 | % | | | 62.9 | % | | | 61.8 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss available to common stockholders | | $ | (299,052 | ) | | $ | (46,829 | ) | | $ | (380,450 | ) | | $ | (53,890 | ) | | $ | (96,305 | ) |

Net loss available to common stockholders - basic and diluted | | | (6.17 | ) | | | (0.97 | ) | | | (7.95 | ) | | | (1.13 | ) | | | (2.02 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Funds from operations (FFO) available to common stockholders (4) | | $ | (265,377 | ) | | $ | (11,699 | ) | | $ | (339,712 | ) | | $ | (30,786 | ) | | $ | (42,180 | ) |

| FFO per share - basic (4) | | | (5.48 | ) | | | (0.24 | ) | | | (7.10 | ) | | | (0.64 | ) | | | (0.88 | ) |

| FFO per share - diluted (4) | | | (5.48 | ) | | | (0.24 | ) | | | (7.10 | ) | | | (0.64 | ) | | | (0.88 | ) |

| FFO per share before specified items - basic (4) | | | 0.03 | | | | 0.06 | | | | 0.08 | | | | 0.07 | | | | 0.04 | |

| FFO per share before specified items - diluted (4) | | | 0.03 | | | | 0.06 | | | | 0.08 | | | | 0.07 | | | | 0.04 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios: | | | | | | | | | | | | | | | | | | | | |

| Interest coverage ratio (5) | | | (3.43 | ) | | | 0.95 | | | | (4.66 | ) | | | 1.11 | | | | 0.40 | |

| Interest coverage ratio before specified items (6) | | | 1.11 | | | | 1.13 | | | | 1.14 | | | | 1.13 | | | | 1.08 | |

| Fixed-charge coverage ratio (7) | | | (3.13 | ) | | | 0.87 | | | | (4.29 | ) | | | 1.02 | | | | 0.37 | |

| Fixed-charge coverage ratio before specified items (8) | | | 1.01 | | | | 1.04 | | | | 1.05 | | | | 1.04 | | | | 1.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Capitalization: | | | | | | | | | | | | | | | | | | | | |

| Common stock price @ quarter end | | $ | 1.51 | | | $ | 2.10 | | | $ | 0.85 | | | $ | 0.72 | | | $ | 1.46 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total consolidated debt | | $ | 4,248,975 | | | $ | 4,421,913 | | | $ | 4,600,771 | | | $ | 4,869,916 | | | $ | 4,882,809 | |

| Preferred stock liquidation preference | | | 250,000 | | | | 250,000 | | | | 250,000 | | | | 250,000 | | | | 250,000 | |

| Common equity value @ quarter end (9) | | | 82,505 | | | | 114,702 | | | | 46,446 | | | | 39,352 | | | | 79,788 | |

| Total consolidated market capitalization | | $ | 4,581,480 | | | $ | 4,786,615 | | | $ | 4,897,217 | | | $ | 5,159,268 | | | $ | 5,212,597 | |

| | | | | | | | | | | | | | | | | | | | | |

| Company share of MMO joint venture debt | | | 160,822 | | | | 160,975 | | | | 161,123 | | | | 161,268 | | | | 161,420 | |

| Total combined market capitalization | | $ | 4,742,302 | | | $ | 4,947,590 | | | $ | 5,058,340 | | | $ | 5,320,536 | | | $ | 5,374,017 | |

| | | | | | | | | | | | | | | | | | | | | |

Total consolidated debt / total consolidated market capitalization | | | 92.7 | % | | | 92.4 | % | | | 93.9 | % | | | 94.4 | % | | | 93.7 | % |

| Total combined debt / total combined market capitalization | | | 93.0 | % | | | 92.6 | % | | | 94.1 | % | | | 94.6 | % | | | 93.9 | % |

Total consolidated debt plus liquidation preference / total consolidated market capitalization | | | 98.2 | % | | | 97.6 | % | | | 99.1 | % | | | 99.2 | % | | | 98.5 | % |

Total combined debt plus liquidation preference / total combined market capitalization | | | 98.3 | % | | | 97.7 | % | | | 99.1 | % | | | 99.3 | % | | | 98.5 | % |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

Financial Highlights (continued)

(unaudited and in thousands, except share, per share, percentage and ratio amounts)

__________

| (1) | Excludes revenue from discontinued operations of approximately $6 million, $10 million, $18 million, $17 million and $16 million for the three months ended December 31, September 30, June 30 and March 31, 2009 and December 31, 2008, respectively. |

| (2) | Represents the net adjustment for above- and below-market leases, which are being amortized over the remaining term of the respective leases from the date of acquisition. |

| (3) | Calculated as follows: (rental, tenant reimbursement and parking revenues - rental property operating and maintenance, real estate taxes and parking expenses) / (rental, tenant reimbursement and parking revenues). Lease termination fees are reported as part of interest and other revenue in the consolidated statements of operations. |

| (4) | For a definition and discussion of FFO, see page 48. For a quantitative reconciliation of the differences between FFO and net loss, see page 15. |

| (5) | Calculated as earnings before interest, taxes and depreciation and amortization and preferred dividends, or EBITDA, of $(220,531), $62,637, $(317,416), $76,027 and $28,970, respectively, divided by cash paid for interest of $64,351, $66,005, $68,159, $68,288 and $73,055, respectively. Cash paid for interest excludes default interest accrued totaling $9.3 million and $4.6 million related to Properties in Default for the three months ended December 31 and September 30, 2009, respectively. For a discussion of EBITDA, see page 50. For a quantitative reconciliation of the differences between EBITDA and net loss, see page 18. |

| (6) | Calculated as Adjusted EBITDA of $71,481, $74,557, $77,684, $77,218 and $78,970, respectively, divided by cash paid for interest of $64,351, $66,005, $68,159, $68,288 and $73,055, respectively. For a discussion of Adjusted EBITDA, see page 50. |

| (7) | Calculated as EBITDA of $(220,531), $62,637, $(317,416), $76,027 and $28,970, respectively, divided by fixed charges of $70,562, $71,989, $74,033, $74,371 and $79,166, respectively. |

| (8) | Calculated as Adjusted EBITDA of $71,481, $74,557, $77,684, $77,218 and $78,970, respectively, divided by fixed charges of $70,562, $71,989, $74,033, $74,371 and $79,166, respectively. |

| (9) | Assumes 100% conversion of the limited partnership units in the Operating Partnership into shares of our common stock. Our limited partners have the right to redeem all or part of their Operating Partnership units at any time. At the time of redemption, we have the right to determine whether to redeem the Operating Partnership units for cash, based upon the fair market value of an equivalent number of shares of our common stock at the time of redemption, or exchange them for shares of our common stock on a one-for-one basis, subject to adjustment in the event of stock splits, stock dividends, issuance of stock rights, specified extraordinary distribution and similar events. |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

(unaudited and in thousands)

| | | December 31, 2009 | | | September 30, 2009 | | | June 30, 2009 | | | March 31, 2009 | | | December 31, 2008 | |

| | | | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | |

| Investments in real estate | | $ | 3,852,198 | | | $ | 4,337,009 | | | $ | 4,559,872 | | | $ | 5,024,534 | | | $ | 5,026,688 | |

| Less: accumulated depreciation | | | (659,753 | ) | | | (647,581 | ) | | | (666,092 | ) | | | (638,343 | ) | | | (604,302 | ) |

| | | | 3,192,445 | | | | 3,689,428 | | | | 3,893,780 | | | | 4,386,191 | | | | 4,422,386 | |

| | | | | | | | | | | | | | | | | | | | | |

| Cash, cash equivalents and restricted cash | | | 242,718 | | | | 222,109 | | | | 223,223 | | | | 256,558 | | | | 280,166 | |

| Rents, deferred rents and other receivables, net | | | 77,657 | | | | 83,593 | | | | 84,206 | | | | 82,024 | | | | 78,938 | |

| Deferred charges, net | | | 134,952 | | | | 154,488 | | | | 165,696 | | | | 176,916 | | | | 184,156 | |

| Other assets | | | 19,887 | | | | 22,287 | | | | 25,396 | | | | 43,601 | | | | 39,166 | |

| Investment in unconsolidated joint ventures | | | – | | | | – | | | | – | | | | 9,428 | | | | 11,606 | |

| Assets associated with real estate held for sale | | | – | | | | – | | | | – | | | | 161,668 | | | | 182,597 | |

| Total assets | | $ | 3,667,659 | | | $ | 4,171,905 | | | $ | 4,392,301 | | | $ | 5,116,386 | | | $ | 5,199,015 | |

| | | | | | | | | | | | | | | | | | | | | |

| Liabilities and Deficit | | | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | | | |

| Mortgage and other secured loans | | $ | 4,248,975 | | | $ | 4,421,913 | | | $ | 4,600,771 | | | $ | 4,704,696 | | | $ | 4,714,090 | |

Accounts payable, accrued interest payable and other liabilities | | | 198,052 | | | | 188,709 | | | | 174,467 | | | | 194,062 | | | | 221,066 | |

| Acquired below-market leases, net | | | 77,609 | | | | 84,013 | | | | 91,015 | | | | 104,359 | | | | 112,173 | |

| Obligations associated with real estate held for sale | | | – | | | | – | | | | – | | | | 169,929 | | | | 171,348 | |

| Total liabilities | | | 4,524,636 | | | | 4,694,635 | | | | 4,866,253 | | | | 5,173,046 | | | | 5,218,677 | |

| | | | | | | | | | | | | | | | | | | | | |

| Deficit: | | | | | | | | | | | | | | | | | | | | |

| Stockholders' Deficit: | | | | | | | | | | | | | | | | | | | | |

| Common and preferred stock and additional paid-in capital | | | 702,361 | | | | 701,110 | | | | 699,931 | | | | 698,377 | | | | 696,840 | |

| Accumulated deficit and dividends | | | (1,420,092 | ) | | | (1,125,223 | ) | | | (1,082,577 | ) | | | (705,730 | ) | | | (656,606 | ) |

| Accumulated other comprehensive loss, net | | | (36,289 | ) | | | (36,659 | ) | | | (35,451 | ) | | | (44,020 | ) | | | (59,896 | ) |

| Total stockholders' deficit | | | (754,020 | ) | | | (460,772 | ) | | | (418,097 | ) | | | (51,373 | ) | | | (19,662 | ) |

| Noncontrolling Interests: | | | | | | | | | | | | | | | | | | | | |

| Common units of our Operating Partnership | | | (102,957 | ) | | | (61,958 | ) | | | (55,855 | ) | | | (5,287 | ) | | | – | |

| Total deficit | | | (856,977 | ) | | | (522,730 | ) | | | (473,952 | ) | | | (56,660 | ) | | | (19,662 | ) |

| Total liabilities and deficit | | $ | 3,667,659 | | | $ | 4,171,905 | | | $ | 4,392,301 | | | $ | 5,116,386 | | | $ | 5,199,015 | |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

(unaudited and in thousands, except share and per share amounts)

| | | For the Three Months Ended | |

| | | December 31, 2009 | | | September 30, 2009 | | | June 30, 2009 | | | March 31, 2009 | | | December 31, 2008 | |

| Revenue: | | | | | | | | | | | | | | | |

| Rental | | $ | 73,357 | | | $ | 72,684 | | | $ | 73,646 | | | $ | 71,586 | | | $ | 72,927 | |

| Tenant reimbursements | | | 26,500 | | | | 27,468 | | | | 25,830 | | | | 27,214 | | | | 29,398 | |

| Hotel operations | | | 5,565 | | | | 4,916 | | | | 5,148 | | | | 4,994 | | | | 6,448 | |

| Parking | | | 11,839 | | | | 11,808 | | | | 11,540 | | | | 11,988 | | | | 12,373 | |

| Management, leasing and development services | | | 1,567 | | | | 1,550 | | | | 1,747 | | | | 2,030 | | | | 1,305 | |

| Interest and other | | | 563 | | | | 429 | | | | 1,942 | | | | 837 | | | | 1,671 | |

| Total revenue | | | 119,391 | | | | 118,855 | | | | 119,853 | | | | 118,649 | | | | 124,122 | |

| | | | | | | | | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | | | | | |

| Rental property operating and maintenance | | | 29,543 | | | | 27,955 | | | | 27,203 | | | | 26,377 | | | | 28,783 | |

| Hotel operating and maintenance | | | 3,763 | | | | 3,371 | | | | 3,481 | | | | 3,449 | | | | 4,021 | |

| Real estate taxes | | | 8,313 | | | | 10,196 | | | | 11,057 | | | | 11,057 | | | | 11,072 | |

| Parking | | | 3,268 | | | | 3,254 | | | | 3,381 | | | | 3,704 | | | | 3,917 | |

| General and administrative | | | 10,325 | | | | 8,603 | | | | 7,914 | | | | 8,264 | | | | 8,038 | |

| Other expense | | | 1,335 | | | | 1,556 | | | | 1,639 | | | | 1,504 | | | | 1,359 | |

| Depreciation and amortization | | | 35,563 | | | | 35,860 | | | | 40,538 | | | | 39,223 | | | | 38,188 | |

| Impairment of long-lived assets | | | 264,274 | | | | – | | | | 236,557 | | | | – | | | | – | |

| Interest | | | 73,071 | | | | 65,852 | | | | 56,548 | | | | 75,162 | | | | 62,423 | |

| Total expenses | | | 429,455 | | | | 156,647 | | | | 388,318 | | | | 168,740 | | | | 157,801 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss from continuing operations before equity in net | | | | | | | | | | | | | | | | | | | | |

loss of unconsolidated joint venture and gain on sale of real estate | | | (310,064 | ) | | | (37,792 | ) | | | (268,465 | ) | | | (50,091 | ) | | | (33,679 | ) |

| Equity in net loss of unconsolidated joint venture | | | 229 | | | | 229 | | | | (9,120 | ) | | | (1,739 | ) | | | (330 | ) |

| Gain on sale of real estate | | | – | | | | – | | | | – | | | | 20,350 | | | | – | |

| Loss from continuing operations | | | (309,835 | ) | | | (37,563 | ) | | | (277,585 | ) | | | (31,480 | ) | | | (34,009 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Discontinued Operations: | | | | | | | | | | | | | | | �� | | | | | |

Loss from discontinued operations before gain on sale of real estate | | | (26,084 | ) | | | (11,017 | ) | | | (151,023 | ) | | | (27,310 | ) | | | (57,530 | ) |

| Gain on sale of real estate | | | – | | | | – | | | | – | | | | 2,170 | | | | – | |

| Loss from discontinued operations | | | (26,084 | ) | | | (11,017 | ) | | | (151,023 | ) | | | (25,140 | ) | | | (57,530 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss | | | (335,919 | ) | | | (48,580 | ) | | | (428,608 | ) | | | (56,620 | ) | | | (91,539 | ) |

Net loss attributable to common units of our Operating Partnership | | | 41,633 | | | | 6,517 | | | | 52,924 | | | | 7,496 | | | | – | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss attributable to Maguire Properties, Inc. | | | (294,286 | ) | | | (42,063 | ) | | | (375,684 | ) | | | (49,124 | ) | | | (91,539 | ) |

| Preferred stock dividends | | | (4,766 | ) | | | (4,766 | ) | | | (4,766 | ) | | | (4,766 | ) | | | (4,766 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss available to common stockholders | | $ | (299,052 | ) | | $ | (46,829 | ) | | $ | (380,450 | ) | | $ | (53,890 | ) | | $ | (96,305 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted loss per common share: | | | | | | | | | | | | | | | | | | | | |

| Loss from continuing operations | | $ | (5.70 | ) | | $ | (0.77 | ) | | $ | (5.18 | ) | | $ | (0.67 | ) | | $ | (0.81 | ) |

| Loss from discontinued operations | | | (0.47 | ) | | | (0.20 | ) | | | (2.77 | ) | | | (0.46 | ) | | | (1.21 | ) |

| Net loss available to common stockholders per share | | $ | (6.17 | ) | | $ | (0.97 | ) | | $ | (7.95 | ) | | $ | (1.13 | ) | | $ | (2.02 | ) |

| Weighted average number of common shares outstanding | | | 48,463,476 | | | | 48,285,111 | | | | 47,836,591 | | | | 47,788,028 | | | | 47,777,101 | |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

(unaudited and in thousands)

| | | For the Three Months Ended | |

| | | December 31, 2009 | | | September 30, 2009 | | | June 30, 2009 | | | March 31, 2009 | | | December 31, 2008 | |

| Revenue: | | | | | | | | | | | | | | | |

| Rental | | $ | 4,590 | | | $ | 8,022 | | | $ | 15,179 | | | $ | 15,002 | | | $ | 13,571 | |

| Tenant reimbursements | | | 714 | | | | 1,160 | | | | 807 | | | | 625 | | | | 447 | |

| Parking | | | 515 | | | | 692 | | | | 1,264 | | | | 1,270 | | | | 1,122 | |

| Interest and other | | | 150 | | | | 126 | | | | 460 | | | | 458 | | | | 916 | |

| Total revenue | | | 5,969 | | | | 10,000 | | | | 17,710 | | | | 17,355 | | | | 16,056 | |

| | | | | | | | | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | | | | | |

| Rental property operating and maintenance | | | 1,438 | | | | 2,788 | | | | 5,442 | | | | 5,088 | | | | 5,204 | |

| Real estate taxes | | | 711 | | | | 1,123 | | | | 2,282 | | | | 2,314 | | | | 2,144 | |

| Parking | | | 216 | | | | 384 | | | | 807 | | | | 764 | | | | 746 | |

| Depreciation and amortization | | | 1,709 | | | | 3,262 | | | | 5,729 | | | | 6,387 | | | | 7,963 | |

| Impairment of long-lived assets | | | 25,992 | | | | 10,131 | | | | 148,116 | | | | 23,500 | | | | 50,000 | |

| Interest | | | 1,673 | | | | 3,066 | | | | 5,980 | | | | 6,401 | | | | 7,529 | |

| Loss from early extinguishment of debt | | | 314 | | | | 263 | | | | 377 | | | | 211 | | | | – | |

| Total expenses | | | 32,053 | | | | 21,017 | | | | 168,733 | | | | 44,665 | | | | 73,586 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss from discontinued operations before gain on sale of real estate | | | (26,084 | ) | | | (11,017 | ) | | | (151,023 | ) | | | (27,310 | ) | | | (57,530 | ) |

| Gain on sale of real estate | | | – | | | | – | | | | – | | | | 2,170 | | | | – | |

| Loss from discontinued operations | | $ | (26,084 | ) | | $ | (11,017 | ) | | $ | (151,023 | ) | | $ | (25,140 | ) | | $ | (57,530 | ) |

Supplemental Operating and Financial Data

Fourth Quarter 2009

(unaudited and in thousands)

| | | For the Three Months Ended | |

| | | December 31, 2009 | | | September 30, 2009 | |

| Revenue: | | | | | | |

| Rental | | $ | 13,368 | | | $ | 13,028 | |

| Tenant reimbursements | | | 2,679 | | | | 3,610 | |

| Parking | | | 1,374 | | | | 1,421 | |

| Interest and other | | | 247 | | | | 106 | |

| Total revenue | | | 17,668 | | | | 18,165 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Rental property operating and maintenance | | | 4,553 | | | | 4,915 | |

| Real estate taxes | | | 1,715 | | | | 1,910 | |

| Parking | | | 393 | | | | 445 | |

| Depreciation and amortization | | | 5,020 | | | | 5,900 | |

| Impairment of long-lived assets | | | 2,094 | | | | – | |

| Interest (2) | | | 24,736 | | | | 17,350 | |

| Total expenses | | | 38,511 | | | | 30,520 | |

| | | | | | | | | |

| Loss from operations related to Properties in Default | | $ | (20,843 | ) | | $ | (12,355 | ) |

__________

| (1) | Properties in Default include the following: Stadium Towers Plaza, Park Place II, 2600 Michelson, Pacific Arts Plaza, 550 South Hope and 500 Orange Tower. As of the date of this report, the mortgage loans on these properties are in default. |

| (2) | Includes default interest totaling $9.3 million and writeoff of deferred financing costs totaling $2.8 million for the three months ended December 31, 2009 and default interest totaling $4.6 million for the three months ended September 30, 2009, respectively. |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

(unaudited and in thousands)

| | | For the Three Months Ended | |

| | | December 31, 2009 | | | September 30, 2009 | | | June 30, 2009 | | | March 31, 2009 | | | December 31, 2008 | |

| | | | | | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | | | | | |

| Rental | | $ | 20,130 | | | $ | 19,532 | | | $ | 19,848 | | | $ | 20,389 | | | $ | 21,445 | |

| Tenant reimbursements | | | 6,613 | | | | 6,920 | | | | 5,885 | | | | 6,439 | | | | 6,579 | |

| Parking | | | 1,586 | | | | 1,532 | | | | 1,655 | | | | 2,035 | | | | 2,041 | |

| Interest and other | | | 824 | | | | 20 | | | | 21 | | | | 27 | | | | 85 | |

| Total revenue | | | 29,153 | | | | 28,004 | | | | 27,409 | | | | 28,890 | | | | 30,150 | |

| | | | | | | | | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | | | | | |

| Rental property operating and maintenance | | | 7,207 | | | | 6,565 | | | | 6,329 | | | | 6,305 | | | | 7,049 | |

| Real estate taxes | | | 3,759 | | | | 4,078 | | | | 4,061 | | | | 3,441 | | | | 2,419 | |

| Parking | | | 375 | | | | 428 | | | | 519 | | | | 422 | | | | 445 | |

| Depreciation and amortization | | | 11,254 | | | | 10,705 | | | | 10,039 | | | | 16,560 | | | | 11,018 | |

| Impairment of long-lived assets | | | – | | | | – | | | | 50,254 | | | | – | | | | – | |

| Interest | | | 10,975 | | | | 10,981 | | | | 10,872 | | | | 10,809 | | | | 11,008 | |

| Other | | | 1,210 | | | | 1,302 | | | | 1,257 | | | | 1,247 | | | | 1,370 | |

| Total expenses | | | 34,780 | | | | 34,059 | | | | 83,331 | | | | 38,784 | | | | 33,309 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss | | $ | (5,627 | ) | | $ | (6,055 | ) | | $ | (55,922 | ) | | $ | (9,894 | ) | | $ | (3,159 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Company share | | $ | (1,126 | ) | | $ | (1,211 | ) | | $ | (11,184 | ) | | $ | (1,979 | ) | | $ | (631 | ) |

| Intercompany eliminations | | | 281 | | | | 280 | | | | 279 | | | | 240 | | | | 301 | |

| Unallocated losses | | | 1,074 | | | | 1,160 | | | | 1,785 | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | |

| Equity in net loss of unconsolidated joint venture | | $ | 229 | | | $ | 229 | | | $ | (9,120 | ) | | $ | (1,739 | ) | | $ | (330 | ) |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

(unaudited and in thousands, except share and per share amounts)

| | | For the Three Months Ended | |

| | | December 31, 2009 | | | September 30, 2009 | | | June 30, 2009 | | | March 31, 2009 | | | December 31, 2008 | |

| | | | | | | | | | | | | | | | |

Reconciliation of net loss available to common stockholders to funds from operations: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net loss available to common stockholders | | $ | (299,052 | ) | | $ | (46,829 | ) | | $ | (380,450 | ) | | $ | (53,890 | ) | | $ | (96,305 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Add: | Depreciation and amortization of real estate assets | | | 37,186 | | | | 39,038 | | | | 46,183 | | | | 45,526 | | | | 46,052 | |

| | Depreciation and amortization of real estate assets - unconsolidated joint venture (1) | | | 2,251 | | | | 2,141 | | | | 2,008 | | | | 3,312 | | | | 2,204 | |

| | Net loss attributable to common units of our Operating Partnership | | | (41,633 | ) | | | (6,517 | ) | | | (52,924 | ) | | | (7,496 | ) | | | – | |

| | Unallocated losses - unconsolidated joint venture (1) | | | (1,074 | ) | | | (1,160 | ) | | | (1,785 | ) | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | |

| Deduct: | Gains on sale of real estate | | | – | | | | – | | | | – | | | | 22,520 | | | | – | |

| | | | | | | | | | | | | | | | | | | | | |

Funds from operations available to common stockholders and unit holders (FFO) (2) | | $ | (302,322 | ) | | $ | (13,327 | ) | | $ | (386,968 | ) | | $ | (35,068 | ) | | $ | (48,049 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Company share of FFO (3) | | $ | (265,377 | ) | | $ | (11,699 | ) | | $ | (339,712 | ) | | $ | (30,786 | ) | | $ | (42,180 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| FFO per share - basic | | $ | (5.48 | ) | | $ | (0.24 | ) | | $ | (7.10 | ) | | $ | (0.64 | ) | | $ | (0.88 | ) |

| FFO per share - diluted | | $ | (5.48 | ) | | $ | (0.24 | ) | | $ | (7.10 | ) | | $ | (0.64 | ) | | $ | (0.88 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Weighted average number of common shares outstanding - basic | | | 48,463,476 | | | | 48,285,111 | | | | 47,836,591 | | | | 47,788,028 | | | | 47,777,101 | |

Weighted average number of common and common equivalent shares outstanding - diluted | | | 49,108,575 | | | | 48,592,128 | | | | 47,837,083 | | | | 47,788,795 | | | | 47,777,868 | |

| Weighted average diluted shares and units | | | 55,783,148 | | | | 55,266,701 | | | | 54,511,656 | | | | 54,463,368 | | | | 54,452,441 | |

| | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of FFO to FFO before specified items: (2) | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

FFO available to common stockholders and unit holders (FFO) | | $ | (302,322 | ) | | $ | (13,327 | ) | | $ | (386,968 | ) | | $ | (35,068 | ) | | $ | (48,049 | ) |

| Add: | Loss from early extinguishment of debt | | | 314 | | | | 263 | | | | 377 | | | | 211 | | | | – | |

| | Unrealized loss on forward-starting interest rate swap | | | – | | | | – | | | | (15,255 | ) | | | 15,255 | | | | – | |

| | Realized loss on forward-starting interest rate swap | | | – | | | | – | | | | 11,340 | | | | – | | | | – | |

| | Default interest accrued on Properties in Default | | | 9,342 | | | | 4,561 | | | | – | | | | – | | | | – | |

| | Writeoff of deferred financing costs related to Properties in Default | | | 2,769 | | | | – | | | | – | | | | – | | | | – | |

| | Severance-related charges | | | – | | | | 1,526 | | | | – | | | | – | | | | – | |

| | 1733 Ocean lease termination charge | | | 1,342 | | | | – | | | | – | | | | – | | | | – | |

| | Impairment of long-lived assets | | | 290,266 | | | | 10,131 | | | | 384,673 | | | | 23,500 | | | | 50,000 | |

| | Impairment of long-lived assets - unconsolidated joint venture (1) | | | – | | | | – | | | | 10,050 | | | | – | | | | – | |

| FFO before specified items | | $ | 1,801 | | | $ | 3,154 | | | $ | 4,217 | | | $ | 3,898 | | | $ | 1,951 | |

| | | | | | | | | | | | | | | | | | | | | |

| Company share of FFO before specified items (3) | | $ | 1,581 | | | $ | 2,769 | | | $ | 3,702 | | | $ | 3,422 | | | $ | 1,713 | |

| | | | | | | | | | | | | | | | | | | | | |

| FFO per share before specified items - basic | | $ | 0.03 | | | $ | 0.06 | | | $ | 0.08 | | | $ | 0.07 | | | $ | 0.04 | |

| FFO per share before specified items - diluted | | $ | 0.03 | | | $ | 0.06 | | | $ | 0.08 | | | $ | 0.07 | | | $ | 0.04 | |

__________ | (1) | Amount represents our 20% ownership interest in the MMO joint venture. |

| (2) | For the definition and discussion of FFO and FFO before specified items, see page 48. |

| (3) | Based on a weighted average interest in our Operating Partnership of approximately 87.8% for all periods presented. |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

(unaudited and in thousands)

| | | For the Three Months Ended | |

| | | December 31, 2009 | | | September 30, 2009 | | | June 30, 2009 | | | March 31, 2009 | | | December 31, 2008 | |

| | | | | | | | | | | | | | | | |

| FFO | | $ | (302,322 | ) | | $ | (13,327 | ) | | $ | (386,968 | ) | | $ | (35,068 | ) | | $ | (48,049 | ) |

| Add: | Non-real estate depreciation | | | 86 | | | | 84 | | | | 84 | | | | 84 | | | | 99 | |

| | Straight line ground lease expense | | | 512 | | | | 511 | | | | 511 | | | | 511 | | | | 51 | |

| | Amortization of deferred financing costs | | | 1,726 | | | | 1,901 | | | | 1,955 | | | | 2,259 | | | | 2,243 | |

| | Unrealized loss on forward-starting interest rate swap | | | – | | | | – | | | | (15,255 | ) | | | 15,255 | | | | – | |

| | Realized loss on forward-starting interest rate swap | | | – | | | | – | | | | 11,340 | | | | – | | | | – | |

| | Default interest accrued on Properties in Default | | | 9,342 | | | | 4,561 | | | | – | | | | – | | | | – | |

| | Writeoff of deferred financing costs related to Properties in Default | | | 2,769 | | | | – | | | | – | | | | – | | | | – | |

| | Non-cash stock compensation | | | 1,218 | | | | 1,182 | | | | 1,539 | | | | 1,500 | | | | 1,443 | |

| | Impairment of long-lived assets | | | 290,266 | | | | 10,131 | | | | 384,673 | | | | 23,500 | | | | 50,000 | |

| | Impairment of long-lived assets - unconsolidated joint venture (2) | | | – | | | | – | | | | 10,050 | | | | – | | | | – | |

| | Loss from early extinguishment of debt | | | 314 | | | | 263 | | | | 377 | | | | 211 | | | | – | |

| | | | | | | | | | | | | | | | | | | | | |

| Deduct: | Straight line rent | | | 4,148 | | | | 3,758 | | | | 5,023 | | | | 4,094 | | | | 3,784 | |

| | Fair value lease revenue | | | 4,406 | | | | 4,532 | | | | 5,900 | | | | 5,057 | | | | 5,643 | |

| | Capitalized payments (3) | | | 3,435 | | | | 4,196 | | | | 3,550 | | | | 4,877 | | | | 5,520 | |

| | Non-recoverable capital expenditures | | | 338 | | | | 614 | | | | 923 | | | | 1,077 | | | | 620 | |

| | Recoverable capital expenditures | | | 588 | | | | 390 | | | | 320 | | | | 90 | | | | 704 | |

| | Hotel improvements, equipment upgrades and replacements | | | 577 | | | | 62 | | | | 251 | | | | 113 | | | | 290 | |

| | 2nd generation tenant improvements and leasing commissions (4), (5) | | | 1,290 | | | | 1,348 | | | | 1,664 | | | | 2,336 | | | | 7,878 | |

| | MMO joint venture AFFO adjustments (2) | | | 925 | | | | 439 | | | | 1,294 | | | | 611 | | | | 532 | |

| | | | | | | | | | | | | | | | | | | | | |

| Adjusted funds from operations (AFFO) | | $ | (11,796 | ) | | $ | (10,033 | ) | | $ | (10,619 | ) | | $ | (10,003 | ) | | $ | (19,184 | ) |

__________ | (1) | For the definition and computation method of AFFO, see page 49. For a quantitative reconciliation of the differences between AFFO and cash flows from operating activities, see page 18. |

| (2) | Amount represents our 20% ownership interest in the MMO joint venture. |

| (3) | Includes capital lease principal payments, regular principal payments required to service our debt, capitalized leasing and development payroll, and capitalized interest. |

| (4) | Excludes 1st generation tenant improvements and leasing commissions of $3.8 million, $5.4 million, $4.9 million, $1.4 million and $6.2 million for the three months ended December 31, September 30, June 30 and March 31, 2009 and December 31, 2008, respectively. |

| (5) | Excludes tenant improvements and leasing commissions paid using cash reserves that were funded through loan proceeds upon acquisition or debt refinancing of $0.3 million, $0.2 million, $0.7 million, $4.7 million and $6.2 million for the three months ended December 31, September 30, June 30 and March 31, 2009 and December 31, 2008, respectively. |

Supplemental Operating and Financial Data

Fourth Quarter 2009

(unaudited and in thousands)

| | | For the Three Months Ended | |

| | | December 31, 2009 | | | September 30, 2009 | |

| | | | | | | |

| FFO | | $ | (15,823 | ) | | $ | (6,455 | ) |

| Add: | Amortization of deferred financing costs | | | 166 | | | | 166 | |

| | Writeoff of deferred financing costs | | | 2,769 | | | | - | |

| | Default interest accrued | | | 9,342 | | | | 4,561 | |

| | Impairment of long-lived assets | | | 2,094 | | | | - | |

| | | | | | | | | |

| Deduct: | Straight line rent | | | 1,998 | | | | 1,035 | |

| | Fair value lease revenue | | | 1,500 | | | | 1,491 | |

| | Capitalized payments (2) | | | 345 | | | | 326 | |

| | Non-recoverable capital expenditures | | | 1 | | | | 1 | |

| | Recoverable capital expenditures | | | – | | | | 32 | |

| | 2nd generation tenant improvements and leasing commissions | | | 86 | | | | 5 | |

| | | | | | | | | |

| Adjusted funds from operations related to Properties in Default | | $ | (5,042 | ) | | $ | (4,618 | ) |

__________ | Properties in Default include the following: Stadium Towers Plaza, Park Place II, 2600 Michelson, Pacific Arts Plaza, 550 South Hope and 500 Orange Tower. As of the date of this report, the mortgage loans on these properties are in default. |

| (2) | Includes regular principal payments related to the Park Place II mortgage loan. |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

(unaudited and in thousands)

| | | For the Three Months Ended | |

| | | December 31, 2009 | | | September 30, 2009 | | | June 30, 2009 | | | March 31, 2009 | | | December 31, 2008 | |

Reconciliation of net loss to earnings before interest, taxes and depreciation and amortization (EBITDA): | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net loss | | $ | (335,919 | ) | | $ | (48,580 | ) | | $ | (428,608 | ) | | $ | (56,620 | ) | | $ | (91,539 | ) |

| Add: | Interest expense (3) | | | 74,744 | | | | 68,918 | | | | 62,528 | | | | 81,563 | | | | 69,952 | |

| | Company share of interest expense included in unconsolidated joint venture | | | 2,195 | | | | 2,196 | | | | 2,174 | | | | 2,162 | | | | 2,202 | |

| | Depreciation and amortization (4) | | | 37,272 | | | | 39,122 | | | | 46,267 | | | | 45,610 | | | | 46,151 | |

| | Company share of depreciation and amortization included in unconsolidated joint venture | | | 2,251 | | | | 2,141 | | | | 2,008 | | | | 3,312 | | | | 2,204 | |

| Deduct: | Unallocated losses from unconsolidated joint venture | | | 1,074 | | | | 1,160 | | | | 1,785 | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | |

| EBITDA | | $ | (220,531 | ) | | $ | 62,637 | | | $ | (317,416 | ) | | $ | 76,027 | | | $ | 28,970 | |

| | | | | | | | | | | | | | | | | | | | | |

| EBITDA | | $ | (220,531 | ) | | $ | 62,637 | | | $ | (317,416 | ) | | $ | 76,027 | | | $ | 28,970 | |

| Add: | Loss from early extinguishment of debt | | | 314 | | | | 263 | | | | 377 | | | | 211 | | | | – | |

| | Severance-related charges | | | – | | | | 1,526 | | | | – | | | | – | | | | – | |

| | 1733 Ocean lease termination charge | | | 1,432 | | | | – | | | | – | | | | – | | | | – | |

| | Impairment of long-lived assets | | | 290,266 | | | | 10,131 | | | | 384,673 | | | | 23,500 | | | | 50,000 | |

| | Company share of impairment of long-lived assets included in unconsolidated joint venture | | | – | | | | – | | | | 10,050 | | | | – | | | | – | |

| Deduct: | Gains on sale of real estate | | | – | | | | – | | | | – | | | | 22,520 | | | | – | |

| | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | | $ | 71,481 | | | $ | 74,557 | | | $ | 77,684 | | | $ | 77,218 | | | $ | 78,970 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Reconciliation of cash flows from operating activities to adjusted funds from operations (AFFO): | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Cash flows from operating activities | | $ | 4,456 | | | $ | 11,029 | | | $ | (248 | ) | | $ | (8,254 | ) | | $ | (26,978 | ) |

| Changes in other assets and liabilities | | | (13,459 | ) | | | (18,648 | ) | | | (7,213 | ) | | | 1,867 | | | | 17,286 | |

| Non-recoverable capital expenditures | | | (338 | ) | | | (614 | ) | | | (923 | ) | | | (1,077 | ) | | | (620 | ) |

| Recoverable capital expenditures | | | (588 | ) | | | (390 | ) | | | (320 | ) | | | (90 | ) | | | (704 | ) |

| Hotel improvements, equipment upgrades and replacements | | | (577 | ) | | | (62 | ) | | | (251 | ) | | | (113 | ) | | | (290 | ) |

2nd generation tenant improvements and leasing commissions (5), (6) | | | (1,290 | ) | | | (1,348 | ) | | | (1,664 | ) | | | (2,336 | ) | | | (7,878 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| AFFO | | $ | (11,796 | ) | | $ | (10,033 | ) | | $ | (10,619 | ) | | $ | (10,003 | ) | | $ | (19,184 | ) |

__________ | (1) | For the definition and discussion of EBITDA and Adjusted EBITDA, see page 50. |

| (2) | For the definition and discussion of AFFO, see page 49. |

| (3) | Includes interest expense of $1.7 million, $3.1 million, $6.0 million, $6.4 million and $7.5 million for the three months ended December 31, September 30, June 30 and March 31, 2009 and December 31, 2008, respectively, related to discontinued operations. |

| (4) | Includes depreciation and amortization of $1.7 million, $3.3 million, $5.7 million, $6.4 million and $8.0 million for the three months ended December 31, September 30, June 30 and March 31, 2009 and December 31, 2008, respectively, related to discontinued operations. |

| (5) | Excludes 1st generation tenant improvements and leasing commissions of $3.8 million, $5.4 million, $4.9 million, $1.4 million and $6.2 million for the three months ended December 31, September 30, June 30 and March 31, 2009 and December 31, 2008, respectively. |

| (6) | Excludes tenant improvements and leasing commissions paid using cash reserves that were funded through loan proceeds upon acquisition or debt refinancing of $0.3 million, $0.2 million, $0.7 million, $4.7 million and $6.2 million for the three months ended December 31, September 30, June 30 and March 31, 2009 and December 31, 2008, respectively. |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

| Debt | |

| (in thousands) | |

| | | | Balance as of | |

| | | | December 31, 2009 | |

| | | | | |

| Mortgage and other secured loans | | | $ | 4,248,975 | |

| Company share of MMO joint venture debt | | | | 160,822 | |

| Total combined debt | | | $ | 4,409,797 | |

| | | | | | |

| Equity | |

| (in thousands) | |

| | | | | | | | |

| | | | | | | | |

| | | Shares Outstanding | | | Total Liquidation Preference | |

| | | | | | | | |

| Preferred stock | | | 10,000 | | | $ | 250,000 | |

| | | Shares & Units Outstanding | | | Market Value (1) | |

| | | | | | | | | |

| Common stock | | | 47,964 | | | $ | 72,426 | |

| | | | | | | | | |

| Noncontrolling common units of our Operating Partnership | | | 6,675 | | | | 10,079 | |

| Total common equity | | | 54,639 | | | $ | 82,505 | |

| | | | | | | | | |

| Total consolidated market capitalization | | | | | | $ | 4,581,480 | |

| | | | | | | | | |

| Total combined market capitalization (2) | | | | | | $ | 4,742,302 | |

__________ | (1) | Value based on the NYSE closing price of $1.51 on December 31, 2009. |

| (2) | Includes our share of Maguire Macquarie Office ("MMO") joint venture debt. |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

(in thousands, except percentages)

| | Maturity Date | | Principal Amount as of December 31, 2009 | | | % of Debt | | Interest Rate as of December 31, 2009 (1) |

| Floating-Rate Debt | | | | | | | | | | |

| | | | | | | | | | | |

| Repurchase facility (2) | May 1, 2011 | | $ | 22,420 | | | | 0.53 | % | | | 2.98 | % |

| | | | | | | | | | | | | | |

| Construction Loans: | | | | | | | | | | | | | |

| 17885 Von Karman | June 30, 2010 | | | 24,154 | | | | 0.57 | % | | | 5.00 | % |

| 207 Goode (3) | May 1, 2010 | | | 22,444 | | | | 0.53 | % | | | 2.03 | % |

| 2385 Northside Drive | August 6, 2010 | | | 17,506 | | | | 0.41 | % | | | 5.00 | % |

| Total construction loans | | | | 64,104 | | | | 1.51 | % | | | 3.96 | % |

| | | | | | | | | | | | | | |

| Variable-Rate Mortgage Loans: | | | | | | | | | | | | | |

| Griffin Towers (4) | May 1, 2010 | | | 125,000 | | | | 2.94 | % | | | 6.50 | % |

| Plaza Las Fuentes (5) | September 29, 2010 | | | 92,600 | | | | 2.17 | % | | | 3.48 | % |

| Brea Corporate Place (6) | May 1, 2010 | | | 70,468 | | | | 1.65 | % | | | 2.18 | % |

| Brea Financial Commons (6) | May 1, 2010 | | | 38,532 | | | | 0.91 | % | | | 2.18 | % |

| Total variable-rate mortgage loans | | | | 326,600 | | | | 7.67 | % | | | 4.20 | % |

| | | | | | | | | | | | | | |

| Variable-Rate Swapped to Fixed-Rate Loans: | | | | | | | | | | | | | |

| KPMG Tower (7) | October 9, 2012 | | | 400,000 | | | | 9.40 | % | | | 7.16 | % |

| 207 Goode (3) | May 1, 2010 | | | 25,000 | | | | 0.59 | % | | | 7.36 | % |

| Total variable-rate swapped to fixed-rate loans | | | | 425,000 | | | | 9.99 | % | | | 7.18 | % |

| | | | | | | | | | | | | | |

| Total floating-rate debt | | | | 838,124 | | | | 19.70 | % | | | 5.66 | % |

| | | | | | | | | | | | | | |

| Fixed-Rate Debt | | | | | | | | | | | | | |

| Wells Fargo Tower | April 6, 2017 | | | 550,000 | | | | 12.92 | % | | | 5.68 | % |

| Two California Plaza | May 6, 2017 | | | 470,000 | | | | 11.04 | % | | | 5.50 | % |

| Gas Company Tower | August 11, 2016 | | | 458,000 | | | | 10.76 | % | | | 5.10 | % |

| 777 Tower | November 1, 2013 | | | 273,000 | | | | 6.41 | % | | | 5.84 | % |

| US Bank Tower | July 1, 2013 | | | 260,000 | | | | 6.11 | % | | | 4.66 | % |

| City Tower | May 10, 2017 | | | 140,000 | | | | 3.29 | % | | | 5.85 | % |

| Glendale Center | August 11, 2016 | | | 125,000 | | | | 2.94 | % | | | 5.82 | % |

| 801 North Brand | April 6, 2015 | | | 75,540 | | | | 1.78 | % | | | 5.73 | % |

| Mission City Corporate Center | April 1, 2012 | | | 52,000 | | | | 1.22 | % | | | 5.09 | % |

| The City - 3800 Chapman | May 6, 2017 | | | 44,370 | | | | 1.04 | % | | | 5.93 | % |

| 701 North Brand | October 1, 2016 | | | 33,750 | | | | 0.79 | % | | | 5.87 | % |

| 700 North Central | April 6, 2015 | | | 27,460 | | | | 0.65 | % | | | 5.73 | % |

| Griffin Towers Senior Mezzanine | May 1, 2011 | | | 20,000 | | | | 0.47 | % | | | 13.00 | % |

| | | | | | | | | | | | | | |

| Total fixed-rate debt | | | | 2,529,120 | | | | 59.42 | % | | | 5.52 | % |

| | | | | | | | | | | | | | |

| Total debt, excluding Properties in Default | | | | 3,367,244 | | | | 79.12 | % | | | 5.56 | % |

| | | | | | | | | | | | | | |

| Properties in Default | | | | | | | | | | | | | |

| Pacific Arts Plaza (8) | April 1, 2012 | | | 270,000 | | | | 6.34 | % | | | 9.15 | % |

| 550 South Hope Street (9) | May 6, 2017 | | | 200,000 | | | | 4.70 | % | | | 10.67 | % |

| 500 Orange Tower (10) | May 6, 2017 | | | 110,000 | | | | 2.59 | % | | | 5.88 | % |

| 2600 Michelson (11) | May 10, 2017 | | | 110,000 | | | | 2.59 | % | | | 10.69 | % |

| Stadium Towers Plaza (12) | May 11, 2017 | | | 100,000 | | | | 2.35 | % | | | 10.78 | % |

| Park Place II (13) | March 11, 2012 | | | 98,482 | | | | 2.31 | % | | | 10.39 | % |

| | | | | | | | | | | | | | |

| Total Properties in Default | | | | 888,482 | | | | 20.88 | % | | | 9.60 | % |

| | | | | | | | | | | | | | |

| Total consolidated debt | | | | 4,255,726 | | | | 100.00 | % | | | 6.40 | % |

| | | | | | | | | | | | | | |

| Debt discount | | | | (6,751 | ) | | | | | | | | |

| | | | | | | | | | | | | | |

| Total consolidated debt, net | | | $ | 4,248,975 | | | | | | | | | |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

(in thousands, except percentages)

__________

| (1) | The December 31, 2009 one-month LIBOR rate of 0.23% was used to calculate interest on the variable-rate loans, except for the 17885 Von Karman and 2385 Northside Drive construction loans which were calculated using the floor interest rate under the loan agreements of 5.00%. |

| (2) | This loan currently bears interest at a variable rate of LIBOR plus 2.75%, increasing to LIBOR plus 3.75% in June 2010. |

| (3) | This loan bears interest at LIBOR plus 1.80%. We have entered into an interest rate swap agreement to hedge this loan up to $25.0 million, which effectively fixes the LIBOR rate at 5.564%. One one-year extension is available at our option, subject to certain conditions, some of which we may be unable to fulfill. |

| (4) | This loan bears interest at a rate of the greater of LIBOR or 3.00%, plus 3.50%. As required by the loan agreement, we have entered into an interest rate cap agreement that limits the LIBOR portion of the interest rate to 5.00% during the loan term, excluding the extension period. One one-year extension is available at our option, subject to certain conditions, some of which we may be unable to fulfill. |

| (5) | As required by the loan agreement, we have entered into an interest rate cap agreement that limits the LIBOR portion of the interest rate to 4.75% during the loan term, excluding extension periods. Three one-year extensions are available at our option, subject to certain conditions, some of which we may be unable to fulfill. |

| (6) | As required by the loan agreement, we have entered into an interest rate cap agreement that limits the LIBOR portion of the interest rate to 6.50% during the loan term, excluding extension periods. Two one-year extensions are available at our option, subject to certain conditions, some of which we may be unable to fulfill. |

| (7) | This loan bears interest at a rate of LIBOR plus 1.60%. We have entered into an interest rate swap agreement to hedge this loan, which effectively fixes the LIBOR rate at 5.564%. |

| (8) | Our special purpose property-owning subsidiary that owns the Pacific Arts Plaza property failed to make the debt service payments under this loan that were due beginning on September 1, 2009 and continuing through and including March 1, 2010. The interest rate shown for this loan is the default rate as defined in the loan agreement. |

| (9) | Our special purpose property-owning subsidiary that owns the 550 South Hope property failed to make the debt service payments under this loan that were due beginning on August 6, 2009 and continuing through and including March 6, 2010. The interest rate shown for this loan is the default rate as defined in the loan agreement. |

| (10) | Our special purpose property-owning subsidiary that owns the 500 Orange Tower property failed to make the debt service payments under this loan that were due beginning on January 6, 2010 and continuing through and including March 6, 2010. |

| (11) | Our special purpose property-owning subsidiary that owns the 2600 Michelson property failed to make the debt service payments under this loan that were due beginning on August 11, 2009 and continuing through and including March 11, 2010. The interest rate shown for this loan is the default rate as defined in the loan agreement. This property was placed in receivership in November 2009. |

| (12) | Our special purpose property-owning subsidiary that owns the Stadium Towers Plaza property failed to make the debt service payments under this loan that were due beginning on August 11, 2009 and continuing through and including March 11, 2010. The interest rate shown for this loan is the default rate as defined in the loan agreement. |

| (13) | Our special purpose property-owning subsidiary that owns the Park Place II property failed to make the debt service payments under this loan that were due beginning on August 11, 2009 and continuing through and including March 11, 2010. The interest rate shown for this loan is the default rate as defined in the loan agreement. |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

(in thousands, except percentages)

| | Maturity Date | | Principal Amount as of December 31, 2009 | | | % of Debt | | Interest Rate as of December 31, 2009 |

| | | | | | | | | | | |

| Fixed-Rate Debt | | | | | | | | | | |

| Wells Fargo Center (Denver, CO) | April 6, 2015 | | $ | 276,000 | | | | 34.41 | % | | | 5.26 | % |

| One California Plaza | December 1, 2010 | | | 140,202 | | | | 17.48 | % | | | 4.73 | % |

| San Diego Tech Center | April 11, 2015 | | | 133,000 | | | | 16.58 | % | | | 5.70 | % |

| Quintana Campus (1) | December 11, 2011 | | | 106,000 | | | | 13.21 | % | | | 5.07 | % |

| Cerritos Corporate Center | February 1, 2016 | | | 95,000 | | | | 11.84 | % | | | 5.54 | % |

| Stadium Gateway | February 1, 2016 | | | 52,000 | | | | 6.48 | % | | | 5.66 | % |

| Total fixed-rate debt | | | | 802,202 | | | | 100.00 | % | | | 5.27 | % |

| | | | | | | | | | | | | | |

| Debt premium, net of discount | | | | 1,908 | | | | | | | | | |

| Total joint venture debt, net | | | $ | 804,110 | | | | | | | | | |

| | | | | | | | | | | | | | |

| Our portion of joint venture debt (2) | | | $ | 160,822 | | | | | | | | | |

__________ | (1) | The MMO joint venture defaulted on its Quintana mortgage loan by failing to make its required debt service payments. This property was placed in receivership in November 2009. |

| (2) | We own 20% of the MMO joint venture. |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

(in thousands, except percentages)

| | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | | Thereafter | | Total |

| Floating-Rate Debt | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Repurchase facility | | $ | 7,420 | | | $ | 15,000 | | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | 22,420 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Construction Loans: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 17885 Von Karman | | | 24,154 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | 24,154 | |

| 207 Goode (1) | | | 22,444 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | 22,444 | |

| 2385 Northside Drive | | | 17,506 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | 17,506 | |

| Total construction loans | | | 64,104 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | 64,104 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Variable-Rate Mortgage Loans: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Griffin Towers (1) | | | 125,000 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | 125,000 | |

| Plaza Las Fuentes (2) | | | 92,600 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | 92,600 | |

| Brea Corporate Place (3) | | | 70,468 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | 70,468 | |

| Brea Financial Commons (3) | | | 38,532 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | 38,532 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total variable-rate mortgage loans | | | 326,600 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | 326,600 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Variable-Rate Swapped to Fixed-Rate Loans: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| KPMG Tower | | | – | | | | – | | | | 400,000 | | | | – | | | | – | | | | – | | | | 400,000 | |

| 207 Goode (1) | | | 25,000 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | 25,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total variable-rate swapped to fixed-rate loans | | | 25,000 | | | | – | | | | 400,000 | | | | – | | | | – | | | | – | | | | 425,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total floating-rate debt | | | 423,124 | | | | 15,000 | | | | 400,000 | | | | – | | | | – | | | | – | | | | 838,124 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fixed-Rate Debt | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Wells Fargo Tower | | | – | | | | – | | | | – | | | | – | | | | – | | | | 550,000 | | | | 550,000 | |

| Two California Plaza | | | – | | | | – | | | | – | | | | – | | | | – | | | | 470,000 | | | | 470,000 | |

| Gas Company Tower | | | – | | | | – | | | | – | | | | – | | | | – | | | | 458,000 | | | | 458,000 | |

| 777 Tower | | | – | | | | – | | | | – | | | | 273,000 | | | | – | | | | – | | | | 273,000 | |

| US Bank Tower | | | – | | | | – | | | | – | | | | 260,000 | | | | – | | | | – | | | | 260,000 | |

| City Tower | | | – | | | | – | | | | – | | | | – | | | | – | | | | 140,000 | | | | 140,000 | |

| Glendale Center | | | – | | | | – | | | | – | | | | – | | | | – | | | | 125,000 | | | | 125,000 | |

| 801 North Brand | | | – | | | | – | | | | – | | | | – | | | | – | | | | 75,540 | | | | 75,540 | |

| Mission City Corporate Center | | | – | | | | – | | | | 52,000 | | | | – | | | | – | | | | – | | | | 52,000 | |

| The City - 3800 Chapman | | | – | | | | – | | | | – | | | | – | | | | – | | | | 44,370 | | | | 44,370 | |

| 701 North Brand | | | – | | | | – | | | | – | | | | – | | | | – | | | | 33,750 | | | | 33,750 | |

| 700 North Central | | | – | | | | – | | | | – | | | | – | | | | – | | | | 27,460 | | | | 27,460 | |

| Griffin Towers Senior Mezzanine | | | – | | | | 20,000 | | | | – | | | | – | | | | – | | | | – | | | | 20,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total fixed-rate debt | | | – | | | | 20,000 | | | | 52,000 | | | | 533,000 | | | | – | | | | 1,924,120 | | | | 2,529,120 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total debt, excluding Properties in Default | | | 423,124 | | | | 35,000 | | | | 452,000 | | | | 533,000 | | | | – | | | | 1,924,120 | | | | 3,367,244 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Debt discount | | | – | | | | – | | | | – | | | | (2,509 | ) | | | – | | | | (3,474 | ) | | | (5,983 | ) |

| Total debt, excluding Properties in Default, net | | | 423,124 | | | | 35,000 | | | | 452,000 | | | | 530,491 | | | | – | | | | 1,920,646 | | | | 3,361,261 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Properties in Default (4) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pacific Arts Plaza | | | – | | | | – | | | | 270,000 | | | | – | | | | – | | | | – | | | | 270,000 | |

| 550 South Hope Street | | | – | | | | – | | | | – | | | | – | | | | – | | | | 200,000 | | | | 200,000 | |

| 500 Orange Tower | | | – | | | | – | | | | – | | | | – | | | | – | | | | 110,000 | | | | 110,000 | |

| 2600 Michelson | | | – | | | | – | | | | – | | | | – | | | | – | | | | 110,000 | | | | 110,000 | |

| Stadium Towers Plaza | | | – | | | | – | | | | – | | | | – | | | | – | | | | 100,000 | | | | 100,000 | |

| Park Place II | | | 1,746 | | | | 1,266 | | | | 95,470 | | | | – | | | | – | | | | – | | | | 98,482 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Properties in Default | | | 1,746 | | | | 1,266 | | | | 365,470 | | | | – | | | | – | | | | 520,000 | | | | 888,482 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Debt discount | | | – | | | | – | | | | – | | | | – | | | | – | | | | (768 | ) | | | (768 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Properties in Default, net | | | 1,746 | | | | 1,266 | | | | 365,470 | | | | – | | | | – | | | | 519,232 | | | | 887,714 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total consolidated debt, net | | $ | 424,870 | | | $ | 36,266 | | | $ | 817,470 | | | $ | 530,491 | | | $ | – | | | $ | 2,439,878 | | | $ | 4,248,975 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted average interest rate, excluding Properties in Default | | | 4.33 | % | | | 8.71 | % | | | 6.93 | % | | | 5.27 | % | | | – | | | | 5.53 | % | | | 5.56 | % |

| Weighted average interest rate, Properties in Default | | | 10.39 | % | | | 10.39 | % | | | 9.48 | % | | | – | | | | – | | | | 9.68 | % | | | 9.60 | % |

| Weighted average interest rate, consolidated | | | 4.36 | % | | | 8.76 | % | | | 8.07 | % | | | 5.27 | % | | | – | | | | 6.41 | % | | | 6.40 | % |

__________

| (1) | One one-year extension is available at our option, subject to certain conditions, some of which we may be unable to fulfill. |

| (2) | Three one-year extensions are available at our option, subject to certain conditions, some of which we may be unable to fulfill. |

| (3) | Two one-year extensions are available at our option, subject to certain conditions, some of which we may be unable to fulfill. |

| (4) | The maturity dates shown above for the Properties in Default reflect the contractual maturity dates per the loan agreements. The actual settlement dates for these loans will depend upon when the properties are disposed of either by the Company or the special servicer, as applicable. |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

(in thousands, except percentages)

| | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | | Thereafter | | Total |

| | | | | | | | | | | | | | | | | | | | | | |

| Fixed-Rate Debt | | | | | | | | | | | | | | | | | | | | | |

| Wells Fargo Center (Denver, CO) | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | 276,000 | | | $ | 276,000 | |

| One California Plaza | | | 140,202 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | 140,202 | |

| San Diego Tech Center | | | – | | | | – | | | | – | | | | – | | | | – | | | | 133,000 | | | | 133,000 | |

Quintana Campus (1) | | | – | | | | 106,000 | | | | – | | | | – | | | | – | | | | – | | | | 106,000 | |

| Cerritos Corporate Center | | | – | | | | 1,054 | | | | 1,330 | | | | 1,406 | | | | 1,486 | | | | 89,724 | | | | 95,000 | |

| Stadium Gateway | | | – | | | | – | | | | – | | | | – | | | | – | | | | 52,000 | | | | 52,000 | |

| | | | 140,202 | | | | 107,054 | | | | 1,330 | | | | 1,406 | | | | 1,486 | | | | 550,724 | | | | 802,202 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Debt premium, net of discount | | | (371 | ) | | | (59 | ) | | | – | | | | – | | | | – | | | | 2,338 | | | | 1,908 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total joint venture debt, net | | $ | 139,831 | | | $ | 106,995 | | | $ | 1,330 | | | $ | 1,406 | | | $ | 1,486 | | | $ | 553,062 | | | $ | 804,110 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted average interest rate | | | 4.73 | % | | | 5.07 | % | | | 5.54 | % | | | 5.54 | % | | | 5.54 | % | | | 5.45 | % | | | 5.27 | % |

__________

| (1) | The MMO joint venture defaulted on its Quintana mortgage loan by failing to make its required debt service payments. This property is currently in receivership. The maturity date shown above reflects the contractual maturity date per the loan agreement. The actual settlement date for this loan will depend upon when the property is disposed of by the special servicer. |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

Portfolio Data

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

(unaudited and in thousands, except percentages)

| | | For the Three Months Ended December 31, (1) | | | For the Year Ended December 31, (2) |

| | | 2009 | | 2008 | | % Change | | | 2009 | | 2008 | | % Change |

| Total Same Store Portfolio | | | | | | | | | | | | | | | | | | | |

| Number of properties | | | 19 | | | | 19 | | | | | | | | 17 | | | | 17 | | | | |

| Square feet as of December 31 | | | 10,790,937 | | | | 10,781,142 | | | | | | | | 10,550,772 | | | | 10,540,977 | | | | |

| Percentage of wholly-owned Office Portfolio | | | 100.0 | % | | | 100.0 | % | | | | | | | 97.8 | % | | | 97.8 | % | | | |

| Weighted average leased percentage (3) | | | 84.5 | % | | | 84.1 | % | | | | | | | 85.3 | % | | | 85.6 | % | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | | | | | | | | | | | | | | | | | | | | | | | |

| Breakdown of Net Operating Income: | | | | | | | | | | | | | | | | | | | | | | | |

| Operating revenue | | $ | 94,405 | | | $ | 96,938 | | | | (2.6 | )% | | | $ | 374,578 | | | $ | 374,375 | | | | 0.1 | % |

| Operating expenses | | | 34,316 | | | | 35,590 | | | | (3.6 | )% | | | | 133,354 | | | | 135,398 | | | | (1.5 | )% |

| Other expense | | | 1,264 | | | | 804 | | | | 57.2 | % | (4) | | | 5,055 | | | | 4,833 | | | | 4.6 | % |

| Net operating income | | $ | 58,825 | | | $ | 60,544 | | | | (2.8 | )% | | | $ | 236,169 | | | $ | 234,144 | | | | 0.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| CASH BASIS | | | | | | | | | | | | | | | | | | | | | | | | | |

| Breakdown of Net Operating Income: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating revenue | | $ | 90,550 | | | $ | 91,666 | | | | (1.2 | )% | | | $ | 356,128 | | | $ | 347,246 | | | | 2.6 | % |

| Operating expenses | | | 34,316 | | | | 35,590 | | | | (3.6 | )% | | | | 133,354 | | | | 135,398 | | | | (1.5 | )% |

| Other expense | | | 743 | | | | 743 | | | | – | | | | | 2,971 | | | | 2,966 | | | | 0.2 | % |

| Net operating income | | $ | 55,491 | | | $ | 55,333 | | | | 0.3 | % | | | $ | 219,803 | | | $ | 208,882 | | | | 5.2 | % |

__________ | (1) | Properties included in the Same Store analysis are the properties in our Office Portfolio, with the exception of the Properties in Default and our joint venture properties. |

| (2) | Properties included in the Same Store analysis are the properties in our Office Portfolio, with the exception of the Properties in Default, our joint venture properties, 2385 Northside Drive and 17885 Von Karman buildings. |

| (3) | Represents weighted average leased amounts for the Same Store portfolio. |

| (4) | Increase due to higher ground lease expense during 2009. |

Maguire Properties, Inc.

Supplemental Operating and Financial Data

Fourth Quarter 2009

| | Ownership | | | Square Feet | | Leased % and In-Place Rents | |

| Property | | Number of Buildings | | | Number of Tenants | | Year Built / Renovated | | % | | | Net Building Rentable | | | Effective (1) | | | % of Net Rentable | | % Leased | | Total Annualized Rents (2) | | | Effective Annualized Rents (2) | | | Annualized Rent $/RSF (3) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Office Properties | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Los Angeles County | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Los Angeles Central Business District: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |