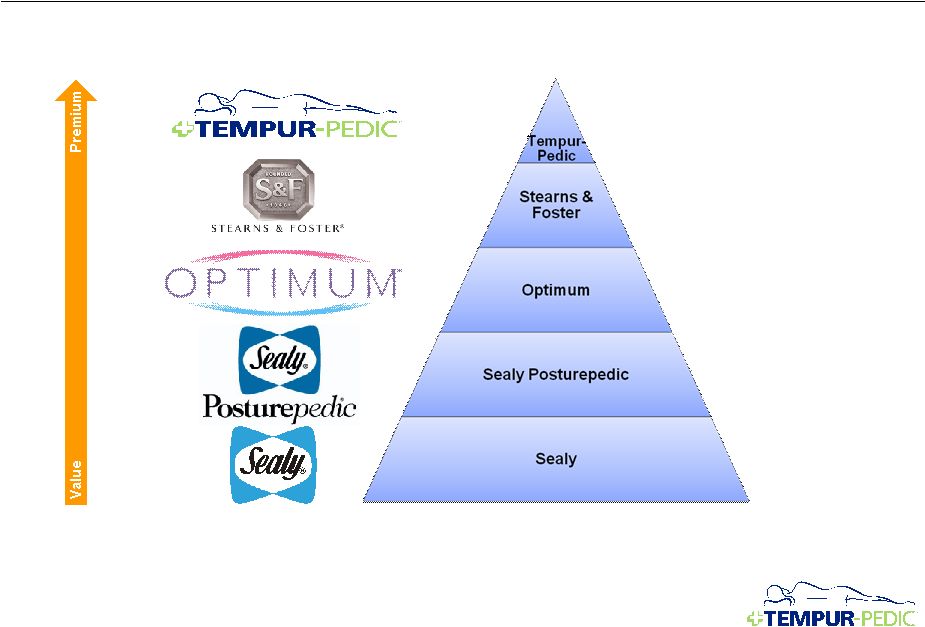

Note Regarding Trademarks, Trade Names and Service Marks: Tempur, Tempur-Pedic, TEMPUR-Cloud Collection, TEMPUR-Cloud Select, TEMPUR-Cloud Supreme, TEMPUR-Cloud Supreme Breeze, TEMPUR-Cloud Luxe, TEMPUR-Cloud Allura, TEMPUR-Cloud Luxe Breeze, TEMPUR-Choice Collection, TEMPUR-Choice Supreme, TEMPUR-Choice Luxe, TEMPUR-Weightless Collection, TEMPUR- Weightless Select, TEMPUR-Weightless Supreme, TEMPUR-Contour Collection, TEMPUR-Contour, TEMPUR-Contour Select, TEMPUR-Contour Signature, TEMPUR-Rhapsody, TEMPUR-Rhapsody Breeze, TEMPUR-Allura, GrandBed, TEMPUR-Simplicity Collection, TEMPUR Original Collection, TEMPUR Sensation Collection, TEMPUR-Ergo Advanced System, TEMPUR-Ergo Premier, TEMPUR-Cloud Pillow, TEMPUR-Neck Pillow, TEMPUR-Symphony Pillow, TEMPUR-Comfort Pillow, TEMPUR-Rhapsody Pillow, and TEMPUR-Traditional Pillow are trademarks, trade names or service marks of Tempur-Pedic International Inc. and its subsidiaries. Sealy, Sealy Posturepedic, Stearns & Foster, and Optimum are trademarks, trade names or service marks of Sealy Corporation and its subsidiaries. All other trademarks, trade names and service marks in this presentation are the property of the respective owners. Forward-Looking Statements 2 This presentation contains "forward-looking statements,” within the meaning of federal securities laws, which include information concerning one or more of the Company's plans, objectives, goals, strategies, and other information that is not historical information. When used in this release, the words "estimates," "expects," "anticipates," "projects," "plans," “proposed,” "intends," "believes," and variations of such words or similar expressions are intended to identify forward-looking statements. These forward-looking statements include, without limitation, statements relating to the Company’s proposed initiatives and product introductions; the Company’s growth potential and strong brand; the proposed merger with Sealy Corporation, including expectations regarding earnings accretion, cost synergies and revenue synergies, and the ability to invest in key growth areas and rapidly delever the combined company; and expectations regarding the Company’s net sales and adjusted EPS for 2013. All forward looking statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that the Company will realize these expectations or that these beliefs will prove correct. Numerous factors, many of which are beyond the Company's control, could cause actual results to differ materially from those expressed as forward- looking statements. These risk factors include general economic, financial and industry conditions, particularly in the retail sector, as well as consumer confidence and the availability of consumer financing; uncertainties arising from global events; the effects of changes in foreign exchange rates on the Company’s reported earnings; consumer acceptance of the Company’s products; industry competition; the efficiency and effectiveness of the Company’s advertising campaigns and other marketing programs; the Company’s ability to increase sales productivity within existing retail accounts and to further penetrate the Company’s retail channel, including the timing of opening or expanding within large retail accounts; the Company’s ability to expand brand awareness, distribution and new products; the Company’s ability to continuously improve and expand its product line, maintain efficient, timely and cost- effective production and delivery of its products, and manage its growth; the effects of strategic investments on the Company’s operations; changes in foreign tax rates and changes in tax laws generally, including the ability to utilize tax loss carry forwards; changing commodity costs; and the effect of future legislative or regulatory changes. Additional information concerning these and other risks and uncertainties are discussed in the Company's filings with the Securities and Exchange Commission, including without limitation the Company's Annual Report on Form 10-K under the headings "Special Note Regarding Forward-Looking Statements" and "Risk Factors." In addition, the proposed merger with Sealy presents risk factors including the ability of the parties to complete the proposed merger in a timely manner or at all; satisfaction of the conditions precedent to the proposed merger, the ability to secure regulatory approvals; the possibility of litigation (including relating to the merger itself); and the ability to successfully integrate Sealy into Tempur-Pedic’s operations and realize synergies from the proposed transaction. Any forward-looking statement speaks only as of the date on which it is made, and the Company undertakes no obligation to update any forward-looking statements for any reason, including to reflect events or circumstances after the date on which such statements are made or to reflect the occurrence of anticipated or unanticipated events or circumstances. |