1 September 2016 “Success is strengthening our Iconic Brands while driving higher ROIC through focused execution” Tempur Sealy International, Inc. (TPX)

2 World’s Largest Bedding Products Company(1) Investment Merits Tempur Sealy is the premium market leader… • Strong brands, complete product portfolio • Distinct near-term opportunities to drive cash flow • Shareholder-focused company • High aspirational goals with new senior leadership putting emphasis on profitable growth • Structural growth industry, with high ROIC and free cash flow • Industry is relatively concentrated in US and fragmented globally …in a growth industry Over 7,000 worldwide employees • 29 Company operated worldwide manufacturing facilities Forward-Looking Statements: This investor presentation contains “forward-looking statements” within the meaning of federal securities laws. Please review carefully the cautionary statements and other information included in the appendix under “Forward looking Statements”. This presentation includes non-GAAP financial measures. Please refer to the footnotes and the explanations about such non-GAAP financial measures, including reconciliations to the corresponding GAAP financial measures, in the appendix at the end of the presentation.

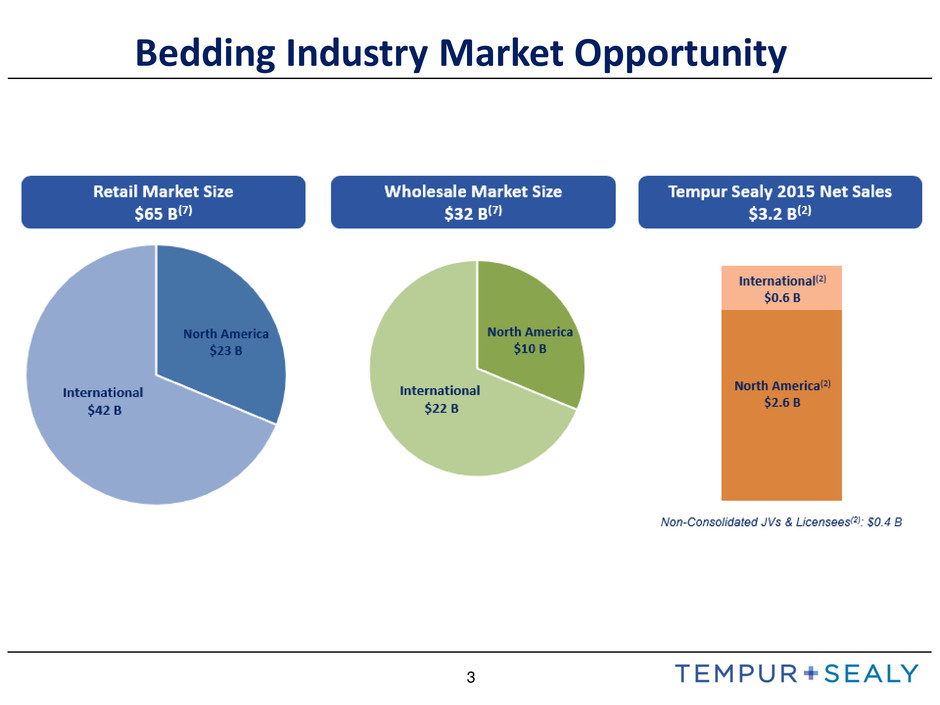

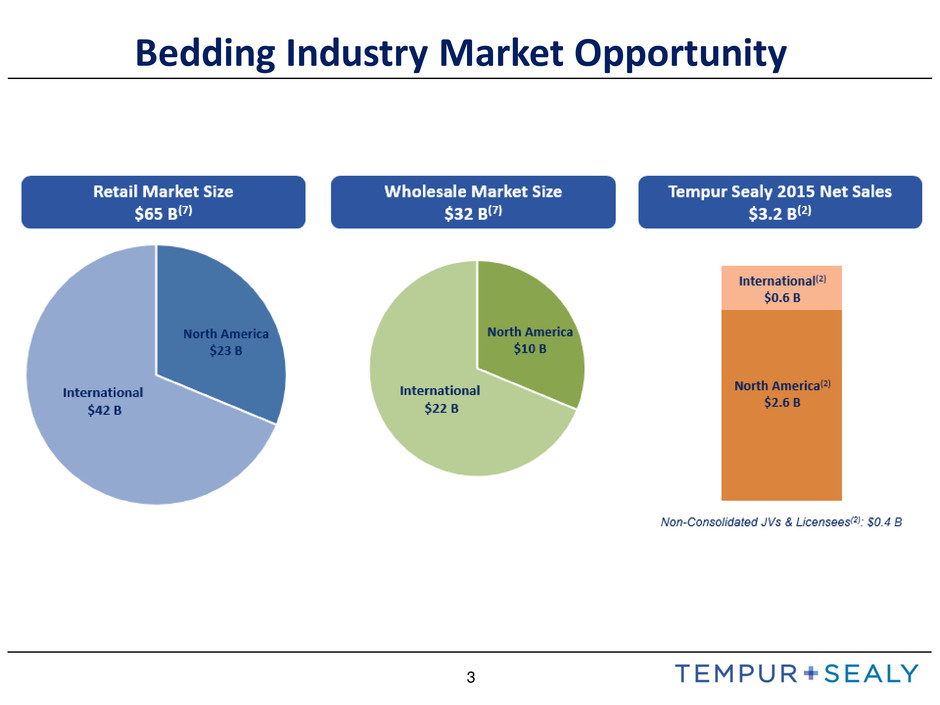

3 Bedding Industry Market Opportunity

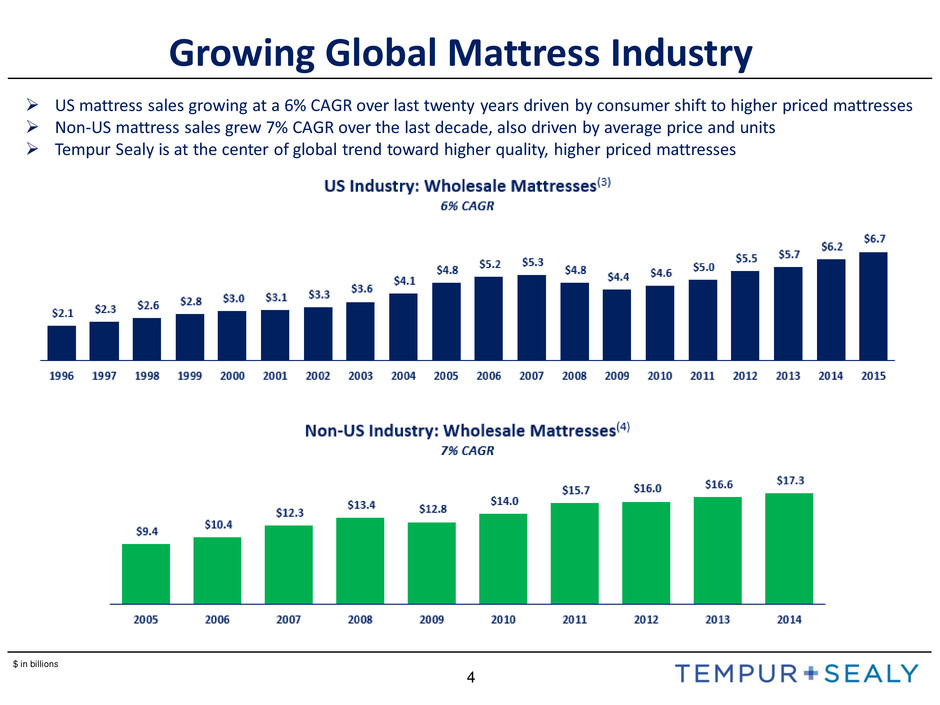

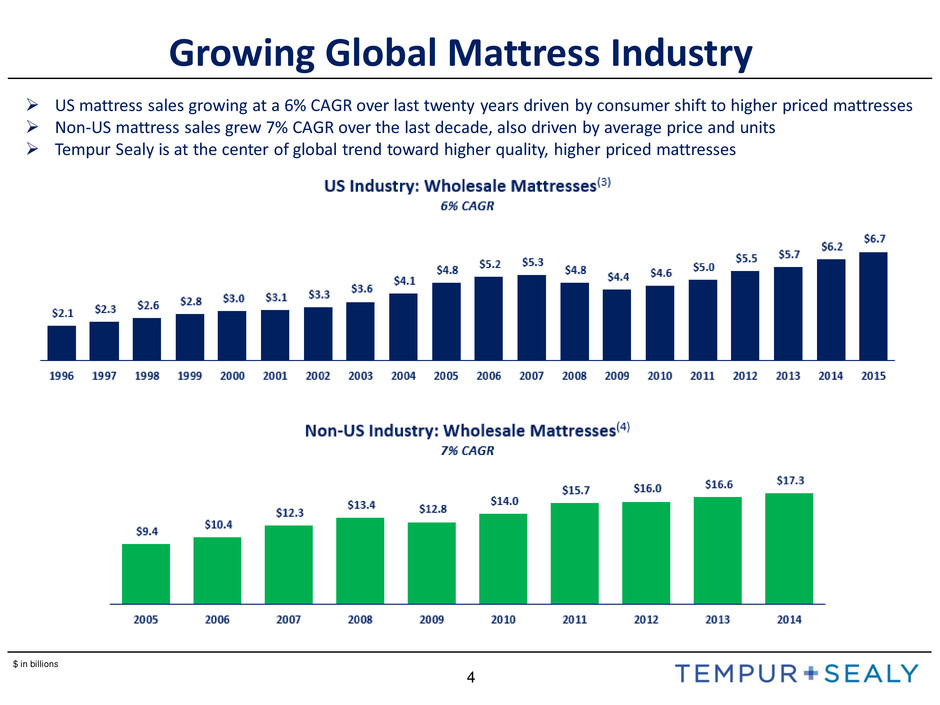

4 Growing Global Mattress Industry $ in billions US mattress sales growing at a 6% CAGR over last twenty years driven by consumer shift to higher priced mattresses Non-US mattress sales grew 7% CAGR over the last decade, also driven by average price and units Tempur Sealy is at the center of global trend toward higher quality, higher priced mattresses

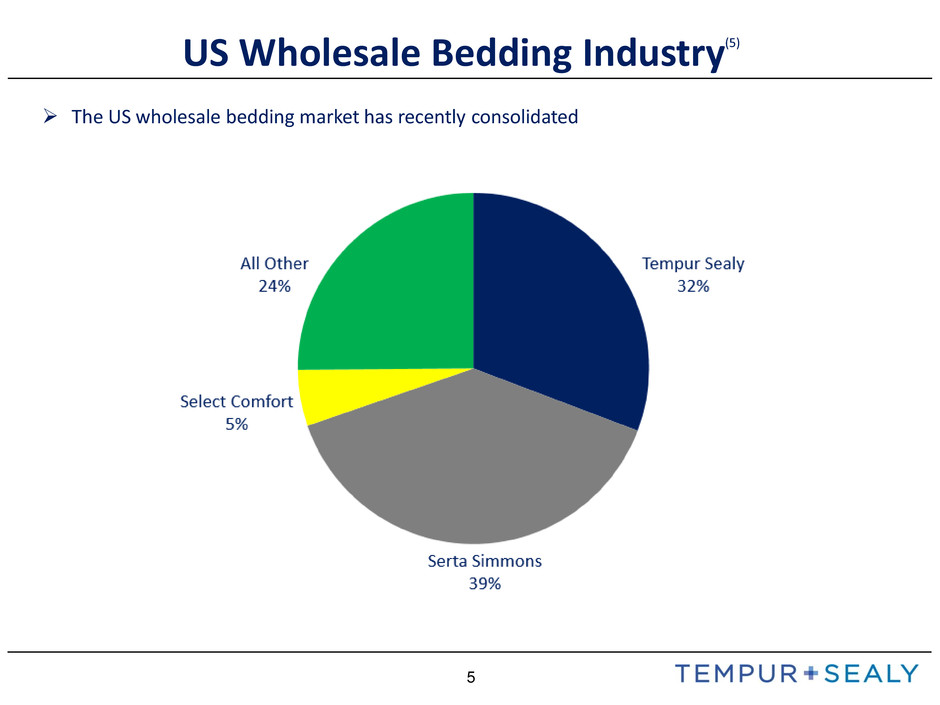

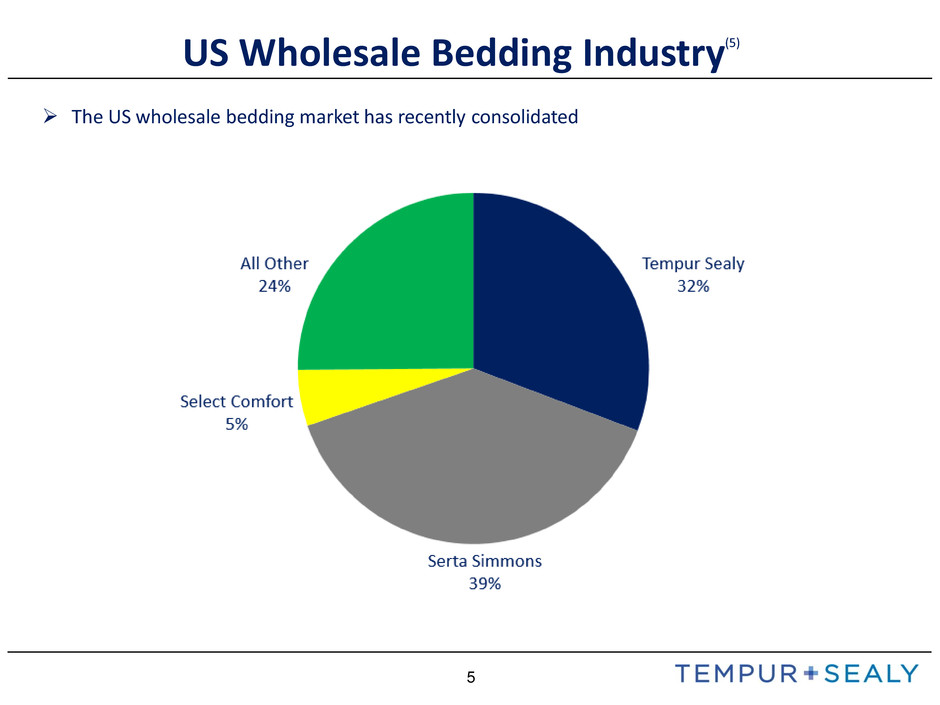

5 US Wholesale Bedding Industry(5) The US wholesale bedding market has recently consolidated

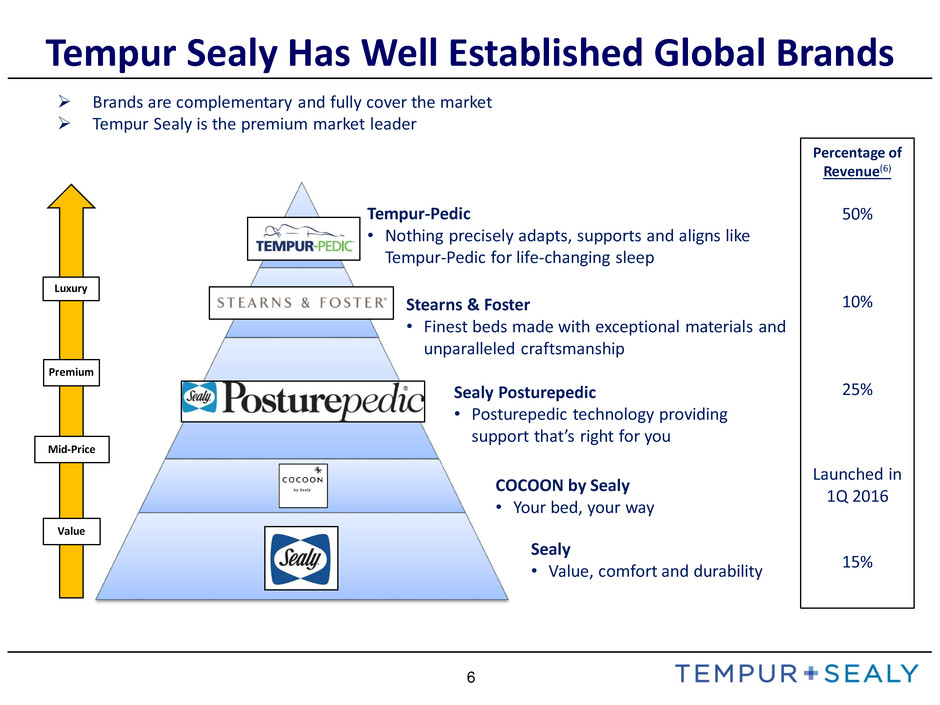

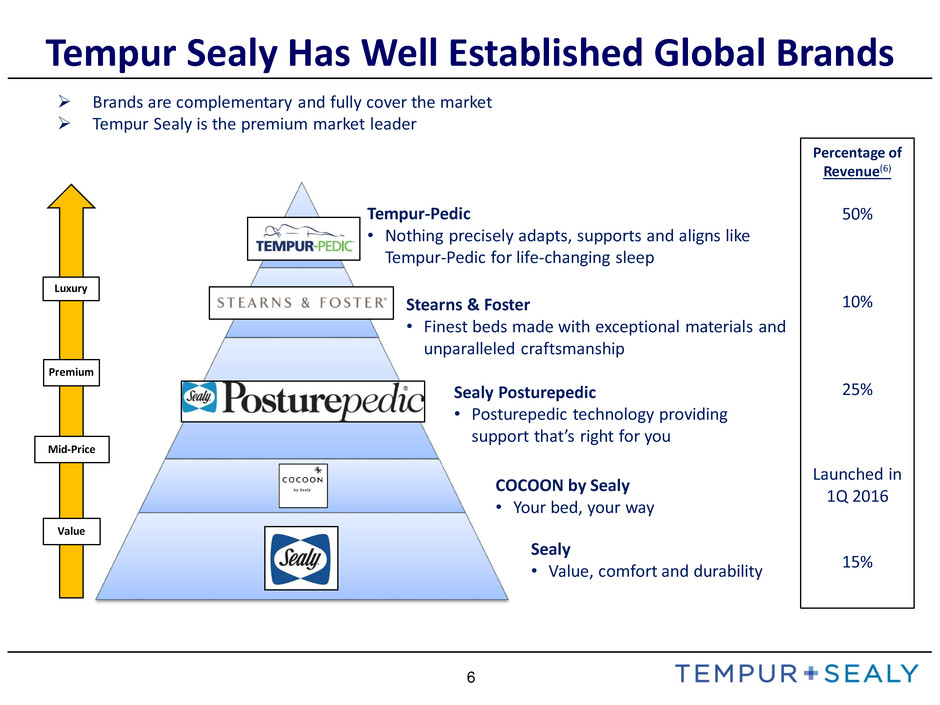

6 Luxury Premium Mid-Price Value Tempur Sealy Has Well Established Global Brands Tempur-Pedic • Nothing precisely adapts, supports and aligns like Tempur-Pedic for life-changing sleep Stearns & Foster • Finest beds made with exceptional materials and unparalleled craftsmanship Sealy Posturepedic • Posturepedic technology providing support that’s right for you Sealy • Value, comfort and durability Percentage of Revenue(6) 50% 10% 25% Launched in 1Q 2016 15% Brands are complementary and fully cover the market Tempur Sealy is the premium market leader COCOON by Sealy • Your bed, your way

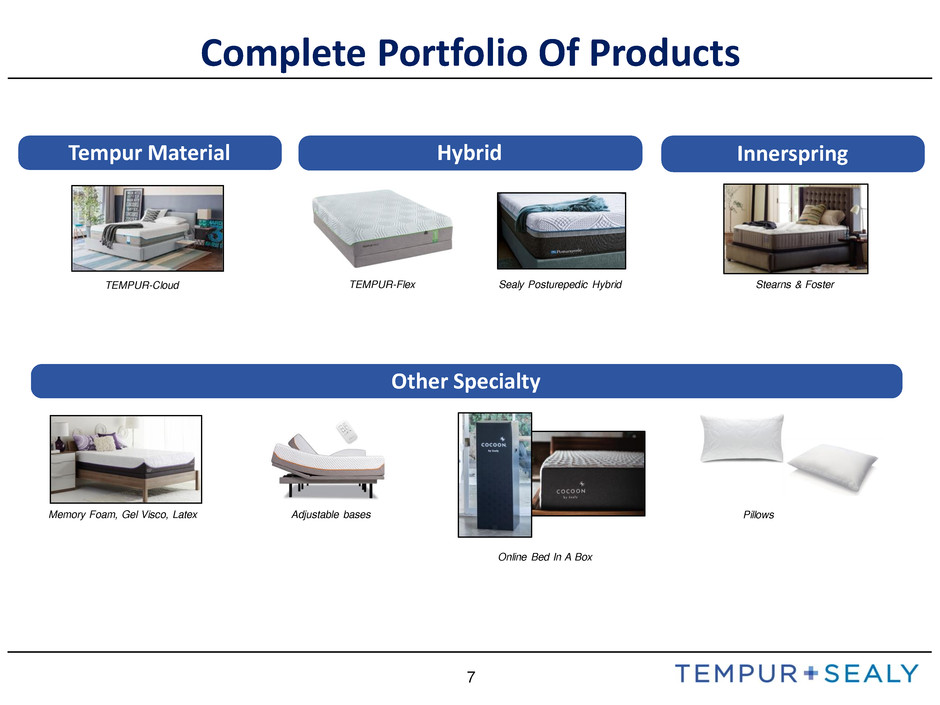

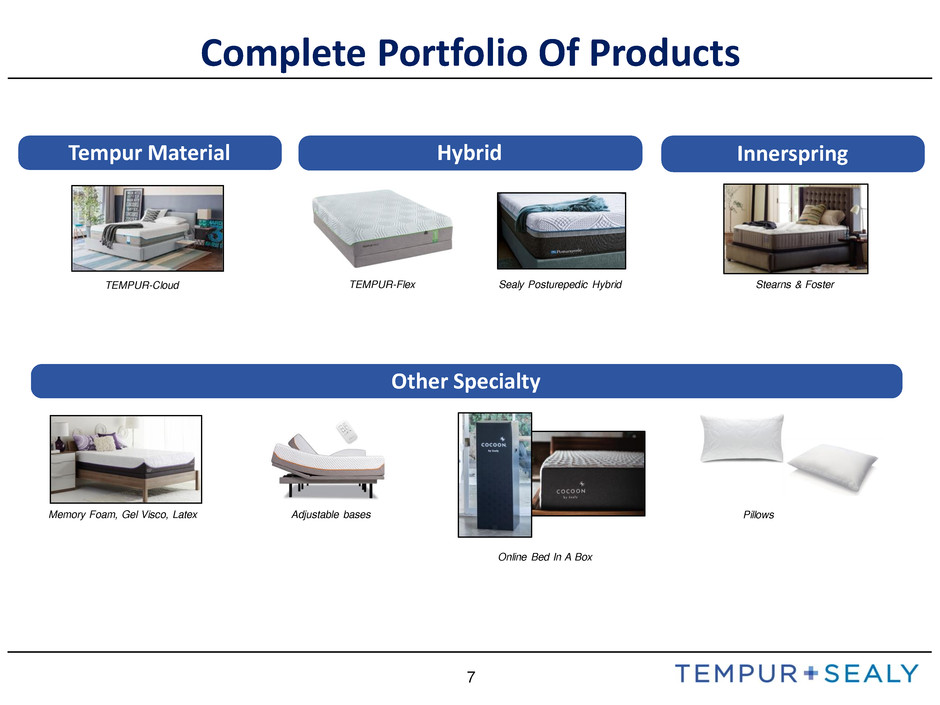

7 InnerspringHybrid Stearns & FosterTEMPUR-FlexTEMPUR-Cloud Memory Foam, Gel Visco, Latex Tempur Material Other Specialty Adjustable bases Pillows Complete Portfolio Of Products Sealy Posturepedic Hybrid Online Bed In A Box

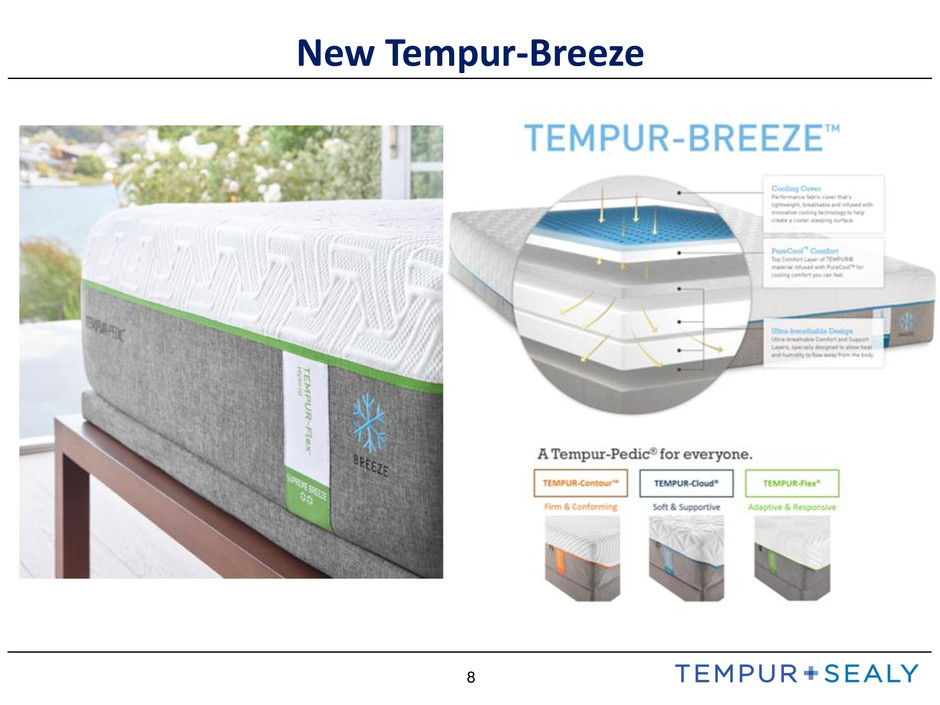

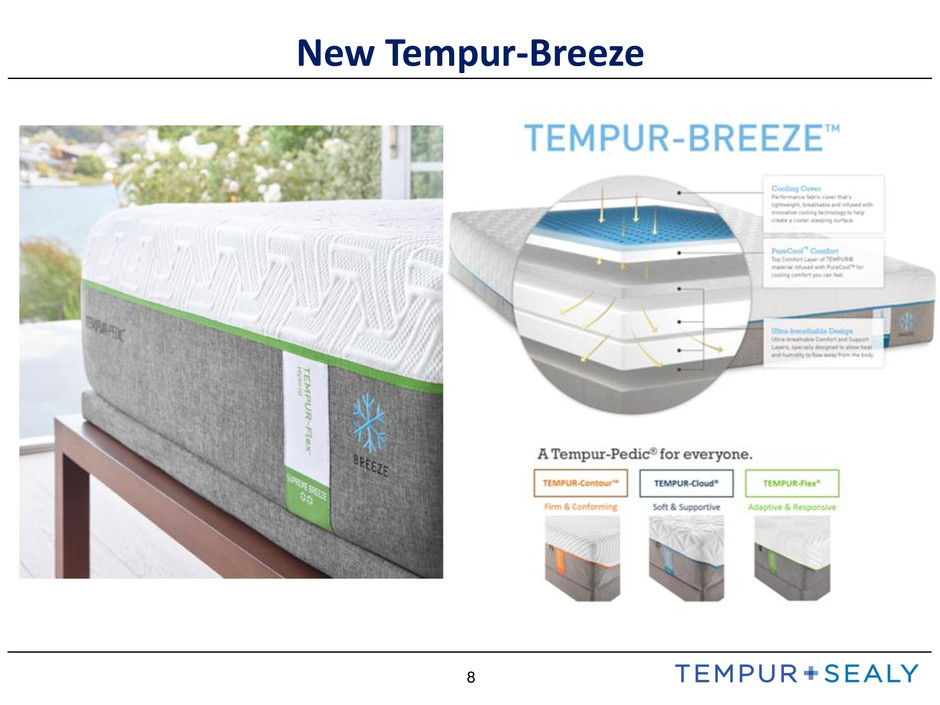

8 New Tempur-Breeze

9 New Stearns & Foster

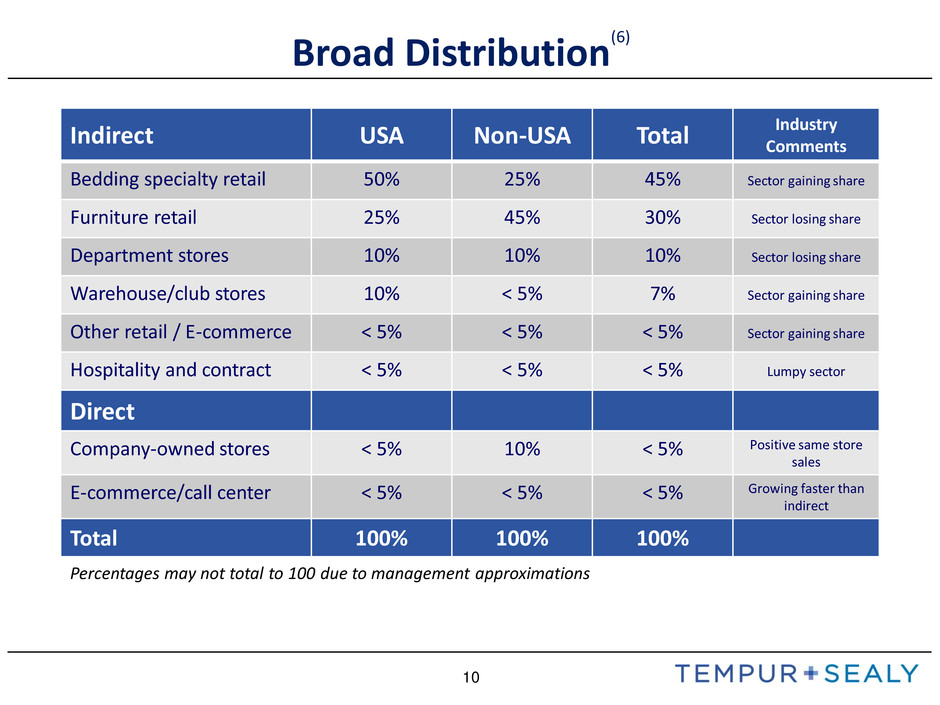

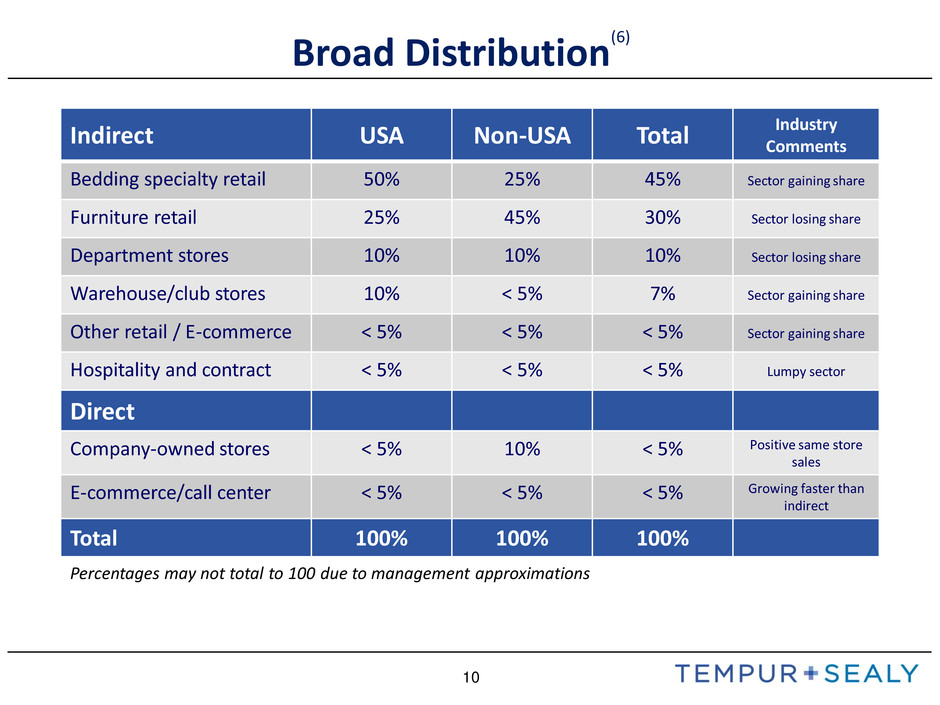

10 Broad Distribution (6) Indirect USA Non-USA Total Industry Comments Bedding specialty retail 50% 25% 45% Sector gaining share Furniture retail 25% 45% 30% Sector losing share Department stores 10% 10% 10% Sector losing share Warehouse/club stores 10% < 5% 7% Sector gaining share Other retail / E-commerce < 5% < 5% < 5% Sector gaining share Hospitality and contract < 5% < 5% < 5% Lumpy sector Direct Company-owned stores < 5% 10% < 5% Positive same store sales E-commerce/call center < 5% < 5% < 5% Growing faster than indirect Total 100% 100% 100% Percentages may not total to 100 due to management approximations

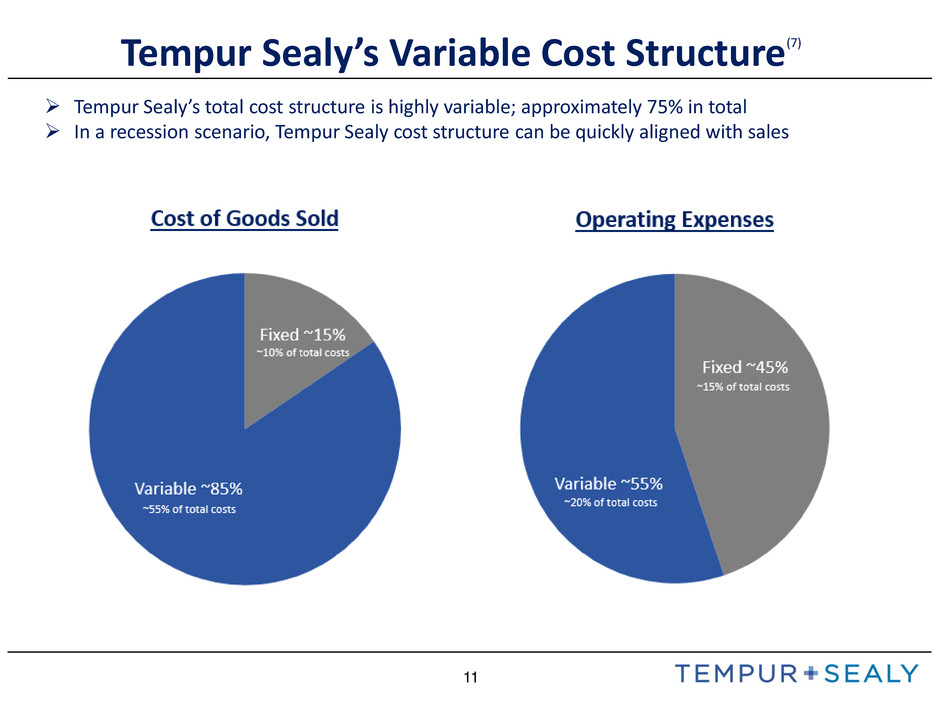

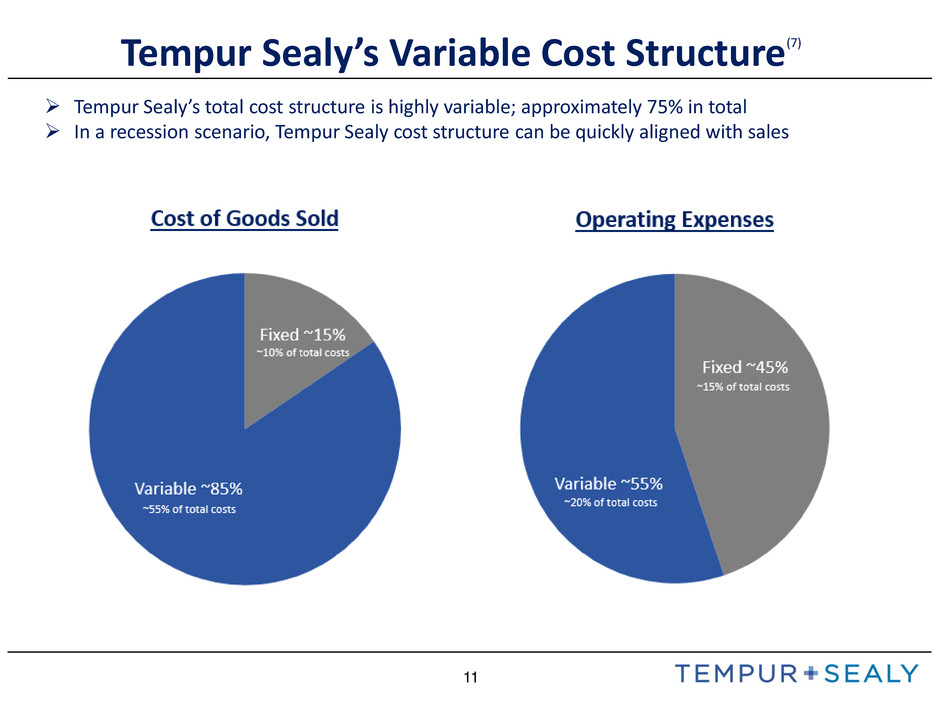

11 Tempur Sealy’s Variable Cost Structure(7) Tempur Sealy’s total cost structure is highly variable; approximately 75% in total In a recession scenario, Tempur Sealy cost structure can be quickly aligned with sales

12 Manufacturing Operations Tempur Sealy has differentiated manufacturing to support brand and customer needs

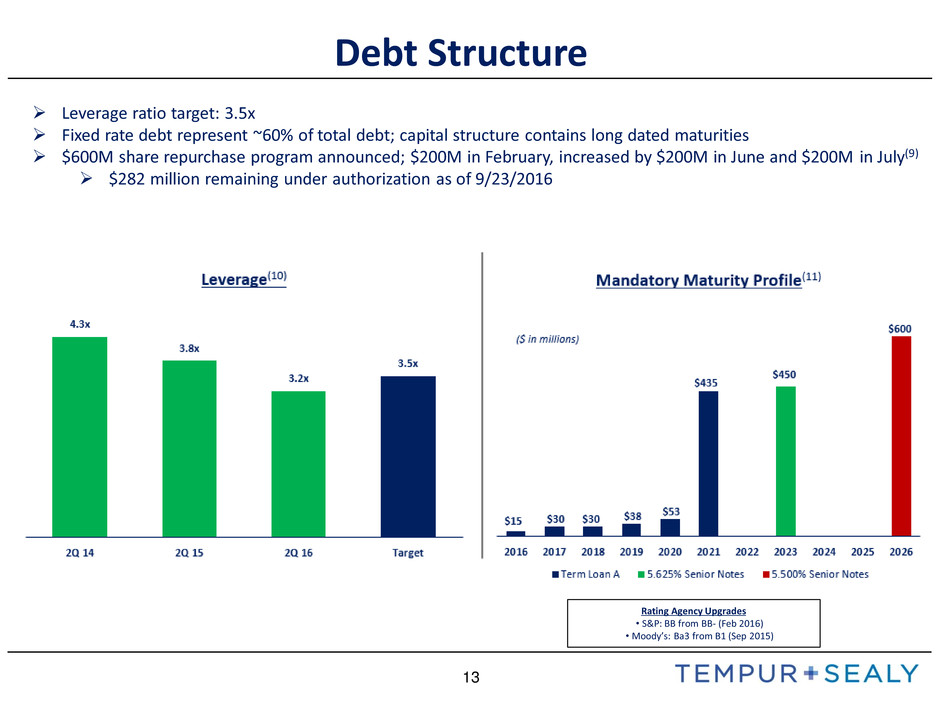

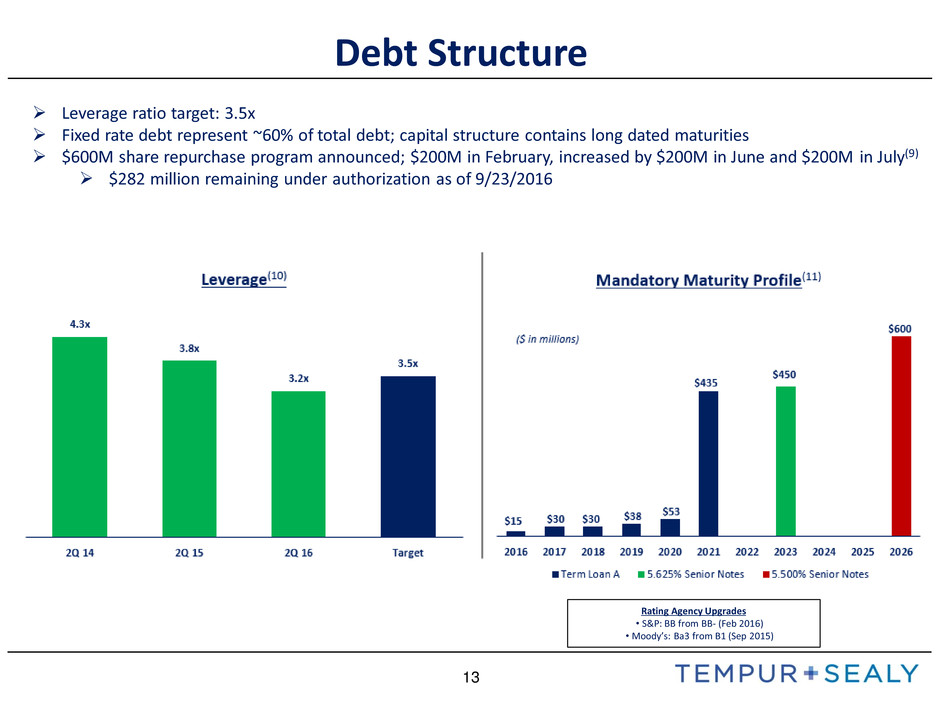

13 Debt Structure Leverage ratio target: 3.5x Fixed rate debt represent ~60% of total debt; capital structure contains long dated maturities $600M share repurchase program announced; $200M in February, increased by $200M in June and $200M in July(9) $282 million remaining under authorization as of 9/23/2016 Rating Agency Upgrades • S&P: BB from BB- (Feb 2016) •Moody’s: Ba3 from B1 (Sep 2015)

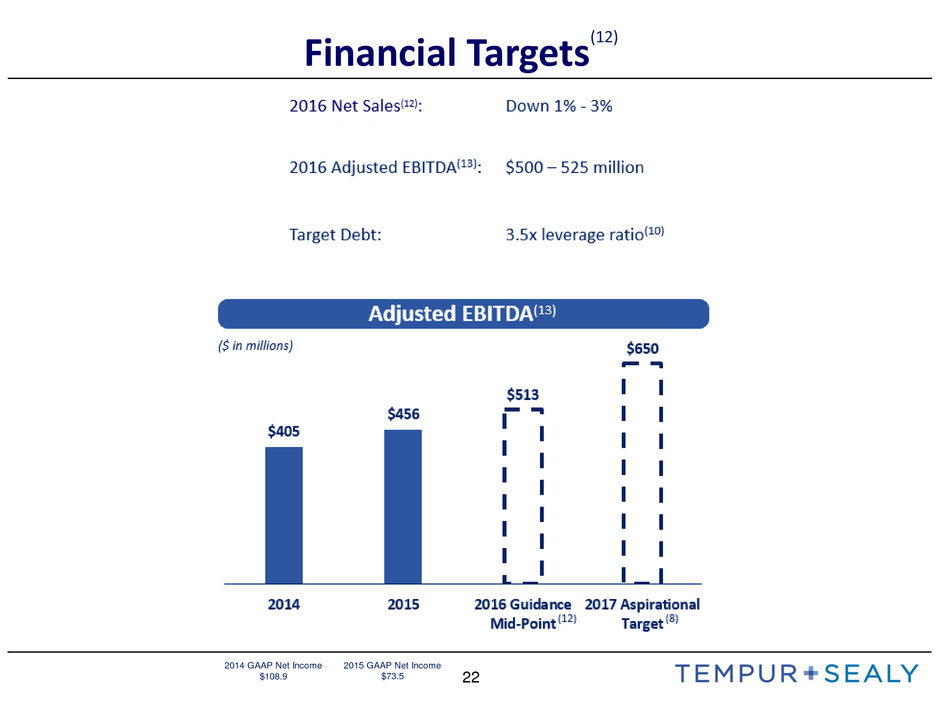

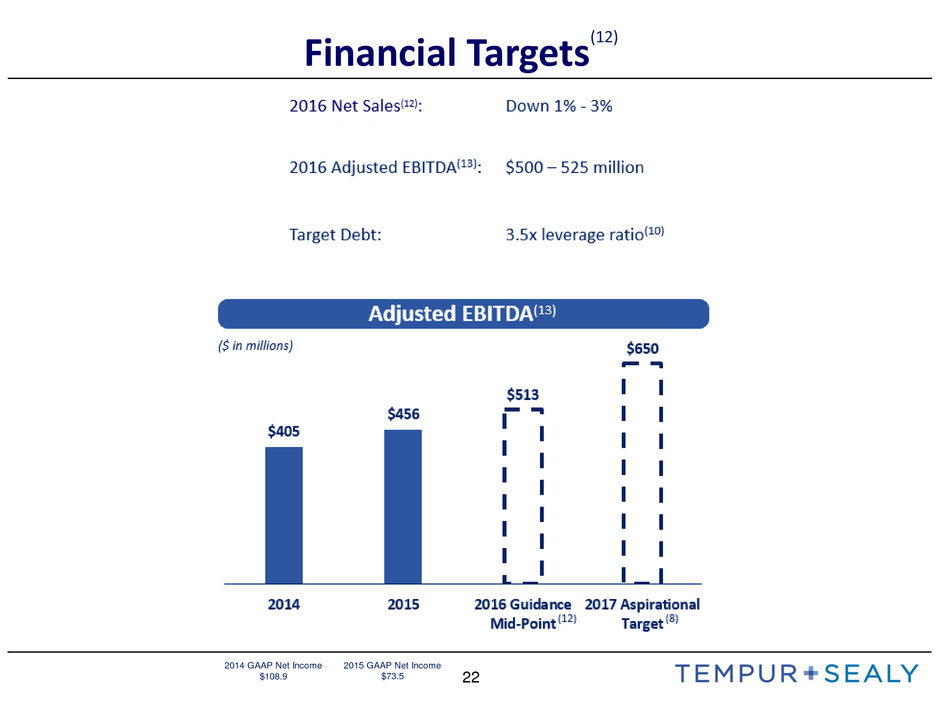

14 Business Update • On September 27, 2016 the Company issued a press release providing a business update, including revised full year financial guidance • In the third quarter, net sales are below our prior expectations • Our operational initiatives are going well and continuing to drive considerable margin expansion • On-time deliveries, quality, global sourcing • Working capital efficiencies • Margin expansion • We are revising our expectations for the full year 2016: • Net sales are expected to be down 1% - 3% versus 2015 • Adjusted EBITDA is expected to be $500 million to $525 million, which at the mid-points represent a 12% growth from 2015 and an approximate 20% growth in adjusted EPS • Debt target remains unchanged at 3.5x leverage ratio • Third quarter results will be reported on October 27, 2016 The Company noted its expectations are based on information available at the time of this release, and are subject to changing conditions, many of which are outside of the Company’s control. Please refer to the Company’s September 27, 2016 press release for more information

15 We Define Success As “Achieve consistent, profitable growth” “Support our portfolio of brands with compelling marketing and product innovation” “Consistently deliver annual total cost improvements with excellent customer service” “Drive traffic and conversion with effective collaboration” “Accelerate profitable growth through the appropriate expansion of distribution, the levering of our global product innovation platform underpinned by investments to increase brand awareness” “Enhance our overall cost competitive position while safeguarding quality and assets” “Strengthen our Iconic Brands while driving higher ROIC through focused execution”

16 Thank you for your interest in Tempur Sealy International Improving the Sleep of More People Every Night, All Around the World For more information please email: investor.relations@tempursealy.com

17 Appendix

18 Forward-Looking Statements This investor presentation contains "forward-looking statements," within the meaning of the federal securities laws, which include information concerning one or more of the Company's plans, objectives, goals, strategies, and other information that are not historical information. When used in this presentation, the words "estimates," "expects," "guidance," "anticipates," "projects," "plans," "proposed," "intends," "believes," and variations of such words or similar expressions are intended to identify forward-looking statements. These forward-looking statements include, without limitation, statements relating to the Company’s expectations regarding adjusted EBITDA and net sales for 2016 and performance generally for 2016 and subsequent years, and expectations regarding the Company’s target leverage ratio, share repurchase program and the capital allocation strategy and expectations regarding the ability to reduce costs in a recession scenario. All forward-looking statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that the Company will realize these expectations or that these beliefs will prove correct. Numerous factors, many of which are beyond the Company's control, could cause actual results to differ materially from those expressed as forward-looking statements. These risk factors include risks associated with the Company’s capital structure and debt level; the ability to successfully integrate Sealy Corporation and its subsidiaries (“Sealy”) into the Company’s operations and realize cost and revenue synergies and other benefits from the acquisition of Sealy in 2013 (“Sealy Acquisition”); general economic, financial and industry conditions, particularly in the retail sector, as well as consumer confidence and the availability of consumer financing; changes in product and channel mix and the impact on the Company's gross margin; changes in interest rates; the impact of the macroeconomic environment in both the U.S. and internationally on the Company's business segments; uncertainties arising from global events; the effects of changes in foreign exchange rates on the Company’s reported earnings; consumer acceptance of the Company’s products; industry competition; the efficiency and effectiveness of the Company’s advertising campaigns and other marketing programs; the Company’s ability to increase sales productivity within existing retail accounts and to further penetrate the Company’s retail channel, including the timing of opening or expanding within large retail accounts and the timing and success of product launches; the effects of consolidation of retailers on revenues and costs; the Company’s ability to expand brand awareness, distribution and new products; the Company’s ability to continuously improve and expand its product line, maintain efficient, timely and cost- effective production and delivery of its products, and manage its growth; the effects of strategic investments on the Company’s operations; changes in foreign tax rates and changes in tax laws generally, including the ability to utilize tax loss carry forwards; the outcome of various pending tax audits or other tax, regulatory or investigative proceedings; changing commodity costs; the effect of future legislative or regulatory changes; and disruptions to the implementation of the Company's strategic priorities and business plan caused by abrupt changes in the Company's senior management team and Board of Directors. There are a number of risks, uncertainties and other important factors, many of which are beyond the Company’s control, that could cause its actual results to differ materially from those expressed as forward-looking statements in this investor presentation, including the risk factors discussed under the heading "Risk Factors" under ITEM 1A of Part 1 of our Annual Report on Form 10-K for the year ended December 31, 2015. There may be other factors that may cause the Company's actual results to differ materially from the forward-looking statements. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. Note Regarding Historical Financial Information: In this investor presentation we provide or refer to certain historical information for the Company. For a more detailed discussion of the Company’s financial performance, please refer to the Company’s SEC filings. Note Regarding Trademarks, Trade Names and Service Marks: TEMPUR, Tempur-Pedic, TEMPUR-Cloud, TEMPUR-Choice, TEMPUR-Weightless, TEMPUR-Contour, TEMPUR-Rhapsody, TEMPUR-Flex, GrandBed, TEMPUR-Simplicity, TEMPUR-Ergo, TEMPUR-UP, TEMPUR-Neck, TEMPUR-Symphony, TEMPUR-Comfort, TEMPUR-Traditional, TEMPUR-Home, Sealy, Sealy Posturepedic, Stearns & Foster, COCOON by Sealy and Optimum are trademarks, trade names or service marks of Tempur Sealy International, Inc. and/or its subsidiaries. All other trademarks, trade names and service marks in this presentation are the property of the respective owners. Limitations on Guidance. The guidance included herein is from the Company’s press release dated September 27, 2016. The Company is neither reconfirming this guidance as of the date of this investor presentation nor assuming any obligation to update or revise such guidance. See Forward Looking Statements.

19 World Class Marketing Campaigns

20 World Class Marketing Campaigns

21 Financial Overview: Aspirational Plan The Board has established an Aspirational Plan Achievement of the Aspirational Plan would likely create significant stockholder value Aspirational Plan Grants – Performance Restricted Stock Units (PRSUs) Equity awards representing approximately 2% of the Company’s common stock have been granted to the leadership team Over 200 employees have various types of performance equity (including the aspirational PRSUs) Aspirational Plan based on achievement of an increase of nearly $200 million, or over 40%, in Adjusted EBITDA from 2015 levels All PRSUs will vest if adjusted EBITDA of greater than $650 million is achieved for 2017 One-third of PRSUs will vest if $650 million target achieved in 2018 (and not achieved in 2017), with remainder forfeited No PRSUs will vest if not achieved in either 2017 or 2018 If an officer or employee leaves for any reason prior to vesting, all of his or her PRSUs will be forfeited Accruing for the Aspirational Plan will begin when achievement of the performance goal is deemed “probable” “Aspirational Pay for Aspirational Performance” (8)

22 Financial Targets (12) 2014 GAAP Net Income $108.9 2015 GAAP Net Income $73.5

23 Footnotes 1. Based on total annual EBITDA/adjusted EBITDA (where applicable) from publicly disclosed competitor financial information. 2. Based on the Company's results for fiscal 2014 or 2015 or Q2 2016 or the first half of 2016, as applicable. For more information please refer to the Annual Report on Form 10-K for the year ended December 31, 2015 or the Quarterly Reports on Form 10-Q for the quarters ended March 31, 2016, and June 30, 2016. 3. According to 2015 Mattress Industry Report of Sales & Trends provided by the International Sleep Products Association (“ISPA”). 4. CSIL World Mattress Report, 2014 (Top 40 Markets Mattress Consumption). 5. Based on Furniture Today report dated November 17, 2015. 6. Management estimates of approximate percentage of net sales. 7. Management estimates. 8. For more information about the aspirational plan and the terms of the aspirational PRSUs, please refer to “Financial Overview: Aspirational Plan” on slide 21 as well as the Company’s SEC filings. In addition, please refer to “Forward Looking Statements”. 9. Stock repurchases under this program may be made through open market transactions, negotiated purchases or otherwise, at times and in such amounts as management deems appropriate. The timing and actual number of shares repurchased will depend on a variety of factors including price, financing and regulatory requirements and other market conditions. The program does not require the purchase of any minimum number of shares and may be suspended, modified or discontinued at any time without prior notice. Repurchases may be made under a Rule 10b5-1 plan, which would permit shares to be repurchased when the Company might otherwise be precluded from doing so under federal securities laws. 10. Adjusted net income, adjusted EPS, leverage and leverage ratio are non-GAAP financial measures. Please refer to the “Use of Non-GAAP Financial Measures” beginning on slide 24 for more information regarding the definition of these non-GAAP financial measures, including the adjustments from the corresponding GAAP information. 11. Based on debt outstanding June 30th, 2016, adjusted pro forma for the repayment of the Sealy PIK Notes and the borrowing on a Delayed Draw Term Loan under the Company’s senior credit facility which all occurred in July 2016. For more information, please refer to the associated SEC filings. 12. Based on the Company’s updated 2016 financial targets provided in the company’s press release dated September 27, 2016. Please refer to “Forward-Looking Statements” and “Limitations on Guidance”. 13. EBITDA and adjusted EBITDA are a non-GAAP financial measures. Please refer to the "Use of Non-GAAP Financial Measures" beginning on slide 24 for more information regarding the definition of adjusted EBITDA, including the adjustments from the corresponding GAAP information. Amount shown for 2016 represents management estimates of adjusted EBITDA performance based on the Company’s guidance presented on February 4, 2016. Please refer to “Forward-Looking Statements” and “Limitations on Guidance”.

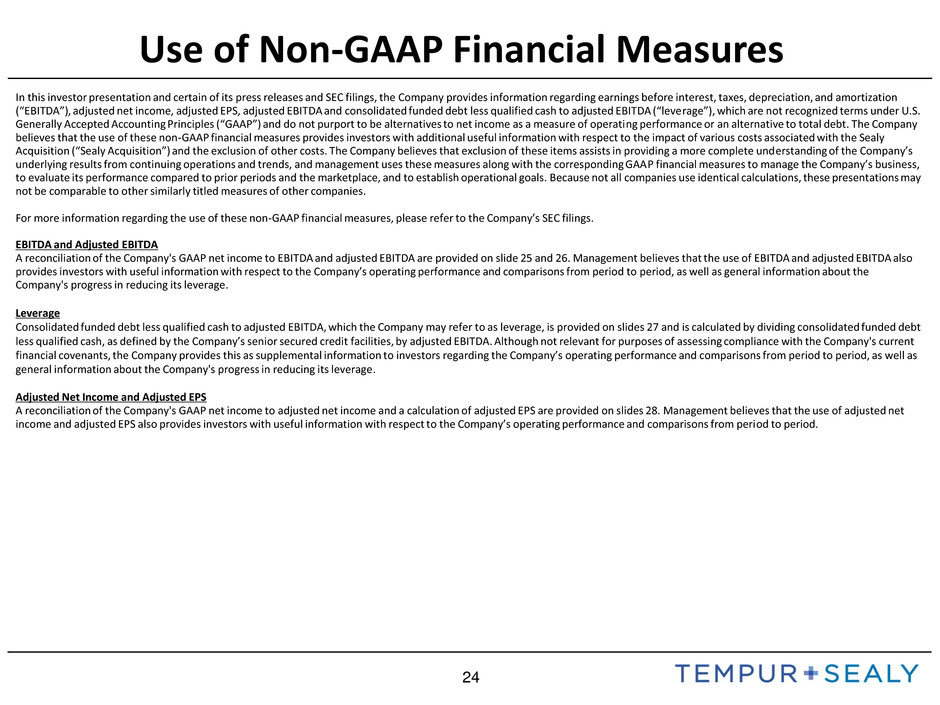

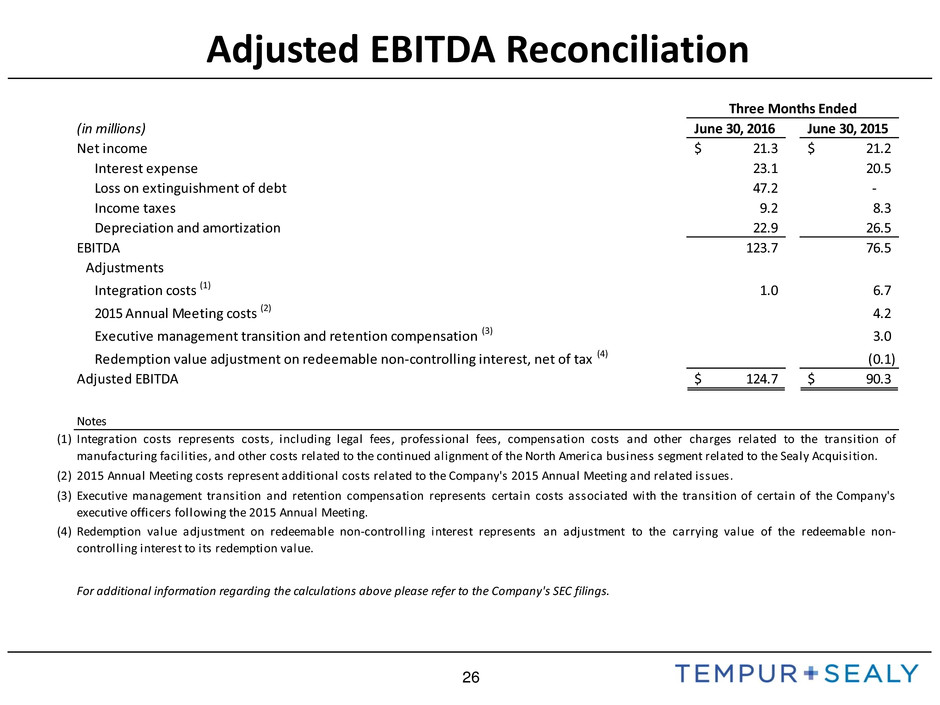

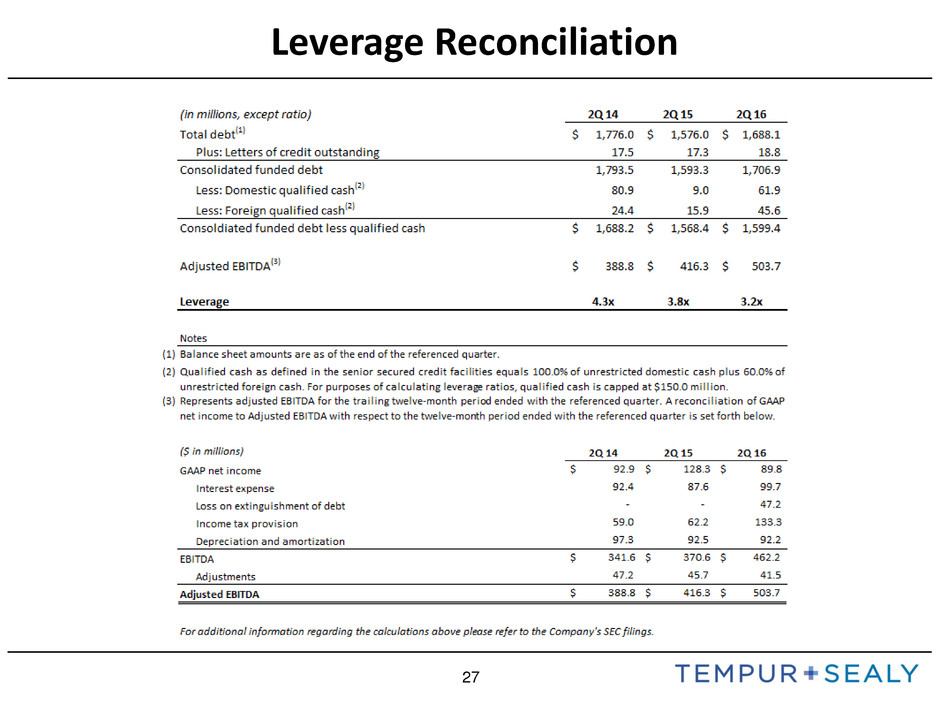

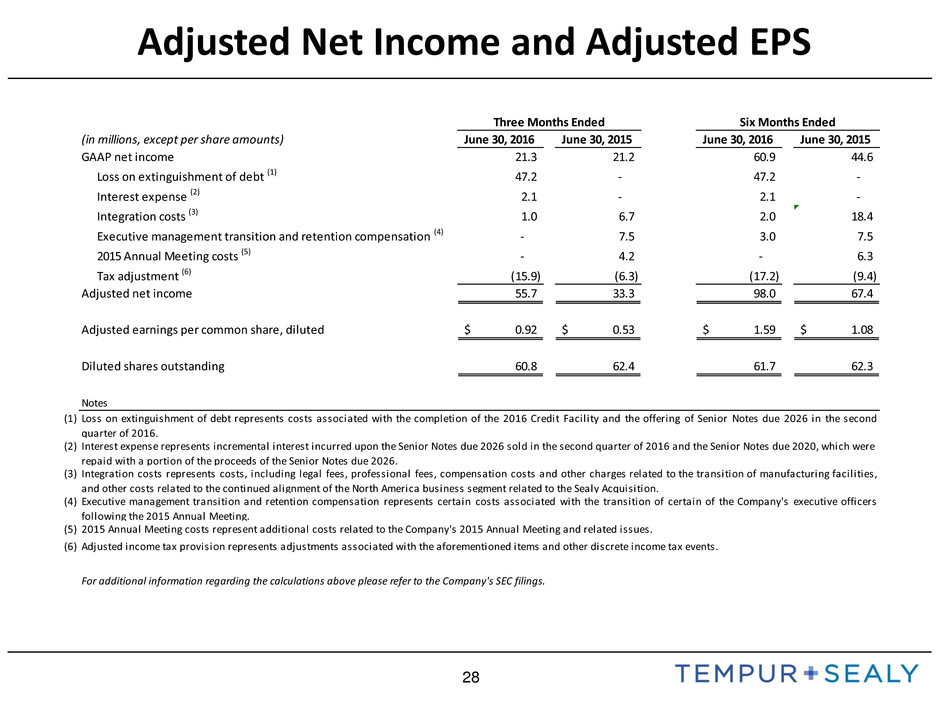

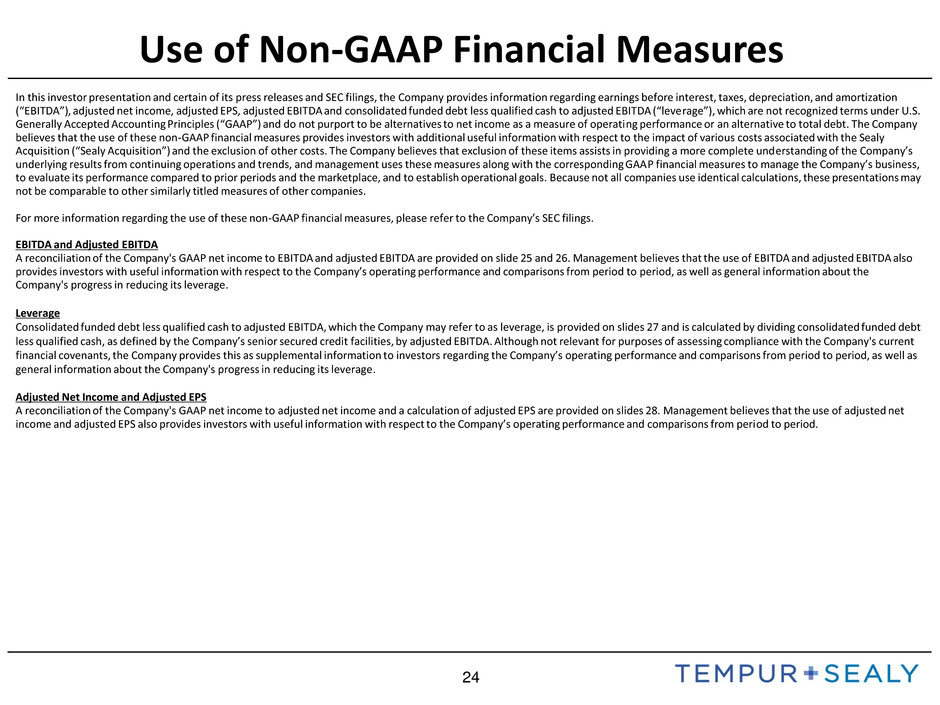

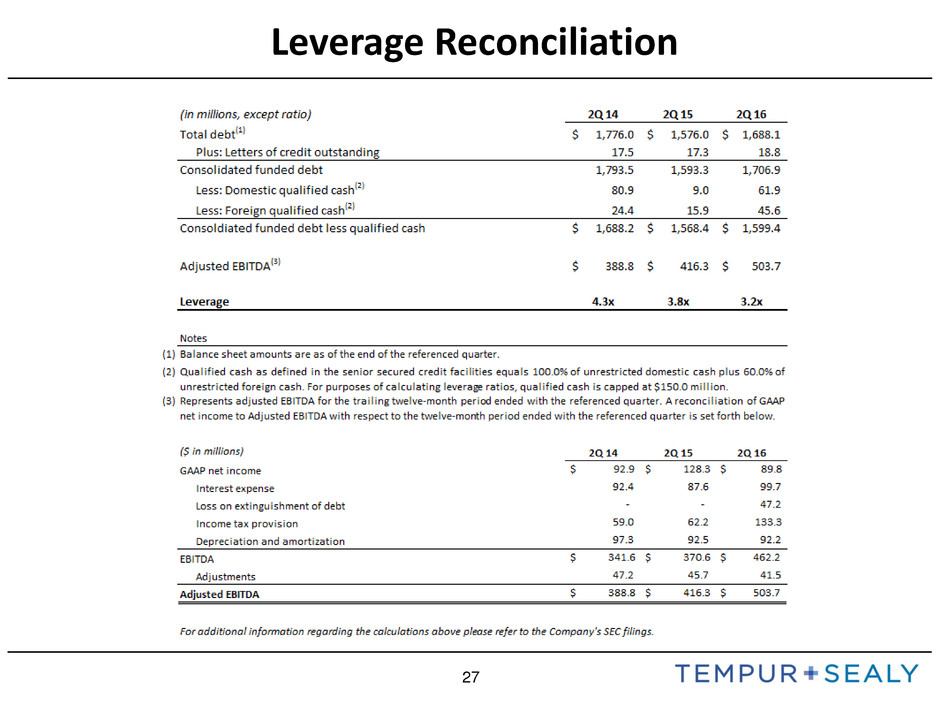

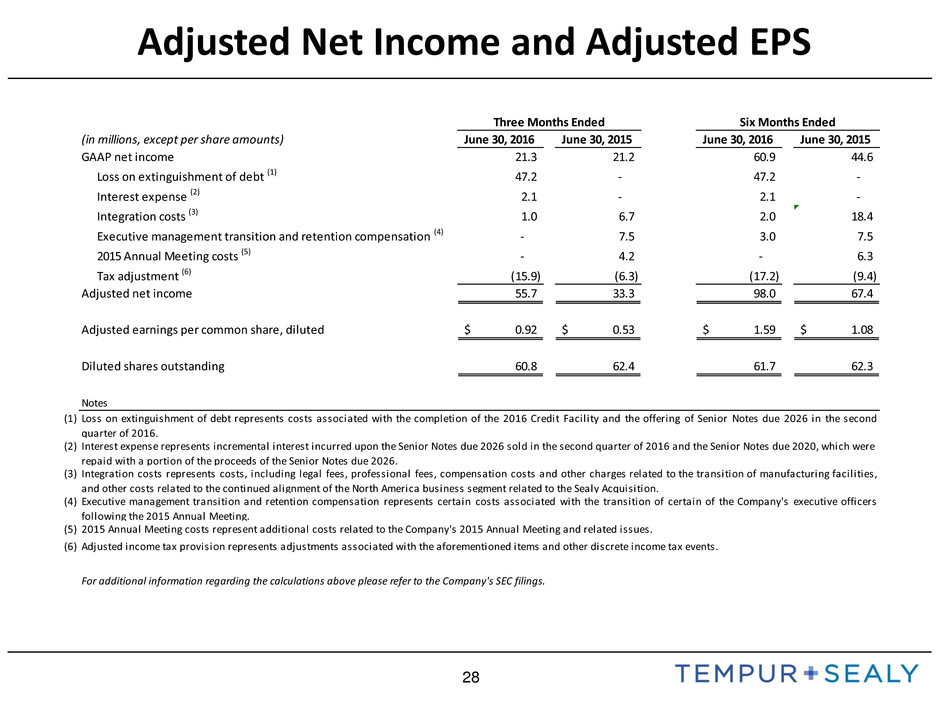

24 Use of Non-GAAP Financial Measures In this investor presentation and certain of its press releases and SEC filings, the Company provides information regarding earnings before interest, taxes, depreciation, and amortization (“EBITDA”), adjusted net income, adjusted EPS, adjusted EBITDA and consolidated funded debt less qualified cash to adjusted EBITDA (“leverage”), which are not recognized terms under U.S. Generally Accepted Accounting Principles (“GAAP”) and do not purport to be alternatives to net income as a measure of operating performance or an alternative to total debt. The Company believes that the use of these non-GAAP financial measures provides investors with additional useful information with respect to the impact of various costs associated with the Sealy Acquisition (“Sealy Acquisition”) and the exclusion of other costs. The Company believes that exclusion of these items assists in providing a more complete understanding of the Company’s underlying results from continuing operations and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company’s business, to evaluate its performance compared to prior periods and the marketplace, and to establish operational goals. Because not all companies use identical calculations, these presentations may not be comparable to other similarly titled measures of other companies. For more information regarding the use of these non-GAAP financial measures, please refer to the Company’s SEC filings. EBITDA and Adjusted EBITDA A reconciliation of the Company's GAAP net income to EBITDA and adjusted EBITDA are provided on slide 25 and 26. Management believes that the use of EBITDA and adjusted EBITDA also provides investors with useful information with respect to the Company’s operating performance and comparisons from period to period, as well as general information about the Company's progress in reducing its leverage. Leverage Consolidated funded debt less qualified cash to adjusted EBITDA, which the Company may refer to as leverage, is provided on slides 27 and is calculated by dividing consolidated funded debt less qualified cash, as defined by the Company’s senior secured credit facilities, by adjusted EBITDA. Although not relevant for purposes of assessing compliance with the Company's current financial covenants, the Company provides this as supplemental information to investors regarding the Company’s operating performance and comparisons from period to period, as well as general information about the Company's progress in reducing its leverage. Adjusted Net Income and Adjusted EPS A reconciliation of the Company's GAAP net income to adjusted net income and a calculation of adjusted EPS are provided on slides 28. Management believes that the use of adjusted net income and adjusted EPS also provides investors with useful information with respect to the Company’s operating performance and comparisons from period to period.

25 Adjusted EBITDA Reconciliation (in millions) Adjusted EBITDA 2014 2015 GAAP net income 108.9$ 73.5$ Interest expense 91.9 96.1 Income tax provision 64.9 125.4 Depreciation and amortization 89.7 93.9 EBITDA 355.4$ 388.9$ Adjustments for financial covenant purposes: Integration costs(1) 40.3 28.6 Restructuring(2) - 11.9 Other income(3) (15.6) (9.5) 2015 Annual Meeting costs(4) - 2.1 Pension settlement(5) - 1.3 Loss on disposal of business(6) 23.2 - Financing costs(7) 1.3 - EBITDA in accordance with the Company's senior secured credit facility 404.6$ 423.3$ Additional Adjustments German legal settlement(8) - 17.6 Executive transition and retention compensation(9) - 10.7 2015 Annual Meeting costs(4) - 4.2 Adjusted EBITDA 404.6$ 455.8$ (1) (2) (3) (4) (5) (6) (7) (8) (9) Notes Year ended December 31, Executive management transition and retention compensation represents certain costs associated with the transition of certain of the Company's executive officers. German legal settlement represents the previously announced €15.5 mill ion settlement the Company reached with the German Federal Cartel Office ("FCO") to fully resolve the FCO's antitrust investigation and related legal fees. Loss on disposal of business represents costs associated with the disposition in 2014 of the three Sealy U.S. innerspring component production facil ities and related equipment. Financing costs represent costs incurred in connection with the amendment of the Company's senior secured credit facil ity in 2014. Integration costs represents costs, including legal fees, professional fees, compensation costs and other charges related to the transition of manufacturing facilities, and other costs related to the continued alignment of the North America business segment related to the Sealy Acquisition. Restructuring costs represents costs associated with headcount reduction and store closures. Other income represents income from a partial settlement of a legal dispute. Pension settlement represents pension expense recorded in conjunction with a settlement offered to terminated, vested participants in a defined benefit pension plan. 2015 An ual Meeting costs represent additional costs related to the Company's 2015 Annual Meeting and related issues.

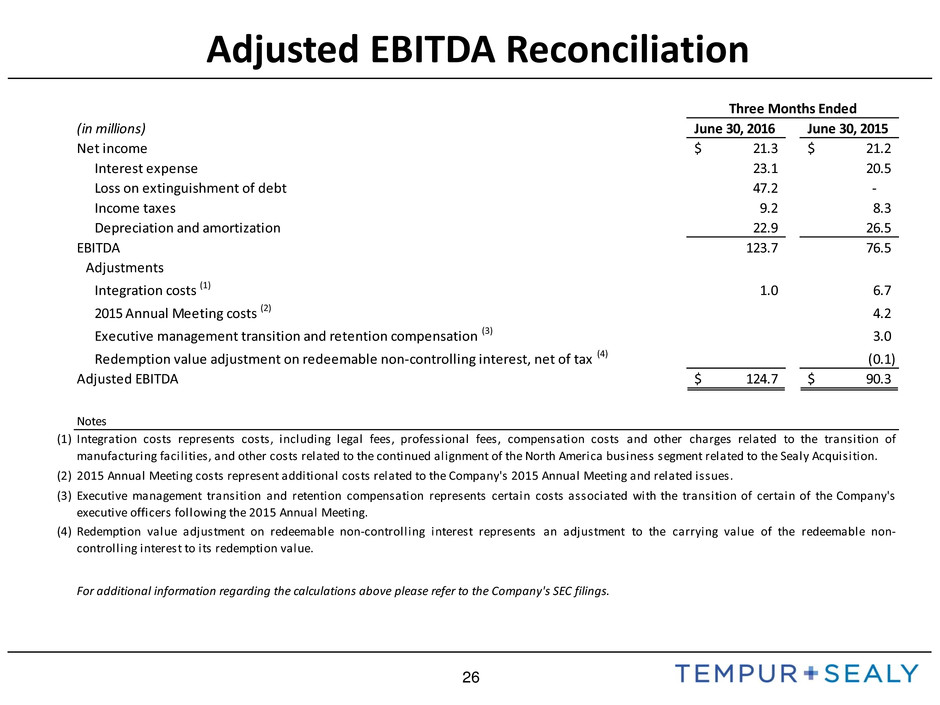

26 Adjusted EBITDA Reconciliation (in millions) June 30, 2016 June 30, 2015 Net income 21.3$ 21.2$ Interest expense 23.1 20.5 Loss on extinguishment of debt 47.2 - Income taxes 9.2 8.3 Depreciation and amortization 22.9 26.5 EBITDA 123.7 76.5 Adjustments Integration costs (1) 1.0 6.7 2015 Annual Meeting costs (2) 4.2 Executive management transition and retention compensation (3) 3.0 Redemption value adjustment on redeemable non-controlling interest, net of tax (4) (0.1) Adjusted EBITDA 124.7$ 90.3$ (1) (2) (3) (4) For additional information regarding the calculations above please refer to the Company's SEC filings. Three Months Ended Notes Redemption value adjustment on redeemable non-controlling interest represents an adjustment to the carrying value of the redeemable non- controlling interest to its redemption value. Integration costs represents costs, including legal fees, professional fees, compensation costs and other charges related to the transition of manufacturing facil ities, and other costs related to the continued alignment of the North America business segment related to the Sealy Acquisition. xecutive management transition and retention compensation represents certain costs associated with the transition of certain of the Company's executive officers following the 2015 Annual Meeting. 2015 Annual Meeting costs represent additional costs related to the Company's 2015 Annual Meeting and related issues.

27 Leverage Reconciliation

28 (in millions, except per share amounts) June 30, 2016 June 30, 2015 June 30, 2016 June 30, 2015 GAAP net income 21.3 21.2 60.9 44.6 Loss on extinguishment of debt (1) 47.2 - 47.2 - Interest expense (2) 2.1 - 2.1 - Integration costs (3) 1.0 6.7 2.0 18.4 Executive management transition and retention compensation (4) - 7.5 3.0 7.5 2015 Annual Meeting costs (5) - 4.2 - 6.3 Tax adjustment (6) (15.9) (6.3) (17.2) (9.4) Adjusted net income 55.7 33.3 98.0 67.4 Adjusted earnings per common share, diluted 0.92$ 0.53$ 1.59$ 1.08$ Diluted shares outstanding 60.8 62.4 61.7 62.3 (1) (2) (3) (4) (5) (6) For additional information regarding the calculations above please refer to the Company's SEC filings. Three Months Ended Six Months Ended Notes Adjusted income tax provision represents adjustments associated with the aforementioned items and other discrete income tax events. 2015 Annual Meeting costs represent additional costs related to the Company's 2015 Annual Meeting and related issues. Executive management transition and retention compensation represents certain costs associated with the transition of certain of the Company's executive officers following the 2015 Annual Meeting. Integration costs represents costs, including legal fees, professional fees, compensation costs and other charges related to the transition of manufacturing facilities, and other costs related to the continued alignment of the North America business segment related to the Sealy Acquisition. Interest expense represents incremental interest incurred upon the Senior Notes due 2026 sold in the second quarter of 2016 and the Senior Notes due 2020, which were repaid with a portion of the proceeds of the Senior Notes due 2026. Loss on extinguishment of debt represents costs associated with the completion of the 2016 Credit Facility and the offering of Senior Notes due 2026 in the second quarter of 2016. Adjusted Net Income and Adjusted EPS