David N. Powers Esq.

Baker Botts L.L.P.

1299 Pennsylvania Ave., N.W.

Washington, D.C. 20004

Telephone: (202-639-7769

* As the filing contains only preliminary communications made before the commencement of the tender off, no filing fee is required.

Check the appropriate boxes to designate any transactions to which this statement relates:

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[LOGO]

Leading Producer of Base and Precious Metals

Leonid Rozhetskin

Member of the Management Board

BMO Nesbitt Burns Natural Resources Conference

February 26, 2003

Tampa, Florida

Today’s Agenda

- Introduction to Norilsk Nickel

- Norilsk Nickel's Strategic Vision

- The Stillwater Mining Transaction

- Next steps

2

Norilsk Nickel - Today

• Norilsk Nickel is the world's largest producer of nickel and palladium and a significant producer of platinum, gold, copper and cobalt

• Norilsk Nickel shares are traded on:

- RTS (GMKN$ RU) and MICEX (GMKN4(5) RM) in Moscow

- ADRs in New York (NILSY US), London (MNOD LI) and Berlin (NNIA GR)

[GRAPH]

3

Periodic Table of Elements

[GRAPHIC]

4

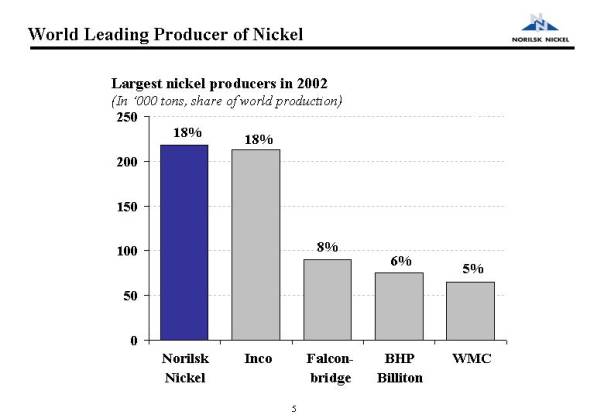

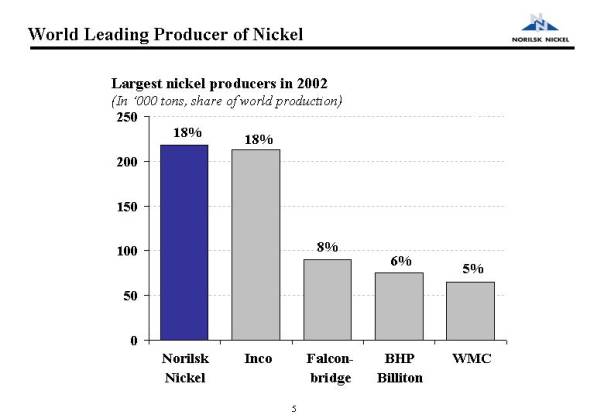

World Leading Producer of Nickel

Largest nickel producers in 2002

[CHART]

5

World Leading Producer of Palladium

Largest palladium producers in 2002

[CHART]

6

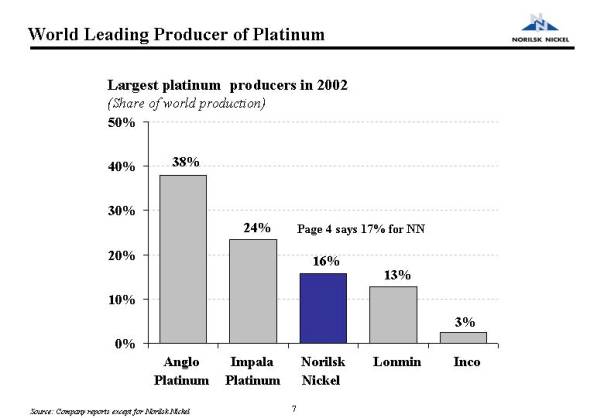

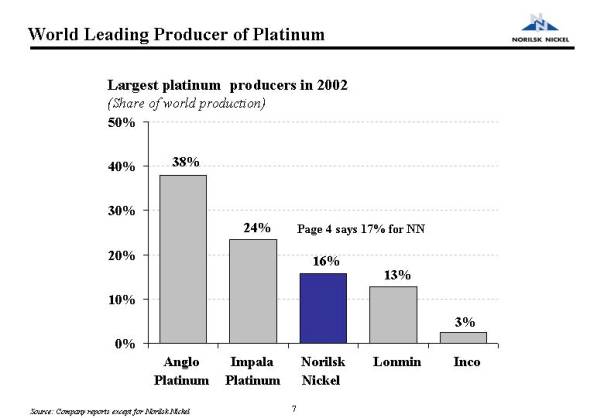

World Leading Producer of Platinum

Largest platinum producers in 2002

[CHART]

7

Leading Producer of Gold in Russia

• After the acquisition of ZAO “Polyus” MMC Norilsk Nickel has become the largest gold producer in Russia with a 12,7 % pro forma market share in 2001 and expected market share of 16-18% in 2002 (production grew from______tons in 2001 to______tons in 2002)

• MMC Norilsk Nickel holds almost 1% share in world gold production

[CHART]

8

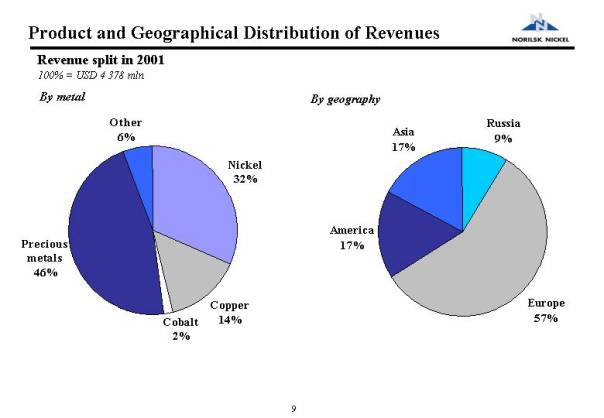

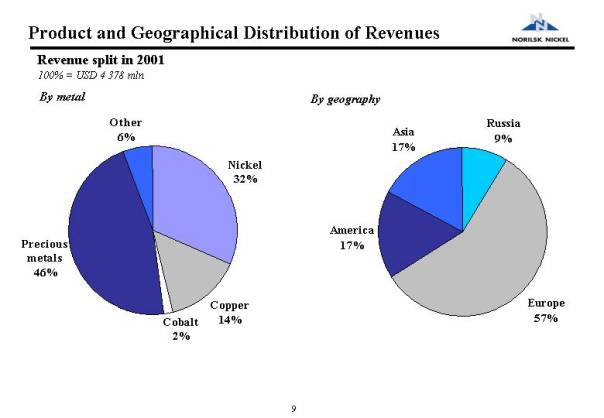

Product and Geographical Distribution of Revenues

Revenue split in 2001

9

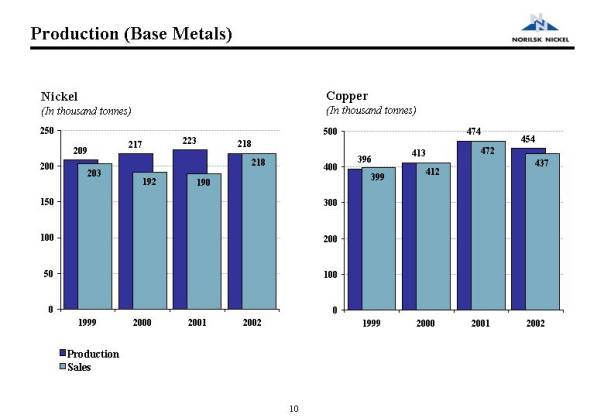

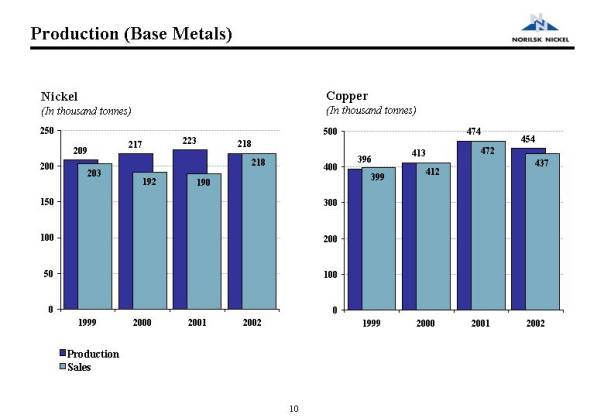

Production (Base Metals)

Nickel | | Copper |

| | |

[GRAPH] | | [GRAPH] |

10

Metal Prices in 2002

Nickel price (LME, spot) | | PGM’s price (spot) |

(In US dollars per ton) | | (In US dollars per ounce) |

| | |

[CHART] | | [CHART] |

| | |

| | |

Copper price (LME, spot) | | Gold price (spot) |

(In US dollars per ton) | | (In US dollars per ounce) |

| | |

[CHART] | | [CHART] |

11

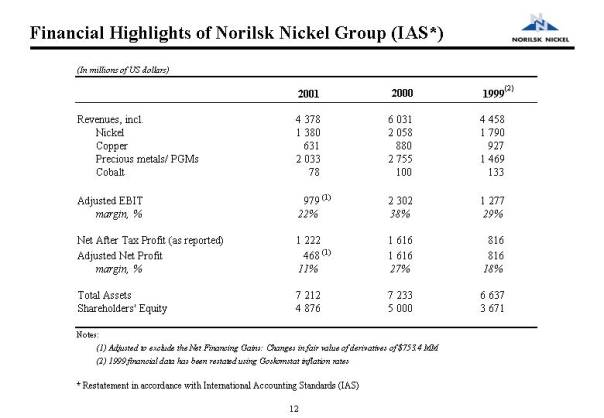

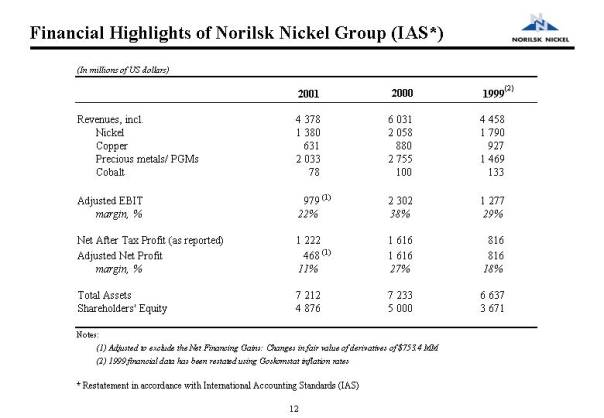

Financial Highlights of Norilsk Nickel Group (IAS*)

(In millions of US dollars) | | | | | | | |

| | 2001 | | 2000 | | 1999(2) | |

Revenues, incl. | | 4 378 | | 6 031 | | 4 458 | |

Nickel | | 1 380 | | 2 058 | | 1 790 | |

Copper | | 631 | | 880 | | 927 | |

Precious metals/ PGMs | | 2 033 | | 2 755 | | 1 469 | |

Cobalt | | 78 | | 100 | | 133 | |

| | | | | | | |

Adjusted EBIT | | 979 | (1) | 2 302 | | 1 277 | |

margin,% | | 22 | % | 38 | % | 29 | % |

| | | | | | | |

Net After Tax Profit (as reported) | | 1 222 | | 1 616 | | 816 | |

Adjusted Net Profit | | 468 | (1) | 1 616 | | 816 | |

margin,% | | 11 | % | 27 | % | 18 | % |

| | | | | | | |

Total Assets | | 7 212 | | 7 233 | | 6 637 | |

Shareholders’ Equity | | 4 876 | | 5 000 | | 3 671 | |

| | | | | | | | |

Notes:

(1) Adjusted to exclude the Net Financing Gains: Changes in fair value of derivatives of $753.4 MM

(2) 1999 financial data has been restated using Goskomstat inflation rates

* Restatement in accordance with International Accounting Standards (IAS)

12

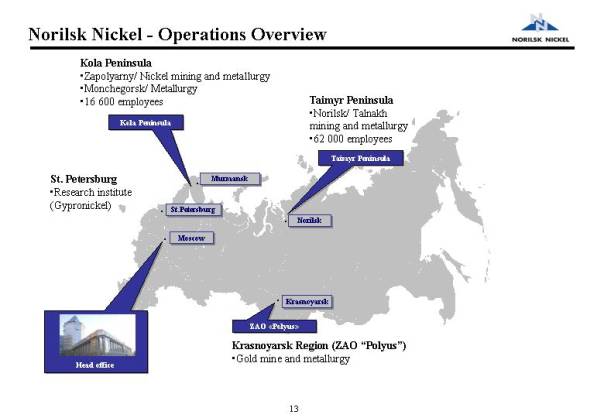

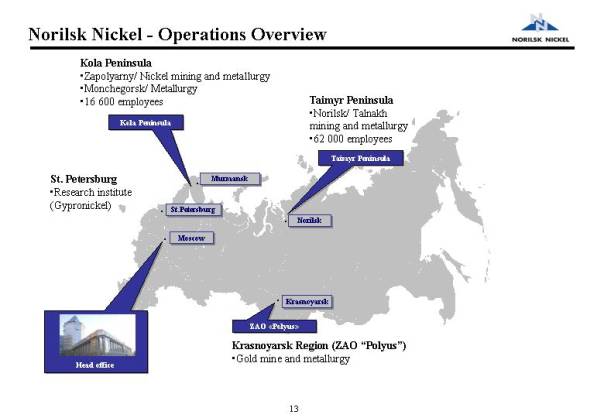

Norilsk Nickel - Operations Overview

[GRAPHIC]

13

Strategic Objective

Create shareholder value — earn returns in

excess of the cost of capital

[LOGO]

Strategies

• Sustainable and effective development of existing production base, reduction of costs and expenditures in main production areas

- Development of independent energy supplies

- Focus on efficient distribution, promotion and marketing of key products

- Improvement of financial management, introduction of up-to-date information technologies facilitating higher efficiency of business operations and executive decision-making

• Identification and pursuit of strategic opportunities in base, precious and other metals where MMC Norilsk Nickel has a strategic interest or competitive advantage

• Divestiture of non-strategic assets

• Development of corporate governance and investor relations in line with international best practices

15

2002 Objectives

Æ Improvement of Corporate Governance

- Amendment of the charter and corporate by-laws to reflect the provisions of the Federal Securities Commission Code of Corporate Conduct and last versions of the Corporate Law

- Election of 3 independent directors to the Board

- Creation of the Management Board with clearly allocated responsibilities

- Announcement of a long-term dividend policy

- Lifting of the secrecy regime on production and sales numbers for base metals

- Management Compensation System has been put on hold

ÆCost Reduction

- Headcount reduction

- Social cost continuing decrease

- Procurement tenders

16

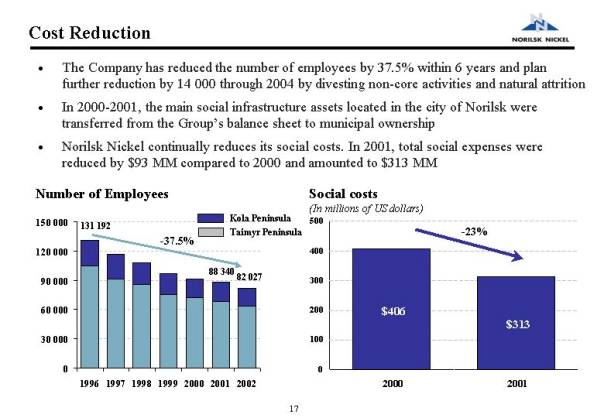

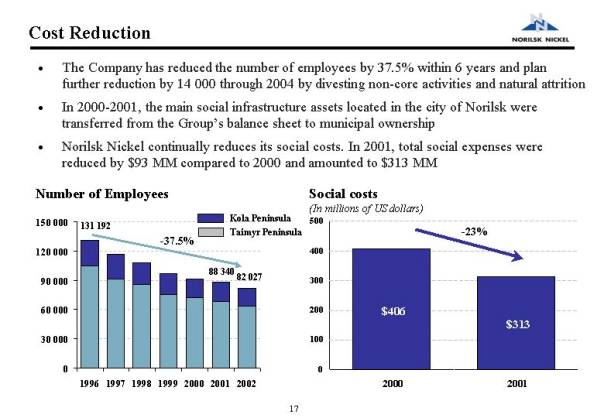

Cost Reduction

• The Company has reduced the number of employees by 37.5% within 6 years and plan further reduction by 14 000 through 2004 by divesting non-core activities and natural attrition

• In 2000-2001, the main social infrastructure assets located in the city of Norilsk were transferred from the Group's balance sheet to municipal ownership

• Norilsk Nickel continually reduces its social costs. In 2001, total social expenses were reduced by $93 MM compared to 2000 and amounted to $313 MM

Number of Employees | | Social costs |

| | |

[CHART] | | [CHART] |

17

2002 Objectives (continued)

ÆPublication of financials based on IAS

- Release of 2000 and 2001 IAS financial statements

- Quarterly production statements are to be prepared starting 2002

- Audit of 2002 financial statements according to IAS to be prepared before General Shareholder Meeting

ÆIncrease transparency

- Declassification of base-metals reserves in Taimyr (Ministry of Natural Resources is to issue formal approval)

- Partial lifting of secrecy on production/ sales volumes (base metals and PGMs)

- Regular Investor presentations & Conference calls

- Extension of coverage by world-wide investment banks

18

2002 Objectives (continued)

ÆPursue efficient M&A policy

- Divestment of non-core assets—Sale of Novolipetsk Metallurgical Combine

- Abandonment of Nakety-project

- Acquisition of Russia's largest gold producer ZAO "Polyus"—diversification of revenues

- Transaction with Stillwater Mining Company—increase reliability and supply certainty in palladium market

ÆSale of Novolipetsk Metallurgical Combine | | + USD 177.9 million | * |

ÆAbandonment of Nakety-project | | — USD 7.5 million | |

ÆAcquisition of Russia's largest gold producer ZAO "Polyus" | | — USD 226 million | |

ÆTransaction with Stillwater Mining Company | | — USD 100 million | ** |

ÆAcquisition of 24% stake in Krasnoyarskenergo*** | | — USD 40 million | |

| | | |

Net Cash Outflow | | —USD 195.6 million | |

Note:

* Norilsk Nickel received the consideration of RUR 5 513 million in March 2002.

** The deal is subject to several approvals: by Russian Central Bank, by US anti-trust authorities, by SWC shareholders.

*** Regional monopoly utility company in Krasnoyarsk region

19

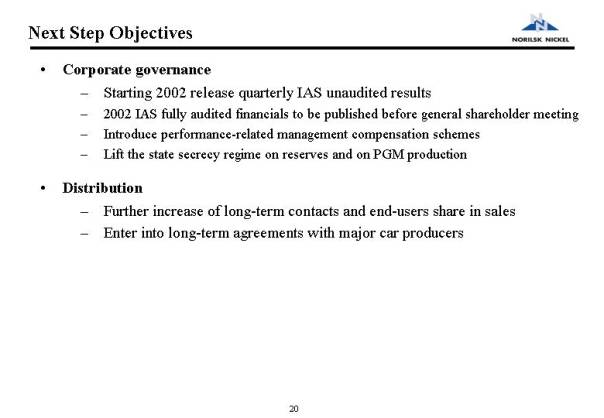

Next Step Objectives

• Corporate governance

- Starting 2002 release quarterly IAS unaudited results

- 2002 IAS fully audited financials to be published before general shareholder meeting

- Introduce performance-related management compensation schemes

- Lift the state secrecy regime on reserves and on PGM production

• Distribution

- Further increase of long-term contacts and end-users share in sales

- Enter into long-term agreements with major car producers

20

Next Step Objectives (continued)

• Improvement of financial management

- Continue reducing labor costs by reducing number of employees

- Put Pelyatka natural gas field into operation as a major step in long-term energy strategy implementation

- Implement management information system

- Expenditures to support social infrastructure to be financed by local authorities from 2003-2004

- Improve working capital management

• Optimization of production

- Implement development strategy to be released in the first months of 2003

• M& A activity

- Fully integrate ZAO "Polyus" into the Group

- Complete the transaction with Stillwater Mining Company

21

Stillwater Transaction

[LOGO]

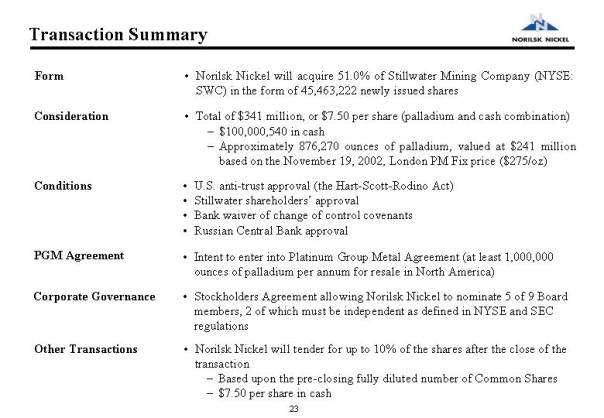

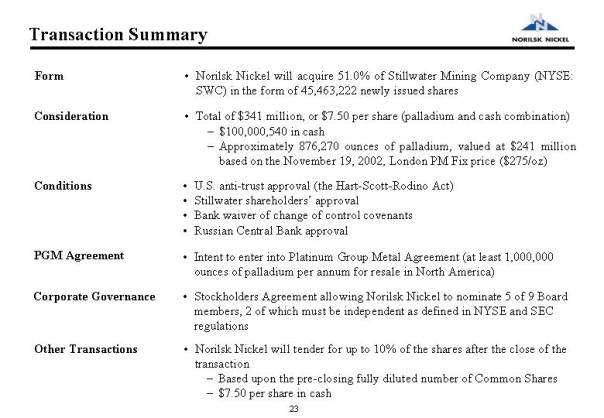

Transaction Summary

Form | | • | Norilsk Nickel will acquire 51.0% of Stillwater Mining Company (NYSE: SWC) in the form of 45,463,222 newly issued shares |

| | | | |

Consideration | | • | Total of $341 million, or $7.50 per share (palladium and cash combination) |

| | | - | $100,000,540 in cash |

| | | - | Approximately 876,270 ounces of palladium, valued at $241 million based on the November 19, 2002, London PM Fix price ($275/oz) |

| | | | |

Conditions | | • | U.S. anti-trust approval (the Hart-Scott-Rodino Act) |

| | • | Stillwater shareholders' approval |

| | • | Bank waiver of change of control covenants |

| | • | Russian Central Bank approval |

| | | |

PGM Agreement | | • | Intent to enter into Platinum Group Metal Agreement (at least 1,000,000 ounces of palladium per annum for resale in North America) |

| | | |

Corporate Governance | | • | Stockholders Agreement allowing Norilsk Nickel to nominate 5 of 9 Board members, 2 of which must be independent as defined in NYSE and SEC regulations |

| | | |

Other Transactions | | • | Norilsk Nickel will tender for up to 10% of the shares after the close of the transaction |

| | | - | Based upon the pre-closing fully diluted number of Common Shares |

| | | - | $7.50 per share in cash |

| | | | |

23

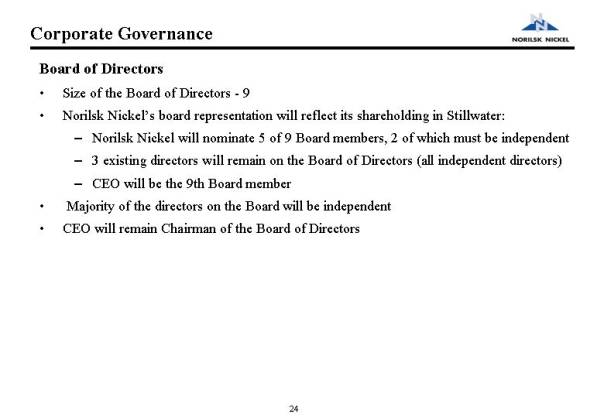

Corporate Governance

Board of Directors

• Size of the Board of Directors - 9

• Norilsk Nickel's board representation will reflect its shareholding in Stillwater:

- Norilsk Nickel will nominate 5 of 9 Board members, 2 of which must be independent

- 3 existing directors will remain on the Board of Directors (all independent directors)

- CEO will be the 9th Board member

• Majority of the directors on the Board will be independent

• CEO will remain Chairman of the Board of Directors

24

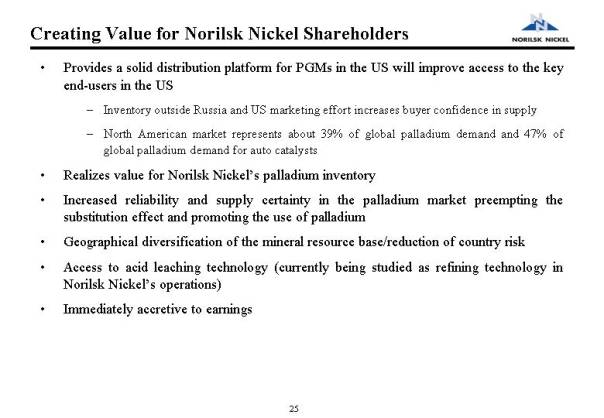

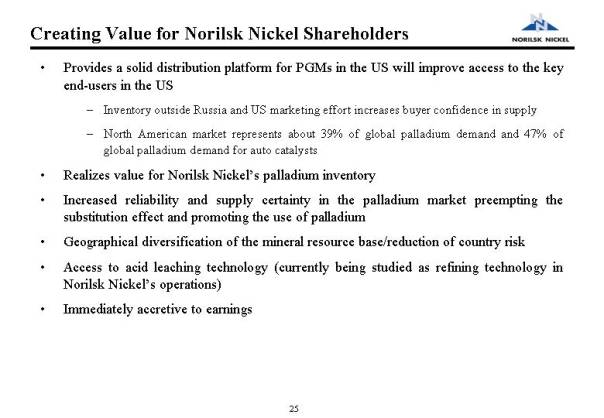

Creating Value for Norilsk Nickel Shareholders

• Provides a solid distribution platform for PGMs in the US will improve access to the key end-users in the US

- Inventory outside Russia and US marketing effort increases buyer confidence in supply

- North American market represents about 39% of global palladium demand and 47% of global palladium demand for auto catalysts

• Realizes value for Norilsk Nickel's palladium inventory

• Increased reliability and supply certainty in the palladium market preempting the substitution effect and promoting the use of palladium

• Geographical diversification of the mineral resource base/reduction of country risk

• Access to acid leaching technology (currently being studied as refining technology in Norilsk Nickel's operations)

• Immediately accretive to earnings

25

Creating Value for Stillwater Stakeholders

• Norilsk Nickel investment provides liquidity to reduce debt, fund capital expenditures, and keep the mines operating

• Access to Norilsk Nickel's palladium makes Stillwater a formidable supplier for users

• Support from Norilsk Nickel to promote usage of palladium in exhaust systems, fuel cells and other applications

• Increased potential to benefit the palladium market

• Norilsk Nickel committed to continuing Stillwater's transparency, corporate governance and environment standards and practices and NYSE listing

• Potential of long-term value creation

26

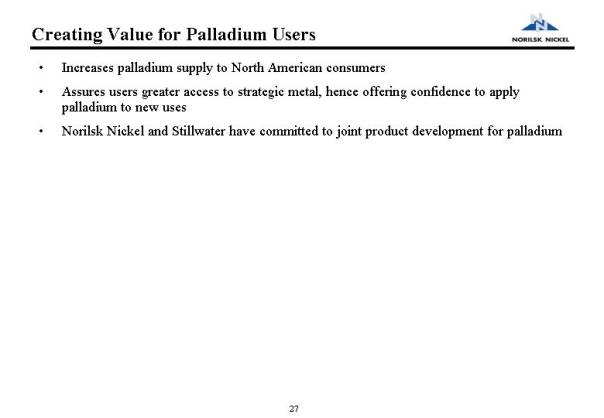

Creating Value for Palladium Users

• Increases palladium supply to North American consumers

• Assures users greater access to strategic metal, hence offering confidence to apply palladium to new uses

• Norilsk Nickel and Stillwater have committed to joint product development for palladium

27