UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| | |

| x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

| | |

| | For the fiscal year ended | October 31, 2013 |

| | |

| | OR |

| | |

| o | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

| | |

| | For the transition period from to . |

| | |

| | COMMISSION FILE NUMBER 000-51177 |

GOLDEN GRAIN ENERGY, LLC

(Exact name of registrant as specified in its charter)

|

| | | | |

| Iowa | | 02-0575361 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

1822 43rd Street SW, Mason City, Iowa 50401 |

| (Address of principal executive offices) |

| |

| (641) 423-8525 |

| (Registrant's telephone number, including area code) |

| |

| Securities registered pursuant to Section 12(b) of the Act: |

| |

| None |

| |

| Securities registered pursuant to Section 12(g) of the Act: |

| |

| Class A Membership Units |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes x No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act:

|

| |

Large Accelerated Filer o | Accelerated Filer o |

Non-Accelerated Filer x | Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

As of April 30, 2013, the aggregate market value of the Class A membership units held by non-affiliates (computed by reference to the most recent offering price of Class A membership units) was $14,802,167. As of April 30, 2013, the aggregate market value of the Class B membership units held by non-affiliates (computed by reference to the most recent offering price of the Class B membership units) was $345,500.

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date:

As of December 23, 2013, there were 18,963,000 Class A membership units outstanding and 920,000 Class B membership units outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant has incorporated by reference into Part III of this Annual Report on Form 10-K portions of its definitive proxy statement to be filed with the Securities and Exchange Commission within 120 days after the close of the fiscal year covered by this Annual Report.

INDEX

Forward Looking Statements

This report contains forward-looking statements that involve future events, our future performance and our expected future operations and actions. In some cases you can identify forward-looking statements by the use of words such as "may," "will," "should," "anticipate," "believe," "expect," "plan," "future," "intend," "could," "estimate," "predict," "hope," "potential," "continue," or the negative of these terms or other similar expressions. These forward-looking statements are only our predictions and involve numerous assumptions, risks and uncertainties, including, but not limited to those listed below and those business risks and factors described elsewhere in this report and our other Securities and Exchange Commission filings.

| |

| • | Ethanol, distiller grains and corn oil supply exceeding demand and corresponding price reductions; |

| |

| • | Changes in the availability and price of corn and natural gas; |

| |

| • | Our ability to profitably operate the ethanol plant, including the sale of distiller grains and corn oil, and maintain a positive spread between the selling price of our products and our raw material costs; |

| |

| • | The effect our hedging activities has on our financial performance and cash flows; |

| |

| • | Our ability to generate free cash flow to invest in our business, service our debt and satisfy the financial covenants contained in our credit agreement with our lender; |

| |

| • | Changes in our business strategy, capital improvements or development plans; |

| |

| • | Changes in plant production capacity or technical difficulties in operating the plant; |

| |

| • | Changes in general economic conditions or the occurrence of certain events causing an economic impact in the agriculture, oil or automobile industries; |

| |

| • | Changes in corn availability due to growing conditions, including unfavorable weather patterns; |

| |

| • | Lack of transport, storage and blending infrastructure preventing our products from reaching high demand markets; |

| |

| • | Changes in federal and/or state laws and environmental regulations (including the elimination or waiver of the Renewable Fuel Standard); |

| |

| • | Changes and advances in ethanol production technology; |

| |

| • | Competition from alternative fuel additives; |

| |

| • | Changes in interest rates or the lack of credit availability; and |

| |

| • | Our ability to retain key employees and maintain labor relations. |

Our actual results or actions could and likely will differ materially from those anticipated in the forward-looking statements for many reasons, including the reasons described in this report. We are not under any duty to update the forward-looking statements contained in this report. We cannot guarantee future results, levels of activity, performance or achievements. We caution you not to put undue reliance on any forward-looking statements, which speak only as of the date of this report. You should read this report and the documents that we reference in this report and have filed as exhibits, completely and with the understanding that our actual future results may be materially different from what we currently expect. We qualify all of our forward-looking statements with these cautionary statements. Unless otherwise stated, references in this report to particular years or quarters refer to our fiscal years ended in October and the associated quarters of those fiscal years.

PART I

ITEM 1. BUSINESS

Business Development

Golden Grain Energy, LLC was formed as an Iowa limited liability company on March 18, 2002, for the purpose of constructing, owning and operating a fuel-grade ethanol plant in Mason City in north central Iowa. References to "we," "us," "our" and the "Company" refer to Golden Grain Energy, LLC. Since December 2004, we have been engaged in the production of ethanol and distiller grains at the plant. We started producing corn oil at the plant in 2009.

On December 12, 2012, we executed an agreement with our largest member to repurchase and retire all of the units owned by this member. We agreed to close on this repurchase prior to December 31, 2012. We repurchased and retired 4,577,000 membership units in exchange for $17 million. In order to finance this repurchase, we entered into amended credit agreements, described below, with our primary lender, Farm Credit Services of America, FLCA and Farm Credit Services of America, PCA (collectively "Farm Credit").

On December 26, 2012, we executed amended credit agreements with Farm Credit. The primary purposes of these credit agreement amendments were to increase the amount that we have available to borrow on our long-term revolving loans and to amend our financial loan covenants. Specifically, we executed an amendment to the Master Loan Agreement, a $30 million Revolving Term Loan Supplement and a $5 million Revolving Term Loan Supplement.

Pursuant to the amended credit agreements, Farm Credit increased our credit availability on our long-term revolving loans from $22.5 million to $35 million. In addition, the amended credit agreements increased our minimum working capital covenant from $12 million to $15 million and reduced our minimum tangible net worth covenant from $62.5 million to $55 million. Our $30 million Revolving Term Loan is subject to a reducing feature which provides that the amount of capital we can borrow decreases by $2.5 million semi-annually starting on August 1, 2013 and continuing until this revolving loan matures on February 1, 2019. Our $5 million Revolving Term Loan is not subject to any reductions until it matures on February 1, 2020.

On August 19, 2013, our board of directors declared a distribution of $0.10 per membership unit for members of record as of August 19, 2013. The distribution was paid in September 2013.

On December 3, 2013, our board of directors declared a distribution of $0.50 per membership unit for members of record as of December 3, 2013. Management anticipates the distribution will be paid by early February 2014. Our lender has verbally consented to the amount of this distribution, however, we are in the process of securing a formal waiver from our lender which we anticipate will be received before the distribution is paid.

Financial Information

Please refer to "ITEM 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" for information about our revenue, profit and loss measurements and total assets and liabilities and "ITEM 8. Financial Statements and Supplementary Data" for our financial statements and supplementary data.

Principal Products

The principal products that we produce are ethanol, distiller grains and corn oil. The table below shows the approximate percentage of our total revenue which is attributed to each of our principal products for each of our last three fiscal years.

|

| | | | | | |

| Product | | Fiscal Year 2013 | | Fiscal Year 2012 | | Fiscal Year 2011 |

| Ethanol | | 76% | | 77% | | 82% |

| Distiller Grains | | 21% | | 20% | | 16% |

| Corn Oil | | 3% | | 3% | | 2% |

Ethanol

Ethanol is ethyl alcohol, a fuel component made primarily from corn and various other grains, which can be used as: (i) an octane enhancer in fuels; (ii) an oxygenated fuel additive for the purpose of reducing ozone and carbon monoxide vehicle emissions; and (iii) a non-petroleum-based gasoline substitute. Ethanol produced in the United States is primarily used for blending with unleaded gasoline and other fuel products. Ethanol blended fuel is typically designated in the marketplace according to the

percentage of the fuel that is ethanol, with the most common fuel blend being E10, which includes 10% ethanol. The United States Environmental Protection Agency ("EPA") has approved the use of gasoline blends that contain 15% ethanol, or E15, for use in all vehicles manufactured in model year 2001 and later. In addition, flexible fuel vehicles can use gasoline blends that contain up to 85% ethanol called E85.

Distiller Grains

The principal co-product of the ethanol production process is distiller grains, a high protein, high-energy animal feed supplement primarily marketed to the dairy and beef industry. We produce two forms of distiller grains: Modified/Wet Distillers Grains ("MWDG") and Distillers Dried Grains with Solubles ("DDGS"). MWDG is processed corn mash that has been dried to approximately 50% moisture. MWDG has a shelf life of approximately seven days and is often sold to nearby markets. DDGS is processed corn mash that has been dried to approximately 10% moisture. It has a longer shelf life and may be sold and shipped to any market regardless of its vicinity to our ethanol plant.

Corn Oil

We separate a portion of the corn oil contained in our distiller grains which we market separately from our distiller grains. The corn oil that we produce is not food grade corn oil and therefore cannot be used for human consumption. The primary uses of the corn oil that we produce are for animal feed, industrial uses and biodiesel production.

Principal Product Markets

As described below in "Distribution Methods," we market and distribute all of our ethanol, distiller grains and corn oil through RPMG, Inc. ("RPMG") a professional third party marketer. We have very limited control over the decisions RPMG makes regarding where our products are marketed. Our products are primarily sold in the domestic market, however, as domestic production of ethanol, distiller grains and corn oil continue to expand, we anticipate increased international sales of our products. The principal purchasers of ethanol are generally wholesale gasoline marketers or blenders. The principal markets for our ethanol are petroleum terminals in the continental United States.

Currently, the United States ethanol industry exports a significant amount of distiller grains to China, Mexico, Turkey and Canada along with many Pacific Rim countries. During 2010, the ethanol industry experienced a significant increase in distiller grains exports to China to meet China's growing need for animal feed. During 2010, China began investigating United States distiller grains exporters for allegedly dumping distiller grains into the Chinese market. In June 2012, the Chinese dropped their anti-dumping investigation without imposing a tariff on distiller grains produced in the United States. Distiller grains exports to China rebounded following the termination of the anti-dumping investigation. However, recently China rejected shipments of corn which contained a non-approved GMO trait. Management believes that China will reject distiller grains which contain this trait as well. If China rejects shipments of distiller grains, it may negatively impact distiller grains prices in the United States as rejected distiller grains would likely be returned to the United States and future shipments may be rejected.

During our 2011 fiscal year, the ethanol industry experienced increased ethanol exports to Europe and Brazil. These ethanol exports benefited ethanol prices in the United States. In 2011, the European Union launched an anti-dumping investigation related to ethanol exports from the United States. The European Union ultimately imposed a tariff on ethanol which is produced in the United States and exported to Europe. This tariff significantly reduced exports of ethanol to Europe during our 2012 and 2013 fiscal years. Legal challenges to the tariff are expected and many in the ethanol industry believe that the European Union's actions in imposing the tariff are not supported by international trade law.

We expect our ethanol, distiller grains and corn oil marketer to explore all markets for our products, including export markets. However, due to high transportation costs, and the fact that we are not located near a major international shipping port, we expect a majority of our products to continue to be marketed and sold domestically.

Distribution Methods

On October 1, 2012, we entered into a new ethanol marketing agreement with RPMG. Because we are an owner of Renewable Products Marketing Group, LLC ("RPMG, LLC"), the parent company of RPMG, we receive favorable marketing fees from RPMG. Our ethanol marketing agreement allows us to elect to sell our ethanol through an index arrangement or at a fixed price agreed to between us and RPMG. Pursuant to the ethanol marketing agreement, RPMG is our exclusive marketer. The term of our ethanol marketing agreement is perpetual, until it is terminated by either party. The primary reasons our ethanol marketing agreement would terminate are if we cease to be an owner of RPMG, LLC, if there is a breach of the ethanol marketing agreement which is not cured, or if we give advance notice to RPMG that we wish to terminate the ethanol marketing agreement. Notwithstanding our right to terminate the ethanol marketing agreement, we may be obligated to continue to market our ethanol through RPMG for a period of time after the termination. Further, following the termination, we agreed to accept an assignment of certain railcar leases which RPMG has secured to service our ethanol sales. If our ethanol marketing agreement is terminated, it would trigger a redemption of our ownership interest in RPMG, LLC at our contributed capital balance at the time of termination.

On December 15, 2010, we entered into a distiller grains marketing agreement with RPMG. Pursuant to the agreement, RPMG agreed to market all of the distiller grains we produce. We agreed to pay RPMG a fee to market our distiller grains equal to the actual cost of marketing the distiller grains due to the fact that we are an owner of RPMG, LLC. The initial term of the RPMG distiller grains marketing agreement was nine months. Following the nine month period, we have the right to terminate the contract by giving RPMG ninety days written notice.

On February 2, 2009, we executed a corn oil marketing agreement with RPMG. Pursuant to the agreement, RPMG agreed to market all of the corn oil we produce, except for certain corn oil we may sell to corn oil customers we identified before we executed the agreement. Currently, all of our corn oil is being sold through RPMG. The initial term of the agreement was for one year. The agreement automatically renews for additional one year terms unless either party gives 180 days notice that the agreement will not be renewed. We agreed to pay RPMG a commission based on each pound of our corn oil that is sold by RPMG.

Sources and Availability of Raw Materials

Corn

Our plant currently uses approximately 40 million bushels of corn per year, or approximately 115,000 bushels per day, as the feedstock for its dry milling process. In October 2008, we received our Iowa grain dealer license which allows us to purchase corn directly from local producers instead of using local grain elevators as intermediaries. Our commodity manager is responsible for purchasing corn for our operations, scheduling corn deliveries and establishing hedging positions to protect the price we pay for corn.

During the 2012 growing season, many of the corn producing regions of the United States experienced drought conditions. In addition, in 2013, corn planting was delayed in a large percentage of the corn belt. Both of these factors negatively impacted corn yields and resulted in a significant increase in corn prices. However, leading up to the corn harvest in 2013, projections regarding the condition and size of the 2013 corn crop improved which resulted in lower corn prices. Corn prices continued lower after the fall harvest due to the fact that a record number of bushels of corn were harvested in 2013. Management expects that corn prices will remain lower than in previous years due to the larger corn crop that was harvested in the fall of 2013. Management does not anticipate difficulty securing corn for its production process during our 2014 fiscal year. However, due to the fact that corn production surrounding our ethanol plant was impacted by a significant number of acres which were not planted due to wet weather conditions early in the 2013 growing season, we may have to pay a higher basis and purchase corn from outside our normal corn supply area, in order to secure the corn we need to operate at capacity.

Natural Gas

Natural gas is an important input to our manufacturing process. We use natural gas to dry our distiller grains products to moisture contents at which they can be stored for longer periods of time. This allows the distiller grains we produce to be transported greater distances to serve broader livestock markets. We entered into an agreement with Interstate Power and Light Company to deliver all of the natural gas required by the plant. The agreement commenced in December 2004 and continues for a period of 10 years with an option for a 5 year renewal. We do not anticipate any problems securing the natural gas that we require to continue to operate the ethanol plant at capacity during our 2014 fiscal year or beyond.

Electricity

We entered into an agreement with Interstate Power and Light Company to supply all electrical energy required by the plant. The agreement commenced on June 2004 and continued through May 2007. After the expiration of the initial term, the agreement continues on a month-to-month basis and may be terminated by either party by giving 60 days prior written notice. We have elected to continue this contract on a month-to-month basis and have not given or received notice of termination of this agreement. We do not anticipate any problems securing the electricity that we require to continue to operate the ethanol plant at capacity during our 2014 fiscal year or beyond.

Water

The primary water supply for our plant is generated by one 800 gallon-per-minute pump at the well drilled at the plant site. We have a second high capacity well that has capacity to produce 600 gallons of water per minute. These two wells provide adequate water capacity to operate the plant under normal circumstances. In addition, we are connected to the City of Mason City's water supply for fire protection and in the event the water supplied by our wells is not sufficient. We have installed an underground distribution system for potable water, process water, fire protection and sanitary sewer lines. We will pay a special fixed user fee of $3,333 per month to Mason City for our back-up water supply until February 2015. In addition, we pay Mason City for any potable water usage at the plant based on our actual usage times the current rate ordinance. We do not anticipate any problems securing the water that we require to continue to operate the ethanol plant at capacity during our 2014 fiscal year or beyond.

Patents, Trademarks, Licenses, Franchises and Concessions

We do not currently hold any patents, trademarks, franchises or concessions. We were granted a perpetual and royalty free license by ICM to use certain ethanol production technology necessary to operate our ethanol plant. The cost of the license granted by ICM was included in the amount we paid to Fagen to design and build our ethanol plant and expansion.

Seasonality Sales

We experience some seasonality of demand for our ethanol, distiller grains and corn oil. Since ethanol is predominantly blended with gasoline for use in automobiles, ethanol demand tends to shift in relation to gasoline demand. As a result, we experience some seasonality of demand for ethanol in the summer months related to increased driving and, as a result, increased gasoline demand. In addition, we experience some increased ethanol demand during holiday seasons related to increased gasoline demand. We also experience decreased distiller grains demand during the summer months due to natural depletion in the size of herds at cattle feed lots and when the animals are turned out to pasture or are slaughtered. Further, we expect some seasonality of demand for our corn oil since a major corn oil user is biodiesel plants which typically reduce production during the winter months.

Working Capital

We primarily use our working capital for purchases of raw materials necessary to operate the ethanol plant and for capital expenditures to maintain and upgrade the ethanol plant. Our primary sources of working capital are income from our operations as well as our revolving term loan with our primary lender, Farm Credit. For our 2014 fiscal year, we anticipate replacing part of our dryers and thermal oxidizers as well as upgrading our distillers grains handling equipment along with completing the railroad track expansion and other smaller capital projects using cash from our operations. In addition, we anticipate using cash from our operations to maintain our current plant infrastructure. Management believes that our current sources of working capital are sufficient to sustain our operations and complete our capital expenditures during our 2014 fiscal year and beyond.

Dependence on a Major Customer

As discussed above, we rely on RPMG for the sale and distribution of all of our products and are highly dependent on RPMG for the successful marketing of our products. We do not currently have the ability to market our ethanol, distiller grains and corn oil internally should RPMG be unable to market these products for us at acceptable prices. We anticipate that we would be able to secure alternate marketers should RPMG fail, however, a loss of our marketer could significantly harm our financial performance.

Competition

We are in direct competition with numerous ethanol producers, many of whom have greater resources than we do. Ethanol is a commodity product where competition in the industry is predominantly based on price and consistent fuel quality. While management believes we are a lower cost producer of ethanol, larger ethanol producers may be able to take advantage of economies of scale due to their larger size and increased bargaining power with both customers and raw material suppliers which could put us at a competitive disadvantage compared to these larger ethanol producers. As of December 14, 2013, the Renewable Fuels Association ("RFA") estimates that there are 211 ethanol production facilities in the United States with capacity to produce approximately 14.9 billion gallons of ethanol per year and another 6 plants under expansion or construction with capacity to produce an additional 165 million gallons of ethanol per year. The RFA estimates that approximately 8% of the ethanol production capacity in the United States was not operating as of December 14, 2013. The largest ethanol producers include Archer Daniels Midland, Flint Hills Resources, Green Plains Renewable Energy, POET, and Valero Renewable Fuels, each of which are capable of producing significantly more ethanol than we produce.

The following table identifies the largest ethanol producers in the United States along with their production capacities.

U.S. FUEL ETHANOL PRODUCTION CAPACITY

BY TOP PRODUCERS

Producers of Approximately 600

million gallons per year (MMgy) or more

|

| | | | | | | | | |

| Company | | Current Capacity (MMgy) | | Under Construction/Expansions (MMgy) | | Percent of Market |

| Archer Daniels Midland | | 1,720 |

| | — |

| | 12 | % |

| Poet Biorefining | | 1,629 |

| | — |

| | 11 | % |

| Valero Renewable Fuels | | 1,130 |

| | — |

| | 8 | % |

| Green Plains Renewable Energy | | 1,004 |

| | — |

| | 7 | % |

| Flint Hills Resources | | 660 |

| | — |

| | 4 | % |

Updated: December 14, 2013

We have experienced increased competition from oil companies which are purchasing ethanol production facilities. These oil companies are required to blend a certain amount of ethanol each year. Therefore, the oil companies may be able to operate their ethanol production facilities at times when it is unprofitable for us to operate our ethanol plant. Further, some ethanol producers own multiple ethanol plants which may allow them to compete more effectively by providing them flexibility to run certain production facilities while they have other facilities shut down. This added flexibility may allow these ethanol producers to compete more effectively, especially during periods when operating margins are unfavorable in the ethanol industry. Finally some ethanol producers who own ethanol plants in geographically diverse areas of the United States may spread the risk they encounter related to feedstock prices. For example, ethanol producers that own production facilities in different areas of the United States may reduce their risk of experiencing higher feedstock prices due to localized decreased corn crops.

Research and Development

We are continually working to develop new methods of operating the ethanol plant more efficiently. We continue to conduct research and development activities in order to realize these efficiency improvements.

Governmental Regulation and Federal Ethanol Supports

Federal Ethanol Supports

The ethanol industry is dependent on several economic incentives to produce ethanol, including federal tax incentives and ethanol use mandates. One significant federal ethanol support is the Federal Renewable Fuels Standard (the "RFS"). The RFS requires that in each year, a certain amount of renewable fuels must be used in the United States. The RFS is a national program that does not require that any renewable fuels be used in any particular area or state, allowing refiners to use renewable fuel blends in those areas where it is most cost-effective. Subject to the EPA's ability to reduce the RFS limits, which authority it appears the EPA will use this year as discussed below, the RFS requirement increases incrementally each year until the United States is required to use 36 billion gallons of renewable fuels by 2022. Starting in 2009, the RFS required that a portion of the RFS must be met by certain "advanced" renewable fuels. These advanced renewable fuels include ethanol that is not made from corn, such as cellulosic ethanol and biomass based biodiesel. The use of these advanced renewable fuels increases each year as a percentage of the total renewable fuels required to be used in the United States.

If the RFS were to be repealed or modified, ethanol demand may be significantly impacted. The RFS for 2013 was approximately 16.55 billion gallons, of which corn based ethanol could be used to satisfy approximately 13.8 billion gallons. The statutory volume requirement of the RFS for 2014 is approximately 18.15 billion gallons, of which corn based ethanol can be used to satisfy approximately 14.4 billion gallons. Recently, there have been proposals in Congress to reduce or eliminate the RFS. In addition, on November 15, 2013, the EPA announced a proposal to significantly reduce the RFS levels for 2014 from the statutory volume requirement of 18.15 billion gallons to 15.21 billion gallons and reduce the renewable volume obligations that can be satisfied by corn based ethanol from 14.4 billion gallons to 13 billion gallons. This proposal would also result in a lowering of the 2014 numbers below the 2013 level of 13.8 billion gallons. The EPA proposal is subject to a 60-day public comment period which expires on January 28, 2014. The EPA is also seeking comment on several petitions it has received for partial waiver of the statutory volumes for 2014. If the EPA's proposal becomes a final rule significantly reducing the RFS or if the RFS were to be otherwise reduced or eliminated by the exercise of the EPA waiver authority or by Congress, the market price and demand for ethanol will likely decrease which will negatively impact our financial performance. Current ethanol production capacity exceeds the EPA's proposed 2014 renewable volume obligation which can be satisfied by corn based ethanol by approximately 1.8 billion gallons.

In February 2010, the EPA issued new regulations governing the RFS. These new regulations have been called RFS2. The most controversial part of RFS2 involves what is commonly referred to as the lifecycle analysis of green house gas emissions. Specifically, the EPA adopted rules to determine which renewable fuels provided sufficient reductions in green house gases, compared to conventional gasoline, to qualify under the RFS program. RFS2 establishes a tiered approach, where regular renewable fuels are required to accomplish a 20% green house gas reduction compared to gasoline, advanced biofuels and biomass-based biodiesel must accomplish a 50% reduction in green house gases, and cellulosic biofuels must accomplish a 60% reduction in green house gases. Any fuels that fail to meet this standard cannot be used by fuel blenders to satisfy their obligations under the RFS program. The scientific method of calculating these green house gas reductions has been a contentious issue. Many in the ethanol industry were concerned that corn based ethanol would not meet the 20% green house gas reduction requirement based on certain parts of the environmental impact model that many in the ethanol industry believed was scientifically suspect. However, RFS2 as adopted by the EPA provides that corn-based ethanol from modern ethanol production processes does meet the definition of a renewable fuel under the RFS program. Our ethanol plant was grandfathered into the RFS due to the fact that it was constructed prior to the effective date of the lifecycle green house gas requirement and is not required to prove compliance with the lifecycle

green house gas reductions. Many in the ethanol industry are concerned that certain provisions of RFS2 as adopted may disproportionately benefit ethanol produced from sugarcane. This could make sugarcane based ethanol, which is primarily produced in Brazil, more competitive in the United States ethanol market. If this were to occur, it could reduce demand for the ethanol that we produce.

Most ethanol that is used in the United States is sold in a blend called E10. E10 is a blend of 10% ethanol and 90% gasoline. E10 is approved for use in all standard vehicles. Estimates indicate that gasoline demand in the United States is approximately 134 billion gallons per year. Assuming that all gasoline in the United States is blended at a rate of 10% ethanol and 90% gasoline, the maximum demand for ethanol is 13.4 billion gallons per year. This is commonly referred to as the "blending wall," which represents a theoretical limit where more ethanol cannot be blended into the national gasoline pool. This is a theoretical limit because it is believed that it would not be possible to blend ethanol into every gallon of gasoline that is being used in the United States and it discounts the possibility of additional ethanol used in higher percentage blends such as E85 used in flex fuel vehicles.

Many in the ethanol industry believe that it will be impossible to meet the RFS requirement in future years without an increase in the percentage of ethanol that can be blended with gasoline for use in standard (non-flex fuel) vehicles. The United States Environmental Protection Agency (the "EPA") has approved the use of E15, gasoline which is blended at a rate of 15% ethanol and 85% gasoline, in vehicles manufactured in the model year 2001 and later. However, there were still significant federal and state regulatory hurdles that needed to be addressed before E15 would be widely available in the marketplace. The EPA has made gains towards clearing those federal regulatory hurdles. In February 2012, the EPA approved health effects and emissions testing on E15 which was required by the Clean Air Act before E15 can be sold into the market. In March 2012, the EPA approved a model Misfueling Mitigation Plan and fuel survey which must be submitted by applicants before E15 registrations can be approved. In April 2012, the EPA approved the first E15 registrations approving twenty producers who have successfully registered their product to be used as E15. Finally, in June 2012, the EPA gave the final approval to allow the sale of E15. Although management believes that these developments are significant steps towards introduction of E15 in the marketplace, there are still obstacles to meaningful market penetration by E15. Many states still have regulatory issues that prevent the sale of E15. Sales of E15 may be limited because it is not approved for use in all vehicles, the EPA requires a label that management believes may discourage consumers from using E15, and retailers may choose not to sell E15 due to concerns regarding liability. In addition, different gasoline blendstocks may be required at certain times of the year in order to use E15 due to federal regulations related to fuel evaporative emissions which may prevent E15 from being used during certain times of the year in various states. As a result, E15 has not had an immediate impact on ethanol demand in the United States.

State Ethanol Supports

In 2006, Iowa passed legislation promoting the use of renewable fuels in Iowa. One of the most significant provisions of the Iowa renewable fuels legislation is a renewable fuels standard encouraging 10% of the gasoline sold in Iowa to be renewable fuels by 2009 and increasing incrementally to 25% renewable fuels by 2019. This is expected to be achieved through the use of tax credits that are designed to encourage the further utilization of renewable fuels in Iowa. This legislation could increase local demand for ethanol and may increase the local price for ethanol. In 2011, the Iowa legislature increased the E85 tax credit to 18 cents per gallon, created an E15 tax credit of 3 cents per gallon from 2011 until 2014, decreasing to 2.5 cents per gallon from 2015 until 2017 and waived the misfueling liability for retailers associated with E15. These changes were intended to encourage the use of higher level blends of ethanol in Iowa.

Effect of Governmental Regulation

The government's regulation of the environment changes constantly. We are subject to extensive air, water and other environmental regulations and we have been required to obtain a number of environmental permits to construct and operate the ethanol plant. It is possible that more stringent federal or state environmental rules or regulations could be adopted, which could increase our operating costs and expenses. It also is possible that federal or state environmental rules or regulations could be adopted that could have an adverse effect on the use of ethanol. Plant operations are governed by the Occupational Safety and Health Administration ("OSHA"). OSHA regulations may change such that the costs of operating the ethanol plant may increase. Any of these regulatory factors may result in higher costs or other adverse conditions effecting our operations, cash flows and financial performance.

We have obtained all of the necessary permits to operate the ethanol plant. During our 2013 fiscal year, we incurred costs and expenses of approximately $47,000 complying with environmental laws, including the cost of obtaining permits. Although we have been successful in obtaining all of the permits currently required, any retroactive change in environmental regulations, either at the federal or state level, could require us to obtain additional or new permits or spend considerable resources in complying with such regulations.

In late 2009, California passed a Low Carbon Fuels Standard ("LCFS"). The California LCFS requires that renewable fuels used in California must accomplish certain reductions in greenhouse gases which is measured using a lifecycle analysis, similar to the RFS. On December 29, 2011, a federal district court in California ruled that the California LCFS was unconstitutional which halted implementation of the California LCFS. However, the California Air Resources Board ("CARB") appealed this court ruling and on September 18, 2013, the federal appellate court reversed the federal district court, finding the LCFS constitutional and remanding the case back to federal district court to determine whether the LCFS imposes a burden on interstate commerce that is excessive in light of the local benefits. In addition, a state court in California recently required that CARB take certain corrective actions regarding the approval of the LCFS regulations while allowing the LCFS regulations to remain in effect during this process. If federal and state challenges to the LCFS are ultimately unsuccessful, the LCFS could have a negative impact on demand for corn-based ethanol in California and result in decreased ethanol prices.

In 2012, the European Union concluded an anti-dumping investigation related to ethanol produced in the United States and exported to Europe. As a result of this investigation, the European Union has imposed a tariff on ethanol which is produced in the United States and exported to Europe. This tariff has resulted in significantly decreased exports of ethanol to Europe which has negatively impacted ethanol demand in the United States.

Employees

As of October 31, 2013, we had 47 full-time employees and no part time employees.

Financial Information about Geographic Areas

All of our operations are domiciled in the United States. All of the products we sold to our customers for our fiscal years 2013, 2012 and 2011 were produced in the United States and all of our long-lived assets are domiciled in the United States. We have engaged a third-party professional marketer who decides where our products are marketed and we have limited control over the marketing decisions made by our marketer. Our marketer may decide to sell our products in countries other than the United States. However, we anticipate that our products will still primarily be marketed and sold in the United States.

ITEM 1A. RISK FACTORS.

You should carefully read and consider the risks and uncertainties below and the other information contained in this report. The risks and uncertainties described below are not the only ones we may face. The following risks, together with additional risks and uncertainties not currently known to us or that we currently deem immaterial could impair our financial condition and results of operation.

Risks Relating to Our Business

Our profitability is dependent on a positive spread between the price we receive for our products and the raw material costs required to produce our products. Practically all of our revenue is derived from the sale of our ethanol, distiller grains and corn oil. Our primary raw material costs are related to corn costs and natural gas costs. Our profitability depends on a positive spread between the market price of the ethanol, distiller grains and corn oil we produce and the raw material costs related to these products. While ethanol, distiller grains and corn oil prices typically change in relation to corn prices, this correlation may not always exist. In the event the prices of our products decrease at a time when our raw material costs are increasing, we may not be able to profitably operate the ethanol plant. Further, if the spread between the price we receive for our products and the raw material costs associated with producing those products is negative for an extended period of time, we may fail which could negatively impact the value of our units.

We may be forced to reduce production or cease production altogether if we are unable to secure the corn we require to operate the ethanol plant. While a record corn crop was harvested in the fall of 2013, the area surrounding our plant had a significant number of acres which were not planted due to wet weather conditions during planting. This decrease in the number of acres planted has impacted the amount of corn that is available in our local area, which may result in difficulty securing the corn we require to operate the ethanol plant. While there is a significant amount of corn available nationally, and corn prices have been trending lower, we may encounter higher corn costs due to local supply shortages. Further, we may be required to source corn from outside of our ordinary corn market, including securing corn that is transported by rail, and we may incur additional costs to transport this corn to our plant. If we are unable to secure the corn we require to continue to operate the ethanol plant, or we are unable to secure corn at prices that allow us to operate profitably, we may have to reduce production or cease operating altogether which may negatively impact the value of our units.

We engage in hedging transactions which involve risks that could harm our business. We are exposed to market risk from changes in commodity prices. Exposure to commodity price risk results from our dependence on corn and natural gas in the ethanol production process, along with sales of ethanol. We seek to minimize the risks from fluctuations in the prices of corn, natural gas and ethanol through the use of hedging instruments. The effectiveness of our hedging strategies is dependent on the price of corn, natural gas and ethanol and our ability to sell sufficient products to use all of the corn and natural gas for which we have futures contracts. Our hedging activities may not successfully reduce the risk caused by price fluctuation which may leave us vulnerable to high corn and natural gas prices or relatively lower ethanol prices. Alternatively, we may choose not to engage in hedging transactions in the future and our operations and financial conditions may be adversely affected during periods in which corn and/or natural gas prices increase or ethanol prices decrease. Further, we may be required to use a significant amount of cash to make margin calls required by our commodities broker as a result of decreases in corn prices and the resulting unrealized and realized losses we may experience on our hedging activities. Utilizing cash for margin calls has an impact on the cash we have available for our operations which could result in liquidity problems during times when corn prices change significantly.

Our business is not diversified. Our success depends almost entirely on our ability to profitably operate our ethanol plant. We do not have any other lines of business or other significant sources of revenue if we are unable to operate our ethanol plant and manufacture ethanol, distiller grains and corn oil. If economic or political factors adversely affect the market for ethanol, distiller grains or corn oil, we have no other line of business to fall back on. Our business would also be significantly harmed if the ethanol plant could not operate at full capacity for any extended period of time.

If RPMG, which markets all of our products, fails, it may negatively impact our ability to profitably operate the ethanol plant. All of our ethanol, distiller grains and corn oil is marketed by RPMG. Therefore, nearly all of our revenue is derived from sales that are secured by RPMG. If RPMG is unable to market all of our products, it may negatively impact our ability to profitably operate the ethanol plant. While management believes that we could secure an alternative marketer if RPMG were to fail, switching marketers may negatively impact our cash flow and our ability to continue to operate the ethanol plant. If we are unable to sell all of our ethanol, distiller grains and corn oil at prices that allow us to operate profitably, it may decrease the value of our units.

We depend on our management and key employees, and the loss of these relationships could negatively impact our ability to operate profitably. We are highly dependent on our management team to operate our ethanol plant. We may not be able to replace these individuals should they decide to cease their employment with us, or if they become unavailable for any other reason. While we seek to compensate our management and key employees in a manner that will encourage them to continue their employment with us, they may choose to seek other employment. Any loss of these executive officers and key employees may prevent us from operating the ethanol plant profitably which could decrease the value of our units.

We may violate the terms of our credit agreements and financial covenants which could result in our lender demanding immediate repayment of our loans. We have a $35 million credit facility with Farm Credit. Our credit agreements with Farm Credit include various financial loan covenants. We are currently in compliance with all of our financial loan covenants. Current management projections indicate that we will be in compliance with our loan covenants for at least the next 12 months. However, unforeseen circumstances may develop which could result in us violating our loan covenants. If we violate the terms of our credit agreements, including our financial loan covenants, Farm Credit could deem us to be in default of our loans and require us to immediately repay the entire outstanding balance of our loans. If we do not have the funds available to repay the loans or we cannot find another source of financing, we may fail which could decrease or eliminate the value of our units.

Our operations may be negatively impacted by natural disasters, severe weather conditions, and other unforeseen plant shutdowns which can negatively impact our operations. Our operations may be negatively impacted by events outside of our control such as natural disasters, severe weather, strikes, train derailments and other unforeseen events which may negatively impact our operations. If we experience any of these unforeseen circumstances which negatively impact our operations, it may affect our cash flow and negatively impact the value of our business.

We may incur casualty losses that are not covered by insurance which could negatively impact the value of our units. We have purchased insurance which we believe adequately covers our losses from foreseeable risks. However, there are risks that we may encounter for which there is no insurance or for which insurance is not available on terms that are acceptable to us. If we experience a loss which materially impairs our ability to operate the ethanol plant which is not covered by insurance, the value of our units could be reduced or eliminated.

Risks Related to Ethanol Industry

Demand for ethanol may not continue to grow unless ethanol can be blended into gasoline in higher percentage blends for standard vehicles. Currently, ethanol is primarily blended with gasoline for use in standard (non-flex fuel) vehicles to create

a blend which is 10% ethanol and 90% gasoline. Estimates indicate that approximately 134 billion gallons of gasoline are sold in the United States each year. Assuming that all gasoline in the United States is blended at a rate of 10% ethanol and 90% gasoline, the maximum demand for ethanol is 13.4 billion gallons. This is commonly referred to as the "blend wall," which represents a theoretical limit where more ethanol cannot be blended into the national gasoline pool. Many in the ethanol industry believe that the ethanol industry has reached this blend wall. In order to expand demand for ethanol, higher percentage blends of ethanol must be utilized in standard vehicles. Such higher percentage blends of ethanol are a contentious issue. Automobile manufacturers and environmental groups have fought against higher percentage ethanol blends. Recently, the EPA approved the use of E15 for standard (non-flex fuel) vehicles produced in the model year 2001 and later. The fact that E15 has not been approved for use in all vehicles and the labeling requirements associated with E15 may lead to gasoline retailers refusing to carry E15. Without an increase in the allowable percentage blends of ethanol that can be used in all vehicles, demand for ethanol may not continue to increase which could decrease the selling price of ethanol and could result in our inability to operate the ethanol plant profitably, which could reduce or eliminate the value of our units.

Technology advances in the commercialization of cellulosic ethanol may decrease demand for corn-based ethanol which may negatively affect our profitability. The current trend in ethanol production research is to develop an efficient method of producing ethanol from cellulose-based biomass, such as agricultural waste, forest residue, municipal solid waste, and energy crops. This trend is driven by the fact that cellulose-based biomass is generally cheaper than corn, and producing ethanol from cellulose-based biomass would create opportunities to produce ethanol in areas of the country which are unable to grow corn. The Energy Independence and Security Act of 2007 and the 2008 Farm Bill offer strong incentives to develop commercial scale cellulosic ethanol. The RFS requires that 16 billion gallons per year of advanced bio-fuels must be consumed in the United States by 2022. Additionally, state and federal grants have been awarded to several companies who are seeking to develop commercial scale cellulosic ethanol plants. This has encouraged innovation and has led to several companies who are in the process of building or have completed construction of commercial scale cellulosic ethanol plants. If an efficient method of producing ethanol from cellulose-based biomass is developed, we may not be able to compete effectively. If we are unable to produce ethanol as cost-effectively as cellulose-based producers, our ability to generate revenue and our financial condition will be negatively impacted.

Changes and advances in ethanol production technology could require us to incur costs to update our plant or could otherwise hinder our ability to compete in the ethanol industry or operate profitably. Advances and changes in the technology of ethanol production are expected to occur. Such advances and changes may make the ethanol production technology installed in our plant less desirable or obsolete. These advances could also allow our competitors to produce ethanol at a lower cost than we are able. If we are unable to adopt or incorporate technological advances, our ethanol production methods and processes could be less efficient than our competitors, which could cause our plant to become uncompetitive or completely obsolete. If our competitors develop, obtain or license technology that is superior to ours or that makes our technology obsolete, we may be required to incur significant costs to enhance or acquire new technology so that our ethanol production remains competitive. Alternatively, we may be required to seek third-party licenses, which could also result in significant expenditures. These third-party licenses may not be available or, once obtained, they may not continue to be available on commercially reasonable terms. These costs could negatively impact our financial performance by increasing our operating costs and reducing our net income.

New plants under construction or decreases in ethanol demand may result in excess production capacity in our industry. The supply of domestically produced ethanol is at an all-time high. According to the Renewable Fuels Association, as of December 14, 2013, there are 211 ethanol plants in the United States with capacity to produce approximately 14.9 billion gallons of ethanol per year. In addition, there are 6 new ethanol plants under construction or expanding which together are estimated to increase ethanol production capacity by 165 million gallons per year. Excess ethanol production capacity may have an adverse impact on our results of operations, cash flows and general financial condition. According to the Renewable Fuels Association, approximately 8% of the ethanol production capacity in the United States was idled as of December 14, 2013. Further, ethanol demand may not increase past approximately 13.4 billion gallons of ethanol due to the blend wall unless higher percentage blends of ethanol are approved by the EPA for use in all standard (non-flex fuel) vehicles, not just vehicles produced in the model year 2001 and later. While the United States is currently exporting some ethanol which has resulted in increased ethanol demand, these ethanol exports may not continue. If ethanol demand does not grow at the same pace as increases in supply, we expect the selling price of ethanol to decline. If excess capacity in the ethanol industry continues to occur, the market price of ethanol may decline to a level that is inadequate to generate sufficient cash flow to cover our costs, which could negatively affect our profitability.

We operate in an intensely competitive industry and compete with larger, better financed companies which could impact our ability to operate profitably. There is significant competition among ethanol producers. There are numerous producer-owned and privately-owned ethanol plants planned and operating throughout the Midwest and elsewhere in the United States. We also face competition from ethanol producers located outside of the United States. The largest ethanol producers include Archer Daniels Midland, Flint Hills Resources, Green Plains Renewable Energy, POET, and Valero Renewable Fuels, each of which are capable of producing significantly more ethanol than we produce. Further, many believe that there will be further consolidation occurring in the ethanol industry which will likely lead to a few companies which control a significant portion of the United States

ethanol production market. We may not be able to compete with these larger producers. These larger ethanol producers may be able to affect the ethanol market in ways that are not beneficial to us which could negatively impact our financial performance and the value of our units.

Competition from the advancement of alternative fuels may lessen demand for ethanol. Alternative fuels, gasoline oxygenates and ethanol production methods are continually under development. A number of automotive, industrial and power generation manufacturers are developing alternative clean power systems using fuel cells, plug-in hybrids, and electric cars or clean burning gaseous fuels. Like ethanol, these emerging technologies offer an option to address worldwide energy costs, the long-term availability of petroleum reserves and environmental concerns. If these alternative technologies continue to expand and gain broad acceptance and become readily available to consumers for motor vehicle use, we may not be able to compete effectively. This additional competition could reduce the demand for ethanol, resulting in lower ethanol prices that might adversely affect our results of operations and financial condition.

If exports to Europe are decreased due to the imposition by the European Union of a tariff on U.S. ethanol, ethanol prices may be negatively impacted. The European Union concluded an anti-dumping investigation related to ethanol produced in the United States and exported to Europe. As a result of this investigation, the European Union imposed a tariff on ethanol which is produced in the United States and exported to Europe. Following the imposition of this tariff, ethanol exports to the European Union decreased significantly. While legal challenges to this tariff are expected, they may not be successful which may allow the tariff to remain in place. If exports of ethanol to Europe continue to decrease as a result of this tariff, it could negatively impact the market price of ethanol in the United States. Any decrease in ethanol prices or demand may negatively impact our ability to profitably operate the ethanol plant.

Consumer resistance to the use of ethanol based on the belief that ethanol is expensive, adds to air pollution, harms engines and/or takes more energy to produce than it contributes or based on perceived issues related to the use of corn as the feedstock to produce ethanol may affect demand for ethanol. Certain individuals believe that the use of ethanol will have a negative impact on gasoline prices at the pump. Some also believe that ethanol adds to air pollution and harms car and truck engines. Still other consumers believe that the process of producing ethanol actually uses more fossil energy, such as oil and natural gas, than the amount of energy that is produced. Further, some consumers object to the fact that ethanol is produced using corn as the feedstock which these consumers perceive as negatively impacting food prices. These consumer beliefs could potentially be wide-spread and may be increasing as a result of efforts to increase the allowable percentage of ethanol that may be blended for use in vehicles. If consumers choose not to buy ethanol based on these beliefs, it would affect demand for the ethanol we produce which could negatively affect our profitability and financial condition.

Risks Related to Regulation and Governmental Action

Government incentives for ethanol production may be eliminated in the future, which could hinder our ability to operate at a profit. The ethanol industry is assisted by various federal incentives, most importantly the RFS set forth in the Energy Policy Act of 2005. The RFS helps support a market for ethanol that might disappear without this incentive. Recently, there have been proposals in Congress to reduce or eliminate the RFS. In addition, on November 15, 2013, the EPA announced a proposal to significantly reduce the RFS levels for 2014 from the statutory volume requirement of 18.15 billion gallons to 15.21 billion gallons and reduce the renewable volume obligations that can be satisfied by corn based ethanol from 14.4 billion gallons to 13 billion gallons. This proposal would also result in a lowering of the 2014 numbers below the 2013 level of 13.8 billion gallons. The EPA is also seeking comment on several petitions it has received for partial waiver of the statutory volumes for 2014. If the EPA's proposal becomes a final rule which significantly reduces the RFS or if the RFS were to be otherwise reduced or eliminated by the exercise of the EPA waiver authority or by Congress, it may lead to a significant decrease in ethanol demand which could negatively impact our results of operations.

The Federal Volumetric Ethanol Excise Tax Credit ("VEETC") expired on December 31, 2011 and its absence could negatively impact our profitability. The ethanol industry has historically been benefited by VEETC which is a federal excise tax credit of 45 cents per gallon of ethanol blended with gasoline. This excise tax credit expired on December 31, 2011. Management believes that without the blenders' credit, fuel blenders will stop blending more ethanol than is required by the Federal Renewable Fuels Standard as these fuel blenders have done in the past. This decrease in what is called discretionary blending may lead to decreased ethanol demand which could negatively impact our profitability and the value of our units.

The Secondary Tariff on Imported Ethanol expired on December 31, 2011, and its absence could negatively impact our profitability. The secondary tariff on imported ethanol was allowed to expire on December 31, 2011. This secondary tariff on imported ethanol was a 54 cent per gallon tariff on ethanol produced in certain foreign countries. Following the expiration of this tariff, the price of ethanol in the United States increased significantly, due in part to higher corn prices. This made the United States a favorable market for foreign ethanol producers to export ethanol, especially in areas of the United States which are served

by international shipping ports. This increase in ethanol imports resulted in lower demand for domestically produced ethanol. Management believes that the increase in ethanol imports may have resulted in less favorable operating margins during 2012 which negatively impacted our operations. While ethanol imports were lower during 2013 due to a number of factors, these imports could come back in the future which could decrease our ability to profitably operate the ethanol plant and may reduce the value of our units.

The California Low Carbon Fuel Standard may decrease demand for corn based ethanol which could negatively impact our profitability. California passed a Low Carbon Fuels Standard ("LCFS") which requires that renewable fuels used in California must accomplish certain reductions in greenhouse gases, which reductions are measured using a lifecycle analysis. Management believes that these regulations could preclude corn based ethanol produced in the Midwest from being used in California. California represents a significant ethanol demand market. If the ethanol industry is unable to supply corn based ethanol to California, it could significantly reduce demand for the ethanol we produce. Recently, a federal appellate court found the LCFS constitutional and remanded the case back to federal district court to determine whether the LCFS imposes a burden on interstate commerce that is excessive in light of the local benefits. If challenges to the LCFS are ultimately unsuccessful, the LCFS could have a negative impact on demand for corn-based ethanol which could negatively impact the price we receive for our ethanol. This could result in a reduction of our revenues and negatively impact our ability to profitably operate the ethanol plant.

Changes in environmental regulations or violations of these regulations could be expensive and reduce our profitability. We are subject to extensive air, water and other environmental laws and regulations. In addition, some of these laws require our plant to operate under a number of environmental permits. These laws, regulations and permits can often require expensive pollution control equipment or operational changes to limit actual or potential impacts to the environment. A violation of these laws and regulations or permit conditions can result in substantial fines, damages, criminal sanctions, permit revocations and/or plant shutdowns. In the future, we may be subject to legal actions brought by environmental advocacy groups and other parties for actual or alleged violations of environmental laws or our permits. Additionally, any changes in environmental laws and regulations, both at the federal and state level, could require us to spend considerable resources in order to comply with future environmental regulations. The expense of compliance could be significant enough to reduce our profitability and negatively affect our financial condition.

Carbon dioxide may be regulated in the future by the EPA as an air pollutant requiring us to obtain additional permits and install additional environmental mitigation equipment, which could adversely affect our financial performance. In 2007, the Supreme Court decided a case in which it ruled that carbon dioxide is an air pollutant under the Clean Air Act for motor vehicle emissions. In 2011 the EPA issued a tailoring rule that deferred greenhouse gas regulations for ethanol plants until July of 2014. However, in July of 2013 the D.C. Circuit issued an opinion vacating the EPA's deferral of those regulations for biogenic sources, including ethanol plants. Our plant produces a significant amount of carbon dioxide. While there are currently no regulations restricting carbon dioxide emissions, if the EPA or the State of Iowa were to regulate carbon dioxide emissions by plants such as ours, we may have to apply for additional permits or we may be required to install carbon dioxide mitigation equipment or take other as yet unknown steps to comply with these potential regulations. Compliance with any future regulation of carbon dioxide, if it occurs, could be costly and may prevent us from operating the ethanol plant profitably which could decrease or eliminate the value of our units.

ITEM 2. PROPERTIES

Our ethanol plant is located on an approximately 124-acre site in north-central Iowa. The plant's address is 1822 43rd Street SW, Mason City, Iowa. We produce all of our ethanol, distiller grains and corn oil at this site. The ethanol plant has capacity to produce more than 110 million gallons of ethanol per year.

All of our tangible and intangible property serves as collateral for our senior credit facility with Farm Credit. Our senior credit facility is discussed in more detail under "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Short-Term and Long-Term Debt Sources."

ITEM 3. LEGAL PROCEEDINGS

From time to time in the ordinary course of business, we may be named as a defendant in legal proceedings related to various issues, including without limitation, workers' compensation claims, tort claims, or contractual disputes. We are not currently involved in any legal proceedings.

ITEM 4. MINE SAFETY DISCLOSURES

None.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

There is no public trading market for our Class A or Class B membership units. We have created a qualified online matching service ("QMS") in order to facilitate trading of our units. The QMS consists of an electronic bulletin board that provides information to prospective sellers and buyers of our units. We do not receive any compensation for creating or maintaining the QMS. We do not become involved in any purchase or sale negotiations arising from the QMS. In advertising the QMS, we do not characterize the Company as being a broker or dealer or an exchange. We do not give advice regarding the merits or shortcomings of any particular transaction. We do not receive, transfer or hold funds or securities as an incident of operating the QMS. We do not use the QMS to offer to buy or sell securities other than in compliance with the securities laws, including any applicable registration requirements. We have no role in effecting the transactions beyond approval, as required under our operating agreement, and the issuance of new certificates. So long as we remain a publicly reporting company, information about the Company will be publicly available through the SEC's filing system. However, if at any time we cease to be a publicly reporting company, we anticipate continuing to make information about the Company publicly available on our website in order to continue operating the QMS.

As of December 23, 2013, there were approximately 948 holders of record of our Class A and Class B units.

The following table contains historical information by quarter for the past two years regarding the actual unit transactions that were completed by our unit-holders during the periods specified. We believe this most accurately represents the current trading value of our units. The information was compiled by reviewing the completed unit transfers that occurred on the QMS bulletin board or through private transfers during the quarters indicated.

|

| | | | | | | | | | | | |

| Quarter | | Low Price | | High Price | | Average Price | | Number of Units Traded |

2012 1st | | 3.00 |

| | 3.20 |

| | 3.12 |

| | 25,000 |

|

2012 2nd | | 3.00 |

| | 3.13 |

| | 3.05 |

| | 16,833 |

|

2012 3rd | | 3.10 |

| | 3.25 |

| | 3.18 |

| | 49,000 |

|

2012 4th | | 2.50 |

| | 3.00 |

| | 2.83 |

| | 36,333 |

|

2013 1st | | 3.00 |

| | 3.05 |

| | 3.03 |

| | 105,000 |

|

2013 2nd | | — |

| | — |

| | — |

| | None |

|

2013 3rd | | — |

| | — |

| | — |

| | None |

|

2013 4th | | 3.00 |

| | 3.70 |

| | 3.31 |

| | 100,000 |

|

The following tables contain the bid and asked prices that were posted on the QMS bulletin board and includes some transactions that were not completed. We believe the table above more accurately describes the trading value of our units as the bid and asked prices below include some offers that never resulted in completed transactions. The information was compiled by reviewing postings that were made on the QMS bulletin board.

|

| | | | | | | | | | | | |

| Seller's Quarter | | Low Price | | High Price | | Average Price | | Number of Units Traded |

2012 1st | | 3.00 |

| | 3.50 |

| | 3.25 |

| | 30,000 |

|

2012 2nd | | 3.10 |

| | 3.10 |

| | 3.10 |

| | 3,333 |

|

2012 3rd | | — |

| | — |

| | — |

| | None |

|

2012 4th | | 3.00 |

| | 3.25 |

| | 3.19 |

| | 13,000 |

|

2013 1st | | 3.00 |

| | 3.00 |

| | 3.00 |

| | 20,000 |

|

2013 2nd | | 3.50 |

| | 4.50 |

| | 4.15 |

| | 115,000 |

|

2013 3rd | | 3.50 |

| | 3.50 |

| | 3.50 |

| | 40,000 |

|

2013 4th | | 3.50 |

| | 3.50 |

| | 3.50 |

| | 40,000 |

|

|

| | | | | | | | | | | | |

| Buyer's Quarter | | Low Price | | High Price | | Average Price | | Number of Units Traded |

2012 1st | | 3.00 |

| | 3.00 |

| | 3.00 |

| | 16,000 |

|

2012 2nd | | 3.00 |

| | 3.15 |

| | 3.07 |

| | 36,000 |

|

2012 3rd | | 3.25 |

| | 3.25 |

| | 3.25 |

| | 10,000 |

|

2012 4th | | 2.50 |

| | 2.75 |

| | 2.73 |

| | 54,000 |

|

2013 1st | | — |

| | — |

| | — |

| | None |

|

2013 2nd | | — |

| | — |

| | — |

| | None |

|

2013 3rd | | 2.75 |

| | 3.10 |

| | 2.81 |

| | 60,000 |

|

2013 4th | | — |

| | — |

| | — |

| | None |

|

As a limited liability company, we are required to restrict the transfers of our membership units in order to preserve our partnership tax status. Our membership units may not be traded on any established securities market or readily traded on a secondary market (or the substantial equivalent thereof). All transfers are subject to a determination that the transfer will not cause us to be deemed a publicly traded partnership.

DISTRIBUTIONS

Distributions are paid to our unit holders in proportion to the number of units held by each unit holder, regardless of class. A unit holder's distribution is determined by dividing the number of units owned by the unit holder by the total number of units outstanding, regardless of class. Our board of directors has complete discretion over the timing and amount of distributions to our unit holders subject to certain restrictions in our credit agreements and our operating agreement. Our operating agreement requires the board of directors to try to make cash distributions at such times and in such amounts as will permit our unit holders to satisfy their income tax liability related to owning our units in a timely fashion. Our expectations with respect to our ability to make future distributions are discussed further in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations." Distributions are restricted by certain loan covenants in our credit agreements with Farm Credit. We may only make distributions to our members in an amount that does not exceed 60% of our net income for the prior fiscal year provided that we are not in default of our credit agreements and the payment of the distribution would not cause us to default on our credit agreements. During our 2012 fiscal year, we made one distribution to our members of $0.65 per unit for members of record as of November 15, 2011 which was paid on December 23, 2011. During our 2013 fiscal year, we made one distribution to our members of $0.10 per unit for members of record as of August 19, 2013 which was paid in September 2013. Subsequent to the end of our 2013 fiscal year, on December 3, 2013, our board of directors declared a distribution of $0.50 per membership unit for a total of $9,941,500 to be paid to members of record as of December 3, 2013. Management anticipates the distribution will be paid by early February 2014. Our lender has verbally consented to the size of this distribution, however, we are in the process of securing a formal waiver from our lender which we anticipate will be received before the distribution is paid.

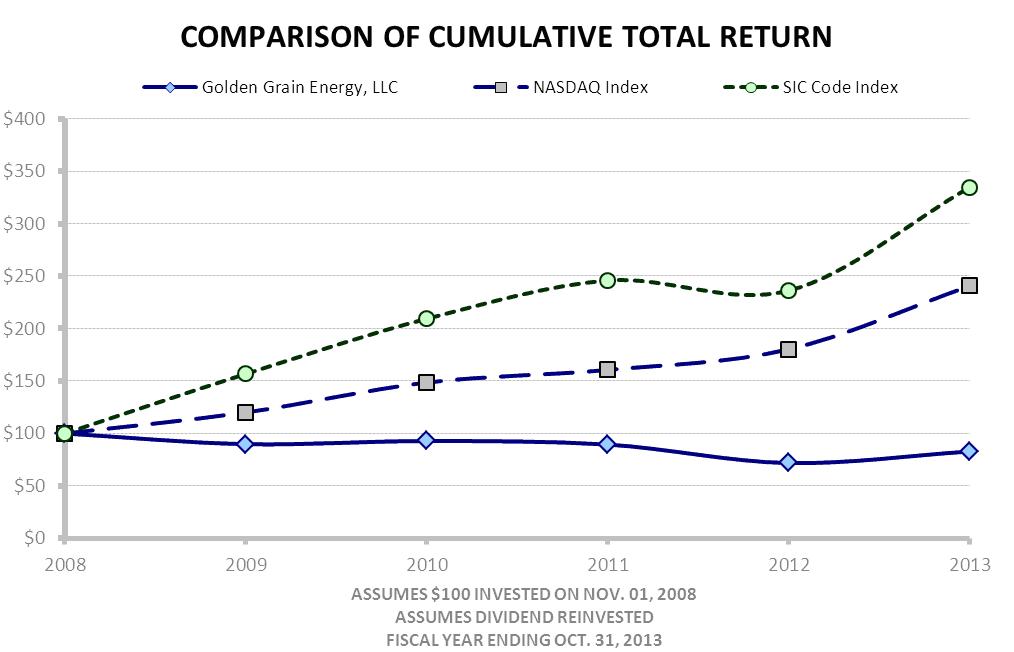

PERFORMANCE GRAPH

The following graph shows a comparison of cumulative total member return since November 1, 2008, calculated on a dividend reinvested basis, for the Company, the NASDAQ Composite Index (the "NASDAQ Market Index") and an index of other companies that have the same SIC code as the Company (the "SIC Code Index"). The graph assumes $100 was invested in each of our units, the NASDAQ Market Index, and the SIC Code Index on November 1, 2008. Data points on the graph are annual. Note that historic unit price performance is not necessarily indicative of future unit price performance.

Pursuant to the rules and regulations of the Securities and Exchange Commission, the performance graph and the information set forth therein shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, and shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 6. SELECTED FINANCIAL DATA

The following table presents selected consolidated financial and operating data as of the dates and for the periods indicated. The selected balance sheet financial data as of October 31, 2011, 2010 and 2009 and the selected income statement data and other financial data for the years ended October 31, 2010 and 2009 have been derived from our audited consolidated financial statements that are not included in this Form 10-K. The selected balance sheet financial data as of October 31, 2013 and 2012 and the selected income statement data and other financial data for each of the years in the three year period ended October 31, 2013 have been derived from the audited Financial Statements included elsewhere in this Form 10-K. You should read the following table in conjunction with "Item 7. Management Discussion and Analysis of Financial Condition and Results of Operations" and the financial statements and the accompanying notes included elsewhere in this Form 10-K. Among other things, those financial statements include more detailed information regarding the basis of presentation for the following consolidated financial data.

|

| | | | | | | | | | | | | | | | | | | | |

| Statement of Operations Data: | | 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

| Revenues | | $ | 350,721,175 |

| | $ | 327,830,377 |

| | $ | 324,927,805 |

| | $ | 208,461,685 |