This information does not constitute an offer of any securities for sale, or an offer or invitation to purchase any securities. In connection with the reorganization, a registration statement on form S-4 has been filed with the Securities and Exchange Commission (“SEC”) containing a form of proxy statement/prospectus. Investors and security holders are urged to carefully read the proxy statement/prospectus regarding the reorganization, because it contains important information. Investors and security holders may obtain a free copy of the proxy statement/prospectus and other documents containing information about the Company and the proposed reorganization, without charge, at the SEC’s web site at www.sec.gov. Copies of the proxy statement/prospectus and the SEC filings that are incorporated by reference in the proxy statement/prospectus may also be obtained for free by directing a request to: Western Goldfields, Inc., 2 Bloor Street West, Suite 2102, P.O. Box 110, Toronto, Ontario, Canada M4W 3E2, Attention: Julie Taylor, telephone: (416) 324-6000.

The Company and its directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies from the Company’s shareholders in connection with the reorganization. Information concerning the Company’s participants in the solicitation is set forth in the Company’s proxy statements and annual reports on Form 10-KSB, filed with SEC, and in the aforementioned proxy statement/prospectus relating to the reorganization.

Transcript

RANDALL OLIPHANT (Chairman, Western Goldfields Inc.): Well good morning everyone and thank you very much for joining us today. My name is Randall Oliphant and I’m the Chairman of Western Goldfields, and welcome to our 2007 Annual and Special Meeting of Stockholders of our company. With us today is my fellow director and nominee for director, Gerald Ruth, is sitting here in the front; as well, Raymond Threlkeld, our President and CEO, but also a nominee for director, sitting right here beside me. Unfortunately two of our directors are not with us today, Vahan Kololian and Martyn Konig, both absent for very, very good reasons, since they wanted to be here. One of them has a son graduating from St. Andrews in Scotland today, and Martin is celebrating his wedding anniversary with his wife, which is a special one, and it’s a plan that they had arranged for a year or so.

In addition, Brian Penny is with us. Brian is our Chief Financial Officer of the company. We also have Graham Desson sitting in the front row here, who’s our Controller and Secretary of the company, and also with us here are a few other key members of our team. Paul Semple, who is sitting in the second row, who’s our Vice President of Projects, and Wes Hanson, who’s our Vice President of Mine Development.

In a few moments we’re going to discuss the company’s operations and refer to some of the announcements that we’ve made over the course of the past week, and we’ll have lots of time for questions and answers. But first we’d like to conduct the formal portion of the meeting to consider the matters described in the proxy statement, which was sent to you on May 18th of this year.

I’d now like to turn the meeting over to Brian Penny who will act as Chairman of the formal part.

BRIAN PENNY (Chief Financial Officer, Western Goldfields Inc.): Thank you Randall. Good morning and welcome to the formal portion of the 2007 Annual and Special Meeting of Stockholders of Western Goldfields Inc. I am Brian Penny, the Chief Financial Officer of the company. Mr. Desson will act as Secretary of this meeting. I will now call the meeting to order.

GRAHAM DESSON (Controller & Secretary, Western Goldfields Inc.): I present to the meeting a list of stockholders entitled to notice of and to vote at the meeting. The list shows that as of the close of business on May 14th, 2007, the record date for determining stockholders entitled to notice of and to vote at the meeting, there were 113,631,153 shares of common stock. No shares of series A1 preferred stock of the company. Each share of common stock entitles the holder thereof to one vote on the matters to be voted on at the meeting.

I also present to the meeting an affidavit signed by Margarita Morales of Computershare. The affidavit states that the notice of meeting was mailed on May the 18th, 2007 to each holder of common stock of record as of the close of business on May 14th, 2007.

BRIAN PENNY: The affidavit of mailing presented to the meeting is ordered and annexed to the minutes of the meeting as Exhibit A.

I appoint Shirley Yuen of Computershare to act as the Inspector of Election. The Inspector has taken the oath of Inspector of Election, which is hereby ordered annexed to the minutes of the meeting as Exhibit B. All items to be voted on at today’s meeting have received overwhelming support. We have distributed ballots to those of you who have requested them, and I understand nobody has requested them. If you have already delivered your proxy, there are no reasons to vote by ballot unless you would like to change your vote. Is there anyone here who did not receive a ballot and wishes to receive one? If you need a ballot, please raise your hand and we will give you one.

Will the Inspector of Election please confirm that more than a majority of the issued and outstanding shares, as of the record date, are represented at the meeting by proxy or in person.

INSPECTOR OF ELECTION: Mr. Chairman, I confirm that a majority of the issued and outstanding stock of the company as of the record date is represented in person or by proxy at the meeting.

GRAHAM DESSON: The Inspector of Election indicates that a majority of the total outstanding shares of common stock of the company is represented at the meeting in person, or by proxy, therefore a quorum is present at the meeting for all purposes.

BRIAN PENNY: I hereby direct that the First Certificate and Report of the Inspector of Election be annexed to the minutes of the meeting as Exhibit C.

Note that the amendment to the Stock Option Plan has been withdrawn from today’s agenda as the company has not received the required regulatory approval since the proxy statement did not contain certain items required for TSX reporting that are not required under US reporting, which right now is our primary jurisdiction. Therefore this item of business will be postponed to a future shareholder meeting.

The minutes of the previous annual meeting are available for review by shareholders. Unless someone wishes them read, I will ask for a motion to take these minutes as tabled.

RAYMOND THRELKELD (President and Chief Executive Officer of Western Goldfields Inc.): I so move.

JULIE TAYLOR: I second the motion.

BRIAN PENNY: All in favour, please raise your hand; any contrary? Motion carried.

The next item of business is the proposal to approve the Agreement and Plan of Merger as more fully described in the proxy statement, and a copy of which is attached hereto as Annex number one.

RAYMOND THRELKELD: I move for the approval of the Agreement and Plan of Merger as more fully described in the proxy statement.

JULIE TAYLOR: I second the motion.

BRIAN PENNY: Is there any discussion on this proposal? If there is no discussion I would ask that any registered shareholder who wishes to vote by ballot, mark their ballot with respect to this proposal. A single ballot with all proposals on it has been prepared. We will gather them together at the end of voting on all proposals.

The next item of business is to approve the Shareholders Rights Plan substantially in the form attached to the proxy statement as Annex six.

RAYMOND THRELKELD: I move for the approval of the Shareholder Rights Plan.

JULIE TAYLOR: I second the motion.

BRIAN PENNY: Is there any discussion on this proposal? If there is no discussion, I would ask any registered shareholder who wishes to vote by ballot to mark their ballot with respect to this proposal.

The next item on the agenda is the election of directors. I call for the election of five directors of the company.

RAYMOND THRELKELD: Mr. Chairman, as a stockholder of record of the company, I nominate Randall Oliphant, Raymond Threlkeld, Vahan Kololian, Martyn Konig, and Gerald Ruth to serve as Directors of the Company, each to serve until their respective successors are elected and qualified, or until death, resignation or removal.

JULIE TAYLOR: As a stockholder of record of the company, I second each of the foregoing nominations.

BRIAN PENNY: If there are no further nominations, I will entertain a motion for the nominations for the election of Directors be closed.

RAYMOND THRELKELD: Mr. Chairman, I move that the nominations for election of five Directors be closed.

JULIE TAYLOR: I second the motion.

BRIAN PENNY: Any discussion? If there is no discussion I would ask any registered shareholder who wishes to vote by ballot to mark their ballot with respect to this proposal.

The next item on the agenda is to ratify the action of the Audit Committee of the Board of Directors in appointing HJ and Associates, LLP, as the company’s independent public accountants for the fiscal year ended December 31st, 2007, or until a successor is appointed.

RAYMOND THRELKELD: I move to ratify the action of the Audit Committee of the Board of Directors in appointing HJ and Associates, LLP, as the company’s independent public accountants for the fiscal year ending December 31st, 2007, or until a successor is appointed.

JULIE TAYLOR: I second the motion.

BRIAN PENNY: Is there any discussion of this proposal? Since there is no discussion, I would ask that any registered shareholder who wishes to vote by ballot mark their ballot with respect to this proposal.

We will now collect the ballots. Since there are no ballots to be collected, I will ask if the Inspector of Election tabulate the results and report back to the meeting, and I now declare the polls closed.

Now I’d like to call on the Inspector of Election to present the results of the matters voted upon at the stockholders, by the stockholders of the company at this meeting.

INSPECTOR OF ELECTION: (inaudible).

GRAHAM DESSON: Thank you. I report that all matters have been duly approved and that all the directors nominated by management have been duly re-elected.

BRIAN PENNY: I now direct that the second certificate and report submitted by the Inspector of Election be annexed to the minutes of the meeting as Exhibit D. Are there any further proposals a shareholder of record wishes to present at this meeting?

I will now entertain a motion to terminate the meeting.

RAYMOND THRELKELD: I move to terminate the meeting.

JULIE TAYLOR: I second the motion.

BRIAN PENNY: All in favour of the motion please signify. Against? Motion carried. On the motion duly made and seconded, this meeting is now terminated.

We would like to take the opportunity to bring you up to date on the progress of the company, which we will have a question and answer session after the presentations by Ray and Randall. I’ll now turn the meeting over to Ray, as he will begin the update discussion. Thank you.

RAYMOND THRELKELD: Thank you Brian and good morning ladies and gentlemen, thank you for joining us today. I’d like to draw your attention to our disclaimer and cautionary statement, and with that, let’s move on to what we’re here to talk about today.

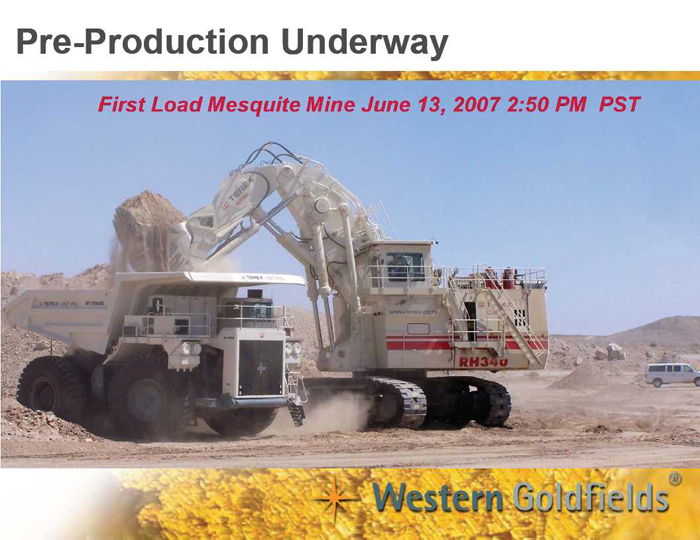

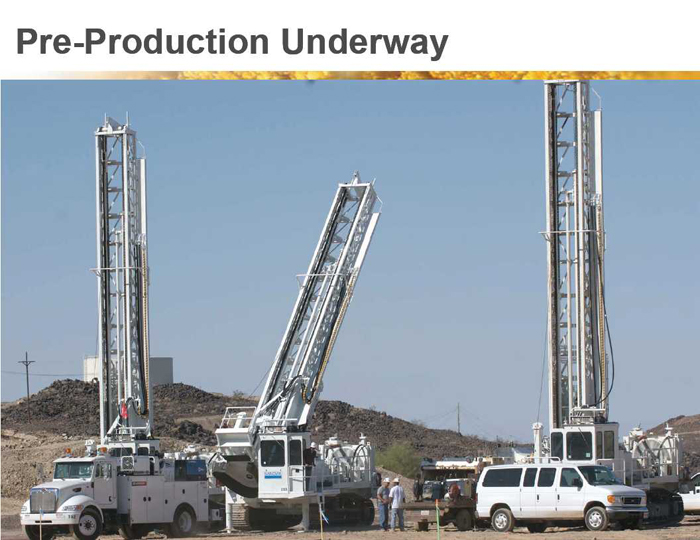

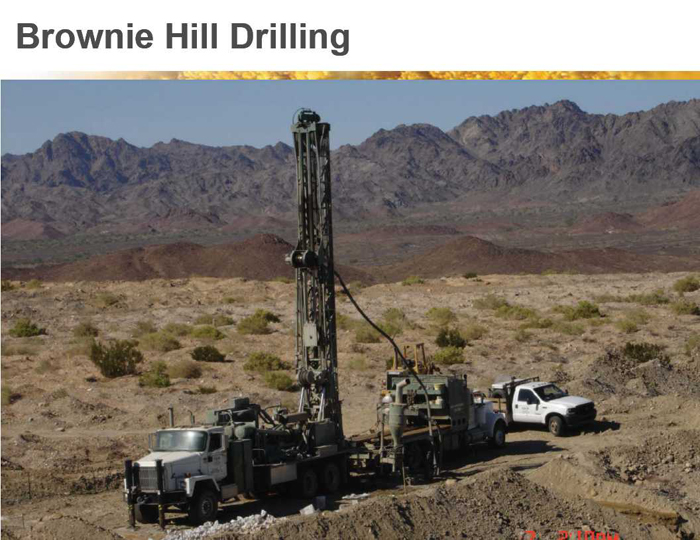

Today I want to bring you some great news about Western Goldfields, but before I begin my remarks, I have a series of photos to show you. This is the first load of Mesquite Mine, June 13th. This is our first shovel load, this is we’re going to production, and these are the first three drill rigs that we’ve brought in to site, blast hole rigs. One is in production as we speak today. And here’s our first drill pattern, this drilling near the Vista Pit, between the Vista and Big Chief Pits. That’s where we’ll start mining first.

And this is our leach pad construction. All permits have been obtained. We’re under construction with the leach pad today. And again, this is our first load, and this is very exciting for all of us. This is the beginning for Western Goldfields. I couldn’t bring you all to the Mesquite Mine to I brought the mine to you today, and I’m sure that these photos warm the hearts of all of us miners here who love trucks and shovels, but there’s a more important message. As you can see, mining operations are underway at Mesquite as we speak. Our mining fleet has arrived and we put it to work. Pre-stripping is underway right on schedule. Ladies and gentlemen that’s what it’s all about. Not only delivering our commitments to shareholders, but in fact, exceeding them.

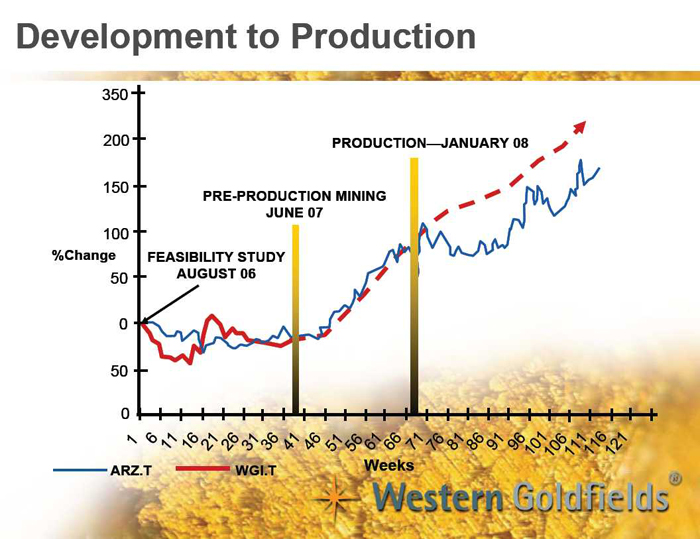

Today I have some important news to announce about Mesquite that some of you may have seen in our news release yesterday. We’re not going to meet our startup date for full production at Mesquite, we’re going to beat it. We will commence full production in January 2008, a full quarter ahead of schedule. The significance of beating our production schedule marks an important step in the transformation of Western Goldfields from a developer to a producer in only 22 months after our management team joined the company,

Our path from development to production includes a new mine plan for Mesquite that will allow full gold production to begin in January 2008, again, a full quarter ahead of schedule. Earlier production means earlier cash flow for our shareholders. This is a great step to becoming a producing gold company. Becoming a producer will have a positive effect on our share price, with a re-rating expected in the marketplace from a development company to a mining company. This in turn will have a great benefit to our shareholders.

Mining production and cash flow will allow us to expand either organically or through acquisitions. Speaking of growth, even while we have remained focused squarely on production, we have continued to find more mineralization at our Brownie Hill zone. This will certainly mean an increase in resources. We will continue to explore in and around Mesquite as an overall growth strategy.

Furthermore, at Mesquite, we’re very eco-conscious. I’m pleased to report that all reclamation bonds have been posted and we’re in full compliance with the strict standards set out in Mesquite’s environmental permit. As well, we have selected an environmentally superior mining fleet with reduced emissions that will comply with the future stringent air quality standards that are present in California.

Returning to our most important change, production, we have a full year of gold production in 2008, and will now have an extended mine life to 12 years. As a miner who has developed and run mines on three continents, it gives me a great deal of personal satisfaction, but as a shareholder I’m even more pleased. The sooner we pour gold, the sooner we make money for our investors. The fact is we are making a rapid transition from developer to producer even more rapid than expected.

We believe that the market should and will take note of this, and reflect that transition in our share price. Consider some of our operational achievements. We completed an initial resource estimate in April of 2006. We finished an initial feasibility in August of 2006, and this feasibility we viewed as a baseline for the added potential we envisioned at Mesquite. We ordered the mining fleet last December, and have already taken the first deliveries. In fact we’ve moved up the delivery of the entire mining fleet.

We started a drilling program to increase reserves and resources in September last year, and based on those successful results we announced the new reserve and resource estimate this past March, and we developed a new mine plan that mines more ounces and brings production forward to January 2008. The bottom line is we’ve executed on the ground and we’ve delivered our commitment to expand the value of Mesquite.

Based on the successful results of our drilling program and a $500 gold price, we’ve increased Mesquite’s proven and probable reserves to 2.8 million ounces of gold, up from the previous 2.4 million ounces. That’s a significant increase of 17 percent. Our measured and indicated resources remain about 1.1 million ounces of gold. As a result, the company has lengthened the estimated mine life of Mesquite from 9.5 years to 12 years.

I’m especially pleased with our discovery in the Brownie Hill zone. We’ve discovered an addition 200,000 ounces, and the zone is still open to the south. Furthermore, we have identified 150,000 ounces of inferred resources in the open pits, which we expect to move into reserves before year end.

While our drill results accounted for one half of the reserve increase, adopting a $500 gold price in keeping with industry standards also had a positive impact. Moving from $450 to $500 gold brought more mineralization into the reserves and resources and helped to increase the mine life.

Under the new mine plan we expect to produce between 160,000 and 170,000 ounces a year at a cash cost of $350 an ounce for the first eight years, to the year 2015. Over the life of the mine, we expect cash costs to be $355 an ounce as we move into lower grade ores after the year 2015. The slight increase in cash costs from our original estimate is due to three factors. We added an additional truck to the mining fleet. This is a result of reduced truck speeds through the type of tires we were able to purchase; an increase in Workmen’s Compensation in California; and added mine site employee incentive programs.

Initial capital costs are estimated to be $108.6 million, virtually the same as previously announced. Our life of mine capital costs has gone up marginally to $114.9 million, from $112.5 million. Basically, we’ve taken a very cautious route and built in higher costs for fleet rebuilds over the extended mine life.

So what’s next? The true potential of Mesquite has yet to be defined. We have a lot more drilling to do. We plan to further enhance the value of the mine by expanding resources through continued drilling, bringing resources into reserves, and reducing costs through mining efficiencies.

Let me elaborate on that a little bit. As a producer, we plan to reduce costs with continuous improvement plans, a rigorous safety policy and the employee performance incentives. We will also look at expanding production in the future. An exploration program will continue to search for oxide and non-oxide or sulfide resources and target the 150,000 ounces of inferred resources in the pit to bring the pit, or bring into reserves that inferred resource.

At Brownie Hill, drilling outside the reserve is adding to the potential. New drilling results are showing a continuation of the mineralization with as much as 1,500 feet south of the current reserve. Let me elaborate and talk to you about this map a little bit. This red line is the Brownie Hill reserve currently. This is the Brownie Hill pit as it stands today. Drilling to the south has indicated a very large lower grade halo, outlined in this blue, of mineralization. We also found some higher grade mineralization that is not inside the reserve, which extends to the south, and we expect that further drilling in this area, over the coming year, will bring more reserves into the Brownie Hill zone and extend this quite a ways to the south.

So it’s very exciting to see this. I mean we’re moving into an area that’s really unknown in Mesquite, and really demonstrating the potential that we have here. Also we have a hole sitting by itself that, you know, has some interesting mineralization in it that could extend north and south, or connect with this low grade zone.

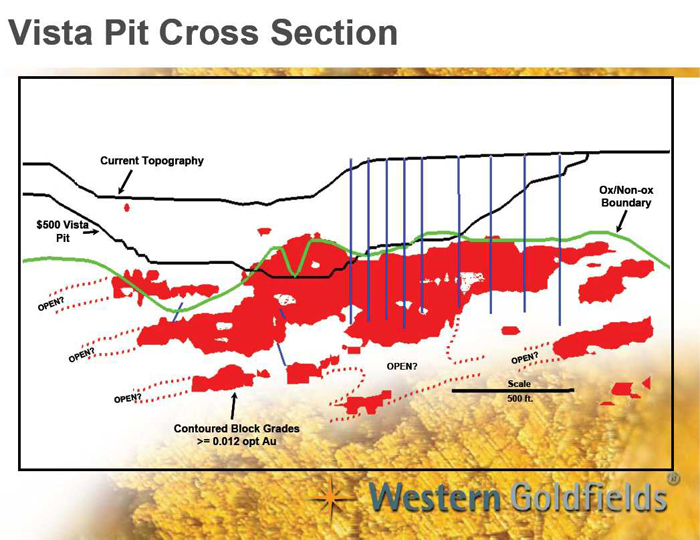

At present we’re taking samples from the Vista pit area and doing test work to review sulfide recoveries. This cross section of the Vista pit shows the non-oxide or sulfide mineralization in red that lies below this green line here. This is our current topography of the current Vista open pit. This is the $500 Vista pit, which we’ll be mining in the future, and these are the drill holes that are currently in the mineralization in the, that were drilled in the past.

We have mineralization that is open to the north here, and open to the south. So, you know, we’re very excited about the potentials that holds for this Vista area. And the other interesting factor here is that as we mine this, it exposes this sulfide ore, and perhaps in the future a lower stripping ratio will allow lower grade sulfide mineralization to become ore for the future.

Stay tuned. I think there’s a lot of interest here, I think there’s a lot of excitement that we can show you in the future on our resources at Mesquite. In the meantime, we’ve remained focused on getting Mesquite into shape to begin full production. We have begun construction of a new heap leach pad on schedule, and are completing the modernisation of the existing facilities which include installation of a new carbon column circuit used to absorb gold during processing.

Full production at Mesquite would give us the platform of opportunities that all production companies need for future growth. Cash flow and revalued shares for acquisitions and exploration will be a catalyst for our growth.

Ladies and gentlemen, the Western Goldfields story is rapidly unfolding. We have a vision for your company as a major gold producer. Our immediate goals are to bring the mine into production as quickly as possible, allowing us to realize the share valuation that reflects this change, create cash flow, and this in turn will put us in a stronger position to add assets that are low risk and high in return.

Reputations count in this business, and at Western Goldfields I like to think that we’re enhancing our reputation based on three pillars. One, our disciplined strategy, and two, our execution on the ground and in our industry, which is a proven and is our trademark, and three, our ability to quickly bring shareholder value by recognizing opportunity and generating value, which is the calling card that will create the growth that we expect. This all adds up to a pretty great company.

Now I want to thank you, and now I’d like to turn the podium over to our Chairman, Randall Oliphant.

RANDALL OLIPHANT: Well thank you very much Ray. I think Ray has given you an excellent oversight in terms of the progress that we’re making at Mesquite and why we’re so excited about it, but also that we see tremendous potential at that property for the future. Before I get into my overview of Western Goldfields I’d like to talk to you personally about why we’re here at the TSX gallery. It’s not an accident that we’re here, the move of our company from the NASDAQ bulletin board and getting an additional listing on the Toronto Stock Exchange was very significant to us. This happened in August of last year and it was really an easy decision for us to make, and the TSX was remarkably co-operative to work with because this is the kind of company that they want listed on the exchange.

As all of you know, companies listed on the TSX have great access to capital, high valuations through the credibility of the exchange, coverage by analysts, and a large investor base here in Toronto. We also, since we’ve been listed on the TSX, the liquidity of our stock has improved dramatically. Combined with that, moving the incorporation of the company from Idaho to Ontario should also be a great help, and we appreciate you voting in favour of making this move. Despite the presence of London, for companies like ours Toronto is still the global leader in mine finance. And as you know yourselves, we have a lot of those leaders for companies like Western Goldfields here with us in the room.

Ontario corporate law is far better understood by most people than the laws of Idaho, so the timeframe for our deals should be faster and having more compliance in Canada and less in the United States should dramatically reduce our costs. Simply put, having a Canadian company listed on the TSX brings us a more conducive environment for the business that we’re in.

Now in the near future what we hope to do is upgrade our US listing from the NASDAQ bulletin board to the AMEX. And the only thing that we needed in order to make that happen was a share price above $2 US. We’re now clearly above that and we just have to count the days to get that listing. I think that will also be great for our shareholders in terms of making the company more accessible to a broader range of US investors. It should dramatically improve our trading volumes in the United States and improve the overall credibility of our company.

As yesterday’s press release announced we’re rapidly closing in on our target, which is full production at Mesquite. And as we do so, I think we’re closing in on our real primary objective, which is a higher share price for our investors. We want a price that reflects the value of our assets, of our team, and of our strategy, and a price that reflects our transition from a developer to a producer. I’d like to congratulate Ray and his entire team for doing their part so rapidly and so efficiently bringing us to full production at Mesquite. The team includes Paul Semple here in Toronto and Wes Hanson, who made a great contribution, and if you wonder how a smaller company can get all the tires it needs, all the trucks that it needed and the other equipment, it was a lot of persistence on the part of these guys who made that happen.

We also have with us today Cory Atiyeh sitting at the end of the second row here, who is the General Manager at Mesquite, and he and his team have done everything that they can and have really pulled through to make this happen. And Cory I hope on behalf of all of us you convey our appreciation to all the guys back at the mine. Together the team is accomplishing the transformation of Western Goldfields.

If you consider where we were back in February of 2006 when we were first speaking with Bill White and Mike White about Western Goldfields, in just 22 months we will have gone from a company that was in default on its debt, that had a market capitalization of about $12 million, and really, very little hope for the future, to a company which is now listed on the Toronto Stock Exchange and in that 22 month period will be in full production.

During this period we’ve also benefited dramatically from the guidance of our Board of Directors. Directors like Gerald Ruth have always been responsive, have done everything they can to help. There’s been a lot of changes, a lot of meetings and Gerald, aside from Ray and I, you, Martyn, and Vahan, have been instrumental in some of this success.

Now we’ve got several financial milestones that we’ve made. Early on we cleaned up the balance sheet as I mentioned, with a $6 million private placement which enabled us to get the company on a steady footing. Then in August, having the company listed on the Toronto Stock Exchange gave us much greater access to capital. At the same time, we lined up more than enough financing to bring Mesquite into full production. Early this year we undertook an equity offering, which was oversubscribed, where we raised $75 million Canadian, or $59 million US net of cost; we finalized a $105 million credit facility with, for Mesquite with the result that the operation is now fully financed. Our aim has always been to strike the right balance between equity and debt, so that we’re not unduly diluting our shareholders. Of the $105 million, $87 million is allocated to Mesquite. In addition to that, we’ve got $18 million in reserve for strategic purposes. At the end of the first quarter your company had $57 million in the treasury.

At this time I’d like to thank our CFO, Brian Penny, and his team for arranging the financing. Now that Mesquite is fully funded, we’re well positioned to grow as a company. And as many of you who worked with us on these financings know, it took a tremendous amount of hard work. Thank you very much Brian.

What we’ve accomplished during the past months is very satisfying, but what lies ahead I believe, is even more exciting. As Ray noted, our immediate priority is to close the valuation gap as we move from a developer to a producer. We’ve got a chart that I’d like to show you which shows the movement of gold company share values as we go from developer to producer. Ian you asked earlier why the stock hasn’t moved, and the stock that we compared this to is Aurizon, which we think is a similar type company to Western Goldfields. Aurizon is redeveloping a mine in northern Quebec, and actually our stock price as we go through the various points is actually tracking very closely to what Aurizon has. From the feasibility study which we did in August of last year to the pre-production mining which we just started on in June of this year, our stock prices followed along with Aurizon’s. But you can see how as we move from this stage forward to full production and generating cash-flow, that the next six months I expect will be a very exciting time for our shareholders.

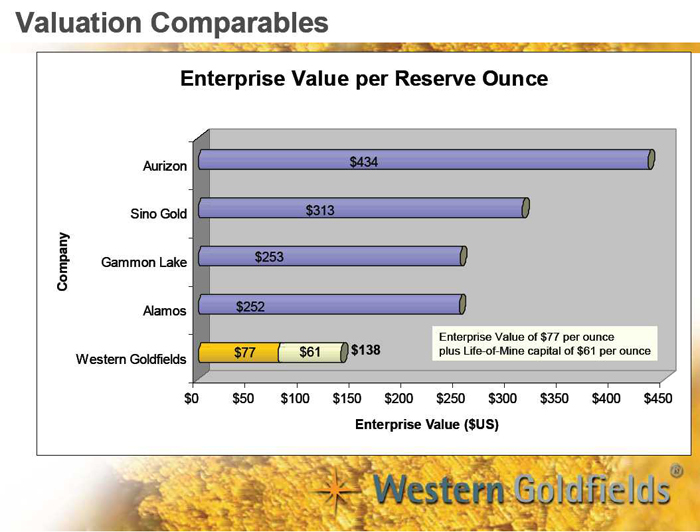

Also, when we compare our company from a valuation perspective, to give you an idea, at $2 US the Enterprise Value of Mesquite is just $77 an ounce, and we’ve compared it to the companies which produce a similar amount of gold to what Mesquite will produce. Now these companies have incurred their capital costs, so on to this $77 we add $61 for our capital cost of getting the mine into full production. In fact it’s probably a conservative number as we’ve included life-of-mine capital. You can see that when we take the $77 that we’re currently valued at, plus the $61 an ounce of capital costs, it gives us a total value of about $138 an ounce. I think this is well below our peer group and I hope you see as we do, significant room for share price appreciation as we move into the producer category.

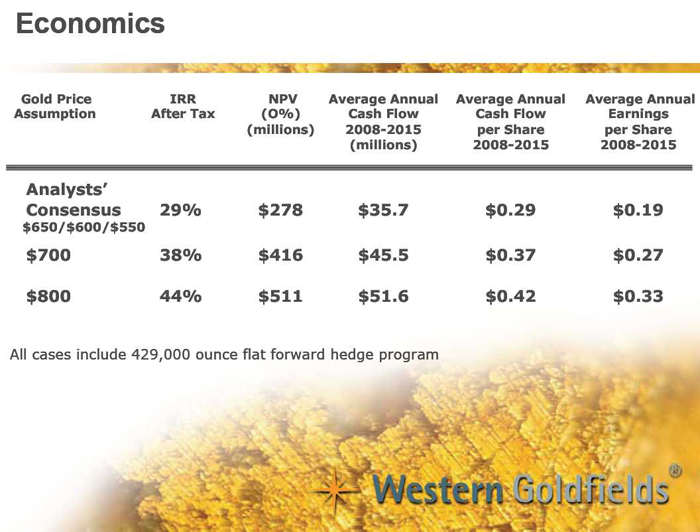

Now if we look at the economics of our deposit, no matter which way you choose to look at it, we’ve shown analyst consensus gold prices which tend to be trailing down toward $550 long term, we’ve shown the gold price of $700 and at $800. Under any of those scenarios you can see that the IRR in our project is robust, going from 29 percent to 44 percent. If gold prices are higher, the returns will just be that much greater. And from a cash-flow perspective, this company will be generating in the order of $40 or $45 million a year in operating cash-flow, which when you compare that to our current Enterprise Value of a little over $200 million US, is a very low cash-flow multiple. These are the types of things that we’ll be seeing in about six month’s time.

So how do we go about closing this value gap? Quite simply by taking one specific step, one that’s very well in hand, which is making this transition to full production and therefore justifying a higher stock price. Last year we also announced to our shareholders that we undertook, or last week, excuse me, we also announced to our shareholders that we undertook a hedging strategy in order to satisfy the conditions of the term loan facility with our bankers. As you know, we’ve contracted to deliver 429,000 ounces of gold at a price of $801 an ounce. We view this as a financial tool to meet the requirements of our bankers, a tool that was used in a minimised and limited way. As mentioned earlier, Mesquite is estimated to produce 160,000-170,000 ounces of gold a year, but 66,000 ounces delivered annually against this program at a price of $801 an ounce, this will leave 100,000 ounces of gold, which are fully leveraged to the price of gold, which we expect to be going up. Put another way, 77 percent of our recovered reserves are unhedged. It’s a much smaller, a much greater percentage of our total reserve then what we expect to get.

The ounces that we have hedged do more than just keep our bankers happy. More importantly, we expect the hedge revenue to pay over 90 percent of the operating costs at Mesquite. The 66,000 ounces of gold delivered a year at $801 an ounce, that’s $53 million in revenue. 165,000 ounces of production at 350 is $58 million of cost, so the other 100,000 ounces virtually fall to the bottom line for our company. All we have to pay out of that is our income tax. So that’s a pretty attractive scenario from my perspective.

Ladies and gentlemen you’ve heard what we’ve done and what we plan to do with our central goal in mind, which is generating attractive returns for our shareholders. We had a very good year in 2006. As you know, the stock has been largely flat to date in 2007. In the near term we’re focused on action and execution to change that over the remaining six months of this year. For the longer term, I think we’ve put a platform in place for growth based on our low risk, high return strategy, our best-in-class team and our financial resources. I trust that you will agree that Western Goldfields indeed represents a unique North American opportunity.

Furthermore I think industry conditions are working in our favour. There’s little new gold production coming on-stream, gold prices are strong, and we believe will continue to go higher. There’s also a shortage of mining talent in this industry, but that may affect other companies, but I hope that you’d agree at Western Goldfields, we’ve hired what’s arguably the best team in the business. I genuinely believe that this company is in the right place at the right time.

Again we thank you for joining us today and we’d like to thank all of our shareholders for participating in our growth and being part of this team that we’ve put together. At this point, all of us on the team, whether it be our Management or our Directors would be happy to take any questions that you have. The only thing I ask is if you could please go to a microphone so that people who are not here in person can hear you, and if you’d please identify yourself. Thank you very much.

DON BEAM: Hi, Don Beam, Nesbitt Burns. That’s all great, that’s all, you‘ve done a great job. Can you articulate some of the plans, some of the thoughts that the board has as to sort of the quote/unquote “what next” kind of program for the company, other than obviously production. But once production, once you’re in production generating cash-flow, add a little bit of thought as to what next after that?

RANDALL OLIPHANT: You know, I’d be happy to Don. And for those of you who don’t know Don Beam, he is somebody who got into the story very early and put a lot of his clients into Western Goldfields shares, so represents a lot of stock on his own but also on behalf of others.

Don our focus has been to get Mesquite into production. I mean we’ve done a lot of looking around for other sort of Western Goldfields situations, but frankly, we were limited in our ability to do things on the corporate front. When you’ve got a share price that represents $77 an ounce in the ground, you can either go out and buy other companies with similar valuations but then it’s hard to figure out how do you create value doing that, or it’d be even worse to go after companies that are trading at $300 an ounce. So our goal over the course of the balance of this year is to get our stock price up to where we’re competitive. Where we can be in that $300 category and go and find companies that are trading at $77 an ounce, apply our team just as we did for Mesquite and continue to grow the company that way.

Unlike a lot of gold companies, your Board and Management own a lot of stock in this company. We spent time with big companies and done things to be big. Our principal driver is, is this accretive to our shareholders and we couldn’t find anything over the course of the past year that enabled us to do it, so we didn’t do it. But I think as we improve this valuation a lot more opportunities are going to come forward.

PETER JACKSON: Yeah, I’m Peter Jackson from Cumberland Private Wealth. I’m just wondering, if you look at the trucks you’ve bought, the leach pads you’re building, you talk about possibly expanding the production, what would be the incremental cost to take it up to that next level?

RANDALL OLIPHANT: Ray do you want to talk to this please?

RAYMOND THRELKELD: Sure. As far as our expansion plans go, we’re certainly looking at trying to increase oxide production via more tonnes, more efficient tonnes, we’ll be looking at enhancing recovery if we possibly can on the oxide. We’ll be looking at sulfides for the future; one, we need to complete our testing and as far as an incremental cost, we haven’t gone into costing as yet, as to what it would take to, just sulfides really represent a good opportunity for us. Once again, once we remove oxide ores from the top of those sulfides, they potentially would become more viable.

RANDALL OLIPHANT: Well if there’s no more questions in this forum I invite you to join us for some refreshments and ask us questions on a one-on-one basis. We’re here not only because we have to be, but we genuinely appreciate the people who’ve invested in our company. So, anything that you want to know about any subject we’d be happy to answer.

I’d like to thank you very much for coming out and again, please feel free to stick around for a bit, join us, and you’re welcome to meet any members of our team. Thank you very much.

*****