UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21279

The Merger Fund VL

(Exact name of registrant as specified in charter)

100 Summit Lake Drive

Valhalla, New York 10595

(Address of principal executive offices) (Zip code)

Bonnie L. Smith

100 Summit Lake Drive

Valhalla, New York 10595

(Name and address of agent for service)

914-741-5600

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: June 30, 2010

Item 1. Reports to Stockholders.

THE MERGER FUND VL

SEMI-ANNUAL REPORT

JUNE 30, 2010

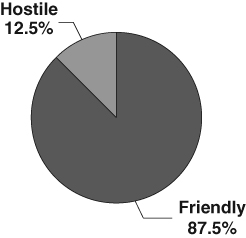

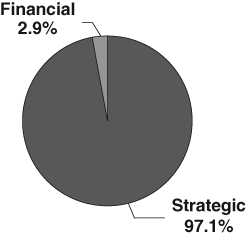

| Chart 1 | Chart 2 |

| | |

| PORTFOLIO COMPOSITION | PORTFOLIO COMPOSITION |

By Type of Deal* | By Type of Buyer* |

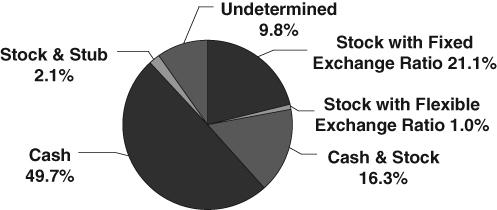

Chart 3

PORTFOLIO COMPOSITION

By Deal Terms*

* Data expressed as a percentage of long equity positions as of June 30, 2010

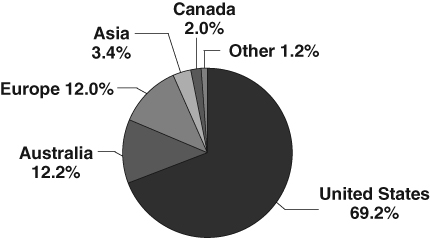

Chart 4

PORTFOLIO COMPOSITION

By Sector*

Chart 5

PORTFOLIO COMPOSITION

By Region*

* Data expressed as a percentage of long equity positions as of June 30, 2010

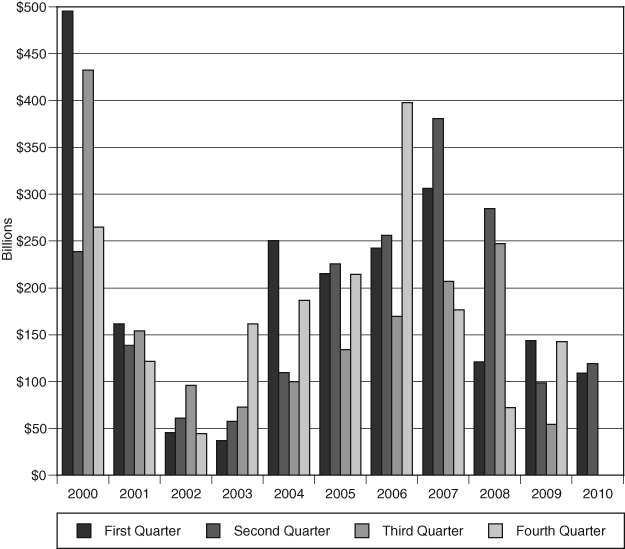

Chart 6

MERGER ACTIVITY

2000 – 2010

Source: Securities Data Corp.

The Merger Fund VL

EXPENSE EXAMPLE

June 30, 2010

(Unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 for the period 1/1/10 – 6/30/10.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. To the extent the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes, but is not limited to, management fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determ ined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the se cond line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account | Ending Account | Expenses Paid During |

| | Value 1/1/10 | Value 6/30/10 | Period 1/1/10 – 6/30/10* |

Actual + (1) | $1,000.00 | $1,006.50 | $13.43 |

Hypothetical ++ (2) | $1,000.00 | $1,011.41 | $13.47 |

| + | Excluding dividends on securities sold short, borrowing expense on securities sold short and interest expense, your actual cost of investment in the Fund would be $6.97. |

| ++ | Excluding dividends on securities sold short, borrowing expense on securities sold short and interest expense, your hypothetical cost of investment in the Fund would be $7.00. |

| (1) | Ending account values and expenses paid during period based on a 0.65% return. This actual return is net of expenses. |

| (2) | Ending account values and expenses paid during period based on a 5.00% annual return before expenses. |

| * | Expenses are equal to the Fund’s annualized expense ratio of 2.70%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

The Merger Fund VL

SCHEDULE OF INVESTMENTS

June 30, 2010

(Unaudited)

| Shares | | | | Value | |

| COMMON STOCKS — 66.89% | | | |

| | | ADMINISTRATIVE AND SUPPORT SERVICES — 1.01% | | | |

| | 11,440 | | KKR Co. (a)(f)(h) | | $ | 108,222 | |

| | | | AMBULATORY HEALTH CARE SERVICES — 3.40% | | | | |

| | 11,159 | | Psychiatric Solutions, Inc. (a)(e) | | | 365,123 | |

| | | | BEVERAGE AND TOBACCO PRODUCT MANUFACTURING — 1.86% | | | | |

| | 7,400 | | Coca-Cola Enterprises Inc. (f) | | | 191,364 | |

| | 200 | | Fomento Economico Mexicano SAB de CV – ADR (h) | | | 8,630 | |

| | | | | | | 199,994 | |

| | | | BROADCASTING (EXCEPT INTERNET) — 1.79% | | | | |

| | 1,100 | | CC Media Holdings, Inc. (a)(c) | | | 7,315 | |

| | 9,700 | | Comcast Corporation Special Class A (f) | | | 159,371 | |

| | 2,400 | | Liberty Media Corp. – Interactive (a) | | | 25,200 | |

| | | | | | | 191,886 | |

| | | | CHEMICAL MANUFACTURING — 3.54% | | | | |

| | 9,800 | | Biovail Corporation (e)(h) | | | 188,552 | |

| | 820 | | CF Industries Holdings Inc. | | | 52,029 | |

| | 13,100 | | Huntsman Corporation (f) | | | 113,577 | |

| | 1,200 | | Talecris Biotherapeutics Holdings Corp. (a) | | | 25,320 | |

| | | | | | | 379,478 | |

| | | | COMPUTER AND ELECTRONIC PRODUCT MANUFACTURING — 5.21% | | | | |

| | 2,900 | | Millipore Corp. (a)(e) | | | 309,285 | |

| | 10,600 | | Motorola, Inc. (a) | | | 69,112 | |

| | 17,600 | | Palm, Inc. (a)(f) | | | 100,144 | |

| | 7,420 | | SunPower Corp. Class B (a) | | | 80,136 | |

| | | | | | | 558,677 | |

| | | | FOOD AND BEVERAGE STORES — 2.34% | | | | |

| | 7,209 | | Casey’s General Stores, Inc. (d) | | | 251,594 | |

| | | | FOOD MANUFACTURING — 0.30% | | | | |

| | 600 | | American Italian Pasta Company (a) | | | 31,722 | |

| | | | FOOD SERVICES AND DRINKING PLACES — 0.69% | | | | |

| | 4,900 | | California Pizza Kitchen, Inc. (a) | | | 74,235 | |

| | | | MACHINERY MANUFACTURING — 6.77% | | | | |

| | 19,300 | | Smith International Inc. | | | 726,645 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

June 30, 2010

(Unaudited)

| Shares | | | | Value | |

| | | MANAGEMENT OF COMPANIES AND ENTERPRISES — 2.09% | | | |

| | 12,000 | | Liberty Acquisition Holdings Corp. (a)(f) | | $ | 118,920 | |

| | 10,999 | | Phoenix Group Holdings (a)(f)(h) | | | 105,582 | |

| | | | | | | 224,502 | |

| | | | MERCHANT WHOLESALERS, NONDURABLE GOODS — 2.03% | | | | |

| | 3,500 | | Airgas, Inc. (d) | | | 217,700 | |

| | | | MINING (EXCEPT OIL AND GAS) — 1.05% | | | | |

| | 29,000 | | Camino Minerals Corp. (a)(c)(h) | | | 7,083 | |

| | 2,220 | | Lihir Gold Ltd. – ADR (h) | | | 79,898 | |

| | 600 | | Rio Tinto PLC – ADR (h) | | | 26,160 | |

| | | | | | | 113,141 | |

| | | | MISCELLANEOUS MANUFACTURING — 6.62% | | | | |

| | 3,113 | | Alcon Inc. – ADR (d)(h) | | | 461,316 | |

| | 11,100 | | Ev3, Inc. (a) (e) | | | 248,751 | |

| | | | | | | 710,067 | |

| | | | NURSING AND RESIDENTIAL CARE FACILITIES — 0.92% | | | | |

| | 3,700 | | Odyssey Healthcare, Inc. (a)(f) | | | 98,864 | |

| | | | OIL AND GAS EXTRACTION — 1.77% | | | | |

| | 8,826 | | Mariner Energy, Inc. (a)(f) | | | 189,582 | |

| | | | OTHER INFORMATION SERVICES — 2.81% | | | | |

| | 11,800 | | CyberSource Corporations (a)(e) | | | 301,254 | |

| | | | PETROLEUM AND COAL PRODUCTS MANUFACTURING — 0.04% | | | | |

| | 67 | | Exxon Mobil Corp. | | | 3,824 | |

| | | | PLASTICS AND RUBBER PRODUCTS MANUFACTURING — 0.05% | | | | |

| | 200 | | Pactiv Corp. (a)(e) | | | 5,570 | |

| | | | PRIMARY METAL MANUFACTURING — 0.62% | | | | |

| | 6,100 | | Gerdau Ameristeel Corp. (a)(h) | | | 66,490 | |

| | | | PROFESSIONAL, SCIENTIFIC, AND TECHNICAL SERVICES — 7.52% | | | | |

| | 39,400 | | Boots & Coots, Inc. (a)(f) | | | 116,230 | |

| | 17,800 | | Bowne & Co. Inc. (f) | | | 199,716 | |

| | 4,200 | | DynCorp International, Inc. (a) | | | 73,584 | |

| | 4,000 | | inVentiv Health, Inc. (a)(f) | | | 102,400 | |

| | 13,296 | | Phase Forward Corporation (a)(e) | | | 221,777 | |

| | 5,800 | | WuXi Pharmatech, Inc. – ADR (a) (h) | | | 92,568 | |

| | | | | | | 806,275 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

June 30, 2010

(Unaudited)

| Shares | | | | Value | |

| | | PUBLISHING INDUSTRIES (EXCEPT INTERNET) — 3.96% | | | |

| | 3,100 | | News Corporation – Class A | | $ | 37,076 | |

| | 6,000 | | Sybase, Inc. (a)(c) | | | 387,960 | |

| | | | | | | 425,036 | |

| | | | RENTAL AND LEASING SERVICES — 1.51% | | | | |

| | 3,800 | | Dollar Thrifty Automotive Group, Inc. (a)(d) | | | 161,918 | |

| | | | SECURITIES, COMMODITY CONTRACTS, AND OTHER | | | | |

| | | | FINANCIAL INVESTMENTS AND RELATED ACTIVITIES — 2.32% | | | | |

| | 34,700 | | GLG Partners Inc. (a)(f) | | | 151,986 | |

| | 2,900 | | Interactive Data Corp. (e) | | | 96,802 | |

| | | | | | | 248,788 | |

| | | | TELECOMMUNICATIONS — 4.63% | | | | |

| | 7,000 | | Fidelity National Information Services Inc. (f) | | | 187,740 | |

| | 58,900 | | Qwest Communications International Inc. (e) | | | 309,225 | |

| | | | | | | 496,965 | |

| | | | UTILITIES — 2.04% | | | | |

| | 8,400 | | Allegheny Energy Inc. (d) | | | 173,712 | |

| | 4,270 | | Mirant Corporation (a) | | | 45,091 | |

| | | | | | | 218,803 | |

| | | | TOTAL COMMON STOCKS (Cost $7,530,179) | | | 7,176,355 | |

| | | | | | | | |

| EXCHANGE-TRADED FUNDS — 0.00% | | | | |

| | 10 | | Market Vectors Global Alternative Energy ETF | | | 183 | |

| | | | TOTAL EXCHANGE-TRADED FUNDS (Cost $215) | | | 183 | |

| | | | | | | | |

| Principal Amount | | | | | | |

| CONVERTIBLE BONDS — 3.18% | | | | |

| | | | General Growth Properties LP | | | | |

| $ | 195,000 | | 3.980%, 04/15/2027 (Acquired 03/08/2010 | | | | |

| | | | through 05/07/2010, Cost $202,282)(b)(c) | | | 200,850 | |

| | | | Millipore Corp. | | | | |

| | 112,000 | | 3.750%, 06/01/2026 (c) | | | 140,420 | |

| | | | TOTAL CONVERTIBLE BONDS (Cost $341,520) | | | 341,270 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

June 30, 2010

(Unaudited)

| Principal Amount | | | | Value | |

| CORPORATE BONDS — 1.55% | | | |

| | | Mariner Energy, Inc. | | | |

| $ | 133,000 | | 11.750%, 06/30/2016 (c) | | $ | 166,250 | |

| | | | TOTAL CORPORATE BONDS (Cost $167,140) | | | 166,250 | |

| | | | | | | | |

| Contracts (100 shares per contract) | | | | |

| PURCHASED PUT OPTIONS — 0.84% | | | | |

| | | | The Blackstone Group, LP | | | | |

| | 54 | | Expiration: September, 2010, Exercise Price: $12.00 | | | 14,256 | |

| | | | Energy Select Sector SPDR | | | | |

| | 5 | | Expiration: September, 2010, Exercise Price: $62.00 | | | 6,337 | |

| | | | Global Alternative Energy ETF | | | | |

| | 41 | | Expiration: July, 2010, Exercise Price: $27.50 | | | 37,679 | |

| | | | iShares MSCI Mexico Investable Market Index Fund | | | | |

| | 3 | | Expiration: July, 2010, Exercise Price: $54.00 | | | 1,833 | |

| | | | iShares MSCI Spain Index | | | | |

| | 2 | | Expiration: July, 2010, Exercise Price: $33.00 | | | 430 | |

| | | | Market Vectors Coal ETF | | | | |

| | 6 | | Expiration: July, 2010, Exercise Price: $40.00 | | | 6,114 | |

| | | | Materials Select Sector SPDR | | | | |

| | 36 | | Expiration: September, 2010, Exercise Price: $33.00 | | | 18,450 | |

| | | | SPDR S&P 500 Retail ETF | | | | |

| | 6 | | Expiration: September, 2010, Exercise Price: $43.00 | | | 4,650 | |

| | | | TOTAL PURCHASED PUT OPTIONS (Cost $47,132) | | | 89,749 | |

| | | | | | | | |

| Principal Amount | | | | | | |

| ESCROW NOTES — 0.07% | | | | |

| $ | 18,300 | | Price Communication Liquidating Trust (a)(g) | | | 7,869 | |

| | | | TOTAL ESCROW NOTES (Cost $7,869) | | | 7,869 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

June 30, 2010

(Unaudited)

| Shares | | | | Value | |

| SHORT-TERM INVESTMENTS — 12.64% | | | |

| | | MONEY MARKETS — 12.64% | | | |

| | 600,000 | | First American Government Obligations Fund, 0.01% (c) | | $ | 600,000 | |

| | 600,000 | | First American Prime Obligations Fund, 0.09% (c) | | | 600,000 | |

| | 155,771 | | First American Treasury Obligations Fund, 0.01% (c) | | | 155,771 | |

| | | | TOTAL SHORT-TERM INVESTMENTS (Cost $1,355,771) | | | 1,355,771 | |

| | | | TOTAL INVESTMENTS (Cost $9,449,826) — 85.17% | | $ | 9,137,447 | |

Percentages are stated as a percent of net assets.

ADR – American Depository Receipt

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. As of June 30, 2010 these securities represented 1.87% of total net assets. |

| (c) | All or a portion of the shares have been committed as collateral for open securities sold short. |

| (d) | All or a portion of the shares have been committed as collateral for written option contracts. |

| (e) | All or a portion of the shares have been committed as collateral for swap contracts. |

| (f) | All or a portion of the shares have been committed as collateral for forward currency exchange contracts. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF SECURITIES SOLD SHORT

June 30, 2010

(Unaudited)

| Shares | | | | Value | |

| | 1,100 | | AMP Ltd. (a) | | $ | 4,824 | |

| | 1,504 | | Apache Corporation | | | 126,622 | |

| | 2,421 | | The Blackstone Group, LP | | | 23,145 | |

| | 8,201 | | CenturyLink, Inc. | | | 273,175 | |

| | 2,138 | | Charles River Laboratories International, Inc. | | | 73,141 | |

| | 9,700 | | Comcast Corporation Class A | | | 168,489 | |

| | 2,956 | | FirstEnergy Corp. | | | 104,140 | |

| | 1,000 | | National Australia Bank Ltd. (a) | | | 19,596 | |

| | 3,100 | | News Corporation Class B | | | 42,935 | |

| | 3,059 | | Novartis AG – ADR (a) | | | 147,811 | |

| | 600 | | Rio Tinto Ltd. (a) | | | 32,307 | |

| | 13,456 | | Schlumberger NV (a) | | | 744,655 | |

| | 7,420 | | SunPower Corp. Class A | | | 89,782 | |

| | 5,496 | | Valeant Pharmaceuticals International | | | 287,386 | |

| | 743 | | Market Vectors Gold Miners ETF | | | 38,606 | |

| | | | TOTAL SECURITIES SOLD SHORT | | | | |

| | | | (Proceeds $2,391,964) | | $ | 2,176,614 | |

ADR – American Depository Receipt

(a)Foreign security.

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF OPTIONS WRITTEN

June 30, 2010

(Unaudited)

| Contracts (100 shares per contract) | | Value | |

| CALL OPTIONS | | | | | |

| | | Airgas, Inc. | | | |

| | 12 | | Expiration: July, 2010, Exercise Price: $60.00 | | $ | 3,000 | |

| | 1 | | Expiration: July, 2010, Exercise Price: $65.00 | | | 20 | |

| | 3 | | Expiration: August, 2010, Exercise Price: $65.00 | | | 225 | |

| | | | Alcon Inc. – ADR | | | | |

| | 4 | | Expiration: July, 2010, Exercise Price: $145.00 | | | 2,340 | |

| | 5 | | Expiration: July, 2010, Exercise Price: $150.00 | | | 1,365 | |

| | | | Allegheny Energy Inc. | | | | |

| | 17 | | Expiration: July, 2010, Exercise Price: $22.50 | | | 127 | |

| | | | AXA Asia Pacific Holdings Ltd. | | | | |

| | 10 | | Expiration: August, 2010, Exercise Price: $6.00 | | | 101 | |

| | | | California Pizza Kitchen, Inc. | | | | |

| | 3 | | Expiration: July, 2010, Exercise Price: $17.50 | | | 75 | |

| | | | Casey’s General Stores, Inc. | | | | |

| | 25 | | Expiration: July, 2010, Exercise Price: $35.00 | | | 1,500 | |

| | | | Coca-Cola Enterprises Inc. | | | | |

| | 3 | | Expiration: July, 2010, Exercise Price: $25.00 | | | 315 | |

| | 22 | | Expiration: July, 2010, Exercise Price: $27.50 | | | 110 | |

| | | | Dollar Thrifty Automotive Group, Inc. | | | | |

| | 33 | | Expiration: July, 2010, Exercise Price: $40.00 | | | 10,396 | |

| | 5 | | Expiration: August, 2010, Exercise Price: $40.00 | | | 1,850 | |

| | | | Fidelity National Information Services Inc. | | | | |

| | 59 | | Expiration: July, 2010, Exercise Price: $27.50 | | | 1,180 | |

| | 9 | | Expiration: July, 2010, Exercise Price: $30.00 | | | 90 | |

| | | | Liberty Media Corp. – Interactive | | | | |

| | 24 | | Expiration: July, 2010, Exercise Price: $12.50 | | | 240 | |

| | | | Motorola, Inc. | | | | |

| | 106 | | Expiration: July, 2010, Exercise Price: $7.00 | | | 636 | |

| | | | Palm, Inc. | | | | |

| | 176 | | Expiration: August, 2010, Exercise Price: $6.00 | | | 88 | |

| | | | Sybase, Inc. | | | | |

| | 32 | | Expiration: September, 2010, Exercise Price: $65.00 | | | 160 | |

| | | | Talecris Biotherapeutics Holding Corp. | | | | |

| | 3 | | Expiration: July, 2010, Exercise Price: $20.00 | | | 375 | |

| | | | TOTAL CALL OPTIONS WRITTEN | | | | |

| | | | (Premiums received $53,537) | | $ | 24,193 | |

ADR – American Depository Receipt

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2010

(Unaudited)

| ASSETS: | | | | | | |

| Investments, at value (Cost $9,449,826) | | | | | $ | 9,137,447 | |

| Deposits at brokers | | | | | | 796,448 | |

| Receivable from brokers | | | | | | 2,322,717 | |

| Receivable for investments sold | | | | | | 1,161,474 | |

| Receivable for forward currency exchange contracts | | | | | | 92,480 | |

| Receivable for swap contracts | | | | | | 218 | |

| Receivable for fund shares issued | | | | | | 14,815 | |

| Receivable form the investment adviser | | | | | | 9,132 | |

| Dividends and interest receivable | | | | | | 2,646 | |

| Swap dividends receivable | | | | | | 3,866 | |

| Prepaid expenses and other receivables | | | | | | 11,018 | |

| Total Assets | | | | | | 13,552,261 | |

| LIABILITIES: | | | | | | | |

| Securities sold short, at value (proceeds of $2,391,964) | | $ | 2,176,614 | | | | | |

| Written option contracts, at value (premiums received $53,537) | | | 24,193 | | | | | |

| Payable to custodian | | | 2,103 | | | | | |

| Payable for forward currency exchange contracts | | | 44,412 | | | | | |

| Payable for swap contracts | | | 196,338 | | | | | |

| Payable for swap interest | | | 600 | | | | | |

| Payable for investments purchased | | | 313,075 | | | | | |

| Payable for fund shares redeemed | | | 147 | | | | | |

| Dividends and interest payable | | | 3,347 | | | | | |

| Accrued expenses and other liabilities | | | 63,537 | | | | | |

| Total Liabilities | | | | | | | 2,824,366 | |

| NET ASSETS | | | | | | $ | 10,727,895 | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Accumulated undistributed net investment loss | | | | | | $ | (117,759 | ) |

| Accumulated undistributed net realized gain on investments, | | | | | | | | |

| securities sold short, written option contracts expired or closed, | | | | | | | | |

| swap contracts, foreign currency translation and forward | | | | | | | | |

| currency exchange contracts | | | | | | | 684,509 | |

| Net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | $ | (312,379 | ) | | | | |

| Securities sold short | | | 215,350 | | | | | |

| Written option contracts | | | 29,344 | | | | | |

| Swap contracts | | | (192,854 | ) | | | | |

| Foreign currency translation | | | 1 | | | | | |

| Forward currency exchange contracts | | | 48,068 | | | | | |

| Net unrealized depreciation | | | | | | | (212,470 | ) |

| Paid-in capital | | | | | | | 10,373,615 | |

| Total Net Assets | | | | | | $ | 10,727,895 | |

| NET ASSET VALUE and offering price per share, | | | | | | | | |

| ($10,727,895 / 997,000 shares of beneficial interest outstanding) | | | | | | $ | 10.76 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2010

(Unaudited)

| INVESTMENT INCOME: | | | | | | |

| Interest | | | | | $ | 3,256 | |

| Dividend income on long positions (net of foreign withholding taxes of $4,205) | | | | | | 39,714 | |

| Total investment income | | | | | | 42,970 | |

| EXPENSES: | | | | | | | |

| Investment advisory fees | | $ | 61,632 | | | | | |

| Transfer agent and shareholder servicing agent fees | | | 13,710 | | | | | |

| Federal and state registration fees | | | 422 | | | | | |

| Professional fees | | | 43,165 | | | | | |

| Trustees’ fees and expenses | | | 2,524 | | | | | |

| Custody fees | | | 1,264 | | | | | |

| Administration fees | | | 19,850 | | | | | |

| Fund accounting expense | | | 22,428 | | | | | |

| Reports to shareholders | | | 3,697 | | | | | |

| Miscellaneous expenses | | | 326 | | | | | |

| Borrowing expense on securities sold short | | | 23,314 | | | | | |

| Dividends on securities sold short | | | 40,666 | | | | | |

| Total expenses before expense waiver by adviser | | | | | | | 232,998 | |

| Less: Expense reimbursed by Adviser (Note 3) | | | | | | | (99,990 | ) |

| Net expenses | | | | | | | 133,008 | |

| NET INVESTMENT LOSS | | | | | | | (90,038 | ) |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | | |

| Realized gain (loss) on: | | | | | | | | |

| Investments | | | 238,904 | | | | | |

| Securities sold short | | | 41,833 | | | | | |

| Written option contracts expired or closed | | | 122,728 | | | | | |

| Swap contracts | | | (31,384 | ) | | | | |

| Foreign currency translation | | | 1,768 | | | | | |

| Forward currency exchange contracts | | | 72,517 | | | | | |

| Net realized gain | | | | | | | 446,366 | |

| Change in unrealized appreciation / depreciation on: | | | | | | | | |

| Investments | | | (449,884 | ) | | | | |

| Securities sold short | | | 292,144 | | | | | |

| Written option contracts | | | 15,236 | | | | | |

| Swap contracts | | | (193,876 | ) | | | | |

| Foreign currency translation | | | (2,423 | ) | | | | |

| Forward currency exchange contracts | | | 40,012 | | | | | |

| Net unrealized depreciation | | | | | | | (298,791 | ) |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | | | | 147,575 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | | | | $ | 57,537 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

STATEMENT OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | Year Ended | |

| | | June 30, 2010 | | | December 31, 2009 | |

| | | (Unaudited) | | | | |

| Net investment loss | | $ | (90,038 | ) | | $ | (133,417 | ) |

| Net realized gain on investments, securities sold short, | | | | | | | | |

| written option contracts expired or closed, swap contracts, | | | | | | | | |

| foreign currency translation and forward currency | | | | | | | | |

| exchange contracts | | | 446,366 | | | | 458,764 | |

| Change in unrealized appreciation (depreciation) on | | | | | | | | |

| investments, securities sold short, written option contracts, | | | | | | | | |

| swap contracts, foreign currency translation and forward | | | | | | | | |

| currency exchange contracts | | | (298,791 | ) | | | 362,955 | |

| Net increase in net assets resulting from operations | | | 57,537 | | | | 688,302 | |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income | | | — | | | | (305,678 | ) |

| Net realized gains | | | — | | | | (7,130 | ) |

| Total dividends and distributions | | | — | | | | (312,808 | ) |

| Net increase in net assets from | | | | | | | | |

| capital share transactions (Note 4) | | | 960,682 | | | | 4,436,488 | |

| Net increase in net assets | | | 1,018,219 | | | | 4,811,982 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 9,709,676 | | | | 4,897,694 | |

| End of period (including accumulated undistributed | | | | | | | | |

| net investment loss of $(117,759) | | | | | | | | |

| and $(27,721), respectively) | | $ | 10,727,895 | | | $ | 9,709,676 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

FINANCIAL HIGHLIGHTS

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | June 30, | | | Year Ended December 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, beginning of period | | $ | 10.70 | | | $ | 9.88 | | | $ | 9.96 | | | $ | 11.56 | | | $ | 10.96 | | | $ | 10.60 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.09 | ) | | | (0.35 | ) | | | (0.13 | ) | | | 0.03 | | | | (0.02 | ) | | | (0.05 | ) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| gain on investments | | | 0.15 | | | | 1.53 | | | | 0.50 | | | | 0.20 | | | | 1.83 | | | | 0.53 | |

| Total from investment operations | | | 0.06 | | | | 1.18 | | | | 0.37 | | | | 0.23 | | | | 1.81 | | | | 0.48 | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | — | | | | (0.35 | ) | | | — | | | | — | | | | — | | | | 0.00 | |

| Distributions from net realized gains | | | — | | | | (0.01 | ) | | | (0.45 | ) | | | (1.83 | ) | | | (1.21 | ) | | | (0.12 | ) |

| Total distributions | | | — | | | | (0.36 | ) | | | (0.45 | ) | | | (1.83 | ) | | | (1.21 | ) | | | (0.12 | ) |

| Net Asset Value, end of period | | $ | 10.76 | | | $ | 10.70 | | | $ | 9.88 | | | $ | 9.96 | | | $ | 11.56 | | | $ | 10.96 | |

| Total Return | | | 0.65 | %(4) | | | 11.80 | % | | | 3.79 | %(1) | | | 2.11 | % | | | 16.55 | % | | | 4.53 | % |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 10,728 | | | $ | 9,710 | | | $ | 4,898 | | | $ | 4,484 | | | $ | 3,794 | | | $ | 5,574 | |

| Ratio of operating expenses to average | | | | | | | | | | | | | | | | | | | | | | | | |

| net assets including interest expense, | | | | | | | | | | | | | | | | | | | | | | | | |

| borrowing expense on securities sold short | | | | | | | | | | | | | | | | | | | | | | | | |

| and dividends on securities sold short: | | | | | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 4.73 | %(3) | | | 7.82 | % | | | 7.85 | % | | | 8.53 | % | | | 8.06 | % | | | 7.40 | % |

| After expense waiver | | | 2.70 | %(3) | | | 4.28 | % | | | 2.98 | % | | | 4.27 | % | | | 3.43 | % | | | 2.39 | % |

| Ratio of operating expenses to average | | | | | | | | | | | | | | | | | | | | | | | | |

| net assets excluding interest expense, | | | | | | | | | | | | | | | | | | | | | | | | |

| borrowing expense on securities sold short | | | | | | | | | | | | | | | | | | | | | | | | |

| and dividends on securities sold short: | | | | | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 3.43 | %(3) | | | 4.94 | % | | | 6.27 | % | | | 5.66 | % | | | 6.03 | % | | | 6.41 | % |

| After expense waiver | | | 1.40 | %(3) | | | 1.40 | % | | | 1.40 | % | | | 1.40 | % | | | 1.40 | % | | | 1.40 | % |

| Ratio of net investment loss | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | (3.86 | )%(3) | | | (5.69 | )% | | | (6.28 | )% | | | (5.52 | )% | | | (5.99 | )% | | | (5.58 | )% |

| After expense waiver | | | (1.83 | )%(3) | | | (2.15 | )% | | | (1.41 | )% | | | (1.26 | )% | | | (1.36 | )% | | | (0.57 | )% |

Portfolio turnover rate(2) | | | 118.26 | %(4) | | | 373.07 | % | | | 743.72 | % | | | 418.22 | % | | | 555.55 | % | | | 497.59 | % |

| (1) | The return would have been 3.06% without the expense credit from the service provider. |

| (2) | The numerator for the portfolio turnover rate includes the lesser of purchases or sales (excluding securities sold short). The denominator includes the average long positions throughout the period. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS

June 30, 2010 (Unaudited)

Note 1 — ORGANIZATION

The Merger Fund VL (the “Fund”) is a no-load, open-end, non-diversified investment company organized as a statutory trust under the laws of Delaware on November 22, 2002, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund commenced operations on May 26, 2004. The investment objective of the Fund is to seek to achieve capital growth by engaging in merger arbitrage. Merger arbitrage is a highly specialized investment approach generally designed to profit from the successful completion of proposed mergers, takeovers, tender offers, leveraged buyouts, liquidations and other types of corporate reorganizations. Shares of the Fund are not offered directly to the public. The Fund’s shares are currently offered only to separate accounts funding variable annuity and variable life insurance contracts. At June 30, 2010, 98.6% of the shares outstanding of the Fund were owned by three insurance companies.

Note 2 — SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles. In preparing these financial statements, the Fund has evaluated subsequent events and transactions for potential recognition or disclosure through the date the financial statements were issued.

A.Investment Valuation

Securities listed on the NASDAQ Global Market and the NASDAQ Global Select Market are valued at the NASDAQ Official Closing Price (“NOCP”). Other listed securities are valued at the last sale price on the exchange on which such securities are primarily traded or, in the case of options, at the last sale price. Securities not listed on an exchange and securities for which there are no transactions are valued at the average of the closing bid and asked prices. When pricing options, if no sales are reported or if the last sale is outside the bid and asked parameters, the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices will be used. Securities for which there are no such valuations are valued at fair value as determined in good faith by management under the supervision of the Board of Trustees. The Adviser (as defined herein) reserves the right to value securities, including options, at prices other than last-sale prices, intrinsic value prices, or the average of closing bid and asked prices, when such prices are believed unrepresentative of fair market value as determined in good faith by the Adviser. When fair-value pricing is employed, the prices of securities used by the Fund to calculate its NAV may differ from quoted or published prices for the same securities. In addition, due to the subjective and variable nature of fair-value pricing, it is possible that the value determined for a particular asset may be materially different from the value realized upon such asset’s sale. At June 30, 2010, fair-valued long securities represented 0.07% of investments, at value. Investments in United States government securities (other than short-term securities) are valued at t he average of the quoted bid and asked prices in the over-the-counter market. Short-term investments are carried at amortized cost, which approximates market value.

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2010 (Unaudited)

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | Level 1 — | Quoted prices in active markets for identical securities. |

| | Level 2 — | Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| | Level 3 — | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following tables provide the fair value measurements of applicable Fund assets and liabilities by level within the fair value hierarchy for the Fund as of June 30, 2010. These assets and liabilities are measured on a recurring basis.

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock* | | $ | 7,061,050 | | | $ | 115,305 | | | $ | — | | | $ | 7,176,355 | |

| Exchange Traded Funds | | | 183 | | | | — | | | | — | | | | 183 | |

| Convertible Bonds | | | — | | | | 341,270 | | | | — | | | | 341,270 | |

| Corporate Bonds | | | — | | | | 166,250 | | | | — | | | | 166,250 | |

| Purchased Put Options | | | 89,749 | | | | — | | | | — | | | | 89,749 | |

| Escrow Notes | | | | | | | — | | | | 7,869 | | | | 7,869 | |

| Swap Contracts** | | | — | | | | 218 | | | | — | | | | 218 | |

| Forward Currency Exchange Contracts** | | | — | | | | 92,480 | | | | — | | | | 92,480 | |

| Short-Term Investments | | | 1,355,771 | | | | — | | | | — | | | | 1,355,771 | |

| Total Investments in Securities | | $ | 8,506,753 | | | $ | 715,523 | | | $ | 7,869 | | | $ | 9,230,145 | |

| Securities Sold Short | | $ | 2,176,614 | | | $ | — | | | $ | — | | | $ | 2,176,614 | |

| Written Options | | | 24,193 | | | | | | | | — | | | | 24,193 | |

| Swap Contracts** | | | — | | | | 196,338 | | | | — | | | | 196,338 | |

| Forward Currency Exchange Contracts** | | | — | | | | 44,412 | | | | — | | | | 44,412 | |

| | * | Please refer to the Schedule of Investments to view common stocks segregated by industry type. |

| | ** | Swap contracts and forward currency exchange contracts are valued at the unrealized appreciation/depreciation on the instrument. |

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2010 (Unaudited)

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

Level 3 Reconciliation Disclosure

Following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value.

| | | Investments | |

| Description | | in Securities | |

| Balance as of December 31, 2009 | | $ | 7,869 | |

| Accrued discounts/premiums | | | — | |

| Realized gain (loss) | | | — | |

| Change in unrealized appreciation (depreciation) | | | — | |

| Net purchases (sales) | | | — | |

| Transfers in and/or out of Level 3 | | | — | |

| Balance as of June 30, 2010 | | $ | 7,869 | |

The Fund did not invest in Level 3 securities during the period. There were no transfers into or out of Level 1 or 2 during the period.

The Fund may sell securities or currencies short for hedging purposes. For financial statement purposes, an amount equal to the settlement amount is initially included in the Statement of Assets and Liabilities as an asset and an equivalent liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the short position. Subsequent fluctuations in the market prices of securities or currencies sold, but not yet purchased, may require purchasing the securities or currencies at prices which may differ from the market value reflected on the Statement of Assets and Liabilities. Short sale transactions result in off balance sheet risk because the ultimate obligation may exceed the related amounts shown in the Statement of Assets and Liabilit ies. The Fund will incur a loss if the price of the security increases between the date of the short sale and the date on which the Fund replaces the borrowed security. The Fund’s loss on a short sale is potentially unlimited because there is no upward limit on the price a borrowed security could attain.

The Fund is liable for any dividends payable on securities while those securities are sold short. Until the security is replaced, the Fund is required to pay to the lender any income earned which is recorded as an expense by the Fund. As collateral for its securities sold short, the Fund is required under the 1940 Act to maintain assets consisting of cash, cash equivalents or liquid securities. These assets are required to be adjusted daily to reflect changes in the value of the securities or currencies sold short.

| C. | Transactions with Brokers for Securities Sold Short |

The Fund’s receivables from brokers for proceeds on securities sold short and deposit at brokers for securities sold short are with three major securities dealers. The Fund does not require the brokers to maintain collateral in support of the receivable from the brokers for proceeds on securities sold short.

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2010 (Unaudited)

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

No provision for federal income taxes has been made since the Fund has complied to date with the provisions of the Internal Revenue Code applicable to regulated investment companies and intends to continue to so comply in future years and to distribute investment company net taxable income and net capital gains to shareholders. Additionally, the Fund intends to make all required distributions to avoid federal excise tax.

The Fund has reviewed all open tax years and major jurisdictions and concluded that there is no impact on the Fund’s net assets and there is no tax liability resulting from unrecognized tax benefits relating to income tax positions taken or expected to be taken on a tax return. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. As of June 30, 2010, open Federal and New York tax years include the tax years ended December 31, 2007 through 2009. The Fund has no examination in progress.

| E. | Written Option Contracts |

The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund writes (sells) call options to hedge portfolio investments. Uncovered put options can also be written by the Fund as part of a merger arbitrage strategy involving a pending corporate reorganization. When the Fund writes (sells) an option, an amount equal to the premium received by the Fund is included in the Statement of Assets and Liabilities as an asset and an equivalent liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the written option contracts. By writing an option, the Fund may become obligated during the term of the option to deliver or purchase the securities underlying the option at the exercise price if the option is exercised. Written option contracts are valued at the higher of the intrinsic value of the option or the last sales price reported on the date of valuation. If no sale is reported or if the last sale is outside the parameters of the closing bid and asked prices, the written option contract is valued at the higher of the intrinsic value of the option or the mean of the last reported bid and asked prices on the day of valuation. When an option expires on its stipulated expiration date or the Fund enters into a closing purchase transaction, the Fund realizes a gain or loss if the cost of the closing purchase transaction differs from the premium received when the option was sold without regard to any unrealized gain or loss on the underlying security, and the liability related to such option is eliminated. When an option is exercised, the premium originally received decreases the cost basis of the security (or increases the proceeds on a sale of the security), and the Fund realizes a gain or loss f rom the sale of the underlying security. With written option contracts, there is minimal counterparty credit risk to the Fund since written option contracts are exchange traded.

The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund purchases put or call options to hedge portfolio investments. Premiums paid for option contracts purchased are included in the Statement of Assets and Liabilities as an asset. Option contracts are valued daily at the higher of the intrinsic value of the option or the last sales price reported

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2010 (Unaudited)

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

on the date of valuation. If no sale is reported or if the last sale is outside the parameters of the closing bid and asked prices, the option contract purchased is valued at the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices on the day of valuation. When option contracts expire or are closed, realized gains or losses are recognized without regard to any unrealized gains or losses on the underlying securities. With purchased options, there is minimal counterparty credit risk to the Fund since purchased options are exchange traded.

G.Forward Currency Exchange Contracts

The Fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The Fund may use forward currency exchange contracts to hedge against changes in the value of foreign currencies. The Fund may enter into forward currency exchange contracts obligating the Fund to deliver or receive a currency at a specified future date. Forward contracts are valued daily, and unrealized appreciation or depreciation is recorded daily as the difference between the contract exchange rate and the closing forward rate applied to the face amount of the contract. A realized gain or loss is recorded at the time the forward contract expired. With forward contracts, there is minimal counterparty credit risk to the Fund since forward contracts are excha nge traded.

The use of forward currency exchange contracts does not eliminate fluctuations in the underlying prices of the Fund’s investment securities; however, it does establish a rate of exchange that can be achieved in the future. The use of forward currency exchange contracts involves the risk that anticipated currency movements will not be accurately predicted. A forward currency exchange contract would limit the risk of loss due to a decline in the value of a particular currency; however it would also limit any potential gain that might result should the value of the currency increase instead of decrease. These contracts may involve market risk in excess of the amount of receivable or payable reflected on the Statement of Assets and Liabilities.

| H. | Distributions to Shareholders |

Dividends from net investment income and net realized capital gains, if any, are declared and paid annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences are due primarily to wash sale-loss deferrals, constructive sales, straddle-loss deferrals, adjustments on swap contracts, and unrealized gains or losses on Section 1256 contracts, which were realized, for tax purposes, at December 31, 2009. Accordingly, reclassifications are made within the net asset accounts for such amounts, as well as amounts related to permanent differences in the character of certain income and expense items for income tax and financial reporting purposes.

Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in U.S. companies and the U.S. government. These risks include revaluation of currencies and adverse political and economic developments. Moreover, securities of many foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies and the U.S. government.

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2010 (Unaudited)

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

| J. | Foreign Currency Translations |

The books and records of the Fund are maintained in U.S. dollars. Foreign currency transactions are translated into U.S. dollars on the following basis: (i) market value of investment securities, assets and liabilities at the daily rates of exchange, and (ii) purchases and sales of investment securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. For financial reporting purposes, the Fund does not isolate changes in the exchange rate of investment securities from the fluctuations arising from changes in the market prices of securities. However, for federal income tax purposes, the Fund does isolate and treat as ordinary income the effect of changes in foreign exchange rates on realized gain or loss f rom the sale of investment securities and payables and receivables arising from trade-date and settlement-date differences.

The Fund may engage in security transactions on a when-issued or delayed-delivery basis. Although the payment and interest terms of these securities are established at the time the Fund enters into the agreement, these securities may be delivered for cash proceeds at a future date. During this period, the securities are subject to market fluctuation. The Fund records sales of when-issued securities and reflects the values of such securities in determining net asset value in the same manner as other open short-sale positions. When delayed-delivery purchases are outstanding, the Fund segregates and maintains at all times cash, cash equivalents or other liquid securities in an amount at least equal to the market value.

L.Cash Equivalents

The Fund considers highly liquid temporary cash investments purchased with an original maturity of less than three months to be cash equivalents. Cash equivalents are included in short-term investments on the Schedule of Investments as well as in investments on the Statement of Assets and Liabilities.

| M. | Guarantees and Indemnifications |

In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2010 (Unaudited)

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

Investment and shareholder transactions are recorded on the trade date. Realized gains and losses from security transactions are recorded on the identified cost basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest is accounted for on the accrual basis and includes amortization of premiums and discounts on the interest method. The Fund may utilize derivative instruments including options, forward currency exchange contracts and other instruments with similar characteristics to the extent that they are consistent with the Fund’s investment objectives and limitations. The use of these instruments may involve additional investment risks, including the possibility of illiquid markets or imperfect correlation between the value of the ins truments and the underlying securities.

P.Counterparty Risk

The Fund helps manage counterparty credit risk by entering into agreements only with counterparties the Adviser believes have the financial resources to honor their obligations and by having the Adviser monitor the financial stability of the counterparties. Collateral pledges are monitored and subsequently adjusted if and when the valuations fluctuate, either up or down, by at least the predetermined threshold amount.

Q.The Right to Offset

Financial assets and liabilities as well as cash collateral received and posted are offset by the counterparty, and the net amount is reported in the consolidated statement of financial condition when the Fund believes there exists a legally enforceable right to offset the recognized amounts.

R.Derivatives

The Fund has adopted authoritative standards regarding disclosure about derivatives and hedging activities and how they affect the Fund’s Statement of Assets and Liabilities and Statement of Operations. For the six months ended June 30, 2010: long option contracts (513 contracts) were purchased and $139,258 premiums were paid, written option contracts (3,519 contracts) were opened and $520,476 premiums were received, equity swap contracts were opened for a notional value of $3,233,688 and closed for a notional value of $1,618,355 and an average of 14 forward currency exchange contract positions were open during the period.

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2010 (Unaudited)

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

Statement of Assets and Liabilities:

Fair values of derivative instruments as of June 30, 2010

| | | Asset Derivatives 2010 | | | Liability Derivatives 2010 | |

| | | Balance | | | | | | Balance | | | | |

| Derivatives | | Sheet Location | | | Fair Value | | | Sheet Location | | | Fair Value | |

| Equity Contracts: | | | | | | | | | | | | |

| Purchased Options | | Investments | | | $ | 89,749 | | | N/A | | | $ | — | |

| Written Option Contracts | | N/A | | | | — | | | Written Options | | | | 24,193 | |

| Swap Contracts | | Receivables | | | | 218 | | | Payables | | | | 196,338 | |

| | | | | | | | | | | | | | | | | |

| Foreign exchange contracts: | | | | | | | | | | | | | | | | |

| Forward Foreign Currency | | | | | | | | | | | | | | | | |

| Exchange Contracts | | Receivables | | | | 92,480 | | | Payables | | | | 44,412 | |

| Total | | | | | | $ | 182,447 | | | | | | | $ | 264,943 | |

Statement of Operations:

The effect of derivative instruments on the Statement of Operations for the period ended June 30, 2010

| Amount of Realized Gain (Loss) on Derivatives | |

| | | | | | | | | Forward | | | | | | | |

| | | Purchased | | | Written | | | Currency | | | | | | | |

| Derivatives | | Options | | | Options | | | Contracts | | | Swaps | | | Total | |

| Equity contracts | | $ | (23,393 | ) | | $ | 122,728 | | | $ | — | | | $ | (31,384 | ) | | $ | 67,951 | |

| Foreign exchange contracts | | | — | | | | — | | | | 72,517 | | | | — | | | | 72,517 | |

| Total | | $ | (23,394 | ) | | $ | 122,728 | | | $ | 72,517 | | | $ | (31,384 | ) | | $ | 140,468 | |

| | |

| Change in Unrealized Appreciation (Depreciation) on Derivatives | |

| | | | | | | | | | | Forward | | | | | | | | | |

| | | Purchased | | | Written | | | Currency | | | | | | | | | |

| Derivatives | | Options | | | Options | | | Contracts | | | Swaps | | | Total | |

| Equity contracts | | $ | 58,811 | | | $ | 15,236 | | | $ | — | | | $ | (193,876 | ) | | $ | (119,829 | ) |

| Foreign exchange contracts | | | — | | | | — | | | | 40,012 | | | | — | | | | 40,012 | |

| Total | | $ | 58,811 | | | $ | 15,236 | | | $ | 40,012 | | | $ | (193,876 | ) | | $ | (79,817 | ) |

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2010 (Unaudited)

Note 3 — AGREEMENTS

The Fund’s investment adviser is Westchester Capital Management, Inc. (the “Adviser”) pursuant to an investment advisory agreement dated July 1, 2003. Under the terms of this agreement, the Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 1.25% of the Fund’s average daily net assets. Certain officers of the Fund are also officers of the Adviser.

The Adviser has agreed to reduce its fees and reimburse the Fund to the extent total annualized expenses, excluding interest expense, borrowing expense on securities sold short and dividends on securities sold short, exceed 1.40% of average daily net assets. The agreement expires on July 1, 2013. The agreement permits the Adviser to recover the expenses paid in excess of the cap on expenses for the three previous years, as long as the recovery does not cause the Fund’s operating expenses, excluding interest expense, borrowing expense on securities sold short and dividends on securities sold short, to exceed the cap on expenses. For the six months ended June 30, 2010, the Adviser reimbursed $99,990 to the Fund.

Reimbursed expenses subject to potential recovery by year of expiration are as follows:

| | | Year of Expiration | Potential Recovery |

| | | 12/31/10 | $209,476 |

| | | 12/31/11 | $227,119 |

| | | 12/31/12 | $220,029 |

| | | 12/31/13 | $ 99,990 |

U.S. Bancorp Fund Services, LLC, a subsidiary of U.S. Bancorp, a publicly held bank holding company, serves as transfer agent, administrator, dividend paying agent and shareholder servicing agent for the Fund. U.S. Bank, N.A. serves as custodian for the Fund.

Note 4 — SHARES OF BENEFICIAL INTEREST

The Board of Trustees has the authority to issue an unlimited amount of shares of beneficial interest without par value.

Changes in shares of beneficial interest were as follows:

| | | Six Months Ended | | | Year Ended | |

| | | June 30, 2010 | | | December 31, 2009 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Sold | | | 115,215 | | | $ | 1,238,656 | | | | 491,549 | | | $ | 5,257,980 | |

| Reinvested | | | — | | | | — | | | | 29,234 | | | | 312,808 | |

| Redeemed | | | (25,961 | ) | | | (277,974 | ) | | | (108,598 | ) | | | (1,134,300 | ) |

| Net Increase | | | 89,254 | | | $ | 960,682 | | | | 412,185 | | | $ | 4,436,488 | |

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2010 (Unaudited)

Note 5 — INVESTMENT TRANSACTIONS

Purchases and sales of securities for the six months ended June 30, 2010 (excluding short-term investments, options and securities sold short) aggregated $15,778,865 and $9,693,029, respectively. There were no purchases or sales of U.S. Government securities.

At December 31, 2009, the components of accumulated earnings (losses) on a tax basis were as follows:

| Cost of Investments* | | $ | 8,867,621 | |

| Gross Unrealized Appreciation | | $ | 251,484 | |

| Gross Unrealized Depreciation | | | (172,990 | ) |

| Net Unrealized Appreciation | | $ | 78,494 | |

| Undistributed Ordinary Income | | $ | 303,259 | |

| Undistributed Long-Term Capital Gain | | | — | |

| Total Distributable Earnings | | $ | 303,259 | |

| Other Accumulated Losses | | $ | (85,010 | ) |

| Total Accumulated Gains | | $ | 296,743 | |

| | * | Represents cost for federal income tax purposes and differs from the cost for financial reporting purposes due to wash sales and constructive sales. |

The tax components of dividends paid during the six months ended June 30, 2010 and the fiscal year ended December 31, 2009 were as follows:

| | 2010 | 2009 |

| Ordinary Income | $— | $305,684 |

| Long-Term Capital Gains | $— | 7,124 |

The Fund designated as long-term capital gain dividends, pursuant to Internal Revenue Code Section 852(b)(3), the amount necessary to reduce the earnings and profits for the Fund related to net capital gains to zero for the tax year ended December 31, 2009.

For the fiscal year ended December 31, 2009, certain dividends paid by the Fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The percentage of dividends declared from net investment income designated as qualified dividend income for the fiscal year ended December 31, 2009 was 12.14% for the Fund (unaudited).

For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends-received deduction for the fiscal year ended December 31, 2009 was 8.64% for the Fund (unaudited).

The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Code Section 871(k)(2)(c) for the fiscal year ended December 31, 2009 was 100.00% for the Fund (unaudited).

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2010 (Unaudited)

Note 6 — WRITTEN OPTION CONTRACTS

The premium amount and the number of written option contracts during the six months ended June 30, 2010 were as follows:

| | | Premium | | | Number of | |

| | | Amount | | | Contracts | |

| Options outstanding at December 31, 2009 | | $ | 86,286 | | | | 234 | |

| Options written | | | 520,476 | | | | 3,519 | |

| Options closed | | | (177,171 | ) | | | (829 | ) |

| Options exercised | | | (270,861 | ) | | | (1,097 | ) |

| Options expired | | | (105,193 | ) | | | (1,275 | ) |

| Options outstanding at June 30, 2010 | | $ | 53,537 | | | | 552 | |

Note 7 — FORWARD CURRENCY EXCHANGE CONTRACTS

At June 30, 2010, the Fund had entered into forward currency exchange contracts that obligated the Fund to deliver or receive currencies at a specified future date. The net unrealized appreciation of $48,068 is included in the net unrealized appreciation (depreciation) section of the Statement of Assets and Liabilities. The terms of the open contracts are as follows:

| Settlement | | Currency to | | U.S. $ Value at | | | Currency to | | U.S. $ Value at | | | | |

| Date | | be Delivered | | June 30, 2010 | | | be Received | | June 30, 2010 | | | Unrealized | |

| 7/29/10 | | | 279,360 | | Australian Dollars | | $ | 234,321 | | | | 228,223 | | U.S. Dollars | | $ | 228,223 | | | $ | (6,098 | ) |

| 7/30/10 | | | 404,592 | | Australian Dollars | | | 339,321 | | | | 363,838 | | U.S. Dollars | | | 363,838 | | | | 24,517 | |

| 7/30/10 | | | 247,019 | | U.S. Dollars | | | 247,019 | | | | 286,692 | | Australian Dollars | | | 240,441 | | | | (6,578 | ) |

| 8/20/10 | | | 156,939 | | Australian Dollars | | | 131,295 | | | | 143,066 | | U.S. Dollars | | | 143,066 | | | | 11,771 | |

| 8/20/10 | | | 64,818 | | U.S. Dollars | | | 64,818 | | | | 75,739 | | Australian Dollars | | | 63,363 | | | | (1,455 | ) |

| 8/27/10 | | | 160,387 | | Australian Dollars | | | 134,069 | | | | 146,080 | | U.S. Dollars | | | 146,080 | | | | 12,011 | |

| 8/27/10 | | | 42,633 | | U.S. Dollars | | | 42,633 | | | | 48,250 | | Australian Dollars | | | 40,333 | | | | (2,300 | ) |

| 8/31/10 | | | 414,500 | | Australian Dollars | | | 346,315 | | | | 370,485 | | U.S. Dollars | | | 370,485 | | | | 24,170 | |

| 8/31/10 | | | 89,406 | | U.S. Dollars | | | 89,406 | | | | 98,000 | | Australian Dollars | | | 81,879 | | | | (7,527 | ) |

| 9/24/10 | | | 89,579 | | Australian Dollars | | | 74,611 | | | | 72,756 | | U.S. Dollars | | | 72,756 | | | | (1,855 | ) |

| 9/24/10 | | | 2,811 | | U.S. Dollars | | | 2,811 | | | | 3,360 | | Australian Dollars | | | 2,799 | | | | (12 | ) |

| 10/29/10 | | | 241,700 | | Australian Dollars | | | 200,492 | | | | 205,678 | | U.S. Dollars | | | 205,678 | | | | 5,186 | |

| 11/1/10 | | | 126,847 | | Australian Dollars | | | 105,184 | | | | 105,162 | | U.S. Dollars | | | 105,162 | | | | (22 | ) |

| 11/30/10 | | | 132,578 | | Australian Dollars | | | 109,571 | | | | 113,752 | | U.S. Dollars | | �� | 113,752 | | | | 4,181 | |

| 8/23/10 | | | 143,828 | | British Pound | | | 214,887 | | | | 208,186 | | U.S. Dollars | | | 208,186 | | | | (6,701 | ) |

| 10/6/10 | | | 182,850 | | British Pound | | | 273,182 | | | | 262,907 | | U.S. Dollars | | | 262,907 | | | | (10,275 | ) |

| 10/6/10 | | | 150,882 | | U.S. Dollars | | | 150,882 | | | | 109,068 | | British Pound | | | 152,839 | | | | 1,957 | |

| 11/26/10 | | | 131,915 | | British Pound | | | 197,078 | | | | 195,489 | | U.S. Dollars | | | 195,489 | | | | (1,589 | ) |

| 9/17/10 | | | 88,015 | | Euros | | | 107,678 | | | | 116,365 | | U.S. Dollars | | | 116,365 | | | | 8,687 | |

| | | | | | | | $ | 3,065,573 | | | | | | | | $ | 3,113,641 | | | $ | 48,068 | |

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2010 (Unaudited)

Note 8 — SWAP CONTRACTS

Equity Swap Contracts

The Fund is subject to equity price risk and interest rate risk in the normal course of pursuing its investment objectives. The Fund has entered into both long and short equity swap contracts with multiple broker-dealers. A long equity swap contract entitles the Fund to receive from the counterparty any appreciation and dividends paid on an individual security, while obligating the Fund to pay the counterparty any depreciation on the security as well as interest on the notional amount of the contract at a rate equal to LIBOR plus 25 to 100 basis points. A short equity swap contract obligates the Fund to pay the counterparty any appreciation and dividends paid on an individual security, while entitling the Fund to receive from the counterparty any depreciation on the security a s well as interest on the notional value of the contract at a rate equal to LIBOR less 25 to 100 basis points.

The Fund may also enter into equity swap contracts whose value is determined by the spread between a long equity position and a short equity position. This type of swap contract obligates the Fund to pay the counterparty an amount tied to any increase in the spread between the two securities over the term of the contract. The Fund is also obligated to pay the counterparty any dividends paid on the short equity holding as well as any net financing costs. This type of swap contract entitles the Fund to receive from the counterparty any gains based on a decrease in the spread as well as any dividends paid on the long equity holding and any net interest income.

Fluctuations in the value of an open contract are recorded daily as a net unrealized gain or loss. The Fund will realize a gain or loss upon termination or reset of the contract. Either party, under certain conditions, may terminate the contract prior to the contract’s expiration date.

Credit risk may arise as a result of the failure of the counterparty to comply with the terms of the contract. The Fund considers the creditworthiness of each counterparty to a contract in evaluating potential credit risk quarterly. The counterparty risk to the Fund is limited to the net unrealized gain, if any, on the contract, along with dividends receivable on long equity contracts and interest receivable on short equity contracts. Additionally, risk may arise from unanticipated movements in interest rates or in the value of the underlying securities. At June 30, 2010, the Fund had the following open equity swap contracts:

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2010 (Unaudited)

Note 8 — SWAP CONTRACTS (continued)

| | | | | | | Unrealized | | |

| | | | | | | Appreciation | | |

| Termination Date | Security | | Shares | | | (Depreciation) | | Counterparty |

| 4/19/11 | Arrow Energy Ltd | | | 63,300 | | | $ | (37,521 | ) | JPMorgan Chase & Co. Inc. |

| 5/24/11 | AMP Ltd | | | (720 | ) | | | 319 | | JPMorgan Chase & Co. Inc. |

| 4/7/11 | Arriva PLC | | | 18,610 | | | | (1,898 | ) | JPMorgan Chase & Co. Inc. |

| 4/19/11 | AXA Asia Pacific Holdings Ltd. | | | 47,065 | | | | (34,887 | ) | JPMorgan Chase & Co. Inc. |

| 6/15/11 | British Sky Broadcasting | | | 9,500 | | | | 218 | | Merrill Lynch & Co. Inc. |

| 6/16/11 | British Sky Broadcasting | | | 9,345 | | | | 917 | | JPMorgan Chase & Co. Inc. |

| 5/25/11 | Chloride Group PLC | | | 26,850 | | | | 48,001 | | JPMorgan Chase & Co. Inc. |

| 4/19/11 | Hillgrove Resources Ltd. | | | 331,444 | | | | (49,372 | ) | JPMorgan Chase & Co. Inc. |

| 6/1/11 | Healthscope Limited | | | 23,063 | | | | (5,504 | ) | JPMorgan Chase & Co. Inc. |

| 4/20/11 | Infigen Energy | | | 81,200 | | | | (38,983 | ) | JPMorgan Chase & Co. Inc. |

| 4/19/11 | Indophil Resources NL | | | 218,250 | | | | (29,329 | ) | JPMorgan Chase & Co. Inc. |

| 4/9/11 | Lihir Gold Ltd. | | | 41,400 | | | | (1,511 | ) | JPMorgan Chase & Co. Inc. |

| 4/23/11 | Newcrest Mining Ltd. | | | (6,055 | ) | | | (6,683 | ) | JPMorgan Chase & Co. Inc. |

| 5/17/11 | Nufarm Limited | | | 12,317 | | | | (12,294 | ) | JPMorgan Chase & Co. Inc. |

| 5/7/11 | Macarthur Coal Ltd. | | | 9,900 | | | | 797 | | JPMorgan Chase & Co. Inc. |

| 4/21/11 | Transurban Group REIT | | | 23,677 | | | | (25,124 | ) | JPMorgan Chase & Co. Inc. |

| | | | | | | | $ | (192,854 | ) | |

The Merger Fund VL

APPROVAL OF ADVISORY CONTRACT (Unaudited)

On January 16, 2010, at a meeting called for the purpose of voting on such approval, the Board of Trustees, including all of the Trustees who are not parties to the Advisory Contract or interested persons of any such party (the non-interested Trustees), approved the continuance of the Advisory Contract for the Fund. In so doing, the Board studied materials specifically relating to the Advisory Contract provided by the Adviser, counsel to the non-interested Trustees and counsel to the Fund. The Board considered a variety of factors, including the following:

The Board considered the nature, extent and quality of the services to be provided by the Adviser to the Fund pursuant to the Advisory Contract, including the Adviser’s competence and integrity; research capabilities; implementation and enforcement of compliance procedures and financial-reporting controls; and adherence to the Fund’s investment objectives, policies and restrictions. The Board also reviewed the Adviser’s methodology, research and analysis that it employs in selecting investments for the Fund. The Board considered the non-traditional nature of the Fund’s investment approach, the specialized expertise and experience of the Fund’s portfolio managers and the difficulty, were it warranted, of selecting an alternative adviser. The Board concluded t hat the Adviser fulfilled all of the foregoing factors and responsibilities in accordance with its obligations under the Advisory Contract.

The Board also evaluated the investment performance of the Fund and the Adviser relative to the S&P 500 Index over the last year, three years, five years and since the Fund’s inception, and relative to the performance of alternative-investment mutual funds, including those that engage in merger arbitrage.

Additionally, the Board reviewed information on the fee structure of the Advisory Contract, including the costs of the services to be provided and the profits to be realized by the Adviser and its affiliate from their relationship with the Fund, as evidenced by the Adviser’s profitability analysis. The profitability analysis consisted of income and expenses by category for calendar years 2009 and 2008, less expenses allocated to other funds managed by the Adviser’s affiliate, expenses absorbed by the Adviser to ensure that total Fund operating expenses do not exceed 1.40% on an annual basis, adjusted total expenses, net income (loss) and profit margin.

The Board considered the Fund’s total expense ratio, contractual investment advisory fees and service-provider fee ratio (in the aggregate and separately by fund administration, custodian, fund accounting and transfer agent fee ratios) compared to the industry average by quartile, within the appropriate Lipper benchmark category and Lipper category range. The Board also considered the amount and nature of fees paid by shareholders.

The Board also reviewed comparisons of the rates of compensation paid to managers of funds in its peer group, Lipper data relating to average expenses and advisory fees for comparable funds and the benefit to the Adviser of the Fund’s soft-dollar arrangements. Based on the information provided, the Board determined that the Fund has been unprofitable to the Adviser, and, hence, the Fund’s fee structure was reasonable compared to funds with similar investment goals and strategies. It was noted that the Fund’s management fees and expense ratio (after the fee waiver and expense reimbursement) are within the average range compared to its peer funds. The Board also considered the fact that the Adviser has agreed to waive a portion of its fees and noted that the fee waiver co uld be discontinued at any time after July 1, 2013.

The Board considered the issue of economies of scale and noted that, given the very small size of the Fund, consideration of fee breakpoints was premature.

Based on its evaluation, in consultation with independent counsel, of all material aspects of the Advisory Contract, including the foregoing factors and the Fund’s investment performance, and such other information believed to be reasonably necessary to evaluate the terms of the Advisory Contract, the Board, including all of the non-interested Trustees voting separately, concluded that the continuation of the Advisory Contract would be in the best interest of the Fund’s shareholders, and determined that the compensation to the Adviser provided for in the Advisory Contract is fair and reasonable.

The Merger Fund VL

AVAILABILITY OF PROXY VOTING INFORMATION

Information regarding how the Fund generally votes proxies relating to portfolio securities may be obtained without charge by calling the Fund’s Transfer Agent at 1-800-343-8959 or by visiting the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies during the most recent 12-month period ended June 30 is available on the SEC’s website or by calling the toll-free number listed above.

AVAILABILITY OF QUARTERLY PORTFOLIO SCHEDULE

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Investment Adviser

Westchester Capital Management, Inc.

100 Summit Lake Drive

Valhalla, NY 10595

(914) 741-5600

Administrator, Transfer Agent, Dividend Paying

Agent and Shareholder Servicing Agent

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

P.O. Box 701

Milwaukee, WI 53201-0701

(800) 343-8959

Custodian

U.S. Bank, N.A.

1555 North RiverCenter Drive, Suite 302

Milwaukee, WI 53212

(800) 343-8959

Trustees

Frederick W. Green

Michael J. Downey

James P. Logan, III

Barry Hamerling

Executive Officers

Frederick W. Green, President

Roy Behren, Vice President

Michael T. Shannon, Vice President

Bonnie L. Smith, Vice President,

Secretary and Treasurer

Bruce Rubin, Chief Compliance Officer

Counsel

Fulbright & Jaworski L.L.P.

666 Fifth Avenue

New York, NY 10103

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

100 East Wisconsin Avenue

Milwaukee, WI 53202

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to stockholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end management investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end management investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end management investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President/Principal Executive Officer and Treasurer/Principal Financial Officer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are reasonably designed to ensure that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy the Item 2 requirements through filing of an exhibit. Not Applicable |

(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end management investment companies.