UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21279

The Merger Fund VL

(Exact name of registrant as specified in charter)

100 Summit Lake Drive

Valhalla, New York 10595

(Address of principal executive offices) (Zip code)

Roy Behren and Michael T. Shannon

100 Summit Lake Drive

Valhalla, New York 10595

(Name and address of agent for service)

1-800-343-8959

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: June 30, 2014

Item 1. Reports to Stockholders.

THE MERGER FUND VL

A Westchester Capital Fund

SEMI-ANNUAL REPORT

June 30, 2014

GLOBAL MERGER ACTIVITY

Quarterly volume of announced global mergers

and acquisitions January 2004 – June 2014 (Unaudited)

Source: Bloomberg, Global Financial Advisory Mergers & Acquisitions Rankings First Six-Months 2014

DEAL COMPOSITION

The Merger Fund VL (Unaudited)

| | Type of Buyer* | | | | | Deal Terms* | | |

| | Strategic | 100.0% | | | | Stock & Stub1 | 35.1% | |

| | Financial | 0.0% | | | | Cash & Stock | 19.8% | |

| | | | | | | Cash | 19.4% | |

| | By Deal Type* | | | | | Stock with Fixed Exchange Ratio | 12.5% | |

| | Friendly | 98.1% | | | | Undetermined2 | 10.9% | |

| | Hostile | 1.9% | | | | Stock with Flexible Exchange Ratio (Collar) | 2.3% | |

| * | Data expressed as a percentage of long common stock, corporate and municipal bonds and swap contract positions as of June 30, 2014. |

| 1 | “Stub” includes assets other than cash and stock (e.g., escrow notes). |

| 2 | The compensation is undetermined because the compensation to be received (e.g., stock, cash, escrow notes, other) will be determined at a later date, potentially at the option of the Fund’s investment adviser. |

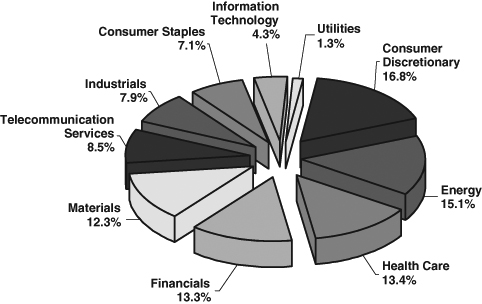

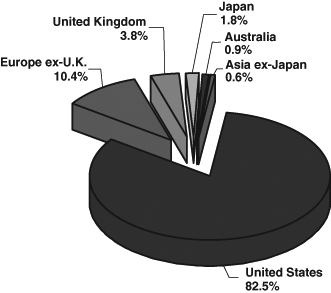

PORTFOLIO COMPOSITION

The Merger Fund VL (Unaudited)

By Sector*

By Region*

| * | Data expressed as a percentage of long common stock, corporate and municipal bonds and swap contract positions as of June 30, 2014. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The Merger Fund VL

EXPENSE EXAMPLE

June 30, 2014 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs as described below and (2) ongoing costs, including management fees, distribution and/or service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 for the period 1/1/14 – 6/30/14.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. The example below includes, among other fees, management fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and extraordinary expenses as determined under generally accepted accounting principles.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The Merger Fund VL

EXPENSE EXAMPLE (continued)

June 30, 2014 (Unaudited)

| | | | Annualized | Expenses Paid |

| | Beginning Account | Ending Account | Expense | During Period |

| | Value 1/1/14 | Value 6/30/14 | Ratio | 1/1/14-6/30/14* |

Actual+(1) | $1,000.00 | $1,029.30 | 1.60% | $8.05 |

Hypothetical+(2) | $1,000.00 | $1,016.86 | 1.60% | $8.00 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| + | Excluding dividends on securities sold short and borrowing expense on securities sold short, your actual cost of investment in and your hypothetical cost of investment in the Fund would have been $7.04 and $7.00, respectively. |

| (1) | Ending account values and expenses paid during the period based on a 2.93% return. This actual return is net of expenses. |

| (2) | Ending account values and expenses paid during period based on a 5.00% annual return before expenses. |

The Merger Fund VL

SCHEDULE OF INVESTMENTS

June 30, 2014 (Unaudited)

| Shares | | | | Value | |

| COMMON STOCKS — 83.82% | | | |

| | | | | | |

| | | ADVERTISING — 2.81% | | | |

| | 12,000 | | Lamar Advertising Company Class A (f) | | $ | 636,000 | |

| | | | | | | | |

| | | | AEROSPACE & DEFENSE — 1.06% | | | | |

| | 2,600 | | B/E Aerospace, Inc. (a)(f) | | | 240,474 | |

| | | | | | | | |

| | | | APPLICATION SOFTWARE — 0.27% | | | | |

| | 2,189 | | AutoNavi Holdings, Ltd. — ADR (a)(g) | | | 45,750 | |

| | 750 | | King Digital Entertainment plc (a)(b) | | | 15,412 | |

| | | | | | | 61,162 | |

| | | | AUTOMOBILE MANUFACTURERS — 1.92% | | | | |

| | 12,000 | | General Motors Company (f) | | | 435,600 | |

| | | | | | | | |

| | | | BROADCASTING & CABLE TV — 1.82% | | | | |

| | 6,504 | | CBS Corporation Class B (e) | | | 404,159 | |

| | 1,100 | | CC Media Holdings, Inc. Class A (a) | | | 7,975 | |

| | | | | | | 412,134 | |

| | | | CABLE & SATELLITE TV — 9.27% | | | | |

| | 5,546 | | DIRECTV (a) | | | 471,466 | |

| | 3,500 | | DISH Network Corporation Class A (a)(h) | | | 227,780 | |

| | 1,345 | | Liberty Global plc Series C (a)(f) | | | 56,907 | |

| | 127,059 | | Sirius XM Holdings, Inc. (a)(f) | | | 439,624 | |

| | 6,147 | | Time Warner Cable, Inc. (f) | | | 905,453 | |

| | | | | | | 2,101,230 | |

| | | | COAL & CONSUMABLE FUELS — 0.02% | | | | |

| | 100 | | CONSOL Energy, Inc. | | | 4,607 | |

| | | | | | | | |

| | | | CONSTRUCTION & ENGINEERING — 0.29% | | | | |

| | 1,915 | | Foster Wheeler AG (b) | | | 65,244 | |

| | | | | | | | |

| | | | CONSTRUCTION & FARM | | | | |

| | | | MACHINERY & HEAVY TRUCKS — 0.20% | | | | |

| | 1,400 | | The Manitowoc Company, Inc. (f) | | | 46,004 | |

| | | | | | | | |

| | | | CONSTRUCTION MATERIALS — 1.91% | | | | |

| | 4,673 | | Texas Industries, Inc. (a) | | | 431,598 | |

| | | | | | | | |

| | | | CONSUMER FINANCE — 2.17% | | | | |

| | 19,769 | | Navient Corporation (e) | | | 350,109 | |

| | 16,926 | | SLM Corporation (f) | | | 140,655 | |

| | | | | | | 490,764 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

June 30, 2014 (Unaudited)

| Shares | | | | Value | |

| | | DIVERSIFIED BANKS — 0.16% | | | |

| | 2,261 | | Wing Hang Bank, Ltd. (b) | | $ | 36,466 | |

| | | | | | | | |

| | | | DIVERSIFIED CHEMICALS — 5.31% | | | | |

| | 5,200 | | The Dow Chemical Company (g) | | | 267,592 | |

| | 5,700 | | E.I. Du Pont de Nemours & Company (e) | | | 373,008 | |

| | 20,042 | | Huntsman Corporation (f) | | | 563,180 | |

| | | | | | | 1,203,780 | |

| | | | DIVERSIFIED METALS & MINING — 0.01% | | | | |

| | 1,140 | | Pilot Gold, Inc. (a)(b) | | | 1,560 | |

| | | | | | | | |

| | | | DIVERSIFIED SUPPORT SERVICES — 1.21% | | | | |

| | 400 | | Civeo Corporation (a) | | | 10,012 | |

| | 7,400 | | Iron Mountain, Inc. (h) | | | 262,330 | |

| | | | | | | 272,342 | |

| | | | DRUG RETAIL — 0.65% | | | | |

| | 2,000 | | Walgreen Company (f) | | | 148,260 | |

| | | | | | | | |

| | | | FOOD RETAIL — 1.49% | | | | |

| | 9,848 | | Safeway, Inc. (e) | | | 338,180 | |

| | | | | | | | |

| | | | GOLD — 0.67% | | | | |

| | 5,985 | | Newmont Mining Corporation (f) | | | 152,258 | |

| | | | | | | | |

| | | | HEALTH CARE EQUIPMENT — 2.76% | | | | |

| | 6,934 | | Covidien plc (b) | | | 625,308 | |

| | | | | | | | |

| | | | INDUSTRIAL MACHINERY — 0.84% | | | | |

| | 2,800 | | The Timken Company (h) | | | 189,952 | |

| | | | | | | | |

| | | | INTEGRATED OIL & GAS — 4.93% | | | | |

| | 2,100 | | BP plc — ADR (f) | | | 110,775 | |

| | 5,700 | | Hess Corporation (f) | | | 563,673 | |

| | 4,300 | | Occidental Petroleum Corporation (f) | | | 441,309 | |

| | | | | | | 1,115,757 | |

| | | | INTEGRATED TELECOMMUNICATION SERVICES — 0.41% | | | | |

| | 1,900 | | Verizon Communications, Inc. (f) | | | 92,967 | |

| | | | | | | | |

| | | | INTERNET SOFTWARE & SERVICES — 1.82% | | | | |

| | 1,200 | | Equinix, Inc. (a)(h) | | | 252,108 | |

| | 4,600 | | Yahoo!, Inc. (a)(f) | | | 161,598 | |

| | | | | | | 413,706 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

June 30, 2014 (Unaudited)

| Shares | | | | Value | |

| | | LIFE & HEALTH INSURANCE — 0.79% | | | |

| | 2,575 | | Protective Life Corporation | | $ | 178,525 | |

| | | | | | | | |

| | | | LIFE SCIENCES TOOLS & SERVICES — 0.53% | | | | |

| | 2,100 | | Agilent Technologies, Inc. (f) | | | 120,624 | |

| | | | | | | | |

| | | | MOVIES & ENTERTAINMENT — 0.04% | | | | |

| | 1,000 | | SFX Entertainment, Inc. (a) | | | 8,100 | |

| | | | | | | | |

| | | | MULTI-LINE INSURANCE — 2.76% | | | | |

| | 11,464 | | American International Group, Inc. (f) | | | 625,705 | |

| | | | | | | | |

| | | | MULTI-UTILITIES — 0.49% | | | | |

| | 4,300 | | CenterPoint Energy, Inc. (f) | | | 109,822 | |

| | | | | | | | |

| | | | OIL & GAS DRILLING — 2.71% | | | | |

| | 3,200 | | Ensco plc Class A (b)(f) | | | 177,824 | |

| | 11,376 | | Noble Corporation plc (b)(e) | | | 381,779 | |

| | 1,200 | | Transocean, Ltd. (b)(f) | | | 54,036 | |

| | | | | | | 613,639 | |

| | | | OIL & GAS EQUIPMENT & SERVICES — 2.45% | | | | |

| | 6,600 | | National Oilwell Varco, Inc. (f) | | | 543,510 | |

| | 200 | | Oil States International, Inc. (a) | | | 12,818 | |

| | | | | | | 556,328 | |

| | | | OIL & GAS EXPLORATION & PRODUCTION — 3.77% | | | | |

| | 4,400 | | Anadarko Petroleum Corporation (f) | | | 481,668 | |

| | 10,800 | | QEP Resources, Inc. (e) | | | 372,600 | |

| | | | | | | 854,268 | |

| | | | PACKAGED FOODS & MEATS — 4.16% | | | | |

| | 15,104 | | The Hillshire Brands Company (f) | | | 940,979 | |

| | | | | | | | |

| | | | PAPER PRODUCTS — 1.49% | | | | |

| | 6,700 | | International Paper Company (g) | | | 338,149 | |

| | | | | | | | |

| | | | PHARMACEUTICALS — 8.88% | | | | |

| | 2,810 | | Allergan, Inc. (f) | | | 475,508 | |

| | 500 | | Endo International plc (a)(b) | | | 35,010 | |

| | 6,982 | | Forest Laboratories, Inc. (a) | | | 691,218 | |

| | 4,100 | | Mallinckrodt plc (a)(b)(g) | | | 328,082 | |

| | 13,933 | | Pfizer, Inc. (f) | | | 413,531 | |

| | 731 | | Questcor Pharmaceuticals, Inc. | | | 67,610 | |

| | | | | | | 2,010,959 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

June 30, 2014 (Unaudited)

| Shares | | | | Value | |

| | | REGIONAL BANKS — 0.26% | | | |

| | 5,280 | | Investors Bancorp, Inc. (h) | | $ | 58,344 | |

| | | | | | | | |

| | | | REITS — 3.91% | | | | |

| | 9,851 | | CommonWealth REIT (h) | | | 259,278 | |

| | 23,633 | | NorthStar Realty Finance Corporation (a)(e) | | | 410,741 | |

| | 5,980 | | Starwood Property Trust, Inc. | | | 142,145 | |

| | 1,090 | | Starwood Waypoint Residential Trust (a) | | | 28,569 | |

| | 1,400 | | Weyerhaeuser Company (f) | | | 46,326 | |

| | | | | | | 887,059 | |

| | | | SECURITY & ALARM SERVICES — 0.39% | | | | |

| | 2,700 | | Corrections Corporation of America (f) | | | 88,695 | |

| | | | | | | | |

| | | | SEMICONDUCTOR EQUIPMENT — 1.68% | | | | |

| | 22,310 | | Tokyo Electron Ltd. — ADR (e) | | | 381,278 | |

| | | | | | | | |

| | | | SEMICONDUCTORS — 0.28% | | | | |

| | 3,662 | | RDA Microelectronics, Inc. — ADR | | | 62,657 | |

| | | | | | | | |

| | | | SPECIALTY CHEMICALS — 1.34% | | | | |

| | 1,000 | | Ashland, Inc. (f) | | | 108,740 | |

| | 7,500 | | Chemtura Corporation (a)(f) | | | 195,975 | |

| | | | | | | 304,715 | |

| | | | THRIFTS & MORTGAGE FINANCE — 1.46% | | | | |

| | 33,665 | | Hudson City Bancorp, Inc. (g) | | | 330,927 | |

| | | | | | | | |

| | | | TOBACCO — 0.19% | | | | |

| | 700 | | Lorillard, Inc. | | | 42,679 | |

| | | | | | | | |

| | | | TRADING COMPANIES & DISTRIBUTORS — 0.26% | | | | |

| | 1,650 | | NOW, Inc. (a)(h) | | | 59,747 | |

| | | | | | | | |

| | | | TRUCKING — 0.10% | | | | |

| | 800 | | Hertz Global Holdings, Inc. (a) | | | 22,424 | |

| | | | | | | | |

| | | | WIRELESS TELECOMMUNICATION SERVICES — 3.88% | | | | |

| | 33,473 | | Sprint Corporation (a)(g) | | | 285,525 | |

| | 13,251 | | T-Mobile U.S., Inc. (a)(f) | | | 445,499 | |

| | 4,401 | | Vodafone Group plc — ADR (f) | | | 146,949 | |

| | | | | | | 877,973 | |

| | | | TOTAL COMMON STOCKS (Cost $17,307,584) | | | 18,988,949 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

June 30, 2014 (Unaudited)

| Shares | | | | Value | |

| CONTINGENT VALUE RIGHTS — 0.00% | | | |

| | 268 | | Leap Wireless International, Inc. (a)(d)(k) | | $ | 670 | |

| | | | TOTAL CONTINGENT VALUE RIGHTS (Cost $0) | | | 670 | |

| | | | | |

| WARRANTS — 0.00% | | | | |

| | 668 | | Kinross Gold Corporation (a)(b) | | | 16 | |

| | | | TOTAL WARRANTS (Cost $2,560) | | | 16 | |

| Principal Amount | | | | | | |

| CORPORATE BONDS — 3.64% | | | | |

| | | | American Airlines Group, Inc. | | | | |

| $ | 189,000 | | 7.500%, 3/15/2016 (Acquired 2/8/13 through 5/23/13, | | | | |

| | | | cost $190,733) (i) | | | 196,678 | |

| | | | B/E Aerospace, Inc. | | | | |

| | 59,000 | | 5.250%, 4/1/2022 (f) | | | 64,531 | |

| | | | Drill Rigs Holdings, Inc. | | | | |

| | 100,000 | | 6.500%, 10/1/2017 (Acquired 5/27/14 through 5/28/14, | | | | |

| | | | cost $104,151) (b)(i) | | | 102,750 | |

| | | | Gentiva Health Services, Inc. | | | | |

| | 133,000 | | 11.500%, 9/1/2018 | | | 142,144 | |

| | | | The Hillman Group, Inc. | | | | |

| | 20,000 | | 10.875%, 6/1/2018 | | | 21,226 | |

| | | | MetroPCS Wireless, Inc. | | | | |

| | 30,000 | | 6.625%, 11/15/2020 | | | 32,137 | |

| | | | National Money Mart Company | | | | |

| | 102,000 | | 10.375%, 12/15/2016 (b) | | | 107,738 | |

| | | | Nuveen Investments, Inc. | | | | |

| | 131,000 | | 9.500%, 10/15/2020 (Acquired 4/17/14 through 6/6/14, | | | | |

| | | | cost $156,171) (i) | | | 155,890 | |

| | | | TOTAL CORPORATE BONDS (Cost $818,929) | | | 823,094 | |

| | | | | | | |

| MUNICIPAL BONDS — 0.75% | | | | |

| | | | Louisiana Public Facilities | | | | |

| | 170,000 | | 9.750%, 8/1/2014 | | | 170,593 | |

| | | | TOTAL MUNICIPAL BONDS (Cost $170,000) | | | 170,593 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

June 30, 2014 (Unaudited)

| Contracts (100 shares per contract) | | Value | |

| PURCHASED CALL OPTIONS — 0.02% | | | |

| | | CBOE Volatility Index | | | |

| | 22 | | Expiration: July 2014, Exercise Price: $13.00 | | $ | 1,232 | |

| | 18 | | Expiration: July 2014, Exercise Price: $14.00 | | | 720 | |

| | 33 | | Expiration: August 2014, Exercise Price: $14.00 | | | 3,465 | |

| | | | | | | 5,417 | |

| PURCHASED PUT OPTIONS — 0.25% | | | | |

| | | | Agilent Technologies, Inc. | | | | |

| | 2 | | Expiration: August 2014, Exercise Price: $50.00 | | | 46 | |

| | 14 | | Expiration: November 2014, Exercise Price: $45.00 | | | 616 | |

| | | | Allergan, Inc. | | | | |

| | 4 | | Expiration: September 2014, Exercise Price: $140.00 | | | 790 | |

| | | | Alstom SA | | | | |

| | 13 | | Expiration: July 2014, Exercise Price: EUR 26.00 (j) | | | 516 | |

| | 11 | | Expiration: August 2014, Exercise Price: EUR 26.00 (j) | | | 904 | |

| | | | American International Group, Inc. | | | | |

| | 13 | | Expiration: August 2014, Exercise Price: $44.00 | | | 91 | |

| | 6 | | Expiration: August 2014, Exercise Price: $45.00 | | | 48 | |

| | 7 | | Expiration: August 2014, Exercise Price: $46.00 | | | 73 | |

| | 64 | | Expiration: August 2014, Exercise Price: $49.00 | | | 1,408 | |

| | | | Anadarko Petroleum Corporation | | | | |

| | 13 | | Expiration: August 2014, Exercise Price: $85.00 | | | 195 | |

| | 21 | | Expiration: August 2014, Exercise Price: $87.50 | | | 389 | |

| | | | Ashland, Inc. | | | | |

| | 9 | | Expiration: July 2014, Exercise Price: $85.00 | | | 27 | |

| | | | B/E Aerospace, Inc. | | | | |

| | 11 | | Expiration: October 2014, Exercise Price: $80.00 | | | 1,210 | |

| | 3 | | Expiration: October 2014, Exercise Price: $85.00 | | | 652 | |

| | | | Barrick Gold Corporation | | | | |

| | 15 | | Expiration: October 2014, Exercise Price: $20.00 | | | 3,525 | |

| | | | BP plc — ADR | | | | |

| | 10 | | Expiration: July 2014, Exercise Price: $44.00 | | | 20 | |

| | 7 | | Expiration: August 2014, Exercise Price: $45.00 | | | 52 | |

| | | | CBS Corporation Class B | | | | |

| | 21 | | Expiration: September 2014, Exercise Price: $50.00 | | | 630 | |

| | 14 | | Expiration: September 2014, Exercise Price: $52.50 | | | 630 | |

| | 8 | | Expiration: September 2014, Exercise Price: $55.00 | | | 600 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

June 30, 2014 (Unaudited)

| Contracts (100 shares per contract) | | Value | |

| | | CenterPoint Energy, Inc. | | | |

| | 28 | | Expiration: August 2014, Exercise Price: $17.50 | | $ | 140 | |

| | | | Chemtura Corporation | | | | |

| | 11 | | Expiration: September 2014, Exercise Price: $17.50 | | | 137 | |

| | 45 | | Expiration: September 2014, Exercise Price: $20.00 | | | 675 | |

| | | | CommonWealth REIT | | | | |

| | 80 | | Expiration: July 2014, Exercise Price: $22.50 | | | 600 | |

| | | | CONSOL Energy, Inc. | | | | |

| | 1 | | Expiration: July 2014, Exercise Price: $36.00 | | | 3 | |

| | | | Corrections Corporation of America | | | | |

| | 13 | | Expiration: September 2014, Exercise Price: $30.00 | | | 422 | |

| | | | DISH Network Corporation Class A | | | | |

| | 32 | | Expiration: September 2014, Exercise Price: $52.50 | | | 2,720 | |

| | | | The Dow Chemical Company | | | | |

| | 7 | | Expiration: September 2014, Exercise Price: $44.00 | | | 203 | |

| | 32 | | Expiration: September 2014, Exercise Price: $49.00 | | | 3,328 | |

| | | | E.I. Du Pont de Nemours & Company | | | | |

| | 38 | | Expiration: July 2014, Exercise Price: $57.50 | | | 133 | |

| | 5 | | Expiration: October 2014, Exercise Price: $55.00 | | | 135 | |

| | | | Endo International plc | | | | |

| | 4 | | Expiration: July 2014, Exercise Price: $50.00 | | | 50 | |

| | | | Ensco plc Class A | | | | |

| | 18 | | Expiration: September 2014, Exercise Price: $46.00 | | | 270 | |

| | | | Equinix, Inc. | | | | |

| | 1 | | Expiration: September 2014, Exercise Price: $180.00 | | | 105 | |

| | 4 | | Expiration: September 2014, Exercise Price: $185.00 | | | 630 | |

| | | | General Motors Company | | | | |

| | 22 | | Expiration: September 2014, Exercise Price: $30.00 | | | 440 | |

| | 16 | | Expiration: September 2014, Exercise Price: $33.00 | | | 832 | |

| | | | Halliburton Company | | | | |

| | 10 | | Expiration: July 2014, Exercise Price: $49.00 | | | 10 | |

| | | | Hertz Global Holdings, Inc. | | | | |

| | 7 | | Expiration: August 2014, Exercise Price: $25.00 | | | 378 | |

| | | | Hess Corporation | | | | |

| | 40 | | Expiration: August 2014, Exercise Price: $77.50 | | | 240 | |

| | | | The Hillshire Brands Company | | | | |

| | 43 | | Expiration: July 2014, Exercise Price: $32.00 | | | 107 | |

| | 16 | | Expiration: July 2014, Exercise Price: $33.00 | | | 40 | |

| | 1 | | Expiration: August 2014, Exercise Price: $50.00 | | | 5 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

June 30, 2014 (Unaudited)

| Contracts (100 shares per contract) | | Value | |

| | | Huntsman Corporation | | | |

| | 98 | | Expiration: August 2014, Exercise Price: $21.00 | | $ | 245 | |

| | 47 | | Expiration: August 2014, Exercise Price: $23.00 | | | 470 | |

| | | | International Paper Company | | | | |

| | 10 | | Expiration: July 2014, Exercise Price: $40.00 | | | 15 | |

| | 31 | | Expiration: October 2014, Exercise Price: $40.00 | | | 465 | |

| | 10 | | Expiration: October 2014, Exercise Price: $41.00 | | | 180 | |

| | | | Iron Mountain, Inc. | | | | |

| | 37 | | Expiration: July 2014, Exercise Price: $22.50 | | | 93 | |

| | 19 | | Expiration: October 2014, Exercise Price: $20.00 | | | 95 | |

| | | | Lamar Advertising Company Class A | | | | |

| | 2 | | Expiration: July 2014, Exercise Price: $45.00 | | | 15 | |

| | 12 | | Expiration: July 2014, Exercise Price: $47.00 | | | 150 | |

| | 12 | | Expiration: July 2014, Exercise Price: $48.00 | | | 120 | |

| | | | Lorillard, Inc. | | | | |

| | 8 | | Expiration: July 2014, Exercise Price: $50.00 | | | 32 | |

| | | | Mallinckrodt plc | | | | |

| | 4 | | Expiration: July 2014, Exercise Price: $50.00 | | | 20 | |

| | 26 | | Expiration: July 2014, Exercise Price: $55.00 | | | 195 | |

| | | | The Manitowoc Company, Inc. | | | | |

| | 11 | | Expiration: August 2014, Exercise Price: $29.00 | | | 440 | |

| | | | National Oilwell Varco, Inc. | | | | |

| | 21 | | Expiration: August 2014, Exercise Price: $65.00 | | | 221 | |

| | 28 | | Expiration: August 2014, Exercise Price: $70.00 | | | 420 | |

| | 3 | | Expiration: August 2014, Exercise Price: $72.50 | | | 54 | |

| | | | Newmont Mining Corporation | | | | |

| | 13 | | Expiration: July 2014, Exercise Price: $23.00 | | | 39 | |

| | | | Noble Corporation plc | | | | |

| | 15 | | Expiration: September 2014, Exercise Price: $26.00 | | | 180 | |

| | 19 | | Expiration: September 2014, Exercise Price: $28.00 | | | 456 | |

| | 51 | | Expiration: September 2014, Exercise Price: $29.00 | | | 1,734 | |

| | | | Occidental Petroleum Corporation | | | | |

| | 5 | | Expiration: August 2014, Exercise Price: $82.50 | | | 38 | |

| | 6 | | Expiration: August 2014, Exercise Price: $85.00 | | | 72 | |

| | 12 | | Expiration: August 2014, Exercise Price: $87.50 | | | 180 | |

| | 6 | | Expiration: November 2014, Exercise Price: $87.50 | | | 552 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

June 30, 2014 (Unaudited)

| Contracts (100 shares per contract) | | Value | |

| | | Pfizer, Inc. | | | |

| | 16 | | Expiration: July 2014, Exercise Price: $27.00 | | $ | 16 | |

| | 8 | | Expiration: July 2014, Exercise Price: $28.00 | | | 16 | |

| | 11 | | Expiration: September 2014, Exercise Price: $24.00 | | | 44 | |

| | 21 | | Expiration: September 2014, Exercise Price: $25.00 | | | 126 | |

| | | | QEP Resources, Inc. | | | | |

| | 86 | | Expiration: September 2014, Exercise Price: $25.00 | | | 774 | |

| | | | SLM Corporation | | | | |

| | 41 | | Expiration: July 2014, Exercise Price: $21.00 | | | 62 | |

| | 1 | | Expiration: July 2014, Exercise Price: $22.00 | | | 2 | |

| | 76 | | Expiration: October 2014, Exercise Price: $21.00 | | | 836 | |

| | | | SPDR S&P 500 ETF Trust | | | | |

| | 15 | | Expiration: August 2014, Exercise Price: $189.00 | | | 1,605 | |

| | 15 | | Expiration: August 2014, Exercise Price: $190.00 | | | 1,845 | |

| | 23 | | Expiration: August 2014, Exercise Price: $191.00 | | | 3,197 | |

| | 18 | | Expiration: December 2014, Exercise Price: $160.00 | | | 1,764 | |

| | 18 | | Expiration: December 2014, Exercise Price: $181.00 | | | 5,850 | |

| | | | Sprint Corporation | | | | |

| | 77 | | Expiration: August 2014, Exercise Price: $6.00 | | | 193 | |

| | 186 | | Expiration: August 2014, Exercise Price: $7.00 | | | 2,046 | |

| | | | Time Warner Cable, Inc. | | | | |

| | 14 | | Expiration: July 2014, Exercise Price: $120.00 | | | 140 | |

| | | | The Timken Company | | | | |

| | 19 | | Expiration: September 2014, Exercise Price: $55.00 | | | 522 | |

| | | | T-Mobile U.S., Inc. | | | | |

| | 103 | | Expiration: August 2014, Exercise Price: $28.00 | | | 2,884 | |

| | | | Transocean, Ltd. | | | | |

| | 1 | | Expiration: August 2014, Exercise Price: $37.00 | | | 16 | |

| | 6 | | Expiration: August 2014, Exercise Price: $38.00 | | | 102 | |

| | | | Verizon Communications, Inc. | | | | |

| | 5 | | Expiration: August 2014, Exercise Price: $45.00 | | | 70 | |

| | 3 | | Expiration: August 2014, Exercise Price: $46.00 | | | 72 | |

| | | | Vodafone Group plc — ADR | | | | |

| | 3 | | Expiration: July 2014, Exercise Price: $30.00 | | | 12 | |

| | 4 | | Expiration: October 2014, Exercise Price: $32.00 | | | 372 | |

| | 3 | | Expiration: October 2014, Exercise Price: $33.00 | | | 390 | |

| | | | Walgreen Company | | | | |

| | 7 | | Expiration: September 2014, Exercise Price: $60.00 | | | 214 | |

| | 8 | | Expiration: September 2014, Exercise Price: $65.00 | | | 724 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

June 30, 2014 (Unaudited)

| Contracts (100 shares per contract) | | Value | |

| | | Weyerhaeuser Company | | | |

| | 47 | | Expiration: July 2014, Exercise Price: $24.00 | | $ | 352 | |

| | 13 | | Expiration: July 2014, Exercise Price: $26.00 | | | 65 | |

| | | | Williams Companies, Inc. | | | | |

| | 8 | | Expiration: July 2014, Exercise Price: $38.00 | | | 12 | |

| | 7 | | Expiration: August 2014, Exercise Price: $39.00 | | | 35 | |

| | | | Yahoo!, Inc. | | | | |

| | 18 | | Expiration: July 2014, Exercise Price: $29.00 | | | 36 | |

| | 21 | | Expiration: July 2014, Exercise Price: $33.00 | | | 672 | |

| | | | | | | 55,572 | |

| | | | TOTAL PURCHASED OPTIONS (Cost $185,931) | | | 60,989 | |

| ESCROW NOTES — 0.06% | | | | |

| $ | 7,668 | | AMR Corporation (a)(d)(k) | | | 14,186 | |

| | 145,000 | | Dallas-Fort Worth International Airport (a)(d)(k) | | | — | |

| | | | TOTAL ESCROW NOTES (Cost $35,800) | | | 14,186 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS — 17.11% | | | | |

| | 1,365,000 | | Fidelity Institutional Government Portfolio, | | | | |

| | | | Institutional Share Class, 0.01% (c)(f) | | | 1,365,000 | |

| | 1,146,157 | | Goldman Sachs Financial Square Money Market Fund, | | | | |

| | | | Institutional Share Class, 0.07% (c)(f) | | | 1,146,157 | |

| | 1,365,000 | | The Liquid Asset Portfolio, Institutional Share Class, | | | | |

| | | | 0.06% (c)(f) | | | 1,365,000 | |

| | | | TOTAL SHORT-TERM INVESTMENTS (Cost $3,876,157) | | | 3,876,157 | |

| | | | TOTAL INVESTMENTS (Cost $22,396,961) — 105.65% | | $ | 23,934,654 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF INVESTMENTS (continued)

June 30, 2014 (Unaudited)

ADR – American Depository Receipt

ETF – Exchange-Traded Fund

EUR – Euro

plc – Public Limited Company

REIT – Real Estate Investment Trust

| (a) | Non-income producing security. |

| (b) | Foreign security. |

| (c) | The rate quoted is the annualized seven-day yield as of June 30, 2014. |

| (d) | Security fair valued by the Adviser in good faith in accordance with the policies adopted by the Board of Trustees. |

| (e) | All or a portion of the shares have been committed as collateral for open securities sold short. |

| (f) | All or a portion of the shares have been committed as collateral for written option contracts. |

| (g) | All or a portion of the shares have been committed as collateral for swap contracts. |

| (h) | All or a portion of the shares have been committed as collateral for forward currency exchange contracts. |

| (i) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. As of June 30, 2014, these securities represented 2.01% of total net assets. |

| (j) | Level 2 Security. Please see Note 2 on the Notes to the Financial Statements. |

| (k) | Level 3 Security. Please see Note 2 on the Notes to the Financial Statements. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by

U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF SECURITIES SOLD SHORT

June 30, 2014 (Unaudited)

| Shares | | | | Value | |

| | 2,700 | | Actavis plc (a) | | $ | 602,235 | |

| | 402 | | American Airlines Group, Inc. | | | 17,270 | |

| | 18,130 | | Applied Materials, Inc. | | | 408,832 | |

| | 7,535 | | AT&T, Inc. | | | 266,438 | |

| | 3,170 | | Comcast Corporation Class A | | | 170,166 | |

| | 1,041 | | Comcast Corporation Special Class A | | | 55,516 | |

| | 2,341 | | Liberty Global plc Class A (a) | | | 103,519 | |

| | 2,824 | | Liberty Global plc Series C (a) | | | 119,483 | |

| | 2,835 | | M&T Bank Corporation | | | 351,682 | |

| | 656 | | Mallinckrodt plc | | | 52,493 | |

| | 3,300 | | Martin Marietta Materials, Inc. | | | 435,765 | |

| | 6,632 | | Medtronic, Inc. | | | 422,856 | |

| | 343 | | Valeant Pharmaceuticals International, Inc. (a) | | | 43,259 | |

| | | | TOTAL SECURITIES SOLD SHORT | | | | |

| | | | (Proceeds $2,735,956) | | $ | 3,049,514 | |

plc – Public Limited Company

(a)Foreign security.

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF OPTIONS WRITTEN

June 30, 2014 (Unaudited)

| Contracts (100 shares per contract) | | Value | |

| CALL OPTIONS WRITTEN | | | |

| | | Agilent Technologies, Inc. | | | |

| | 3 | | Expiration: August 2014, Exercise Price: $55.00 | | $ | 1,080 | |

| | 18 | | Expiration: November 2014, Exercise Price: $55.00 | | | 8,910 | |

| | | | Allergan, Inc. | | | | |

| | 18 | | Expiration: September 2014, Exercise Price: $155.00 | | | 35,370 | |

| | 6 | | Expiration: September 2014, Exercise Price: $160.00 | | | 9,540 | |

| | | | Alstom SA | | | | |

| | 16 | | Expiration: July 2014, Exercise Price: EUR 28.00 (a) | | | 241 | |

| | 11 | | Expiration: August 2014, Exercise Price: EUR 29.00 (a) | | | 241 | |

| | 16 | | Expiration: September 2014, Exercise Price: EUR 27.00 (a) | | | 2,125 | |

| | 31 | | Expiration: September 2014, Exercise Price: EUR 28.00 (a) | | | 2,420 | |

| | | | American International Group, Inc. | | | | |

| | 18 | | Expiration: August 2014, Exercise Price: $49.00 | | | 11,070 | |

| | 10 | | Expiration: August 2014, Exercise Price: $50.00 | | | 5,050 | |

| | 87 | | Expiration: August 2014, Exercise Price: $52.50 | | | 24,360 | |

| | | | Anadarko Petroleum Corporation | | | | |

| | 18 | | Expiration: August 2014, Exercise Price: $95.00 | | | 27,585 | |

| | 26 | | Expiration: August 2014, Exercise Price: $97.50 | | | 34,710 | |

| | | | Ashland, Inc. | | | | |

| | 10 | | Expiration: July 2014, Exercise Price: $95.00 | | | 13,740 | |

| | | | AT&T, Inc. | | | | |

| | 8 | | Expiration: October 2014, Exercise Price: $33.00 | | | 1,908 | |

| | | | B/E Aerospace, Inc. | | | | |

| | 22 | | Expiration: October 2014, Exercise Price: $90.00 | | | 14,080 | |

| | 4 | | Expiration: October 2014, Exercise Price: $95.00 | | | 1,520 | |

| | | | BP plc — ADR | | | | |

| | 12 | | Expiration: July 2014, Exercise Price: $48.00 | | | 5,724 | |

| | 9 | | Expiration: August 2014, Exercise Price: $50.00 | | | 2,700 | |

| | | | CBOE Volatility Index | | | | |

| | 15 | | Expiration: July 2014, Exercise Price: $19.00 | | | 225 | |

| | 7 | | Expiration: July 2014, Exercise Price: $20.00 | | | 105 | |

| | 20 | | Expiration: July 2014, Exercise Price: $21.00 | | | 100 | |

| | 33 | | Expiration: August 2014, Exercise Price: $22.00 | | | 825 | |

| | | | CBS Corporation Class B | | | | |

| | 11 | | Expiration: September 2014, Exercise Price: $55.00 | | | 8,525 | |

| | 33 | | Expiration: September 2014, Exercise Price: $57.50 | | | 19,800 | |

| | 18 | | Expiration: September 2014, Exercise Price: $60.00 | | | 7,740 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF OPTIONS WRITTEN (continued)

June 30, 2014 (Unaudited)

| Contracts (100 shares per contract) | | Value | |

| | | CenterPoint Energy, Inc. | | | |

| | 43 | | Expiration: August 2014, Exercise Price: $22.50 | | $ | 13,975 | |

| | | | Chemtura Corporation | | | | |

| | 18 | | Expiration: September 2014, Exercise Price: $22.50 | | | 7,020 | |

| | 57 | | Expiration: September 2014, Exercise Price: $25.00 | | | 11,457 | |

| | | | Comcast Corporation Special Class A | | | | |

| | 16 | | Expiration: October 2014, Exercise Price: $45.00 | | | 13,600 | |

| | 11 | | Expiration: October 2014, Exercise Price: $47.00 | | | 7,425 | |

| | 11 | | Expiration: October 2014, Exercise Price: $48.00 | | | 6,380 | |

| | | | CommonWealth REIT | | | | |

| | 8 | | Expiration: July 2014, Exercise Price: $25.00 | | | 1,160 | |

| | 85 | | Expiration: July 2014, Exercise Price: $27.50 | | | 850 | |

| | | | CONSOL Energy, Inc. | | | | |

| | 1 | | Expiration: July 2014, Exercise Price: $39.00 | | | 707 | |

| | | | Corrections Corporation of America | | | | |

| | 27 | | Expiration: September 2014, Exercise Price: $33.00 | | | 2,902 | |

| | | | DISH Network Corporation Class A | | | | |

| | 35 | | Expiration: September 2014, Exercise Price: $57.50 | | | 34,300 | |

| | | | The Dow Chemical Company | | | | |

| | 10 | | Expiration: September 2014, Exercise Price: $50.00 | | | 2,850 | |

| | 42 | | Expiration: September 2014, Exercise Price: $52.50 | | | 6,132 | |

| | | | E.I. Du Pont de Nemours & Company | | | | |

| | 50 | | Expiration: July 2014, Exercise Price: $65.00 | | | 5,175 | |

| | 7 | | Expiration: October 2014, Exercise Price: $65.00 | | | 1,575 | |

| | | | Endo International plc | | | | |

| | 5 | | Expiration: July 2014, Exercise Price: $55.00 | | | 7,510 | |

| | | | Ensco plc Class A | | | | |

| | 12 | | Expiration: September 2014, Exercise Price: $49.00 | | | 8,100 | |

| | 20 | | Expiration: September 2014, Exercise Price: $50.00 | | | 12,000 | |

| | | | Equinix, Inc. | | | | |

| | 1 | | Expiration: September 2014, Exercise Price: $190.00 | | | 2,220 | |

| | 3 | | Expiration: September 2014, Exercise Price: $195.00 | | | 5,520 | |

| | 8 | | Expiration: September 2014, Exercise Price: $200.00 | | | 12,160 | |

| | | | General Motors Company | | | | |

| | 8 | | Expiration: September 2014, Exercise Price: $35.00 | | | 1,824 | |

| | 22 | | Expiration: September 2014, Exercise Price: $36.00 | | | 3,729 | |

| | 59 | | Expiration: September 2014, Exercise Price: $37.00 | | | 7,021 | |

| | | | Hertz Global Holdings, Inc. | | | | |

| | 8 | | Expiration: August 2014, Exercise Price: $27.00 | | | 1,720 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF OPTIONS WRITTEN (continued)

June 30, 2014 (Unaudited)

| Contracts (100 shares per contract) | | Value | |

| | | Hess Corporation | | | |

| | 57 | | Expiration: August 2014, Exercise Price: $87.50 | | $ | 66,547 | |

| | | | The Hillshire Brands Company | | | | |

| | 4 | | Expiration: August 2014, Exercise Price: $52.50 | | | 4,100 | |

| | 18 | | Expiration: August 2014, Exercise Price: $57.50 | | | 9,450 | |

| | 17 | | Expiration: October 2014, Exercise Price: $45.00 | | | 30,090 | |

| | 18 | | Expiration: October 2014, Exercise Price: $47.00 | | | 28,800 | |

| | | | Huntsman Corporation | | | | |

| | 122 | | Expiration: August 2014, Exercise Price: $24.00 | | | 51,850 | |

| | 71 | | Expiration: August 2014, Exercise Price: $25.00 | | | 23,430 | |

| | 2 | | Expiration: August 2014, Exercise Price: $28.00 | | | 210 | |

| | | | International Paper Company | | | | |

| | 13 | | Expiration: July 2014, Exercise Price: $45.00 | | | 7,150 | |

| | 12 | | Expiration: October 2014, Exercise Price: $45.00 | | | 6,690 | |

| | 42 | | Expiration: October 2014, Exercise Price: $46.00 | | | 19,845 | |

| | | | Iron Mountain, Inc. | | | | |

| | 24 | | Expiration: October 2014, Exercise Price: $25.00 | | | 25,080 | |

| | 50 | | Expiration: October 2014, Exercise Price: $32.50 | | | 17,500 | |

| | | | Koninklijke KPN NV | | | | |

| | 181 | | Expiration: August 2014, Exercise Price: EUR 2.70 (a) | | | 3,222 | |

| | 37 | | Expiration: August 2014, Exercise Price: EUR 2.80 (a) | | | 507 | |

| | 48 | | Expiration: September 2014, Exercise Price: EUR 2.60 (a) | | | 1,446 | |

| | 143 | | Expiration: September 2014, Exercise Price: EUR 2.70 (a) | | | 3,329 | |

| | | | Lamar Advertising Company Class A | | | | |

| | 31 | | Expiration: July 2014, Exercise Price: $49.00 | | | 12,555 | |

| | 89 | | Expiration: July 2014, Exercise Price: $50.00 | | | 27,946 | |

| | | | Liberty Global plc Class A | | | | |

| | 2 | | Expiration: July 2014, Exercise Price: $72.50 | | | 2,806 | |

| | | | Lorillard, Inc. | | | | |

| | 7 | | Expiration: July 2014, Exercise Price: $55.00 | | | 4,235 | |

| | | | Mallinckrodt plc | | | | |

| | 9 | | Expiration: July 2014, Exercise Price: $55.00 | | | 22,518 | |

| | 32 | | Expiration: July 2014, Exercise Price: $65.00 | | | 48,544 | |

| | | | The Manitowoc Company, Inc. | | | | |

| | 14 | | Expiration: August 2014, Exercise Price: $31.00 | | | 3,815 | |

| | | | Market Vectors Gold Miners ETF | | | | |

| | 11 | | Expiration: September 2014, Exercise Price: $20.50 | | | 6,655 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF OPTIONS WRITTEN (continued)

June 30, 2014 (Unaudited)

| Contracts (100 shares per contract) | | Value | |

| | | National Oilwell Varco, Inc. | | | |

| | 61 | | Expiration: August 2014, Exercise Price: $77.50 | | $ | 85,400 | |

| | 5 | | Expiration: August 2014, Exercise Price: $80.00 | | | 5,925 | |

| | | | Navient Corporation | | | | |

| | 6 | | Expiration: August 2014, Exercise Price: $17.50 | | | 405 | |

| | | | Newmont Mining Corporation | | | | |

| | 40 | | Expiration: July 2014, Exercise Price: $25.00 | | | 3,200 | |

| | | | Noble Corporation plc | | | | |

| | 21 | | Expiration: September 2014, Exercise Price: $29.00 | | | 9,922 | |

| | 92 | | Expiration: September 2014, Exercise Price: $32.00 | | | 21,344 | |

| | | | NorthStar Realty Finance Corporation | | | | |

| | 54 | | Expiration: September 2014, Exercise Price: $14.00 | | | 18,900 | |

| | 95 | | Expiration: September 2014, Exercise Price: $15.00 | | | 24,700 | |

| | 71 | | Expiration: September 2014, Exercise Price: $16.00 | | | 12,425 | |

| | | | Occidental Petroleum Corporation | | | | |

| | 32 | | Expiration: August 2014, Exercise Price: $95.00 | | | 27,200 | |

| | 11 | | Expiration: November 2014, Exercise Price: $97.50 | | | 8,552 | |

| | | | Oil States International, Inc. | | | | |

| | 2 | | Expiration: July 2014, Exercise Price: $100.00 | | | 2,900 | |

| | | | Pfizer, Inc. | | | | |

| | 20 | | Expiration: July 2014, Exercise Price: $30.00 | | | 300 | |

| | 23 | | Expiration: July 2014, Exercise Price: $31.00 | | | 69 | |

| | 14 | | Expiration: September 2014, Exercise Price: $28.00 | | | 2,604 | |

| | 21 | | Expiration: September 2014, Exercise Price: $29.00 | | | 2,289 | |

| | | | QEP Resources, Inc. | | | | |

| | 108 | | Expiration: September 2014, Exercise Price: $31.00 | | | 42,120 | |

| | | | Sirius XM Holdings, Inc. | | | | |

| | 52 | | Expiration: September 2014, Exercise Price: $3.50 | | | 780 | |

| | 604 | | Expiration: December 2014, Exercise Price: $3.50 | | | 13,288 | |

| | | | SLM Corporation | | | | |

| | 33 | | Expiration: July 2014, Exercise Price: $24.00 | | | 6,682 | |

| | 15 | | Expiration: July 2014, Exercise Price: $25.00 | | | 1,583 | |

| | 27 | | Expiration: July 2014, Exercise Price: $26.00 | | | 945 | |

| | 31 | | Expiration: October 2014, Exercise Price: $25.00 | | | 4,635 | |

| | 61 | | Expiration: October 2014, Exercise Price: $26.00 | | | 5,185 | |

| | | | Sprint Corporation | | | | |

| | 328 | | Expiration: August 2014, Exercise Price: $8.00 | | | 27,880 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF OPTIONS WRITTEN (continued)

June 30, 2014 (Unaudited)

| Contracts (100 shares per contract) | | Value | |

| | | Time Warner Cable, Inc. | | | |

| | 17 | | Expiration: July 2014, Exercise Price: $135.00 | | $ | 20,995 | |

| | 9 | | Expiration: July 2014, Exercise Price: $140.00 | | | 6,975 | |

| | 5 | | Expiration: October 2014, Exercise Price: $140.00 | | | 4,950 | |

| | | | The Timken Company | | | | |

| | 28 | | Expiration: September 2014, Exercise Price: $62.50 | | | 18,200 | |

| | | | T-Mobile U.S., Inc. | | | | |

| | 44 | | Expiration: August 2014, Exercise Price: $30.00 | | | 18,150 | |

| | 88 | | Expiration: August 2014, Exercise Price: $31.00 | | | 29,920 | |

| | | | Transocean, Ltd. | | | | |

| | 11 | | Expiration: August 2014, Exercise Price: $41.00 | | | 4,840 | |

| | 1 | | Expiration: August 2014, Exercise Price: $44.00 | | | 206 | |

| | | | Verizon Communications, Inc. | | | | |

| | 8 | | Expiration: August 2014, Exercise Price: $47.00 | | | 1,544 | |

| | 7 | | Expiration: August 2014, Exercise Price: $48.00 | | | 816 | |

| | 4 | | Expiration: August 2014, Exercise Price: $49.00 | | | 248 | |

| | | | Vivendi SA | | | | |

| | 117 | | Expiration: September 2014, Exercise Price: EUR 19.00 (a) | | | 2,563 | |

| | | | Vodafone Group plc — ADR | | | | |

| | 8 | | Expiration: July 2014, Exercise Price: $37.00 | | | 40 | |

| | 6 | | Expiration: October 2014, Exercise Price: $35.00 | | | 462 | |

| | 10 | | Expiration: October 2014, Exercise Price: $37.00 | | | 380 | |

| | | | Walgreen Company | | | | |

| | 20 | | Expiration: September 2014, Exercise Price: $70.00 | | | 12,350 | |

| | | | Weyerhaeuser Company | | | | |

| | 14 | | Expiration: July 2014, Exercise Price: $29.00 | | | 5,810 | |

| | | | Yahoo!, Inc. | | | | |

| | 21 | | Expiration: July 2014, Exercise Price: $32.00 | | | 6,930 | |

| | 25 | | Expiration: July 2014, Exercise Price: $36.00 | | | 1,925 | |

| | | | | | | 1,311,863 | |

| PUT OPTIONS WRITTEN | | | | |

| | | | CBOE Volatility Index | | | | |

| | 8 | | Expiration: July 2014, Exercise Price: $12.00 | | | 320 | |

| | 7 | | Expiration: July 2014, Exercise Price: $13.00 | | | 777 | |

| | 22 | | Expiration: July 2014, Exercise Price: $14.00 | | | 4,268 | |

| | 33 | | Expiration: August 2014, Exercise Price: $13.00 | | | 3,300 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF OPTIONS WRITTEN (continued)

June 30, 2014 (Unaudited)

| Contracts (100 shares per contract) | | Value | |

| | | SPDR S&P 500 ETF Trust | | | |

| | 39 | | Expiration: August 2014, Exercise Price: $183.00 | | $ | 2,087 | |

| | 11 | | Expiration: August 2014, Exercise Price: $184.00 | | | 671 | |

| | 36 | | Expiration: December 2014, Exercise Price: $170.00 | | | 6,264 | |

| | | | | | | 17,687 | |

| | | | TOTAL OPTIONS WRITTEN | | | | |

| | | | (Premiums received $926,397) | | $ | 1,329,550 | |

ADR – American Depository Receipt

ETF – Exchange-Traded Fund

EUR – Euro

plc – Public Limited Company

REIT – Real Estate Investment Trust

(a)Level 2 Security. Please see Note 2 on the Notes to the Financial Statements.

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF FORWARD CURRENCY EXCHANGE CONTRACTS*

June 30, 2014 (Unaudited)

| | | | | | | U.S. | | | | | | | U.S. | | | | |

| | | | | | | $ Value at | | | | | | | $ Value at | | | Unrealized | |

| Settlement | | Currency to | | June 30, | | | Currency to | | June 30, | | | Appreciation | |

| Date | | be Delivered | | 2014 | | | be Received | | 2014 | | | (Depreciation)** | |

| 8/20/14 | | 22,596 | | Australian Dollars | | $ | 21,226 | | | 20,788 | | U.S. Dollars | | $ | 20,788 | | | $ | (438 | ) |

| 8/21/14 | | 122,904 | | Australian Dollars | | | 115,444 | | | 113,165 | | U.S. Dollars | | | 113,165 | | | | (2,279 | ) |

| 9/24/14 | | 78,195 | | Australian Dollars | | | 73,277 | | | 71,814 | | U.S. Dollars | | | 71,814 | | | | (1,463 | ) |

| 8/20/14 | | 3,420 | | Canadian Dollars | | | 3,201 | | | 3,132 | | U.S. Dollars | | | 3,132 | | | | (69 | ) |

| 7/17/14 | | 122,001 | | Euros | | | 167,067 | | | 166,106 | | U.S. Dollars | | | 166,106 | | | | (961 | ) |

| 7/23/14 | | 259,400 | | Euros | | | 355,229 | | | 357,744 | | U.S. Dollars | | | 357,744 | | | | 2,515 | |

| 7/23/14 | | 8,698 | | U.S. Dollars | | | 8,698 | | | 6,400 | | Euros | | | 8,765 | | | | 67 | |

| 9/26/14 | | 328,900 | | Euros | | | 450,514 | | | 448,623 | | U.S. Dollars | | | 448,623 | | | | (1,891 | ) |

| 10/22/14 | | 60,071 | | Euros | | | 82,292 | | | 81,976 | | U.S. Dollars | | | 81,976 | | | | (316 | ) |

| 8/20/14 | | 286,288 | | Hong Kong Dollars | | | 36,923 | | | 36,919 | | U.S. Dollars | | | 36,919 | | | | (4 | ) |

| 7/9/14 | | 258,800 | | Japanese Yen | | | 2,555 | | | 2,548 | | U.S. Dollars | | | 2,548 | | | | (7 | ) |

| | | | | | | $ | 1,316,426 | | | | | | | $ | 1,311,580 | | | $ | (4,846 | ) |

| * | JPMorgan Chase & Co. Inc. is the counterparty for all open forward currency exchange contracts held by the Fund as of June 30, 2014. |

| ** | Unrealized appreciation is a receivable and unrealized depreciation is a payable on the Statement of Assets and Liabilities. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

SCHEDULE OF SWAP CONTRACTS

June 30, 2014 (Unaudited)

| | | | | | | | | | | Unrealized | | | |

| Termination | | | | | | | | | | Appreciation | | | |

| Date | | Security | | Shares | | | Notional | | | (Depreciation)* | | | Counterparty |

| LONG TOTAL RETURN SWAP CONTRACTS | | | | | | | | | | | |

| 4/30/15 | | Alstom SA | | 9,000 | | | $ | 328,118 | | | $ | (36,549 | ) | | JPMorgan Chase & Co. Inc. |

| 12/3/14 | | GrainCorp, Ltd. | | 9,238 | | | | 73,172 | | | | (148 | ) | | JPMorgan Chase & Co. Inc. |

| 10/18/14 | | Hillgrove Resources, Ltd. | | 113,277 | | | | 8,438 | | | | (221 | ) | | JPMorgan Chase & Co. Inc. |

| 12/19/14 | | Koninklijke KPN NV | | 45,574 | | | | 166,058 | | | | 3,311 | | | JPMorgan Chase & Co. Inc. |

| 5/28/15 | | PetroLogistics LP | | 14,924 | | | | 214,309 | | | | 1,093 | | | Merrill Lynch & Co. Inc. |

| 6/3/15 | | SAI Global, Ltd. | | 22,760 | | | | 109,669 | | | | 1,851 | | | JPMorgan Chase & Co. Inc. |

| 3/3/15 | | Toko, Inc. | | 647 | | | | 1,961 | | | | (513 | ) | | JPMorgan Chase & Co. Inc. |

| 8/20/14 | | Vivendi SA | | 16,500 | | | | 403,745 | | | | (28,626 | ) | | JPMorgan Chase & Co. Inc. |

| 1/28/15 | | Ziggo NV (a) | | 5,461 | | | | 252,874 | | | | 13,145 | | | JPMorgan Chase & Co. Inc. |

| | | | | | | | | | | | | | | | |

| SHORT TOTAL RETURN SWAP CONTRACTS | | | | | | | | | | | | | |

| 3/26/15 | | AMEC plc | | (1,722 | ) | | | (35,806 | ) | | | (3,967 | ) | | JPMorgan Chase & Co. Inc. |

| | | | | | | | | | | | $ | (50,624 | ) | | |

plc – Public Limited Company

| * | Based on the net value of each counterparty, unrealized appreciation is a receivable and unrealized depreciation is a payable on the Statement of Assets and Liabilities. |

| (a) | Security fair valued by the Adviser in good faith in accordance with the policies adopted by the Board of Trustees. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2014 (Unaudited)

| ASSETS: | | | | | | |

| Investments, at value (Cost $22,396,961) | | | | | $ | 23,934,654 | |

| Receivable from brokers | | | | | | 2,735,956 | |

| Deposits at brokers | | | | | | 386,935 | |

| Receivable for forward currency exchange contracts | | | | | | 2,582 | |

| Receivable for swap contracts | | | | | | 1,093 | |

| Receivable for investments sold | | | | | | 475,721 | |

| Dividends and interest receivable | | | | | | 49,417 | |

| Receivable for fund shares issued | | | | | | 43,357 | |

| Swap dividends receivable | | | | | | 36,321 | |

| Prepaid expenses and other receivables | | | | | | 5,177 | |

| Total Assets | | | | | | 27,671,213 | |

| LIABILITIES: | | | | | | | |

| Securities sold short, at value (proceeds of $2,735,956) | | $ | 3,049,514 | | | | | |

| Written option contracts, at value (premiums received $926,397) | | | 1,329,550 | | | | | |

| Payable for forward currency exchange contracts | | | 7,428 | | | | | |

| Payable for swap contracts | | | 51,717 | | | | | |

| Payable for investments purchased | | | 508,814 | | | | | |

| Accrued expenses and other liabilities | | | 63,785 | | | | | |

| Dividends and interest payable | | | 4,265 | | | | | |

| Payable to the investment adviser | | | 909 | | | | | |

| Swap dividends payable | | | 825 | | | | | |

| Payable for fund shares redeemed | | | 158 | | | | | |

| Total Liabilities | | | | | | | 5,016,965 | |

| NET ASSETS | | | | | | $ | 22,654,248 | |

| NET ASSETS CONSISTS OF: | | | | | | | | |

| Accumulated undistributed net investment income | | | | | | $ | 897,869 | |

| Accumulated net realized loss on investments, securities sold short, | | | | | | | | |

| written option contracts expired or closed, swap contracts, foreign | | | | | | | | |

| currency translation and forward currency exchange contracts | | | | | | | (507,229 | ) |

| Net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | $ | 1,537,693 | | | | | |

| Securities sold short | | | (313,558 | ) | | | | |

| Written option contracts | | | (403,153 | ) | | | | |

| Swap contracts | | | (50,624 | ) | | | | |

| Forward currency exchange contracts | | | (4,846 | ) | | | | |

| Net unrealized appreciation | | | | | | | 765,512 | |

| Paid-in capital | | | | | | | 21,498,096 | |

| Total Net Assets | | | | | | $ | 22,654,248 | |

| NET ASSET VALUE and offering price per share* | | | | | | | | |

| ($22,654,248 / 2,016,152 shares of beneficial interest outstanding) | | | | | | $ | 11.24 | |

| * | The redemption price per share may vary based on the length of time a shareholder holds Fund shares. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2014 (Unaudited)

| INVESTMENT INCOME: | | | | | | |

| Interest | | | | | $ | 31,588 | |

| Dividend income on long positions (net of foreign withholding taxes of $227) | | | | | | 687,141 | |

| Total investment income | | | | | | 718,729 | |

| EXPENSES: | | | | | | | |

| Investment advisory fees | | $ | 125,612 | | | | | |

| Professional fees | | | 39,120 | | | | | |

| Transfer agent and shareholder servicing agent fees | | | 31,796 | | | | | |

| Fund accounting expense | | | 26,819 | | | | | |

| Administration fees | | | 13,937 | | | | | |

| Reports to shareholders | | | 7,339 | | | | | |

| Custody fees | | | 3,658 | | | | | |

| Trustees’ fees and expenses | | | 3,547 | | | | | |

| Miscellaneous expenses | | | 3,487 | | | | | |

| Federal and state registration fees | | | 451 | | | | | |

| Borrowing expense on securities sold short | | | 7,070 | | | | | |

| Dividends on securities sold short | | | 13,452 | | | | | |

| Total expenses before expense waiver by adviser | | | | | | | 276,288 | |

| Less: Expense reimbursed by Adviser (Note 3) | | | | | | | (115,080 | ) |

| Net expenses | | | | | | | 161,208 | |

| NET INVESTMENT INCOME | | | | | | | 557,521 | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | | |

| Realized gain (loss) on: | | | | | | | | |

| Investments | | | (147,541 | ) | | | | |

| Securities sold short | | | (13,276 | ) | | | | |

| Written option contracts expired or closed | | | (47,526 | ) | | | | |

| Swap contracts | | | 54,866 | | | | | |

| Foreign currency translation | | | (152 | ) | | | | |

| Forward currency exchange contracts | | | (32,628 | ) | | | | |

| Net realized loss | | | | | | | (186,257 | ) |

| Change in unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | 514,428 | | | | | |

| Securities sold short | | | (141,410 | ) | | | | |

| Written option contracts | | | (145,073 | ) | | | | |

| Swap contracts | | | (40,963 | ) | | | | |

| Forward currency exchange contracts | | | 32,404 | | | | | |

| Net unrealized appreciation | | | | | | | 219,386 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | | | | 33,129 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | | | | $ | 590,650 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | Year Ended | |

| | | June 30, 2014 | | | December 31, 2013 | |

| | | (Unaudited) | | | | |

| Net investment income | | $ | 557,521 | | | $ | 26,650 | |

| Net realized gain (loss) on investments, securities sold short, | | | | | | | | |

| written option contracts expired or closed, swap contracts, | | | | | | | | |

| foreign currency translation and forward currency exchange contracts | | | (186,257 | ) | | | 233,046 | |

| Change in unrealized appreciation on investments, securities sold short, | | | | | | | | |

| written option contracts, swap contracts, foreign currency translation | | | | | | | | |

| and forward currency exchange contracts | | | 219,386 | | | | 400,494 | |

| Net increase in net assets resulting from operations | | | 590,650 | | | | 660,190 | |

| | | | | | | | | |

| Distributions to shareholders from: (Note 5) | | | | | | | | |

| Net investment income | | | — | | | | (49,575 | ) |

| Net realized gains | | | — | | | | — | |

| Total dividends and distributions – Single Class | | | — | | | | (49,575 | ) |

| | | | | | | | | |

| Net increase in net assets from capital share transactions (Note 4) | | | 2,985,406 | | | | 4,083,274 | |

| Net increase in net assets | | | 3,576,056 | | | | 4,693,889 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 19,078,192 | | | | 14,384,303 | |

| End of period (including accumulated undistributed net | | | | | | | | |

| investment income of $897,869 and $340,348, respectively) | | $ | 22,654,248 | | | $ | 19,078,192 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

FINANCIAL HIGHLIGHTS

Selected per share data is based on a share of beneficial interest outstanding throughout each period.

| | | Six Months Ended | | | Year Ended December 31, | |

| | | June 30, 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010(1) | | | 2009(1) | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

| Net Asset Value, beginning of period | | $ | 10.92 | | | $ | 10.54 | | | $ | 10.44 | | | $ | 11.03 | | | $ | 10.70 | | | $ | 9.88 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.30 | (2) | | | 0.02 | (2) | | | (0.04 | )(2) | | | (0.13 | )(2) | | | 0.02 | (3) | | | (0.35 | )(3) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| gain on investments | | | 0.02 | | | | 0.39 | | | | 0.30 | | | | 0.23 | | | | 0.54 | | | | 1.53 | |

| Total from investment operations | | | 0.32 | | | | 0.41 | | | | 0.26 | | | | 0.10 | | | | 0.56 | | | | 1.18 | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | — | | | | (0.03 | ) | | | — | | | | — | | | | — | | | | (0.35 | ) |

| From net realized gains | | | — | | | | — | | | | (0.16 | ) | | | (0.69 | ) | | | (0.23 | ) | | | (0.01 | ) |

| Total dividends and distributions | | | — | | | | (0.03 | ) | | | (0.16 | ) | | | (0.69 | ) | | | (0.23 | ) | | | (0.36 | ) |

| Net Asset Value, end of period | | $ | 11.24 | | | $ | 10.92 | | | $ | 10.54 | | | $ | 10.44 | | | $ | 11.03 | | | $ | 10.70 | |

| Total Return | | | 2.93 | %(5) | | | 3.88 | % | | | 2.52 | % | | | 0.87 | % | | | 5.30 | % | | | 11.80 | % |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 22,654 | | | $ | 19,078 | | | $ | 14,384 | | | $ | 14,326 | | | $ | 14,817 | | | $ | 9,710 | |

| Ratio of gross expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 2.75 | %(4) | | | 2.96 | % | | | 3.06 | % | | | 3.44 | % | | | 5.26 | % | | | 7.82 | % |

| After expense waiver | | | 1.60 | %(4) | | | 1.65 | % | | | 1.92 | % | | | 2.19 | % | | | 3.16 | % | | | 4.28 | % |

| Ratio of dividends and borrowing | | | | | | | | | | | | | | | | | | | | | | | | |

| expense on securities sold short | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 0.20 | %(4) | | | 0.25 | % | | | 0.52 | % | | | 0.79 | % | | | 1.76 | % | | | 2.88 | % |

| Ratio of operating expenses to average | | | | | | | | | | | | | | | | | | | | | | | | |

| net assets excluding dividends and | | | | | | | | | | | | | | | | | | | | | | | | |

| borrowing expense on securities sold short | | | 1.40 | %(4) | | | 1.40 | % | | | 1.40 | % | | | 1.40 | % | | | 1.40 | % | | | 1.40 | % |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | | | | | | |

| (loss) to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 4.40 | %(4) | | | (1.15 | )% | | | (1.57 | )% | | | (2.44 | )% | | | (4.29 | )% | | | (5.69 | )% |

| After expense waiver | | | 5.55 | %(4) | | | 0.16 | % | | | (0.43 | )% | | | (1.19 | )% | | | (2.19 | )% | | | (2.15 | )% |

Portfolio turnover rate(6) | | | 67.06 | %(5) | | | 195.96 | % | | | 268.78 | % | | | 272.58 | % | | | 187.18 | % | | | 373.07 | % |

| (1) | Performance data included for periods prior to 2011 reflect that of Westchester Capital Management, Inc. the Fund’s prior investment adviser. See Note 1 for additional information. |

| (2) | Net investment income (loss) per share has been calculated based on average shares outstanding during the period. |

| (3) | Net investment income (loss) per share is calculated using ending balance after consideration of adjustments for permanent book and tax differences. |

| (4) | Annualized. |

| (5) | Not annualized. |

| (6) | The numerator for the portfolio turnover rate includes the lesser of purchases or sales (excluding short positions). The denominator includes the average long positions throughout the period. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS

June 30, 2014 (Unaudited)

Note 1 — ORGANIZATION

The Merger Fund VL (the “Fund”) is a no-load, open-end, diversified investment company organized as a statutory trust under the laws of Delaware on November 22, 2002, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund commenced operations on May 26, 2004. In a transaction that closed on December 31, 2010, Westchester Capital Management, Inc. transferred substantially all of its business and assets to Westchester Capital Management, LLC (the “Adviser”), which became the Fund’s investment adviser. Therefore, the performance information included herein for periods prior to 2011 reflect the performance of Westchester Capital Management, Inc. Roy Behren and Michael Shannon, the Fund’s current portfolio managers, assumed portfolio management duties for the Fund in January 2007. The investment objective of the Fund is to seek to achieve capital growth by engaging in merger arbitrage. Merger arbitrage is a highly specialized investment approach generally designed to profit from the successful completion of publicly announced mergers, takeovers, tender offers, leveraged buyouts, liquidations and other types of corporate reorganizations. The Fund’s shares are currently offered only to separate accounts funding variable annuity and variable life insurance contracts. At June 30, 2014, 95.7% of the shares outstanding of the Fund were owned by three insurance companies. Activities of these shareholders may have a significant effect on the operations of the Fund.

Note 2 — SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were available to be issued. The presentation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and assumptions.

The following is a summary of the Fund’s pricing procedures. It is intended to be a general discussion and may not necessarily reflect all pricing procedures followed by the Fund.

Securities listed on the NASDAQ are valued at the NASDAQ Official Closing Price (“NOCP”). Investments in registered open-end investment companies other than exchange-traded funds are valued at their reported net asset value (“NAV”). Equity securities that are traded on a national securities exchange are valued at the last sale price at the close of that exchange. The securities valued using quoted prices in active markets are classified as Level 1 investments. Securities not listed on an exchange, but for which market transaction prices are reported, are valued at the last sale price as of the close of the New York Stock Exchange. If such a security does not trade on a particular day, then the mean between the closing bid and asked prices will be used. These securities are classified as Level 2 investments. In pricing corporate bonds and other debt

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2014 (Unaudited)

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

securities that are not obligations of the U.S. Government or its agencies, the mean of the bid and asked prices provided by a third party is used. These are classified as Level 2 investments. As a secondary source, an individual broker bid may be used to value debt securities if the Adviser reasonably believes such bid is an actionable bid in that the broker would be willing to transact at that price. These securities are generally classified as Level 2 or Level 3 investments.

Exchange-traded options are valued at the higher of the intrinsic value of the option (i.e., what the Fund would pay or can receive upon the option being exercised) or the last reported composite sale price. If no sales are reported or if the last sale is outside the bid and asked parameters, the higher of the intrinsic value of the option or the mean between the last reported bid and asked price is used. Non-exchange-traded options will be valued at the higher of the intrinsic value of the option or at the price supplied by the counterparty. Options for which there is an active market are classified as Level 1 investments, but options not listed on an exchange are classified as Level 2 investments. Investments in United States government securities (other than short-term securities) are valued at the mean between the 4:00 PM bid and asked prices supplied by a third party vendor. Short-term fixed-income securities having a maturity of less than 60 days are valued at amortized cost.

Securities for which there are no market quotations readily available or for which such quotations are unreliable are valued at fair value as determined in accordance with procedures adopted by the Board of Trustees of the Fund (“the Board of Trustees” or “Trustees”) and under the supervision of the Board of Trustees. The factors for fair valuation the Adviser may consider include, among other things: fundamental analytical data; the nature and duration of restrictions on disposition; an evaluation of forces that influence the market in which the securities are purchased and sold; public trading in similar securities of the issuer or comparable issuers. When fair-value pricing is employed, the prices of securities used by the Fund to calculate its NAV may differ from quoted or published prices for the same securities. These securities are generally classified as Level 2 or 3 depending on the inputs as described below. At June 30, 2014, securities fair valued in good faith based on the absolute value of long investments and securities sold short and based on the absolute value of unrealized gains or losses on swap contracts represented 0.12% of net assets.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | Level 1 — | Quoted prices in active markets for identical securities. |

| | Level 2 — | Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| | Level 3 — | Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2014 (Unaudited)

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following tables provide the fair value measurements of applicable Fund assets and liabilities by level within the fair value hierarchy for the Fund as of June 30, 2014. These assets and liabilities are measured on a recurring basis.

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | Assets | | | | | | | | | | | | |

| | Common Stocks* | | $ | 18,988,949 | | | $ | — | | | $ | — | | | $ | 18,988,949 | |

| | Contingent Value Rights | | | — | | | | — | | | | 670 | | | | 670 | |

| | Warrants | | | 16 | | | | — | | | | — | | | | 16 | |

| | Corporate Bonds | | | — | | | | 823,094 | | | | — | | | | 823,094 | |

| | Municipal Bonds | | | — | | | | 170,593 | | | | — | | | | 170,593 | |

| | Purchased Option Contracts | | | 59,569 | | | | 1,420 | | | | — | | | | 60,989 | |

| | Escrow Notes | | | — | | | | — | | | | 14,186 | | | | 14,186 | |

| | Short-Term Investments | | | 3,876,157 | | | | — | | | | — | | | | 3,876,157 | |

| | Swap Contracts** | | | — | | | | 1,093 | | | | — | | | | 1,093 | |

| | Forward Currency | | | | | | | | | | | | | | | | |

| | Exchange Contracts** | | | — | | | | 2,582 | | | | — | | | | 2,582 | |

| | Liabilities | | | | | | | | | | | | | | | | |

| | Common Stocks Sold Short | | $ | 3,049,514 | | | $ | — | | | $ | — | | | $ | 3,049,514 | |

| | Written Option Contracts | | | 1,313,456 | | | | 16,094 | | | | — | | | | 1,329,550 | |

| | Swap Contracts** | | | — | | | | 51,717 | | | | — | | | | 51,717 | |

| | Forward Currency | | | | | | | | | | | | | | | | |

| | Exchange Contracts** | | | — | | | | 7,428 | | | | — | | | | 7,428 | |

| * | | Please refer to the Schedule of Investments to view common stocks segregated by industry type. |

| ** | | Swap contracts and forward currency exchange contracts are valued at the net unrealized appreciation (depreciation) on the instrument. |

The Level 2 securities are priced using inputs such as current yields, discount rates, credit quality, yields on comparable securities, trading volume, maturity date, market bid and ask prices, prices on comparable securities and other significant inputs. There were no transfers into or out of Level 1 or 2 Securities during the period.

Level 3 Reconciliation Disclosure

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value.

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2014 (Unaudited)

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

| | Description | | Investments | | |

| | Balance as of December 31, 2013 | | $ | 133,441 | | |

| | Change in unrealized depreciation | | | (44,351 | ) | |

| | Net purchases | | | 670 | | |

| | Net sales | | | (74,904 | ) | |

| | Balance as of June 30, 2014 | | $ | 14,856 | | |

Significant unobservable valuation inputs developed by the Board of Trustees for material Level 3 investments as of June 30, 2014, are as follows:

| | | | Fair Value at | | Valuation | | Unobservable | | | |

| | Description | | June 30, 2014 | | Technique | | Input | | Range | |

| | Escrow Notes | | $ | 14,186 | | Broker Quote | | No Active Market | | 1.80 – 1.90 | |

| | Escrow Notes | | $ | — | | Projected Final | | Final Distribution | | 0.00 | |

| | | | | | | Distribution(1) | | | | | |

| | Contingent Value | | | | | | | | | | |

| | Rights Sold Short | | $ | 670 | | Broker Quote | | No Active Market | | 2.40 – 2.60 | |

| | (1) | This Level 3 security was received through a corporate action and is being priced at an estimate of the expected final distribution. |

The Fund may sell securities or currencies short for economic hedging purposes or any other investment purpose. For financial statement purposes, an amount equal to the settlement amount is initially included in the Statement of Assets and Liabilities as an asset and an equivalent liability. The amount of the liability is subsequently priced to reflect the current value of the short position. Subsequent fluctuations in the market prices of securities or currencies sold, but not yet purchased, may require purchasing the securities or currencies at prices which may differ from the market value reflected on the Statement of Assets and Liabilities. Short sale transactions result in off balance sheet risk because the ultimate obligation may exceed the related amounts shown in the Statement of Assets and Liabilities. The Fund will incur a loss if the price of the security increases between the date of the short sale and the date on which the Fund purchases the security to replace the borrowed security. The Fund’s loss on a short sale is potentially unlimited because there is no upward limit on the price a borrowed security could attain.

The Fund is liable for any dividends payable on securities while those securities are sold short. Until the security is replaced, the Fund is required to pay to the lender any income earned, which is recorded as an expense by the Fund. The Fund generally segregates liquid assets in an amount equal to the market value of securities sold short. These assets are required to be adjusted daily to reflect changes in the value of the securities or currencies sold short.

| C. | Transactions with Brokers for Securities Sold Short |

The Fund’s receivables from brokers for proceeds on securities sold short and deposits at brokers for securities sold short are with two securities dealers. The Fund does not require the brokers to maintain collateral in support of the receivable from the brokers for proceeds on securities sold short. The Fund is required by the brokers to maintain collateral at the brokers for

The Merger Fund VL

NOTES TO THE FINANCIAL STATEMENTS (continued)

June 30, 2014 (Unaudited)

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

securities sold short. The receivable from brokers on the Statement of Assets and Liabilities represents the collateral for securities sold short. The Fund maintains cash deposits at brokers beyond the receivable for short sales. These cash deposits are presented as deposits at brokers on the Statement of Assets and Liabilities. These transactions may involve market risk in excess of the amount of receivable or payable reflected on the Statement of Assets and Liabilities.

No provision for federal income taxes has been made since the Fund has complied to date with the provisions of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and intends to continue to so comply in future years and to distribute investment company net taxable income and net capital gains to shareholders. Additionally, the Fund intends to make all required distributions to avoid federal excise tax.