Filed pursuant to Rule 424(b)(3)

Registration No. 333-106263

PROSPECTUS

| | | WMC Finance (USA) Limited Offer to Exchange US$500,000,000 Guaranteed Notes due 2013 for US$500,000,000 Guaranteed Notes due 2013 | |  |

| | | Offer to Exchange US$200,000,000 Guaranteed Notes due 2033 for US$200,000,000 Guaranteed notes due 2033 The Notes are fully and unconditionally guaranteed by | |

WMC Resources Ltd WMC (Olympic Dam Corporation) Pty Ltd WMC Fertilizers Pty Ltd |

WMC Finance (USA) Limited is offering to exchange up to US$500,000,000 of its new 5.125% Guaranteed Notes due 2013 and up to US$200,000,000 of its new 6.250% Guaranteed Notes due 2033 all of which have been registered under the U.S. Securities Act of 1933 and are referred to collectively as the New Notes for any and all of its outstanding 5.125% Guaranteed Notes due 2013 and 6.250% Guaranteed Notes due 2033, respectively, which were sold previously in private placements and which are referred to collectively as the Old Notes.

See “Risk Factors” beginning on page 16 for a discussion of material risks associated with the exchange offer, our business and the New Notes.

WMC Finance (USA) Limited will exchange New Notes for all Old Notes that are validly tendered and not withdrawn before expiration of the exchange offer relating to that series of Old Notes. You may withdraw tenders of Old Notes at any time prior to the expiration of the exchange offer relating to that series of Old Notes. The exchange procedure is more fully described in “The Exchange Offers—Procedures for Tendering” beginning on page 117.

The terms of the New Notes are identical in all material respects to those of the Old Notes, except that the transfer restrictions, registration rights and provisions for special interest applicable to the Old Notes do not apply to the New Notes. See “Description of the New Notes and Guarantees” beginning on page 126 for more details on the terms of the New Notes.

We will not receive any proceeds from the exchange offers.

There is no established trading market for the New Notes or the Old Notes. However, we have applied to list the New Notes on the Luxembourg Stock Exchange.

The exchange of Old Notes for New Notes should not be a taxable event for United States federal income tax purposes. See “Material Tax Consequences—United States Taxation” on page 149.

All broker-dealers must comply with the registration and prospectus delivery requirements of the Securities Act. See “Plan of Distribution” on page 154.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated June 26, 2003.

Information in our exchange offer registration statement is available to holders of Notes without charge upon written or oral request. Please contact The Bank of New York, attention Mr. Santino Ginocchietti, at 101 Barclay Street, 7th Floor, East, New York, New York 10286, telephone (212) 815-6331, fax (212) 815-1915 to make a request. To obtain timely delivery, any request should be made no later than five business days prior to the date you need the information.

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the notes offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

TABLE OF CONTENTS

In this prospectus, the terms “we”, “our”, “us”, “WMC Resources” and “WMC Resources Group” refer to WMC Resources Ltd together with its subsidiaries (including the issuer). We refer to WMC Finance (USA) Limited as “WMC Finance (USA)” or the “issuer”. We also refer to WMC Resources Ltd as the “parent guarantor” and to WMC (Olympic Dam Corporation) Pty Ltd and WMC Fertilizers Pty Ltd as the subsidiary guarantors. We refer to the parent guarantor and the subsidiary guarantors collectively as the “guarantors”.

In this prospectus, we rely on and refer to information and statistics regarding our industry. We obtained these market data from independent industry publications or other publicly available information. Although we believe that these sources are reliable, we have not independently verified and do not guarantee the accuracy and completeness of this information.

This prospectus contains summaries believed to be accurate with respect to certain documents, but reference is made to the actual documents for complete information. All such summaries are qualified in their entirety by such reference. Copies of documents referred to herein will be made available to you upon request to us.

SUMMARY

This summary highlights selected information from this prospectus and does not contain all of the information that may be important to you. You should read this entire prospectus carefully, including the risk factors and financial statements.

We are a diversified mining and resources company involved in the discovery, development, production, processing and marketing of minerals and metals. We produce nickel, copper, uranium oxide, phosphate fertilizers and a range of other intermediate products from a portfolio of three quality businesses:

| | • | | Nickel Business Unit—a fully integrated nickel mining, concentrating, smelting and refining business in Western Australia, |

| | • | | Olympic Dam—a copper-uranium mining, smelting and refinery business in South Australia, and |

| | • | | Queensland Fertilizer—a high analysis fertilizer production complex and distribution business in Queensland. |

On November 21, 2001, WMC Limited announced a proposal to demerge its interest in the Alcoa World Alumina and Chemicals venture with Alcoa Inc. from its nickel, copper-uranium and fertilizer businesses and its exploration and development interests. Following approval from the WMC Limited shareholders, the demerger was effected through an Australian court-approved scheme of arrangement and associated capital reduction and dividend distribution. As a result of the demerger, WMC Limited continues to hold its interest in the Alcoa World Alumina and Chemicals venture, but changed its name to Alumina Limited, and we became an independent company, holding the nickel, copper-uranium and fertilizer businesses of, as well as the exploration and development interests previously held by, WMC Limited.

In 2002, our consolidated net loss after tax from continuing operations was A$14.7 million and our net sales revenue from continuing operations was A$2,487.2 million. After giving effect to the demerger, our pro forma consolidated net loss after tax from continuing operations for 2002 was A$3.7 million. At December 31, 2002, we had net assets of A$3,606.6 million and total assets of A$7,348.1 million.

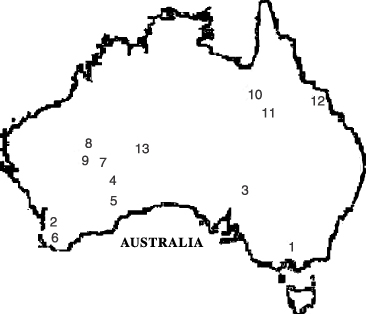

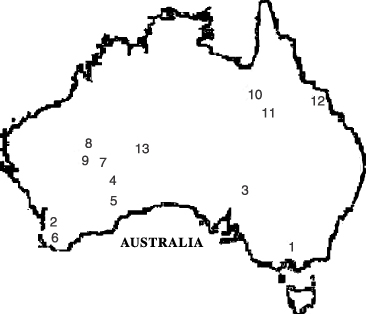

Nickel Business Unit

Our nickel business unit is the world’s third largest producer of contained nickel based on production during 2002. It is a fully integrated nickel business, comprising mines, concentrators, a smelter and a refinery, all located in Western Australia. We operate underground and open-cut nickel mines at Leinster and a large scale open-cut nickel mine at Mount Keith. We concentrate nickel ore at both Leinster and Mount Keith. We also operate a concentrator at Kambalda, which treats nickel ore sourced from third parties in the region. We sell approximately 13% of the total nickel-in-concentrate we produce to export customers and we rail the balance of the nickel-in-concentrate we produce to our nickel smelter in Kalgoorlie. At our Kalgoorlie nickel smelter, we smelt nickel-in-concentrate into nickel matte. We export approximately 28% of the nickel matte we produce at our Kalgoorlie nickel smelter and rail the balance to our Kwinana nickel refinery, where we refine nickel matte to produce LME accredited nickel briquettes and nickel powder. Our Kwinana nickel refinery also produces a number of intermediate products, including copper-sulphide, cobalt-nickel sulphide and ammonium sulphate, which we sell to third parties. We sell nickel metal to customers in Europe, North America and Asia.

In 2002, our nickel business unit produced 106,423 tonnes of contained nickel-in-concentrate, 91,574 tonnes of nickel matte and 65,055 tonnes of nickel metal, and generated net sales revenue of A$1,314.9 million.

1

Olympic Dam

Our copper-uranium business is located at our extensive Olympic Dam operations in South Australia, situated on an ore body with significant copper ore and uranium oxide deposits. Based on 2002 year end reserves, our Olympic Dam mine is the world’s eighth largest copper ore body and the world’s largest uranium oxide deposit. Our operations at Olympic Dam comprise a fully integrated mine and metallurgical complex with three shafts, major underground facilities and rail systems, a grinding and concentrating circuit, a hydrometallurgical plant incorporating solvent extraction circuits for copper and uranium oxide, a copper smelter, a copper refinery and a recovery circuit for precious metals. We produce both LME-accredited electrolytic refined copper cathode and electro-won copper, which is not yet LME accredited. We sell our copper products to customers in Europe, Australia and Asia, while we sell our uranium oxide produced under long-term contracts to electricity-generating utilities in several countries, including the United Kingdom, Finland, Sweden, Belgium, France, Japan, Canada and the United States.

We completed a major expansion project at Olympic Dam in 1999 at a cost of A$1.94 billion, which increased production capacity at the site to 200,000 tonnes of refined copper and 4,300 tonnes of uranium oxide per year. We have also completed an optimization plan at the site to further increase production capacity to 235,000 tonnes of refined copper per year and 4,500 tonnes of uranium oxide per year. Actual production has been affected in recent years, however, by two fires, one in 1999 at the copper solvent extraction plant and one in 2001 in both the copper and uranium solvent extraction plants. We are in the process of repairing the uranium solvent extraction plant and are planning to repair the damage to the copper solvent extraction plant by the end of the first quarter of 2004.

In 2002, our production at Olympic Dam was 178,120 tonnes of refined copper and 2,891 tonnes of uranium oxide and our copper-uranium business unit generated net sales revenue of A$723.3 million.

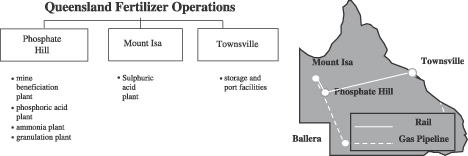

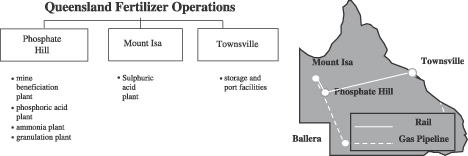

Queensland Fertilizer

Our fertilizer business unit is a vertically integrated production facility that utilizes phosphate rock from our own deposits, sulphuric acid produced from the Mount Isa smelting facilities of MIM Holdings Limited and the Korea Zinc refinery in Townsville and ammonia from natural gas. We produce both di-ammonium phosphate and mono-ammonium phosphate fertilizers. The primary market for our fertilizers is the Australian market, where 74% of our production is sold. The remaining 26% is sold in Asian markets. Our fertilizer operation is Australia’s largest fertilizer production facility and we are currently the only Australian producer of di-ammonium phosphate.

We commenced production of fertilizers at our fertilizer operations during 2001 and we have gradually increased production since. In 2002, we produced 718,287 tonnes of di-ammonium phosphate and 102,713 tonnes of mono-ammonium phosphate and our fertilizer business unit generated net sales revenue of A$420.4 million.

Regional Exploration and New Business

Regional Exploration

Our global minerals exploration program is part of our strategy to seek mineral discoveries that provide significant growth opportunities in places where we can manage the business and technical risks. In 2002, we conducted exploration in Australia, China, Mongolia, Peru, Tanzania and the United States. In Australia, we continued to test nickel, copper sulphide and platinum group metal mineralization in the West Musgrave area of Western Australia.

In 2002, we spent A$23.4 million on minerals exploration for continuing operations.

2

New Business

We had increased our ownership interest to 100% in the Corridor Sands heavy minerals project in December 2002. This project is intended to exploit large, currently undeveloped titanium sands deposits in southern Mozambique. We acquired the interest from Southern Mining Corporation Limited following the completion of a bankable feasibility study on the project in 2002. The Industrial Development Corporation of South Africa exercised an option in May 2003 to acquire a 10% interest in the project, subject to completion of documentation, South African Reserve Bank approval and the completion of a number of key project milestones.

The Issuer

The issuer, WMC Finance (USA) Limited, a corporation organized under the laws of the Commonwealth of Australia, is a wholly-owned finance subsidiary of WMC Resources Ltd. WMC Finance (USA) was formed for the purpose of borrowing funds and advancing the net proceeds of such borrowings to members of the WMC Resources Group.

The principal executive offices of the issuer and each of the guarantors are located at 60 City Road, Level 16, Southbank, Victoria 3006, Australia. Our telephone number is +61-3-9685-6000.

3

The Exchange Offers

On May 8, 2003, WMC Finance (USA) completed the private offering of US$500,000,000 aggregate principal amount of its 5.125% Guaranteed Notes due 2013 and US$200,000,000 aggregate principal amount of its 6.250% Guaranteed Notes due 2033. As part of that offering, the issuer and the guarantors entered into a registration rights agreement with the initial purchasers of the Old Notes in which the issuer and the guarantors agreed, among other things, to deliver this prospectus to you and to complete exchange offers for the Old Notes. Below is a summary of the exchange offers.

Old notes | | 5.125% Guaranteed Notes due 2013 6.250% Guaranteed Notes due 2033 |

| |

New notes | | Notes of the same series, the issuance of which has been registered under the Securities Act of 1933. The terms of the New Notes are identical in all material respects to those of the Old Notes, except that the transfer restrictions, registration rights and provisions for special interest, each relating to the Old Notes, do not apply to the New Notes. |

| |

Terms of the offers | | We are offering to exchange a like amount of New Notes for our Old Notes of the same series in minimum denominations of US$1,000 in principal amount and multiples thereof. In order to be exchanged, an Old Note must be properly tendered and accepted. All Old Notes that are validly tendered and not withdrawn will be exchanged. As of the date of this prospectus, there are US$500,000,000 principal amount of 5.125% Guaranteed Notes due 2013 and US$200,000,000 principal amount of 6.250% Guaranteed Notes due 2033 outstanding. We will issue New Notes promptly after the expiration of the exchange offer relating to the particular series. |

| |

Expiration time | | The exchange offers will expire at 5:00 P.M., New York City time, on August 8, 2003, unless extended as to one or more series. |

| |

Procedures for tendering | | Holders of Old Notes registered in the name of a broker, dealer, commercial bank, trust company or other nominee are urged to contact such person promptly if they wish to tender Old Notes pursuant to the exchange offers. See “The Exchange Offers—Procedures for Tendering.” To tender Old Notes, you must complete and sign a letter of transmittal in accordance with the instructions contained in it and forward it by mail, facsimile or hand delivery, together with any other documents required by the letter of transmittal, to the exchange agent, either with the Old Notes to be tendered or in compliance with the specified procedures for guaranteed delivery of Old Notes. Certain brokers, dealers, commercial banks, trust companies and other nominees may also effect tenders by book-entry transfer. |

4

| | | Letters of transmittal and certificates representing Old Notes should not be sent to us. Such documents should only be sent to the exchange agent. Questions regarding how to tender and requests for information should be directed to the exchange agent. See “The Exchange Offers—Exchange Agent.” |

| |

| Acceptance of Old Notes for exchange; Issuance of New Notes | |

Subject to the conditions stated in “The Exchange Offers—Conditions to the Exchange Offers,” we will accept for exchange any and all Old Notes which are properly tendered in the exchange offer relating to that series before the expiration time for such exchange offer. The New Notes will be delivered promptly after the expiration time with respect to that series. |

| |

Interest payments on the New Notes | | The New Notes will bear interest from the most recent date to which interest has been paid on the Old Notes. If your Old Notes are accepted for exchange, then you will receive interest on the New Notes and not on the Old Notes. |

| |

Withdrawal rights | | You may withdraw your tender at any time before the expiration time for the series tendered. |

| |

Conditions to the exchange offer | | The exchange offers are subject to customary conditions. We may assert or waive these conditions in our sole discretion. In addition, the letter of transmittal contains representations that you will be required to make to us before we will exchange your Old Notes for New Notes. If we materially change the terms of an exchange offer for a series, we will resolicit tenders of the Old Notes of that series. See “The Exchange Offers—Conditions to the Exchange Offers” for more information. |

| |

Resales of New Notes | | Based on interpretations by the staff of the Securities and Exchange Commission, or the SEC, as detailed in a series of no- action letters issued by the SEC to third parties, we believe that the New Notes issued in the exchange offers may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act so long as: • you are acquiring the New Notes in the ordinary course of your business; • you are not participating, do not intend to participate and have no arrangement or understanding with any person to participate in a distribution of the New Notes; and • you are not an “affiliate” of ours. You must represent that you meet the above three requirements if you wish to exchange Old Notes for New Notes in the exchange offers. |

5

| | | If you are an affiliate of ours or are engaged in or intend to engage in or have any arrangement or understanding with any person to participate in the distribution of the New Notes: • you cannot rely on the applicable interpretations of the staff of the SEC; and • you must comply with the registration requirements of the Securities Act in connection with any resale transaction. |

| |

| | | Each broker or dealer that receives New Notes for its own account in exchange for Old Notes that were acquired as a result of market making or other trading activities must acknowledge that it will comply with the registration and prospectus delivery requirements of the Securities Act in connection with any offer to resell or other transfer of the New Notes issued in the exchange offers, including the delivery of a prospectus that contains information with respect to any selling security holder required by the Securities Act in connection with any resale of the New Notes. Furthermore, any broker-dealer that acquired any of its Old Notes directly from us: • may not rely on the applicable interpretation of the staff of the SEC; and • must also be named as a selling security holder in connection with the registration and prospectus delivery requirements of the Securities Act relating to any resale transaction. |

| |

Exchange agent | | The Bank of New York is serving as the exchange agent in connection with the exchange offers. The address and telephone and facsimile numbers of the exchange agent are listed under the heading “The Exchange Offers—Exchange Agent.” |

| |

Use of proceeds | | We will not receive any proceeds from the issuance of New Notes in the exchange offers. We will pay all expenses incident to the exchange offers. See “Use of Proceeds” and “The Exchange Offers—Fees and Expenses.” |

| |

Certain tax considerations | | The exchange offers should not be a taxable exchange for U.S. federal income tax purposes. |

| |

Consequences of failure to exchange | | If we complete the exchange offers and you do not participate, then: • your Old Notes will continue to be subject to the existing restrictions upon their transfer, • we will have no further obligation to provide for the registration under the Securities Act of those Old Notes, except under certain limited circumstances, and, following completion of the exchange offer, those Old Notes will bear interest at the same rate as the New Notes, and • the liquidity of the market for your Old Notes is likely to be adversely affected. |

6

The New Notes

The terms of the New Notes are identical in all material respects to those of the Old Notes, except that the transfer restrictions, registration rights and provisions for special interest applicable to the Old Notes do not apply to the New Notes. The New Notes will evidence the same debt as the Old Notes and will be governed by the same indenture and supplemental indenture. Where we refer to “Notes” in this prospectus, we are referring collectively to both the Old Notes and the New Notes of both series.

Notes offered | | Up to: • US$500,000,000 principal amount of 5.125% Guaranteed Notes due 2013, called the 2013 Notes; and • US$200,000,000 principal amount of 6.250% Guaranteed Notes due 2033, called the 2033 Notes; all of which have been registered under the Securities Act. |

| |

Maturity date | | 2013 Notes: May 15, 2013 2033 Notes: May 15, 2033 |

| |

Interest | | Interest on the New Notes will accrue at the rates per annum set forth on the cover page. Interest on the New Notes will be payable semi-annually in arrears on May 15 and November 15 of each year, commencing on November 15, 2003, to holders of record on the immediately preceding May 1 and November 1. Interest on the New Notes will accrue from the most recent date to which interest has been paid on or, if no interest has been paid, from the date of original issuance of, the Old Notes. |

| |

Ranking | | Each series of New Notes will be unsecured obligations of WMC Finance (USA) and will rank equally in right of payment with all other unsecured and unsubordinated indebtedness of WMC Finance (USA), and the new guarantees will be unsecured obligations of WMC Resources Ltd, WMC (Olympic Dam Corporation) Pty Ltd and WMC Fertilizers Pty Ltd, respectively, and will rank equally in right of payment with all other unsecured and unsubordinated indebtedness of WMC Resources Ltd, WMC (Olympic Dam Corporation) Pty Ltd and WMC Fertilizers Pty Ltd, respectively, except, in each case, indebtedness given preference by applicable law. |

| |

Guarantees | | WMC Resources Ltd will fully and unconditionally guarantee the payment of the principal of, premium, if any, and interest on the New Notes, including any additional amounts which may be payable in respect of the New Notes, as described under “Additional Amounts”. In addition to the parent guarantee, each series of New Notes will be unconditionally guaranteed by the subsidiary guarantors so that such series of New Notes will not be structurally subordinated to |

7

| | | WMC Resources Ltd’s obligations under its US$600 million senior credit facility, dated November 14, 2002, or any other of its funded indebtedness in excess of A$25 million that is guaranteed, from time to time, by either of the subsidiary guarantors. If the obligations of any subsidiary guarantor under all our funded indebtedness in excess of A$25 million terminates, that subsidiary guarantor will also be released from its guarantee of the New Notes. See “Description of the New Notes and Guarantees—Guarantees.” |

|

Further Issues | | We may from time to time, without notice to or the consent of the registered holders of a series of New Notes, create and issue additional debt securities having the same terms as and ranking equally and ratably with the New Notes of that series in all respects, as described more fully in “Description of the New Notes and Guarantees—Further Issues”. |

|

Additional amounts | | In the event that Australian withholding taxes are required to be withheld or deducted from payments on the New Notes or the related guarantees, we will, subject to certain exceptions described in this prospectus, pay such additional amounts as will result, after deduction or withholding of such taxes, in the payment of the amounts which would have been payable in respect of the New Notes or guarantees had no such withholding or deduction been required. See “Description of the New Notes and Guarantees—Special Situations—Payment of Additional Amounts”. |

|

Optional redemption for tax reasons | | Each of the 2013 Notes and the 2033 Notes may be redeemed at the issuer’s option in whole but not in part, at 100% of the principal amount thereof plus accrued interest and any additional amounts due on the date fixed for redemption if certain events occur that would cause the issuer or guarantors to become obligated to pay additional amounts as described under “Description of the New Notes and Guarantees—Special Situations—Optional Tax Redemption”. |

|

Optional redemption | | The issuer may redeem some or all of each series of New Notes at any time or from time to time at a price equal to 100% of the principal amount of the New Notes of such series plus a make- whole premium, and accrued and unpaid interest. See “Description of the New Notes and Guarantees—Special Situations—Optional Redemption”. |

|

Form and denomination | | The New Notes will be issued only in fully registered form without interest coupons and in minimum denominations of US$1,000. The New Notes will be evidenced by a global note for each series deposited with the trustee for the New Notes, as custodian for The Depository Trust Company, or DTC. Beneficial interests in the global notes will be shown on, and transfers of those beneficial |

8

| | | interests can only be made through, records maintained by DTC and its participants. See “Description of the New Notes and Guarantees—Global Notes”. |

|

Listing | | We have applied to list both series of New Notes on the Luxembourg Stock Exchange. |

|

Restrictive covenants | | The issuer and the guarantors have agreed to observe covenants, including covenants as to limitation on the incurrence of liens and limitations on sale and leaseback transactions. See “Description of the New Notes and Guarantees—Restrictive Covenants”. |

|

Trustee | | The Bank of New York is the trustee under the indenture, as supplemented by the first supplemental indenture, both dated as of May 8, 2003. |

|

United States taxation consequences | | We believe that the exchange of your Old Notes for New Notes to be issued in connection with the exchange offers should not result in any gain or loss to you for United States federal income tax purposes. See “Material Tax Consequences—United States Taxation”. |

|

Governing law | | Each series of New Notes, the related guarantees, the indenture and the first supplemental indenture will each be governed by New York law. |

|

Prescription | | Under the laws of New York, claims relating to payment of principal and interest on the New Notes will be prescribed according to the applicable statute of limitations. |

|

Risk factors | | You should consider carefully all of the information set forth in this prospectus and, in particular, the information set forth under “Risk Factors”. |

9

Summary Consolidated Financial Data

The summary financial data appearing below as at December 31, 2002 and 2001 and for the years ended December 31, 2002, 2001 and 2000 are set forth in Australian dollars (except as otherwise indicated), and are extracted, in relevant part, from our audited Consolidated Financial Statements which appear elsewhere in this prospectus. The summary financial data appearing below as at December 31, 2000 and for the year ended December 31, 1999 are extracted, in relevant part, from our audited Combined Financial Statements. The summary financial data appearing below as at December 31, 1999 and 1998 and for the year ended December 31, 1998 are derived from unaudited consolidated financial data that is not included herein. As discussed in Note 1 to our audited Consolidated Financial Statements, these financial statements reflect our statements of income and comprehensive income and balance sheets as if we were a separate consolidated group for all periods presented rather than part of the WMC Limited group. As a result, this historical financial information may not necessarily be indicative of our future financial performance and it does not necessarily reflect what our financial position and results of operations would have been had we operated as a separate, consolidated group during the periods presented. Our audited Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in Australia (“Australian GAAP”), which differ in certain respects from accounting principles generally accepted in the United States of America (“US GAAP”). Note 45 to our audited Consolidated Financial Statements provides an explanation of these differences as they affect us and reconciles from Australian GAAP to US GAAP our net income, comprehensive income, certain balance sheet items, shareholders’ equity and cashflows.

Statement of Financial Performance

| | | Year ended December 31,

| |

| | | 2002(1)

| | | 2002

| | | 2001

| | | 2000

| | 1999

| | | 1998

| |

| | | (millions, except per share amounts) | |

Amounts in accordance with Australian GAAP | | | | | | | | | | | | | | | | | | | | | | | |

Net sales revenue from continuing operations | | US$ | 1,660.5 | | | A$ | 2,487.2 | | | A$ | 2,364.1 | | | A$ | 2,666.0 | | A$ | 1,672.7 | | | A$ | 1,315.1 | |

Profit/(loss) before interest and income tax from continuing operations | | | 78.5 | | | | 117.6 | | | | 71.9 | | | | 782.5 | | | 86.8 | | | | (362.1 | ) |

Net interest expense(2) | | | 83.2 | | | | 124.6 | | | | 140.9 | | | | 148.1 | | | 78.6 | | | | 4.8 | |

Net (loss)/profit from continuing operations | | | (9.8 | ) | | | (14.7 | ) | | | (157.5 | ) | | | 327.2 | | | (5.7 | ) | | | (215.9 | ) |

Net profit from discontinued operations | | | 25.2 | | | | 37.7 | | | | 283.5 | | | | 72.7 | | | 89.8 | | | | 167.4 | |

Net profit/(loss) attributable to shareholders | | | 15.4 | | | | 23.0 | | | | 126.0 | | | | 399.9 | | | 84.1 | | | | (48.5 | ) |

Net income/(loss) from continuing operations per ordinary share ($/share)(4)(7) | | US$ | (0.01 | ) | | A$ | (0.01 | ) | | A$ | (0.14 | ) | | A$ | 0.29 | | A$ | (0.01 | ) | | A$ | (0.19 | ) |

Diluted net income/(loss) from continuing operations per ordinary share ($/share)(6)(7) | | | (0.01 | ) | | | (0.01 | ) | | | (0.14 | ) | | | 0.29 | | | (0.01 | ) | | | (0.19 | ) |

| | | | | | |

Amounts in accordance with US GAAP | | | | | | | | | | | | | | | | | | | | | | | |

Net sales revenue from continuing operations | | US$ | 1,660.5 | | | A$ | 2,487.2 | | | A$ | 2,364.1 | | | A$ | 2,666.0 | | A$ | 1,672.7 | | | A$ | 1,315.1 | |

Net (loss)/profit from continuing operations | | | (81.0 | ) | | | (121.3 | ) | | | (231.5 | ) | | | 241.6 | | | (9.2 | ) | | | (220.8 | ) |

Comprehensive income/(loss) | | | 57.5 | | | | 86.2 | | | | (804.7 | ) | | | 288.4 | | | 2.1 | | | | (98.5 | ) |

Net income/(loss) from continuing operations per ordinary share ($/share)(4)(5)(7) | | US$ | (0.09 | ) | | A$ | (0.14 | ) | | A$ | (0.21 | ) | | A$ | 0.21 | | A$ | (0.02 | ) | | A$ | (0.19 | ) |

Diluted net income/(loss) from continuing operations per ordinary share ($/share)(6)(7) | | | (0.09 | ) | | | (0.14 | ) | | | (0.21 | ) | | | 0.21 | | | (0.02 | ) | | | (0.19 | ) |

10

Statement of Financial Position

| | | As at December 31,

|

| | | 2002(1)

| | 2002

| | 2001

| | 2000

| | 1999

| | 1998

|

| | | (millions) |

Amounts in accordance with Australian GAAP | | | | | | | | | | | | | | | | | | |

Total assets | | US$ | 4,905.6 | | A$ | 7,348.1 | | A$ | 8,242.9 | | A$ | 8,597.0 | | A$ | 7,275.8 | | A$ | 7,374.3 |

Long-term obligations | | | 1,141.0 | | | 1,709.1 | | | 3,476.3 | | | 4,304.2 | | | 3,053.1 | | | 3,592.6 |

Shareholders’ equity | | | 2,407.8 | | | 3,606.6 | | | 3,220.3 | | | 3,123.8 | | | 3,214.3 | | | 3,010.8 |

| | | | | | |

Amounts in accordance with US GAAP | | | | | | | | | | | | | | | | | | |

Total assets | | US$ | 4,437.0 | | A$ | 6,646.2 | | A$ | 6,691.4 | | A$ | 8,368.2 | | A$ | 7,146.7 | | A$ | 7,296.6 |

Long-term obligations | | | 1,141.0 | | | 1,709.1 | | | 3,476.3 | | | 4,304.2 | | | 3,053.1 | | | 3,592.6 |

Shareholders’ equity | | | 1,721.6 | | | 2,578.8 | | | 2,068.8 | | | 2,888.9 | | | 3,071.7 | | | 2,893.7 |

Statement of Cash Flows

| | | Year ended December 31,

| |

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| | | 1998

| |

| | | (millions) | |

Amounts in accordance with Australian GAAP | | | | | | | | | | | | | | | | | | | | |

Net cash provided by operating activities | | A$ | 336.7 | | | A$ | 577.7 | | | A$ | 898.1 | | | A$ | 164.9 | | | A$ | 172.3 | |

Net cash provided by/(used in) investing activities | | | (381.0 | ) | | | 279.1 | | | | (419.3 | ) | | | (624.7 | ) | | | (1,337.6 | ) |

Net cash (used in)/provided by financing activities | | | 15.8 | | | | (793.7 | ) | | | (508.9 | ) | | | 485.1 | | | | 1,128.8 | |

Net increase/(decrease) in cash held | | | (28.5 | ) | | | 63.1 | | | | (30.1 | ) | | | 25.3 | | | | (36.5 | ) |

Other financial data

| | | Year ended December 31,

| |

| | | 2002(1)

| | 2002

| | 2001

| | 2000

| | 1999

| | 1998

| |

| | | (millions) | |

EBITDA(3) | | US$ | 350.6 | | A$ | 525.1 | | A$ | 399.3 | | A$ | 1,059.2 | | A$ | 320.7 | | A$ | (82.6 | ) |

Capital expenditure | | | 313.4 | | | 469.4 | | | 456.9 | | | 468.6 | | | 984.9 | | | 1,932.0 | |

| (1) | | Australian dollar amounts have been translated into US dollars solely for the convenience of the reader at the rate of A$1.00 = US$0.6676, the Noon Buying Rate on June 16, 2003. A significant portion of the Company’s liabilities and revenues and a portion of the assets and expenses are denominated in currencies other than Australian dollars and, for the purpose of preparing the financial data for the year ended December 31, 2002 have been translated into Australian dollars using an exchange rate on December 31, 2002 of A$1.00 = US$0.5666, or average exchange rates for the 2002 fiscal year, as appropriate, as required under Australian GAAP. The convenience translation of these Australian dollar amounts into US dollars therefore does not necessarily represent the actual US dollar value of such assets and liabilities or revenues and expenses as of the dates or for the periods presented. The Noon Buying Rate on December 31, 2002 was A$1.00 = US$0.5625. See “Currency of Presentation and Exchange Rates”. |

| (2) | | Net interest expense is equal to gross interest expense less interest income, such as interest income generated from interest rate swaps and cross currency swaps entered into with respect to our borrowings. It does not include capitalized interest of A$3.5 million in 2002, nil in 2001, A$24.9 million in 2000, A$61.9 million in 1999 and A$89.9 million in 1998. See Note 3 to our Consolidated Financial Statements for a reconciliation of gross interest expense to net interest expense. The net interest expense for 2002 does not |

11

| | include one-off interest income of A$75.9 million generated from the early termination of interest rate swaps in conjunction with the demerger. Our historical gross and net interest expense was based primarily on the level of debt existing prior to the demerger. In conjunction with the demerger, our level of debt was reduced by approximately A$577 million. In addition our historical gross and net interest expense reflected debt bearing interest rates higher than the interest rates that apply to our existing debt. For 2003, we expect that our gross interest expense will be approximately A$77.4 million based on the lower level of debt following the demerger and these lower interest rates (taking into account the placement of US$700 million of the Notes, the application of the proceeds thereof and expected exchange rates for the year). |

| (3) | | EBITDA is defined as profit before interest and income tax plus depreciation and amortization, and reflects only continuing operations. EBITDA should not be construed as an alternative to operating income, or net income, as determined in accordance with Australian or US GAAP, as an indicator of our operating performance, or as an alternative to cash flows from operating activities, as determined in accordance with Australian or US GAAP, as a measure of liquidity. EBITDA is presented solely as a supplemental disclosure because we believe that it is a widely used measure of operating performance and we use it to measure our internal profitability. Because all companies do not calculate EBITDA identically, the presentation of EBITDA in this prospectus is not necessarily comparable to similarly entitled measures of other companies. |

A reconciliation of EBITDA to profit before interest and income tax from continuing operations is as follows:

| | | Year ended December 31,

| |

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| | | 1998

| |

| | | (millions) | |

EBITDA | | A$ | 525.1 | | | A$ | 399.3 | | | A$ | 1,059.2 | | | A$ | 320.7 | | | A$ | (82.6 | ) |

Depreciation and amortization | | | (511.0 | ) | | | (480.9 | ) | | | (428.8 | ) | | | (318.3 | ) | | | (327.4 | ) |

Interest income | | | 103.5 | | | | 153.5 | | | | 152.1 | | | | 84.4 | | | | 47.9 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Profit/(loss) before interest expense and income tax from continuing operations | | | 117.6 | | | | 71.9 | | | | 782.5 | | | | 86.8 | | | | (362.1 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (4) | | The number of our shares used in the 2002 basic net income per share calculation was determined on the basis of the weighted average number of outstanding WMC Limited shares for the 11 months to November 30, 2002 (the effective demerger date) and the actual number of WMC Resources Ltd shares for the month of December 2002. For prior periods, the number of our shares used in the basic net income per share calculation was determined on the basis of the weighted average number of outstanding WMC Limited shares for the periods indicated, as in the demerger each WMC Limited shareholder received one of our shares for each share in WMC Limited it held. Refer also to Notes 1(y) and 6 to the Consolidated Financial Statements. |

| (5) | | On a US GAAP basis, net loss from continuing operations per share in 1999 was A$0.04 before the cumulative effect of an accounting policy change for start-up costs. On a US GAAP basis, net loss from continuing operations per share in 2002 was A$0.06 before the cumulative effect of an accounting policy change for amortization of mine development and post-production waste removal costs. |

| (6) | | The number of our shares used in the 2002 diluted net income from continuing operations per share calculation was determined on the basis of the weighted average of the number of outstanding WMC Limited shares for the 11 months to November 30, 2002 (the effective demerger date) and the actual number of WMC Resources Ltd shares for the month of December 2002. For prior periods, the number of our shares used in the diluted net income from continuing operations per share calculation was determined on the basis of the weighted average of the number of outstanding WMC Limited shares for the periods indicated, including potential shares from the conversion of partly paid shares and options into shares of WMC Limited. Refer also to Notes 1(y) and 6 to the Consolidated Financial Statements. |

| (7) | | The number of shares used in our per share calculations were as follows: |

| | | Year ended December 31,

|

| | | 2002

| | 2001

| | 2000

| | 1999

| | 1998

|

| | | (millions of shares) |

Basic | | 1,115.8 | | 1,103.3 | | 1,127.1 | | 1,146.1 | | 1,140.8 |

Diluted | | 1,127.3 | | 1,120.8 | | 1,137.4 | | 1,161.9 | | 1,149.0 |

12

Summary Unaudited Pro Forma Financial Data

In December 2002, WMC Limited completed the demerger of its interests in the Alcoa World Alumina and Chemicals venture with Alcoa Inc. from its other businesses and interests. Through an Australian court-approved scheme of arrangement, WMC Limited distributed the shares it held in us to its shareholders and we became an independent consolidated group. In conjunction with the demerger, WMC Limited undertook certain internal restructuring transactions and effected certain share transfers. Thus, as part of the scheme of arrangement, we acquired from WMC Limited the shares it held in the legal entities within the WMC Limited group that held the copper-uranium and fertilizer operations and assets as well as WMC Limited’s exploration and development interests. In addition, as part of the scheme of arrangement, WMC Limited transferred some other entities to us and we replaced some of WMC Limited’s debt facilities and borrowings with new debt facilities and borrowings. Under Australian GAAP, these transfers, which included the fair value transfer of some derivative and financial instruments held in finance subsidiaries transferred to us in connection with the scheme of arrangement and demerger, were required to be at fair value on the date of the transfer. Under US GAAP, these transfers were accounted for at book value.

Our summary unaudited pro forma financial data, set forth below, was extracted in relevant part from our unaudited pro forma Consolidated Financial Statements, which appear elsewhere in this prospectus. Our unaudited pro forma Consolidated Financial Statements are derived from our historical audited Consolidated Financial Statements for the year ended December 31, 2002. The unaudited pro forma consolidated statement of income for the year ended December 31, 2002 gives pro forma effect to the demerger, as though the demerger had occurred on January 1, 2002. The unaudited pro forma financial data is presented for illustrative purposes only and does not purport to represent what our actual financial performance would have been if the demerger had occurred at January 1, 2002. Our unaudited pro forma Consolidated Financial Statements should be read in connection with, and are qualified by reference to, our historical Consolidated Financial Statements and “Operating and Financial Review and Prospects” in this prospectus.

Unaudited Pro Forma Income Statement

| | | Year ended December 31, 2002

| |

| | | Historical

| | | Pro Forma

Adjustments

| | | Pro Forma

| | | Pro

Forma(5)

| |

| | | (millions) | |

Amounts in accordance with Australian GAAP | | | | | | | | | | | | | | | | |

Net sales revenue from continuing operations | | A$ | 2,487.2 | | | A$ | — | | | A$ | 2,487.2 | | | US$ | 1,660.5 | |

Income/(loss) before interest and tax from continuing operations | | | 117.6 | | | | (6.0 | )(1) | | | 111.6 | | | | 74.5 | |

Interest Income/(expense) (gross) | | | (152.2 | ) | | | 24.3 | (2) | | | (127.9 | ) | | | (85.4 | ) |

Income tax credit/(expense) | | | 19.9 | | | | (7.3 | )(3) | | | 12.6 | | | | 8.4 | |

Net (loss)/profit from continuing operations | | | (14.7 | ) | | | 11.0 | | | | (3.7 | ) | | | (2.5 | ) |

Basic and diluted net (loss)/profit from continuing operations, per share ($/share)(6)(7)(8) | | | (0.01 | ) | | | 0.01 | | | | — | (9) | | | — | (9) |

Amounts in accordance with US GAAP | | | | | | | | | | | | | | | | |

Net (loss)/profit from continuing operations | | | (121.3 | ) | | | 17.0 | (4) | | | (104.3 | ) | | | (69.6 | ) |

Basic and diluted net (loss)/profit from continuing operations, per share ($/share)(6)(7)(8) | | | (0.14 | ) | | | 0.05 | | | | (0.09 | ) | | | (0.06 | ) |

| (1) | | Under Australian GAAP, our acquisition of WMC Limited’s copper-uranium and fertilizer businesses, WMC Finance Ltd and WMC Finance (USA) Ltd, as well as WMC Limited’s international exploration assets and business (other than those relating to Alcoa World Alumina and Chemicals) resulted in the assets and liabilities being transferred at fair value on the date of transfer. The fair values of the net assets of the operations transferred were calculated using discounted cash flow models. Our unaudited pro forma |

13

| | | consolidated statement of income includes an adjustment for the difference in depreciation and amortization expense resulting from the differing carrying value of property, plant and equipment, and acquired minerals rights as if the changes in carrying value had been recorded as at January 1, 2002. |

| (2) | | In conjunction with the scheme of arrangement and demerger, we obtained new credit facilities to replace the borrowings under WMC Limited’s credit facilities. Our unaudited pro forma consolidated statement of income includes an adjustment to reflect the reduced interest expense under the new debt balance for the full year. |

| (3) | | Our unaudited pro forma consolidated statement of income includes an adjustment to the income tax (expense)/credit in relating to the decreased interest expense under the changed debt balance. The adjustment has been calculated at the statutory tax rate in effect during the periods presented of 30%. There is no tax effect applicable to the additional depreciation and amortization expense as these amounts are not deductible for tax purposes. |

| (4) | | The proforma US GAAP adjustment comprises the interest adjustment and the consequential tax adjustment as outlined in (2) and (3) above. Under US GAAP, the demerger is similar to a pro-rata distribution of stock to shareholders and therefore the internal transfers of assets and liabilities made to effect the reorganization and demerger were accounted for at historical cost. Consequently, there is no adjustment to the US GAAP net loss from continuing operations for the difference in depreciation and amortization expense outlined in (1) above as the amortization of the fair value adjustments do not form part of the US GAAP net loss from continuing operations. |

| (5) | | Australian dollar amounts have been translated into US dollars solely for the convenience of the reader at the rate of A$1.00 = US$0.6676, the Noon Buying Rate on June 16, 2003. A significant portion of the Company’s liabilities and revenues and a portion of the assets and expenses are denominated in currencies other than Australian dollars and, for the purpose of preparing the financial data for the year ended December 31, 2002 have been translated into Australian dollars using the rate on December 31, 2002 of A$1.00 = US$0.5666, or average rates for the 2002 fiscal year, as appropriate, as required under Australian GAAP. The convenience translation of these Australian dollar amounts into US dollars therefore does not necessarily represent the actual US dollar value of such assets and liabilities or revenues and expenses. The Noon Buying Rate on December 31, 2002 was A$1.00 = US$0.5625. See “Currency of Presentation and Exchange Rates”. |

| (6) | | The number of our shares used in the 2002 basic net income per share calculation was determined on the basis of the weighted average number of outstanding WMC Limited shares for the 11 months to November 30, 2002 (the effective demerger date) and the actual number of WMC Resources Ltd shares for the month of December 2002. Refer also to Notes 1(y) and 6 to the Consolidated Financial Statements. |

| (7) | | The number of our shares used in the 2002 diluted net income from continuing operations per share calculation was determined on the basis of the weighted average of the number of outstanding WMC Limited shares for the 11 months to November 30, 2002 (the effective demerger date) and the actual number of WMC Resources Ltd shares for the month of December 2002. Refer also to Notes 1(y) and 6 to the Consolidated Financial Statements. |

| (8) | | We used 1,128.4 million shares in our 2002 per share calculations. |

| (9) | | Amounts per share are less than 1 cent as amounts are rounded to the nearest whole cent. |

14

Ratio of Earnings to Fixed Charges

We have shown our consolidated ratios of earnings to fixed charges for continuing operations, for each of the five years ended December 31, 2002. This information has been calculated in accordance with Australian GAAP and US GAAP.

| | | Year ended December 31,

| |

| | | 2002

| | | 2001

| | | 2000

| | 1999

| | | 1998

| |

Historical ratios | | | | | | | | | | | | | | |

In accordance with Australian GAAP | | 0.76 | * | | 0.25 | * | | 2.39 | | 0.37 | * | | — | * |

In accordance with US GAAP | | — | * | | — | * | | 2.04 | | 0.18 | * | | — | * |

| | | | | |

Pro Forma ratios | | | | | | | | | | | | | | |

In accordance with Australian GAAP | | 0.86 | * | | N/A | | | N/A | | N/A | | | N/A | |

In accordance with US GAAP | | 0.32 | * | | N/A | | | N/A | | N/A | | | N/A | |

| * | | During these periods, our earnings were insufficient to cover fixed charges. Where a dash appears our earnings were negative during the period. Our deficiencies to cover fixed charges in each of the periods presented were as follows: |

| | | Year ended December 31,

|

| | | 2002

| | 2001

| | 2000

| | 1999

| | 1998

|

| | | A$ millions |

Historical | | | | | | | | | | |

In accordance with Australian GAAP | | 38.1 | | 223.3 | | N/A | | 143.1 | | 507.7 |

In accordance with US GAAP | | 175.4 | | 342.7 | | N/A | | 185.0 | | 519.5 |

| | | | | |

Pro Forma | | | | | | | | | | |

In accordance with Australian GAAP | | 19.8 | | N/A | | N/A | | N/A | | N/A |

In accordance with US GAAP | | 94.7 | | N/A | | N/A | | N/A | | N/A |

We computed the ratio of earnings to fixed charges by dividing the amount of earnings by the amount of fixed charges. For the purposes of calculating this ratio, we have calculated earnings by adding pre-tax income from continuing operations before adjustment for minority interests in consolidated subsidiaries or income or loss from equity investees, fixed charges and distributed income of equity investees. Interest capitalized and the minority interest in pre-tax income of subsidiaries that have not incurred fixed charges were subtracted from the total of the added items. Fixed charges consist of interest costs, both expensed and capitalized, a reasonable approximation of the interest component of rental expense and pre-tax earnings required to cover any preferred stock dividend requirements.

The pro forma ratio of earnings to fixed charges was calculated by adjusting historical pre-tax income from continuing operations to give pro forma effect to the reduced interest expense arising from the May 8, 2003 private placement of US$500 million of our 5.125% Guaranteed Notes due 2013 and US$200 million of our 6.250% Guaranteed Notes due 2033 as if they had been in place since January 1, 2002.

Adjusting unaudited pro forma pre-tax income from continuing operations to give effect to the private placement of the Old Notes outlined above results in a pro forma ratio of earnings to fixed charges of 0.82 in accordance with Australian GAAP and 0.16 in accordance with US GAAP.

This prospectus relates to exchange offers being made for these Old Notes. Because the terms of the New Notes are essentially identical to those of the Old Notes, we do not expect the exchange offers to alter the ratio of earnings to fixed charges.

15

RISK FACTORS

Before you elect to participate in either exchange offer described in this prospectus, you should be aware of the significant risks described below. You should carefully consider these risks, together with all of the other information included in this prospectus.

Risks relating to the exchange offers

You may have difficulty selling the Old Notes you do not exchange.

If you do not exchange your Old Notes for New Notes in the exchange offers, you will continue to be subject to the restrictions on transfer of your Old Notes as described in the legend on the global notes representing the Old Notes. There are restrictions on transfer of your Old Notes because we issued the Old Notes under an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state securities laws. In general, you may only offer or sell the Old Notes if they are registered under the Securities Act and applicable state securities laws or offered and sold under an exemption from, or in a transaction not subject to, these requirements. We do not intend to register any Old Notes and, upon consummation of the exchange offer relating to a series of notes, you will not be entitled to any rights to have your untendered Old Notes registered under the Securities Act. In addition, the trading market, if any, for the remaining Old Notes will be adversely affected depending on the extent to which Old Notes are tendered and accepted in the exchange offers.

You may have difficulty selling the New Notes because there is no existing trading market for them.

The New Notes are being offered to the holders of the Old Notes, which were issued on May 8, 2003 to a small number of institutional investors. There is no existing trading market for the New Notes. Although the initial purchasers in the offering of the Old Notes have informed us that they intend to make a market in the New Notes, they are not obligated to do so and any market making activity may be discontinued at any time without notice. As a result, the market price of the New Notes could be adversely affected.

We have applied to list the New Notes on the Luxembourg Stock Exchange. The liquidity of any market for the New Notes will depend upon the number of holders of the New Notes, our performance, the market for similar securities, the interest of securities dealers in making a market in the New Notes and other factors relating to us and our business. A liquid trading market may never develop for the New Notes.

Broker-dealers may need to comply with the registration and prospectus delivery requirements of the Securities Act when dealing in the New Notes.

Any broker-dealer that (1) exchanges its Old Notes in the exchange offers for the purpose of participating in a distribution of the New Notes or (2) resells New Notes that were received by it for its own account in the exchange offers may be deemed to have received restricted securities and will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction by that broker-dealer. Any profit on the resale of the New Notes and any commission or concessions received by a broker-dealer may be deemed to be underwriting compensation under the Securities Act.

You may not receive New Notes in the exchange offers if the exchange offer procedure is not followed.

We will issue the New Notes in exchange for your Old Notes only if you tender the Old Notes and deliver a properly completed and duly executed letter of transmittal and other required documents before expiration of the relevant exchange offer. You should allow sufficient time to ensure timely delivery of the necessary documents. Neither the exchange agent nor we are under any duty to give notification of defects or irregularities with respect to the tenders of Old Notes for exchange. If you are the beneficial holder of Old Notes that are registered in the

16

name of your broker, dealer, commercial bank, trust company or other nominee, and you wish to tender in the exchange offers, you should promptly contact the person in whose name your Old Notes are registered and instruct that person to tender on your behalf.

Risks relating to the WMC Resources Group’s business

We believe that, because of the international scope of our operations and the industries in which we are engaged, numerous factors have an effect on our results and operations. The following describes the material risks that could affect us.

A reduction in commodity prices could materially reduce our revenues and profits.

Our revenue is derived from sales of nickel, copper, uranium, gold and fertilizers. The prices we obtain for our products are determined by, or linked to, prices in the world markets, which have historically been subject to substantial fluctuations arising from changes in supply and demand, various Australian and international macro-economic and political conditions, the cost of substitute materials, and the speculative activities of various market participants. This will have a consequent effect on the prices we can charge for our products and the revenues we receive, including under supply contracts the pricing terms of which track market prices, which consequently affects our profitability. The general trend in commodity prices has been characterized by an increase from 1999 through the end of 2000, followed by a decline over the course of 2001 into 2002. For further information about historical commodity price movements in the commodities we produce, please see the following sections “Qualitative and Quantitative Disclosures About Market Risk—Average Quarterly Prices”, “Business Description—Nickel—Markets and Competition”, “Business Description—Copper-uranium—Market and Competition” and “Business Description—Fertilizer—Markets and Competition”.

Material changes in the prices we receive for our products could have a significant effect on our results. Consequently, a sustained and uninterrupted period of unusually low prices of the products we sell could reduce our profitability and our ability to pay principal and interest on our debt, dividends, or meet our other obligations.

We expect that commodity prices may not rise until economic activity in the markets we serve starts to increase significantly. The general volatility in commodity prices makes it difficult for us to predict the extent and duration of any decline or increase in the cyclical commodity prices relating to our products. We expect that volatility in prices and in demand for most of our products will continue for the foreseeable future. We may enter into hedging transactions with respect to nickel, gold, copper and fertilizer with a view to reducing the potentially adverse effects of commodity price fluctuations. Since 2000, any new hedging activity has been limited to securing acceptable rates of return for new projects. For a statement of our current hedging activity, and movements in the selling price of nickel, gold, copper and fertilizer over the last five years, see the section entitled “Quantitative and Qualitative Disclosure about Market Risk”.

Fluctuations in foreign exchange rates could adversely affect our revenues and profits.

The products we export from Australia are predominantly sold in US dollars. In the year ended December 31, 2002, 90% of our sales revenue was denominated in or linked to US dollars. However, any dividend payments and the majority of our operating costs are denominated in Australian dollars. Therefore, in the absence of other changes, if the Australian dollar strengthens in value relative to the value of the US dollar, our financial results will be adversely affected. Conversely, a weakening of the Australian dollar relative to the US dollar will tend to have a favorable effect on our financial results. Because much of our borrowings and the majority of our receivables are denominated in US dollars, movements in the A$/US$ exchange rate will also affect our net asset value. As at December 31, 2002, we had US$824.9 million of US dollar repayment obligations and US dollars receivables of US$123.0 million. We have from time to time sought to hedge our foreign currency exchange position. See the section entitled “Quantitative and Qualitative Disclosure about Market Risk” for a more detailed discussion of our foreign exchange hedging policy.

17

We may have fewer ore reserves than our estimates indicate.

There are a number of uncertainties inherent in estimating quantities of reserves, including many factors beyond our control. The reserves data included in this prospectus are estimates. The actual volume and grade of reserves recovered and our rates of production may be less than these estimates may imply.

Our reserves estimations may change substantially if new information subsequently becomes available. Such estimates are, to a large extent, based on the interpretations of geological data obtained from drill holes and other sampling techniques, and feasibility studies which derive estimates of operating costs based upon anticipated tonnage and grades of the material to be mined and processed, expected recovery rates, equipment operating costs and other factors. Further, it may take many years from the initial phase of drilling before production is possible and, during that time, the economic feasibility of exploiting a discovery may change. Fluctuations in the price of commodities, variations in operating and capital costs, different recovery rates and other factors, including but not limited to, short-term operating factors such as the need for sequential development of ore bodies and the processing of new or different ore grades, may ultimately result in our estimated reserves being revised. If such a revision were to indicate a substantial reduction in proven or probable reserves at one or more of our major projects, it could negatively affect our financial condition and prospects.

A decline in the market price of a particular metal or mineral may also render the exploitation of reserves containing relatively lower grades of mineralization uneconomical. If the price we realized for a particular commodity were to decline substantially below the price at which our ore reserves were estimated for a sustained period of time, we could experience reductions in reserves and asset write-downs. Under some such circumstances, we may discontinue the development of a project or mining at one or more properties.

An increase in our production costs could reduce our profitability.

Changes in our costs have a major impact on our profitability. Our main expense categories are salaries and wages, energy, transport, materials, and amortization and depreciation of property, plant and equipment. Some of our costs are also affected by government imposts and regulations. Our costs depend upon the efficient design and construction of mining and processing facilities and competent operation of those facilities. Changes in costs of mining and processing operations can occur as a result of unforeseen events or changes in reserve estimates.

Our energy costs represent a significant portion of the production costs for our operations. The principal sources of energy for our mining operations are purchased electricity and natural gas. Energy will continue to represent a significant portion of our production costs, and we may be adversely impacted if future energy sources are not available or energy prices increase. If we are unable to procure sufficient energy at reasonable prices in the future, it could reduce the earnings or cash flow that we otherwise might realize.

Our ability to sustain or increase our current levels of production in the medium to long term is partly dependent on the development of new projects and expansion of existing operations.

Our ability to sustain or increase our current levels of production, and, therefore, our potential revenues and profits, in the medium to long term is partly dependent on the development of new projects and on the expansion of existing operations. Planned development or expansion projects may not result in the entire planned additional production. The economics of any project is based upon, among other factors, estimates of non-reserve mineralization and reserves, recovery rates, production rates, capital and operating costs of these development projects and future commodity prices. The uncertainty and volatility of some or all of these factors contributes to the risks associated with project development and expansion activities. See “Business Description—Capitalization Expenditure and Divestiture” for a more detailed discussion of our capital expenditure and divestiture activities.

18

Our business may be affected by planned and unplanned outages and other material disruptions.

Industrial disruptions, work stoppages, refurbishments, installation of new plants, accidents or sustained bad weather at our operations can result in production losses and delays in delivery of products, which may adversely affect our profitability. Production may fall below historic or estimated levels as a result of unplanned outages. For example, in 2001, we experienced a fire at both of our copper and uranium solvent extraction units at our Olympic Dam operations. We also experienced a fire in the copper solvent extraction unit in 1999. As a result, our copper and uranium production was adversely affected following these incidents.

We are exposed to regulatory, legislative and judicial action, both in Australia and in other countries in which we conduct operations.

Our operations in each of the jurisdictions in which we conduct operations could be affected by government actions, such as controls on imports, exports and prices, variations in taxation laws (including royalties), government directions, guidelines and regulations, particularly in relation to the environment and mine operations, legislation, indigenous people’s rights and court decisions, particularly those that impact on land access and freedom to conduct mining operations. Any such government action or court decisions may require increased capital or operating expenditures or both, or could prevent or delay the development of some of our operations.

Of particular relevance to our operations in Australia is the impact of pending judicial decisions and potential legislative action concerning the effect of native title in land held under mining or other leases or waters used in our operations. This is discussed in detail in “Business Description—Legal Proceedings”. We are also subject to the requirements of Australian mining law and the conditions of leases granted to us by state or territorial governments. See “Business Description—Australian Mining Law and Leases” for a more detailed discussions of these requirements. Finally, we must comply with extensive environmental regulations in Australia and the other countries where we have operations, see “Business Description—Environmental Matters”.

In addition, some of our exploration and potential projects and activities are in developing countries where political, economic and other risks may be more acute than in developed countries, including our Corridor Sands project in Mozambique. These risks include: expropriation or nationalization of property; currency fluctuations (particularly in countries with high inflation); restrictions on the ability to pay dividends offshore; risks of loss due to civil strife, acts of war, guerilla activities, insurrection and terrorism; and other risks arising out of foreign sovereignty over the areas in which operations are conducted. Consequently, our exploration, development, and future production activities outside of Australia may be adversely affected by factors beyond our control, any of which could materially adversely affect our financial position or results of operations. Furthermore, in the event of a dispute arising from such activities, we may be subject to the exclusive jurisdiction of courts outside Australia or may not be successful in subjecting persons to the jurisdiction of the courts in Australia, which could adversely affect the outcome of a dispute.

We are subject to stringent environmental laws and regulations, which impose substantial costs and subject us to significant potential liabilities.

Compliance with environmental laws and regulations imposes substantial costs and subjects us to significant potential liabilities. Our business is subject to particular risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Our operations in Australia are subject to stringent federal, state and local laws and regulations relating to improving or maintaining environmental quality. Environmental laws often require parties to pay for remedial action or to pay damages regardless of fault. Environmental laws also often impose liability with respect to divested or terminated operations, even if the operations were terminated or divested many years ago. Costs associated with environmental and regulatory compliance have increased over time. In addition, the costs of environmental obligations may exceed the reserves we have established for these liabilities. For a discussion of our significant remediation projects in Australia, see “Business Description—Environmental Matters”.

19

We cannot reasonably estimate the cost of future compliance or remedial work or further investment necessitated through the introduction of further environmental regulation or by any causes of contamination, including those occurring prior to the introduction of such regulation or before or after the property in question was owned or occupied by us. Among other things, the level of these costs will be dependent upon the nature and extent of the current and future environmental regulation, the time and nature of required remedial work, the extent of any contamination, the technology available to meet the required standards, the determination of our liabilities in proportion to those of other parties and the extent to which costs are recoverable from insurance and third parties.

Native Title in Australia.

“Native Title” describes the rights and interests of Aboriginal and Torres Strait Islander people in land and waters according to their traditional laws and customs that are recognized under Australian law. There are current claimant applications for native title determinations in the Federal Court of Australia over areas that include the majority of our operations. We cannot make any assessment as to whether any of our existing assets or operations will be materially affected until court determinations are made. Court decisions and various pieces of legislation make it evident that there are complex legal and factual issues affecting our existing and future interests. Accordingly, the impact of native title is being closely monitored but cannot be determined at this time. See “Business Description—Legal Proceedings—Native Title in Australia” for a discussion of native title issues in Australia that have an impact on our operations.

Risks in Relation to the Notes

Since each series of Notes is unsecured, your right to receive payments may be adversely affected.

Each series of Notes that WMC Finance (USA) is offering for exchange in this prospectus will be unsecured. If WMC Finance (USA) defaults on either series of Notes or the guarantors default on their respective guarantees as a result of the bankruptcy, liquidation or reorganization of either WMC Finance (USA) or any of the guarantors, then, to the extent that any of the guarantors or the issuer have granted security over our assets, the assets that secure our debts will be used to satisfy the obligations under that secured debt before payment on the Notes or the guarantees can be made. In such a case, there may only be limited assets available to make payments on the Notes or the guarantees in the event of an acceleration of the Notes. If there is not enough collateral to satisfy the obligations of the secured debt then the remaining amounts on the secured debt would share equally with all unsubordinated unsecured indebtedness.

The subsidiary guarantees may be released in the future if certain events occur.

Under the terms of the indenture as supplemented by the first supplemental indenture, a subsidiary guarantor shall be automatically and unconditionally released from its guarantee upon:

| | • | | any sale, exchange or other disposition (including by way of consolidation or merger) to any person (other than an affiliate of ours) of all of the equity securities of such subsidiary guarantor or all or substantially all of the assets of such subsidiary guarantor, or |

| | • | | such subsidiary guarantor ceasing to be a restricted subsidiary under the indenture, in each case in compliance with the terms of the indenture as supplemented by the first supplemental indenture, or |

| | • | | such subsidiary guarantor ceasing to be a guarantor of (or co-obligor on) any funded indebtedness other than the Notes and other than funded indebtedness the related guarantee (or obligations) of which |

| | • | | is subject to a release provision similar to the release provision described in this paragraph, and |

| | • | | will be released concurrently with the release of the guarantee of such subsidiary guarantor pursuant to such release provision. |

20

Currently, in order for a subsidiary guarantee to be released under the Notes, the relevant subsidiary guarantor would have to have no further guarantee obligations under our senior credit facility or other funded indebtedness in excess of A$25 million. See “Description of the New Notes and Guarantees.”

To the extent that one or both subsidiary guarantors released as described above, the parent guarantor would depend on dividends, loans or advances, or payments from the subsidiary guarantors to satisfy its financial obligations and make payments to its investors to the extent the parent guarantor could not satisfy them through its own operations and earnings. The ability of the subsidiary guarantors to pay dividends and make other payments to the parent guarantor is restricted by, among other things, applicable corporate and other laws and regulations. This ability may be further restricted in the future by agreements to which the subsidiary guarantors may be parties. Accordingly, in certain circumstances, the parent guarantor may be unable to make required payments on its debt obligations, including the guarantee of the Notes, as those obligations become due.

If WMC Finance (USA) defaults on the Notes, or any of the guarantors default on their respective guarantees, your right to receive payments on the Notes or the guarantees may be adversely affected by Australian insolvency laws.

The guarantors and WMC Finance (USA) are incorporated under the laws of Australia and, therefore, insolvency proceedings with respect to them would likely proceed under, and be governed by, Australian insolvency law. The procedural and substantive provisions of Australian insolvency laws are generally more favorable to secured creditors than comparable provisions of United States law. These provisions afford debtors and unsecured creditors only limited protection from the claims of secured creditors, and it will generally not be possible for any of the guarantors, the issuer or other unsecured creditors to prevent or delay the secured creditors from enforcing their security to repay the debts due to them.

Service of process, enforcement of judgments and bringing of original actions in the United States may be more difficult.

Since we and our officers and directors reside outside the United States and a substantial portion of our assets are located outside the United States, there is a risk that service of process, enforcement of judgments and bringing of original actions by a U.S. investor would be more difficult than it would be in the United States.

21

FORWARD LOOKING STATEMENTS

This prospectus contains forward-looking statements, including statements regarding (i) estimated reserves, (ii) certain plans, strategies and objectives of management, (iii) scheduled closure of certain operations or facilities, (iv) scheduled refurbishment, repair, maintenance, reconstruction and recommissioning activities, (v) anticipated production or construction commencement dates, (vi) expected costs or production output, (vii) the anticipated productive lives of projects and mines and (viii) the anticipated prices and market dynamics of commodities produced. These forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause actual results to differ materially from those expressed in such forward-looking statements.

For example, future revenues from operations, projects or mines described in this prospectus will be based in part on the market price of the minerals or metals produced, which may vary significantly from current levels. These variations, if materially adverse, may impact the timing or feasibility of the development of a particular project or the expansion of certain facilities or mines. Other factors that may affect the actual construction or production commencement dates, costs or production output and anticipated lives of operations, mines or facilities include: