UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 15, 2008

CHINA ENERGY RECOVERY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 005-80670 | 33-0843696 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

7F, De Yang Garden, No. 267 Qu Yang Road, | |

Hongkou District, Shanghai, Shanghai, China | 200081 |

(Address of Principal Executive Offices) | (Zip Code) |

+86 (0)21 5556-0020

(Registrant's telephone number, including area code)

| | 9440 S. Santa Monica Blvd., Suite 400 Beverly Hills, CA 90210 | |

| | (Former name or former address, if changed since last report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| 1 |

| 2 |

| 3 |

| | | 5 |

| | | 22 |

| | | 41 |

| | | 51 |

| | | 51 |

| | | 53 |

| | | 55 |

| | | 57 |

| | | 60 |

| | | 61 |

| | | 62 |

| | | 64 |

| | | 66 |

| | | 67 |

| | | 68 |

| 68 |

| 68 |

| 68 |

| 69 |

| 69 |

| 69 |

| 73 |

| 74 |

This Current Report on Form 8-K and other materials we will file with the Securities and Exchange Commission ("SEC") contain, or will contain, disclosures which are forward-looking statements. Forward-looking statements include all statements that do not relate solely to historical or current facts, such as, but not limited to, the discussion of economic conditions in market areas and their effect on revenue growth, the discussion of our growth strategy, the potential for and effect of future governmental regulation, fluctuation in global energy costs, the effectiveness of our management information systems, and the availability of financing and working capital to meet funding requirements, and can generally be identified by the use of words such as "may," "believe," "will," "expect," "project," "estimate," "anticipate," "plan" or "continue." These forward-looking statements are based on the current plans and expectations of our management and are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or those anticipated. These factors include, but are not limited to: economic conditions affecting manufacturers of energy recovery systems and the industry segments they serve; the adverse effect of governmental regulation and other matters affecting energy recovery system manufacturers; increased competition in the industry; our dependence on certain customer segments; the availability of and costs associated with potential sources of financing; difficulties associated with managing future growth; our inability to increase manufacturing capacity to meet demand; fluctuations in currency exchange rates; restrictions on foreign investments in China; uncertainties associated with the Chinese legal system; the loss of key personnel; and our inability to attract and retain new qualified personnel.

These forward-looking statements speak only as of the date of this Current Report on Form 8-K. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You should also read, among other things, the risks and uncertainties described in the section of this Current Report on Form 8-K entitled "Risk Factors."

On April 15, 2008, China Energy Recovery, Inc. (the "Company") consummated a share exchange with the stockholders of Poise Profit International, Ltd., a private British Virgin Islands corporation ("Poise"), pursuant to which we acquired all of the issued and outstanding shares of Poise's common stock in exchange for the issuance of shares of our common stock representing approximately 81.5% of our issued and outstanding common stock (the "Share Exchange"). After the Share Exchange, our business operations consist of those of Poise's wholly-owned subsidiary, HAIE Hi-tech Engineering (Hong Kong) Company, Limited ("Hi-tech"), incorporated in the Hong Kong Special Administration Region, China. Unless otherwise indicated or the context otherwise requires, the terms "the Company," "we," "us," and "our" refer to China Energy Recovery, Inc. and its subsidiaries after giving effect to the Share Exchange. This Current Report on Form 8-K contains summaries of the material terms of various agreements executed in connection with the Share Exchange described herein. The summaries of these agreements are subject to, and qualified in their entirety by, reference to these agreements, all of which are incorporated herein by reference. Unless otherwise noted, all amounts of securities disclosed herein are adjusted for our April 16, 2008 stock split, as further described in Item 2.01 hereof.

Closing of the Share Exchange

On April 15, 2008, the Company consummated the transaction contemplated by the Share Exchange Agreement entered into among the Company, Poise and the stockholders of Poise as previously disclosed in the Company's Current Report on Form 8-K filed on January 30, 2008 (the "Share Exchange Agreement"). Pursuant to the terms of the Share Exchange Agreement, we acquired all of the issued and outstanding shares of Poise's common stock in exchange for the issuance of 20,757,090 shares of our common stock to Poise's stockholders. Upon the closing of the transaction, Poise became our wholly-owned subsidiary and Poise's stockholders (a) became the owners of approximately 81.5% of our outstanding common stock (subject to reduction by the escrow arrangements described below), (b) may designate four of the five members of our board of directors, and (c) may appoint our executive officers.

Poise, through its Chinese subsidiary Hi-tech, is principally engaged in designing, marketing, licensing, fabricating, implementing and servicing energy recovery systems capable of capturing industrial waste energy for reuse in industrial processes or for the production of electricity and thermal power. Hi-tech has installed more than 100 energy recovery systems and has deployed and is deploying its systems throughout China and in a variety of international markets including in Egypt, Turkey, Korea, Vietnam and Malaysia.

Following is a brief description of certain material terms of, and conditions to, closing of the transaction contemplated by the Share Exchange Agreement:

| | · | Simultaneously with the closing of the Share Exchange, we completed an equity financing (the "Financing") of $8,504,181 by issuing an aggregate of 7,874,241 shares of our Series A Convertible Preferred Stock at a price of $1.08 per share and warrants to purchase 1,968,561 shares of our common stock at an exercise price of $2.58 per share, as further described in Item 2.01 of this Current Report on Form 8-K under the caption "Closing of the Financing;" |

| | · | At the closing of the Share Exchange, we placed 1,779,180 shares of our common stock, representing approximately 7% of our currently outstanding common stock, issued to the Poise stockholders at the closing into an escrow account to be released to either: (a) the Poise stockholders if Hi-tech meets certain financial targets described below for the period ending December 31, 2008; or (b) to the investors in the Financing if Hi-tech does not meet the financial targets; and |

| | · | Poise delivered to us audited financial statements for its last two fiscal years, prepared in accordance with U.S. GAAP and audited by an independent auditor registered with the Public Company Accounting Oversight Board in the United States. |

We issued the shares of our common stock pursuant to the terms of the Share Exchange Agreement in reliance on the exemption from registration under Section 4(2) of the Securities Act of 1933, as amended (the "Securities Act"), and Regulation S promulgated thereunder, based upon our compliance with such rules and regulations. In that respect, we note that: (a) the offer and sale was made in an offshore transaction, (b) no direct selling efforts were made in the United States, (c) we implemented necessary offering restrictions, (d) the offer and sale were not made to a U.S. person or for the account or benefit of a U.S. person and the Poise stockholders provided the necessary certifications to that effect, (e) the Poise stockholders agreed to the resale limitations imposed by Regulation S, (f) the issued securities contain the necessary restrictive legend, and (g) we provided the Poise stockholders with the necessary notice about the restrictions on offer or sale of the securities.

Closing of the Financing

On April 15, 2008 and as a condition to closing of the Share Exchange, we entered into a Securities Purchase Agreements (the "Securities Purchase Agreement") with 26 accredited investors pursuant to which we issued and sold an aggregate of 7,874,241 units at a price per unit of $1.08 with each unit consisting of one share of our Series A Convertible Preferred Stock, par value $0.001 per share, and one warrant to purchase one-half of one share of our common stock at an exercise price of $2.58 per share. Thus, at the closing, we issued 7,874,241 shares of our Series A Convertible Preferred Stock to the investors and we also issued warrants to the investors for the purchase of an aggregate of 1,968,561 shares of our common stock for an aggregate purchase price of $8,504,181.

The Securities Purchase Agreement contains certain other provisions which are customary for agreements of this nature, such as representations, warranties, covenants and indemnities. The closing of the Financing was expressly conditioned upon: (a) completion of the purchase and sale of shares of our Series A Convertible Preferred Stock and warrants of not less than $8,500,000 and (b) the Company's execution and delivery of registration rights agreements, as further described below. As further described in Section 7 of Item 2.01 of this Current Report on Form 8-K, part of the minimum amount required in the Financing under the Share Exchange Agreement was satisfied by the conversion of a loan to Shanghai Engineering (as defined below) into a subscription for the Company's Series A Convertible Preferred Stock and warrants.

Pursuant to the terms of the Securities Purchase Agreement, we are required to register the common stock underlying the Series A Convertible Preferred Stock and the common stock underlying the warrants issued to the investors in the Financing with the SEC for resale by the investors. The Company and the investors are required to pay the fees and expenses of their respective advisers and counsel in connection with the Financing. However, the Company will pay all fees and expenses incident to the registration of the common stock, other than any underwriting discounts and selling commissions and fees and expenses of the investors' advisers and counsel. After commissions, legal fees and transaction expenses, we received net proceeds of approximately $6.6 million upon closing the Financing (after taking into account the conversion of the loan to Shanghai Engineering).

We issued the Series A Convertible Preferred Stock and the warrants in the Financing in reliance on the exemption from registration in Section 4(2) of the Securities Act and Rule 506 of Regulation D promulgated thereunder. In this respect, we note that: (a) we issued securities to 26 accredited investors; (b) we did not conduct any general solicitation or general advertising in connection with the issuance; (c) each investor agreed to hold the acquired shares of Series A Convertible Preferred Stock and warrants and the underlying shares of common stock for its own account and not on behalf of others; (d) each investor represented that he or she acquired the securities and will acquire the underlying shares of common stock for investment purposes only and not with a view to sell them; and (e) the certificates for the shares of Series A Convertible Preferred Stock and warrants and the certificates for the underlying shares of common stock will contain a restrictive legend in accordance with the rules and regulations of the Securities Act. As such, the issued securities may not be offered or sold in the United States unless they are registered under the Securities Act, or an exemption from the registration requirements of the Securities Act is available. We have not filed a registration statement covering these securities with the SEC or with any state securities commission in respect of the Share Exchange or the Financing.

However, pursuant to the Share Exchange Agreement and in connection with the Financing, we entered into registration rights agreements (the "Registration Rights Agreement") with the investors. Pursuant to the Registration Rights Agreement, we have agreed to register for re-sale all of the shares of common stock underlying the Series A Convertible Preferred Stock and all of the common stock underlying the warrants issued to the investors in the Financing, except that if the SEC limits the number of shares of common stock that may be registered in the registration statement, then the number of shares to be registered shall be reduced accordingly on a pro rata basis to each investor to comply with any such limitation imposed by the SEC. The Registration Rights Agreement provides that we must file a registration statement on Form S-3 relating to the resale of the common stock within 30 days following the closing of the Financing and that we shall use commercially reasonable efforts to cause such registration statement to become effective 90 days after the closing of the Financing (or, in the event of a "full review" of the registration statement by the SEC, 150 days after the closing). If the registration statement is not filed on a timely basis or is not declared effective by the SEC on a timely basis, the Company will be required to make a cash payment to each investor in an amount equal to 1% of the purchase price paid for the units purchased by such investor and not previously sold by such investor for each 30-day period (or portion thereof) until the registration statement is filed or declared effective by the SEC, as the case may be; provided, however, that in no event shall these registration penalties, if any, exceed in the aggregate 10% of such purchase price. The registration penalties will be prorated on a daily basis during each 30-day period and will be paid to the investors by wire transfer or check within five business days after the earlier of (a) the end of each 30-day period following the required filing or effective date or (b) the filing or effective date of the registration statement.

Capital Structure and Ownership after Closing of the Share Exchange and the Financing

The Company's authorized capital stock consists of 100,000,000 shares of common stock, $0.001 par value per share, and 50,000,000 shares of preferred stock, $0.001 par value per share. Before the closing of the Share Exchange and Financing and on a pre-split basis, there were 9,451,889 shares of common stock and no shares of preferred stock outstanding. We issued 41,514,179 shares of common stock in the Share Exchange and 7,874,241 shares of Series A Convertible Preferred Stock and warrants to purchase 3,937,121 shares of common stock in the Financing on a pre-split basis.

Immediately upon completion of the Share Exchange and the Financing and after taking into account our April 16, 2008 1-for-2 reverse stock split, the former Poise stockholders own 20,757,090 shares of our common stock, representing approximately 81.5% of our issued and outstanding shares of common stock after the closing (including the shares escrowed in the Share Exchange). The Company's pre-Share Exchange stockholders own 4,725,945 shares of our common stock, representing approximately 18.5% of our issued and convertible outstanding shares of common stock after the closing. The foregoing percentages do not reflect any conversion or exercise of the Series A Preferred Stock or warrants, respectively, issued to the investors in the Financing. The following table shows our share ownership immediately after giving effect to the Share Exchange, on an actual and a fully-diluted basis:

| Owner | | Shares, pre-conversion or

exercise (post-split) | | Shares, fully-diluted (post-split) | |

| Pre-Share Exchange stockholders of the Company | | 4,725,945 | | 4,783,815 | |

| New Poise stockholders | | 20,757,090 | | 20,757,090 | |

| New preferred stock investors | | — | | 5,614,043 | |

Effective as of the closing of the Share Exchange and the Financing and pursuant to the terms of the Share Exchange Agreement, the following persons were appointed to hold the following positions with the Company:

Name | | Position |

| Mr. Wu Qinghuan | | Chairman of the Board, Chief Executive Officer and Director |

| Mr. Chen Qi | | General Manager and Director |

| Mr. Richard Liu | | Chief Financial Officer |

| Mrs. Zhou Jialing | | Director |

Effective as of the closing of the Share Exchange, Mr. Kurdziel resigned from all his positions as a director and an executive officer. There were no known disagreements with Mr. Kurdziel on any matters relating to the Company's operations, policies or practices.

Overview of Our Business

The Company is headquartered in Shanghai, China, and, through its wholly-owned subsidiary, Hi-tech, is in the business of designing, fabricating, implementing and servicing industrial energy recovery systems. The Company's energy recovery systems capture industrial waste energy for reuse in industrial processes or to produce electricity and thermal power, thereby allowing industrial manufacturers to reduce their energy costs, shrink their emissions, reduce capital expenditures on cooling equipment and generate sellable emissions credits. A majority of the manufacturing takes place at the Company’s leased manufacturing facilities in Shanghai, China. The Company transports the manufactured systems in parts via truck, train or ship to the end-users’ facilities where the system is assembled and installed. The Company has installed over 100 energy recovery systems both in China and internationally. The Company sells its energy recovery systems and services mainly directly to customers.

Our History

The disclosures about our history reflect the Company's capital structure as of the time of the occurrences described and do not take into account subsequent stock splits or other adjustments to the Company's capital structure.

We incorporated in the State of Maryland in May 1998 under the name Majestic Financial, Ltd. From inception to March 31, 2002, we were a wholly-owned subsidiary of The Majestic Companies, Ltd. In March 2002, The Majestic Companies' board of directors approved a plan to spin-off our company to an entity controlled by The Majestic Companies' former chief executive officer and to The Majestic Companies' stockholders.

On September 24, 2002, we acquired USM Financial Solutions, Inc., a wholly-owned subsidiary of U.S. Microbics, Inc., through a Stock Exchange Agreement. Pursuant to the agreement, USM Financial Solutions became our wholly-owned subsidiary. USM Financial Solutions has no assets and liabilities and has had no business activities since December 31, 2002.

We changed our name to Commerce Development Corporation, Ltd. in April 2002.

On April 7, 2006, we entered into an Agreement and Plan of Merger with a newly formed wholly-owned subsidiary, Commerce Development Corporation, Ltd., a Delaware corporation, for purposes of changing our state of incorporation from Maryland to Delaware. On the same day, we conducted a 2,184-to-1 reverse stock split of our issued and outstanding capital stock pursuant to which each 2,184 shares of our common stock issued and outstanding on the record date of April 5, 2006 was combined and converted into one share of our common stock. We had 98,285,596 shares of common stock issued and outstanding immediately prior to the reverse stock split and 45,096 shares thereafter.

Effective June 5, 2007, we changed our name to MMA Media Inc. and conducted a 40-for-1 forward stock split of our issued and outstanding capital stock pursuant to which each one share of our common stock issued and outstanding on the record date of June 5, 2007 was split into 40 shares of our common stock. We had 1,348,050 shares of common stock issued and outstanding immediately prior to the forward stock split and 53,922,000 shares thereafter.

On January 25, 2008, we entered into and closed an Asset Purchase Agreement with MMA Acquisition Company, a Delaware corporation, pursuant to which we sold substantially all of our assets to MMA Acquisition Company in exchange for MMA Acquisition Company's assuming a substantial majority of our outstanding liabilities. The transferred assets consisted of letters of intent for the proposed acquisitions of MMAWeekly.com, dated June 9, 2007, and Blackbelt TV, Inc., dated July 16, 2007, and all shares of common stock in Blackbelt TV, Inc. we owned, among other things. The total book value of the assets acquired was approximately $317,000. The assumed liabilities consist of accounts payable, convertible debt, accrued expenses and shareholder advances of approximately $360,000.

Effective February 5, 2008, we changed our name to China Energy Recovery, Inc. and conducted a 1-for-9 reverse stock split of our issued and outstanding capital stock pursuant to which each nine shares of our common stock issued and outstanding on the record date of February 4, 2008 was converted into one share of our common stock. We had 85,067,000 shares of common stock issued and outstanding immediately prior to the forward stock split and 9,451,889 shares thereafter.

On April 15, 2008, we closed the Share Exchange pursuant to which we acquired all of the issued and outstanding shares of Poise's common stock in exchange for the issuance of 41,514,179 shares of our common stock to Poise's stockholders. Upon the closing of the transaction, Poise became our wholly-owned subsidiary.

On April 16, 2008, we conducted a 1-for-2 reverse stock split of our issued and outstanding capital stock pursuant to which each two shares of our common stock issued and outstanding on the record date of April 15, 2008 was converted into one share of our common stock. We had 50,966,068 shares of common stock issued and outstanding immediately prior to the forward stock split and 25,483,034 shares thereafter.

From inception until 2000, we were engaged in the limited origination and servicing of new modular building leases. We conducted such activity primarily in the State of California and accounted for all the leases we entered into as operating leases. We ceased entering into new leases in 2000. Between 2000 and January 24, 2007, we were a development stage company in the business of providing business management and capital acquisition solutions. Upon closing of the Share Exchange on April 15, 2008, through Poise's Chinese subsidiary, Hi-tech, we became engaged in designing, marketing, licensing, fabricating, implementing and servicing energy recovery systems capable of capturing industrial waste energy for reuse in industrial processes or to produce electricity and thermal power.

We are headquartered in Shanghai, China and we have manufactured and installed over 100 energy recovery systems in China and internationally.

Organizational Structure and Subsidiaries

Our organizational structure reflects Chinese limitations on foreign investments and ownership in Chinese businesses. Generally, these limitations prevent a U.S. corporation from owning directly certain types of Chinese businesses, such as those engaged in the manufacturing, sale and design of boilers and related engineering projects. Instead, a U.S. corporation can obtain the benefits and risk of equity ownership of a Chinese business either by being a part-owner of a Chinese joint venture or by entering into fairly extensive and complicated contractual relationships with Chinese companies wholly-owned by Chinese owners. Our business relies on contractual relationships.

Poise is our only wholly-owned subsidiary. Poise, in turn, owns 100% of the issued and outstanding equity interests in Hi-tech. Hi-tech is engaged in the marketing and sale of energy recovery systems which are designed, manufactured and installed by affiliated companies. Hi-tech owns 90% of a joint venture called Shanghai Haie Investment Consultation Co., Ltd. ("JV Entity"), a company organized in Shanghai, China, providing investment consultancy services, enterprise management consultancy services and marketing policy planning services to third-party customers as well as affiliates. The remaining 10% is owned by Shanghai Hai Lu Kun Lun Hi-tech Engineering Co., Ltd. ("Shanghai Engineering"), a company organized in Shanghai, China and with which Hi-tech has a contractual relationship. In addition, Hi-tech has a contractual relationship with another entity organized in Shanghai, China called Shanghai Xin Ye Environmental Protection Engineering Technology Co., Ltd. ("Shanghai Environmental"). Each of Shanghai Engineering and Shanghai Environmental is considered a "variable interest entity" and its financial information must be consolidated with Hi-tech's pursuant to the Financial Accounting Standards Board's ("FASB") Financial Interpretation 46 (Revised), Consolidation of Variable Interest Entities, which interprets Accounting Research Bulletin ("ARB") 51, Consolidated Financial Statements. Hi-tech has entered into contractual relationships with Shanghai Engineering and Shanghai Environmental to comply with Chinese laws regulating foreign-ownership of Chinese companies. Shanghai Engineering is engaged in the business of designing, manufacturing and installing energy recovery systems. All manufacturing is done by a subsidiary of Shanghai Si Fang Boiler Factory ("Shanghai Si Fang"), named Shanghai Si Fang Boiler Factory-Vessel Works Division ("Vessel Works Division"), pursuant to a cooperative manufacturing agreement between Shanghai Engineering and Shanghai Si Fang, as further described below. Vessel Works Division holds important permits for the manufacturing and installation of boilers used in our energy recovery systems. Shanghai Environmental is not an operating company but serves as a vehicle for arranging sales and maximizing tax benefits. Shanghai Engineering is owned jointly by Mr. Wu Qinghuan, one of our directors and our Chairman of the Board and Chief Executive Officer, and his spouse, Mrs. Zhou Jialing, who is one of our directors. Shanghai Environmental is wholly-owned by Mr. Wu.

The material contractual relationships between Hi-tech and each of Shanghai Engineering and Shanghai Environmental consist of:

| · | Consulting Services Agreements – These agreements allow Hi-tech to manage and operate Shanghai Engineering and Shanghai Environmental, and collect the respective net profits of each company. Under the terms of the agreements, Hi-tech is the exclusive provider of advice and consultancy services to Shanghai Engineering and Shanghai Environmental, respectively, related to the companies' general business operations, human resources needs and research and development, among other things. In exchange for such services, each of Shanghai Engineering and Shanghai Environmental must pay to Hi-tech such company's net profits. Each of Shanghai Engineering and Shanghai Environmental are required to cause their respective shareholders to pledge such shareholders' equity interests in the respective companies to secure the fee payable by Shanghai Engineering and Shanghai Environmental, respectively, under the agreements. The agreements contain negative covenants preventing each of Shanghai Engineering and Shanghai Environmental from taking certain actions such as issuing equity, incurring indebtedness and changing its business. The agreements are effective until terminated and they may be terminated by Hi-tech for any or no reason and by either party for reasons explicitly set forth in the agreements, including a breach by the other party or the other party's becoming bankrupt or insolvent. |

| · | Operating Agreements – The parties to each of these agreements are Hi-tech, Shanghai Engineering, Shanghai Environmental and all of the shareholders of each of Shanghai Engineering and Shanghai Environmental. Shanghai Engineering is owned 60% by Mr. Wu Qinghuan, our Chief Executive Officer, and 40% by his spouse, Mrs. Zhou Jialing. Shanghai Environmental is owned 100% by Mr. Wu Qinghuan. Under the agreements, Hi-tech guarantees the contractual performance by each company under any agreements with third parties, in exchange for a pledge by each of Shanghai Engineering and Shanghai Environmental of all of its respective assets, including accounts receivable. Hi-tech has the right to approve any transactions that may materially affect the assets, liabilities, rights or operations of each company and provide, binding advice regarding each company's daily operations, financial management and employment matters, including the dismissal of employees. In addition, Hi-tech has the right to recommend director candidates and appoint the senior executives of each company. The agreements expire 10 years from execution unless renewed. Hi-tech has the right to terminate each of the agreements upon 30 days' written notice but Shanghai Engineering and Shanghai Environmental do not have the right to terminate their respective agreement during its term. |

| · | Proxy Agreements – Hi-tech has entered into proxy agreements with all of the shareholders of each of Shanghai Engineering and Shanghai Environmental under which the shareholders have vested their voting power of the companies in Hi-tech and agreed to not transfer the shareholders' respective equity interests in the two companies to anyone but Hi-tech or its designee(s). The agreements do not have an expiration date. Hi-tech has the right to terminate each of the agreements upon 30 days' written notice but the shareholders may not terminate the agreements without Hi-tech's consent. |

| · | Option Agreements – The parties to each of these agreements are Hi-tech, Shanghai Engineering, Shanghai Environmental and all of the shareholders of each of Shanghai Engineering and Shanghai Environmental. The shareholders of each of Shanghai Engineering and Shanghai Environmental have granted Hi-tech or its designee(s) the irrevocable right and option to acquire all or a portion of such shareholders' equity interests in the two companies. The purchase price for a shareholder's equity interests will be equal to such shareholder's original paid-in price for such equity interest. Pursuant to the terms of the agreements, the shareholders and each of Shanghai Engineering and Shanghai Environmental have agreed to certain restrictive covenants to safeguard Hi-tech's rights under the respective agreement. The agreements expire 10 years from execution unless renewed. |

| · | Equity Pledge Agreements – The parties to each of these agreements are Hi-tech, Shanghai Engineering, Shanghai Environmental and all of the shareholders of each of Shanghai Engineering and Shanghai Environmental. The shareholders of each of Shanghai Engineering and Shanghai Environmental have pledged all of their respective equity interests in the two companies to Hi-tech to guarantee each of Shanghai Engineering and Shanghai Environmental's performance of these companies' respective obligations under the Consulting Services Agreements. The pledge expires two years after the obligations under the Consulting Services Agreements are fulfilled. Hi-tech has the right to collect any and all dividends paid on the pledged equity interests. Pursuant to the terms of the agreements, the shareholders and each of Shanghai Engineering and Shanghai Environmental have agreed to certain restrictive covenants to safeguard Hi-tech's rights under the respective agreement. Upon an event of default under the agreements, Hi-tech may require the shareholders to pay all outstanding and unpaid amounts due under the Consulting Services Agreement, or foreclose on the pledged equity interests. |

All of Shanghai Engineering's manufacturing activities are conducted through a Leasing and Operation Agreement, a form of cooperative manufacturing agreement, originally effective as of May 1, 2003 and subsequently amended, with a state-owned enterprise, Shanghai Si Fang. Pursuant to the agreement, Shanghai Si Fang leases one of its subsidiaries, Vessel Works Division (sometimes also translated from Chinese into English as "Shanghai Si Fang Boiler Factory Container Branch Factory"), to Shanghai Engineering. The agreement expires on December 31, 2009 unless renewed. According to the agreement, we have the following rights: (a) complete control over the operations of Vessel Works Division; (b) right of use of the employees, property, plant and equipment of Vessel Works Division; (c) use of the "Si Fang" brand name and license for pressure vessels; and (d) entitlement to the net profits of Vessel Works Division. Shanghai Si Fang provides quality control for the manufactured products. We pay Shanghai Si Fang rental and management fees of 2.4 million Renminbi in the aggregate (approximately $340,000 as of April 7, 2008) per year during the period from January 1, 2008 to December 31, 2009. We are in the process of renegotiating the rental and management fees and expect them to increase in the near future due to inflation and an increase in the price of land in the area. Although we do not own any of the outstanding equity interests in Vessel Works Division, we have control over Vessel Works Division and the risks and rewards associated with equity ownership under the terms of the agreement.

The following is an organizational chart setting forth the Company's subsidiaries and affiliated companies:

Industry Overview

Global demand is increasing for innovative environmental protection and renewable energy solutions for sustainable economic growth. Modern industrial nations and emerging markets today are faced with the growing challenge of reducing and controlling air pollution emissions that present serious health risks to national populations, cross international borders, and damage the environment. Increased energy consumption has forced governments and industries to invest in alternative forms of power generation and conservation. As the global power generation industry increases its focus on improving efficiency and mitigating the environmental impact of its processes, we believe that energy recovery systems will play a major role in improving the output that can be obtained from current supplies.

Energy recovery systems can salvage the majority of the wasted energy from excess heat that industrial facilities and power plants release into the atmosphere in the form of hot exhaust gases or high pressure steam by converting the heat into electricity (often through steam driven generator turbines) which can be used in industrial processes, thereby lowering energy costs. In addition, energy recovery systems capture the majority of carbon emissions and other harmful pollutants that would otherwise be released into the environment. These reduced emissions can also help companies meet environmental regulations. Energy recovery systems may also be used in heat recovery applications whereby excess heat may be used to heat buildings and water. Examples of end-users of this type of energy recovery system include hospitals and schools that may heat their buildings and water with excess heat generated by their own large electrical equipment. This type of energy recovery system is less complicated and requires significantly less technical qualifications to build than the industrial energy recovery systems described above as it is essentially redirecting the heat generated by one system into other on site systems. As a result, this type of energy recovery system is cheaper to build and the barriers to entry into this market are lower than in the market for industrial energy recovery systems. Our business focuses on energy recovery systems for industrial applications.

We believe that energy recovery systems represent a large-scale, environmentally friendly and economically feasible form of power generation. Compared with other alternative forms of power, such as solar, wind or biomass, we believe that energy recovery systems are dramatically more affordable for technology capable of delivering power on the scale necessary for industrial clients. In our opinion, energy recovery systems are cost competitive even with large-scale, traditional power sources such as coal, fossil fuels and nuclear power, but have the added benefit of reducing pollution and greenhouse gas emissions.

According to recent studies from the U.S. Department of Energy and the U.S. Environmental Protection Agency, energy recovery systems could generate nearly 200 gigawatt ("GW") of new power, equivalent to approximately 20% of current U.S. power generation capacity. The European Union is a significant user of energy recovery systems, with 104 GW installed power generating capacity; Germany and Italy have the most installed capacity at 16 GW and 13 GW, respectively.

Through our subsidiary Hi-tech, we have developed and commercialized our proprietary customized energy recovery technologies and solutions to cost-effectively reduce pollution and capture the waste heat released by our customer's industrial processes. Our energy recovery systems can help our customers improve their energy use efficiency. For example, our energy recovery systems applied in sulfuric acid manufacturing processes can produce as much as three times the useable energy from the same fuel by recovering otherwise lost energy and reusing it to generate electrical power, which may allow customers to slash energy expenditures by up to two-thirds. Additionally, these systems significantly reduce combustible wastes such as carbon monoxide gas, sour gas, carbon black off gases and other harmful emissions. Other benefits include our customers' ability to sell carbon credits, reduction of flue gas and equipment sizes of all flue gas handling equipment such as fans, stacks, ducts, and burners, and a reduction in auxiliary energy consumption.

The most notable target customers for our energy recovery systems include petrochemical plants, paper manufacturing plants, power generation facilities, oil refineries, cement plants and steel mills. These types of customers generally operate manufacturing equipment that is equipped with steam-driven turbines to produce electricity into which our energy recovery systems can be implemented.

Competitive Markets and Competition

Competition in the energy recovery system industry generally is divided by segment following the differentiation between low-grade energy recovery systems used for heat recovery applications (lower power extraction/generation capacity) and high-grade energy recovery systems used in industrial applications (higher power extraction/generation capacity).

Most of the players in the market are engineering firms that produce low-grade energy recovery systems for heat recovery applications mainly used by schools, hospitals and similar facilities. These products are generally undifferentiated and require lower levels of capital to develop. This type of energy recovery system is less complicated and requires significantly less technical qualifications to build than high-grade industrial energy recovery systems. As a result, this type of energy recovery system is cheaper to build and the barriers to entry into this market are lower than in the market for industrial energy recovery systems.

High-grade energy recovery systems for industrial applications, like ours, require large amounts of capital investment and high levels of expertise resulting in barriers to entry to most prospective market entrants. Because energy recovery systems of this type are highly customized based on the particular customer's need, manufacturers mainly compete based on their respective engineering capabilities. The manufacturers of industrial energy recovery systems generally fall into one of the following classifications:

| · | Companies that specialize exclusively in energy recovery systems and account for the majority of the larger and more advanced production of energy recovery systems; and |

| · | Major equipment manufacturers for which energy recovery systems are not a key focus but that have the necessary resources to build effective systems. |

Barriers to entry for the production of high grade energy recovery systems have resulted in a majority of the global sales for energy recovery systems being generated by a few large players. These industry participants focus on large scale projects leaving many intermediate opportunities for companies such as ours. The largest of these players globally include Babcock-Hitachi (Japan), Foster Wheeler (USA), and Mitsubishi Heavy Industries (Japan). The major players in China include Dong Fang Boiler Group, Wuhan Boiler, Hangzhou Boiler Group, and Anshan Boiler.

The Company differentiates itself from its competitors by specializing solely in energy recovery systems and being one of the few players in the market capable of undertaking engineering, procurement and construction contracts, a concept known in the industry under the acronym "EPC," for waste heat recovery. We believe that we are currently a dominant player in energy recovery systems to sulfuric acid manufacturers in China. We believe that energy recovery systems for sulfuric manufacturing are the most difficult to design and engineer due to the strong erosive character of the sulfuric acid.

Global Market Overview

The world currently faces fundamental problems with its energy supply, which are due primarily to the reliance on fossil fuels. The economic prosperity of the wealthiest nations in the twentieth century was built on a ready supply of inexpensive fossil fuel and developing nations have continued in the twenty-first century to consume fossil fuel reserves at an ever increasing rate. This has led to worldwide reserve depletions, indicating that both oil and gas are likely to be effectively exhausted before the end of this century. Only coal reserves are expected to last into the next century. Yet even if fossil fuel supplies were unconstrained, their continued use poses its own problems. All fossil fuel combustion produces carbon dioxide, which appears to result in the warming of the earth's atmosphere with profound environmental implications across the globe.

These problems have resulted in the realization that the world must both increase the efficiency of its utilization of fossil fuels and decrease its reliance upon them. Environmental issues related to fossil fuel combustion arose first during the 1980s with the advent of acid rain, a product of the sulfur and nitrogen emissions from fossil fuel combustion. Power plants were forced by legislation and economic measures to control these emissions. However it is the recognition of global warming that presents the most serious challenge because carbon dioxide exists at much higher levels in the flue gases of power plants than sulfur dioxide and nitrogen oxides.

Although renewable energy capacity offers a hedge against major price rises because most renewable technologies exploit a source of energy that is freely available, many renewable technologies today still rely on government subsidies to make them competitive. Governments may also impose penalties upon companies, such as carbon trading schemes, which discourage the use of fossil fuels or increase its costs by imposing stringent emissions limits.

Given the international concerns regarding global warming and pollution and the need to more efficiently utilize fossil fuels, we believe that there exists massive worldwide demand and a growing market for technologies that can enable companies to generate greater amounts of energy from the same supply of fossil fuels and that also reduce the amount of harmful emissions that would otherwise be released from the combustion of those fossil fuels. These technologies, including energy recovery systems, could benefit companies by both reducing energy costs and mitigating possible emissions penalties.

China Market Overview

Booming economic growth and rapid industrialization has spurred demand for electric power in China over the previous few years. By the end of 2006, China's total installed generating capacity reached 622 GW, an increase of more than 20% over the capacity at the end of 2005. Due to the expansion of energy intensive industrial sectors such as steel, cement, and chemicals, China's energy consumption has been growing faster than the country's gross domestic product ("GDP") and thus causing a shortage of electricity and coal and blackouts in over 20 of the country's 32 provinces, autonomous regions and municipalities. With the rapid modernization and industrialization of the country's economy, China is the world's second largest consumer of energy after the United States with its demand now accounting for over 15% of the world's energy consumption. According to the International Energy Agency, China needs to add 1,300 GW to its electricity-generating capacity, more than the total installed capacity currently in the United States, to meet its demands over the next several years.

We predict that the result of this massive increase in electric generation capacity will be a rapid rise in harmful emissions. China has already surpassed the United States to become the world's largest emitter of greenhouse gases, and the country faces enormous challenges from the pollution brought about by its energy needs. Only 1% of China's 560 million city dwellers breathe air considered safe by EU standards, environmental problems have led to industrial cities where people rarely see the sun, and birth defects in infants have soared nearly 40% since 2001. In addition, sulfur dioxide and nitrogen oxides released by coal-fired power plants fall as acid rain on Seoul, South Korea and Tokyo, Japan. A 2005 report by Chinese environmental experts, quoted in a New York Times article (“As China Roars, Pollution Reaches Deadly Extremes,” August 26, 2007), estimates that annual premature deaths attributable to outdoor air pollution in China were likely to reach 380,000 in 2010 and 550,000 in 2020.

China has set internal targets for energy efficiency to mitigate the negative impact of growth in future energy demand on the country's environmental problems. China aims to improve energy efficiency per unit of GDP in 2010 by 20% compared with 2005. To enable the implementation of China's recent climate change policy, mayors across each province are required to develop local plans, and their performance against implementing these plans will be measured. In order to meet demand more efficiently and without further increasing pollution, significant investment in alternative energy and clean technologies such as energy recovery systems will be crucial.

Use of alternative and renewable energy is expanding rapidly in China and currently contributes approximately 16% to total electricity generation and 7.5% to total primary energy supply. In China the generation capacity of electricity from renewable energy is dominated by hydropower, which accounted for more than 95% of the total electricity from renewable energy in 2005. Wind energy accounted for 1.1% of the total renewable installed capacity at the end of 2005, but China has more than doubled its total wind power capacity by installing additional capacity of 1,347 MW of wind energy during 2006. To reduce the country's current reliance on coal-fired generation, the Chinese government is stepping up efforts to accelerate the development of renewable energy. The Renewable Energy Law, which came into effect on January 1, 2006, along with a number of incentive policies ranging from tax incentives to subsidies, have been introduced to stimulate investment in renewable energy technologies. NDRC, a macroeconomic management agency under the State Council, has set a target to source 16% of primary energy from renewable energy by 2020, up from a 7.5% actual share in 2005. This includes development of 300 GW of hydropower, 30 GW of wind power, 30 GW of biomass power, 1.8 GW of solar photovoltaic systems, and smaller amounts of solar thermal and geothermal power. Business Insights, a company involved in providing strategic market and company analyses, estimates that realizing this target would require approximately 130 GW of new renewable energy capacity with an investment of up to $184 billion.

We are principally engaged in the designing, manufacturing, installation and servicing of fully-customized energy recovery systems. While most of our competitors only offer one or two off-the-rack models, we develop products across varying specifications to best suit each customer's needs and objectives. Our products can recycle as much as 70% of the energy that would otherwise have been lost.

We have made substantial gains in energy efficiency and continue to invest heavily in research and development to enhance efficiencies and decrease environmental impact. We employ approximately 80 highly trained engineers to enable the deployment of several energy recovery systems for large sulfuric acid plants, each producing approximately 3,000 metric tons of sulfuric acid per day, with power generating capabilities of approximately 53 MW each.

We have targeted our products at industrial sectors with significant amounts of waste heat. These sectors include:

| · | Chemical and Petrochemical Industry; |

Design and Engineering

Our primary design and engineering facility is located in Shanghai, China. The facility employs approximately 80 engineers. Approximately 65 of the engineers engage in project design, customizing the energy recovery systems to meet the individual needs of various industries. The balance of the engineers manage our production processes at the facility. We believe that our engineering team is highly experienced and accomplished in its field.

Manufacturing

Our subsidiary Hi-tech operates a manufacturing facility, owned by Shanghai Si Fang and through Shanghai Engineering as further described above, in Shanghai, China. The facility occupies approximately 10 acres (4 hectares) of land with approximately 617,000 square feet of manufacturing space and storage. We employ a team of 250 skilled workers, technicians and quality assurance personnel at the manufacturing facility. Our employees utilize a vast array of equipment including lathes, drills, metal cutting machines, forging equipment, handling equipment (cranes), welding machines, and testing equipment. A majority of the equipment is leased from Shanghai Si Fang pursuant to the cooperative manufacturing agreement descried above. This equipment will remain the property of Shanghai Si Fang when the agreement expires. Hi-tech does not own the facility but leases it from Shanghai Si Fang.

Marketing and Sales

We market and sell our products worldwide through our direct sales force, which is based in Shanghai, China. Our marketing programs include industrial conferences, trade fairs, sales training, and trade publication advertising. Our sales and marketing groups work closely with our research and development and manufacturing groups to coordinate our product development activities, product launches and ongoing demand and supply planning. We sell our products directly to the end users of our energy recovery systems.

We are also planning on entering into marketing partnerships and licensing deals that will enable us to reach a boarder segment of the market. We believe that there is significant opportunity in international markets such as the United States, Latin America and Europe, and we intend to enter these markets through partnerships. Additionally, we will look to expand into new industrial sectors through partnerships with leading engineering firms that specialize in specific industry verticals.

Products and Technology

We have four main service offerings available to our customers:

| · | Design. Our primary product line of energy recovery systems can be designed to meet the specific needs of our customers. We typically focus on heavy industrial applications and have designed systems with electricity generation capacity ranging from 50 to over 100 MW. In addition to the designing of energy recovery systems for our own customers, we occasionally are approached by and contract with third party manufacturers to design systems for their customers. This offers a peripheral revenue stream to supplement our core operations. We employ a flexible pricing scheme when designing for third party manufacturers that depends upon the size, application and deadline of the proposed energy recovery system. |

| · | Fabrication. We have highly-trained manufacturing teams capable of building high quality energy recovery systems in a timely fashion. All of our energy recovery systems are of modular design with a high degree of factory assembly. With modular construction, site welds on heat exchanger pressure parts are kept to a minimum. We design all energy recovery systems we manufacture to protect our brand. We collect a one-time fee for the fabrication of each of our units. |

| · | Implementation. Our subsidiary Hi-tech also possesses the resources, expertise and capabilities to act as the lead engineering procurement and construction contractor, overseeing the implementation of energy recovery systems for our customers. EPC services involve the whole process of the construction of projects from design, development, engineering, manufacturing up to installation. Similar to the revenue model employed for our design services, we either package the implementation of our energy recovery system with the design and fabrication of our units, or outsource this function to third party manufacturers for a service charge; this allows smaller third party manufacturers to convert fixed costs to variable costs, while offering us an ancillary revenue stream. |

| · | Maintenance. Our team is responsible for the overall maintenance of the energy recovery systems we install. In the event that major repairs are needed, the maintenance team is capable of rebuilding the equipment in order to repair or replace any necessary components. The maintenance team is contracted to service our own as well as other manufacturers' energy recovery systems. Our maintenance team charges an hourly fee for its services. |

Our energy recovery systems represent a fully-customizable technology capable of meeting the varying needs of a diversified customer base. The systems are capable of recycling up to 70% of the energy that would otherwise be lost in customers' industrial processes, in many cases allowing our customers to recover their costs of the energy recovery system in energy savings within one to three years. The energy recovery systems capture and eliminate harmful particles, carbon dioxide, sulfur dioxide and other emissions.

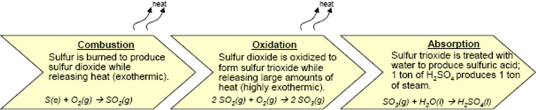

Our energy recovery systems are suitable for use in a wide range of industries, including chemical processing, papermaking, and oil and ethanol refining. The core technology is easily adaptable to meet a variety of different size facilities and types of plant design. Below is an illustration of our technology as it is implemented in the sulfuric acid production industry.

| · | Traditional Sulfuric Acid Production Process. The production of sulfuric acid involves highly exothermic chemical reactions. Most of the heat is released into the atmosphere through cooling towers without capturing any of the energy contained therein. Some of the heat from the production process is captured as steam, which the manufacturer can use to, for example, generate electricity. Without the use of one of our energy recovery systems, the production of one ton of sulfuric acid will produce approximately one ton of steam. |

| · | Sulfuric Acid Production Process with our Technologies. The incorporation of an energy recovery system increases the manufacturer's ability to extract energy from the production process such that the production of one ton of sulfuric acid can produce between 1.3 and 1.65 tons of steam. In so doing, 94% of the heat that would have otherwise been released to the atmosphere is utilized to provide a larger quantity of steam that can be used in industrial applications. The harnessed steam can be used for various applications, most commonly to drive generator turbines to produce electricity. Doing so decreases the manufacturer's demand for externally produced energy as the manufacturer instead can use internally produced energy resulting from the energy recovery system’s increased production and utilization of steam. |

Research and Development

We are focused on a strategy of utilizing our research and development capabilities to continuously improve the waste heat and emissions capture technology of our energy recovery systems. Our research and development efforts focus specifically on maximizing efficiency and reliability while minimizing the cost to customers. We have currently been focusing our efforts on new products with immediate demand in the markets such as capturing and reducing emissions of vitriol (a sulfate of any of various metals), alkali, and carbinol (an alcohol) released in various industrial processes. We maintain strong relationships with many professional engineering firms in China that can provide technical support in the development process.

We employ approximately 80 specialized engineers at our Shanghai, China facilities who are engaged in refining the core technology for our energy recovery systems, developing our intellectual property rights, enhancing energy efficiencies and decreasing environmental impact for our customers. We estimate that our engineers spend between 30% and 40% of their time on research and development efforts, resulting in company expenses on research and development of approximately 2 million and 3 million Renminbi in 2006 and 2007, respectively. Shanghai Engineering has a portfolio of core Chinese patents on various components of our energy recovery systems as described elsewhere in this Current Report on Form 8-K.

Our Business Strategy

We have established a three-phase growth strategy:

| · | Phase One. During the first phase of our growth strategy, we will continue to fulfill our current orders while growing our domestic Chinese business. During this time, we intend to establish long-term strategic purchasing agreements with suppliers that provide key raw materials. |

| · | Phase Two. The second phase of our growth strategy involves increased expenditures that will support our growth. We intend to start construction of our first owned manufacturing facility, which we believe will increase our profit margins and efficiency. We also intend to invest in specialized equipment to further increase the efficiency of our manufacturing process. While these capital expenditures are underway, we expect to increase our research and development expenditures to support an expansion into new sectors such as coke refining and cement. We anticipate recruiting an international sales and marketing team to assist with this expansion effort. |

| · | Phase Three. In the third phase of our growth strategy, we expect to construct a second manufacturing facility to meet future demand. We also anticipate expanding our EPC business by increasing the size of our engineering and design teams. Finally, we expect to increase our marketing efforts in Europe and the United States during this phase. |

Raw Materials and Principal Suppliers

We do not have any long term supply agreements. We do not believe that we are reliant on our current suppliers. We believe that we could substitute other suppliers if needed. Our five largest suppliers (by value) supplied approximately 62% of our raw materials in 2007.

Customers

Our subsidiary Hi-tech has provided over 100 unique customers with energy recovery systems, and more than 25% of these customers have purchased multiple other products and services from us. Our customers are mainly industrial manufacturers, such as chemical plants, paper manufacturers and industrial engineering firms. Our energy recovery systems are currently deployed and being deployed in a variety of international markets, including Egypt, Turkey, Korea, Vietnam and Malaysia, as well as in 15 of China's 31 provinces, including Yunnan, Jiangsu, Shandong, Sichuan, Hunan and Hubei.

We currently have a backlog of orders from a number of domestic Chinese and international customers, including our first North American orders.

Because of the long life of our energy recovery systems, a majority of our sales are from new customers. We are therefore not dependent upon a few major customers to continue our current level of sales. As of December 31, 2007, our top five customers accounted for approximately 67% of our total sales, three of which were new customers.

Intellectual Property and Other Proprietary Rights

The Chinese State IPR Office has authorized and granted the following patents to Shanghai Engineering on various components of our energy recovery systems:

Patent Type | | Patent Name | | Expiration Date |

| Utility model | | Drum-type sectional ache fire tube boiler made by sulphur | | 5/6/2013 |

| Utility model | | Double drum-type fire tube exhaust-heat boiler which shares one steam dome | | 11/6/2013 |

| Utility model | | Improvement of tube compensator breed which makes ache fume | | 11/6/2013 |

| Utility model | | Improvement of protective casing tube | | 11/6/2013 |

| Utility model | | Triple drum-type fire tube exhaust-heat boiler which shares one steam dome | | 1/30/2015 |

Shanghai Engineering has, together with an unrelated company, Zhejiang Jia Hua Group Joint Stock Co., Ltd., submitted the following patent applications to the Chinese State IPR Office, which are currently pending authorization:

Patent Type | | Patent Name | | Application Date |

| Utility model | | Spray pump synthesizing tower | | 8/31/2007 |

| Invention | | Chlorosulfonic acid preparation new craftwork and equipment | | 8/31/2007 |

Governmental Regulation

The manufacture of boilers and pressure vessels used in our energy recovery systems is subject to licensing requirements imposed by the Chinese national government, as well as regional and local governments, depending on the type of license needed. Shanghai Si Fang conducts all our manufacturing operations and has obtains the required licenses. Boilers and pressure vessels manufactured without such licenses are not allowed to be sold in China. To qualify for a license, a manufacturer must (a) be a legal entity registered with the local government; (b) have a production facility, equipment, technical expertise, and inspection and testing capabilities suitable for producing boilers and pressure vessels; (c) establish and maintain an effective quality assurance system; and (d) manufacture the boilers and pressure vessels in accordance with the requirements of the applicable safety and technical standards.

Our operations are also subject to governmental regulation applicable to any business such as general permitting, licensing and registration. For example, the installation of energy recovery systems at our clients' locations requires a construction project building permit from the applicable regional government.

Compliance with Environmental Laws

We belong to what is known as the "machinery manufacturing industry" in China which industry is considered not to generate exhaust gas, waste liquor or waste residue during manufacturing. Therefore, our manufacturing operations are not subject to any material environmental regulations.

The installation and construction of our energy recovery systems at our clients' locations are subject to environmental laws applicable to construction projects generally. As part of the procedure for obtaining a construction project building permit, we must submit an environmental impact statement for each construction project which assesses the pollution the projects is likely to produce, its impact on the environment, and stipulates preventive and curative measures. The issuance of a building permit is conditioned on the approval of the environmental impact statement.

There are emissions standards applicable to the operation of coal-burning, oil-burning or gas-fired boilers (China National General Standard GWPB 3-1999). We do not believe that these emission standards are applicable to the boilers included within our energy recovery systems because our boilers are not independently emitting any emissions as they are being heated by industrial processes as opposed by coal, oil or gas.

Employees

As of April 1, 2008, we had approximately 330 employees, all of which are full time employees. Of these, approximately 80 are management and engineering personnel. We expect to add additional personnel over the course of 2008 to meet our current customer orders.

None of our employees are covered by a collective bargaining agreement. Each of our managerial, sales and administrative employees has entered into a standard form of employment agreement which, among other things, contains covenants not to compete for 12 months following termination of employment and to maintain the confidentiality of certain proprietary information. We believe that our employee relations are good.

Available Information

We are a reporting registrant under the Exchange Act. Our website address is http://www.chinaenergyrecovery.com. The information included on our website is not included as a part of, or incorporated by reference into, this Current Report on Form 8-K. We will make available through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we have filed or furnished such material to the SEC.

You may read and copy any materials we file with the SEC at the SEC's Public Reference room at 450 Fifth Street, NW, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, at http://www.sec.gov.

Risks Related to Our Business

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations.

Our limited operating history and the unpredictability of our industry make it difficult for investors to evaluate our business and future operating results. An investor in our securities must consider the risks, uncertainties and difficulties frequently encountered by companies in new and rapidly evolving markets. The risks and difficulties we face include challenges in accurate financial planning as a result of limited historical data and the uncertainties resulting from having had a relatively limited time period in which to implement and evaluate our business strategies as compared to companies with longer operating histories.

Projections about our future financial performance are uncertain and our future financial performance is not guaranteed.

This Current Report on Form 8-K contains projections of our future financial performance. The financial projections are based on assumptions that we believe to be reasonable but that are inherently uncertain and unpredictable. These assumptions may be incomplete or inaccurate and unanticipated events and circumstances are likely to occur. For these reasons, actual results achieved during the periods covered may vary from the projections, and such variations may be material and adverse. Independent accountants and consultants have not compiled or examined these projections and, accordingly, do not express an opinion or any other form of assurance on them. You are cautioned that there are numerous risks and uncertainties that could affect the achievement of the projections. Accordingly, the projections are provided for illustrative purposes only, and your return as an investor indicated in the projections is by no means guaranteed.

Our dependence on a limited number of customer segments may cause significant fluctuations or declines in our revenues.

We currently sell a substantial portion of our energy recovery systems to companies in either the chemical or paper manufacturing sectors. In the fiscal year ended 2007, approximately 97% and 3% of our total sales were attributable to the chemical and paper manufacturing sectors, respectively. We anticipate that our dependence on a limited number of customer sectors will continue for the foreseeable future. Consequently, any one of the following events may cause material fluctuations or declines in our revenues and have a material adverse effect on our results of operations:

| · | Decreased demand for the products of these manufacturing sectors; |

| · | Advances in the manufacturing processes of these sectors that could eliminate the economic feasibility of our technology; and |

| · | Failure to successfully implement our systems for one or more customers within a particular sector could adversely affect the reputation of our products and services have as a viable option for other companies within that sector. |

We face risks associated with the marketing, distribution and sale of our energy recovery systems, and if we are unable to effectively manage these risks, they could impair our ability to expand our business.

The marketing, distribution and sale of our products expose us to a number of risks, including:

| · | Increased costs associated with maintaining marketing efforts in various countries; |

| · | Marketing campaigns that are either ineffective or negatively perceived in one or more countries and/or across one or more industry sectors; |

| · | Difficulty and cost relating to compliance with the different commercial and legal requirements of the overseas markets in which we offer our products; |

| · | Inability to obtain, maintain or enforce intellectual property rights; and |

| · | Trade barriers such as export requirements, tariffs, taxes and other restrictions and expenses, which could increase the prices of our products and make us less competitive in some countries. |

The success of our business depends on the continuing contributions of our senior management and other key personnel who may terminate their employment with us at any time causing us to lose experienced personnel and to expend resources in securing qualified replacements.

We depend substantially on the current and continued services and performance of our senior management and other key personnel. Loss of the services of any of such individuals would adversely impact our operations. In addition, we believe that our technical personnel represent a significant asset and provide us with a competitive advantage over many of our competitors and that our future success will depend upon our ability to hire and retain these key employees and our ability to attract and retain other skilled financial, engineering, technical and managerial personnel. None of our key personnel, including our Chief Executive Officer, is party to any employment agreements with us and management and other employees may voluntarily terminate their employment at any time. Our Chief Financial Officer has entered into a short-term consulting agreement with us that expires in July 2008. There is no guarantee that we will be able to retain the services of these, or other, individuals on reasonable terms or at all. We do not currently maintain any "key man" life insurance with respect to any of such individuals.

Our inability to obtain capital, use internally generated cash, or use shares of our capital stock or debt to finance future expansion efforts could impair the growth and expansion of our business.

Reliance on internally generated cash or debt to finance our operations or complete business expansion efforts could substantially limit our operational and financial flexibility. The extent to which we will be able or willing to use shares of capital stock to consummate expansions will depend on the market value of our capital stock from time to time and the willingness of potential investors, sellers or business partners to accept it as full or partial payment. Using shares of capital stock for this purpose also may result in significant dilution to our then existing stockholders. To the extent that we are unable to use capital stock to make future expansions, our ability to grow through expansions may be limited by the extent to which we are able to raise capital for this purpose through debt or equity financings. Raising external capital in the form of debt could require periodic interest payments that could hinder our financial flexibility in the future. No assurance can be given that we will be able to obtain the necessary capital to finance a successful expansion program or our other cash needs. If we are unable to obtain additional capital on acceptable terms, we may be required to reduce the scope of any expansion. In addition to requiring funding for expansions, we may need additional funds to implement our internal growth and operating strategies or to finance other aspects of our operations. Our failure to (a) obtain additional capital on acceptable terms, (b) use internally generated cash or debt to complete expansions because it significantly limits our operational or financial flexibility, or (c) use shares of capital stock to make future expansions may hinder our ability to actively pursue any expansion program we may decide to implement. In addition, if we are unable to obtain necessary capital going forward, our ability to continue as a going concern would be negatively impacted.

Our future success substantially depends on our ability to significantly increase our manufacturing capacity. Our ability to achieve our capacity expansion goals is subject to a number of risks and uncertainties.

Our future success depends on our ability to significantly increase our manufacturing capacity. If we are unable to do so, we may be unable to expand our business, decrease our average cost per watt, maintain our competitive position and improve our profitability. Our ability to establish additional manufacturing capacity is subject to significant risks and uncertainties. We may be unable to raise the necessary capital to initiate and complete the construction of a new manufacturing facility, acquire the appropriate permits to allow construction of a new manufacturing facility, or engage a company qualified to construct our manufacturing facility at a reasonable price, or at all.

We may not be able to manage our expansion of operations effectively and if we are unable to do so, our profits may decrease.

We are in the process of significantly expanding our business in order to meet the increasing demand for our products and services, as well as to capture new market opportunities. As we continue to grow, we must continue to improve our operational and financial systems, procedures and controls, increase manufacturing capacity and output, and expand, train and manage our growing employee base. In order to fund our on-going operations and our future growth, we need to have sufficient internal sources of liquidity or access to additional financing from external sources. Furthermore, our management will be required to maintain and strengthen our relationships with our customers, suppliers and other third parties. As a result, our continued expansion has placed, and will continue to place, significant strains on our management personnel, systems and resources. We will also need to further strengthen our internal control and compliance functions to ensure that we will be able to comply with our legal and contractual obligations and minimize our operational and compliance risks. Our current and planned operations, personnel, systems, internal procedures and controls may not be adequate to support our future growth. If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities, execute our business strategies or respond to competitive pressures. As a result, our results from operations may decline.

Our failure to protect our intellectual property rights may undermine our competitive position, and litigation to protect our intellectual property rights or defend against third-party allegations of infringement may be costly.